DEF 14A: Definitive proxy statements

Published on March 12, 2025

Table of Contents

☑ Filed by the Registrant

|

☐ Filed by a Party other than the Registrant

|

Check the appropriate box: |

||

☐ |

Preliminary Proxy Statement |

|

☐ |

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2))

|

|

☑ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under §240.14a-12

|

|

Payment of Filing Fee (Check the appropriate box): |

||

☑ |

No fee required |

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

Table of Contents

2025 Notice of Annual Meeting and Orixy Statement Annual Meeting of Shareholders Wednesday, April 23, 2025 11:00 a.m. Eastern Time THE PNC FINANCIAL SERVICES GROUP

Table of Contents

|

Letter from the Chairman and Chief Executive Officer to Our Shareholders

|

Dear Shareholders,

It is my pleasure to invite you to attend the 2025 Annual Meeting of Shareholders of The PNC Financial Services Group, Inc. The annual meeting will be held on Wednesday, April 23, 2025, at 11:00 a.m. Eastern Time in a virtual-only format via webcast.

We will consider the matters described in the proxy statement and also review business developments since last year’s annual meeting of shareholders.

We are again making our proxy materials available to you electronically. We hope this continues to offer you convenience while allowing us to reduce the number of copies we print.

The proxy statement contains important information, and you should read it carefully. Your vote is important, and we strongly encourage you to vote your shares using one of the voting methods described in the proxy statement. Please see the notice that follows for more information.

We look forward to your participation and thank you for your support of PNC.

| March 12, 2025 |

Sincerely, |

William S. Demchak

Chairman and Chief Executive Officer

Table of Contents

|

Letter from the

|

Fellow Shareholders,

On behalf of the independent directors, thank you for your support of PNC.

2024 was a very strong year for the company—generating record revenue, strengthening capital levels and delivering positive operating leverage.

The board would like to acknowledge and thank PNC’s employees for all their contributions to this strong performance.

As we progressed through this notable year, the board remained closely connected to company management. Through our regular engagement and established board committees, we continued to provide oversight into the development and execution of company strategy and helped ensure management decisions aligned to that strategy.

We recently welcomed Douglas Dachille to the board. With experience spanning three decades, Douglas brings a unique perspective of the financial services sector. As you will read within this proxy statement, all of the independent directors nominated for election this year come from widely varied backgrounds. Each of us brings a unique set of perspectives and expertise to our conversations with management, which we believe makes us more effective in providing strategic counsel and recommendations.

I, along with my fellow independent directors, share PNC Chairman and CEO Bill Demchak’s excitement about the growth opportunities ahead. The company is favorably positioned to capitalize on its strategic priorities, and to continue delivering for all of its stakeholders.

Thank you once again for your support.

| March 12, 2025 |

Sincerely, |

Andrew Feldstein

Presiding Director

Table of Contents

The PNC Financial Services Group, Inc.

Notice of Annual Meeting of Shareholders

Wednesday, April 23, 2025

11:00 a.m. Eastern Time

Virtual-only Annual Meeting

Our 2025 Annual Meeting of Shareholders will be held in a virtual-only format online via webcast on Wednesday, April 23, 2025, at 11:00 a.m. Eastern Time. The annual meeting will be accessible online, including to vote and/or submit questions, at www.virtualshareholdermeeting.com/PNC2025.

Items of Business

| 1. | Election of the 13 director nominees named in the proxy statement to serve until the next annual meeting and until their successors are elected and qualified |

| 2. | Ratification of the Audit Committee’s selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2025 |

| 3. | Advisory vote to approve named executive officer compensation |

We will also consider such other business as may properly come before the meeting.

Record Date

The close of business on January 31, 2025 is the record date for determining the shareholders entitled to receive notice of and to vote at the annual meeting and any adjournment or postponement thereof.

Materials to Review

Our proxy materials became accessible to shareholders starting on March 12, 2025. Shareholders will receive either a Notice of Internet Availability of Proxy Materials explaining how to access our proxy materials and vote electronically, or a printed copy of our proxy materials and proxy card. Even if you plan to attend the virtual annual meeting, we encourage you to vote in advance by proxy to ensure your vote is received.

| March 12, 2025 |

By Order of the Board of Directors, | |

|

||

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS: |

Laura Gleason Corporate Secretary |

|

|

This Notice of Annual Meeting and Proxy

|

||

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

Table of Contents

PROXY STATEMENT SUMMARY

ITEM 1 – ELECTION OF DIRECTORS

BOARD’S ROLE IN CORPORATE GOVERNANCE

| Corporate governance guidelines | 28 | |||

| Oversight of enterprise strategy and risk | 29 | |||

| Board leadership | 33 | |||

| Board committees | 35 |

MANAGING WITH INTEGRITY

DIRECTOR COMPENSATION

ITEM 2 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| Role of the Audit Committee | 54 | |||

| Selection of PricewaterhouseCoopers LLP | 54 | |||

| Audit, audit-related and permitted non-audit fees | 55 |

| Procedures for pre-approving audit services, audit-related services and permitted non-audit services | 56 |

ITEM 3 – ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

| 2024 performance overview | 60 | |||

| Shareholder engagement and 2024 say-on-pay response | 62 | |||

| Our compensation program | 62 |

| 2024 performance and compensation decisions | 70 | |||

| Compensation policies and practices | 77 | |||

| Glossary of performance metrics | 83 |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | i |

Table of Contents

TABLE OF CONTENTS

COMPENSATION TABLES

| Summary compensation table | 87 | |||

| Grants of plan-based awards in fiscal 2024 | 89 | |||

| Outstanding equity awards at 2024 fiscal year-end | 90 |

| Option exercises and stock vested in fiscal 2024 | 93 | |||

| Pension benefits at 2024 fiscal year-end | 94 | |||

| Non-qualified deferred compensation in fiscal 2024 | 96 |

CHANGE IN CONTROL AND TERMINATION OF EMPLOYMENT

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

GENERAL INFORMATION

SHAREHOLDER PROPOSALS FOR THE 2026 ANNUAL MEETING

ANNEX B — REGULATIONS FOR CONDUCT AT ANNUAL MEETING

| ii | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

PARTICIPATE IN THE FUTURE OF PNC — PLEASE CAST YOUR VOTE

Your vote is important to us, and we want your shares to be represented at the annual meeting. Please review this proxy statement and vote right away. See “General Information” in this proxy statement for more information about how to vote your shares, how votes are counted and the vote result required to approve each proposal. This proxy statement and related soliciting materials became accessible for shareholder review beginning on March 12, 2025.

Attend The PNC Financial Services Group, Inc. 2025 Annual Meeting

| Wednesday, April 23, 2025 |

If voting by internet or telephone, your vote

must be received by 11:59 p.m. ET on

Tuesday, April 22, 2025.*

|

|||

|

11:00 a.m. Eastern Time

www.virtualshareholdermeeting.com/PNC2025

|

||||

| Record date: January 31, 2025 | ||||

|

*Participants in the PNC Stock Fund of PNC’s 401(k) plan must vote by 11:59 p.m. ET on April 18, 2025. |

Proposals requiring your vote

| For more information

|

Board recommendations

|

|||||

| Item 1 | Election of directors | Page 8 | FOR each nominee |

|||

| Item 2 | Ratification of the selection of PricewaterhouseCoopers LLP as PNC’s independent registered public accounting firm for 2025 | Page 54 | FOR | |||

| Item 3 | Advisory vote to approve named executive officer compensation | Page 58 | FOR | |||

How to vote your shares

We offer a number of ways for you to vote. Voting instructions are included on the Notice of Internet Availability of Proxy Materials and the proxy card. If you hold shares in “street name,” you will receive information from your broker, bank or other nominee regarding how to give them voting instructions.

|

|

|

|

||

| Vote online: www.proxyvote.com |

Vote by phone: For registered holders: (800) 690-6903 For beneficial holders: (800) 454-8683 |

If you received a printed version of these proxy materials, complete, sign and date your proxy card and return it in the envelope provided.

|

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

Proxy statement summary

The PNC Financial Services Group, Inc. (“we,” “PNC” or the “Company”) is one of the largest diversified financial services institutions in the United States. We have businesses engaged in retail banking, including residential mortgage, corporate and institutional banking, and asset management, providing many of our products and services nationally. Our retail branch network is located coast-to-coast. We also have strategic international offices in four countries outside the United States.

PNC’s Board of Directors (the “Board”) and Management Executive Committee (“MEC”) seek to manage PNC for the long term, through all phases of the economic cycle. Our strength and stability as a financial institution have enabled us to pursue growth and scale responsibly, diversifying our geographical presence, business mix and product capabilities through organic growth, strategic bank and non-bank acquisitions and equity investments. We offer a broad range of deposit, credit and fee-based products and services to serve our customers.

At December 31, 2024, our consolidated total assets, total deposits and total shareholders’ equity were $560.0 billion, $426.7 billion and $54.4 billion, respectively, and we had over 55,000 employees.

For more information

For more information, please see the relevant sections of this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2024 (the “2024 Form 10-K”). You may read these materials at www.proxyvote.com or on our website at pnc.com/annualmeeting. The 2024 Form 10-K was filed with the U.S. Securities and Exchange Commission on February 21, 2025 and will be made available to shareholders without charge upon request to: Corporate Secretary, 300 Fifth Avenue, Mail Stop: PT-PTWR-18-1, Pittsburgh, PA 15222 USA or corporate.secretary@pnc.com.

