10-Q: Quarterly report [Sections 13 or 15(d)]

Published on May 2, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________________________

FORM 10-Q

______________________________________

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended March 31, 2025

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

___________________________________________________________

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|||||||

(Address of principal executive offices, including zip code)

(888 ) 762-2265

(Registrant’s telephone number including area code)

(Former name, former address and former fiscal year, if changed since last report)

___________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) |

Name of Each Exchange

on Which Registered

|

||||||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of April 16, 2025, there were 395,567,009 shares of the registrant’s common stock ($5 par value) outstanding.

THE PNC FINANCIAL SERVICES GROUP, INC.

Cross-Reference Index to First Quarter 2024 Form 10-Q

| Pages | |||||

| PART I – FINANCIAL INFORMATION | |||||

| Item 1. Financial Statements (Unaudited). | |||||

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A). | |||||

| Item 3. Quantitative and Qualitative Disclosures about Market Risk. | 21-38, 49-50, 83-89 |

||||

| Item 4. Controls and Procedures. | |||||

| MD&A TABLE REFERENCE | ||||||||

| Table | Description | Page | ||||||

| 1 | ||||||||

| 2 | ||||||||

| 3 | ||||||||

| 4 | ||||||||

| 5 | ||||||||

| 6 | ||||||||

| 7 | ||||||||

| 8 | ||||||||

| 9 | ||||||||

| 10 | ||||||||

| 11 | ||||||||

| 12 | ||||||||

| 13 | ||||||||

| 14 | ||||||||

| 15 | ||||||||

| 16 | ||||||||

| 17 | ||||||||

| 18 | ||||||||

| 19 | ||||||||

| 20 | ||||||||

| 21 | ||||||||

| 22 | ||||||||

| 23 | ||||||||

| 24 | ||||||||

| 25 | ||||||||

| 26 | ||||||||

| 27 | ||||||||

| 28 | ||||||||

| 29 | ||||||||

| 30 | ||||||||

| 31 | ||||||||

| 32 | ||||||||

| 33 | ||||||||

| 34 | ||||||||

| 35 | ||||||||

| 36 | ||||||||

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS TABLE REFERENCE | ||||||||

| Table | Description | Page | ||||||

| 37 | ||||||||

| 38 | ||||||||

| 39 | ||||||||

| 40 | ||||||||

| 41 | ||||||||

| 42 | ||||||||

| 43 | ||||||||

| 44 | ||||||||

| 45 | ||||||||

| 46 | ||||||||

| 47 | ||||||||

| 48 | ||||||||

| 49 | ||||||||

| 50 | ||||||||

| 51 | ||||||||

| 52 | ||||||||

| 53 | ||||||||

| 54 | ||||||||

| 55 | ||||||||

| 56 | ||||||||

| 57 | ||||||||

| 58 | ||||||||

| 59 | ||||||||

| 60 | ||||||||

| 61 | ||||||||

| 62 | ||||||||

| 63 | ||||||||

| 64 | ||||||||

| 65 | ||||||||

| 66 | ||||||||

| 67 | ||||||||

| 68 | ||||||||

| 69 | ||||||||

| 70 | ||||||||

| 71 | ||||||||

| 72 | ||||||||

| 73 | ||||||||

| 74 | ||||||||

| 75 | ||||||||

| 76 | ||||||||

| 77 | ||||||||

| 78 | ||||||||

| 79 | ||||||||

| 80 | ||||||||

| 81 | ||||||||

| 82 | ||||||||

FINANCIAL REVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review, including the Consolidated Financial Highlights, should be read together with our unaudited Consolidated Financial Statements included elsewhere in this Quarterly Report on Form 10-Q (the “Report” or “Form 10-Q”) and with Items 7, 8 and 9A of our 2024 Annual Report on Form 10-K (our “2024 Form 10-K”). For information regarding certain business, regulatory and legal risks, see the following: the Risk Management section of this Financial Review and Item 7 in our 2024 Form 10-K; Item 1A Risk Factors included in our 2024 Form 10-K; and the Commitments and Legal Proceedings Notes included in this Report and Item 8 of our 2024 Form 10-K. Also, see the Cautionary Statement Regarding Forward-Looking Information section in this Financial Review and the Critical Accounting Estimates and Judgments section in this Financial Review and in our 2024 Form 10-K for certain other factors that could cause actual results or future events to differ, perhaps materially, from historical performance and from those anticipated in the forward-looking statements included in this Report. See Note 14 Segment Reporting for a reconciliation of total business segment earnings to total PNC consolidated net income as reported on a GAAP basis. In this Report, “PNC,” “we” or “us” refers to The PNC Financial Services Group, Inc. and its subsidiaries on a consolidated basis (except when referring to PNC as a public company, its common stock or other securities issued by PNC, which just refer to The PNC Financial Services Group, Inc.). References to The PNC Financial Services Group, Inc. or to any of its subsidiaries are specifically made where applicable.

See page 90 for a glossary of certain terms and acronyms used in this Report.

EXECUTIVE SUMMARY

Headquartered in Pittsburgh, Pennsylvania, we are one of the largest diversified financial institutions in the U.S. We have businesses engaged in retail banking, corporate and institutional banking and asset management, providing many of our products and services nationally. Our retail branch network is located coast-to-coast. We also have strategic international offices in four countries outside the U.S.

Key Strategic Goals

At PNC we manage our company for the long term. We are focused on the fundamentals of growing customers, loans, deposits and revenue and improving profitability, while investing for the future and managing risk, expenses and capital. We continue to invest in our products, markets and brand, and embrace our commitments to our customers, shareholders, employees and the communities where we do business.

We strive to serve our customers and expand and deepen relationships by offering a broad range of deposit, credit and fee-based products and services. We are focused on delivering those products and services to our customers with the goal of addressing their financial objectives and needs. Our business model is built on customer loyalty and engagement, understanding our customers’ financial goals and offering our diverse products and services to help them achieve financial well-being. Our approach is concentrated on organically growing and deepening client relationships across our businesses that meet our risk/return measures.

We are focused on our strategic priorities, which are designed to enhance value over the long term, and consist of:

•Expanding our leading banking franchise to new markets and digital platforms,

•Deepening customer relationships by delivering a superior banking experience and financial solutions, and

•Leveraging technology to create efficiencies that help us better serve customers.

Our capital and liquidity priorities are to support customers, fund business investments and return excess capital to shareholders, while maintaining appropriate capital and liquidity in light of economic conditions, the Basel III framework and other regulatory expectations. For more detail, see the Capital and Liquidity Highlights portion of this Executive Summary, the Liquidity and Capital Management portion of the Risk Management section of this Financial Review and the Supervision and Regulation section in Item 1 Business of our 2024 Form 10-K.

1 The PNC Financial Services Group, Inc. – Form 10-Q

Selected Financial Data

The following tables include selected financial data which should be reviewed in conjunction with the Consolidated Financial Statements and Notes included in Item 1 of this Report as well as the other disclosures in this Report concerning our historical financial performance, our future prospects and the risks associated with our business and financial performance:

Table 1: Summary of Operations, Per Common Share Data and Performance Ratios

| Dollars in millions, except per share data Unaudited |

Three months ended | |||||||||||||

| March 31 | December 31 | March 31 | ||||||||||||

| 2025 | 2024 | 2024 | ||||||||||||

| Summary of Operations (a) | ||||||||||||||

| Net interest income | $ | 3,476 | $ | 3,523 | $ | 3,264 | ||||||||

| Noninterest income | 1,976 | 2,044 | 1,881 | |||||||||||

| Total revenue | 5,452 | 5,567 | 5,145 | |||||||||||

| Provision for credit losses | 219 | 156 | 155 | |||||||||||

| Noninterest expense | 3,387 | 3,506 | 3,334 | |||||||||||

| Income before income taxes and noncontrolling interests |

1,846 | 1,905 | 1,656 | |||||||||||

| Income taxes |

347 | 278 | 312 | |||||||||||

| Net income | $ | 1,499 | $ | 1,627 | $ | 1,344 | ||||||||

| Net income attributable to common shareholders | $ | 1,408 | $ | 1,514 | $ | 1,247 | ||||||||

|

Per Common Share

|

||||||||||||||

| Basic | $ | 3.52 | $ | 3.77 | $ | 3.10 | ||||||||

| Diluted | $ | 3.51 | $ | 3.77 | $ | 3.10 | ||||||||

| Book value per common share | $ | 127.98 | $ | 122.94 | $ | 113.30 | ||||||||

| Performance Ratios | ||||||||||||||

| Net interest margin (non-GAAP) (b) | 2.78 | % | 2.75 | % | 2.57 | % | ||||||||

| Noninterest income to total revenue | 36 | % | 37 | % | 37 | % | ||||||||

| Efficiency | 62 | % | 63 | % | 65 | % | ||||||||

| Return on: | ||||||||||||||

| Average common shareholders’ equity | 11.60 | % | 12.38 | % | 11.39 | % | ||||||||

| Average assets | 1.09 | % | 1.14 | % | 0.97 | % | ||||||||

(a)The Executive Summary and Consolidated Income Statement Review portions of this Financial Review section provide information regarding items impacting the comparability of the periods presented.

