UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| {x} |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2008

or

| { } |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| |

|

Pennsylvania

|

|

|

|

25-1435979

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

|

|

(I.R.S. Employer Identification No.) |

|

|

One PNC Plaza,

249 Fifth Avenue,

Pittsburgh, Pennsylvania 15222-2707

(Address of principal executive offices, including zip code)

(412) 762-2000

(Registrants telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by

check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of large accelerated filer, accelerated

filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

Large accelerated filer X Accelerated filer

Non-accelerated filer Smaller reporting company

Indicate by

check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No X

As of April 30, 2008, there were 345,849,293 shares of the registrants common stock ($5 par value) outstanding.

The PNC Financial Services Group, Inc.

Cross-Reference Index to First Quarter 2008 Form 10-Q

FINANCIAL REVIEW

CONSOLIDATED FINANCIAL HIGHLIGHTS

THE PNC

FINANCIAL SERVICES GROUP, INC.

|

|

|

|

|

|

|

|

|

| Dollars in millions, except per share data |

|

Three months ended March 31

|

|

| Unaudited |

|

2008 |

|

|

2007 |

|

| FINANCIAL PERFORMANCE (a)

|

|

|

|

|

|

|

|

|

| Revenue

|

|

|

|

|

|

|

|

|

| Net interest income, taxable-equivalent basis (b)

|

|

$ |

863 |

|

|

$ |

629 |

|

| Noninterest income

|

|

|

967 |

|

|

|

991 |

|

| Total revenue

|

|

$ |

1,830 |

|

|

$ |

1,620 |

|

| Noninterest expense

|

|

$ |

1,042 |

|

|

$ |

944 |

|

| Net income

|

|

$ |

377 |

|

|

$ |

459 |

|

| Per common share

|

|

|

|

|

|

|

|

|

| Diluted earnings

|

|

$ |

1.09 |

|

|

$ |

1.46 |

|

| Cash dividends declared

|

|

$ |

.63 |

|

|

$ |

.55 |

|

| SELECTED RATIOS

|

|

|

|

|

|

|

|

|

| Net interest margin

|

|

|

3.09 |

% |

|

|

2.95 |

% |

| Noninterest income to total revenue (c)

|

|

|

53 |

|

|

|

61 |

|

| Efficiency (d)

|

|

|

57 |

|

|

|

58 |

|

| Return on

|

|

|

|

|

|

|

|

|

| Average tangible common shareholders equity

|

|

|

25.98 |

% |

|

|

26.63 |

% |

| Average common shareholders equity

|

|

|

10.62 |

|

|

|

15.59 |

|

| Average assets

|

|

|

1.08 |

|

|

|

1.73 |

|

See page 37 for a glossary of certain terms used in this Report.

| (a) |

The Executive Summary and Consolidated Income Statement Review portions of the Financial Review section of this Report provide information regarding items impacting the

comparability of the periods presented. |

| (b) |

The interest income earned on certain assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than

taxable investments. To provide more meaningful comparisons of yields and margins for all earning assets, we also provide revenue on a taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent

to interest income earned on taxable investments. This adjustment is not permitted under GAAP in the Consolidated Income Statement. |

The

following is a reconciliation of net interest income as reported in the Consolidated Income Statement to net interest income on a taxable-equivalent basis (in millions):

|

|

|

|

|

|

|

| |

|

Three months ended

March 31 |

|

|

|

2008 |

|

2007 |

| Net interest income, GAAP basis

|

|

$ |

854 |

|

$ |

623 |

| Taxable-equivalent adjustment

|

|

|

9 |

|

|

6 |

| Net interest income, taxable-equivalent basis

|

|

$ |

863 |

|

$ |

629 |

| (c) |

Calculated as noninterest income divided by the sum of net interest income (GAAP basis) and noninterest income. |

| (d) |

Calculated as noninterest expense divided by the sum of net interest income (GAAP basis) and noninterest income. |

1

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited |

|

March 31

2008 |

|

|

December 31

2007 |

|

|

March 31

2007 |

|

| BALANCE SHEET DATA (dollars in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets

|

|

$ |

139,991 |

|

|

$ |

138,920 |

|

|

$ |

122,563 |

|

| Loans, net of unearned income

|

|

|

70,802 |

|

|

|

68,319 |

|

|

|

62,925 |

|

| Allowance for loan and lease losses

|

|

|

865 |

|

|

|

830 |

|

|

|

690 |

|

| Securities available for sale

|

|

|

28,581 |

|

|

|

30,225 |

|

|

|

26,475 |

|

| Loans held for sale

|

|

|

2,516 |

|

|

|

3,927 |

|

|

|

2,382 |

|

| Goodwill and other intangibles

|

|

|

9,349 |

|

|

|

9,551 |

|

|

|

8,668 |

|

| Equity investments

|

|

|

6,187 |

|

|

|

6,045 |

|

|

|

5,408 |

|

| Deposits

|

|

|

80,410 |

|

|

|

82,696 |

|

|

|

77,367 |

|

| Borrowed funds

|

|

|

32,779 |

|

|

|

30,931 |

|

|

|

20,456 |

|

| Shareholders equity

|

|

|

14,423 |

|

|

|

14,854 |

|

|

|

14,739 |

|

| Common shareholders equity

|

|

|

14,416 |

|

|

|

14,847 |

|

|

|

14,732 |

|

| Book value per common share

|

|

|

42.26 |

|

|

|

43.60 |

|

|

|

42.63 |

|

| Common shares outstanding (millions)

|

|

|

341 |

|

|

|

341 |

|

|

|

346 |

|

| Loans to deposits

|

|

|

88 |

% |

|

|

83 |

% |

|

|

81 |

% |

|

|

|

|

| ASSETS ADMINISTERED (billions)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Managed

|

|

$ |

65 |

|

|

$ |

73 |

|

|

$ |

76 |

|

| Nondiscretionary

|

|

|

111 |

|

|

|

113 |

|

|

|

111 |

|

|

|

|

|

| FUND ASSETS SERVICED (billions)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounting/administration net assets

|

|

$ |

1,000 |

|

|

$ |

990 |

|

|

$ |

822 |

|

| Custody assets

|

|

|

476 |

|

|

|

500 |

|

|

|

435 |

|

|

|

|

|

| CAPITAL RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 risk-based (a)

|

|

|

7.7 |

% |

|

|

6.8 |

% |

|

|

8.6 |

% |

| Total risk-based (a)

|

|

|

11.4 |

|

|

|

10.3 |

|

|

|

12.2 |

|

| Leverage (a)

|

|

|

6.8 |

|

|

|

6.2 |

|

|

|

8.7 |

|

| Tangible common equity

|

|

|

4.7 |

|

|

|

4.7 |

|

|

|

5.8 |

|

| Common shareholders equity to assets

|

|

|

10.3 |

|

|

|

10.7 |

|

|

|

12.0 |

|

|

|

|

|

| ASSET QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total loans

|

|

|

.77 |

% |

|

|

.64 |

% |

|

|

.28 |

% |

| Nonperforming assets to total loans and foreclosed assets

|

|

|

.83 |

|

|

|

.70 |

|

|

|

.32 |

|

| Nonperforming assets to total assets

|

|

|

.42 |

|

|

|

.34 |

|

|

|

.17 |

|

| Net charge-offs to average loans

|

|

|

.57 |

|

|

|

.49 |

|

|

|

.27 |

|

| Allowance for loan and lease losses to loans

|

|

|

1.22 |

|

|

|

1.21 |

|

|

|

1.10 |

|

| Allowance for loan and lease losses to nonperforming loans

|

|

|

159 |

|

|

|

190 |

|

|

|

388 |

|

| (a) |

The regulatory minimums are 4.0% for Tier 1, 8.0% for Total, and 4.0% for Leverage ratios. The well-capitalized levels are 6.0% for Tier 1, 10.0% for Total, and 5.0% for Leverage

ratios. |

2

FINANCIAL REVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review should be read together with our unaudited Consolidated Financial Statements and unaudited Statistical Information included elsewhere in this

