EXHIBIT 99.1

Published on March 2, 2020

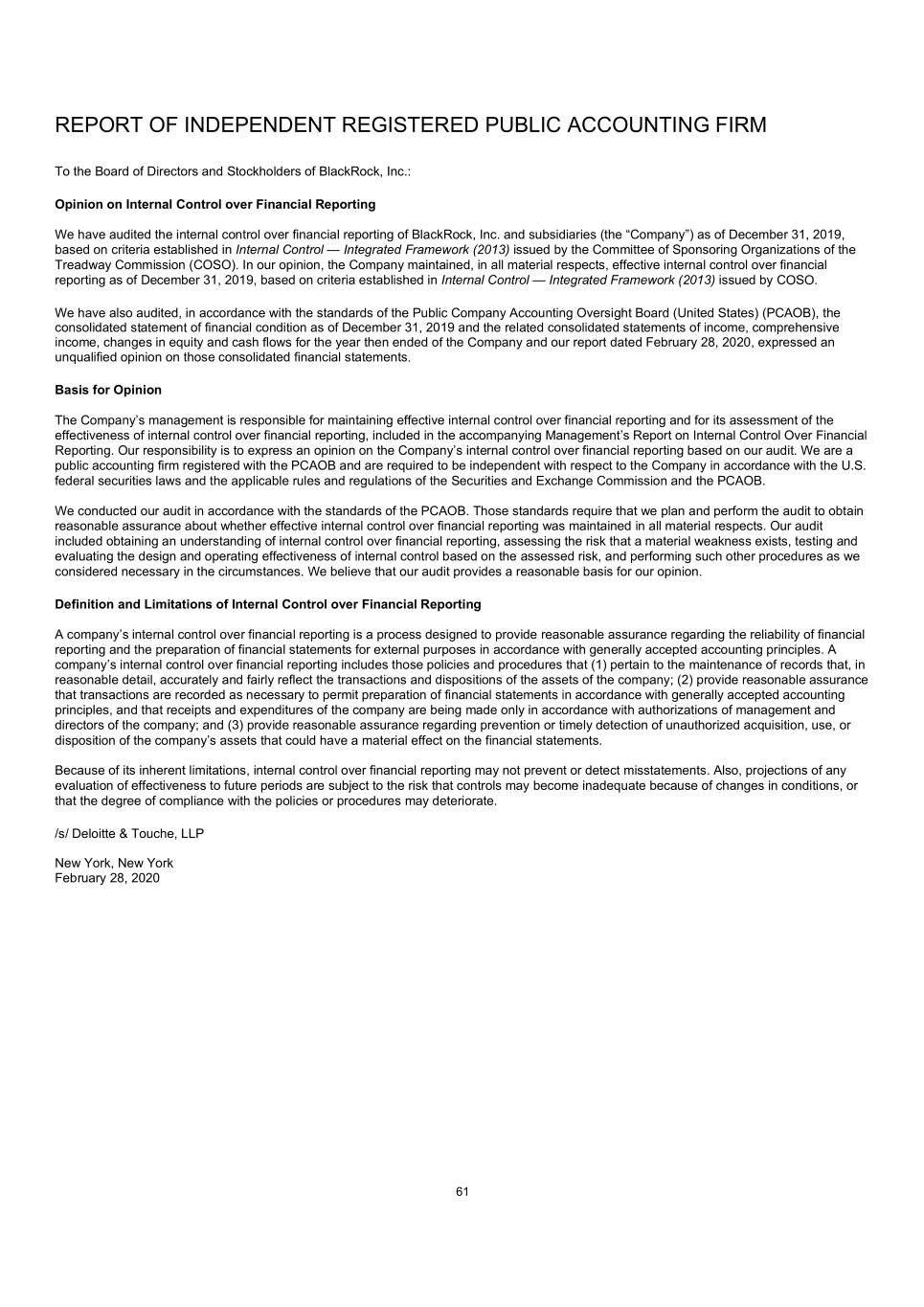

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of BlackRock, Inc.: Opinion on Internal Control over Financial Reporting We have audited the internal control over financial reporting of BlackRock, Inc. and subsidiaries (the “Company”) as of December 31, 2019, based on criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2019, based on criteria established in Internal Control — Integrated Framework (2013) issued by COSO. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated statement of financial condition as of December 31, 2019 and the related consolidated statements of income, comprehensive income, changes in equity and cash flows for the year then ended of the Company and our report dated February 28, 2020, expressed an unqualified opinion on those consolidated financial statements. Basis for Opinion The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion. Definition and Limitations of Internal Control over Financial Reporting A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. /s/ Deloitte & Touche, LLP New York, New York February 28, 2020 61

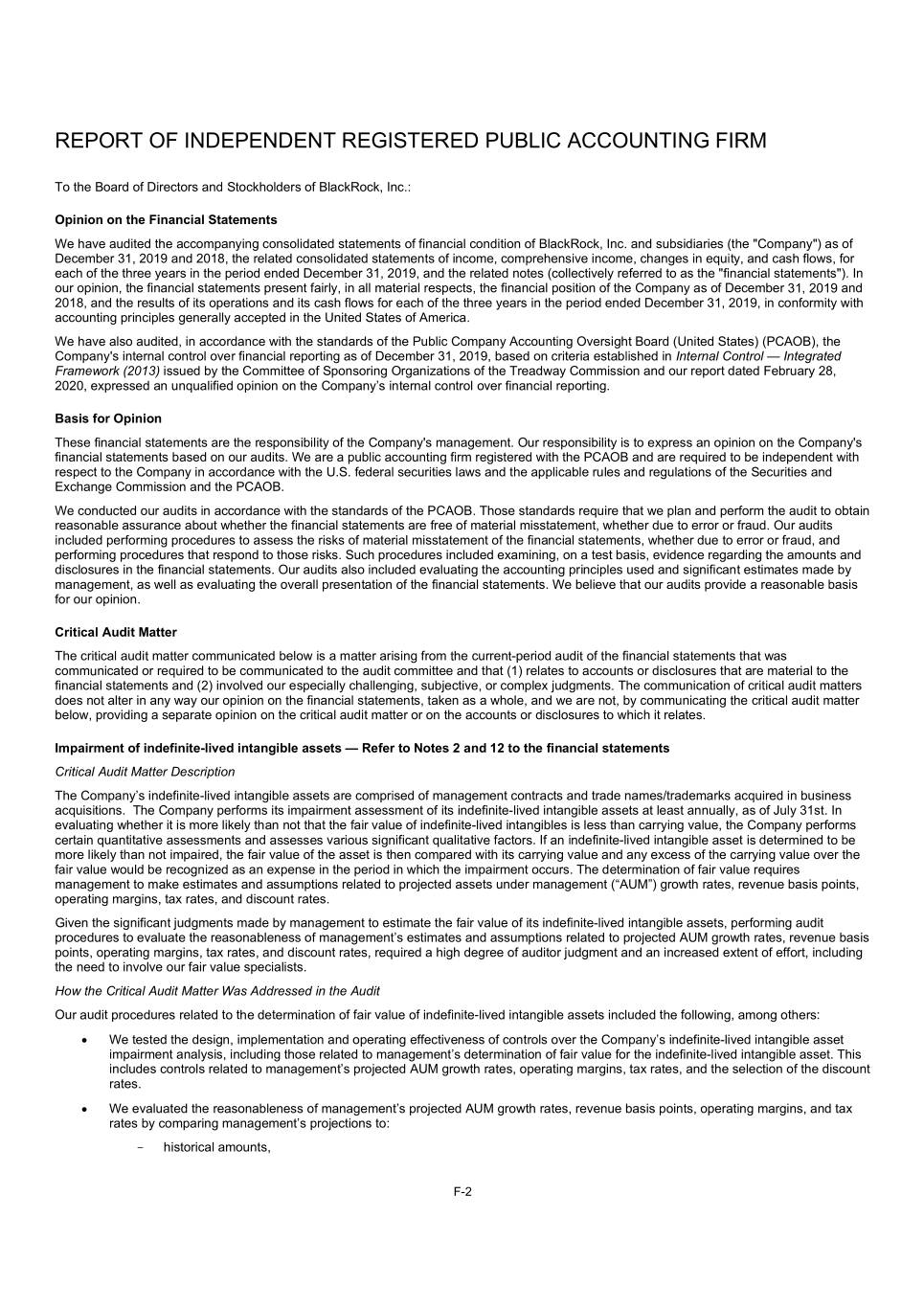

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of BlackRock, Inc.: Opinion on the Financial Statements We have audited the accompanying consolidated statements of financial condition of BlackRock, Inc. and subsidiaries (the "Company") as of December 31, 2019 and 2018, the related consolidated statements of income, comprehensive income, changes in equity, and cash flows, for each of the three years in the period ended December 31, 2019, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2019 and 2018, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2019, in conformity with accounting principles generally accepted in the United States of America. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company's internal control over financial reporting as of December 31, 2019, based on criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 28, 2020, expressed an unqualified opinion on the Company’s internal control over financial reporting. Basis for Opinion These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion. Critical Audit Matter The critical audit matter communicated below is a matter arising from the current-period audit of the financial statements that was communicated or required to be communicated to the audit committee and that (1) relates to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates. Impairment of indefinite-lived intangible assets — Refer to Notes 2 and 12 to the financial statements Critical Audit Matter Description The Company’s indefinite-lived intangible assets are comprised of management contracts and trade names/trademarks acquired in business acquisitions. The Company performs its impairment assessment of its indefinite-lived intangible assets at least annually, as of July 31st. In evaluating whether it is more likely than not that the fair value of indefinite-lived intangibles is less than carrying value, the Company performs certain quantitative assessments and assesses various significant qualitative factors. If an indefinite-lived intangible asset is determined to be more likely than not impaired, the fair value of the asset is then compared with its carrying value and any excess of the carrying value over the fair value would be recognized as an expense in the period in which the impairment occurs. The determination of fair value requires management to make estimates and assumptions related to projected assets under management (“AUM”) growth rates, revenue basis points, operating margins, tax rates, and discount rates. Given the significant judgments made by management to estimate the fair value of its indefinite-lived intangible assets, performing audit procedures to evaluate the reasonableness of management’s estimates and assumptions related to projected AUM growth rates, revenue basis points, operating margins, tax rates, and discount rates, required a high degree of auditor judgment and an increased extent of effort, including the need to involve our fair value specialists. How the Critical Audit Matter Was Addressed in the Audit Our audit procedures related to the determination of fair value of indefinite-lived intangible assets included the following, among others: We tested the design, implementation and operating effectiveness of controls over the Company’s indefinite-lived intangible asset impairment analysis, including those related to management’s determination of fair value for the indefinite-lived intangible asset. This includes controls related to management’s projected AUM growth rates, operating margins, tax rates, and the selection of the discount rates. We evaluated the reasonableness of management’s projected AUM growth rates, revenue basis points, operating margins, and tax rates by comparing management’s projections to: - historical amounts, F-2

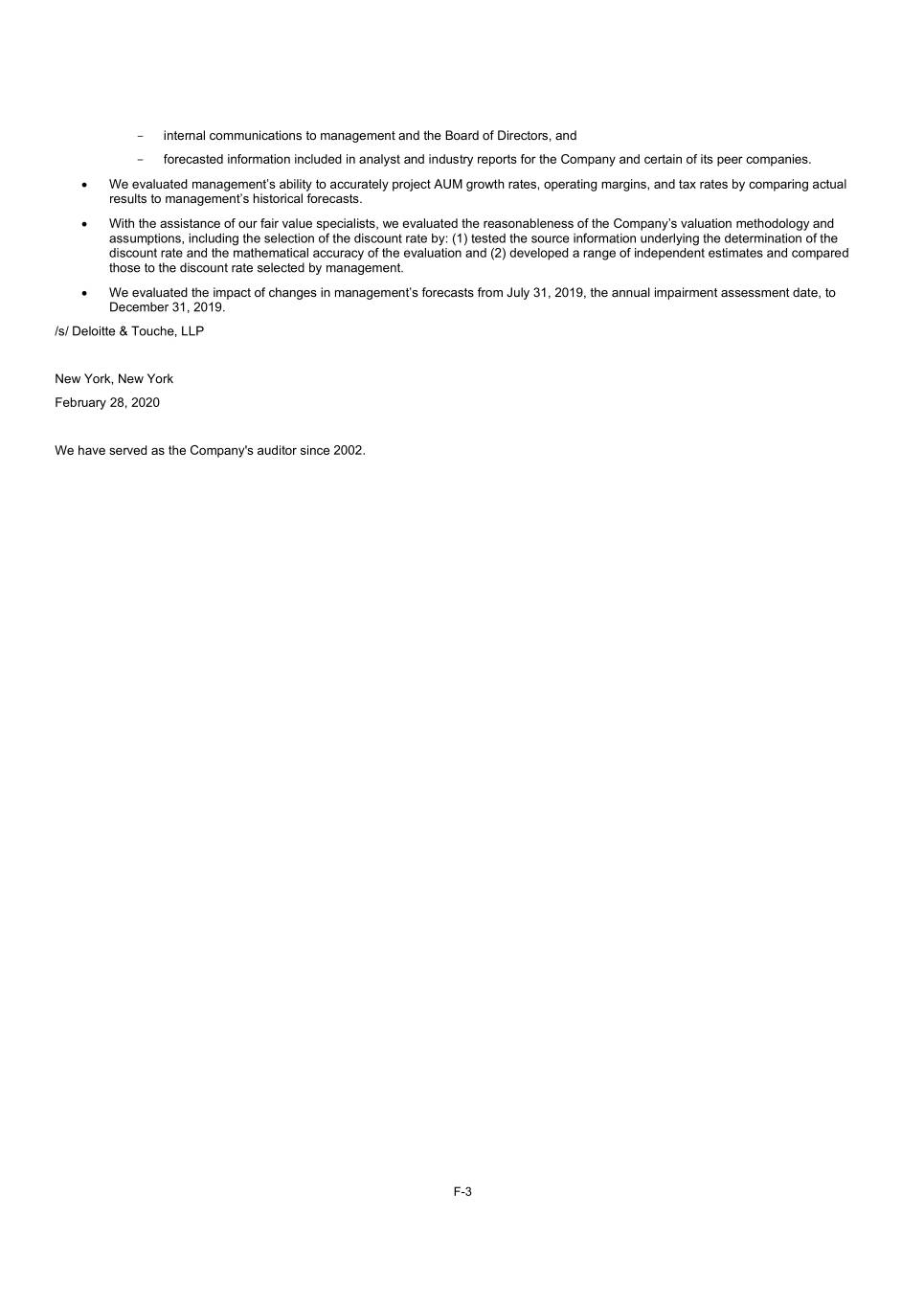

- internal communications to management and the Board of Directors, and - forecasted information included in analyst and industry reports for the Company and certain of its peer companies. We evaluated management’s ability to accurately project AUM growth rates, operating margins, and tax rates by comparing actual results to management’s historical forecasts. With the assistance of our fair value specialists, we evaluated the reasonableness of the Company’s valuation methodology and assumptions, including the selection of the discount rate by: (1) tested the source information underlying the determination of the discount rate and the mathematical accuracy of the evaluation and (2) developed a range of independent estimates and compared those to the discount rate selected by management. We evaluated the impact of changes in management’s forecasts from July 31, 2019, the annual impairment assessment date, to December 31, 2019. /s/ Deloitte & Touche, LLP New York, New York February 28, 2020 We have served as the Company's auditor since 2002. F-3

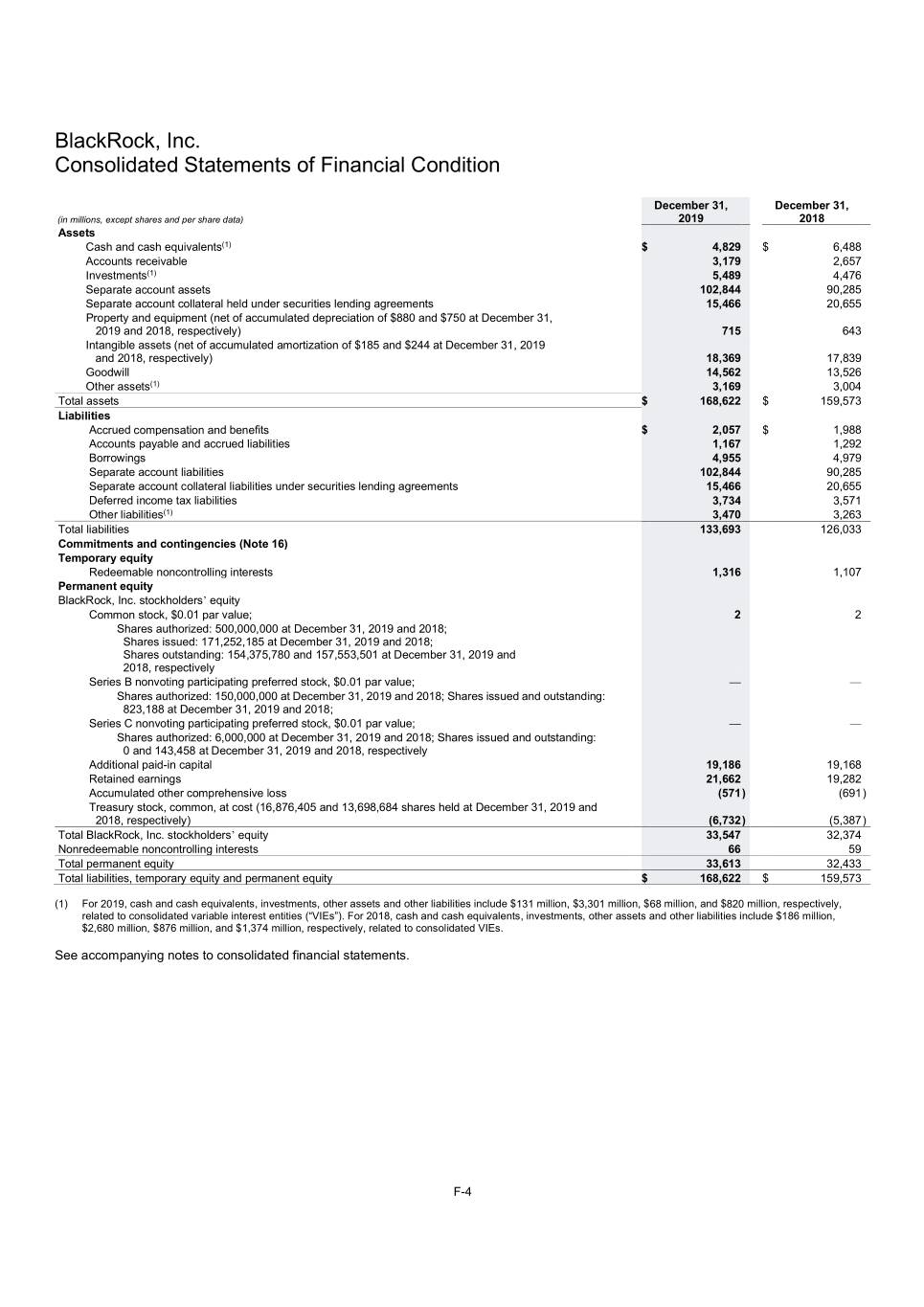

BlackRock, Inc. Consolidated Statements of Financial Condition December 31, December 31, (in millions, except shares and per share data) 2019 2018 Assets Cash and cash equivalents(1) $ 4,829 $ 6,488 Accounts receivable 3,179 2,657 Investments(1) 5,489 4,476 Separate account assets 102,844 90,285 Separate account collateral held under securities lending agreements 15,466 20,655 Property and equipment (net of accumulated depreciation of $880 and $750 at December 31, 2019 and 2018, respectively) 715 643 Intangible assets (net of accumulated amortization of $185 and $244 at December 31, 2019 and 2018, respectively) 18,369 17,839 Goodwill 14,562 13,526 Other assets(1) 3,169 3,004 Total assets $ 168,622 $ 159,573 Liabilities Accrued compensation and benefits $ 2,057 $ 1,988 Accounts payable and accrued liabilities 1,167 1,292 Borrowings 4,955 4,979 Separate account liabilities 102,844 90,285 Separate account collateral liabilities under securities lending agreements 15,466 20,655 Deferred income tax liabilities 3,734 3,571 Other liabilities(1) 3,470 3,263 Total liabilities 133,693 126,033 Commitments and contingencies (Note 16) Temporary equity Redeemable noncontrolling interests 1,316 1,107 Permanent equity BlackRock, Inc. stockholders’ equity Common stock, $0.01 par value; 2 2 Shares authorized: 500,000,000 at December 31, 2019 and 2018; Shares issued: 171,252,185 at December 31, 2019 and 2018; Shares outstanding: 154,375,780 and 157,553,501 at December 31, 2019 and 2018, respectively Series B nonvoting participating preferred stock, $0.01 par value; — — Shares authorized: 150,000,000 at December 31, 2019 and 2018; Shares issued and outstanding: 823,188 at December 31, 2019 and 2018; Series C nonvoting participating preferred stock, $0.01 par value; — — Shares authorized: 6,000,000 at December 31, 2019 and 2018; Shares issued and outstanding: 0 and 143,458 at December 31, 2019 and 2018, respectively Additional paid-in capital 19,186 19,168 Retained earnings 21,662 19,282 Accumulated other comprehensive loss (571 ) (691 ) Treasury stock, common, at cost (16,876,405 and 13,698,684 shares held at December 31, 2019 and 2018, respectively) (6,732 ) (5,387 ) Total BlackRock, Inc. stockholders’ equity 33,547 32,374 Nonredeemable noncontrolling interests 66 59 Total permanent equity 33,613 32,433 Total liabilities, temporary equity and permanent equity $ 168,622 $ 159,573 (1) For 2019, cash and cash equivalents, investments, other assets and other liabilities include $131 million, $3,301 million, $68 million, and $820 million, respectively, related to consolidated variable interest entities (“VIEs”). For 2018, cash and cash equivalents, investments, other assets and other liabilities include $186 million, $2,680 million, $876 million, and $1,374 million, respectively, related to consolidated VIEs. See accompanying notes to consolidated financial statements. F-4

