ELECTRONIC PRESENTATION SLIDES FOR EARNINGS RELEASE CONFERENCE CALL

Published on October 18, 2007

The PNC

Financial Services Group, Inc. Third Quarter 2007 Earnings Conference Call October 18, 2007 Exhibit 99.2 |

This

presentation contains forward-looking statements regarding our outlook or expectations relating to PNCs future business, operations, financial condition, financial performance and asset quality. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix, which is included in the version of the presentation materials posted on our corporate website at www.pnc.com/investorevents. We provide greater detail regarding these factors in our 2006 Form 10-K, including in the Risk Factors and Risk Management sections, and in our first and second quarter 2007 Form 10-Qs and other SEC reports (accessible on the SECs website at www.sec.gov and on or through our corporate website). Future events or circumstances may change our outlook or expectations and may also affect the

nature of the assumptions, risks and uncertainties to which our forward-looking

statements are subject. The forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake to

update those statements. In this presentation, we will sometimes refer to adjusted results to help illustrate the impact of the deconsolidation of BlackRock near the end of third quarter 2006 and the impact of certain types of items. Adjusted results reflect, as applicable, the following types of adjustments: (1) 2006 periods reflect the impact of the deconsolidation of BlackRock by adjusting as if we had recorded our BlackRock investment on the equity method prior to its deconsolidation; (2) adjusting the 2006 periods to exclude the impact of the third quarter 2006 gain on the BlackRock/MLIM transaction and losses on the repositioning of PNCs securities and mortgage loan portfolios; (3) adjusting fourth quarter 2006 and the 2007 periods to exclude the net mark-to-market adjustments on PNCs remaining BlackRock LTIP shares obligation and, as applicable, the gain PNC recognized in first quarter 2007 in connection with the companys transfer of BlackRock shares to satisfy a portion of its BlackRock LTIP shares obligation; (4) adjusting all periods to exclude, as applicable, integration costs related to acquisitions and to the BlackRock/MLIM transaction; and (5) adjusting, as appropriate, for the tax impact of these adjustments. We have provided these adjusted amounts and reconciliations so that investors, analysts, regulators and others will be better able to evaluate the impact of these items on our results for the periods presented, in addition to providing a basis of comparability for the impact of the BlackRock deconsolidation given the magnitude of the impact of deconsolidation on various components of our income statement and balance sheet. We believe that information as adjusted for the impact of the specified items may be useful due to the extent to which these items are not indicative of our ongoing operations as the result of our management activities on those operations. While we have not provided other adjustments for the periods discussed, this is not intended to imply that there could not have been other similar types of adjustments, but any such adjustments would not have been similar in magnitude to the amount of the adjustments shown. In certain discussions, we also provide revenue information on a taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. We believe this adjustment may be useful when comparing yields and margins for all earning assets. This presentation may also include a discussion of other non-GAAP financial measures, which, to the extent not so qualified therein or in the Appendix, is qualified by GAAP reconciliation information available on our corporate website at www.pnc.com under About PNC Investor Relations. Cautionary Statement Regarding Forward-Looking Information and Adjusted Information |

Organic

client growth is strong Expense base contained and well managed Primary businesses met or exceeded expectations Asset quality remains strong Mercantile integration successful Well-positioned balance sheet Continuing to Execute on Our Strategies 2007 Third Quarter Highlights |

Key

Take-Aways Execution Delivers Outstanding Results Reported 3Q07 earnings of $1.19 per diluted share Adjusted earnings 1 of $1.37 per diluted share Diverse revenue streams delivering strong results despite market volatility Continued to create year-to-date positive operating leverage on an adjusted basis 2 Maintaining a moderate risk profile and flexible balance sheet (1) Adjusted third quarter 2007 earnings are reconciled to GAAP earnings in the Appendix. (2) GAAP basis operating leverage for the year-to-date period was negative due to the impact

of the third quarter 2006 gain from the BlackRock/MLIM transaction and is reconciled

