EXHIBIT 99.2

Published on August 4, 2020

Exhibit 99.2 ITEM 7 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF CONTINUING OPERATIONS (MD&A) The information contained herein updates selected sections of Management's Discussion and Analysis of Financial Condition and Results of Operations as previously presented in Item 7 of Part II of PNC's 2019 Form 10-K. As more fully described in Item 8.01 of this Current Report on Form 8-K, sections of the 2019 Form 10-K are being updated to reflect the presentation of historical results to reflect the results of BlackRock as discontinued operations. The following sections in Item 7 of Part II of the 2019 Form 10-K are updated as previously presented: • Executive Summary • Consolidated Income Statement Review • Consolidated Balance Sheet Review • Business Segment Review • Liquidity Risk Management EXECUTIVE SUMMARY Key Strategic Goals At PNC we manage our company for the long term. We are focused on the fundamentals of growing customers, loans, deposits and revenue and improving profitability, while investing for the future and managing risk, expenses and capital. We continue to invest in our products, markets and brand, and embrace our commitments to our customers, shareholders, employees and the communities where we do business. We strive to expand and deepen customer relationships by offering a broad range of deposit, credit and fee-based products and services. We are focused on delivering those products and services to our customers with the goal of addressing their financial objectives and putting customers’ needs first. Our business model is built on customer loyalty and engagement, understanding our customers’ financial goals and offering our diverse products and services to help them achieve financial well-being. Our approach is concentrated on organically growing and deepening client relationships across our businesses that meet our risk/return measures. We are focused on our strategic priorities, which are designed to enhance value over the long term, and consist of: • Expanding our leading banking franchise to new markets and digital platforms; • Deepening customer relationships by delivering a superior banking experience and financial solutions; and • Leveraging technology to innovate and enhance products, services, security and processes. Our capital priorities are to support client growth and business investment, maintain appropriate capital in light of economic conditions, the Basel III framework and other regulatory expectations, and return excess capital to shareholders. For more detail, see the Capital Highlights portion of this Executive Summary and the Liquidity and Capital Management portion of the Risk Management section of this Item 7 and the Supervision and Regulation section in Item 1 Business of this Report. Key Factors Affecting Financial Performance We face a variety of risks that may impact various aspects of our risk profile from time to time. The extent of such impacts may vary depending on factors such as the current business and economic conditions, political and regulatory environment and operational challenges. Many of these risks and our risk management strategies are described in more detail elsewhere in this Report. Our financial performance is substantially affected by a number of external factors outside of our control, including the following: • Global and domestic economic conditions, including the continuity and stamina of the current U.S. economic expansion; • The monetary policy actions and statements of the Federal Reserve and the Federal Open Market Committee (FOMC); • The level of, and direction, timing and magnitude of movement in, interest rates and the shape of the interest rate yield curve; • The functioning and other performance of, and availability of liquidity in, U.S. and global financial markets, including capital markets; • The impact of tariffs and other trade policies of the U.S. and its global trading partners; • Changes in the competitive and regulatory landscape; • The impact of legislative, regulatory and administrative initiatives and actions; • The impact of market credit spreads on asset valuations; • The ability of customers, counterparties and issuers to perform in accordance with contractual terms, and the resulting impact on our asset quality; • Loan demand, utilization of credit commitments and standby letters of credit; and • The impact on customers and changes in customer behavior due to changing business and economic conditions or regulatory or legislative initiatives.

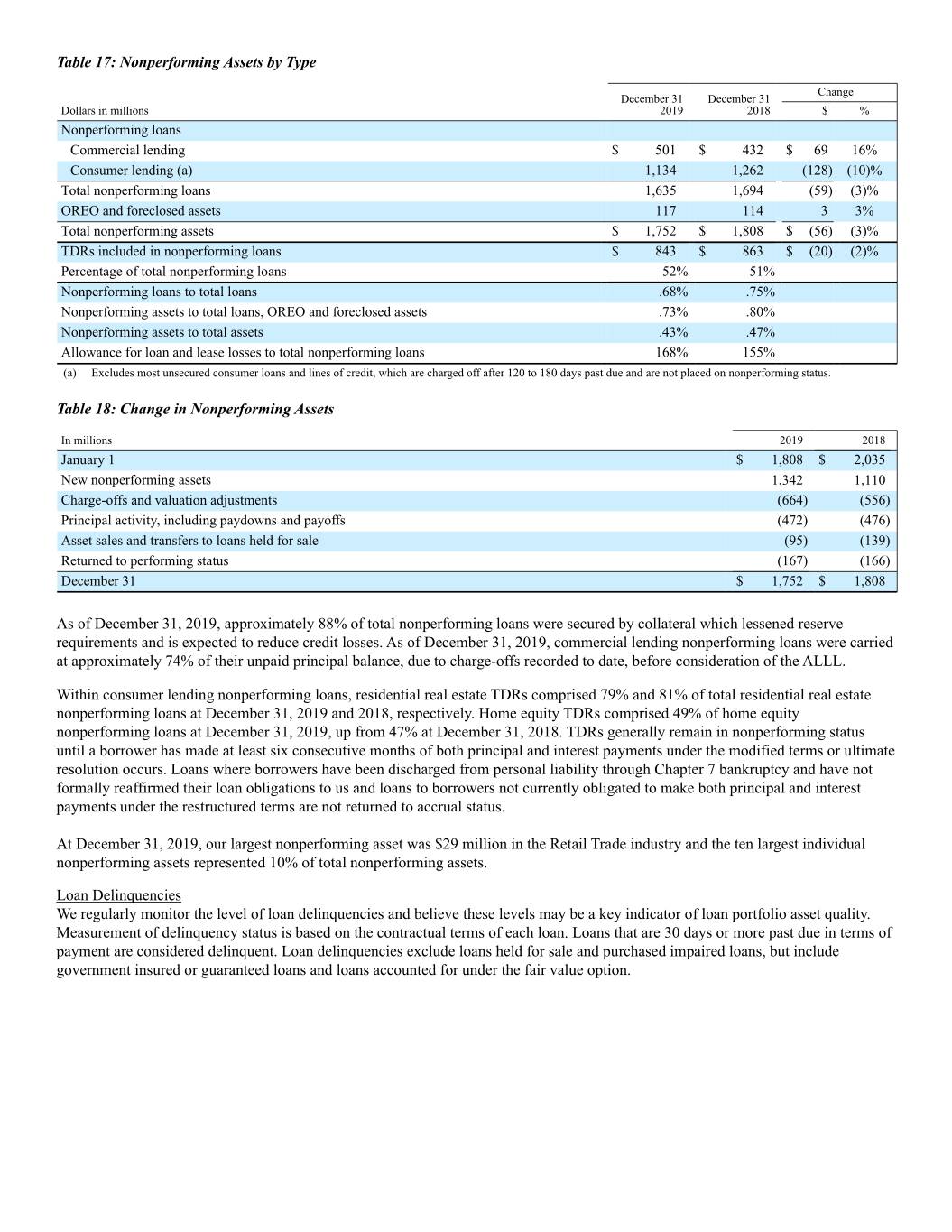

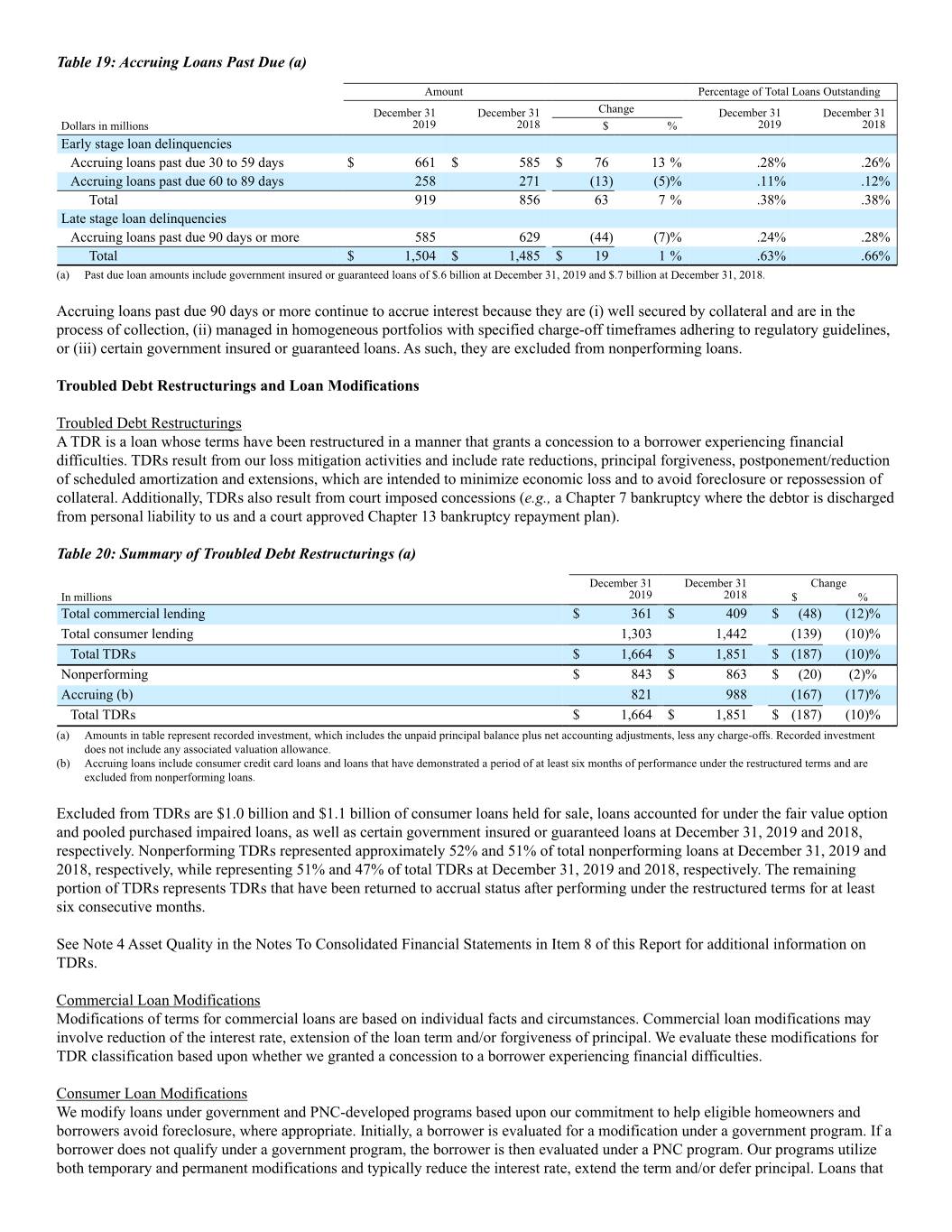

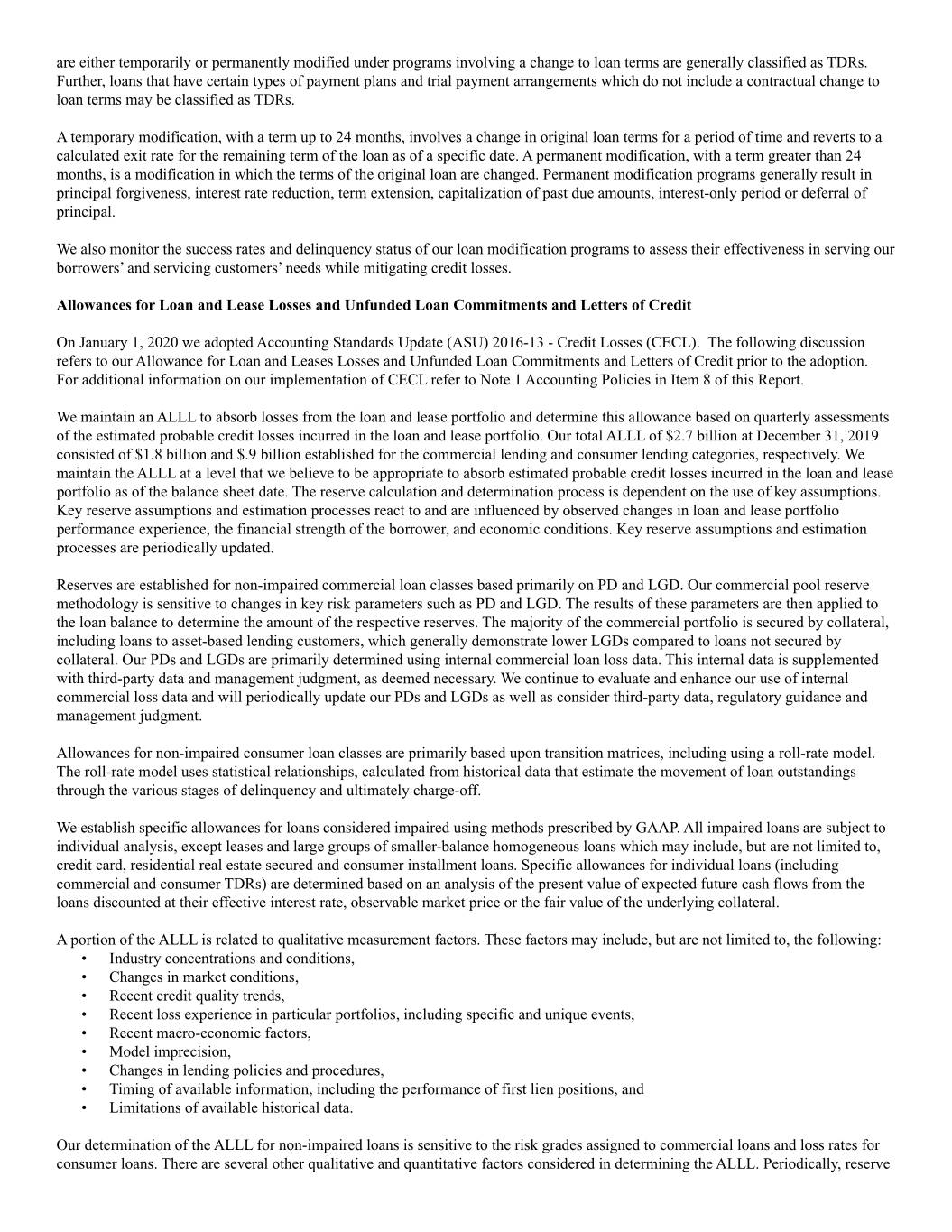

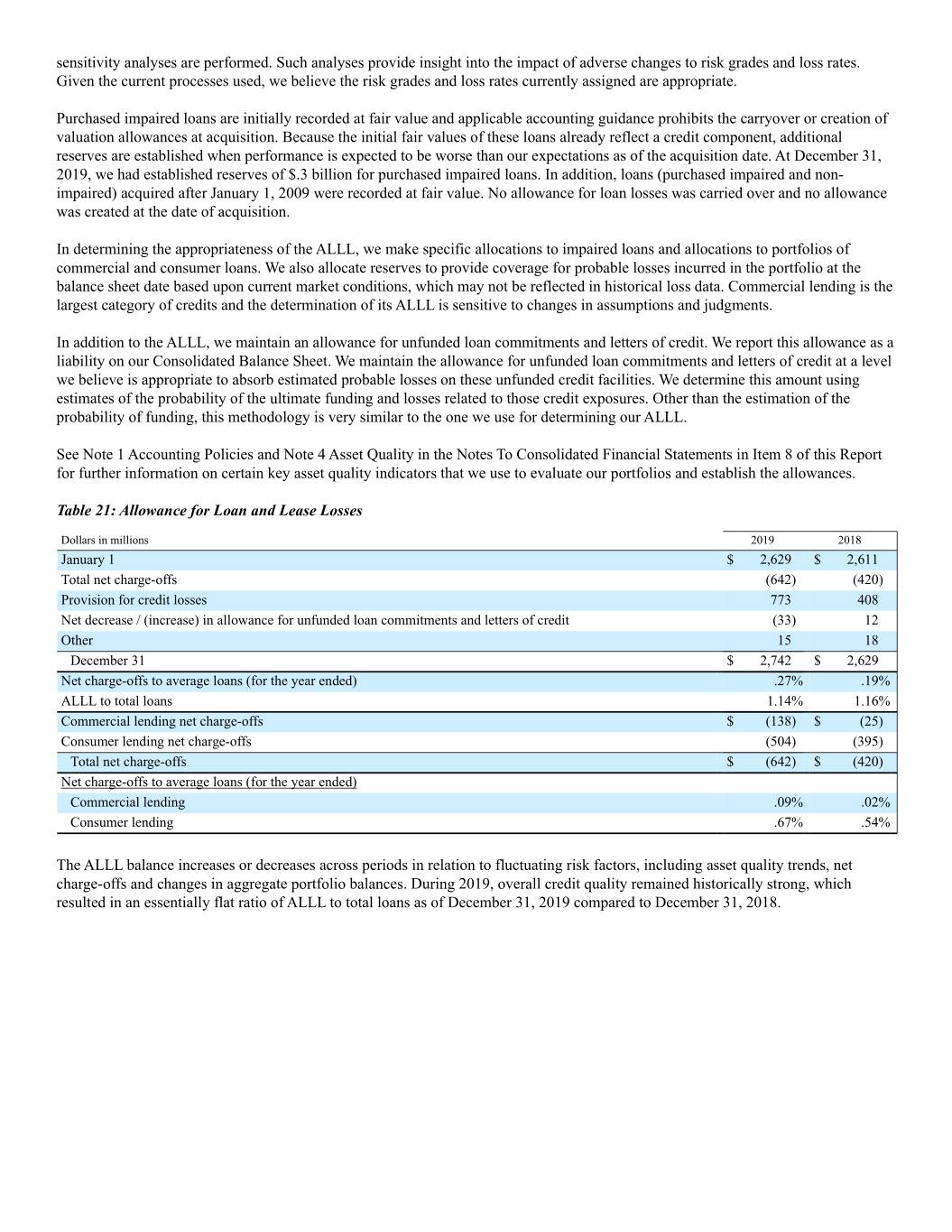

In addition, our success will depend upon, among other things: • Effectively managing capital and liquidity including: • Continuing to maintain and grow our deposit base as a low-cost stable funding source; • Prudent liquidity and capital management to meet evolving regulatory capital, capital planning, stress testing and liquidity standards; and • Actions we take within the capital and other financial markets. • Execution of our strategic priorities; • Management of credit risk in our portfolio; • Our ability to manage and implement strategic business objectives within the changing regulatory environment; • The impact of legal and regulatory-related contingencies; and • The appropriateness of reserves needed for critical accounting estimates and related contingencies. For additional information, see the Cautionary Statement Regarding Forward-Looking Information section in this Item 7 and Item 1A Risk Factors in this Report. Income Statement Highlights Net income from continuing operations for 2019 was $4.6 billion, or $9.57 per diluted common share, an increase of 1% compared to $4.6 billion or $9.06 per diluted common share, for 2018. • Total revenue increased $649 million, or 4%, to $16.8 billion. • Net interest income increased $244 million, or 3%, to $10.0 billion. • Net interest margin decreased to 2.89% for 2019 compared to 2.97% for 2018. • Noninterest income increased $405 million, or 6%, to $6.9 billion. • Provision for credit losses was $773 million in 2019 compared to $408 million for 2018. • Noninterest expense increased $278 million, or 3%, to $10.6 billion. • We generated positive operating leverage in 2019 of 1.3%. • Earnings per diluted common share from continuing operations increased reflecting lower average common shares outstanding due to share repurchases, and higher net income. For additional detail, see the Consolidated Income Statement Review section of this Item 7. Balance Sheet Highlights Our balance sheet was strong and well positioned at December 31, 2019 and 2018. In comparison to December 31, 2018: • Total loans increased $13.6 billion, or 6%, to $239.8 billion. • Total commercial lending grew $8.3 billion, or 5%, to $160.6 billion. • Total consumer lending increased $5.3 billion, or 7%, to $79.2 billion. • Total deposits increased $20.7 billion, or 8%, to $288.5 billion. • Investment securities increased $4.1 billion, or 5%, to $86.8 billion. • Interest earning deposits with banks, primarily with the Federal Reserve Bank, increased $12.5 billion to $23.4 billion. • Borrowed funds of $60.3 billion increased $2.8 billion, or 5%. • Shareholders' equity increased $1.6 billion, or 3%, to $49.3 billion. For additional detail, see the Consolidated Balance Sheet Review section of this Item 7. Credit Quality Highlights Overall credit quality remained historically strong. • At December 31, 2019 compared to December 31, 2018: Nonperforming assets of $1.8 billion decreased $56 million, or 3%. Overall loan delinquencies of $1.5 billion increased $19 million, or 1%. • Net charge-offs of $642 million in 2019 increased 53% compared to net charge-offs of $420 million for 2018. • The allowance for loan and lease losses to total loans was 1.14% at December 31, 2019 and 1.16% at December 31, 2018. For additional detail, see the Credit Risk Management portion of the Risk Management section of this Item 7. Capital Highlights We maintained a strong capital position during 2019 and continued to return capital to shareholders. • The Basel III common equity Tier 1 capital ratio was 9.5% at December 31, 2019 compared with 9.6% at December 31, 2018.

