EX-99.1

Published on May 3, 2017

Exhibit 99.1

ITEM 7 MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

Forward-Looking Statements: From time to time, The PNC Financial Services Group, Inc. (PNC or the Corporation) has made and may continue to make written or oral forward-looking statements regarding our outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position and other matters regarding or affecting us and our future business and operations or the impact of legal, regulatory or supervisory matters on our business operations or performance. This Report and our 2016 Annual Report on Form 10-K (2016 Form 10-K) also includes forward-looking statements. With respect to all such forward-looking statements, you should review our Risk Factors discussion in Item 1A of our 2016 Form 10-K, our Risk Management, Critical Accounting Estimates And Judgments, and Cautionary Statement Regarding Forward-Looking Information sections included in Item 7 of this Report, and Note 19 Legal Proceedings and Note 20 Commitments in the Notes To Consolidated Financial Statements included in Item 8 of this Report for factors that could cause actual results or future events to differ, perhaps materially, from historical performance and from those anticipated in the forward-looking statements included in this Report. See page 45 for a glossary of certain terms used in this Report. In this Report, PNC, we or us refers to The PNC Financial Services Group, Inc. and its subsidiaries on a consolidated basis. References to The PNC Financial Services Group, Inc. or to any of its subsidiaries are specifically made where applicable.

EXECUTIVE SUMMARY

Key Strategic Goals

At PNC we manage our company for the long term. We are focused on the fundamentals of growing customers, loans, deposits and revenue and improving profitability, while investing for the future and managing risk, expenses and capital. We continue to invest in our products, markets and brand, and embrace our commitments to our customers, shareholders, employees and the communities where we do business.

We strive to expand and deepen customer relationships by offering a broad range of deposit, fee-based and credit products and services. We are focused on delivering those products and services to our customers with the goal of addressing their financial objectives and putting customers needs first. Our business model is built on customer loyalty and engagement, understanding our customers financial goals and offering our diverse products and services to help them achieve financial wellbeing. Our approach is concentrated on organically growing and deepening client relationships across our lines of business that meet our risk/return measures.

Our strategic priorities are designed to enhance value over the long term. One of our priorities is to build a leading banking franchise in our underpenetrated geographic markets. We are focused on reinventing the retail banking experience by transforming the retail distribution network and the home lending process for a better customer experience and improved efficiency, and growing our consumer loan portfolio. In addition, we are seeking to attract more of the investable assets of new and existing clients and we continue to focus on expense management while investing in technology to bolster critical business infrastructure and streamline core processes.

Our capital priorities are to support client growth and business investment, maintain appropriate capital in light of economic conditions and the Basel III framework and return excess capital to shareholders, in accordance with the currently effective capital plan included in our Comprehensive Capital Analysis and Review (CCAR) submission to the Board of Governors of the Federal Reserve System (Federal Reserve). For more detail, see the Capital Highlights portion of this Executive Summary and the Liquidity and Capital Management portion of the Risk Management section of this Item 7 and the Supervision and Regulation section in Item 1 Business of our 2016 Form 10-K.

Key Factors Affecting Financial Performance

We face a variety of risks that may impact various aspects of our risk profile from time to time. The extent of such impacts may vary depending on factors such as the current economic, political and regulatory environment, merger and acquisition activity and operational challenges. Many of these risks and our risk management strategies are described in more detail elsewhere in this Report.

Our financial performance is substantially affected by a number of external factors outside of our control, including the following:

| | Domestic and global economic conditions, including the continuity, speed and stamina of the current U.S. economic expansion in general and its impact on our customers in particular; |

| | The monetary policy actions and statements of the Federal Reserve and the Federal Open Market Committee (FOMC); |

| | The level of, and direction, timing and magnitude of movement in, interest rates and the shape of the interest rate yield curve; |

| | The functioning and other performance of, and availability of liquidity in, the capital and other financial markets; |

| | Changes in the competitive and regulatory landscape and in counterparty creditworthiness and performance; |

| | The impact of legislative, regulatory and administrative initiatives and actions, including the form and timing of any further implementation, or changes to, certain reforms enacted by the Dodd-Frank legislation; |

| | The impact of market credit spreads on asset valuations; |

1

| | Asset quality and the ability of customers, counterparties and issuers to perform in accordance with contractual terms; |

