EX-99.4

Published on August 5, 2021

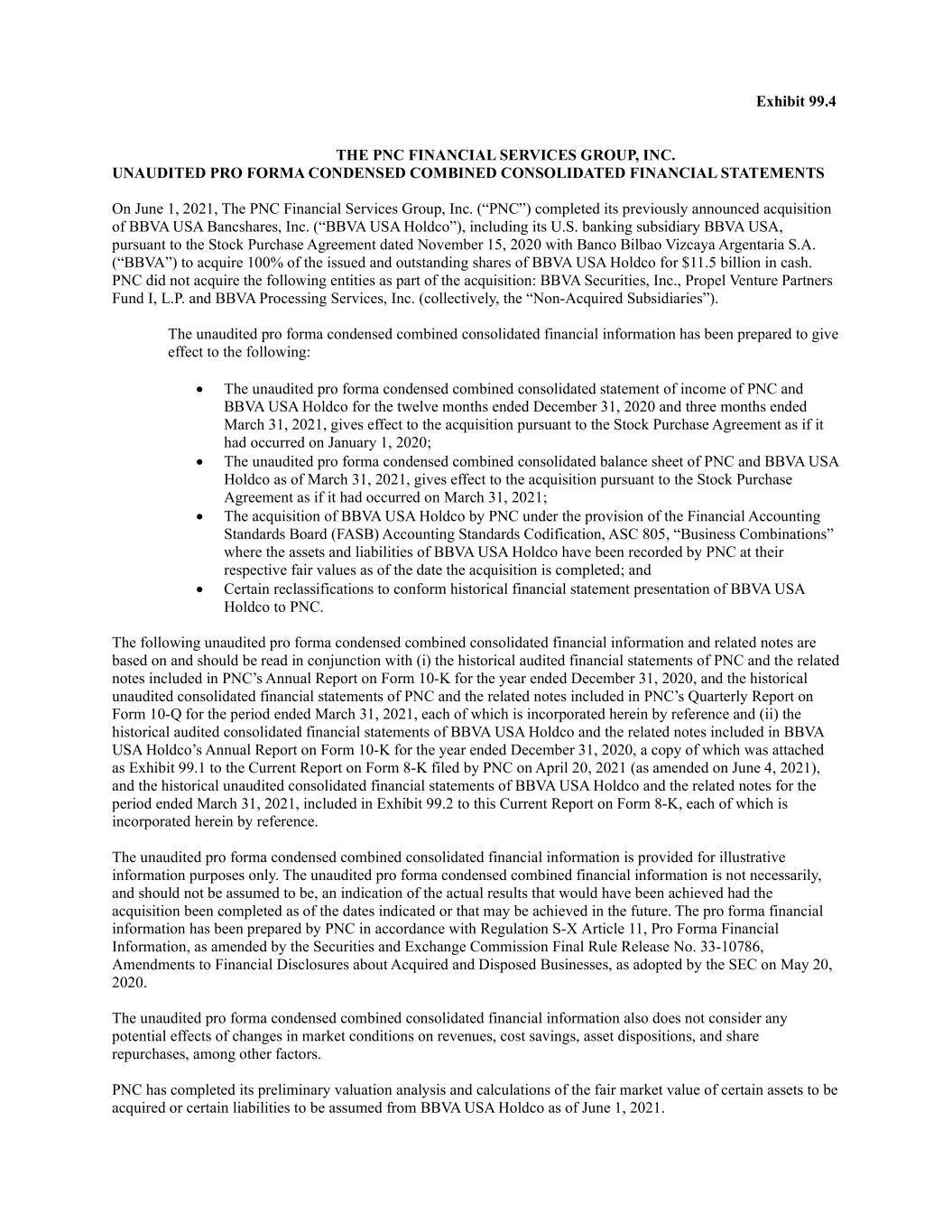

Exhibit 99.4 THE PNC FINANCIAL SERVICES GROUP, INC. UNAUDITED PRO FORMA CONDENSED COMBINED CONSOLIDATED FINANCIAL STATEMENTS On June 1, 2021, The PNC Financial Services Group, Inc. (“PNC”) completed its previously announced acquisition of BBVA USA Bancshares, Inc. (“BBVA USA Holdco”), including its U.S. banking subsidiary BBVA USA, pursuant to the Stock Purchase Agreement dated November 15, 2020 with Banco Bilbao Vizcaya Argentaria S.A. (“BBVA”) to acquire 100% of the issued and outstanding shares of BBVA USA Holdco for $11.5 billion in cash. PNC did not acquire the following entities as part of the acquisition: BBVA Securities, Inc., Propel Venture Partners Fund I, L.P. and BBVA Processing Services, Inc. (collectively, the “Non-Acquired Subsidiaries”). The unaudited pro forma condensed combined consolidated financial information has been prepared to give effect to the following: The unaudited pro forma condensed combined consolidated statement of income of PNC and BBVA USA Holdco for the twelve months ended December 31, 2020 and three months ended March 31, 2021, gives effect to the acquisition pursuant to the Stock Purchase Agreement as if it had occurred on January 1, 2020; The unaudited pro forma condensed combined consolidated balance sheet of PNC and BBVA USA Holdco as of March 31, 2021, gives effect to the acquisition pursuant to the Stock Purchase Agreement as if it had occurred on March 31, 2021; The acquisition of BBVA USA Holdco by PNC under the provision of the Financial Accounting Standards Board (FASB) Accounting Standards Codification, ASC 805, “Business Combinations” where the assets and liabilities of BBVA USA Holdco have been recorded by PNC at their respective fair values as of the date the acquisition is completed; and Certain reclassifications to conform historical financial statement presentation of BBVA USA Holdco to PNC. The following unaudited pro forma condensed combined consolidated financial information and related notes are based on and should be read in conjunction with (i) the historical audited financial