EXHIBIT 99..1

Published on March 1, 2019

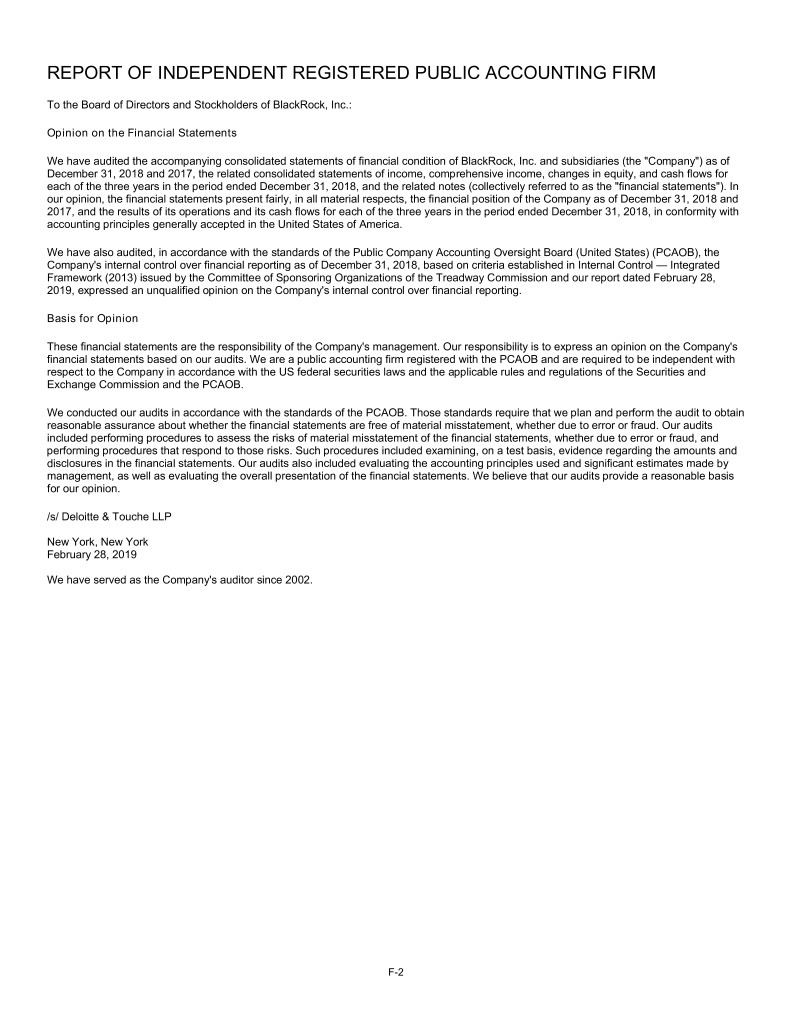

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of BlackRock, Inc.: Opinion on the Financial Statements We have audited the accompanying consolidated statements of financial condition of BlackRock, Inc. and subsidiaries (the "Company") as of December 31, 2018 and 2017, the related consolidated statements of income, comprehensive income, changes in equity, and cash flows for each of the three years in the period ended December 31, 2018, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2018 and 2017, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2018, in conformity with accounting principles generally accepted in the United States of America. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company's internal control over financial reporting as of December 31, 2018, based on criteria established in Internal Control — Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 28, 2019, expressed an unqualified opinion on the Company's internal control over financial reporting. Basis for Opinion These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the US federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion. /s/ Deloitte & Touche LLP New York, New York February 28, 2019 We have served as the Company's auditor since 2002. F-2

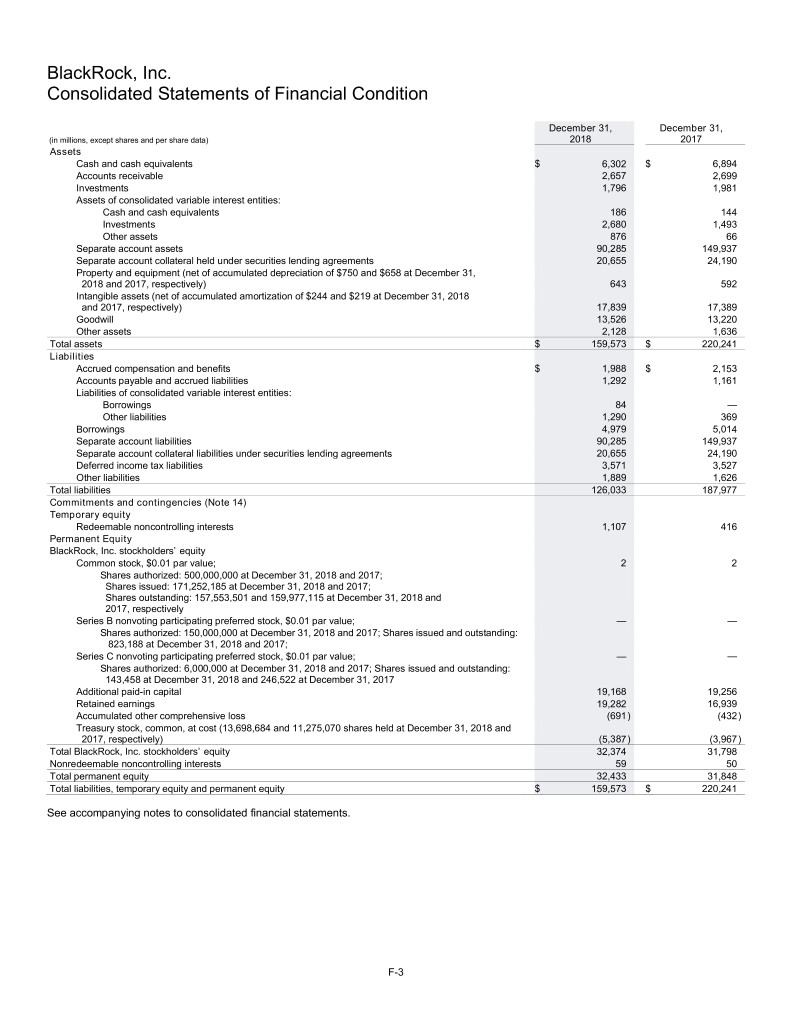

BlackRock, Inc. Consolidated Statements of Financial Condition December 31, December 31, (in millions, except shares and per share data) 2018 2017 Assets Cash and cash equivalents $ 6,302 $ 6,894 Accounts receivable 2,657 2,699 Investments 1,796 1,981 Assets of consolidated variable interest entities: Cash and cash equivalents 186 144 Investments 2,680 1,493 Other assets 876 66 Separate account assets 90,285 149,937 Separate account collateral held under securities lending agreements 20,655 24,190 Property and equipment (net of accumulated depreciation of $750 and $658 at December 31, 2018 and 2017, respectively) 643 592 Intangible assets (net of accumulated amortization of $244 and $219 at December 31, 2018 and 2017, respectively) 17,839 17,389 Goodwill 13,526 13,220 Other assets 2,128 1,636 Total assets $ 159,573 $ 220,241 Liabilities Accrued compensation and benefits $ 1,988 $ 2,153 Accounts payable and accrued liabilities 1,292 1,161 Liabilities of consolidated variable interest entities: Borrowings 84 — Other liabilities 1,290 369 Borrowings 4,979 5,014 Separate account liabilities 90,285 149,937 Separate account collateral liabilities under securities lending agreements 20,655 24,190 Deferred income tax liabilities 3,571 3,527 Other liabilities 1,889 1,626 Total liabilities 126,033 187,977 Commitments and contingencies (Note 14) Temporary equity Redeemable noncontrolling interests 1,107 416 Permanent Equity BlackRock, Inc. stockholders’ equity Common stock, $0.01 par value; 2 2 Shares authorized: 500,000,000 at December 31, 2018 and 2017; Shares issued: 171,252,185 at December 31, 2018 and 2017; Shares outstanding: 157,553,501 and 159,977,115 at December 31, 2018 and 2017, respectively Series B nonvoting participating preferred stock, $0.01 par value; — — Shares authorized: 150,000,000 at December 31, 2018 and 2017; Shares issued and outstanding: 823,188 at December 31, 2018 and 2017; Series C nonvoting participating preferred stock, $0.01 par value; — — Shares authorized: 6,000,000 at December 31, 2018 and 2017; Shares issued and outstanding: 143,458 at December 31, 2018 and 246,522 at December 31, 2017 Additional paid-in capital 19,168 19,256 Retained earnings 19,282 16,939 Accumulated other comprehensive loss (691 ) (432 ) Treasury stock, common, at cost (13,698,684 and 11,275,070 shares held at December 31, 2018 and 2017, respectively) (5,387 ) (3,967 ) Total BlackRock, Inc. stockholders’ equity 32,374 31,798 Nonredeemable noncontrolling interests 59 50 Total permanent equity 32,433 31,848 Total liabilities, temporary equity and permanent equity $ 159,573 $ 220,241 See accompanying notes to consolidated financial statements. F-3