(b)See explanation and reconciliation of this non-GAAP measure in the Average Consolidated Balance Sheet and Net Interest Analysis and Non-GAAP Financial Information sections of this Item 2.

Table 2: Balance Sheet Highlights and Other Selected Ratios

| Dollars in millions, except as noted Unaudited |

March 31 2025 |

December 31 2024 |

March 31 2024 |

|||||||||||

| Balance Sheet Highlights (a) | ||||||||||||||

| Assets | $ | 554,722 | $ | 560,038 | $ | 566,162 | ||||||||

| Loans | $ | 318,850 | $ | 316,467 | $ | 319,781 | ||||||||

|

Allowance for loan and lease losses |

$ | 4,544 | $ | 4,486 | $ | 4,693 | ||||||||

| Interest-earning deposits with banks | $ | 32,298 | $ | 39,347 | $ | 53,612 | ||||||||

| Investment securities | $ | 137,775 | $ | 139,732 | $ | 130,460 | ||||||||

| Total deposits | $ | 422,915 | $ | 426,738 | $ | 425,624 | ||||||||

| Borrowed funds | $ | 60,722 | $ | 61,673 | $ | 72,707 | ||||||||

| Total shareholders’ equity | $ | 56,405 | $ | 54,425 | $ | 51,340 | ||||||||

| Common shareholders’ equity | $ | 50,654 | $ | 48,676 | $ | 45,097 | ||||||||

| Other Selected Ratios | ||||||||||||||

| Common equity Tier 1 (b) | 10.6 | % | 10.5 | % | 10.1 | % | ||||||||

| Loans to deposits | 75 | % | 74 | % | 75 | % | ||||||||

| Common shareholders’ equity to total assets | 9.1 | % | 8.7 | % | 8.0 | % | ||||||||

(a)The Executive Summary and Consolidated Balance Sheet Review portions of this Financial Review provide information regarding items impacting the comparability of the periods presented.

(b)The March 31, 2025 ratio is calculated to reflect the full impact of CECL. The December 31, 2024 and March 31, 2024 ratios are calculated to reflect PNC’s election to adopt the CECL optional five-year transition provisions. The impact of the provisions was phased-in to regulatory capital through December 31, 2024.

2 The PNC Financial Services Group, Inc. – Form 10-Q

Income Statement Highlights

Net income of $1.5 billion, or $3.51 per diluted common share, for the first quarter of 2025 decreased $128 million, or 8%, compared to $1.6 billion, or $3.77 per diluted common share, for the fourth quarter of 2024, due to lower noninterest and net interest income and a higher provision for credit losses, partially offset by lower noninterest expenses.

•For the three months ended March 31, 2025 compared to the three months ended December 31, 2024:

•Total revenue of $5.5 billion decreased $115 million, or 2%.

•Net interest income of $3.5 billion decreased $47 million, or 1%, driven by two fewer days in the quarter, partially offset by the benefit of lower funding costs and fixed rate asset repricing.

•Net interest margin increased 3 basis points to 2.78%.

•Noninterest income of $2.0 billion decreased $68 million, or 3%, reflecting lower capital markets and advisory activity and higher negative Visa derivative adjustments. The first quarter of 2025 included negative $40 million of Visa derivative fair value adjustments, primarily related to litigation escrow funding, compared to negative $23 million in the fourth quarter of 2024.

•Provision for credit losses was $219 million in the first quarter of 2025 and was driven by net charge-offs, primarily in our commercial and industrial and credit card loan classes, and a net increase in the ACL due to changes in macroeconomic factors and portfolio activity. The fourth quarter of 2024 included a provision for credit losses of $156 million.

•Noninterest expense decreased $119 million, or 3%, to $3.4 billion, reflecting asset impairments recognized in the fourth quarter of $97 million as well as seasonally lower other noninterest expense and marketing.

Net income increased $155 million, or 12%, compared to $1.3 billion, or $3.10 per diluted common share, for the first three months of 2024 driven by higher net interest and noninterest income, partially offset by a higher provision for credit losses and higher noninterest expenses.

•For the three months ended March 31, 2025 compared to the three months ended March 31, 2024:

•Total revenue increased $307 million, or 6%, to $5.5 billion.

•Net interest income increased $212 million, or 6%, reflecting the benefit of lower funding costs and the continued repricing of fixed rate assets.

•Net interest margin increased 21 basis points.

•Noninterest income increased $95 million, or 5%, primarily due to higher merger and acquisition advisory activity, increased underwriting fees and higher average equity markets.

•Provision for credit losses was $219 million in the first three months of 2025. The first three months of 2024 included a provision for credit losses of $155 million.

•Noninterest expense increased $53 million, or 2%, compared to the first three months of 2024 as a result of increased business activity, technology investments and higher marketing spend.

For additional detail, see the Consolidated Income Statement Review section of this Financial Review.

Balance Sheet Highlights

Our balance sheet was well positioned at March 31, 2025. In comparison to December 31, 2024:

•Total assets of $554.7 billion decreased $5.3 billion, or 1%, reflecting lower balances held with the FRB and lower securities balances, partially offset by higher loans outstanding.

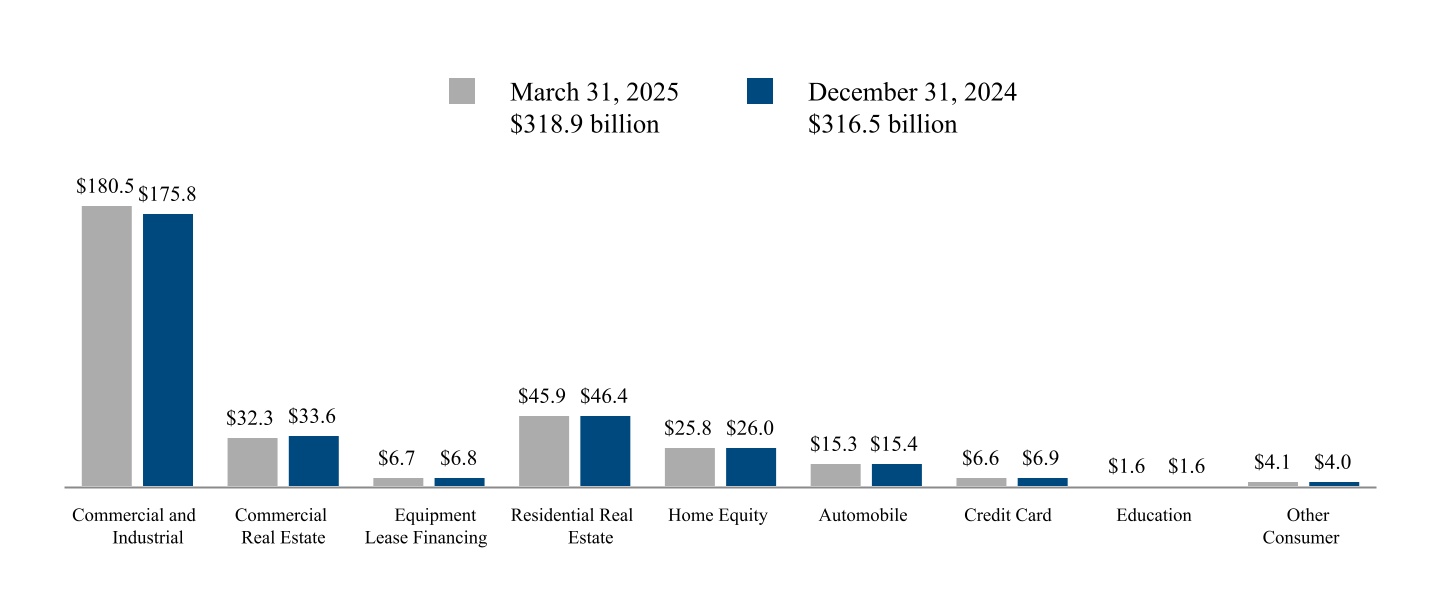

•Total loans of $318.9 billion increased $2.4 billion, or 1%.

•Total commercial loans increased $3.4 billion, or 2%, to $219.6 billion, due to higher utilization of loan commitments and new production within the commercial and industrial portfolio, partially offset by lower commercial real estate loans.

•Total consumer loans decreased $1.0 billion, or 1%, to $99.3 billion, primarily due to lower residential real estate loans, as paydowns outpaced originations.

•Investment securities decreased $2.0 billion, or 1%, to $137.8 billion, primarily due to prepayments and maturities of both available-for-sale and held-to-maturity securities outpacing purchases of available-for-sale securities.

•Interest-earning deposits with banks, primarily with the FRB, decreased $7.0 billion, or 18%, to $32.3 billion, driven by lower deposits and higher loan balances, partially offset by lower securities balances.

•Total deposits decreased $3.8 billion, or 1%, to $422.9 billion, primarily due to lower interest-bearing deposits. The decrease in interest-bearing deposits was driven by lower commercial balances and brokered time deposits, partially offset by higher consumer balances.

•Borrowed funds decreased $1.0 billion, or 2%, to $60.7 billion, due to lower FHLB advances, partially offset by parent company senior debt issuances in the first quarter of 2025.

For additional detail, see the Consolidated Balance Sheet Review section of this Financial Review.