Business performance in 2024

Financial performance highlights

PNC achieved strong results in 2024 and delivered value for all its stakeholders, generating net income of $6.0 billion, or $13.74 diluted earnings per share (“EPS”). We believe these results demonstrate the strength of the PNC franchise, including our diversified business mix, our disciplined approach to balance sheet management and our strong risk management framework. In 2024, we returned $3.1 billion of capital to shareholders through dividends on common stock of $2.5 billion and repurchases of 3.5 million shares of common stock for $0.6 billion.

|

|

2024 Highlights

◾ Generated record revenue, supported by 6% increase in noninterest income

◾ Expenses well-controlled. Continued investments in businesses, technology and employees; generated positive operating leverage

◾ Maintained strong credit quality; commercial real estate portfolio adequately reserved

◾ Increased capital position, remaining well above regulatory minimums

◾ Grew customers and deepened relationships

|

(dollars in billions, except per share data) | 2024 | 2023 |

|

YoY change |

|

|||||||||||||||

| Revenue | $ | 21.6 | $ | 21.5 | * | |||||||||||||||||

| Net income | $ | 6.0 | $ | 5.6 | 5% | |||||||||||||||||

| Diluted earnings per share | $ | 13.74 | $ | 12.79 | 7% | |||||||||||||||||

| Book value per common share | $ | 122.94 | $ | 112.72 | 9% | |||||||||||||||||

| Tangible book value per common share (non-GAAP)† |

$ | 95.33 | $ | 85.08 | 12% | |||||||||||||||||

| Common equity Tier 1 (CET1) capital ratio |

10.5% | 9.9% | 60 bps | |||||||||||||||||||

|

* Not meaningful; less than 1%.

|

||||||||||||||||||||||

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 1 |

Table of Contents

PROXY STATEMENT SUMMARY

New products, services and solutions

In 2024, we introduced new products and services that further strengthened our business mix and the breadth of solutions we can deliver to our customers, including:

|

Introducing the PNC Cash Unlimited® Visa Signature® Credit Card, an industry-leading card that helps customers optimize their everyday spending

|

|

Launching a strategic partnership with the TCW Group, Inc. to deliver private credit solutions to middle market companies |

|

Rolling out PazeSM, an online checkout solution for e-commerce transactions to improve ease and security of online shopping |

Supporting our customers, communities and employees

We strive to manage our business responsibly and to do right by all our constituents. Below are examples of some of the ways we delivered on this commitment in 2024. For more information about the range of corporate responsibility matters in which we are engaged, see “Managing with integrity — Corporate responsibility” in this proxy statement.

|

◾ PNC’s signature philanthropic focus, Grow Up Great®, celebrated its 20-year anniversary in 2024. Since 2004, this $500 million early childhood education initiative has helped prepare children from birth to age five for success in school and life.

◾ In 2024, we continued to expand our mobile branch services — essentially bank branches on wheels — to bring financial services to underserved communities across the country as well as communities affected by natural disasters and other emergencies.

◾ The PNC Center for Financial Education, an initiative designed to boost the money management skills of individuals, first-time homebuyers and small business owners, was expanded to nine new markets in addition to the six initial markets for the program launch in 2023. PNC intends to continue expanding the program to new markets in the coming years.

◾ PNC was recognized for the second year in a row by the American Opportunity Index as one of the top financial institutions most effective at developing talent to drive business performance and employee growth (overall, PNC ranked 18th out of 395 of the largest U.S. employers included in the index and 2nd among financial services companies).

|

Our business model

We go to market at the local level to help us better understand and meet the needs of our customers and communities. Our Regional Presidents drive the collaboration of our on-the-ground teams of bankers, advisors and specialists and are core to this business model.

| 2 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

PROXY STATEMENT SUMMARY

We deliver our products and services through three complementary lines of business, as described below.

|

Corporate & |

Retail Banking |

Asset Management Group |

||||||||

| ◾ Aim to be the leading relationship-based provider of traditional banking products and services to our customers through the economic cycles.

◾ Deliver value-added solutions that help our clients better run their organizations in order to grow our market share and drive higher returns, all while maintaining prudent risk and expense management.

◾ Coast-to-coast franchise — our full suite of commercial products and services is offered nationally. |

◾ Aim to build lifelong, primary relationships by creating a sense of financial well-being and ease for our clients.

◾ Deliver solutions in the most seamless and efficient way possible, meeting our customers where they are — whether in a branch, through digital channels, at an ATM or through our phone-based contact centers — while continuously optimizing the cost to sell and service.

◾ Deploy differentiated products and leading digital channels to grow our customer base, enhance the breadth and depth of our client relationships and improve our efficiency. |

◾ Strive to be a leading relationship-based provider of investment, planning, credit and cash management solutions and fiduciary services to affluent individuals and institutions by endeavoring to proactively deliver value-added ideas, solutions and exceptional service.

◾ Serve our clients’ financial objectives; grow and deepen customer relationships. |

Corporate governance highlights

| Annual elections: | ◾ The entire Board is elected each year; we have no staggered elections. |

|||

| Majority vote standard: | ◾ The election of directors is subject to a majority voting requirement; any director who does not receive a majority of the votes cast in an uncontested election must tender his or her resignation to the Board. |

|||

| Robust independent oversight: |

◾ Our corporate governance guidelines require the Board to have a substantial majority (at least two-thirds) of independent directors. All of our current directors and nominees to the Board are independent, except our CEO.

◾ The Board regularly holds executive sessions of its independent directors with no members of management present.

◾ All Board committees with specific areas of responsibility, except for the Risk Committee, are composed entirely of independent directors. We believe the CEO’s membership on the Risk Committee helps facilitate the committee’s effective monitoring and evaluation of enterprise strategy and risk-taking activities. |

|||

| Independent Board leadership: |

◾ The Board has a Presiding Director who serves as the lead independent director.

◾ The Presiding Director has specific duties relating to Board operations and governance, including approval of Board meeting agendas and presiding over executive sessions of the Board’s independent directors. |

|||

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 3 |

Table of Contents

PROXY STATEMENT SUMMARY

| Well-developed committee structure: |

◾ To operate more effectively, the Board conducts certain oversight and governance activities through a robust committee structure. The Board currently has six committees with distinct areas of responsibility:

|

|||

| Audit Committee

|

Risk Committee | |||

| Human Resources Committee

|

Corporate Responsibility Committee | |||

| Nominating and Governance Committee |

Technology Committee | |||

| CEO / senior executive succession planning: |

◾ Succession planning encompasses both long-term succession scenarios and contingencies or unplanned scenarios.

◾ At least annually, the Human Resources Committee of the Board reviews a detailed succession planning report from PNC’s talent management function. The report typically includes a discussion of the individual performance of each executive officer, as well as succession plans and development initiatives for other emerging talent. |

|||

| Director education: | ◾ All new directors undergo a director orientation program, which includes written materials and personalized orientation sessions.

◾ Our continuing education program takes into account directors’ knowledge and experience and our risk profile, and it includes training on complex products and services, our lines of business, significant risks to the company, applicable laws, regulations and supervisory requirements, and other relevant topics, as identified by the Board and members of senior management. |

|||

| Board evaluations: | ◾ The Board and its committees each conduct a self-evaluation annually under the oversight of the Nominating and Governance Committee. Feedback is obtained through discussions among the Board and committee members. Appropriate action plans are then developed to implement enhancements and other changes based on the feedback received. |

|||

| Retirement policy: | ◾ The Board has set age 75 as the mandatory retirement age for directors, subject to waiver by the Board when determined to be in the best interests of the Company. |

|||

| Directors’ external commitments: |

◾ Audit Committee members may not serve on the audit committees of more than three public companies, including PNC.

◾ The Board will consider a director’s availability to fulfill his or her responsibilities as a director if he or she serves on more than three other public company boards. |

|||

| Corporate responsibility: |

◾ The Board reviews PNC’s corporate responsibility strategic plan annually and receives updates on corporate responsibility matters at least quarterly. |

|||

| Stakeholder engagement: |

◾ We regularly engage with shareholders and other stakeholders. We discuss a wide variety of topics in our engagements, such as strategy, financial and operating performance, corporate responsibility matters, executive compensation and corporate governance, among others.

◾ During 2024, we had approximately 280 meetings with institutional investors and engaged with approximately 75% of our top 100 active shareholders.

◾ These discussions included participation from our investor relations team as well as our CEO and CFO, leaders from our lines of business and our technology, risk, corporate responsibility, corporate governance and human resources functions, and our Presiding Director, as applicable, based on the topics being covered.