statements of PNC and the related notes included in PNC’s Annual Report on Form 10-K for the year ended December 31, 2020, and the historical unaudited consolidated financial statements of PNC and the related notes included in PNC’s Quarterly Report on Form 10-Q for the period ended March 31, 2021, each of which is incorporated herein by reference and (ii) the historical audited consolidated financial statements of BBVA USA Holdco and the related notes included in BBVA USA Holdco’s Annual Report on Form 10-K for the year ended December 31, 2020, a copy of which was attached as Exhibit 99.1 to the Current Report on Form 8-K filed by PNC on April 20, 2021 (as amended on June 4, 2021), and the historical unaudited consolidated financial statements of BBVA USA Holdco and the related notes for the period ended March 31, 2021, included in Exhibit 99.2 to this Current Report on Form 8-K, each of which is incorporated herein by reference. The unaudited pro forma condensed combined consolidated financial information is provided for illustrative information purposes only. The unaudited pro forma condensed combined financial information is not necessarily, and should not be assumed to be, an indication of the actual results that would have been achieved had the acquisition been completed as of the dates indicated or that may be achieved in the future. The pro forma financial information has been prepared by PNC in accordance with Regulation S-X Article 11, Pro Forma Financial Information, as amended by the Securities and Exchange Commission Final Rule Release No. 33-10786, Amendments to Financial Disclosures about Acquired and Disposed Businesses, as adopted by the SEC on May 20, 2020. The unaudited pro forma condensed combined consolidated financial information also does not consider any potential effects of changes in market conditions on revenues, cost savings, asset dispositions, and share repurchases, among other factors. PNC has completed its preliminary valuation analysis and calculations of the fair market value of certain assets to be acquired or certain liabilities to be assumed from BBVA USA Holdco as of June 1, 2021.

