ELECTRONIC PRESENTATION SLIDES FOR EARNINGS RELEASE CONFERENCE CALL

Published on January 18, 2012

The PNC

Financial Services Group, Inc. Fourth Quarter and Full Year 2011

Earnings Conference Call

January 18, 2012

Exhibit 99.2 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information |

3

Todays Discussion

Significant 2011 achievements and financial

highlights

Strong growth in customers, loans and deposits

Delivered strong returns

Positioned to achieve strong results in 2012

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company. |

4

Significant 2011 Achievements

PNCs Business Model Delivered Strong Results in 2011.

2011 financial

summary

Net income

Diluted EPS from

net income

Return on

average assets

$3.1 billion

$5.64

1.16%

Delivered good financial results through exceptional client growth across businesses and

markets

Grew commercial loans

Maintained a high quality balance sheet that reflected an overall moderate risk profile

Managed expenses while investing for growth in our businesses

Continued to maintain strong capital levels and liquidity positions

Expansion in attractive growth markets

2011 highlights |

5

-$2.3

$0.8

FY10

FY11

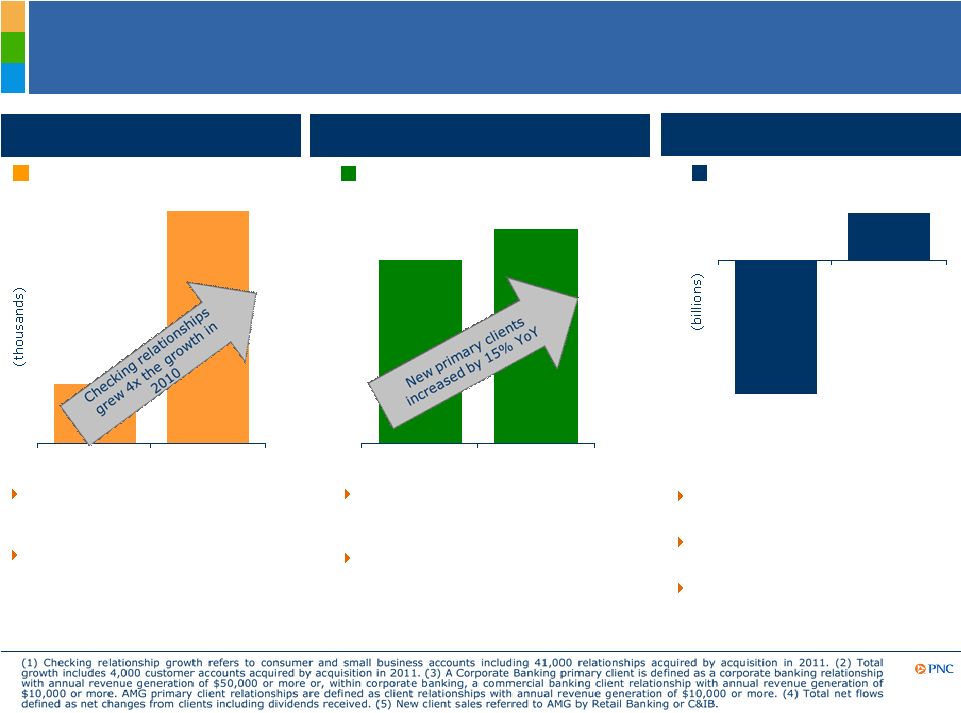

Focused on Growing Client Relationships

Asset Management Group

Retail Banking

Corporate & Institutional Banking

Discretionary AUM Total

Net Flows

4

1,012

1,165

FY10

FY11

2011 referral sales

5

up 52% vs.