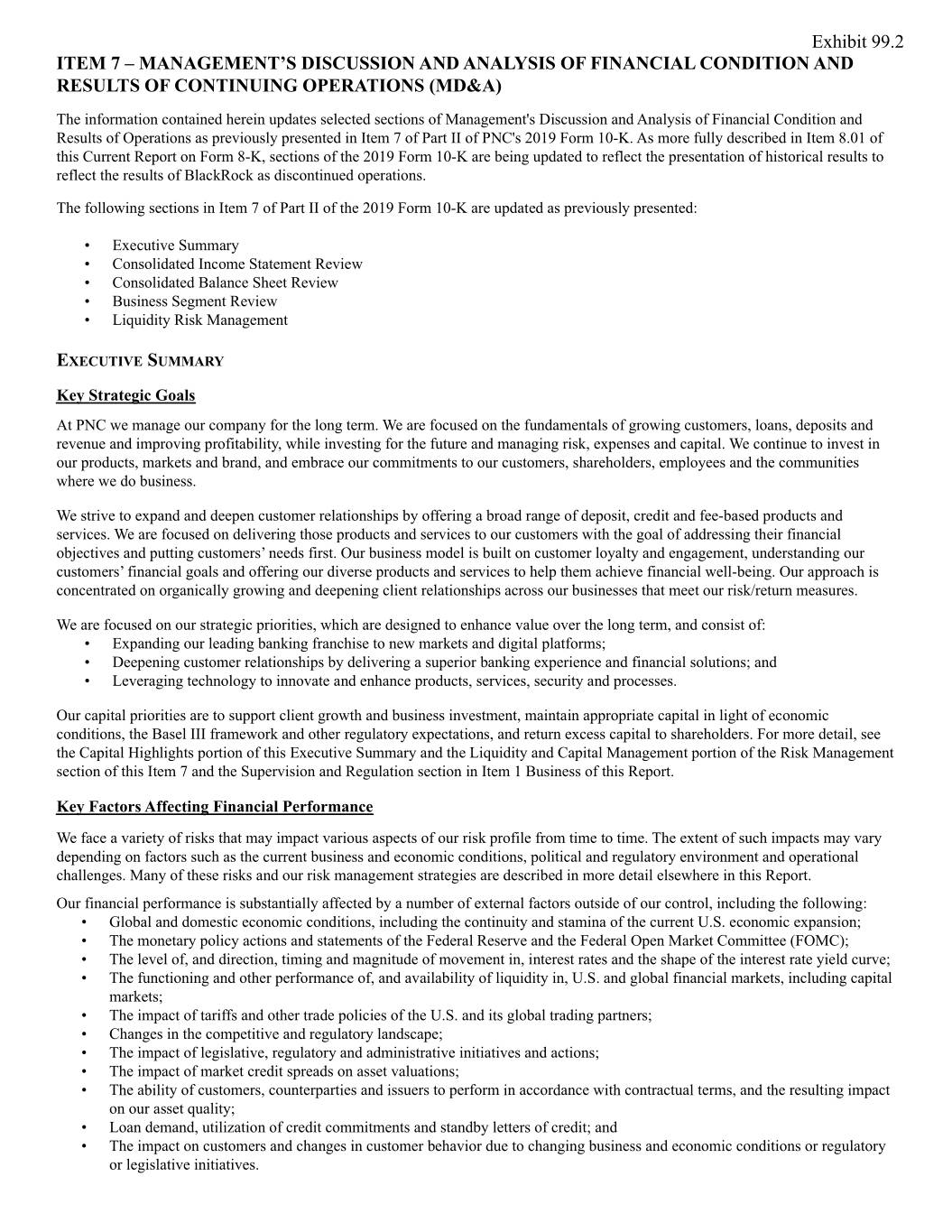

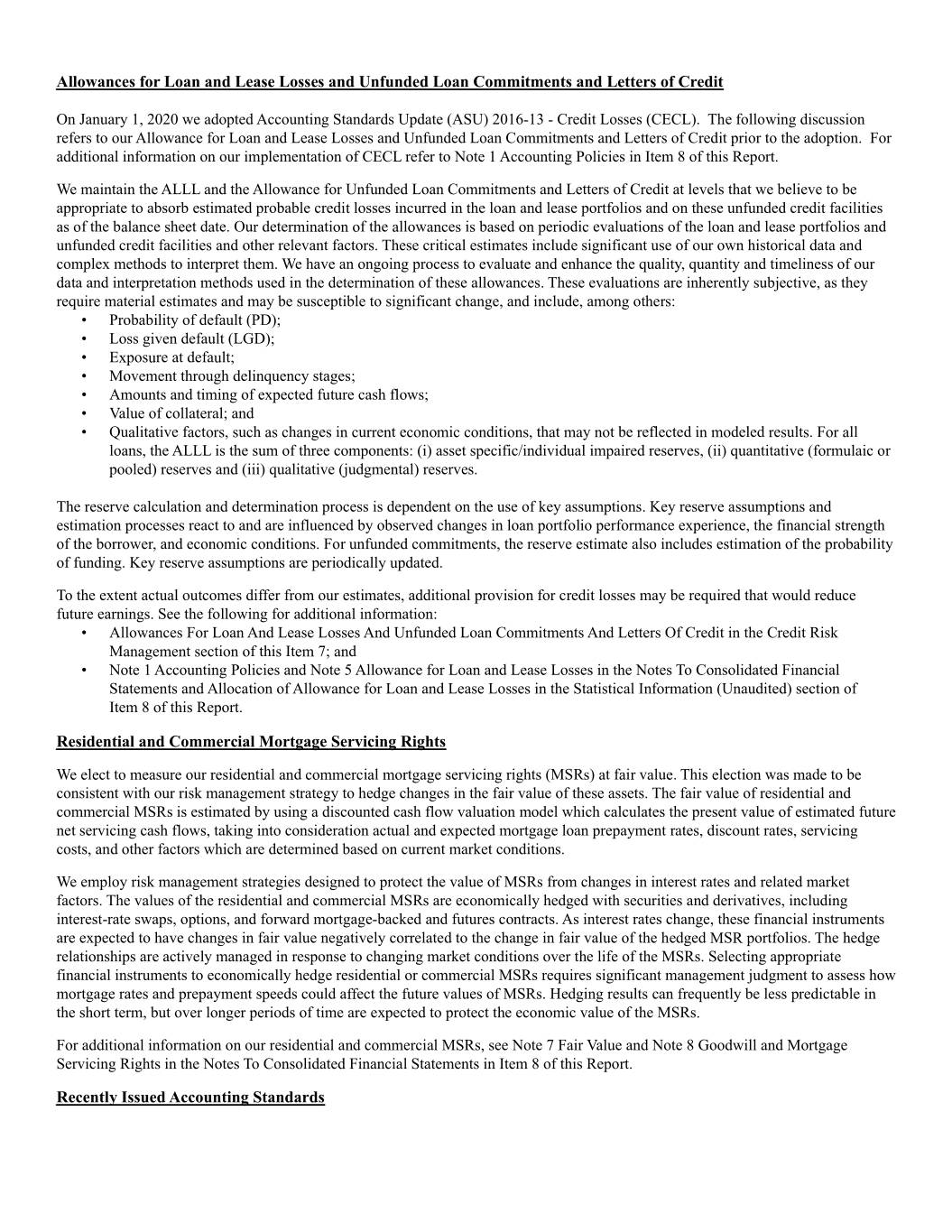

• In 2019, we returned $5.4 billion of capital to shareholders through repurchases of 25.9 million common shares for $3.5 billion and dividends on common shares of $1.9 billion. • In June 2019, we announced share repurchase programs of up to $4.3 billion for the four quarter period beginning with the third quarter of 2019. In January 2020, we announced an increase to these programs of up to $1.0 billion in additional common share repurchases through the end of second quarter of 2020. • The quarterly cash dividend on common stock was increased from $.95 to $1.15 per share effective with the August 5, 2019 dividend payment date. Our ability to take certain capital actions, including plans to pay or increase common stock dividends or to repurchase shares under current or future programs, is subject to the results of the supervisory assessment of capital adequacy undertaken by the Federal Reserve as part of the Comprehensive Capital Analysis and Review (CCAR) process. For additional information, see the Supervision and Regulation section in Item 1 Business of this Report. See the Liquidity and Capital Management portion of the Risk Management section of this Item 7 for more detail on our 2019 capital and liquidity actions as well as our capital ratios. CONSOLIDATED INCOME STATEMENT REVIEW Our Consolidated Income Statement is presented in Item 8 of this Report. For additional detail of the comparison of 2018 over 2017, see the 2018 Compared to 2017 section of this Income Statement Review and Item 7 of our 2018 Form 10-K. Net income from continuing operations for 2019 was $4.6 billion, or $9.57 per diluted common share, an increase of 1% compared to $4.6 billion, or $9.06 per diluted common share, for 2018. The increase was driven by higher noninterest income and net interest income, partially offset by increases in provision for credit losses and noninterest expense. Net Interest Income Table 1: Summarized Average Balances and Net Interest Income (a) 2019 2018 Average Interest Average Interest Year ended December 31 Average Yields/ Income/ Average Yields/ Income/ Dollars in millions Balances Rates Expense Balances Rates Expense Assets Interest-earning assets Investment securities $ 83,666 2.93% $ 2,450 $ 78,784 2.91% $ 2,289 Loans 235,016 4.51% 10,604 223,278 4.33% 9,667 Interest-earning deposits with banks 16,878 2.09% 353 20,603 1.84% 379 Other 12,425 3.69% 458 8,093 4.47% 362 Total interest-earning assets/interest income $ 347,985 3.98% 13,865 $ 330,758 3.84% 12,697 Liabilities Interest-bearing liabilities Interest-bearing deposits $ 204,588 .97% 1,986 $ 186,361 .66% 1,229 Borrowed funds 61,528 2.94% 1,811 59,306 2.75% 1,632 Total interest-bearing liabilities/interest expense $ 266,116 1.43% 3,797 $ 245,667 1.16% 2,861 Net interest income/margin (Non-GAAP) 2.89% 10,068 2.97% 9,836 Taxable-equivalent adjustments (103) (115) Net interest income (GAAP) $ 9,965 $ 9,721 (a) Interest income calculated as taxable-equivalent interest income. To provide more meaningful comparisons of interest income and yields for all interest-earning assets, as well as net interest margins, we use interest income on a taxable-equivalent basis in calculating average yields and net interest margins by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP on the Consolidated Income Statement. For more information, see Reconciliation of Taxable-Equivalent Net Interest Income (Non-GAAP) in the Statistical Information (Unaudited) section in Item 8 of this Report. Changes in net interest income and margin result from the interaction of the volume and composition of interest-earning assets and related yields, interest-bearing liabilities and related rates paid, and noninterest-bearing sources of funding. See the Statistical Information (Unaudited) – Average Consolidated Balance Sheet And Net Interest Analysis and Analysis Of Year-To-Year Changes In Net Interest Income in Item 8 of this Report. Net interest income increased $244 million, or 3%, in 2019 compared with 2018 as higher loan and securities yields and balances were partially offset by higher funding costs. Net interest margin of 2.89% decreased 8 basis points in 2019 compared to 2018, driven by the declining rate environment in 2019.

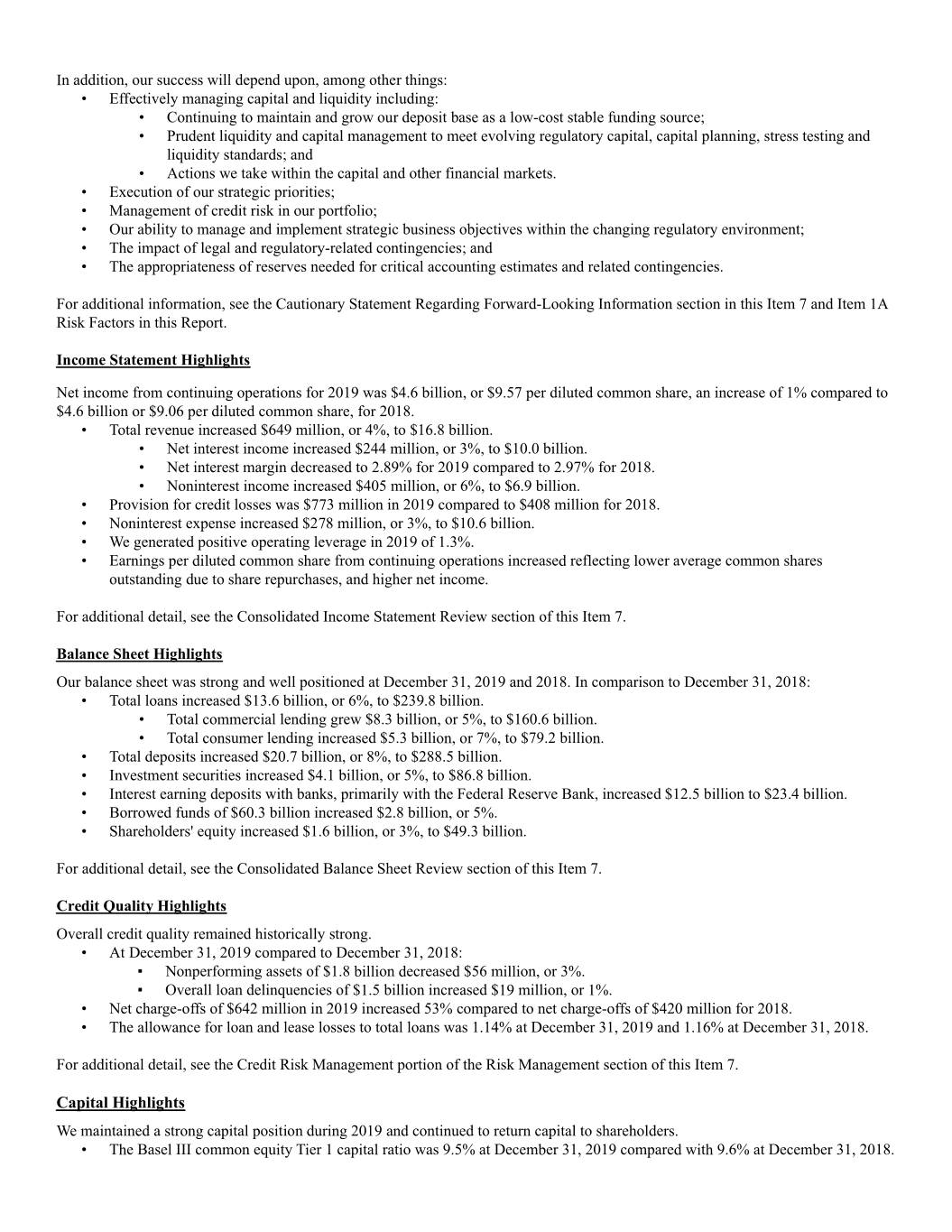

Average investment securities increased $4.9 billion, or 6%, reflecting net purchases of agency residential mortgage-backed securities of $4.1 billion, U.S. Treasury and government agency securities of $1.3 billion and commercial mortgage-backed securities of $.9 billion, partially offset by decreases of $.9 billion to other securities, $.4 billion to non-agency residential mortgage backed securities and $.1 billion to asset-backed securities . Average investment securities represented 24% of average interest-earning assets in both 2019 and 2018. Average loans grew $11.7 billion, or 5%, driven by commercial and consumer lending growth. Average commercial lending increased $9.3 billion, or 6%, to $159.3 billion reflecting strong growth in our Corporate Banking and Business Credit businesses in our Corporate & Institutional Banking segment. Average consumer lending increased $2.4 billion, or 3%, to $75.7 billion as growth in residential real estate, auto, credit card and unsecured installment loans was partially offset by declines in home equity and education loans. Lower home equity loans reflected paydowns and payoffs that exceeded new originated volume and continued runoff of brokered home equity loans. Additionally, government guaranteed education loans continued to run off. Average loans represented 68% of average interest-earning assets in both 2019 and 2018. Average interest-bearing deposits grew $18.2 billion, or 10%, reflecting overall deposit and customer growth. The increase included a shift from noninterest-bearing deposits, which declined $4.1 billion, or 5%, to interest-bearing deposits. Within average interest- bearing deposits, average savings deposits increased $11.0 billion, due in part to a shift to relationship-based savings products from money market deposits, which decreased $.8 billion, and to growth from the retail national expansion strategy. Additionally, average interest-bearing demand deposits grew $5.1 billion and average time deposits grew $2.9 billion. Average interest-bearing deposits represented 77% of average interest-bearing liabilities in 2019 compared to 76% in 2018. Further details regarding average loans and deposits are included in the Business Segments Review section of this Item 7. Average borrowed funds increased $2.2 billion, or 4%, primarily due to higher federal funds purchased of $2.1 billion and Federal Home Loan Bank (FHLB) borrowings of $1.3 billion, partially offset by a decline in bank notes and senior debt of $1.1 billion. See the Consolidated Balance Sheet Review portion of this Item 7 for additional detail on the level and composition of borrowed funds. Noninterest Income Table 2: Noninterest Income Year ended December 31 Change Dollars in millions 2019 2018 $ % Noninterest income Asset management $ 862 $ 883 $ (21) (2)% Consumer services 1,555 1,502 53 4 % Corporate services 1,914 1,849 65 4 % Residential mortgage 368 316 52 16 % Service charges on deposits 702 714 (12) (2)% Other 1,473 1,205 268 22 % Total noninterest income $ 6,874 $ 6,469 $ 405 6 % Noninterest income as a percentage of total revenue was 41% for 2019 and 40% for 2018. Asset management revenue decreased driven by the sales of businesses and the impact of lower yielding assets under management partially offset by increases in the average equity markets. PNC's discretionary client assets under management increased to $154 billion at December 31, 2019 compared with $148 billion at December 31, 2018 primarily attributable to higher equity markets partially offset by the impact of the sales of businesses. Consumer services revenue increased primarily due to growth in debit and credit card fees, net of rewards, and higher brokerage fees, reflecting continued momentum in both transaction activity and customer growth. Growth in corporate services revenue reflected broad-based increases, including higher treasury management product revenue, partially offset by a decline in loan syndication revenue. Residential mortgage revenue increased due to a higher benefit from residential mortgage servicing rights valuation, net of economic hedge, and higher loan sales revenue driven by increased loan origination volume. Service charges on deposits declined, reflecting our ongoing efforts to simplify products and reduce transaction fees for our customers.