THE PNC FINANCIAL SERVICES GROUP, INC. & BBVA USA Holdco excluding Non-Acquired Subsidiaries Pro Forma Condensed Combined Consolidated Balance Sheet (Unaudited) – presented as if the acquisition of BBVA USA Holdco was effective as of March 31, 2021. As of March 31, 2021 PNC as Reported BBVA USA Holdco as Reported Excluded Non- Acquired Subsidiaries as Reported (A) Transaction Accounting Adjustments (B) Pro Forma PNC & BBVA USA Holdco In millions, except par value Assets Cash and due from banks $ 7,455 $ 1,045 $ 18 $ (5) (C) $ 8,477 Interest-earning deposits with banks 86,161 14,098 233 (11,480) (D) 88,546 Loans held for sale 1,967 296 251 (E) 2,514 Investment securities 98,255 17,748 170 (F) 116,173 Loans 237,013 63,960 23 (G) 300,996 Allowance for credit losses loan and lease losses (4,714) (1,499) (491) (H) (6,704) Net loans 232,299 62,461 (468) 294,292 Equity investments 6,386 6,386 Mortgage servicing rights 1,680 1,680 Goodwill 9,317 2,328 (823) (I) 10,822 Other 30,894 6,007 1,293 24 (J) 35,632 Total assets $ 474,414 $ 103,983 $ 1,544 $ (12,331) $ 564,522 Liabilities Deposits $ 375,067 $ 85,971 $ (2) $ 11 (K) $ 461,051 Borrowed funds 33,030 3,518 966 70 (L) 35,652 Accrued expenses and other liabilities 12,438 2,475 90 1,123 (M) 15,946 Total liabilities 420,535 91,964 1,054 1,204 512,649 Equity Preferred stock 3,518 229 (229) 3,518 Common stock 50,331 11,760 490 (13,299) 48,302 Total shareholders’ equity 53,849 11,989 490 (13,528) 51,820 Noncontrolling interests 30 30 (7) 53 Total equity 53,879 12,019 490 (13,535) 51,873 Total liabilities and equity $ 474,414 $ 103,983 $ 1,544 $ (12,331) $ 564,522

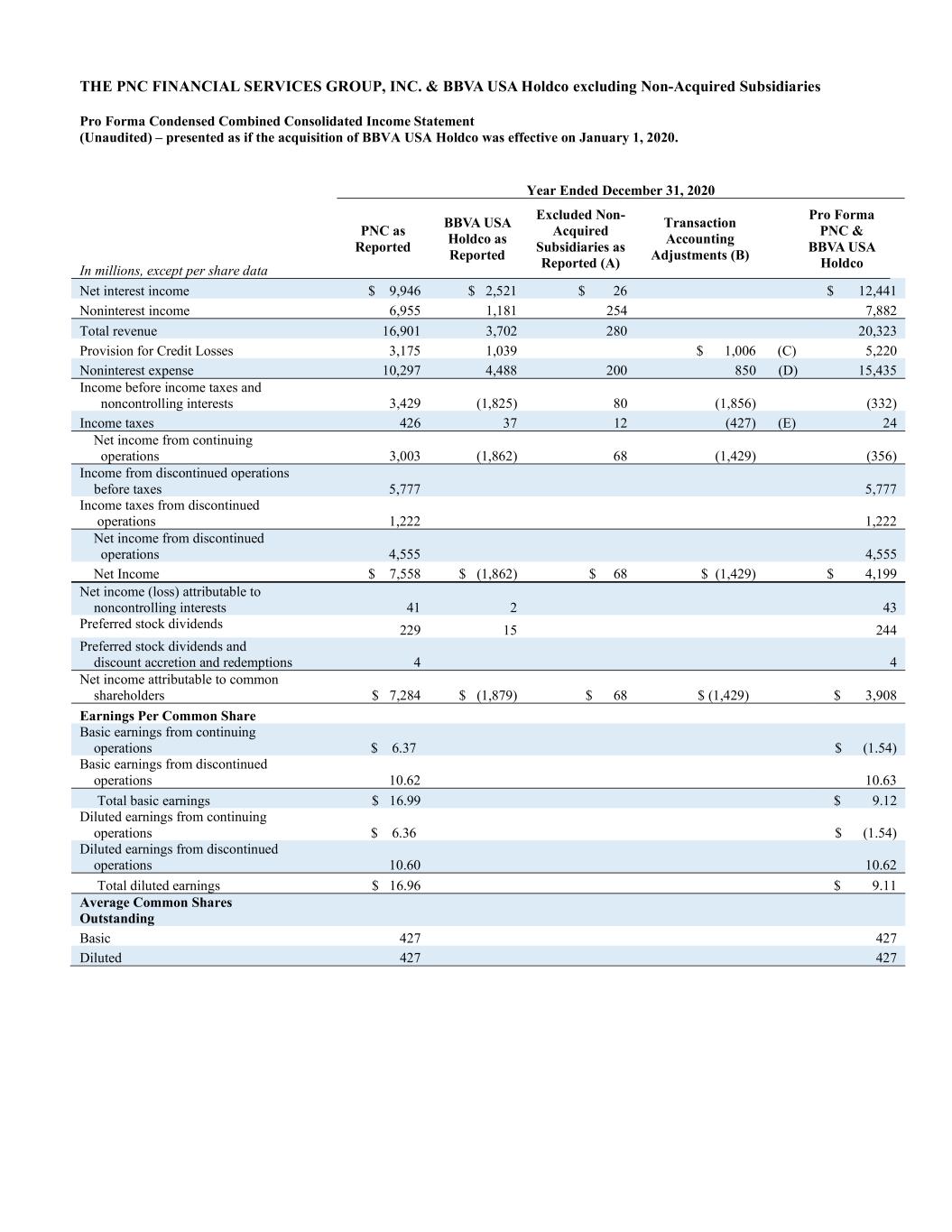

THE PNC FINANCIAL SERVICES GROUP, INC. & BBVA USA Holdco excluding Non-Acquired Subsidiaries Pro Forma Condensed Combined Consolidated Income Statement (Unaudited) – presented as if the acquisition of BBVA USA Holdco was effective on January 1, 2020. Year Ended December 31, 2020 PNC as Reported BBVA USA Holdco as Reported Excluded Non- Acquired Subsidiaries as Reported (A) Transaction Accounting Adjustments (B) Pro Forma PNC & BBVA USA Holdco In millions, except per share data Net interest income $ 9,946 $ 2,521 $ 26 $ 12,441 Noninterest income 6,955 1,181 254 7,882 Total revenue 16,901 3,702 280 20,323 Provision for Credit Losses 3,175 1,039 $ 1,006 (C) 5,220 Noninterest expense 10,297 4,488 200 850 (D) 15,435 Income before income taxes and noncontrolling interests 3,429 (1,825) 80 (1,856) (332) Income taxes 426 37 12 (427) (E) 24 Net income from continuing operations 