424B2: Prospectus filed pursuant to Rule 424(b)(2)

Published on May 9, 2024

Filed Pursuant to Rule 424(b)(2)

File No. 333-261622

PROSPECTUS SUPPLEMENT

(To Prospectus dated December 13, 2021)

$1,750,000,000

The PNC Financial Services Group, Inc.

5.492% Fixed Rate/Floating Rate Senior Notes Due May 14, 2030

The senior notes (the “Senior Notes”) in the aggregate principal amount of $1,750,000,000 offered pursuant to this prospectus supplement and the accompanying prospectus will mature on May 14, 2030 and initially bear interest at 5.492% per annum, payable semi-annually in arrears on May 14 and November 14 of each year, commencing November 14, 2024 and ending on May 14, 2029. Beginning on May 14, 2029, the Senior Notes will bear interest at a floating rate per annum equal to Compounded SOFR (determined with respect to each quarterly interest period using the SOFR Index as described herein) plus 1.198%, payable quarterly in arrears on August 14, 2029, November 14, 2029, February 14, 2030 and at the maturity date. The Senior Notes will be redeemable in whole, but not in part, by us on May 14, 2029, the date that is one year prior to the maturity date, at 100% of the principal amount of the notes (par), plus accrued and unpaid interest thereon to the date of redemption. In addition, the Senior Notes will be redeemable in whole, or in part, by us during the 30-day period prior to, and including, the maturity date at 100% of the principal amount of the notes (par), plus accrued and unpaid interest thereon to the date of redemption. We will provide 5 to 30 calendar days’ notice of the redemption to the registered holders of the Senior Notes. There is no sinking fund for the Senior Notes.

The Senior Notes will rank equally with all of our other existing and future senior unsecured indebtedness.

See “Risk Factors” on page S-10 to read about important factors you should consider before buying the Senior Notes. The Senior Notes are not deposits of a bank and are not insured by the United States Federal Deposit Insurance Corporation or any other insurer or government agency.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Price to Public(1)

|

Underwriting Discount |

Proceeds to us | |||||||||||||||

Per Senior Note |

100.000 | % | 0.350 | % | 99.650 | % | |||||||||||

| Total | $ | 1,750,000,000 | $ | 6,125,000 | $ | 1,743,875,000 | |||||||||||

__________________

(1)Plus accrued interest, if any, from the original issue date.

The Senior Notes will not be listed on any securities exchange. Currently, there is no public trading market for the Senior Notes.

The underwriters expect to deliver the Senior Notes to purchasers in book-entry form through the facilities of The Depository Trust Company and its direct participants, including Euroclear Bank SA/NV, as operator of the Euroclear System (“Euroclear”), and Clearstream Banking S.A. (“Clearstream”), on or about May 14, 2024.

Because our affiliate, PNC Capital Markets LLC, is participating in the offer and sale of the Senior Notes, the offering is being conducted in compliance with Financial Industry Regulatory Authority (“FINRA”) Rule 5121. See “Underwriting (Conflicts of Interest)” on page S-30.

| Joint Book-Running Managers | |||||||||||

Citigroup |

Morgan Stanley |

PNC Capital Markets LLC |

|||||||||

Co-Managers | |||||||||||

Academy Securities |

Siebert Williams Shank |

||||||||||

May 8, 2024 | |||||||||||

Table of Contents

| Page | |||||

| Prospectus Supplement | |||||

| Page | |||||

| Prospectus | |||||

S-i

About This Prospectus Supplement

We provide information to you about this offering in two separate documents. The accompanying prospectus provides general information about us and the securities we may offer from time to time, some of which may not apply to this offering. This prospectus supplement describes the specific details regarding this offering. Generally, when we refer to the “prospectus,” we are referring to both documents combined. Additional information is incorporated by reference in this prospectus supplement. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement.

Unless otherwise mentioned or unless the context requires otherwise, all references in this prospectus supplement to “PNC,” “we,” “us,” “our” or similar references mean The PNC Financial Services Group, Inc. and its successors.

References to The PNC Financial Services Group, Inc. and its subsidiaries, on a consolidated basis, are specifically made where applicable.

We have not, and the underwriters have not, authorized anyone to provide any information other than the information contained or incorporated by reference in this prospectus supplement or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

We are offering to sell the Senior Notes only in places where sales are permitted. We are not, and the underwriters are not, making an offer to sell the Senior Notes in any jurisdiction where the offer or sale is not permitted. You should not assume that the information appearing in this prospectus supplement or any document incorporated by reference herein or in the accompanying prospectus is accurate as of any date other than the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since that date. Neither this prospectus supplement nor the accompanying prospectus constitutes an offer, or an invitation on our behalf or on behalf of the underwriters, to subscribe for and purchase any of the Senior Notes and may not be used for or in connection with an offer or solicitation by anyone, in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

S-1

Cautionary Statement Regarding Forward-Looking Information

We make statements in this prospectus supplement and the accompanying prospectus, and we may from time to time make other statements, regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting us and our future business and operations, including our sustainability strategy, that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,” “estimate,” “goal,” “will,” “should” and other similar words and expressions.

Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements speak only as of the date made. We do not assume any duty and do not undertake any obligation to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements.

Our forward-looking statements are subject to the following principal risks and uncertainties.

•Our businesses, financial results and balance sheet values are affected by business and economic conditions, including:

•Changes in interest rates and valuations in debt, equity and other financial markets,

•Disruptions in the U.S. and global financial markets,

•Actions by the Federal Reserve Board, U.S. Treasury and other government agencies, including those that impact money supply, market interest rates and inflation,

•Changes in customer behavior due to changing business and economic conditions or legislative or regulatory initiatives,

•Changes in customers’, suppliers’ and other counterparties’ performance and creditworthiness,

•Impacts of sanctions, tariffs and other trade policies of the U.S. and its global trading partners,

•Impacts of changes in federal, state and local governmental policy, including on the regulatory landscape, capital markets, taxes, infrastructure spending and social programs,

•Our ability to attract, recruit and retain skilled employees, and

•Commodity price volatility.

•Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting. These statements are based on our views that:

•Our baseline forecast is for slower economic growth in 2024 as consumer spending growth slows and higher interest rates remain a drag on the economy. The ongoing strength of the labor market will continue to support consumer spending. The Federal Open Market Committee is indicating that it will start to cut the federal funds rate later this year, with rate cuts supporting economic growth toward the end of 2024.

•Real GDP growth this year will be close to its trend of 2% and the unemployment rate will increase modestly to just above 4% by the end of 2024. Inflation will continue to slow as wage pressures abate, moving back to the Federal Reserve’s 2% long-term objective by the end of 2025.

S-2

•We expect the federal funds rate to remain unchanged between 5.25% and 5.50% through at least the first half of 2024, with federal funds rate cuts starting in the third quarter as inflationary pressures ease further. We expect two federal funds rate cuts in 2024, with the rate ending this year in a range between 4.75% and 5.00%.