2010

2011 new primary

clients³

up 26%

vs. 2010

Total sales have increased by 38%

for 2011 vs. 2010

New clients represent 12% of total

existing primary clients at

December 31, 2011

Strong 2011 sales across all

markets and client segments

2011 total growth of 5.4%, greater

than 1.2% footprint population

growth

Active online bill payment customers

showed total

growth²

of 2.4%

from 3Q11, 13% from 4Q10

Corporate Banking new primary

clients

3

Checking relationship

growth

1

75

296

FY10

FY11

+

+ |

6

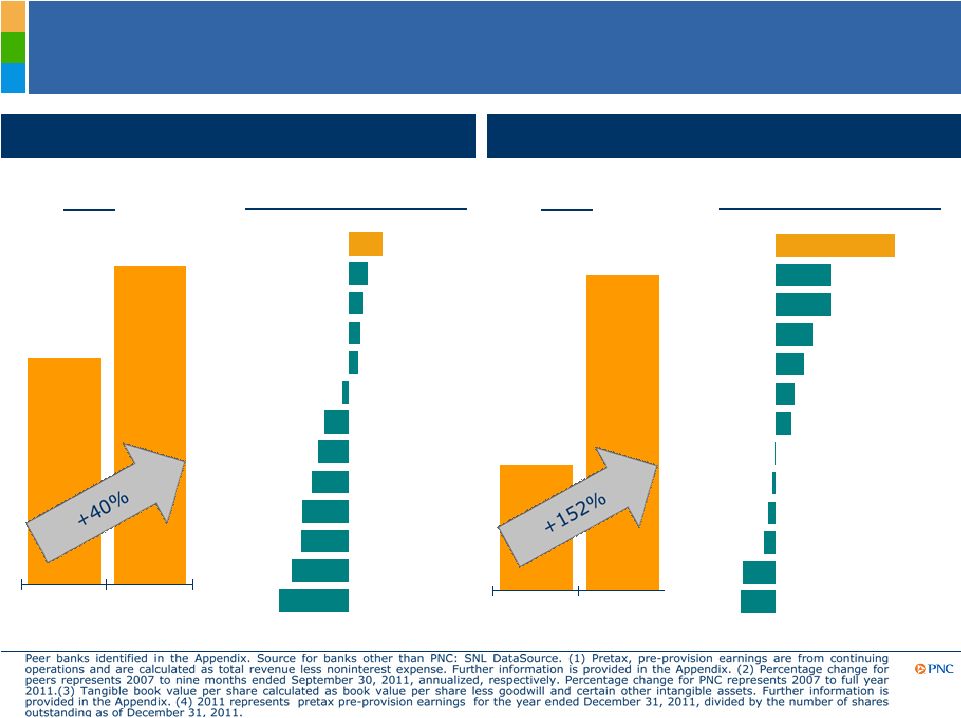

Delivering Long-Term Shareholder Value

$7.06

$9.91

2007

2011

4

40%

23%

17%

13%

11%

-8%

-29%

-36%

-43%

-55%

-57%

-68%

-84%

PNC

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 9

Peer 10

Peer 11

Peer 12

$17.58

$44.38

12/31/07

12/31/11

Pretax pre-provision earnings per share¹

PNC

% change 2007-2011²

Tangible book value per share³

152%

72%

71%

48%

36%

24%

18%

-2%

-5%

-10%

-15%

-42%

-44%

PNC

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 9

Peer 10

Peer 11

Peer 12

PNC

% change 2007-2011²

|

7

2011 Risk Management Progress

Credit, Market and Operational risk

Credit costs significantly improved

Continued to position balance sheet for rising interest rates

Repositioned retail deposit products and reduced higher cost retail CDs

Added new clients and loans at lower risk weighting

Continued enhancements to risk management capabilities and

technologies

Reputational and Industry risk

Settled (or has settlements pending) several meaningful legal matters

Increased residential mortgage foreclosure-related expenses primarily

as a result of ongoing governmental matters

Implemented several new regulatory requirements

Strategic Positioning

Enhanced strong capital and liquidity positions

Strengthened brand recognition and awareness

Announced RBC Bank (USA) acquisition to expand in attractive growth

markets |

8

Financial Performance

Fourth Quarter Highlights

Continued focus on high quality loan growth

Delivered strong revenue performance

NII growth driven by increase in core net interest income

Noninterest income grew excluding the impact of regulatory

changes¹

Overall improved credit quality resulted in reduced credit costs

Expenses

were elevated due to several items

1Q12

estimated

expenses²

expected to be more consistent with

3Q11

Capital and liquidity positions continued to be strong

4Q11 financial

summary

Net income

Diluted EPS from

net income

Tier 1 common

ratio

$493 million

$0.85

10.3%³

(1)

Further information is provided in the Appendix. (2)Excluding legal and regulatory related

contingencies, integration costs, additional capital actions related to TPS

redemptions, and additional residential mortgage foreclosure-related costs. (3) Estimated. |

9

A Higher Quality, Differentiated Balance Sheet

Change from:

Category (billions)

