EX-99.2

Published on April 20, 2021

Exhibit 99.2 THE PNC FINANCIAL SERVICES GROUP, INC. UNAUDITED PRO FORMA CONDENSED COMBINED CONSOLIDATED FINANCIAL STATEMENTS The following unaudited pro forma condensed combined consolidated financial information combines the historical financial position and results of operations of The PNC Financial Services Group, Inc. (“PNC”) and BBVA USA Bancshares, Inc. (“BBVA USA Holdco”) after giving effect to the acquisition by PNC of BBVA USA Holdco. PNC entered into a Stock Purchase Agreement on November 15, 2020 with Banco Bilbao Vizcaya Argentaria S.A. (“BBVA”) to acquire 100% of the issued and outstanding shares of BBVA USA Holdco for $11.6 billion in cash. PNC is not acquiring the following entities as part of the BBVA USA Holdco acquisition: BBVA Securities, Inc., Propel Venture Partners Fund I, L.P. and BBVA Processing Services, Inc. (collectively, the “Non-Acquired Subsidiaries”). The unaudited pro forma condensed combined consolidated financial information has been prepared to give effect to the following: The unaudited pro forma condensed combined consolidated statement of income of PNC and BBVA USA Holdco for the twelve months ended December 31, 2020, gives effect to the acquisition pursuant to the Stock Purchase Agreement as if it had occurred on January 1, 2020; The unaudited pro forma condensed combined consolidated balance sheet of PNC and BBVA USA Holdco as of December 31, 2020, gives effect to the acquisition pursuant to the Stock Purchase Agreement as if it had occurred on December 31, 2020; The acquisition of BBVA USA Holdco by PNC under the provision of the Financial Accounting Standards Board (FASB) Accounting Standards Codification, ASC 805, “Business Combinations” where the assets and liabilities of BBVA USA Holdco will be recorded by PNC at their respective fair values as of the date the acquisition is completed; Certain reclassifications to conform historical financial statement presentation of BBVA USA Holdco to PNC; and Estimated transaction costs that PNC expects to incur as a result of the acquisition. The following unaudited pro forma condensed combined consolidated financial information and related notes are based on and should be read in conjunction with (i) the historical audited financial statements of PNC and the related notes included in PNC’s Annual Report on From 10-K for the year ended December 31, 2020, and (ii) the historical audited consolidated financial statements of BBVA USA Holdco and the related notes included in Exhibit 99.1 to this Current Report on Form 8-K. The unaudited pro forma condensed combined consolidated financial information is provided for illustrative information purposes only. The unaudited pro forma condensed combined financial information is not necessarily, and should not be assumed to be, an indication of the actual results that would have been achieved had the acquisition been completed as of the dates indicated or that may be achieved in the future. The pro forma financial information has been prepared by PNC in accordance with Regulation S-X Article 11, Pro Forma Financial Information, as amended by the Securities and Exchange Commission Final Rule Release No. 33-10786, Amendments to Financial Disclosures about Acquired and Disposed Businesses, as adopted by the SEC on May 20, 2020. The unaudited pro forma condensed combined consolidated financial information also does not consider any potential effects of changes in market conditions on revenues, cost savings, asset dispositions, and share repurchases, among other factors. In addition, as explained in more detail in the accompanying notes, the preliminary allocation of the pro forma purchase price reflected in the unaudited pro forma condensed combined consolidated financial information is subject to adjustment and may vary significantly from the actual purchase price allocation that will be recorded upon completion of the acquisition.