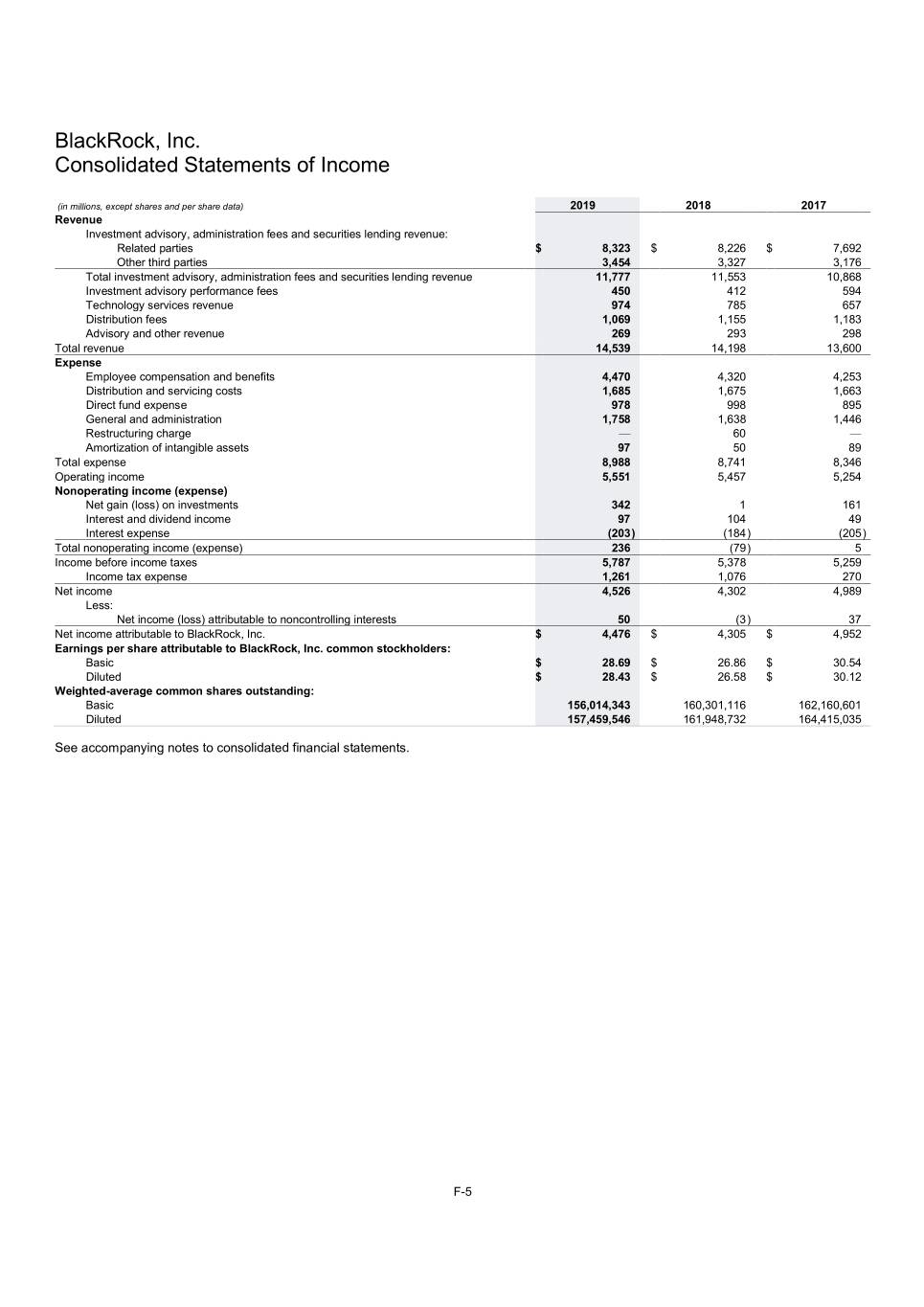

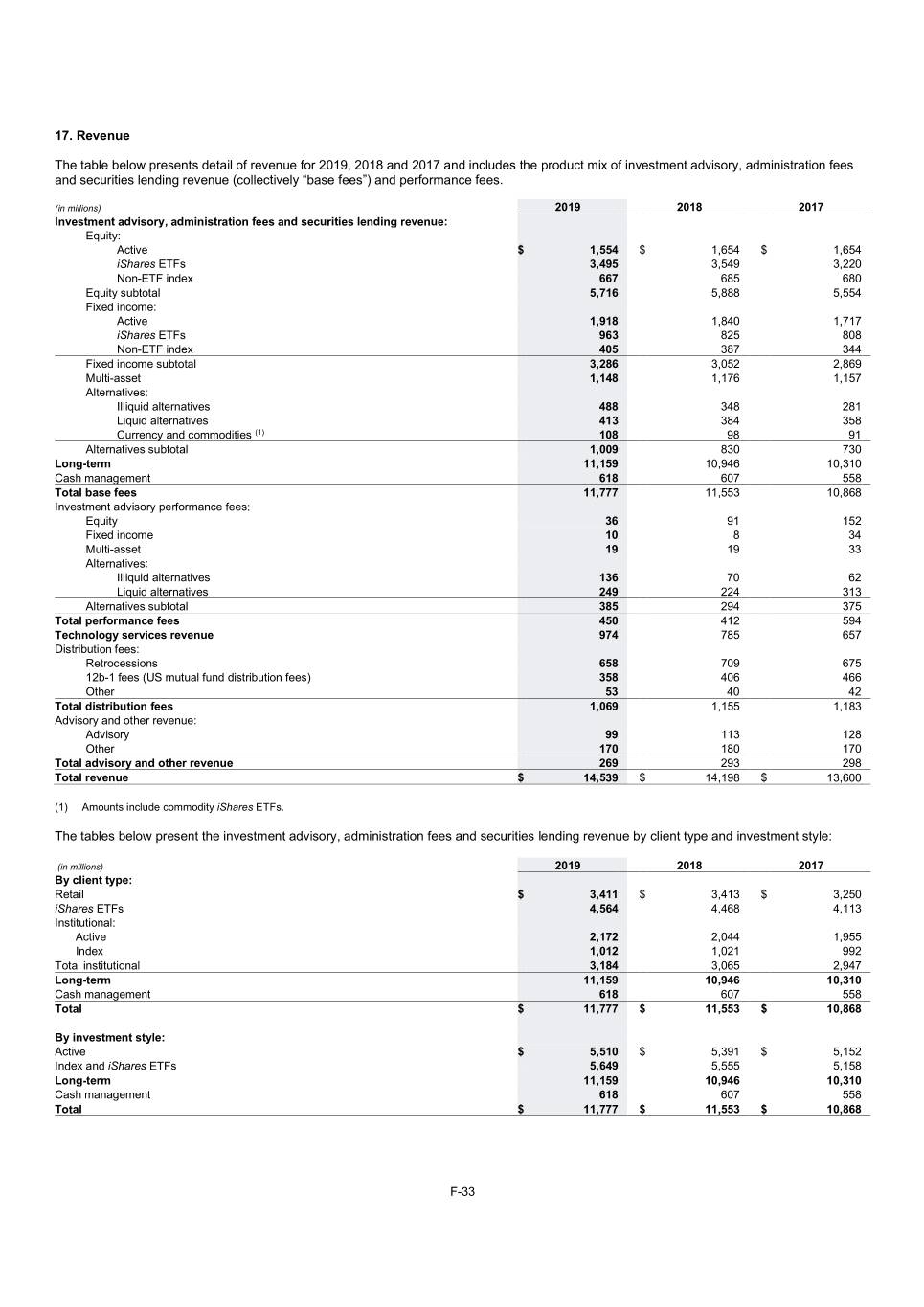

BlackRock, Inc. Consolidated Statements of Income (in millions, except shares and per share data) 2019 2018 2017 Revenue Investment advisory, administration fees and securities lending revenue: Related parties $ 8,323 $ 8,226 $ 7,692 Other third parties 3,454 3,327 3,176 Total investment advisory, administration fees and securities lending revenue 11,777 11,553 10,868 Investment advisory performance fees 450 412 594 Technology services revenue 974 785 657 Distribution fees 1,069 1,155 1,183 Advisory and other revenue 269 293 298 Total revenue 14,539 14,198 13,600 Expense Employee compensation and benefits 4,470 4,320 4,253 Distribution and servicing costs 1,685 1,675 1,663 Direct fund expense 978 998 895 General and administration 1,758 1,638 1,446 Restructuring charge — 60 — Amortization of intangible assets 97 50 89 Total expense 8,988 8,741 8,346 Operating income 5,551 5,457 5,254 Nonoperating income (expense) Net gain (loss) on investments 342 1 161 Interest and dividend income 97 104 49 Interest expense (203 ) (184 ) (205 ) Total nonoperating income (expense) 236 (79 ) 5 Income before income taxes 5,787 5,378 5,259 Income tax expense 1,261 1,076 270 Net income 4,526 4,302 4,989 Less: Net income (loss) attributable to noncontrolling interests 50 (3 ) 37 Net income attributable to BlackRock, Inc. $ 4,476 $ 4,305 $ 4,952 Earnings per share attributable to BlackRock, Inc. common stockholders: Basic $ 28.69 $ 26.86 $ 30.54 Diluted $ 28.43 $ 26.58 $ 30.12 Weighted-average common shares outstanding: Basic 156,014,343 160,301,116 162,160,601 Diluted 157,459,546 161,948,732 164,415,035 See accompanying notes to consolidated financial statements. F-5

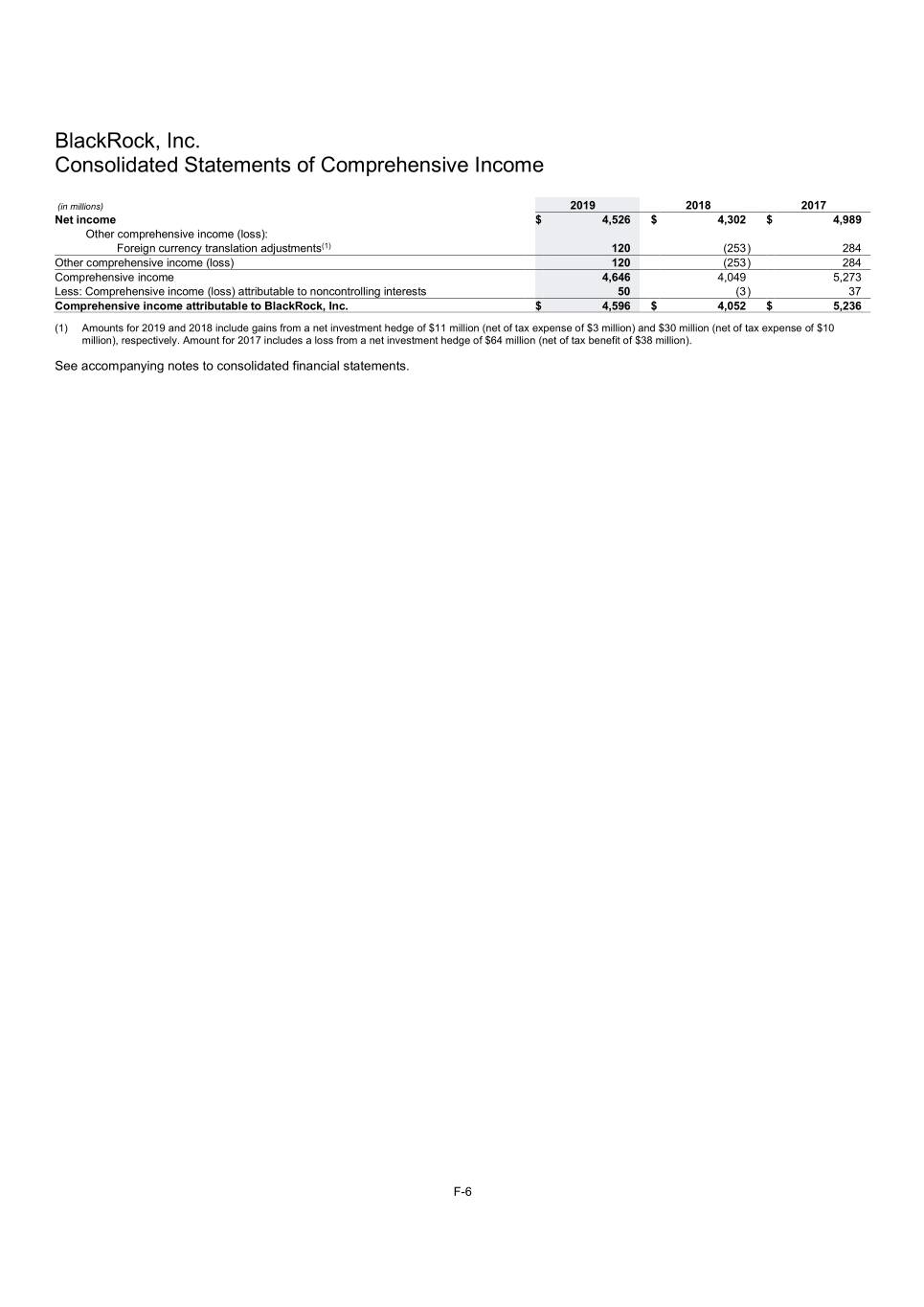

BlackRock, Inc. Consolidated Statements of Comprehensive Income (in millions) 2019 2018 2017 Net income $ 4,526 $ 4,302 $ 4,989 Other comprehensive income (loss): Foreign currency translation adjustments(1) 120 (253 ) 284 Other comprehensive income (loss) 120 (253 ) 284 Comprehensive income 4,646 4,049 5,273 Less: Comprehensive income (loss) attributable to noncontrolling interests 50 (3 ) 37 Comprehensive income attributable to BlackRock, Inc. $ 4,596 $ 4,052 $ 5,236 (1) Amounts for 2019 and 2018 include gains from a net investment hedge of $11 million (net of tax expense of $3 million) and $30 million (net of tax expense of $10 million), respectively. Amount for 2017 includes a loss from a net investment hedge of $64 million (net of tax benefit of $38 million). See accompanying notes to consolidated financial statements. F-6

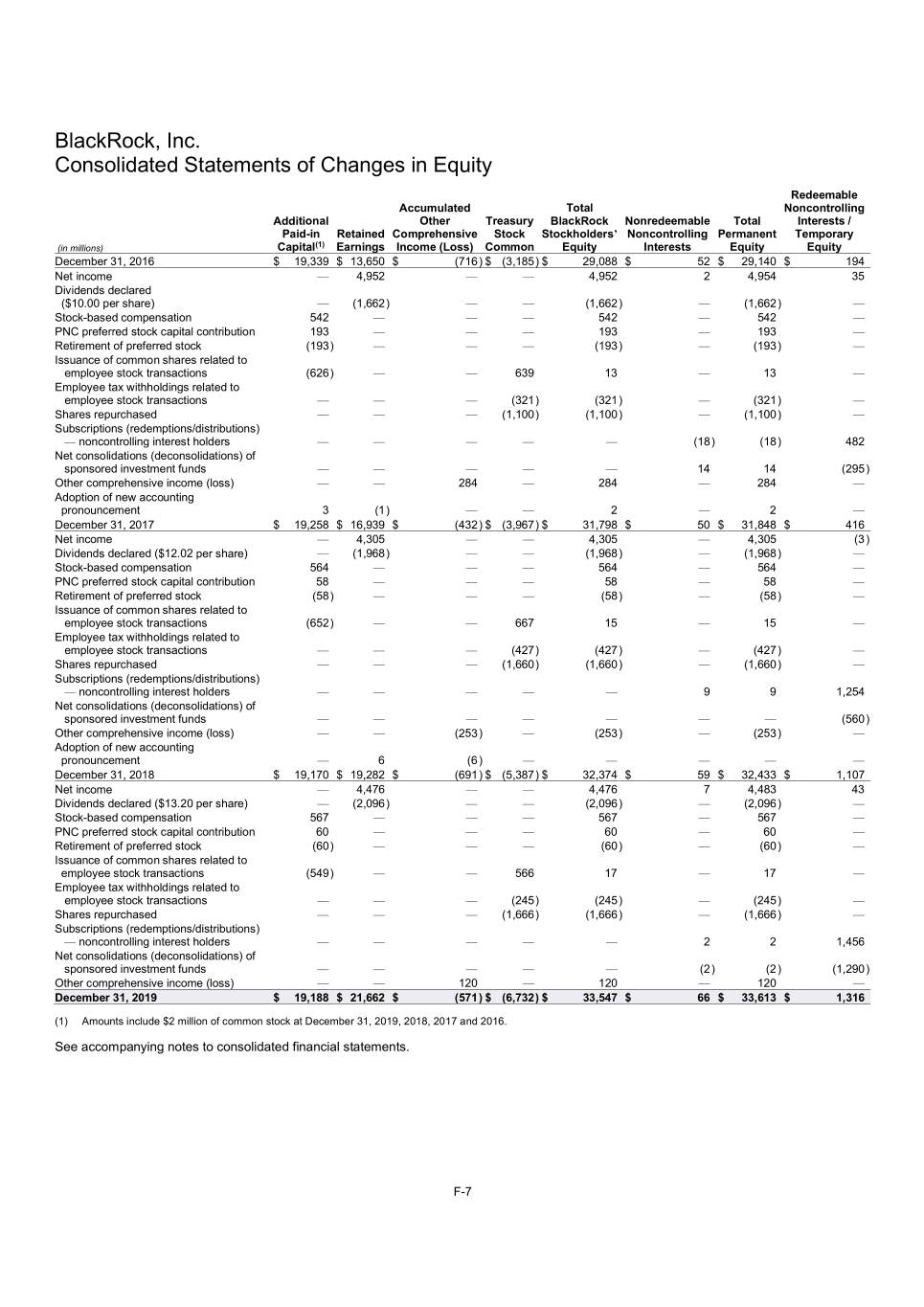

BlackRock, Inc. Consolidated Statements of Changes in Equity Redeemable Accumulated Total Noncontrolling Additional Other Treasury BlackRock Nonredeemable Total Interests / Paid-in Retained Comprehensive Stock Stockholders’ Noncontrolling Permanent Temporary (in millions) Capital(1) Earnings Income (Loss) Common Equity Interests Equity Equity December 31, 2016 $ 19,339 $ 13,650 $ (716 ) $ (3,185 ) $ 29,088 $ 52 $ 29,140 $ 194 Net income — 4,952 — — 4,952 2 4,954 35 Dividends declared ($10.00 per share) — (1,662 ) — — (1,662 ) — (1,662 ) — Stock-based compensation 542 — — — 542 — 542 — PNC preferred stock capital contribution 193 — — — 193 — 193 — Retirement of preferred stock (193 ) — — — (193 ) — (193 ) — Issuance of common shares related to employee stock transactions (626 ) — — 639 13 — 13 — Employee tax withholdings related to employee stock transactions — — — (321 ) (321 ) — (321 ) — Shares repurchased — — — (1,100 ) (1,100 ) — (1,100 ) — Subscriptions (redemptions/distributions) — noncontrolling interest holders — — — — — (18 ) (18 ) 482 Net consolidations (deconsolidations) of sponsored investment funds — — — — — 14 14 (295 ) Other comprehensive income (loss) — — 284 — 284 — 284 — Adoption of new accounting pronouncement 3 (1 ) — — 2 — 2 — December 31, 2017 $ 19,258 $ 16,939 $ (432 ) $ (3,967 ) $ 31,798 $ 50 $ 31,848 $ 416 Net income — 4,305 — — 4,305 — 4,305 (3 ) Dividends declared ($12.02 per share) — (1,968 ) — — (1,968 ) — (1,968 ) — Stock-based compensation 564 — — — 564 — 564 — PNC preferred stock capital contribution 58 — — — 58 — 58 — Retirement of preferred stock (58 ) — — — (58 ) — (58 ) — Issuance of common shares related to employee stock transactions (652 ) — — 667 15 — 15 — Employee tax withholdings related to employee stock transactions — — — (427 ) (427 ) — (427 ) — Shares repurchased — — — (1,660 ) (1,660 ) — (1,660 ) — Subscriptions (redemptions/distributions) — noncontrolling interest holders — — — — — 9 9 1,254 Net consolidations (deconsolidations) of sponsored investment funds — — — — — — — (560 ) Other comprehensive income (loss) — — (253 ) — (253 ) — (253 ) — Adoption of new accounting pronouncement — 6 (6 ) — — — — — December 31, 2018 $ 19,170 $ 19,282 $ (691 ) $ (5,387 ) $ 32,374 $ 59 $ 32,433 $ 1,107 Net income — 4,476 — — 4,476 7 4,483 43 Dividends declared ($13.20 per share) — (2,096 ) — — (2,096 ) — (2,096 ) — Stock-based compensation 567 — — — 567 — 567 — PNC preferred stock capital contribution 60 — — — 60 — 60 — Retirement of preferred stock (60 ) — — — (60 ) — (60 ) — Issuance of common shares related to employee stock transactions (549 ) — — 566 17 — 17 — Employee tax withholdings related to employee stock transactions — — — (245 ) (245 ) — (245 ) — Shares repurchased — — — (1,666 ) (1,666 ) — (1,666 ) — Subscriptions (redemptions/distributions) — noncontrolling interest holders — — — — — 2 2 1,456 Net consolidations (deconsolidations) of sponsored investment funds — — — — — (2 ) (2 ) (1,290 ) Other comprehensive income (loss) — — 120 — 120 — 120 — December 31, 2019 $ 19,188 $ 21,662 $ (571 ) $ (6,732 ) $ 33,547 $ 66 $ 33,613 $ 1,316 (1) Amounts include $2 million of common stock at December 31, 2019, 2018, 2017 and 2016. See accompanying notes to consolidated financial statements. F-7

