DEF 14A: Definitive proxy statements

Published on March 13, 2024

| ☑ Filed by the Registrant

|

☐ Filed by a Party other than the Registrant

|

| Check the appropriate box: | ||

| ☐ |

Preliminary Proxy Statement | |

| ☐ |

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2))

| |

| ☑ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Material under §240.14a-12

| |

| Payment of Filing Fee (Check the appropriate box): | ||

| ☑ |

No fee required | |

| ☐ |

Fee paid previously with preliminary materials | |

| ☐ |

Fee computed on table in exhibit required by Item 259b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

2024 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT ANNUAL MEETING OF SHAREHOLDERS Wednesday, April 24, 2024 11:00 a.m. Eastern Time THE PNC FINANCIAL SERVICES GROUP, INC.

|

Letter from the Chairman and Chief Executive Officer to Our Shareholders

|

Dear Shareholders,

It is my pleasure to invite you to attend the 2024 Annual Meeting of Shareholders of The PNC Financial Services Group, Inc. The annual meeting will be held on Wednesday, April 24, 2024, at 11:00 a.m. Eastern Time in a virtual-only format via webcast.

We will consider the matters described in the proxy statement and also review significant developments since last year’s annual meeting of shareholders.

We are again making our proxy materials available to you electronically. We hope this continues to offer you convenience while allowing us to reduce the number of copies we print.

The proxy statement contains important information and you should read it carefully. Your vote is important, and we strongly encourage you to vote your shares using one of the voting methods described in the proxy statement. Please see the notice that follows for more information.

We look forward to your participation and thank you for your support of PNC.

| March 13, 2024 |

Sincerely, |

William S. Demchak

Chairman and Chief Executive Officer

|

Letter from the

|

Fellow Shareholders,

On behalf of the independent directors, thank you for your support of PNC.

In 2023, amidst a challenging operating environment, PNC performed well and delivered value for its customers, employees, communities and for you, the shareholders.

The board would like to acknowledge and thank PNC’s employees for everything they did in 2023 to make this possible.

During a year characterized by heightened industry volatility and uncertainty, the board remained closely connected to company management during 2023. Through our regular engagement and established board committees, we continued to provide oversight into the development and execution of company strategy and helped ensure management decisions aligned to that strategy.

As you will read within this proxy statement, the independent directors nominated for election this year come from a wide range of backgrounds. Each director brings a unique set of perspectives and expertise to our conversations with management, which we believe makes us more effective in providing strategic guidance and recommendations.

The independent directors unanimously share in PNC Chairman and CEO Bill Demchak’s optimism for the future. The company’s successes in 2023 position it well to capitalize on new growth opportunities and continue delivering for all its stakeholders in 2024 and beyond. And we are excited for what’s to come.

Thank you once again for your support.

| March 13, 2024 |

Sincerely, |

Andrew Feldstein

Presiding Director

The PNC Financial Services Group, Inc.

Proxy Statement Summary

The PNC Financial Services Group, Inc. (“we,” “PNC” or the “Company”) is one of the largest diversified financial services institutions in the United States. We offer a broad range of deposit, credit and fee-based products and services to serve our customers. We have businesses engaged in retail banking, including residential mortgage, corporate and institutional banking, and asset management, providing many of our products and services nationally. Our retail branch network is located coast-to-coast. We also have strategic international offices in four countries outside the U.S.

PNC’s Board of Directors (the “Board”) and senior executive management team seek to manage PNC for the long term, through all phases of the economic cycle. Our strength and stability as a financial institution have enabled us to pursue growth and scale responsibly, diversifying our geographical presence, business mix and product capabilities through organic growth, strategic bank and non-bank acquisitions and equity investments, and the formation of various non-banking subsidiaries.

At December 31, 2023, our consolidated total assets, total deposits and total shareholders’ equity were $561.6 billion, $421.4 billion and $51.1 billion, respectively, and we had over 56,000 employees.

For more information about the matters covered in this summary, please see the relevant sections of this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”). You may read these materials at www.proxyvote.com, or on our website at pnc.com/annualmeeting. PNC’s Form 10-K was filed with the U.S. Securities and Exchange Commission on February 21, 2024 and will be made available to shareholders without charge upon request to: Corporate Secretary, 300 Fifth Avenue, Mail Stop: PT-PTWR-18-1, Pittsburgh, PA 15222 USA or corporate.secretary@pnc.com.

Financial Performance Highlights

During a tumultuous year in the banking industry, PNC delivered strong full year 2023 financial performance results by executing well and staying focused on its strategy. We generated record revenue and controlled core expenses, delivering positive adjusted operating leverage (growing revenue faster than expenses). Importantly, we achieved these outcomes while maintaining strong credit quality metrics as well as a strong capital and liquidity position. For the full year 2023, we also returned $3.1 billion of capital to our shareholders through common stock dividends and share repurchases.

| ∎ | Delivered value to our shareholders, while managing the balance sheet for long-term success: |

| ∎ | PNC reported strong financial results, generating record full-year revenue of $21.5 billion, an increase of $370 million, or 2%, compared to 2022, driven by net interest income growth, reflecting the benefit of higher interest earnings asset yields and balances. |

| ∎ | Maintained a strong balance sheet: Average loans grew $15.8 billion, or 5%, compared to 2022. |

| ∎ | Credit quality metrics demonstrated our thoughtful approach to lending and client selection, including a net loan charge-offs to average loans ratio of 0.22% for 2023, which remains below historical levels and is one of the lowest in the peer group. |

| ∎ | Capital and liquidity positions remained strong throughout the year, with a Basel III common equity Tier 1 capital ratio of 9.9% as of December 31, 2023. We continue to monitor discussions regarding regulatory changes related to Basel III endgame and based on our current estimates, we are well positioned to meet the proposed requirement without meaningful changes to how we operate. |

| ∎ | Expenses remained well controlled amidst continued investments in our businesses, technology and employees. Excluding non-core noninterest expenses (see footnote), core noninterest expenses remained well controlled, increasing 1% or $177 million from 2022. In mid-2023 PNC increased its initial continuous improvement program (“CIP”) target by $50 million to $450 million and once again exceeded this target.1 |

| 1 | Core noninterest expense is a non-GAAP measure calculated by excluding non-core noninterest expense adjustments from noninterest expense. Non-core noninterest expense adjustments include the $515 million pre-tax impact of the FDIC special assessment for the recovery of losses related to the closures of Silicon Valley Bank and Signature Bank as well as workforce reduction charges, in each case, incurred in the fourth quarter of 2023. See this and other non-GAAP measures in Annex A. |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | i |

PROXY STATEMENT SUMMARY

| ∎ | Supporting our customers, communities and employees |

| ∎ | Met all six of our organizational workforce objectives in 2023 and were recognized by the American Opportunity Index as the financial institution most effective at developing talent and advancing employee careers (overall PNC ranked 4th out of 396 of the largest U.S. employers included in the index regardless of industry). |

| ∎ | Continued significant progress under our four-year, $88 billion Community Benefits Plan aimed at advancing economic opportunities for low- and moderate-income individuals and communities and people of color, including by expanding PNC’s Mobile Branch footprint in 10 markets to make banking more accessible for underserved markets and by financing or investing in approximately $10.5 million in affordable housing initiatives in two states. |

| ∎ | Executing against our three strategic priorities |

| (1) | Expanding our leading banking franchise to new markets and digital platforms |

| ∎ | Achieved success in new market expansion efforts in Corporate and Commercial Banking, where both average loans and revenues increased more year-over-year as compared to PNC’s mature markets. |

| ∎ | Launched approximately 200 additional video banking machines throughout the country, with locations in all four time zones, providing more opportunities for customers to video connect directly to a remote banking consultant. |

| (2) | Deepening our customer relationships by delivering a superior banking experience and financial solutions |

| ∎ | Launched a new Construction-to-Permanent loan product offering a single solution for financing new home builds, combining a construction loan and permanent mortgage in one product, and PNC Student Debt Solution, a student debt and savings optimization platform designed to help employees of our Organizational Financial Wellness clients better manage their financial health. |

| (3) | Leveraging technology to create efficiencies that help us better serve customers |

| ∎ | Further strengthened monitoring capability by adding new technology from Ookla, LLC known as “Downdetector®” to detect outages and service issues in near real-time and increasing operational resilience. |

| ∎ | Launched PNC Claim Predictor, an artificial intelligence and machine learning-enabled solution that helps healthcare organizations proactively identify inaccurate or insufficiently populated insurance claims prior to submission for payment. |

Corporate Governance Highlights

| ∎ | Snapshot of corporate governance practices |

| Annual elections:

|

∎ The entire Board is elected each year; we have no staggered elections.

|

|||||

| Majority vote standard: | ∎ The election of directors is subject to a majority voting requirement; any director who does not receive a majority of the votes cast in an uncontested election must tender his or her resignation to the Board.

|

|||||

| Robust independent oversight: | ∎ Our corporate governance guidelines require the Board to have a substantial majority (at least two-thirds) of independent directors. All of our current directors and nominees to the Board are independent, except our CEO.