| | Loan demand, utilization of credit commitments and standby letters of credit; and |

| | Customer demand for non-loan products and services. |

In addition, our success will depend upon, among other things:

| | Effectively managing capital and liquidity including: |

| | Continuing to maintain and grow our deposit base as a low-cost stable funding source; |

| | Prudent liquidity and capital management to meet evolving regulatory capital, capital planning, stress testing and liquidity standards; and |

| | Actions we take within the capital and other financial markets. |

| | Managing credit risk in our portfolio; |

| | Execution of our strategic priorities; |

| | Our ability to manage and implement strategic business objectives within the changing regulatory environment; |

| | The impact of legal and regulatory-related contingencies; and |

| | The appropriateness of reserves needed for critical accounting estimates and related contingencies. |

For additional information, see the Cautionary Statement Regarding Forward-Looking Information section in this Item 7 and Item 1A Risk Factors in our 2016 Form 10-K.

Income Statement Highlights

Net income for 2016 was $4.0 billion, or $7.30 per diluted common share, a decrease of 4% compared to $4.1 billion, or $7.39 per diluted common share, for 2015.

| | Total revenue decreased $63 million to $15.2 billion. |

| | Net interest income increased $113 million, or 1%, to $8.4 billion. |

| | Net interest margin declined slightly to 2.73% for 2016 compared to 2.74% for 2015. |

| | Noninterest income decreased $176 million, or 3%, to $6.8 billion as growth in fee income was more than offset by a decline in other noninterest income. Noninterest income as a percentage of total revenue was 45% for 2016 and 46% for 2015. |

| | Provision for credit losses increased to $433 million in 2016 compared to $255 million for 2015. |

| | Noninterest expense of $9.5 billion was essentially stable as we continued to focus on disciplined expense management. |

For additional detail, please see the Consolidated Income Statement Review section of this Item 7.

Balance Sheet Highlights

Our balance sheet was strong and well positioned at December 31, 2016 and December 31, 2015.

| | Total loans increased $4.1 billion, or 2%, to $210.8 billion. |

| | Total commercial lending grew $4.4 billion, or 3%. |

| | Total consumer lending decreased $.3 billion. |

| | Total deposits increased $8.2 billion, or 3%, to $257.2 billion. |

| | Investment securities increased $5.4 billion, or 8%, to $75.9 billion. |

For additional detail, see the Consolidated Balance Sheet Review section of this Item 7.

Credit Quality Highlights

Overall credit quality remained relatively stable in 2016 compared to 2015.

| | Nonperforming assets decreased $51 million, or 2%, to $2.4 billion at December 31, 2016 compared to December 31, 2015. |

| | Overall loan delinquencies of $1.6 billion at December 31, 2016 decreased $64 million, or 4%, compared with December 31, 2015. |

| | Net charge-offs of $543 million in 2016 increased compared to net charge-offs of $386 million for 2015. |

For additional detail, see the Credit Risk Management portion of the Risk Management section of this Item 7.

2

Capital Highlights

We maintained a strong capital position and continued to return capital to shareholders.

| | The Transitional Basel III common equity Tier 1 capital ratio was 10.6% at both December 31, 2016 and December 31, 2015. |

| | Pro forma fully phased-in Basel III common equity Tier 1 capital ratio, a non-GAAP financial measure, remained stable at an estimated 10.0% at December 31, 2016 and December 31, 2015 based on the standardized approach rules. |

| | For the full year 2016, we returned $3.1 billion of capital to shareholders through repurchases of 22.8 million common shares for $2.0 billion and dividends on common shares of $1.1 billion, which included an increase of 4 cents in our cash dividend on common stock to 55 cents per share in August 2016. |

See the Liquidity and Capital Management portion of the Risk Management section of this Item 7 for more detail on our 2016 capital and liquidity actions as well as our capital ratios.

Our ability to take certain capital actions, including plans to pay or increase common stock dividends or to repurchase shares under current or future programs, is subject to the results of the supervisory assessment of capital adequacy undertaken by the Federal Reserve as part of the CCAR process. For additional information, see the Supervision and Regulation section in Item 1 Business in our 2016 Form 10-K.