BlackRock, Inc. Consolidated Statements of Cash Flows (in millions) 2019 2018 2017 Operating activities Net income $ 4,526 $ 4,302 $ 4,989 Adjustments to reconcile net income to net cash provided by/(used in) operating activities: Depreciation and amortization 405 220 240 Stock-based compensation 567 564 542 Deferred income tax expense (benefit) 17 (226 ) (1,221 ) Contingent consideration fair value adjustments 53 65 8 Other gains (30 ) (50 ) — Net (gains) losses within consolidated sponsored investment products (254 ) 149 (218 ) Net (purchases) proceeds within consolidated sponsored investment products (1,746 ) (1,938 ) (570 ) (Earnings) losses from equity method investees (116 ) (94 ) (122 ) Distributions of earnings from equity method investees 70 30 35 Changes in operating assets and liabilities: Accounts receivable (433 ) 4 (521 ) Investments, trading (21 ) 179 146 Other assets 141 (223 ) (173 ) Accrued compensation and benefits 58 (230 ) 276 Accounts payable and accrued liabilities (111 ) 43 308 Other liabilities (242 ) 280 231 Net cash provided by/(used in) operating activities 2,884 3,075 3,950 Investing activities Purchases of investments (693 ) (327 ) (489 ) Proceeds from sales and maturities of investments 417 449 166 Distributions of capital from equity method investees 136 24 32 Net consolidations (deconsolidations) of sponsored investment funds (110 ) (51 ) (60 ) Acquisitions, net of cash acquired (1,510 ) (699 ) (102 ) Purchases of property and equipment (254 ) (204 ) (155 ) Net cash provided by/(used in) investing activities (2,014 ) (808 ) (608 ) Financing activities Proceeds from long-term borrowings 992 — 697 Repayments of long-term borrowings (1,000 ) — (700 ) Cash dividends paid (2,096 ) (1,968 ) (1,662 ) Repurchases of common stock (1,911 ) (2,087 ) (1,421 ) Net proceeds from (repayments of) borrowings by consolidated sponsored investment products 111 40 — Net (redemptions/distributions paid)/subscriptions received from noncontrolling interest holders 1,458 1,263 464 Other financing activities (137 ) (13 ) (8 ) Net cash provided by/(used in) financing activities (2,583 ) (2,765 ) (2,630 ) Effect of exchange rate changes on cash, cash equivalents and restricted cash 54 (93 ) 192 Net increase (decrease) in cash, cash equivalents and restricted cash (1,659 ) (591 ) 904 Cash, cash equivalents and restricted cash, beginning of year 6,505 7,096 6,192 Cash, cash equivalents and restricted cash, end of year $ 4,846 $ 6,505 $ 7,096 Supplemental disclosure of cash flow information: Cash paid for: Interest $ 193 $ 177 $ 205 Income taxes (net of refunds) $ 1,168 $ 1,159 $ 1,124 Supplemental schedule of noncash investing and financing transactions: Issuance of common stock $ 549 $ 652 $ 626 PNC preferred stock capital contribution $ 60 $ 58 $ 193 Increase (decrease) in noncontrolling interests due to net consolidation (deconsolidation) of sponsored investment funds $ (1,292 ) $ (560 ) $ (281 ) See accompanying notes to consolidated financial statements. F-8

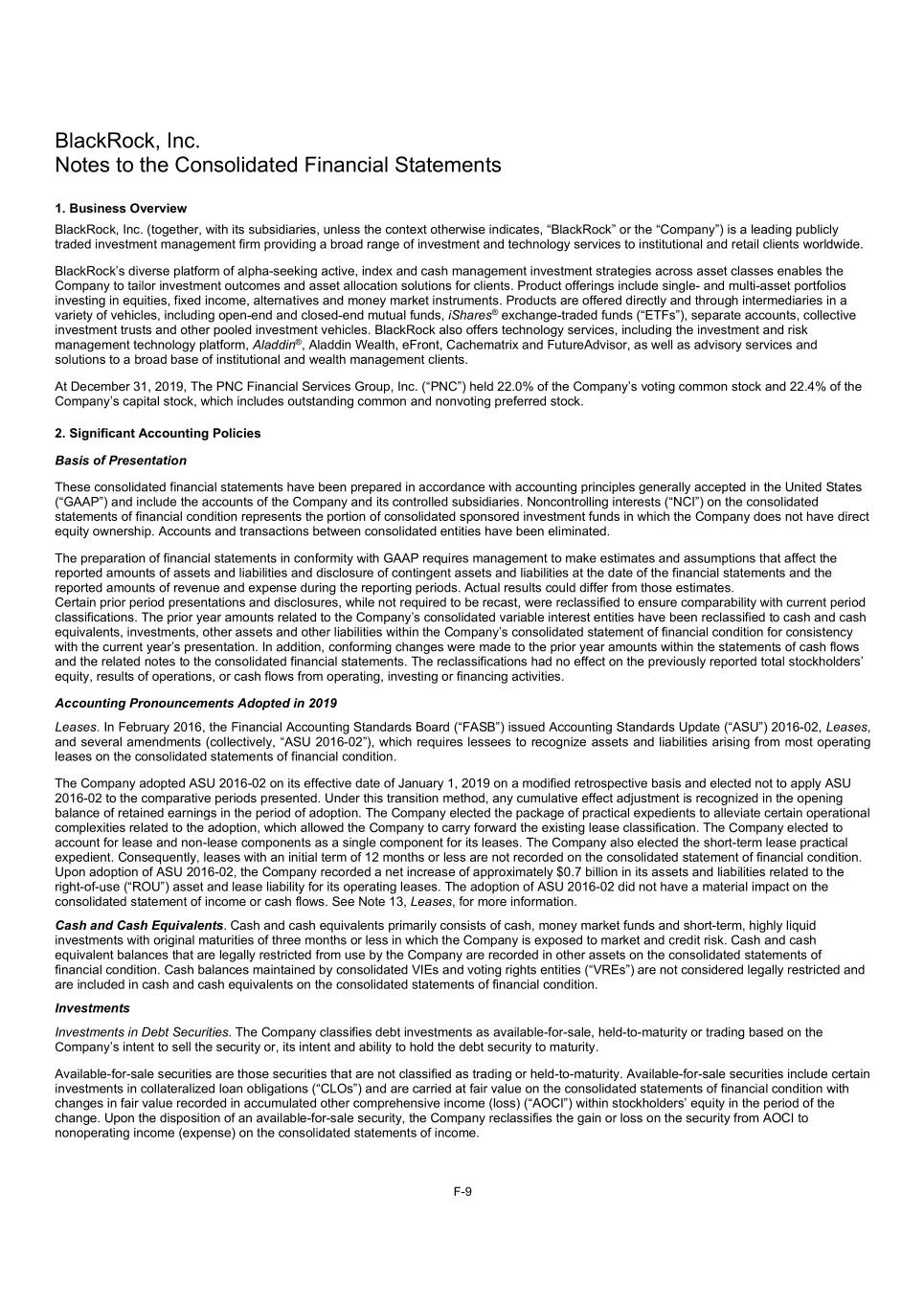

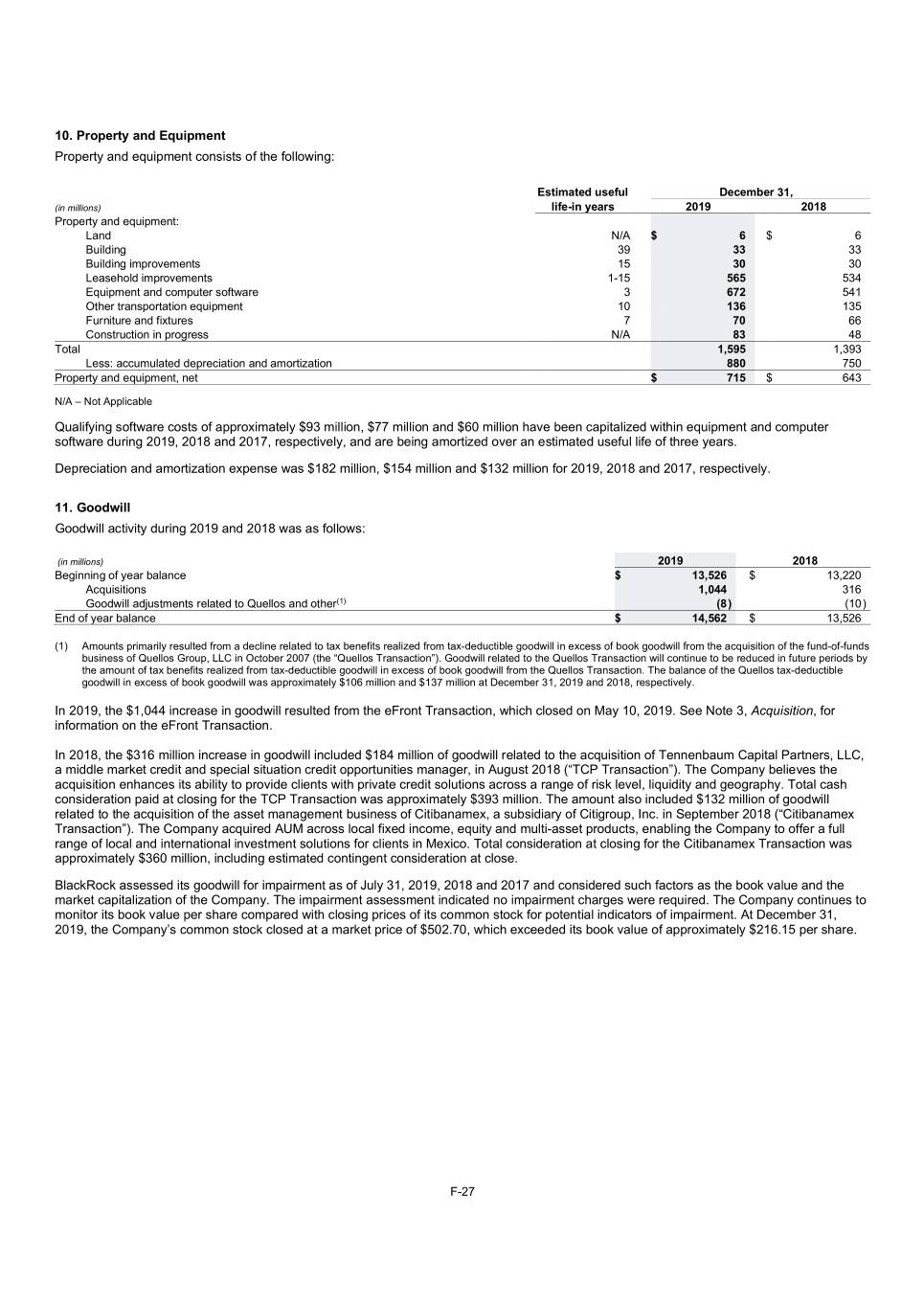

BlackRock, Inc. Notes to the Consolidated Financial Statements 1. Business Overview BlackRock, Inc. (together, with its subsidiaries, unless the context otherwise indicates, “BlackRock” or the “Company”) is a leading publicly traded investment management firm providing a broad range of investment and technology services to institutional and retail clients worldwide. BlackRock’s diverse platform of alpha-seeking active, index and cash management investment strategies across asset classes enables the Company to tailor investment outcomes and asset allocation solutions for clients. Product offerings include single- and multi-asset portfolios investing in equities, fixed income, alternatives and money market instruments. Products are offered directly and through intermediaries in a variety of vehicles, including open-end and closed-end mutual funds, iShares® exchange-traded funds (“ETFs”), separate accounts, collective investment trusts and other pooled investment vehicles. BlackRock also offers technology services, including the investment and risk management technology platform, Aladdin®, Aladdin Wealth, eFront, Cachematrix and FutureAdvisor, as well as advisory services and solutions to a broad base of institutional and wealth management clients. At December 31, 2019, The PNC Financial Services Group, Inc. (“PNC”) held 22.0% of the Company’s voting common stock and 22.4% of the Company’s capital stock, which includes outstanding common and nonvoting preferred stock. 2. Significant Accounting Policies Basis of Presentation These consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and include the accounts of the Company and its controlled subsidiaries. Noncontrolling interests (“NCI”) on the consolidated statements of financial condition represents the portion of consolidated sponsored investment funds in which the Company does not have direct equity ownership. Accounts and transactions between consolidated entities have been eliminated. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expense during the reporting periods. Actual results could differ from those estimates. Certain prior period presentations and disclosures, while not required to be recast, were reclassified to ensure comparability with current period classifications. The prior year amounts related to the Company’s consolidated variable interest entities have been reclassified to cash and cash equivalents, investments, other assets and other liabilities within the Company’s consolidated statement of financial condition for consistency with the current year’s presentation. In addition, conforming changes were made to the prior year amounts within the statements of cash flows and the related notes to the consolidated financial statements. The reclassifications had no effect on the previously reported total stockholders’ equity, results of operations, or cash flows from operating, investing or financing activities. Accounting Pronouncements Adopted in 2019 Leases. In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-02, Leases, and several amendments (collectively, “ASU 2016-02”), which requires lessees to recognize assets and liabilities arising from most operating leases on the consolidated statements of financial condition. The Company adopted ASU 2016-02 on its effective date of January 1, 2019 on a modified retrospective basis and elected not to apply ASU 2016-02 to the comparative periods presented. Under this transition method, any cumulative effect adjustment is recognized in the opening balance of retained earnings in the period of adoption. The Company elected the package of practical expedients to alleviate certain operational complexities related to the adoption, which allowed the Company to carry forward the existing lease classification. The Company elected to account for lease and non-lease components as a single component for its leases. The Company also elected the short-term lease practical expedient. Consequently, leases with an initial term of 12 months or less are not recorded on the consolidated statement of financial condition. Upon adoption of ASU 2016-02, the Company recorded a net increase of approximately $0.7 billion in its assets and liabilities related to the right-of-use (“ROU”) asset and lease liability for its operating leases. The adoption of ASU 2016-02 did not have a material impact on the consolidated statement of income or cash flows. See Note 13, Leases, for more information. Cash and Cash Equivalents. Cash and cash equivalents primarily consists of cash, money market funds and short-term, highly liquid investments with original maturities of three months or less in which the Company is exposed to market and credit risk. Cash and cash equivalent balances that are legally restricted from use by the Company are recorded in other assets on the consolidated statements of financial condition. Cash balances maintained by consolidated VIEs and voting rights entities (“VREs”) are not considered legally restricted and are included in cash and cash equivalents on the consolidated statements of financial condition. Investments Investments in Debt Securities. The Company classifies debt investments as available-for-sale, held-to-maturity or trading based on the Company’s intent to sell the security or, its intent and ability to hold the debt security to maturity. Available-for-sale securities are those securities that are not classified as trading or held-to-maturity. Available-for-sale securities include certain investments in collateralized loan obligations (“CLOs”) and are carried at fair value on the consolidated statements of financial condition with changes in fair value recorded in accumulated other comprehensive income (loss) (“AOCI”) within stockholders’ equity in the period of the change. Upon the disposition of an available-for-sale security, the Company reclassifies the gain or loss on the security from AOCI to nonoperating income (expense) on the consolidated statements of income. F-9

Held-to-maturity securities are purchased with the positive intent and ability to be held to maturity and are recorded at amortized cost on the consolidated statements of financial condition. Trading securities are those investments that are purchased principally for the purpose of selling them in the near term. Trading securities are carried at fair value on the consolidated statements of financial condition with changes in fair value recorded in nonoperating income (expense) on the consolidated statements of income. Trading securities include certain investments in CLOs for which the fair value option is elected in order to reduce operational complexity of bifurcating embedded derivatives. Investments in Equity Securities. Equity securities are generally carried at fair value on the consolidated statements of financial condition with changes in the fair value recorded through net income (“FVTNI”) within nonoperating income (expense). For nonmarketable equity securities, the Company generally elects to apply the practicality exception to fair value measurement, under which such securities will be measured at cost, less impairment, plus or minus observable price changes for identical or similar securities of the same issuer with such changes recorded in the consolidated statements of income. Dividends received are recorded as dividend income within nonoperating income (expense). Equity Method. The Company applies the equity method of accounting for equity investments where the Company does not consolidate the investee, but can exert significant influence over the financial and operating policies of the investee. The Company’s share of the investee’s underlying net income or loss is recorded as net gain (loss) on investments within nonoperating income (expense) and as other revenue for certain corporate minority investments since such investees are considered to be an extension of the Company’s core business. The Company’s share of net income of the investee is recorded based upon the most current information available at the time, which may precede the date of the consolidated statement of financial condition. Distributions received reduce the Company’s carrying value of the investee and the cost basis if deemed to be a return of capital. Impairments of Investments. Management periodically assesses equity method, available-for-sale and held-to-maturity investments for other- than-temporary impairment (“OTTI”). If an OTTI exists, an impairment charge would be recorded for the excess of the carrying amount of the investment over its estimated fair value in the consolidated statements of income. For equity method investments and held-to-maturity investments, if circumstances indicate that an OTTI may exist, the investments are evaluated using market values, where available, or the expected future cash flows of the investment. For the Company’s investments in CLOs, the Company reviews cash flow estimates over the life of each CLO investment. On a quarterly basis, if the present value of the estimated future cash flows is lower than the carrying value of the investment and there is an adverse change in estimated cash flows, an impairment is considered to be other-than-temporary. In addition, for nonmarketable equity securities that are accounted for under the measurement alternative to fair value, the Company applies the impairment model that does not require the Company to consider whether the impairment is other-than-temporary. Consolidation. The Company performs an analysis for investment products to determine if the product is a VIE or a VRE. Assessing whether an entity is a VIE or a VRE involves judgment and analysis. Factors considered in this assessment include the entity’s legal organization, the entity’s capital structure and equity ownership, and any related party or de facto agent implications of the Company’s involvement with the entity. Investments that are determined to be VIEs are consolidated if the Company is the primary beneficiary (“PB”) of the entity. VREs are typically consolidated if the Company holds the majority voting interest. Upon the occurrence of certain events (such as contributions and redemptions, either by the Company, or third parties, or amendments to the governing documents of the Company’s investment products), management reviews and reconsiders its previous conclusion regarding the status of an entity as a VIE or a VRE. Additionally, management continually reconsiders whether the Company is deemed to be a VIE’s PB that consolidates such entity. Consolidation of Variable Interest Entities. Certain investment products for which a controlling financial interest is achieved through arrangements that do not involve or are not directly linked to voting interests are deemed VIEs. BlackRock reviews factors, including whether or not i) the entity has equity at risk that is sufficient to permit the entity to finance its activities without additional subordinated support from other parties and ii) the equity holders at risk have the obligation to absorb losses, the right to receive residual returns, and the right to direct the activities of the entity that most significantly impact the entity’s economic performance, to determine if the investment product is a VIE. BlackRock re-evaluates such factors as facts and circumstances change. The PB of a VIE is defined as the variable interest holder that has a controlling financial interest in the VIE. A controlling financial interest is defined as (i) the power to direct the activities of the VIE that most significantly impact its economic performance and (ii) the obligation to absorb losses of the entity or the right to receive benefits from the entity that potentially could be significant to the VIE. The Company generally consolidates VIEs in which it holds an economic interest of 10% or greater and deconsolidates such VIEs once equity ownership falls below 10%. Consolidation of Voting Rights Entities. BlackRock is required to consolidate an investee to the extent that BlackRock can exert control over the financial and operating policies of the investee, which generally exists if there is a greater than 50% voting equity interest. Retention of Specialized Investment Company Accounting Principles. Upon consolidation of sponsored investment funds, the Company retains the specialized investment company accounting principles of the underlying funds. All of the underlying investments held by such consolidated sponsored investment funds are carried at fair value with corresponding changes in the investments’ fair values reflected in nonoperating income (expense) on the consolidated statements of income. When the Company no longer controls these funds due to reduced ownership percentage or other reasons, the funds are deconsolidated and accounted for as an equity method investment or equity securities FVTNI if the Company still maintains an investment. F-10