◾ Management reports to the independent directors regarding investor discussions and feedback on topics of interest. |

|||

| 4 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

PROXY STATEMENT SUMMARY

Snapshot of 2025 director nominees

| Name | Age* | Director Since |

Independent | Committee Memberships |

Other Public Co. Boards |

|||||

| Joseph Alvarado Former Chairman, President and CEO, Commercial Metals Company |

72 | 2019 | • | Audit; Corporate Responsibility |

3 | |||||

| Debra A. Cafaro Chairman and CEO, Ventas, Inc. |

67 | 2017 | • | Audit; Human Resources (Chair) |

1 | |||||

| Marjorie Rodgers Cheshire Principal, A&R Development Corp. |

56 | 2014 | • | Nominating and Governance; Risk; Corporate Responsibility (Chair) |

1 | |||||

| Douglas A. Dachille Former Chief Investment Officer, American International Group, Inc. |

61 | 2025 | • | Risk | 2 | |||||

| William S. Demchak Chairman and CEO, The PNC Financial Services Group, Inc. |

62 | 2013 | — | Risk | — | |||||

| Andrew T. Feldstein (Presiding Director) Former CEO and CIO, BlueMountain Capital Management, LLC |

60 | 2013 | • | Human Resources; Nominating and Governance (Chair); Risk |

— | |||||

| Richard J. Harshman Former Chairman, CEO and President, Allegheny Technologies Incorporated (n/k/a ATI Inc.) |

68 | 2019 | • | Audit (Chair); Human Resources; Nominating and Governance |

1 | |||||

| Daniel R. Hesse Former President and CEO, Sprint Corporation |

71 | 2016 | • | Nominating and Governance; Risk; Technology (Chair) |

1 | |||||

| Renu Khator Chancellor, University of Houston System and President, University of Houston |

69 | 2022 | • | Audit; Nominating and Governance |

1 | |||||

| Linda R. Medler Retired Brigadier General, United States Air Force and Founder, President and CEO, L A Medler & Associates, LLC |

68 | 2018 | • | Risk; Technology |

1 | |||||

| Robert A. Niblock Former Chairman, President and CEO, Lowe’s Companies, Inc. |

62 | 2022 | • | Audit; Human Resources |

2 | |||||

| Martin Pfinsgraff Retired Senior Deputy Comptroller Large Bank Supervision, Office of the Comptroller of the Currency |

70 | 2018 | • | Audit; Risk (Chair) |

— | |||||

| Bryan S. Salesky Co-Founder and CEO, Stack AV Co. |

44 | 2021 | • | Corporate Responsibility; Technology |

— | |||||

| * | Age as of April 23, 2025 |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 5 |

Table of Contents

PROXY STATEMENT SUMMARY

Skills, experience and perspectives

The Board as a whole possesses valuable senior leadership experience across the key fields shown below as well as demographic diversity:

| ∎ Large institution leadership

∎ Public company board

∎ Regulatory / risk management

∎ Finance / accounting / audit

∎ Financial services |

∎ Marketing / branding / retail

∎ Technology / cybersecurity

∎ Corporate responsibility

∎ Talent management and succession planning |

|

* Age and tenure as of April 23, 2025 |

|

Executive compensation highlights

Approach to executive compensation

Management of talent and executive compensation is a vital part of PNC’s governance and risk management activities, enabling our forward planning and stability as a financial institution. Set forth below is an overview of how we approach our executive compensation program and make the decisions that we do.

|

Evaluating performance: |

We believe that an effective executive compensation program requires a comprehensive evaluation of performance across multiple categories. Our evaluation generally includes a review of PNC’s financial performance, how we executed against our strategic objectives and how we manage risk, the customer experience, talent management, financial accountability and leadership. See “Compensation Discussion and Analysis” in this proxy statement for a detailed discussion of how performance was evaluated.

|

|

|

Risk-mitigating features: |

Our executive compensation program also includes several complementary, risk-mitigating features:

– We provide incentives for performance over different time horizons (short- and long-term).

– We embed performance goals into a significant portion of our long-term incentive awards and include a risk-based performance review that could reduce or eliminate the awards.

– We place a substantial majority of compensation at risk, including deferring at least 50% of our named executive officers’ compensation into equity-based long-term incentive awards that are not payable for several years.

– We reward achievement against both quantitative and qualitative goals, while allowing for discretion.

– We connect pay to company performance, relative to our internal objectives as well as the performance of a carefully selected peer group.

– We consider market data and trends when making pay decisions.

|

| 6 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

PROXY STATEMENT SUMMARY

2024 compensation decisions

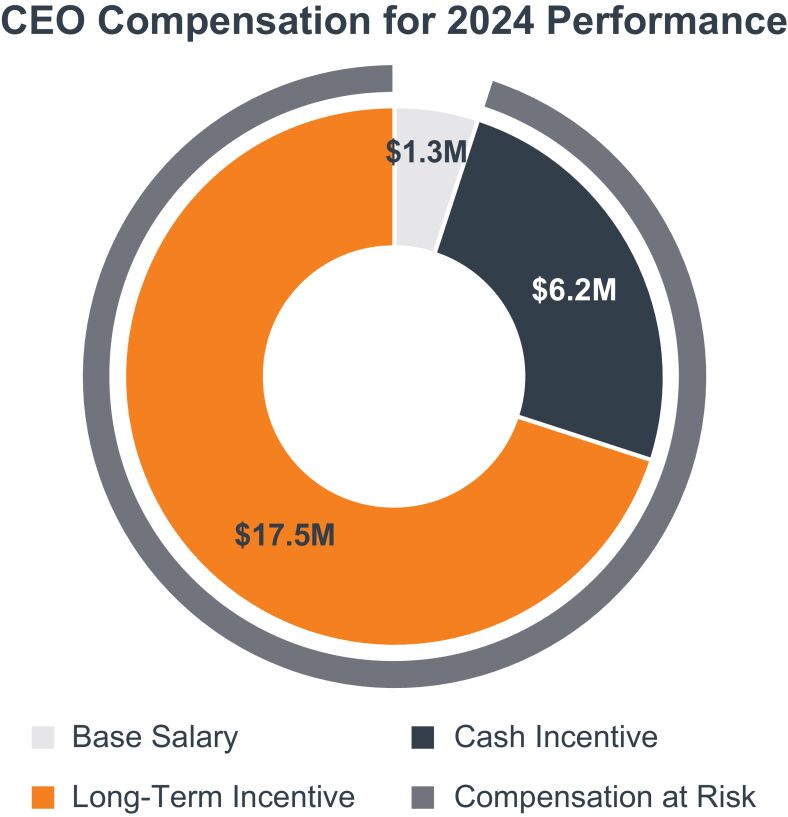

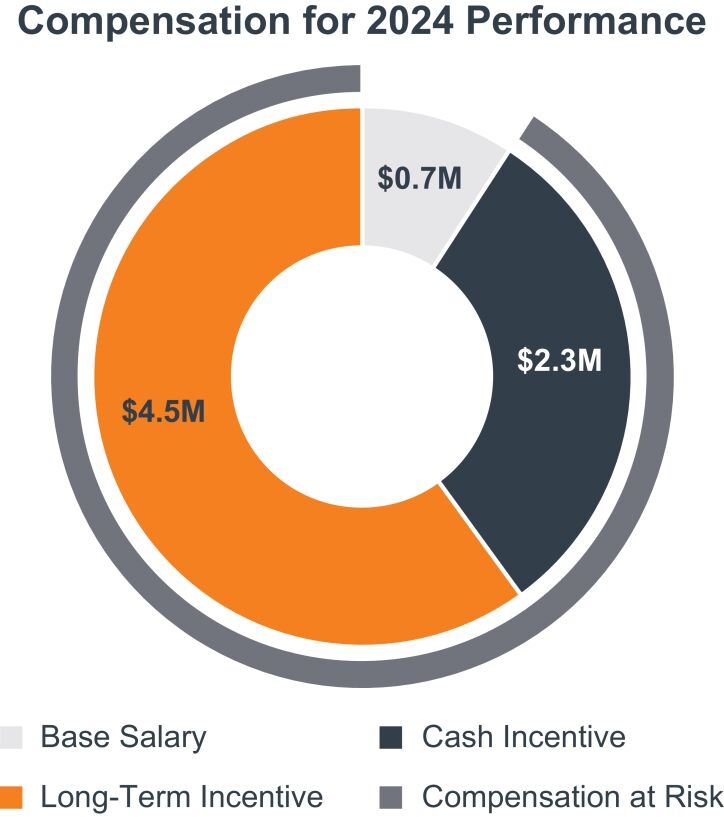

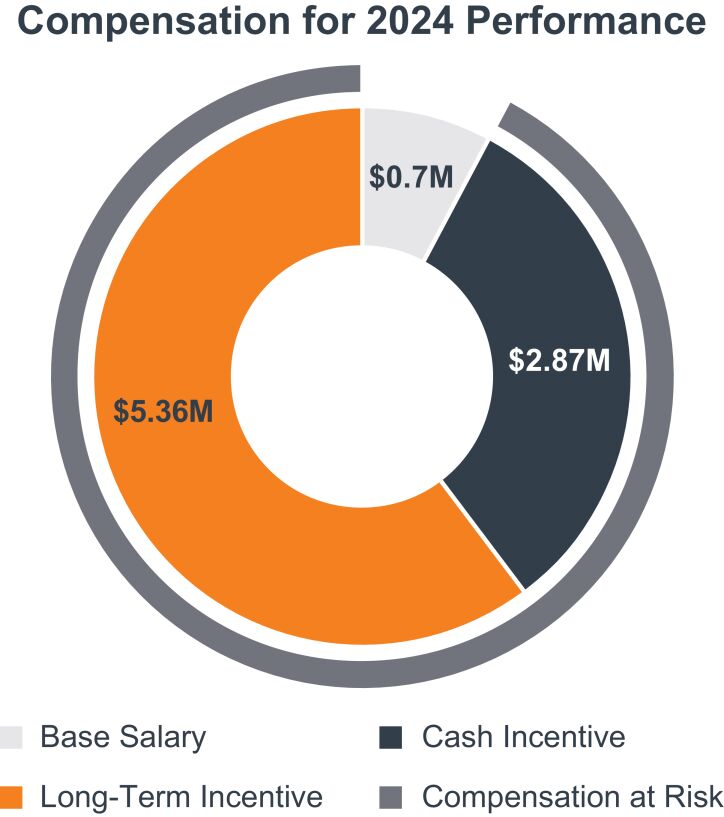

The table below shows for each named executive officer (“NEO”) the 2024 incentive compensation target set by the Human Resources Committee of the Board (the “HR Committee”) in the first quarter of 2024, and the actual annual cash incentive and long-term equity-based incentive awarded by the HR Committee in the first quarter of 2025 for 2024 performance.

| William S. Demchak

Chairman and

|

Robert Q. Reilly

Exec. VP and |

E William

Exec. VP and |

Deborah

Exec. VP and |

Alexander

Exec. VP and |

Michael P.