Business Outlook

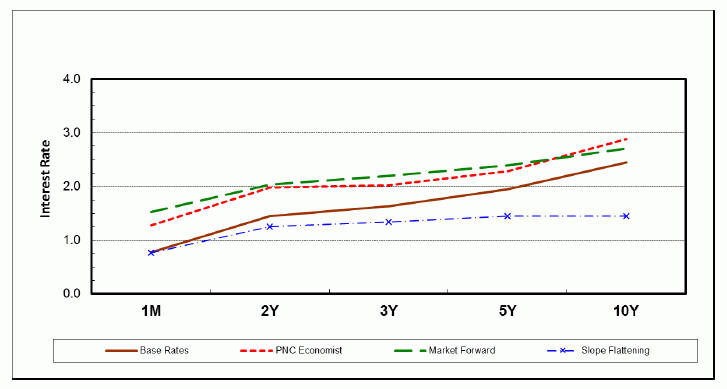

Statements regarding our business outlook are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Our forward-looking statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our current view that the U.S. economy and the labor market will grow moderately in 2017, boosted by stable oil/energy prices, improving consumer spending and housing activity, and expanded federal fiscal policy stimulus as a result of the 2016 elections. Short-term interest rates and bond yields are expected to continue rising in 2017, along with inflation. Specifically, our business outlook reflects our expectation of two 25 basis point increases in short-term interest rates by the Federal Reserve in June and December of 2017. See the Cautionary Statement Regarding Forward-Looking Information section in this Item 7 and Item 1A Risk Factors in our 2016 Form 10-K for other factors that could cause future events to differ, perhaps materially, from those anticipated in these forward-looking statements.

For the full year 2017 compared to full year 2016, we expect:

| | Loan growth to be up mid-single digits, on a percentage basis; |

| | Revenue to increase mid-single digits, on a percentage basis; |

| | Purchase accounting accretion to decline $75 million; |

| | Noninterest expense to increase by low single digits, on a percentage basis; and |

| | The effective tax rate to be approximately 25% to 26%, absent any tax reform. |

In 2017, we expect quarterly other noninterest income to be between $250 million to $275 million, excluding debt securities gains and net Visa activity.

For the first quarter of 2017 compared to the fourth quarter of 2016, we expect:

| | Modest loan growth; |

| | Stable net interest income; |

| | Fee income to decrease by mid-single digits, on a percentage basis, mainly attributable to seasonality and lower first quarter client activity. Fee income consists of asset management, consumer services, corporate services, residential mortgage and service charges on deposits; |

| | Provision for credit losses to be between $75 million and $125 million; and |

| | Noninterest expense to decrease by low single digits, on a percentage basis. |

CONSOLIDATED INCOME STATEMENT REVIEW

Our Consolidated Income Statement is presented in Item 8 of this Report.

Net income for 2016 was $4.0 billion, or $7.30 per diluted common share, a decrease of 4% compared with $4.1 billion, or $7.39 per diluted common share, for 2015. The decrease was driven by higher provision for credit losses and a 3% decline in noninterest income, partially offset by 1% increase in net interest income.

3

Net Interest Income

| Table 1: Summarized Average Balances and Net Interest Income (a) | ||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||

| Year Ended December 31 Dollars in millions |

Average Balances |

Average Yields/Rates |

Interest Income/ Expense |

Average Balances |

Average Yields/Rates |

Interest Income/ Expense |

||||||||||||||||||

| Assets |

||||||||||||||||||||||||

| Interest-earning assets |

||||||||||||||||||||||||

| Investment securities |

$ | 72,046 | 2.62 | % | $ | 1,889 | $ | 61,665 | 2.83 | % | $ | 1,744 | ||||||||||||

| Loans |

208,817 | 3.61 | % | 7,543 | 205,349 | 3.57 | % | 7,333 | ||||||||||||||||

| Interest-earning deposits with banks |

26,328 | .52 | % | 136 | 32,908 | .26 | % | 86 | ||||||||||||||||

| Other |

7,843 | 3.56 | % | 279 | 8,903 | 4.00 | % | 356 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-earning assets/interest income |

