EX-99.1

Published on March 1, 2013

Exhibit 99.1

From the Chairman

March 1, 2013

To Our Shareholders,

In nearly every way, todays banking industry is a world away from the one I joined nearly 41 years ago. New regulations, persistently low interest rates, evolving customer preferences and stunning enhancements in technology are just some of the differences we see as we begin 2013. Then as now, one attribute transcends the decades trust.

Trust is the quality that people seek from a financial institution, and banks that can earn the confidence of their customers are those that will have enduring success. We believe PNC is such a bank.

We have strategies for growth, a business model and an approach to risk that drive our performance. Our products are designed to provide customers with the level of safety and liquidity they seek and to create opportunities for financial growth. But it is trust that creates the loyalty necessary to sustain relationships, and that is why we believe customers are the foundation for revenue potential.

Growing Customers as Never Before

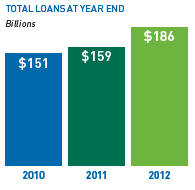

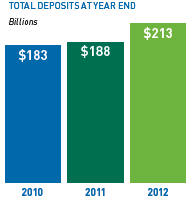

Our customer relationships drove PNCs progress in 2012. By increasing customers both organically and through acquisition we were able to grow full-year loans by $27 billion and deposits by $25 billion compared to 2011. As a result, 2012 revenue increased $1.2 billion or 8 percent from the previous year.

714,000 net new checking relationships during the year. Of that amount, 254,000 were net new organic relationships, growth of 4 percent from year-end 2011 or more than double the population growth rate in our footprint. Over the last three years, from 2010 through 2012, we acquired about 3,000 new Corporate Banking primary clients. In 2012 compared with 2011, new primary client acquisitions for our Asset Management Group were 37 percent higher and Residential Mortgage originations increased by $3.8 billion or 33 percent.

This growth helped to create full year earnings of $3 billion or $5.30 per diluted common share. Overall, I was pleased but not entirely satisfied with our results.

| | Developments in the residential mortgage banking industry required us to set aside a provision of $761 million primarily for obligations to repurchase loans that were acquired when we purchased National City. This had a negative impact on revenue. |

| | On the expense side, residential mortgage foreclosure-related expenses were $225 million for the year. |

| | Other expenses included integration costs of RBC Bank (USA) and the noncash charges related to the redemption of $2.3 billion in high-cost trust preferred securities. Both provide PNC with benefits in the form of an expanded footprint and lower funding costs, respectively. |

On balance this was a good year for PNC but because of these minuses, our financial results do not reflect the full potential of the investments we have made and the value we believe PNC can create for shareholders.

Priorities for 2013

Building on the strong customer growth in our business segments Retail Banking, Corporate & Institutional Banking, Asset Management Group and Residential Mortgage 2013 provides us with greater opportunities to deepen relationships through cross selling and increase fee-based income, while we also look to reduce expenses. Additionally, we have established several growth priorities for 2013.

REDEFINE THE RETAIL BANKING EXPERIENCE.

CAPTURE MORE OF OUR CUSTOMERS INVESTABLE ASSETS.

PNCs expansion in the Southeast combined with a commitment to innovation, expense management and energy efficiency led to the opening of a net-zero energy bank branch in Fort Lauderdale in January 2012.

CONTINUE TO BUILD OUR PRESENCE IN NEWLY ACQUIRED MARKETS.

BUILD A SUSTAINABLE RESIDENTIAL MORTGAGE BUSINESS.

MANAGE RISK, EXPENSES AND CAPITAL.

These priorities along with our commitment to executing give us confidence that we can deliver shareholder value in 2013.

| * | PNC believes that tangible book value per common share, a non-GAAP measure, is useful as a tool to help to better evaluate growth of a companys business apart from the amount, on a per share basis, of intangible assets other than servicing rights included in book value per common share. PNCs book value per share was $67.05 at year-end 2012, a 41% increase over $47.68 at year-end 2009. Subtracting approximately $9.8 billion ($10.9 billion of goodwill and other intangible assets less $1.1 billion of servicing rights) or $18.54 per share for year-end 2012, and subtracting approximately $10.7 billion ($12.9 billion of goodwill and other intangible assets less $2.2 billion of servicing rights) or $23.09 per share for year-end 2009, results in tangible book value per share of approximately $48.51 for year-end 2012, a 97% increase over approximately $24.59 at year-end 2009. |

PNCs 2012 peer group consists of BB&T Corporation, Bank of America Corporation, Capital One Financial Corporation, Comerica Incorporated, Fifth Third Bancorp, JPMorgan Chase & Co., KeyCorp, M&T Bank Corporation, The PNC Financial Services Group, Inc., Regions Financial Corporation, SunTrust Banks, Inc., U.S. Bancorp, and Wells Fargo & Company.