Dec. 31,

2011

Sep. 30,

2011

Dec. 31,

2010

Total investment securities

$60.6

$(1.5)

$(3.6)

Core commercial

loans¹

86.7

3.6

9.6

Core consumer

loans¹

59.9

1.4

1.2

Non-strategic

loans²

12.4

(0.5)

(2.4)

Total loans

159.0

4.5

8.4

Other assets

51.6

(1.3)

2.1

Total assets

$271.2

$1.7

$6.9

Transaction deposits

$147.6

$4.6

$13.0

Retail CDs

29.5

(2.9)

(7.8)

Other

10.9

(1.5)

(0.6)

Total deposits

188.0

0.2

4.6

Borrowed funds, other

49.1

1.7

(1.5)

Shareholders

equity

34.1

(0.2)

3.8

Total liabilities and equity

$271.2

$1.7

$6.9

Loans increased $4.5 billion or

3% linked-quarter driven by

commercial and consumer loans

Transaction deposits increased

$4.6 billion or 3% linked-quarter

reflecting increased commercial

and consumer liquidity

Retail CDs declined $2.9 billion

linked-quarter reflecting

expected run-off of higher cost

CDs

As of December 31, 2011,

equity increased 13% compared

to year-end 2010

4Q11 highlights

(1) Excludes loans assigned to the Non-Strategic Assets (formerly Distressed Assets