PNC has completed its preliminary valuation analysis and calculations of the fair market value of certain assets to be acquired or certain liabilities to be assumed from BBVA USA Holdco as of December 31, 2020. A final determination of the fair value of BBVA USA Holdco’s assets and liabilities will be based on BBVA USA Holdco’s actual assets and liabilities as of the date on which the closing of the acquisition occurs (the “closing date”) and, therefore, cannot be made prior to the completion of the acquisition. Actual adjustments may differ from the amounts reflected in the unaudited pro forma condensed combined consolidated financial information, and the differences may be material. Further, PNC has not identified all adjustments necessary to conform BBVA USA Holdco’s accounting policies to PNC’s accounting policies. Upon completion of the acquisition, or as more information becomes available, PNC will perform a more detailed review of BBVA USA Holdco’s accounting policies. As a result of that review, differences could be identified between the accounting policies of the two companies that, when conformed, could have a material impact on the financial information of PNC after giving effect to the acquisition (the “combined company”). As a result of the foregoing, the pro forma adjustments are preliminary and are subject to change as additional information becomes available and as additional analysis is performed. The preliminary pro forma adjustments have been made solely for the purpose of providing the unaudited pro forma condensed combined consolidated financial information. PNC estimated the fair value of certain BBVA USA Holdco’s assets and liabilities based on a preliminary valuation analysis, due diligence information, information presented in BBVA USA Holdco’s SEC filings and other publicly available information. Until the acquisition is completed, both companies are limited in their ability to share certain information. Upon completion of the acquisition, a final determination of the fair value of BBVA USA Holdco’s assets acquired