Achievement Through Teamwork

None of these accomplishments would have been possible without the hard work of our more than 56,000 employees. In 2012, our employee engagement scores reached new highs, and for the fourth straight year, PNC was named a Gallup Great Workplace Award winner. Our Retail Bank won the award in 2009 and 2010 and the full company received the honor in 2011 and 2012, the only U.S.-based bank to do so.

There were other accolades as well: for the 10th straight year, we were a Training Top 125 company in recognition of our employee training and development programs; we were named one of the nations 100 Best Companies by Working Mother magazine for the 11th year; and U.S. Veterans Magazine said PNC was one of the top companies in the country working to hire military veterans.

After some three decades of service, Vice Chairman Tom Whitford will retire in March 2013. Among his many assignments, he led the successful integration of National City, which doubled our size and ultimately became the industry model for large mergers. Succeeding Tom as head of our operations and technology areas is Steve Van Wyk. We were pleased to welcome him to PNC in January 2013.

|

|

Our Values

Performance

Customer Focus

Respect

Integrity

Diversity

Teamwork

Quality of Life |

Employees accept the 2012 Gallup Great Workplace Award, which recognizes companies for excellence in workforce engagement. This marked the fourth straight year PNC has received the award. From left are: Sharon Lamcha, Bob Leininger, Mike Brundage, Rick Baumgartner and Debbie Campbell.

Giving Back to the Community

At PNC, we have always believed that a company is only as strong as the community it serves. Overall, we contributed more than $73 million to strengthen communities and enrich lives in the places where we had a significant presence in 2012.

For example, in Clevelands historic Eastside community, PNC Fairfax Connection now provides educational programs to local residents and business owners. In the headquarters city, the Legacy Project opened as a historical tribute to the transformation of Pittsburgh and PNCs place in it. And in Philadelphia, a premier PNC sponsorship of the Barnes Foundation is leading to an unprecedented increase in visibility for one of the worlds finest collections of Impressionist, Post-Impressionist and early Modern paintings.

Grow Up Great, our signature philanthropic initiative in early childhood education, was introduced to new Southeast markets in 2012. Our grant making is focused on science, math, the arts and financial education, areas that should lay the foundation for tomorrows dynamic workforce. In almost eight years, this $350 million, multi-year program has helped more than 1.7 million children under age 5 prepare for school and life. In 2012, more than 35 percent of our employees participated in a Grow Up Great activity, which helps to enhance overall engagement and retention.

Following the devastation of Hurricane Sandy, PNC donated $300,000 to relief efforts, matched employee contributions up to $150,000, and supported customers by waiving a total of $7 million in fees immediately following the storm. While as many as 1,000 branches along the East Coast were affected, we are pleased that our employees rallied to restore services and serve customers.

These are just some of the ways that PNC and our employees support the communities where we live and do business.

New Leadership

The boards action was in response to my desire to step down as chief executive officer at the upcoming Annual Meeting of Shareholders on April 23, 2013, and retire the following year.

Bill has demonstrated exceptional leadership since joining PNC in 2002. He was named president in April 2012, and enhanced customer growth by successfully aligning our businesses to deliver the entire company for our clients.

Since my election to CEO, PNCs assets have increased from $70 billion at the end of 2000 to $305 billion as of December 31, 2012. Given our products, scale and recently expanded footprint, your bank is poised for continued growth.

As new chapters are written in the PNC story, I believe many of our best qualities will persevere: the importance we place on delivering value to our shareholders while serving the needs of our customers, employees and communities, along with maintaining the trust we have earned from those who do business with us.

Trust may not appear on our financial statements, but it underscores the values and principles that have driven PNCs successes and that will sustain us in the years to come as we continue to build a great company.

Sincerely,

James E. Rohr

Chairman and Chief Executive Officer

For more information regarding certain factors that could cause future results to differ, possibly materially, from historical performance or from those anticipated in forward-looking statements, see the Cautionary Statement in Item 7 of our 2012 Annual Report on Form 10-K, which accompanies this letter.