Former |

|||||||||||||||||||

| Incentive compensation target for 2024 |

$ | 18,700,000 | $ | 6,000,000 | $ | 7,800,000 | $ | 3,400,000 | $ | 3,800,000 | $ | 9,626,923 | (2) | |||||||||||

| Incentive compensation awarded for 2024 performance |

$ | 23,700,000 | $ | 6,800,000 | $ | 8,225,000 | $ | 5,400,000 | $ | 5,300,000 | n/a | |||||||||||||

| Annual cash incentive portion |

$ | 6,200,000 | $ | 2,300,000 | $ | 2,870,000 | $ | 2,400,000 | $ | 2,300,000 | n/a | |||||||||||||

| Long-term incentive portion |

$

|

17,500,000

|

|

$

|

4,500,000

|

|

$

|

5,355,000

|

|

$

|

3,000,000

|

|

$

|

3,000,000

|

|

|

n/a

|

|

||||||

| Incentive compensation disclosed in the Summary compensation table(3) |

||||||||||||||||||||||||

| Annual cash incentive portion (2024 performance) |

$ | 6,200,000 | $ | 2,300,000 | $ | 2,870,000 | $ | 2,400,000 | $ | 2,300,000 | n/a | |||||||||||||

| Long-term incentive portion (2023 performance) |

$

|

13,090,041

|

|

$

|

2,887,690

|

|

$

|

5,100,196

|

|

$

|

2,000,098

|

|

$

|

2,100,124

|

|

$

|

5,850,103

|

|

||||||

| (1) | Mr. Lyons resigned from PNC effective January 23, 2025, and, as a result, was not eligible to receive incentive compensation for 2024 performance. |

| (2) | Presented as a prorated amount; Mr. Lyons’ incentive compensation target was increased from $9,000,000 to $10,500,000 in connection with his promotion to President in February 2024. |

| (3) | Under SEC regulations, the incentive compensation amounts disclosed in the Summary compensation table on page 87 include the annual cash incentive award paid in 2025 for 2024 performance (the “Non-Equity Incentive Plan Compensation” column) and the long-term equity-based incentive award granted in 2024 for 2023 performance (the “Stock Awards” column). The amounts shown in the “Stock Awards” column of the Summary compensation table may differ slightly from the amounts shown in the table above due to the impact of rounding related to fractional shares. |

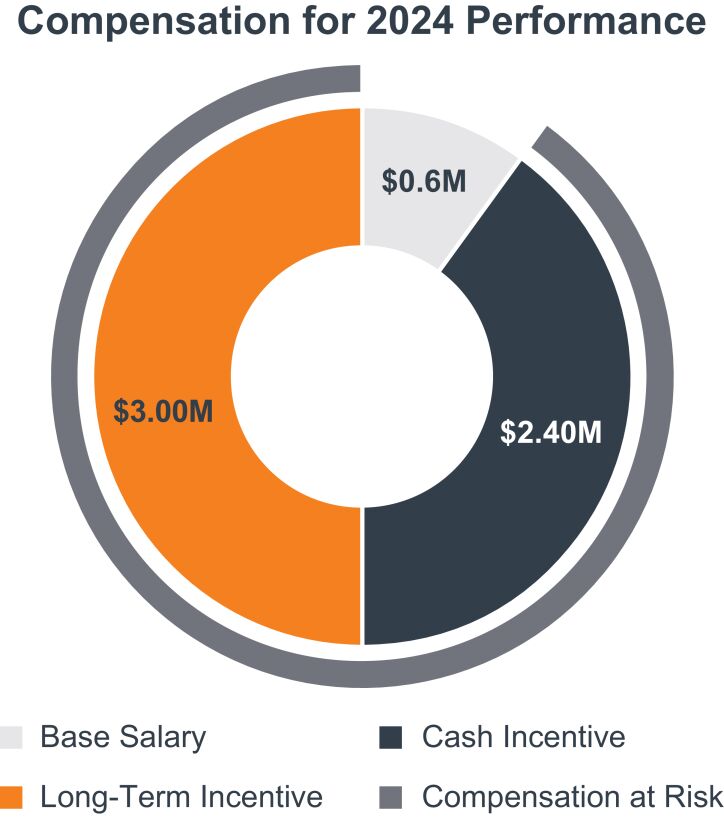

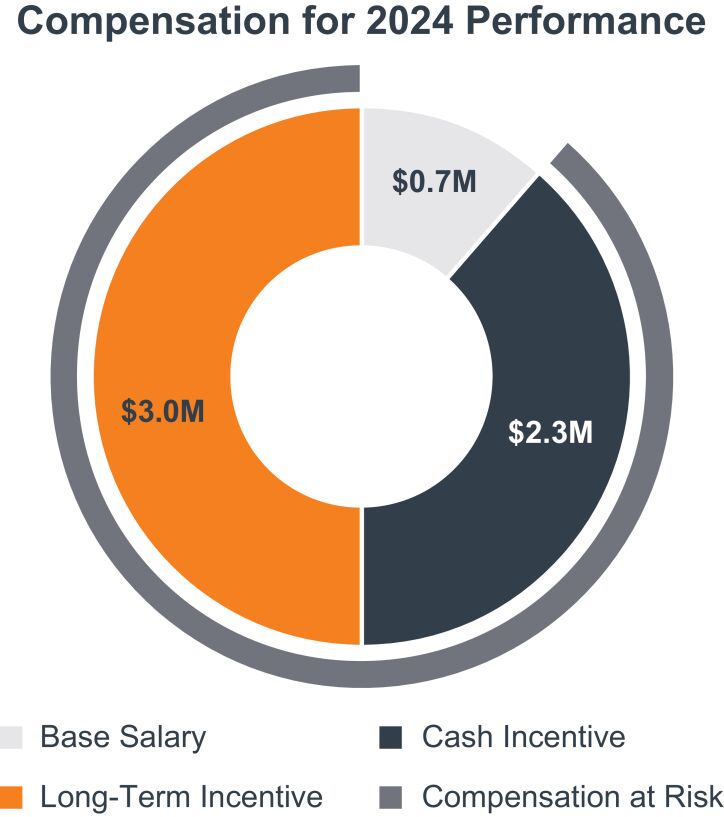

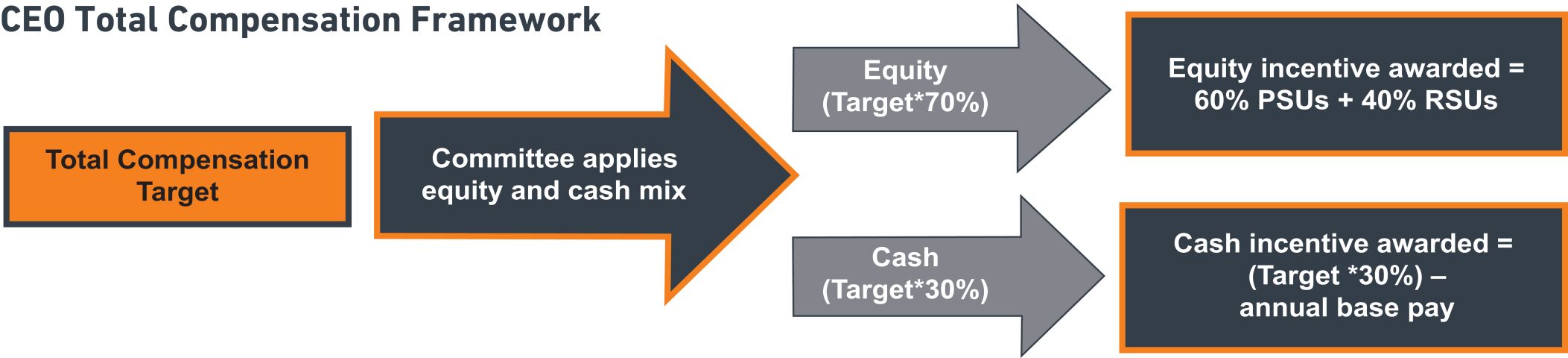

Significant portion of compensation is equity-based and not payable for several years

The HR Committee believes that a significant portion of compensation should be at risk or variable, tied to PNC stock performance and not payable until earned (if at all) for several years. Accordingly, at the beginning of the year, the HR Committee establishes a specific minimum percentage of each NEO’s total compensation that will be delivered through long-term equity-based awards. For 2024, the HR Committee established minimum equity percentages for each NEO ranging from 50% to 70%. The specific mix of cash and equity for each NEO is set forth in the table below and discussed in more detail in “Compensation Discussion and Analysis—2024 incentive compensation decisions” in this proxy statement.

| William S. Demchak |

Robert Q. Reilly |

E William Parsley, III |

Deborah Guild |

Alexander

|

Michael P. |

|||||||||||

| Total compensation mix: |

Long-term incentive |

70% | 60% | 60% | 50% | 50% | n/a | |||||||||

|

Cash compensation* |

30% | 40% | 40% | 50% | 50% | n/a | ||||||||||

| Total incentive compensation mix: |

Long-term incentive |

74% | 66% | 65% | 56% | 57% | n/a | |||||||||

|

Annual cash incentive |

26% | 34% | 35% | 44% | 43% | n/a | ||||||||||

|

* Includes annual base salary and annual cash incentive |

||||||||||||||||

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 7 |

Table of Contents

Item 1 - Election of directors

The Board is PNC’s highest governing body and oversees PNC’s strategy, business and culture.

The entire Board stands for election at each annual meeting of shareholders, consistent with PNC’s governing documents. Each director who is elected at the annual meeting of shareholders will serve a one-year term until the next year’s annual meeting and the election of a successor or until the director’s earlier death, resignation or removal.

The Board is authorized to have 13 members at the date of PNC’s 2025 annual meeting of shareholders. This proxy statement provides information about the 13 director nominees who will be presented for election at PNC’s annual meeting.

