10-Q: Quarterly report [Sections 13 or 15(d)]

Published on August 1, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________________________

FORM 10-Q

______________________________________

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended June 30, 2025

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

___________________________________________________________

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|||||||

(Address of principal executive offices, including zip code)

(888 ) 762-2265

(Registrant’s telephone number including area code)

(Former name, former address and former fiscal year, if changed since last report)

___________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) |

Name of Each Exchange

on Which Registered

|

||||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of July 15, 2025, there were 393,807,382 shares of the registrant’s common stock ($5 par value) outstanding.

THE PNC FINANCIAL SERVICES GROUP, INC.

Cross-Reference Index to Second Quarter 2024 Form 10-Q

| Pages | |||||

| PART I – FINANCIAL INFORMATION | |||||

| Item 1. Financial Statements (Unaudited). | |||||

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A). | |||||

| Item 3. Quantitative and Qualitative Disclosures about Market Risk. | 21-38, 49-50, 83-89 |

||||

| Item 4. Controls and Procedures. | |||||

| MD&A TABLE REFERENCE | ||||||||

| Table | Description | Page | ||||||

| 1 | ||||||||

| 2 | ||||||||

| 3 | ||||||||

| 4 | ||||||||

| 5 | ||||||||

| 6 | ||||||||

| 7 | ||||||||

| 8 | ||||||||

| 9 | ||||||||

| 10 | ||||||||

| 11 | ||||||||

| 12 | ||||||||

| 13 | ||||||||

| 14 | ||||||||

| 15 | ||||||||

| 16 | ||||||||

| 17 | ||||||||

| 18 | ||||||||

| 19 | ||||||||

| 20 | ||||||||

| 21 | ||||||||

| 22 | ||||||||

| 23 | ||||||||

| 24 | ||||||||

| 25 | ||||||||

| 26 | ||||||||

| 27 | ||||||||

| 28 | ||||||||

| 29 | ||||||||

| 30 | ||||||||

| 31 | ||||||||

| 32 | ||||||||

| 33 | ||||||||

| 34 | ||||||||

| 35 | ||||||||

| 36 | ||||||||

| 37 | ||||||||

| 38 | ||||||||

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS TABLE REFERENCE | ||||||||

| Table | Description | Page | ||||||

| 39 | ||||||||

| 40 | ||||||||

| 41 | ||||||||

| 42 | ||||||||

| 43 | ||||||||

| 44 | ||||||||

| 45 | ||||||||

| 46 | ||||||||

| 47 | ||||||||

| 48 | ||||||||

| 49 | ||||||||

| 50 | ||||||||

| 51 | ||||||||

| 52 | ||||||||

| 53 | ||||||||

| 54 | ||||||||

| 55 | ||||||||

| 56 | ||||||||

| 57 | ||||||||

| 58 | ||||||||

| 59 | ||||||||

| 60 | ||||||||

| 61 | ||||||||

| 62 | ||||||||

| 63 | ||||||||

| 64 | ||||||||

| 65 | ||||||||

| 66 | ||||||||

| 67 | ||||||||

| 68 | ||||||||

| 69 | ||||||||

| 70 | ||||||||

| 71 | ||||||||

| 72 | ||||||||

| 73 | ||||||||

| 74 | ||||||||

| 75 | ||||||||

| 76 | ||||||||

| 77 | ||||||||

| 78 | ||||||||

| 79 | ||||||||

| 80 | ||||||||

| 81 | ||||||||

| 82 | ||||||||

| 83 | ||||||||

FINANCIAL REVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review, including the Consolidated Financial Highlights, should be read together with our unaudited Consolidated Financial Statements included elsewhere in this Quarterly Report on Form 10-Q (the “Report” or “Form 10-Q”) and with Items 7, 8 and 9A of our 2024 Annual Report on Form 10-K (our “2024 Form 10-K”). For information regarding certain business, regulatory and legal risks, see the following: the Risk Management section of this Financial Review and Item 7 in our 2024 Form 10-K; Item 1A Risk Factors included in our 2024 Form 10-K; and the Commitments and Legal Proceedings Notes included in this Report and Item 8 of our 2024 Form 10-K. Also, see the Cautionary Statement Regarding Forward-Looking Information section in this Financial Review and the Critical Accounting Estimates and Judgments section in this Financial Review and in our 2024 Form 10-K for certain other factors that could cause actual results or future events to differ, perhaps materially, from historical performance and from those anticipated in the forward-looking statements included in this Report. See Note 14 Segment Reporting for a reconciliation of total business segment earnings to total PNC consolidated net income as reported on a GAAP basis. In this Report, “PNC,” “we” or “us” refers to The PNC Financial Services Group, Inc. and its subsidiaries on a consolidated basis (except when referring to PNC as a public company, its common stock or other securities issued by PNC, which just refer to The PNC Financial Services Group, Inc.). References to The PNC Financial Services Group, Inc. or to any of its subsidiaries are specifically made where applicable.

See page 102 for a glossary of certain terms and acronyms used in this Report.

EXECUTIVE SUMMARY

Headquartered in Pittsburgh, Pennsylvania, we are one of the largest diversified financial institutions in the U.S. We have businesses engaged in retail banking, corporate and institutional banking and asset management, providing many of our products and services nationally. Our retail branch network is located coast-to-coast. We also have strategic international offices in four countries outside the U.S.

Key Strategic Goals

At PNC we manage our company for the long term. We are focused on the fundamentals of growing customers, loans, deposits and revenue and improving profitability, while investing for the future and managing risk, expenses and capital. We continue to invest in our products, markets and brand, and embrace our commitments to our customers, shareholders, employees and the communities where we do business.

We strive to serve our customers and expand and deepen relationships by offering a broad range of deposit, credit and fee-based products and services. We are focused on delivering those products and services to our customers with the goal of addressing their financial objectives and needs. Our business model is built on customer loyalty and engagement, understanding our customers’ financial goals and offering our diverse products and services to help them achieve financial well-being. Our approach is concentrated on organically growing and deepening client relationships across our businesses that meet our risk/return measures.

We are focused on our strategic priorities, which are designed to enhance value over the long term, and consist of:

•Expanding our leading banking franchise to new markets and digital platforms,

•Deepening customer relationships by delivering a superior banking experience and financial solutions, and

•Leveraging technology to create efficiencies that help us better serve customers.

Our capital and liquidity priorities are to support customers, fund business investments and return excess capital to shareholders, while maintaining appropriate capital and liquidity in light of economic conditions, the Basel III framework and other regulatory expectations. For more detail, see the Capital and Liquidity Highlights portion of this Executive Summary, the Liquidity and Capital Management portion of the Risk Management section of this Financial Review and the Supervision and Regulation section in Item 1 Business of our 2024 Form 10-K.

Second Quarter 2024 Significant Items

In the second quarter of 2024, PNC participated in the Visa exchange program, allowing PNC to convert its Visa Class B-1 common

shares into approximately equal amounts of Visa Class B-2 common shares and Visa Class C common shares. This conversion event

resulted in a gain of $754 million related to the Visa Class C common shares received. PNC retained the Visa Class B-2 common

shares. The second quarter of 2024 also included Visa Class B-2 derivative fair value adjustments of negative $116 million and a $120

million expense related to a PNC Foundation contribution. During the second quarter, PNC also repositioned the investment securities

portfolio, selling low-yielding investment securities for net proceeds of $3.8 billion, resulting in a loss of $497 million. PNC

redeployed the full proceeds from the sale into higher-yielding investment securities. The combined impact of all of these significant

items on pre-tax noninterest income and pre-tax noninterest expense in the second quarter of 2024 was $141 million and $120 million,

respectively.

The PNC Financial Services Group, Inc. – Form 10-Q 1

Selected Financial Data

The following tables include selected financial data which should be reviewed in conjunction with the Consolidated Financial Statements and Notes included in Item 1 of this Report as well as the other disclosures in this Report concerning our historical financial performance, our future prospects and the risks associated with our business and financial performance:

Table 1: Summary of Operations, Per Common Share Data and Performance Ratios

| Dollars in millions, except per share data Unaudited |

Three months ended | Six months ended | |||||||||||||||||||||

| June 30 | March 31 | June 30 | June 30 | June 30 | |||||||||||||||||||

| 2025 | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Summary of Operations (a) | |||||||||||||||||||||||

| Net interest income | $ | 3,555 | $ | 3,476 | $ | 3,302 | $ | 7,031 | $ | 6,566 | |||||||||||||

| Noninterest income | 2,106 | 1,976 | 2,109 | 4,082 | 3,990 | ||||||||||||||||||

| Total revenue | 5,661 | 5,452 | 5,411 | 11,113 | 10,556 | ||||||||||||||||||

| Provision for credit losses | 254 | 219 | 235 | 473 | 390 | ||||||||||||||||||

| Noninterest expense | 3,383 | 3,387 | 3,357 | 6,770 | 6,691 | ||||||||||||||||||

| Income before income taxes and noncontrolling interests |

2,024 | 1,846 | 1,819 | 3,870 | 3,475 | ||||||||||||||||||

| Income taxes |

381 | 347 | 342 | 728 | 654 | ||||||||||||||||||

| Net income | $ | 1,643 | $ | 1,499 | $ | 1,477 | $ | 3,142 | $ | 2,821 | |||||||||||||

| Net income attributable to common shareholders | $ | 1,542 | $ | 1,408 | $ | 1,362 | $ | 2,950 | $ | 2,609 | |||||||||||||

|

Per Common Share

|

|||||||||||||||||||||||

| Basic | $ | 3.86 | $ | 3.52 | $ | 3.39 | $ | 7.37 | $ | 6.49 | |||||||||||||

| Diluted | $ | 3.85 | $ | 3.51 | $ | 3.39 | $ | 7.37 | $ | 6.48 | |||||||||||||

| Book value per common share | $ | 131.61 | $ | 127.98 | $ | 116.70 | |||||||||||||||||

| Performance Ratios | |||||||||||||||||||||||

| Net interest margin (non-GAAP) (b) | 2.80 | % | 2.78 | % | 2.60 | % | 2.79 | % | 2.58 | % | |||||||||||||

| Noninterest income to total revenue | 37 | % | 36 | % | 39 | % | 37 | % | 38 | % | |||||||||||||

| Efficiency | 60 | % | 62 | % | 62 | % | 61 | % | 63 | % | |||||||||||||

| Return on: | |||||||||||||||||||||||

| Average common shareholders’ equity | 12.20 | % | 11.60 | % | 12.16 | % | 11.91 | % | 11.78 | % | |||||||||||||

| Average assets | 1.17 | % | 1.09 | % | 1.05 | % | 1.13 | % | 1.01 | % | |||||||||||||

(a)The Executive Summary and Consolidated Income Statement Review portions of this Financial Review section provide information regarding items impacting the comparability of the periods presented.

(b)See explanation and reconciliation of this non-GAAP measure in the Average Consolidated Balance Sheet and Net Interest Analysis and Non-GAAP Financial Information sections of this Item 2.

Table 2: Balance Sheet Highlights and Other Selected Ratios

| Dollars in millions, except as noted Unaudited |

June 30 2025 |

December 31 2024 |

June 30 2024 |

|||||||||||

| Balance Sheet Highlights (a) | ||||||||||||||

| Assets | $ | 559,107 | $ | 560,038 | $ | 556,519 | ||||||||

| Loans | $ | 326,340 | $ | 316,467 | $ | 321,429 | ||||||||

|

Allowance for loan and lease losses |

$ | 4,523 | $ | 4,486 | $ | 4,636 | ||||||||

| Interest-earning deposits with banks | $ | 24,455 | $ | 39,347 | $ | 33,039 | ||||||||

| Investment securities | $ | 142,348 | $ | 139,732 | $ | 138,645 | ||||||||

| Total deposits | $ | 426,696 | $ | 426,738 | $ | 416,391 | ||||||||

| Borrowed funds | $ | 60,424 | $ | 61,673 | $ | 71,391 | ||||||||

| Total shareholders’ equity | $ | 57,607 | $ | 54,425 | $ | 52,642 | ||||||||

| Common shareholders’ equity | $ | 51,854 | $ | 48,676 | $ | 46,397 | ||||||||

| Other Selected Ratios | ||||||||||||||

| Common equity Tier 1 (b) | 10.5 | % | 10.5 | % | 10.2 | % | ||||||||

| Loans to deposits | 76 | % | 74 | % | 77 | % | ||||||||

| Common shareholders’ equity to total assets | 9.3 | % | 8.7 | % | 8.3 | % | ||||||||

(a)The Executive Summary and Consolidated Balance Sheet Review portions of this Financial Review provide information regarding items impacting the comparability of applicable periods presented.

(b)The December 31, 2024 and June 30, 2024 ratios are calculated to reflect PNC’s election to adopt the CECL optional five-year transition provisions. The impact of the provisions was phased-in to regulatory capital through December 31, 2024.

2 The PNC Financial Services Group, Inc. – Form 10-Q

Income Statement Highlights

Net income of $1.6 billion, or $3.85 per diluted common share, for the second quarter of 2025 increased $144 million, or 10%, compared to $1.5 billion, or $3.51 per diluted common share, for the first quarter of 2025, primarily due to higher noninterest and net interest income, partially offset by a higher provision for credit losses.

•For the three months ended June 30, 2025 compared to the three months ended March 31, 2025:

•Total revenue of $5.7 billion increased $209 million, or 4%.

•Net interest income of $3.6 billion increased $79 million, or 2%, driven by loan growth, the continued benefit of fixed rate asset repricing and one additional day in the quarter.

•Net interest margin increased 2 basis points to 2.80%.

•Noninterest income of $2.1 billion increased $130 million, or 7%, primarily due to Visa related activity and other positive valuation adjustments as well as higher card and cash management revenue. The second quarter of 2025 included positive $2 million of Visa derivative fair value adjustments, compared to negative $40 million in the first quarter of 2025.

•Provision for credit losses was $254 million in the second quarter of 2025 and was driven by net charge-offs and a net increase in the ACL due to changes in macroeconomic scenarios, tariff related considerations and portfolio activity, including loan growth. The first quarter of 2025 included a provision for credit losses of $219 million.

•Noninterest expense was stable compared to the first quarter of 2025, reflecting a continued focus on expense management, offset by seasonally higher marketing spend and expenses related to continued technology investment.

Net income of $3.1 billion, or $7.37 per diluted common share, for the first six months of 2025 increased $321 million, or 11%, compared to $2.8 billion, or $6.48 per diluted common share, for the same period in 2024 driven by higher net interest and noninterest income, partially offset by a higher provision for credit losses and increased noninterest expense.

•For the six months ended June 30, 2025 compared to the six months ended June 30, 2024:

•Total revenue increased $557 million, or 5%, to $11.1 billion.

•Net interest income increased $465 million, or 7%, primarily due to the benefit of lower funding costs and continued repricing of fixed rate assets.

•Net interest margin increased 21 basis points.

•Noninterest income increased $92 million, or 2%, primarily due to higher capital markets and advisory fees, asset management and brokerage income and card and cash management revenue, partially offset by lower other noninterest income. Other noninterest income for the first six months of 2024 included the benefit of $141 million of significant items recognized in the second quarter of 2024.

•Provision for credit losses was $473 million in the first six months of 2025 and was driven by net charge-offs and a net increase in the ACL due to changes in macroeconomic scenarios, tariff related considerations and portfolio activity, including loan growth. The first six months of 2024 included a provision for credit losses of $390 million.

•Noninterest expense increased $79 million, or 1%, compared to the first six months of 2024, due to higher expenses related to personnel and technology investments as well as increased marketing spend, partially offset by other noninterest expense. Other noninterest expense included $120 million of significant items in the second quarter of 2024 as well as a $130 million pre-tax expense in the first quarter of 2024 related to the FDIC’s special assessment.

For additional detail, see the Consolidated Income Statement Review section of this Financial Review.

Balance Sheet Highlights

Our balance sheet was well positioned at June 30, 2025. In comparison to December 31, 2024:

•Total assets of $559.1 billion were stable reflecting lower balances held with the FRB, partially offset by higher loans and securities balances.

•Total loans of $326.3 billion increased $9.9 billion, or 3%.

•Total commercial loans increased $10.8 billion, or 5%, to $227.0 billion, due to growth in the commercial and industrial portfolio, reflecting new production and higher utilization of loan commitments, partially offset by lower commercial real estate loans.

•Total consumer loans decreased $1.0 billion, or 1%, to $99.3 billion primarily due to lower residential real estate loans as paydowns outpaced originations, partially offset by growth in the auto loan portfolio.

•Investment securities increased $2.6 billion, or 2%, to $142.3 billion due to net purchase activity, primarily of agency residential mortgage-backed securities.

•Interest-earning deposits with banks, primarily with the FRB, decreased $14.9 billion, or 38%, to $24.5 billion, primarily driven by higher loans and securities balances.

•Total deposits were stable as lower interest-bearing deposits were offset by higher noninterest-bearing deposits.

•Borrowed funds decreased $1.2 billion, or 2%, to $60.4 billion due to lower FHLB advances, partially offset by higher senior debt outstanding.

The PNC Financial Services Group, Inc. – Form 10-Q 3

For additional detail, see the Consolidated Balance Sheet Review section of this Financial Review.

Credit Quality Highlights

The second quarter of 2025 reflected solid credit quality performance.

•At June 30, 2025 compared to December 31, 2024:

•Overall loan delinquencies of $1.3 billion decreased $79 million, or 6%, reflecting lower consumer and commercial loan delinquencies.

•The ACL related to loans, which consists of the ALLL and the allowance for unfunded lending related commitments, totaled $5.3 billion at June 30, 2025, compared to $5.2 billion at December 31, 2024. The increase in reserves was driven primarily by changes in macroeconomic scenarios. ACL to total loans was 1.62% at June 30, 2025, compared to 1.64% at December 31, 2024.

•Nonperforming assets of $2.1 billion decreased $0.2 billion, or 9%, primarily driven by lower commercial nonperforming loans, including lower commercial real estate nonperforming loans.

•Net loan charge-offs of $198 million, or 0.25% of average loans, in the second quarter of 2025 decreased $7 million compared to the first quarter of 2025, due to lower consumer net loan charge-offs, partially offset by higher commercial net loan charge-offs, primarily related to the commercial real estate portfolio.