•Our ability to take certain capital actions, including returning capital to shareholders, is subject to PNC meeting or exceeding minimum capital levels, including a stress capital buffer established by the Federal Reserve Board in connection with the Federal Reserve Board’s Comprehensive Capital Analysis and Review process.

•Our regulatory capital ratios in the future will depend on, among other things, the company’s financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of our balance sheet. In addition, our ability to determine, evaluate and forecast regulatory capital ratios, and to take actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent at least in part on the development, validation and regulatory review of related models and the reliability of and risks resulting from extensive use of such models.

•Legal and regulatory developments could have an impact on our ability to operate our businesses, financial condition, results of operations, competitive position, reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business generation and retention, liquidity, funding and ability to attract and retain employees. These developments could include:

•Changes to laws and regulations, including changes affecting oversight of the financial services industry, changes in the enforcement and interpretation of such laws and regulations and changes in accounting and reporting standards.

•Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries resulting in monetary losses, costs, or alterations in our business practices and potentially causing reputational harm to PNC.

•Results of the regulatory examination and supervision process, including our failure to satisfy requirements of agreements with governmental agencies.

•Costs associated with obtaining rights in intellectual property claimed by others and of adequacy of our intellectual property protection in general.

•Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques and to meet evolving regulatory capital and liquidity standards.

•Our reputation and business and operating results may be affected by our ability to appropriately meet or address environmental, social or governance targets, goals, commitments or concerns that may arise.

•We grow our business in part through acquisitions and new strategic initiatives. Risks and uncertainties include those presented by the nature of the business acquired or strategic initiative, including in some cases those associated with our entry into new businesses or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, the integration of the acquired businesses into PNC after closing or any failure to execute strategic or operational plans.

•Competition can have an impact on customer acquisition, growth and retention and on credit spreads and product pricing, which can affect market share, deposits and revenues. Our ability to anticipate and respond to technological changes can also impact our ability to respond to customer needs and meet competitive demands.

S-3

•Business and operating results can also be affected by widespread manmade, natural and other disasters (including severe weather events), health emergencies, dislocations, geopolitical instabilities or events, terrorist activities, system failures or disruptions, security breaches, cyberattacks, international hostilities, or other extraordinary events beyond our control through impacts on the economy and financial markets generally or on us or our counterparties, customers or third-party vendors and service providers specifically.

We provide greater detail regarding these as well as other factors in our Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 and elsewhere in this prospectus supplement. Our forward-looking statements may also be subject to other risks and uncertainties, including those discussed elsewhere in this prospectus supplement and the accompanying prospectus or in our other filings with the SEC.

S-4

Incorporation of Certain Documents by Reference

The SEC allows us to incorporate information in this document by reference to other documents filed separately with the SEC. This means that PNC can disclose important information to you by referring you to those other documents. The information incorporated by reference is considered to be a part of this document, except for any information that is superseded by information that is included directly in this document. You may read this information at the SEC’s website, www.sec.gov. The reports and other information filed by PNC with the SEC are also available at our website, www.pnc.com. We have included the web addresses of the SEC and PNC as inactive textual references only. Except as specifically incorporated by reference into this document, information on those websites is not part of this prospectus supplement or the accompanying prospectus.

This document incorporates by reference the documents listed below that we previously filed with the SEC. They contain important information about PNC and its financial condition.

| Filing | Period or date filed | |||||||

| Annual Report on Form 10-K |

Year ended December 31, 2023

|

|||||||

Quarterly Report on Form 10-Q |

Quarter ended March 31, 2024

|

|||||||

| Current Reports on Form 8-K |

Filed with the SEC on January 22, 2024, February 20, 2024, March 5, 2024 (solely with respect to Item 8.01 thereof), April 16, 2024 (solely with respect to Item 8.01 thereof) and April 29, 2024

|

|||||||

PNC also incorporates by reference additional documents that we file with the SEC under Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), between the date of this document and the date of the termination of the offer being made pursuant to this prospectus supplement. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements. Notwithstanding the foregoing, PNC is not incorporating any document or information that it furnished rather than filed with the SEC.

Any statement contained in a document incorporated by reference, or deemed to be incorporated by reference, in this prospectus supplement or the accompanying prospectus shall be deemed to be modified or superseded for purposes of this prospectus supplement or the accompanying prospectus to the extent that a statement contained in this prospectus supplement or the accompanying prospectus or in any other subsequently filed document which also is incorporated by reference in this prospectus supplement or the accompanying prospectus modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement or the accompanying prospectus.

Statements contained in this prospectus supplement or the accompanying prospectus as to the contents of any contract or other document referred to in this prospectus supplement or the accompanying prospectus do not purport to be complete, and where reference is made to the particular provisions of such contract or other document, such provisions are qualified in all respects by reference to all of the provisions of such contract or other document. We will provide without charge to each person to whom a copy of this prospectus supplement and the accompanying prospectus has been delivered, on the written or oral request of such person, a copy of any or all of the documents which have been or may be incorporated in this prospectus supplement or the accompanying prospectus by reference (other than exhibits to such documents unless such exhibits are specifically incorporated by reference in any such documents) and a copy of any or all other contracts or documents which are referred to in this prospectus supplement or the accompanying prospectus. You may request a copy of these filings at the address and telephone number set forth below.

In reviewing any agreements incorporated by reference, please remember they are included to provide you with information regarding the terms of such agreements and are not intended to provide any other factual or disclosure information about PNC. The agreements may contain representations and warranties by PNC or other parties, which should not be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those statements prove to be inaccurate. The representations and warranties were made only as of the date of the relevant agreement or such other date or dates as may be specified in such agreement and are subject to more recent

S-5

developments. Accordingly, these representations and warranties alone may not describe the actual state of affairs as of the date they were made or at any other time.

Documents incorporated by reference are available from PNC without charge, excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference as an exhibit into this prospectus supplement or the accompanying prospectus. You can obtain documents incorporated by reference in this prospectus supplement or the accompanying prospectus by requesting them in writing or by telephone at the following address:

The PNC Financial Services Group, Inc.

The Tower at PNC Plaza

300 Fifth Avenue

Pittsburgh, Pennsylvania 15222-2401

Attention: Shareholder Services

Telephone: (800) 982-7652

www.computershare.com/contactus

S-6

Summary

The following information about this offering summarizes, and should be read in conjunction with, the information contained in this prospectus supplement and in the accompanying prospectus, and the documents incorporated herein and therein by reference. This summary is not complete and does not contain all of the information that you should consider before investing in the Senior Notes. You should pay special attention to the “Risk Factors” section of this prospectus supplement and the accompanying prospectus to determine whether an investment in the Senior Notes is appropriate for you.

About The PNC Financial Services Group, Inc.

Headquartered in Pittsburgh, Pennsylvania, PNC is one of the largest diversified financial services companies in the U.S. We have businesses engaged in retail banking, including residential mortgage, corporate and institutional banking and asset management, providing many of our products and services nationally. Our retail branch network is located coast-to-coast. We also have strategic international offices in four countries outside the U.S. At March 31, 2024, our consolidated total assets, total deposits and total shareholders’ equity were $566.2 billion, $425.6 billion and $51.3 billion, respectively.