and liabilities assumed will be performed. Any changes in the fair values of the net assets or total purchase price consideration as compared with the information shown in the unaudited pro forma condensed combined consolidated financial information may change the amount of the total purchase price consideration allocated to goodwill and other assets and liabilities and may impact the combined company’s statement of income. The final purchase price consideration allocation may be materially different than the preliminary purchase price consideration allocation presented in the unaudited pro forma condensed financial statements.

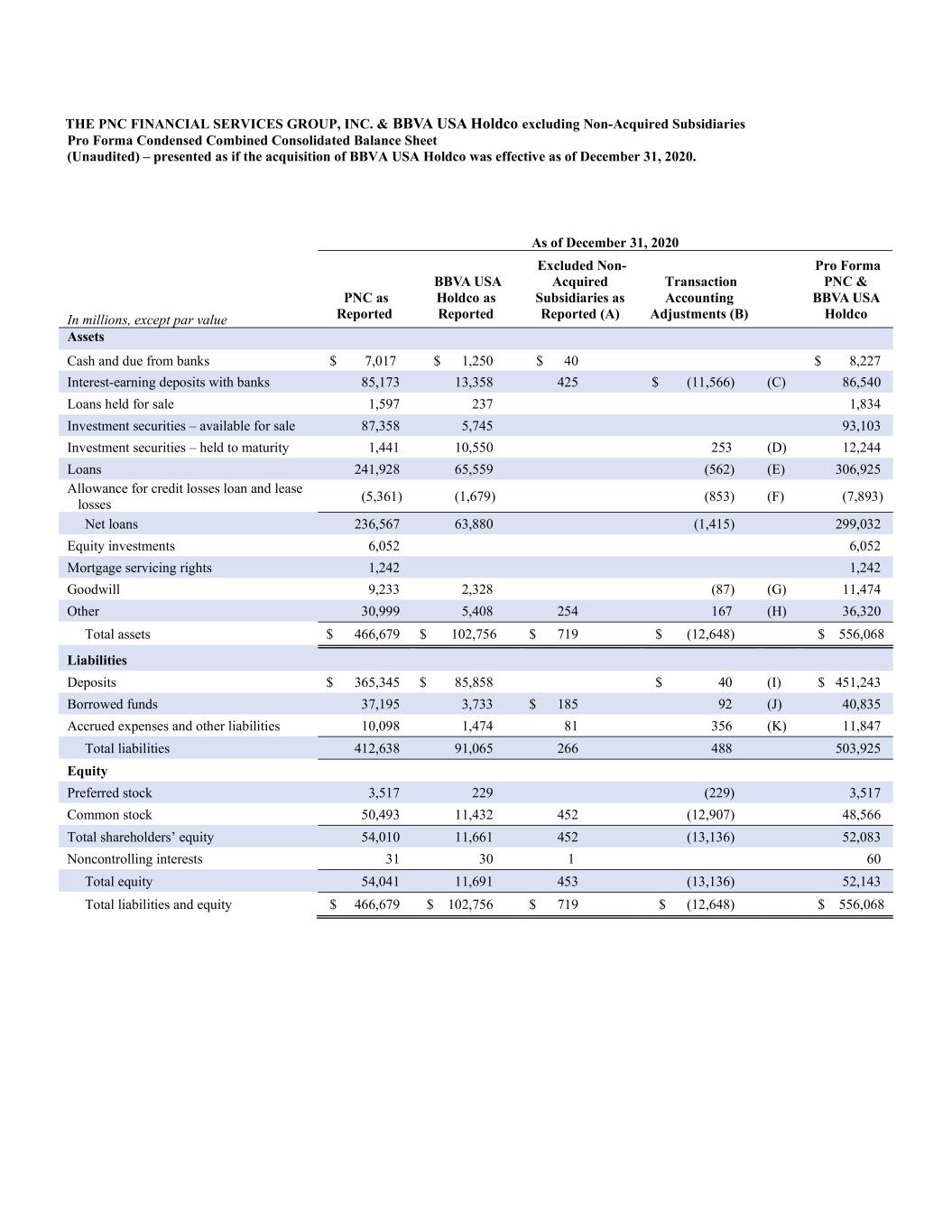

THE PNC FINANCIAL SERVICES GROUP, INC. & BBVA USA Holdco excluding Non-Acquired Subsidiaries Pro Forma Condensed Combined Consolidated Balance Sheet (Unaudited) – presented as if the acquisition of BBVA USA Holdco was effective as of December 31, 2020. As of December 31, 2020 PNC as Reported BBVA USA Holdco as Reported Excluded Non- Acquired Subsidiaries as Reported (A) Transaction Accounting Adjustments (B) Pro Forma PNC & BBVA USA Holdco In millions, except par value Assets Cash and due from banks $ 7,017 $ 1,250 $ 40 $ 8,227 Interest-earning deposits with banks 85,173 13,358 425 $ (11,566) (C) 86,540 Loans held for sale 1,597 237 1,834 Investment securities – available for sale 87,358 5,745 93,103 Investment securities – held to maturity 1,441 10,550 253 (D) 12,244 Loans 241,928 65,559 (562) (E) 306,925 Allowance for credit losses loan and lease losses (5,361) (1,679) (853) (F) (7,893) Net loans 236,567 63,880 (1,415) 299,032 Equity investments 6,052 6,052 Mortgage servicing rights 1,242 1,242 Goodwill 9,233 2,328 (87) (G) 11,474 Other 30,999 5,408 254 167 (H) 36,320 Total assets $ 466,679 $ 102,756 $ 719 $ (12,648) $ 556,068 Liabilities Deposits $ 365,345 $ 85,858 $ 40 (I) $ 451,243 Borrowed funds 37,195 3,733 $ 185 92 (J) 40,835 Accrued expenses and other liabilities 10,098 1,474 81 356 (K) 11,847 Total liabilities 412,638 91,065 266 488 503,925 Equity Preferred stock 3,517 229 (229) 3,517 Common stock 50,493 11,432 452 (12,907) 48,566 Total shareholders’ equity 54,010 11,661 452 (13,136) 52,083 Noncontrolling interests 31 30 1 60 Total equity 54,041 11,691 453 (13,136) 52,143 Total liabilities and equity $ 466,679 $ 102,756 $ 719 $ (12,648) $ 556,068