3,003 (1,862) 68 (1,429) (356) Income from discontinued operations before taxes 5,777 5,777 Income taxes from discontinued operations 1,222 1,222 Net income from discontinued operations 4,555 4,555 Net Income $ 7,558 $ (1,862) $ 68 $ (1,429) $ 4,199 Net income (loss) attributable to noncontrolling interests 41 2 43 Preferred stock dividends 229 15 244 Preferred stock dividends and discount accretion and redemptions 4 4 Net income attributable to common shareholders $ 7,284 $ (1,879) $ 68 $ (1,429) $ 3,908 Earnings Per Common Share Basic earnings from continuing operations $ 6.37 $ (1.54) Basic earnings from discontinued operations 10.62 10.63 Total basic earnings $ 16.99 $ 9.12 Diluted earnings from continuing operations $ 6.36 $ (1.54) Diluted earnings from discontinued operations 10.60 10.62 Total diluted earnings $ 16.96 $ 9.11 Average Common Shares Outstanding Basic 427 427 Diluted 427 427

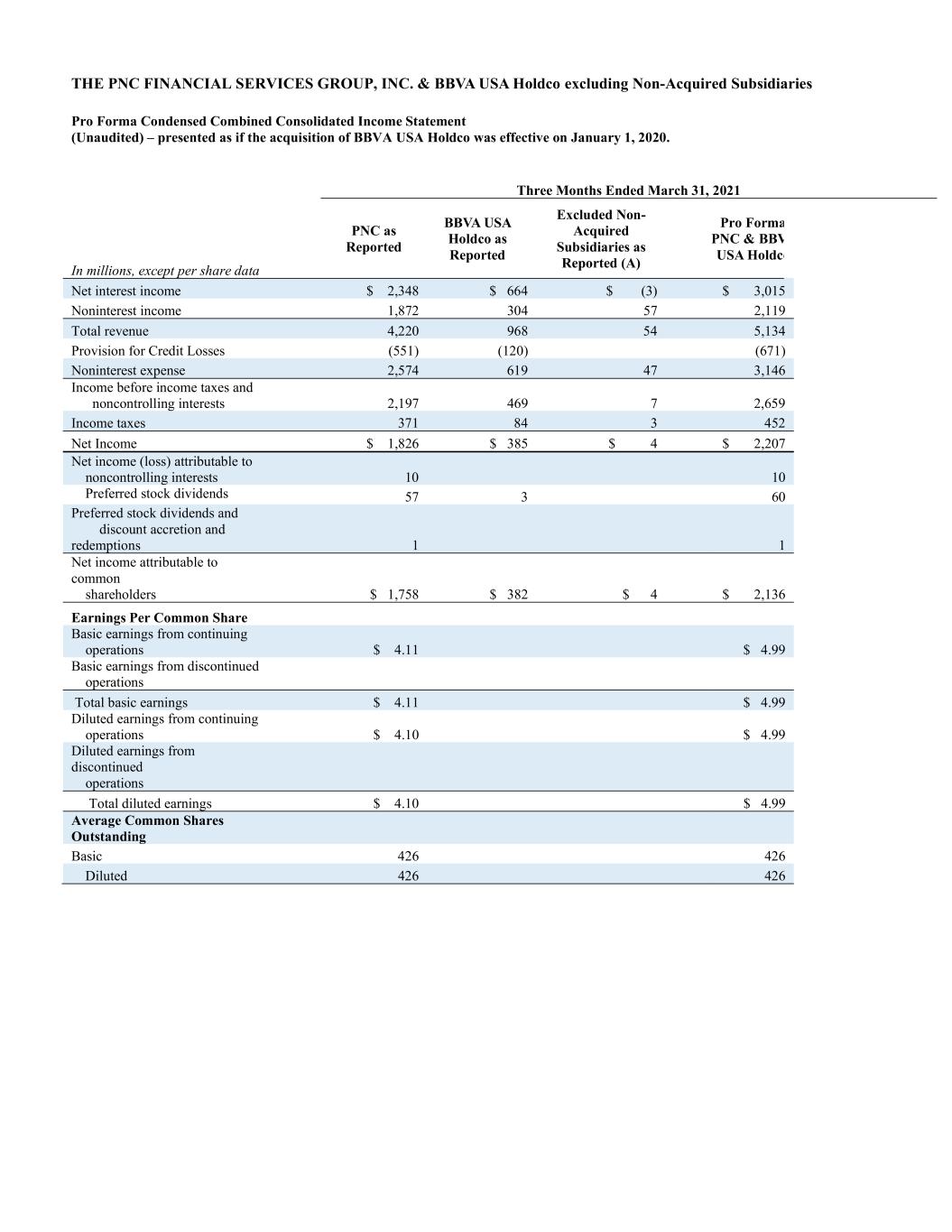

THE PNC FINANCIAL SERVICES GROUP, INC. & BBVA USA Holdco excluding Non-Acquired Subsidiaries Pro Forma Condensed Combined Consolidated Income Statement (Unaudited) – presented as if the acquisition of BBVA USA Holdco was effective on January 1, 2020. Three Months Ended March 31, 2021 PNC as Reported BBVA USA Holdco as Reported Excluded Non- Acquired Subsidiaries as Reported (A) Pro Forma PNC & BBVA USA Holdco In millions, except per share data Net interest income $ 2,348 $ 664 $ (3) $ 3,015 Noninterest income 1,872 304 57 2,119 Total revenue 4,220 968 54 5,134 Provision for Credit Losses (551) (120) (671) Noninterest expense 2,574 619 47 3,146 Income before income taxes and noncontrolling interests 2,197 469 7 2,659 Income taxes 371 84 3 452 Net Income $ 1,826 $ 385 $ 4 $ 2,207 Net income (loss) attributable to noncontrolling interests 10 10 Preferred stock dividends 57 3 60 Preferred stock dividends and discount accretion and redemptions 1 1 Net income attributable to common shareholders $ 1,758 $ 382 $ 4 $ 2,136 Earnings Per Common Share Basic earnings from continuing operations $ 4.11 $ 4.99 Basic earnings from discontinued operations Total basic earnings $ 4.11 $ 4.99 Diluted earnings from continuing operations $ 4.10 $ 4.99 Diluted earnings from discontinued operations Total diluted earnings $ 4.10 $ 4.99 Average Common Shares Outstanding Basic 426 426 Diluted 426 426