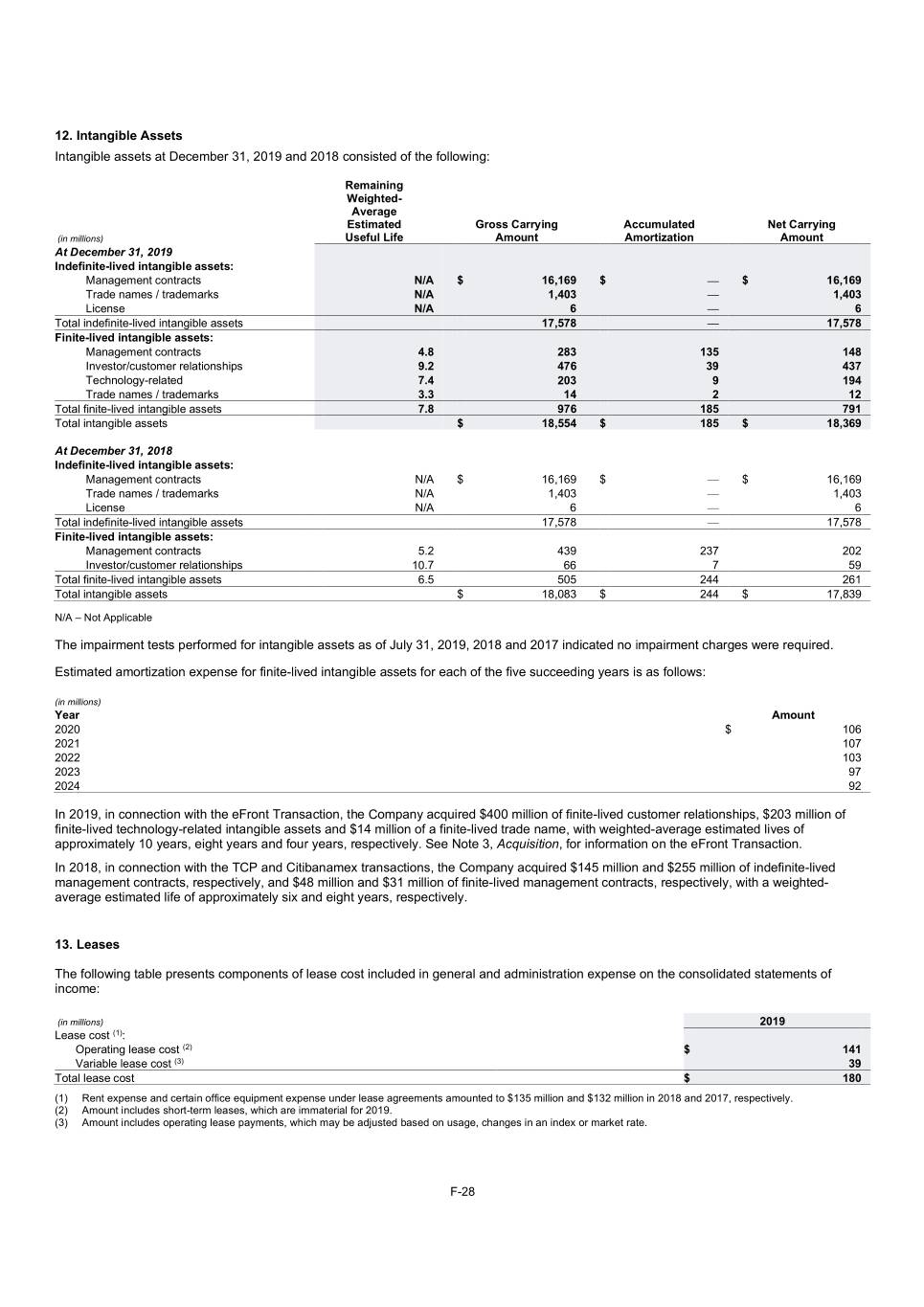

Separate Account Assets and Liabilities. Separate account assets are maintained by BlackRock Life Limited, a wholly owned subsidiary of the Company, which is a registered life insurance company in the United Kingdom, and represent segregated assets held for purposes of funding individual and group pension contracts. The life insurance company does not underwrite any insurance contracts that involve any insurance risk transfer from the insured to the life insurance company. The separate account assets primarily include equity securities, debt securities, money market funds and derivatives. The separate account assets are not subject to general claims of the creditors of BlackRock. These separate account assets and the related equal and offsetting liabilities are recorded as separate account assets and separate account liabilities on the consolidated statements of financial condition. The net investment income attributable to separate account assets supporting individual and group pension contracts accrues directly to the contract owner and is not reported on the consolidated statements of income. While BlackRock has no economic interest in these separate account assets and liabilities, BlackRock earns policy administration and management fees associated with these products, which are included in investment advisory, administration fees and securities lending revenue on the consolidated statements of income. Separate Account Collateral Assets Held and Liabilities Under Securities Lending Agreements. The Company facilitates securities lending arrangements whereby securities held by separate accounts maintained by BlackRock Life Limited are lent to third parties under global master securities lending agreements. In exchange, the Company receives legal title to the collateral with minimum values generally ranging from approximately 102% to 112% of the value of the securities lent in order to reduce counterparty risk. The required collateral value is calculated on a daily basis. The global master securities lending agreements provide the Company the right to request additional collateral or, in the event of borrower default, the right to liquidate collateral. The securities lending transactions entered into by the Company are accompanied by an agreement that entitles the Company to request the borrower to return the securities at any time; therefore, these transactions are not reported as sales. The Company records on the consolidated statements of financial condition the cash and noncash collateral received under these BlackRock Life Limited securities lending arrangements as its own asset in addition to an equal and offsetting collateral liability for the obligation to return the collateral. The securities lending revenue earned from lending securities held by the separate accounts is included in investment advisory, administration fees and securities lending revenue on the consolidated statements of income. During 2019 and 2018, the Company had not resold or repledged any of the collateral received under these arrangements. At December 31, 2019 and 2018, the fair value of loaned securities held by separate accounts was approximately $14.4 billion and $18.9 billion, respectively, and the fair value of the collateral held under these securities lending agreements was approximately $15.5 billion and $20.7 billion, respectively. Property and Equipment. Property and equipment are recorded at cost less accumulated depreciation. Depreciation is generally determined by cost less any estimated residual value using the straight-line method over the estimated useful lives of the various classes of property and equipment. Leasehold improvements are amortized using the straight-line method over the shorter of the estimated useful life or the remaining lease term. The Company capitalizes certain costs incurred in connection with developing or obtaining software within property and equipment. Capitalized software costs are amortized, beginning when the software product is ready for its intended use, over the estimated useful life of the software of approximately three years. Goodwill and Intangible Assets. Goodwill represents the cost of a business acquisition in excess of the fair value of the net assets acquired. The Company has determined that it has one reporting unit for goodwill impairment testing purposes, the consolidated BlackRock single operating segment, which is consistent with internal management reporting and management's oversight of operations. In its assessment of goodwill for impairment, the Company considers such factors as the book value and market capitalization of the Company. On a quarterly basis, the Company considers if triggering events have occurred that may indicate a potential goodwill impairment. If a triggering event has occurred, the Company performs assessments, which may include reviews of significant valuation assumptions, to determine if goodwill may be impaired. The Company performs an impairment assessment of its goodwill at least annually, as of July 31st. Intangible assets are comprised of indefinite-lived intangible assets and finite-lived intangible assets acquired in a business acquisition. The value of contracts to manage assets in proprietary open-end funds and collective trust funds and certain other commingled products without a specified termination date is generally classified as indefinite-lived intangible assets. The assignment of indefinite lives to such contracts primarily is based upon the following: (i) the assumption that there is no foreseeable limit on the contract period to manage these products; (ii) the Company expects to, and has the ability to, continue to operate these products indefinitely; (iii) the products have multiple investors and are not reliant on a single investor or small group of investors for their continued operation; (iv) current competitive factors and economic conditions do not indicate a finite life; and (v) there is a high likelihood of continued renewal based on historical experience. In addition, trade names/trademarks are considered indefinite-lived intangible assets when they are expected to generate cash flows indefinitely. Indefinite-lived intangible assets and goodwill are not amortized. Finite-lived management contracts, which relate to acquired separate accounts and funds and investor/customer relationships, and technology-related assets that are expected to contribute to the future cash flows of the Company for a specified period of time, are amortized over their remaining useful lives. The Company performs assessments to determine if any intangible assets are potentially impaired and whether the indefinite-lived and finite- lived classifications are still appropriate at least annually, as of July 31st. The carrying value of finite-lived assets and their remaining useful lives are reviewed at least annually to determine if circumstances exist which may indicate a potential impairment or revisions to the amortization period. F-11

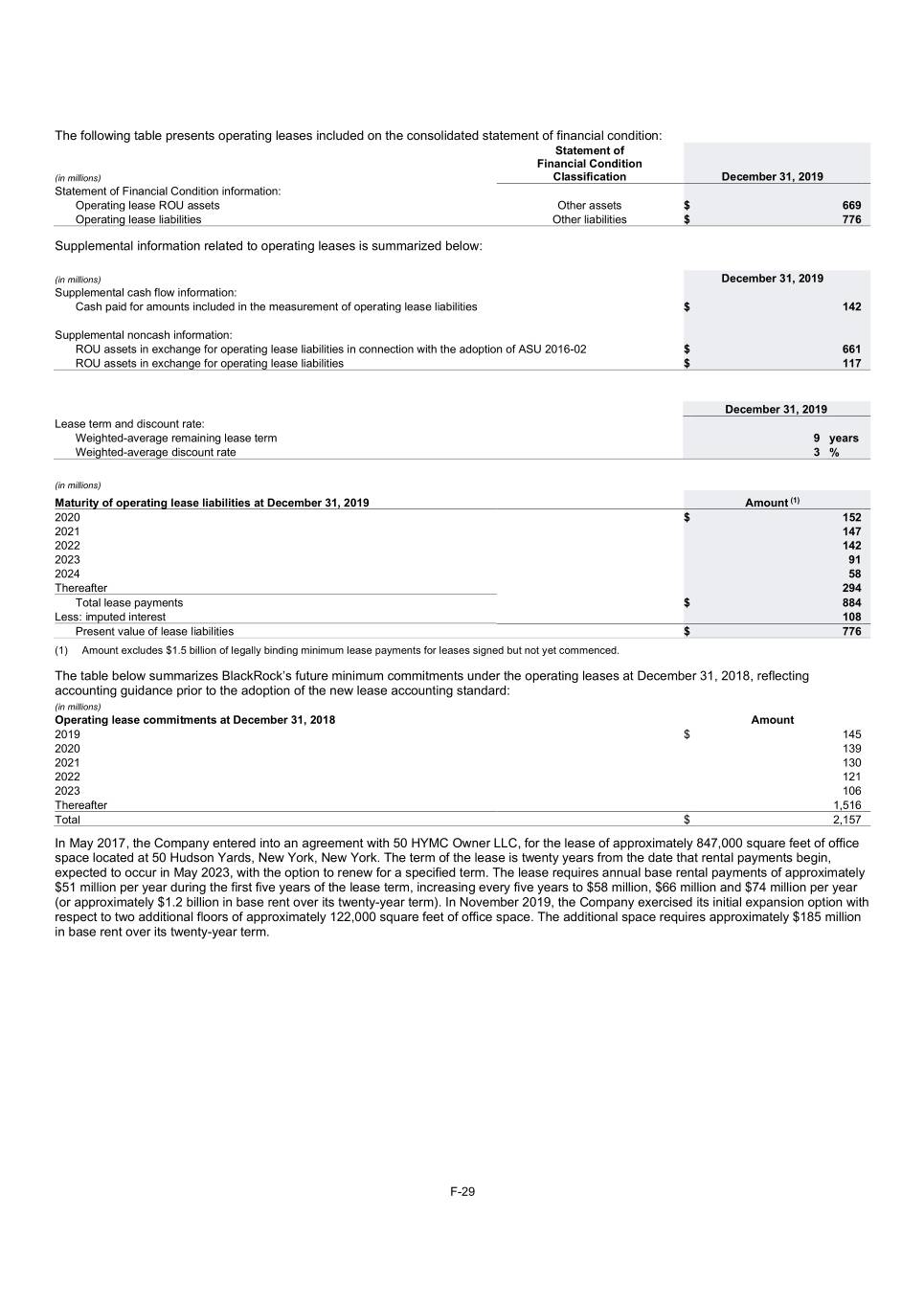

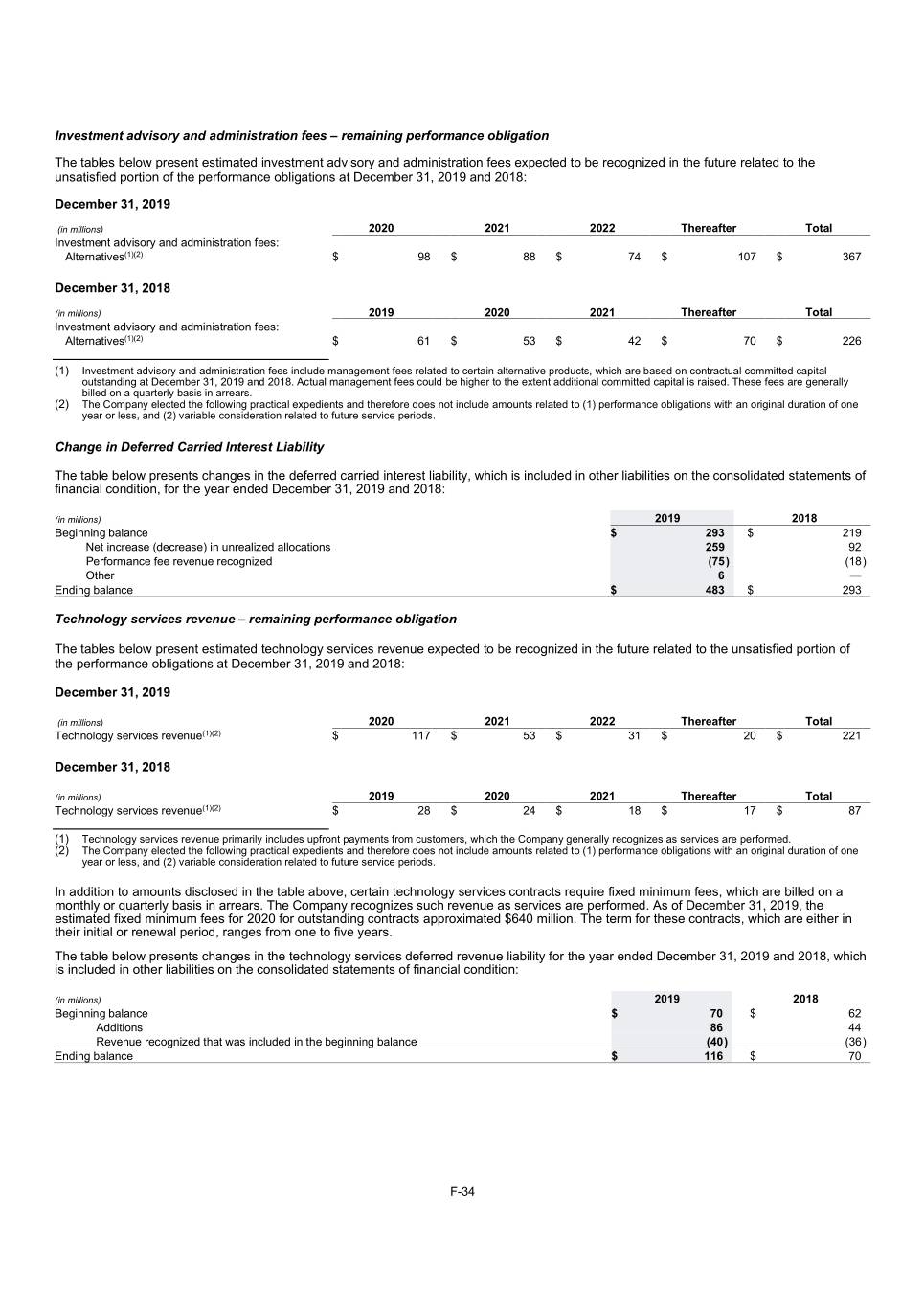

In evaluating whether it is more likely than not that the fair value of indefinite-lived intangibles is less than its carrying value, BlackRock assesses various significant qualitative factors, including assets under management (“AUM”), revenue basis points, projected AUM growth rates, operating margins, tax rates and discount rates. In addition, the Company considers other factors, including (i) macroeconomic conditions such as a deterioration in general economic conditions, limitations on accessing capital, fluctuations in foreign exchange rates, or other developments in equity and credit markets; (ii) industry and market considerations such as a deterioration in the environment in which the entity operates, an increased competitive environment, a decline in market-dependent multiples or metrics, a change in the market for an entity’s services, or regulatory, legal or political developments; and (iii) entity-specific events, such as a change in management or key personnel, overall financial performance and litigation that could affect significant inputs used to determine the fair value of the indefinite-lived intangible asset. If an indefinite-lived intangible is determined to be more likely than not impaired, then the fair value of the asset is compared with its carrying value and any excess of the carrying value over the fair value would be recognized as an expense in the period in which the impairment occurs. For finite-lived intangible assets, if potential impairment circumstances are considered to exist, the Company will perform a recoverability test using an undiscounted cash flow analysis. Actual results could differ from these cash flow estimates, which could materially impact the impairment conclusion. If the carrying value of the asset is determined not to be recoverable based on the undiscounted cash flow test, the difference between the carrying value of the asset and its current fair value would be recognized as an expense in the period in which the impairment occurs. Noncontrolling Interests. The Company reports noncontrolling interests as equity, separate from the parent’s equity, on the consolidated statements of financial condition. In addition, the Company’s consolidated net income on the consolidated statements of income includes the income (loss) attributable to noncontrolling interest holders of the Company’s consolidated sponsored investment products. Income (loss) attributable to noncontrolling interests is not adjusted for income taxes for consolidated sponsored investment products that are treated as pass-through entities for tax purposes. Classification and Measurement of Redeemable Securities. The Company includes redeemable noncontrolling interests related to certain consolidated sponsored investment products in temporary equity on the consolidated statements of financial condition. Treasury Stock. The Company records common stock purchased for treasury at cost. At the date of subsequent reissuance, the treasury stock account is reduced by the cost of such stock using the average cost method. Revenue Recognition. Revenue is recognized upon transfer of control of promised services to customers in an amount to which the Company expects to be entitled in exchange for those services. The Company enters into contracts that can include multiple services, which are accounted for separately if they are determined to be distinct. Consideration for the Company’s services is generally in the form of variable consideration because the amount of fees is subject to market conditions that are outside of the Company’s influence. The Company includes variable consideration in revenue when it is no longer probable of significant reversal, i.e. when the associated uncertainty is resolved. For some contracts with customers, the Company has discretion to involve a third party in providing services to the customer. Generally, the Company is deemed to be the principal in these arrangements because the Company controls the promised services before they are transferred to customers, and accordingly presents the revenue gross of related costs. Investment Advisory, Administration Fees and Securities Lending Revenue. Investment advisory and administration fees are recognized as the services are performed over time because the customer is receiving and consuming the benefits as they are provided by the Company. Fees are primarily based on agreed-upon percentages of AUM and recognized for services provided during the period, which are distinct from services provided in other periods. Such fees are affected by changes in AUM, including market appreciation or depreciation, foreign exchange translation and net inflows or outflows. Investment advisory and administration fees for investment funds are shown net of fee waivers. In addition, the Company may contract with third parties to provide sub-advisory services on its behalf. The Company presents the investment advisory fees and associated costs to such third-party advisors on a gross basis where it is deemed to be the principal and on a net basis where it is deemed to be the agent. Management judgment involved in making these assessments is focused on ascertaining whether the Company is primarily responsible for fulfilling the promised service. The Company earns revenue by lending securities on behalf of clients, primarily to highly rated banks and broker-dealers. Revenue is recognized over time as services are performed. Generally, the securities lending fees are shared between the Company and the funds or other third-party accounts managed by the Company from which the securities are borrowed. Investment Advisory Performance Fees / Carried Interest. The Company receives investment advisory performance fees, including incentive allocations (carried interest) from certain actively managed investment funds and certain separately managed accounts. These performance fees are dependent upon exceeding specified relative or absolute investment return thresholds, which may vary by product or account, and include monthly, quarterly, annual or longer measurement periods. Performance fees, including carried interest, are recognized when it is determined that they are no longer probable of significant reversal (such as upon the sale of a fund’s investment or when the amount of AUM becomes known as of the end of a specified measurement period). Given the unique nature of each fee arrangement, contracts with customers are evaluated on an individual basis to determine the timing of revenue recognition. Significant judgement is involved in making such determination. Performance fees typically arise from investment management services that began in prior reporting periods. Consequently, a portion of the fees the Company recognizes may be partially related to the services performed in prior periods that meet the recognition criteria in the current period. At each reporting date, the Company considers various factors in estimating performance fees to be recognized, including carried interest. These factors include but are not limited to whether: (1) the fees are dependent on the market and thus are highly susceptible to factors outside the Company’s influence; (2) the fees have a large number and a broad range of possible amounts; and (3) the funds or separately managed accounts have the ability to invest or reinvest their sales proceeds. F-12