in the Appendix. |

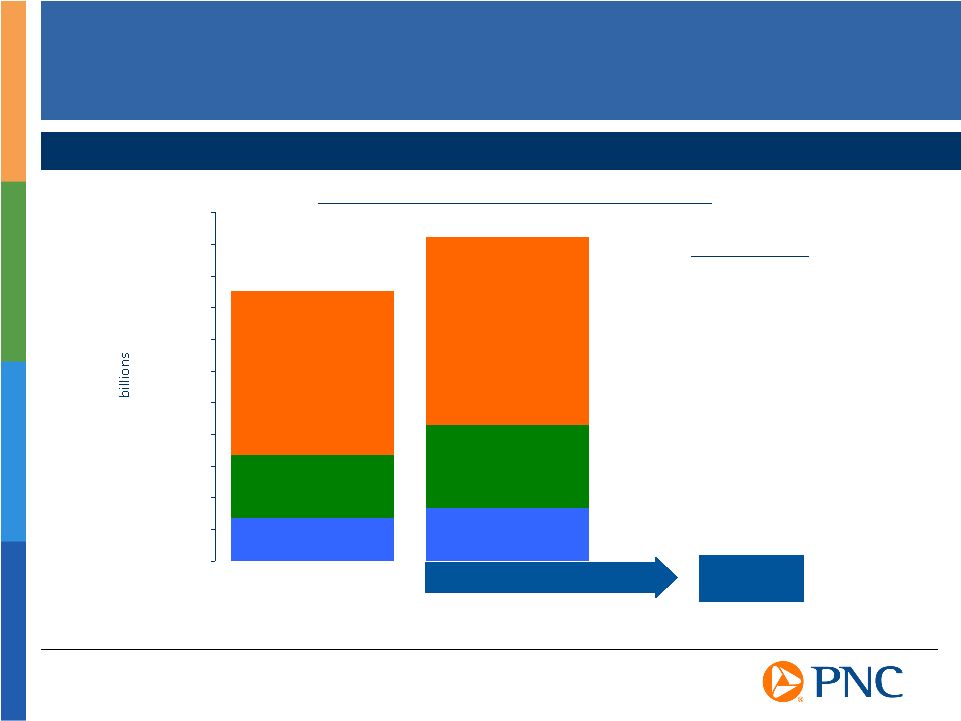

Nine months

ended September 30, As Adjusted 1,2 +15% +32% +20% +20% Growing High Quality Revenue Streams Total Revenue Growth (1) Adjusted amounts are reconciled to GAAP amounts in the Appendix. (2) Unadjusted 2006 mix: noninterest income 76%, deposit net interest income 14%, loan net

interest income 10%. Unadjusted 2007 mix: noninterest income 58%, deposit net

interest income 26%, loan net interest income 16%. (3) Unadjusted % change: total revenue (28%), noninterest income (45%), deposit net interest income

32%, loan net interest income 18%. 2007 vs 2006 1,3 2006 Mix 2006 Mix Revenue Mix 2007 Mix 2007 Mix Noninterest Income 61% Deposit NII 23% Loan NII 16% Noninterest Income 58% Deposit NII 26% Loan NII 16% $5.5 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 $0.0 |