$ | 315,034 | 3.13 | % | 9,847 | $ | 308,825 | 3.08 | % | 9,519 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Liabilities |

||||||||||||||||||||||||

| Interest-bearing liabilities |

||||||||||||||||||||||||

| Interest-bearing deposits |

$ | 172,764 | .25 | % | 430 | $ | 163,965 | .25 | % | 403 | ||||||||||||||

| Borrowed funds |

52,939 | 1.57 | % | 831 | 56,513 | 1.14 | % | 642 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-bearing liabilities/interest expense |

$ | 225,703 | .56 | % | 1,261 | $ | 220,478 | .47 | % | 1,045 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net interest income/margin (Non-GAAP) |

2.73 | % | 8,586 | 2.74 | % | 8,474 | ||||||||||||||||||

| Taxable-equivalent adjustments |

(195 | ) | (196 | ) | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Net interest income (GAAP) |

$ | 8,391 | $ | 8,278 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| (a) | Interest income calculated as taxable-equivalent interest income. The interest income earned on certain earning assets is completely or partially exempt from federal income tax. To provide more meaningful comparisons of interest income and yields for all interest-earning assets, as well as net interest margins, we use interest income on a taxable-equivalent basis in calculating average yields and net interest margins by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP on the Consolidated Income Statement. For more information, see the Statistical Information (Unaudited) section in Item 8 of this Report. |

Changes in net interest income and margin result from the interaction of the volume and composition of interest-earning assets and related yields, interest-bearing liabilities and related rates paid, and noninterest-bearing sources of funding. See the Statistical Information (Unaudited) - Average Consolidated Balance Sheet And Net Interest Analysis and Analysis Of Year-To-Year Changes In Net Interest Income in Item 8 of this Report.

Net interest income increased $113 million, or 1%, in 2016 compared with 2015 due to increases in loan and securities balances and higher loan yields, partially offset by an increase in borrowing costs and lower securities yields.

Average investment securities increased due to higher average agency residential mortgage-backed securities and U.S. Treasury and government agency securities, partially offset by a decrease in average non-agency residential mortgage-backed securities. Total investment securities increased to 23% of average interest-earning assets in 2016 compared to 20% in 2015.

The increase in average loans was driven by growth in average commercial real estate loans of $3.6 billion and average commercial loans of $2.2 billion, partially offset by a decrease in consumer loans of $2.6 billion. The decline in consumer loans was primarily attributable to declines in certain run-off consumer loan portfolios. Loans represented 66% of average interest-earning assets in 2016 and 2015.

Average interest-bearing deposits increased $8.8 billion primarily due to higher average savings deposits, which largely reflected a shift from money market deposits to relationship-based savings products, as well as higher average interest-bearing demand deposits. Average interest-bearing deposits increased to 77% of average interest-bearing liabilities in 2016 compared to 74% in 2015.

4

Noninterest Income

Table 2: Noninterest Income

| Year ended December 31 | Change | |||||||||||||||

| Dollars in millions |

2016 | 2015 | $ | % | ||||||||||||

| Noninterest income |

||||||||||||||||

| Asset management |

$ | 1,521 | $ | 1,567 | $ | (46 | ) | (3 | )% | |||||||

| Consumer services |

1,388 | 1,335 | 53 | 4 | % | |||||||||||

| Corporate services |

1,504 | 1,491 | 13 | 1 | % | |||||||||||

| Residential mortgage |

567 | 566 | 1 | | ||||||||||||

| Service charges on deposits |

667 | 651 | 16 | 2 | % | |||||||||||

| Other |

1,124 | 1,337 | (213 | ) | (16 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income |

$ | 6,771 | $ | 6,947 | $ | (176 | ) | (3 | )% | |||||||

|

|

|

|

|

|

|

|||||||||||

Noninterest income as a percentage of total revenue was 45% for 2016 and 46% for 2015.

Asset management revenue decreased mainly due to lower earnings from BlackRock and the impact from a $30 million trust settlement in 2015 in our asset management business segment. Discretionary client assets under management in the Asset Management Group were $137 billion at December 31, 2016 compared with $134 billion at December 31, 2015.

Consumer service fees increased primarily from growth in payment-related products including debit card and credit card, as well as higher brokerage fees.

Corporate service fees increased reflecting higher treasury management fees and a higher benefit from commercial mortgage servicing rights valuation, net of economic hedge, partially offset by lower merger and acquisition advisory fees.