Report and with Items 6, 7, 8 and 9A of our 2007 Annual Report on Form 10-K (2007 Form 10-K). We have reclassified certain prior period amounts to conform with the current period presentation. For information regarding certain business

and regulatory risks, see the Risk Management section in this Financial Review and Items 1A and 7 of our 2007 Form 10-K and Item 1A included in Part II of this Report. Also, see the Cautionary Statement Regarding Forward-Looking Information and

Critical Accounting Policies And Judgments sections in this Financial Review for certain other factors that could cause actual results or future events to differ, perhaps materially, from historical performance and those anticipated in the

forward-looking statements included in this Report. See Note 16 Segment Reporting in the Notes To Consolidated Financial Statements included in Part I, Item 1 of this Report for a reconciliation of total business segment earnings to total PNC

consolidated net income as reported on a generally accepted accounting principles (GAAP) basis.

EXECUTIVE SUMMARY

THE PNC FINANCIAL SERVICES

GROUP, INC.

PNC is one of the largest diversified financial services companies in the United States based on assets,

with businesses engaged in retail banking, corporate and institutional banking, asset management, and global fund processing services. We provide many of our products and services nationally and others in our primary geographic markets located in

Pennsylvania, New Jersey, Washington, DC, Maryland, Virginia, Ohio, Kentucky and Delaware. We also provide certain fund processing services internationally.

KEY STRATEGIC GOALS

Our strategy to enhance shareholder value centers on driving

positive operating leverage by achieving growth in revenue from our diverse business mix that exceeds growth in expenses as a result of disciplined cost management. In each of our business segments, the primary drivers of revenue growth are the

acquisition, expansion and retention of customer relationships. We strive to expand our customer base by offering convenient banking options and leading technology systems, providing a broad range of fee-based products and services, focusing on

customer service, and through a significantly enhanced branding initiative. We may also grow revenue through appropriate and targeted acquisitions and, in certain businesses, by expanding into new geographical markets.

A volatile and significantly challenging financial market environment began in 2007 and has continued into 2008, and has been accompanied by uncertain prospects for the

overall national economy. We are focused on our strategies for growth. We remain committed to maintaining a moderate risk profile characterized by disciplined credit management and limited exposure to earnings volatility resulting from interest rate

fluctuations and the shape of the interest rate yield curve. Our actions have created a well-positioned and strong balance sheet, ample liquidity and investment flexibility to adjust, where appropriate, to changing interest rates and market

conditions. We continue to be disciplined in investing capital in our businesses while returning a portion to shareholders through dividends and share repurchases when appropriate.

ACQUISITION AND DIVESTITURE ACTIVITY

On March 31, 2008, we sold

J.J.B. Hilliard, W.L. Lyons, LLC (Hilliard Lyons), a Louisville, Kentucky-based wholly-owned subsidiary of PNC and a full-service brokerage and financial services provider, to Houchens Industries, Inc. We recognized an after-tax gain of

$23 million in the first quarter of 2008 in connection with this divestiture.

On April 4, 2008, we acquired Lancaster, Pennsylvania-based Sterling

Financial Corporation (Sterling) for approximately 4.6 million shares of PNC common stock and $224 million in cash. Sterling is a banking and financial services company with approximately $3.2 billion in assets, $2.7 billion in

deposits, and 67 branches in south-central Pennsylvania, northern Maryland and northern Delaware.

KEY FACTORS

AFFECTING FINANCIAL PERFORMANCE

Our financial performance is substantially affected by several

external factors outside of our control, including:

| |

|

|

General economic conditions,

|

| |

|

|

The level of, and direction, timing and magnitude of movement in interest rates, and the shape of the interest rate yield curve,

|

| |

|

|

The functioning and other performance of, and availability of liquidity in, the capital and other financial markets,

|

| |

|

|

Loan demand, utilization of credit commitments and standby letters of credit, and asset quality,

|

| |

|

|

Customer demand for other products and services,

|

| |

|

|

Movement of customer deposits from lower to higher rate accounts or to investment alternatives, and

|

| |

|

|

The impact of market credit spreads on asset valuations.

|

Starting in the middle of 2007, and continuing at present, there has been significant turmoil and volatility in worldwide financial markets, accompanied by uncertain prospects for the overall national economy. Our performance for the

remainder of 2008 will be impacted by developments in these areas. In addition, our success in 2008 will depend, among other things, upon:

| |

|

|

Further success in the acquisition, growth and retention of customers,

|

3

| |

|

|

The successful integration of our recent acquisitions,

|

| |

|

|

Continued development of the Mercantile franchise, including full deployment of our product offerings,

|

| |

|

|

A sustained focus on expense management and creating positive operating leverage,

|

| |

|

|

Maintaining solid overall asset quality,

|

| |

|

|

Prudent risk and capital management, and

|

| |

|

|

Actions we take within the capital and other financial markets.

|

SUMMARY FINANCIAL RESULTS

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

|

|

March 31,

2008 |

|

|

March 31,

2007 |

|

| Net income (millions)

|

|

$ |

377 |

|

|

$ |

459 |

|

| Diluted earnings per share

|

|

$ |

1.09 |

|

|

$ |

1.46 |

|

| Return on

|

|

|

|

|

|

|

|

|

| Average tangible common shareholders equity

|

|

|

25.98 |

% |

|

|

26.63 |

% |

| Average common shareholders equity

|

|

|

10.62 |

% |

|

|

15.59 |

% |

| Average assets

|

|

|

1.08 |

% |

|

|

1.73 |

% |

The decline in earnings for the first quarter of 2008 compared with the first quarter of 2007 reflected a higher

provision for credit losses in 2008, partially offset by an increase in operating leverage as the increase in net interest income exceeded the decline in noninterest income and increase in noninterest expense. Our Consolidated Income Statement

Review section of this Financial Review describes in greater detail the various items that impacted our results for the first quarter of 2008 and 2007.