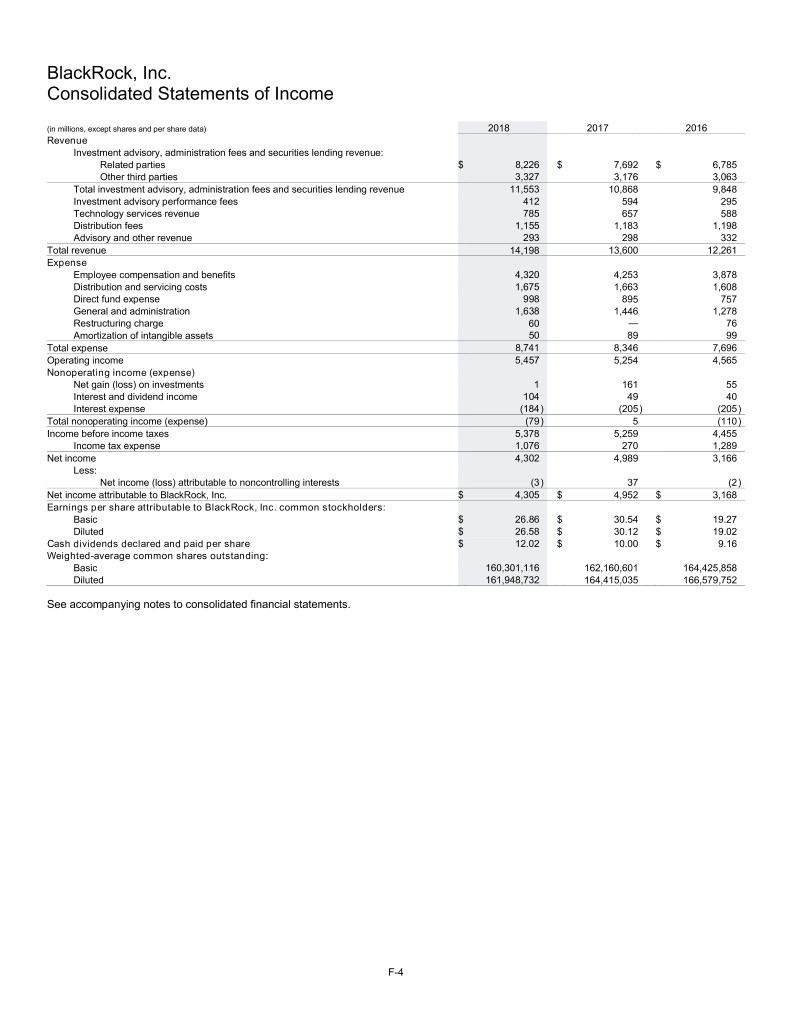

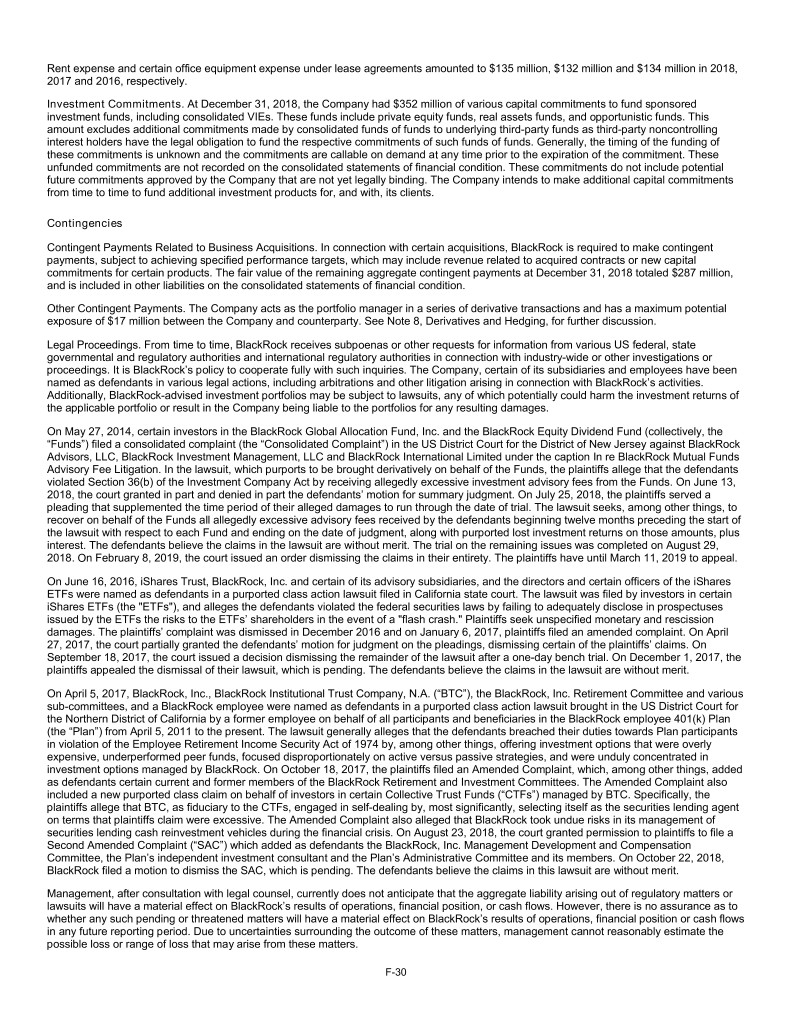

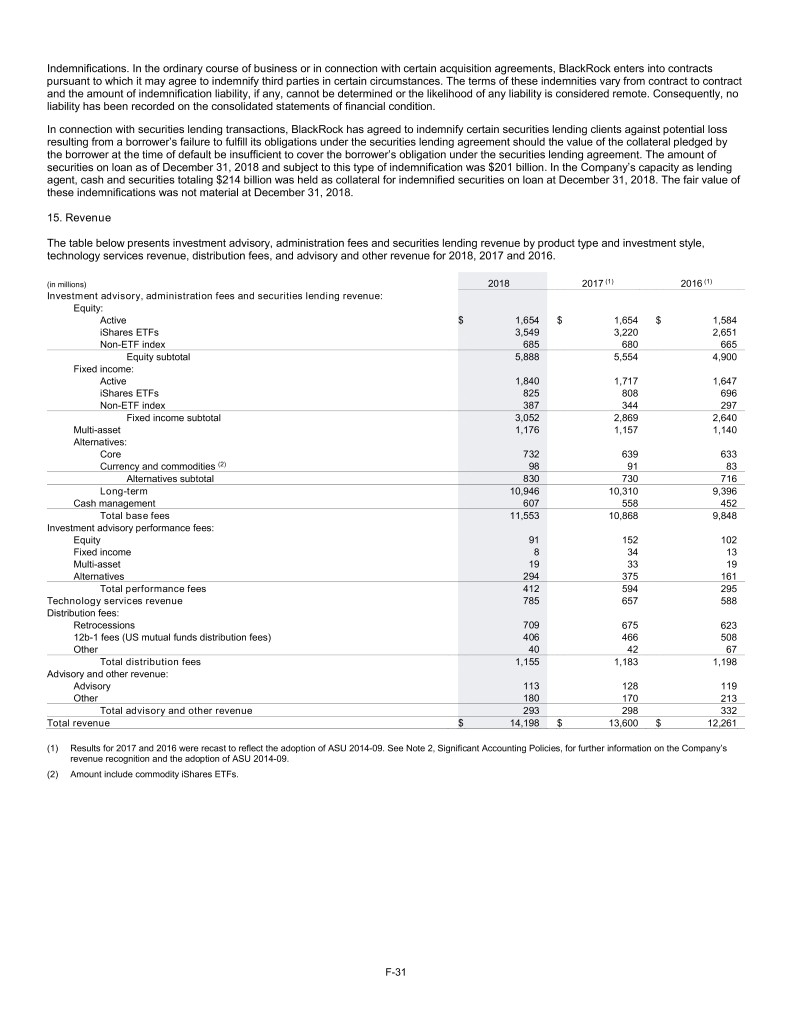

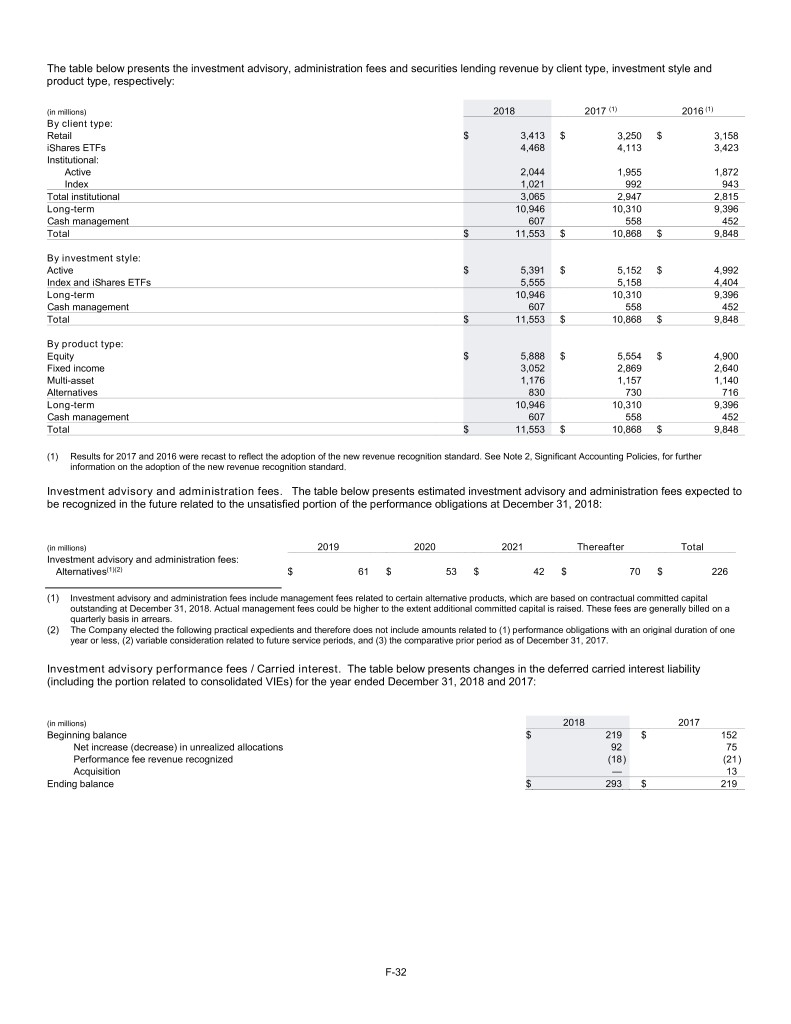

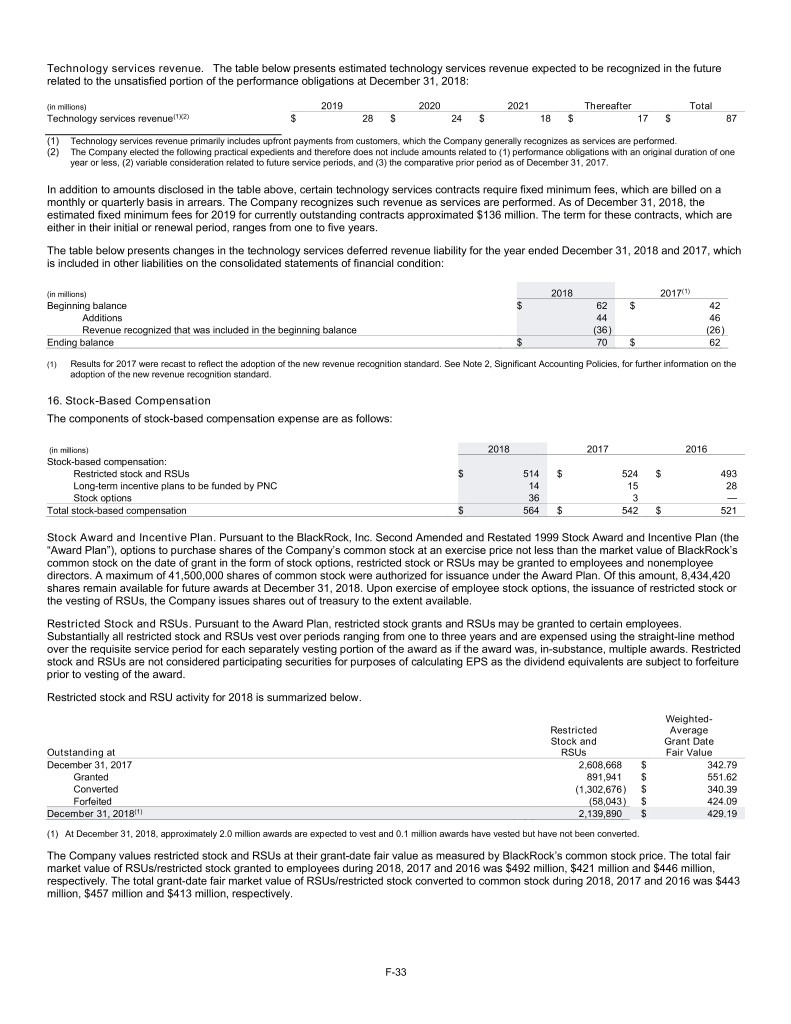

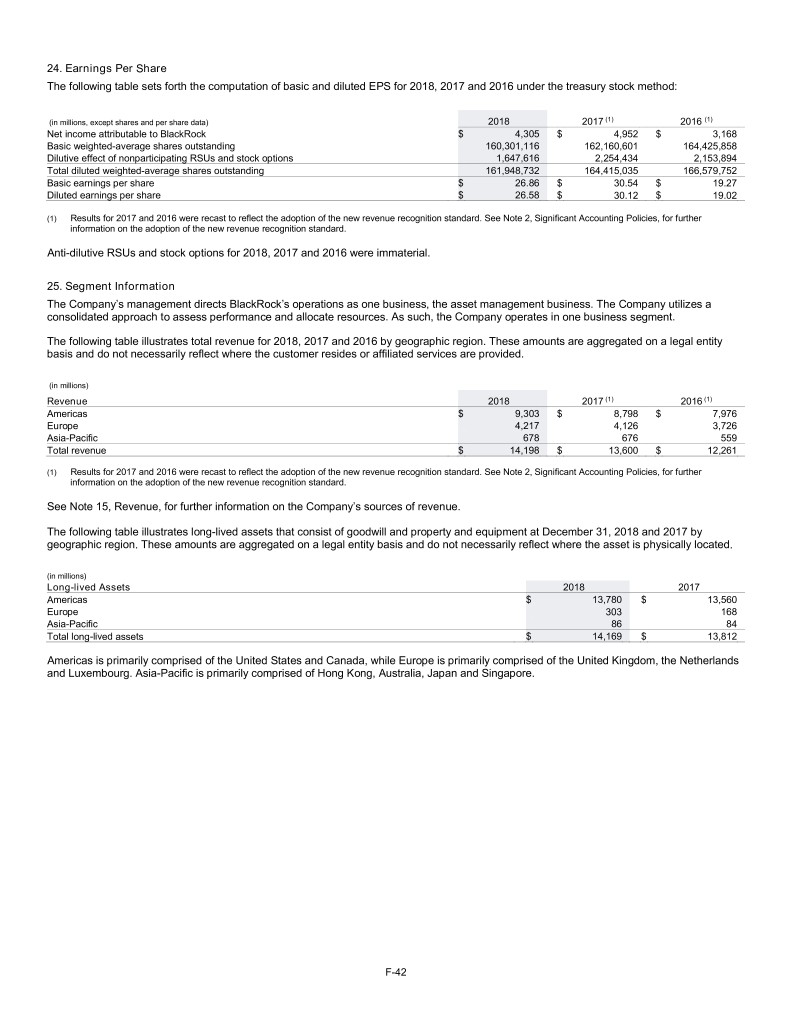

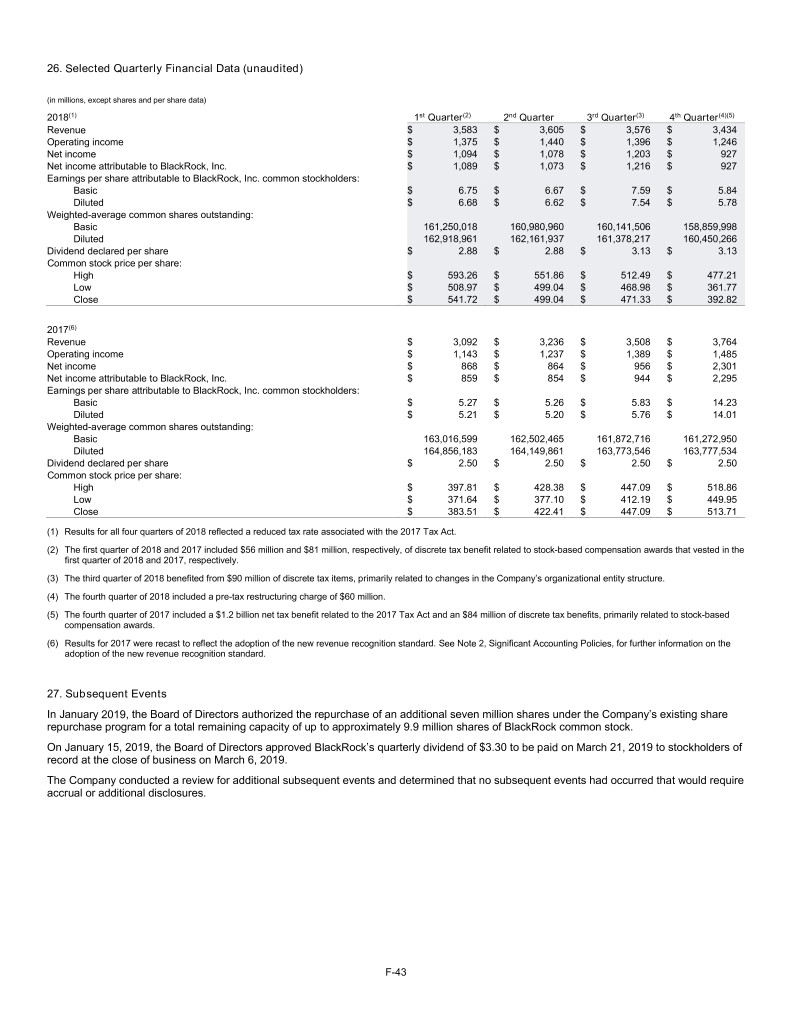

BlackRock, Inc. Consolidated Statements of Income (in millions, except shares and per share data) 2018 2017 2016 Revenue Investment advisory, administration fees and securities lending revenue: Related parties $ 8,226 $ 7,692 $ 6,785 Other third parties 3,327 3,176 3,063 Total investment advisory, administration fees and securities lending revenue 11,553 10,868 9,848 Investment advisory performance fees 412 594 295 Technology services revenue 785 657 588 Distribution fees 1,155 1,183 1,198 Advisory and other revenue 293 298 332 Total revenue 14,198 13,600 12,261 Expense Employee compensation and benefits 4,320 4,253 3,878 Distribution and servicing costs 1,675 1,663 1,608 Direct fund expense 998 895 757 General and administration 1,638 1,446 1,278 Restructuring charge 60 — 76 Amortization of intangible assets 50 89 99 Total expense 8,741 8,346 7,696 Operating income 5,457 5,254 4,565 Nonoperating income (expense) Net gain (loss) on investments 1 161 55 Interest and dividend income 104 49 40 Interest expense (184 ) (205 ) (205 ) Total nonoperating income (expense) (79 ) 5 (110 ) Income before income taxes 5,378 5,259 4,455 Income tax expense 1,076 270 1,289 Net income 4,302 4,989 3,166 Less: Net income (loss) attributable to noncontrolling interests (3 ) 37 (2 ) Net income attributable to BlackRock, Inc. $ 4,305 $ 4,952 $ 3,168 Earnings per share attributable to BlackRock, Inc. common stockholders: Basic $ 26.86 $ 30.54 $ 19.27 Diluted $ 26.58 $ 30.12 $ 19.02 Cash dividends declared and paid per share $ 12.02 $ 10.00 $ 9.16 Weighted-average common shares outstanding: Basic 160,301,116 162,160,601 164,425,858 Diluted 161,948,732 164,415,035 166,579,752 See accompanying notes to consolidated financial statements. F-4

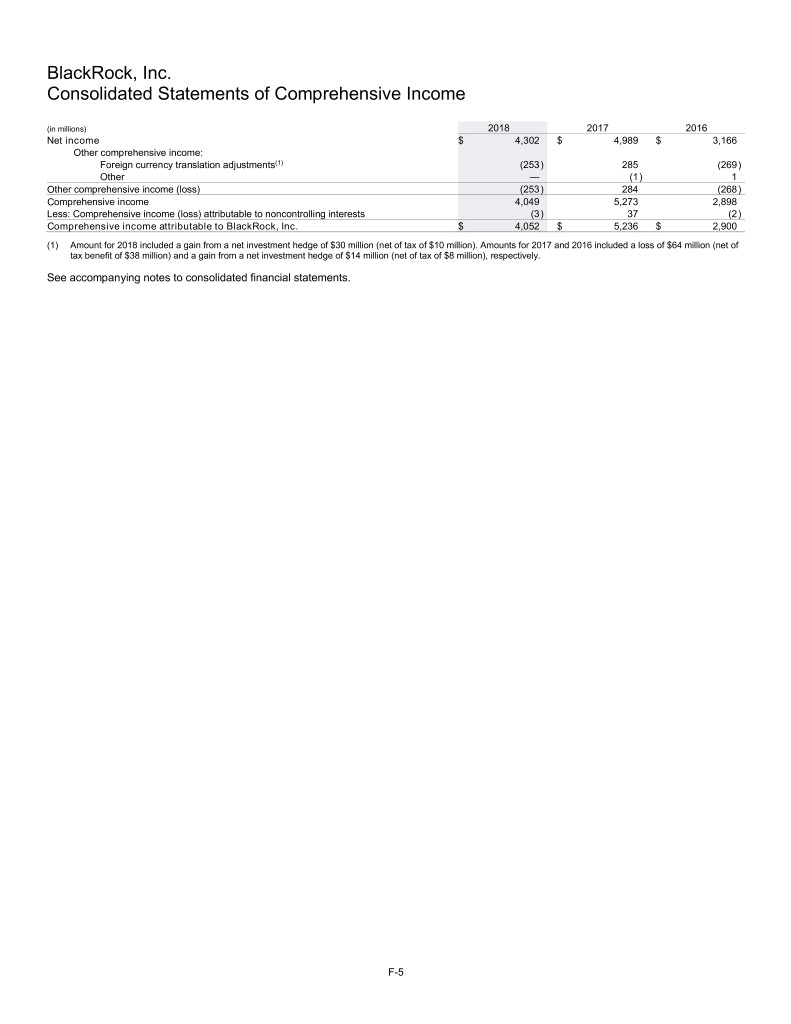

BlackRock, Inc. Consolidated Statements of Comprehensive Income (in millions) 2018 2017 2016 Net income $ 4,302 $ 4,989 $ 3,166 Other comprehensive income: Foreign currency translation adjustments(1) (253 ) 285 (269 ) Other — (1 ) 1 Other comprehensive income (loss) (253 ) 284 (268 ) Comprehensive income 4,049 5,273 2,898 Less: Comprehensive income (loss) attributable to noncontrolling interests (3 ) 37 (2 ) Comprehensive income attributable to BlackRock, Inc. $ 4,052 $ 5,236 $ 2,900 (1) Amount for 2018 included a gain from a net investment hedge of $30 million (net of tax of $10 million). Amounts for 2017 and 2016 included a loss of $64 million (net of tax benefit of $38 million) and a gain from a net investment hedge of $14 million (net of tax of $8 million), respectively. See accompanying notes to consolidated financial statements. F-5

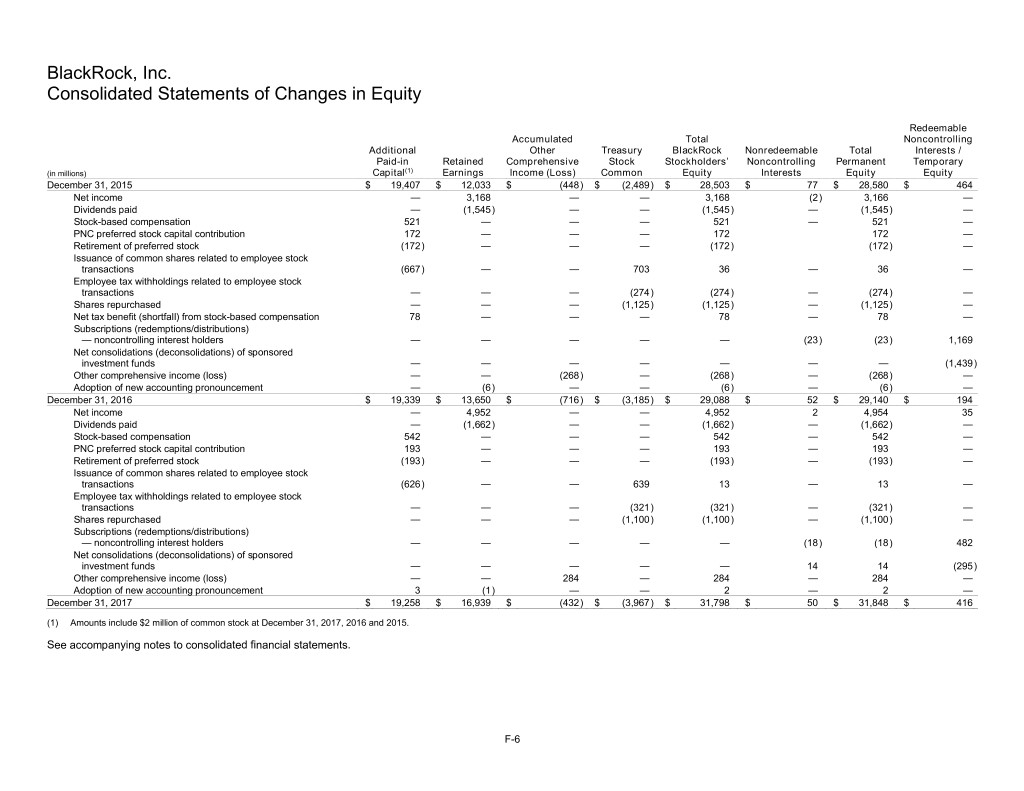

BlackRock, Inc. Consolidated Statements of Changes in Equity Redeemable Accumulated Total Noncontrolling Additional Other Treasury BlackRock Nonredeemable Total Interests / Paid-in Retained Comprehensive Stock Stockholders’ Noncontrolling Permanent Temporary (in millions) Capital(1) Earnings Income (Loss) Common Equity Interests Equity Equity December 31, 2015 $ 19,407 $ 12,033 $ (448 ) $ (2,489 ) $ 28,503 $ 77 $ 28,580 $ 464 Net income — 3,168 — — 3,168 (2 ) 3,166 — Dividends paid — (1,545 ) — — (1,545 ) — (1,545 ) — Stock-based compensation 521 — — — 521 — 521 — PNC preferred stock capital contribution 172 — — — 172 172 — Retirement of preferred stock (172 ) — — — (172 ) (172 ) — Issuance of common shares related to employee stock transactions (667 ) — — 703 36 — 36 — Employee tax withholdings related to employee stock transactions — — — (274 ) (274 ) — (274 ) — Shares repurchased — — — (1,125 ) (1,125 ) — (1,125 ) — Net tax benefit (shortfall) from stock-based compensation 78 — — — 78 — 78 — Subscriptions (redemptions/distributions) — noncontrolling interest holders — — — — — (23 ) (23 ) 1,169 Net consolidations (deconsolidations) of sponsored investment funds — — — — — — — (1,439 ) Other comprehensive income (loss) — — (268 ) — (268 ) — (268 ) — Adoption of new accounting pronouncement — (6 ) — — (6 ) — (6 ) — December 31, 2016 $ 19,339 $ 13,650 $ (716 ) $ (3,185 ) $ 29,088 $ 52 $ 29,140 $ 194 Net income — 4,952 — — 4,952 2 4,954 35 Dividends paid — (1,662 ) — — (1,662 ) — (1,662 ) — Stock-based compensation 542 — — — 542 — 542 — PNC preferred stock capital contribution 193 — — — 193 — 193 — Retirement of preferred stock (193 ) — — — (193 ) — (193 ) — Issuance of common shares related to employee stock transactions (626 ) — — 639 13 — 13 — Employee tax withholdings related to employee stock transactions — — — (321 ) (321 ) — (321 ) — Shares repurchased — — — (1,100 ) (1,100 ) — (1,100 ) — Subscriptions (redemptions/distributions) — noncontrolling interest holders — — — — — (18 ) (18 ) 482 Net consolidations (deconsolidations) of sponsored investment funds — — — — — 14 14 (295 ) Other comprehensive income (loss) — — 284 — 284 — 284 — Adoption of new accounting pronouncement 3 (1 ) — — 2 — 2 — December 31, 2017 $ 19,258 $ 16,939 $ (432 ) $ (3,967 ) $ 31,798 $ 50 $ 31,848 $ 416 (1) Amounts include $2 million of common stock at December 31, 2017, 2016 and 2015. See accompanying notes to consolidated financial statements. F-6