The PNC Financial Services Group, Inc. – Form 10-Q 3

Credit Quality Highlights

The first quarter of 2025 reflected solid credit quality performance.

•At March 31, 2025 compared to December 31, 2024:

•Overall loan delinquencies of $1.4 billion increased $49 million, or 4%, and included higher consumer loan delinquencies, primarily related to forbearance activity associated with the California wildfires.

•The ACL related to loans, which consists of the ALLL and the allowance for unfunded lending related commitments, totaled $5.2 billion at both March 31, 2025 and December 31, 2024. ACL to total loans was 1.64% at both March 31, 2025 and December 31, 2024.

•Nonperforming assets of $2.3 billion were stable.

•Net loan charge-offs of $205 million, or 0.26% of average loans, in the first quarter of 2025 decreased $45 million compared to the fourth quarter of 2024, primarily due to lower commercial real estate net loan charge-offs.

For additional detail see the Credit Risk Management portion of the Risk Management section of this Financial Review.

Capital and Liquidity Highlights

We maintained our strong capital and liquidity positions.

•Common shareholders’ equity of $50.7 billion at March 31, 2025 increased $2.0 billion compared to December 31, 2024, due to the benefit of net income and an improvement in AOCI, partially offset by common dividends paid and common share repurchases.

•In the first quarter of 2025, PNC returned $0.8 billion of capital to shareholders, including $0.6 billion of dividends on common shares and $0.2 billion of common share repurchases.

•On April 3, 2025, the PNC Board of Directors declared a quarterly cash dividend on common stock of $1.60 per share to be paid on May 5, 2025 to shareholders of record at the close of business April 16, 2025.

•Our CET1 ratio increased to 10.6% at March 31, 2025 from 10.5% at December 31, 2024.

PNC’s ability to take certain capital actions, including returning capital to shareholders, is subject to PNC meeting or exceeding an SCB established by the Federal Reserve Board in connection with the Federal Reserve Board’s CCAR process. PNC’s SCB for the four-quarter period beginning October 1, 2024 is the regulatory minimum of 2.5%. For additional information on our liquidity and capital actions as well as our capital ratios, see Capital Management in the Risk Management section in this Financial Review, the Recent Regulatory Developments section in this Financial Review and the Supervision and Regulation section in our 2024 Form 10-K.

Business Outlook

Statements regarding our business outlook are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our views that:

•The economic fundamentals remain solid in the spring of 2025. The labor market remains strong, and job and income gains have supported consumer spending growth in early 2025. However, downside risks have materially increased with recent substantial changes to U.S. tariffs and corresponding policy changes by U.S. trading partners.

•PNC’s baseline forecast remains for continued expansion, but slower economic growth in 2025 than in 2024. High interest rates remain a drag on the economy, consumer spending growth will slow to a pace more consistent with household income growth, and government’s contribution to economic growth will be smaller.

•The baseline forecast is for real GDP growth of less than 1% in 2025 and between 1% and 2% in 2026, with the unemployment rate increasing to around 5% over the next year. However, the recent turbulence in trade policy indicates that growth may be significantly weaker than in this forecast and the unemployment rate higher. It remains to be seen the extent that policies will be implemented or persist. If implemented as proposed, higher prices will weigh on consumers and businesses, and retaliatory policy changes will weigh on U.S. exports. The large decline in equity prices will also be a drag on consumer spending. The longer the ongoing trade dispute persists, the greater the likelihood of near-term recession.

•The baseline forecast is for four federal funds rate cuts of 25 basis points each in 2025, starting in July. This would take the federal funds rate to a range between 3.25% and 3.50% at the end of 2025. High inflation could mean less monetary easing than in the forecast, but if the economy enters recession the Federal Reserve could cut the federal funds rate more aggressively this year.

Consistent with the forward guidance we provided on April 15, 2025, for the second quarter of 2025, compared to the first quarter of 2025, we expect:

•Average loans to be up approximately 1%,

•Net interest income to be up 1% to 2%,

•Fee income to be up 1% to 3%,

4 The PNC Financial Services Group, Inc. – Form 10-Q

•Other noninterest income to be $150 million to $200 million,

•Total revenue to be up 1% to 3%,

•Noninterest expense to be stable,

•Net loan charge-offs to be approximately $300 million.

Consistent with the forward guidance we provided on January 16, 2025 and April 15, 2025, for the full year 2025, compared to the full year of 2024, we expect:

•Average loans to be stable,

•Spot loans to be up 2% to 3%,

•Net interest income to be up 6% to 7%,

•Noninterest income to be up approximately 5%,

•Revenue to be up approximately 6%,

•Noninterest expense to be up approximately 1%, and

•The effective tax rate to be approximately 19%.

Noninterest income, other noninterest income and total revenue guidance does not forecast net securities gains or losses or Visa activity.

We are unable to provide a meaningful or accurate reconciliation of forward-looking non-GAAP measures, without unreasonable effort, to their most directly comparable GAAP financial measures. This is due to the inherent difficulty of forecasting the timing and amounts necessary for the reconciliation, when such amounts are subject to events that cannot be reasonably predicted, as noted in our Cautionary Statement. Accordingly, we cannot address the probable significance of unavailable information.

See the Cautionary Statement Regarding Forward-Looking Information section in this Financial Review and Item 1A Risk Factors included in our 2024 Form 10-K for other factors that could cause future events to differ, perhaps materially, from those anticipated in these forward-looking statements.

CONSOLIDATED INCOME STATEMENT REVIEW

Our Consolidated Income Statement is presented in Item 1 of this Report.

Net income of $1.5 billion, or $3.51 per diluted common share, for the first quarter of 2025 decreased $128 million, or 8%, compared to $1.6 billion, or $3.77 per diluted common share, for the fourth quarter of 2024, due to lower noninterest and net interest income and a higher provision for credit losses, partially offset by lower noninterest expenses. Net income increased $155 million, or 12%, compared to $1.3 billion, or $3.10 per diluted common share, for the same period in 2024, driven by higher net interest and noninterest income, partially offset by a higher provision for credit losses and higher noninterest expenses.

Table 3: Summarized Average Balances and Net Interest Income (a)

| March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||||||||||||||||||||||||||||

| Three months ended Dollars in millions |

Average Balances |

Average Yields/ Rates |

Interest Income/ Expense |

Average Balances |

Average Yields/ Rates |

Interest Income/ Expense |

Average Balances |

Average Yields/ Rates |

Interest Income/ Expense |

|||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | ||||||||||||||||||||||||||||||||||||||

| Investment securities | $ | 142,181 | 3.17 | % | $ | 1,129 | $ | 143,863 | 3.17 | % | $ | 1,147 | $ | 135,434 | 2.62 | % | $ | 888 | ||||||||||||||||||||

| Loans | 316,624 | 5.70 | % | 4,495 | 319,058 | 5.87 | % | 4,756 | 320,609 | 6.01 | % | 4,848 | ||||||||||||||||||||||||||

| Interest-earning deposits with banks (b) | 34,614 | 4.42 | % | 381 | 37,929 | 4.86 | % | 461 | 48,250 | 5.47 | % | 660 | ||||||||||||||||||||||||||

| Other | 10,147 | 6.02 | % | 153 | 10,337 | 6.17 | % | 160 | 8,002 | 6.92 | % | 138 | ||||||||||||||||||||||||||

| Total interest-earning assets/interest income | $ | 503,566 | 4.90 | % | 6,158 | $ | 511,187 | 5.04 | % | 6,524 | $ | 512,295 | 5.08 | % | 6,534 | |||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 328,281 | 2.23 | % | 1,808 | $ | 329,126 | 2.43 | % | 2,010 | $ | 321,280 | 2.60 | % | 2,077 | |||||||||||||||||||||||

| Borrowed funds | 64,505 | 5.25 | % | 846 | 67,169 | 5.61 | % | 961 | 75,590 | 6.07 | % | 1,159 | ||||||||||||||||||||||||||

| Total interest-bearing liabilities/interest expense | $ | 392,786 | 2.72 | % | 2,654 | $ | 396,295 | 2.95 | % | 2,971 | $ | 396,870 | 3.24 | % | 3,236 | |||||||||||||||||||||||

| Net interest margin/income (non-GAAP) | 2.78 | % | 3,504 | 2.75 | % | 3,553 | 2.57 | % | 3,298 | |||||||||||||||||||||||||||||

| Taxable-equivalent adjustments | (28) | (30) | (34) | |||||||||||||||||||||||||||||||||||

| Net interest income (GAAP) | $ | 3,476 | $ | 3,523 | $ | 3,264 | ||||||||||||||||||||||||||||||||

(a)Interest income calculated as taxable-equivalent interest income. To provide more meaningful comparisons of interest income and yields for all interest-earning assets, as well as net interest margins, we use interest income on a taxable-equivalent basis in calculating average yields and net interest margins by increasing the interest income

The PNC Financial Services Group, Inc. – Form 10-Q 5

earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP on the Consolidated Income Statement. For more information, see Table 35 Reconciliation of Taxable-Equivalent Net Interest Income (non-GAAP).

(b)Interest income from Interest-earning deposits with banks primarily includes interest earned on our balances held with the FRB and is reported as Other interest income on our Consolidated Income Statement.