Highlights of the first quarter of 2008 included the following:

| |

|

|

We continued to grow revenue while controlling noninterest expense, creating positive operating leverage. Revenue growth of 13% exceeded noninterest expense growth

of 10% in the year-over-year comparison.

|

| |

|

|

Net interest income on a taxable-equivalent basis grew 37% in the first quarter of 2008 compared with the first quarter of 2007. The net interest margin improved to

3.09% compared with 2.95% in the first quarter of 2007. Noninterest income declined 2% compared with the first quarter of 2007 as several increases in fee income were more than offset by valuation and trading losses.

|

| |

|

|

Average loans for the first quarter increased 28% over first quarter 2007, while average deposits increased 17% in the comparison.

|

| |

|

|

Overall asset quality remained solid despite the impact of the challenging credit environment. The allowance for loan and lease losses was 1.22% of total loans at

March 31, 2008 and 1.21% at December 31, 2007.

|

| |

|

|

PNC maintained a strong liquidity position and continued to be well capitalized, building the Tier 1 risk-based capital ratio to 7.7% at March 31, 2008

compared with 6.8% at December 31, 2007. In April 2008, we announced a 5% increase of the cash dividend on common stock to 66 cents per share in recognition of the current market environment and reflecting confidence in our ability to grow

earnings.

|

BALANCE SHEET HIGHLIGHTS

Total assets were $140.0 billion at March 31, 2008 compared with $138.9 billion at December 31, 2007. Total average assets were $140.6 billion for the first

three months of 2008 compared with $107.4 billion for the first three months of 2007. This increase reflected a $26.1 billion increase in average interest-earning assets and a $7.1 billion increase in average noninterest-earning assets. An increase

of $15.3 billion in loans and a $6.6 billion increase in securities available for sale were the primary factors for the increase in average interest-earning assets.

The increase in average noninterest-earning assets for the first quarter of 2008 reflected an increase in average goodwill of $3.6 billion primarily related to the acquisition of Mercantile on March 2, 2007 and

Yardville on October 26, 2007.

The impact of the Mercantile and Yardville acquisitions is also reflected in our year-over-year increases in average

total loans, average securities available for sale and average total deposits described further below.

Average total loans were $69.3 billion for the

first three months of 2008 and $54.1 billion in the first three months of 2007. The increase in average total loans included growth in commercial loans of $7.7 billion and growth in commercial real estate loans of $3.5 billion. Loans represented 62%

of average interest-earning assets for the first three months of 2008 and 63% for the first three months of 2007.

Average securities available for sale

totaled $30.0 billion for the first quarter of 2008 and $23.4 billion for the first quarter of 2007. Average residential and commercial mortgage-backed securities increased $5.5 billion on a combined basis in the comparison. Securities available for

sale comprised 27% of average interest-earning assets for both the first three months of 2008 and 2007.

Average total deposits were $81.6 billion for the

first three months of 2008, an increase of $11.9 billion over the first three months of 2007. Average deposits grew from the prior year period primarily as a result of increases in money market accounts, time deposits in foreign offices, other time

deposits, and demand and other noninterest-bearing deposits.

Average total deposits represented 58% of average total assets for the first three months of

2008 and 65% for the first three months of 2007. Average transaction deposits were $52.5 billion for the first quarter of 2008 compared with $47.0 billion for the first quarter of 2007.

4

Average borrowed funds were $32.1 billion for the first three months of 2008 and $16.8 billion for the first three months of 2007. Increases of $8.2 billion in Federal Home Loan Bank borrowings, $2.6 billion in bank notes and senior debt

and $2.4 billion in other borrowed funds drove the increase compared with the first quarter of 2007.

Shareholders equity totaled $14.4 billion at

March 31, 2008 compared with $14.9 billion at December 31, 2007. See the Consolidated Balance Sheet Review section of this Financial Review for additional information.

BUSINESS SEGMENT HIGHLIGHTS

Total business segment earnings

decreased $103 million for the first quarter of 2008, to $313 million, compared with the first quarter of 2007. Highlights of results for the first three months of 2008 and 2007 are included below. The Business Segments Review section of this

Financial Review includes further analysis of our business segment results over these periods.

We provide a reconciliation of total business segment

earnings to total PNC consolidated net income as reported on a GAAP basis in Note 16 Segment Reporting in the Notes To Consolidated Financial Statements in this Report.

Retail Banking

Retail Bankings earnings were $221 million for the first quarter of 2008 compared with $201

million for the same period in 2007. The 10% increase in earnings over the first quarter in 2007 was driven by acquisitions and gains related to our ownership interest in Visa and the Hilliard Lyons sale, partially offset by an increase in the

provision for credit losses.

Corporate & Institutional Banking

Corporate &

Institutional Banking earned $2 million in the first quarter of 2008 compared with $132 million in the first quarter of 2007. First quarter 2008 earnings were impacted by pretax valuation losses of $177 million on commercial mortgage loans and

commitments held for sale, net of hedges. The decrease compared with the first quarter of 2007 also resulted from higher provision for credit losses and noninterest expense somewhat offset by higher taxable-equivalent net interest income.

BlackRock

Our BlackRock business segment earned $60

million for the first quarter of 2008, a 15% increase compared with $52 million in the first quarter of 2007.

PFPC

PFPC earned $30 million for the first three months of 2008 compared with $31 million in the year-earlier period. While servicing revenue growth of 14% was realized

through new business, organic growth, and the completion of two acquisitions in December 2007, increased costs related to this growth and the acquisitions offset the increase.

Other

Other earnings for the first quarter of 2008 totaled $64 million compared with earnings of $43

million for the first quarter of 2007. The higher earnings in the first quarter of 2008 reflected growth in net interest income related to asset and liability management activity, net securities gains and the partial reversal of the Visa

indemnification liability, partially offset by net trading losses.

5

CONSOLIDATED INCOME STATEMENT REVIEW

Our Consolidated Income

Statement is presented in Part I, Item 1 of this Report. Total revenue for the first quarter of 2008 increased 13% compared with the first quarter of 2007. We created positive operating leverage as total noninterest expense increased 10% in the

comparison.

NET INTEREST INCOME AND NET INTEREST

MARGIN

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31 |

|

| Dollars in millions |

|

2008 |

|

|

2007 |

|

| Taxable-equivalent net interest income

|

|

$ |

863 |

|

|

$ |

629 |

|

| Net interest margin

|

|

|

3.09 |

% |

|

|

2.95 |

% |

We provide a reconciliation of net interest income as reported under GAAP to net interest income presented on a

taxable-equivalent basis in the Consolidated Financial Highlights section on page 1 of this Report.

Changes in net interest income and margin result from

the interaction of the volume and composition of interest-earning assets and related yields, interest-bearing liabilities and related rates paid, and noninterest-bearing sources of funding. See the Statistical Information-Average Consolidated

Balance Sheet And Net Interest Analysis section of this Report for additional information.

The 37% increase in taxable-equivalent net interest income for

the first three months of 2008 compared with the first three months of 2007 was consistent with the $26.1 billion, or 31%, increase in average interest-earning assets and wider net interest margin over this period. The reasons driving the higher

interest-earning assets in the comparison are further discussed in the Balance Sheet Highlights portion of the Executive Summary section of this Financial Review.

We expect net interest income to be at least 20% higher for full year 2008 compared with 2007, assuming our current expectations for interest rates and economic conditions. Our forward-looking statements are based on our current

expectations that interest rates will remain low through most of 2008 with continued wide market credit spreads and our view that national economic conditions currently point toward a mild recession.

The net interest margin was 3.09% for the first quarter of 2008 and 2.95% for the first quarter of 2007. The following factors impacted the comparison:

| |

|

|

The Mercantile acquisition.

|

| |

|

|

A decrease in the rate paid on interest-bearing liabilities of 78 basis points. The rate paid on interest-bearing deposits, the single largest component, decreased

70 basis points.

|

| |

|

|

These factors were partially offset by a 40 basis point decrease in the yield on interest-earning assets. The

|

| |

yield on loans, the single largest component, decreased 50 basis points.

|

| |

|

|

In addition, the impact of noninterest-bearing sources of funding decreased 24 basis points due to lower interest rates and a lower proportion of

noninterest-bearing sources of funding to interest-earning assets.

|

Comparing yields and rates paid to the broader market, during the

first three months of 2008, the average federal funds rate was 3.17% compared with 5.26% for the first three months of 2007.