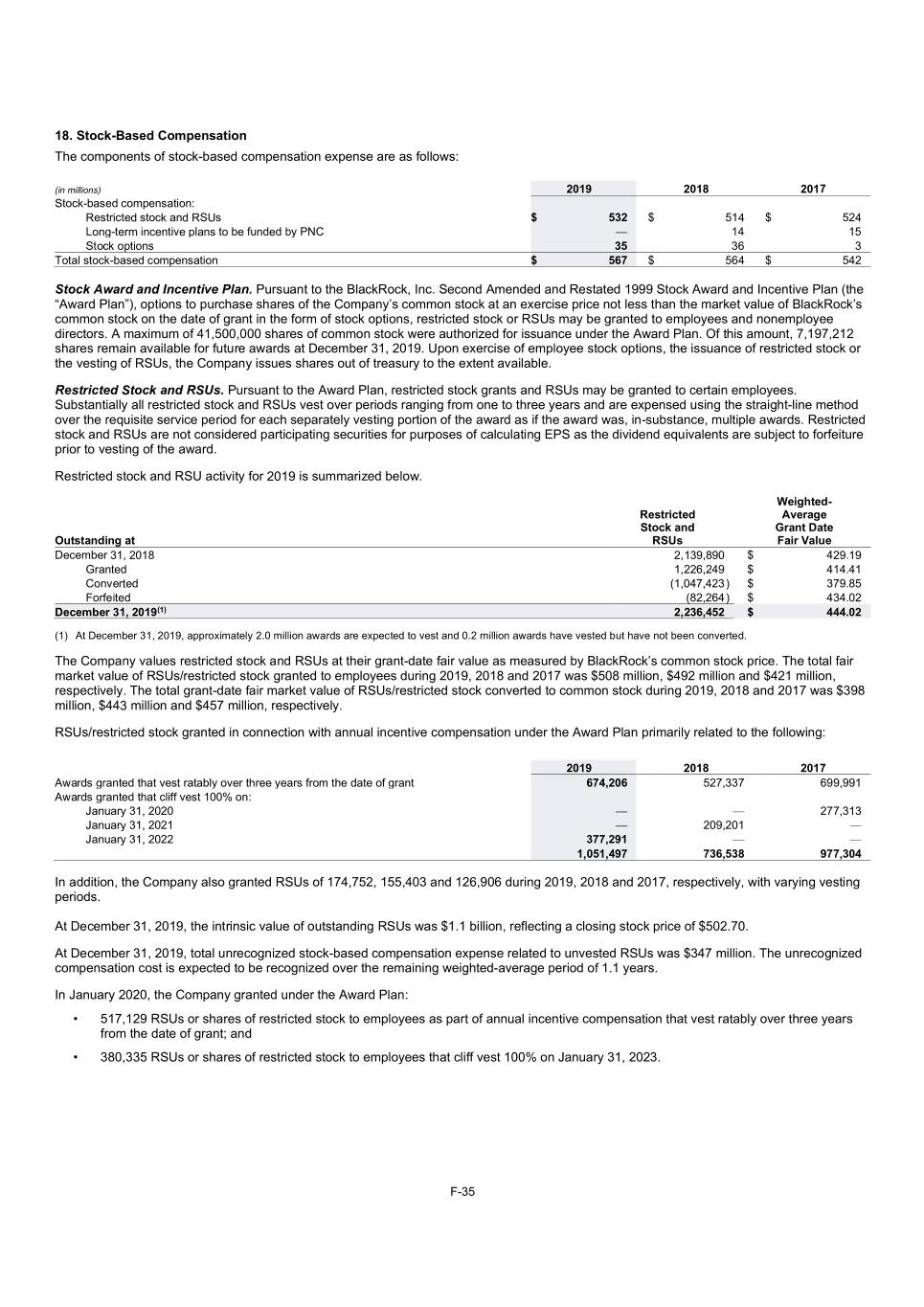

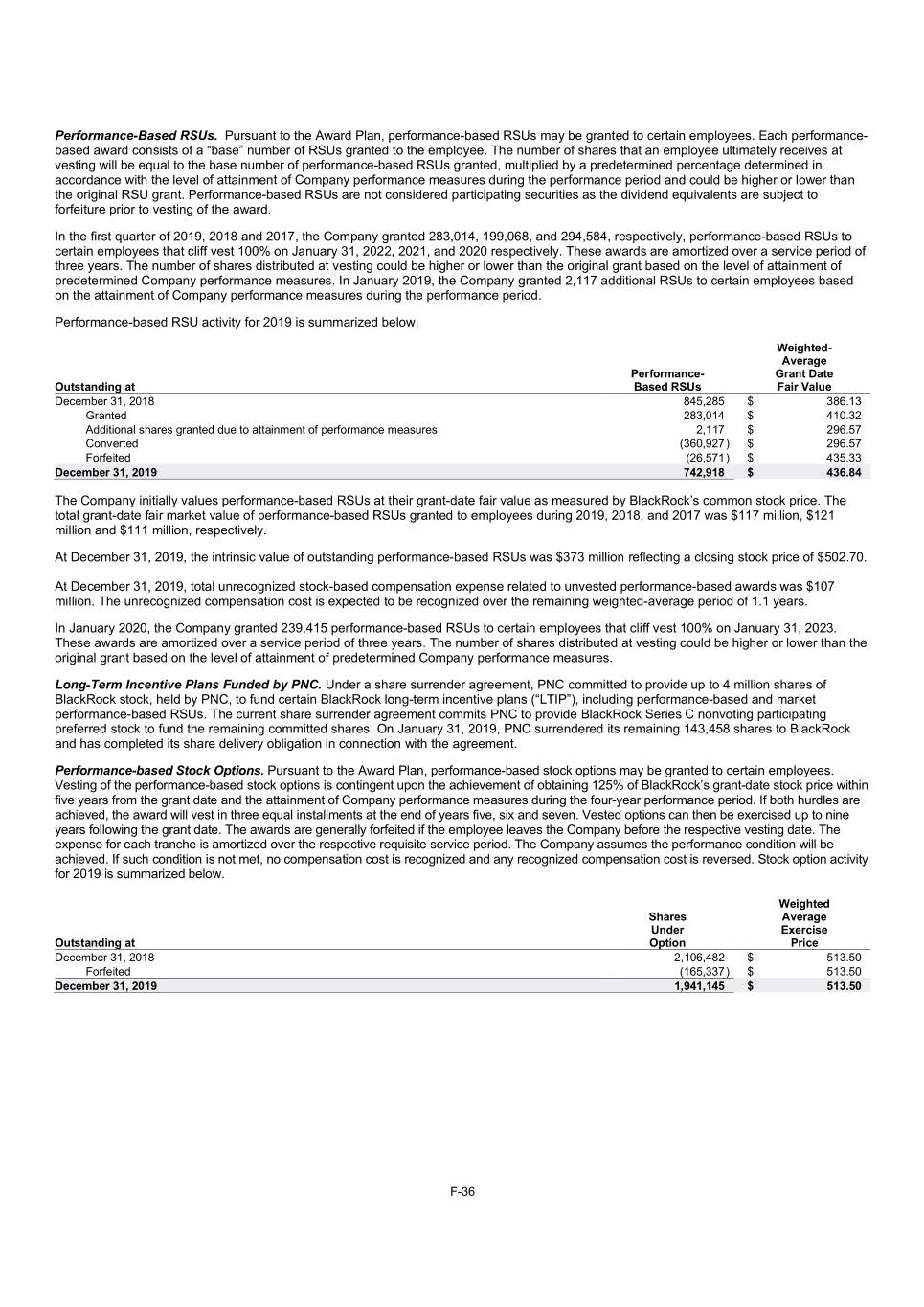

The Company is allocated carried interest from certain alternative investment products upon exceeding performance thresholds. The Company may be required to reverse/return all, or part, of such carried interest allocations/distributions depending upon future performance of these funds. Carried interest subject to such clawback provisions is recorded in investments or cash and cash equivalents to the extent that it is distributed, on its consolidated statements of financial condition. The Company records a liability for deferred carried interest to the extent it receives cash or capital allocations related to carried interest prior to meeting the revenue recognition criteria. A portion of the deferred carried interest may also be paid to certain employees. The ultimate timing of the recognition of performance fee revenue and related compensation expense, if any, for these products is unknown. Technology services revenue. The Company offers investment management technology systems, risk management services, wealth management and digital distribution tools, all on a fee basis. Clients include banks, insurance companies, official institutions, pension funds, asset managers, retail distributors and other investors. Fees earned for technology services are primarily recorded as services are performed over time and are generally determined using the value of positions on the Aladdin platform, or a fixed-rate basis. Revenue derived from the sale of software licenses is recognized upon the granting of access rights. Distribution Fees. The Company earns distribution and service fees for distributing investment products and providing ongoing shareholder support services to investment portfolios. Distribution fees are passed-through to third-party distributors, which perform various fund distribution services and shareholder servicing of certain funds on the Company’s behalf, and are recognized as distribution and servicing costs. The Company presents distribution fees and related distribution and servicing costs incurred on a gross basis. Distribution fees primarily consist of ongoing distribution fees, shareholder servicing fees and upfront sales commissions for serving as the principal underwriter and/or distributor for certain managed mutual funds. The service of distribution is satisfied at the point in time when an investor makes an investment in a share class of the managed mutual funds. Fees are generally considered variable consideration because they are based on the value of AUM and are uncertain on trade date. Accordingly, the Company recognizes distribution fees over the investment period as the amounts become known and the portion recognized in the current period may relate to distribution services performed in prior periods. Upfront sales commissions are recognized on a trade date basis. Shareholder servicing fees are based on AUM and recognized in revenue as the services are performed. Advisory and other revenue. Advisory and other revenue primarily includes fees earned for advisory services, fees earned for transition management services primarily comprised of commissions recognized in connection with buying and selling securities on behalf of customers, and equity method investment earnings related to certain corporate minority investments. Advisory services fees are determined using fixed-rate fees and are recognized over time as the related services are completed. Commissions related to transition management services are recorded on a trade-date basis as transactions occur. Stock-based Compensation. The Company recognizes compensation cost for equity classified awards based on the grant-date fair value of the award. The compensation cost is recognized over the period during which an employee is required to provide service (usually the vesting period) in exchange for the stock-based award. The Company measures the grant-date fair value of restricted stock units (“RSUs”) using the Company’s share price on the date of grant. For employee share options and instruments with market conditions, the Company uses pricing models. Stock option awards may have performance, market and/or service conditions. If an equity award is modified after the grant-date, incremental compensation cost is recognized for an amount equal to the excess of the fair value of the modified award over the fair value of the original award immediately before the modification. Awards under the Company’s stock-based compensation plans vest over various periods. Compensation cost is recorded by the Company on a straight-line basis over the requisite service period for each separate vesting portion of the award as if the award is, in- substance, multiple awards and is adjusted for actual forfeitures as they occur. The Company amortizes the grant-date fair value of stock-based compensation awards made to retirement-eligible employees over the requisite service period. Upon notification of retirement, the Company accelerates the unamortized portion of the award over the contractually required retirement notification period. The Company recognizes all excess tax benefits and deficiencies in income tax expense on the consolidated statements of income, which results in volatility of income tax expense as a result of fluctuations in the Company’s stock price. Accordingly, the Company recorded a discrete income tax benefit of $23 million, $64 million and $151 million during 2019, 2018 and 2017, respectively, for vested RSUs where the grant date stock price was lower than the vesting date stock price. The Company accounts for forfeitures as they occur. Distribution and Servicing Costs. Distribution and servicing costs include payments to third parties, primarily associated with distribution and servicing of client investments in certain BlackRock products. Distribution and servicing costs are expensed when incurred. Direct Fund Expense. Direct fund expense, which is expensed as incurred, primarily consists of third-party nonadvisory expense incurred by BlackRock related to certain funds for the use of certain index trademarks, reference data for certain indices, custodial services, fund administration, fund accounting, transfer agent services, shareholder reporting services, audit and tax services as well as other fund-related expense directly attributable to the nonadvisory operations of the fund. Leases. The Company determines if a contract is a lease or contains a lease at inception. The Company accounts for its office facility leases as operating leases, which may include escalation clauses that are based on an index or market rate. The Company accounts for lease and non- lease components as a single component for its leases. The Company elected the short-term lease exception for leases with an initial term of 12 months or less. Consequently, such leases are not recorded on the consolidated statement of financial condition. The Company’s lease terms include options to extend or terminate the lease when it is reasonably certain they will be exercised or not, respectively. F-13