We encourage shareholders to review the sections listed below for detailed information about our 13 director nominees, the composition of the Board and our director nomination process.

Directors’ biographical information (pages 9 to 20)

| ∎ | Name and age (as of April 23, 2025) |

| ∎ | The year in which they first became a director of PNC |

| ∎ | Principal occupation and public company directorships over the past five years |

| ∎ | The specific experience, qualifications, attributes or skills that led to the Board’s conclusion that the individual should serve as a director |

Board composition and the director nomination process (pages 22 to 27)

| ∎ | Overview of the skills and experience represented on our Board |

| ∎ | Demographic information for our Board, e.g., age, gender and race/ethnicity |

| ∎ | Identification of our Board’s independent directors |

| ∎ | Summary of our director nomination process |

|

The Board of Directors recommends voting “FOR” each of our 13 director nominees |

Additional information about our nominations:

| ∎ | Each nominee was recommended by the Nominating and Governance Committee of the Board (the “N&G Committee”). The N&G Committee is responsible for identifying individuals who are qualified to become PNC directors and for recommending to the Board the slate of nominees to present to shareholders at each annual meeting. |

| ∎ | Each nominee is a current member of the Board. Each nominee was previously elected by shareholders at our 2024 annual meeting, except for Douglas A. Dachille, who was appointed to the Board on February 3, 2025. |

| ∎ | Each nominee has consented to being named in this proxy statement and to serve as a director if elected. The Board has no reason to believe any nominee will be unavailable or unable to serve as a director. |

| ∎ | In the event that a nominee becomes unable to serve as a director, proxies will be voted for the election of such other person as the Board may designate as a nominee, unless the Board chooses to reduce the number of directors authorized to serve on the Board. |

| 8 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Our director nominees

Joseph Alvarado

— Former Chairman, President and Chief Executive Officer, Commercial Metals Company (NYSE: CMC)

|

Age: 72

Director since: 2019

Independent director

Board committees:

• Audit • Corporate Responsibility

|

Experience, Qualifications, Attributes or Skills:

The Board values Mr. Alvarado’s extensive business knowledge and experience in accounting, sales, manufacturing, planning and global operations.

Other Public Company Directorships (within the past 5 years):

Arcosa, Inc. Kennametal, Inc. Trinseo PLC

Professional Background:

Joseph Alvarado is the former Chairman, President and Chief Executive Officer of Commercial Metals Company (“CMC”), a Fortune 500 global metals company that under his leadership was active in recycling, manufacturing, fabricating and trading. In this role, Mr. Alvarado was responsible for the overall strategic leadership of CMC, with nearly 9,000 employees and operations in over 200 locations in more than 20 countries. Mr. Alvarado served as Chairman, President and CEO of CMC for approximately seven years, retiring in 2018. Mr. Alvarado previously served as Executive Vice President and Chief Operating Officer of CMC from 2010 to 2011, during which time he had full profit and loss and operating responsibility for the company’s diverse global businesses.

Prior to his career with CMC, Mr. Alvarado was an Operating Partner for Wingate Partners and The Edgewater Funds from 2009 to 2010, where he consulted on new deal evaluation and portfolio company management. Mr. Alvarado worked for a number of other businesses throughout his career of more than four decades within the steel, metal processing, energy and chemical industries. Mr. Alvarado held the position of President at United States Steel Tubular Products, Inc. from 2007 to 2009; President and Chief Operating Officer at Lone Star Technologies from 2004 to 2007; Vice President, Long Product Sales and Marketing, North America at ArcelorMittal from 1998 to 2004; and Executive Vice President, Commercial for Birmingham Steel from 1997 to 1998. Mr. Alvarado also held various positions at Inland Steel Company from 1976 to 1997, ultimately serving as President, Inland Steel Bar Company (a division of Inland Steel Company) from 1995 to 1997.

Mr. Alvarado received a BA in Economics from the University of Notre Dame and an MBA from Cornell University’s SC Johnson Graduate School of Management. |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 9 |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Debra A. Cafaro

— Chairman and Chief Executive Officer, Ventas, Inc. (NYSE: VTR)

|

Age: 67

Director since: 2017

Independent director

Board committees:

• Audit • Human Resources (Chair) • Executive

|

Experience, Qualifications, Attributes or Skills:

The Board values Ms. Cafaro’s extensive corporate leadership, knowledge and experience. Her years of experience as a public company CEO in the financial sector provide insight into the oversight of financial and accounting matters. Her vision as a strategic thinker adds depth and strength to the Board in its oversight of PNC’s continued growth. The Board also values Ms. Cafaro’s active community involvement.

Other Public Company Directorships (within the past 5 years):

Ventas, Inc.

Professional Background:

Debra A. Cafaro is Chairman of the Board and Chief Executive Officer of Ventas, Inc. (“Ventas”), an S&P 500 company that is a leading owner of senior housing, healthcare and research properties.

Building on her early career in law and 25-year tenure as CEO of Ventas, Ms. Cafaro is broadly engaged across the business, public policy and nonprofit sectors. She is a past chair of the Real Estate Roundtable and the Economic Club of Chicago, and is a member of the American Academy of Arts & Sciences and The Business Council. She serves on the boards of the Civic Committee of the Commercial Club of Chicago, the Harvard Kennedy School Taubman Center and the University of Chicago. Ms. Cafaro has been recognized multiple times by Harvard Business Review as one of the top 100 global CEOs and by Modern Healthcare as one of the top 100 leaders in healthcare.

Ms. Cafaro received a JD from the University of Chicago Law School and a BA from the University of Notre Dame. |

| 10 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Marjorie Rodgers Cheshire

— Principal, A&R Development Corp.

|

Age: 56

Director since: 2014

Independent director

Board committees:

• Nominating & Governance • Risk • Corporate Responsibility (Chair)

|

Experience, Qualifications, Attributes or Skills:

The Board values Ms. Cheshire’s executive management experience and her background in real estate marketing and media, as well as her active involvement in the Baltimore community.

Other Public Company Directorships (within the past 5 years):

Empowerment & Inclusion Capital I Corp. (until December 2022) Exelon Corporation

Professional Background:

Marjorie Rodgers Cheshire is a corporate board director and an investor in commercial real estate. She is a Principal of A&R Development Corp. (“A&R”), a diversified real estate investment company that owns and invests in large scale multifamily, mixed use and retail real estate in the Baltimore and Washington, DC markets. Ms. Cheshire additionally served as A&R’s President and Chief Operating Officer from 2004 to 2021, and was responsible for the firm’s business operations, asset management and strategic initiatives.

Ms. Cheshire also spent many years in senior leadership positions in the media and sports industries. Ms. Cheshire was the Senior Director of Brand & Consumer Marketing for the National Football League, a Vice President of Business Development for Oxygen Media, and a Director and Special Assistant to the Chairman and CEO of ESPN. Early in her career, Ms. Cheshire worked as a consultant at The Boston Consulting Group and in brand management at Nestlé Foods.

Ms. Cheshire is chair of the board of Baltimore Equitable Insurance and is a trustee of Johns Hopkins Medicine and Johns Hopkins Hospital.

Ms. Cheshire received a BS in Economics from the Wharton School of the University of Pennsylvania and an MBA from the Stanford University Graduate School of Business. |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 11 |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Douglas A. Dachille

— Former Chief Investment Officer, American International Group, Inc. (NYSE: AIG)

|

Age: 61

Director since: 2025

Independent director

Board committees:

• Risk

|

Experience, Qualifications, Attributes or Skills:

The Board values Mr. Dachille’s decades of investment management expertise and his strategic thinking. Mr. Dachille has an extensive track record in asset management, structured finance and risk management. His experience with key strategic issues in the insurance, banking and asset management industries will be an asset to the Board as PNC navigates potential growth opportunities.

Other Public Company Directorships (within the past 5 years):

BridgeBio Pharma, Inc. Equitable Holdings, Inc.

Professional Background:

Mr. Dachille served as Executive Vice President and Chief Investment Officer for American International Group, Inc. (“AIG”) from September 2015 to June 2021. Before assuming these roles at AIG, Mr. Dachille served as the Chief Executive Officer of First Principles Capital Management, LLC (“First Principles”), an institutional fixed income investment manager, from September 2003 until its acquisition by AIG in September 2015. Prior to co-founding First Principles, he was President and Chief Operating Officer of Zurich Capital Markets. Mr. Dachille began his career at J.P. Morgan & Co., a predecessor to JPMorgan Chase & Co., where he served as the Global Head of Proprietary Trading and Co-Treasurer.

Mr. Dachille earned his bachelor’s degree in a special joint biomedical education program through Union College and Albany Medical College and an MBA in finance from the University of Chicago.

Mr. Dachille was initially recommended to the Board by our CEO and one of our independent directors. |

| 12 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

William S. Demchak

— Chairman and Chief Executive Officer, The PNC Financial Services Group, Inc. (NYSE: PNC)

|

Age: 62

Director since: 2013

Management director

Board committees:

• Risk • Executive

|

Experience, Qualifications, Attributes or Skills:

The Board believes that the current CEO should also serve as a director. Under the leadership structure discussed elsewhere in this proxy statement, a CEO-director acts as a liaison between the Board and management, and assists the Board in its oversight of the company. Mr. Demchak’s experience and strong leadership provide the Board with insight into the business and strategic priorities of PNC.

Other Public Company Directorships (within the past 5 years):

BlackRock, Inc. (until May 2020)

Professional Background:

William S. Demchak is the Chairman and Chief Executive Officer of PNC, one of the largest diversified financial services companies in the United States.