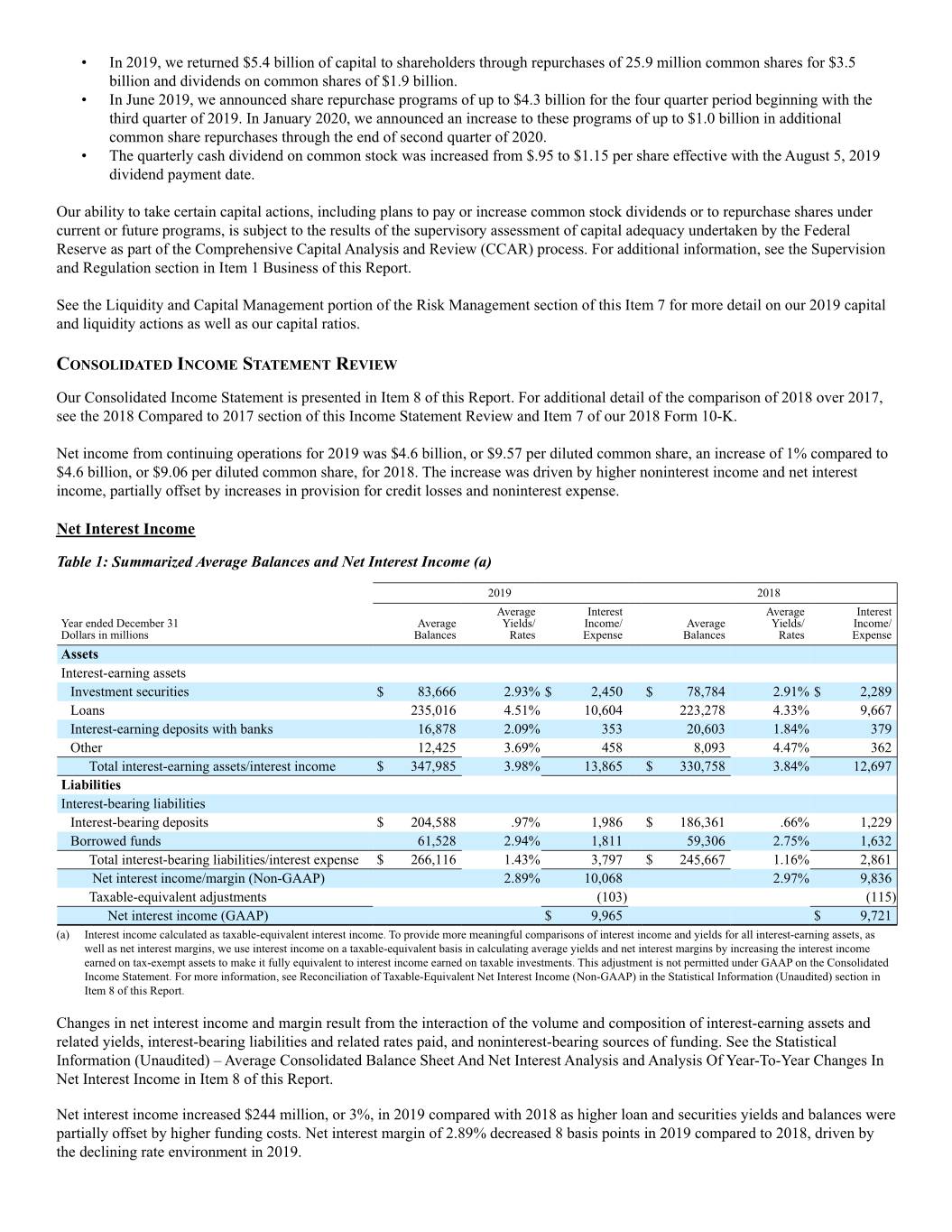

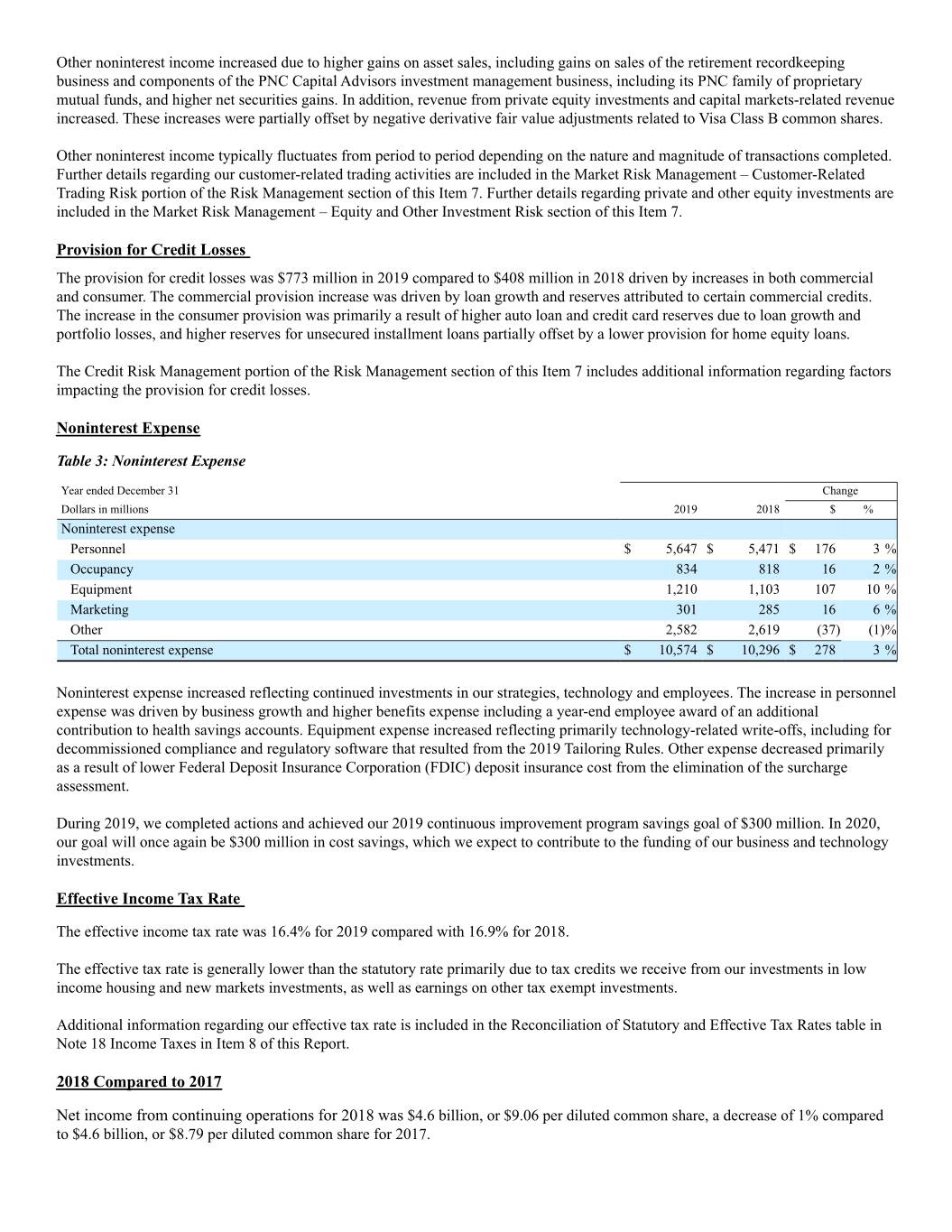

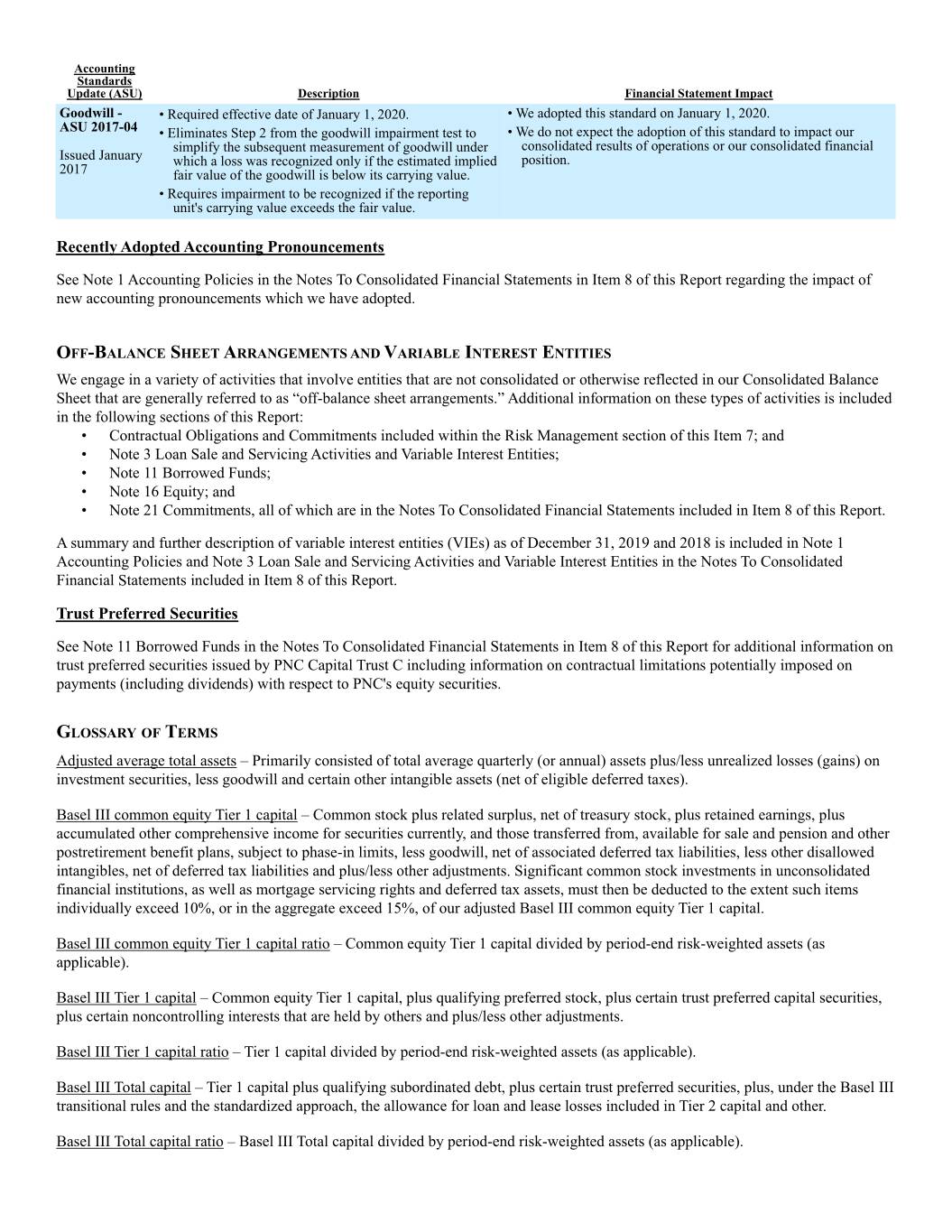

Other noninterest income increased due to higher gains on asset sales, including gains on sales of the retirement recordkeeping business and components of the PNC Capital Advisors investment management business, including its PNC family of proprietary mutual funds, and higher net securities gains. In addition, revenue from private equity investments and capital markets-related revenue increased. These increases were partially offset by negative derivative fair value adjustments related to Visa Class B common shares. Other noninterest income typically fluctuates from period to period depending on the nature and magnitude of transactions completed. Further details regarding our customer-related trading activities are included in the Market Risk Management – Customer-Related Trading Risk portion of the Risk Management section of this Item 7. Further details regarding private and other equity investments are included in the Market Risk Management – Equity and Other Investment Risk section of this Item 7. Provision for Credit Losses The provision for credit losses was $773 million in 2019 compared to $408 million in 2018 driven by increases in both commercial and consumer. The commercial provision increase was driven by loan growth and reserves attributed to certain commercial credits. The increase in the consumer provision was primarily a result of higher auto loan and credit card reserves due to loan growth and portfolio losses, and higher reserves for unsecured installment loans partially offset by a lower provision for home equity loans. The Credit Risk Management portion of the Risk Management section of this Item 7 includes additional information regarding factors impacting the provision for credit losses. Noninterest Expense Table 3: Noninterest Expense Year ended December 31 Change Dollars in millions 2019 2018 $ % Noninterest expense Personnel $ 5,647 $ 5,471 $ 176 3 % Occupancy 834 818 16 2 % Equipment 1,210 1,103 107 10 % Marketing 301 285 16 6 % Other 2,582 2,619 (37) (1)% Total noninterest expense $ 10,574 $ 10,296 $ 278 3 % Noninterest expense increased reflecting continued investments in our strategies, technology and employees. The increase in personnel expense was driven by business growth and higher benefits expense including a year-end employee award of an additional contribution to health savings accounts. Equipment expense increased reflecting primarily technology-related write-offs, including for decommissioned compliance and regulatory software that resulted from the 2019 Tailoring Rules. Other expense decreased primarily as a result of lower Federal Deposit Insurance Corporation (FDIC) deposit insurance cost from the elimination of the surcharge assessment. During 2019, we completed actions and achieved our 2019 continuous improvement program savings goal of $300 million. In 2020, our goal will once again be $300 million in cost savings, which we expect to contribute to the funding of our business and technology investments. Effective Income Tax Rate The effective income tax rate was 16.4% for 2019 compared with 16.9% for 2018. The effective tax rate is generally lower than the statutory rate primarily due to tax credits we receive from our investments in low income housing and new markets investments, as well as earnings on other tax exempt investments. Additional information regarding our effective tax rate is included in the Reconciliation of Statutory and Effective Tax Rates table in Note 18 Income Taxes in Item 8 of this Report. 2018 Compared to 2017 Net income from continuing operations for 2018 was $4.6 billion, or $9.06 per diluted common share, a decrease of 1% compared to $4.6 billion, or $8.79 per diluted common share for 2017.

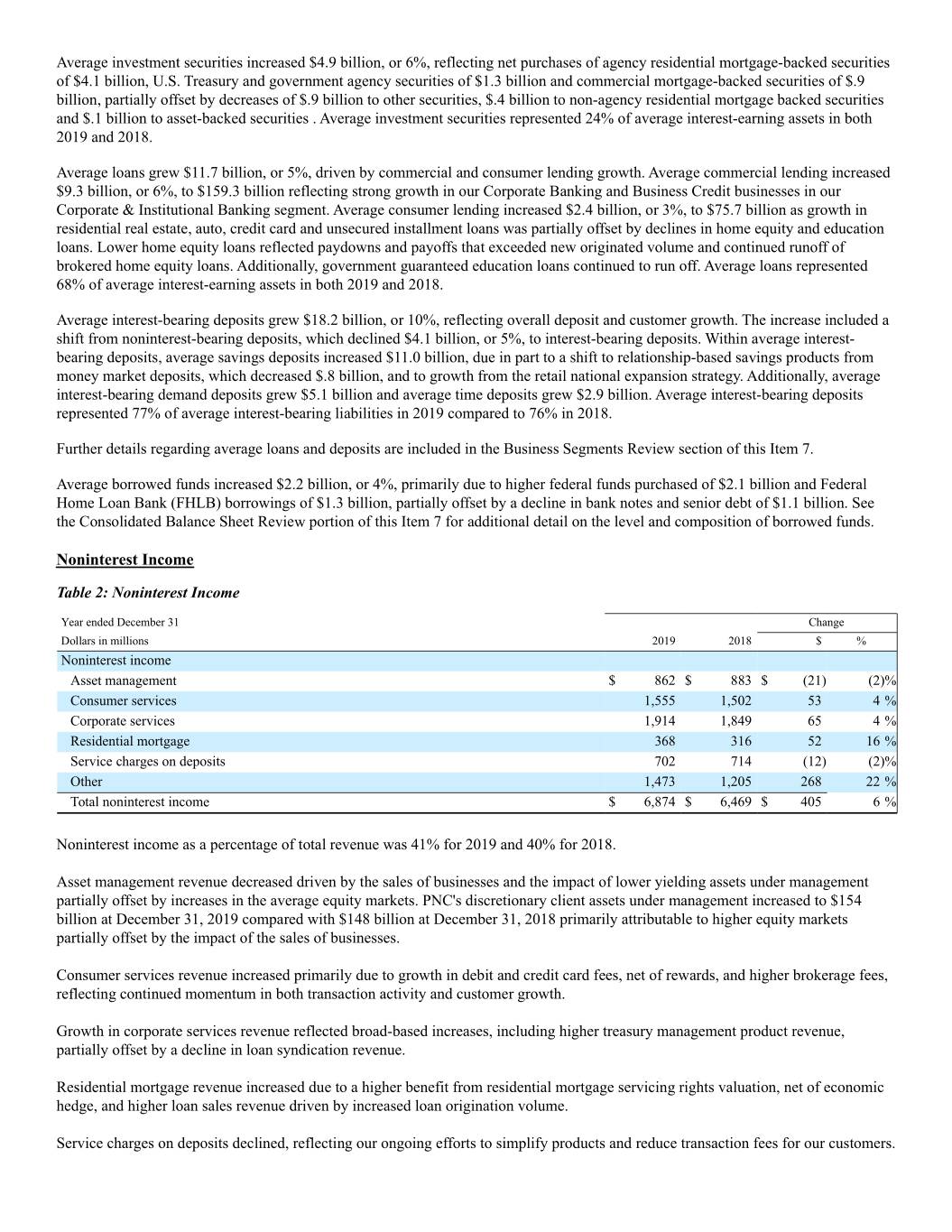

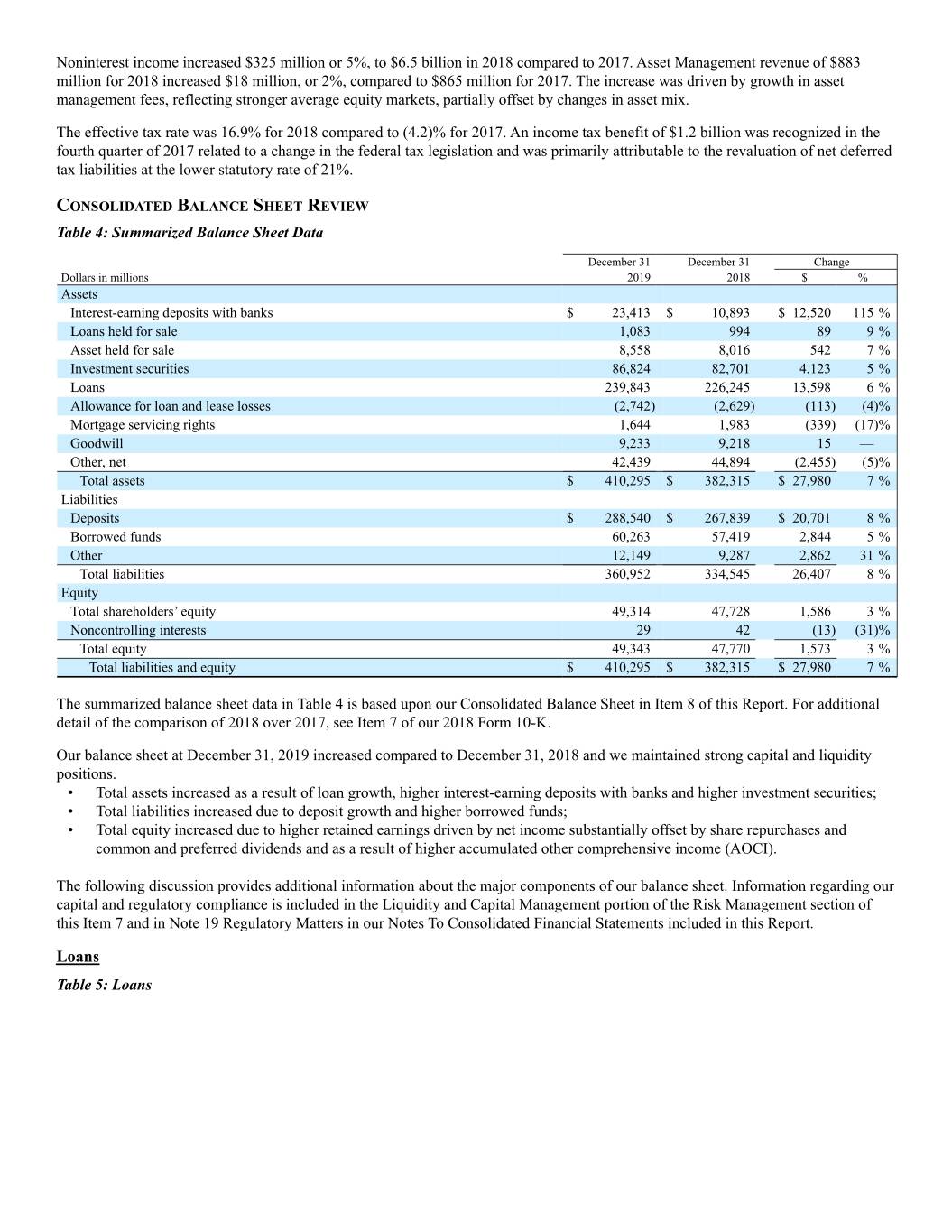

Noninterest income increased $325 million or 5%, to $6.5 billion in 2018 compared to 2017. Asset Management revenue of $883 million for 2018 increased $18 million, or 2%, compared to $865 million for 2017. The increase was driven by growth in asset management fees, reflecting stronger average equity markets, partially offset by changes in asset mix. The effective tax rate was 16.9% for 2018 compared to (4.2)% for 2017. An income tax benefit of $1.2 billion was recognized in the fourth quarter of 2017 related to a change in the federal tax legislation and was primarily attributable to the revaluation of net deferred tax liabilities at the lower statutory rate of 21%. CONSOLIDATED BALANCE SHEET REVIEW Table 4: Summarized Balance Sheet Data December 31 December 31 Change Dollars in millions 2019 2018 $ % Assets Interest-earning deposits with banks $ 23,413 $ 10,893 $ 12,520 115 % Loans held for sale 1,083 994 89 9 % Asset held for sale 8,558 8,016 542 7 % Investment securities 86,824 82,701 4,123 5 % Loans 239,843 226,245 13,598 6 % Allowance for loan and lease losses (2,742) (2,629) (113) (4)% Mortgage servicing rights 1,644 1,983 (339) (17)% Goodwill 9,233 9,218 15 — Other, net 42,439 44,894 (2,455) (5)% Total assets $ 410,295 $ 382,315 $ 27,980 7 % Liabilities Deposits $ 288,540 $ 267,839 $ 20,701 8 % Borrowed funds 60,263 57,419 2,844 5 % Other 12,149 9,287 2,862 31 % Total liabilities 360,952 334,545 26,407 8 % Equity Total shareholders’ equity 49,314 47,728 1,586 3 % Noncontrolling interests 29 42 (13) (31)% Total equity 49,343 47,770 1,573 3 % Total liabilities and equity $ 410,295 $ 382,315 $ 27,980 7 % The summarized balance sheet data in Table 4 is based upon our Consolidated Balance Sheet in Item 8 of this Report. For additional detail of the comparison of 2018 over 2017, see Item 7 of our 2018 Form 10-K. Our balance sheet at December 31, 2019 increased compared to December 31, 2018 and we maintained strong capital and liquidity positions. • Total assets increased as a result of loan growth, higher interest-earning deposits with banks and higher investment securities; • Total liabilities increased due to deposit growth and higher borrowed funds; • Total equity increased due to higher retained earnings driven by net income substantially offset by share repurchases and common and preferred dividends and as a result of higher accumulated other comprehensive income (AOCI). The following discussion provides additional information about the major components of our balance sheet. Information regarding our capital and regulatory compliance is included in the Liquidity and Capital Management portion of the Risk Management section of this Item 7 and in Note 19 Regulatory Matters in our Notes To Consolidated Financial Statements included in this Report. Loans Table 5: Loans

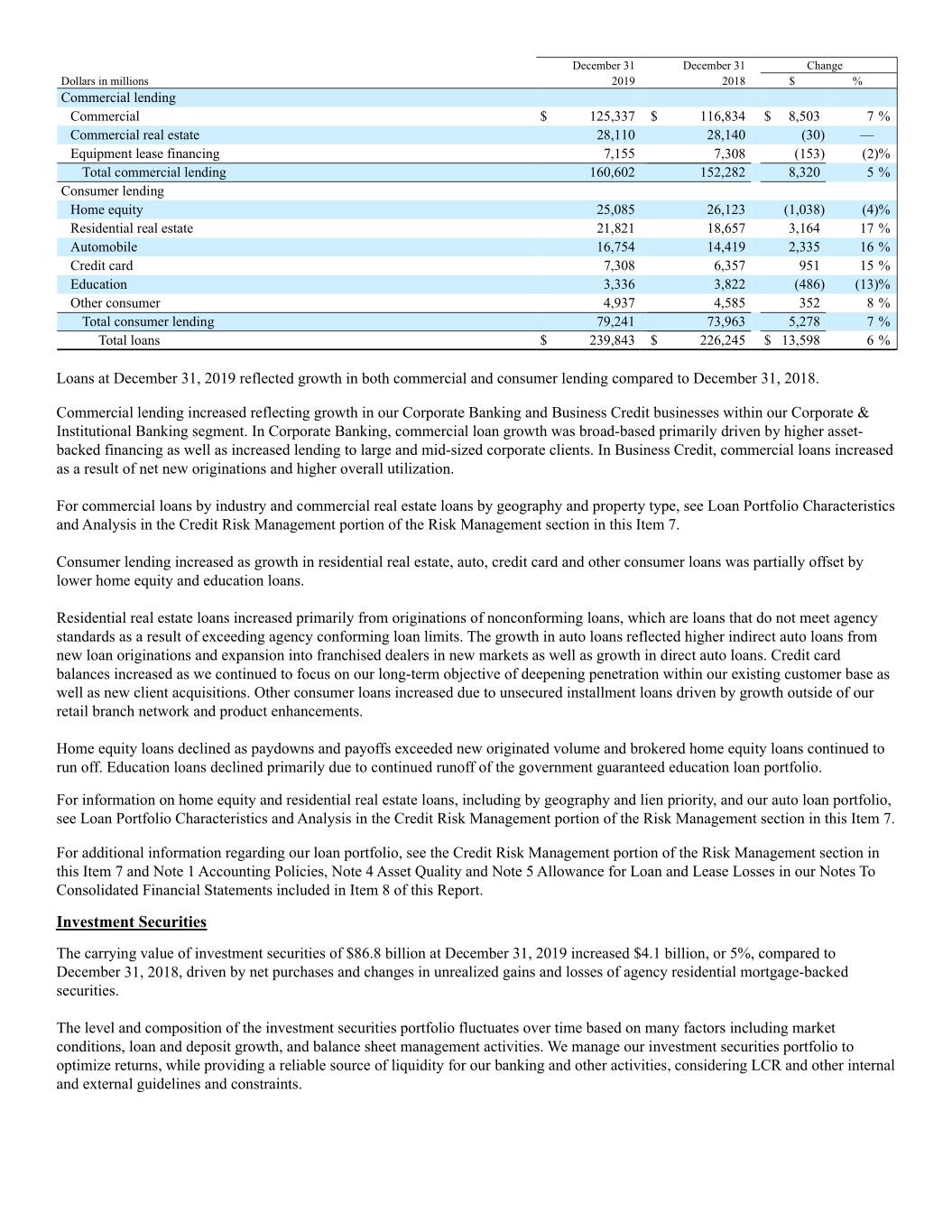

December 31 December 31 Change Dollars in millions 2019 2018 $ % Commercial lending Commercial $ 125,337 $ 116,834 $ 8,503 7 % Commercial real estate 28,110 28,140 (30) — Equipment lease financing 7,155 7,308 (153) (2)% Total commercial lending 160,602 152,282 8,320 5 % Consumer lending Home equity 25,085 26,123 (1,038) (4)% Residential real estate 21,821 18,657 3,164 17 % Automobile 16,754 14,419 2,335 16 % Credit card 7,308 6,357 951 15 % Education 3,336 3,822 (486) (13)% Other consumer 4,937 4,585 352 8 % Total consumer lending 79,241 73,963 5,278 7 % Total loans $ 239,843 $ 226,245 $ 13,598 6 % Loans at December 31, 2019 reflected growth in both commercial and consumer lending compared to December 31, 2018. Commercial lending increased reflecting growth in our Corporate Banking and Business Credit businesses within our Corporate & Institutional Banking segment. In Corporate Banking, commercial loan growth was broad-based primarily driven by higher asset- backed financing as well as increased lending to large and mid-sized corporate clients. In Business Credit, commercial loans increased as a result of net new originations and higher overall utilization. For commercial loans by industry and commercial real estate loans by geography and property type, see Loan Portfolio Characteristics and Analysis in the Credit Risk Management portion of the Risk Management section in this Item 7. Consumer lending increased as growth in residential real estate, auto, credit card and other consumer loans was partially offset by lower home equity and education loans. Residential real estate loans increased primarily from originations of nonconforming loans, which are loans that do not meet agency standards as a result of exceeding agency conforming loan limits. The growth in auto loans reflected higher indirect auto loans from new loan originations and expansion into franchised dealers in new markets as well as growth in direct auto loans. Credit card balances increased as we continued to focus on our long-term objective of deepening penetration within our existing customer base as well as new client acquisitions. Other consumer loans increased due to unsecured installment loans driven by growth outside of our retail branch network and product enhancements. Home equity loans declined as paydowns and payoffs exceeded new originated volume and brokered home equity loans continued to run off. Education loans declined primarily due to continued runoff of the government guaranteed education loan portfolio. For information on home equity and residential real estate loans, including by geography and lien priority, and our auto loan portfolio, see Loan Portfolio Characteristics and Analysis in the Credit Risk Management portion of the Risk Management section in this Item 7. For additional information regarding our loan portfolio, see the Credit Risk Management portion of the Risk Management section in this Item 7 and Note 1 Accounting Policies, Note 4 Asset Quality and Note 5 Allowance for Loan and Lease Losses in our Notes To Consolidated Financial Statements included in Item 8 of this Report. Investment Securities The carrying value of investment securities of $86.8 billion at December 31, 2019 increased $4.1 billion, or 5%, compared to December 31, 2018, driven by net purchases and changes in unrealized gains and losses of agency residential mortgage-backed securities. The level and composition of the investment securities portfolio fluctuates over time based on many factors including market conditions, loan and deposit growth, and balance sheet management activities. We manage our investment securities portfolio to optimize returns, while providing a reliable source of liquidity for our banking and other activities, considering LCR and other internal and external guidelines and constraints.