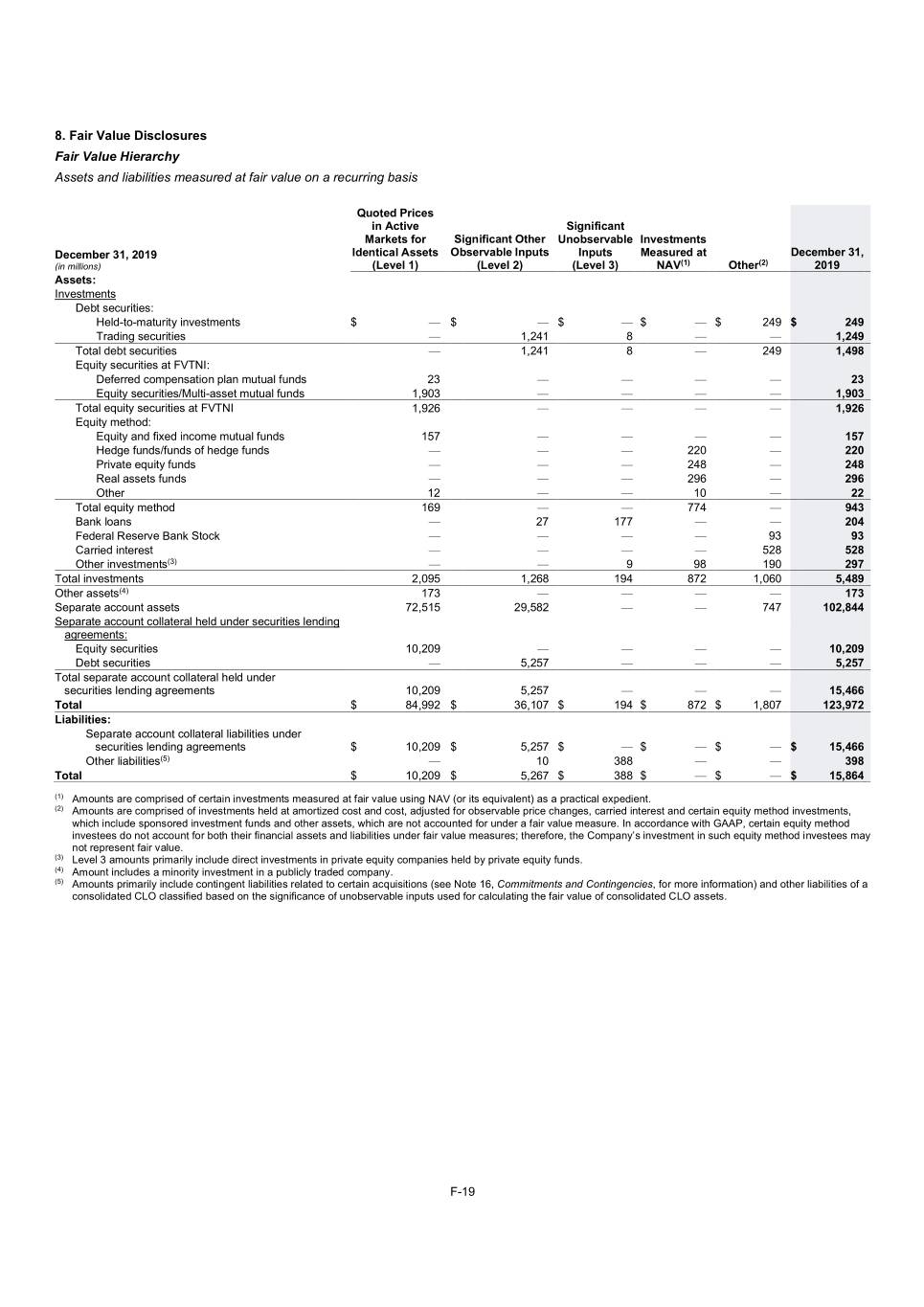

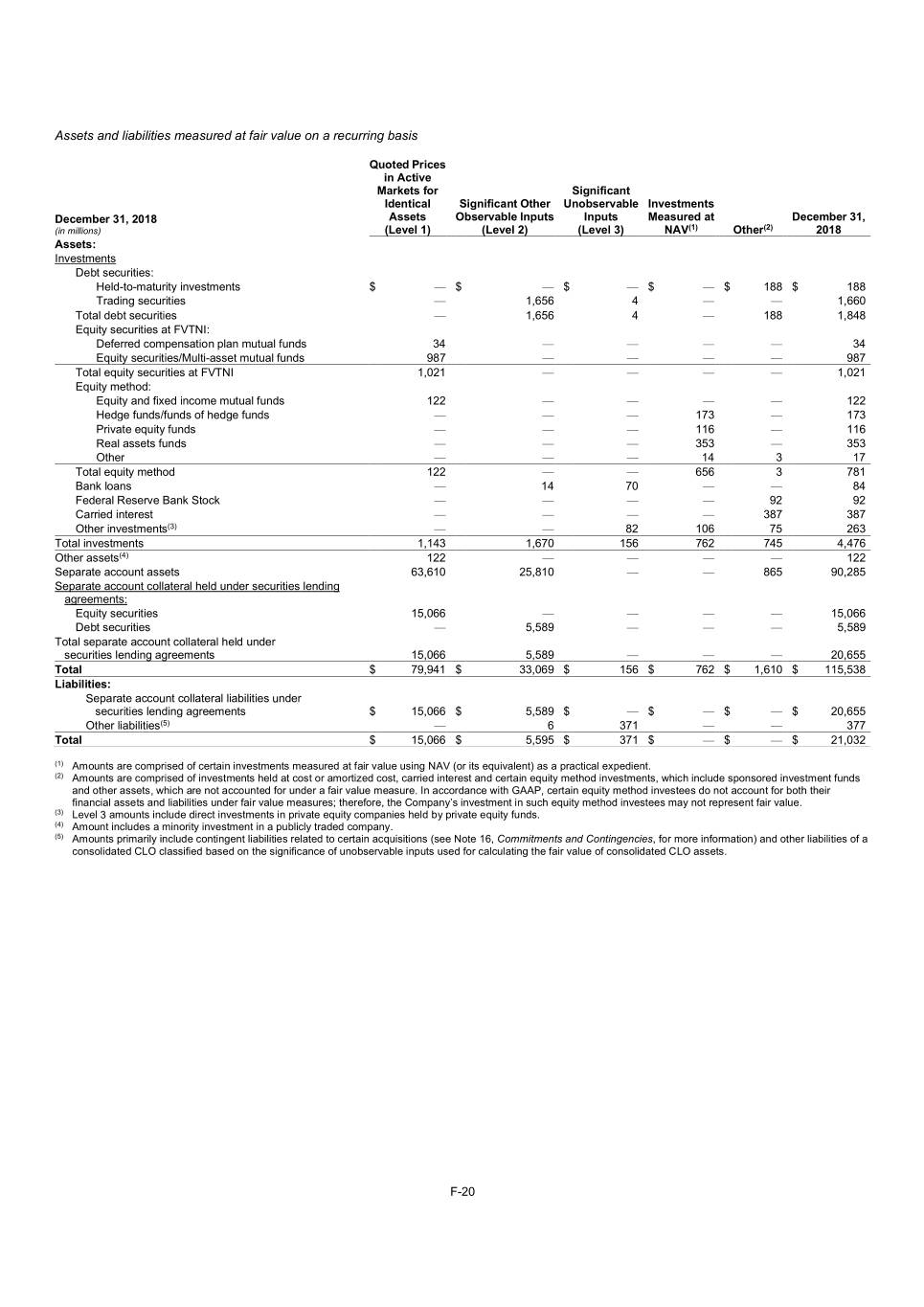

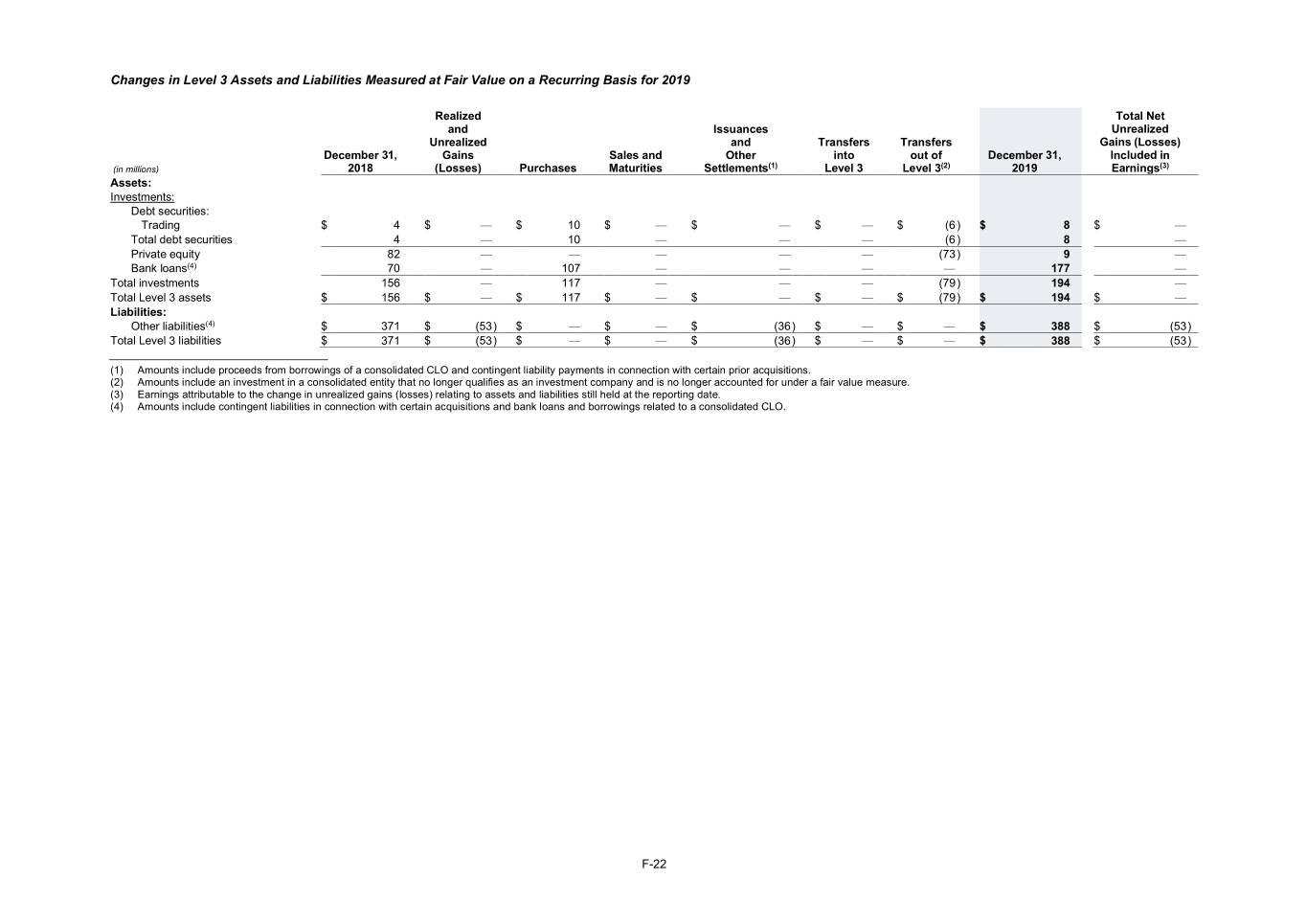

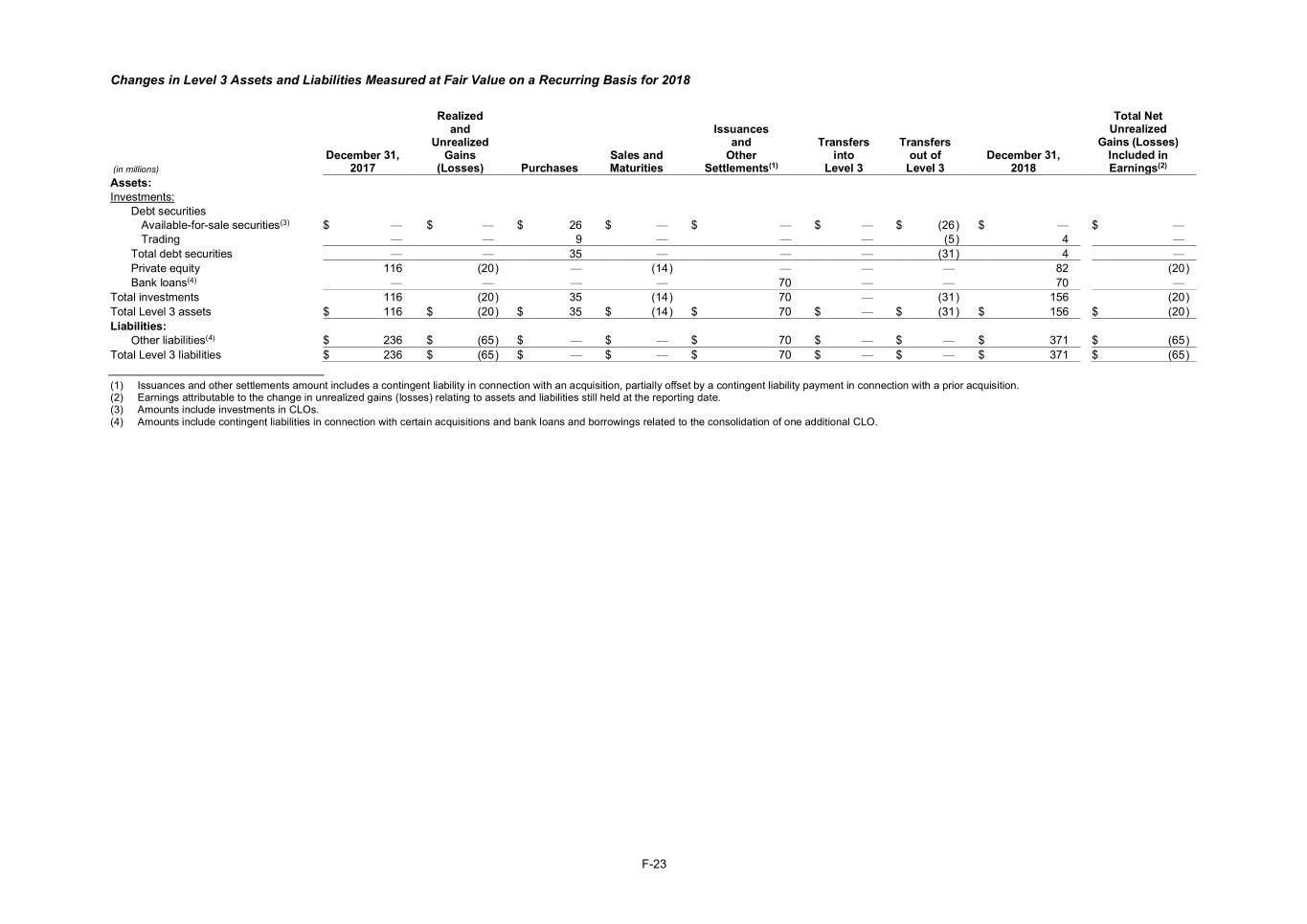

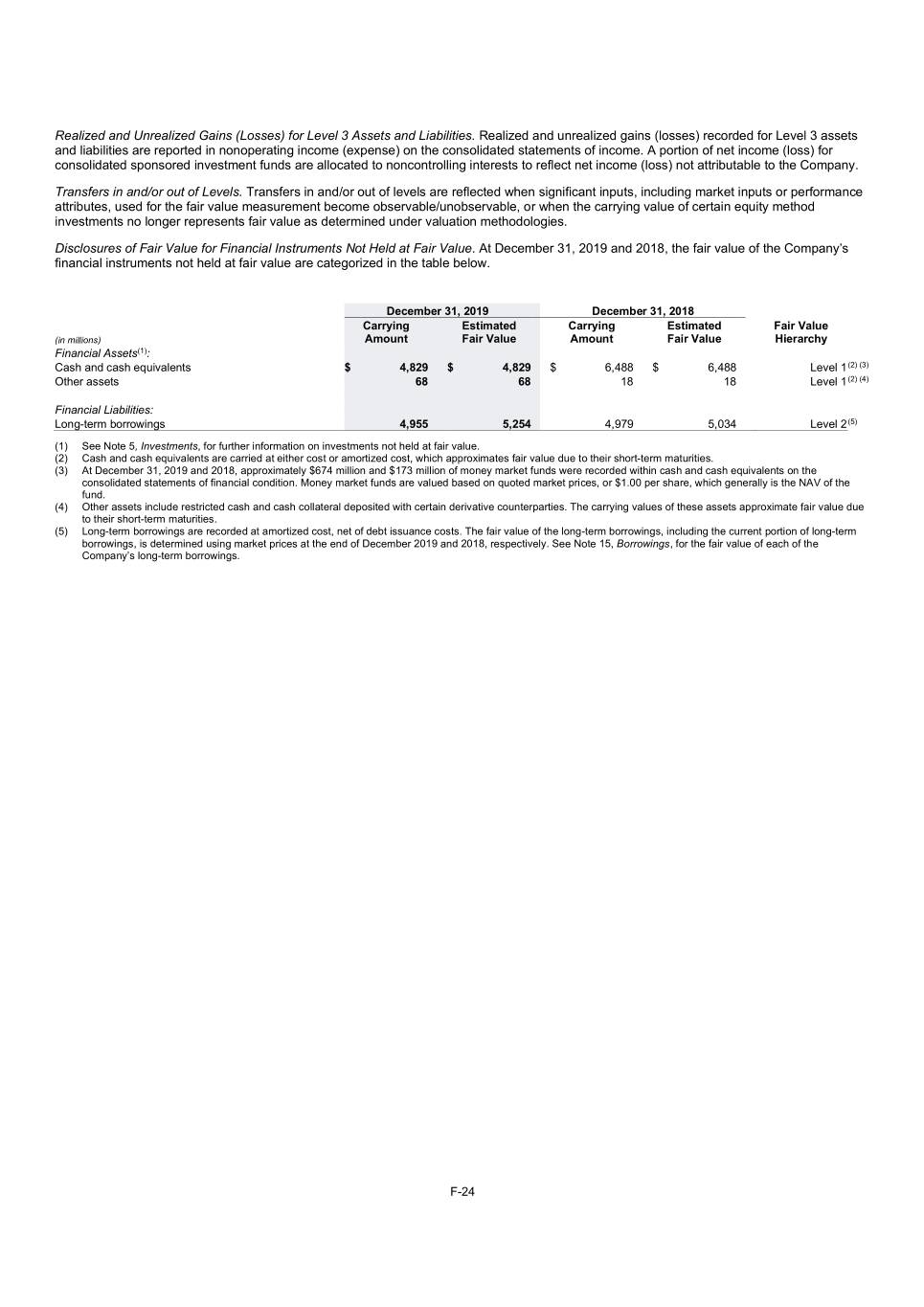

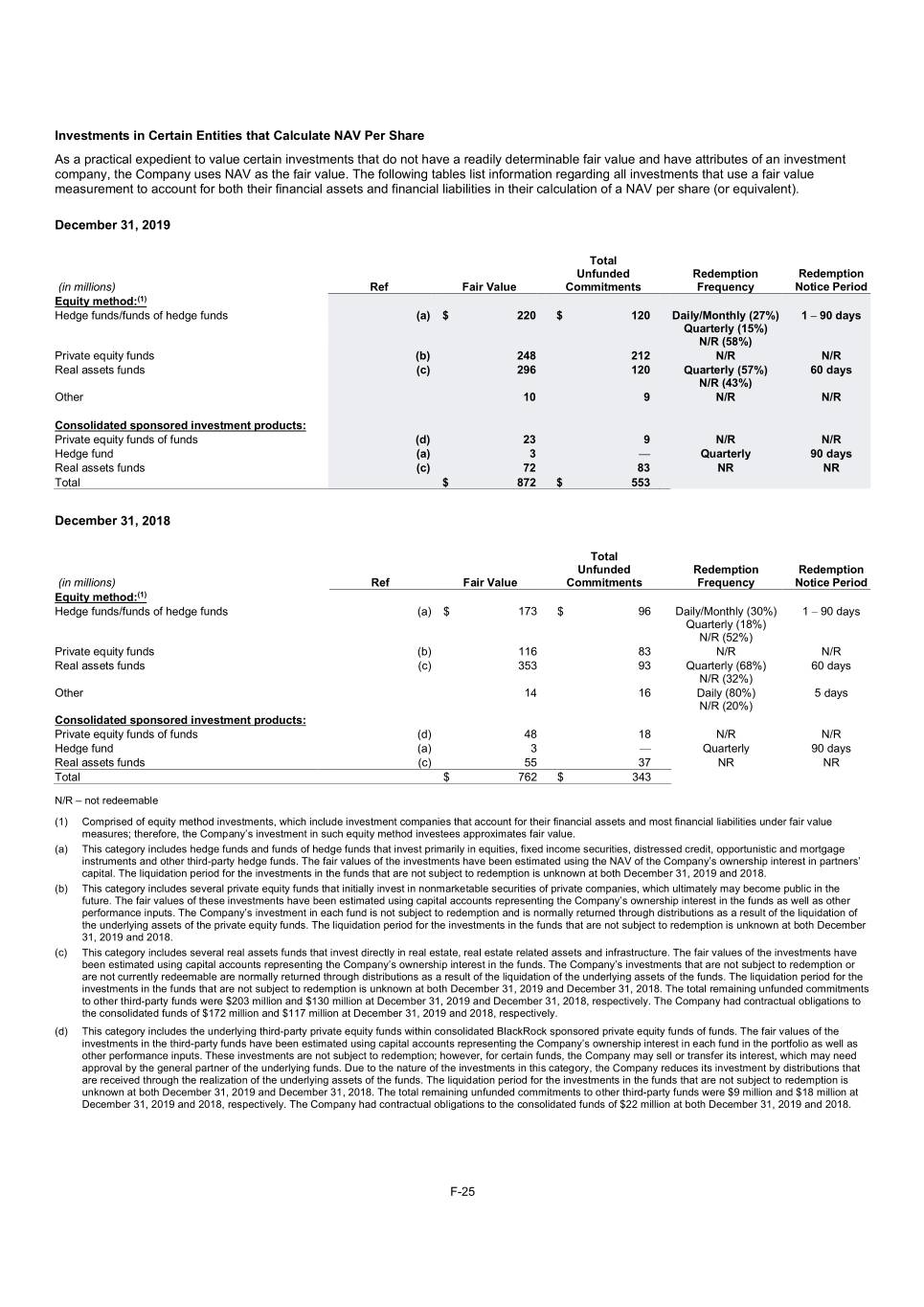

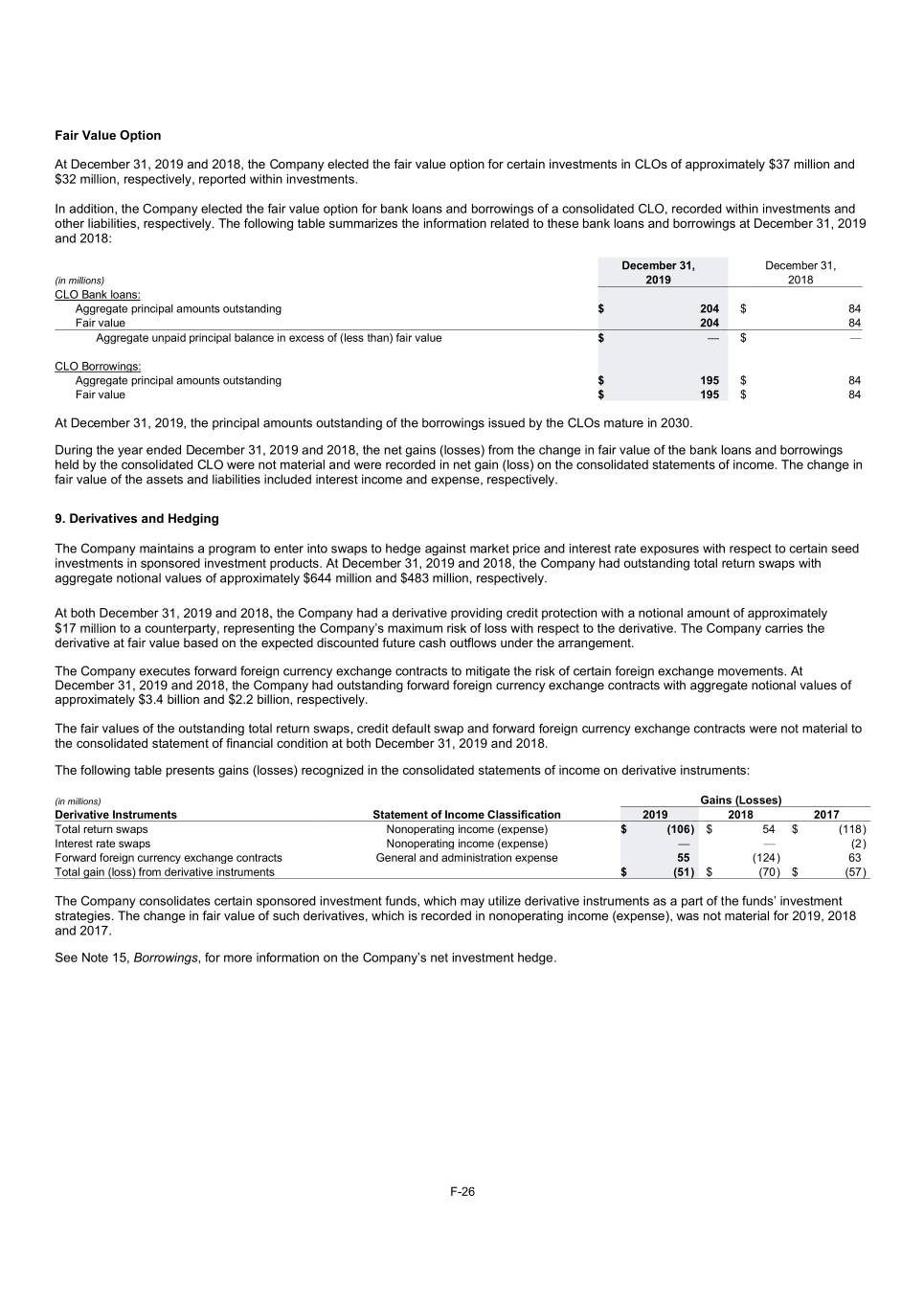

Fixed lease payments are included in ROU assets and lease liabilities within other assets and other liabilities, respectively, on the consolidated statement of financial condition. ROU assets and lease liabilities are recognized based on the present value of these future lease payments over the lease term at the commencement date using the Company’s incremental borrowing rate as the discount rate. Fixed lease payments made over the lease term are recorded as lease expense on a straight-line basis. Variable lease payments based on usage, changes in an index or market rate are expensed as incurred. Upon adoption of ASU 2016-02, for existing leases, the Company elected to determine the discount rate based on the remaining lease term as of January 1, 2019 and for lease payments based on an index or rate to apply the rate at commencement date. For new leases, the discount rates are based on the entire noncancelable lease term. Foreign Exchange. Foreign currency transactions are recorded at the exchange rates prevailing on the dates of the transactions. Monetary assets and liabilities that are denominated in foreign currencies are subsequently remeasured into the functional currencies of the Company's subsidiaries at the rates prevailing at each balance sheet date. Gains and losses arising on remeasurement are included in general and administration expense on the consolidated statements of income. Revenue and expenses are translated at average exchange rates during the period. Gains or losses resulting from translating foreign currency financial statements into US dollars are included in AOCI, a separate component of stockholders’ equity, on the consolidated statements of financial condition. Income Taxes. Deferred income tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases using currently enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of a change in tax rates on deferred income tax assets and liabilities is recognized on the consolidated statements of income in the period that includes the enactment date. Management periodically assesses the recoverability of its deferred income tax assets based upon expected future earnings, taxable income in prior carryback years, future deductibility of the asset, changes in applicable tax laws and other factors. If management determines that it is not more likely than not that the deferred tax asset will be fully recoverable in the future, a valuation allowance will be established for the difference between the asset balance and the amount expected to be recoverable in the future. This allowance will result in additional income tax expense. Further, the Company records its income taxes receivable and payable based upon its estimated income tax position. Excess tax benefits related to stock-based compensation are recognized as an income tax benefit on the consolidated statements of income and are reflected as operating cash flows on the consolidated statements of cash flows. Earnings per Share (“EPS”). Basic EPS is calculated by dividing net income applicable to common shareholders by the weighted-average number of shares outstanding during the period. Diluted EPS includes the determinants of basic EPS and common stock equivalents outstanding during the period. Diluted EPS is computed using the treasury stock method. Due to the similarities in terms between BlackRock’s nonvoting participating preferred stock and the Company’s common stock, the Company considers its nonvoting participating preferred stock to be a common stock equivalent for purposes of EPS calculations. As such, the Company has included the outstanding nonvoting participating preferred stock in the calculation of average basic and diluted shares outstanding. Business Segments. The Company’s management directs BlackRock’s operations as one business, the asset management business. The Company utilizes a consolidated approach to assess performance and allocate resources. As such, the Company operates in one business segment. Fair Value Measurements Hierarchy of Fair Value Inputs. The Company uses a fair value hierarchy that prioritizes inputs to valuation approaches used to measure fair value. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. Assets and liabilities measured and reported at fair value are classified and disclosed in one of the following categories: Level 1 Inputs: Quoted prices (unadjusted) in active markets for identical assets or liabilities at the reporting date. • Level 1 assets may include listed mutual funds, ETFs, listed equities and certain exchange-traded derivatives. Level 2 Inputs: Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities that are not active; quotes from pricing services or brokers for which the Company can determine that orderly transactions took place at the quoted price or that the inputs used to arrive at the price are observable; and inputs other than quoted prices that are observable, such as models or other valuation methodologies. • Level 2 assets may include debt securities, investments in CLOs, bank loans, short-term floating-rate notes, asset- backed securities, securities held within consolidated hedge funds, restricted public securities valued at a discount, as well as over-the-counter derivatives, including interest and inflation rate swaps and foreign currency exchange contracts that have inputs to the valuations that generally can be corroborated by observable market data. Level 3 Inputs: Unobservable inputs for the valuation of the asset or liability, which may include nonbinding broker quotes. Level 3 assets include investments for which there is little, if any, market activity. These inputs require significant management judgment or estimation. • Level 3 assets may include direct private equity investments held within consolidated funds, investments in CLOs and bank loans of a consolidated CLO. • Level 3 liabilities include contingent liabilities related to acquisitions valued based upon discounted cash flow analyses using unobservable market data and borrowings of a consolidated CLO. F-14

Significance of Inputs. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the financial instrument. Valuation Approaches. The fair values of certain Level 3 assets and liabilities were determined using various valuation approaches as appropriate, including third-party pricing vendors, broker quotes and market and income approaches. A significant number of inputs used to value equity, debt securities, investments in CLOs and bank loans is sourced from third-party pricing vendors. Generally, prices obtained from pricing vendors are categorized as Level 1 inputs for identical securities traded in active markets and as Level 2 for other similar securities if the vendor uses observable inputs in determining the price. In addition, quotes obtained from brokers generally are nonbinding and categorized as Level 3 inputs. However, if the Company is able to determine that market participants have transacted for the asset in an orderly manner near the quoted price or if the Company can determine that the inputs used by the broker are observable, the quote is classified as a Level 2 input. Investments Measured at NAV. As a practical expedient, the Company uses net asset value (“NAV”) as the fair value for certain investments. The inputs to value these investments may include the Company’s capital accounts for its partnership interests in various alternative investments, including hedge funds, real assets and private equity funds, which may be adjusted by using the returns of certain market indices. The various partnerships generally are investment companies, which record their underlying investments at fair value based on fair value policies established by management of the underlying fund. Fair value policies at the underlying fund generally require the fund to utilize pricing/valuation information from third-party sources, including independent appraisals. However, in some instances, current valuation information for illiquid securities or securities in markets that are not active may not be available from any third-party source or fund management may conclude that the valuations that are available from third-party sources are not reliable. In these instances, fund management may perform model-based analytical valuations that could be used as an input to value these investments. Fair Value Assets and Liabilities of Consolidated CLO. The Company applies the fair value option provisions for eligible assets, including bank loans, held by a consolidated CLO. As the fair value of the financial assets of the consolidated CLO is more observable than the fair value of the borrowings of the consolidated CLO, the Company measures the fair value of the borrowings of the consolidated CLO as the fair value of the assets of the consolidated CLO less the fair value of the Company’s economic interest in the CLO. Derivatives and Hedging Activities. The Company does not use derivative financial instruments for trading or speculative purposes. The Company uses derivative financial instruments primarily for purposes of hedging exposures to fluctuations in foreign currency exchange rates of certain assets and liabilities, and market exposures for certain seed investments. However, certain consolidated sponsored investment funds may also utilize derivatives as a part of their investment strategy. Changes in the fair value of the Company’s derivative financial instruments are recognized in earnings and, where applicable, are offset by the corresponding gain or loss on the related foreign-denominated assets or liabilities or hedged investments, on the consolidated statements of income. The Company may also use financial instruments designated as net investment hedges for accounting purposes to hedge net investments in international subsidiaries whose functional currency is not US dollars. The gain or loss from revaluing accounting hedges of net investments in foreign operations at the spot rate is deferred and reported within AOCI on the consolidated statements of financial condition. Amounts excluded from the effectiveness assessment are reported in the consolidated statements of income using a systematic and rational method. The Company reassesses the effectiveness of its net investment hedge at least quarterly. Recent Accounting Pronouncements Not Yet Adopted in 2019 Measurement of Credit Losses. In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”), which significantly changes the accounting and disclosures for credit losses for most financial assets. The new guidance requires an estimate of expected lifetime credit losses and eliminates the existing recognition thresholds under current models. The adoption of ASU 2016- 13, which was effective for the Company on January 1, 2020, did not have a material impact on its consolidated financial statements. 3. Acquisition On May 10, 2019, the Company acquired 100% of the equity interests of eFront Holding SAS (“eFront Transaction” or “eFront”), a leading alternative investment management software and solutions provider for approximately $1.3 billion, excluding the settlement of eFront’s outstanding debt. The acquisition of eFront expands Aladdin’s illiquid alternative capabilities and enables BlackRock to provide individual alternative or whole-portfolio technology solutions to clients. The purchase price was funded through a combination of existing cash and issuance of commercial paper (subsequently repaid with existing cash) and long-term notes in April 2019. See Note 15, Borrowings, for information on the debt issuance in April 2019. The purchase price for the eFront Transaction was allocated to the assets acquired and liabilities assumed based upon their estimated fair values at the date of the transaction. The goodwill recognized in connection with the acquisition is non-deductible for tax purposes and is primarily attributable to anticipated synergies from the transaction. F-15