For additional detail see the Credit Risk Management portion of the Risk Management section of this Financial Review.

Capital and Liquidity Highlights

We maintained our strong capital and liquidity positions.

•Common shareholders’ equity of $51.9 billion at June 30, 2025 increased $3.2 billion compared to December 31, 2024, due to the benefit of net income and an improvement in AOCI, partially offset by common dividends paid and common share repurchases.

•In the second quarter of 2025, PNC returned $1.0 billion of capital to shareholders, including more than $0.6 billion of dividends on common shares and more than $0.3 billion of common share repurchases.

•On July 3, 2025, the PNC Board of Directors raised the quarterly cash dividend on common stock to $1.70 per share, an increase of 10 cents, or 6%, per share. The dividend is payable on August 5, 2025 to shareholders of record at the close of business July 15, 2025.

•Our CET1 ratio was 10.5% at both June 30, 2025 and December 31, 2024.

PNC’s ability to take certain capital actions, including returning capital to shareholders, is subject to PNC meeting or exceeding an SCB established by the Federal Reserve Board in connection with the Federal Reserve Board’s CCAR process. Based on the results of the Federal Reserve's 2025 annual stress test, PNC’s SCB for the four-quarter period beginning October 1, 2025 will remain at the regulatory minimum of 2.5%. For additional information on our liquidity and capital actions as well as our capital ratios, see Capital Management in the Risk Management section in this Financial Review, the Recent Regulatory Developments section in this Financial Review and the Supervision and Regulation section in our 2024 Form 10-K.

Business Outlook

Statements regarding our business outlook are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our views that:

•The economic fundamentals remain solid in mid-2025. The labor market has eased but job growth continues, and job and income gains have supported consumer spending growth in the first half of 2025. However, downside risks have materially increased with recent substantial changes to U.S. tariffs and corresponding policy changes by U.S. trading partners.

•PNC’s baseline forecast remains for continued expansion, but slower economic growth in 2025 than in 2024. Tariffs and the uncertainty surrounding them will weigh on consumer spending and business investment. High interest rates remain a drag on the economy, consumer spending growth will slow to a pace more consistent with household income growth, and government’s contribution to economic growth will be smaller.

•The baseline forecast is for real GDP growth of around 1.5% in 2025 and 2026, with the unemployment rate increasing to around 4.5% over the next year. However, the recent turbulence in trade policy indicates that growth may be significantly weaker than in this forecast and the unemployment rate higher. The higher tariffs rates are, the longer they remain in place, and the more uncertainty that exists around them, the weaker economic growth will be and the higher the unemployment rate will be. The longer trade disputes persist, the greater the likelihood of near-term recession.

•The baseline forecast is for one federal funds rate cut of 25 basis points this year, at the last FOMC meeting of 2025, with additional rate cuts of 25 basis points at each of the first two FOMC meetings of 2026. This would put the federal funds rate in a range of 3.50% to 3.75% by the spring of next year. High inflation could mean less monetary easing than in the forecast,

4 The PNC Financial Services Group, Inc. – Form 10-Q

but if the economy enters recession the Federal Reserve could cut the federal funds rate more aggressively this year.

Consistent with the forward guidance we provided on July 16, 2025, for the third quarter of 2025, compared to the second quarter of 2025, we expect:

•Average loans to be up approximately 1%,

•Net interest income to be up approximately 3%,

•Fee income to be up 3% to 4%,

•Other noninterest income to be $150 million to $200 million,

•Total revenue to be up 2% to 3%,

•Noninterest expense to be up approximately 2%, and

•Net loan charge-offs to be $275 million to $300 million.

Consistent with the forward guidance we provided on July 16, 2025, for the full year 2025, compared to the full year of 2024, we expect:

•Average loans to be up approximately 1%,

•Net interest income to be up approximately 7%,

•Noninterest income to be up 4% to 5%,

•Revenue to be up approximately 6%,

•Noninterest expense to be up approximately 1%, and

•The effective tax rate to be approximately 19%.

Other noninterest income, noninterest income and total revenue guidance does not forecast net securities gains or losses or Visa activity.

We are unable to provide a meaningful or accurate reconciliation of forward-looking non-GAAP measures, without unreasonable effort, to their most directly comparable GAAP financial measures. This is due to the inherent difficulty of forecasting the timing and amounts necessary for the reconciliation, when such amounts are subject to events that cannot be reasonably predicted, as noted in our Cautionary Statement. Accordingly, we cannot address the probable significance of unavailable information.

See the Cautionary Statement Regarding Forward-Looking Information section in this Financial Review and Item 1A Risk Factors included in our 2024 Form 10-K for other factors that could cause future events to differ, perhaps materially, from those anticipated in these forward-looking statements.

CONSOLIDATED INCOME STATEMENT REVIEW

Our Consolidated Income Statement is presented in Item 1 of this Report.

Net income of $1.6 billion, or $3.85 per diluted common share, for the second quarter of 2025 increased $144 million, or 10%, compared to $1.5 billion, or $3.51 per diluted common share, for the first quarter of 2025, primarily due to higher noninterest and net interest income, partially offset by a higher provision for credit losses. Net income of $3.1 billion, or $7.37 per diluted common share, for the first six months of 2025 increased $321 million, or 11%, compared to $2.8 billion, or $6.48 per diluted common share, for the same period in 2024, driven by higher net interest and noninterest income, partially offset by a higher provision for credit losses and increased noninterest expense.

The PNC Financial Services Group, Inc. – Form 10-Q 5

Net Interest Income

Table 3: Summarized Average Balances and Net Interest Income (a)

| June 30, 2025 | March 31, 2025 | ||||||||||||||||||||||||||||||||||||||||

| Three months ended Dollars in millions |

Average Balances |

Average Yields/ Rates |

Interest Income/ Expense |

Average Balances |

Average Yields/ Rates |

Interest Income/ Expense |

|||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | |||||||||||||||||||||||||||||||||||||||||

| Investment securities | $ | 141,935 | 3.26 | % | $ | 1,155 | $ | 142,181 | 3.17 | % | $ | 1,129 | |||||||||||||||||||||||||||||

| Loans | 322,754 | 5.70 | % | 4,633 | 316,624 | 5.70 | % | 4,495 | |||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks (b) | 31,570 | 4.38 | % | 350 | 34,614 | 4.42 | % | 381 | |||||||||||||||||||||||||||||||||

| Other | 11,348 | 5.66 | % | 160 | 10,147 | 6.02 | % | 153 | |||||||||||||||||||||||||||||||||

| Total interest-earning assets/interest income | $ | 507,607 | 4.93 | % | 6,298 | $ | 503,566 | 4.90 | % | 6,158 | |||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 329,833 | 2.24 | % | 1,845 | $ | 328,281 | 2.23 | % | 1,808 | |||||||||||||||||||||||||||||||

| Borrowed funds | 65,293 | 5.31 | % | 870 | 64,505 | 5.25 | % | 846 | |||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities/interest expense | $ | 395,126 | 2.74 | % | 2,715 | $ | 392,786 | 2.72 | % | 2,654 | |||||||||||||||||||||||||||||||

| Interest rate spread | 2.19 | % | 2.18 | % | |||||||||||||||||||||||||||||||||||||

| Impact of noninterest-bearing sources | 0.61 | 0.60 | |||||||||||||||||||||||||||||||||||||||

| Net interest margin/income (non-GAAP) | 2.80 | % | 3,583 | 2.78 | % | 3,504 | |||||||||||||||||||||||||||||||||||

| Taxable-equivalent adjustments | (28) | (28) | |||||||||||||||||||||||||||||||||||||||

| Net interest income (GAAP) | $ | 3,555 | $ | 3,476 | |||||||||||||||||||||||||||||||||||||

| June 30, 2025 | June 30, 2024 | ||||||||||||||||||||||||||||||||||||||||

| Six months ended Dollars in millions |

Average Balances |

Average Yields/ Rates |

Interest Income/ Expense |

Average Balances |

Average Yields/ Rates |

Interest Income/ Expense |

|||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | |||||||||||||||||||||||||||||||||||||||||

| Investment securities | $ | 142,058 | 3.22 | % | $ | 2,284 | $ | 138,370 | 2.74 | % | $ | 1,894 | |||||||||||||||||||||||||||||

| Loans | 319,706 | 5.70 | % | 9,128 | 320,263 | 6.03 | % | 9,719 | |||||||||||||||||||||||||||||||||

| Interest-earning deposits with banks (b) | 33,209 | 4.38 | % | 731 | 44,682 | 5.47 | % | 1,223 | |||||||||||||||||||||||||||||||||

| Other | 10,750 | 5.83 | % | 313 | 8,641 | 6.95 | % | 300 | |||||||||||||||||||||||||||||||||

| Total interest-earning assets/interest income | $ | 505,723 | 4.92 | % | 12,456 | $ | 511,956 | 5.11 | % | 13,136 | |||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 329,061 | 2.24 | % | 3,653 | $ | 321,115 | 2.60 | % | 4,161 | |||||||||||||||||||||||||||||||

| Borrowed funds | 64,901 | 5.28 | % | 1,716 | 76,523 | 6.06 | % | 2,341 | |||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities/interest expense | $ | 393,962 | 2.73 | % | 5,369 | $ | 397,638 | 3.25 | % | 6,502 | |||||||||||||||||||||||||||||||

| Interest rate spread | 2.19 | % | 1.86 | ||||||||||||||||||||||||||||||||||||||

| Impact of noninterest-bearing sources | 0.60 | 0.72 | |||||||||||||||||||||||||||||||||||||||

| Net interest margin/income (non-GAAP) | 2.79 | % | 7,087 | 2.58 | % | 6,634 | |||||||||||||||||||||||||||||||||||

| Taxable-equivalent adjustments | (56) | (68) | |||||||||||||||||||||||||||||||||||||||

| Net interest income (GAAP) | $ | 7,031 | $ | 6,566 | |||||||||||||||||||||||||||||||||||||

(a)Interest income calculated as taxable-equivalent interest income. To provide more meaningful comparisons of interest income and yields for all interest-earning assets, as well as net interest margins, we use interest income on a taxable-equivalent basis in calculating average yields and net interest margins by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP on the Consolidated Income Statement. For more information, see Table 37 Reconciliation of Taxable-Equivalent Net Interest Income (non-GAAP).