We believe that net interest

margins for our industry will continue to be impacted by competition for high quality loans and deposits and customer migration from lower to higher rate deposit or other products. We expect our net interest margin to improve for full year 2008

compared with 2007, assuming our current expectations for interest rates and economic conditions.

PROVISION FOR

CREDIT LOSSES

The provision for credit losses totaled $151 million for the first quarter of 2008 compared with $8

million for the first quarter of 2007. The higher provision in the comparison was driven by general credit quality migration, especially in our commercial real estate portfolio, including residential real estate development exposure, and growth in

total credit exposure. Total residential real estate development outstandings were approximately $2.1 billion at March 31, 2008.

Given our

projections for loan growth and continued credit deterioration, and our view that national economic conditions currently point toward a mild recession, we expect that the provision for credit losses will be approximately $600 million for full year

2008, including the impact of the Sterling acquisition.

The Credit Risk Management portion of the Risk Management section of this Financial Review

includes additional information regarding factors impacting the provision for credit losses.

NONINTEREST INCOME

Summary

Noninterest income totaled

$967 million for the first three months of 2008 compared with $991 million for the first three months of 2007.

Noninterest income for the first quarter of

2008 included the following items:

| |

|

|

A gain of $114 million from the sale of Hilliard Lyons,

|

| |

|

|

A gain of $95 million related to the redemption of a portion of our Visa Class B common shares related to Visas March 2008 initial public offering,

|

6

| |

|

|

Net securities gains of $41 million,

|

| |

|

|

Gains of $40 million related to our equity investment in BlackRock, largely due to a net mark-to-market adjustment on our remaining BlackRock LTIP shares

obligation,

|

| |

|

|

Equity management gains of $23 million,

|

| |

|

|

Valuation losses related to our commercial mortgage loans and commitments held for sale, net of hedges, of $177 million, and

|

| |

|

|

Trading losses of $76 million.

|

Noninterest income

for the first quarter of 2007 included the following:

| |

|

|

A net gain related to our equity investment in BlackRock of $52 million, representing an $82 million gain recognized in connection with our transfer of BlackRock

shares to satisfy a portion of our 2002 LTIP obligation, partially offset by a net mark-to-market adjustment totaling $30 million on our remaining BlackRock LTIP shares obligation,

|

| |

|

|

Trading income of $52 million, and

|

| |

|

|

Equity management gains of $32 million and net securities losses of $3 million.

|

Apart from the impact of these items, noninterest income increased $49 million, or 6%, for the first three months of 2008 compared with the first three months of 2007.

Additional Analysis

Fund servicing fees increased $25

million, to $228 million, in the first three months of 2008 compared with the first three months of 2007. This increase primarily resulted from the growth in PFPCs offshore operations and its acquisitions of Albridge Solutions Inc. and Coates

Analytics, LP in December 2007.

PFPC provided fund accounting/administration services for $1 trillion of net fund investment assets and provided custody

services for $476 billion of fund investment assets at March 31, 2008, compared with $822 billion and $435 billion, respectively, at March 31, 2007. PFPC continued to see both organic growth and growth from new business in each of its

product areas.

Asset management fees totaled $212 million in the first quarter of 2008, an increase of $47 million compared with the first quarter of

2007. Higher equity earnings from our BlackRock investment and the full quarter impact in 2008 of Mercantile, which we acquired in March 2007, drove the increase compared with the first quarter of 2007. Assets managed at March 31, 2008 totaled

$65 billion compared with $76 billion at March 31, 2007. The decline in assets under management was primarily due to the effects of the Hilliard Lyons sale and comparatively lower equity markets in the first quarter of 2008.

Consumer services fees grew $13 million, to $170 million, for the first quarter of 2008 compared with the first quarter of

2007. This increase reflected the impact of Mercantile and higher debit card revenues resulting from higher transaction volumes.

Corporate services revenue totaled $164 million in the first three months of 2008 compared with $159 million in the first three months of 2007. Higher revenue from

treasury management and third party consumer loan servicing activities, along with the full quarter impact of Mercantile, were the primary factors in the increase.

Service charges on deposits grew $5 million, to $82 million, in the first three months of 2008 compared with the first three months of 2007. The increase reflected the full quarter impact in 2008 of Mercantile.

Net securities gains totaled $41 million for the first quarter of 2008 compared with net securities losses of $3 million in the first quarter of 2007.

Other noninterest income totaled $70 million for the first three months of 2008 compared with $233 million for the first three months of 2007.

Other noninterest income for 2008 included the $114 million gain from the sale of Hilliard Lyons, the $95 million gain from the redemption of a portion of our investment

in Visa related to their March 2008 initial public offering, and gains of $40 million related to our equity investment in BlackRock as described above. The impact of these items was more than offset by valuation losses related to our commercial

mortgage loans and commitments held for sale, net of hedges, of $177 million, and trading losses of $76 million.

The net gain related to our equity

investment in BlackRock of $52 million and trading income of $52 million were included in other noninterest income for the first quarter of 2007.

Additional information regarding our transactions related to Visa is included in Note 15 Commitments And Guarantees in the Notes To Consolidated Financial Statements included in this Report. Further details regarding our trading activities

are included in the Market Risk Management Trading Risk portion of the Risk Management section of this Financial Review.

Other noninterest income

typically fluctuates from period to period depending on the nature and magnitude of transactions completed.

We expect that total revenue will increase by

a low teens percentage for full year 2008 compared with full year 2007, assuming our current expectations for interest rates and economic conditions. We also expect PNC to create positive operating leverage for full year 2008 with a percentage

growth in total revenue relative to 2007 that will exceed the percentage growth in noninterest expense from 2007.

7

PRODUCT REVENUE

In addition to credit and deposit products for commercial customers,

Corporate & Institutional Banking offers other services, including treasury management and capital markets-related products and services, and commercial loan servicing that are marketed by several businesses across PNC.

Revenue from capital markets-related products and services totaled $76 million in the first quarter of 2008 compared with $67 million in the first quarter of 2007. This

increase was primarily driven by strong customer derivative activity partially offset by a decline in merger and acquisition advisory fees.

Treasury

management revenue, which includes fees as well as net interest income from customer deposit balances, increased 21% to $133 million in the first quarter of 2008 compared with $110 million for the first quarter of 2007. The higher revenue reflected

the impact of Mercantile and strong growth in the commercial payment card services business and in investment products.

Commercial mortgage banking

activities include revenue derived from loan originations, commercial mortgage servicing, direct loan sales, and mark-to-market valuation adjustments and related hedging activities for held for sale commercial mortgage loans intended for

securitization. Commercial mortgage banking activities resulted in a net loss of $96 million in the first quarter of 2008, including valuation losses of $177 million on commercial mortgage loans and commitments held for sale, net of hedges, due to

the impact of an illiquid market. Excluding these losses, commercial mortgage banking activities revenue was $81 million in the first quarter of 2008 compared with $73 million in the first quarter of 2007. This increase was largely due to higher net

interest income from a larger portfolio of commercial mortgage loans held for sale.