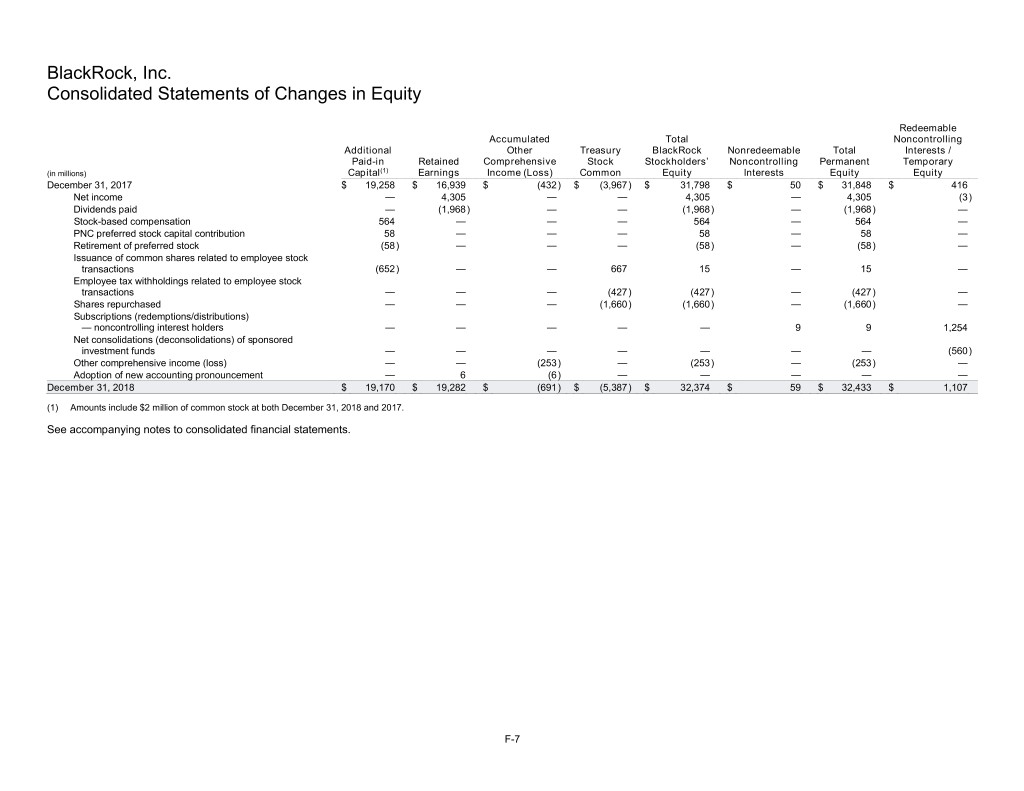

BlackRock, Inc. Consolidated Statements of Changes in Equity Redeemable Accumulated Total Noncontrolling Additional Other Treasury BlackRock Nonredeemable Total Interests / Paid-in Retained Comprehensive Stock Stockholders’ Noncontrolling Permanent Temporary (in millions) Capital(1) Earnings Income (Loss) Common Equity Interests Equity Equity December 31, 2017 $ 19,258 $ 16,939 $ (432 ) $ (3,967 ) $ 31,798 $ 50 $ 31,848 $ 416 Net income — 4,305 — — 4,305 — 4,305 (3 ) Dividends paid — (1,968 ) — — (1,968 ) — (1,968 ) — Stock-based compensation 564 — — — 564 — 564 — PNC preferred stock capital contribution 58 — — — 58 — 58 — Retirement of preferred stock (58 ) — — — (58 ) — (58 ) — Issuance of common shares related to employee stock transactions (652 ) — — 667 15 — 15 — Employee tax withholdings related to employee stock transactions — — — (427 ) (427 ) — (427 ) — Shares repurchased — — — (1,660 ) (1,660 ) — (1,660 ) — Subscriptions (redemptions/distributions) — noncontrolling interest holders — — — — — 9 9 1,254 Net consolidations (deconsolidations) of sponsored investment funds — — — — — — — (560 ) Other comprehensive income (loss) — — (253 ) — (253 ) — (253 ) — Adoption of new accounting pronouncement — 6 (6 ) — — — — — December 31, 2018 $ 19,170 $ 19,282 $ (691 ) $ (5,387 ) $ 32,374 $ 59 $ 32,433 $ 1,107 (1) Amounts include $2 million of common stock at both December 31, 2018 and 2017. See accompanying notes to consolidated financial statements. F-7

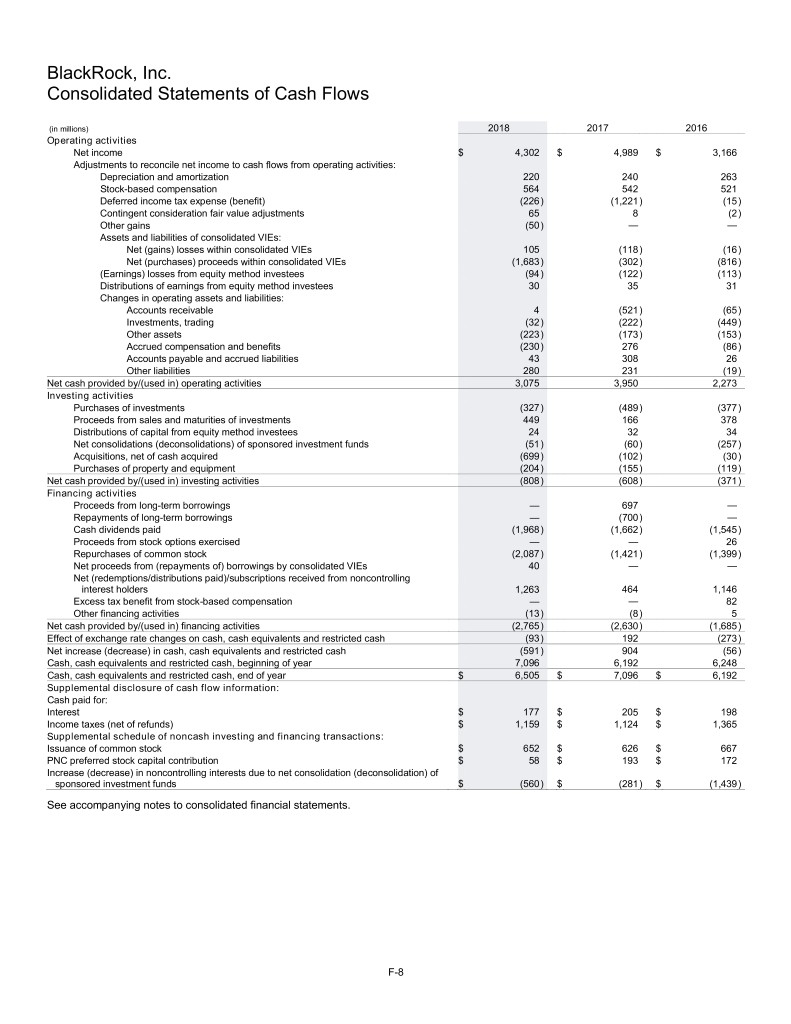

BlackRock, Inc. Consolidated Statements of Cash Flows (in millions) 2018 2017 2016 Operating activities Net income $ 4,302 $ 4,989 $ 3,166 Adjustments to reconcile net income to cash flows from operating activities: Depreciation and amortization 220 240 263 Stock-based compensation 564 542 521 Deferred income tax expense (benefit) (226 ) (1,221 ) (15 ) Contingent consideration fair value adjustments 65 8 (2 ) Other gains (50 ) — — Assets and liabilities of consolidated VIEs: Net (gains) losses within consolidated VIEs 105 (118 ) (16 ) Net (purchases) proceeds within consolidated VIEs (1,683 ) (302 ) (816 ) (Earnings) losses from equity method investees (94 ) (122 ) (113 ) Distributions of earnings from equity method investees 30 35 31 Changes in operating assets and liabilities: Accounts receivable 4 (521 ) (65 ) Investments, trading (32 ) (222 ) (449 ) Other assets (223 ) (173 ) (153 ) Accrued compensation and benefits (230 ) 276 (86 ) Accounts payable and accrued liabilities 43 308 26 Other liabilities 280 231 (19 ) Net cash provided by/(used in) operating activities 3,075 3,950 2,273 Investing activities Purchases of investments (327 ) (489 ) (377 ) Proceeds from sales and maturities of investments 449 166 378 Distributions of capital from equity method investees 24 32 34 Net consolidations (deconsolidations) of sponsored investment funds (51 ) (60 ) (257 ) Acquisitions, net of cash acquired (699 ) (102 ) (30 ) Purchases of property and equipment (204 ) (155 ) (119 ) Net cash provided by/(used in) investing activities (808 ) (608 ) (371 ) Financing activities Proceeds from long-term borrowings — 697 — Repayments of long-term borrowings — (700 ) — Cash dividends paid (1,968 ) (1,662 ) (1,545 ) Proceeds from stock options exercised — — 26 Repurchases of common stock (2,087 ) (1,421 ) (1,399 ) Net proceeds from (repayments of) borrowings by consolidated VIEs 40 — — Net (redemptions/distributions paid)/subscriptions received from noncontrolling interest holders 1,263 464 1,146 Excess tax benefit from stock-based compensation — — 82 Other financing activities (13 ) (8 ) 5 Net cash provided by/(used in) financing activities (2,765 ) (2,630 ) (1,685 ) Effect of exchange rate changes on cash, cash equivalents and restricted cash (93 ) 192 (273 ) Net increase (decrease) in cash, cash equivalents and restricted cash (591 ) 904 (56 ) Cash, cash equivalents and restricted cash, beginning of year 7,096 6,192 6,248 Cash, cash equivalents and restricted cash, end of year $ 6,505 $ 7,096 $ 6,192 Supplemental disclosure of cash flow information: Cash paid for: Interest $ 177 $ 205 $ 198 Income taxes (net of refunds) $ 1,159 $ 1,124 $ 1,365 Supplemental schedule of noncash investing and financing transactions: Issuance of common stock $ 652 $ 626 $ 667 PNC preferred stock capital contribution $ 58 $ 193 $ 172 Increase (decrease) in noncontrolling interests due to net consolidation (deconsolidation) of sponsored investment funds $ (560 ) $ (281 ) $ (1,439 ) See accompanying notes to consolidated financial statements. F-8

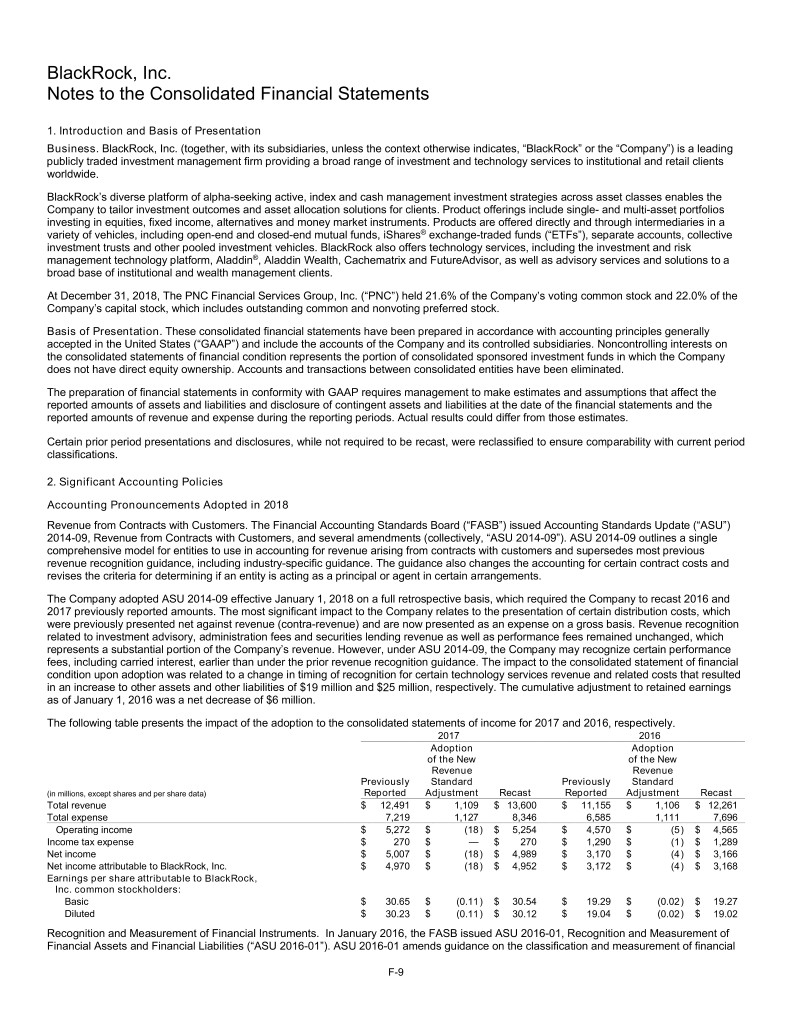

BlackRock, Inc. Notes to the Consolidated Financial Statements 1. Introduction and Basis of Presentation Business. BlackRock, Inc. (together, with its subsidiaries, unless the context otherwise indicates, “BlackRock” or the “Company”) is a leading publicly traded investment management firm providing a broad range of investment and technology services to institutional and retail clients worldwide. BlackRock’s diverse platform of alpha-seeking active, index and cash management investment strategies across asset classes enables the Company to tailor investment outcomes and asset allocation solutions for clients. Product offerings include single- and multi-asset portfolios investing in equities, fixed income, alternatives and money market instruments. Products are offered directly and through intermediaries in a variety of vehicles, including open-end and closed-end mutual funds, iShares® exchange-traded funds (“ETFs”), separate accounts, collective investment trusts and other pooled investment vehicles. BlackRock also offers technology services, including the investment and risk management technology platform, Aladdin®, Aladdin Wealth, Cachematrix and FutureAdvisor, as well as advisory services and solutions to a broad base of institutional and wealth management clients. At December 31, 2018, The PNC Financial Services Group, Inc. (“PNC”) held 21.6% of the Company’s voting common stock and 22.0% of the Company’s capital stock, which includes outstanding common and nonvoting preferred stock. Basis of Presentation. These consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and include the accounts of the Company and its controlled subsidiaries. Noncontrolling interests on the consolidated statements of financial condition represents the portion of consolidated sponsored investment funds in which the Company does not have direct equity ownership. Accounts and transactions between consolidated entities have been eliminated. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expense during the reporting periods. Actual results could differ from those estimates. Certain prior period presentations and disclosures, while not required to be recast, were reclassified to ensure comparability with current period classifications. 2. Significant Accounting Policies Accounting Pronouncements Adopted in 2018 Revenue from Contracts with Customers. The Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers, and several amendments (collectively, “ASU 2014-09”). ASU 2014-09 outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most previous revenue recognition guidance, including industry-specific guidance. The guidance also changes the accounting for certain contract costs and revises the criteria for determining if an entity is acting as a principal or agent in certain arrangements. The Company adopted ASU 2014-09 effective January 1, 2018 on a full retrospective basis, which required the Company to recast 2016 and 2017 previously reported amounts. The most significant impact to the Company relates to the presentation of certain distribution costs, which were previously presented net against revenue (contra-revenue) and are now presented as an expense on a gross basis. Revenue recognition related to investment advisory, administration fees and securities lending revenue as well as performance fees remained unchanged, which represents a substantial portion of the Company’s revenue. However, under ASU 2014-09, the Company may recognize certain performance fees, including carried interest, earlier than under the prior revenue recognition guidance. The impact to the consolidated statement of financial condition upon adoption was related to a change in timing of recognition for certain technology services revenue and related costs that resulted in an increase to other assets and other liabilities of $19 million and $25 million, respectively. The cumulative adjustment to retained earnings as of January 1, 2016 was a net decrease of $6 million. The following table presents the impact of the adoption to the consolidated statements of income for 2017 and 2016, respectively. 2017 2016 Adoption Adoption of the New of the New Revenue Revenue Previously Standard Previously Standard (in millions, except shares and per share data) Reported Adjustment Recast Reported Adjustment Recast Total revenue $ 12,491 $ 1,109 $ 13,600 $ 11,155 $ 1,106 $ 12,261 Total expense 7,219 1,127 8,346 6,585 1,111 7,696 Operating income $ 5,272 $ (18 ) $ 5,254 $ 4,570 $ (5 ) $ 4,565 Income tax expense $ 270 $ — $ 270 $ 1,290 $ (1 ) $ 1,289 Net income $ 5,007 $ (18 ) $ 4,989 $ 3,170 $ (4 ) $ 3,166 Net income attributable to BlackRock, Inc. $ 4,970 $ (18 ) $ 4,952 $ 3,172 $ (4 ) $ 3,168 Earnings per share attributable to BlackRock, Inc. common stockholders: Basic $ 30.65 $ (0.11 ) $ 30.54 $ 19.29 $ (0.02 ) $ 19.27 Diluted $ 30.23 $ (0.11 ) $ 30.12 $ 19.04 $ (0.02 ) $ 19.02 Recognition and Measurement of Financial Instruments. In January 2016, the FASB issued ASU 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities (“ASU 2016-01”). ASU 2016-01 amends guidance on the classification and measurement of financial F-9