(b)Interest income from Interest-earning deposits with banks primarily includes interest earned on our balances held with the FRB and is reported as Other interest income on our Consolidated Income Statement.

Changes in net interest income and margin result from the interaction of the volume and composition of interest-earning assets and related yields, interest-bearing liabilities and related rates paid and noninterest-bearing sources of funding. See Table 36 Average Consolidated Balance Sheet And Net Interest Analysis for additional information.

Net interest income increased $79 million, or 2%, and net interest margin increased 2 basis points, compared to the first quarter of 2025, driven by loan growth, the continued benefit of fixed rate asset repricing and one additional day in the quarter. Net interest income increased $465 million, or 7%, and net interest margin increased 21 basis points, compared to the first six months of 2024, primarily due to the benefit of lower funding costs and the continued repricing of fixed rate assets.

6 The PNC Financial Services Group, Inc. – Form 10-Q

Average investment securities were stable, compared to the first quarter of 2025. Average investment securities increased $3.7 billion, or 3%, compared to the first six months of 2024, driven by net purchase activity of U.S. Treasury and government agency securities. Average investment securities represented 28% of average interest-earning assets for both the second and first quarters of 2025, and 28% for the first six months of 2025 compared to 27% for the first six months of 2024.

Average loans increased $6.1 billion, or, 2%, compared to the first quarter of 2025, driven by growth in commercial and industrial loans, reflecting strong new production and increased utilization of loan commitments, partially offset by a decline in commercial real estate loans. Compared to the first six months of 2024, average loans were stable. Average loans represented 64% of average interest-earning assets for the second quarter of 2025, compared to 63% for the first quarter of 2025, and 63% for both year-to-date periods.

Average interest-earning deposits with banks for the second quarter of 2025 decreased $3.0 billion, or 9%, compared to the first quarter of 2025, primarily driven by loan growth. Compared to the first six months of 2024, average interest-earning deposits with banks decreased $11.5 billion, or 26%, primarily due to lower borrowed funds outstanding.

Average interest-bearing deposits for the second quarter of 2025 were stable compared to the first quarter of 2025. Compared to the first six months of 2024 average interest-bearing deposits increased $7.9 billion, or 2%, as higher commercial deposits were partially offset by lower brokered time deposits. In total, average interest-bearing deposits represented 83% of average interest-bearing liabilities for the second quarter of 2025, compared to 84% for the first quarter of 2025, and 84% for the first six months of 2025 compared to 81% for the first six months of 2024.

Average borrowed funds increased $0.8 billion, or 1%, compared to the first quarter of 2025, and included higher senior debt outstanding. Average borrowed funds decreased $11.6 billion, or 15%, in the year-to-date comparison, primarily driven by lower FHLB advances, partially offset by higher senior debt outstanding.

Further details regarding average loans and deposits are included in the Business Segments Review section of this Financial Review.

Noninterest Income

Table 4: Noninterest Income

| Three months ended | Six months ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30 | March 31 | Change | June 30 | June 30 | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars in millions | 2025 | 2025 | $ | % | 2025 | 2024 | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset management and brokerage | $ | 391 | $ | 391 | $ | — | — | % | $ | 782 | $ | 728 | $ | 54 | 7 | % | ||||||||||||||||||||||||||||||||||||||||

| Capital markets and advisory | 321 | 306 | 15 | 5 | % | 627 | 531 | 96 | 18 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Card and cash management | 737 | 692 | 45 | 7 | % | 1,429 | 1,377 | 52 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Lending and deposit services | 317 | 316 | 1 | — | % | 633 | 609 | 24 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Residential and commercial mortgage | 128 | 134 | (6) | (4) | % | 262 | 278 | (16) | (6) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other income | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gain on Visa shares exchange program | — | — | — | * | — | 754 | (754) | * | ||||||||||||||||||||||||||||||||||||||||||||||||

| Securities gains (losses) | — | (2) | 2 | * | (2) | (499) | 497 | * | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 212 | 139 | 73 | 53 | % | 351 | 212 | 139 | 66 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total other income | 212 | 137 | 75 | 55 | % | 349 | 467 | (118) | (25) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | $ | 2,106 | $ | 1,976 | $ | 130 | 7 | % | $ | 4,082 | $ | 3,990 | $ | 92 | 2 | % | ||||||||||||||||||||||||||||||||||||||||

*-Not meaningful

Noninterest income as a percentage of total revenue was 37% for the second quarter of 2025 compared to 36% for the first quarter of 2025, and 37% for the first six months of 2025 compared to 38% for the same period in 2024.

Asset management and brokerage fees were stable compared to the first quarter of 2025. The increase in the year-to-date comparison reflected the impact of higher average equity markets. PNC’s discretionary client assets under management of $217 billion at June 30, 2025 increased compared to $210 billion at March 31, 2025, and $196 billion at June 30, 2024. Compared to June 30, 2024, the increase included the impact from higher spot equity markets and positive net flows.

Capital markets and advisory fees increased compared to the first quarter of 2025, reflecting an increase in trading revenue,

primarily related to derivative sales. The increase in the year-to-date comparison was primarily due to increased trading revenue and higher merger and acquisition advisory activity.

The PNC Financial Services Group, Inc. – Form 10-Q 7

Card and cash management revenue increased compared to the first quarter of 2025, as a result of seasonally higher consumer transaction volumes and growth in treasury management product revenue. The increase compared to the first six months of 2024 was primarily due to higher treasury management product revenue.

Lending and deposit services were stable compared to the first quarter of 2025. The increase compared to the first six months of 2024 reflected increased customer activity and growth in consumer checking accounts.

Residential and commercial mortgage decreased in both the quarterly and year-to-date comparisons, primarily due to lower residential mortgage revenue.

Other noninterest income increased compared to the first quarter of 2025, reflecting Visa related activity and other positive valuation adjustments, partially offset by lower private equity revenue. Visa derivative adjustments were positive $2 million in the second quarter of 2025 compared to negative $40 million in the first quarter of 2025. Compared to the first six months of 2024, other noninterest income decreased reflecting the benefit of $141 million of significant items recognized in the second quarter of 2024. Visa derivative adjustments were negative $38 million for the first six months of 2025 compared to negative $123 million for the same period in 2024.

Noninterest Expense

Table 5: Noninterest Expense

| Three months ended | Six months ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30 | March 31 | Change | June 30 | June 30 | Change | ||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars in millions | 2025 | 2025 | $ | % | 2025 | 2024 | $ | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personnel | $ | 1,889 | $ | 1,890 | $ | (1) | — | % | $ | 3,779 | $ | 3,576 | $ | 203 | 6 | % | |||||||||||||||||||||||||||||||||||||

| Occupancy | 235 | 245 | (10) | (4) | % | 480 | 480 | — | — | % | |||||||||||||||||||||||||||||||||||||||||||

| Equipment | 394 | 384 | 10 | 3 | % | 778 | 697 | 81 | 12 | % | |||||||||||||||||||||||||||||||||||||||||||

| Marketing | 99 | 85 | 14 | 16 | % | 184 | 157 | 27 | 17 | % | |||||||||||||||||||||||||||||||||||||||||||

| Other | 766 | 783 | (17) | (2) | % | 1,549 | 1,781 | (232) | (13) | % | |||||||||||||||||||||||||||||||||||||||||||

Total noninterest expense |

$ | 3,383 | $ | 3,387 | $ | (4) | — | % | $ | 6,770 | $ | 6,691 | $ | 79 | 1 | % | |||||||||||||||||||||||||||||||||||||

Noninterest expense was stable compared to the first quarter of 2025, reflecting a continued focus on expense management, partially offset by seasonally higher marketing spend and expenses related to continued technology investment. Noninterest expense increased compared to the first six months of 2024, due to higher expenses related to personnel and technology investments as well as increased marketing spend, partially offset by other noninterest expense. Other noninterest expense included $120 million of significant items in the second quarter of 2024 as well as a $130 million pre-tax expense in the first quarter of 2024 related to the FDIC’s special assessment.

Effective Income Tax Rate

The effective income tax rate was 18.8% for both the second and first quarters of 2025, and for the first six months of 2025 and 2024.