As a component of our advisory services to clients, we provide a

select set of insurance products to fulfill specific customer financial needs. Primary insurance offerings include annuities, life, credit life, health, and disability. Revenue from these products totaled $18 million for the first three months of

both 2008 and 2007.

PNC, through its subsidiary company Alpine Indemnity Limited, participates as a direct writer for its general liability, automobile

liability, workers compensation, property and terrorism insurance programs. In the normal course of business, Alpine Indemnity Limited maintains insurance reserves for reported claims and for claims incurred but not reported based on actuarial

assessments. We believe these reserves were adequate at March 31, 2008.

NONINTEREST EXPENSE

Total noninterest expense was $1.042 billion for the first quarter of 2008 and $944 million for the first quarter of 2007. Noninterest expense for 2008

included the reversal of $43 million of the Visa indemnification liability that we established in the fourth quarter of 2007.

Apart from the impact of

this item, noninterest expense increased $141 million, or 15%, in the first three months of 2008 compared with the first three months of 2007. The higher noninterest expense in 2008 resulted from Mercantile and Yardville operating and Yardville

integration costs, and investments in growth initiatives while maintaining disciplined expense management. Additional information regarding our transactions related to Visa is included in Note 15 Commitments and Guarantees in the Notes To

Consolidated Financial Statements included in this Report.

We expect noninterest expense to grow at a mid-single digit percentage for full year 2008

compared with 2007.

PERIOD-END EMPLOYEES

|

|

|

|

|

|

|

| |

|

March 31 2008 |

|

December 31 2007 |

|

March 31 2007 |

| Full-time

|

|

24,492 |

|

25,480 |

|

24,828 |

| Part-time

|

|

2,843 |

|

2,840 |

|

2,867 |

|

|

|

| Total

|

|

27,335 |

|

28,320 |

|

27,695 |

Statistics at March 31, 2008 exclude 994 Hilliard Lyons employees as we sold Hilliard Lyons on that date.

EFFECTIVE TAX RATE

Our effective tax rate was 40.0% for the first quarter of 2008 and 30.7% for the first quarter of 2007. The higher effective tax rate for the first quarter of 2008 was due to taxes associated with the gain on the sale

of Hilliard Lyons. We expect our effective tax rate to be approximately 31% for the remainder of 2008.

8

CONSOLIDATED BALANCE SHEET REVIEW

SUMMARIZED BALANCE SHEET DATA

|

|

|

|

|

|

|

| In millions |

|

March 31

2008 |

|

December 31

2007 |

| Assets

|

|

|

|

|

|

|

| Loans, net of unearned income

|

|

$ |

70,802 |

|

$ |

68,319 |

| Securities available for sale

|

|

|

28,581 |

|

|

30,225 |

| Cash and short-term investments

|

|

|

10,078 |

|

|

10,425 |

| Loans held for sale

|

|

|

2,516 |

|

|

3,927 |

| Equity investments

|

|

|

6,187 |

|

|

6,045 |

| Goodwill and other intangible assets

|

|

|

9,349 |

|

|

9,551 |

| Other

|

|

|

12,478 |

|

|

10,428 |

| |

| Total assets

|

|

$ |

139,991 |

|

$ |

138,920 |

| Liabilities

|

|

|

|

|

|

|

| Funding sources

|

|

$ |

113,189 |

|

$ |

113,627 |

| Other

|

|

|

10,371 |

|

|

8,785 |

| |

| Total liabilities

|

|

|

123,560 |

|

|

122,412 |

| Minority and noncontrolling interests in consolidated entities

|

|

|

2,008 |

|

|

1,654 |

| Total shareholders equity

|

|

|

14,423 |

|

|

14,854 |

| |

| Total liabilities, minority and noncontrolling interests, and shareholders

equity

|

|

$ |

139,991 |

|

$ |

138,920 |

The summarized balance sheet data above is based upon our Consolidated Balance Sheet that is presented in Part I,

Item 1 of this Report.

Various seasonal and other factors impact our period-end balances whereas average balances (discussed under the Balance Sheet

Highlights section of this Financial Review above and included in the Statistical Information section of this Report) are more indicative of underlying business trends.

An analysis of changes in certain balance sheet categories follows.

LOANS, NET

OF UNEARNED INCOME

Loans increased $2.5 billion, to $70.8 billion, at March 31, 2008 compared

with the balance at December 31, 2007. In February 2008, we transferred the education loans in our held for sale portfolio to the loan portfolio as further described in the Loans Held For Sale section of this Consolidated Balance Sheet Review.

Details Of Loans

|

|

|

|

|

|

|

|

|

| In millions |

|

March 31

2008 |

|

|

December 31

2007 |

|

| Commercial

|

|

|

|

|

|

|

|

|

| Retail/wholesale

|

|

$ |

6,298 |

|

|

$ |

5,973 |

|

| Manufacturing

|

|

|

5,170 |

|

|

|

4,705 |

|

| Other service providers

|

|

|

3,563 |

|

|

|

3,529 |

|

| Real estate related (a)

|

|

|

5,701 |

|

|

|

5,425 |

|

| Financial services

|

|

|

1,390 |

|

|

|

1,268 |

|

| Health care

|

|

|

1,605 |

|

|

|

1,446 |

|

| Other

|

|

|

5,912 |

|

|

|

6,261 |

|

| Total commercial

|

|

|

29,639 |

|

|

|

28,607 |

|

| Commercial real estate

|

|

|

|

|

|

|

|

|

| Real estate projects

|

|

|

6,448 |

|

|

|

6,114 |

|

| Mortgage

|

|

|

2,603 |

|

|

|

2,792 |

|

| Total commercial real estate

|

|

|

9,051 |

|

|

|

8,906 |

|

| Lease financing

|

|

|

3,464 |

|

|

|

3,500 |

|

| Total commercial lending

|

|

|

42,154 |

|

|

|

41,013 |

|

| Consumer

|

|

|

|

|

|

|

|

|

| Home equity

|

|

|

14,315 |

|

|

|

14,447 |

|

| Education

|

|

|

2,024 |

|

|

|

132 |

|

| Automobile

|

|

|

1,533 |

|

|

|

1,513 |

|

| Other

|

|

|

2,156 |

|

|

|

2,234 |

|

| Total consumer

|

|

|

20,028 |

|

|

|

18,326 |

|

| Residential mortgage

|

|

|

9,299 |

|

|

|

9,557 |

|

| Other

|

|

|

272 |

|

|

|

413 |

|

| Unearned income

|

|

|

(951 |

) |

|

|

(990 |

) |

| Total, net of unearned income

|

|

$ |

70,802 |

|

|

$ |

68,319 |

|

| (a) |

Includes loans related to customers in the real estate and construction industries. |

Total loans represented 51% of total assets at March 31, 2008 and 49% of total assets at December 31, 2007.

Our

total loan portfolio continued to be diversified among numerous industries and types of businesses. The loans that we hold are also concentrated in, and diversified across, our principal geographic markets.

Approximately $2.1 billion of the $6.5 billion of real estate projects loans at March 31, 2008 were in residential real estate development. These represented

approximately 3% of total loans and 2% of total assets at March 31, 2008.