∎ The Board regularly holds executive sessions of its independent directors, with no members of management present.

∎ All of our Board committees with specific areas of responsibility, except for the Risk Committee, are comprised entirely of directors who are independent under applicable standards. The membership of both the CEO and the Presiding Director on the Risk Committee enables them to maintain engagement and proficiency with the risk management process.

|

|||||

| Independent Board leadership: | ∎ The Board has a Presiding Director who serves as the lead independent director.

∎ The Presiding Director has specific duties relating to Board operations and governance, including approval of Board meeting agendas.

|

|||||

| ii | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

PROXY STATEMENT SUMMARY

| Well-developed committee structure: |

∎ To operate more effectively, the Board conducts certain oversight and governing activities through a robust committee structure. The Board currently has seven committees focused on distinct areas of responsibility, as delineated below.

|

|||||

| Audit Committee Human Resources Committee Nominating and Governance Committee Risk Committee

|

Corporate Responsibility Committee Technology Committee Compliance Subcommittee

|

|||||

| Corporate responsibility and climate risk oversight: |

∎ The Board reviews PNC’s corporate responsibility strategic plan annually and receives updates on corporate responsibility matters at least quarterly.

∎ The Risk Committee additionally receives regular reports from management on climate-related risks.

|

|||||

| CEO / senior executive succession planning: |

∎ Succession planning encompasses both long-term succession scenarios and contingencies or unplanned scenarios.

∎ At least annually, the Human Resources Committee reviews a detailed succession planning report from PNC’s talent management function. The report typically includes a discussion of the individual performance of each executive officer, as well as succession plans and development initiatives for other emerging talent.

|

|||||

| Director education: | ∎ All new directors undergo a director orientation program, which includes written materials and personalized orientation sessions.

∎ Our continuing education program takes into account directors’ knowledge and experience and our risk profile, and includes training on complex products and services, our lines of business, significant risks to the company, applicable laws, regulations and supervisory requirements, and other relevant topics, as identified by the Board and members of senior management.

|

|||||

| Board evaluations: | ∎ The Board and its committees and subcommittee each conduct a self-evaluation annually under the oversight of the Nominating and Governance Committee. Feedback is obtained through discussions among the Board, committee, and subcommittee members. Appropriate action plans are then developed to implement enhancements and other changes based on the feedback received.

|

|||||

| Retirement policy: | ∎ The Board has set age 72 as the mandatory retirement age for directors, subject to waiver.

|

|||||

| Directors’ external commitments: | ∎ Audit Committee members may not serve on the audit committees of more than three public companies, including PNC.

∎ The Board will consider a director’s availability to fulfill his or her responsibilities as a director if he or she serves on more than three other public company boards.

|

|||||

| Shareholder engagement: | ∎ During 2023, we engaged with 210 unique firms representing approximately 50% of the ownership of our outstanding common stock. These discussions included participation from our investor relations team as well as our CEO and CFO, line of business leaders, and technology, risk, corporate responsibility, corporate governance and human resources teams. Management regularly reports to the independent directors regarding investor discussions and feedback on topics of interest.

|

|||||

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | iii |

PROXY STATEMENT SUMMARY

| ∎ | Snapshot of 2024 Board nominees |

| Name | Age | Director since |

Independent | Committee & Subcommittee Memberships |

Other Public Co. Boards |

|||||

| Joseph Alvarado Former Chairman and CEO, Commercial Metals Company |

71 | 2019 |

|

Audit; Corporate Responsibility; Compliance |

3 | |||||

| Debra A. Cafaro Chairman and CEO, Ventas, Inc. |

66 | 2017 |

|

Audit; Human Resources (Chair) |

1 | |||||

| Marjorie Rodgers Cheshire Principal, A&R Development Corp. |

55 | 2014 |

|

Nominating and Governance; Risk; Corporate Responsibility (Chair); Compliance (Chair) |

1 | |||||

| William S. Demchak Chairman and CEO, The PNC Financial Services Group, Inc. |

61 | 2013 | — | Risk | — | |||||

| Andrew T. Feldstein (Presiding Director) Former CEO, BlueMountain Capital Management |

59 | 2013 |

|

Human Resources; Nominating and Governance (Chair); Risk; Corporate Responsibility |

— | |||||

| Richard J. Harshman Former Chairman, CEO and President, Allegheny Technologies Incorporated (n/k/a ATI Inc.) |

67 | 2019 |

|

Audit (Chair); Human Resources; Nominating and Governance; Corporate Responsibility |

1 | |||||

| Daniel R. Hesse Former President and CEO, Sprint Corporation |

70 | 2016 |

|

Nominating and Governance; Risk; Technology (Chair) |

1 | |||||

| Renu Khator Chancellor, University of Houston System and President, University of Houston |

68 | 2022 |

|

Audit; Nominating and Governance |

1 | |||||

| Linda R. Medler Retired Brigadier General, United States Air Force and Founder, President and CEO, L A Medler & Associates, LLC |

67 | 2018 |

|

Risk; Technology; Compliance |

1 | |||||

| Robert A. Niblock Former Chairman, President and CEO, Lowe’s Companies, Inc. |

61 | 2022 |

|

Audit; Human Resources |

2 | |||||

| Martin Pfinsgraff Retired Senior Deputy Comptroller Large Bank Supervision, Office of the Comptroller of the Currency |

69 | 2018 |

|

Audit; Risk (Chair); Compliance |

— | |||||

| Bryan S. Salesky Co-Founder and CEO, Stack AV Co. |

43 | 2021 |

|

Corporate Responsibility; Technology |

— |

| iv | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

PROXY STATEMENT SUMMARY

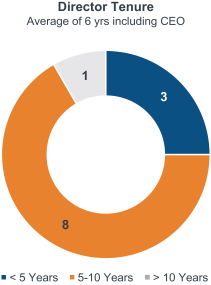

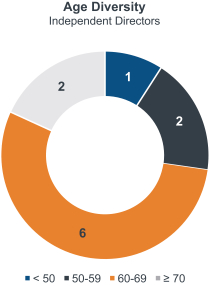

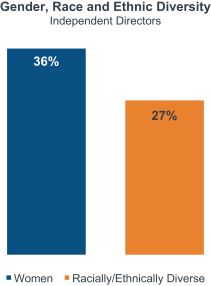

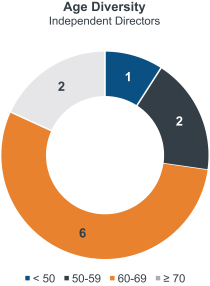

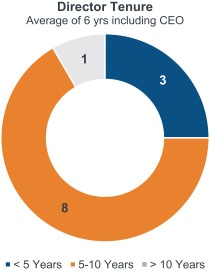

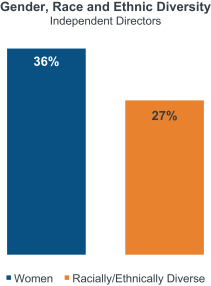

| ∎ | Snapshot of Board diversity |

We strive for an effective board culture based on robust independent oversight. Consistent with this objective, we value diversity of perspective, experience, knowledge, education, age and skills among our Board members and maintain a commitment to periodic refreshment of Board membership. The charts below provide certain demographic information about this year’s nominees. For more information about our nominees and the composition of our Board, see “Item 1—Election of Directors.”

|

|

|

||||||

2023 Say-on-Pay Vote and Shareholder Engagement

In 2023, our say-on-pay proposal received 79.8% shareholder support. Although this result represents significant support for our executive compensation program, it also represents a decrease from prior years’ support levels, which have averaged approximately 95% since 2009, the year PNC first held a say-on-pay vote. Following the results of the say-on-pay vote at the 2023 annual meeting, we invited a substantial number of investors to discuss our compensation philosophy, program and decisions in more detail.

|

|

|

|

We value the views of our shareholders and appreciate the feedback shared with us. We reviewed what we learned and summarized this feedback according to the themes we heard, all of which was discussed with the Human Resources Committee, along with our perspective and opportunities for additional enhancements. For details, see “Compensation Discussion and Analysis—Shareholder engagement and 2023 say-on-pay response.”