Provision For Credit Losses

Table 6: Provision for Credit Losses

| Three months ended | Six months ended | ||||||||||||||||||||||||||||||||||

| June 30 | March 31 | Change | June 30 | June 30 | Change | ||||||||||||||||||||||||||||||

| Dollars in millions | 2025 | 2025 | $ | 2025 | 2024 | $ | |||||||||||||||||||||||||||||

| Provision for (recapture of) credit losses | |||||||||||||||||||||||||||||||||||

| Loans and leases | $ | 171 | $ | 260 | $ | (89) | $ | 431 | $ | 351 | $ | 80 | |||||||||||||||||||||||

| Unfunded lending related commitments | 84 | (46) | 130 | 38 | 54 | (16) | |||||||||||||||||||||||||||||

| Investment securities | (1) | 3 | (4) | 2 | (10) | 12 | |||||||||||||||||||||||||||||

| Other financial assets | — | 2 | (2) | 2 | (5) | 7 | |||||||||||||||||||||||||||||

| Total provision for credit losses | $ | 254 | $ | 219 | $ | 35 | $ | 473 | $ | 390 | $ | 83 | |||||||||||||||||||||||

The provision for credit losses was $254 million and $473 million for the three and six months ended June 30, 2025, respectively. Both periods were driven by net charge-offs and a net increase in the ACL due to changes in macroeconomic scenarios, tariff related considerations and portfolio activity, including loan growth.

8 The PNC Financial Services Group, Inc. – Form 10-Q

CONSOLIDATED BALANCE SHEET REVIEW

The summarized balance sheet data in Table 7 is based upon our Consolidated Balance Sheet in Item 1 of this Report.

Table 7: Summarized Balance Sheet Data

| June 30 | December 31 | Change | |||||||||||||||||||||

| Dollars in millions | 2025 | 2024 | $ | % | |||||||||||||||||||

| Assets | |||||||||||||||||||||||

| Interest-earning deposits with banks | $ | 24,455 | $ | 39,347 | $ | (14,892) | (38) | % | |||||||||||||||

| Loans held for sale | 1,837 | 850 | 987 | 116 | % | ||||||||||||||||||

| Investment securities | 142,348 | 139,732 | 2,616 | 2 | % | ||||||||||||||||||

| Loans | 326,340 | 316,467 | 9,873 | 3 | % | ||||||||||||||||||

| Allowance for loan and lease losses | (4,523) | (4,486) | (37) | (1) | % | ||||||||||||||||||

| Mortgage servicing rights | 3,467 | 3,711 | (244) | (7) | % | ||||||||||||||||||

| Goodwill | 10,932 | 10,932 | — | — | % | ||||||||||||||||||

| Other | 54,251 | 53,485 | 766 | 1 | % | ||||||||||||||||||

| Total assets | $ | 559,107 | $ | 560,038 | $ | (931) | — | % | |||||||||||||||

| Liabilities | |||||||||||||||||||||||

| Deposits | $ | 426,696 | $ | 426,738 | $ | (42) | — | % | |||||||||||||||

| Borrowed funds | 60,424 | 61,673 | (1,249) | (2) | % | ||||||||||||||||||

| Allowance for unfunded lending related commitments | 759 | 719 | 40 | 6 | % | ||||||||||||||||||

| Other | 13,573 | 16,439 | (2,866) | (17) | % | ||||||||||||||||||

| Total liabilities | 501,452 | 505,569 | (4,117) | (1) | % | ||||||||||||||||||

| Equity | |||||||||||||||||||||||

| Total shareholders’ equity | 57,607 | 54,425 | 3,182 | 6 | % | ||||||||||||||||||

| Noncontrolling interests | 48 | 44 | 4 | 9 | % | ||||||||||||||||||

| Total equity | 57,655 | 54,469 | 3,186 | 6 | % | ||||||||||||||||||

| Total liabilities and equity | $ | 559,107 | $ | 560,038 | $ | (931) | — | % | |||||||||||||||

Our balance sheet was well positioned at June 30, 2025. In comparison to December 31, 2024:

•Total assets were stable reflecting lower balances held with the FRB, offset by higher loans and securities balances.

•Total liabilities decreased and included lower trading liabilities and borrowed funds.

•Total equity increased due to the benefit of net income and an improvement in AOCI, partially offset by dividends paid and common shares repurchased.

The following discussion provides additional information about the major components of our balance sheet. Information regarding our ACL related to loans is included in the Credit Risk Management section and Critical Accounting Estimates and Judgements section of this Financial Review and in Note 3 Loans and Related Allowance for Credit Losses. Information regarding our capital and regulatory compliance is included in the Liquidity and Capital Management portion of the Risk Management section and the Recent Regulatory Developments section in this Financial Review and in Note 19 Regulatory Matters in our 2024 Form 10-K.

The PNC Financial Services Group, Inc. – Form 10-Q 9

Loans

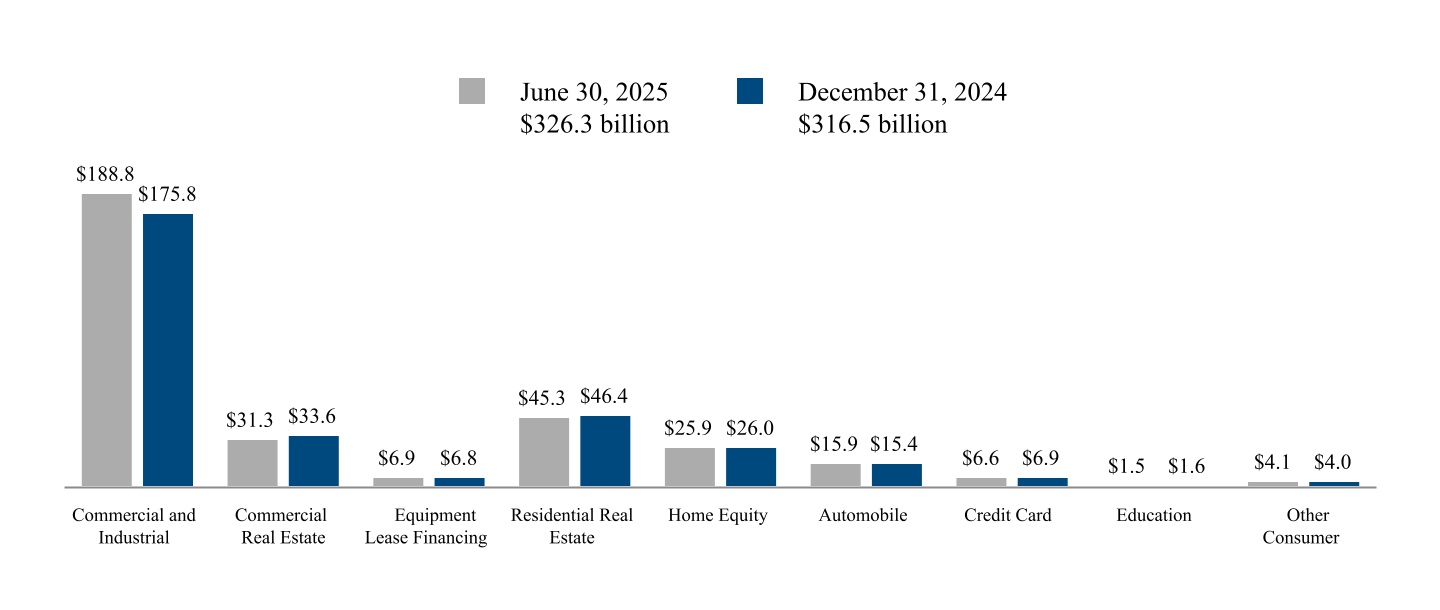

Table 8: Loans

| June 30 | December 31 | Change | |||||||||||||||||||||

| Dollars in millions | 2025 | 2024 | $ | % | |||||||||||||||||||

| Commercial | |||||||||||||||||||||||

| Commercial and industrial | $ | 188,830 | $ | 175,790 | $ | 13,040 | 7 | % | |||||||||||||||

| Commercial real estate | 31,250 | 33,619 | (2,369) | (7) | % | ||||||||||||||||||

| Equipment lease financing | 6,928 | 6,755 | 173 | 3 | % | ||||||||||||||||||

| Total commercial | 227,008 | 216,164 | 10,844 | 5 | % | ||||||||||||||||||

| Consumer | |||||||||||||||||||||||

| Residential real estate | 45,257 | 46,415 | (1,158) | (2) | % | ||||||||||||||||||

| Home equity | 25,928 | 25,991 | (63) | — | % | ||||||||||||||||||

| Automobile | 15,892 | 15,355 | 537 | 3 | % | ||||||||||||||||||

| Credit card | 6,570 | 6,879 | (309) | (4) | % | ||||||||||||||||||

| Education | 1,547 | 1,636 | (89) | (5) | % | ||||||||||||||||||

| Other consumer | 4,138 | 4,027 | 111 | 3 | % | ||||||||||||||||||

| Total consumer | 99,332 | 100,303 | (971) | (1) | % | ||||||||||||||||||

| Total loans | $ | 326,340 | $ | 316,467 | $ | 9,873 | 3 | % | |||||||||||||||

Commercial loans increased due to growth in the commercial and industrial portfolio, reflecting new production and higher utilization of loan commitments, partially offset by lower commercial real estate loans.