Note 1. Basis of Presentation The accompanying unaudited pro forma condensed combined consolidated financial information and related notes were prepared in accordance with Article 11 of Regulation S-X. The unaudited pro forma condensed combined consolidated income statement for the year ended December 31, 2020 and three months ended March 31, 2021 combine the historical consolidated income statements of PNC and BBVA USA Holdco, giving effect to the acquisition as if it had been completed on January 1, 2020. The accompanying unaudited pro forma condensed combined consolidated balance sheet as of March 31, 2021 combines the historical consolidated balance sheets of PNC and BBVA USA Holdco, giving effect to the acquisition as if it had been completed on March 31, 2021. The unaudited pro forma condensed combined consolidated financial information and explanatory notes have been prepared to illustrate the effects of the acquisition involving PNC and BBVA USA Holdco under the acquisition method of accounting with PNC treated as the acquirer. The unaudited pro forma condensed combined consolidated financial information is presented for illustrative purposes only and does not necessarily indicate the financial results of the combined company had the companies actually been combined at the beginning of each period presented, nor does it necessarily indicate the results of operations in future periods or the future financial position of the combined company. Under the acquisition method of accounting, the assets and liabilities of BBVA USA Holdco as of the closing date, have been recorded by PNC at their respective fair values, and the excess of the acquisition consideration over the fair value of BBVA USA Holdco’s net assets has been allocated to goodwill. The pro forma allocation of the preliminary purchase price reflected in the unaudited pro forma condensed combined consolidated financial information is subject to adjustment and may vary from the final actual purchase price allocation. Valuations subject to adjustment include, but are not limited to, loans, certain deposits, certain other assets, customer relationships, and the core deposit intangibles. Note 2. Reclassification Adjustments During the preparation of the unaudited pro forma condensed combined consolidated financial information, management performed a preliminary analysis of BBVA USA Holdco’s financial information to identify differences in accounting policies and differences in balance sheet and income statement presentation as compared to the presentation of PNC. These unaudited pro forma condensed combined financial statements include certain reclassifications to conform historical financial statement presentation of BBVA USA Holdco to PNC.