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | v |

PROXY STATEMENT SUMMARY

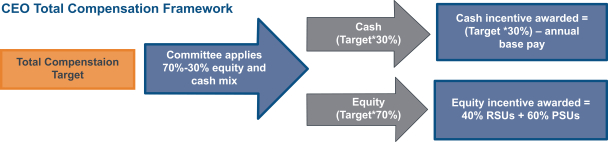

Executive Compensation Highlights

Management of talent and executive compensation is a vital part of PNC’s governance and risk management activities, enabling our forward planning and stability as a financial institution. Our executive compensation philosophy has four basic principles, as set forth below, which guide our executive compensation program design and compensation decisions.

|

|

Compensation principles

|

|||||

| ∎ Pay for performance: | Provide appropriate compensation for demonstrated performance across the enterprise |

|||||

| ∎ Create value: | Align executive compensation with long-term shareholder value creation |

|||||

| ∎ Manage talent: | Provide competitive compensation opportunities to attract, retain and motivate high-quality executives |

|||||

| ∎ Discourage excessive risk-taking: | Encourage focus on the long-term success of PNC and discourage excessive risk-taking

|

|||||

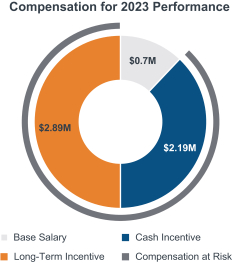

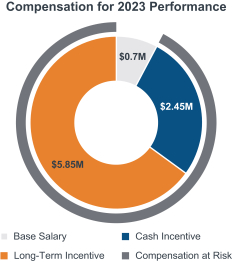

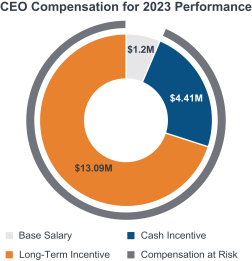

| ∎ | 2023 compensation decisions |

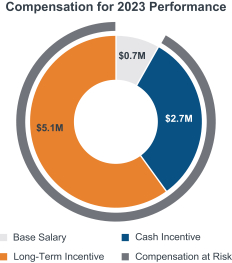

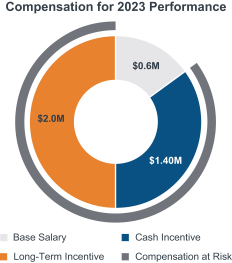

The table below shows for each named executive officer (“NEO”) the 2023 incentive compensation target set by the Committee in the first quarter of 2023, and the actual annual cash incentive and long-term equity-based incentive awarded by the Committee in the first quarter of 2024 for 2023 performance.

|

|

William S. Demchak |

Robert Q. Reilly |

Michael P. Lyons |

E William Parsley, III |

Deborah Guild |

|||||||||||||||

| Incentive compensation target for 2023 |

$ | 15,800,000 | $ | 4,800,000 | $ | 8,300,000 | $ | 7,800,000 | $ | 3,400,000 | ||||||||||

| Incentive compensation awarded for 2023 performance |

$ | 17,500,000 | $ | 5,075,000 | $ | 8,300,000 | $ | 7,800,000 | $ | 3,400,000 | ||||||||||

| Annual cash incentive portion |

$ | 4,410,000 | $ | 2,187,500 | $ | 2,450,000 | $ | 2,700,000 | $ | 1,400,000 | ||||||||||

| Long-term incentive portion |

$ | 13,090,000 | $ | 2,887,500 | $ | 5,850,000 | $ | 5,100,000 | $ | 2,000,000 | ||||||||||

| Long-term incentive as % of total compensation |

70% | 50% | 65% | 60% | 50% | |||||||||||||||

| Incentive compensation disclosed in the Summary compensation table(1) |

$ | 17,160,000 | $ | 4,937,500 | $ | 7,910,000 | $ | 7,800,000 | $ | 3,275,000 | ||||||||||

| Annual cash incentive portion (2023 performance) |

$ | 4,410,000 | $ | 2,187,500 | $ | 2,450,000 | $ | 2,700,000 | $ | 1,400,000 | ||||||||||

| Long-term incentive portion (2022 performance) |

$ | 12,750,000 | $ | 2,750,000 | $ | 5,460,000 | $ | 5,100,000 | $ | 1,875,000 | ||||||||||

| (1) | Under SEC regulations, the incentive compensation amounts disclosed in the Summary compensation table on page 79 include the annual cash incentive award paid in 2024 for 2023 performance (the “Non-Equity Incentive Plan Compensation” column) and the long-term equity-based incentive award granted in 2023 for 2022 performance (the “Stock Awards” column). The amounts shown in the “Stock Awards” column of the Summary compensation table differ slightly from the amounts shown in the table above due to the impact of rounding related to fractional shares. |

Significant portion of compensation is equity-based and not payable for several years. As illustrated above, at least 70% of our CEO’s total compensation (i.e., base salary and incentive compensation) is in the form of long-term equity-based incentive awards. All other NEOs receive at least 50% of their total compensation in the form of long-term equity-based incentive awards. In addition to being at-risk, these incentives are not payable for several years. For more information, see “Compensation Discussion and Analysis—Our compensation program—Incentive compensation program.”

| vi | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

PARTICIPATE IN THE FUTURE OF PNC — PLEASE CAST YOUR VOTE

| ∎ | Your vote is important to us, and we want your shares to be represented at the annual meeting. Please review this proxy statement and vote right away. See “General Information” in this proxy statement for more information about how to vote your shares, how votes are counted, and the vote required to approve each proposal. This proxy statement and related soliciting materials became accessible for shareholder review beginning on March 13, 2024. |

Attend The PNC Financial Services Group, Inc. 2024 Annual Meeting

|

Wednesday, April 24, 2024

11:00 a.m. Eastern Time

www.virtualshareholdermeeting.com/PNC2024

Record date: February 2, 2024

|

If voting by internet or telephone, your vote

must be received by 11:59 p.m. ET on

Tuesday, April 23, 2024.*

|

|

|

* Participants in the PNC Stock Fund of PNC’s 401(k) plan must vote by 11:59 p.m. ET on April 18, 2024. |

Proposals requiring your vote

| For more information |

Board recommendations |

|||||||||||

| ∎ MANAGEMENT PROPOSALS

|

||||||||||||

| Item 1 | Election of 12 nominated directors | Page 5 |

|

FOR each nominee |

|

|

|

|

||||

| Item 2 | Ratification of the selection of PricewaterhouseCoopers LLP as PNC’s independent registered public accounting firm for 2024 |

Page 104 | FOR |

|

|

|

||||||

| Item 3 | Advisory vote to approve named executive officer compensation | Page 108 | FOR |

|

|

|

||||||

| Item 4 | Approval of The PNC Financial Services Group, Inc. 2025 Employee Stock Purchase Plan | Page 109 | FOR |

|

|

|

||||||

| ∎ SHAREHOLDER PROPOSAL, IF PROPERLY PRESENTED

|

||||||||||||

| Item 5 | Shareholder proposal regarding report on risk management and implementation of PNC’s Human Rights Statement | Page 114 | AGAINST |

|

|

|

||||||

Vote your shares

We offer a number of ways for you to vote. Voting instructions are included in the Notice of Internet Availability of Proxy Materials and the proxy card. If you hold shares in “street name,” you will receive information from your broker, bank or other nominee regarding how to provide voting instructions.