Changes in net interest income and margin result from the interaction of the volume and composition of interest-earning assets and related yields, interest-bearing liabilities and related rates paid and noninterest-bearing sources of funding. See Table 34 Average Consolidated Balance Sheet And Net Interest Analysis for additional information.

Net interest income decreased $47 million, or 1%, compared to the fourth quarter of 2024, and increased $212 million, or 6%, from the first quarter of 2024. Both comparisons reflected the benefit of lower funding costs and the continued repricing of fixed rate assets. In comparison to the fourth quarter of 2024, the benefit was more than offset by two fewer days in the quarter. Net interest margin increased 3 basis points compared to the fourth quarter of 2024, and 21 basis points compared to the first three months of 2024. In both comparisons, the increase was primarily driven by lower funding rates.

Average investment securities decreased $1.7 billion, or 1%, compared to the fourth quarter of 2024, reflecting maturities and net paydowns of held-to-maturity securities. Average investment securities increased $6.7 billion, or 5%, compared to the first three months of 2024, driven by net purchase activity of available-for-sale securities. Average investment securities represented 28% of average interest-earning assets for both the first quarter of 2025 and the fourth quarter of 2024, compared to 26% for the first quarter of 2024.

Average loans decreased $2.4 billion, compared to the fourth quarter of 2024 and $4.0 billion, compared to the first three months of 2024. In both comparisons the decrease was primarily due to lower commercial real estate loans. Average loans represented 63% of average interest-earning assets for the first quarter of 2025, compared to 62% for the fourth quarter of 2024 and 63% for the first quarter of 2024.

Average interest-earning deposits with banks for the first quarter of 2025 decreased $3.3 billion, or 9%, compared to the fourth quarter of 2024 and $13.6 billion, or 28%, compared to the first quarter of 2024, primarily due to lower brokered time deposits and borrowed funds outstanding.

Average interest-bearing deposits for the first quarter of 2025 were stable compared to the fourth quarter of 2024. Compared to the same period in 2024, average interest-bearing deposits increased $7.0 billion, or 2%, as higher commercial and consumer deposits were partially offset by lower brokered time deposits. In total, average interest-bearing deposits represented 84% of average interest-bearing liabilities for the first quarter of 2025, compared to 83% for the fourth quarter of 2024 and 81% for the first quarter of 2024.

Average borrowed funds decreased $2.7 billion, or 4%, compared to the fourth quarter of 2024, and $11.1 billion, or 15%, compared to the first quarter of 2024. In both comparisons, the decrease was driven by lower FHLB advances, partially offset by higher parent company senior debt issuances.

Further details regarding average loans and deposits are included in the Business Segments Review section of this Financial Review.

Noninterest Income

Table 4: Noninterest Income

| Three months ended | Three months ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31 | December 31 | Change | March 31 | March 31 | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars in millions | 2025 | 2024 | $ | % | 2025 | 2024 | $ | % | ||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest income | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asset management and brokerage | $ | 391 | $ | 374 | $ | 17 | 5 | % | $ | 391 | $ | 364 | $ | 27 | 7 | % | ||||||||||||||||||||||||||||||||||||||||

| Capital markets and advisory | 306 | 348 | (42) | (12) | % | 306 | 259 | 47 | 18 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Card and cash management | 692 | 695 | (3) | — | % | 692 | 671 | 21 | 3 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Lending and deposit services | 316 | 330 | (14) | (4) | % | 316 | 305 | 11 | 4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Residential and commercial mortgage | 134 | 122 | 12 | 10 | % | 134 | 147 | (13) | (9) | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Other | 137 | 175 | (38) | (22) | % | 137 | 135 | 2 | 1 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | $ | 1,976 | $ | 2,044 | $ | (68) | (3) | % | $ | 1,976 | $ | 1,881 | $ | 95 | 5 | % | ||||||||||||||||||||||||||||||||||||||||

Noninterest income as a percentage of total revenue was 36% for the first quarter of 2025 compared to 37% for both the fourth and first quarters of 2024.

Asset management and brokerage fees increased compared to the fourth quarter of 2024, driven by higher brokerage client activity and positive net flows. The increase compared to the first quarter of 2024 reflected the impact of higher average equity markets. PNC’s

6 The PNC Financial Services Group, Inc. – Form 10-Q

discretionary client assets under management of $210 billion at March 31, 2025 were stable compared to $211 billion at December 31, 2024, and increased from $195 billion at March 31, 2024. Compared to March 31, 2024, the increase included the impact from higher spot equity markets.

Capital markets and advisory fees decreased compared to the fourth quarter of 2024, primarily due to lower merger and acquisition advisory activity and a decline in trading revenue. The increase compared to the first quarter of 2024 was primarily due to higher merger and acquisition advisory activity and increased trading revenue, partially offset by lower underwriting fees.

Card and cash management revenue decreased compared to the fourth quarter of 2024, as higher treasury management revenue was more than offset by seasonally lower consumer spending. The increase compared to the first three months of 2024 was primarily due to higher treasury management product revenue.

Lending and deposit services decreased compared to the fourth quarter of 2024 and included seasonally lower customer activity. The increase compared to the first quarter of 2024 reflected increased customer activity.

Residential and commercial mortgage increased compared to the fourth quarter of 2024, driven by higher results from residential mortgage rights valuation, net of economic hedge. The decrease compared to the first three months of 2024 was due to lower residential mortgage banking revenue.

Other noninterest income decreased compared to the fourth quarter of 2024, largely due to negative $40 million of Visa derivative adjustments primarily related to litigation escrow funding. Compared to the first three months of 2024, other noninterest income increased driven by higher private equity revenue, partially offset by higher negative Visa derivative adjustments. Visa derivative adjustments were negative $23 million in the fourth quarter of 2024 and negative $7 million in the first quarter of 2024.

Noninterest Expense

Table 5: Noninterest Expense

| Three months ended | Three months ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31 | December 31 | Change | March 31 | March 31 | Change | ||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars in millions | 2025 | 2024 | $ | % | 2025 | 2024 | $ | % | |||||||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personnel | $ | 1,890 | $ | 1,857 | $ | 33 | 2 | % | $ | 1,890 | $ | 1,794 | $ | 96 | 5 | % | |||||||||||||||||||||||||||||||||||||

| Occupancy | 245 | 240 | 5 | 2 | % | 245 | 244 | 1 | — | % | |||||||||||||||||||||||||||||||||||||||||||

| Equipment | 384 | 473 | (89) | (19) | % | 384 | 341 | 43 | 13 | % | |||||||||||||||||||||||||||||||||||||||||||

| Marketing | 85 | 112 | (27) | (24) | % | 85 | 64 | 21 | 33 | % | |||||||||||||||||||||||||||||||||||||||||||

| Other | 783 | 824 | (41) | (5) | % | 783 | 891 | (108) | (12) | % | |||||||||||||||||||||||||||||||||||||||||||

Total noninterest expense |

$ | 3,387 | $ | 3,506 | $ | (119) | (3) | % | $ | 3,387 | $ | 3,334 | $ | 53 | 2 | % | |||||||||||||||||||||||||||||||||||||

Noninterest expense decreased compared to the fourth quarter of 2024, reflecting asset impairments recognized in the fourth quarter of $97 million as well as seasonally lower other noninterest expense and marketing. Noninterest expense increased compared to the first three months of 2024 as a result of increased business activity, technology investments and higher marketing spend. The first quarter of 2024 included a pre-tax expense of $130 million related to the FDIC’s special assessment.

Effective Income Tax Rate

The effective income tax rate was 18.8% in the first quarter of 2025, 14.6% for the fourth quarter of 2024 and 18.8% in the first quarter of 2024. The fourth quarter of 2024 included a benefit from the resolution of certain tax matters.

The PNC Financial Services Group, Inc. – Form 10-Q 7

Provision For Credit Losses

Table 6: Provision for (Recapture of) Credit Losses

| Three months ended | Three months ended | ||||||||||||||||||||||||||||||||||

| March 31 | December 31 | Change | March 31 | March 31 | Change | ||||||||||||||||||||||||||||||

| Dollars in millions | 2025 | 2024 | $ | 2025 | 2024 | $ | |||||||||||||||||||||||||||||

| Provision for (recapture of) credit losses | |||||||||||||||||||||||||||||||||||

| Loans and leases | $ | 260 | $ | 155 | $ | 105 | $ | 260 | $ | 147 | $ | 113 | |||||||||||||||||||||||

| Unfunded lending related commitments | (46) | (5) | (41) | (46) | 9 | (55) | |||||||||||||||||||||||||||||

| Investment securities | 3 | — | 3 | 3 | 1 | 2 | |||||||||||||||||||||||||||||

| Other financial assets | 2 | 6 | (4) | 2 | (2) | 4 | |||||||||||||||||||||||||||||

| Total provision for credit losses | $ | 219 | $ | 156 | $ | 63 | $ | 219 | $ | 155 | $ | 64 | |||||||||||||||||||||||

The provision for credit losses for the first quarter of 2025 was driven by net charge-offs, primarily in our commercial and industrial and credit card loan classes, and a net increase in the ACL due to changes in macroeconomic factors and portfolio activity.