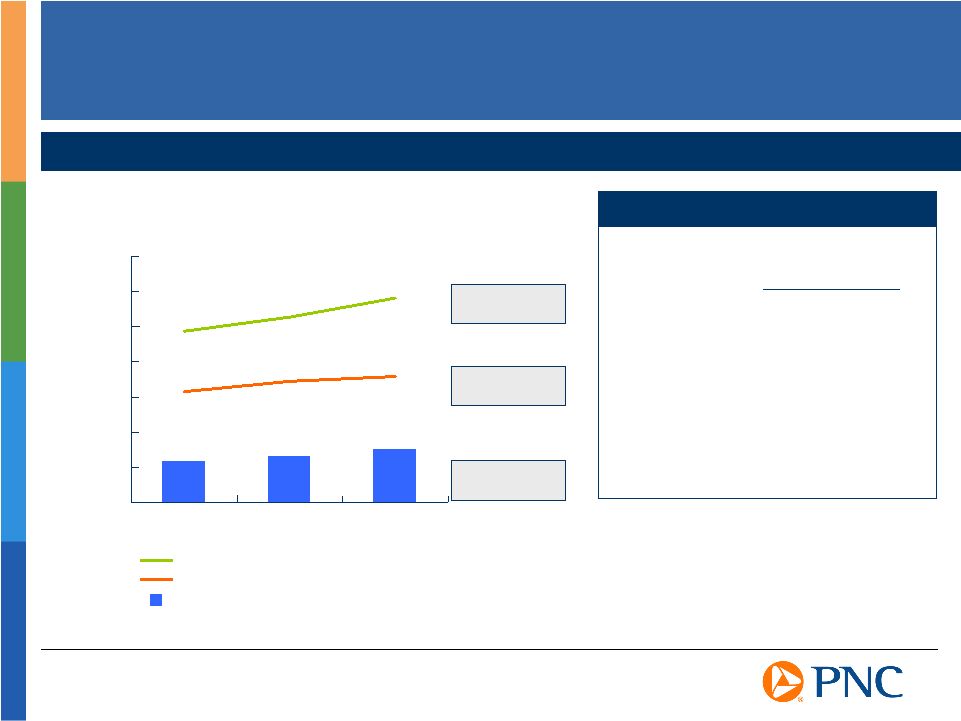

$0 $1 $2 $3 $4 $5 $6 $7 2004 2005 2006 Revenue 9% Creating Positive Operating Leverage Growing Revenues Faster Than Expenses billions Compound Annual Growth Rate (2004 2006) Adjusted Revenue (as reported $5.5 billion, $6.3 billion, $8.6 billion for 2004, 2005, 2006, respectively) Adjusted Noninterest Expense (as reported $3.7 billion, $4.3 billion, $4.4 billion for 2004, 2005, 2006,

respectively) Adjusted Net Income (as reported $1.2 billion, $1.3 billion, $2.6 billion for 2004, 2005, 2006,

respectively) Net Income 12% $1.2 $1.3 $1.5 Expense 7% Revenue

+20% Expense

+15% Net

Income +19% Trend

Continues¹

(1) As reported: revenue (28%) expense (11%) net

income (42%). Adjusted amounts are reconciled to GAAP in the Appendix. Nine

months ended September 30, as adjusted 2007 vs 2006 |

Maintaining a

Moderate Risk Profile Strong credit quality Credit decisions driven by risk- adjusted returns Minimal exposure to subprime mortgages, high-yield bridge and leveraged finance loans No hung syndications Relatively low commercial real estate exposure as a percentage of Tier 1 capital Credit Risk Profile Well-Positioned for the Yield Curve Duration of equity 3 years Low loan to deposit ratio High fee income to revenue percentage High demand deposits as a percentage of total deposits |

Cautionary

Statement Regarding Forward-Looking Information Appendix We make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses and/or other matters regarding or affecting PNC that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, outlook, estimate, forecast, project and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance. Our forward-looking statements are subject to the following principal risks and uncertainties. We provide greater detail regarding some of these factors in our Form 10-K for the year ended December 31, 2006, including in the Risk Factors and Risk Management sections of that report, and in our first and second quarter 2007 Form 10-Qs and other SEC reports. Our forward-looking statements may also be subject to other risks and uncertainties, including those that we may discuss elsewhere in this news release or in our filings with the SEC, accessible on the SECs website at www.sec.gov and on or through our corporate website at www.pnc.com under About PNC Investor Relations Financial Information. Our businesses and financial results are affected by business and economic conditions, both generally and specifically in the principal markets in which we operate. In particular, our businesses and financial results may be impacted by Changes in interest rates and valuations in the debt, equity and other financial markets. Disruptions in the liquidity and other functioning of financial markets, including such disruptions in the markets for real estate and other assets commonly securing financial products. Actions by the Federal Reserve and other government agencies, including those that impact