|

|

|

|

||||

| Vote online: www.proxyvote.com. |

Vote by phone: For registered holders: (800) 690-6903 For beneficial holders: (800) 454-8683 |

If you received a printed version of these

|

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 1 |

Table of Contents

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | 4 | |||

| ITEM 1 — ELECTION OF DIRECTORS | 5 | |||

| CORPORATE GOVERNANCE | 20 | |||

| 20 | ||||

| 21 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 28 | ||||

| 38 | ||||

| DIRECTOR AND EXECUTIVE OFFICER RELATIONSHIPS | 39 | |||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| RELATED PERSON TRANSACTIONS | 44 | |||

| 44 | ||||

| 44 | ||||

| DIRECTOR COMPENSATION | 45 | |||

| 47 | ||||

| COMPENSATION DISCUSSION AND ANALYSIS | 49 | |||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| 61 | ||||

| 69 | ||||

| 75 | ||||

| COMPENSATION COMMITTEE REPORT | 76 | |||

| COMPENSATION AND RISK | 77 | |||

| 77 | ||||

| 78 | ||||

| COMPENSATION TABLES | 79 | |||

| 79 | ||||

| 2 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 3 |

| The PNC Financial Services Group, Inc.

Notice of Annual Meeting of Shareholders |

Wednesday, April 24, 2024

11:00 a.m. Eastern Time

VIRTUAL-ONLY ANNUAL MEETING

Our 2024 Annual Meeting of Shareholders will be held in a virtual-only format online via webcast on Wednesday, April 24, 2024 at 11:00 a.m. Eastern Time. The annual meeting will be accessible online, including to vote and/or submit questions, at www.virtualshareholdermeeting.com/PNC2024.

ITEMS OF BUSINESS

Management Proposals

| 1. | Election of the 12 director nominees named in the proxy statement to serve until the next annual meeting and until their successors are elected and qualified |

| 2. | Ratification of the Audit Committee’s selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024 |

| 3. | Advisory vote to approve named executive officer compensation |

| 4. | Approval of The PNC Financial Services Group, Inc. 2025 Employee Stock Purchase Plan |

Shareholder Proposal, if properly presented

| 5. | Shareholder proposal regarding report on risk management and implementation of PNC’s Human Rights Statement |

Such other business as may properly come before the meeting.

RECORD DATE

The close of business on February 2, 2024 is the record date for determining the shareholders entitled to receive notice of and to vote at the annual meeting and any adjournment.

MATERIALS TO REVIEW

Our proxy materials became accessible to shareholders starting on March 13, 2024. Shareholders will receive either a Notice of Internet Availability of Proxy Materials explaining how to access our proxy materials and vote electronically, or a printed copy of our proxy materials and proxy card. Even if you plan to attend the virtual annual meeting, we encourage you to vote in advance by proxy to ensure your vote is received.

| March 13, 2024 |

By Order of the Board of Directors, | |

|

|

||

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS:

|

Laura Gleason Corporate Secretary |

|

|

This Notice of Annual Meeting and Proxy

|

| 4 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

Currently, our Board consists of 12 members. Under PNC’s governing documents, all directors are elected annually to serve a one-year term until the next annual meeting and until their successors are elected and qualified. Our Bylaws contemplate a range in the size of the Board from five to 25 directors.

For the 2024 annual meeting, the Board has fixed the number of directors to be elected at 12 and nominated each incumbent director to serve for another one-year term ending at next year’s annual meeting. All nominees were previously elected to the Board by our shareholders at PNC’s 2023 annual meeting. Each of our nominees has consented to being named in this proxy statement and to serve if elected. The Board has no reason to believe that any nominee will be unavailable or unable to serve as a director. In the event that a nominee becomes unable to serve as a director, proxies will be voted for the election of such other person as the Board may designate as a nominee, unless the Board chooses to reduce the number of directors authorized to serve on the Board.

Of our 12 director nominees, all 12 have valuable senior leadership experience, 11 are independent, four are women and three bring racial or ethnic diversity to the Board.

In this section, we provide the following information regarding each nominee:

| ∎ | Name and age (as of the date of the annual meeting, April 24, 2024) |

| ∎ | The year in which they first became a director of PNC |

| ∎ | Principal occupation and public company directorships over the past five years |

| ∎ | A brief discussion of the specific experience, qualifications, attributes or skills that led to the Board’s conclusion that the individual should serve as a director |

|

For information about the Board’s nomination process, see “Corporate Governance—Board committees—Nominating and Governance Committee” in this proxy statement.

|

Board composition and attributes

The slate of director nominees for the 2024 annual meeting was developed by the Board with the assistance of its Nominating and Governance Committee. The Board and its Nominating and Governance Committee consider Board composition holistically; their goal is to assure that the Board, as PNC’s highest governing body, has the experience, qualities, attributes and skills needed to enable effective oversight of PNC and its strategic direction.

Accordingly, our slate of director nominees includes senior leaders with substantial experience in technology, cybersecurity, financial services, regulatory affairs, risk management, operations and strategic planning, finance and accounting, marketing and branding, corporate responsibility matters, talent management and succession planning.

We also recognize the value of a Board that is diverse in perspectives and experience. We understand that a diverse board helps us reach better decisions and achieve better outcomes for our employees, customers and communities. In developing the slate of director nominees, the Nominating and Governance Committee considered demographic, cognitive, gender and ethnic diversity, as well as breadth of background, skills and experience and the incumbent directors’ contributions to the effectiveness of the Board.

As of our 2024 annual meeting, the average tenure on our Board (including our CEO) will be approximately 6 years. The Board’s commitment to regular refreshment of its membership is evidenced by the addition of 13 new directors and 11 director retirements since our 2015 annual meeting of shareholders.

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 5 |

ITEM 1 — ELECTION OF DIRECTORS

|

Board diversity

We believe a combination of newer and longer-tenured members as well as a range of backgrounds and overall experience help to maintain an effective board culture that is based on robust independent oversight.

|

|

|

|

| 6 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

The graphic below highlights the skills, experience and demographics of the Board as composed of our 12 director nominees. Each nominee, except Mr. Demchak, our CEO, is an independent director. For a discussion of the criteria PNC uses to determine director independence, see “Director and Executive Officer Relationships—Director independence” in this proxy statement.

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Knowledge, Skills and Experience | ||||||||||||||||||||||||

| Large institution leadership |

∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||||||

| Public company board |

∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||

| Regulatory / risk management |

∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||||||||||

| Finance / accounting / audit |

∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||

| Financial services |

∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||

| Marketing / branding / retail |

∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||

| Corporate responsibility |

∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||

| Technology / cybersecurity |

∎ | ∎ | ∎ | ∎ | ||||||||||||||||||||

| Talent management / succession planning |

∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||||||

| Demographic Background | ||||||||||||||||||||||||

| Tenure (Years)* |

5 | 6 | 9 | 11 | 10 | 5 | 8 | 1 | 6 | 2 | 6 | 2 | ||||||||||||

| Age (Years)* |

71 | 66 | 55 | 61 | 59 | 67 | 70 | 68 | 67 | 61 | 69 | 43 | ||||||||||||

| Gender (Male / Female) |

M | F | F | M | M | M | M | F | F | M | M | M | ||||||||||||

| Race / Ethnicity |

||||||||||||||||||||||||

| African American / Black |

∎ | |||||||||||||||||||||||

| Alaskan Native / Native American |

||||||||||||||||||||||||

| Asian, including South Asian |

∎ | |||||||||||||||||||||||

| Hispanic / Latino |

∎ | |||||||||||||||||||||||

| Native Hawaiian or Pacific Islander |

||||||||||||||||||||||||

| White |

∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||

| Two or more races or ethnicities |

||||||||||||||||||||||||

| * | As of April 24, 2024 |

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 7 |

ITEM 1 — ELECTION OF DIRECTORS

|

Joseph Alvarado

Director Since 2019

Age 71

Independent |

Board committees / subcommittee:

∎ Audit

∎ Corporate Responsibility

∎ Compliance

|

Joseph Alvarado is the former Chairman, President and Chief Executive Officer of Commercial Metals Company (“CMC”), a Fortune 500 global metals company that under his leadership was active in recycling, manufacturing, fabricating and trading. In this role, Mr. Alvarado was responsible for the overall strategic leadership of CMC, with nearly 9,000 employees and operations in over 200 locations in more than 20 countries. Mr. Alvarado served as Chairman, President and CEO of CMC for approximately seven years, retiring in 2018. Mr. Alvarado previously served as Executive Vice President and Chief Operating Officer of CMC from 2010 to 2011, during which time he had full profit and loss and operating responsibility for the company’s diverse global businesses.