CONSOLIDATED BALANCE SHEET REVIEW

The summarized balance sheet data in Table 7 is based upon our Consolidated Balance Sheet in Item 1 of this Report.

Table 7: Summarized Balance Sheet Data

| March 31 | December 31 | Change | |||||||||||||||||||||

| Dollars in millions | 2025 | 2024 | $ | % | |||||||||||||||||||

| Assets | |||||||||||||||||||||||

| Interest-earning deposits with banks | $ | 32,298 | $ | 39,347 | $ | (7,049) | (18) | % | |||||||||||||||

| Loans held for sale | 1,236 | 850 | 386 | 45 | % | ||||||||||||||||||

| Investment securities | 137,775 | 139,732 | (1,957) | (1) | % | ||||||||||||||||||

| Loans | 318,850 | 316,467 | 2,383 | 1 | % | ||||||||||||||||||

| Allowance for loan and lease losses | (4,544) | (4,486) | (58) | (1) | % | ||||||||||||||||||

| Mortgage servicing rights | 3,564 | 3,711 | (147) | (4) | % | ||||||||||||||||||

| Goodwill | 10,932 | 10,932 | — | — | % | ||||||||||||||||||

| Other | 54,611 | 53,485 | 1,126 | 2 | % | ||||||||||||||||||

| Total assets | $ | 554,722 | $ | 560,038 | $ | (5,316) | (1) | % | |||||||||||||||

| Liabilities | |||||||||||||||||||||||

| Deposits | $ | 422,915 | $ | 426,738 | $ | (3,823) | (1) | % | |||||||||||||||

| Borrowed funds | 60,722 | 61,673 | (951) | (2) | % | ||||||||||||||||||

| Allowance for unfunded lending related commitments | 674 | 719 | (45) | (6) | % | ||||||||||||||||||

| Other | 13,960 | 16,439 | (2,479) | (15) | % | ||||||||||||||||||

| Total liabilities | 498,271 | 505,569 | (7,298) | (1) | % | ||||||||||||||||||

| Equity | |||||||||||||||||||||||

| Total shareholders’ equity | 56,405 | 54,425 | 1,980 | 4 | % | ||||||||||||||||||

| Noncontrolling interests | 46 | 44 | 2 | 5 | % | ||||||||||||||||||

| Total equity | 56,451 | 54,469 | 1,982 | 4 | % | ||||||||||||||||||

| Total liabilities and equity | $ | 554,722 | $ | 560,038 | $ | (5,316) | (1) | % | |||||||||||||||

Our balance sheet was well positioned at March 31, 2025. In comparison to December 31, 2024:

•Total assets decreased reflecting lower balances held with the FRB and lower securities balances, partially offset by higher loans outstanding.

•Total liabilities decreased primarily due to lower deposits.

•Total equity increased due to the benefit of net income and an improvement in AOCI, partially offset by dividends paid and common shares repurchased.

The following discussion provides additional information about the major components of our balance sheet. Information regarding our ACL related to loans is included in the Credit Risk Management section and Critical Accounting Estimates and Judgements section of this Financial Review and in Note 3 Loans and Related Allowance for Credit Losses. Information regarding our capital and regulatory compliance is included in the Liquidity and Capital Management portion of the Risk Management section in this Financial Review and in Note 19 Regulatory Matters in our 2024 Form 10-K.

8 The PNC Financial Services Group, Inc. – Form 10-Q

Loans

Table 8: Loans

| March 31 | December 31 | Change | |||||||||||||||||||||

| Dollars in millions | 2025 | 2024 | $ | % | |||||||||||||||||||

| Commercial | |||||||||||||||||||||||

| Commercial and industrial | $ | 180,537 | $ | 175,790 | $ | 4,747 | 3 | % | |||||||||||||||

| Commercial real estate | 32,307 | 33,619 | (1,312) | (4) | % | ||||||||||||||||||

| Equipment lease financing | 6,732 | 6,755 | (23) | — | % | ||||||||||||||||||

| Total commercial | 219,576 | 216,164 | 3,412 | 2 | % | ||||||||||||||||||

| Consumer | |||||||||||||||||||||||

| Residential real estate | 45,890 | 46,415 | (525) | (1) | % | ||||||||||||||||||

| Home equity | 25,846 | 25,991 | (145) | (1) | % | ||||||||||||||||||

| Automobile | 15,324 | 15,355 | (31) | — | % | ||||||||||||||||||

| Credit card | 6,550 | 6,879 | (329) | (5) | % | ||||||||||||||||||

| Education | 1,597 | 1,636 | (39) | (2) | % | ||||||||||||||||||

| Other consumer | 4,067 | 4,027 | 40 | 1 | % | ||||||||||||||||||

| Total consumer | 99,274 | 100,303 | (1,029) | (1) | % | ||||||||||||||||||

| Total loans | $ | 318,850 | $ | 316,467 | $ | 2,383 | 1 | % | |||||||||||||||

Commercial loans increased due to higher utilization of loan commitments and new production within the commercial and industrial portfolio, partially offset by lower commercial real estate loans.

Consumer loans decreased primarily due to lower residential real estate loans, as paydowns outpaced originations.

For additional information regarding our loan portfolio see the Credit Risk Management portion of the Risk Management section in this Financial Review and Note 3 Loans and Related Allowance for Credit Losses.

Investment Securities

Total investment securities of $137.8 billion at March 31, 2025 decreased $2.0 billion, or 1%, compared to December 31, 2024, primarily due to prepayments and maturities of both available-for-sale and held-to-maturity securities outpacing purchases of available-for-sale securities.

The level and composition of the investment securities portfolio fluctuates over time based on many factors, including market conditions, loan and deposit growth and balance sheet management activities. We manage our investment securities portfolio to optimize returns, while providing a reliable source of liquidity for our banking and other activities, considering the LCR, NSFR and other internal and external guidelines and constraints.

Table 9: Investment Securities (a)

| March 31, 2025 | December 31, 2024 | ||||||||||||||||||||||

| Dollars in millions | Amortized Cost (b) |

Fair Value |

Amortized Cost (b) |

Fair Value |

|||||||||||||||||||

| U.S. Treasury and government agencies | $ | 52,543 | $ | 51,689 | $ | 53,382 | $ | 52,075 | |||||||||||||||

| Agency residential mortgage-backed | 72,535 | 67,197 | 73,760 | 67,117 | |||||||||||||||||||

| Non-agency residential mortgage-backed | 725 | 816 | 744 | 822 | |||||||||||||||||||

| Agency commercial mortgage-backed | 3,470 | 3,368 | 3,032 | 2,875 | |||||||||||||||||||

| Non-agency commercial mortgage-backed (c) | 1,257 | 1,248 | 1,542 | 1,523 | |||||||||||||||||||

| Asset-backed (d) | 5,215 | 5,285 | 5,733 | 5,793 | |||||||||||||||||||

| Other (e) | 4,736 | 4,641 | 4,998 | 4,892 | |||||||||||||||||||

| Total investment securities (f) | $ | 140,481 | $ | 134,244 | $ | 143,191 | $ | 135,097 | |||||||||||||||

(a)Of our total securities portfolio, 97% were rated AAA/AA at both March 31, 2025 and December 31, 2024.

(b)Amortized cost is presented net of the allowance for investment securities, which totaled $68 million at March 31, 2025 and primarily related to non-agency commercial mortgage-backed securities. The comparable amount at December 31, 2024 was $91 million.

(c)Collateralized primarily by multifamily housing, office buildings, retail properties, lodging properties and industrial properties.

(d)Collateralized primarily by consumer credit products, corporate debt and government guaranteed education loans.

(e)Includes state and municipal securities and corporate bonds.

(f)Includes available-for-sale and held-to-maturity securities, which are recorded on our balance sheet at fair value and amortized cost, respectively.

Table 9 presents our investment securities portfolio by amortized cost and fair value. The difference between fair value and amortized cost at March 31, 2025 primarily reflected the impact of higher interest rates on the valuation of fixed-rate securities. We continually

The PNC Financial Services Group, Inc. – Form 10-Q 9

monitor the credit risk in our portfolio and maintain the allowance for investment securities at an appropriate level to absorb expected credit losses on our investment securities portfolio for the remaining contractual term of the securities adjusted for expected prepayments. See Note 2 Investment Securities for additional details regarding the allowance for investment securities.

The duration of investment securities was 3.4 years and 3.5 years at March 31, 2025 and December 31, 2024, respectively. We estimate that at March 31, 2025 the effective duration of investment securities was 3.4 years for an immediate 50 basis points parallel increase in interest rates and 3.4 years for an immediate 50 basis points parallel decrease in interest rates. Comparable amounts at December 31, 2024 for the effective duration of investment securities were 3.4 years and 3.5 years, respectively.

Based on expected prepayment speeds, the weighted-average expected maturity of the investment securities portfolio was 5.2 years and 5.3 years at March 31, 2025 and December 31, 2024, respectively.

Table 10: Weighted-Average Expected Maturities of Mortgage and Asset-Backed Debt Securities

| March 31, 2025 | Years | |||||||

| Agency residential mortgage-backed | 6.6 | |||||||

| Non-agency residential mortgage-backed | 10.2 | |||||||

| Agency commercial mortgage-backed | 3.7 | |||||||

| Non-agency commercial mortgage-backed | 0.6 | |||||||

| Asset-backed | 2.2 | |||||||

Additional information regarding our investment securities portfolio is included in Note 2 Investment Securities and Note 11 Fair Value.