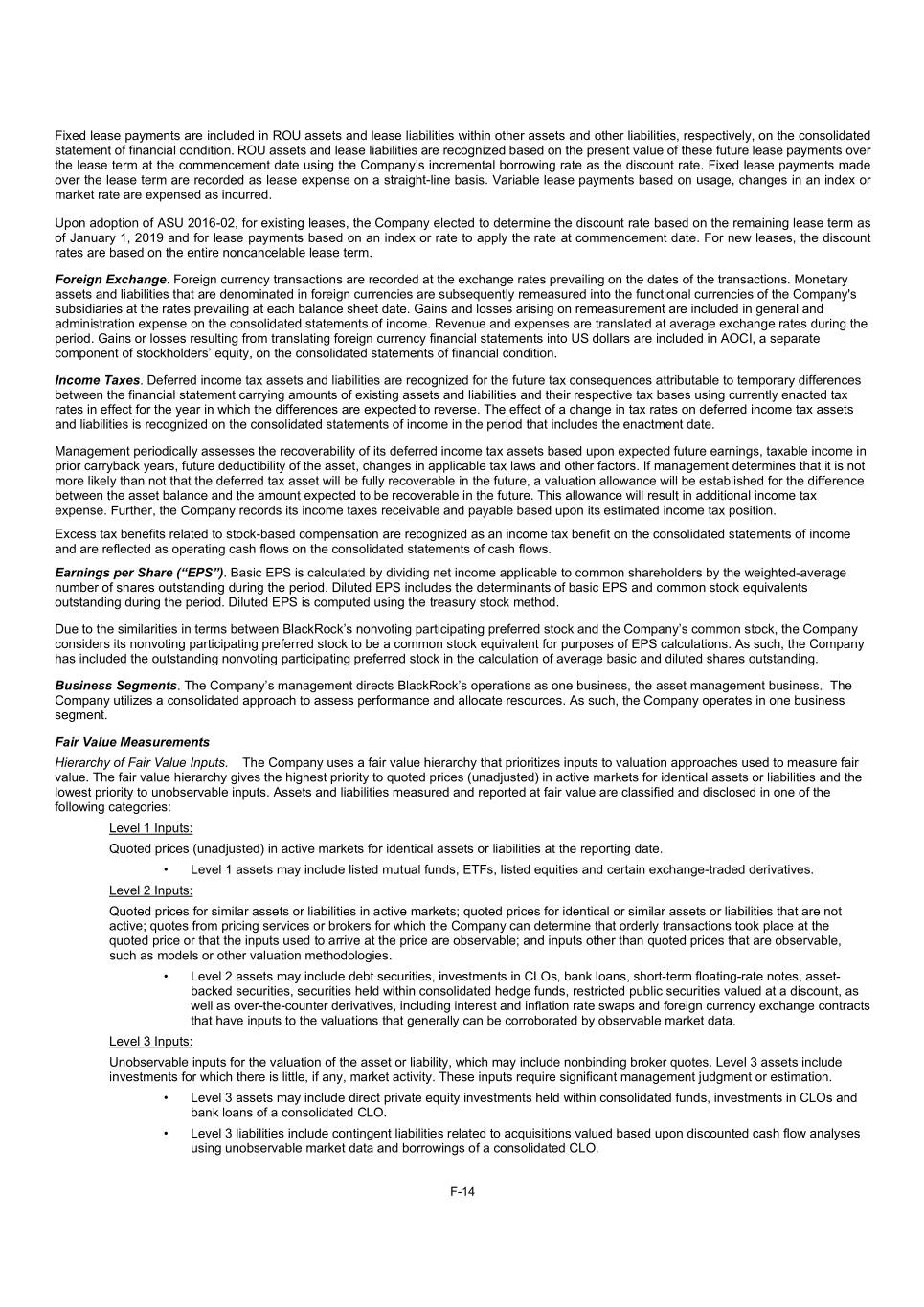

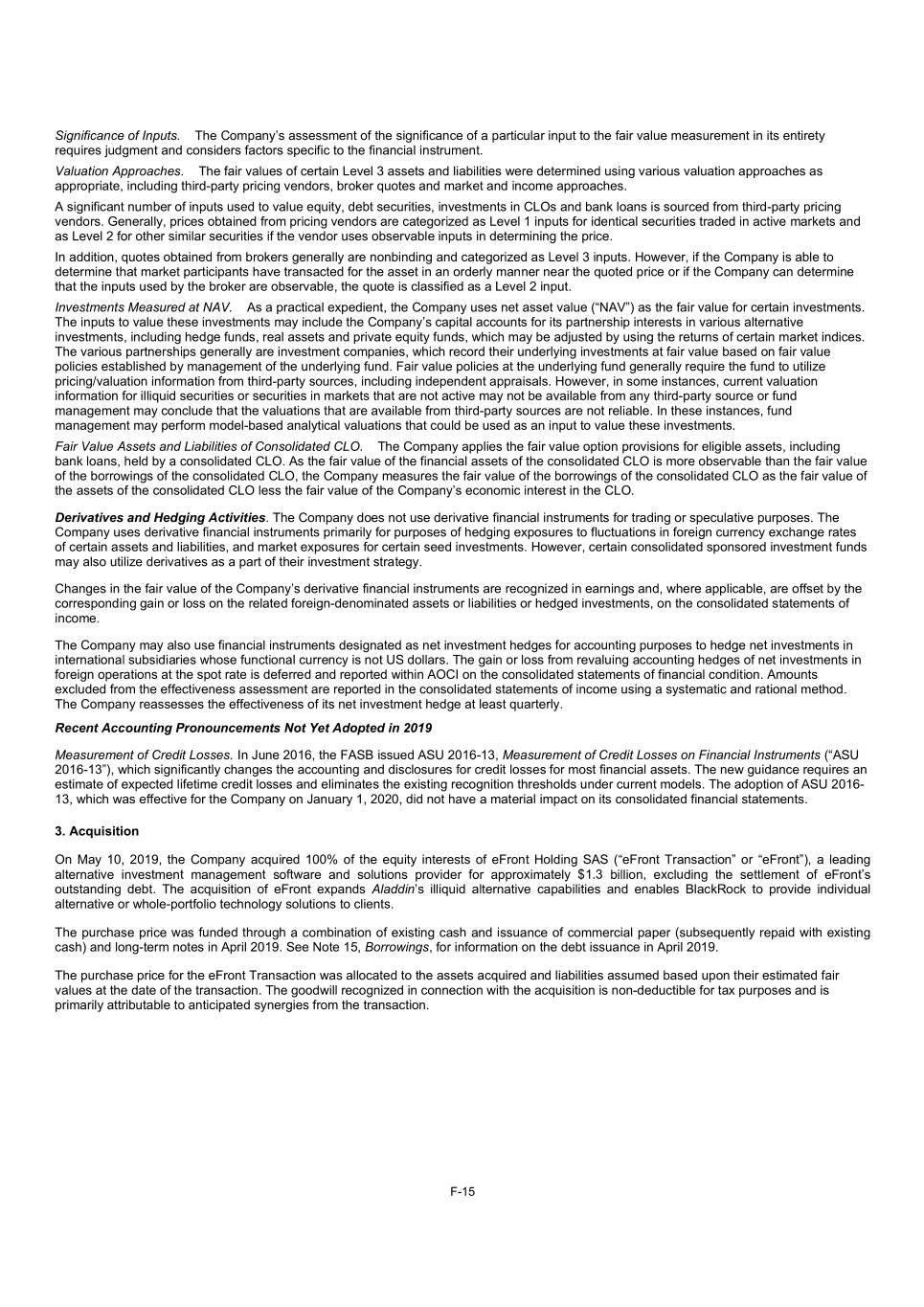

Goodwill, finite-lived intangible assets and deferred income tax liabilities were retrospectively adjusted to reflect new information obtained about facts that existed as of May 10, 2019, the eFront acquisition date. There was no material change to the consolidated statements of income for the year ended December 31, 2019 as a result of these adjustments. A summary of the initial and revised fair values of the assets acquired and liabilities assumed in this acquisition is as follows(1): Initial Revised Estimate of Estimate of (in millions) Fair Value Fair Value Accounts receivable $ 65 $ 61 Finite-lived intangible assets: Customer relationships(2) 452 400 Technology-related(3) 205 203 Trade name(4) 21 14 Goodwill 990 1,044 Other assets 31 49 Deferred income tax liabilities (194 ) (146 ) Other liabilities assumed (64 ) (125 ) Total consideration, net of cash acquired $ 1,506 $ 1,500 Summary of consideration, net of cash acquired: Cash paid including settlement of outstanding debt of approximately $0.2 billion $ 1,555 $ 1,555 Cash acquired (49 ) (55 ) Total consideration, net of cash acquired $ 1,506 $ 1,500 (1) At this time, the Company does not expect additional material changes to the value of the assets acquired or liabilities assumed in conjunction with the transaction. (2) The fair value was determined based on the excess earnings method (a Level 3 input), has a weighted-average estimated useful life of approximately 10 years and is amortized using the accelerated amortization method. (3) The fair value was determined based upon a relief from royalty method (a Level 3 input), has a weighted-average estimated useful life of approximately eight years and is amortized using the accelerated amortization method. (4) The fair value was determined using a relief from royalty method (a Level 3 input), has an estimated useful life of approximately four years and is amortized using the accelerated amortization method. Finite-lived intangible assets in the table above are amortized over their estimated useful lives, which range from four to 10 years. Amortization expense related to the finite-lived intangible assets was $38 million for the year ended December 31, 2019. The finite-lived intangible assets had a weighted-average remaining useful life of approximately nine years with remaining amortization expense as follows: (in millions) Year Amount 2020 $ 60 2021 64 2022 68 2023 69 2024 71 Thereafter 247 Total $ 579 For the year ended December 31, 2019, eFront contributed $96 million of revenue and did not have a material impact to net income attributable to BlackRock, Inc. Consequently, the Company has not presented pro forma combined results of operations for this acquisition. 4. Cash, Cash Equivalents and Restricted Cash The following table provides a reconciliation of cash and cash equivalents reported within the consolidated statements of financial condition to the cash, cash equivalents, and restricted cash reported within the consolidated statements of cash flows. December 31, December 31, (in millions) 2019 2018 Cash and cash equivalents $ 4,829 $ 6,488 Restricted cash included in other assets 17 17 Total cash, cash equivalents and restricted cash $ 4,846 $ 6,505 F-16