Prior to his career with CMC, Mr. Alvarado was an Operating Partner for Wingate Partners and The Edgewater Funds from 2009 to 2010, where he consulted on new deal evaluation and portfolio company management. Mr. Alvarado worked for a number of other businesses throughout his career of more than four decades within the steel, metal processing, energy and chemical industries. Mr. Alvarado held the position of President at United States Steel Tubular Products, Inc. from 2007 to 2009; President and Chief Operating Officer at Lone Star Technologies from 2004 to 2007; Vice President, Long Product Sales and Marketing, North America at ArcelorMittal from 1998 to 2004; and Executive Vice President, Commercial for Birmingham Steel from 1997 to 1998. Mr. Alvarado also held various positions at Inland Steel Company from 1976 to 1997, ultimately serving as President, Inland Steel Bar Company (a division of Inland Steel Company) from 1995 to 1997.

Mr. Alvarado received a BA in Economics from the University of Notre Dame and an MBA from Cornell University’s SC Johnson Graduate School of Management.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board values Mr. Alvarado’s extensive business knowledge and experience in accounting, sales, manufacturing, planning and global operations.

| ∎ | Other Public Company Directorships (within past five years): |

Arcosa, Inc.

Kennametal, Inc.

Trinseo PLC

| 8 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

|

Debra A. Cafaro

Director Since 2017

Age 66

Independent |

Board committees:

∎ Audit

∎ Human Resources (Chair)

∎ Executive

|

Debra A. Cafaro is Chairman of the Board and Chief Executive Officer of Ventas, Inc. (“Ventas”), an S&P 500 company that is a leading owner of senior housing, healthcare and research properties.

Building on her early career in law and 24-year tenure as CEO of Ventas, Ms. Cafaro is broadly engaged across the business, public policy and non-profit sectors. She is a past chair of the Real Estate Roundtable and the Economic Club of Chicago, and is a member of the American Academy of Arts & Sciences and The Business Council. She serves on the boards of the Civic Committee of the Commercial Club of Chicago, the Harvard Kennedy School Taubman Center, the University of Chicago and the Chicago Symphony Orchestra. Ms. Cafaro has been recognized multiple times by Harvard Business Review as one of the top 100 global CEOs and by Modern Healthcare as one of the top 100 leaders in healthcare.

Ms. Cafaro received a JD from the University of Chicago Law School and a BA from the University of Notre Dame.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board values Ms. Cafaro’s extensive corporate leadership, knowledge and experience. Her years of experience as a public company CEO in the financial sector provide insight into the oversight of financial and accounting matters. Her vision as a strategic thinker adds depth and strength to the Board in its oversight of PNC’s continued growth. The Board also values Ms. Cafaro’s active community involvement.

| ∎ | Other Public Company Directorships (within past five years): |

Ventas, Inc.

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 9 |

ITEM 1 — ELECTION OF DIRECTORS

|

Marjorie Rodgers Cheshire

Director Since 2014

Age 55

Independent |

Board committees / subcommittee:

∎ Nominating and Governance

∎ Risk

∎ Corporate Responsibility (Chair)

∎ Compliance (Chair)

|

Marjorie Rodgers Cheshire is a corporate board director and an investor in commercial real estate. She is a Principal of A&R Development Corp. (“A&R”), a diversified real estate investment company that owns and invests in large scale multifamily, mixed use and retail real estate in the Baltimore and Washington, D.C. markets. Ms. Cheshire additionally served as A&R’s President and Chief Operating Officer from 2004 to 2021, and was responsible for the firm’s business operations, asset management and strategic initiatives.

Ms. Cheshire also spent many years in senior leadership positions in the media and sports industries. Ms. Cheshire was the Senior Director of Brand & Consumer Marketing for the National Football League, a Vice President of Business Development for Oxygen Media, and a Director and Special Assistant to the Chairman and CEO of ESPN. Early in her career, Ms. Cheshire worked as a consultant at The Boston Consulting Group and in brand management at Nestlé Foods.

Ms. Cheshire is chair of the board of Baltimore Equitable Insurance and is a trustee of Johns Hopkins Medicine and Johns Hopkins Hospital.

Ms. Cheshire received a BS in Economics from the Wharton School of the University of Pennsylvania and an MBA from the Stanford University Graduate School of Business.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board values Ms. Cheshire’s executive management experience and her background in real estate marketing and media, as well as her active involvement in the Baltimore community.

| ∎ | Other Public Company Directorships (within past five years): |

Empowerment & Inclusion Capital I Corp. (until December 2022)

Exelon Corporation

| 10 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

|

William S. Demchak

Director Since 2013

Age 61

Chairman and CEO |

Board committees:

∎ Risk

∎ Executive

|

William S. Demchak is the Chairman and Chief Executive Officer of PNC, one of the largest diversified financial services companies in the United States.

Mr. Demchak joined PNC in 2002 as Chief Financial Officer. In July 2005, he was named head of PNC’s Corporate & Institutional Banking segment responsible for PNC’s middle market and large corporate businesses, as well as capital markets, real estate finance, equity management and leasing. Mr. Demchak was promoted to Senior Vice Chairman in 2009 and named Head of PNC Businesses in August 2010. He held the office of President from April 2012 through February 2024 and has served as Chief Executive Officer since April 2013 and as Chairman since April 2014.

Before joining PNC in 2002, Mr. Demchak served as the Global Head of Structured Finance and Credit Portfolio for JPMorgan Chase (“JPMorgan”). He also held key leadership roles at JPMorgan prior to its merger with the Chase Manhattan Corporation in 2000. He was actively involved in developing JPMorgan’s strategic agenda and was a member of the company’s capital and credit risk committees.

Mr. Demchak is a member and past chairman of the board of directors of the Bank Policy Institute and is a member of The Business Council and the Federal Advisory Committee for the Federal Reserve. In addition, he is the past chairman of the Allegheny Conference on Community Development and is a member of the boards of directors of the Extra Mile Education Foundation and the Pittsburgh Cultural Trust.

Mr. Demchak received a BS from Allegheny College and an MBA from the University of Michigan.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board believes that the current CEO should also serve as a director. Under the leadership structure discussed elsewhere in this proxy statement, a CEO-director acts as a liaison between directors and management, and assists the Board in its oversight of the company. Mr. Demchak’s experience and strong leadership provide the Board with insight into the business and strategic priorities of PNC.

| ∎ | Other Public Company Directorships (within past five years): |

BlackRock, Inc. (until May 2020)

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 11 |

ITEM 1 — ELECTION OF DIRECTORS

|

|

Andrew T. Feldstein

Director Since 2013

Age 59

Independent Presiding Director |

Board committees:

∎ Human Resources

∎ Nominating and Governance (Chair)

∎ Risk

∎ Corporate Responsibility

∎ Executive (Chair)

|

Andrew T. Feldstein, our Presiding Director, is the former Chief Executive Officer of BlueMountain Capital Management (now known as Assured Investment Management, a subsidiary of Assured Guaranty) (“BlueMountain”) and was the Chief Investment Officer for both Assured Guaranty and BlueMountain. Under Mr. Feldstein’s leadership, BlueMountain was a leading alternative asset manager with $18 billion in assets under management. Assured Guaranty is a leading provider of financial guaranty insurance.