Our home equity loan outstandings totaled $14.3 billion at March 31,

2008. In this portfolio, we consider the higher risk loans to be those with a recent FICO credit score of less than or equal to 660 and a loan-to-value ratio greater than or equal to 90%. We had $569 million or approximately 4% of the total

portfolio in this grouping at March 31, 2008. Consistent with the entire home equity portfolio, approximately 93% of these higher-risk loans are located in our geographic footprint. In our $9.3 billion residential mortgage portfolio, loans with

a recent FICO credit score of less than or equal to 660 and a loan-to-value ratio greater than or equal to 90% totaled $105 million and comprised approximately 1% of the total at March 31, 2008.

9

Commercial lending outstandings in the table above are the largest category and are the most sensitive to changes in assumptions and judgments underlying the determination of the allowance for loan and lease losses. We have allocated

approximately $777 million, or 90%, of the total allowance for loan and lease losses at March 31, 2008 to these loans. We allocated $77 million, or 9%, of the remaining allowance at that date to consumer loans and $11 million, or 1%, to all

other loans. This allocation also considers other relevant factors such as:

| |

|

|

Actual versus estimated losses,

|

| |

|

|

Regional and national economic conditions,

|

| |

|

|

Business segment and portfolio concentrations,

|

| |

|

|

The impact of government regulations, and

|

| |

|

|

Risk of potential estimation or judgmental errors, including the accuracy of risk ratings.

|

Net Unfunded Credit Commitments

|

|

|

|

|

|

|

| In millions |

|

March 31

2008 |

|

December 31

2007 |

| Commercial

|

|

$ |

38,402 |

|

$ |

39,171 |

| Consumer

|

|

|

11,075 |

|

|

10,875 |

| Commercial real estate

|

|

|

2,652 |

|

|

2,734 |

| Other

|

|

|

297 |

|

|

567 |

| Total

|

|

$ |

52,426 |

|

$ |

53,347 |

Unfunded commitments are concentrated in our primary geographic markets. Commitments to extend credit represent

arrangements to lend funds or provide liquidity subject to specified contractual conditions. Commercial commitments are reported net of participations, assignments and syndications, primarily to financial institutions, totaling $7.9 billion at

March 31, 2008 and $8.9 billion at December 31, 2007.

Unfunded liquidity facility commitments and standby bond purchase agreements totaled $9.4

billion at both March 31, 2008 and December 31, 2007 and are included in the preceding table primarily within the Commercial and Consumer categories.

In addition to credit commitments, our net outstanding standby letters of credit totaled $5.2 billion at March 31, 2008 and $4.8 billion at December 31, 2007. Standby letters of credit commit us to make

payments on behalf of our customers if specified future events occur.

SECURITIES AVAILABLE

FOR SALE

|

|

|

|

|

|

|

| In millions |

|

Amortized

Cost |

|

Fair Value |

| March 31, 2008

|

|

|

|

|

|

|

| Debt securities

|

|

|

|

|

|

|

| Residential mortgage-backed

|

|

$ |

20,510 |

|

$ |

19,333 |

| Commercial mortgage-backed

|

|

|

5,837 |

|

|

5,762 |

| Asset-backed

|

|

|

2,858 |

|

|

2,538 |

| US Treasury and government agencies

|

|

|

40 |

|

|

41 |

| State and municipal

|

|

|

581 |

|

|

561 |

| Other debt

|

|

|

108 |

|

|

108 |

| Corporate stocks and other

|

|

|

240 |

|

|

238 |

| Total securities available for sale

|

|

$ |

30,174 |

|

$ |

28,581 |

| December 31, 2007

|

|

|

|

|

|

|

| Debt securities

|

|

|

|

|

|

|

| Residential mortgage-backed

|

|

$ |

21,147 |

|

$ |

20,952 |

| Commercial mortgage-backed

|

|

|

5,227 |

|

|

5,264 |

| Asset-backed

|

|

|

2,878 |

|

|

2,770 |

| US Treasury and government agencies

|

|

|

151 |

|

|

155 |

| State and municipal

|

|

|

340 |

|

|

336 |

| Other debt

|

|

|

85 |

|

|

84 |

| Corporate stocks and other

|

|

|

662 |

|

|

664 |

| Total securities available for sale

|

|

$ |

30,490 |

|

$ |

30,225 |

Securities available for sale represented 20% of total assets at March 31, 2008 and 22% of total assets at

December 31, 2007.

We evaluate our portfolio of securities available for sale in light of changing market conditions and other factors and, where

appropriate, take steps intended to improve our overall positioning.

At March 31, 2008, securities available for sale included a net pretax

unrealized loss of $1.6 billion, which represented the difference between fair value and amortized cost. The comparable amount at December 31, 2007 was a net unrealized loss of $265 million. We believe that the majority of the decline in value

of these securities is attributable to changes in market spreads and not from deterioration in the credit quality of individual securities or underlying collateral where applicable. See Note 4 Securities in the Notes To Consolidated Financial

Statements included in this Report for further information.

10

Net unrealized gains and losses in the securities available for sale portfolio are included in shareholders equity as accumulated other comprehensive

income or loss, net of tax. The fair value of debt securities available for sale generally increases when market interest rates decrease and vice versa. Market values are also impacted by volatility and illiquidity.

The expected weighted-average life of securities available for sale (excluding corporate stocks and other) was 3 years and 6 months at both March 31, 2008 and

December 31, 2007.

We estimate that at March 31, 2008 the effective duration of securities available for sale was 3.5 years for an immediate 50

basis points parallel increase in interest rates and 3.3 years for an immediate 50 basis points parallel decrease in interest rates. Comparable amounts at December 31, 2007 were 2.8 years and 2.5 years, respectively.

LOANS HELD FOR SALE

|

|

|

|

|

|

|

| In millions |

|

March 31

2008 |

|

December 31

2007 |

| Commercial mortgage

|

|

$ |

2,268 |

|

$ |

2,116 |

| Residential mortgage

|

|

|

112 |

|

|

117 |

| Education

|

|

|

|

|

|

1,525 |

| Other

|

|

|

136 |

|

|

169 |

| Total

|

|

$ |

2,516 |

|

$ |

3,927 |

Commercial mortgage loans held for sale included loans intended for securitization of $2.1 billion at

March 31, 2008 and $2.0 billion at December 31, 2007 that were recorded at fair value. During the first quarter of 2008, we recorded a negative valuation adjustment for loans and commitments of $177 million, net of hedges. This loss was

reflected in the other noninterest income line item in our Consolidated Income Statement and in the results of the Corporate & Institutional Banking business segment. We value our commercial mortgage loans held for sale based on

securitization prices. In early 2008, spreads widened and there was limited activity in the commercial real estate loan securitization market. Therefore, if these conditions continue, additional valuation losses may be incurred. If spreads narrow,

we may realize valuation gains. However, we do not expect the impact to be significant to our capital position. Currently, these valuation losses are unrealized. We are not currently originating commercial mortgages for distribution through

commercial real estate loan securitizations. We intend to pursue opportunities to reduce our loans held for sale position when we can receive prices we feel are appropriate.

Historically, we classified substantially all of our education loans as loans held for sale. In the past, we have sold education loans to issuers of asset-backed paper when the loans are placed into repayment status.

Recently, the secondary markets for education loans have been impacted by liquidity issues similar to those for other asset classes. In February 2008, given this outlook and the economic and

customer relationship value inherent in this product, we transferred these loans at lower of cost or market value from held for sale to the loan portfolio.

We do not anticipate sales of education loans in the foreseeable future.