instruments, including requiring an entity to measure substantially all equity securities (other than those accounted for under the equity method of accounting) at fair value through earnings. ASU 2016-01 also amends certain disclosures associated with the fair value of financial instruments. The Company adopted ASU 2016-01 using a modified retrospective approach on January 1, 2018. The reclassification of unrealized gains (losses) on equity securities within accumulated other comprehensive income (“AOCI”) to retained earnings was not material upon adoption. Cash Flow Classification. In August 2016, the FASB issued ASU 2016-15, Classification of Certain Cash Receipts and Cash Payments (“ASU 2016-15”), which amends and clarifies the current guidance to reduce diversity in practice of the classification of certain cash receipts and payments in the consolidated statement of cash flows. The Company adopted ASU 2016-15 on January 1, 2018 retrospectively to all periods presented. The adoption of ASU 2016-15 did not have a material impact on the consolidated statements of cash flows. Restricted Cash. In November 2016, the FASB issued 2016-18, Restricted Cash (“ASU 2016-18”), which clarifies the classification and presentation of restricted cash in the consolidated statement of cash flows. The Company adopted ASU 2016-18 on January 1, 2018 retrospectively to all periods presented. The adoption of ASU 2016-18 did not have a material impact on the consolidated statements of cash flows. See Note 3, Cash, Cash Equivalents and Restricted Cash, for additional disclosures related to restricted cash. Reclassifications from Accumulated Other Comprehensive Income. In February 2018, the FASB issued ASU 2018-02, Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income (“ASU 2018-02”). ASU 2018-02 allows reclassification from AOCI to retained earnings for stranded tax effects resulting from the Tax Cuts and Jobs Act. The Company adopted ASU 2018-02 prospectively on January 1, 2018. The adoption of ASU 2018-02 did not have a material impact on the consolidated statement of financial condition. Fair Value Disclosure Requirements. In August 2018, the FASB issued ASU 2018-13, Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”), which adds, modifies and removes certain disclosure requirements for fair value measurements. The Company early adopted the provisions of ASU 2018-13 that remove and modify disclosure requirements effective July 1, 2018, which included the removal of the estimated liquidation periods for investments measured at net asset value on a retrospective basis and removal of the valuation processes discussion for Level 3 fair value measurements. The additional disclosure requirements under ASU 2018-13 are required to be applied prospectively and are effective for the Company on January 1, 2020. The Company does not expect the additional disclosure requirements to have a material impact on its consolidated financial statements. Cash and Cash Equivalents. Cash and cash equivalents primarily consists of cash, money market funds and short-term, highly liquid investments with original maturities of three months or less in which the Company is exposed to market and credit risk. Cash and cash equivalent balances that are legally restricted from use by the Company are recorded in other assets on the consolidated statements of financial condition. Cash balances maintained by consolidated voting rights entities (“VREs”) are not considered legally restricted and are included in cash and cash equivalents on the consolidated statements of financial condition. Cash balances maintained by consolidated variable interest entities (“VIEs”) are included in assets of consolidated VIE on the consolidated statements of financial condition. Investments Investments in Debt Securities. The Company classifies debt investments as available-for-sale, held-to-maturity or trading based on the Company’s intent to sell the security or, its intent and ability to hold the debt security to maturity. Available-for-sale securities are those securities that are not classified as trading or held-to-maturity. Available-for-sale securities include certain investments in collateralized loan obligations (“CLOs”) and are carried at fair value on the consolidated statements of financial condition with changes in fair value recorded in AOCI within stockholders’ equity in the period of the change. Upon the disposition of an available-for-sale security, the Company reclassifies the gain or loss on the security from AOCI to nonoperating income (expense) on the consolidated statements of income. Held-to-maturity securities are purchased with the positive intent and ability to be held to maturity and are recorded at amortized cost on the consolidated statements of financial condition. Trading securities are those investments that are purchased principally for the purpose of selling them in the near term. Trading securities are carried at fair value on the consolidated statements of financial condition with changes in fair value recorded in nonoperating income (expense) on the consolidated statements of income. Trading securities include certain investments in CLOs for which the fair value option is elected in order to reduce operational complexity of bifurcating embedded derivatives. Investments in Equity Securities. Equity securities are generally carried at fair value on the consolidated statements of financial condition with changes in the fair value recorded through net income (“FVTNI”) within nonoperating income (expense). For nonmarketable equity securities, the Company generally elects to apply the practicality exception to fair value measurement, under which such securities will be measured at cost, less impairment, plus or minus observable price changes for identical or similar securities of the same issuer with such changes recorded in the consolidated statements of income. Dividends received are recorded as dividend income within nonoperating income (expense). Equity Method. The Company applies the equity method of accounting for equity investments where the Company does not consolidate the investee, but can exert significant influence over the financial and operating policies of the investee. The Company’s share of the investee’s underlying net income or loss is recorded as net gain (loss) on investments within nonoperating income (expense) and as other revenue for certain strategic investments since such companies are considered to be an extension of the Company’s core business. The Company’s share of net income of the investee is recorded based upon the most current information available at the time, which may precede the date of the consolidated statement of financial condition. Distributions received reduce the Company’s carrying value of the investee and the cost basis if deemed to be a return of capital. Impairments of Investments. Management periodically assesses equity method, available-for-sale and held-to-maturity investments for other- than-temporary impairment (“OTTI”). If an OTTI exists, an impairment charge would be recorded for the excess of the carrying amount of the investment over its estimated fair value in the consolidated statements of income. F-10

For equity method investments and held-to-maturity investments, if circumstances indicate that an OTTI may exist, the investments are evaluated using market values, where available, or the expected future cash flows of the investment. For the Company’s investments in CLOs, the Company reviews cash flow estimates over the life of each CLO investment. On a quarterly basis, if the present value of the estimated future cash flows is lower than the carrying value of the investment and there is an adverse change in estimated cash flows, an impairment is considered to be other-than-temporary. In addition, for nonmarketable equity securities that are accounted for under the measurement alternative to fair value, the Company applies the impairment model that does not require the Company to consider whether the impairment is other-than-temporary. Consolidation. The Company performs an analysis for investment products to determine if the product is a VIE or a VRE. Assessing whether an entity is a VIE or a VRE involves judgment and analysis. Factors considered in this assessment include the entity’s legal organization, the entity’s capital structure and equity ownership, and any related party or de facto agent implications of the Company’s involvement with the entity. Investments that are determined to be VIEs are consolidated if the Company is the primary beneficiary (“PB”) of the entity. VREs are typically consolidated if the Company holds the majority voting interest. Upon the occurrence of certain events (such as contributions and redemptions, either by the Company, or third parties, or amendments to the governing documents of the Company’s investment products), management reviews and reconsiders its previous conclusion regarding the status of an entity as a VIE or a VRE. Additionally, management continually reconsiders whether the Company is deemed to be a VIE’s PB that consolidates such entity. Consolidation of Variable Interest Entities. Certain investment products for which a controlling financial interest is achieved through arrangements that do not involve or are not directly linked to voting interests are deemed VIEs. BlackRock reviews factors, including whether or not i) the entity has equity that is sufficient to permit the entity to finance its activities without additional subordinated support from other parties and ii) the equity holders at risk have the obligation to absorb losses, the right to receive residual returns, and the right to direct the activities of the entity that most significantly impact the entity’s economic performance, to determine if the investment product is a VIE. BlackRock re- evaluates such factors as facts and circumstances change. The PB of a VIE is defined as the variable interest holder that has a controlling financial interest in the VIE. A controlling financial interest is defined as (i) the power to direct the activities of the VIE that most significantly impact its economic performance and (ii) the obligation to absorb losses of the entity or the right to receive benefits from the entity that potentially could be significant to the VIE. The Company generally consolidates VIEs in which it holds an equity ownership interest of 10% or greater and deconsolidates such VIEs once equity ownership falls below 10%. Consolidation of Voting Rights Entities. BlackRock is required to consolidate an investee to the extent that BlackRock can exert control over the financial and operating policies of the investee, which generally exists if there is a greater than 50% voting equity interest. Retention of Specialized Investment Company Accounting Principles. Upon consolidation of sponsored investment funds, the Company retains the specialized investment company accounting principles of the underlying funds. All of the underlying investments held by such consolidated sponsored investment funds are carried at fair value with corresponding changes in the investments’ fair values reflected in nonoperating income (expense) on the consolidated statements of income. When the Company no longer controls these funds due to reduced ownership percentage or other reasons, the funds are deconsolidated and accounted for as an equity method investment or equity securities FVTNI if the Company still maintains an investment. Money Market Fee Waivers. The Company may voluntarily waive a portion of its management fees on certain money market funds to ensure that they maintain a targeted level of daily net investment income (the “Yield Support waivers”). During 2018, 2017 and 2016, these waivers resulted in a reduction of management fees of approximately $0 million, $6 million and $56 million, respectively. Approximately 0% and 35% of Yield Support waivers for 2017 and 2016, respectively, were offset by a reduction of BlackRock’s distribution and servicing costs paid to a financial intermediary. BlackRock may increase or decrease the level of fee waivers in future periods. Separate Account Assets and Liabilities. Separate account assets are maintained by BlackRock Life Limited, a wholly owned subsidiary of the Company, which is a registered life insurance company in the United Kingdom, and represent segregated assets held for purposes of funding individual and group pension contracts. The life insurance company does not underwrite any insurance contracts that involve any insurance risk transfer from the insured to the life insurance company. The separate account assets primarily include equity securities, debt securities, money market funds and derivatives. The separate account assets are not subject to general claims of the creditors of BlackRock. These separate account assets and the related equal and offsetting liabilities are recorded as separate account assets and separate account liabilities on the consolidated statements of financial condition. The net investment income attributable to separate account assets supporting individual and group pension contracts accrues directly to the contract owner and is not reported on the consolidated statements of income. While BlackRock has no economic interest in these separate account assets and liabilities, BlackRock earns policy administration and management fees associated with these products, which are included in investment advisory, administration fees and securities lending revenue on the consolidated statements of income. Separate Account Collateral Assets Held and Liabilities Under Securities Lending Agreements. The Company facilitates securities lending arrangements whereby securities held by separate accounts maintained by BlackRock Life Limited are lent to third parties under global master securities lending agreements. In exchange, the Company receives legal title to the collateral with minimum values generally ranging from approximately 102% to 112% of the value of the securities lent in order to reduce counterparty risk. The required collateral value is calculated on a daily basis. The global master securities lending agreements provide the Company the right to request additional collateral or, in the event of borrower default, the right to liquidate collateral. The securities lending transactions entered into by the Company are accompanied by an agreement that entitles the Company to request the borrower to return the securities at any time; therefore, these transactions are not reported as sales. The Company records on the consolidated statements of financial condition the cash and noncash collateral received under these BlackRock Life Limited securities lending arrangements as its own asset in addition to an equal and offsetting collateral liability for the obligation to return the collateral. The securities lending revenue earned from lending securities held by the separate accounts is included in investment advisory, F-11

administration fees and securities lending revenue on the consolidated statements of income. During 2018 and 2017, the Company had not resold or repledged any of the collateral received under these arrangements. At December 31, 2018 and 2017, the fair value of loaned securities held by separate accounts was approximately $18.9 billion and $22.3 billion, respectively, and the fair value of the collateral held under these securities lending agreements was approximately $20.7 billion and $24.2 billion, respectively. Property and Equipment. Property and equipment are recorded at cost less accumulated depreciation. Depreciation is generally determined by cost less any estimated residual value using the straight-line method over the estimated useful lives of the various classes of property and equipment. Leasehold improvements are amortized using the straight-line method over the shorter of the estimated useful life or the remaining lease term. BlackRock develops a variety of risk management, investment analytic and investment system services for internal use, utilizing proprietary software that is hosted and maintained by BlackRock. The Company capitalizes certain costs incurred in connection with developing or obtaining software for internal use. Capitalized software costs are included within property and equipment on the consolidated statements of financial condition and are amortized, beginning when the software project is ready for its intended use, over the estimated useful life of the software of approximately three years. Goodwill and Intangible Assets. Goodwill represents the cost of a business acquisition in excess of the fair value of the net assets acquired. The Company has determined that it has one reporting unit for goodwill impairment testing purposes, the consolidated BlackRock single operating segment, which is consistent with internal management reporting and management's oversight of operations. In its assessment of goodwill for impairment, the Company considers such factors as the book value and market capitalization of the Company. On a quarterly basis, the Company considers if triggering events have occurred that may indicate a potential goodwill impairment. If a triggering event has occurred, the Company performs assessments, which may include reviews of significant valuation assumptions, to determine if goodwill may be impaired. The Company performs an impairment assessment of its goodwill at least annually as of July 31st. Intangible assets are comprised of indefinite-lived intangible assets and finite-lived intangible assets acquired in a business acquisition. The value of contracts to manage assets in proprietary open-end funds and collective trust funds and certain other commingled products without a specified termination date is generally classified as indefinite-lived intangible assets. The assignment of indefinite lives to such contracts primarily is based upon the following: (i) the assumption that there is no foreseeable limit on the contract period to manage these products; (ii) the Company expects to, and has the ability to, continue to operate these products indefinitely; (iii) the products have multiple investors and are not reliant on a single investor or small group of investors for their continued operation; (iv) current competitive factors and economic conditions do not indicate a finite life; and (v) there is a high likelihood of continued renewal based on historical experience. In addition, trade names/trademarks are considered indefinite-lived intangible assets when they are expected to generate cash flows indefinitely. Indefinite-lived intangible assets and goodwill are not amortized. Finite-lived management contracts, which relate to acquired separate accounts and funds and investor/customer relationships with a specified termination date, are amortized over their remaining useful lives. The Company performs assessments to determine if any intangible assets are potentially impaired and whether the indefinite-lived and finite- lived classifications are still appropriate. The carrying value of finite-lived assets and their remaining useful lives are reviewed at least annually to determine if circumstances exist which may indicate a potential impairment or revisions to the amortization period. The Company performs impairment assessments of all of its intangible assets at least annually, as of July 31st. In evaluating whether it is more likely than not that the fair value of indefinite-lived intangibles is less than its carrying value, BlackRock assesses various significant qualitative factors, including assets under management (“AUM”), revenue basis points, projected AUM growth rates, operating margins, tax rates and discount rates. In addition, the Company considers other factors, including (i) macroeconomic conditions such as a deterioration in general economic conditions, limitations on accessing capital, fluctuations in foreign exchange rates, or other developments in equity and credit markets; (ii) industry and market considerations such as a deterioration in the environment in which the entity operates, an increased competitive environment, a decline in market-dependent multiples or metrics, a change in the market for an entity’s services, or regulatory, legal or political developments; and (iii) entity-specific events, such as a change in management or key personnel, overall financial performance and litigation that could affect significant inputs used to determine the fair value of the indefinite-lived intangible asset. If an indefinite-lived intangible is determined to be more likely than not impaired, then the fair value of the asset is compared with its carrying value and any excess of the carrying value over the fair value would be recognized as an expense in the period in which the impairment occurs. For finite-lived intangible assets, if potential impairment circumstances are considered to exist, the Company will perform a recoverability test using an undiscounted cash flow analysis. Actual results could differ from these cash flow estimates, which could materially impact the impairment conclusion. If the carrying value of the asset is determined not to be recoverable based on the undiscounted cash flow test, the difference between the carrying value of the asset and its current fair value would be recognized as an expense in the period in which the impairment occurs. Noncontrolling Interests. The Company reports noncontrolling interests as equity, separate from the parent’s equity, on the consolidated statements of financial condition. In addition, the Company’s consolidated net income on the consolidated statements of income includes the income (loss) attributable to noncontrolling interest holders of the Company’s consolidated investment products. Income (loss) attributable to noncontrolling interests is not adjusted for income taxes for consolidated investment products that are treated as pass-through entities for tax purposes. Classification and Measurement of Redeemable Securities. The Company includes redeemable noncontrolling interests related to certain consolidated investment products in temporary equity on the consolidated statements of financial condition. Treasury Stock. The Company records common stock purchased for treasury at cost. At the date of subsequent reissuance, the treasury stock account is reduced by the cost of such stock using the average cost method. F-12