money supply and market interest rates. Changes in our customers, suppliers and other counterparties performance in general and their creditworthiness in particular. Changes in customer preferences and behavior, whether as a result of changing business and economic conditions or other factors. A continuation of recent turbulence in significant portions of the global financial markets could impact our performance, both directly by affecting our revenues and the value of our assets and liabilities and indirectly by affecting the economy generally. Our operating results are affected by our liability to provide shares of BlackRock common stock to help fund BlackRock long-term incentive plan (LTIP) programs, as our LTIP liability is adjusted quarterly (marked-to-market) based on changes in BlackRocks common stock price and the number of remaining committed shares, and we recognize gain or loss on such shares at such times as shares are transferred for payouts under the LTIP programs. Competition can have an impact on customer acquisition, growth and retention, as well as on our credit spreads and product pricing, which can affect market share, deposits and revenues. |

Our ability to implement our business initiatives and strategies could affect our financial performance over the next several years. Legal and regulatory developments could have an impact on our ability to operate our businesses or our financial condition or results of operations or our competitive position or reputation. Reputational impacts, in turn, could affect matters such as business generation and retention, our ability to attract and retain management, liquidity and funding. These legal and regulatory developments could include: (a) the unfavorable resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to laws and regulations involving tax, pension, education lending, and the protection of confidential customer information; and (e) changes in accounting policies and principles. Our business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through the effective use of third-party insurance and capital management techniques. Our ability to anticipate and respond to technological changes can have an impact on our ability to respond to customer needs and to meet competitive demands. The adequacy of our intellectual property protection, and the extent of any costs associated with obtaining rights in intellectual property claimed by others, can impact our business and operating results. Our business and operating results can also be affected by widespread natural disasters, terrorist activities or international hostilities, either as a result of the impact on the economy and financial and capital markets generally or on us or on our customers, suppliers or other counterparties specifically. Also, risks and uncertainties that could affect the results anticipated in forward-looking statements or from historical performance relating to our equity interest in BlackRock, Inc. are discussed in more detail in BlackRocks 2006 Form 10-K, including in the Risk Factors section, and in BlackRocks other filings with the SEC, accessible on the SECs website and on or through BlackRocks website at www.blackrock.com. We grow our business from time to time by acquiring other financial services companies, including our pending Sterling Financial Corporation (Sterling) and Yardville National Bancorp (Yardville) acquisitions. Acquisitions in general present us with risks other than those presented by the nature of the business acquired. In particular, acquisitions may be substantially more expensive to complete (including as a result of costs incurred in connection with the integration of the acquired company) and the anticipated benefits (including anticipated cost savings and strategic gains) may be significantly harder or take longer to achieve than expected. In some cases, acquisitions involve our entry into new businesses or new geographic or other markets, and these situations also present risks resulting from our inexperience in these new areas. As a regulated financial institution, our pursuit of attractive acquisition opportunities could be negatively impacted due to regulatory delays or other regulatory issues. Regulatory and/or legal issues related to the pre-acquisition operations of an acquired business may cause reputational harm to PNC following the acquisition and integration of the acquired business into ours and may result in additional future costs arising as a result of those issues. Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs, Yardvilles, Sterlings or other companys actual or

anticipated results. Cautionary Statement Regarding Forward-Looking Information (continued)