Other noninterest income decreased primarily attributable to the impact of lower net gains on sales of Visa Class B common shares and lower revenue from private equity investments. Net gains on the sale of Visa shares for 2016 were $32 million compared with $166 million in 2015. Net gains on Visa sales include derivative fair value adjustments related to swap agreements with purchasers of Visa shares in connection with all prior sales to date.

Other noninterest income typically fluctuates from period to period depending on the nature and magnitude of transactions completed. Further details regarding our customer-related trading activities are included in the Market Risk Management Customer-Related Trading Risk portion of the Risk Management section of this Item 7. Further details regarding private and other equity investments are included in the Market Risk Management Equity and Other Investment Risk section, and further details regarding gains or losses related to our equity investment in BlackRock are included in the Business Segments Review section of this Item 7.

Provision for Credit Losses

The provision for credit losses increased to $433 million in 2016 compared with $255 million in 2015, primarily attributable to a higher provision for energy related loans in the oil, gas, and coal sectors. Additionally, overall credit portfolio performance and loan growth contributed to the higher provision.

The Credit Risk Management portion of the Risk Management section of this Item 7 includes additional information regarding factors impacting the provision for credit losses.

Noninterest Expense

Table 3: Noninterest Expense

| Year ended December 31 | Change | |||||||||||||||

| Dollars in millions |

2016 | 2015 | $ | % | ||||||||||||

| Noninterest expense |

||||||||||||||||

| Personnel |

$ | 4,841 | $ | 4,831 | $ | 10 | | |||||||||

| Occupancy |

861 | 842 | 19 | 2 | % | |||||||||||

| Equipment |

974 | 925 | 49 | 5 | % | |||||||||||

| Marketing |

247 | 249 | (2 | ) | (1 | )% | ||||||||||

| Other |

2,553 | 2,616 | (63 | ) | (2 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total noninterest expense |

$ | 9,476 | $ | 9,463 | $ | 13 | | |||||||||

|

|

|

|

|

|

|

|||||||||||

5

Noninterest expense increased slightly in the comparison to the prior year as we continued to focus on disciplined expense management. The increase reflected higher 2016 contributions to the PNC Foundation, a new FDIC deposit insurance surcharge and investments in technology and business infrastructure mostly offset by net lower contingency accruals.

During 2016, we completed actions and achieved our 2016 continuous improvement program savings goal of $400 million, which largely funded our investments in technology and business infrastructure. In 2017, we have a goal of $350 million in cost savings through our continuous improvement program, which we expect will substantially fund our 2017 business and technology investments.

Effective Income Tax Rate

The effective income tax rate was 24.1% for 2016 compared with 24.8% for 2015. The effective tax rate is generally lower than the statutory rate primarily due to tax credits we receive from our investments in low income housing and new markets investments, as well as earnings in other tax exempt investments. The decline in the comparison reflected the tax favorability of the 2016 PNC Foundation contributions.

CONSOLIDATED BALANCE SHEET REVIEW

Table 4: Summarized Balance Sheet Data

| December 31 | December 31 | Change | ||||||||||||||

| Dollars in millions |

2016 | 2015 | $ | % | ||||||||||||

| Assets |

||||||||||||||||

| Interest-earning deposits with banks |

$ | 25,711 | $ | 30,546 | $ | (4,835 | ) | (16 | )% | |||||||

| Loans held for sale |

2,504 | 1,540 | 964 | 63 | % | |||||||||||

| Investment securities |

75,947 | 70,528 | 5,419 | 8 | % | |||||||||||

| Loans |

210,833 | 206,696 | 4,137 | 2 | % | |||||||||||

| Allowance for loan and lease losses |

(2,589 | ) | (2,727 | ) | 138 | 5 | % | |||||||||

| Mortgage servicing rights |

1,758 | 1,589 | 169 | 11 | % | |||||||||||

| Goodwill |

9,103 | 9,103 | | | ||||||||||||

| Other, net |

43,113 | 41,218 | 1,895 | 5 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 366,380 | $ | 358,493 | $ | 7,887 | 2 | % | ||||||||

| Liabilities |

||||||||||||||||

| Deposits |

$ | 257,164 | $ | 249,002 | $ | 8,162 | 3 | % | ||||||||

| Borrowed funds |

52,706 | 54,532 | (1,826 | ) | (3 | )% | ||||||||||

| Other |

9,656 | 8,979 | 677 | 8 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

319,526 | 312,513 | 7,013 | 2 | % | |||||||||||

| Equity |

||||||||||||||||

| Total shareholders equity |

45,699 | 44,710 | 989 | 2 | % | |||||||||||

| Noncontrolling interests |

1,155 | 1,270 | (115 | ) | (9 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total equity |

46,854 | 45,980 | 874 | 2 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

$ | 366,380 | $ | 358,493 | $ | 7,887 | 2 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

The summarized balance sheet data in Table 4 is based upon our Consolidated Balance Sheet in Item 8 of this Report.