Portfolio) Portfolio business segment. (2) Represents loans assigned to the

Non-Strategic Assets Portfolio business segment. |

10

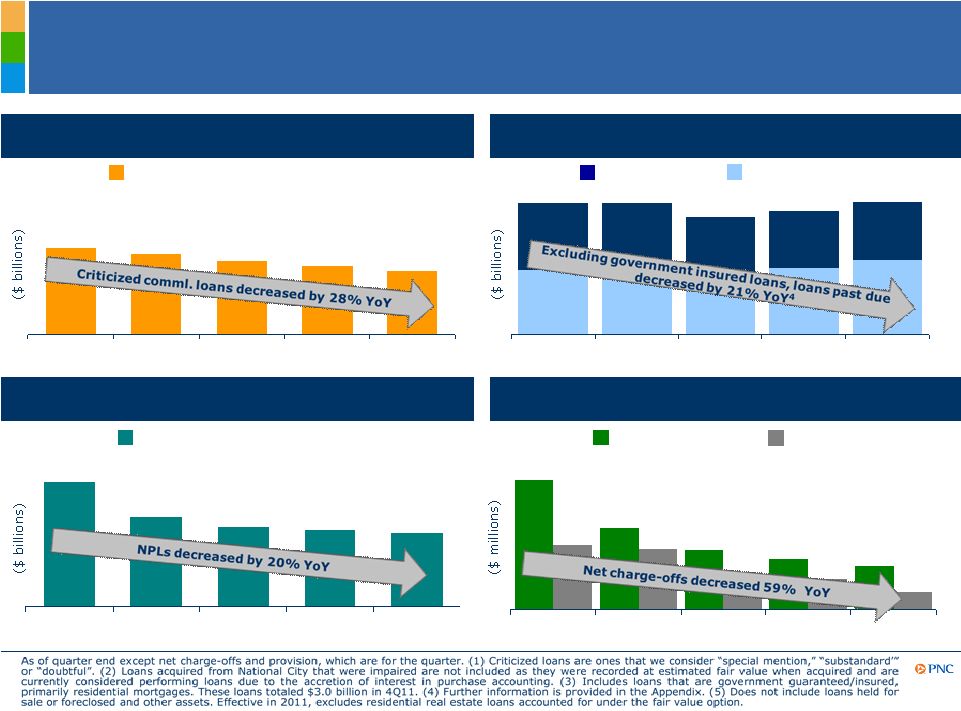

Credit Trends Continue to Improve

$791

$533

$414

$365

$327

$442

$421

$280

$261

$190

4Q10

1Q11

2Q11

3Q11

4Q11

Nonperforming

loans

2,5

Provision and net charge-offs

Criticized commercial loans

30-89 Days

90 Days +

Accruing

loans

past

due

2,3

$2.7

$2.6

$2.6

$2.8

$3.0

$1.8

$1.9

$1.5

$1.6

$1.6

4Q10

1Q11

2Q11

3Q11

4Q11

$13.7

$12.7

$11.7

$10.8

$9.9

4Q10

1Q11

2Q11

3Q11

4Q11

Criticized Commercial

loans¹

Provision

Net charge-offs

4Q10

1Q11

2Q11

3Q11

4Q11

Total nonperforming loans

$4.5

$4.3

$3.9

$3.7

$3.6 |

11

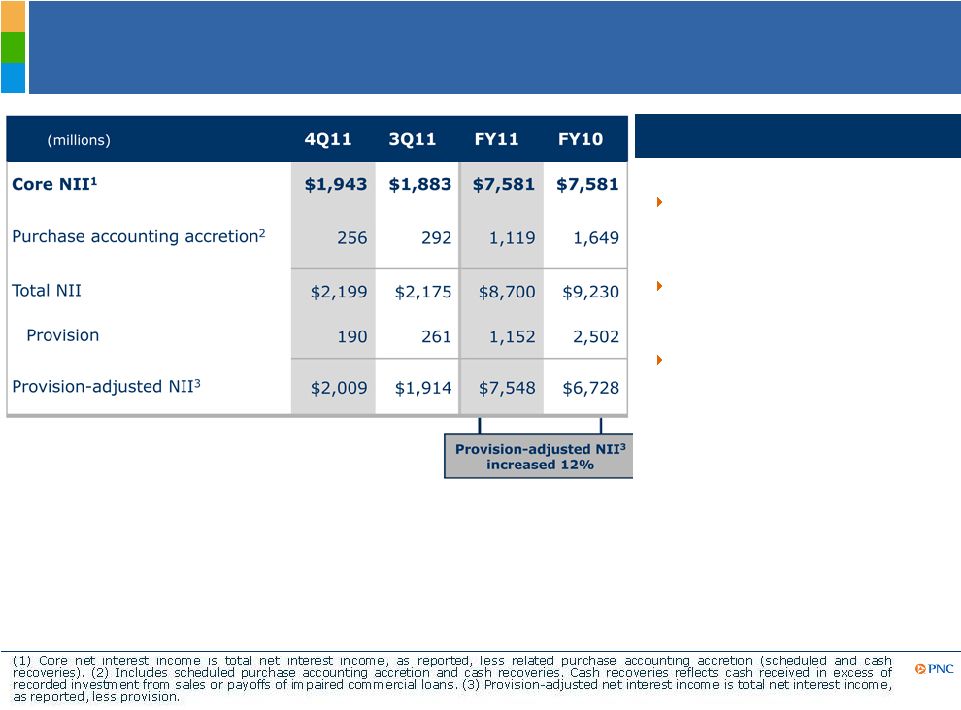

Improving Net Interest Income and Provision Trends

Highlights

Quarterly:

Total NII improved from 3Q11 due

to growth in core NII

1

, partially

offset by lower purchase

accounting accretion

Provision declined as overall credit

quality continued to improve

Full Year 2011:

Provision-adjusted NII

3

increased

12% as core NII remained stable

while significantly lower provision

more than offset the expected

decline in purchase accounting

accretion |

12

Client Growth and Sales Momentum Provide

Opportunities to Increase Noninterest Revenue

4Q11 highlights

(millions)

4Q11

3Q11

FY11

FY10

Asset management

1

$250

$287

$1,088

$1,054

Consumer services

269

330

1,243

1,261

Corporate services

2

266

187

898

1,082

Residential mortgage

157

198

713

699

Deposit service charges

140

140

534

705

Client fee income

$1,082

$1,142

$4,476

$4,801

Net gains on sales of

securities

less net OTTI

18

33

97

101

Other

250

194

1,053

1,044

Total noninterest income

$1,350

$1,369

$5,626

$5,946

Quarterly:

Asset management declined

partially due to a third quarter

non-cash tax benefit at BlackRock

Consumer services declined

reflecting regulatory impact on

debit card interchange fees of $75

million

Corporate services increased

primarily due to a valuation

impairment of CMSR in 3Q11

Residential mortgage decreased

primarily from lower MSR hedge

gains

Other improved primarily due to

higher values on deferred

compensation hedges

Full Year 2011:

Noninterest income decline

primarily driven by impact of

regulatory changes

3 |

13

WellManaged Expenses While Investing for Growth

(millions)

4Q11

3Q11

FY11

FY10

Personnel

$1,052

$949

$3,966

$3,906

Occupancy

198

171

738

730

Equipment

177

159

661

668

Marketing

74

72

249

266

Other

1,218

789

3,491

3,043

Total noninterest expense

$2,719

$2,140

$9,105

$8,613

PNC is Committed to Disciplined Expense Management.