Mr. Demchak joined PNC in 2002 as Chief Financial Officer. In July 2005, he was named head of PNC’s Corporate & Institutional Banking segment, responsible for PNC’s middle market and large corporate businesses, as well as capital markets, real estate finance, equity management and leasing. Mr. Demchak was promoted to Senior Vice Chairman in 2009 and named Head of PNC Businesses in August 2010. He held the office of President from April 2012 through February 2024 and has served as Chief Executive Officer since April 2013 and as Chairman since April 2014.

Before joining PNC in 2002, Mr. Demchak served as the Global Head of Structured Finance and Credit Portfolio for JPMorgan Chase & Co. He also held key leadership roles at J.P. Morgan & Co. prior to its merger with The Chase Manhattan Corporation in 2000, establishing JPMorgan Chase & Co. He was actively involved in developing JPMorgan Chase & Co.’s strategic agenda and was a member of the company’s capital and credit risk committees.

Mr. Demchak is a member and past chairman of the board of directors of the Bank Policy Institute and is a member of The Business Council and the Federal Advisory Committee for the Federal Reserve. In addition, he is the past chairman of the Allegheny Conference on Community Development and is a member of the boards of directors of the Extra Mile Education Foundation and the Pittsburgh Cultural Trust.

Mr. Demchak received a BS from Allegheny College and an MBA from the University of Michigan. |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 13 |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Andrew T. Feldstein

— Former Chief Executive Officer and Chief Investment Officer, BlueMountain Capital Management, LLC

|

Age: 60

Director since: 2013

Presiding Director (lead

Board committees:

• Human Resources • Nominating and Governance (Chair) • Risk • Executive

|

Experience, Qualifications, Attributes or Skills:

The Board values Mr. Feldstein’s extensive financial and risk management expertise. As founder and former CEO of BlueMountain Capital Management, LLC and through his senior management positions at JPMorgan, Mr. Feldstein built a reputation for innovation and significant insight into risk management. The Board believes these skills are particularly valuable to Mr. Feldstein’s role as Presiding Director and to the Board’s effective oversight of risk management, as well as a valuable resource to PNC as it continues to grow its business while maintaining a strong balance sheet.

Other Public Company Directorships (within the past 5 years):

None

Professional Background:

Andrew T. Feldstein, our Presiding Director, is the former Chief Executive Officer of BlueMountain Capital Management, LLC (now known as Assured Investment Management, a subsidiary of Assured Guaranty) (“BlueMountain”) and served as the Chief Investment Officer for both Assured Guaranty and BlueMountain. Under Mr. Feldstein’s leadership, BlueMountain was a leading alternative asset manager with $18 billion in assets under management. Assured Guaranty is a leading provider of financial guaranty insurance.

Prior to co-founding BlueMountain in 2003, Mr. Feldstein spent over a decade at JPMorgan Chase & Co., where he was a Managing Director and served as Head of Structured Credit, Head of High Yield Sales, Trading and Research, and Head of Global Credit Portfolio.

Mr. Feldstein is a member of the Harvard Law School Leadership Council.

Mr. Feldstein received a BA from Georgetown University and a JD from Harvard Law School. |

| 14 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Richard J. Harshman

— Former Chairman, President and Chief Executive Officer, Allegheny Technologies Incorporated (NYSE: ATI)

|

Age: 68

Director since: 2019

Independent director

Board committees:

• Audit (Chair) • Human Resources • Nominating and Governance • Executive

|

Experience, Qualifications, Attributes or Skills:

The Board values Mr. Harshman’s depth of experience with the operational, human capital management, sustainability and financial aspects of leading a public company, including as chief executive officer, chief financial officer and chief operating officer. The Board also values Mr. Harshman’s active involvement in the Pittsburgh community and his prior board leadership experience as the lead independent director for another publicly-traded company.

Other Public Company Directorships (within the past 5 years):

Ameren Corporation

Professional Background:

Richard J. Harshman is the retired Executive Chairman and former President and Chief Executive Officer of Allegheny Technologies Incorporated (now known as ATI Inc.) (“ATI”), a global manufacturer of technically advanced specialty materials and complex parts and components. Mr. Harshman served as the Chairman, President and CEO of ATI from 2011 through 2018. Mr. Harshman previously served in other roles at ATI, including President and Chief Operating Officer from 2010 to 2011, Executive Vice President and Chief Financial Officer from 2000 to 2010 and other roles of increasing responsibility since 1996. Mr. Harshman began his career as an internal auditor at Teledyne, Inc., a predecessor company to ATI, in 1978.

Mr. Harshman is active within the Pittsburgh community, including through his service with several nonprofit boards. He is the immediate past chair and a current member of the Executive Committee of the Board of Trustees of the Pittsburgh Cultural Trust. Mr. Harshman also is a member of the Executive Committee of the Board of Directors of the United Way of Southwestern Pennsylvania. Previously, he served as the chair of the Allegheny Conference on Community Development and as a member of the board of trustees of Robert Morris University, in addition to his service with other Pittsburgh-based nonprofit organizations.

Mr. Harshman received a BS in Accounting from Robert Morris University and was previously licensed as a Certified Public Accountant by the California Board of Accountancy. |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 15 |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Daniel R. Hesse

— Former President and Chief Executive Officer, Sprint Corporation

|

Age: 71

Director since: 2016

Independent director

Board committees:

• Nominating and Governance • Risk • Technology (Chair)

|

Experience, Qualifications, Attributes or Skills:

Mr. Hesse brings extensive corporate leadership experience to the Board, having served in a variety of executive positions, including as CEO of Sprint Corporation. His years of experience in the wireless communications industry provide insight into the dynamic and strategic matters overseen by the Board. The broad spectrum of technology issues he navigated during his career enable him to bring valuable perspective to assist the Board in its oversight of technology and related risks and opportunities.

Other Public Company Directorships (within the past 5 years):

Akamai Technologies, Inc. Tech and Energy Transition Corporation (until March 2023)

Professional Background:

Daniel R. Hesse is the former President and Chief Executive Officer of Sprint Corporation (“Sprint”), one of the United States’ largest wireless carriers, serving from 2007 to 2014. A well-known advocate for the conscience-driven corporation and its responsibility in creating a sustainable world, during his tenure as CEO of Sprint, Mr. Hesse was a recipient of the Responsible CEO Lifetime Achievement Award from Corporate Responsibility Magazine.

Mr. Hesse received a BA from the University of Notre Dame, an MBA from Cornell University and an MS from Massachusetts Institute of Technology where he was awarded the Brooks Thesis Prize. |

| 16 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Renu Khator

— Chancellor, University of Houston System and President, University of Houston

|

Age: 69

Director since: 2022

Independent director

Board committees:

• Audit • Nominating and Governance

|

Experience, Qualifications, Attributes or Skills:

The Board values Dr. Khator’s significant leadership experience in academia and expertise in economic development and funding research for community programs, which will be instrumental in expanding opportunities and executing on strategies as PNC continues to invest for growth. The Board also values Dr. Khator’s active involvement in the Houston community.

Other Public Company Directorships (within the past 5 years):

The Camden Property Trust

Professional Background:

Renu Khator holds the dual titles of Chancellor of the University of Houston System (“UH System”) and President of the University of Houston (“UH”). She also serves as a professor in UH’s Department of Government and International Affairs. As Chancellor of the UH System, Dr. Khator oversees a four-university organization that serves more than 76,000 students. During her tenure as President since 2008, UH has experienced record-breaking research funding, enrollment and private support, as well as earning Tier One status in 2011, with the Carnegie Foundation elevating it to the top category of research universities.

Prior to her appointment at UH, Dr. Khator had a 22-year career at the University of South Florida, most recently serving as Provost and Senior Vice President and as a professor in the Department of Government and International Affairs.

Dr. Khator is currently a member of the Association of Governing Boards of Colleges and Universities Council of Presidents, and she has been named to the American Academy of Arts and Sciences. She previously served as a member of the Indian Prime Minister’s Empowered Expert Committee and the U.S. Department of Homeland Security’s Academic Advisory Council, and she was 11th District Chair of the Federal Reserve Bank of Dallas.

Dr. Khator received a BA in Liberal Arts from Kanpur University, India and an MA and PhD in Political Science from Purdue University. |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 17 |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Linda R. Medler

— Retired Brigadier General, United States Air Force; Founder, President and Chief Executive Officer, L A Medler & Associates, LLC

|

Age: 68

Director since: 2018

Independent director

Board committees:

• Risk • Technology

|

Experience, Qualifications, Attributes or Skills:

The Board values Ms. Medler’s extensive leadership experience and her deep knowledge of cybersecurity and information technology. Her years of experience leading cybersecurity, information technology and multi-function organizations facing a broad range of technology and operational issues provide the Board with valuable cyber and technology risk expertise, as well as a strong understanding of emerging technology and digital business transformation strategies, to facilitate effective governance and oversight of the cybersecurity and technology issues facing PNC.

Other Public Company Directorships (within the past 5 years):

Target Hospitality Corp.

Professional Background:

Linda Medler is a retired U.S. Air Force (“USAF”) Brigadier General with more than 20 years of experience developing cutting-edge cyber and technology strategies for highly regulated public and private institutions, as well as within the highest levels of government. She is the founder, President and CEO of L A Medler & Associates, a boutique cybersecurity consulting company. She previously served as the Chief Information Security Officer for Raytheon Missile Systems, and also as an Executive and Senior Officer for the Department of Defense, where she led mission-critical business, technology and cybersecurity strategies.

In 2014, Ms. Medler completed 30 years of total military service, including 27 years of service in the USAF, retiring as a Brigadier General. She began her military service as an enlisted U.S. Marine. Her last position held with the USAF was Director of Capability and Resource Integration for the United States Cyber Command. Her previous assignments included Director of Communications and Networks for the Joint Staff, Joint Chiefs of Staff Deputy CIO, Chief of Staff for Air Force Materiel Command, and Commander/Vice Commander for the 75th Air Base Wing.