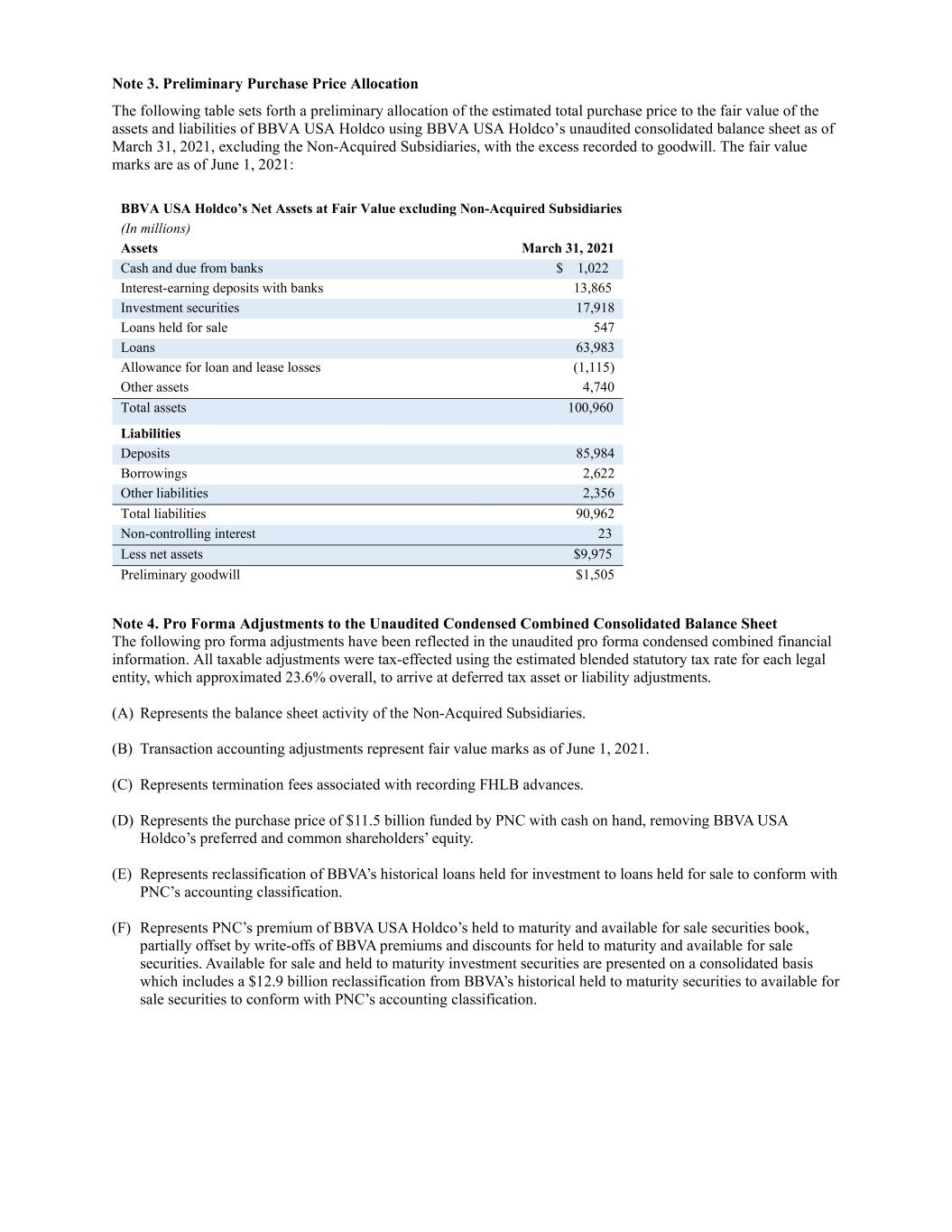

Note 3. Preliminary Purchase Price Allocation The following table sets forth a preliminary allocation of the estimated total purchase price to the fair value of the assets and liabilities of BBVA USA Holdco using BBVA USA Holdco’s unaudited consolidated balance sheet as of March 31, 2021, excluding the Non-Acquired Subsidiaries, with the excess recorded to goodwill. The fair value marks are as of June 1, 2021: BBVA USA Holdco’s Net Assets at Fair Value excluding Non-Acquired Subsidiaries (In millions) Assets March 31, 2021 Cash and due from banks $ 1,022 Interest-earning deposits with banks 13,865 Investment securities 17,918 Loans held for sale 547 Loans 63,983 Allowance for loan and lease losses (1,115) Other assets 4,740 Total assets 100,960 Liabilities Deposits 85,984 Borrowings 2,622 Other liabilities 2,356 Total liabilities 90,962 Non-controlling interest 23 Less net assets $9,975 Preliminary goodwill $1,505 Note 4. Pro Forma Adjustments to the Unaudited Condensed Combined Consolidated Balance Sheet The following pro forma adjustments have been reflected in the unaudited pro forma condensed combined financial information. All taxable adjustments were tax-effected using the estimated blended statutory tax rate for each legal entity, which approximated 23.6% overall, to arrive at deferred tax asset or liability adjustments. (A) Represents the balance sheet activity of the Non-Acquired Subsidiaries. (B) Transaction accounting adjustments represent fair value marks as of June 1, 2021. (C) Represents termination fees associated with recording FHLB advances. (D) Represents the purchase price of $11.5 billion funded by PNC with cash on hand, removing BBVA USA Holdco’s preferred and common shareholders’ equity. (E) Represents reclassification of BBVA’s historical loans