Revenue Recognition. Revenue is recognized upon transfer of control of promised services to customers in an amount to which the Company expects to be entitled in exchange for those services. The Company enters into contracts that can include multiple services, which are accounted for separately if they are determined to be distinct. Consideration for the Company’s services is generally in the form of variable consideration because the amount of fees is subject to market conditions that are outside of the Company’s influence. The Company includes variable consideration in revenue when it is no longer probable of significant reversal, i.e. when the associated uncertainty is resolved. For some contracts with customers, the Company has discretion to involve a third party in providing services to the customer. Generally, the Company is deemed to be the principal in these arrangements because the Company controls the promised services before they are transferred to customers, and accordingly presents the revenue gross of related costs. Investment Advisory, Administration Fees and Securities Lending Revenue. Investment advisory and administration fees are recognized as the services are performed over time because the customer is receiving and consuming the benefits as they are provided by the Company. Fees are primarily based on agreed-upon percentages of AUM and recognized for services provided during the period, which are distinct from services provided in other periods. Such fees are affected by changes in AUM, including market appreciation or depreciation, foreign exchange translation and net inflows or outflows. Investment advisory and administration fees for investment funds are shown net of fee waivers. In addition, the Company may contract with third parties to provide sub-advisory services on its behalf. The Company presents the investment advisory fees and associated costs to such third-party advisors on a gross basis where it is deemed to be the principal and on a net basis where it is deemed to be the agent. Management judgment involved in making these assessments is focused on ascertaining whether the Company is primarily responsible for fulfilling the promised service. The Company earns revenue by lending securities on behalf of clients, primarily to highly rated banks and broker-dealers. Revenue is recognized over time as services are performed. Generally, the securities lending fees are shared between the Company and the funds or other third-party accounts managed by the Company from which the securities are borrowed. Investment Advisory Performance Fees / Carried Interest. The Company receives investment advisory performance fees, including incentive allocations (carried interest) from certain actively managed investment funds and certain separately managed accounts. These performance fees are dependent upon exceeding specified relative or absolute investment return thresholds, which may vary by product or account, and include monthly, quarterly, annual or longer measurement periods. Performance fees, including carried interest, are recognized when it is determined that they are no longer probable of significant reversal (such as upon the sale of a fund’s investment or when the amount of AUM becomes known as of the end of a specified measurement period). Given the unique nature of each fee arrangement, contracts with customers are evaluated on an individual basis to determine the timing of revenue recognition. Significant judgement is involved in making such determination. Performance fees typically arise from investment management services that began in prior reporting periods. Consequently, a portion of the fees the Company recognizes may be partially related to the services performed in prior periods that meet the recognition criteria in the current period. At each reporting date, the Company considers various factors in estimating performance fees to be recognized, including carried interest. These factors include but are not limited to whether: (1) the fees are dependent on the market and thus are highly susceptible to factors outside the Company’s influence; (2) the fees have a large number and a broad range of possible amounts; and (3) the funds or separately managed accounts have the ability to invest or reinvest their sales proceeds. The Company is allocated carried interest from certain alternative investment products upon exceeding performance thresholds. The Company may be required to reverse/return all, or part, of such carried interest allocations/distributions depending upon future performance of these funds. Therefore, carried interest subject to such clawback provisions is recorded in investments/investments of consolidated VIEs or cash/cash of consolidated VIEs to the extent that it is distributed, on its consolidated statements of financial condition. The Company records a liability for deferred carried interest to the extent it receives cash or capital allocations related to carried interest prior to meeting the revenue recognition criteria. A portion of the deferred carried interest may also be paid to certain employees. The ultimate timing of the recognition of performance fee revenue and related compensation expense, if any, for these products is unknown. Technology services revenue. The Company offers investment management technology systems, risk management services, wealth management and digital distribution tools on a fee basis. Clients include banks, insurance companies, official institutions, pension funds, asset managers, retail distributors and other investors. Fees earned for technology services are recorded as services are performed over time and are generally determined using the value of positions on the Aladdin platform or on a fixed-rate basis. Distribution Fees. The Company accounts for fund distribution services and shareholder servicing as distinct services, separate from fund management services, because customers can benefit from each of the services on their own and because the services are separately identifiable (that is, the nature of the promised services is to transfer each service individually). The Company records upfront and ongoing sales commissions as distribution fee revenue for serving as the principal underwriter and/or distributor for certain managed mutual funds. Fund distribution services are satisfied at the point in time when an investor makes an investment in a share class of the managed mutual funds. Accordingly, the Company recognizes the upfront fees for front-end load funds on a trade date basis when the services are performed and the amount is known. However, the on-going distribution fees (e.g., 12b-1 fees) from the back-end load funds are based on net asset values over the investment period and are recognized when the amount is known. Consequently, a portion of the on-going distribution fees the Company recognized may be related to the services performed in prior periods that meet the recognition criteria in the current period. Generally, retail products offered outside of the United States do not generate a separate distribution fee as the quoted management fee rate is inclusive of these services. The Company recognizes ongoing shareholder servicing fee revenue as shareholder services are performed over time. On- going distribution fees are largely passed through as a distribution expense to third-party client intermediaries who distribute the funds. The Company contracts with third parties for various fund distribution services and shareholder servicing of certain funds to be performed on its behalf. These arrangements are generally priced as a portion of the fee paid to the Company by the fund or as an agreed-upon percentage of net asset value. The Company presents its distribution fees and distribution and servicing costs incurred on a gross basis in the consolidated statements of income because it has primary responsibility for fulfilling the promise to provide the specified services. F-13

Advisory and other revenue. Advisory and other revenue primarily includes fees earned for advisory services, fees earned for transition management services primarily comprised of commissions recognized in connection with buying and selling securities on behalf of customers, and equity method investment earnings related to certain strategic investments. Advisory services fees are determined using fixed-rate fees and are recognized over time as the related services are completed. Commissions related to transition management services are recorded on a trade-date basis as securities transactions occur. Stock-based Compensation. In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting (“ASU 2016-09”). ASU 2016-09 simplifies accounting for employee share-based payment transactions, including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the consolidated statements of cash flows. The Company adopted ASU 2016-09 as of January 1, 2017. ASU 2016-09 requires all excess tax benefits and deficiencies to be recognized in income tax expense on the consolidated statements of income. Accordingly, the Company recorded a discrete income tax benefit of $64 million and $151 million during 2018 and 2017, respectively, for vested restricted stock units (“RSUs”) where the grant date stock price was lower than the vesting date stock price. The new guidance could result in more volatility of income tax expense as a result of fluctuations in the Company’s stock price. Upon adoption, the Company elected to account for forfeitures as they occur, which did not have a material impact on the consolidated financial statements. In addition, the Company elected to present excess tax benefits and deficiencies prospectively in operating activities on the consolidated statements of cash flows. The Company recognizes compensation cost for equity classified awards based on the grant-date fair value of the award. The compensation cost is recognized over the period during which an employee is required to provide service (usually the vesting period) in exchange for the stock-based award. The Company measures the grant-date fair value of RSUs using the Company’s share price on the date of grant. For employee share options and instruments with market conditions, the Company uses pricing models. Stock option awards may have performance, market and/or service conditions. If an equity award is modified after the grant-date, incremental compensation cost is recognized for an amount equal to the excess of the fair value of the modified award over the fair value of the original award immediately before the modification. Awards under the Company’s stock-based compensation plans vest over various periods. Compensation cost is recorded by the Company on a straight-line basis over the requisite service period for each separate vesting portion of the award as if the award is, in-substance, multiple awards and is adjusted for actual forfeitures as they occur during 2018 and 2017. For 2016, forfeitures were estimated prior to vesting. The Company amortizes the grant-date fair value of stock-based compensation awards made to retirement-eligible employees over the requisite service period. Upon notification of retirement, the Company accelerates the unamortized portion of the award over the contractually required retirement notification period. Distribution and Servicing Costs. Distribution and servicing costs include payments to third parties, primarily associated with distribution and servicing of client investments in certain BlackRock products. Distribution and servicing costs are expensed when incurred. Direct Fund Expense. Direct fund expense, which is expensed as incurred, primarily consists of third-party nonadvisory expense incurred by BlackRock related to certain funds for the use of certain index trademarks, reference data for certain indices, custodial services, fund administration, fund accounting, transfer agent services, shareholder reporting services, audit and tax services as well as other fund-related expense directly attributable to the nonadvisory operations of the fund. Leases. The Company accounts for its office facilities leases as operating leases, which may include escalation clauses. The Company expenses the lease payments associated with operating leases evenly during the lease term (including rent-free periods) commencing when the Company obtains the right to control the use of the leased property. Foreign Exchange. Foreign currency transactions are recorded at the exchange rates prevailing on the dates of the transactions. Monetary assets and liabilities that are denominated in foreign currencies are subsequently remeasured into the functional currencies of the Company's subsidiaries at the rates prevailing at each balance sheet date. Gains and losses arising on remeasurement are included in general and administration expense on the consolidated statements of income. Revenue and expenses are translated at average exchange rates during the period. Gains or losses resulting from translating foreign currency financial statements into US dollars are included in AOCI, a separate component of stockholders’ equity, on the consolidated statements of financial condition. Income Taxes. Deferred income tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases using currently enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of a change in tax rates on deferred income tax assets and liabilities is recognized on the consolidated statements of income in the period that includes the enactment date. Management periodically assesses the recoverability of its deferred income tax assets based upon expected future earnings, taxable income in prior carryback years, future deductibility of the asset, changes in applicable tax laws and other factors. If management determines that it is not more likely than not that the deferred tax asset will be fully recoverable in the future, a valuation allowance will be established for the difference between the asset balance and the amount expected to be recoverable in the future. This allowance will result in additional income tax expense. Further, the Company records its income taxes receivable and payable based upon its estimated income tax position. In 2018 and 2017, excess tax benefits related to stock-based compensation were recognized as an income tax benefit on the consolidated statements of income and are reflected as operating cash flows on the consolidated statements of cash flows. For 2016, excess tax benefits were recognized as additional paid-in capital and financing cash flows. Earnings per Share (“EPS”). Basic EPS is calculated by dividing net income applicable to common shareholders by the weighted-average number of shares outstanding during the period. Diluted EPS includes the determinants of basic EPS and common stock equivalents outstanding during the period. Diluted EPS is computed using the treasury stock method. F-14

Due to the similarities in terms between BlackRock’s nonvoting participating preferred stock and the Company’s common stock, the Company considers its nonvoting participating preferred stock to be a common stock equivalent for purposes of EPS calculations. As such, the Company has included the outstanding nonvoting participating preferred stock in the calculation of average basic and diluted shares outstanding. Business Segments. The Company’s management directs BlackRock’s operations as one business, the asset management business. The Company utilizes a consolidated approach to assess performance and allocate resources. As such, the Company operates in one business segment. Fair Value Measurements Hierarchy of Fair Value Inputs. The Company uses a fair value hierarchy that prioritizes inputs to valuation approaches used to measure fair value. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. Assets and liabilities measured and reported at fair value are classified and disclosed in one of the following categories: Level 1 Inputs: Quoted prices (unadjusted) in active markets for identical assets or liabilities at the reporting date. • Level 1 assets may include listed mutual funds, ETFs, listed equities and certain exchange-traded derivatives. Level 2 Inputs: Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities that are not active; quotes from pricing services or brokers for which the Company can determine that orderly transactions took place at the quoted price or that the inputs used to arrive at the price are observable; and inputs other than quoted prices that are observable, such as models or other valuation methodologies. • Level 2 assets may include debt securities, investments in CLOs, bank loans, short-term floating-rate notes, asset- backed securities, securities held within consolidated hedge funds, restricted public securities valued at a discount, as well as over-the-counter derivatives, including interest and inflation rate swaps and foreign currency exchange contracts that have inputs to the valuations that generally can be corroborated by observable market data. Level 3 Inputs: Unobservable inputs for the valuation of the asset or liability, which may include nonbinding broker quotes. Level 3 assets include investments for which there is little, if any, market activity. These inputs require significant management judgment or estimation. • Level 3 assets may include direct private equity investments held within consolidated funds, investments in CLOs and bank loans of consolidated CLOs. • Level 3 liabilities include contingent liabilities related to acquisitions valued based upon discounted cash flow analyses using unobservable market data and borrowings of a consolidated CLO. Significance of Inputs. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the financial instrument. Valuation Approaches. The fair values of certain Level 3 assets and liabilities were determined using various valuation approaches as appropriate, including third-party pricing vendors, broker quotes and market and income approaches. A significant number of inputs used to value equity, debt securities, investments in CLOs and bank loans is sourced from third-party pricing vendors. Generally, prices obtained from pricing vendors are categorized as Level 1 inputs for identical securities traded in active markets and as Level 2 for other similar securities if the vendor uses observable inputs in determining the price. In addition, quotes obtained from brokers generally are nonbinding and categorized as Level 3 inputs. However, if the Company is able to determine that market participants have transacted for the asset in an orderly manner near the quoted price or if the Company can determine that the inputs used by the broker are observable, the quote is classified as a Level 2 input. Investments Measured at Net Asset Values. As a practical expedient, the Company uses net asset value (“NAV”) as the fair value for certain investments. The inputs to value these investments may include the Company’s capital accounts for its partnership interests in various alternative investments, including hedge funds, real assets and private equity funds, which may be adjusted by using the returns of certain market indices. The various partnerships generally are investment companies, which record their underlying investments at fair value based on fair value policies established by management of the underlying fund. Fair value policies at the underlying fund generally require the fund to utilize pricing/valuation information from third-party sources, including independent appraisals. However, in some instances, current valuation information for illiquid securities or securities in markets that are not active may not be available from any third-party source or fund management may conclude that the valuations that are available from third-party sources are not reliable. In these instances, fund management may perform model-based analytical valuations that could be used as an input to value these investments. Fair Value of Asset and Liabilities of Consolidated CLO. The Company applies the fair value option provisions for eligible assets, including bank loans, held by a consolidated CLO. As the fair value of the financial assets of the consolidated CLO is more observable than the fair value of the borrowings of the consolidated CLO, the Company measures the fair value of the borrowings of the consolidated CLO as the fair value of the assets of the consolidated CLO less the fair value of the Company’s economic interest in the CLO. Derivative Instruments and Hedging Activities. The Company does not use derivative financial instruments for trading or speculative purposes. The Company uses derivative financial instruments primarily for purposes of hedging exposures to fluctuations in foreign currency exchange rates of certain assets and liabilities, and market exposures for certain seed investments. However, certain consolidated sponsored investment funds may also utilize derivatives as a part of their investment strategy. Changes in the fair value of the Company’s derivative financial instruments are recognized in earnings and, where applicable, are offset by the corresponding gain or loss on the related foreign-denominated assets or liabilities or hedged investments, on the consolidated statements of income. F-15