Funding Sources

Table 11: Details of Funding Sources

| March 31 | December 31 | Change | |||||||||||||||||||||

| Dollars in millions | 2025 | 2024 | $ | % | |||||||||||||||||||

| Deposits | |||||||||||||||||||||||

| Noninterest-bearing | $ | 92,369 | $ | 92,641 | $ | (272) | — | % | |||||||||||||||

| Interest-bearing | |||||||||||||||||||||||

| Money market | 71,655 | 73,801 | (2,146) | (3) | % | ||||||||||||||||||

| Demand | 126,829 | 128,810 | (1,981) | (2) | % | ||||||||||||||||||

| Savings | 98,596 | 97,147 | 1,449 | 1 | % | ||||||||||||||||||

| Time deposits (a) | 33,466 | 34,339 | (873) | (3) | % | ||||||||||||||||||

| Total interest-bearing deposits | 330,546 | 334,097 | (3,551) | (1) | % | ||||||||||||||||||

| Total deposits | 422,915 | 426,738 | (3,823) | (1) | % | ||||||||||||||||||

| Borrowed funds | |||||||||||||||||||||||

| Federal Home Loan Bank advances | 18,000 | 22,000 | (4,000) | (18) | % | ||||||||||||||||||

| Senior debt | 34,987 | 32,497 | 2,490 | 8 | % | ||||||||||||||||||

| Subordinated debt | 4,163 | 4,104 | 59 | 1 | % | ||||||||||||||||||

| Other | 3,572 | 3,072 | 500 | 16 | % | ||||||||||||||||||

| Total borrowed funds | 60,722 | 61,673 | (951) | (2) | % | ||||||||||||||||||

| Total funding sources | $ | 483,637 | $ | 488,411 | $ | (4,774) | (1) | % | |||||||||||||||

(a) Includes $1.2 billion of certain brokered time deposits accounted for under the fair value option at March 31, 2025.

Deposits are considered an attractive source of funding due to their stability and relatively low cost to fund. Compared to December 31, 2024, both deposits and borrowed funds declined.

Total deposits decreased primarily due to lower interest-bearing deposits. The decrease in interest-bearing deposits was driven by lower commercial balances, partially offset by higher consumer balances. This shift in deposit composition contributed to a decrease in funding costs compared to the fourth quarter of 2024. Our total brokered deposit balances of $5.9 billion at March 31, 2025 decreased compared to $7.3 billion at December 31, 2024, and were significantly below both our internal and regulatory guidelines and limits.

Borrowed funds decreased due to lower FHLB advances, partially offset by parent company senior debt issuances in the first quarter of 2025.

The level and composition of borrowed funds fluctuates over time based on many factors, including market conditions, capital considerations, and funding needs, which are primarily driven by changes in loan, deposit and investment securities balances. While

10 The PNC Financial Services Group, Inc. – Form 10-Q

our largest source of liquidity on a consolidated basis is the customer deposit base generated by our banking businesses, we also manage our borrowed funds to provide a reliable source of liquidity for our banking and other activities, considering our LCR and NSFR requirements and other internal and external guidelines and constraints. See the Liquidity and Capital Management portion of the Risk Management section in this Financial Review for additional information regarding our liquidity and capital activities. See Note 7 Borrowed Funds in this Report and Note 9 Borrowed Funds in our 2024 Form 10-K for additional information related to our borrowings. See the Average Consolidated Balance Sheet and Net Interest Analysis section of this Financial Review for additional information on volume and related funding cost changes.

Shareholders’ Equity

Total shareholders’ equity of $56.4 billion at March 31, 2025 increased $2.0 billion, or 4%, compared to December 31, 2024, primarily due to net income of $1.5 billion and an improvement in AOCI of $1.3 billion, partially offset by dividends paid of $0.6 billion and $0.2 billion of common share repurchases.

BUSINESS SEGMENTS REVIEW

We have three reportable business segments: Retail Banking, Corporate & Institutional Banking and the Asset Management Group. Our reportable business segments are defined by the nature of products and services, types of customers, methods used to distribute products or provide services and similar financial performance.

Total business segment financial results differ from our consolidated reporting due to the remaining corporate operations, or other activities, that do not meet the criteria for disclosure as a separate reportable business. These other activities include residual activities such as asset and liability management activities including net securities gains or losses, ACL for investment securities, certain trading activities, certain runoff consumer loan portfolios, private equity investments, intercompany eliminations, corporate overhead net of allocations, tax adjustments that are not allocated to business segments, exited businesses and the residual impact from FTP operations. See Table 80 in Note 14 Segment Reporting for additional information.

Certain amounts included in this Business Segments Review differ from those amounts shown in Note 14, primarily due to the presentation in this Financial Review of business net interest income on a taxable-equivalent basis.

See Note 14 Segment Reporting for additional information on our business segments, including a description of each business.

The PNC Financial Services Group, Inc. – Form 10-Q 11

Retail Banking

Retail Banking’s core strategy is to build lifelong, primary relationships by creating a sense of financial well-being and ease for our clients. Over time, we seek to deepen those relationships by meeting the broad range of our clients’ financial needs across savings, liquidity, lending, payments, investment and retirement solutions. We work to deliver these solutions in the most seamless and efficient way possible, meeting our customers where they are - whether in a branch, through digital channels, at an ATM or through our phone-based customer contact centers - while continuously optimizing the cost to sell and service. We believe that, over time, we can grow our customer base, enhance the breadth and depth of our client relationships and improve our efficiency through differentiated products and leading digital channels.

Table 12: Retail Banking Table

| (Unaudited) | |||||||||||||||||||||||

| Three months ended March 31 | Change | ||||||||||||||||||||||

| Dollars in millions, except as noted | 2025 | 2024 | $ | % | |||||||||||||||||||

| Income Statement | |||||||||||||||||||||||

| Net interest income | $ | 2,826 | $ | 2,617 | $ | 209 | 8 | % | |||||||||||||||

| Noninterest income | 706 | 764 | (58) | (8) | % | ||||||||||||||||||

| Total revenue | 3,532 | 3,381 | 151 | 4 | % | ||||||||||||||||||

| Provision for credit losses | 168 | 118 | 50 | 42 | % | ||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||

| Personnel | 548 | 551 | (3) | (1) | % | ||||||||||||||||||

| Segment allocations (a) | 938 | 894 | 44 | 5 | % | ||||||||||||||||||

| Depreciation and amortization | 89 | 79 | 10 | 13 | % | ||||||||||||||||||

| Other (b) | 328 | 313 | 15 | 5 | % | ||||||||||||||||||

| Total noninterest expense | 1,903 | 1,837 | 66 | 4 | % | ||||||||||||||||||

| Pretax earnings | 1,461 | 1,426 | 35 | 2 | % | ||||||||||||||||||

| Income taxes | 340 | 333 | 7 | 2 | % | ||||||||||||||||||

| Noncontrolling interests | 9 | 8 | 1 | 13 | % | ||||||||||||||||||

| Earnings | $ | 1,112 | $ | 1,085 | $ | 27 | 2 | % | |||||||||||||||

| Average Balance Sheet | |||||||||||||||||||||||

| Loans held for sale | $ | 860 | $ | 478 | $ | 382 | 80 | % | |||||||||||||||

| Loans | |||||||||||||||||||||||

| Consumer | |||||||||||||||||||||||

| Residential real estate | $ | 33,169 | $ | 34,600 | $ | (1,431) | (4) | % | |||||||||||||||

| Home equity | 24,358 | 24,462 | (104) | — | % | ||||||||||||||||||

| Automobile | 15,240 | 14,839 | 401 | 3 | % | ||||||||||||||||||

| Credit card | 6,568 | 6,930 | (362) | (5) | % | ||||||||||||||||||

| Education | 1,637 | 1,933 | (296) | (15) | % | ||||||||||||||||||

| Other consumer | 1,754 | 1,771 | (17) | (1) | % | ||||||||||||||||||

| Total consumer | 82,726 | 84,535 | (1,809) | (2) | % | ||||||||||||||||||

| Commercial | 12,840 | 12,620 | 220 | 2 | % | ||||||||||||||||||

| Total loans | $ | 95,566 | $ | 97,155 | $ | (1,589) | (2) | % | |||||||||||||||

| Total assets | $ | 112,971 | $ | 114,199 | $ | (1,228) | (1) | % | |||||||||||||||

| Deposits | |||||||||||||||||||||||

| Noninterest-bearing | $ | 51,229 | $ | 53,395 | $ | (2,166) | (4) | % | |||||||||||||||

| Interest-bearing | 193,832 | 195,615 | (1,783) | (1) | % | ||||||||||||||||||

| Total deposits | $ | 245,061 | $ | 249,010 | $ | (3,949) | (2) | % | |||||||||||||||

| Performance Ratios | |||||||||||||||||||||||

| Return on average assets | 3.99 | % | 3.85 | % | |||||||||||||||||||

| Noninterest income to total revenue | 20 | % | 23 | % | |||||||||||||||||||

| Efficiency | 54 | % | 54 | % | |||||||||||||||||||

| Supplemental Noninterest Income Information | |||||||||||||||||||||||

| Asset management and brokerage | $ | 152 | $ | 137 | $ | 15 | 11 | % | |||||||||||||||

| Card and cash management | $ | 296 | $ | 306 | $ | (10) | (3) | % | |||||||||||||||

| Lending and deposit services | $ | 184 | $ | 178 | $ | 6 | 3 | % | |||||||||||||||

| Residential and commercial mortgage | $ | 65 | $ | 97 | $ | (32) | (33) | % | |||||||||||||||