PNC was incorporated under the laws of the Commonwealth of Pennsylvania in 1983 with the consolidation of Pittsburgh National Corporation and Provident National Corporation. Since 1983, we have diversified our geographical presence, business mix and product capabilities through organic growth, strategic bank and non-bank acquisitions and equity investments, and the formation of various non-banking subsidiaries.

PNC common stock is listed on the New York Stock Exchange under the symbol “PNC.”

PNC is a holding company and services its obligations primarily with dividends and advances that it receives from subsidiaries. PNC’s subsidiaries that operate in the banking and securities businesses can pay dividends only if they are in compliance with the applicable regulatory requirements imposed on them by federal and state bank regulatory authorities and securities regulators. PNC’s subsidiaries may be party to credit or other agreements that also may restrict their ability to pay dividends. PNC currently believes that none of these regulatory or contractual restrictions on the ability of its subsidiaries to pay dividends will affect PNC’s ability to service its own debt or pay dividends on its preferred stock. PNC must also maintain the required capital levels of a bank holding company before it may pay dividends on its stock.

Under the regulations of the Federal Reserve, a bank holding company is expected to act as a source of financial strength for its subsidiary banks. As a result of this regulatory policy, the Federal Reserve might require PNC to commit resources to its subsidiary banks, even when doing so is not otherwise in the interests of PNC or its shareholders or creditors.

PNC’s principal executive offices are located at The Tower at PNC Plaza, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2401, and its telephone number is (888) 762-2265.

S-7

The Offering

The following description contains basic information about the Senior Notes and this offering. This description is not complete and does not contain all of the information that you should consider before investing in the Senior Notes. For a more complete understanding of the Senior Notes, you should read the section of this prospectus supplement entitled “Certain Terms of the Senior Notes” and the section in the accompanying prospectus entitled “Description of Debt Securities.” To the extent the following information is inconsistent with the information in the accompanying prospectus, you should rely on the following information.

Securities Offered

|

5.492% Fixed Rate/Floating Rate Senior Notes Due May 14, 2030 |

||||

Issuer

|

The PNC Financial Services Group, Inc. | ||||

Aggregate Principal Amount

|

$1,750,000,000 |

||||

Maturity Date

|

May 14, 2030 |

||||

Issue Date

|

May 14, 2024 |

||||

Issue Price

|

100.000% plus accrued interest, if any, from and including May 14, 2024 |

||||

Summary Terms of the Senior Notes during the Fixed Rate Period | |||||

Fixed Rate Period

|

From, and including, May 14, 2024 to, but excluding, May 14, 2029 |

||||

Interest Rate

|

5.492% annually |

||||

Interest Payment Dates

|

Each May 14 and November 14, commencing on November 14, 2024 and ending on May 14, 2029, as further described below under “Certain Terms of the Senior Notes—Interest” |

||||

Summary Terms of the Senior Notes during the Floating Rate Period | |||||

Floating Rate Period

|

From, and including, May 14, 2029 to, but excluding, the maturity date |

||||

Interest Rate

|

Compounded SOFR, determined as set forth under “Certain Terms of the Senior Notes—Interest—Floating Rate Period,” plus 1.198% |

||||

Interest Payment Dates

|

August 14, 2029, November 14, 2029, February 14, 2030 and at the maturity date, as further described below under “Certain Terms of the Senior Notes—Interest” |

||||

S-8

Other Terms Applicable to the Senior Notes

Record Dates

|

15 calendar days prior to each interest payment date | ||||

Form

|

Fully-registered global notes in book-entry form | ||||

Denominations

|

$2,000 and integral multiples of $1,000 in excess thereof | ||||

Further Issuance

|

The Senior Notes will be limited initially to $1,750,000,000 in aggregate principal amount. PNC may, however, “reopen” the Senior Notes and issue an unlimited principal amount of additional notes in the future without the consent of the holders. |

||||

Use of Proceeds

|

We estimate that the net proceeds of this offering will be approximately $1,743,475,000 after deducting the underwriting discount and expenses. We expect to use the net proceeds from the sale of the Senior Notes for general corporate purposes, which may include: investments in or advances to our existing or future subsidiaries, repayment of outstanding indebtedness, and repurchases and redemptions of issued and outstanding securities of PNC and its subsidiaries, including PNC common stock and PNC preferred stock. Pending our use of the net proceeds from this offering as described above, we will use the net proceeds to reduce our short-term indebtedness or for temporary investments. |

||||

Optional Redemption

|

The Senior Notes will be redeemable in whole, but not in part, by us on May 14, 2029, the date that is one year prior to the maturity date, at 100% of the principal amount of the notes (par), plus accrued and unpaid interest thereon to the date of redemption. In addition, the Senior Notes will be redeemable in whole, or in part, by us during the 30-day period prior to, and including, the maturity date at 100% of the principal amount of the notes (par), plus accrued and unpaid interest thereon to the date of redemption. We will provide 5 to 30 calendar days’ notice of redemption to the registered holders of the Senior Notes. |

||||

Risk Factors

|

|||||

Ranking

|

The Senior Notes are our direct, unsecured and unsubordinated obligations and rank equal in priority with all of our existing and future unsecured and unsubordinated indebtedness and senior in right of payment to all of our existing and future subordinated indebtedness. | ||||

Conflicts of Interest

Our affiliate, PNC Capital Markets LLC, is a member of FINRA and is participating in the distribution of the Senior Notes. The distribution arrangements for this offering comply with the requirements of FINRA Rule 5121 regarding a FINRA member firm’s participation in the distribution of securities of an affiliate. In accordance with Rule 5121, PNC Capital Markets LLC may not make sales in this offering to any discretionary account without the prior approval of the customer. Our affiliates, including PNC Capital Markets LLC, may use this prospectus supplement and the accompanying prospectus in connection with offers and sales of the Senior Notes in the secondary market. These affiliates may act as principal or agent in those transactions. Secondary market sales will be made at prices related to prevailing market prices at the time of sale.

S-9

Risk Factors

Your investment in the Senior Notes involves risks. This prospectus supplement does not describe all of those risks. Before purchasing any of the Senior Notes, you should carefully consider the following risk factors, which are specific to the Senior Notes being offered, as well as the risks and other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, including the discussion under “Item 1A—Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, as such discussion may be amended or updated in other reports filed by us with the SEC.

Risks Related to Payment on and the Market Price for the Senior Notes

We and our subsidiaries have significant leverage and debt obligations; payments on the Senior Notes will depend on receipt of dividends and distributions from our subsidiaries.

We are a holding company and we conduct substantially all of our operations through subsidiaries, including PNC Bank, National Association, which is our principal banking subsidiary. We depend on dividends, distributions and other payments from our subsidiaries to meet our obligations, including to fund payments on the Senior Notes, and to provide funds for payment of dividends to our shareholders, to the extent declared by our board of directors. There are various legal limitations on the extent to which PNC Bank, National Association and our other subsidiaries can finance or otherwise supply funds to us (by dividend or otherwise) and certain of our affiliates. In addition, contractual or other restrictions may also limit our subsidiaries’ abilities to pay dividends or make distributions, loans or advances to us. For these reasons, we may not have access to any assets or cash flow of our subsidiaries to make payments on the Senior Notes.