Prior to co-founding BlueMountain in 2003, Mr. Feldstein spent over a decade at JPMorgan where he was a Managing Director and served as Head of Structured Credit, Head of High Yield Sales, Trading and Research, and Head of Global Credit Portfolio.

Mr. Feldstein is a trustee of Third Way, a public policy think tank, and a member of the Harvard Law School Leadership Council.

Mr. Feldstein received a BA from Georgetown University and a JD from Harvard Law School.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board values Mr. Feldstein’s extensive financial and risk management expertise. As founder and former CEO of BlueMountain and through his senior management positions at JPMorgan, Mr. Feldstein built a reputation for innovation and significant insight into risk management. The Board believes these skills are particularly valuable to Mr. Feldstein’s role as Presiding Director and to the Board’s effective oversight of risk management, as well as a valuable resource to PNC as it continues to grow its business and strengthen its balance sheet.

| 12 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

|

|

Richard J. Harshman

Director Since 2019

Age 67

Independent |

Board committees:

∎ Audit (Chair)

∎ Human Resources

∎ Nominating and Governance

∎ Corporate Responsibility

∎ Executive

|

Richard J. Harshman is the retired Executive Chairman and former President and Chief Executive Officer of Allegheny Technologies Incorporated (now known as ATI Inc.) (“ATI”), a global manufacturer of technically advanced specialty materials and complex parts and components. Mr. Harshman served as President and CEO of ATI from 2011 through 2018. Mr. Harshman previously served in other roles at ATI, including President and Chief Operating Officer from 2010 to 2011, Executive Vice President and Chief Financial Officer from 2000 to 2010 and other roles of increasing responsibility since 1996. Mr. Harshman began his career as an internal auditor at Teledyne, Inc., a predecessor company to ATI, in 1978.

Mr. Harshman is active within the Pittsburgh community, including through his service with several non-profit boards. Mr. Harshman is a member of the Executive Committee of the Board of Trustees of the Pittsburgh Cultural Trust (the “Cultural Trust”) and is the Cultural Trust’s immediate past chair. Mr. Harshman also is a member of the Executive Committee of the Board of Directors of the United Way of Southwestern Pennsylvania. Previously, Mr. Harshman served as the chair of the Allegheny Conference on Community Development and as a member of the board of trustees of Robert Morris University, in addition to his service with other Pittsburgh-based non-profit organizations.

Mr. Harshman received a BS in Accounting from Robert Morris University and was previously licensed as a Certified Public Accountant by the California Board of Accountancy.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board values Mr. Harshman’s depth of experience with the operational, human capital management, sustainability and financial aspects of leading a public company, including as chief executive officer, chief financial officer and chief operating officer. The Board also values Mr. Harshman’s active involvement in the Pittsburgh community and his prior board leadership experience as the lead independent director for another publicly-traded company.

| ∎ | Other Public Company Directorships (within past five years): |

Allegheny Technologies Incorporated (n/k/a ATI Inc.) (until May 2019)

Ameren Corporation

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 13 |

ITEM 1 — ELECTION OF DIRECTORS

|

Daniel R. Hesse

Director Since 2016

Age 70

Independent |

Board committees:

∎ Nominating and Governance

∎ Risk

∎ Technology (Chair)

|

Daniel R. Hesse is the former President and Chief Executive Officer of Sprint Corporation (“Sprint”), one of the United States’ largest wireless carriers, serving from 2007 to 2014. A well-known advocate for the conscience-driven corporation and its responsibility in creating an equitable, inclusive and sustainable world, during his tenure as CEO of Sprint, Mr. Hesse was a recipient of the Responsible CEO Lifetime Achievement Award from Corporate Responsibility Magazine.

Mr. Hesse received a BA from the University of Notre Dame, an MBA from Cornell University and an MS from Massachusetts Institute of Technology where he was awarded the Brooks Thesis Prize.

| ∎ | Experience, Qualifications, Attributes or Skills: |

Mr. Hesse brings extensive corporate leadership experience to the Board, having served in a variety of executive positions, including as CEO of Sprint. His years of experience in the wireless communications industry provide insight into the dynamic and strategic issues overseen by the Board. The broad spectrum of technological issues in this industry give him a strong understanding to assist the Board in its oversight of technological issues.

| ∎ | Other Public Company Directorships (within past five years): |

Akamai Technologies, Inc.

Tech and Energy Transition Corporation (until March 2023)

| 14 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

|

Renu Khator

Director Since 2022

Age 68

Independent |

Board committees:

∎ Audit

∎ Nominating and Governance

|

Renu Khator holds the dual titles of Chancellor of the University of Houston System (“UH System”) and President of the University of Houston (“UH”). She also serves as a professor in UH’s Department of Government and International Affairs. As Chancellor of the UH System, Dr. Khator oversees a four-university organization that serves more that 76,000 students. During her tenure as President since 2008, UH has experienced record-breaking research funding, enrollment and private support, as well as earning Tier One status in 2011, with the Carnegie Foundation elevating it to the top category of research universities.

Prior to her appointment at UH, Dr. Khator had a 22-year career at the University of South Florida, most recently serving as Provost and Senior Vice President and as a professor in the Department of Government and International Affairs.

Dr. Khator is currently a member of the Association of Governing Boards of Colleges and Universities Council of Presidents, and she has been named to the American Academy of Arts and Sciences. She previously served as a member of the Indian Prime Minister’s Empowered Expert Committee and the U.S. Department of Homeland Security’s Academic Advisory Council, and she was 11th District Chair of the Federal Reserve Bank of Dallas.

Dr. Khator received a BA in Liberal Arts from Kanpur University, India and an MA and PhD in Political Science from Purdue University.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board values Dr. Khator’s significant leadership experience in academia and expertise in economic development and funding research for community programs, which will be instrumental in expanding opportunities and executing on strategies as PNC continues to invest for growth. The Board also values Dr. Khator’s active involvement in the Houston community.

| ∎ | Other Public Company Directorships (within past five years): |

The Camden Property Trust

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 15 |

ITEM 1 — ELECTION OF DIRECTORS

|

Linda R. Medler

Director Since 2018

Age 67

Independent |

Board committees / subcommittee:

∎ Risk

∎ Technology

∎ Compliance

|

Linda Medler is a retired USAF Brigadier General with more than 20 years of experience developing cutting-edge cyber and technology strategies for highly regulated public and private institutions, as well as within the highest levels of government. She is the founder, President and CEO of L A Medler & Associates, a boutique cybersecurity consulting company. She previously served as the Chief Information Security Officer for Raytheon Missile Systems, and also as an Executive and Senior Officer for the Department of Defense, where she led mission-critical business, technology and cybersecurity strategies.

In 2014, Ms. Medler completed 30 years of total military service, including 27 years of service in the U.S. Air Force, retiring as a Brigadier General. She began her military service as an enlisted U.S. Marine. Her last position held was Director of Capability and Resource Integration for the United States Cyber Command. Her previous assignments included Director of Communications and Networks for the Joint Staff, Joint Chiefs of Staff Deputy CIO, Chief of Staff for Air Force Materiel Command, and Commander/Vice Commander for the 75th Air Base Wing.

Ms. Medler received a BBA in Management & Computer Information Systems from the University of Arkansas at Little Rock, an MS in National Security & Strategic Studies from the Naval War College, and an MBA in Management Information Systems Concentration from the University of Arizona.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board values Ms. Medler’s extensive leadership experience and her deep knowledge of cybersecurity and information technology. Her years of experience leading cybersecurity, information technology and multi-function organizations facing a broad range of technology and operational issues provide the Board with valuable cyber and technology risk expertise, as well as a strong understanding of emerging technology and digital business transformation strategies, to facilitate effective governance and oversight of the cybersecurity and technology issues facing PNC.

| ∎ | Other Public Company Directorships (within past five years): |

Target Hospitality Corp.

| 16 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

|

Robert A. Niblock

Director Since 2022

Age 61

Independent |

Board committees:

∎ Audit

∎ Human Resources

|

Robert A. Niblock is the former Chairman, President and Chief Executive Officer of Lowe’s Companies, Inc. (“Lowe’s”), which operates together with its subsidiaries as a home improvement retailer in the U.S.