12 The PNC Financial Services Group, Inc. – Form 10-Q

(Continued from previous page)

At or for three months ended March 31 |

Change | ||||||||||||||||||||||

| Dollars in millions, except as noted | 2025 | 2024 | $ | % | |||||||||||||||||||

| Residential Mortgage Information | |||||||||||||||||||||||

| Residential mortgage servicing statistics (in billions, except as noted) (c) | |||||||||||||||||||||||

| Serviced portfolio balance (d) | $ | 193 | $ | 207 | $ | (14) | (7) | % | |||||||||||||||

| MSR asset value (d) | $ | 2.5 | $ | 2.7 | $ | (0.2) | (7) | % | |||||||||||||||

| Servicing income: (in millions) | |||||||||||||||||||||||

| Servicing fees, net (e) | $ | 71 | $ | 82 | $ | (11) | (13) | % | |||||||||||||||

| Mortgage servicing rights valuation, net of economic hedge | $ | (4) | $ | (6) | $ | 2 | 33 | % | |||||||||||||||

| Residential mortgage loan statistics | |||||||||||||||||||||||

| Loan origination volume (in billions) | $ | 1.0 | $ | 1.3 | $ | (0.3) | (23) | % | |||||||||||||||

| Loan sale margin percentage | 0.58 | % | 2.53 | % | |||||||||||||||||||

| Other Information | |||||||||||||||||||||||

| Credit-related statistics | |||||||||||||||||||||||

| Nonperforming assets (d) | $ | 804 | $ | 841 | $ | (37) | (4) | % | |||||||||||||||

| Net charge-offs - loans and leases | $ | 144 | $ | 139 | $ | 5 | 4 | % | |||||||||||||||

| Other statistics | |||||||||||||||||||||||

| Branches (d) (f) | 2,217 | 2,271 | (54) | (2) | % | ||||||||||||||||||

| Brokerage account client assets (in billions) (d) (g) | $ | 84 | $ | 81 | $ | 3 | 4 | % | |||||||||||||||

(a)Represents expense allocations for corporate overhead services used by each business segment; primarily comprised of technology, human resources and occupancy-related allocations.

(b)Other is primarily comprised of other direct expenses including outside services and equipment expense.

(c)Represents mortgage loan servicing balances for third parties and the related income.

(d)As of March 31.

(e)Servicing fees net of impact of decrease in MSR value due to passage of time, which includes the impact from regularly scheduled loan principal payments, prepayments and loans paid off during the period.

(f)Reflects all branches excluding standalone mortgage offices and satellite offices (e.g., drive-ups, electronic branches and retirement centers) that provide limited products and/or services.

(g)Includes cash and money market balances.

Retail Banking earnings for the first three months of 2025 increased $27 million compared to the same period in 2024 as a result of higher net interest income, offset by higher noninterest expense, lower noninterest income and higher provision for credit losses.

Net interest income increased in the comparison primarily due to wider interest rate spreads on the value of deposits, partially offset by declines in average deposit and loan balances.

Noninterest income decreased in the comparison due to lower residential mortgage revenue and higher negative Visa derivative adjustments primarily related to litigation escrow funding.

Provision for credit losses for the first three months of 2025 was driven by net charge-offs and changes in the ACL due to macroeconomic factors and portfolio activity.

Noninterest expense increased in the comparison due to technology investments, higher marketing spend and increased customer activity.

Retail Banking average total loans decreased in the first three months of 2025 compared to the same period in 2024. Average consumer loans decreased driven by lower residential real estate, as a result of paydowns outpacing new volume, lower credit card loan balances, and continued declines in education loans from runoff in the government guaranteed portfolio. Average commercial loans increased due to higher loan commitment utilization, primarily within the automobile dealer segment.

Our focus on growing primary customer relationships is at the core of our deposit strategy in Retail, which is based on attracting and retaining stable, low-cost deposits as a key funding source for PNC. We have taken a disciplined approach to pricing, focused on retaining relationship-based balances and executing on targeted deposit growth and retention strategies aimed at more rate-sensitive customers. Our goal with regard to deposits is to optimize balances, economics and long-term customer growth. In the first three months of 2025, average total deposits decreased compared to the same period in 2024, and included lower brokered time deposits.

Retail Banking continues to enhance the customer experience with refinements to product and service offerings that drive value for consumers and small businesses. As part of our strategic focus on growing customers and meeting their financial needs, we operate and continue to optimize a coast-to-coast network of retail branches, solution centers and ATMs, which are complemented by PNC’s suite of digital capabilities. In 2024, PNC announced it would be investing approximately $1.5 billion, over the next five years, to open more than 200 new branches in key locations, including Atlanta, Austin, Charlotte, Dallas, Denver, Houston, Miami, Orlando, Phoenix, Raleigh, San Antonio, and Tampa, while completing renovations of 1,400 existing locations across the country during the same time period to enhance the customer experience.

The PNC Financial Services Group, Inc. – Form 10-Q 13

Corporate & Institutional Banking

Corporate & Institutional Banking’s strategy is to be the leading relationship-based provider of traditional banking products and services to its customers through the economic cycles. We aim to grow our market share and drive higher returns by delivering value-added solutions that help our clients better run their organizations, all while maintaining prudent risk and expense management. We continue to focus on building client relationships where the risk-return profile is attractive. We are a coast-to-coast franchise and our full suite of commercial products and services is offered nationally.

Table 13: Corporate & Institutional Banking Table

| (Unaudited) | |||||||||||||||||||||||

| Three months ended March 31 | Change | ||||||||||||||||||||||

| Dollars in millions, except as noted | 2025 | 2024 | $ | % | |||||||||||||||||||

| Income Statement | |||||||||||||||||||||||

| Net interest income | $ | 1,652 | $ | 1,549 | $ | 103 | 7 | % | |||||||||||||||

| Noninterest income | 978 | 888 | 90 | 10 | % | ||||||||||||||||||

| Total revenue | 2,630 | 2,437 | 193 | 8 | % | ||||||||||||||||||

| Provision for credit losses | 49 | 47 | 2 | 4 | % | ||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||

| Personnel | 376 | 366 | 10 | 3 | % | ||||||||||||||||||

| Segment allocations (a) | 383 | 366 | 17 | 5 | % | ||||||||||||||||||

| Depreciation and amortization | 51 | 50 | 1 | 2 | % | ||||||||||||||||||

| Other (b) | 146 | 140 | 6 | 4 | % | ||||||||||||||||||

| Total noninterest expense | 956 | 922 | 34 | 4 | % | ||||||||||||||||||

| Pretax earnings | 1,625 | 1,468 | 157 | 11 | % | ||||||||||||||||||

| Income taxes | 377 | 342 | 35 | 10 | % | ||||||||||||||||||

| Noncontrolling interests | 4 | 5 | (1) | (20) | % | ||||||||||||||||||

| Earnings | $ | 1,244 | $ | 1,121 | $ | 123 | 11 | % | |||||||||||||||

| Average Balance Sheet | |||||||||||||||||||||||

| Loans held for sale | $ | 255 | $ | 151 | $ | 104 | 69 | % | |||||||||||||||

| Loans | |||||||||||||||||||||||

| Commercial | |||||||||||||||||||||||

| Commercial and industrial | $ | 163,379 | $ | 163,326 | $ | 53 | — | % | |||||||||||||||

| Commercial real estate | 32,151 | 34,420 | (2,269) | (7) | % | ||||||||||||||||||

| Equipment lease financing | 6,692 | 6,467 | 225 | 3 | % | ||||||||||||||||||

| Total commercial | 202,222 | 204,213 | (1,991) | (1) | % | ||||||||||||||||||

| Consumer | 3 | 3 | — | — | % | ||||||||||||||||||

| Total loans | $ | 202,225 | $ | 204,216 | $ | (1,991) | (1) | % | |||||||||||||||

| Total assets | $ | 227,069 | $ | 228,698 | $ | (1,629) | (1) | % | |||||||||||||||

| Deposits | |||||||||||||||||||||||

| Noninterest-bearing | $ | 39,501 | $ | 43,854 | $ | (4,353) | (10) | % | |||||||||||||||

| Interest-bearing | 108,503 | 98,841 | 9,662 | 10 | % | ||||||||||||||||||

| Total deposits | $ | 148,004 | $ | 142,695 | $ | 5,309 | 4 | % | |||||||||||||||

| Performance Ratios | |||||||||||||||||||||||

| Return on average assets | 2.22 | % | 1.99 | % | |||||||||||||||||||

| Noninterest income to total revenue | 37 | % | 36 | % | |||||||||||||||||||

| Efficiency | 36 | % | 38 | % | |||||||||||||||||||

14 The PNC Financial Services Group, Inc. – Form 10-Q

(Continued from previous page)