FUNDING AND CAPITAL

SOURCES

Details Of Funding Sources

|

|

|

|

|

|

|

| In millions |

|

March 31

2008 |

|

December 31

2007 |

| Deposits

|

|

|

|

|

|

|

| Money market

|

|

$ |

35,792 |

|

$ |

32,785 |

| Demand

|

|

|

19,168 |

|

|

20,861 |

| Retail certificates of deposit

|

|

|

16,050 |

|

|

16,939 |

| Savings

|

|

|

2,608 |

|

|

2,648 |

| Other time

|

|

|

4,716 |

|

|

2,088 |

| Time deposits in foreign offices

|

|

|

2,076 |

|

|

7,375 |

| Total deposits

|

|

|

80,410 |

|

|

82,696 |

| Borrowed funds

|

|

|

|

|

|

|

| Federal funds purchased

|

|

|

5,154 |

|

|

7,037 |

| Repurchase agreements

|

|

|

2,510 |

|

|

2,737 |

| Federal Home Loan Bank borrowings

|

|

|

9,663 |

|

|

7,065 |

| Bank notes and senior debt

|

|

|

6,842 |

|

|

6,821 |

| Subordinated debt

|

|

|

5,402 |

|

|

4,506 |

| Other

|

|

|

3,208 |

|

|

2,765 |

| Total borrowed funds

|

|

|

32,779 |

|

|

30,931 |

| Total

|

|

$ |

113,189 |

|

$ |

113,627 |

Total funding sources were relatively unchanged at March 31, 2008 compared with the balance at

December 31, 2007. Total deposits declined $2.3 billion, or 3%, as increases in money market and other time deposits were more than offset with declines in other categories, primarily time deposits in foreign offices. Total borrowed funds

increased $1.8 billion, or 6%, primarily due to the increase of $2.6 billion in Federal Home Loan Bank borrowings at March 31, 2008 compared with December 31, 2007. The increase in this category reduced our overnight borrowings. The

Liquidity Risk Management portion of the Risk Management section of this Financial Review includes additional information regarding our first quarter 2008 borrowed funds activities.

Capital

We manage our capital position by making adjustments to our balance sheet size and composition,

issuing debt, equity or hybrid instruments, executing treasury stock transactions, maintaining dividend policies and retaining earnings.

Total

shareholders equity decreased $.4 billion, to $14.4 billion, at March 31, 2008 compared with December 31, 2007. This decline was primarily due to a $.6 billion decrease in accumulated other comprehensive income (loss) which more than

offset the net impact of earnings and dividends in the first

11

quarter of 2008. The decrease in accumulated other comprehensive income (loss) was primarily due to higher net unrealized securities losses.

Common shares outstanding totaled 341 million at both March 31, 2008 and December 31, 2007. PNC issued 4.6 million common shares in April 2008 in

connection with the closing of the Sterling acquisition.

Our current common stock repurchase program permits us to purchase up to 25 million shares

of PNC common stock on the open market or in privately negotiated transactions. This program will remain in effect until fully utilized or until modified, superseded or terminated. The extent and timing of share repurchases under this program will

depend on a number of factors including, among others, market and general economic conditions, economic and regulatory capital considerations, alternative uses of capital, regulatory limitations resulting from merger activity, and the potential

impact on our credit ratings.

We did not purchase any shares during the first quarter of 2008 under this program. We do not expect to actively engage in

share repurchase activity for the foreseeable future as we look to enhance our capital position.

Risk-Based Capital

|

|

|

|

|

|

|

|

|

| Dollars in millions |

|

March 31

2008 |

|

|

December 31

2007 |

|

| Capital components

|

|

|

|

|

|

|

|

|

| Shareholders equity

|

|

|

|

|

|

|

|

|

| Common

|

|

$ |

14,416 |

|

|

$ |

14,847 |

|

| Preferred

|

|

|

7 |

|

|

|

7 |

|

| Trust preferred capital securities

|

|

|

1,021 |

|

|

|

572 |

|

| Minority interest

|

|

|

1,352 |

|

|

|

985 |

|

| Goodwill and other intangible assets

|

|

|

(8,668 |

) |

|

|

(8,853 |

) |

| Eligible deferred income taxes on intangible assets

|

|

|

113 |

|

|

|

119 |

|

| Pension, other postretirement benefit plan adjustments

|

|

|

149 |

|

|

|

177 |

|

| Net unrealized securities losses, after-tax

|

|

|

1,005 |

|

|

|

167 |

|

| Net unrealized (gains) losses on cash flow hedge derivatives, after-tax

|

|

|

(356 |

) |

|

|

(175 |

) |

| Equity investments in

nonfinancial companies

|

|

|

(32 |

) |

|

|

(31 |

) |

| Tier 1 risk-based capital

|

|

|

9,007 |

|

|

|

7,815 |

|

| Subordinated debt

|

|

|

3,298 |

|

|

|

3,024 |

|

| Eligible allowance for credit losses

|

|

|

1,017 |

|

|

|

964 |

|

| Total risk-based capital

|

|

$ |

13,322 |

|

|

$ |

11,803 |

|

| Assets

|

|

|

|

|

|

|

|

|

| Risk-weighted assets, including off- balance sheet instruments and market risk equivalent assets

|

|

$ |

117,041 |

|

|

$ |

115,132 |

|

| Adjusted average total assets

|

|

|

132,219 |

|

|

|

126,139 |

|

| Capital ratios

|

|

|

|

|

|

|

|

|

| Tier 1 risk-based

|

|

|

7.7 |

% |

|

|

6.8 |

% |

| Total risk-based

|

|

|

11.4 |

|

|

|

10.3 |

|

| Leverage

|

|

|

6.8 |

|

|

|

6.2 |

|

| Tangible common equity

|

|

|

|

|

|

|

|

|

| Common shareholders equity

|

|

$ |

14,416 |

|

|

$ |

14,847 |

|

| Goodwill and other intangibles

|

|

|

(8,668 |

) |

|

|

(8,853 |

) |

| Total deferred income taxes on goodwill and other intangible assets (a)

|

|

|

393 |

|

|

|

119 |

|

| Tangible common equity

|

|

$ |

6,141 |

|

|

$ |

6,113 |

|

| Total assets excluding goodwill and other intangible assets, net of deferred income taxes

|

|

$ |

131,716 |

|

|

$ |

130,185 |

|

| Tangible common equity ratio

|

|

|

4.7 |

% |

|

|

4.7 |

% |

| (a) |

As of March 31, 2008, deferred taxes on taxable combinations were added to eligible deferred income taxes for non-taxable combinations that are used in the calculation of

Regulatory Capital Ratios. |

The access to, and cost of, funding new business initiatives including acquisitions, the ability to engage in

expanded business activities, the ability to pay dividends, the level of deposit insurance costs, and the level and nature of regulatory oversight depend, in part, on a financial institutions capital strength. At March 31, 2008, each of

our domestic banking subsidiaries was considered well-capitalized based on US regulatory capital ratio requirements, as indicated in the Capital Ratios section of Consolidated Financial Highlights on page 2 of this Report. We believe our

current bank subsidiaries will continue to meet these requirements during the remainder of 2008.