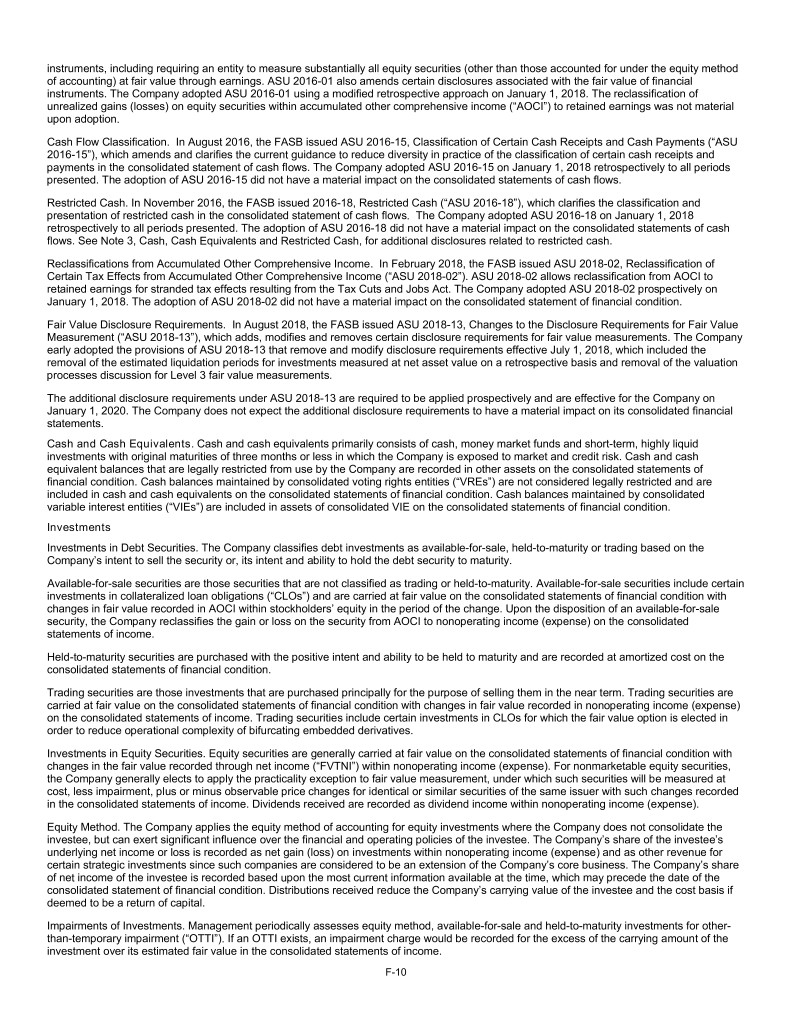

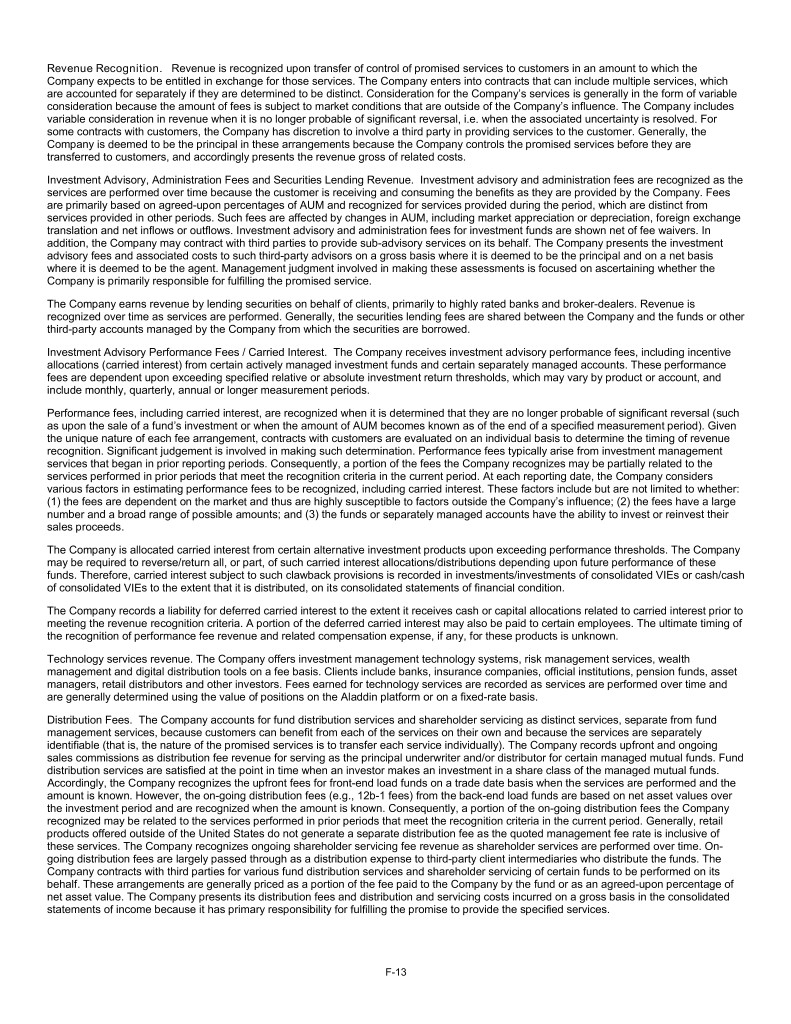

The Company may also use financial instruments designated as net investment hedges for accounting purposes to hedge net investments in international subsidiaries whose functional currency is not US dollars. The gain or loss from revaluing accounting hedges of net investments in foreign operations at the spot rate is deferred and reported within AOCI on the consolidated statements of financial condition. The Company reassesses the effectiveness of its net investment hedge on a quarterly basis. Recent Accounting Pronouncements Not Yet Adopted in 2018 Leases. In February 2016, the FASB issued ASU 2016-02, Leases, and several amendments (collectively, “ASU 2016-02”), which requires lessees to recognize assets and liabilities arising from most operating leases on the consolidated statements of financial condition. In July 2018, the FASB issued ASU 2018-11, Targeted Improvements (“ASU 2018-11”), which provides entities a transition option to not apply the new lease standard to the comparative periods presented in financial statements. Under this transition option, an entity applies the new leases standard at the adoption date and recognizes any cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption. The Company adopted ASU 2016-02 on its effective date of January 1, 2019 on a modified retrospective basis applying the transition option permitted by ASU 2018-11. The Company elected the package of practical expedients to alleviate certain operational complexities related to the adoption. The Company recorded a net increase of approximately $0.7 billion in its assets and liabilities related to the right-of-use asset and lease liability for its current operating leases upon adoption of ASU 2016-02 and does not expect the adoption to have a material impact on its results of operations or cash flows. See Note 14, Commitments and Contingencies, for information on the Company’s operating lease commitments. 3. Cash, Cash Equivalents and Restricted Cash The following table provides a reconciliation of cash and cash equivalents reported within the consolidated statements of financial condition to the cash, cash equivalents, and restricted cash reported within the consolidated statements of cash flows. December 31, December 31, 2018 2017 (in millions) Cash and cash equivalents $ 6,302 $ 6,894 Cash and cash equivalents of consolidated VIEs 186 144 Restricted cash included in other assets 17 58 Total cash, cash equivalents and restricted cash $ 6,505 $ 7,096 4. Investments A summary of the carrying value of total investments is as follows: December 31, (in millions) 2018(1) Debt securities: Held-to-maturity investments $ 188 Trading securities ($233 debt securities of consolidated sponsored investment funds) 265 Total debt securities 453 Equity securities at FVTNI ($291 equity securities of consolidated sponsored investment funds) 452 Equity method investments(2) 781 Federal Reserve Bank stock(3) 92 Carried interest(4) 18 Total investments $ 1,796 December 31, (in millions) 2017(1) Available-for-sale investments $ 103 Held-to-maturity investments 102 Trading investments: Consolidated sponsored investment funds: Debt securities 267 Equity securities 245 Other equity and debt securities 267 Deferred compensation plan mutual funds 56 Total trading investments 835 Other investments: Equity method investments(2) 816 Cost method investments(3) 93 Carried interest(4) 32 Total other investments 941 Total investments $ 1,981 (1) Amounts at December 31, 2018 reflect the adoption of ASU 2016-01. See Note 2, Significant Accounting Policies, for further information. Amounts at December 31, 2017 reflect accounting guidance prior to ASU 2016-01. (2) Equity method investments primarily include BlackRock’s direct investments in certain BlackRock sponsored investment funds. (3) Amounts include Federal Reserve Bank stock, which is held for regulatory purposes and is restricted from sale. At December 31, 2017, amount also includes other nonmarketable securities, which were immaterial. At December 31, 2018 and December 31, 2017, there were no indicators of impairment on these investments. (4) Carried interest of consolidated sponsored investment funds accounted for as VREs represents allocations to BlackRock’s general partner capital accounts from certain funds. These balances are subject to change upon cash distributions, additional allocations or reallocations back to limited partners within the respective funds. F-16

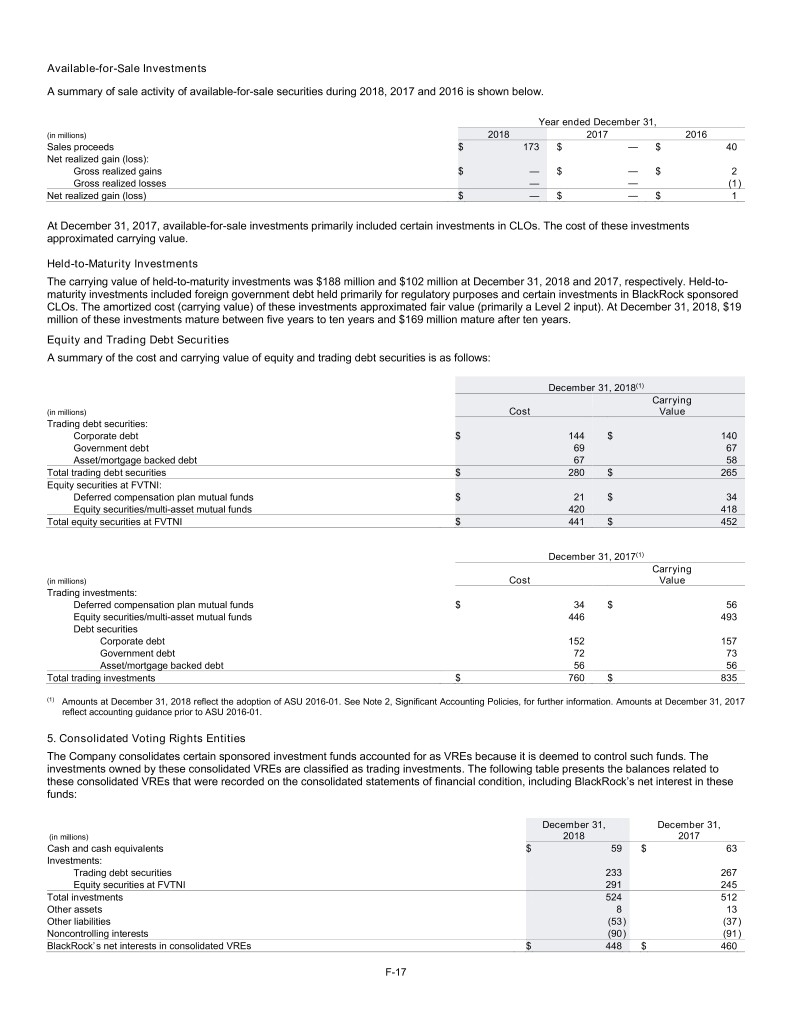

Available-for-Sale Investments A summary of sale activity of available-for-sale securities during 2018, 2017 and 2016 is shown below. Year ended December 31, (in millions) 2018 2017 2016 Sales proceeds $ 173 $ — $ 40 Net realized gain (loss): Gross realized gains $ — $ — $ 2 Gross realized losses — — (1 ) Net realized gain (loss) $ — $ — $ 1 At December 31, 2017, available-for-sale investments primarily included certain investments in CLOs. The cost of these investments approximated carrying value. Held-to-Maturity Investments The carrying value of held-to-maturity investments was $188 million and $102 million at December 31, 2018 and 2017, respectively. Held-to- maturity investments included foreign government debt held primarily for regulatory purposes and certain investments in BlackRock sponsored CLOs. The amortized cost (carrying value) of these investments approximated fair value (primarily a Level 2 input). At December 31, 2018, $19 million of these investments mature between five years to ten years and $169 million mature after ten years. Equity and Trading Debt Securities A summary of the cost and carrying value of equity and trading debt securities is as follows: December 31, 2018(1) Carrying (in millions) Cost Value Trading debt securities: Corporate debt $ 144 $ 140 Government debt 69 67 Asset/mortgage backed debt 67 58 Total trading debt securities $ 280 $ 265 Equity securities at FVTNI: Deferred compensation plan mutual funds $ 21 $ 34 Equity securities/multi-asset mutual funds 420 418 Total equity securities at FVTNI $ 441 $ 452 December 31, 2017(1) Carrying (in millions) Cost Value Trading investments: Deferred compensation plan mutual funds $ 34 $ 56 Equity securities/multi-asset mutual funds 446 493 Debt securities Corporate debt 152 157 Government debt 72 73 Asset/mortgage backed debt 56 56 Total trading investments $ 760 $ 835 (1) Amounts at December 31, 2018 reflect the adoption of ASU 2016-01. See Note 2, Significant Accounting Policies, for further information. Amounts at December 31, 2017 reflect accounting guidance prior to ASU 2016-01. 5. Consolidated Voting Rights Entities The Company consolidates certain sponsored investment funds accounted for as VREs because it is deemed to control such funds. The investments owned by these consolidated VREs are classified as trading investments. The following table presents the balances related to these consolidated VREs that were recorded on the consolidated statements of financial condition, including BlackRock’s net interest in these funds: December 31, December 31, (in millions) 2018 2017 Cash and cash equivalents $ 59 $ 63 Investments: Trading debt securities 233 267 Equity securities at FVTNI 291 245 Total investments 524 512 Other assets 8 13 Other liabilities (53 ) (37 ) Noncontrolling interests (90 ) (91 ) BlackRock’s net interests in consolidated VREs $ 448 $ 460 F-17

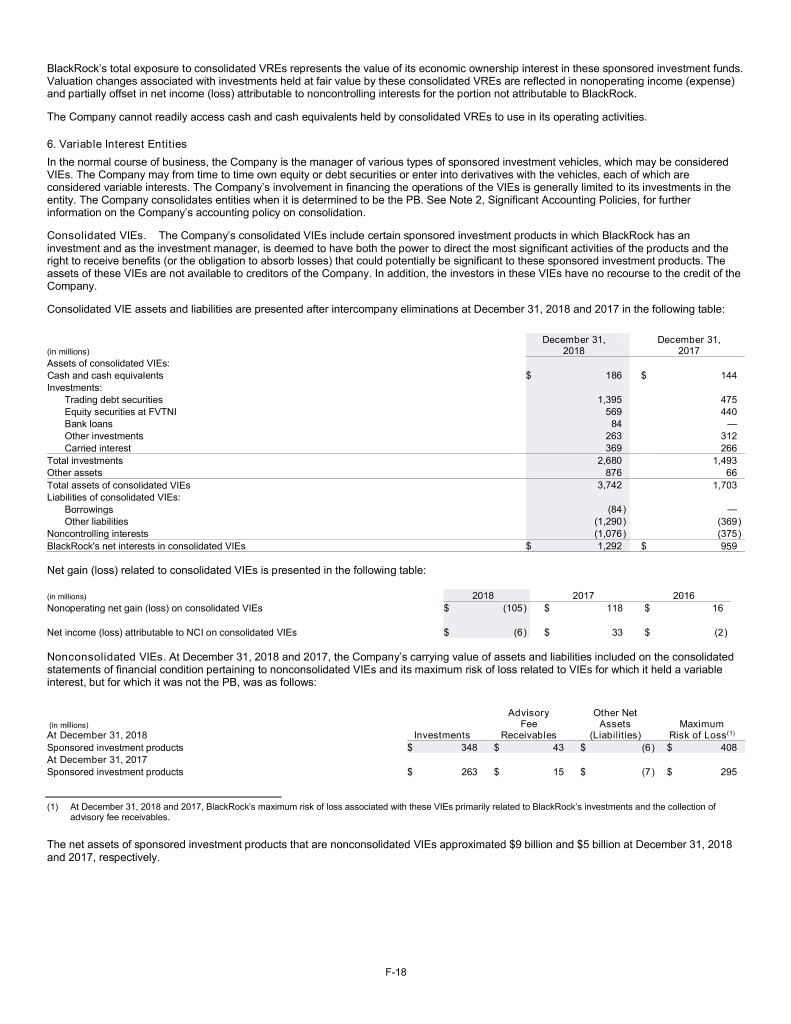

BlackRock’s total exposure to consolidated VREs represents the value of its economic ownership interest in these sponsored investment funds. Valuation changes associated with investments held at fair value by these consolidated VREs are reflected in nonoperating income (expense) and partially offset in net income (loss) attributable to noncontrolling interests for the portion not attributable to BlackRock. The Company cannot readily access cash and cash equivalents held by consolidated VREs to use in its operating activities. 6. Variable Interest Entities In the normal course of business, the Company is the manager of various types of sponsored investment vehicles, which may be considered VIEs. The Company may from time to time own equity or debt securities or enter into derivatives with the vehicles, each of which are considered variable interests. The Company’s involvement in financing the operations of the VIEs is generally limited to its investments in the entity. The Company consolidates entities when it is determined to be the PB. See Note 2, Significant Accounting Policies, for further information on the Company’s accounting policy on consolidation. Consolidated VIEs. The Company’s consolidated VIEs include certain sponsored investment products in which BlackRock has an investment and as the investment manager, is deemed to have both the power to direct the most significant activities of the products and the right to receive benefits (or the obligation to absorb losses) that could potentially be significant to these sponsored investment products. The assets of these VIEs are not available to creditors of the Company. In addition, the investors in these VIEs have no recourse to the credit of the Company. Consolidated VIE assets and liabilities are presented after intercompany eliminations at December 31, 2018 and 2017 in the following table: December 31, December 31, (in millions) 2018 2017 Assets of consolidated VIEs: Cash and cash equivalents $ 186 $ 144 Investments: Trading debt securities 1,395 475 Equity securities at FVTNI 569 440 Bank loans 84 — Other investments 263 312 Carried interest 369 266 Total investments 2,680 1,493 Other assets 876 66 Total assets of consolidated VIEs 3,742 1,703 Liabilities of consolidated VIEs: Borrowings (84 ) — Other liabilities (1,290 ) (369 ) Noncontrolling interests (1,076 ) (375 ) BlackRock's net interests in consolidated VIEs $ 1,292 $ 959 Net gain (loss) related to consolidated VIEs is presented in the following table: (in millions) 2018 2017 2016 Nonoperating net gain (loss) on consolidated VIEs $ (105 ) $ 118 $ 16 Net income (loss) attributable to NCI on consolidated VIEs $ (6 ) $ 33 $ (2 ) Nonconsolidated VIEs. At December 31, 2018 and 2017, the Company’s carrying value of assets and liabilities included on the consolidated statements of financial condition pertaining to nonconsolidated VIEs and its maximum risk of loss related to VIEs for which it held a variable interest, but for which it was not the PB, was as follows: Advisory Other Net (in millions) Fee Assets Maximum At December 31, 2018 Investments Receivables (Liabilities) Risk of Loss(1) Sponsored investment products $ 348 $ 43 $ (6 ) $ 408 At December 31, 2017 Sponsored investment products $ 263 $ 15 $ (7 ) $ 295 (1) At December 31, 2018 and 2017, BlackRock’s maximum risk of loss associated with these VIEs primarily related to BlackRock’s investments and the collection of advisory fee receivables. The net assets of sponsored investment products that are nonconsolidated VIEs approximated $9 billion and $5 billion at December 31, 2018 and 2017, respectively. F-18