| (Unaudited) | |||||||||||||||||||||||

| Three months ended March 31 | Change | ||||||||||||||||||||||

| Dollars in millions, except as noted | 2025 | 2024 | $ | % | |||||||||||||||||||

| Other Information | |||||||||||||||||||||||

| Consolidated revenue from: (c) | |||||||||||||||||||||||

| Treasury Management (d) | $ | 1,049 | $ | 936 | $ | 113 | 12 | % | |||||||||||||||

| Commercial mortgage banking activities: | |||||||||||||||||||||||

| Commercial mortgage loans held for sale (e) | $ | 26 | $ | 10 | $ | 16 | 160 | % | |||||||||||||||

| Commercial mortgage loan servicing income (f) | 94 | 67 | 27 | 40 | % | ||||||||||||||||||

| Commercial mortgage servicing rights valuation, net of economic hedge | 39 | 37 | 2 | 5 | % | ||||||||||||||||||

| Total | $ | 159 | $ | 114 | $ | 45 | 39 | % | |||||||||||||||

| Commercial mortgage servicing statistics | |||||||||||||||||||||||

| Serviced portfolio balance (in billions) (g) (h) | $ | 294 | $ | 287 | $ | 7 | 2 | % | |||||||||||||||

| MSR asset value (g) | $ | 1,041 | $ | 1,075 | $ | (34) | (3) | % | |||||||||||||||

| Average loans by C&IB business | |||||||||||||||||||||||

| Corporate Banking | $ | 117,659 | $ | 116,845 | $ | 814 | 1 | % | |||||||||||||||

| Real Estate | 43,283 | 46,608 | (3,325) | (7) | % | ||||||||||||||||||

| Business Credit | 30,044 | 28,929 | 1,115 | 4 | % | ||||||||||||||||||

| Commercial Banking | 7,343 | 7,546 | (203) | (3) | % | ||||||||||||||||||

| Other | 3,896 | 4,288 | (392) | (9) | % | ||||||||||||||||||

| Total average loans | $ | 202,225 | $ | 204,216 | $ | (1,991) | (1) | % | |||||||||||||||

| Credit-related statistics | |||||||||||||||||||||||

| Nonperforming assets (g) | $ | 1,372 | $ | 1,419 | $ | (47) | (3) | % | |||||||||||||||

| Net charge-offs - loans and leases | $ | 64 | $ | 108 | $ | (44) | (41) | % | |||||||||||||||

(a)Represents expense allocations for corporate overhead services used by each business segment; primarily comprised of technology, human resources and occupancy-related allocations.

(b)Other is primarily comprised of other direct expenses including outside services and equipment expense.

(c)See the additional revenue discussion regarding treasury management and commercial mortgage banking activities in the Product Revenue section of this Corporate & Institutional Banking section.

(d)Amounts are reported in net interest income and noninterest income.

(e)Represents commercial mortgage banking income for valuations on commercial mortgage loans held for sale and related commitments, derivative valuations, origination fees, gains on sale of loans held for sale and net interest income on loans held for sale.

(f)Represents net interest income and noninterest income from loan servicing, net of reduction in commercial mortgage servicing rights due to time and payoffs. Commercial mortgage servicing rights valuation, net of economic hedge is shown separately.

(g)As of March 31.

(h)Represents balances related to capitalized servicing.

Corporate & Institutional Banking earnings in the first three months of 2025 increased $123 million compared to the same period in 2024 driven by higher revenue, partially offset by higher noninterest expense.

Net interest income increased in the comparison primarily due to wider interest rate spreads on the value of deposits and higher average deposit balances, partially offset by lower average loan balances.

Noninterest income increased in the comparison primarily due to higher merger and acquisition advisory activity and growth in treasury management product revenue.

Provision for credit losses for the first three months of 2025 was driven by net charge-offs and changes in the ACL due to macroeconomic factors and portfolio activity.

Noninterest expense increased in the comparison largely due to continued investments to support business growth and higher variable compensation associated with increased business activity.

Average total loans decreased compared with the three months ended March 31, 2024:

•Corporate Banking provides lending, equipment finance, treasury management and capital markets products and services to

mid-sized and large corporations, and government and not-for-profit entities. Average loans for this business increased reflecting new production that was partially offset by lower average utilization of loan commitments.

•Real Estate provides banking, financing and servicing solutions for commercial real estate clients across the country. Average loans for this business declined largely due to paydowns outpacing new production.

•Business Credit provides asset-based lending and equipment financing solutions. The loan and lease portfolio is mainly secured by business assets. Average loans for this business increased reflecting a higher average utilization of loan commitments and new production.

•Commercial Banking provides lending, treasury management and capital markets products and services to smaller corporations and businesses. Average loans for this business declined driven by paydowns outpacing new production.

The PNC Financial Services Group, Inc. – Form 10-Q 15

The deposit strategy of Corporate & Institutional Banking is to remain disciplined on pricing and focused on growing and retaining relationship-based balances over time, executing on customer and segment-specific deposit growth strategies and continuing to provide funding and liquidity to PNC. Average total deposits increased compared to the three months ended March 31, 2024, due to growth in interest-bearing deposits, partially offset by lower noninterest-bearing deposits. We continue to actively monitor the interest rate environment and make adjustments to our deposit strategy in response to evolving market conditions, bank funding needs and client relationship dynamics.

Product Revenue

In addition to credit and deposit products for commercial customers, Corporate & Institutional Banking offers other services, including treasury management, capital markets and advisory products and services and commercial mortgage banking activities, for customers of all business segments. On a consolidated basis, the revenue from these other services is included in net interest income and noninterest income, as appropriate. From a business perspective, the majority of the revenue and expense related to these services is reflected in the Corporate & Institutional Banking segment results, and the remainder is reflected in the results of other businesses where the customer relationships exist. The Other Information section in Table 13 includes the consolidated revenue to PNC for treasury management and commercial mortgage banking services. A discussion of the consolidated revenue from these services follows.

The Treasury Management business provides corporations with cash and investment management services, receivables and disbursement management services, funds transfer services, international payment services and access to online/mobile information management and reporting services. Treasury management revenue is reported in noninterest income and net interest income. Noninterest income includes treasury management product revenue less earnings credits provided to customers on compensating deposit balances used to pay for products and services. Net interest income includes funding credit from all treasury management customer deposit balances. Compared to the first three months of 2024, treasury management revenue increased due to wider interest rate spreads on the value of deposits, higher average deposit balances and higher product revenue.

Commercial mortgage banking activities include revenue derived from commercial mortgage servicing (both net interest income and

noninterest income), revenue derived from commercial mortgage loans held for sale and hedges related to those activities. Total

revenue from commercial mortgage banking activities increased in the comparison primarily due to higher commercial mortgage loan servicing income and revenue from commercial mortgage loans held for sale.

Capital markets and advisory includes services and activities primarily related to merger and acquisition advisory, equity capital markets advisory, asset-backed financing, loan syndication, securities underwriting and customer-related trading. The increase in capital markets and advisory fees in the comparison was largely driven by higher merger and acquisition advisory fees and loan syndication fees, partially offset by lower underwriting fees.

16 The PNC Financial Services Group, Inc. – Form 10-Q

Asset Management Group

The Asset Management Group strives to be a leading relationship-based provider of investment, planning, credit and cash management solutions and fiduciary services to affluent individuals and institutions by endeavoring to proactively deliver value-added ideas, solutions and exceptional service. The Asset Management Group’s priorities are to serve our clients’ financial objectives, grow and deepen customer relationships and deliver solid financial performance with prudent risk and expense management.

Table 14: Asset Management Group Table

| (Unaudited) | |||||||||||||||||||||||

| Three months ended March 31 | Change | ||||||||||||||||||||||

| Dollars in millions, except as noted | 2025 | 2024 | $ | % | |||||||||||||||||||

| Income Statement | |||||||||||||||||||||||

| Net interest income | $ | 184 | $ | 157 | $ | 27 | 17 | % | |||||||||||||||

| Noninterest income | 243 | 230 | 13 | 6 | % | ||||||||||||||||||

| Total revenue | 427 | 387 | 40 | 10 | % | ||||||||||||||||||

| Provision for (recapture of) credit losses | 1 | (5) | 6 | * | |||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||

| Personnel | 121 | 121 | — | — | % | ||||||||||||||||||

| Segment allocations (a) | 117 | 107 | 10 | 9 | % | ||||||||||||||||||

| Depreciation and amortization | 8 | 7 | 1 | 14 | % | ||||||||||||||||||

| Other (b) | 33 | 30 | 3 | 10 | % | ||||||||||||||||||

| Total noninterest expense | 279 | 265 | 14 | 5 | % | ||||||||||||||||||

| Pretax earnings | 147 | 127 | 20 | 16 | % | ||||||||||||||||||

| Income taxes | 34 | 30 | 4 | 13 | % | ||||||||||||||||||

| Earnings | $ | 113 | $ | 97 | $ | 16 | 16 | % | |||||||||||||||

| Average Balance Sheet | |||||||||||||||||||||||

| Loans | |||||||||||||||||||||||