Mr. Niblock joined Lowe’s in 1993 and served in various financial roles throughout his career, including as Director of Taxation, Vice President and Treasurer, Senior Vice President, Finance, and Executive Vice President and Chief Financial Officer.

Mr. Niblock retired from Lowe’s in 2018 as Chairman, President and Chief Executive Officer. Under his leadership as CEO from 2005 to 2018, the company’s revenues grew from $36.5 billion to $68.6 billion, and Lowe’s built a major digital business to expand the reach of its national stores. The company’s share price also more than tripled from the time of his appointment as CEO to the time of his retirement.

Prior to joining Lowe’s, Mr. Niblock had a nine-year career with the accounting firm Ernst & Young LLP.

Mr. Niblock received a BS in Accounting from the University of North Carolina at Charlotte.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board values Mr. Niblock’s significant financial expertise, knowledge of the retail industry and experience in building a digital presence, which will be instrumental to PNC as it expands its digital presence and pursues transformative growth.

| ∎ | Other Public Company Directorships (within past five years): |

ConocoPhillips

Lamb Weston Holdings, Inc.

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 17 |

ITEM 1 — ELECTION OF DIRECTORS

|

Martin Pfinsgraff

Director Since 2018

Age 69

Independent |

Board committees / subcommittee:

∎ Audit

∎ Risk (Chair)

∎ Executive

∎ Compliance

|

Martin Pfinsgraff retired as Senior Deputy Comptroller Large Bank Supervision of the Office of the Comptroller of the Currency (the “OCC”) in February 2017. He held the position of Deputy Comptroller for Credit and Market Risk from 2011 to 2013. Mr. Pfinsgraff served on the Executive Committee of the OCC and as a member of the Senior Supervisors Group, an international committee comprised of supervisors from 10 Organisation for Economic Co-operation and Development (“OECD”) member countries and the European Central Bank.

Prior to his career with the OCC, Mr. Pfinsgraff held various positions from 2000 to 2009 at iJet International, a provider of operating risk management solutions, including Chief Operating Officer and Chief Financial Officer. Mr. Pfinsgraff held various positions with Prudential Financial’s operating subsidiaries from 1989 through 2000, including as Treasurer of Prudential Insurance and CFO and President, Capital Markets of Prudential Securities.

Mr. Pfinsgraff received a BBA in Psychology from Allegheny College and an MBA from Harvard Business School.

| ∎ | Experience, Qualifications, Attributes or Skills: |

The Board values Mr. Pfinsgraff’s leadership experience as well as his extensive knowledge of the financial services industry and the regulatory requirements applicable to the industry. His experience in banking regulation, risk management and finance, along with his years of executive leadership, provide the Board with additional skills to oversee complex regulatory, risk management and financial matters.

| 18 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

|

Bryan S. Salesky

Director Since 2021

Age 43

Independent |

Board committees:

∎ Corporate Responsibility

∎ Technology

|

Bryan S. Salesky is a co-founder and has served as the Chief Executive Officer of Stack AV Co., a developer and provider of advanced autonomous systems designed to meet the safety, reliability and efficiency demands of the trucking industry, since the company’s inception in 2023. Mr. Salesky founded and served as the CEO of Argo AI, LLC, a self-driving technology platform company that partnered with leading automakers to develop the software, hardware, maps and cloud-support infrastructure to power self-driving vehicles, from 2016 to 2022. Previously, Mr. Salesky spent more than a decade in roles of increasing responsibility across leading technology companies, including Google and Carnegie Mellon University’s National Robotics Engineering Center (“NREC”).

Mr. Salesky brings significant experience across the robotics and software engineering disciplines. In addition to co-leading Carnegie Mellon University’s team that won the 2007 DARPA Urban Challenge autonomous vehicle race, he managed a portfolio of NREC’s largest commercial programs, including autonomous mining trucks for Caterpillar. While at Google, Mr. Salesky was responsible for the development and manufacture of the company’s self-driving hardware portfolio, which included self-driving sensors, computers and several vehicle development programs.

Mr. Salesky is chair of the board of directors of the Greater Pittsburgh Chamber of Commerce, a member of the board of directors of the Allegheny Conference on Community Development, and serves on the board of trustees of the University of Pittsburgh.

Mr. Salesky received a BS in Computer Engineering from the University of Pittsburgh.

| ∎ | Experience, Qualifications, Attributes or Skills: |

Mr. Salesky has built a reputation for strategic vision and entrepreneurism in the technology and artificial intelligence industries. The Board believes these skills are particularly valuable to PNC as it continues to invest in new product innovation and growth. The Board also values Mr. Salesky’s active involvement in the Pittsburgh community.

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 19 |

CORPORATE GOVERNANCE

Our Board and executive management seek to manage PNC for the long-term, to maximize shareholder value and opportunities for growth, through all phases of the economic cycle. In furtherance of this objective, the Board is committed to maintaining strong corporate governance practices that help protect PNC’s value for its shareholders and other stakeholders.

Corporate governance guidelines

The Board has approved corporate governance guidelines to define certain important principles of our Board governance and areas of responsibility, as summarized below.

| ∎ | The qualifications a director should possess |

| ∎ | The director nomination process |

| ∎ | The Board’s leadership structure |

| ∎ | The responsibilities of our lead independent director (the “Presiding Director”) |

| ∎ | The role of Board committees in fulfilling the Board’s duties |

| ∎ | A description of ordinary course relationships that will not impair a director’s independence |

| ∎ | The ability of the Board to meet in executive session without management present |

| ∎ | The ability of the Board to have access to management |

| ∎ | The majority voting requirement for director elections |

| ∎ | The mandatory director retirement age of 72 |

| ∎ | How the Board evaluates our CEO’s performance |

| ∎ | The Board’s role in management succession planning |

| ∎ | Our views on directors holding board positions at other public companies |

| ∎ | How the Board continually evaluates its own performance and composition |

| ∎ | Our approach to director orientation and education |

| ∎ | The Board’s role in strategic planning and oversight of our strategy, including the risks and opportunities flowing from the environmental, social and governance issues material to our business |

The Nominating and Governance Committee reviews the corporate governance guidelines at least annually. Any changes recommended by the Committee are reviewed and approved by the Board. Through the Nominating and Governance Committee, the Board periodically considers its corporate governance policies and practices and evolving best practices based on PNC’s organizational structure.

|

u |

For more information about corporate governance at PNC, see the following documents available at www.pnc.com/corporategovernance:

∎ Corporate governance guidelines

∎ Bylaws

∎ Code of Business Conduct and Ethics

∎ Charters of the following Board committees: Audit, Human Resources, Nominating and Governance, and Risk

|

To receive free printed copies of any of these documents, please send a request to:

Corporate Secretary The PNC Financial Services Group, Inc. 300 Fifth Avenue Pittsburgh, Pennsylvania 15222 or corporate.secretary@pnc.com

This proxy statement is also available at www.pnc.com/proxystatement

|

| 20 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

CORPORATE GOVERNANCE

Our Board leadership structure

Based on an assessment of PNC’s business, organizational structure and strategic direction, as well as the composition, skills and qualifications of the Board as a whole, the Board believes the board leadership structure for PNC should include the following attributes:

|

|

∎ A substantial majority (at least two-thirds) of independent directors

∎ A Presiding Director who serves as the lead independent director

∎ Regular executive sessions of all independent directors without management present

|

|

As described in more detail below, the current leadership structure of the Board includes all three attributes.

Defining leadership roles

As one of its key responsibilities, the Board monitors and, as needed, updates its leadership structure to promote robust independent oversight of PNC and an engaged and effective board with complementary qualities.