The Senior Notes are unsecured and structurally subordinated to the debt of our subsidiaries, which means that creditors (including depositors) of our subsidiaries generally will be paid from those subsidiaries’ assets before holders of the Senior Notes would have any claims to those assets.

Because we are a holding company, our rights and the rights of our creditors, including the holders of the Senior Notes, to participate in the distribution or allocation of the assets of any subsidiary during its liquidation or reorganization will be subject to the prior claims of the subsidiary’s creditors, unless we are ourselves a creditor with recognized claims against the subsidiary. Any capital loans that we make to any of our banking subsidiaries would be subordinate in right of payment to deposits and to other indebtedness of these banking subsidiaries. Claims from creditors (other than us) against the subsidiaries may include long-term and medium-term debt and substantial obligations related to deposit liabilities, federal funds purchased, securities sold under repurchase agreements, and other short-term borrowings.

An active trading market for the Senior Notes may not develop.

The Senior Notes constitute a new issue of securities, for which there is no existing market. We do not intend to apply for listing of the Senior Notes on any securities exchange or for quotation of the Senior Notes in any automated dealer quotation system. We cannot provide you with any assurance regarding whether a trading market for the Senior Notes will develop, the ability of holders of the Senior Notes to sell their Senior Notes or the prices at which holders may be able to sell their Senior Notes. The underwriters have advised us that they currently intend to make a market in the Senior Notes. The underwriters, however, are not obligated to do so, and any market-making with respect to the Senior Notes may be discontinued at any time without notice. You should also be aware that there may be a limited number of buyers when you decide to sell your Senior Notes. This may affect the price you receive for your Senior Notes or your ability to sell your Senior Notes at all.

If a trading market for the Senior Notes develops, changes in our credit ratings or the debt markets, among others, could adversely affect the market price of the Senior Notes.

Credit rating agencies continually review their ratings for the companies they follow, including us. A negative change in our rating could have an adverse effect on the price of the Senior Notes. In addition to our creditworthiness, many factors affect the trading market for, and the trading value of, the Senior Notes. These factors include: the time remaining to the maturity of the Senior Notes, the ranking of the Senior Notes, the

S-10

outstanding amount of Senior Notes with terms identical to the Senior Notes offered hereby, the prevailing interest rates being paid by other companies similar to us, our financial condition, financial performance and future prospects and the level, direction and volatility of market interest rates generally. The condition of the financial markets and prevailing interest rates have fluctuated significantly in the past and are likely to fluctuate in the future. Such fluctuations could have an adverse effect on the price of the Senior Notes.

Our credit ratings may not reflect all risks of an investment in the Senior Notes.

The cost and availability of short-term and long-term funding, as well as collateral requirements for certain derivative instruments, is influenced by our credit ratings. Our credit ratings are an assessment of our ability to pay our obligations. Consequently, real or anticipated changes in our credit ratings may generally affect the market value of the Senior Notes. Our credit ratings, however, may not reflect the potential impact of risks related to market or other factors discussed above on the value of the Senior Notes.

The Senior Notes will not be guaranteed by the FDIC, any other governmental agency or any of our subsidiaries.

The Senior Notes are not bank deposits and are not insured by the FDIC or any other governmental agency, nor are they obligations of, or guaranteed by, a bank. The Senior Notes will be obligations of The PNC Financial Services Group, Inc. only and will not be guaranteed by any of our subsidiaries, including PNC Bank, National Association, which is our principal banking subsidiary.

The Senior Notes may be redeemed, at our option, and you may not be able to reinvest the proceeds in a comparable security.

We may, at our option, redeem the Senior Notes at the applicable times and at the applicable redemption price described herein under “Certain Terms of the Senior Notes—Optional Redemption.” We may choose to redeem the Senior Notes at times when prevailing interest rates are relatively low and, as a result, you may not be able to reinvest the proceeds you receive from the redemption in a comparable security at an effective interest rate as high as the interest rate on your Senior Notes being redeemed.

Risks Related to our Indenture

The indenture governing the Senior Notes does not contain any limitations on our ability to incur additional indebtedness, issue preferred stock, sell or otherwise dispose of assets, pay dividends or repurchase our capital stock.

Neither we nor any of our subsidiaries is restricted from incurring additional indebtedness or other liabilities, including additional senior or subordinated indebtedness, under the indenture governing the Senior Notes. If we incur additional indebtedness or liabilities, our ability to pay our obligations on the Senior Notes could be adversely affected. We expect that we will from time to time incur additional indebtedness and other liabilities. In addition, we are not restricted under the indenture governing the Senior Notes from issuing preferred stock, paying dividends or issuing or repurchasing our securities.

In addition, there are no financial covenants in the indenture governing the Senior Notes. You are not protected under the indenture governing the Senior Notes in the event of a highly leveraged transaction, reorganization, default under our existing indebtedness, restructuring, merger or similar transaction that may adversely affect you, except to the extent the merger covenant described under “Description of Debt Securities—Certain Covenants” in the accompanying prospectus would apply to the transaction.

Events for which acceleration rights under the Senior Notes may be exercised are more limited than those available under the terms of our outstanding senior debt securities issued prior to April 23, 2021.

We entered into a First Supplemental Indenture, dated April 23, 2021, between us, as Issuer, and The Bank of New York Mellon, as Trustee (the “First Supplemental Indenture”) to the indenture governing the Senior Notes, dated as of September 6, 2012, between us, as Issuer, and The Bank of New York Mellon, as Trustee (the “Indenture”), pursuant to which the terms of our senior debt securities to be issued on or after the date of the First Supplemental Indenture, including the Senior Notes, are modified. The modifications to the terms of our senior debt

S-11

securities include, among other things, limiting the circumstances under which the payment of the principal amount of such senior debt securities can be accelerated.

All or substantially all of our outstanding senior debt securities issued prior to April 23, 2021 (the “Pre-April 2021 Senior Debt Securities”) provide acceleration rights for nonpayment of principal, premium (if any) or interest and for certain events relating to our bankruptcy, insolvency or reorganization. The Pre-April 2021 Senior Debt Securities also provide acceleration rights for our failure to perform any other covenant or warranty in the Indenture governing the Senior Notes for 90 days after we have received written notice of such failure, as well as for certain events relating to the bankruptcy, insolvency or reorganization of any principal subsidiary bank. In addition, the Pre-April 2021 Senior Debt Securities do not require a 30-day cure period before a nonpayment of principal becomes an event of default and acceleration rights become exercisable with respect to such nonpayment.

However, under the Indenture, as supplemented by the First Supplemental Indenture, payment of the principal amount of the Senior Notes:

•may be accelerated only for (i) our failure to pay the principal of, premium (if any) or interest on the Senior Notes and, in each case, such nonpayment continues for 30 days after such payment is due, or (ii) the occurrence of certain events relating to bankruptcy, insolvency or reorganization of PNC; and

•may not be accelerated if (i) we fail to perform any covenant or agreement (other than nonpayment of principal, premium (if any) or interest) in the Indenture governing the Senior Notes, or (ii) for the bankruptcy, insolvency or reorganization of any principal subsidiary bank.