Appendix |

The

PNC Financial Services Group, Inc. and Sterling Financial Corporation will be filing a proxy statement/prospectus and other relevant documents concerning the merger with the United States Securities and Exchange Commission (the SEC). WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents free of charge at the SECs web site at http://www.sec.gov. In addition, documents filed with the SEC by The PNC Financial Services Group, Inc. will be available free of charge from Shareholder Relations at (800) 843-2206. Documents filed with the SEC by Sterling Financial Corporation will be available free of charge from Sterling Financial Corporation by contacting Shareholder Relations at (877) 248-6420. The directors, executive officers, and certain other members of management and employees of Sterling Financial Corporation are participants in the solicitation of proxies in favor of the merger from the shareholders of Sterling Financial Corporation. Information about the directors and executive officers of Sterling Financial Corporation is included in the proxy statement for its May 8, 2007 annual meeting of shareholders, which was filed with the SEC on April 2, 2007. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and the other relevant documents filed with the SEC when they become available. Additional Information About The PNC/Sterling Financial Corporation Transaction Appendix |

The

PNC Financial Services Group, Inc. (PNC) and Yardville National Bancorp (Yardville) have filed with the United States Securities and Exchange Commission (the SEC) a proxy statement/prospectus and other relevant documents concerning the proposed transaction. YARDVILLE SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER OF PNC AND YARDVILLE, WHICH WAS FIRST MAILED TO YARDVILLE SHAREHOLDERS ON OR ABOUT SEPTEMBER 5, 2007, BECAUSE IT CONTAINS IMPORTANT INFORMATION. Yardville shareholders may obtain a free copy of the proxy statement/prospectus and other related documents filed by PNC and Yardville with the SEC at the SECs web site at http://www.sec.gov. In addition, documents filed with the SEC by PNC will be available free of charge from Shareholder Relations at (800) 843-2206. Documents filed with the SEC by Yardville will be available free of charge from Yardville by contacting Howard N. Hall, Assistant Treasurers Office, 2465 Kuser Road, Hamilton, NJ 08690 or by calling (609) 631-6223. The directors, executive officers, and certain other members of management and employees of Yardville are participants in the solicitation of proxies in favor of the merger from the shareholders of Yardville. Information about the directors and executive officers of Yardville is set forth in its Annual Report on Form 10-K filed on March 30, 2007 for the year ended December 31, 2006, as amended by the Form 10-K/A filed on May 10, 2007. Additional information regarding the interests of such participants is included in the proxy statement/prospectus and the other relevant documents filed with the SEC. Additional Information About The PNC/ Yardville National Bancorp Transaction Appendix |

Non-GAAP

to GAAP Reconcilement Earnings Summary Appendix THREE MONTHS ENDED In millions, except per share data Adjustments, Net Diluted Adjustments, Net Diluted Pretax Income EPS Pretax Income EPS Net income, as reported $407 $1.19 $423 $1.22 Adjustments: BlackRock LTIP (a) $50 32 .09 $1 Integration costs (b) 43 30 .09 16 11 .03 Net income, as adjusted $469 $1.37 $434 $1.25 Adjustments, Net Diluted Pretax Income EPS Net income, as reported $1,484 $5.01 Adjustments: Gain on BlackRock/MLIM transaction (c) $(2,078) (1,293) (4.36) Securities portfolio rebalancing loss (c) 196 127 .43 Integration costs (b) 72 31 .10 Mortgage loan portfolio repositioning loss (c) 48 31 .10 Net income, as adjusted $380 $1.28 (a) Includes the impact of the gain recognized in connection with PNC's transfer of BlackRock shares to satisfy a portion of our BlackRock LTIP shares obligation and the net mark-to-market adjustment on our remaining BlackRock LTIP shares obligation, as

applicable. (b) In addition to acquisition integration costs related to recent or pending PNC acquisitions reflected in the 2007 periods, all 2007 and 2006 periods presented include BlackRock/MLIM transaction integration costs. BlackRock/MLIM transaction integration costs recognized by PNC in 2007 were included in noninterest income as a negative component of the "Asset management" line item, which includes the impact of our equity earnings from our investment in BlackRock. The third quarter of 2006 BlackRock/MLIM transaction integration costs were included in noninterest expense. (c) Included in noninterest income on a pretax basis. September 30, 2007 June 30, 2007 September 30, 2006 |