Our balance sheet reflected asset growth compared to December 31, 2015 and we maintained strong liquidity and capital positions at December 31, 2016.

| | Total assets increased primarily due to higher investment securities and loan balances, partially offset by lower interest-earning deposits with banks. |

| | Higher total liabilities were driven by deposit growth. |

| | The increase to total equity reflected increased retained earnings driven by net income, partially offset by share repurchases. |

The following discussion provides additional information about the major components of our balance sheet. Information regarding our capital and regulatory compliance is included in the Liquidity and Capital Management portion of the Risk Management section of this Item 7 and in Note 18 Regulatory Matters in our Notes To Consolidated Financial Statements included in this Report.

6

Loans

Table 5: Details of Loans

| December 31 | December 31 | Change | ||||||||||||||

| Dollars in millions |

2016 | 2015 | $ | % | ||||||||||||

| Commercial lending |

||||||||||||||||

| Commercial |

||||||||||||||||

| Manufacturing |

$ | 18,891 | $ | 19,014 | $ | (123 | ) | (1 | )% | |||||||

| Retail/wholesale trade |

16,752 | 16,661 | 91 | 1 | % | |||||||||||

| Service providers |

14,707 | 13,970 | 737 | 5 | % | |||||||||||

| Real estate related (a) |

11,920 | 11,659 | 261 | 2 | % | |||||||||||

| Health care |

9,491 | 9,210 | 281 | 3 | % | |||||||||||

| Financial services |

7,241 | 7,234 | 7 | | ||||||||||||

| Other industries |

22,362 | 20,860 | 1,502 | 7 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total commercial |

101,364 | 98,608 | 2,756 | 3 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Commercial real estate |

29,010 | 27,468 | 1,542 | 6 | % | |||||||||||

| Equipment lease financing |

7,581 | 7,468 | 113 | 2 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total commercial lending |

137,955 | 133,544 | 4,411 | 3 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Consumer lending |

||||||||||||||||

| Home equity |

29,949 | 32,133 | (2,184 | ) | (7 | )% | ||||||||||

| Residential real estate |

15,598 | 14,411 | 1,187 | 8 | % | |||||||||||

| Credit card |

5,282 | 4,862 | 420 | 9 | % | |||||||||||

| Other consumer |

||||||||||||||||

| Automobile |

12,380 | 11,157 | 1,223 | 11 | % | |||||||||||

| Education |

5,159 | 5,881 | (722 | ) | (12 | )% | ||||||||||

| Other |

4,510 | 4,708 | (198 | ) | (4 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total consumer lending |

72,878 | 73,152 | (274 | ) | | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total loans |

$ | 210,833 | $ | 206,696 | $ | 4,137 | 2 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| (a) | Includes loans to customers in the real estate and construction industries. |

Loan growth was the result of an increase in total commercial lending from higher commercial and commercial real estate loans. Consumer lending declined due to lower home equity and education loans, partially offset by higher automobile loans, residential real estate loans and credit cards.

See the Credit Risk Management portion of the Risk Management section of this Item 7 and Note 1 Accounting Policies, Note 3 Asset Quality and Note 4 Allowances for Loan and Lease Losses in our Notes To Consolidated Financial Statements included in Item 8 of this Report for additional information regarding our loan portfolio.