As a result of these differing provisions, if we fail to perform any covenant or agreement (other than nonpayment of principal, premium (if any) or interest) that applies both to the Senior Notes and to any Pre-April 2021 Senior Debt Securities, or if certain events of bankruptcy, insolvency or reorganization occur with respect to any principal subsidiary bank, the Trustee and the holders of the Pre-April 2021 Senior Debt Securities would have acceleration rights that would not be available to the Trustee or the holders of the Senior Notes. In addition, if we fail to pay the principal of any Pre-April 2021 Senior Debt Securities when due, an event of default would occur immediately with respect to such Pre-April 2021 Senior Debt Securities (and the exercise of acceleration rights could proceed immediately in accordance with the provisions of the applicable indenture under which such Pre-April 2021 Senior Debt Securities were issued), whereas, if we fail to pay the principal of the Senior Notes when due, the Trustee and the holders of the Senior Notes must wait for the 30-day cure period to expire before such nonpayment of principal becomes an event of default and any acceleration rights are triggered with respect to such nonpayment. Any repayment of the principal amount of Pre-April 2021 Senior Debt Securities following the exercise of acceleration rights in circumstances in which such rights are not available to the holders of the Senior Notes could adversely affect our ability to make timely payments on the Senior Notes thereafter. These limitations on the rights and remedies of holders of the Senior Notes could adversely affect the market value of the Senior Notes, especially during times of financial stress for us or our industry.

Holders of the Senior Notes could be at greater risk for being structurally subordinated if we sell or convey all or substantially all of our assets to one or more of our majority-owned subsidiaries.

If we sell or convey all or substantially all of our assets to one or more of our direct or indirect majority-owned subsidiaries, under the Indenture, as supplemented by the First Supplemental Indenture, such subsidiary or subsidiaries will not be required to assume our obligations under the Senior Notes, and we will remain the sole obligor on the Senior Notes. In such event, creditors of any such subsidiary or subsidiaries would have additional assets from which to recover on their claims while holders of the Senior Notes would be structurally subordinated to creditors of such subsidiary or subsidiaries with respect to such assets. See “Description of Debt Securities—Certain Covenants” in the accompanying prospectus for further information.

S-12

Risks Related to the Interest Rate During the Floating Rate Period

The amount of interest payable with respect to each interest period during the floating rate period will be determined near the end of such interest period for the Senior Notes.

The interest rate with respect to any interest period during the floating rate period will only be capable of being determined near the end of such interest period in relation to the Senior Notes. Consequently, it may be difficult for investors in the Senior Notes to estimate reliably the amount of interest that will be payable on the Senior Notes. In addition, some investors may be unwilling or unable to trade the Senior Notes without changes to their information technology systems, both of which could adversely impact the liquidity and trading price of the Senior Notes.

The interest rate on the Senior Notes during the floating rate period will be based on a Compounded SOFR, which will be determined by reference to the SOFR Index, a relatively new market index.

For each interest period during the floating rate period, the interest rate on the Senior Notes will be based on a Compounded SOFR (as defined below) rate calculated by reference to the SOFR Index (as defined below) using the specific formula described in this prospectus supplement. The SOFR Index measures the cumulative impact of compounding the daily secured overnight financing rate (“SOFR”) as provided by the Federal Reserve Bank of New York (the “FRBNY”). The value of the SOFR Index on a particular business day reflects the effect of compounding SOFR on such business day and allows the calculation of compounded SOFR averages over custom time periods. For this and other reasons, the interest rate during any Observation Period (as defined below) will not be the same as the interest rate on other SOFR-linked investments that use an alternative basis to determine the applicable interest rate. Further, if the SOFR rate in respect of a particular date during the Observation Period for an interest period is negative, its contribution to the SOFR Index will be less than one, resulting in a reduction in the Compounded SOFR used to calculate the interest rate on the Senior Notes during the relevant interest period.

The FRBNY only began publishing the SOFR Index on March 2, 2020. In addition, very limited market precedent exists for securities that use SOFR as the interest rate, and the method for calculating an interest rate based upon SOFR in those precedents varies. Accordingly, the specific formula for Compounded SOFR used in the Senior Notes may not be widely adopted by other market participants, if at all. The market value of the Senior Notes would likely be adversely affected if the market adopts a different calculation method.

SOFR has a very limited history, and its historical performance is not indicative of future performance.

The FRBNY began to publish SOFR in April 2018. Although the FRBNY has also begun publishing historical indicative SOFR going back to 2014, such historical indicative data inherently involves assumptions, estimates and approximations. Therefore, SOFR has limited performance history and no actual investment based on the performance of SOFR was possible before April 2018. The level of SOFR during the floating rate period for the Senior Notes may bear little or no relation to the historical level of SOFR. The future performance of SOFR is impossible to predict and, therefore, no future performance of SOFR or the Senior Notes may be inferred from any of the hypothetical or actual historical performance data. Hypothetical or actual historical performance data are not indicative of the future performance of SOFR or the Senior Notes. Changes in the levels of SOFR will affect Compounded SOFR and, therefore, the return on the Senior Notes and the trading price of such Senior Notes, but it is impossible to predict whether such levels will rise or fall. There can be no assurance that SOFR or Compounded SOFR will be positive.

The composition and characteristics of SOFR are not the same as those of U.S. dollar LIBOR and any failure of SOFR to gain market acceptance could adversely affect the Senior Notes.

SOFR may fail to maintain market acceptance. SOFR was developed for use in certain U.S. dollar derivatives and other financial contracts as an alternative to the U.S. dollar London interbank offered rate (“U.S. dollar LIBOR”) in part because it is considered representative of general funding conditions in the overnight Treasury repo market. However, as a rate based on transactions secured by U.S. Treasury securities, it does not measure bank-specific credit risk and, as a result, is less likely to correlate with the unsecured short-term funding costs of banks. This means that SOFR is fundamentally different from LIBOR for two key reasons. First, SOFR is a secured rate, while LIBOR is an unsecured rate. Second, SOFR is an overnight rate, while U.S. dollar LIBOR represents

S-13

interbank funding over different maturities. As a result, there can be no assurance that SOFR or the SOFR Index will perform in the same way as U.S. dollar LIBOR would have at any time, including, without limitation, as a result of changes in interest and yield rates in the market, market volatility, or global or regional economic, financial, political, regulatory, judicial or other events.