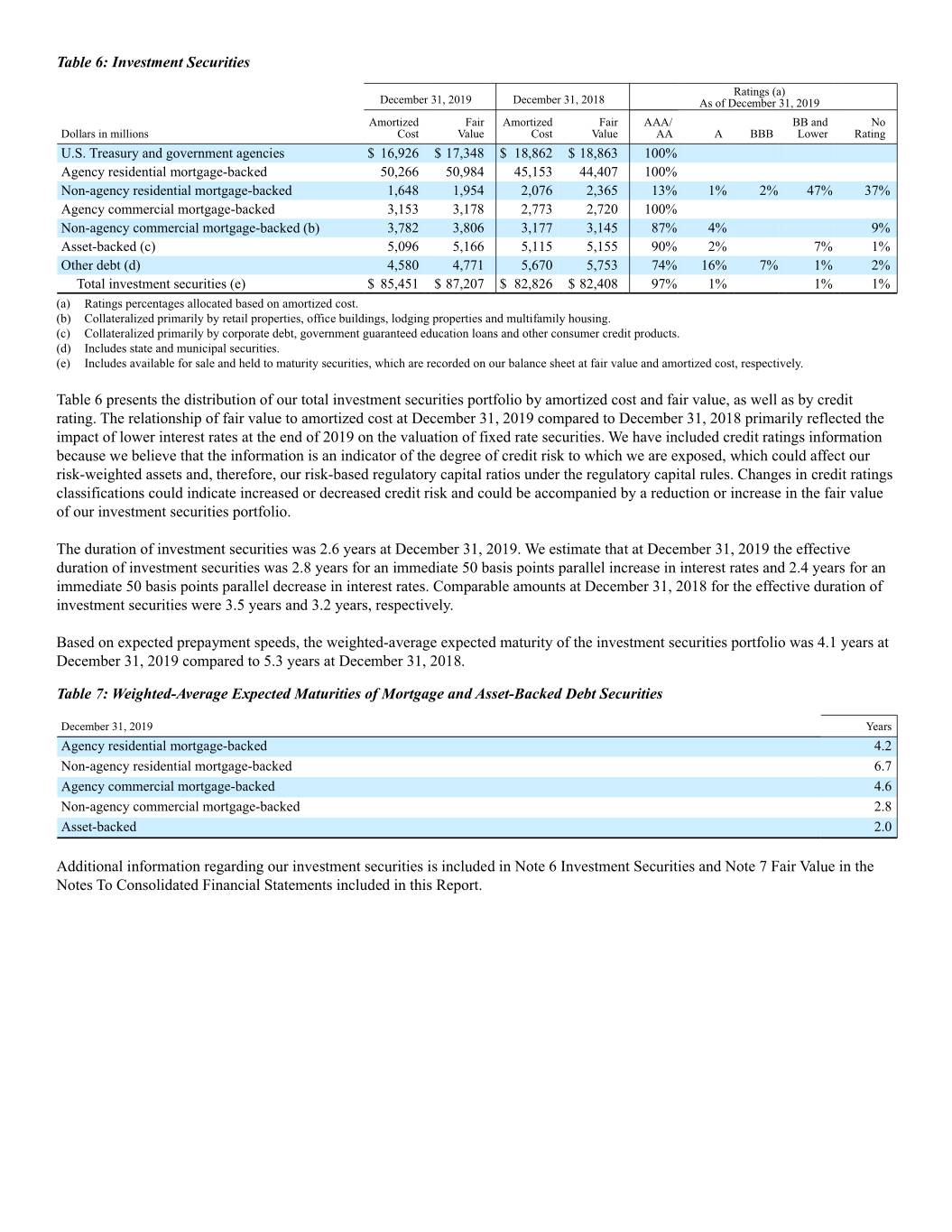

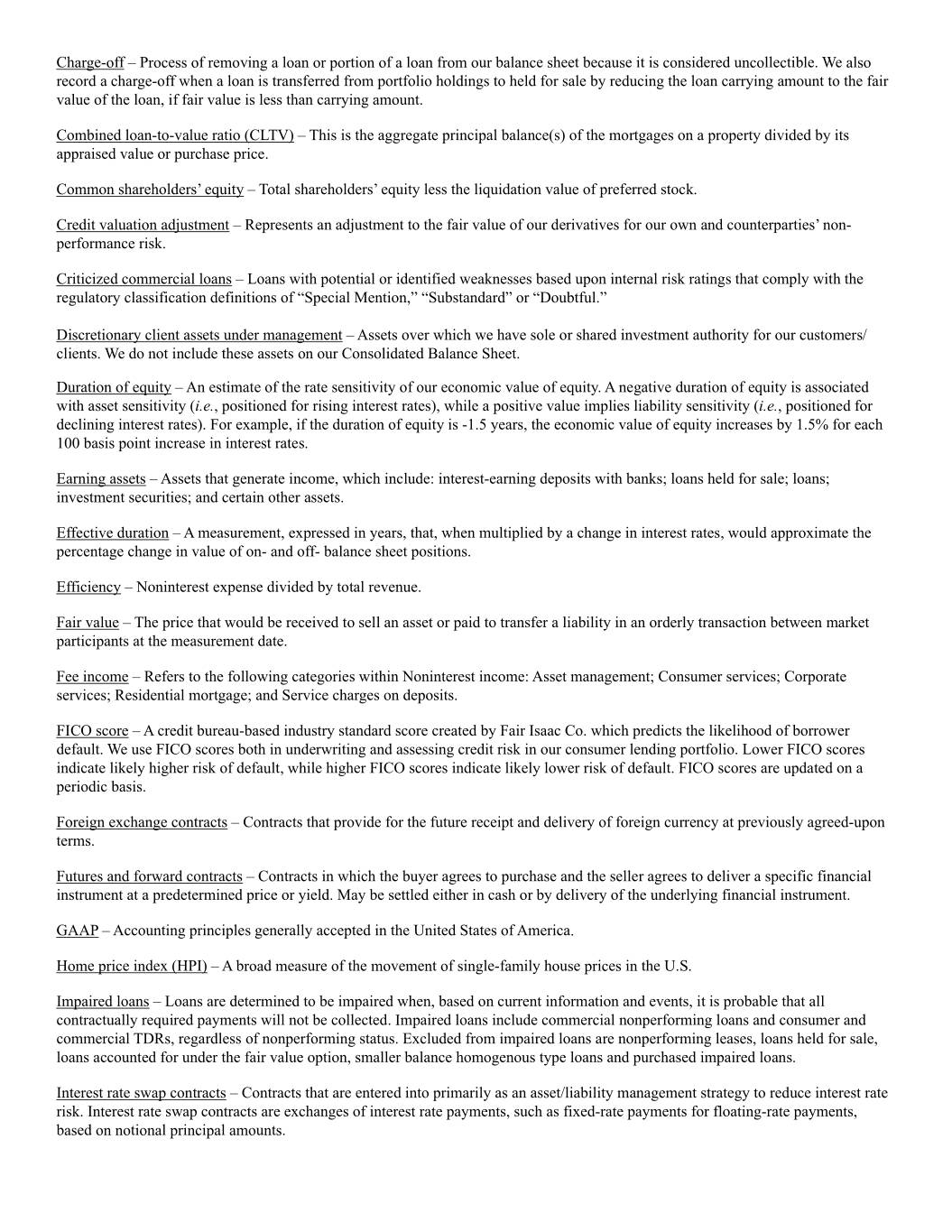

Table 6: Investment Securities Ratings (a) December 31, 2019 December 31, 2018 As of December 31, 2019 Amortized Fair Amortized Fair AAA/ BB and No Dollars in millions Cost Value Cost Value AA A BBB Lower Rating U.S. Treasury and government agencies $ 16,926 $ 17,348 $ 18,862 $ 18,863 100% Agency residential mortgage-backed 50,266 50,984 45,153 44,407 100% Non-agency residential mortgage-backed 1,648 1,954 2,076 2,365 13% 1% 2% 47% 37% Agency commercial mortgage-backed 3,153 3,178 2,773 2,720 100% Non-agency commercial mortgage-backed (b) 3,782 3,806 3,177 3,145 87% 4% 9% Asset-backed (c) 5,096 5,166 5,115 5,155 90% 2% 7% 1% Other debt (d) 4,580 4,771 5,670 5,753 74% 16% 7% 1% 2% Total investment securities (e) $ 85,451 $ 87,207 $ 82,826 $ 82,408 97% 1% 1% 1% (a) Ratings percentages allocated based on amortized cost. (b) Collateralized primarily by retail properties, office buildings, lodging properties and multifamily housing. (c) Collateralized primarily by corporate debt, government guaranteed education loans and other consumer credit products. (d) Includes state and municipal securities. (e) Includes available for sale and held to maturity securities, which are recorded on our balance sheet at fair value and amortized cost, respectively. Table 6 presents the distribution of our total investment securities portfolio by amortized cost and fair value, as well as by credit rating. The relationship of fair value to amortized cost at December 31, 2019 compared to December 31, 2018 primarily reflected the impact of lower interest rates at the end of 2019 on the valuation of fixed rate securities. We have included credit ratings information because we believe that the information is an indicator of the degree of credit risk to which we are exposed, which could affect our risk-weighted assets and, therefore, our risk-based regulatory capital ratios under the regulatory capital rules. Changes in credit ratings classifications could indicate increased or decreased credit risk and could be accompanied by a reduction or increase in the fair value of our investment securities portfolio. The duration of investment securities was 2.6 years at December 31, 2019. We estimate that at December 31, 2019 the effective duration of investment securities was 2.8 years for an immediate 50 basis points parallel increase in interest rates and 2.4 years for an immediate 50 basis points parallel decrease in interest rates. Comparable amounts at December 31, 2018 for the effective duration of investment securities were 3.5 years and 3.2 years, respectively. Based on expected prepayment speeds, the weighted-average expected maturity of the investment securities portfolio was 4.1 years at December 31, 2019 compared to 5.3 years at December 31, 2018. Table 7: Weighted-Average Expected Maturities of Mortgage and Asset-Backed Debt Securities December 31, 2019 Years Agency residential mortgage-backed 4.2 Non-agency residential mortgage-backed 6.7 Agency commercial mortgage-backed 4.6 Non-agency commercial mortgage-backed 2.8 Asset-backed 2.0 Additional information regarding our investment securities is included in Note 6 Investment Securities and Note 7 Fair Value in the Notes To Consolidated Financial Statements included in this Report.

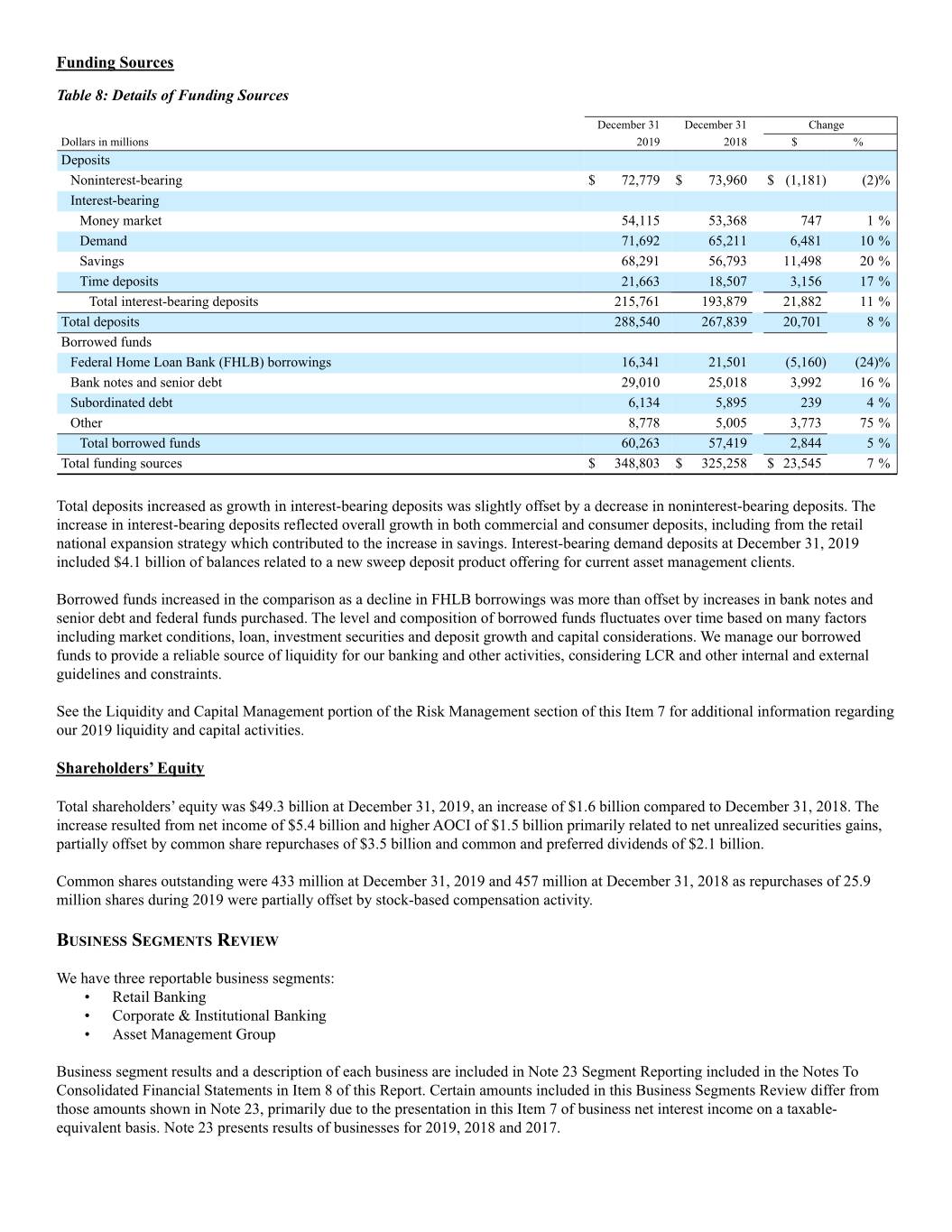

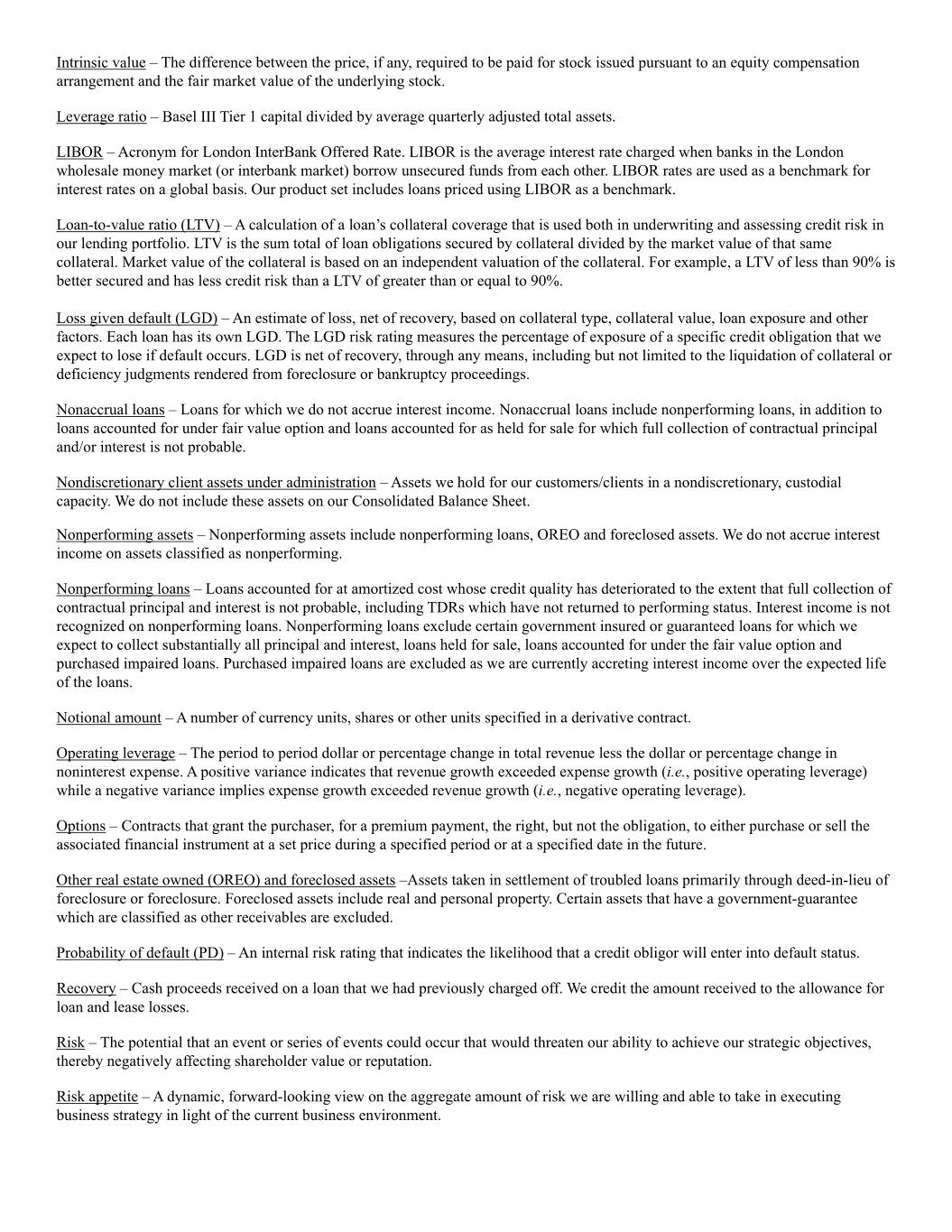

Funding Sources Table 8: Details of Funding Sources December 31 December 31 Change Dollars in millions 2019 2018 $ % Deposits Noninterest-bearing $ 72,779 $ 73,960 $ (1,181) (2)% Interest-bearing Money market 54,115 53,368 747 1 % Demand 71,692 65,211 6,481 10 % Savings 68,291 56,793 11,498 20 % Time deposits 21,663 18,507 3,156 17 % Total interest-bearing deposits 215,761 193,879 21,882 11 % Total deposits 288,540 267,839 20,701 8 % Borrowed funds Federal Home Loan Bank (FHLB) borrowings 16,341 21,501 (5,160) (24)% Bank notes and senior debt 29,010 25,018 3,992 16 % Subordinated debt 6,134 5,895 239 4 % Other 8,778 5,005 3,773 75 % Total borrowed funds 60,263 57,419 2,844 5 % Total funding sources $ 348,803 $ 325,258 $ 23,545 7 % Total deposits increased as growth in interest-bearing deposits was slightly offset by a decrease in noninterest-bearing deposits. The increase in interest-bearing deposits reflected overall growth in both commercial and consumer deposits, including from the retail national expansion strategy which contributed to the increase in savings. Interest-bearing demand deposits at December 31, 2019 included $4.1 billion of balances related to a new sweep deposit product offering for current asset management clients. Borrowed funds increased in the comparison as a decline in FHLB borrowings was more than offset by increases in bank notes and senior debt and federal funds purchased. The level and composition of borrowed funds fluctuates over time based on many factors including market conditions, loan, investment securities and deposit growth and capital considerations. We manage our borrowed funds to provide a reliable source of liquidity for our banking and other activities, considering LCR and other internal and external guidelines and constraints. See the Liquidity and Capital Management portion of the Risk Management section of this Item 7 for additional information regarding our 2019 liquidity and capital activities. Shareholders’ Equity Total shareholders’ equity was $49.3 billion at December 31, 2019, an increase of $1.6 billion compared to December 31, 2018. The increase resulted from net income of $5.4 billion and higher AOCI of $1.5 billion primarily related to net unrealized securities gains, partially offset by common share repurchases of $3.5 billion and common and preferred dividends of $2.1 billion. Common shares outstanding were 433 million at December 31, 2019 and 457 million at December 31, 2018 as repurchases of 25.9 million shares during 2019 were partially offset by stock-based compensation activity. BUSINESS SEGMENTS REVIEW We have three reportable business segments: • Retail Banking • Corporate & Institutional Banking • Asset Management Group Business segment results and a description of each business are included in Note 23 Segment Reporting included in the Notes To Consolidated Financial Statements in Item 8 of this Report. Certain amounts included in this Business Segments Review differ from those amounts shown in Note 23, primarily due to the presentation in this Item 7 of business net interest income on a taxable- equivalent basis. Note 23 presents results of businesses for 2019, 2018 and 2017.

Net interest income in business segment results reflects our internal funds transfer pricing methodology. Assets receive a funding charge and liabilities and capital receive a funding credit based on a transfer pricing methodology that incorporates product repricing characteristics, tenor and other factors. Total business segment financial results differ from total consolidated net income. The impact of these differences is reflected in the “Other” category as shown in Table 100 in Note 23 Segment Reporting in Item 8 of this Report. “Other” includes residual activities that do not meet the criteria for disclosure as a separate reportable business, such as asset and liability management activities including net securities gains or losses, other-than-temporary impairment of investment securities, certain trading activities, certain runoff consumer loan portfolios, private equity investments, intercompany eliminations, certain corporate overhead, tax adjustments that are not allocated to business segments, exited businesses, and differences between business segment performance reporting and financial statement reporting (GAAP), including the presentation of net income attributable to noncontrolling interests as the segments’ results exclude their portion of net income attributable to noncontrolling interests.