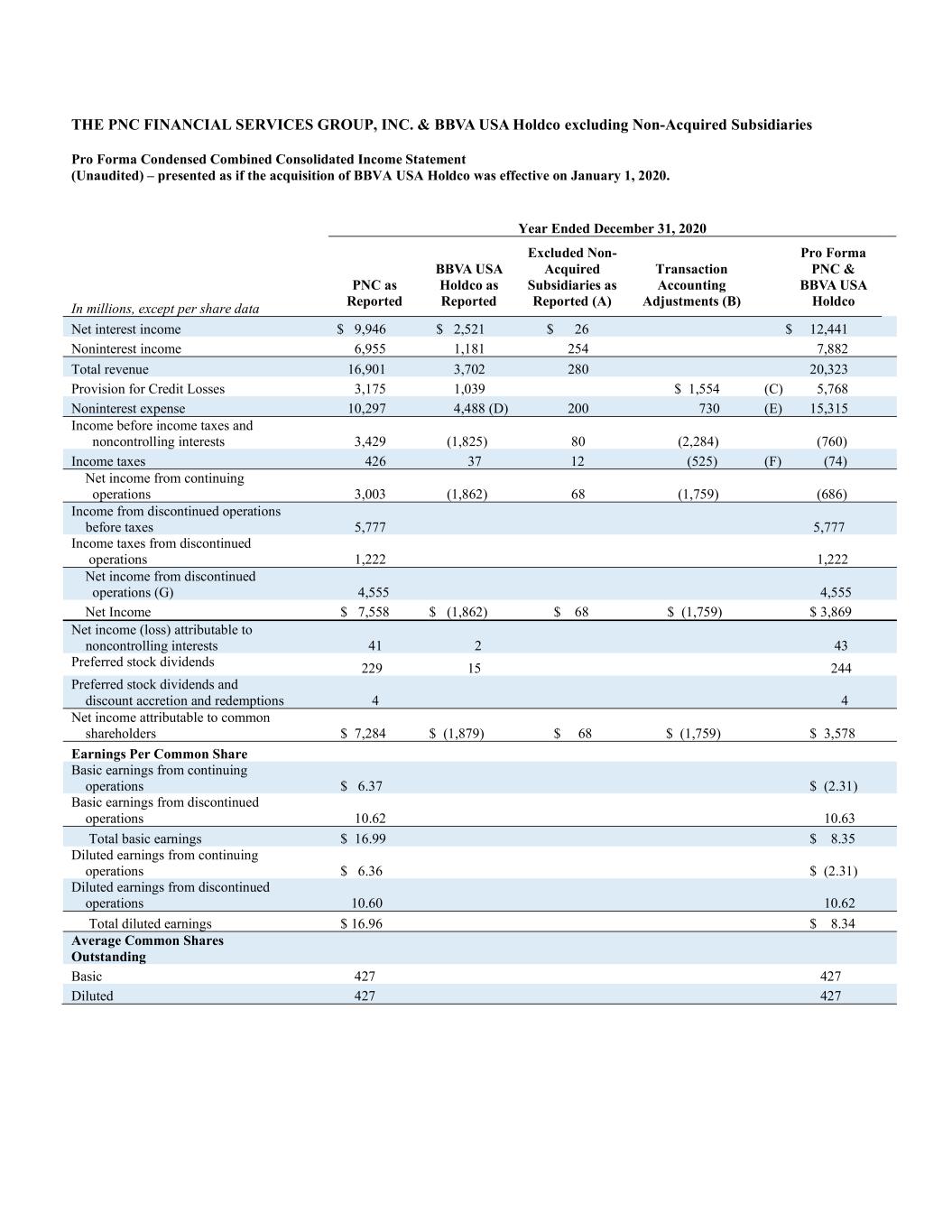

THE PNC FINANCIAL SERVICES GROUP, INC. & BBVA USA Holdco excluding Non-Acquired Subsidiaries Pro Forma Condensed Combined Consolidated Income Statement (Unaudited) – presented as if the acquisition of BBVA USA Holdco was effective on January 1, 2020. Year Ended December 31, 2020 PNC as Reported BBVA USA Holdco as Reported Excluded Non- Acquired Subsidiaries as Reported (A) Transaction Accounting Adjustments (B) Pro Forma PNC & BBVA USA Holdco In millions, except per share data Net interest income $ 9,946 $ 2,521 $ 26 $ 12,441 Noninterest income 6,955 1,181 254 7,882 Total revenue 16,901 3,702 280 20,323 Provision for Credit Losses 3,175 1,039 $ 1,554 (C) 5,768 Noninterest expense 10,297 4,488 (D) 200 730 (E) 15,315 Income before income taxes and noncontrolling interests 3,429 (1,825) 80 (2,284) (760) Income taxes 426 37 12 (525) (F) (74) Net income from continuing operations 3,003 (1,862) 68 (1,759) (686) Income from discontinued operations before taxes 5,777 5,777 Income taxes from discontinued operations 1,222 1,222 Net income from discontinued operations (G) 4,555 4,555 Net Income $ 7,558 $ (1,862) $ 68 $ (1,759) $ 3,869 Net income (loss) attributable to noncontrolling interests 41 2 43 Preferred stock dividends 229 15 244 Preferred stock dividends and discount accretion and redemptions 4 4 Net income attributable to common shareholders $ 7,284 $ (1,879) $ 68 $ (1,759) $ 3,578 Earnings Per Common Share Basic earnings from continuing operations $ 6.37 $ (2.31) Basic earnings from discontinued operations 10.62 10.63 Total basic earnings $ 16.99 $ 8.35 Diluted earnings from continuing operations $ 6.36 $ (2.31) Diluted earnings from discontinued operations 10.60 10.62 Total diluted earnings $ 16.96 $ 8.34 Average Common Shares Outstanding Basic 427 427 Diluted 427 427