held for investment to loans held for sale to conform with PNC’s accounting classification. (F) Represents PNC’s premium of BBVA USA Holdco’s held to maturity and available for sale securities book, partially offset by write-offs of BBVA premiums and discounts for held to maturity and available for sale securities. Available for sale and held to maturity investment securities are presented on a consolidated basis which includes a $12.9 billion reclassification from BBVA’s historical held to maturity securities to available for sale securities to conform with PNC’s accounting classification.

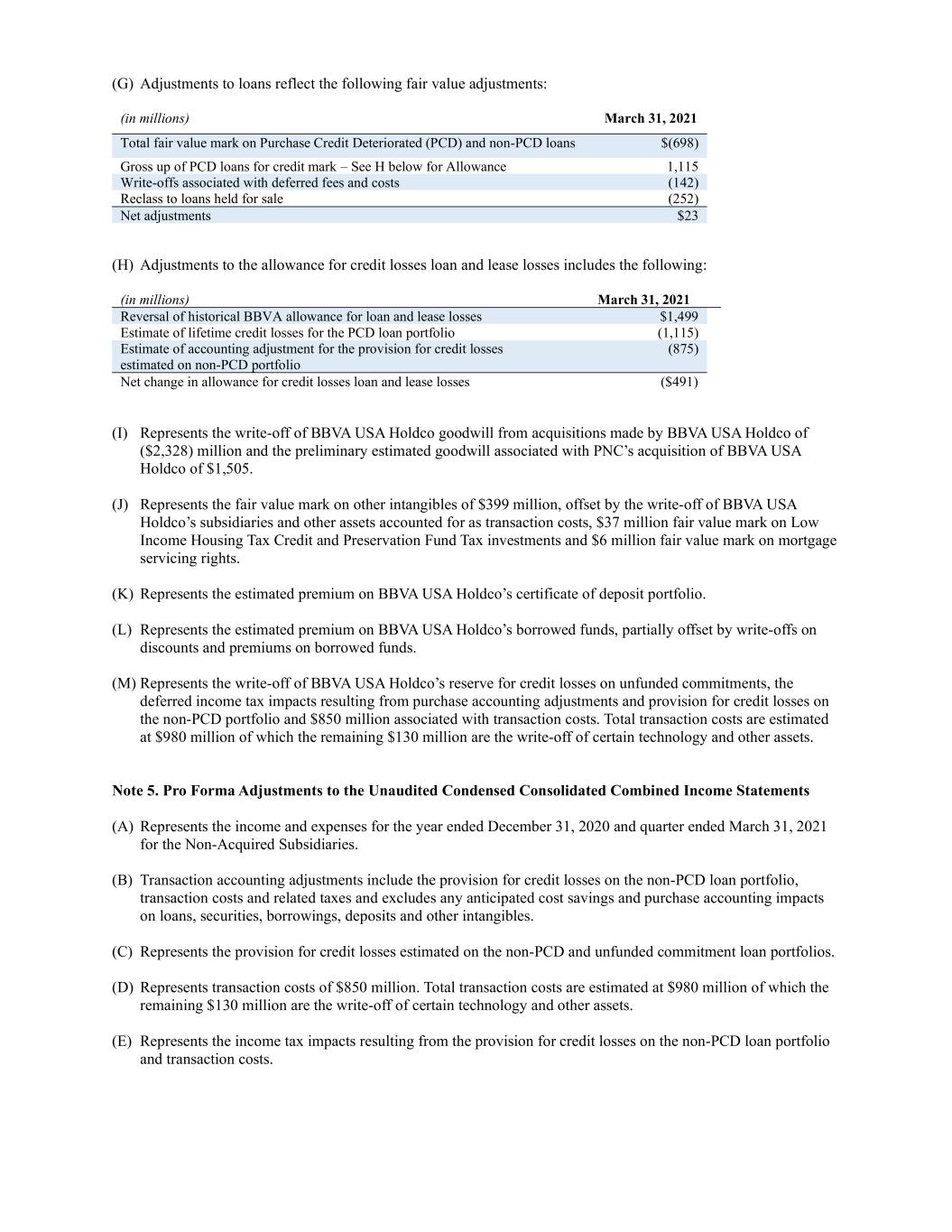

(G) Adjustments to loans reflect the following fair value adjustments: (in millions) March 31, 2021 Total fair value mark on Purchase Credit Deteriorated (PCD) and non-PCD loans $(698) Gross up of PCD loans for credit mark – See H below for Allowance 1,115 Write-offs associated with deferred fees and costs (142) Reclass to loans held for sale (252) Net adjustments $23 (H) Adjustments to the allowance for credit losses loan and lease losses includes the following: (in millions) March 31, 2021 Reversal of historical BBVA allowance for loan and lease losses $1,499 Estimate of lifetime credit losses for the PCD loan portfolio (1,115) Estimate of accounting adjustment for the provision for credit losses estimated on non-PCD portfolio (875) Net change in allowance for credit losses loan and lease losses ($491) (I) Represents the write-off of BBVA USA Holdco goodwill from acquisitions made by BBVA USA Holdco of ($2,328) million and the preliminary estimated goodwill associated with PNC’s acquisition of BBVA USA Holdco of $1,505. (J) Represents the fair value mark on other intangibles of $399 million, offset by the write-off of BBVA USA Holdco’s subsidiaries and other assets accounted