Non-GAAP

to GAAP Reconcilement Income Statement Summary For the Nine Months Ended September 30 Appendix NINE MONTHS ENDED In millions As Reported Adjustments As Adjusted (a) As Reported Adjustments As Adjusted (b) Net interest income $2,122 $2,122 $1,679 ($10) $1,669 Net interest income: % Change As Reported % Change As Adjusted Loans 806 806 682 (10) 672 18% 20% Deposits 1,316 1,316 997 997 32% 32% Noninterest Income 2,956 $4 2,960 5,358 (2,777) 2,581 (45%) 15% Total revenue 5,078 4 5,082 7,037 (2,787) 4,250 (28%) 20% Loan net interest income as a % of total revenue 15.9% 15.9% 9.7% 15.8% Deposit net interest income as a % of total revenue 25.9% 25.9% 14.2% 23.5% Noninterest income as a % of total revenue 58.2% 58.2% 76.1% 60.7% Provision for credit losses 127 127 82 82 Noninterest income 2,956 4 2,960 5,358 (2,777) 2,581 Noninterest expense 3,083 (67) 3,016 3,474 (856) 2,618 (11%) 15% Income before minority interest and income taxes 1,868 71 1,939 3,481 (1,931) 1,550 Minority interest in income of BlackRock 47 (47) Income taxes 579 23 602 1,215 (788) 427 Net income $1,289 $48 $1,337 $2,219 ($1,096) $1,123 (42%) 19% OPERATING LEVERAGE - NINE MONTHS ENDED As Reported As Adjusted Total revenue (28%) 20% Noninterest expense (11%) 15% Operating leverage (17%) 5% (a) Amounts adjusted to exclude the impact of the following pretax items: (1) the gain of $83 million recognized in connection with PNC's transfer of BlackRock shares to satisfy a portion of our BlackRock LTIP shares obligation, (2) the net mark-to-market adjustment totaling $82 million on our remaining BlackRock LTIP shares obligation, and (3) acquisition and BlackRock/MLIM transaction integration costs totaling $72 million. The net tax impact of these items is

reflected in the adjustment to income taxes. (b) Amounts adjusted to exclude the impact of the following pretax items: (1) the gain of $2.078 billion on the BlackRock/MLIM transaction, (2) the loss of $196 million on the securities portfolio rebalancing, (3) BlackRock/MLIM transaction integration costs of $91 million for the first nine months of 2006, and (4) the mortgage loan portfolio repositioning loss of $48 million. The net tax impact of these items is reflected in the adjustment to income taxes. We believe that information as adjusted for the impact of these items may be useful due to the extent to which these items are not indicative of our ongoing operations as the result of our management activities. Additionally, the amounts are also adjusted as if we had recorded our investment in BlackRock on the equity method. We believe that providing amounts adjusted as if we had recorded our investment in BlackRock on the equity method for all periods presented provides a basis of comparability for the impact of the BlackRock deconsolidation given the magnitude of the

impact on various components of our consolidated income statement. 2006 to 2007

Change September 30, 2007 September 30, 2006 |

Non-GAAP

to GAAP Reconcilement Income Statement Summary For the Three Months Ended Appendix For the three months ended September 30, 2007 PNC PNC In millions As Reported Adjustments (a) As Adjusted Reported Adjusted Net interest income $761 $761 Loan net interest income 294 294 5% 5% Deposit net interest income 467 467 2% 2% Provision for credit losses 65 65 Net interest income less provision for credit losses 696 696 Asset management 204 $2 206 Other 786 50 836 Total noninterest income 990 52 1,042 2% 7% Compensation and benefits 553 (16) 537 Other 546 (25) 521 Total noninterest expense 1,099 (41) 1,058 6% 3% Income before income taxes 587 93 680 Income taxes 180 31 211 Net income $407 $62 $469 (4%) 8% For the three months ended June 30, 2007 PNC PNC In millions As Reported Adjustments (b) As Adjusted Net interest income $738 $738 Loan net interest income 280 280 Deposit net interest income 458 458 Provision for credit losses 54 54 Net interest income less provision for credit losses 684 684 Asset management 190 $1 191 Other 785 1 786 Total noninterest income 975 2 977 Compensation and benefits 544 (9) 535 Other 496 (6) 490 Total noninterest expense 1,040 (15) 1,025 Income before income taxes 619 17 636 Income taxes 196 6 202 Net income $423 $11 $434 % Change vs. June 30, 2007 (a) Includes the impact of the following items on a pretax basis: $50 million net loss related to our BlackRock LTIP shares obligation and $43 million of acquisition and BlackRock/MLIM transaction integration costs. The net tax impact of these items is reflected