The Board believes its leadership structure should be flexible enough to accommodate different circumstances. Accordingly, our governing documents permit the roles of Chair and CEO to be filled by the same or different individuals, and the Board has not adopted a policy with respect to the separation of the Chair and CEO positions. However, to maintain robust independent leadership on the Board, our corporate governance guidelines provide that the Board shall appoint a Presiding Director to function as its lead independent director, and that the Presiding Director also shall serve as the chair of the Nominating and Governance Committee.

The Board reviews its leadership structure each year and may choose a different leadership structure if circumstances should arise that lead the Board to conclude that a different leadership structure would enable the Board to manage PNC more effectively for the long-term interests of our shareholders. The Board determines whether to separate the Chair and CEO positions as necessary or appropriate, in its judgment, including but not limited to when selecting a new CEO. The Board considers a range of factors, including: (i) the individuals serving in the roles of CEO, Chair, and Presiding Director and their record of leadership and performance in those roles; (ii) the composition of the Board; (iii) PNC’s operating and financial performance and strategic plans; (iv) any recent or anticipated changes in the CEO role; (v) the effectiveness of the processes and structures for Board interaction with and oversight of management; and (vi) the importance of maintaining a single voice in leadership communications and Board oversight, both internally and with shareholders and other stakeholders.

The Board believes the interests of our shareholders are best served at this time through the current combined Chair and CEO leadership structure, in conjunction with a Presiding Director who has robust oversight and leadership responsibilities. This structure provides the appropriate balance between a Chair and CEO with responsibilities for day-to-day management, Board leadership and setting long-term strategy, and an empowered independent Presiding Director with well-defined responsibilities, such as facilitating the Board’s independent oversight of PNC, conducting the CEO evaluation, promoting a clear understanding and communication between members of senior management and the Board on strategic issues such as management development and succession planning, executive compensation and company performance, and engaging and communicating with shareholders and other stakeholders as appropriate.

| William S. Demchak, our CEO, serves as the Chair of the Board. Andrew T. Feldstein, the chair of the Nominating and Governance Committee, serves as the Presiding Director. Mr. Feldstein also serves as a member of the Risk Committee, where he leverages his expertise in identifying, assessing and managing credit, market and other risks to assist the Committee in performing its risk oversight function. See “—Presiding Director responsibilities” below for more information about the duties and responsibilities of the Presiding Director.

|

∎ Substantial majority of independent directors

Robust independent oversight is one of the cornerstones of PNC’s strong corporate governance practices. We have long maintained a Board with a substantial majority of directors who are not PNC employees and who otherwise qualify as independent under the corporate governance rules of the New York Stock Exchange (the “NYSE”). The NYSE requires at least a majority of corporate directors to be independent from management.

| THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement | 21 |

CORPORATE GOVERNANCE

Mr. Demchak is the only director and nominee who is not independent under our corporate governance guidelines and the NYSE’s corporate governance rules, due to his employment by PNC as its CEO. The Board has affirmatively determined that each of the other 11 directors and nominees named in this proxy statement is independent. See “Director and Executive Officer Relationships” in this proxy statement for a description of our annual evaluation of director independence.

∎ Presiding Director responsibilities

The Presiding Director, as the lead independent director for the Board, is appointed annually. The Presiding Director is charged with supervising various aspects of board operations and governance to promote an independent, engaged and effective board culture. By way of illustration, the Board has approved the following duties and responsibilities for the Presiding Director, which are included in our corporate governance guidelines:

| ∎ | Preside at meetings of the Board in the event of the Chair’s unavailability |

| ∎ | Preside at regularly scheduled executive sessions of the Board’s independent directors |

| ∎ | When the Presiding Director considers it appropriate, convene and preside at meetings or executive sessions of the Board’s independent directors |

| ∎ | If the Board includes non-management directors who are not independent, when the Presiding Director considers it appropriate to do so, will convene and preside at meetings or executive sessions that include such non-management directors |

| ∎ | Confer with the Chair or CEO immediately following the meetings or executive sessions of the Board’s independent or non-management directors to convey the substance of the discussions held during those sessions, subject to any limitations specified by the independent directors |

| ∎ | Act as the principal liaison between the Chair and CEO and the Board’s independent and non-management directors |

| ∎ | Be available for confidential discussions with any director who may have concerns that he or she believes have not been properly considered by the Board |

| ∎ | Following consultation with the Chair and CEO and other directors as appropriate, approve the Board’s meeting agendas in order to promote the effectiveness of the Board’s operation and decision making and help ensure there is sufficient time for discussion of all agenda items |

| ∎ | Be available for consultation and direct communication with major shareholders as appropriate |

| ∎ | Discharge such other responsibilities as the Board’s independent directors may assign from time to time |

During the course of the year, the Presiding Director may suggest, revise or otherwise discuss agenda items for Board meetings with the Chair or CEO. In between meetings, each director is encouraged to raise with the Presiding Director any topics or issues that the director believes should be discussed in executive session.

As chair of the Nominating and Governance Committee, the Presiding Director leads the annual self-evaluation process for the Board and its committees and subcommittee and the annual evaluation of director independence. The Nominating and Governance Committee also reviews, and the Presiding Director as chair of the Committee reports to the Board on, developments in corporate governance that may be relevant to PNC.

∎ Regular executive sessions of independent directors

To help sustain a board culture of robust independent oversight, the agenda for each quarterly meeting of the Board includes a regularly scheduled executive session of the independent directors. These sessions provide dedicated time for the independent directors to engage in candid discussions as a group. Pursuant to our corporate governance guidelines, Andrew T. Feldstein, our Presiding Director, presides over these executive sessions.

| 22 | THE PNC FINANCIAL SERVICES GROUP, INC. - 2024 Proxy Statement |

CORPORATE GOVERNANCE

Board’s role in risk oversight

A strong risk culture that effectively informs strategic decisions is central to PNC’s vision for long-term success as a large, complex financial institution.

ERM Framework

PNC’s enterprise-wide risk governance framework (the “ERM Framework”) guides the objectives and design of our risk management processes. The ERM Framework consists of the following seven core components that provide executive management and the Board with an aggregate view of the significant risks impacting the organization: risk culture, enterprise strategy (including risk appetite, strategic planning, capital planning and stress testing), risk governance and oversight, risk identification, risk assessments, risk controls and monitoring, and risk aggregation and reporting. Because we seek to manage PNC for the long term, our ERM Framework and risk appetite primarily address our longer term strategic risks as understood, analyzed and quantified through all phases of the economic cycle. However, a significant focus is also applied to specific risks, such as credit, operational, liquidity, market and information security risks, that could have a material impact in the short or medium term.

| The Board oversees our risk-taking activities, holds management accountable for adhering to the ERM Framework, and is responsible for exercising sound, independent judgment when assessing risk. The Board receives assistance in carrying out its duties by delegations of oversight responsibility to its committees and subcommittee. For more information, see “—Board committees” in this proxy statement.

|

The enterprise policies that form the core components of the ERM Framework are subject to review and approval by the Board’s Risk Committee at least annually. Additionally, the risk management processes that are established from time to time under the ERM Framework to identify, assess, monitor and report the Company’s risks are subject to the oversight and approval of the Risk Committee or its Compliance Subcommittee or, in the case of technology-related risks, the Technology Committee.

Enterprise risk management function

In addition to oversight of PNC’s ERM Framework, the Board’s Risk Committee is directly responsible for the selection, appointment, compensation and oversight of PNC’s Chief Risk Officer. The Chief Risk Officer is the senior executive who is responsible for PNC’s enterprise risk management function and leads PNC’s internal independent risk organization (“Independent Risk Organization”), which is independent from PNC’s lines of business. The Chief Risk Officer also chairs the Enterprise Risk Management Committee, which provides executive-level oversight of risk management and implementation of the Enterprise Risk Profile across the lines of business, as well as emerging risk trends and issues. The Chief Risk Officer and PNC’s Chief Compliance Officer, who reports up through the Chief Risk Officer, provide regular reports to the Risk Committee (or the Compliance Subcommittee, as applicable) regarding the Company’s risk profile; significant existing, new or emerging risks; significant initiatives to identify, manage and control such risks; and the operations of the risk management function.