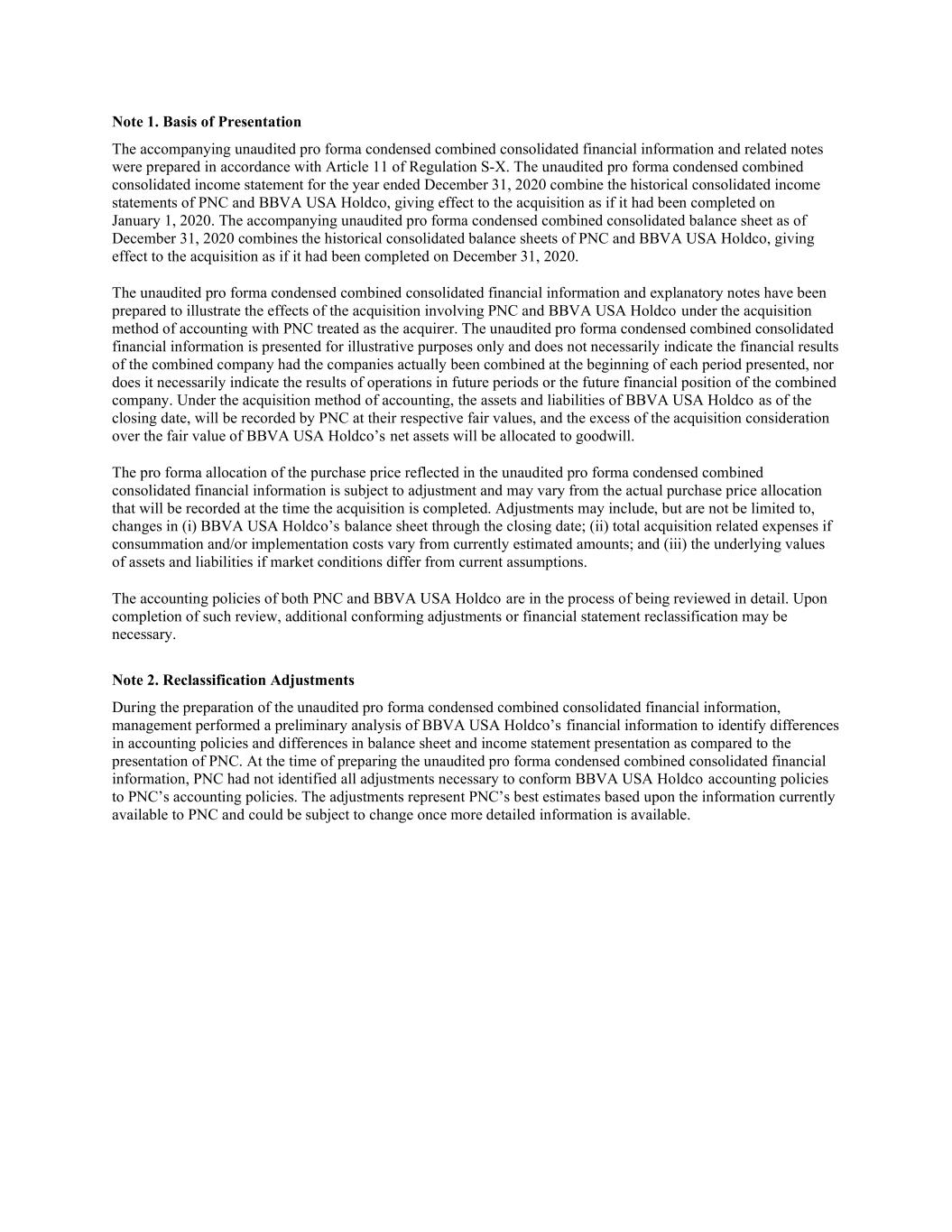

Note 1. Basis of Presentation The accompanying unaudited pro forma condensed combined consolidated financial information and related notes were prepared in accordance with Article 11 of Regulation S-X. The unaudited pro forma condensed combined consolidated income statement for the year ended December 31, 2020 combine the historical consolidated income statements of PNC and BBVA USA Holdco, giving effect to the acquisition as if it had been completed on January 1, 2020. The accompanying unaudited pro forma condensed combined consolidated balance sheet as of December 31, 2020 combines the historical consolidated balance sheets of PNC and BBVA USA Holdco, giving effect to the acquisition as if it had been completed on December 31, 2020. The unaudited pro forma condensed combined consolidated financial information and explanatory notes have been prepared to illustrate the effects of the acquisition involving PNC and BBVA USA Holdco under the acquisition method of accounting with PNC treated as the acquirer. The unaudited pro forma condensed combined consolidated financial information is presented for illustrative purposes only and does not necessarily indicate the financial results of the combined company had the companies actually been combined at the beginning of each period presented, nor does it necessarily indicate the results of operations in future periods or the future financial position of the combined company. Under the acquisition method of accounting, the assets and liabilities of BBVA USA Holdco as of the closing date, will be recorded by PNC at their respective fair values, and the excess of the acquisition consideration over the fair value of BBVA USA Holdco’s net assets will be allocated to goodwill. The pro forma allocation of the purchase price reflected in the unaudited pro forma condensed combined consolidated financial information is subject to adjustment and may vary from the actual purchase price allocation that will be