The differences between SOFR and U.S. dollar LIBOR may mean that market participants would not consider SOFR a suitable substitute or successor for all of the purposes for which U.S. dollar LIBOR historically has been used (including, without limitation, as a representation of the unsecured short-term funding costs of banks), which may, in turn, lessen market acceptance of SOFR. In addition, an established trading market for the Senior Notes may never develop or may not be very liquid if developed. Market terms for debt securities that are linked to SOFR, such as the spread over the base rate reflected in the interest rate provisions applicable to the Senior Notes, may evolve over time, and as a result, trading prices of the Senior Notes may be lower than those of later-issued debt securities that are linked to SOFR. If for these or other reasons SOFR does not prove to be widely used in debt securities that are similar or comparable to the Senior Notes, the trading price of the Senior Notes may be lower than those of debt securities that are linked to rates that are more widely used. Investors in the Senior Notes may not be able to sell their Senior Notes at all or may not be able to sell their Senior Notes at prices that will provide them with a yield comparable to similar investments that have a developed secondary market. Further, investors wishing to sell the Senior Notes in the secondary market during the applicable floating rate period will have to make assumptions as to the future performance of SOFR during the applicable interest period in which they intend the sale to take place. As a result, investors may consequently suffer from increased pricing volatility and market risk.

The SOFR Index may be modified, suspended or discontinued and the Senior Notes may bear interest during the floating rate period by reference to a rate other than Compounded SOFR, which could adversely affect the value of the Senior Notes.

The interest rate during the floating rate period for the Senior Notes will be determined by reference to the SOFR Index as published by the FRBNY, as administrator of SOFR, based on data received by it from sources other than us, and we have no control over its methods of calculation, publication schedule, rate revision practices or availability of the SOFR Index at any time. The FRBNY may make methodological or other changes that could change the value of SOFR, including changes related to the method by which SOFR is calculated, eligibility criteria applicable to the transactions used to calculate SOFR or timing related to the publication of SOFR. These changes may be materially adverse to the interests of investors in the Senior Notes, by, for example, reducing the amount of interest payable on the Senior Notes during the floating rate period and the trading prices of the Senior Notes. In addition, the FRBNY may withdraw, modify or amend the published SOFR Index or other SOFR data in its sole discretion and without notice. The administrator has no obligation to consider your interests in calculating, adjusting, converting, revising or discontinuing SOFR. The interest rate for any interest period will not be adjusted for any modifications or amendments to the SOFR Index or other SOFR data that the FRBNY may publish after the interest rate for such interest period has been determined.

If we or our designee determine that a Benchmark Transition Event (as defined below) and its related Benchmark Replacement Date (as defined below) have occurred with respect to the Senior Notes, then the interest rate on the Senior Notes during the floating rate period will no longer be determined by reference to the SOFR Index, but instead will be determined by reference to a different rate, plus a spread adjustment, which we refer to as a “Benchmark Replacement,” as further described under the caption “Certain Terms of the Senior Notes—Interest—Floating Rate Period—Compounded SOFR.” If a particular Benchmark Replacement (as defined below) or Benchmark Replacement Adjustment (as defined below) cannot be determined, then the next-available Benchmark Replacement or Benchmark Replacement Adjustment will apply. These replacement rates and adjustments may be selected, recommended or formulated by (i) the Relevant Governmental Body (as defined below) (such as the Alternative Reference Rates Committee (“ARRC”)), (ii) the International Swaps and Derivatives Association, Inc. (“ISDA”) or (iii) in certain circumstances, us or our designee.

In addition, the terms of the Senior Notes expressly authorize us or our designee, in connection with a Benchmark Replacement, to make Benchmark Replacement Conforming Changes (as defined below) with respect to, among other things, changes to the definition of “interest period,” the timing and frequency of determining rates and making payments of interest, the rounding of amounts or tenors and other administrative matters. The

S-14

determination of a Benchmark Replacement, the calculation of the interest rate on the Senior Notes during the floating rate period by reference to a Benchmark Replacement (including the application of a Benchmark Replacement Adjustment), any implementation of Benchmark Replacement Conforming Changes and any other determinations, decisions or elections that may be made under the terms of the Senior Notes in connection with a Benchmark Transition Event, could adversely affect the value of the Senior Notes, the return on the Senior Notes and the price at which you can sell the Senior Notes.

Any determination, decision or election described above will be made in our or our designee’s sole discretion.

Further, (i) the composition and characteristics of the Benchmark Replacement will not be the same as those of Compounded SOFR, the Benchmark Replacement may not be the economic equivalent of Compounded SOFR, there can be no assurance that the Benchmark Replacement will perform in the same way as Compounded SOFR would have at any time and there is no guarantee that the Benchmark Replacement will be a comparable substitute for Compounded SOFR (each of which means that a Benchmark Transition Event could adversely affect the value of the Senior Notes, the return on the Senior Notes and the price at which you can sell the Senior Notes), (ii) any failure of the Benchmark Replacement to gain market acceptance could adversely affect the Senior Notes, (iii) the Benchmark Replacement may have a very limited history and the future performance of the Benchmark Replacement may not be predictable based on historical performance, (iv) the secondary trading market for the Senior Notes linked to the Benchmark Replacement may be limited and (v) the administrator of the Benchmark Replacement may make changes that could change the value of the Benchmark Replacement or discontinue the Benchmark Replacement and has no obligation to consider your interests in doing so.

SOFR may be more volatile than other benchmark or market rates.

Since the initial publication of SOFR, daily changes in the rate have, on occasion, been more volatile than daily changes in other benchmark or market rates, such as U.S. dollar LIBOR, during corresponding periods. In addition, although changes in Compounded SOFR generally are not expected to be as volatile as changes in SOFR on a daily basis, the return on, value of and market for the Senior Notes may fluctuate more than floating rate debt securities with interest rates based on less volatile rates.

We or our designee will make certain determinations with respect to the Senior Notes, which determinations may adversely affect the Senior Notes.

We or our designee will make certain determinations with respect to the Senior Notes as further described under the caption “Certain Terms of the Senior Notes—Interest—Floating Rate Period.” For example, if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, we or our designee will make certain determinations with respect to the Senior Notes in our or our designee’s sole discretion as further described under the caption “Certain Terms of the Senior Notes—Interest—Floating Rate Period—Compounded SOFR.” In making such determinations, potential conflicts of interest may exist between us, or our designee, and you. Any of these determinations may adversely affect the value of the Senior Notes, the return on the Senior Notes and the price at which you can sell the Senior Notes. Moreover, certain determinations may require the exercise of discretion and the making of subjective judgments, such as with respect to Compounded SOFR or the occurrence or non-occurrence of a Benchmark Transition Event and any Benchmark Replacement Conforming Changes. These potentially subjective determinations may adversely affect the value of the Senior Notes, the return on the Senior Notes and the price at which you can sell the Senior Notes. For further information regarding these types of determinations, see “Certain Terms of the Senior Notes—Interest—Floating Rate Period—Compounded SOFR.”

The price at which the Senior Notes may be sold prior to maturity will depend on a number of factors and may be substantially less than the amount for which they were originally purchased.

Some of these factors include, but are not limited to: (i) actual or anticipated changes in the level of SOFR, (ii) volatility of the level of SOFR, (iii) changes in interest and yield rates, (iv) any actual or anticipated changes in our credit ratings or credit spreads and (v) the time remaining to maturity of such notes. Generally, the longer the time remaining to maturity and the more tailored the exposure, the more the market price of the Senior Notes will be affected by the other factors described in the preceding sentence. This can lead to significant adverse changes in the market price of securities like the Senior Notes. Depending on the actual or anticipated level of SOFR, the market

S-15

value of the Senior Notes may decrease and you may receive substantially less than 100% of the issue price if you are able to sell your Senior Notes prior to maturity.