PNC is Committed to Disciplined Expense Management.

Highlights

Quarterly:

Personnel increased primarily due to higher

personnel expenses largely driven by higher

stock market prices and higher business

production

Occupancy and Equipment increased due to

a lease termination and equipment write-

offs

Other increased primarily due to higher

residential mortgage foreclosure-related

expenses and trust preferred securities

redemption charge

Full Year 2011:

Excluding residential mortgage foreclosure-

related expenses and trust preferred

securities redemption charges, noninterest

expense remained flat

1

First Quarter Outlook:

Excluding RBC Bank (USA) integration and

other costs, 1Q12 expenses

2

expected to

return to 3Q11 levels

(1) Further information is provided in the Appendix. (2) Excluding legal and regulatory

related contingencies, integration costs, additional capital actions related to

remaining TPS redemption, and additional residential mortgage foreclosure-related costs. |

14

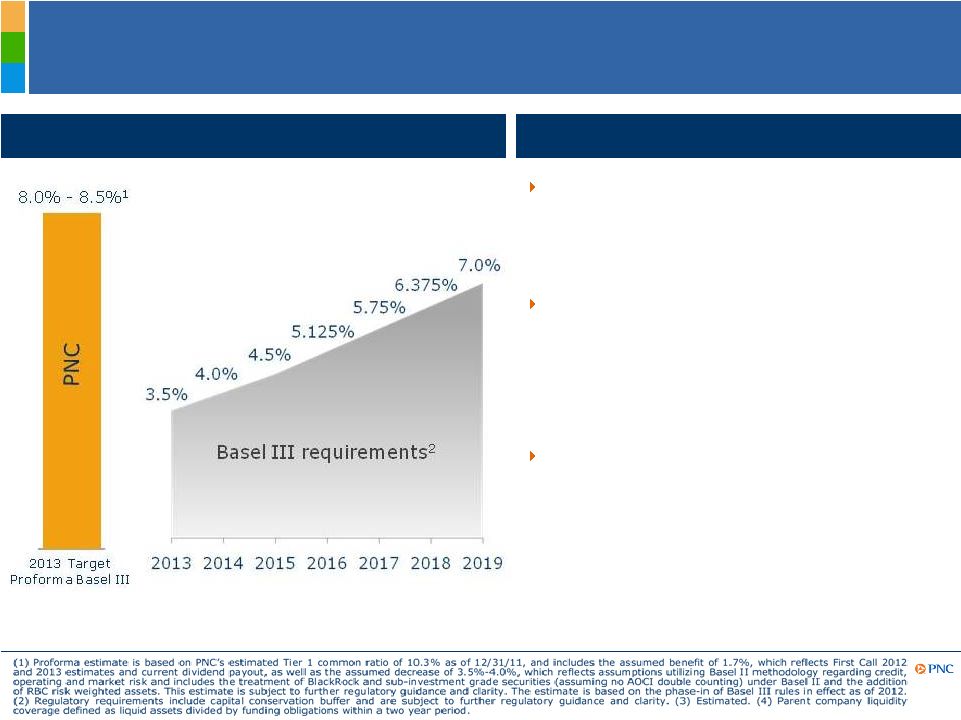

Strong Capital and Liquidity Position

Highlights

Tier 1 common ratio

Proforma Basel III Tier 1 common ratio estimated

to be between 8.0-8.5%

1

during 2013

Possible improvement assuming final capital

requirements reflect the inherent risk profile

in our sub-investment grade securities

Capital priorities:

Build capital to support client growth and

business investment

Maintain appropriate capital in light of

economic uncertainty

Return excess capital to shareholders

Strong liquidity position

Loan-to-deposit ratio of 85%

Parent company two year liquidity coverage

4

of 172% |

15

Outlook

1

Full Year 2012 vs. 2011

PNC is Positioned to Deliver Strong Results in 2012.

PNC is Positioned to Deliver Strong Results in 2012.