recorded at the time the acquisition is completed. Adjustments may include, but are not be limited to, changes in (i) BBVA USA Holdco’s balance sheet through the closing date; (ii) total acquisition related expenses if consummation and/or implementation costs vary from currently estimated amounts; and (iii) the underlying values of assets and liabilities if market conditions differ from current assumptions. The accounting policies of both PNC and BBVA USA Holdco are in the process of being reviewed in detail. Upon completion of such review, additional conforming adjustments or financial statement reclassification may be necessary. Note 2. Reclassification Adjustments During the preparation of the unaudited pro forma condensed combined consolidated financial information, management performed a preliminary analysis of BBVA USA Holdco’s financial information to identify differences in accounting policies and differences in balance sheet and income statement presentation as compared to the presentation of PNC. At the time of preparing the unaudited pro forma condensed combined consolidated financial information, PNC had not identified all adjustments necessary to conform BBVA USA Holdco accounting policies to PNC’s accounting policies. The adjustments represent PNC’s best estimates based upon the information currently available to PNC and could be subject to change once more detailed information is available.

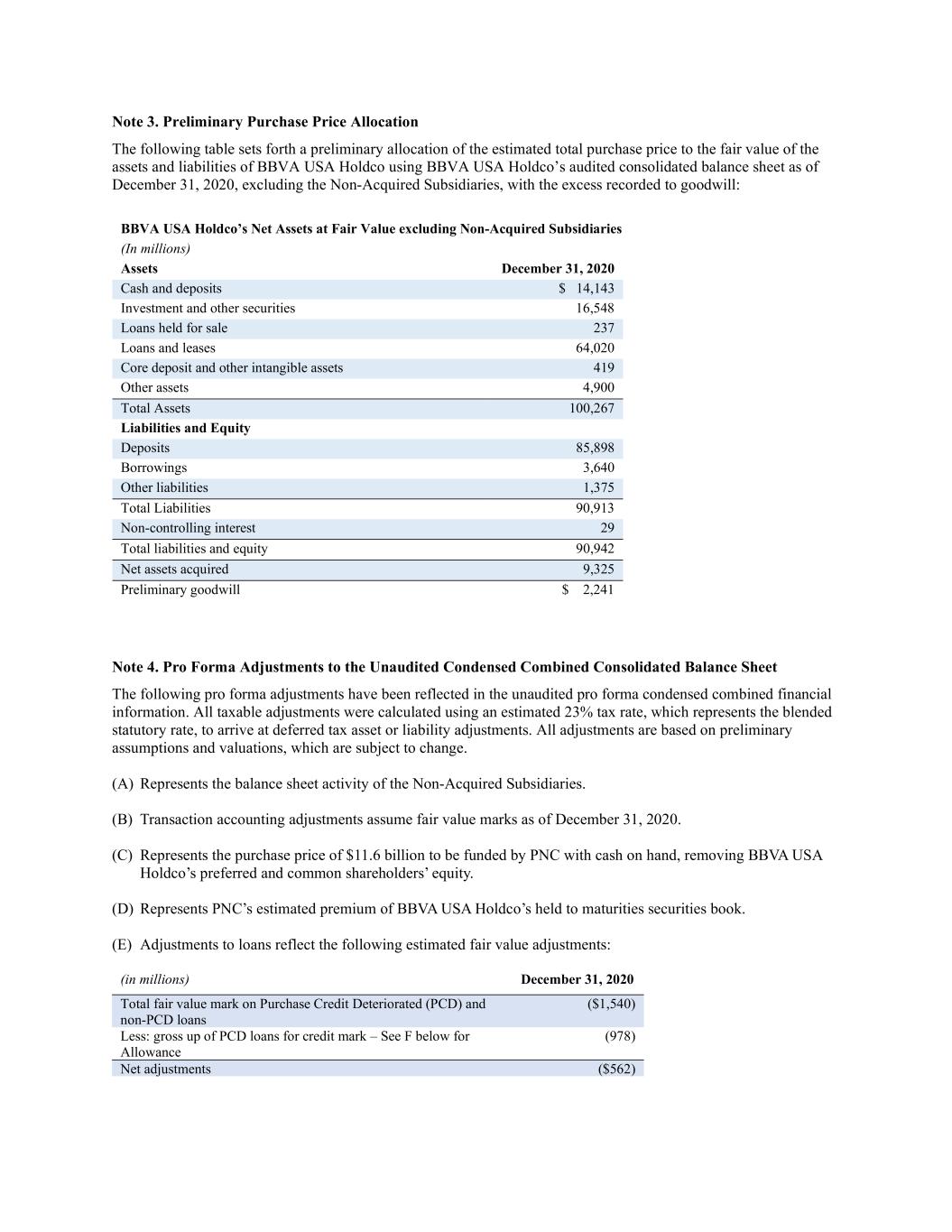

Note 3. Preliminary Purchase Price Allocation The following table sets forth a preliminary allocation of the estimated total purchase price to the fair value of the assets and liabilities of BBVA USA Holdco using BBVA USA Holdco’s audited consolidated balance sheet as of December 31, 2020, excluding the Non-Acquired Subsidiaries, with the excess recorded to goodwill: BBVA USA Holdco’s Net Assets at Fair Value excluding Non-Acquired Subsidiaries (In millions) Assets December 31, 2020 Cash and deposits $ 14,143 Investment and other securities 16,548 Loans held for sale 237 Loans and leases 64,020 Core