We or our affiliates may publish research reports that could affect the market value of the Senior Notes.

We or one or more of our affiliates, at present or in the future, may publish research reports with respect to movements in interest rates generally, or with respect to the U.S. dollar LIBOR transition to alternative reference rates or SOFR specifically. This research may be modified from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding the Senior Notes. Any of these activities may affect the market value of the Senior Notes.

S-16

Use of Proceeds

We estimate that the net proceeds of this offering will be approximately $1,743,475,000 after deducting the underwriting discount and expenses. We expect to use the net proceeds from the sale of the Senior Notes for general corporate purposes, which may include: investments in or advances to our existing or future subsidiaries, repayment of outstanding indebtedness, and repurchases and redemptions of issued and outstanding securities of PNC and its subsidiaries, including PNC common stock and PNC preferred stock. Pending our use of the net proceeds from this offering as described above, we will use the net proceeds to reduce our short-term indebtedness or for temporary investments.

S-17

Certain Terms of the Senior Notes

The Senior Notes offered by this prospectus supplement will be issued under the Indenture dated as of September 6, 2012, between us, as Issuer, and The Bank of New York Mellon, as Trustee, as supplemented by the First Supplemental Indenture dated April 23, 2021, between us, as Issuer, and The Bank of New York Mellon, as Trustee (as so supplemented, the “Indenture”). The accompanying prospectus provides a more complete description of the Indenture. The Senior Notes will be senior debt securities, as such term is described in the accompanying prospectus. The following description of the particular terms of the Senior Notes supplements, and to the extent inconsistent therewith replaces, the description of the general terms and provisions of the senior debt securities in the accompanying prospectus, to which description we refer you. The accompanying prospectus sets forth the meaning of certain capitalized terms used herein and not otherwise defined.

General

The Senior Notes issued in this offering initially will be limited to $1,750,000,000 principal amount. The Senior Notes will mature on May 14, 2030. There is no sinking fund for the Senior Notes. The Senior Notes are not convertible into, or exchangeable for, equity securities of PNC. The Senior Notes will rank equally with all of PNC’s other senior unsecured indebtedness. As of March 31, 2024, PNC had $23.3 billion of outstanding senior unsecured indebtedness.

Interest

Interest on the Senior Notes will accrue from, and including, the issue date to, but excluding, the first interest payment date and then from, and including, the immediately preceding interest payment date to which interest has been paid or duly provided for to, but excluding, the next interest payment date or the maturity date, as the case may be. Each of these periods is referred to as an “interest period” for the Senior Notes. If an interest payment date during the fixed rate period or the maturity date for the Senior Notes falls on a day that is not a business day, PNC will postpone the interest payment or the payment of principal and interest at the maturity date to the next succeeding business day, but the payments made on such dates will be treated as being made on the date that the payment was first due and the holders of the Senior Notes will not be entitled to any further interest or other payments with respect to such postponements. If an interest payment date during the floating rate period falls on a day that is not a business day, PNC will postpone the interest payment to the next succeeding business day, except that, if the next succeeding business day falls in the next calendar month, then such interest payment will be advanced to the immediately preceding day that is a business day and, in each case, the related interest periods also will be adjusted for such non-business days.

When we use the term “business day,” we mean any day except a Saturday, a Sunday or a legal holiday in the City of New York or the City of Pittsburgh on which banking institutions are authorized or obligated by law, regulation or executive order to close. The interest payable on the Senior Notes on any interest payment date, subject to certain exceptions, will be paid to the person in whose name the Senior Notes are registered at the close of business on the 15th calendar day, whether or not a business day, immediately preceding the interest payment date. However, interest that PNC pays on the maturity date will be paid to the person to whom the principal will be payable. Interest will be payable by wire transfer in immediately available funds in U.S. dollars at the office of the principal paying agent in New York, New York or, at PNC’s option in the event the Senior Notes are not represented by Global Notes (as defined below), by check mailed to the address of the person specified for payment in the preceding sentences.

Fixed Rate Period. During the period from, and including, May 14, 2024 to, but excluding, May 14, 2029, the Senior Notes will accrue interest at the rate of 5.492% per annum. Such interest will be payable semi-annually in arrears on May 14 and November 14 of each year, commencing on November 14, 2024 and ending on May 14, 2029. Interest will be computed on the basis of a 360-day year consisting of twelve 30-day months.

Floating Rate Period. During the period from, and including, May 14, 2029 to, but excluding, the maturity date, the Senior Notes will bear interest at a floating rate per annum equal to Compounded SOFR plus 1.198%, as determined by the Calculation Agent (as defined below) in the manner described below. Such interest will be payable quarterly in arrears on August 14, 2029, November 14, 2029, February 14, 2030 and at the maturity date.

S-18

Compounded SOFR for each interest period will be calculated by the Calculation Agent in accordance with the formula set forth below with respect to the Observation Period relating to such interest period.

The amount of accrued interest payable on the Senior Notes for each interest period will be computed by multiplying (i) the outstanding principal amount of the Senior Notes by (ii) the product of (a) the interest rate for the relevant interest period multiplied by (b) the quotient of the actual number of calendar days in the applicable Observation Period relating to such interest period (or any other relevant period) divided by 360. The interest rate on the Senior Notes will in no event be lower than zero.

The Calculation Agent will determine Compounded SOFR, the interest rate and accrued interest for each interest period in arrears as soon as reasonably practicable on or after the Interest Payment Determination Date (as defined below) for such interest period and prior to the relevant interest payment date and will notify us of Compounded SOFR, such interest rate and accrued interest for each interest period as soon as reasonably practicable after such determination, but in any event by the business day immediately prior to the interest payment date. At the request of a holder of the Senior Notes, the Calculation Agent will provide Compounded SOFR, the interest rate and the amount of interest accrued with respect to any interest period, after Compounded SOFR, such interest rate and accrued interest have been determined.

Secured Overnight Financing Rate and the SOFR Index

SOFR is published by the FRBNY and is intended to be a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities.

The SOFR Index measures the cumulative impact of compounding SOFR on a unit of investment over time, with the initial value set to 1.00000000 on April 2, 2018, the first value date of SOFR. The SOFR Index value reflects the effect of compounding SOFR each business day and allows the calculation of compounded SOFR averages over custom time periods.

The FRBNY notes on its publication page for the SOFR Index that use of the SOFR Index is subject to important limitations, indemnification obligations and disclaimers, including that the FRBNY may alter the methods of calculation, publication schedule, rate revision practices or availability of the SOFR Index at any time without notice. The interest rate for any interest period during the floating rate period will not be adjusted for any modifications or amendments to the SOFR Index or SOFR data that the FRBNY may publish after the interest rate for that interest period has been determined.