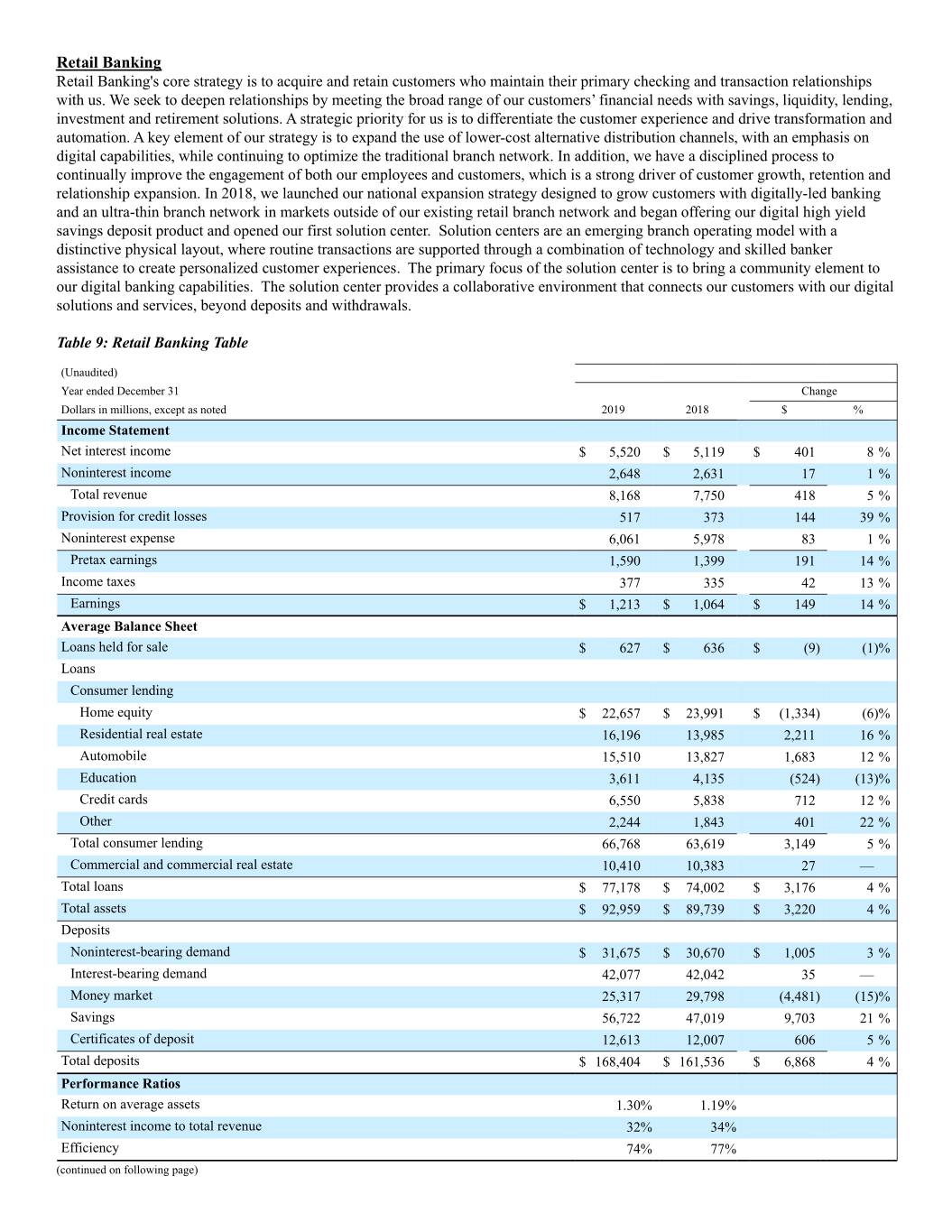

Retail Banking Retail Banking's core strategy is to acquire and retain customers who maintain their primary checking and transaction relationships with us. We seek to deepen relationships by meeting the broad range of our customers’ financial needs with savings, liquidity, lending, investment and retirement solutions. A strategic priority for us is to differentiate the customer experience and drive transformation and automation. A key element of our strategy is to expand the use of lower-cost alternative distribution channels, with an emphasis on digital capabilities, while continuing to optimize the traditional branch network. In addition, we have a disciplined process to continually improve the engagement of both our employees and customers, which is a strong driver of customer growth, retention and relationship expansion. In 2018, we launched our national expansion strategy designed to grow customers with digitally-led banking and an ultra-thin branch network in markets outside of our existing retail branch network and began offering our digital high yield savings deposit product and opened our first solution center. Solution centers are an emerging branch operating model with a distinctive physical layout, where routine transactions are supported through a combination of technology and skilled banker assistance to create personalized customer experiences. The primary focus of the solution center is to bring a community element to our digital banking capabilities. The solution center provides a collaborative environment that connects our customers with our digital solutions and services, beyond deposits and withdrawals. Table 9: Retail Banking Table (Unaudited) Year ended December 31 Change Dollars in millions, except as noted 2019 2018 $ % Income Statement Net interest income $ 5,520 $ 5,119 $ 401 8 % Noninterest income 2,648 2,631 17 1 % Total revenue 8,168 7,750 418 5 % Provision for credit losses 517 373 144 39 % Noninterest expense 6,061 5,978 83 1 % Pretax earnings 1,590 1,399 191 14 % Income taxes 377 335 42 13 % Earnings $ 1,213 $ 1,064 $ 149 14 % Average Balance Sheet Loans held for sale $ 627 $ 636 $ (9) (1)% Loans Consumer lending Home equity $ 22,657 $ 23,991 $ (1,334) (6)% Residential real estate 16,196 13,985 2,211 16 % Automobile 15,510 13,827 1,683 12 % Education 3,611 4,135 (524) (13)% Credit cards 6,550 5,838 712 12 % Other 2,244 1,843 401 22 % Total consumer lending 66,768 63,619 3,149 5 % Commercial and commercial real estate 10,410 10,383 27 — Total loans $ 77,178 $ 74,002 $ 3,176 4 % Total assets $ 92,959 $ 89,739 $ 3,220 4 % Deposits Noninterest-bearing demand $ 31,675 $ 30,670 $ 1,005 3 % Interest-bearing demand 42,077 42,042 35 — Money market 25,317 29,798 (4,481) (15)% Savings 56,722 47,019 9,703 21 % Certificates of deposit 12,613 12,007 606 5 % Total deposits $ 168,404 $ 161,536 $ 6,868 4 % Performance Ratios Return on average assets 1.30% 1.19% Noninterest income to total revenue 32% 34% Efficiency 74% 77% (continued on following page)

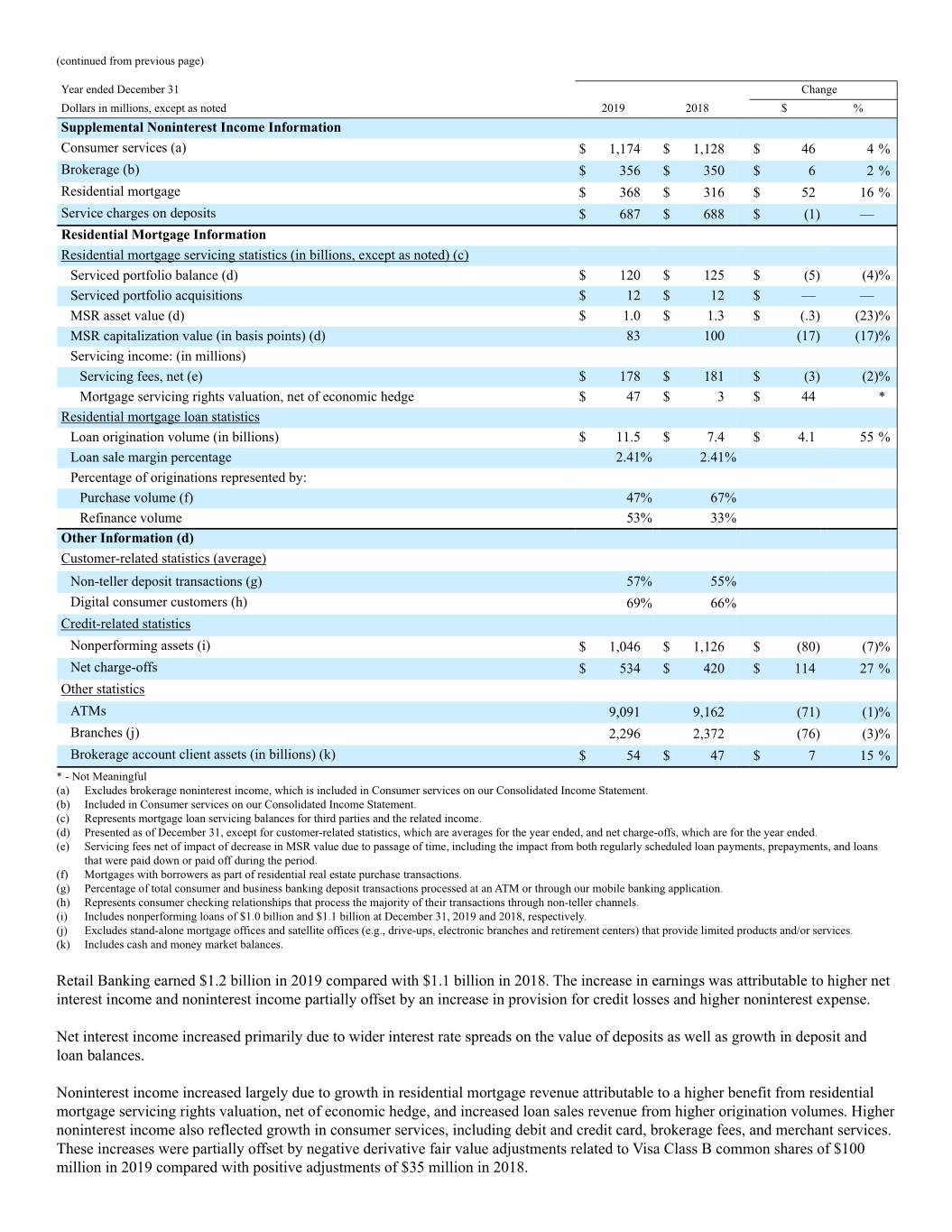

(continued from previous page) Year ended December 31 Change Dollars in millions, except as noted 2019 2018 $ % Supplemental Noninterest Income Information Consumer services (a) $ 1,174 $ 1,128 $ 46 4 % Brokerage (b) $ 356 $ 350 $ 6 2 % Residential mortgage $ 368 $ 316 $ 52 16 % Service charges on deposits $ 687 $ 688 $ (1) — Residential Mortgage Information Residential mortgage servicing statistics (in billions, except as noted) (c) Serviced portfolio balance (d) $ 120 $ 125 $ (5) (4)% Serviced portfolio acquisitions $ 12 $ 12 $ — — MSR asset value (d) $ 1.0 $ 1.3 $ (.3) (23)% MSR capitalization value (in basis points) (d) 83 100 (17) (17)% Servicing income: (in millions) Servicing fees, net (e) $ 178 $ 181 $ (3) (2)% Mortgage servicing rights valuation, net of economic hedge $ 47 $ 3 $ 44 * Residential mortgage loan statistics Loan origination volume (in billions) $ 11.5 $ 7.4 $ 4.1 55 % Loan sale margin percentage 2.41% 2.41% Percentage of originations represented by: Purchase volume (f) 47% 67% Refinance volume 53% 33% Other Information (d) Customer-related statistics (average) Non-teller deposit transactions (g) 57% 55% Digital consumer customers (h) 69% 66% Credit-related statistics Nonperforming assets (i) $ 1,046 $ 1,126 $ (80) (7)% Net charge-offs $ 534 $ 420 $ 114 27 % Other statistics ATMs 9,091 9,162 (71) (1)% Branches (j) 2,296 2,372 (76) (3)% Brokerage account client assets (in billions) (k) $ 54 $ 47 $ 7 15 % * - Not Meaningful (a) Excludes brokerage noninterest income, which is included in Consumer services on our Consolidated Income Statement. (b) Included in Consumer services on our Consolidated Income Statement. (c) Represents mortgage loan servicing balances for third parties and the related income. (d) Presented as of December 31, except for customer-related statistics, which are averages for the year ended, and net charge-offs, which are for the year ended. (e) Servicing fees net of impact of decrease in MSR value due to passage of time, including the impact from both regularly scheduled loan payments, prepayments, and loans that were paid down or paid off during the period. (f) Mortgages with borrowers as part of residential real estate purchase transactions. (g) Percentage of total consumer and business banking deposit transactions processed at an ATM or through our mobile banking application. (h) Represents consumer checking relationships that process the majority of their transactions through non-teller channels. (i) Includes nonperforming loans of $1.0 billion and $1.1 billion at December 31, 2019 and 2018, respectively. (j) Excludes stand-alone mortgage offices and satellite offices (e.g., drive-ups, electronic branches and retirement centers) that provide limited products and/or services. (k) Includes cash and money market balances. Retail Banking earned $1.2 billion in 2019 compared with $1.1 billion in 2018. The increase in earnings was attributable to higher net interest income and noninterest income partially offset by an increase in provision for credit losses and higher noninterest expense. Net interest income increased primarily due to wider interest rate spreads on the value of deposits as well as growth in deposit and loan balances. Noninterest income increased largely due to growth in residential mortgage revenue attributable to a higher benefit from residential mortgage servicing rights valuation, net of economic hedge, and increased loan sales revenue from higher origination volumes. Higher noninterest income also reflected growth in consumer services, including debit and credit card, brokerage fees, and merchant services. These increases were partially offset by negative derivative fair value adjustments related to Visa Class B common shares of $100 million in 2019 compared with positive adjustments of $35 million in 2018.

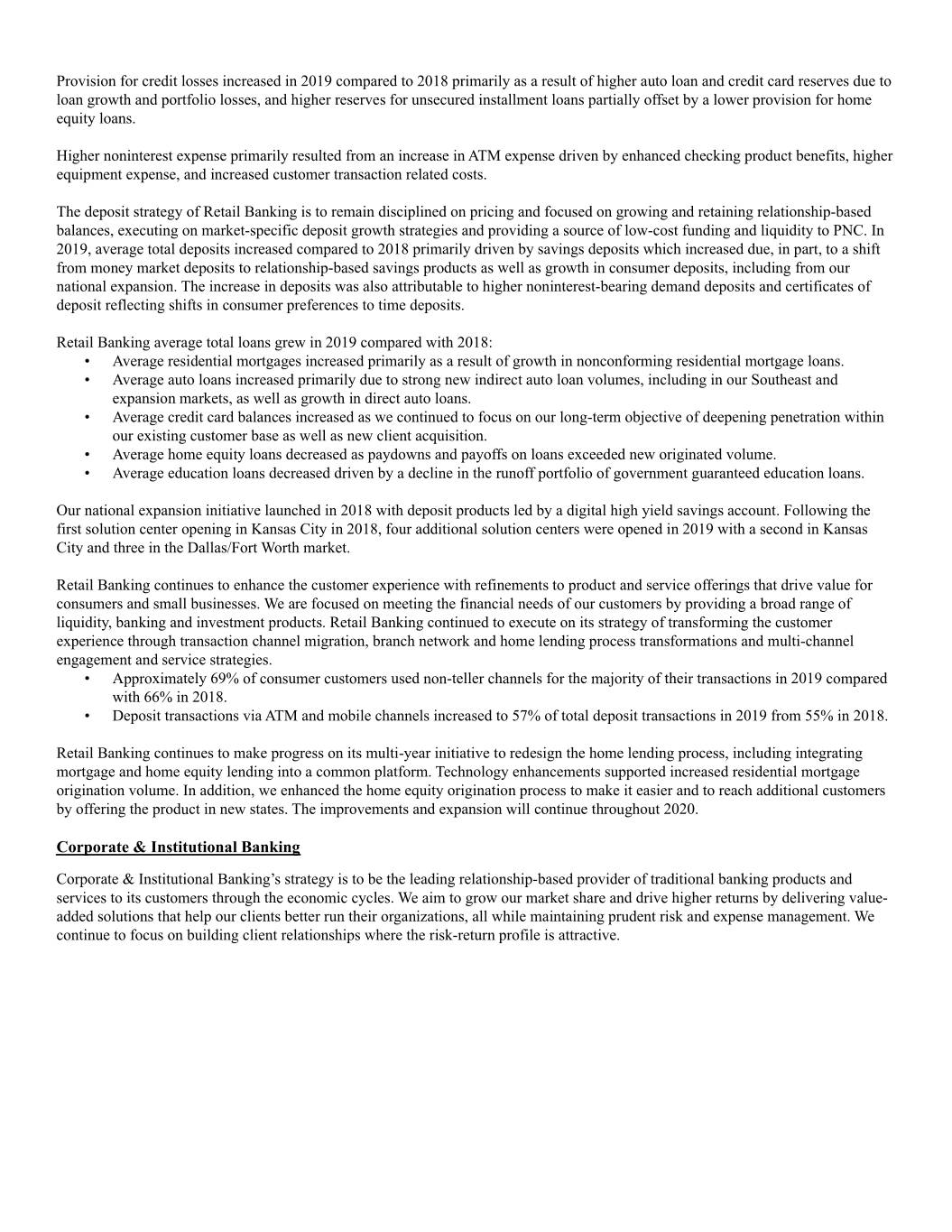

Provision for credit losses increased in 2019 compared to 2018 primarily as a result of higher auto loan and credit card reserves due to loan growth and portfolio losses, and higher reserves for unsecured installment loans partially offset by a lower provision for home equity loans. Higher noninterest expense primarily resulted from an increase in ATM expense driven by enhanced checking product benefits, higher equipment expense, and increased customer transaction related costs. The deposit strategy of Retail Banking is to remain disciplined on pricing and focused on growing and retaining relationship-based balances, executing on market-specific deposit growth strategies and providing a source of low-cost funding and liquidity to PNC. In 2019, average total deposits increased compared to 2018 primarily driven by savings deposits which increased due, in part, to a shift from money market deposits to relationship-based savings products as well as growth in consumer deposits, including from our national expansion. The increase in deposits was also attributable to higher noninterest-bearing demand deposits and certificates of deposit reflecting shifts in consumer preferences to time deposits. Retail Banking average total loans grew in 2019 compared with 2018: • Average residential mortgages increased primarily as a result of growth in nonconforming residential mortgage loans. • Average auto loans increased primarily due to strong new indirect auto loan volumes, including in our Southeast and expansion markets, as well as growth in direct auto loans. • Average credit card balances increased as we continued to focus on our long-term objective of deepening penetration within our existing customer base as well as new client acquisition. • Average home equity loans decreased as paydowns and payoffs on loans exceeded new originated volume. • Average education loans decreased driven by a decline in the runoff portfolio of government guaranteed education loans. Our national expansion initiative launched in 2018 with deposit products led by a digital high yield savings account. Following the first solution center opening in Kansas City in 2018, four additional solution centers were opened in 2019 with a second in Kansas City and three in the Dallas/Fort Worth market. Retail Banking continues to enhance the customer experience with refinements to product and service offerings that drive value for consumers and small businesses. We are focused on meeting the financial needs of our customers by providing a broad range of liquidity, banking and investment products. Retail Banking continued to execute on its strategy of transforming the customer experience through transaction channel migration, branch network and home lending process transformations and multi-channel engagement and service strategies. • Approximately 69% of consumer customers used non-teller channels for the majority of their transactions in 2019 compared with 66% in 2018. • Deposit transactions via ATM and mobile channels increased to 57% of total deposit transactions in 2019 from 55% in 2018. Retail Banking continues to make progress on its multi-year initiative to redesign the home lending process, including integrating mortgage and home equity lending into a common platform. Technology enhancements supported increased residential mortgage origination volume. In addition, we enhanced the home equity origination process to make it easier and to reach additional customers by offering the product in new states. The improvements and expansion will continue throughout 2020. Corporate & Institutional Banking Corporate & Institutional Banking’s strategy is to be the leading relationship-based provider of traditional banking products and services to its customers through the economic cycles. We aim to grow our market share and drive higher returns by delivering value- added solutions that help our clients better run their organizations, all while maintaining prudent risk and expense management. We continue to focus on building client relationships where the risk-return profile is attractive.