deposit and other intangible assets 419 Other assets 4,900 Total Assets 100,267 Liabilities and Equity Deposits 85,898 Borrowings 3,640 Other liabilities 1,375 Total Liabilities 90,913 Non-controlling interest 29 Total liabilities and equity 90,942 Net assets acquired 9,325 Preliminary goodwill $ 2,241 Note 4. Pro Forma Adjustments to the Unaudited Condensed Combined Consolidated Balance Sheet The following pro forma adjustments have been reflected in the unaudited pro forma condensed combined financial information. All taxable adjustments were calculated using an estimated 23% tax rate, which represents the blended statutory rate, to arrive at deferred tax asset or liability adjustments. All adjustments are based on preliminary assumptions and valuations, which are subject to change. (A) Represents the balance sheet activity of the Non-Acquired Subsidiaries. (B) Transaction accounting adjustments assume fair value marks as of December 31, 2020. (C) Represents the purchase price of $11.6 billion to be funded by PNC with cash on hand, removing BBVA USA Holdco’s preferred and common shareholders’ equity. (D) Represents PNC’s estimated premium of BBVA USA Holdco’s held to maturities securities book. (E) Adjustments to loans reflect the following estimated fair value adjustments: (in millions) December 31, 2020 Total fair value mark on Purchase Credit Deteriorated (PCD) and non-PCD loans ($1,540) Less: gross up of PCD loans for credit mark – See F below for Allowance (978) Net adjustments ($562)

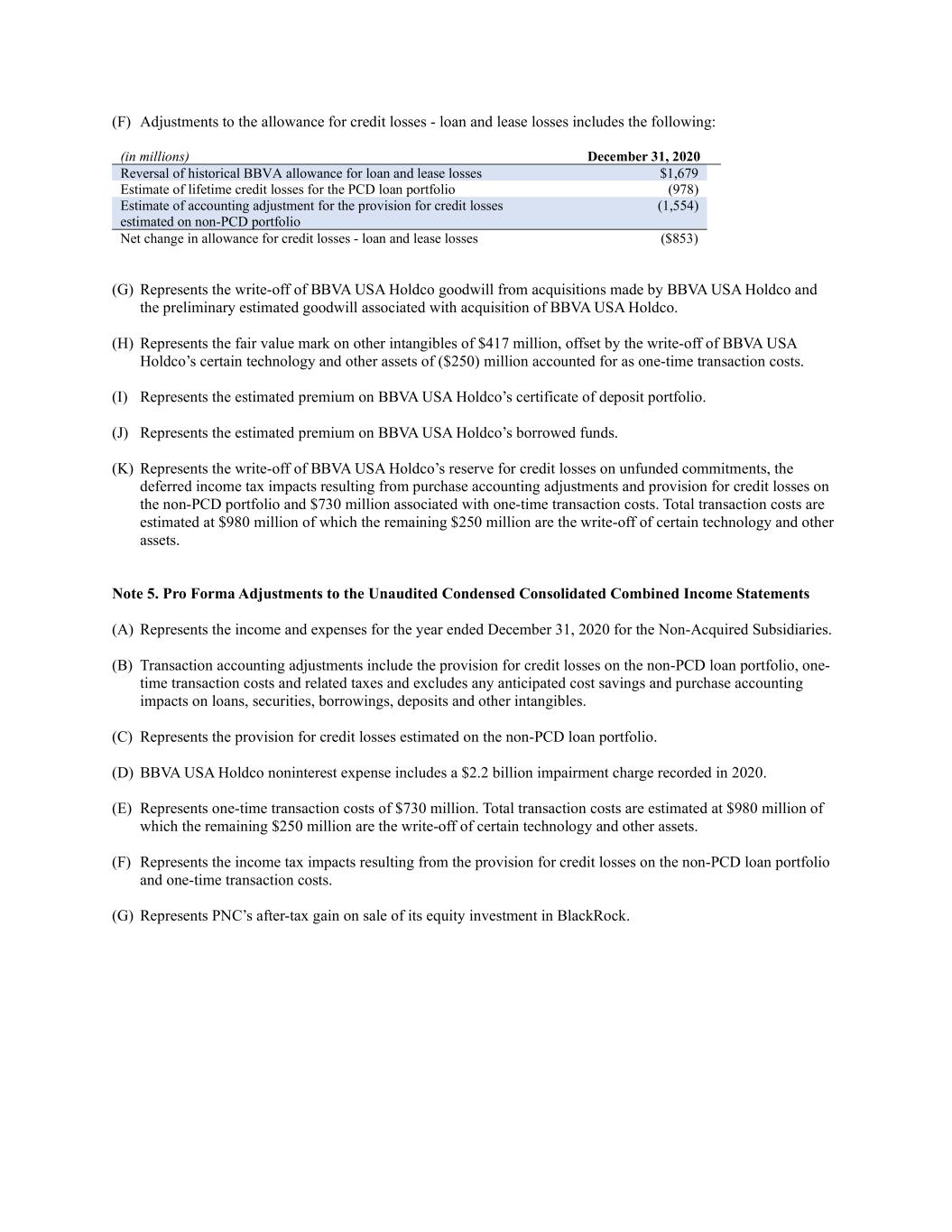

(F) Adjustments to the allowance for credit losses - loan and lease losses includes the following: (in millions) December 31, 2020 Reversal of historical BBVA allowance for loan and lease losses $1,679 Estimate of lifetime credit losses for the PCD loan portfolio (978) Estimate of accounting adjustment for the provision for credit losses estimated on non-PCD portfolio (1,554) Net change in allowance for credit losses - loan and lease losses ($853) (G) Represents the write-off of BBVA USA Holdco goodwill from