Consumer loans decreased primarily due to lower residential real estate loans as paydowns outpaced originations, partially offset by growth in the auto loan portfolio.

For additional information regarding our loan portfolio see the Credit Risk Management portion of the Risk Management section in this Financial Review and Note 3 Loans and Related Allowance for Credit Losses.

Investment Securities

Total investment securities of $142.3 billion at June 30, 2025 increased $2.6 billion, or 2%, compared to December 31, 2024, due to net purchase activity, primarily of agency residential mortgage-backed securities.

The level and composition of the investment securities portfolio fluctuates over time based on many factors, including market conditions, loan and deposit growth and balance sheet management activities. We manage our investment securities portfolio to optimize returns, while providing a reliable source of liquidity for our banking and other activities, considering the LCR, NSFR and other internal and external guidelines and constraints.

Table 9: Investment Securities (a)

| June 30, 2025 | December 31, 2024 | ||||||||||||||||||||||

| Dollars in millions | Amortized Cost (b) |

Fair Value |

Amortized Cost (b) |

Fair Value |

|||||||||||||||||||

| U.S. Treasury and government agencies | $ | 52,391 | $ | 51,591 | $ | 53,382 | $ | 52,075 | |||||||||||||||

| Agency residential mortgage-backed | 77,268 | 72,156 | 73,760 | 67,117 | |||||||||||||||||||

| Non-agency residential mortgage-backed | 704 | 795 | 744 | 822 | |||||||||||||||||||

| Agency commercial mortgage-backed | 3,917 | 3,840 | 3,032 | 2,875 | |||||||||||||||||||

| Non-agency commercial mortgage-backed (c) | 1,082 | 1,077 | 1,542 | 1,523 | |||||||||||||||||||

| Asset-backed (d) | 4,988 | 5,062 | 5,733 | 5,793 | |||||||||||||||||||

| Other (e) | 4,620 | 4,535 | 4,998 | 4,892 | |||||||||||||||||||

| Total investment securities (f) | $ | 144,970 | $ | 139,056 | $ | 143,191 | $ | 135,097 | |||||||||||||||

(a)Of our total securities portfolio, 97% were rated AAA/AA at both June 30, 2025 and December 31, 2024.

(b)Amortized cost is presented net of the allowance for investment securities, which totaled $68 million at June 30, 2025 and primarily related to non-agency commercial mortgage-backed securities. The comparable amount at December 31, 2024 was $91 million.

(c)Collateralized primarily by multifamily housing, office buildings, retail properties, lodging properties and industrial properties.

(d)Collateralized primarily by consumer credit products, corporate debt and government guaranteed education loans.

(e)Includes state and municipal securities and corporate bonds.

(f)Includes available-for-sale and held-to-maturity securities, which are recorded on our balance sheet at fair value and amortized cost, respectively.

Table 9 presents our investment securities portfolio by amortized cost and fair value. The difference between fair value and amortized cost at June 30, 2025 primarily reflected the impact of higher interest rates on the valuation of fixed-rate securities. We continually

10 The PNC Financial Services Group, Inc. – Form 10-Q

monitor the credit risk in our portfolio and maintain the allowance for investment securities at an appropriate level to absorb expected credit losses on our investment securities portfolio for the remaining contractual term of the securities adjusted for expected prepayments. See Note 2 Investment Securities for additional details regarding the allowance for investment securities.

The duration of investment securities was 3.4 years and 3.5 years at June 30, 2025 and December 31, 2024, respectively. We estimate that at June 30, 2025 the effective duration of investment securities was 3.4 years for both an immediate 50 basis points parallel increase and decrease in interest rates. Comparable amounts at December 31, 2024 for the effective duration of investment securities were 3.4 years and 3.5 years, respectively.

Based on expected prepayment speeds, the weighted-average expected maturity of the investment securities portfolio was 5.2 years and 5.3 years at June 30, 2025 and December 31, 2024, respectively.

Table 10: Weighted-Average Expected Maturities of Mortgage and Asset-Backed Debt Securities

| June 30, 2025 | Years | |||||||

| Agency residential mortgage-backed | 6.5 | |||||||

| Non-agency residential mortgage-backed | 10.1 | |||||||

| Agency commercial mortgage-backed | 3.6 | |||||||

| Non-agency commercial mortgage-backed | 0.5 | |||||||

| Asset-backed | 2.1 | |||||||

Additional information regarding our investment securities portfolio is included in Note 2 Investment Securities and Note 11 Fair Value.

Funding Sources

Table 11: Details of Funding Sources

| June 30 | December 31 | Change | |||||||||||||||||||||

| Dollars in millions | 2025 | 2024 | $ | % | |||||||||||||||||||

| Deposits | |||||||||||||||||||||||

| Noninterest-bearing | $ | 93,253 | $ | 92,641 | $ | 612 | 1 | % | |||||||||||||||

| Interest-bearing | |||||||||||||||||||||||

| Money market | 72,259 | 73,801 | (1,542) | (2) | % | ||||||||||||||||||

| Demand | 127,794 | 128,810 | (1,016) | (1) | % | ||||||||||||||||||

| Savings | 96,732 | 97,147 | (415) | — | % | ||||||||||||||||||

| Time deposits (a) | 36,658 | 34,339 | 2,319 | 7 | % | ||||||||||||||||||

| Total interest-bearing deposits | 333,443 | 334,097 | (654) | — | % | ||||||||||||||||||

| Total deposits | 426,696 | 426,738 | (42) | — | % | ||||||||||||||||||

| Borrowed funds | |||||||||||||||||||||||

| Federal Home Loan Bank advances | 18,000 | 22,000 | (4,000) | (18) | % | ||||||||||||||||||

| Senior debt | 35,750 | 32,497 | 3,253 | 10 | % | ||||||||||||||||||

| Subordinated debt | 3,490 | 4,104 | (614) | (15) | % | ||||||||||||||||||

| Other | 3,184 | 3,072 | 112 | 4 | % | ||||||||||||||||||

| Total borrowed funds | 60,424 | 61,673 | (1,249) | (2) | % | ||||||||||||||||||

| Total funding sources | $ | 487,120 | $ | 488,411 | $ | (1,291) | — | % | |||||||||||||||

(a) Includes $5.6 billion of certain brokered time deposits accounted for under the fair value option at June 30, 2025.

Deposits are considered an attractive source of funding due to their stability and relatively low cost to fund. Compared to December 31, 2024, our funding source composition included lower borrowed funds outstanding and stable deposit balances. This shift in composition contributed to a decrease in funding costs compared to the fourth quarter of 2024.

Total deposits compared to December 31, 2024 were stable as lower interest-bearing deposits were offset by higher noninterest-bearing deposits. The decrease in interest-bearing deposits was due to lower commercial and consumer balances, partially offset by higher brokered time deposits. The increase in noninterest-bearing deposits was due to higher consumer and commercial balances. Our total brokered deposit balance of $8.0 billion at June 30, 2025 increased compared to $7.3 billion at December 31, 2024, and was significantly below both our internal and regulatory guidelines and limits.

Borrowed funds decreased due to lower FHLB advances, partially offset by higher senior debt outstanding.

The level and composition of borrowed funds fluctuates over time based on many factors, including market conditions, capital considerations, and funding needs, which are primarily driven by changes in loan, deposit and investment securities balances. While

The PNC Financial Services Group, Inc. – Form 10-Q 11

our largest source of liquidity on a consolidated basis is the customer deposit base generated by our banking businesses, we also manage our borrowed funds to provide a reliable source of liquidity for our banking and other activities, considering our LCR and NSFR requirements and other internal and external guidelines and constraints. See the Liquidity and Capital Management portion of the Risk Management section and the Recent Regulatory Developments section in this Financial Review and in Note 19 Regulatory Matters of our 2024 Form 10-K for additional information regarding our liquidity and capital activities. See Note 7 Borrowed Funds in this Report and Note 9 Borrowed Funds in our 2024 Form 10-K for additional information related to our borrowings. See the Average Consolidated Balance Sheet and Net Interest Analysis section of this Financial Review for additional information on volume and related funding cost changes.

Shareholders’ Equity

Total shareholders’ equity of $57.6 billion at June 30, 2025 increased $3.2 billion, or 6%, compared to December 31, 2024, primarily due to net income of $3.1 billion and an improvement in AOCI of $1.9 billion, partially offset by dividends paid of $1.4 billion and $0.5 billion of common share repurchases.

BUSINESS SEGMENTS REVIEW

We have three reportable business segments: Retail Banking, Corporate & Institutional Banking and the Asset Management Group. Our reportable business segments are defined by the nature of products and services, types of customers, methods used to distribute products or provide services and similar financial performance.

Total business segment financial results differ from our consolidated reporting due to the remaining corporate operations, or other activities, that do not meet the criteria for disclosure as a separate reportable business. These other activities include residual activities such as asset and liability management activities including net securities gains or losses, ACL for investment securities, certain trading activities, certain runoff consumer loan portfolios, private equity investments, intercompany eliminations, corporate overhead net of allocations, tax adjustments that are not allocated to business segments, exited businesses and the residual impact from FTP operations. See Table 82 in Note 14 Segment Reporting for additional information.

Certain amounts included in this Business Segments Review differ from those amounts shown in Note 14, primarily due to the presentation in this Financial Review of business net interest income on a taxable-equivalent basis.