Estimated % Change

3

Combined

2

Balance sheet

Loans

Increase mid to high teens

Total revenue

Increase mid to high single digits

Combined

2

Income

statement

Net interest income

Increase mid to high single digits

Noninterest income

Increase mid single digits

Noninterest expense

Increase mid single digits

4

Loan loss provision

Stable

5

PNC stand-alone positioned for strong results in 2012

RBC Bank (USA) pending acquisition expected to be accretive in 2012,

excluding integration costs

(1) Refer to the Cautionary Statement in the Appendix, including assumptions. (2) Reflects

combined PNC and RBC Bank (USA). (3) Estimated change for 2012 is based on 2011

reported results. (4) Excluding legal and regulatory related contingencies, integration costs and any

additional capital actions related to TPS redemptions for 2011 and 2012. (5) Excluding legal

and regulatory related contingencies.

|

16

Cautionary Statement Regarding Forward-Looking

Information

Appendix |

17

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix |

18

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix |

19

Non-GAAP to GAAP Reconcilement

Appendix

In millions

Dec. 31, 2007

Dec. 31, 2011

% Change

Total revenue

$6,705

$14,326

Noninterest expense

4,296

9,105

Pretax pre-provision earnings

$2,409

$5,221

Common shares outstanding

341

527

Pretax pre-provision earnings per share

$7.06

$9.91

40%

PNC

believes

that

pretax

pre-provision

earnings

from

continuing

operations,

a

non-GAAP

measure,

is

useful

as

a

tool

to help evaluate ability to provide for credit costs through operations.

For the year ended

As of

In millions except per share data

Dec. 31, 2007

Dec. 31, 2011

% Change

Common shareholders' equity

$14,847

$32,417

Common shares outstanding

341

527

Book value per common share

$43.60

$61.52

41%

Goodwill and other intangible assets other than servicing rights (1)

$8,853

$9,027

Common shareholders' equity less intangible assets

$5,994

$23,390

Common shares outstanding

341

527

Tangible book value per common share

$17.58

$44.38

152%

PNC

believes

that

tangible

book

value

per

common

share,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

amount,

on

a

per

share

basis,

of

goodwill

and

certain

other

intangible

assets

included

in

book

value

per

common

share.

(1) Servicing rights were $701 million and $1,115 million at December 31, 2007 and December

31, 2011, respectively. |

20

Non-GAAP to GAAP Reconcilement

Appendix

Year over year

$ in millions

Dec. 31, 2011

Sept. 30, 2011

June 30, 2011

Mar. 31, 2011

Dec. 31, 2010

% Change

Accruing loans past due, 30-89 days

$1,565

$1,551

$1,498

$1,868

$1,817

Accruing loans past due, 90+ days

2,973

2,768

2,646

2,645

2,709

Total accruing loans past due

$4,538

$4,319

$4,144

$4,513

$4,526

0%

Government guaranteed/insured loans

3,031

2,821

2,658

2,617

2,624

16%

Total accruing loans past due,

excluding government guaranteed/insured loans

$1,507

$1,498

$1,486

$1,896

$1,902

-21%

For the three months ended

PNC believes that information adjusted for the impact of certain items may be useful to help

evaluate the impact of those items on our operations. |

21

Non-GAAP to GAAP Reconcilement

Appendix

2011 vs. 2010

In millions

Dec. 31, 2011

Sept. 30, 2011

Dec. 31, 2011

Dec. 31, 2010

% Change

Total noninterest income, as reported

$1,350

$1,369

$5,626

$5,946

-5%

Adjustments for negative impact of regulatory changes:

Regulation E

100

90

345

145

Credit Card Act

5

5

20

15

Debit card transaction interchange fee limits

75

-

75

-

Total noninterest income, as adjusted

$1,530

$1,464

$6,066

$6,106

-1%

2011 vs. 2010

In millions

Dec. 31, 2011

Sept. 30, 2011

Dec. 31, 2011

Dec. 31, 2010

% Change

Total noninterest expense, as reported

$2,719

$2,140

$9,105

$8,613

6%

Adjustments:

Trust preferred securities redemption charge

198

-

198

-

Residential mortgage foreclosure-related expenses

240

63

324

71

Total noninterest expense, as adjusted

$2,281

$2,077

$8,583

$8,542

0%

PNC believes that information adjusted for the impact of certain items may be useful to help

evaluate the impact of those items on our operations.

For the year ended

For the quarter ended

PNC believes that information adjusted for the impact of certain items may be useful to help

evaluate the impact of those items on our operations.

For the quarter ended

For the year ended |

22

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC

Ticker |