in the adjustment to income taxes. (b) Includes the impact of the following items on a pretax basis: $16 million of acquisition and BlackRock/MLIM transaction integration costs and $1 million net loss related to our BlackRock LTIP shares obligation. The net tax impact of these items is

reflected in the adjustment to income taxes. |

Non-GAAP

to GAAP Reconcilement Income Statement Summary 2004 to 2006 Appendix BlackRock For the year ended December 31, 2006 PNC Deconsolidation and BlackRock PNC In millions As Reported Adjustments (a) Other Adjustments Equity Method As Adjusted Net interest income $2,245 $(10) $2,235 Provision for credit losses 124 124 Noninterest income 6,327 $(1,812) (1,087) $144 3,572 Noninterest expense 4,443 (91) (765) 3,587 Income before minority interest and income taxes 4,005 (1,721) (332) 144 2,096 Minority interest in income of BlackRock 47 18 (65) Income taxes 1,363 (658) (130) 7 582 Net income $2,595 $(1,081) $(137) $137 $1,514 For the year ended December 31, 2005 BlackRock PNC Deconsolidation and BlackRock PNC In millions As Reported Other Adjustments Equity Method As Adjusted Net interest income $2,154 $(12) $2,142 Provision for credit losses 21 21 Noninterest income 4,173 (1,214) $163 3,122 Noninterest expense 4,306 (853) 3,453 Income before minority interest and income taxes 2,000 (373) 163 1,790 Minority interest in income of BlackRock 71 (71) Income taxes 604 (150) 11 465 Net income $1,325 $(152) $152 $1,325 (a) Includes the impact of the following items, all on a pretax basis, and adjustment for the tax impact thereof: $2,078 million gain on BlackRock/MLIM transaction, $196 million securities portfolio rebalancing loss, $101 million of BlackRock/MLIM transaction integration costs, $48 million mortgage loan portfolio repositioning loss, and $12 million net loss related to our BlackRock LTIP shares obligation.

|

Non-GAAP

to GAAP Reconcilement Income Statement Summary 2004 to 2006 (continued) Appendix For the year ended December 31, 2004 BlackRock PNC Deconsolidation and BlackRock PNC In millions As Reported Other Adjustments Equity Method As Adjusted Net interest income $1,969 $(14) $1,955 Provision for credit losses 52 52 Noninterest income 3,572 (745) $101 2,928 Noninterest expense 3,712 (564) 3,148 Income before minority interest and income taxes 1,777 (195) 101 1,683 Minority interest in income of BlackRock 42 (42) Income taxes 538 (59) 7 486 Net income $1,197 $(94) $94 $1,197 In millions 2004 2005 2006 CAGR Adjusted net interest income $1,955 $2,142 $2,235 Adjusted noninterest income 2,928 3,122 3,572 Adjusted total revenue 4,883 5,264 5,807 9% Adjusted noninterest expense 3,148 3,453 3,587 7% Adjusted net income $1,197 $1,325 $1,514 12% In millions 2004 2005 2006 CAGR Net interest income, as reported $1,969 $2,154 $2,245 Noninterest income, as reported 3,572 4,173 6,327 Total revenue, as reported 5,541 6,327 8,572 24% Noninterest expense, as reported 3,712 4,306 4,443 9% Net income, as reported $1,197 $1,325 $2,595 47% |