Compounded SOFR

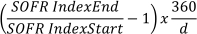

With respect to any interest period, “Compounded SOFR” will be determined by the Calculation Agent in accordance with the following formula (and the resulting percentage will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point):

where:

“SOFR IndexStart” = For periods other than the initial interest period, the SOFR Index value on the preceding Interest Payment Determination Date, and, for the initial interest period, the SOFR Index value on the date that is two U.S. Government Securities Business Days before the first day of such initial interest period (such first day expected to be May 14, 2029);

“SOFR IndexEnd” = The SOFR Index value on the Interest Payment Determination Date relating to the applicable interest payment date (or in the final interest period, relating to the maturity date, or, in the case of the redemption of the Senior Notes, relating to the applicable redemption date); and

“d” is the number of calendar days in the relevant Observation Period. For purposes of determining Compounded SOFR,

S-19

“Interest Payment Determination Date” means the date two U.S. Government Securities Business Days before each interest payment date (or, in the case of the redemption of the Senior Notes, preceding the applicable redemption date).

“Observation Period” means, in respect of each interest period, the period from, and including, the date two U.S. Government Securities Business Days preceding the first date in such interest period to, but excluding, the date two U.S. Government Securities Business Days preceding the interest payment date for such interest period (or in the final interest period, preceding the maturity date or, in the case of the redemption of the Senior Notes, preceding the applicable redemption date).

“SOFR Index” means, with respect to any U.S. Government Securities Business Day:

(1)the SOFR Index value as published by the SOFR Administrator as such index appears on the SOFR Administrator’s Website at 3:00 p.m. (New York time) on such U.S. Government Securities Business Day (the “SOFR Index Determination Time”); or:

(2)if a SOFR Index value does not so appear as specified in (1) above at the SOFR Index Determination Time, then: (i) if a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred with respect to SOFR, Compounded SOFR shall be the rate determined pursuant to the “SOFR Index Unavailable Provisions” described below; or (ii) if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR, Compounded SOFR shall be the rate determined pursuant to the “Effect of a Benchmark Transition Event” provisions described below.

“SOFR” means the daily secured overnight financing rate as provided by the SOFR Administrator on the SOFR Administrator’s Website. “SOFR Administrator” means the FRBNY (or a successor administrator of SOFR).

“SOFR Administrator’s Website” means the website of the FRBNY, currently at https://www.newyorkfed.org, or any successor source. The information contained on such website is not part of this prospectus supplement and is not incorporated in this prospectus supplement by reference.

“U.S. Government Securities Business Day” means any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association or any successor organization recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

Notwithstanding anything to the contrary in the Indenture or the Senior Notes, if we or our designee determines on or prior to the relevant Reference Time (as defined below) that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to determining SOFR, then the benchmark replacement provisions set forth below under “Effect of Benchmark Transition Event” will thereafter apply to all determinations of the rate of interest payable on the Senior Notes.

For the avoidance of doubt, in accordance with the benchmark replacement provisions, after a Benchmark Transition Event and its related Benchmark Replacement Date have occurred, the interest rate for each interest period will be an annual rate equal to the sum of the Benchmark Replacement plus 1.198%.

SOFR Index Unavailable Provisions

If a SOFR IndexStart or SOFR IndexEnd is not published on the associated Interest Payment Determination Date and a Benchmark Transition Event and its related Benchmark Replacement Date have not occurred with respect to SOFR, “Compounded SOFR” means, for the applicable interest period for which such index is not available, the rate of return on a daily compounded interest investment calculated in accordance with the formula for SOFR Averages, and definitions required for such formula, published on the SOFR Administrator’s Website at https://www.newyorkfed.org/markets/reference-rates/additional-information-about-reference-rates. For the purposes of this provision, references in the SOFR Averages compounding formula and related definitions to “calculation period” shall be replaced with “Observation Period” and the words “that is, 30-, 90-, or 180- calendar days” shall be removed. If SOFR (“SOFRi”) does not so appear for any day, “i” in the Observation Period, SOFRi for such day “i”

S-20

shall be SOFR published in respect of the first preceding U.S. Government Securities Business Day for which SOFR was published on the SOFR Administrator’s Website.

Effect of Benchmark Transition Event

(1)Benchmark Replacement. If we or our designee determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred on or prior to the Reference Time in respect of any determination of the Benchmark (as defined below) on any date, the Benchmark Replacement will replace the then-current Benchmark for all purposes relating to the Senior Notes in respect of such determination on such date and all determinations on all subsequent dates.

(2)Benchmark Replacement Conforming Changes. In connection with the implementation of a Benchmark Replacement, we or our designee will have the right to make Benchmark Replacement Conforming Changes from time to time.

(3)Decisions and Determinations. Any determination, decision or election that may be made by us or our designee pursuant to the benchmark replacement provisions described herein, including any determination with respect to tenor, rate or adjustment, or the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection:

•will be conclusive and binding absent manifest error;

•if made by us, will be made in our sole discretion;

•if made by our designee, will be made after consultation with us, and such designee will not make any such determination, decision or election to which we object; and

•notwithstanding anything to the contrary in the Indenture or the Senior Notes, shall become effective without consent from the holders of the Senior Notes or any other party.

Any determination, decision or election pursuant to the benchmark replacement provisions shall be made by us or our designee (which may be our affiliate) on the basis as described above, and in no event shall the Calculation Agent be responsible for making any such determination, decision or election.

Certain Defined Terms

As used herein:

“Benchmark” means, initially, Compounded SOFR, as such term is defined above; provided that if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Compounded SOFR (or the published SOFR Index used in the calculation thereof) or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by us or our designee as of the Benchmark Replacement Date; provided that if the Benchmark Replacement cannot be determined in accordance with clause (1) below as of the Benchmark Replacement Date and we or our designee shall have determined that the ISDA Fallback Rate determined in accordance with clause (2) below is not an industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar-denominated floating rate notes at such time, then clause (2) below shall be disregarded, and the Benchmark Replacement shall be determined in accordance with clause (3) below:

(1)the sum of: (a) an alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark and (b) the Benchmark Replacement Adjustment;

(2)the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; or

S-21

(3)the sum of: (a) the alternate rate of interest that has been selected by us or our designee as the replacement for the then-current Benchmark giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar denominated floating rate notes at such time and (b) the Benchmark Replacement Adjustment.

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by us or our designee as of the Benchmark Replacement Date:

(1)the spread adjustment (which may be a positive or negative value or zero), or method for calculating or determining such spread adjustment, that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement;

(2)if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, the ISDA Fallback Adjustment; or

(3)the spread adjustment (which may be a positive or negative value or zero) that has been selected by us or our designee giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar denominated floating rate notes at such time.

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definitions or interpretations of interest period, the timing and frequency of determining rates and making payments of interest, the rounding of amounts or tenors, and other administrative matters) that we or our designee decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if we or our designee decides that adoption of any portion of such market practice is not administratively feasible or if we or our designee determines that no market practice for use of the Benchmark Replacement exists, in such other manner as we or our designee determines is reasonably practicable).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark (including any daily published component used in the calculation thereof):