See Note 14 Segment Reporting for additional information on our business segments, including a description of each business.

12 The PNC Financial Services Group, Inc. – Form 10-Q

Retail Banking

Retail Banking’s core strategy is to build lifelong, primary relationships by creating a sense of financial well-being and ease for our clients. Over time, we seek to deepen those relationships by meeting the broad range of our clients’ financial needs across savings, liquidity, lending, payments, investment and retirement solutions. We work to deliver these solutions in the most seamless and efficient way possible, meeting our customers where they are - whether in a branch, through digital channels, at an ATM or through our phone-based customer contact centers - while continuously optimizing the cost to sell and service. We believe that, over time, we can grow our customer base, enhance the breadth and depth of our client relationships and improve our efficiency through differentiated products and leading digital channels.

Table 12: Retail Banking Table

| (Unaudited) | |||||||||||||||||||||||

| Six months ended June 30 | Change | ||||||||||||||||||||||

| Dollars in millions, except as noted | 2025 | 2024 | $ | % | |||||||||||||||||||

| Income Statement | |||||||||||||||||||||||

| Net interest income (a)(b) | $ | 5,810 | $ | 5,338 | $ | 472 | 9 | % | |||||||||||||||

| Noninterest income | 1,488 | 2,173 | (685) | (32) | % | ||||||||||||||||||

| Total revenue (a)(b) | 7,298 | 7,511 | (213) | (3) | % | ||||||||||||||||||

| Provision for credit losses | 251 | 145 | 106 | 73 | % | ||||||||||||||||||

| Noninterest expense (c) | |||||||||||||||||||||||

| Personnel | 1,077 | 1,074 | 3 | — | % | ||||||||||||||||||

| Segment allocations (d) | 1,945 | 1,867 | 78 | 4 | % | ||||||||||||||||||

| Depreciation and amortization | 173 | 153 | 20 | 13 | % | ||||||||||||||||||

| Other (e) | 597 | 584 | 13 | 2 | % | ||||||||||||||||||

| Total noninterest expense | 3,792 | 3,678 | 114 | 3 | % | ||||||||||||||||||

| Pretax earnings (a)(b) | 3,255 | 3,688 | (433) | (12) | % | ||||||||||||||||||

| Income taxes (a)(b) | 756 | 861 | (105) | (12) | % | ||||||||||||||||||

| Noncontrolling interests | 19 | 19 | — | — | % | ||||||||||||||||||

| Earnings (a)(b) | $ | 2,480 | $ | 2,808 | $ | (328) | (12) | % | |||||||||||||||

| Average Balance Sheet | |||||||||||||||||||||||

| Loans held for sale | $ | 867 | $ | 560 | $ | 307 | 55 | % | |||||||||||||||

| Loans (a) | |||||||||||||||||||||||

| Consumer | |||||||||||||||||||||||

| Residential real estate | $ | 34,920 | $ | 36,394 | $ | (1,474) | (4) | % | |||||||||||||||

| Home equity | 24,548 | 24,600 | (52) | — | % | ||||||||||||||||||

| Automobile | 15,491 | 14,812 | 679 | 5 | % | ||||||||||||||||||

| Credit card | 6,525 | 6,885 | (360) | (5) | % | ||||||||||||||||||

| Education | 1,612 | 1,877 | (265) | (14) | % | ||||||||||||||||||

| Other consumer | 1,756 | 1,758 | (2) | — | % | ||||||||||||||||||

| Total consumer | 84,852 | 86,326 | (1,474) | (2) | % | ||||||||||||||||||

| Commercial | 12,783 | 12,704 | 79 | 1 | % | ||||||||||||||||||

| Total loans | $ | 97,635 | $ | 99,030 | $ | (1,395) | (1) | % | |||||||||||||||

| Total assets (a) | $ | 114,601 | $ | 116,856 | $ | (2,255) | (2) | % | |||||||||||||||

| Deposits (a) | |||||||||||||||||||||||

| Noninterest-bearing | $ | 51,833 | $ | 53,505 | $ | (1,672) | (3) | % | |||||||||||||||

| Interest-bearing (b) | 190,381 | 187,010 | 3,371 | 2 | % | ||||||||||||||||||

| Total deposits | $ | 242,214 | $ | 240,515 | $ | 1,699 | 1 | % | |||||||||||||||

| Performance Ratios (a)(b) | |||||||||||||||||||||||

| Return on average assets | 4.36 | % | 4.85 | % | |||||||||||||||||||

| Noninterest income to total revenue | 20 | % | 29 | % | |||||||||||||||||||

| Efficiency | 52 | % | 49 | % | |||||||||||||||||||

| Supplemental Noninterest Income Information | |||||||||||||||||||||||

| Asset management and brokerage | $ | 302 | $ | 272 | $ | 30 | 11 | % | |||||||||||||||

| Card and cash management | $ | 624 | $ | 636 | $ | (12) | (2) | % | |||||||||||||||

| Lending and deposit services | $ | 374 | $ | 360 | $ | 14 | 4 | % | |||||||||||||||

| Residential and commercial mortgage | $ | 126 | $ | 167 | $ | (41) | (25) | % | |||||||||||||||

| Other income - Gain on Visa shares exchange program | $ | — | $ | 754 | $ | (754) | (100) | % | |||||||||||||||

The PNC Financial Services Group, Inc. – Form 10-Q 13

(Continued from previous page)

At or for six months ended June 30 |

Change | ||||||||||||||||||||||

| Dollars in millions, except as noted | 2025 | 2024 | $ | % | |||||||||||||||||||

| Residential Mortgage Information | |||||||||||||||||||||||

| Residential mortgage servicing statistics (in billions, except as noted) (f) | |||||||||||||||||||||||

| Serviced portfolio balance (g) | $ | 189 | $ | 204 | $ | (15) | (7) | % | |||||||||||||||

| MSR asset value (g) | $ | 2.5 | $ | 2.7 | $ | (0.2) | (7) | % | |||||||||||||||

| Servicing income: (in millions) | |||||||||||||||||||||||

| Servicing fees, net (h) | $ | 131 | $ | 149 | $ | (18) | (12) | % | |||||||||||||||

| Mortgage servicing rights valuation, net of economic hedge | $ | (2) | $ | (20) | $ | 18 | 90 | % | |||||||||||||||

| Residential mortgage loan statistics | |||||||||||||||||||||||

| Loan origination volume (in billions) | $ | 2.7 | $ | 3.0 | $ | (0.3) | (10) | % | |||||||||||||||

| Loan sale margin percentage | 0.78 | % | 2.21 | % | |||||||||||||||||||

| Other Information | |||||||||||||||||||||||

| Credit-related statistics | |||||||||||||||||||||||

| Nonperforming assets (g) | $ | 812 | $ | 840 | $ | (28) | (3) | % | |||||||||||||||

| Net charge-offs - loans and leases | $ | 264 | $ | 277 | $ | (13) | (5) | % | |||||||||||||||

| Other statistics | |||||||||||||||||||||||

| Branches (g)(i) | 2,218 | 2,247 | (29) | (1) | % | ||||||||||||||||||

| Brokerage account client assets (in billions) (g)(j) | $ | 87 | $ | 81 | $ | 6 | 7 | % | |||||||||||||||

(a)During the second quarter of 2025, certain loans and deposits, and the associated income statement impact, were transferred from the Asset Management Group to Retail Banking to better align products and services with the appropriate business segment. Prior periods have been adjusted to conform with the current presentation.

(b)During the second quarter of 2025, brokered time deposits, and the associated income statement impact, were reclassified from Retail Banking to other activities, reflecting their use for asset and liability management. Prior periods have been adjusted to conform with the current presentation.

(c)As a result of an organizational realignment, certain expenses were reclassified as corporate operations and were moved from Retail Banking to other activities during the second quarter of 2025. Prior periods have been adjusted to conform with the current presentation.

(d)Represents expense allocations for corporate overhead services used by each business segment; primarily comprised of technology, human resources and occupancy-related allocations.

(e)Other is primarily comprised of other direct expenses including outside services and equipment expense.

(f)Represents mortgage loan servicing balances for third parties and the related income.

(g)As of June 30.

(h)Servicing fees net of impact of decrease in MSR value due to passage of time, which includes the impact from regularly scheduled loan principal payments, prepayments and loans paid off during the period.

(i)Reflects all branches excluding standalone mortgage offices and satellite offices (e.g., drive-ups, electronic branches and retirement centers) that provide limited products and/or services.

(j)Includes cash and money market balances.

Retail Banking earnings for the first six months of 2025 decreased $328 million compared to the same period in 2024 as a result of lower noninterest income, higher noninterest expense and higher provision for credit losses, partially offset by higher net interest income.

Net interest income increased in the comparison primarily due to wider interest rate spreads on the value of deposits.

Noninterest income decreased in the comparison driven by a gain of $754 million from the Visa exchange program that occurred in the second quarter of 2024.

Provision for credit losses for the first six months of 2025 was driven by net charge-offs and changes in the ACL due to macroeconomic scenarios and portfolio activity.

Noninterest expense increased in the comparison primarily due to technology investments and higher marketing spend.