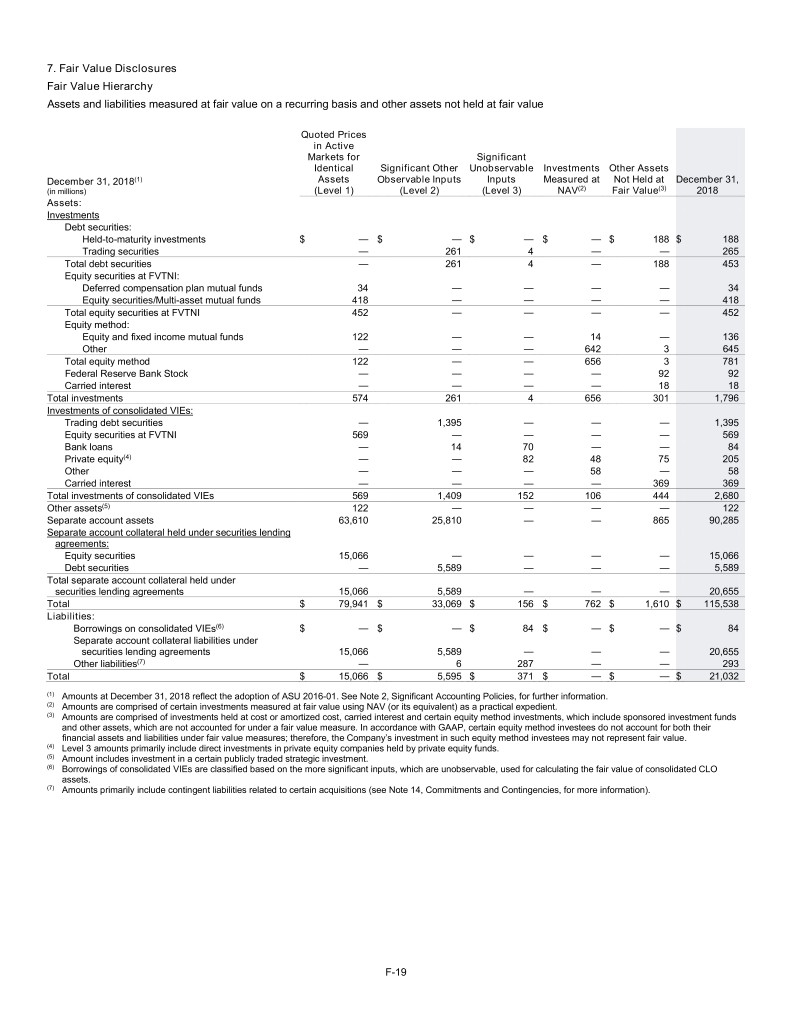

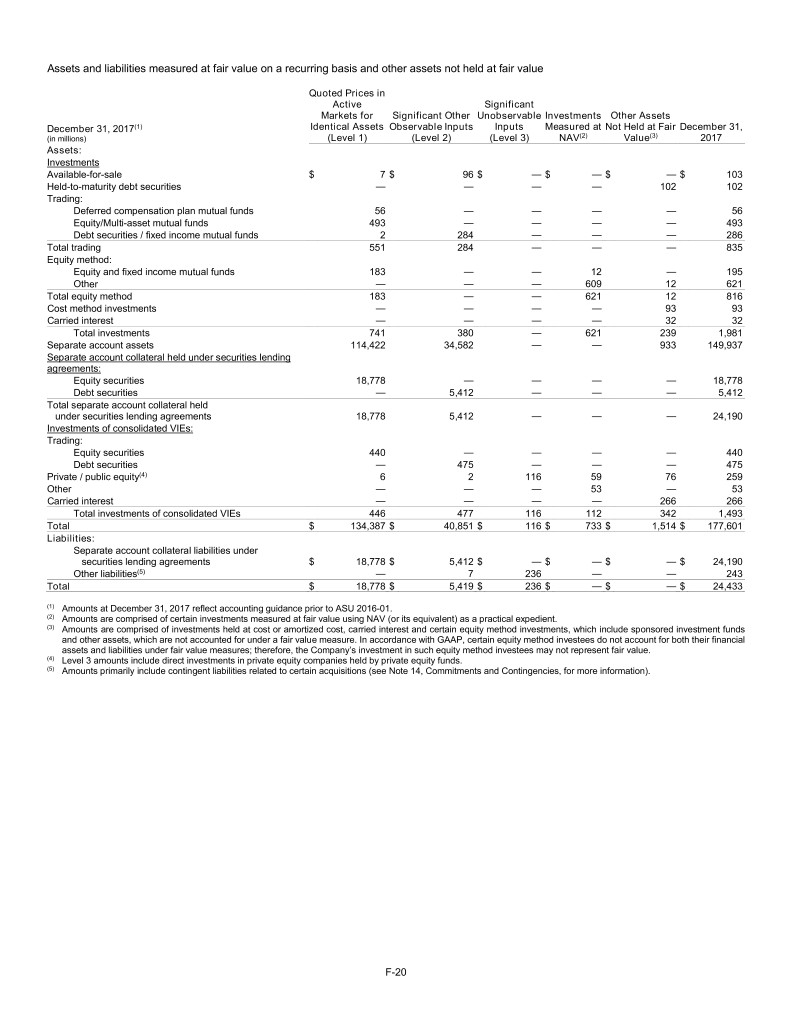

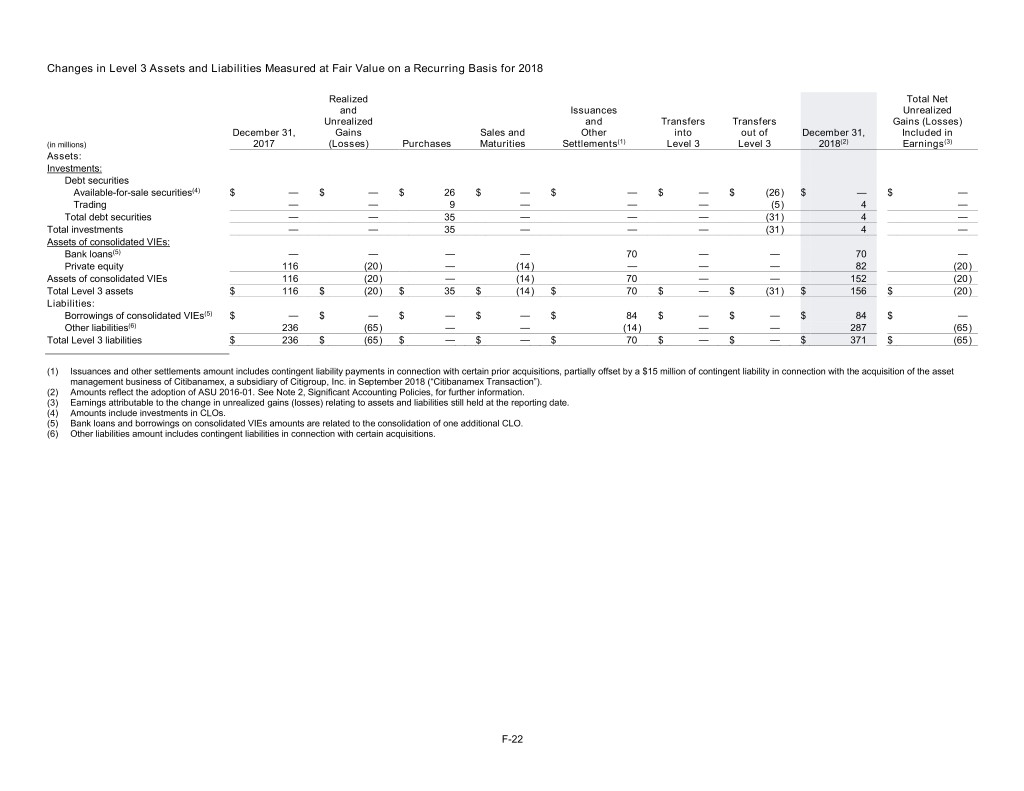

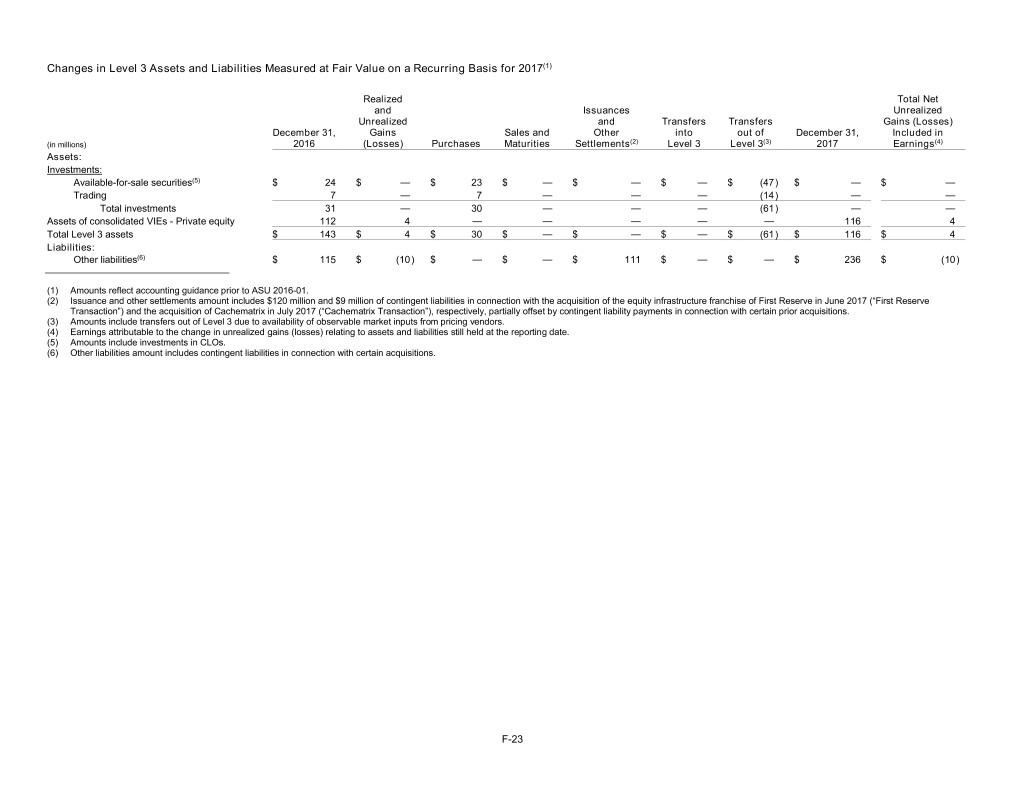

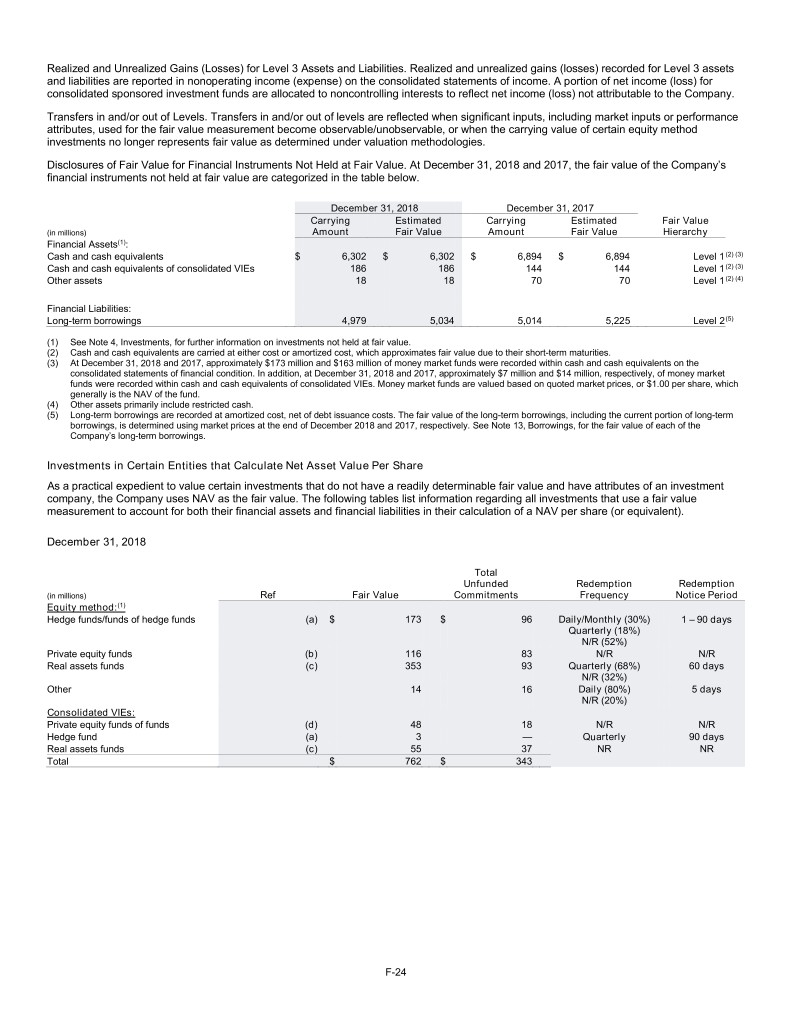

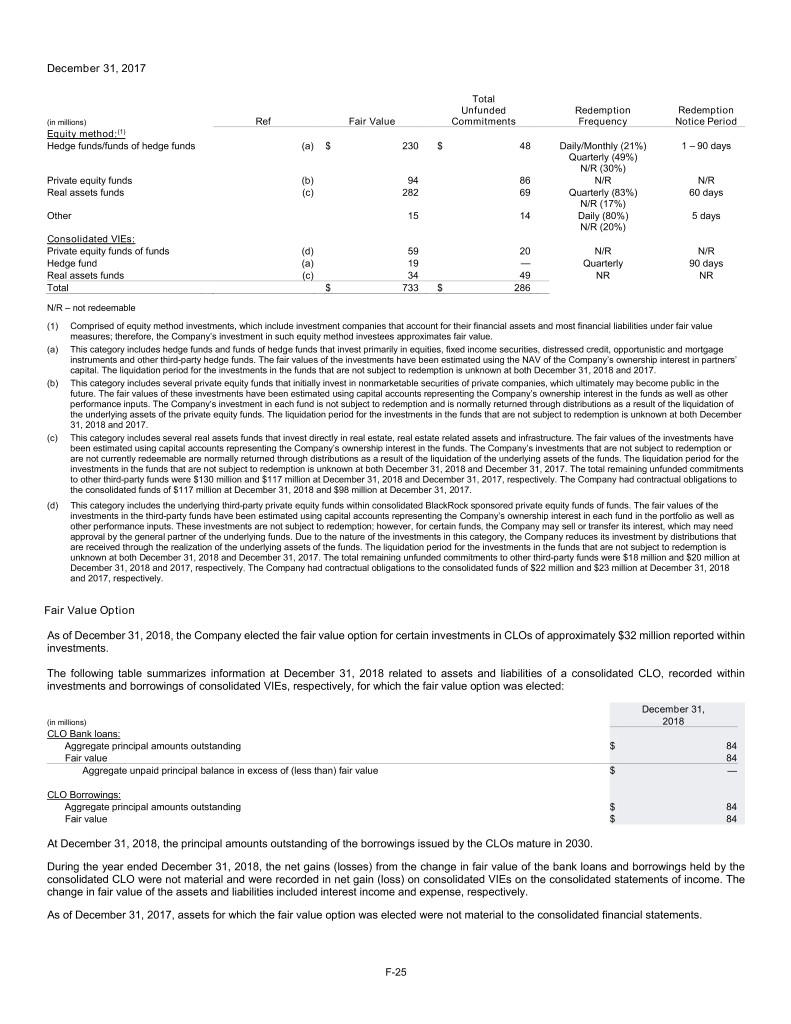

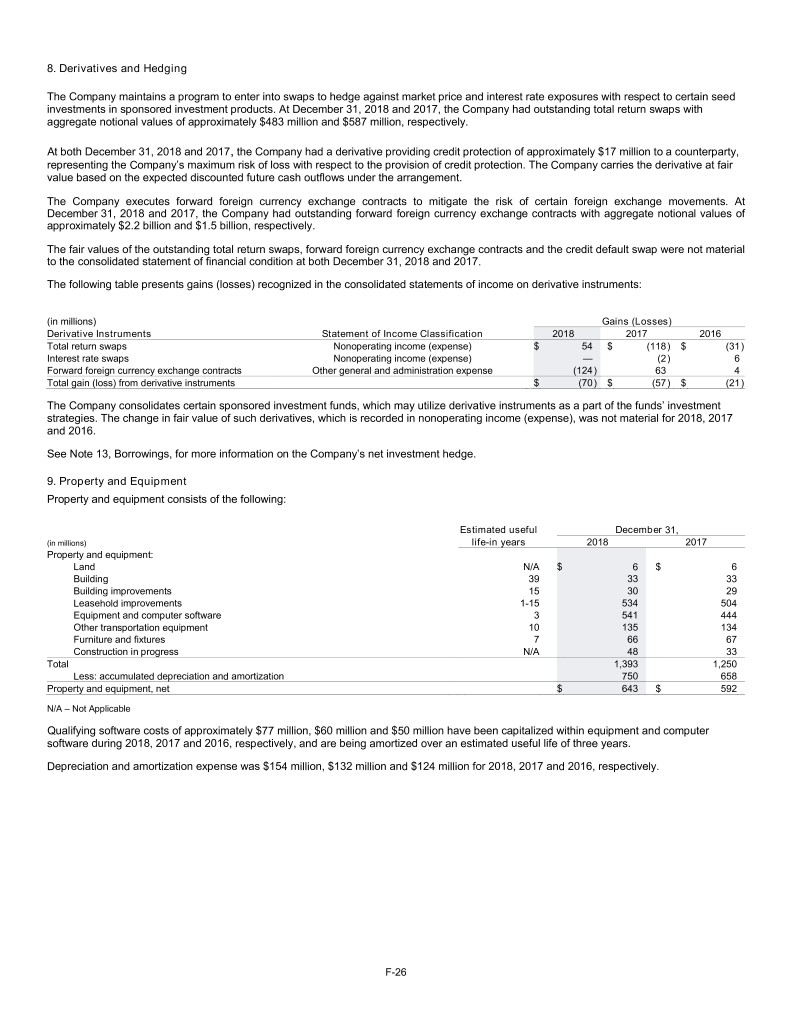

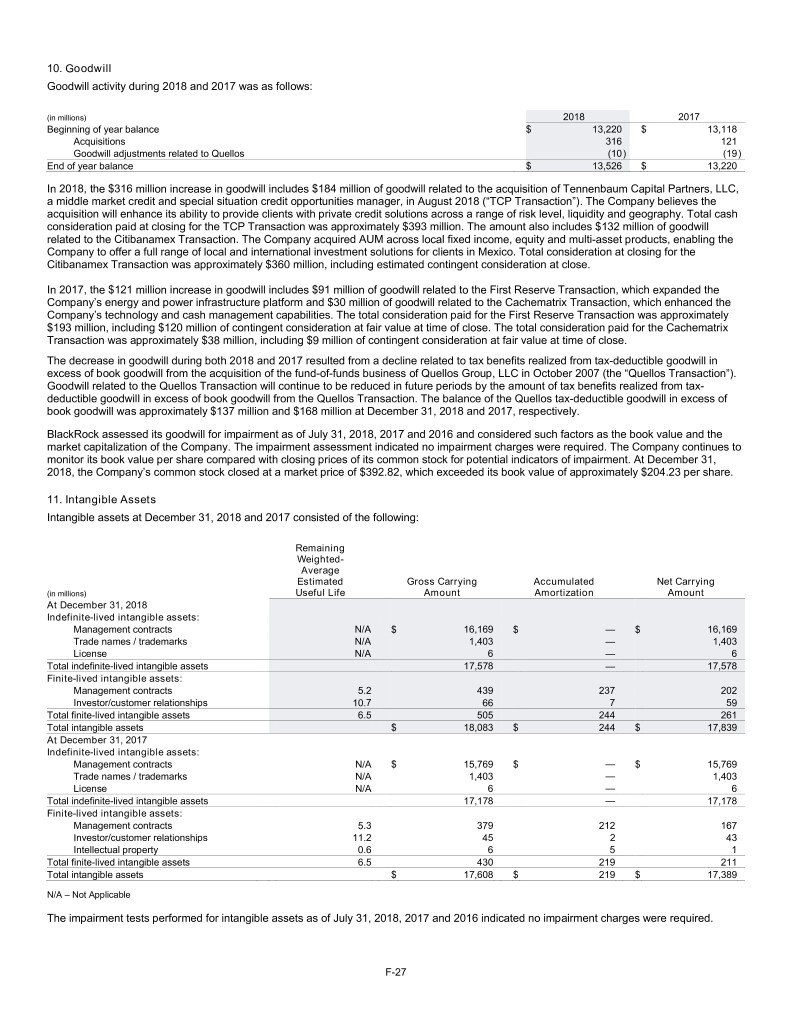

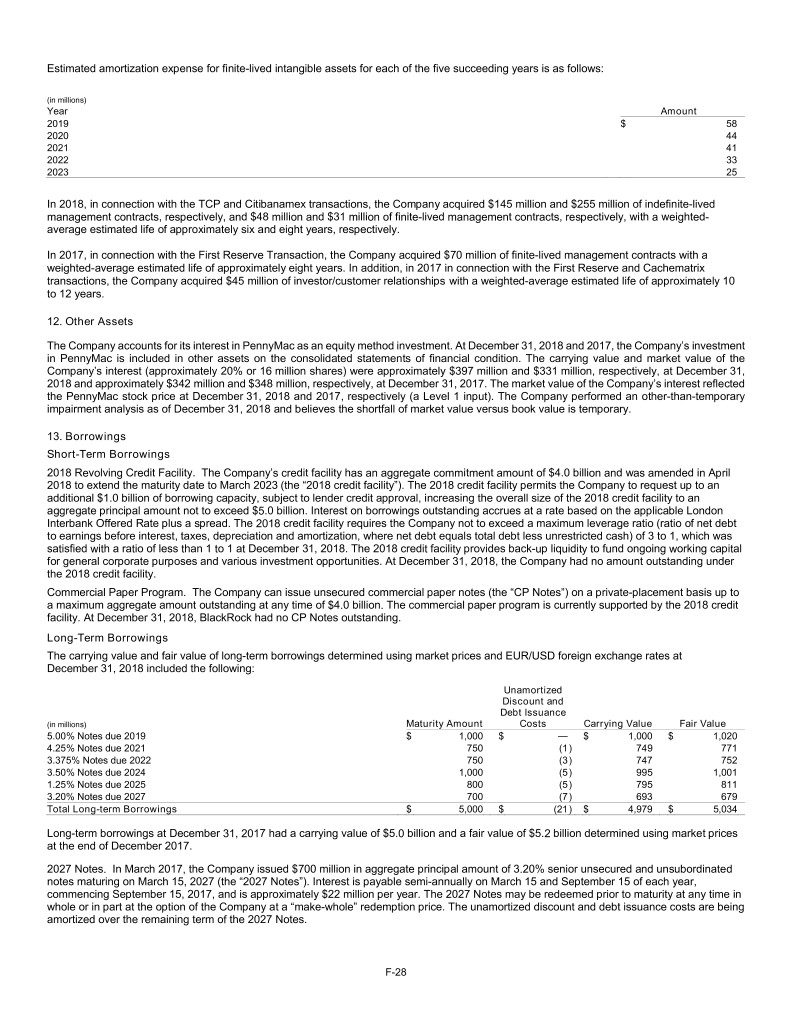

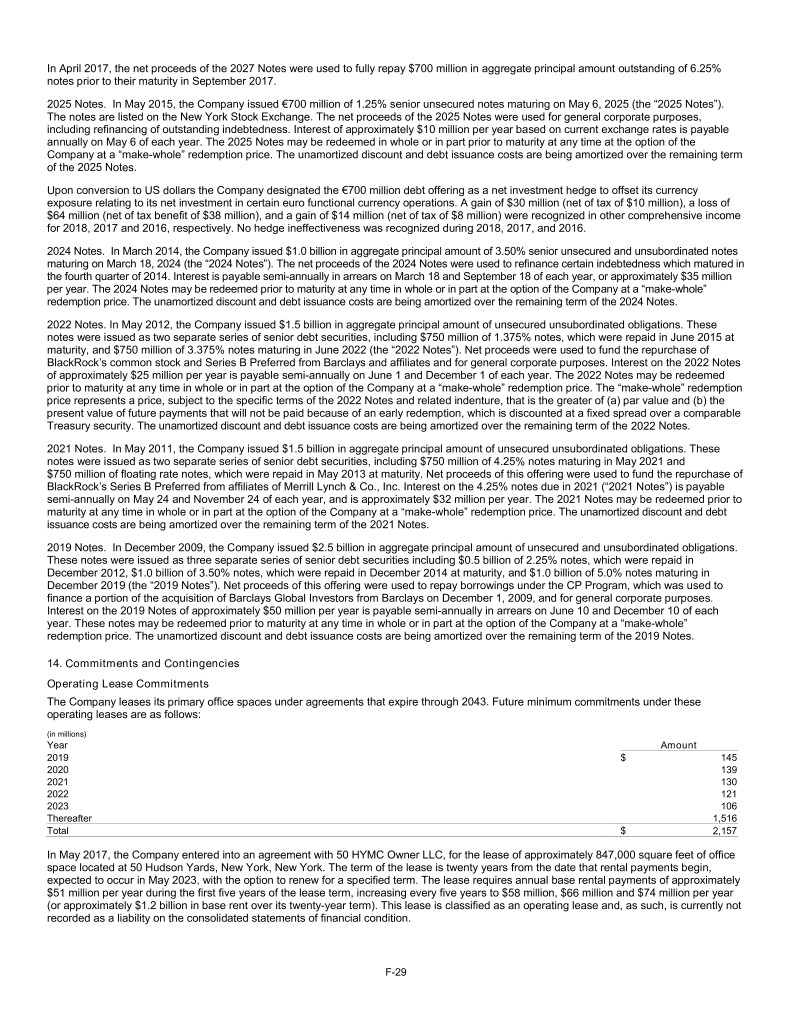

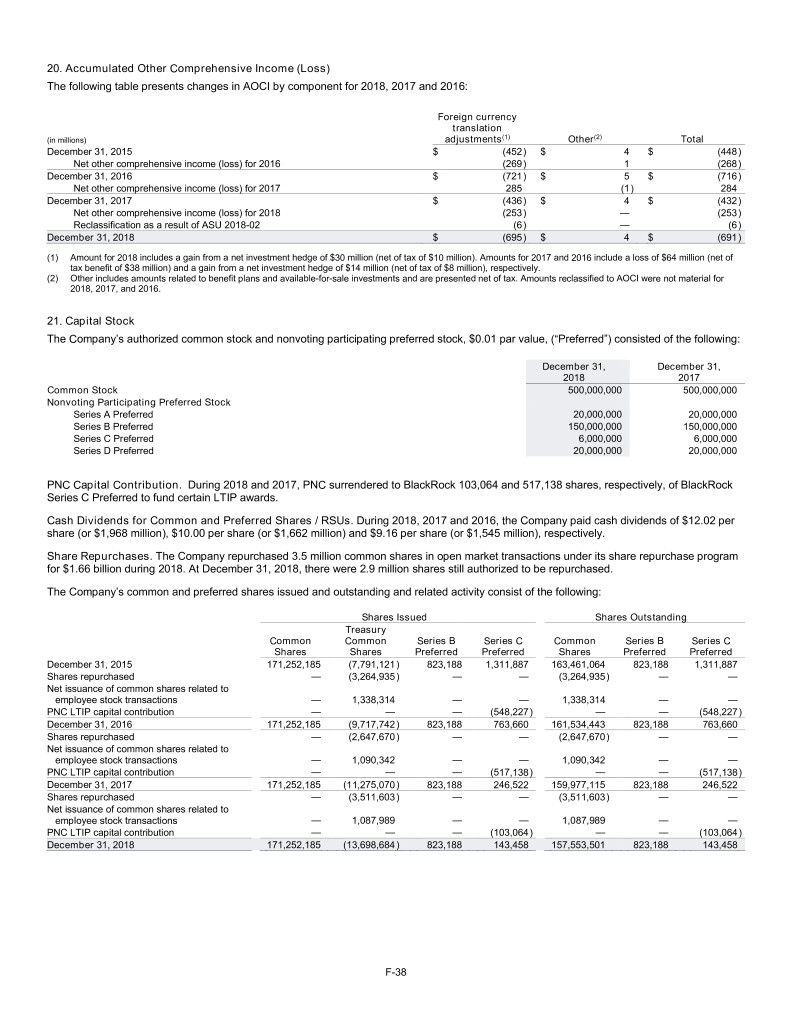

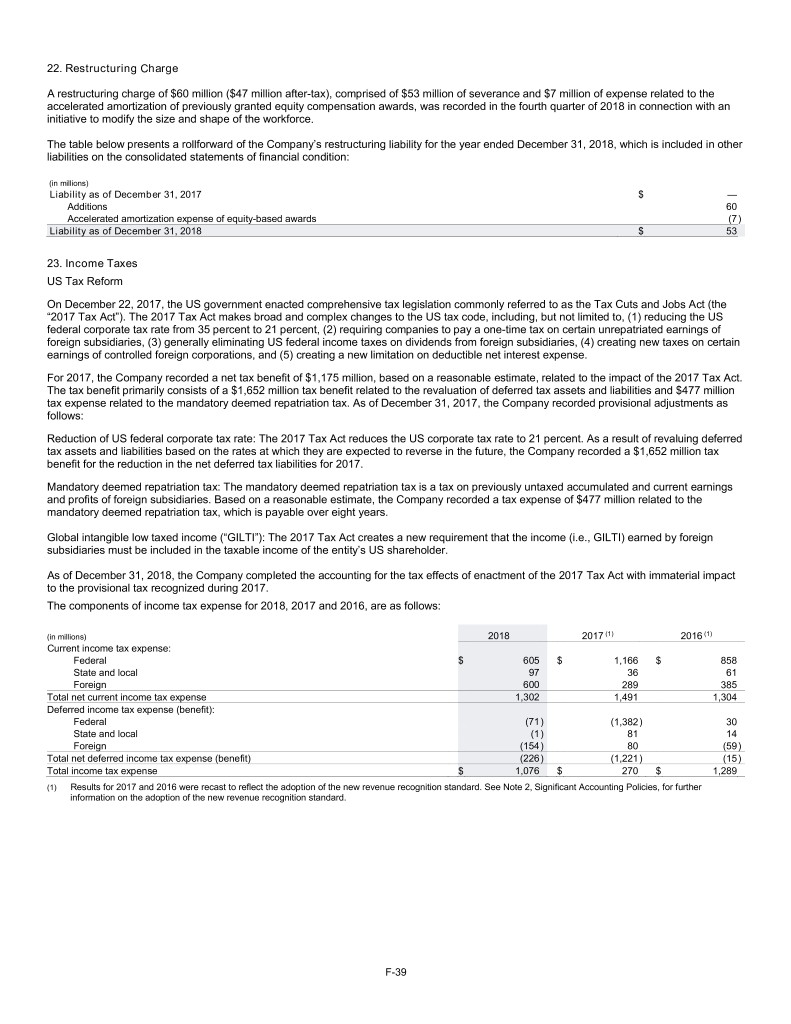

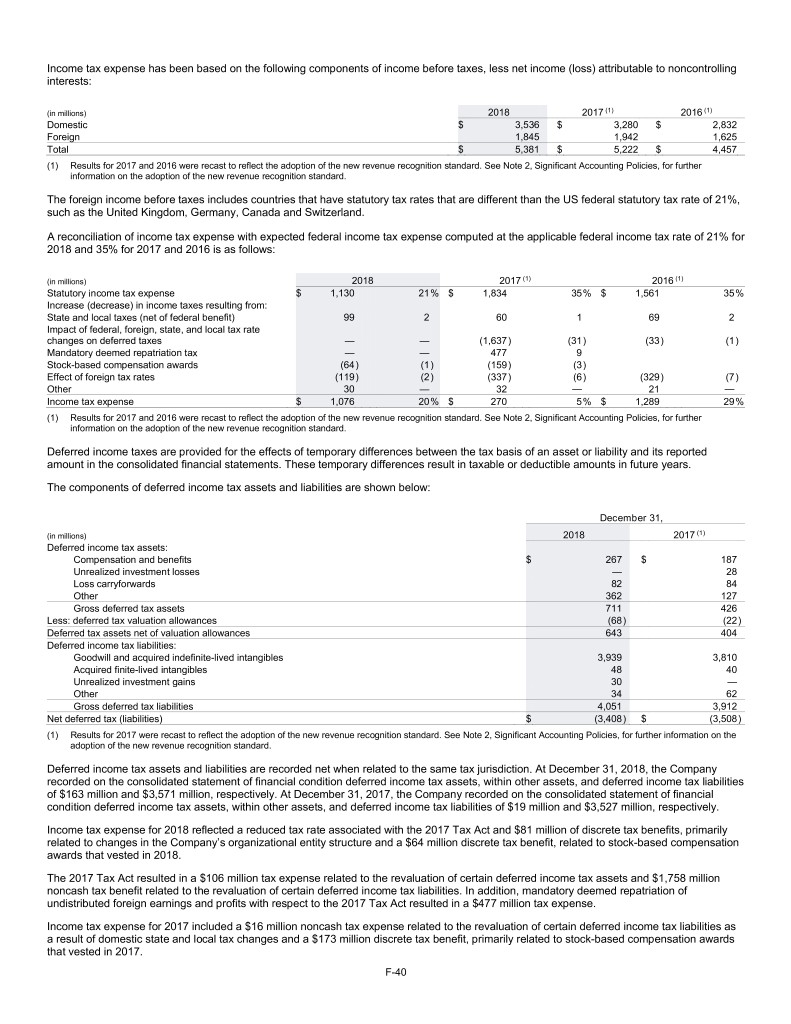

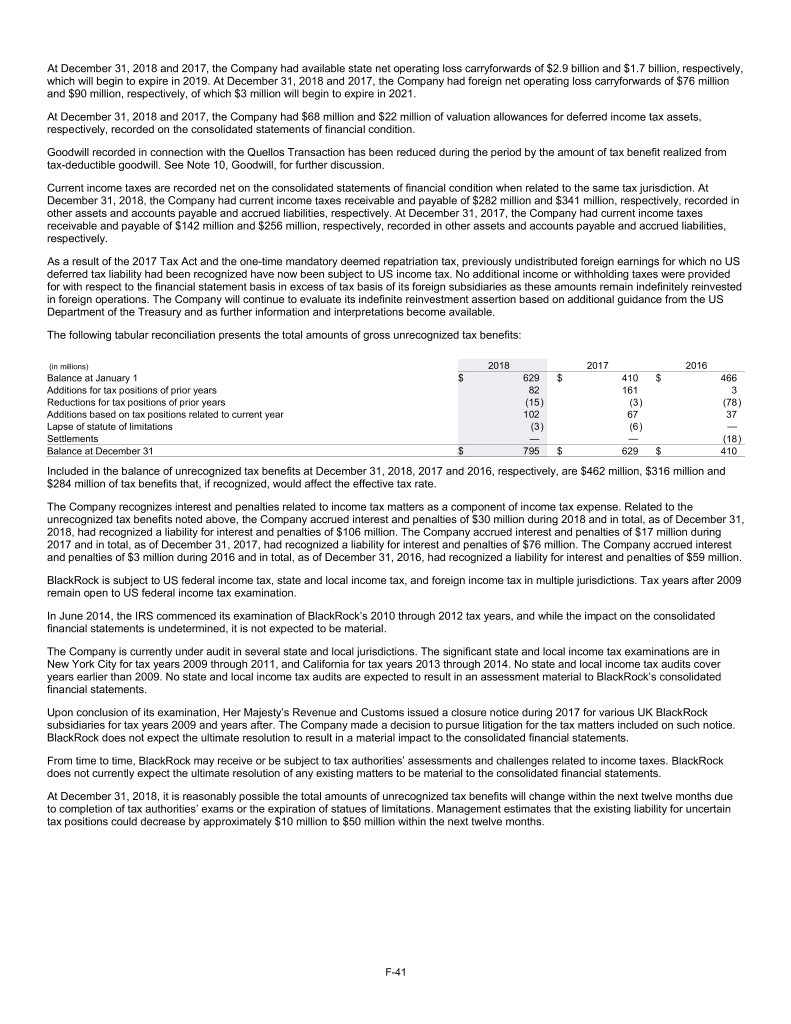

7. Fair Value Disclosures Fair Value Hierarchy Assets and liabilities measured at fair value on a recurring basis and other assets not held at fair value Quoted Prices in Active Markets for Significant Identical Significant Other Unobservable Investments Other Assets December 31, 2018(1) Assets Observable Inputs Inputs Measured at Not Held at December 31, (in millions) (Level 1) (Level 2) (Level 3) NAV(2) Fair Value(3) 2018 Assets: Investments Debt securities: Held-to-maturity investments $ — $ — $ — $ — $ 188 $ 188 Trading securities — 261 4 — — 265 Total debt securities — 261 4 — 188 453 Equity securities at FVTNI: Deferred compensation plan mutual funds 34 — — — — 34 Equity securities/Multi-asset mutual funds 418 — — — — 418 Total equity securities at FVTNI 452 — — — — 452 Equity method: Equity and fixed income mutual funds 122 — — 14 — 136 Other — — — 642 3 645 Total equity method 122 — — 656 3 781 Federal Reserve Bank Stock — — — — 92 92 Carried interest — — — — 18 18 Total investments 574 261 4 656 301 1,796 Investments of consolidated VIEs: Trading debt securities — 1,395 — — — 1,395 Equity securities at FVTNI 569 — — — — 569 Bank loans — 14 70 — — 84 Private equity(4) — — 82 48 75 205 Other — — — 58 — 58 Carried interest — — — — 369 369 Total investments of consolidated VIEs 569 1,409 152 106 444 2,680 Other