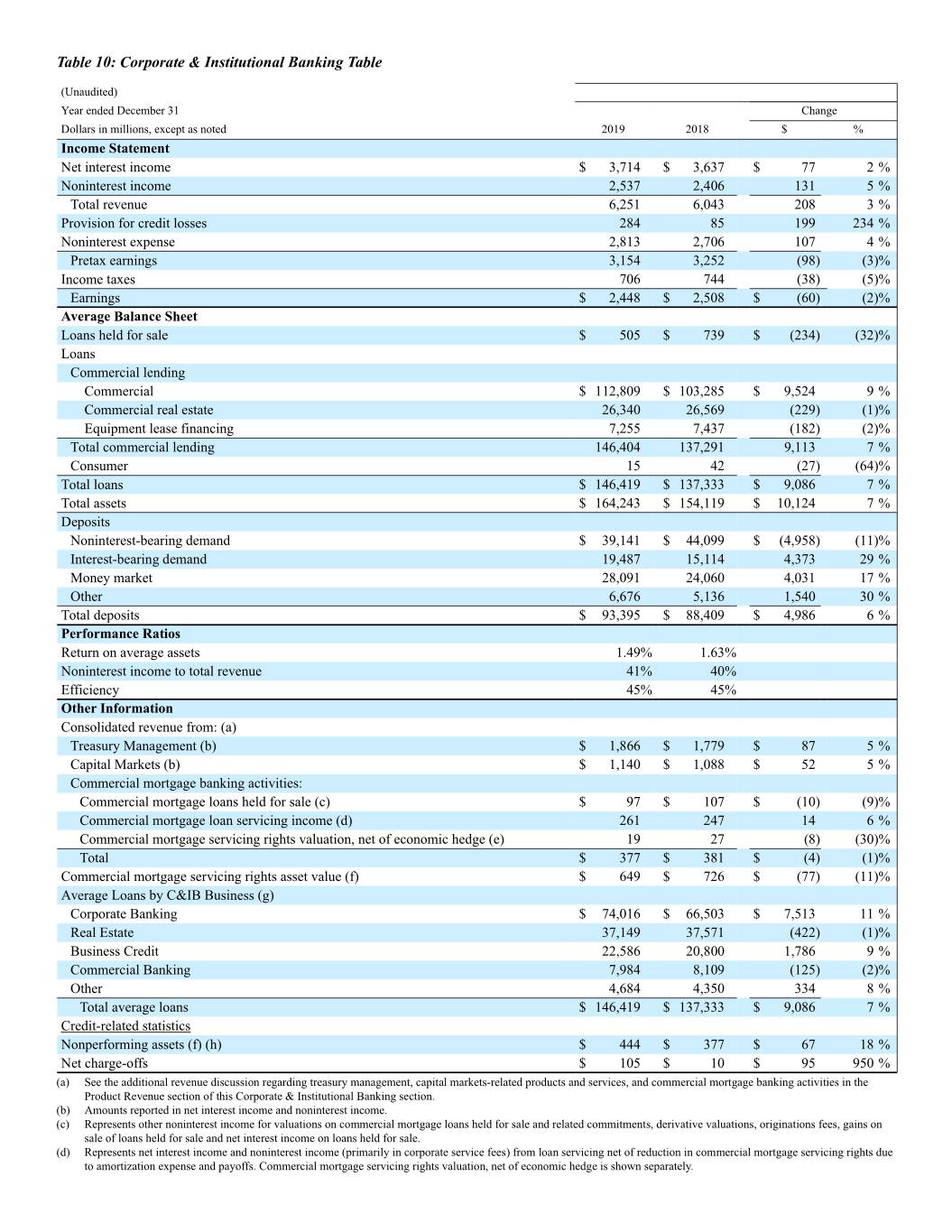

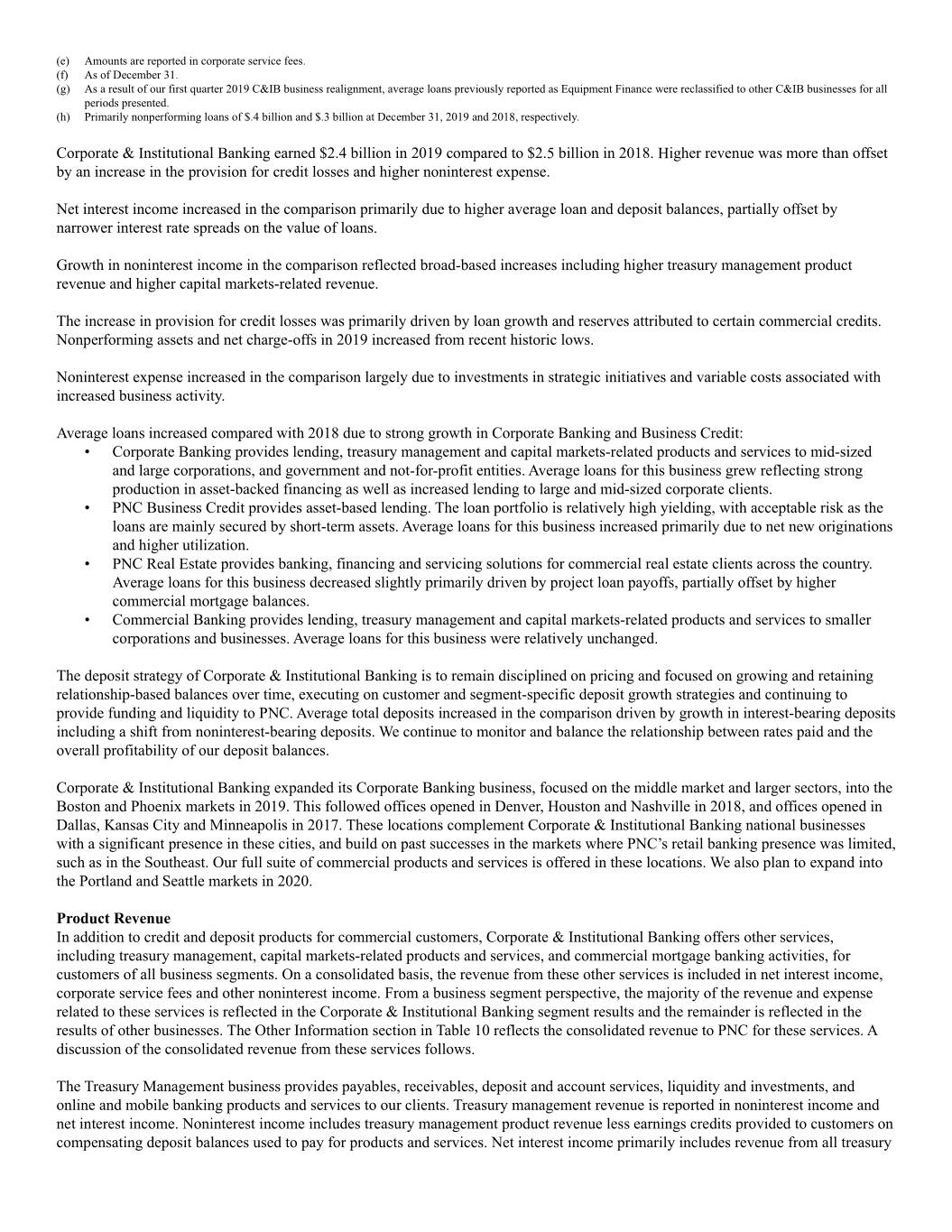

Table 10: Corporate & Institutional Banking Table (Unaudited) Year ended December 31 Change Dollars in millions, except as noted 2019 2018 $ % Income Statement Net interest income $ 3,714 $ 3,637 $ 77 2 % Noninterest income 2,537 2,406 131 5 % Total revenue 6,251 6,043 208 3 % Provision for credit losses 284 85 199 234 % Noninterest expense 2,813 2,706 107 4 % Pretax earnings 3,154 3,252 (98) (3)% Income taxes 706 744 (38) (5)% Earnings $ 2,448 $ 2,508 $ (60) (2)% Average Balance Sheet Loans held for sale $ 505 $ 739 $ (234) (32)% Loans Commercial lending Commercial $ 112,809 $ 103,285 $ 9,524 9 % Commercial real estate 26,340 26,569 (229) (1)% Equipment lease financing 7,255 7,437 (182) (2)% Total commercial lending 146,404 137,291 9,113 7 % Consumer 15 42 (27) (64)% Total loans $ 146,419 $ 137,333 $ 9,086 7 % Total assets $ 164,243 $ 154,119 $ 10,124 7 % Deposits Noninterest-bearing demand $ 39,141 $ 44,099 $ (4,958) (11)% Interest-bearing demand 19,487 15,114 4,373 29 % Money market 28,091 24,060 4,031 17 % Other 6,676 5,136 1,540 30 % Total deposits $ 93,395 $ 88,409 $ 4,986 6 % Performance Ratios Return on average assets 1.49% 1.63% Noninterest income to total revenue 41% 40% Efficiency 45% 45% Other Information Consolidated revenue from: (a) Treasury Management (b) $ 1,866 $ 1,779 $ 87 5 % Capital Markets (b) $ 1,140 $ 1,088 $ 52 5 % Commercial mortgage banking activities: Commercial mortgage loans held for sale (c) $ 97 $ 107 $ (10) (9)% Commercial mortgage loan servicing income (d) 261 247 14 6 % Commercial mortgage servicing rights valuation, net of economic hedge (e) 19 27 (8) (30)% Total $ 377 $ 381 $ (4) (1)% Commercial mortgage servicing rights asset value (f) $ 649 $ 726 $ (77) (11)% Average Loans by C&IB Business (g) Corporate Banking $ 74,016 $ 66,503 $ 7,513 11 % Real Estate 37,149 37,571 (422) (1)% Business Credit 22,586 20,800 1,786 9 % Commercial Banking 7,984 8,109 (125) (2)% Other 4,684 4,350 334 8 % Total average loans $ 146,419 $ 137,333 $ 9,086 7 % Credit-related statistics Nonperforming assets (f) (h) $ 444 $ 377 $ 67 18 % Net charge-offs $ 105 $ 10 $ 95 950 % (a) See the additional revenue discussion regarding treasury management, capital markets-related products and services, and commercial mortgage banking activities in the Product Revenue section of this Corporate & Institutional Banking section. (b) Amounts reported in net interest income and noninterest income. (c) Represents other noninterest income for valuations on commercial mortgage loans held for sale and related commitments, derivative valuations, originations fees, gains on sale of loans held for sale and net interest income on loans held for sale. (d) Represents net interest income and noninterest income (primarily in corporate service fees) from loan servicing net of reduction in commercial mortgage servicing rights due to amortization expense and payoffs. Commercial mortgage servicing rights valuation, net of economic hedge is shown separately.

(e) Amounts are reported in corporate service fees. (f) As of December 31. (g) As a result of our first quarter 2019 C&IB business realignment, average loans previously reported as Equipment Finance were reclassified to other C&IB businesses for all periods presented. (h) Primarily nonperforming loans of $.4 billion and $.3 billion at December 31, 2019 and 2018, respectively. Corporate & Institutional Banking earned $2.4 billion in 2019 compared to $2.5 billion in 2018. Higher revenue was more than offset by an increase in the provision for credit losses and higher noninterest expense. Net interest income increased in the comparison primarily due to higher average loan and deposit balances, partially offset by narrower interest rate spreads on the value of loans. Growth in noninterest income in the comparison reflected broad-based increases including higher treasury management product revenue and higher capital markets-related revenue. The increase in provision for credit losses was primarily driven by loan growth and reserves attributed to certain commercial credits. Nonperforming assets and net charge-offs in 2019 increased from recent historic lows. Noninterest expense increased in the comparison largely due to investments in strategic initiatives and variable costs associated with increased business activity. Average loans increased compared with 2018 due to strong growth in Corporate Banking and Business Credit: • Corporate Banking provides lending, treasury management and capital markets-related products and services to mid-sized and large corporations, and government and not-for-profit entities. Average loans for this business grew reflecting strong production in asset-backed financing as well as increased lending to large and mid-sized corporate clients. • PNC Business Credit provides asset-based lending. The loan portfolio is relatively high yielding, with acceptable risk as the loans are mainly secured by short-term assets. Average loans for this business increased primarily due to net new originations and higher utilization. • PNC Real Estate provides banking, financing and servicing solutions for commercial real estate clients across the country. Average loans for this business decreased slightly primarily driven by project loan payoffs, partially offset by higher commercial mortgage balances. • Commercial Banking provides lending, treasury management and capital markets-related products and services to smaller corporations and businesses. Average loans for this business were relatively unchanged. The deposit strategy of Corporate & Institutional Banking is to remain disciplined on pricing and focused on growing and retaining relationship-based balances over time, executing on customer and segment-specific deposit growth strategies and continuing to provide funding and liquidity to PNC. Average total deposits increased in the comparison driven by growth in interest-bearing deposits including a shift from noninterest-bearing deposits. We continue to monitor and balance the relationship between rates paid and the overall profitability of our deposit balances. Corporate & Institutional Banking expanded its Corporate Banking business, focused on the middle market and larger sectors, into the Boston and Phoenix markets in 2019. This followed offices opened in Denver, Houston and Nashville in 2018, and offices opened in Dallas, Kansas City and Minneapolis in 2017. These locations complement Corporate & Institutional Banking national businesses with a significant presence in these cities, and build on past successes in the markets where PNC’s retail banking presence was limited, such as in the Southeast. Our full suite of commercial products and services is offered in these locations. We also plan to expand into the Portland and Seattle markets in 2020. Product Revenue In addition to credit and deposit products for commercial customers, Corporate & Institutional Banking offers other services, including treasury management, capital markets-related products and services, and commercial mortgage banking activities, for customers of all business segments. On a consolidated basis, the revenue from these other services is included in net interest income, corporate service fees and other noninterest income. From a business segment perspective, the majority of the revenue and expense related to these services is reflected in the Corporate & Institutional Banking segment results and the remainder is reflected in the results of other businesses. The Other Information section in Table 10 reflects the consolidated revenue to PNC for these services. A discussion of the consolidated revenue from these services follows. The Treasury Management business provides payables, receivables, deposit and account services, liquidity and investments, and online and mobile banking products and services to our clients. Treasury management revenue is reported in noninterest income and net interest income. Noninterest income includes treasury management product revenue less earnings credits provided to customers on compensating deposit balances used to pay for products and services. Net interest income primarily includes revenue from all treasury

management customer deposit balances. Compared with 2018, treasury management revenue increased primarily due to higher product revenue and higher deposit balances. Capital markets-related products and services include foreign exchange, derivatives, securities underwriting, loan syndications, mergers and acquisitions advisory and equity capital markets advisory related services. The increase in capital markets-related revenue in the comparison was broad based across most products and services and included higher asset-backed finance structuring fees, underwriting fees, and customer-related derivatives fees, partially offset by lower loan syndication revenue. Commercial mortgage banking activities include revenue derived from commercial mortgage servicing (both net interest income and noninterest income) and revenue derived from commercial mortgage loans held for sale and related hedges. Total revenue from commercial mortgage banking activities decreased in the comparison due to lower revenue from commercial mortgage loans held for sale and related hedges and a lower benefit from commercial mortgage servicing rights valuation, net of economic hedge, mostly offset by higher commercial mortgage loan servicing income.

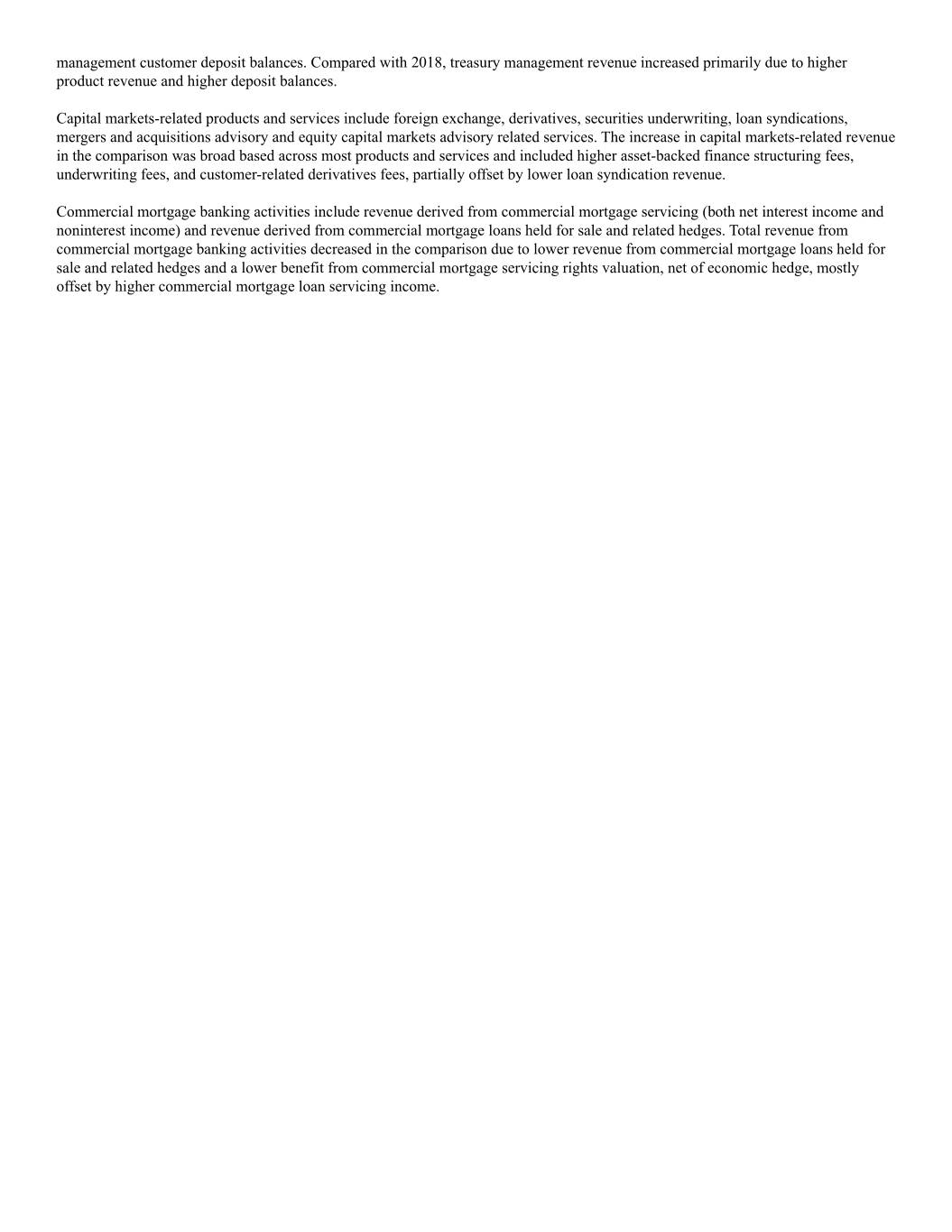

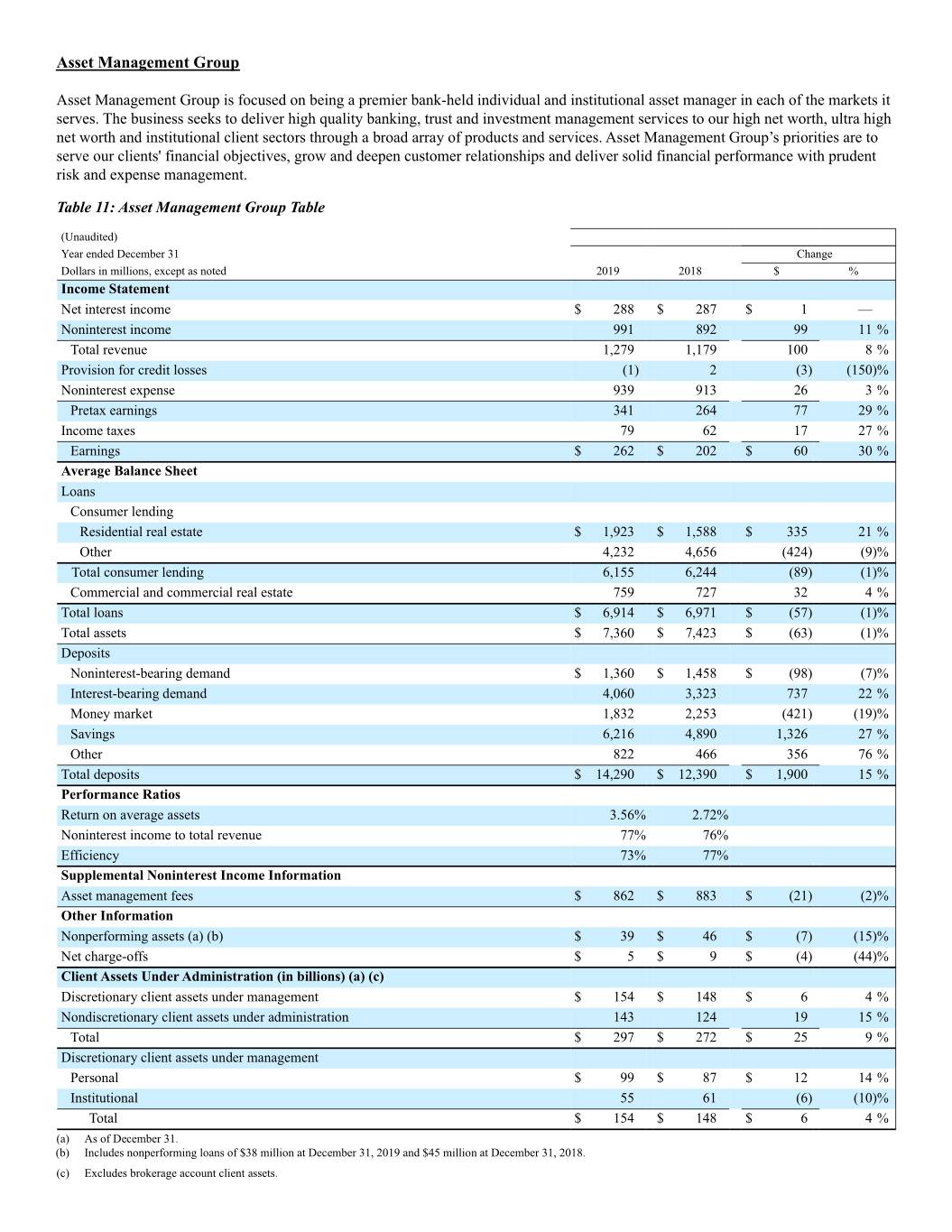

Asset Management Group Asset Management Group is focused on being a premier bank-held individual and institutional asset manager in each of the markets it serves. The business seeks to deliver high quality banking, trust and investment management services to our high net worth, ultra high net worth and institutional client sectors through a broad array of products and services. Asset Management Group’s priorities are to serve our clients' financial objectives, grow and deepen customer relationships and deliver solid financial performance with prudent risk and expense management. Table 11: Asset Management Group Table (Unaudited) Year ended December 31 Change Dollars in millions, except as noted 2019 2018 $ % Income Statement Net interest income $ 288 $ 287 $ 1 — Noninterest income 991 892 99 11 % Total revenue 1,279 1,179 100 8 % Provision for credit losses (1) 2 (3) (150)% Noninterest expense 939 913 26 3 % Pretax earnings 341 264 77 29 % Income taxes 79 62 17 27 % Earnings $ 262 $ 202 $ 60 30 % Average Balance Sheet Loans Consumer lending Residential real estate $ 1,923 $ 1,588 $ 335 21 % Other 4,232 4,656 (424) (9)% Total consumer lending 6,155 6,244 (89) (1)% Commercial and commercial real estate 759 727 32 4 % Total loans $ 6,914 $ 6,971 $ (57) (1)% Total assets $ 7,360 $ 7,423 $ (63) (1)% Deposits Noninterest-bearing demand $ 1,360 $ 1,458 $ (98) (7)% Interest-bearing demand 4,060 3,323 737 22 % Money market 1,832 2,253 (421) (19)% Savings 6,216 4,890 1,326 27 % Other 822 466 356 76 % Total deposits $ 14,290 $ 12,390 $ 1,900 15 % Performance Ratios Return on average assets 3.56% 2.72% Noninterest income to total revenue 77% 76% Efficiency 73% 77% Supplemental Noninterest Income Information Asset management fees $ 862 $ 883 $ (21) (2)% Other Information Nonperforming assets (a) (b) $ 39 $ 46 $ (7) (15)% Net charge-offs $ 5 $ 9 $ (4) (44)% Client Assets Under Administration (in billions) (a) (c) Discretionary client assets under management $ 154 $ 148 $ 6 4 % Nondiscretionary client assets under administration 143 124 19 15 % Total $ 297 $ 272 $ 25 9 % Discretionary client assets under management Personal $ 99 $ 87 $ 12 14 % Institutional 55 61 (6) (10)% Total $ 154 $ 148 $ 6 4 % (a) As of December 31. (b) Includes nonperforming loans of $38 million at December 31, 2019 and $45 million at December 31, 2018. (c) Excludes brokerage account client assets.

Asset Management Group earned $262 million in 2019 compared with $202 million in 2018. Earnings increased primarily due to higher revenue partially offset by higher noninterest expense. Growth in noninterest income was driven by the gains on sale of the retirement recordkeeping business and the sale of components of the PNC Capital Advisors investment management business, including its PNC family of proprietary mutual funds. Increases in the average equity markets also contributed to noninterest income growth in 2019. These increases were partially offset by lower asset management fees as a result of the business sales and the impact of lower yielding assets under management. The increase in noninterest expense was primarily attributable to higher personnel expenses and costs associated with the sale transactions, including asset write-offs. Asset Management Group’s discretionary client assets under management increased primarily attributable to higher equity markets as of December 31, 2019. The Asset Management Group strives to be the leading relationship-based provider of investment, planning, banking and fiduciary services to wealthy individuals and institutions by proactively delivering value-added ideas and solutions and exceptional service. Wealth Management and Hawthorn have nearly 100 offices operating in seven out of the ten most affluent states in the U.S. with a majority co-located with retail banking branches. The businesses provide customized investment management, wealth planning, trust and estate administration and private banking solutions to affluent individuals and ultra-affluent families. Institutional Asset Management provides outsourced chief investment officer, custody, private real estate, cash and fixed income client solutions, and fiduciary retirement advisory services to institutional clients including corporations, healthcare systems, insurance companies, unions, municipalities and non-profits.