Ms. Medler received a BBA in Management & Computer Information Systems from the University of Arkansas at Little Rock, an MS in National Security & Strategic Studies from the Naval War College, and an MBA in Management Information Systems Concentration from the University of Arizona. |

| 18 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Robert A. Niblock

— Former Chairman, President and Chief Executive Officer, Lowe’s Companies, Inc. (NYSE: LOW)

|

Age: 62

Director since: 2022

Independent director

Board committees:

• Audit • Human Resources

|

Experience, Qualifications, Attributes or Skills:

The Board values Mr. Niblock’s significant financial expertise, knowledge of the retail industry and experience in building a digital business, which will be instrumental to PNC as it continues to expand its digital presence and pursues transformative growth.

Other Public Company Directorships (within the past 5 years):

ConocoPhillips Lamb Weston Holdings, Inc.

Professional Background:

Robert A. Niblock is the former Chairman, President and Chief Executive Officer of Lowe’s Companies, Inc. (“Lowe’s”), which operates together with its subsidiaries as a home improvement retailer in the United States.

Mr. Niblock joined Lowe’s in 1993 and served in various financial roles throughout his career, including as Director of Taxation, Vice President and Treasurer, Senior Vice President, Finance, and Executive Vice President and Chief Financial Officer.

Mr. Niblock retired from Lowe’s in 2018 as Chairman, President and Chief Executive Officer. Under his leadership as CEO from 2005 to 2018, the company’s revenues grew from $36.5 billion to $68.6 billion, and Lowe’s built a major digital business to expand the reach of its national stores. The company’s share price also more than tripled from the time of his appointment as CEO to the time of his retirement.

Prior to joining Lowe’s, Mr. Niblock had a nine-year career with the accounting firm Ernst & Young LLP.

Mr. Niblock received a BS in Accounting from the University of North Carolina at Charlotte. |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 19 |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Martin Pfinsgraff

— Retired Senior Deputy Comptroller, Large Bank Supervision, Office of the Comptroller of the Currency

|

Age: 70

Director since: 2018

Independent director

Board committees:

• Audit • Risk (Chair) • Executive

|

Experience, Qualifications, Attributes or Skills:

The Board values Mr. Pfinsgraff’s leadership experience as well as his extensive knowledge of the financial services industry and the regulatory requirements applicable to the industry. His experience in banking regulation, risk management and finance, along with his years of executive leadership, provide the Board with additional skills to oversee complex regulatory, risk management and financial matters.

Other Public Company Directorships (within the past 5 years):

None

Professional Background:

Martin Pfinsgraff retired as Senior Deputy Comptroller Large Bank Supervision of the Office of the Comptroller of the Currency (the “OCC”) in February 2017. He held the position of Deputy Comptroller for Credit and Market Risk from 2011 to 2013. Mr. Pfinsgraff served on the Executive Committee of the OCC and as a member of the Senior Supervisors Group, an international committee comprised of supervisors from 10 Organisation for Economic Co-operation and Development (“OECD”) member countries and the European Central Bank.

Prior to his career with the OCC, Mr. Pfinsgraff held various positions from 2000 to 2009 at iJet International, a provider of operating risk management solutions, including Chief Operating Officer and Chief Financial Officer. Mr. Pfinsgraff held various positions with Prudential Financial’s operating subsidiaries from 1989 through 2000, including as Treasurer of Prudential Insurance and CFO and President, Capital Markets of Prudential Securities.

Mr. Pfinsgraff received a BBA in Psychology from Allegheny College and an MBA from Harvard Business School. |

| 20 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Bryan S. Salesky

— Co-founder and Chief Executive Officer, Stack AV Co.

|

Age: 44

Director since: 2021

Independent director

Board committees:

• Corporate Responsibility • Technology |

Experience, Qualifications, Attributes or Skills:

Mr. Salesky has built a reputation for strategic vision and entrepreneurism in the technology and artificial intelligence industries. The Board believes these skills are particularly valuable to PNC as it continues to invest in new product innovation and growth. The Board also values Mr. Salesky’s active involvement in the Pittsburgh community.

Other Public Company Directorships (within the past 5 years):

None

Professional Background:

Bryan S. Salesky is a co-founder and has served as the Chief Executive Officer of Stack AV Co., a developer and provider of advanced autonomous systems designed to meet the safety, reliability and efficiency demands of the trucking industry, since the company’s inception in 2023. Mr. Salesky founded and served as the CEO of Argo AI, LLC, a self-driving technology platform company that partnered with leading automakers to develop the software, hardware, maps and cloud-support infrastructure to power self-driving vehicles, from 2016 to 2022. Previously, Mr. Salesky spent more than a decade in roles of increasing responsibility across leading technology companies, including Google and Carnegie Mellon University’s National Robotics Engineering Center (“NREC”).

Mr. Salesky brings significant experience across the robotics and software engineering disciplines. In addition to co-leading Carnegie Mellon University’s team that won the 2007 DARPA Urban Challenge autonomous vehicle race, he managed a portfolio of NREC’s largest commercial programs, including autonomous mining trucks for Caterpillar. While at Google, Mr. Salesky was responsible for the development and manufacture of the company’s self-driving hardware portfolio, which included self-driving sensors, computers and several vehicle development programs.

Mr. Salesky is chair of the Inclusive Growth Committee of the board of directors of the Allegheny Conference on Community Development, and serves on the board of trustees of the University of Pittsburgh.

Mr. Salesky received a BS in Computer Engineering from the University of Pittsburgh. |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 21 |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Skills, experience and perspectives

The N&G Committee annually reviews the skills, experience, qualifications and independence of PNC’s directors and periodically considers the composition of the entire Board. We present below an aggregate view of some of the attributes of the Board that contribute to its overall effectiveness.

| Knowledge and skills The Board as a whole possesses valuable senior leadership experience across key fields, including technology, cybersecurity, financial services, regulatory affairs, risk management, operations and strategic planning, finance and accounting, marketing and branding, corporate responsibility, talent management and succession planning. |

Independence A substantial majority of the Board is independent from management.

Twelve of our 13 directors (or 92% of the Board) are independent under the New York Stock Exchange (“NYSE”) standards that we have adopted as |

|||

|

|

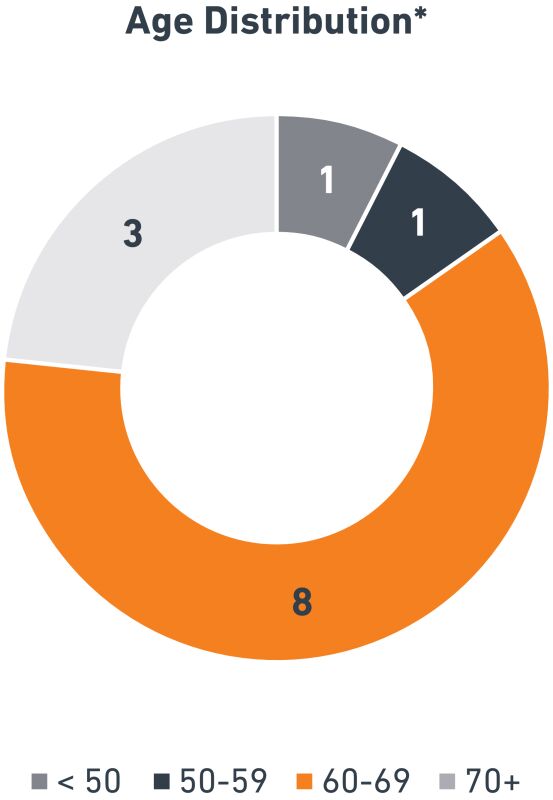

||||

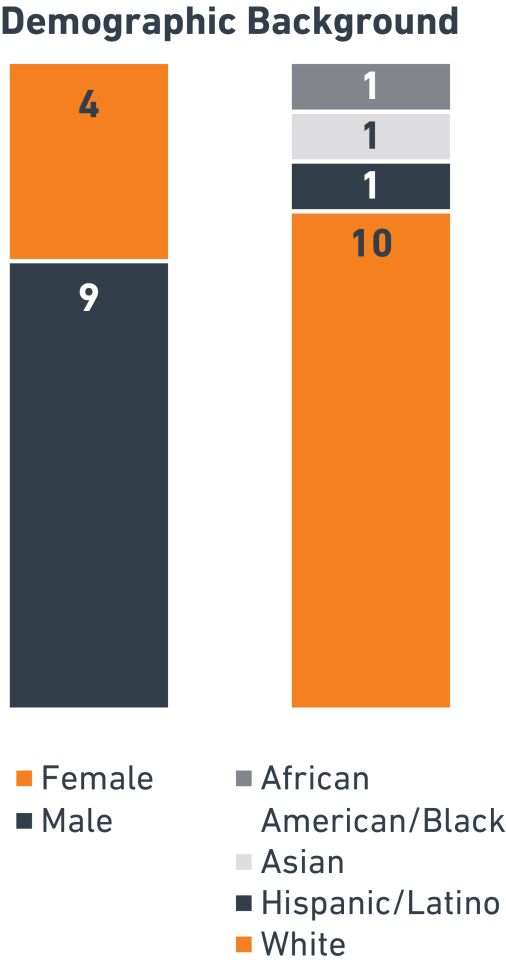

| Demographic snapshot The Board as a whole reflects the following demographics:

– Gender: 4 Female 9 Male

– Race/ethnicity: 1 African American/Black 1 Asian 1 Hispanic/Latino 10 White

– Age range†: 44 to 72 |

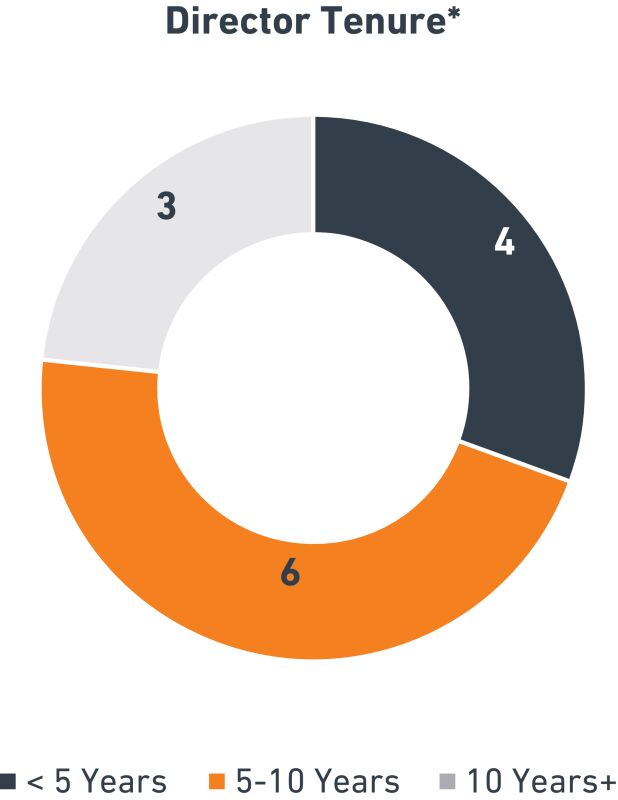

Tenure mix The Board and the N&G Committee strive to maintain a mix of long-, medium-, and short-tenured directors. The average tenure of our 13 director nominees is 6.3 years.†

The Board’s commitment to regular refreshment of its membership is evidenced by our addition of 14 new directors and 11 director retirements since 2015. |

|||

† As of April 23, 2025

| 22 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Key categories of experience, qualifications, attributes and skills

The matrix below presents the key categories of experience, qualifications, attributes and skills that our Board members possess. For more information, see their biographies under “—Our director nominees.” Our Board members also possess additional experience, qualifications, attributes and skills that are not depicted in the below matrix.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

| Knowledge, skills and experience | ||||||||||||||||||||||||||

| Large institution leadership |

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

|||||||||||||

| Public company board |

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

||||||||||||||||

| Regulatory / risk management |

• |

• |

• |

• |

• |

• |

• |

• |

• |

|||||||||||||||||

| Finance / accounting / audit |

• |

• |

• |

• |

• |

• |

• |

• |

||||||||||||||||||

| Financial services |

• |

• |

• |

• |

• |

• |

||||||||||||||||||||

| Marketing / branding / retail |

• |

• |

• |

• |

• |

|||||||||||||||||||||

| Corporate responsibility |

• |

• |

• |

• |

• |

• |

• |

|||||||||||||||||||

| Technology / cybersecurity |

• |

• |

• |

• |

||||||||||||||||||||||

| Talent management / succession planning |

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

• |

||||||||||||||

Director independence

Robust independent oversight is one of the cornerstones of PNC’s strong corporate governance practices. We have long maintained a Board with a substantial majority of directors who are not PNC employees and who otherwise qualify as independent under the corporate governance rules of the NYSE. The NYSE requires at least a majority of corporate directors to be independent from management.

| Board composition 92% independent |

We present below the Board’s annual determination of the independence of each of its members, based upon the recommendation of the N&G Committee. The Board’s decisions took into account the relationships described in “— Guidelines on certain nonmaterial relationships — Transactions with directors.” There are no family relationships among the directors or between any director and any executive officer.

◾ Twelve independent Board members. The Board determined that each non-employee director of PNC (namely, Joseph Alvarado, Debra A. Cafaro, Marjorie Rodgers Cheshire, Douglas A. Dachille, Andrew T. Feldstein, Richard J. Harshman, Daniel R. Hesse, Renu Khator, Linda R. Medler, Robert A. Niblock, Martin Pfinsgraff, and Bryan S. Salesky) is independent according to NYSE rules.

◾ One nonindependent Board member. The Board determined that William S. Demchak is not independent under NYSE rules because he serves as CEO of PNC.

|

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement | 23 |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

Evaluation criteria

A director will be considered independent if the director has no “material relationship” with PNC that would interfere with the director’s exercise of independent judgment. NYSE rules set forth “bright-line” or objective tests, as described below, that define the types of relationships that are categorically deemed to be “material relationships.”

In the event a director has a relationship with PNC that is relevant to his or her independence and is not addressed by the bright-line independence tests under NYSE rules, the Board would determine, after considering all relevant facts and circumstances, whether such relationship is material to the director’s ability to exercise independent judgment as a member of the Board. Relevant factors to be considered by the Board may include a director’s affiliation with an organization that has a relationship with PNC or any commercial, industrial, banking, consulting, legal, accounting, charitable and family relationships. Consistent with NYSE rules, the ownership of a significant amount of PNC stock, by itself, will not prevent a finding of independence.

|

NYSE bright-line independence tests. The following relationships are categorically deemed to impair independence:

◾ A director currently is employed by PNC or was employed by PNC within the last three years

◾ A director’s immediate family member currently is an executive officer of PNC or was an executive officer of PNC within the last three years

◾ A director or immediate family member received more than $120,000 in direct compensation from PNC, except for certain permitted payments (such as director and committee fees, pension or other forms of deferred compensation), during any 12-month period within the last three years

◾ Certain employment relationships between a director or an immediate family member and PNC’s internal or external auditors

◾ A director or immediate family member is an executive officer of a company, or has within the last three years been an executive officer of a company, during the same time that a PNC executive officer served on that company’s compensation committee

◾ A director is an employee or an immediate family member is an executive officer of a company that has made payments to, or received payments from, PNC for property or services in excess of the greater of $1 million or 2% of such other company’s consolidated gross revenue in any of the last three fiscal years |

| For purposes of these bright-line tests, references to PNC include certain of PNC’s subsidiaries.

|

Guidelines on certain nonmaterial relationships

Some of our directors may be PNC customers or have other relationships with PNC that are nonmaterial because they are conducted on nonpreferential terms or otherwise would not affect the director’s independent judgment.

The Board has approved guidelines describing four types of relationships that would not constitute a material relationship between the director and PNC. If a relationship involving a director meets the criteria outlined in these guidelines, the director may be deemed to be independent for NYSE purposes, provided that the director otherwise meets the relevant independence tests under NYSE rules.

The four categories of relationships described in our director independence guidelines include:

| ◾ | Ordinary course business relationships, such as lending, deposit, banking or other financial service relationships, or other relationships involving the provision of products or services by or to PNC or its subsidiaries and involving a director, an immediate family member, or an affiliated entity of a director or immediate family member, where such relationships satisfy the criteria described in the guidelines |

| ◾ | Contributions made by PNC, its subsidiaries or a PNC-sponsored foundation to a charitable organization of which a director or an immediate family member is an executive officer, director or trustee, subject to the conditions described in our director independence guidelines |

| ◾ | Relationships involving a director’s relative who is not an immediate family member |

| ◾ | Relationships or transactions between PNC or its subsidiaries and a company or charitable organization where a director or an immediate family member serves solely as a non-management board member or trustee or where an immediate family member is employed in a non-officer position |

| 24 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2025 Proxy Statement |

Table of Contents

ITEM 1 — ELECTION OF DIRECTORS

In applying these guidelines, an “immediate family member” includes a person’s spouse, parents, children, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, brothers- and sisters-in-law, and anyone (other than domestic employees) who shares such person’s home.

If a director has a relationship that would not be considered material under our director independence guidelines but is one of the relationships described in the NYSE’s bright-line independence tests, the NYSE rules govern and the director will not qualify as independent.

For more information, see our corporate governance guidelines, which can be found at www.pnc.com/corporategovernance.

Transactions with directors in 2024

The following is a summary of the nonmaterial relationships that existed between current Board members and PNC in 2024. Under our director independence guidelines, such transactions would not be deemed to impair a director’s independent judgment.

The table below reflects the following:

| ◾ | We provided financial services during 2024 to most of our directors, some of their immediate family members, and certain of their respective affiliated entities. Affiliated entities include companies of which a director is, or was during 2024, a partner, executive officer or employee; companies of which a director’s immediate family member is, or was during 2024, a partner or executive officer; and companies in which a director and/or the director’s immediate family member holds a significant ownership or voting position. We offer those services in the ordinary course of business on substantially the same terms and conditions, including price, as we provide to other similarly situated customers. |

| ◾ | We also extended credit to some of our directors, their immediate family members and certain of their respective affiliated entities. We maintain policies and procedures to help us comply with Regulation O, a federal banking regulation intended to prevent banks from giving preferential treatment to their insiders, including directors and executive officers, when extending credit. Among other provisions, Regulation O prescribes lending limits applicable to insiders individually and in the aggregate as a group, prohibits lending to insiders on preferential terms and requires prior board approval for extensions of credit to an insider above a specified threshold amount. Under our corporate governance guidelines, a director who has received an extension of credit shall not be considered independent if the extension of credit did not comply with Regulation O. |

| ◾ | We made charitable contributions during 2024 to charitable organizations where our directors or their immediate family members serve as directors, trustees or executive officers. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Personal or Family Relationships |

Deposit, Wealth Management and Similar Banking Products(1)

|

• |

• |

• |

• |

• |

• |

• |

• |

• |

||||||||||||||||||

|

Credit Relationships(2)

|

• |

• |

• |

• |

• |

• |

• |

• |

• |

|||||||||||||||||||

|

Charitable Contributions(3)

|

• |

• |

• |

• |

• |

• |

||||||||||||||||||||||