12

OFF-BALANCE SHEET ARRANGEMENTS AND VARIABLE INTEREST ENTITIES

We engage in a variety of activities that involve unconsolidated entities or that are otherwise not reflected in our Consolidated Balance Sheet that are generally

referred to as off-balance sheet arrangements. The following sections of this Report provide further information on these types of activities:

| |

|

|

Commitments, including contractual obligations and other commitments, included within the Risk Management section of this Financial Review, and

|

| |

|

|

Note 15 Commitments And Guarantees in the Notes To Consolidated Financial Statements included in Part I, Item 1 of this Report.

|

The following provides a summary of variable interest entities (VIEs), including those in which we hold a significant variable interest but have not

consolidated and those that we have consolidated into our financial statements as of March 31, 2008 and December 31, 2007. Additional information on our partnership interests in low income housing projects is included in our 2007 Form 10-K

under this same heading in Part I, Item 7 and in Note 3 Variable Interest Entities in the Notes To Consolidated Financial Statements included in Part II, Item 8 of that report.

Non-Consolidated VIEs - Significant Variable Interests

|

|

|

|

|

|

|

|

|

|

|

| In millions |

|

Aggregate

Assets |

|

Aggregate

Liabilities |

|

PNC Risk of Loss

|

|

| March 31, 2008

|

|

|

|

|

|

|

|

|

|

|

| Market Street

|

|

$ |

5,186 |

|

$ |

5,252 |

|

$ |

8,992 |

(a) |

| Collateralized debt obligations

|

|

|

55 |

|

|

1 |

|

|

5 |

|

| Partnership interests in low income housing projects

|

|

|

50 |

|

|

34 |

|

|

8 |

|

| Total

|

|

$ |

5,291 |

|

$ |

5,287 |

|

$ |

9,005 |

|

| December 31, 2007

|

|

|

|

|

|

|

|

|

|

|

| Market Street

|

|

$ |

5,304 |

|

$ |

5,330 |

|

$ |

9,019 |

(a) |

| Collateralized debt obligations

|

|

|

255 |

|

|

177 |

|

|

6 |

|

| Partnership interests in low income housing projects

|

|

|

50 |

|

|

34 |

|

|

8 |

|

| Total

|

|

$ |

5,609 |

|

$ |

5,541 |

|

$ |

9,033 |

|

| (a) |

PNCs risk of loss consists of off-balance sheet liquidity commitments to Market Street of $8.8 billion and other credit enhancements of $.2 billion at both March 31, 2008

and December 31, 2007. These liquidity commitments are included in the Net Unfunded Credit Commitments table in the Consolidated Balance Sheet Review section of this Report. |

Market Street

Market Street Funding LLC (Market

Street) is a multi-seller asset-backed commercial paper conduit that is owned by an independent third party. Market Streets activities primarily involve purchasing assets or making loans secured by interests in pools of receivables from

US corporations that desire access to the commercial paper market. Market Street funds

the purchases of assets or loans by issuing commercial paper which has been rated A1/P1 by Standard & Poors and Moodys, respectively,

and is supported by pool-specific credit enhancements, liquidity facilities and program-level credit enhancement. Generally, Market Street mitigates its potential interest rate risk by entering into agreements with its borrowers that reflect

interest rates based upon its weighted average commercial paper cost of funds. During 2007 and the first three months of 2008, Market Street met all of its funding needs through the issuance of commercial paper.

Market Street commercial paper outstanding was $5.1 billion at both March 31, 2008 and December 31, 2007. The weighted average maturity of the commercial paper

was 31 days at March 31, 2008 compared with 32 days at December 31, 2007.

In the ordinary course of business during the first quarter of 2008,

PNC Capital Markets, acting as a placement agent for Market Street, held a maximum daily position in Market Street commercial paper of $75 million with an average of $35 million and a quarter-end position of $35 million. This compares with a maximum

daily position of $113 million with an average of $27 million during the year ended December 31, 2007. PNC Capital Markets owned less than $1 million of any Market Street commercial paper at December 31, 2007. PNC made no other purchases

of Market Street commercial paper during 2007 or the first three months of 2008.

PNC Bank, National Association (PNC Bank, N.A.) provides

certain administrative services, a portion of the program-level credit enhancement and 99% of liquidity facilities to Market Street in exchange for fees negotiated based on market rates. PNC recognized program administrator fees and commitments fees

related to PNCs portion of the liquidity facilities of $4 million and $1 million, respectively, for the three months ended March 31, 2008.

PNC

views its credit exposure for the Market Street transactions as limited. Neither creditors nor investors in Market Street have any recourse to our general credit. The commercial paper obligations at March 31, 2008 and December 31, 2007

were effectively collateralized by Market Streets assets. While PNC may be obligated to fund under liquidity facilities for events such as commercial paper market disruptions, borrower bankruptcies, collateral deficiencies or covenant

violations, our credit risk under the liquidity facilities is secondary to the risk of first loss provided by the borrower or another third party in the form of deal-specific credit enhancement for example, by the over collateralization of

the assets. Deal-specific credit enhancement that supports the commercial paper issued by Market Street is generally structured to cover a multiple of expected losses for the pool of assets and is sized to generally meet rating agency standards for

comparably structured transactions. Of the $8.8 billion of liquidity facilities provided by PNC at March 31, 2008, only $2.8 billion required PNC to fund if the assets are in default.

13

Program-level credit enhancement in the amount of 10% of commitments, excluding explicitly rated AAA/Aaa facilities, is provided by PNC and Ambac, a monoline insurer. PNC provides 25% of the enhancement in the form of a cash collateral

account funded by a loan facility. This facility expires in March 2013. See Note 15 Commitments And Guarantees included in the Notes To Consolidated Financial Statements of this Report for additional information. The monoline insurer provides the

remaining 75% of the enhancement in the form of a surety bond. The cash collateral account is subordinate to the surety bond.

Market Street is a limited

liability company that has entered into a Subordinated Note Purchase Agreement (Note) with an unrelated third party. The Note provides first loss coverage whereby the investor absorbs losses up to the amount of the Note, which was $8.7

million as of March 31, 2008. Proceeds from the issuance of the Note are held by Market Street in a first loss reserve account that will be used to reimburse any losses incurred by Market Street, PNC Bank, N.A. or other providers under the

liquidity facilities and the credit enhancement arrangements.

Assets of Market Street Funding LLC

|

|

|

|

|

|

|

|

|

| In millions |

|

Outstanding |

|

Commitments |

|

Weighted

Average

Remaining

Maturity

In Years

|

| March 31, 2008 (a)

|

|

|

|

|

|

|

|

|

| Trade receivables

|

|

$ |

1,195 |

|

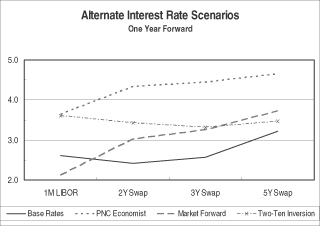

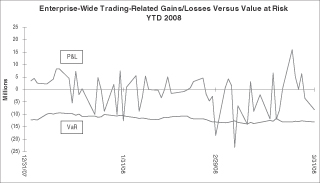

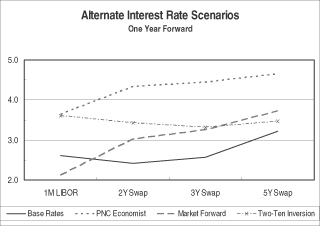

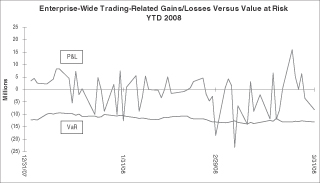

$ |