for as transaction costs, $37 million fair value mark on Low Income Housing Tax Credit and Preservation Fund Tax investments and $6 million fair value mark on mortgage servicing rights. (K) Represents the estimated premium on BBVA USA Holdco’s certificate of deposit portfolio. (L) Represents the estimated premium on BBVA USA Holdco’s borrowed funds, partially offset by write-offs on discounts and premiums on borrowed funds. (M) Represents the write-off of BBVA USA Holdco’s reserve for credit losses on unfunded commitments, the deferred income tax impacts resulting from purchase accounting adjustments and provision for credit losses on the non-PCD portfolio and $850 million associated with transaction costs. Total transaction costs are estimated at $980 million of which the remaining $130 million are the write-off of certain technology and other assets. Note 5. Pro Forma Adjustments to the Unaudited Condensed Consolidated Combined Income Statements (A) Represents the income and expenses for the year ended December 31, 2020 and quarter ended March 31, 2021 for the Non-Acquired Subsidiaries. (B) Transaction accounting adjustments include the provision for credit losses on the non-PCD loan portfolio, transaction costs and related taxes and excludes any anticipated cost savings and purchase accounting impacts on loans, securities, borrowings, deposits and other intangibles. (C) Represents the provision for credit losses estimated on the non-PCD and unfunded commitment loan portfolios. (D) Represents transaction costs of $850 million. Total transaction costs are estimated at $980 million of which the remaining $130 million are the write-off of certain technology and other assets. (E) Represents the income tax impacts resulting from the provision for credit losses on the non-PCD loan portfolio and transaction costs.