RISK MANAGEMENT Enterprise Risk Management We encounter risk as part of the normal course of operating our business. Accordingly, we design risk management processes to help manage this risk. We manage risk in light of our risk appetite to optimize long-term shareholder value while supporting our employees, customers and communities. Our Enterprise Risk Management (ERM) Framework is structurally aligned with enhanced prudential standards that establish minimum requirements for the design and implementation of a risk management framework. This Risk Management section describes our ERM Framework which consists of risk culture, enterprise strategy (including risk appetite, strategic planning, capital planning and stress testing), risk governance and oversight, risk identification, risk assessments, risk controls and monitoring, and risk aggregation and reporting. The overall Risk Management section of this Item 7 also provides an analysis of our key areas of risk, which include but are not limited to credit, liquidity and capital, market and operational. Our use of financial derivatives as part of our overall asset and liability risk management process is also addressed within this Risk Management section. We operate within a rapidly evolving regulatory environment. Accordingly, we are actively focused on the timely adoption of applicable regulatory pronouncements within our ERM Framework. We view risk management as a cohesive combination of the following risk elements which form our ERM Framework:

Risk Culture A strong risk culture helps us make well-informed decisions, ensures individuals conform to the established culture, reduces an individual’s ability to do something for personal gain, and rewards employees working toward a common goal rather than individual interests. Our risk culture reinforces the appropriate protocols for responsible and ethical behavior. These protocols are especially critical in terms of our risk awareness, risk-taking behavior and risk management practices. Managing risk is every employee’s responsibility. All of our employees individually and collectively are responsible for ensuring the organization is performing with the utmost integrity, is applying sound risk management practices and is striving to achieve our stated objectives rather than pursuing individual interests. All employees are also responsible for understanding our Enterprise Risk Appetite Statement, the ERM Framework and how risk management applies to their respective roles and responsibilities. Employees are encouraged to collaborate across groups to identify and mitigate risks and elevate issues as required. We reinforce risk management responsibilities through a performance management system where employee performance goals include risk management objectives and incentives for employees to reinforce balanced measures of risk-adjusted performance. Proactive communication, between groups and up to the Board of Directors, facilitates timely identification and resolution of risk issues. Our multi-level risk committee structure provides formal channels to identify and report risk. Enterprise Strategy We ensure that our overall enterprise strategy is within acceptable risk parameters through our risk appetite, strategic planning, capital planning and stress testing processes. These components are reviewed and approved at least annually by the Board of Directors. Risk Appetite: Our risk appetite represents the organization’s desired enterprise risk position, set within our capital based risk and liquidity capacity to achieve our strategic objectives and business plans. The Enterprise Risk Appetite Statement qualitatively describes the aggregate level of risk we are willing to accept in order to execute our business strategies. Qualitative guiding principles further define each of the risks within our taxonomy to support the risk appetite statement. Risk appetite metrics and limits, including forward-looking metrics, quantitatively measure whether we are operating within our stated Risk Appetite. Our risk appetite metrics reflect material risks, align with our established Risk Appetite Framework, balance risk and reward, leverage analytics, and adjust in a timely manner to changes in the external and internal risk environments. Strategic Planning: Our enterprise and line of business strategic plans outline major objectives, strategies and goals which are expected to be achieved over the next five years while seeking to ensure we remain compliant with all capital, risk appetite and liquidity targets and guidelines. Our CEO and CFO lead the development of the corporate strategic plan, the strategic objectives and the comprehensive identification of material risks that could hinder successful implementation and execution of strategies. Strategic planning is linked to our risk management and capital planning processes. Capital Planning and Stress Testing: Capital planning helps to ensure we are maintaining safe and sound operations and viability. The capital planning process and the resulting capital plan evolve as our overall risks, activities and risk management practices change. Capital planning aligns with our strategic planning process. Stress testing is an essential element of the capital planning process. Effective stress testing enables us to consider the estimated effect on capital of various hypothetical scenarios. Risk Governance and Framework We employ a comprehensive risk management governance framework to help ensure that risks are identified, balanced decisions are made that consider risk and return, and risks are adequately monitored and managed. Risk committees established within this risk governance and oversight framework provide oversight for risk management activities at the Board of Directors, executive, corporate and business levels. Committee composition is designed to provide effective oversight balanced across the three lines of defense in accordance with the OCC’s heightened risk management and governance standards and guidelines. See discussion of the enhanced prudential standards in the Supervision and Regulation section in Item 1 of this Report. To ensure the appropriate risks are being taken and effectively managed and controlled, risk is managed across three lines of defense. The Board of Directors’ and each line of defense’s responsibilities are detailed below: Board of Directors – The Board of Directors oversees our risk-taking activities and is responsible for exercising sound, independent judgment when assessing risk. First line of defense – The front line units are accountable for identifying, owning and managing risks to within acceptable levels while adhering to the risk management framework established by the Independent Risk Management department. Our businesses strive to enhance risk management and internal control processes within their areas. Integrated and comprehensive processes are designed to adequately identify, measure, manage, monitor and report risks which may significantly impact each business.

Second line of defense – The second line of defense is independent from the first line of defense and is responsible for establishing the standards for identifying, measuring, monitoring, controlling and reporting aggregate risks. As the second line of defense, the independent risk areas monitor the risks generated by the first line of defense, review and challenge the implementation of effective risk management practices, and report any issues or exceptions. The risk areas help to ensure processes and controls owned by the businesses are designed and operating as intended, and they may intervene directly in modifying and developing first line of defense risk processes and controls. Third line of defense – As the third line of defense, Internal Audit is independent from the first and second lines of defense. Internal Audit provides the Board of Directors and executive management comprehensive assurance on the effectiveness of risk management practices across the organization. Within the three lines of defense, the independent risk organization has sufficient authority to influence material decisions. Our business oversight and decision-making is supported through a governance structure at the Board of Directors and management level. Specific responsibilities include: Board of Directors – Our Board of Directors oversees our business and affairs as managed by our officers and employees. The Board of Directors may receive assistance in carrying out its duties and may delegate authority through the following standing committees: • Audit Committee: monitors the integrity of our consolidated financial statements; monitors internal control over financial reporting; monitors compliance with our code of ethics; evaluates and monitors the qualifications and independence of our independent auditors; and evaluates and monitors the performance of our Internal Audit function and our independent auditors. • Nominating and Governance Committee: oversees the implementation of sound corporate governance principles and practices while promoting our best interests and those of our shareholders • Personnel and Compensation Committee: oversees the compensation of our executive officers and other specified responsibilities related to personnel and compensation matters affecting us. The committee is also responsible for evaluating the relationship between risk-taking activities and incentive compensation plans. • Risk Committee: oversees enterprise-wide risk structure and the processes established to identify, measure, monitor and manage the organization’s risks and evaluates and approves our risk governance framework. The Risk Committee has formed a Technology Subcommittee and a Compliance Subcommittee to facilitate Board-level oversight of risk management in these areas. Executive Committee – The Executive Committee is responsible for guiding the creation and execution of our business strategy across the company. With this responsibility, the Executive Committee executes various strategic approval and review activities, with a focus on capital deployment, business performance and risk management. Corporate Committees – The Corporate Committees operate at the senior management level and are designed to facilitate the review, evaluation, oversight and approval of key risk activities. Working Committees – The Working Committees are generally subcommittees of the Corporate Committees. Working Committees are intended to assist in the implementation of key enterprise-level activities within a business or function and support the oversight of the businesses key risk activities. Transactional Committees – Transactional Committees are generally created for the specific purpose of approving individual transactions or movements on the organization’s balance sheet. Policies and Procedures – We have established risk management Policies and Procedures to support our ERM Framework, articulate our risk culture, define the parameters and processes within which employees are to manage risk and conduct our business activities and to provide direction, guidance and clarity on roles and responsibilities to management and the Board of Directors. These Policies and Procedures are organized in a multi-tiered framework and require periodic review and approval by relevant Committees or management. Risk Identification Risk identification takes place across a variety of risk types throughout the organization. These risk types consist of, but are not limited to, credit, liquidity and capital, market, operational and compliance. Risks are identified based on a balanced use of analytical tools and management judgment for both on- and off-balance sheet exposures. Our governance structure supports risk identification by facilitating assessment of key risk issues, emerging risks and idiosyncratic risks and implementation of mitigation strategies as appropriate. These risks are prioritized based on quantitative and qualitative analysis and assessed against the risk appetite. Multiple tools and approaches are used to help identify and prioritize risks, including Risk Appetite Metrics, Key Risk Indicators, Key Performance Indicators, Risk Control and Self-Assessments, scenario analysis, stress testing and special investigations.

Risks are aggregated and assessed within and across risk functions or businesses. The aggregated risk information is reviewed and reported at an enterprise level for adherence to the Risk Appetite Framework and approved by the Board of Directors or by appropriate committees. This enterprise aggregation and reporting approach promotes the identification and appropriate escalation of material risks across the organization and supports an understanding of the cumulative impact of risk in relation to our risk appetite. Risk Assessment Once risks are identified, they are evaluated based on quantitative and qualitative analysis to determine whether they are material. Risk assessments support the overall management of an effective ERM Framework and allow us to control and monitor our actual risk level and risk management effectiveness through the use of risk measures. Comprehensive, accurate and timely assessments of risk are essential to an effective ERM Framework. Effective risk measurement practices will uncover recurring risks that have been experienced in the past; make the known risks easy to see, understand, compare and report; and reveal unanticipated risks that may not be easy to understand or predict. Risk Controls and Monitoring Our ERM Framework consists of policies, processes, personnel and control systems. Risk controls and limits provide the linkage from our Risk Appetite Statement and associated guiding principles to the risk-taking activities of our businesses. In addition to risk appetite limits, a system of more detailed internal controls exists which oversees and monitors our various processes and functions. These control systems measure performance, help employees make correct decisions, help ensure information is accurate and reliable, and document compliance with laws and regulations. We design our monitoring and evaluation of risks and controls to provide assurance that policies, procedures and controls are effective and also to result in the identification of control improvement recommendations. Risk monitoring is a daily, ongoing process used by both the first and second line of defense to ensure compliance with our ERM Framework. Risk monitoring is accomplished in many ways, including performing risk assessments at the prime process and risk assessment unit level, monitoring an area’s key controls, the timely reporting of issues, and establishing a quality control and/or quality assurance function, as applicable. Risk Aggregation and Reporting Risk reporting is a comprehensive way to: (i) aggregate risks; (ii) identify concentrations; (iii) help ensure we remain within our established risk appetite; (iv) serve as a basis for monitoring our risk profile in relation to our risk appetite and (v) communicate risks to the Board of Directors and executive management. Risk reports are produced at the line of business, functional risk and enterprise levels. The enterprise level risk report aggregates risks identified in the functional and business reports to define the enterprise risk profile. The enterprise risk profile is a point-in-time assessment of enterprise risk and represents our overall risk position in relation to the desired enterprise risk appetite. The determination of the enterprise risk profile is based on analysis of quantitative reporting of risk limits and other measures along with qualitative assessments. Quarterly aggregation of our risk profile enables a clear view of our risk level relative to our quantitative risk appetite. The enterprise level report is provided through the governance structure to the Board of Directors. Each individual risk report includes an assessment of inherent risk, quality of risk management, residual risk, risk appetite and risk outlook. The enterprise level risk report includes an aggregate view of risks identified in the individual report and provides a summary of our overall risk profile compared to our risk appetite. Credit Risk Management Credit risk represents the possibility that a customer, counterparty or issuer may not perform in accordance with contractual terms. Credit risk is inherent in the financial services business and results from extending credit to customers, purchasing securities, and entering into financial derivative transactions and certain guarantee contracts. Credit risk is one of our most significant risks. Our processes for managing credit risk are embedded in our risk culture and in our decision-making processes using a systematic approach whereby credit risks and related exposures are identified and assessed, managed through specific policies and processes, measured and evaluated against our risk appetite and credit concentration limits, and reported, along with specific mitigation activities, to management and the Board of Directors through our governance structure. Our most significant concentration of credit risk is in our loan portfolio.