Retail Banking average total loans decreased in the first six months of 2025 compared to the same period in 2024. Average consumer loans decreased as growth in the automobile portfolio was more than offset by lower residential real estate, as a result of paydowns outpacing new volume, lower credit card loan balances, and continued declines in education loans from runoff in the government guaranteed portfolio. Average commercial loans were stable in the comparison.

Our focus on growing primary customer relationships is at the core of our deposit strategy in Retail, which is based on attracting and retaining stable, low-cost deposits as a key funding source for PNC. We have taken a disciplined approach to pricing, focused on retaining relationship-based balances and executing on targeted deposit growth and retention strategies aimed at more rate-sensitive customers. Our goal with regard to deposits is to optimize balances, economics and long-term customer growth. In the first six months of 2025, average total deposits increased compared to the same period in 2024, driven by higher consumer time deposits.

Retail Banking continues to enhance the customer experience with refinements to product and service offerings that drive value for consumers and small businesses. As part of our strategic focus on growing customers and meeting their financial needs, we operate and continue to optimize a coast-to-coast network of retail branches, solution centers and ATMs, which are complemented by PNC’s suite of digital capabilities. In 2024, PNC announced it would be investing approximately $1.5 billion, over the next five years, to

14 The PNC Financial Services Group, Inc. – Form 10-Q

open more than 200 new branches in key locations, including Atlanta, Austin, Charlotte, Dallas, Denver, Houston, Miami, Orlando, Phoenix, Raleigh, San Antonio, and Tampa, while completing renovations of 1,400 existing locations across the country during the same time period.

The PNC Financial Services Group, Inc. – Form 10-Q 15

Corporate & Institutional Banking

Corporate & Institutional Banking’s strategy is to be the leading relationship-based provider of traditional banking products and services to its customers through the economic cycles. We aim to grow our market share and drive higher returns by delivering value-added solutions that help our clients better run their organizations, all while maintaining prudent risk and expense management. We continue to focus on building client relationships where the risk-return profile is attractive. We are a coast-to-coast franchise and our full suite of commercial products and services is offered nationally.

Table 13: Corporate & Institutional Banking Table

| (Unaudited) | |||||||||||||||||||||||

| Six months ended June 30 | Change | ||||||||||||||||||||||

| Dollars in millions, except as noted | 2025 | 2024 | $ | % | |||||||||||||||||||

| Income Statement | |||||||||||||||||||||||

| Net interest income | $ | 3,350 | $ | 3,109 | $ | 241 | 8 | % | |||||||||||||||

| Noninterest income | 2,000 | 1,830 | 170 | 9 | % | ||||||||||||||||||

| Total revenue | 5,350 | 4,939 | 411 | 8 | % | ||||||||||||||||||

| Provision for credit losses | 233 | 275 | (42) | (15) | % | ||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||

| Personnel | 746 | 714 | 32 | 4 | % | ||||||||||||||||||

| Segment allocations (a) | 764 | 740 | 24 | 3 | % | ||||||||||||||||||

| Depreciation and amortization | 100 | 101 | (1) | (1) | % | ||||||||||||||||||

| Other (b) | 296 | 278 | 18 | 6 | % | ||||||||||||||||||

| Total noninterest expense | 1,906 | 1,833 | 73 | 4 | % | ||||||||||||||||||

| Pretax earnings | 3,211 | 2,831 | 380 | 13 | % | ||||||||||||||||||

| Income taxes | 729 | 654 | 75 | 11 | % | ||||||||||||||||||

| Noncontrolling interests | 9 | 10 | (1) | (10) | % | ||||||||||||||||||

| Earnings | $ | 2,473 | $ | 2,167 | $ | 306 | 14 | % | |||||||||||||||

| Average Balance Sheet | |||||||||||||||||||||||

| Loans held for sale | $ | 516 | $ | 181 | $ | 335 | 185 | % | |||||||||||||||

| Loans | |||||||||||||||||||||||

| Commercial | |||||||||||||||||||||||

| Commercial and industrial | $ | 167,125 | $ | 163,205 | $ | 3,920 | 2 | % | |||||||||||||||

| Commercial real estate | 31,553 | 34,430 | (2,877) | (8) | % | ||||||||||||||||||

| Equipment lease financing | 6,747 | 6,479 | 268 | 4 | % | ||||||||||||||||||

| Total commercial | 205,425 | 204,114 | 1,311 | 1 | % | ||||||||||||||||||

| Consumer | 3 | 3 | — | — | % | ||||||||||||||||||

| Total loans | $ | 205,428 | $ | 204,117 | $ | 1,311 | 1 | % | |||||||||||||||

| Total assets | $ | 230,750 | $ | 229,151 | $ | 1,599 | 1 | % | |||||||||||||||

| Deposits | |||||||||||||||||||||||

| Noninterest-bearing | $ | 39,347 | $ | 42,520 | $ | (3,173) | (7) | % | |||||||||||||||

| Interest-bearing | 107,886 | 98,778 | 9,108 | 9 | % | ||||||||||||||||||

| Total deposits | $ | 147,233 | $ | 141,298 | $ | 5,935 | 4 | % | |||||||||||||||

| Performance Ratios | |||||||||||||||||||||||

| Return on average assets | 2.16 | % | 1.91 | % | |||||||||||||||||||

| Noninterest income to total revenue | 37 | % | 37 | % | |||||||||||||||||||

| Efficiency | 36 | % | 37 | % | |||||||||||||||||||

16 The PNC Financial Services Group, Inc. – Form 10-Q

(Continued from previous page)

| (Unaudited) | |||||||||||||||||||||||

| Six months ended June 30 | Change | ||||||||||||||||||||||

| Dollars in millions, except as noted | 2025 | 2024 | $ | % | |||||||||||||||||||

| Other Information | |||||||||||||||||||||||

| Consolidated revenue from: (c) | |||||||||||||||||||||||

| Treasury Management (d) | $ | 2,126 | $ | 1,890 | $ | 236 | 12 | % | |||||||||||||||

| Commercial mortgage banking activities: | |||||||||||||||||||||||

| Commercial mortgage loans held for sale (e) | $ | 50 | $ | 27 | $ | 23 | 85 | % | |||||||||||||||

| Commercial mortgage loan servicing income (f) | 210 | 151 | 59 | 39 | % | ||||||||||||||||||

| Commercial mortgage servicing rights valuation, net of economic hedge | 75 | 76 | (1) | (1) | % | ||||||||||||||||||

| Total | $ | 335 | $ | 254 | $ | 81 | 32 | % | |||||||||||||||

| Commercial mortgage servicing statistics | |||||||||||||||||||||||

| Serviced portfolio balance (in billions) (g) (h) | $ | 295 | $ | 289 | $ | 6 | 2 | % | |||||||||||||||

| MSR asset value (g) | $ | 1,010 | $ | 1,082 | $ | (72) | (7) | % | |||||||||||||||

| Average loans by C&IB business | |||||||||||||||||||||||

| Corporate Banking | $ | 120,379 | $ | 116,642 | $ | 3,737 | 3 | % | |||||||||||||||

| Real Estate | 42,906 | 46,297 | (3,391) | (7) | % | ||||||||||||||||||

| Business Credit | 30,798 | 29,291 | 1,507 | 5 | % | ||||||||||||||||||

| Commercial Banking | 7,312 | 7,536 | (224) | (3) | % | ||||||||||||||||||

| Other | 4,033 | 4,351 | (318) | (7) | % | ||||||||||||||||||

| Total average loans | $ | 205,428 | $ | 204,117 | $ | 1,311 | 1 | % | |||||||||||||||

| Credit-related statistics | |||||||||||||||||||||||

| Nonperforming assets (g) | $ | 1,160 | $ | 1,528 | $ | (368) | (24) | % | |||||||||||||||

| Net charge-offs - loans and leases | $ | 147 | $ | 237 | $ | (90) | (38) | % | |||||||||||||||

(a)Represents expense allocations for corporate overhead services used by each business segment; primarily comprised of technology, human resources and occupancy-related allocations.

(b)Other is primarily comprised of other direct expenses including outside services and equipment expense.

(c)See the additional revenue discussion regarding treasury management and commercial mortgage banking activities in the Product Revenue section of this Corporate & Institutional Banking section.

(d)Amounts are reported in net interest income and noninterest income.

(e)Represents commercial mortgage banking income for valuations on commercial mortgage loans held for sale and related commitments, derivative valuations, origination fees, gains on sale of loans held for sale and net interest income on loans held for sale.

(f)Represents net interest income and noninterest income from loan servicing, net of reduction in commercial mortgage servicing rights due to time and payoffs. Commercial mortgage servicing rights valuation, net of economic hedge is shown separately.

(g)As of June 30.

(h)Represents balances related to capitalized servicing.

Corporate & Institutional Banking earnings in the first six months of 2025 increased $306 million compared to the same period in 2024 driven by higher revenue and a lower provision for credit losses, partially offset by higher noninterest expense.

Net interest income increased in the comparison primarily due to wider interest rate spreads on the value of deposits and higher average deposit and loan balances, partially offset by narrower interest rate spreads on the value of loans.

Noninterest income increased in the comparison and reflected broad-based growth.

Provision for credit losses for the first six months of 2025 was driven by net charge-offs and a net increase in the ACL due to changes in macroeconomic scenarios, tariff related considerations and portfolio activity, including loan growth.