assets(5) 122 — — — — 122 Separate account assets 63,610 25,810 — — 865 90,285 Separate account collateral held under securities lending agreements: Equity securities 15,066 — — — — 15,066 Debt securities — 5,589 — — — 5,589 Total separate account collateral held under securities lending agreements 15,066 5,589 — — — 20,655 Total $ 79,941 $ 33,069 $ 156 $ 762 $ 1,610 $ 115,538 Liabilities: Borrowings on consolidated VIEs(6) $ — $ — $ 84 $ — $ — $ 84 Separate account collateral liabilities under securities lending agreements 15,066 5,589 — — — 20,655 Other liabilities(7) — 6 287 — — 293 Total $ 15,066 $ 5,595 $ 371 $ — $ — $ 21,032 (1) Amounts at December 31, 2018 reflect the adoption of ASU 2016-01. See Note 2, Significant Accounting Policies, for further information. (2) Amounts are comprised of certain investments measured at fair value using NAV (or its equivalent) as a practical expedient. (3) Amounts are comprised of investments held at cost or amortized cost, carried interest and certain equity method investments, which include sponsored investment funds and other assets, which are not accounted for under a fair value measure. In accordance with GAAP, certain equity method investees do not account for both their financial assets and liabilities under fair value measures; therefore, the Company’s investment in such equity method investees may not represent fair value. (4) Level 3 amounts primarily include direct investments in private equity companies held by private equity funds. (5) Amount includes investment in a certain publicly traded strategic investment. (6) Borrowings of consolidated VIEs are classified based on the more significant inputs, which are unobservable, used for calculating the fair value of consolidated CLO assets. (7) Amounts primarily include contingent liabilities related to certain acquisitions (see Note 14, Commitments and Contingencies, for more information). F-19