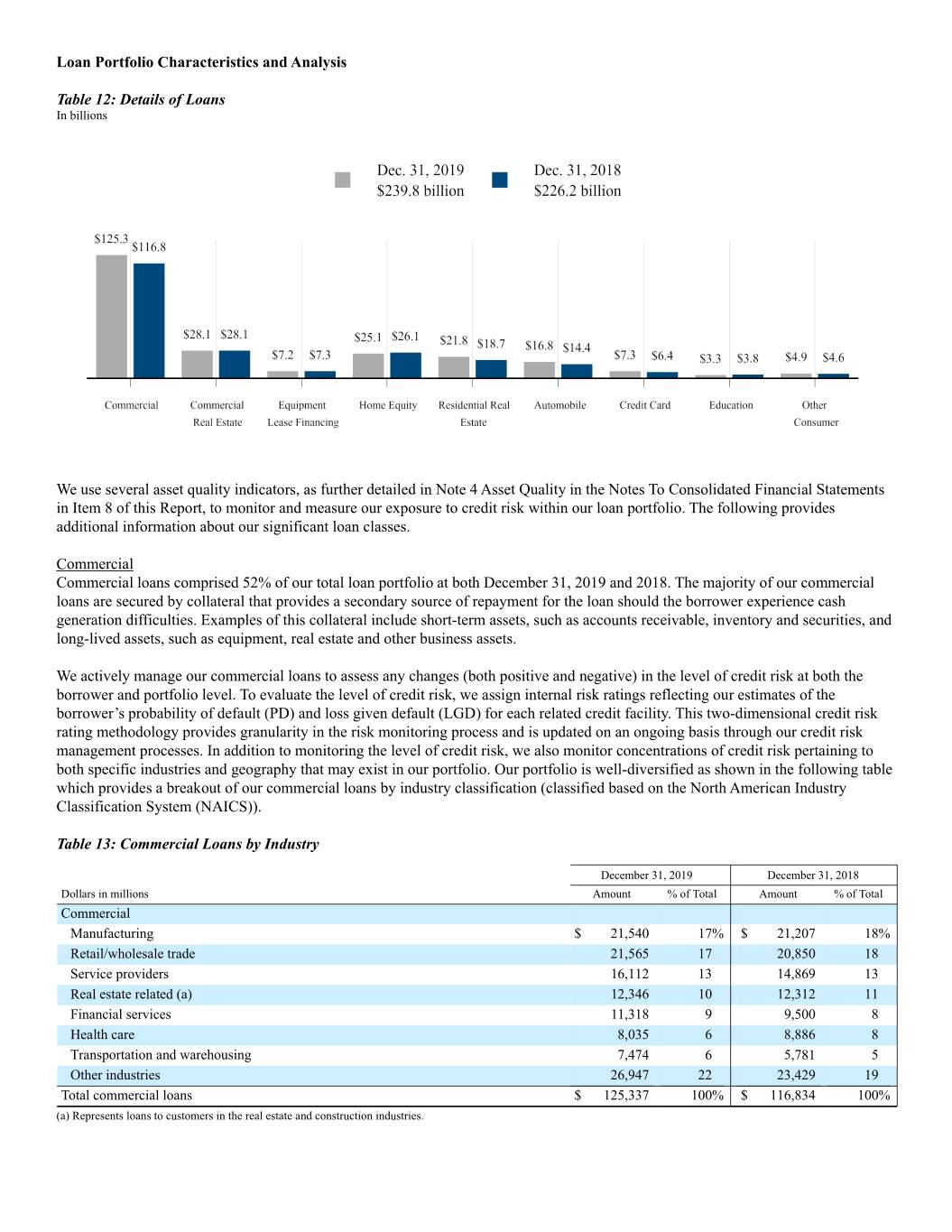

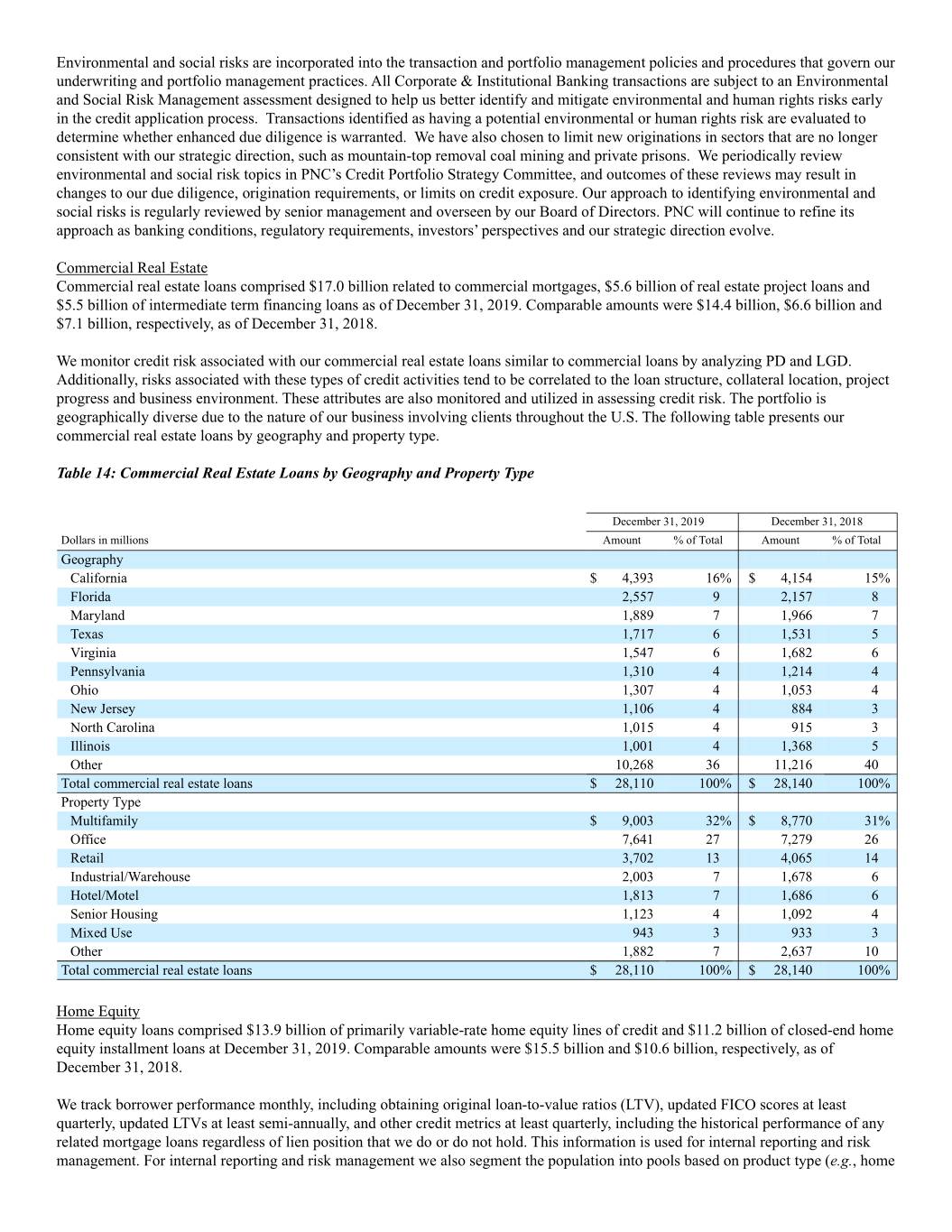

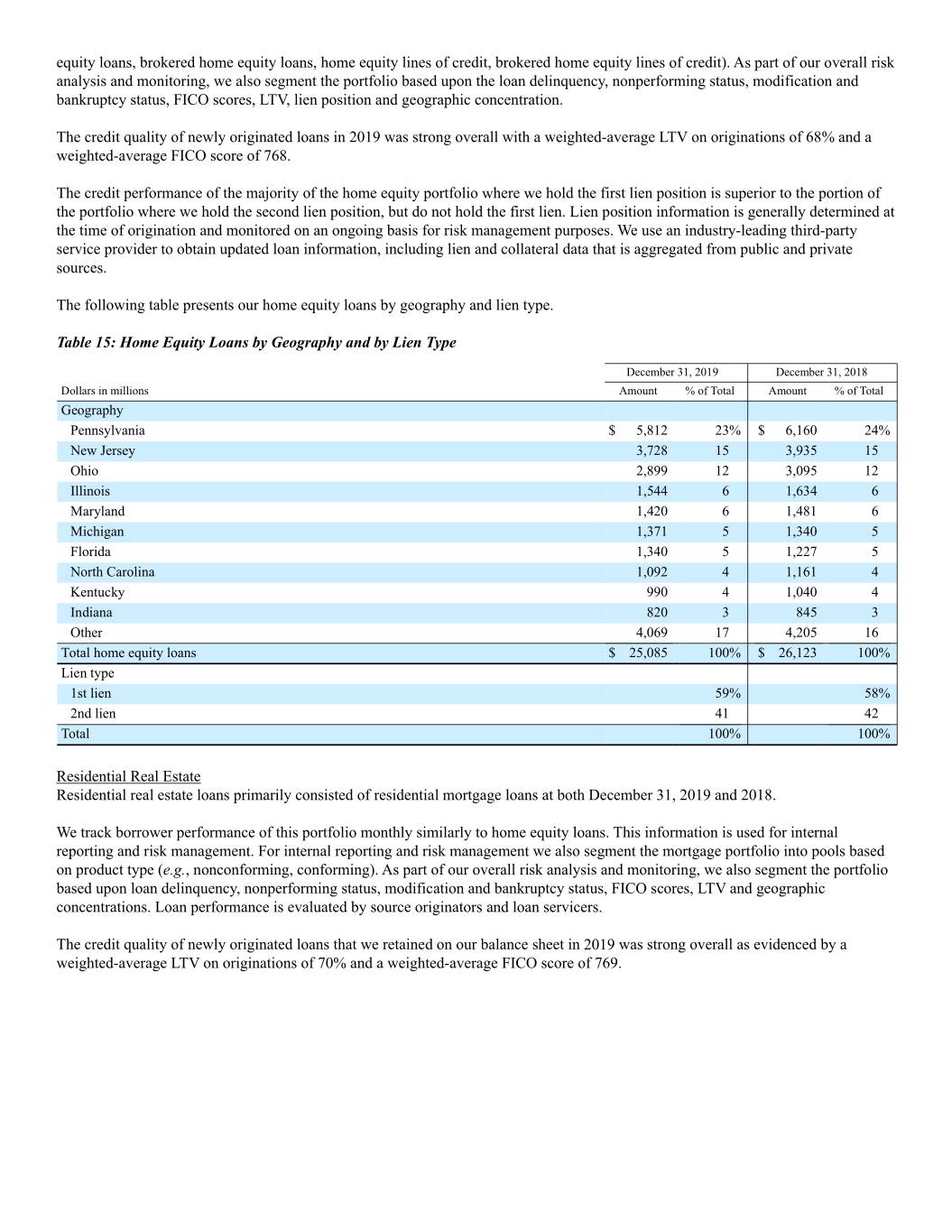

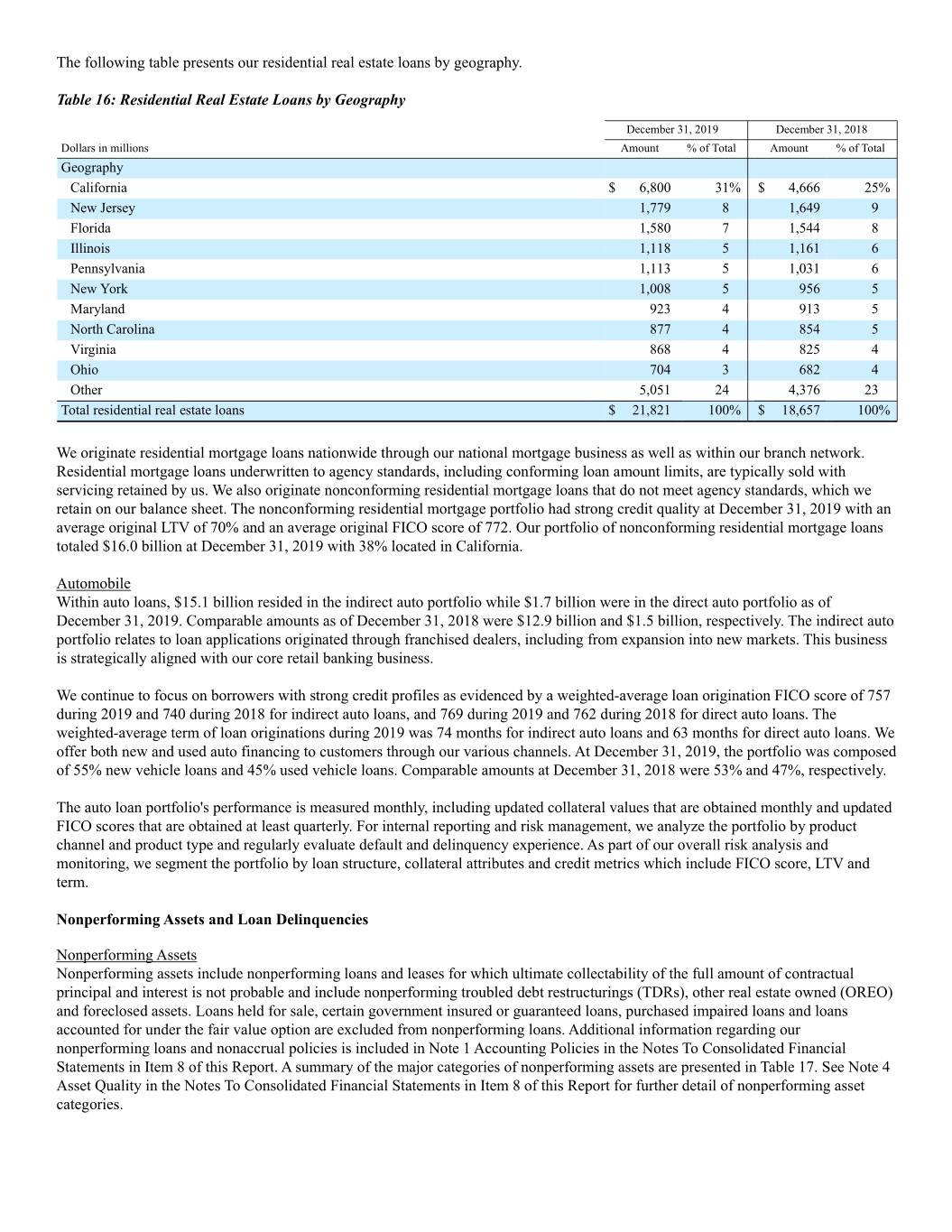

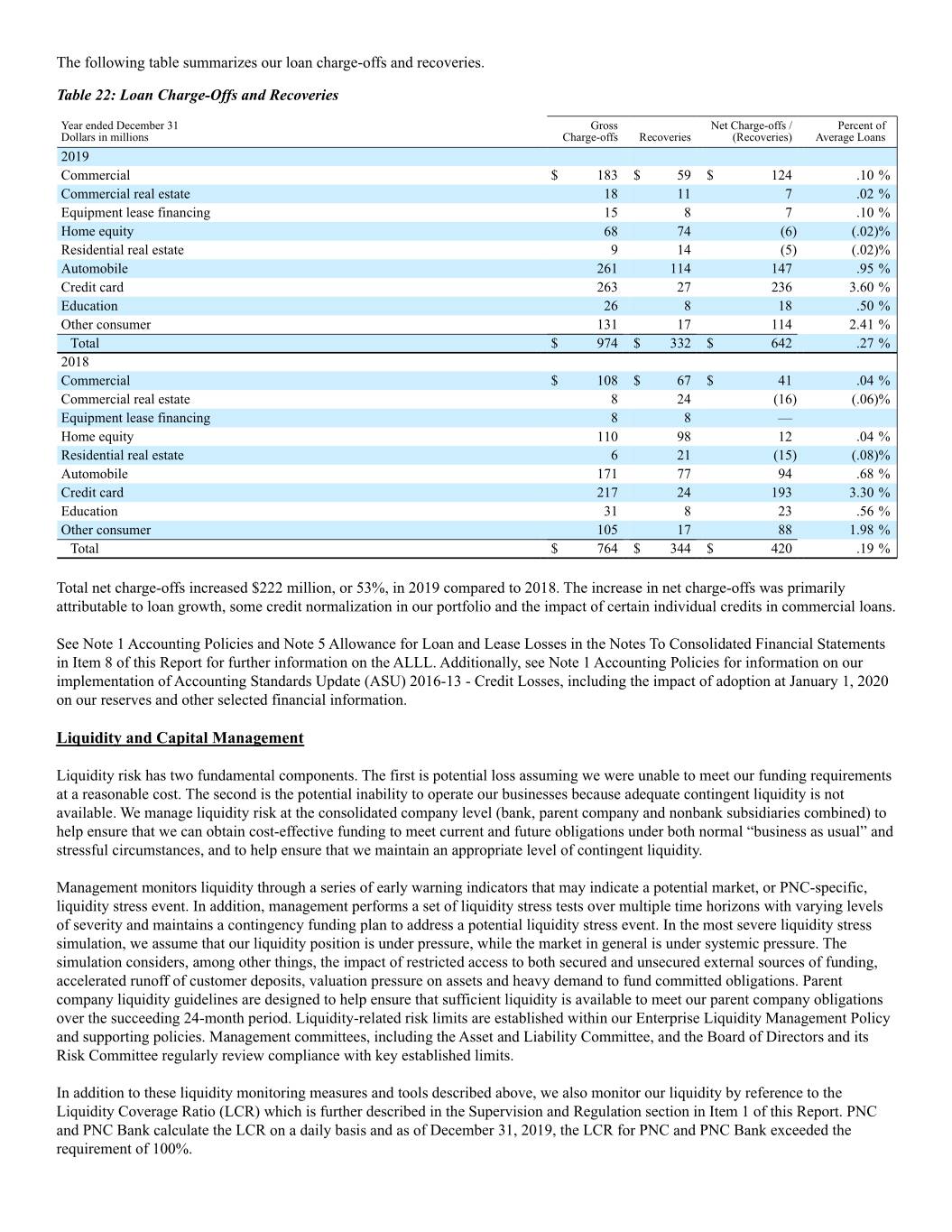

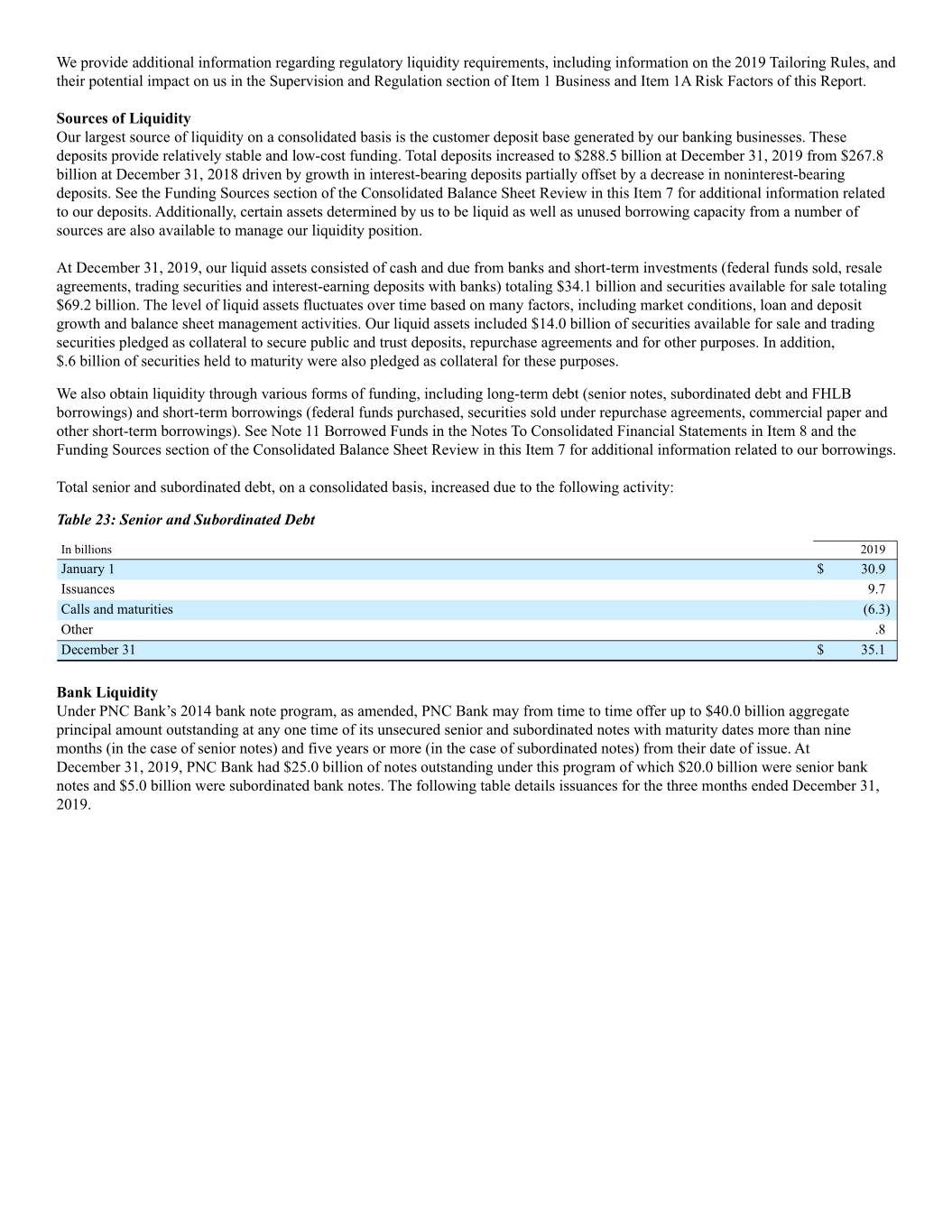

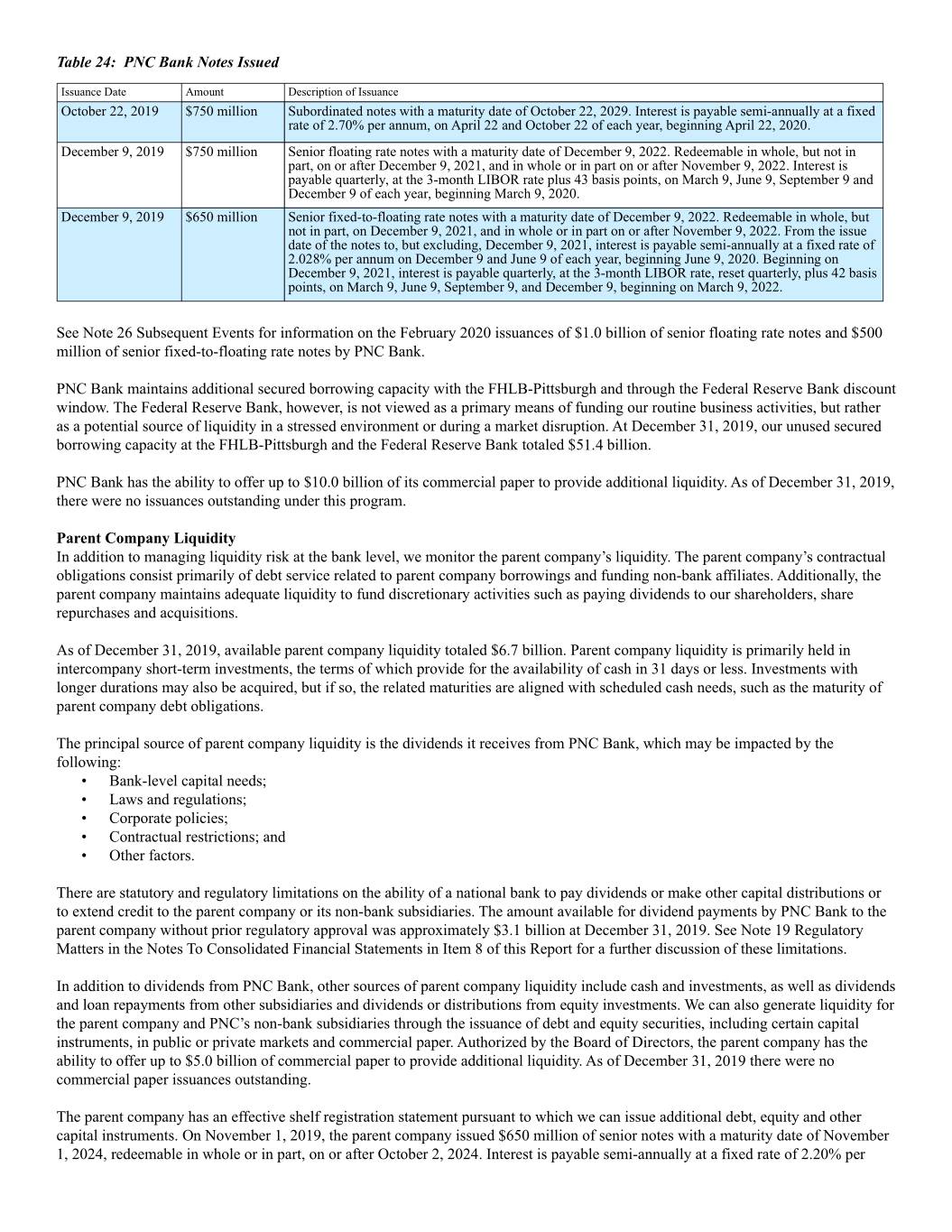

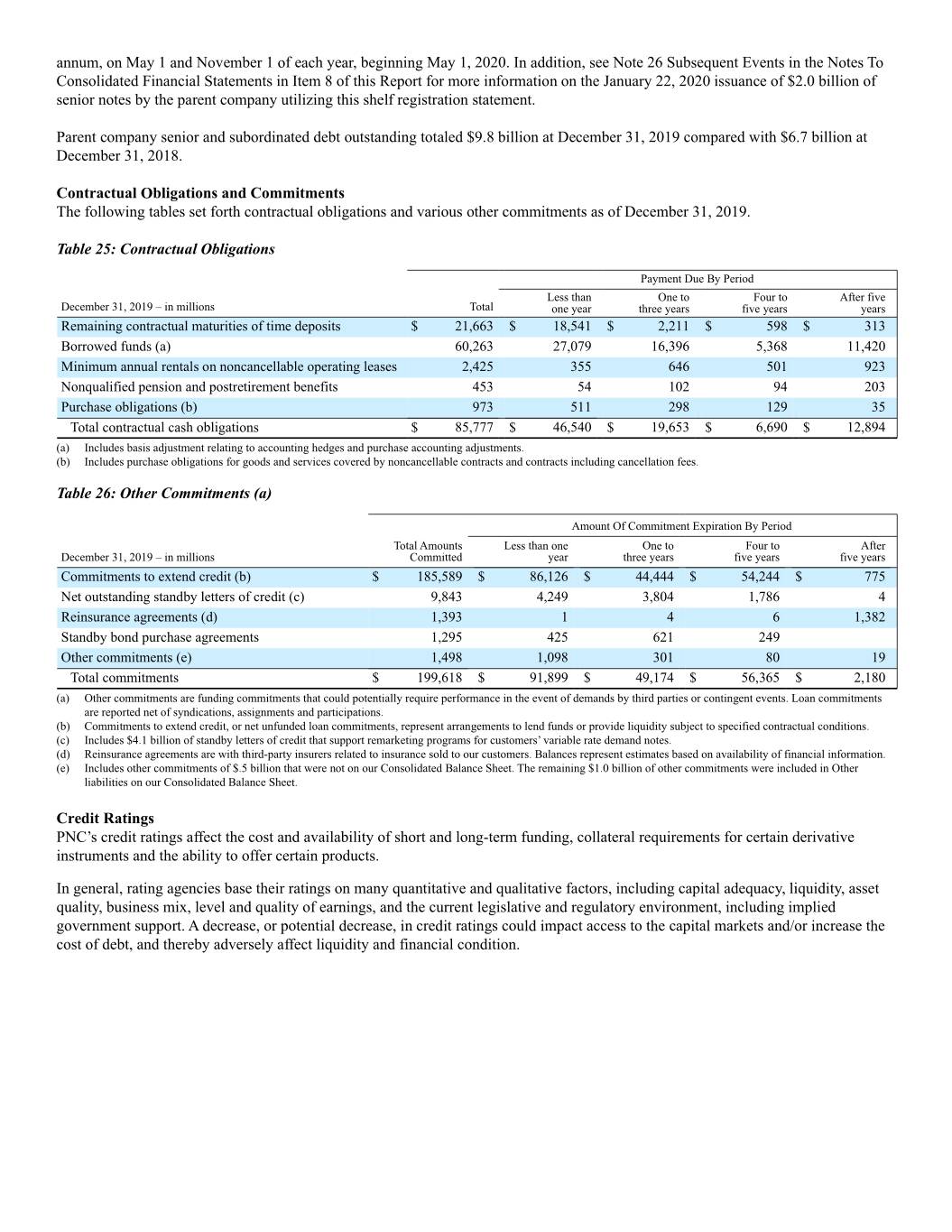

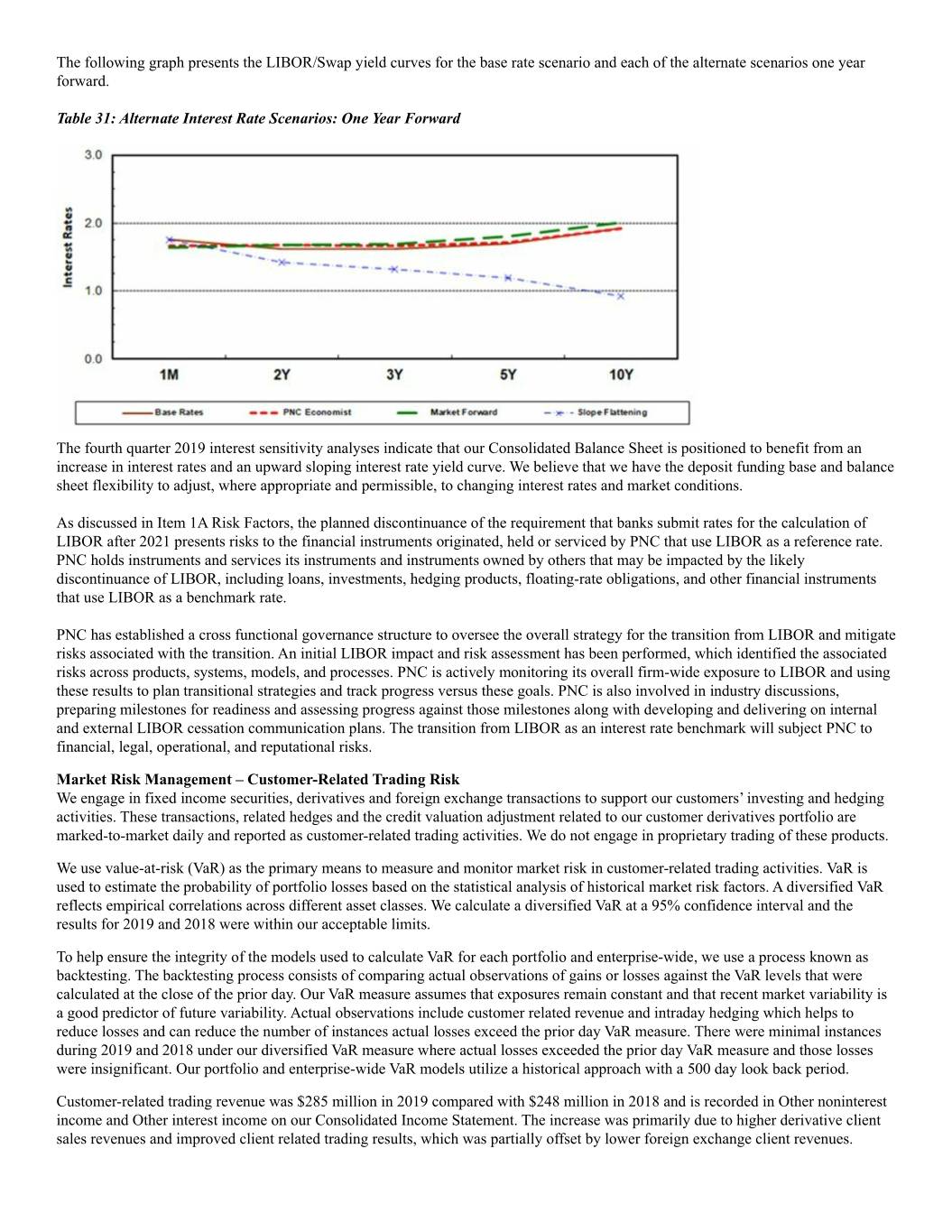

Loan Portfolio Characteristics and Analysis Table 12: Details of Loans In billions We use several asset quality indicators, as further detailed in Note 4 Asset Quality in the Notes To Consolidated Financial Statements in Item 8 of this Report, to monitor and measure our exposure to credit risk within our loan portfolio. The following provides additional information about our significant loan classes. Commercial Commercial loans comprised 52% of our total loan portfolio at both December 31, 2019 and 2018. The majority of our commercial loans are secured by collateral that provides a secondary source of repayment for the loan should the borrower experience cash generation difficulties. Examples of this collateral include short-term assets, such as accounts receivable, inventory and securities, and long-lived assets, such as equipment, real estate and other business assets. We actively manage our commercial loans to assess any changes (both positive and negative) in the level of credit risk at both the borrower and portfolio level. To evaluate the level of credit risk, we assign internal risk ratings reflecting our estimates of the borrower’s probability of default (PD) and loss given default (LGD) for each related credit facility. This two-dimensional credit risk rating methodology provides granularity in the risk monitoring process and is updated on an ongoing basis through our credit risk management processes. In addition to monitoring the level of credit risk, we also monitor concentrations of credit risk pertaining to both specific industries and geography that may exist in our portfolio. Our portfolio is well-diversified as shown in the following table which provides a breakout of our commercial loans by industry classification (classified based on the North American Industry Classification System (NAICS)). Table 13: Commercial Loans by Industry December 31, 2019 December 31, 2018 Dollars in millions Amount % of Total Amount % of Total Commercial Manufacturing $ 21,540 17% $ 21,207 18% Retail/wholesale trade 21,565 17 20,850 18 Service providers 16,112 13 14,869 13 Real estate related (a) 12,346 10 12,312 11 Financial services 11,318 9 9,500 8 Health care 8,035 6 8,886 8 Transportation and warehousing 7,474 6 5,781 5 Other industries 26,947 22 23,429 19 Total commercial loans $ 125,337 100% $ 116,834 100% (a) Represents loans to customers in the real estate and construction industries.