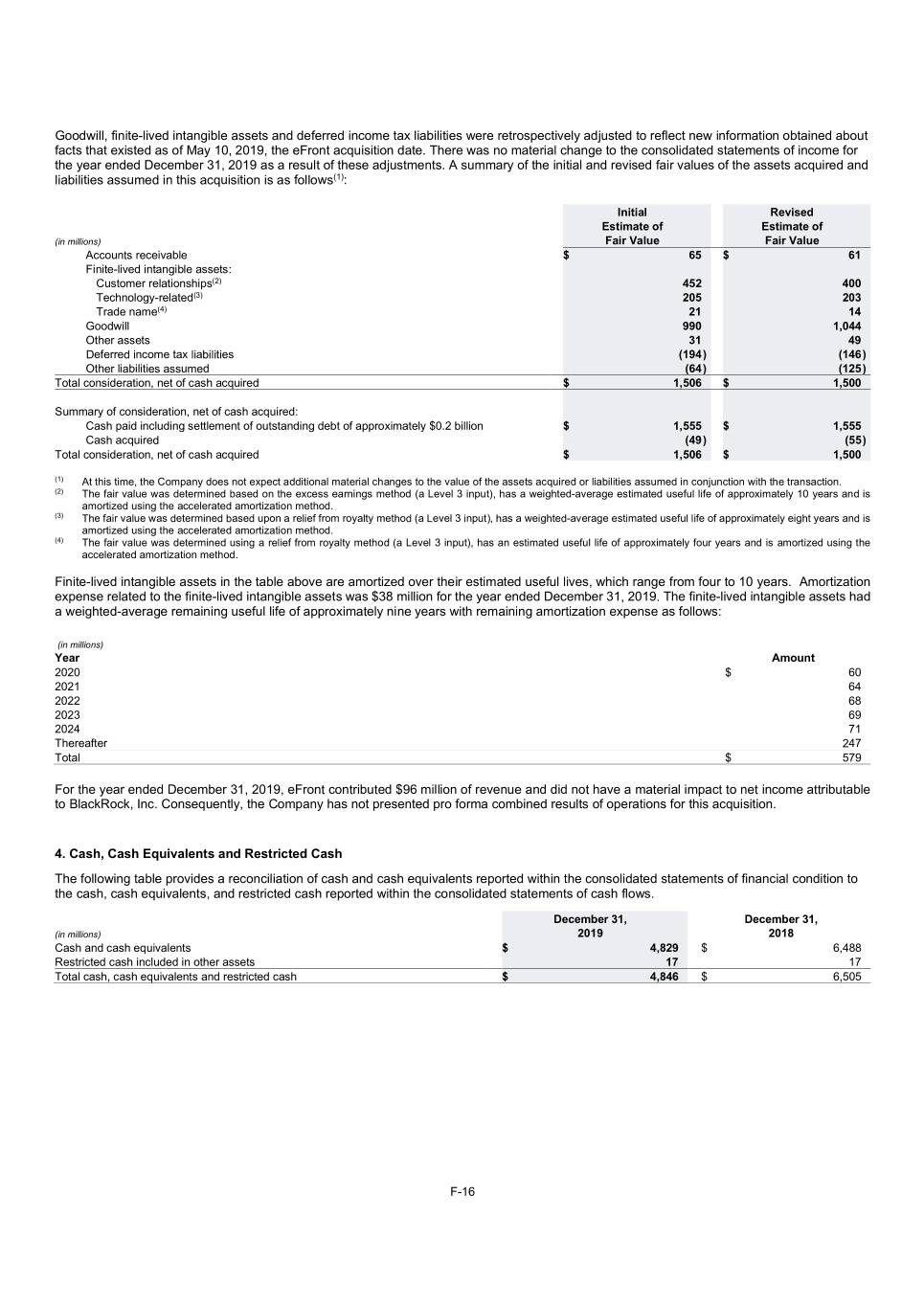

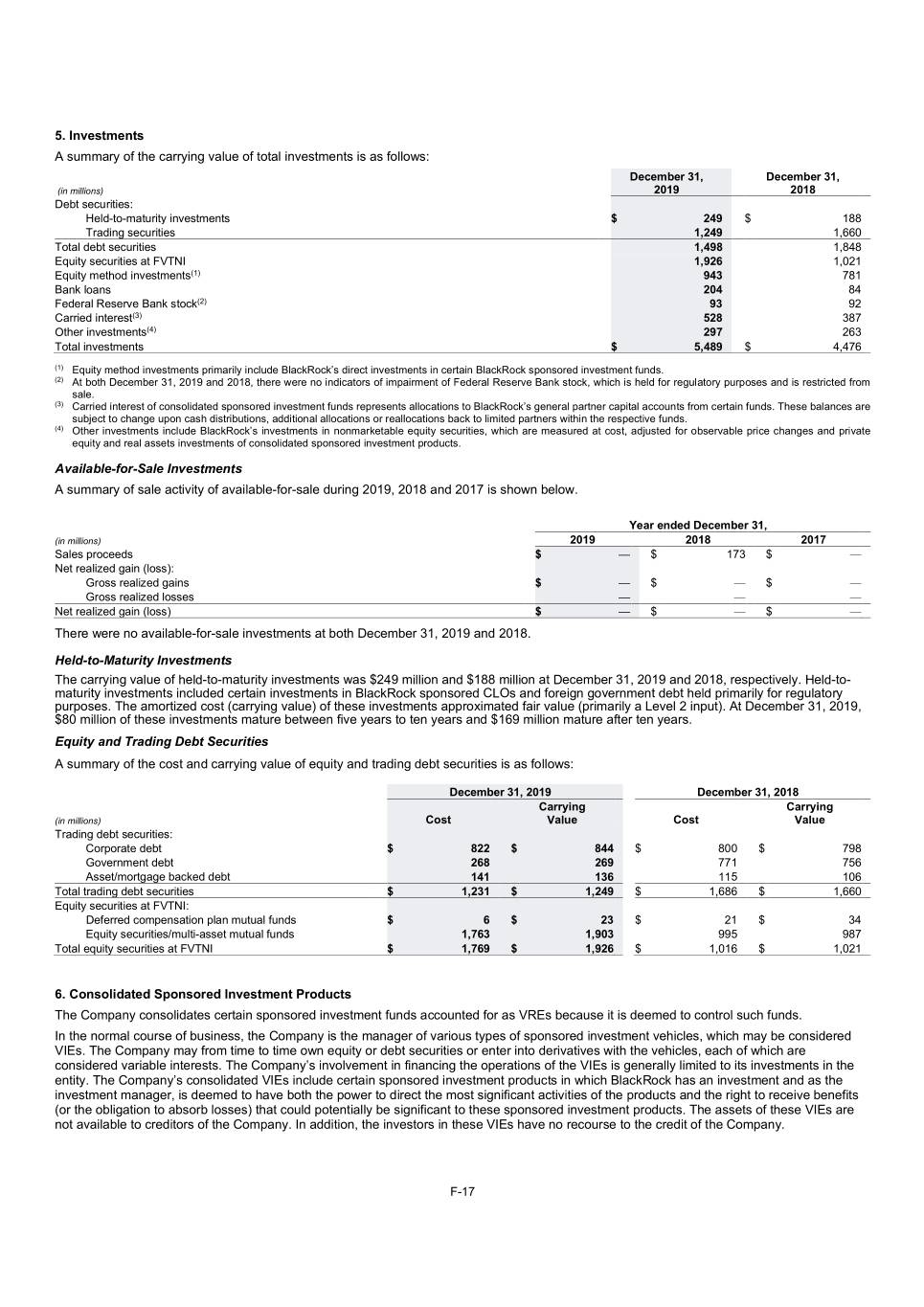

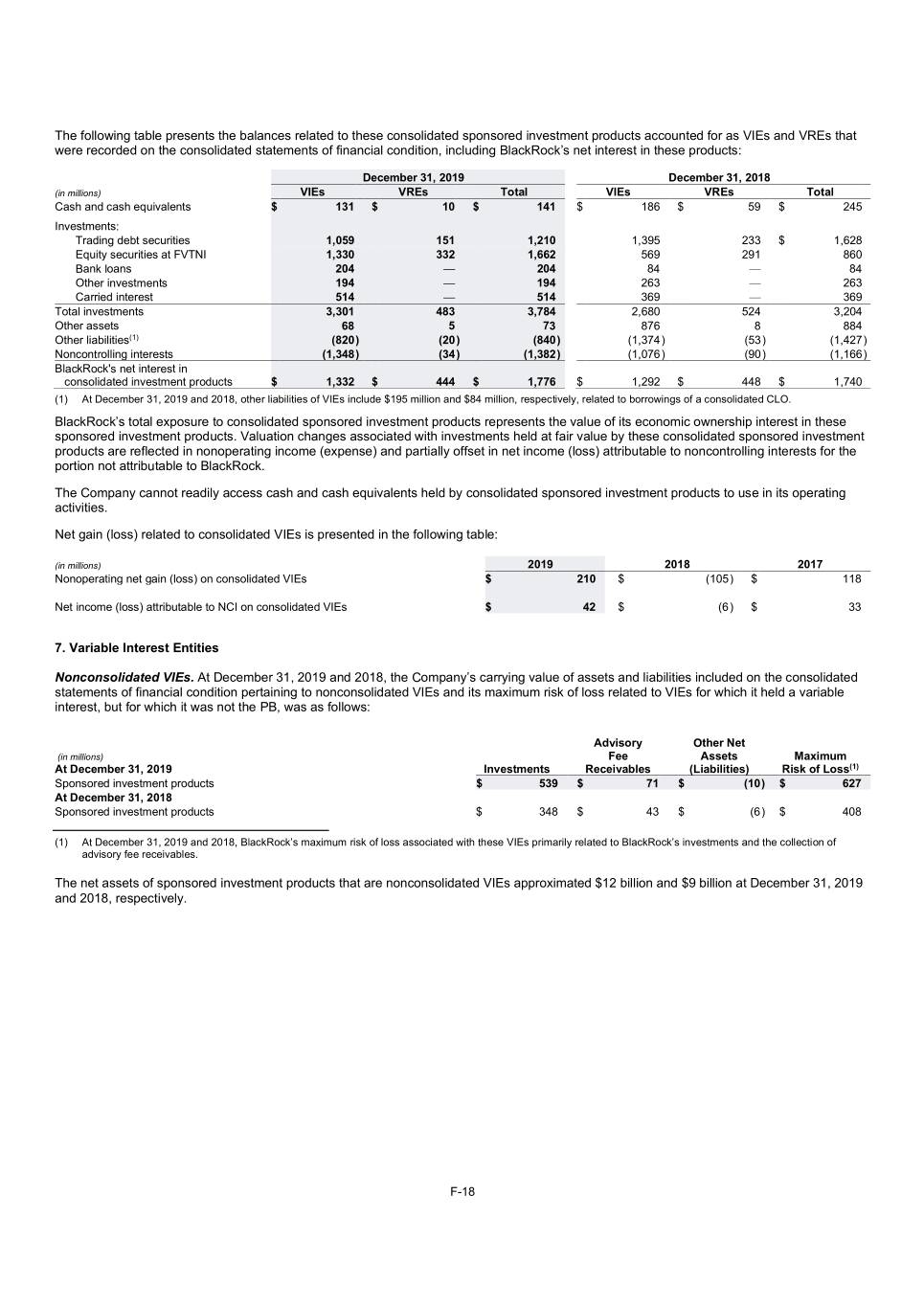

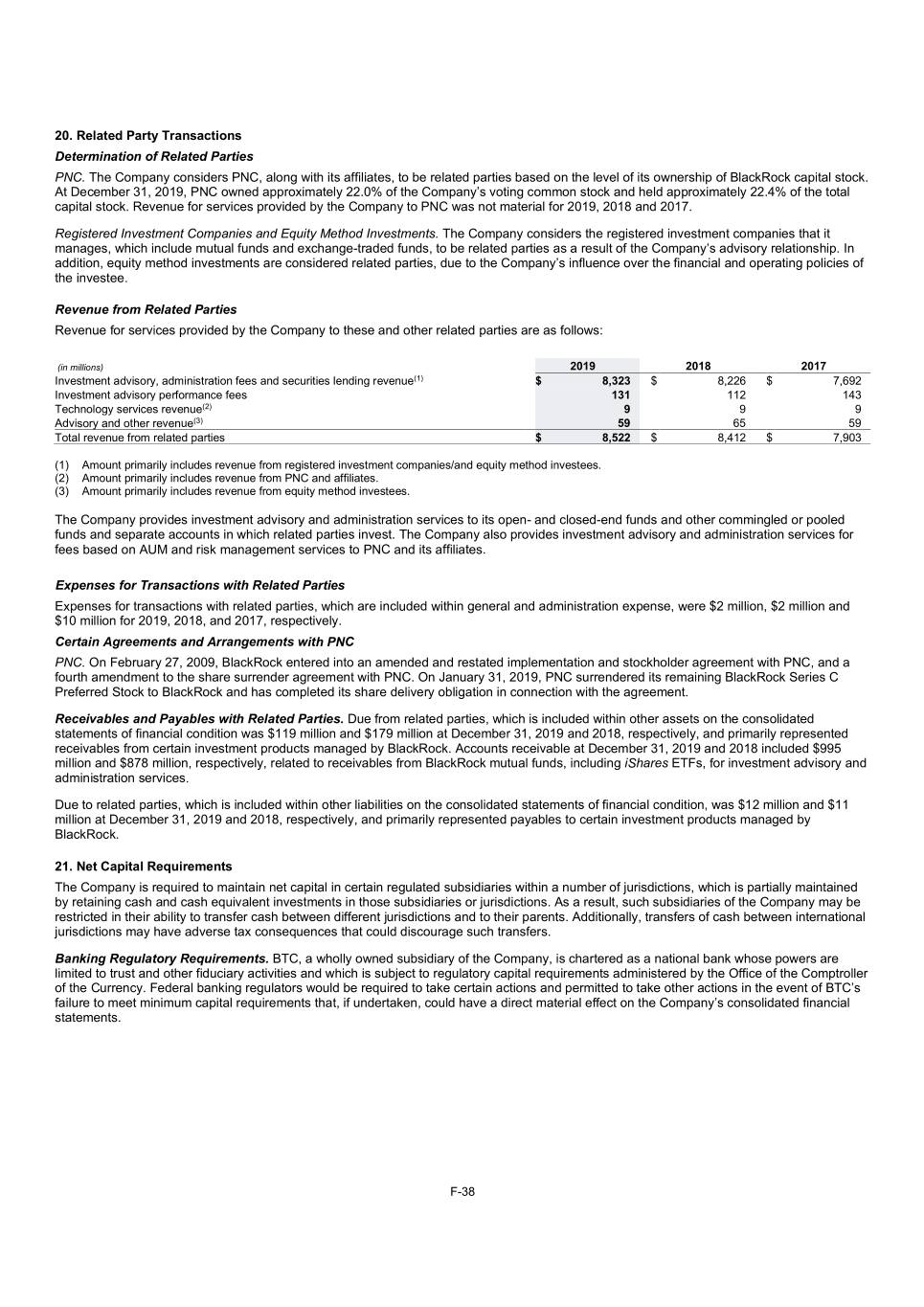

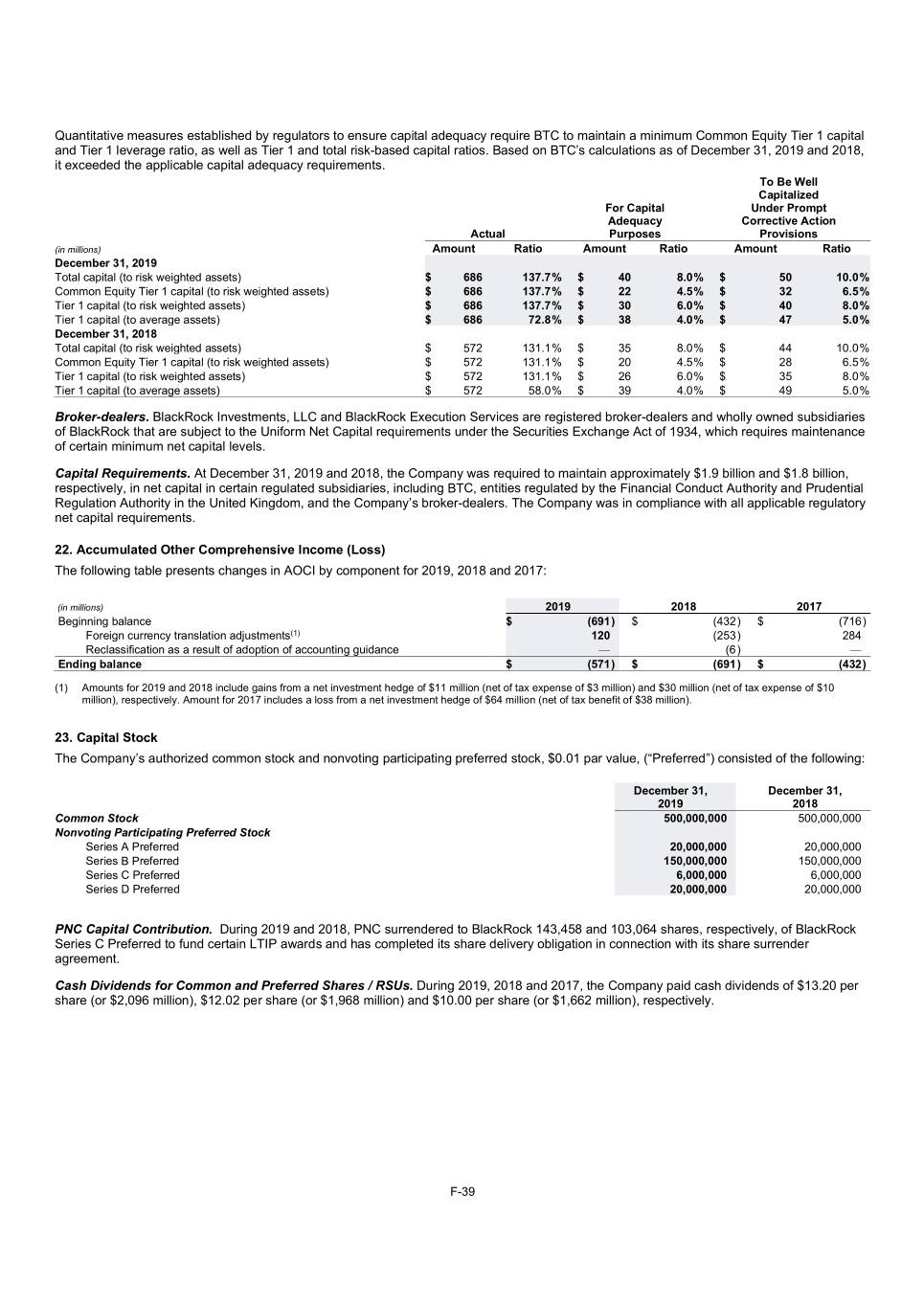

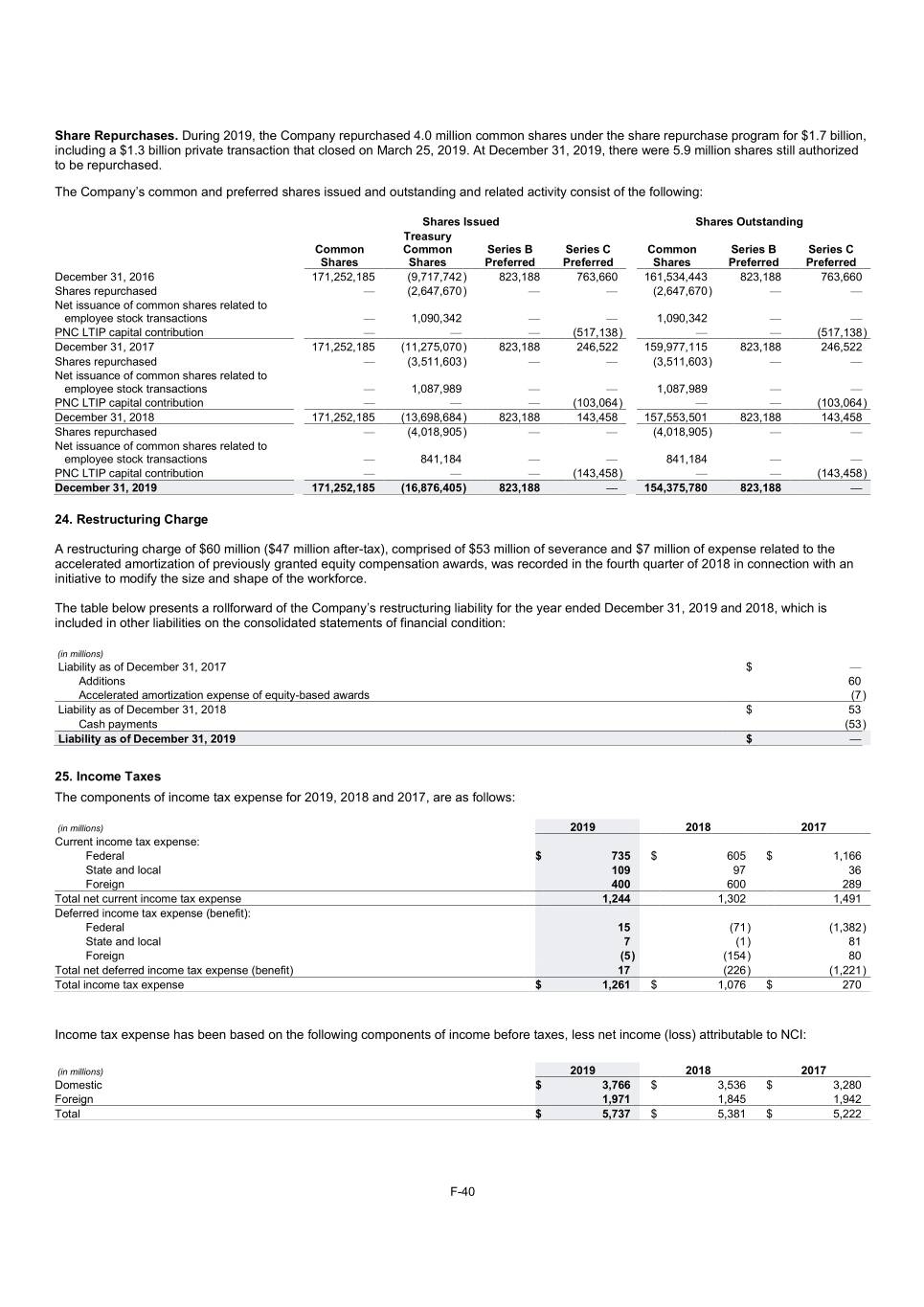

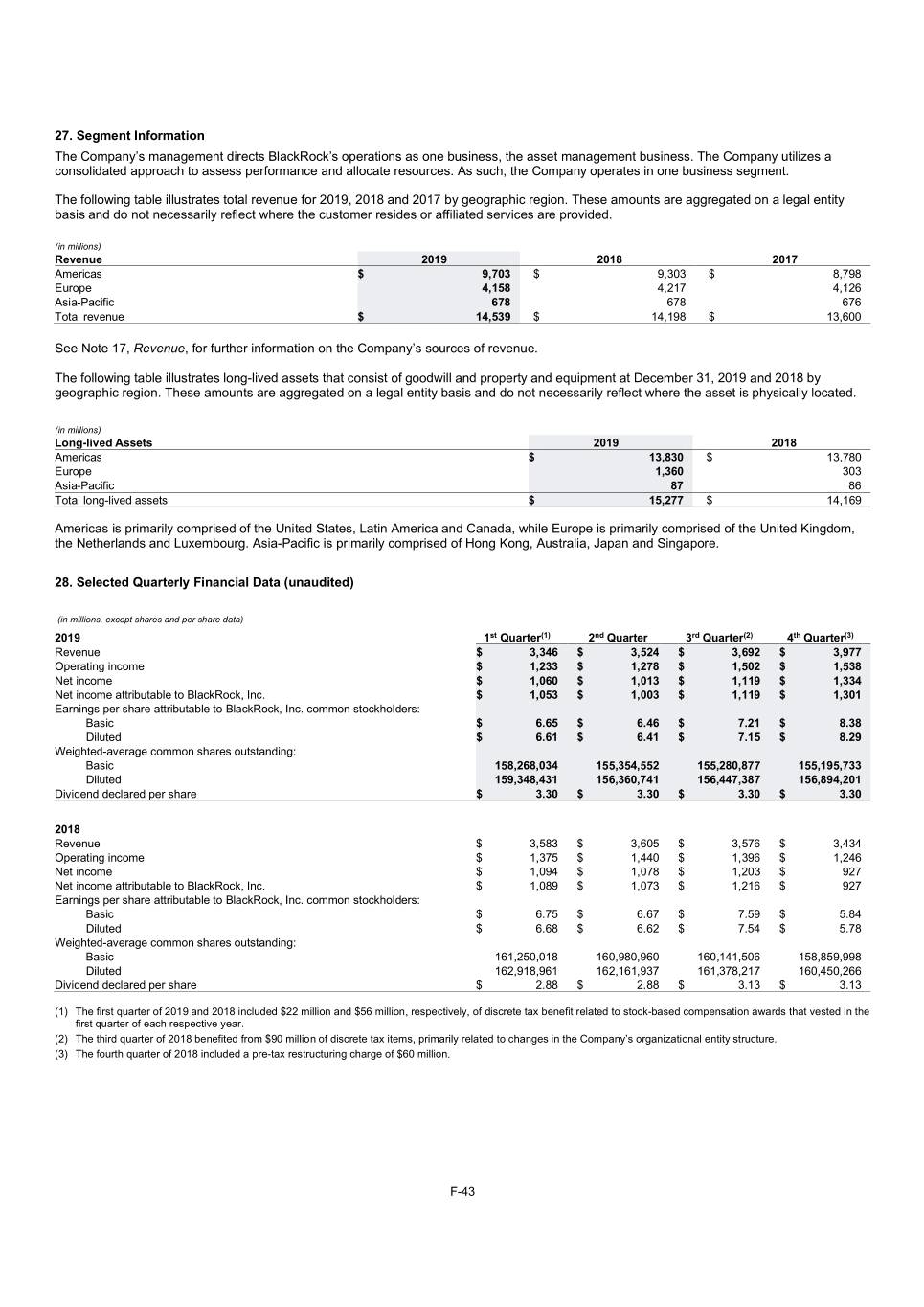

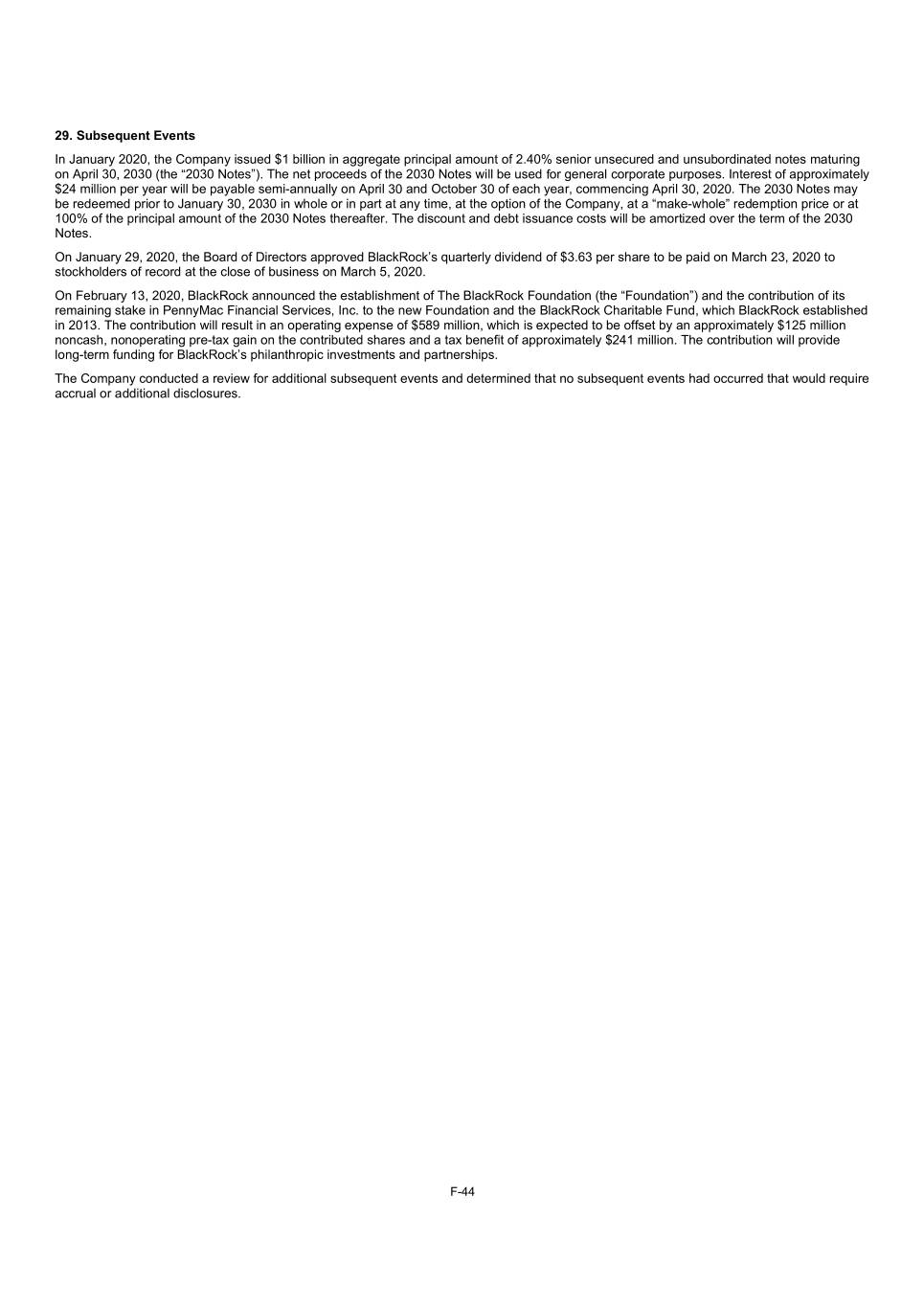

5. Investments A summary of the carrying value of total investments is as follows: December 31, December 31, (in millions) 2019 2018 Debt securities: Held-to-maturity investments $ 249 $ 188 Trading securities 1,249 1,660 Total debt securities 1,498 1,848 Equity securities at FVTNI 1,926 1,021 Equity method investments(1) 943 781 Bank loans 204 84 Federal Reserve Bank stock(2) 93 92 Carried interest(3) 528 387 Other investments(4) 297 263 Total investments $ 5,489 $ 4,476 (1) Equity method investments primarily include BlackRock’s direct investments in certain BlackRock sponsored investment funds. (2) At both December 31, 2019 and 2018, there were no indicators of impairment of Federal Reserve Bank stock, which is held for regulatory purposes and is restricted from sale. (3) Carried interest of consolidated sponsored investment funds represents allocations to BlackRock’s general partner capital accounts from certain funds. These balances are subject to change upon cash distributions, additional allocations or reallocations back to limited partners within the respective funds. (4) Other investments include BlackRock’s investments in nonmarketable equity securities, which are measured at cost, adjusted for observable price changes and private equity and real assets investments of consolidated sponsored investment products. Available-for-Sale Investments A summary of sale activity of available-for-sale during 2019, 2018 and 2017 is shown below. Year ended December 31, (in millions) 2019 2018 2017 Sales proceeds $ — $ 173 $ — Net realized gain (loss): Gross realized gains $ — $ — $ — Gross realized losses — — — Net realized gain (loss) $ — $ — $ — There were no available-for-sale investments at both December 31, 2019 and 2018. Held-to-Maturity Investments The carrying value of held-to-maturity investments was $249 million and $188 million at December 31, 2019 and 2018, respectively. Held-to- maturity investments included certain investments in BlackRock sponsored CLOs and foreign government debt held primarily for regulatory purposes. The amortized cost (carrying value) of these investments approximated fair value (primarily a Level 2 input). At December 31, 2019, $80 million of these investments mature between five years to ten years and $169 million mature after ten years. Equity and Trading Debt Securities A summary of the cost and carrying value of equity and trading debt securities is as follows: December 31, 2019 December 31, 2018 Carrying Carrying (in millions) Cost Value Cost Value Trading debt securities: Corporate debt $ 822 $ 844 $ 800 $ 798 Government debt 268 269 771 756 Asset/mortgage backed debt 141 136 115 106 Total trading debt securities $ 1,231 $ 1,249 $ 1,686 $ 1,660 Equity securities at FVTNI: Deferred compensation plan mutual funds $ 6 $ 23 $ 21 $ 34 Equity securities/multi-asset mutual funds 1,763 1,903 995 987 Total equity securities at FVTNI $ 1,769 $ 1,926 $ 1,016 $ 1,021 6. Consolidated Sponsored Investment Products The Company consolidates certain sponsored investment funds accounted for as VREs because it is deemed to control such funds. In the normal course of business, the Company is the manager of various types of sponsored investment vehicles, which may be considered VIEs. The Company may from time to time own equity or debt securities or enter into derivatives with the vehicles, each of which are considered variable interests. The Company’s involvement in financing the operations of the VIEs is generally limited to its investments in the entity. The Company’s consolidated VIEs include certain sponsored investment products in which BlackRock has an investment and as the investment manager, is deemed to have both the power to direct the most significant activities of the products and the right to receive benefits (or the obligation to absorb losses) that could potentially be significant to these sponsored investment products. The assets of these VIEs are not available to creditors of the Company. In addition, the investors in these VIEs have no recourse to the credit of the Company. F-17