acquisitions made by BBVA USA Holdco and the preliminary estimated goodwill associated with acquisition of BBVA USA Holdco. (H) Represents the fair value mark on other intangibles of $417 million, offset by the write-off of BBVA USA Holdco’s certain technology and other assets of ($250) million accounted for as one-time transaction costs. (I) Represents the estimated premium on BBVA USA Holdco’s certificate of deposit portfolio. (J) Represents the estimated premium on BBVA USA Holdco’s borrowed funds. (K) Represents the write-off of BBVA USA Holdco’s reserve for credit losses on unfunded commitments, the deferred income tax impacts resulting from purchase accounting adjustments and provision for credit losses on the non-PCD portfolio and $730 million associated with one-time transaction costs. Total transaction costs are estimated at $980 million of which the remaining $250 million are the write-off of certain technology and other assets. Note 5. Pro Forma Adjustments to the Unaudited Condensed Consolidated Combined Income Statements (A) Represents the income and expenses for the year ended December 31, 2020 for the Non-Acquired Subsidiaries. (B) Transaction accounting adjustments include the provision for credit losses on the non-PCD loan portfolio, one- time transaction costs and related taxes and excludes any anticipated cost savings and purchase accounting impacts on loans, securities, borrowings, deposits and other intangibles. (C) Represents the provision for credit losses estimated on the non-PCD loan portfolio. (D) BBVA USA Holdco noninterest expense includes a $2.2 billion impairment charge recorded in 2020. (E) Represents one-time transaction costs of $730 million. Total transaction costs are estimated at $980 million of which the remaining $250 million are the write-off of certain technology and other assets. (F) Represents the income tax impacts resulting from the provision for credit losses on the non-PCD loan portfolio and one-time transaction costs. (G) Represents PNC’s after-tax gain on sale of its equity investment in BlackRock.