7

Investment Securities

Table 6: Investment Securities

| December 31, 2016 | December 31, 2015 | Ratings (a) As of December 31, 2016 | ||||||||||||||||||||||||||||||||||

| Dollars in millions |

Amortized Cost |

Fair Value | Amortized Cost |

Fair Value |

AAA/ AA |

A | BBB | BB and Lower |

No Rating |

|||||||||||||||||||||||||||

| U.S. Treasury and government agencies |

$ | 13,627 | $ | 13,714 | $ | 10,022 | $ | 10,172 | 100 | % | ||||||||||||||||||||||||||

| Agency residential mortgage-backed |

37,319 | 37,109 | 34,250 | 34,408 | 100 | |||||||||||||||||||||||||||||||

| Non-agency residential mortgage-backed |

3,382 | 3,564 | 4,225 | 4,392 | 11 | 4 | % | 76 | % | 9 | % | |||||||||||||||||||||||||

| Agency commercial mortgage-backed |

3,053 | 3,046 | 3,045 | 3,086 | 100 | |||||||||||||||||||||||||||||||

| Non-agency commercial mortgage-backed (b) |

4,590 | 4,602 | 5,624 | 5,630 | 82 | 6 | % | 2 | 1 | 9 | ||||||||||||||||||||||||||

| Asset-backed (c) |

6,496 | 6,524 | 6,134 | 6,130 | 84 | 5 | 3 | 7 | 1 | |||||||||||||||||||||||||||

| Other debt (d) |

6,679 | 6,810 | 6,147 | 6,355 | 73 | 16 | 7 | 1 | 3 | |||||||||||||||||||||||||||

| Corporate stock and other |

603 | 601 | 590 | 589 | 100 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total investment securities (e) |

$ | 75,749 | $ | 75,970 | $ | 70,037 | $ | 70,762 | 91 | % | 2 | % | 1 | % | 4 | % | 2 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| (a) | Ratings percentages allocated based on amortized cost. |

| (b) | Collateralized primarily by retail properties, office buildings, lodging properties and multi-family housing. |

| (c) | Collateralized primarily by corporate debt, government guaranteed education loans and other consumer credit products. |

| (d) | Includes state and municipal securities. |

| (e) | Includes available for sale and held to maturity securities. |

Investment securities increased $5.4 billion at December 31, 2016 compared to December 31, 2015. Growth in investment securities was driven by net purchases of U.S. Treasury and government agencies and agency residential mortgage-backed securities, partially offset by prepayments of non-agency commercial mortgage-backed and non-agency residential mortgage-backed securities.

Table 6 presents the distribution of our investment securities portfolio by credit rating. We have included credit ratings information because we believe that the information is an indicator of the degree of credit risk to which we are exposed, which could affect our risk-weighted assets and, therefore, our risk-based regulatory capital ratios under the regulatory capital rules. Changes in credit ratings classifications could indicate increased or decreased credit risk and could be accompanied by a reduction or increase in the fair value of our investment securities portfolio.

At least quarterly, we conduct a comprehensive security-level impairment assessment on all securities. If economic conditions, including home prices, were to deteriorate from current levels, and if market volatility and liquidity were to deteriorate from current levels, or if market interest rates were to increase or credit spreads were to widen appreciably, the valuation of our investment securities portfolio would likely be adversely affected and we could incur additional OTTI credit losses that would impact our Consolidated Income Statement.

The duration of investment securities was 3.0 years at December 31, 2016. We estimate that at December 31, 2016 the effective duration of investment securities was 3.1 years for an immediate 50 basis points parallel increase in interest rates and 2.9 years for an immediate 50 basis points parallel decrease in interest rates. Comparable amounts at December 31, 2015 for the effective duration of investment securities were 2.8 years and 2.6 years, respectively.

Based on expected prepayment speeds, the weighted-average expected maturity of the investment securities portfolio (excluding corporate stock and other) was 5.0 years at December 31, 2016 compared to 4.8 years at December 31, 2015.

Table 7: Weighted-Average Expected Maturities of Mortgage and Other Asset-Backed Debt Securities

| December 31, 2016 |

Years | |||

| Agency residential mortgage-backed |

5.2 | |||

| Non-agency residential mortgage-backed |

5.8 | |||

| Agency commercial mortgage-backed |

3.5 | |||

| Non-agency commercial mortgage-backed |

3.5 | |||

| Asset-backed |

2.5 | |||

Additional information regarding our investment securities is included in Note 5 Investment Securities and Note 6 Fair Value in the Notes To Consolidated Financial Statements included in this Report.

8

Funding Sources

Table 8: Details of Funding Sources

| December 31 | December 31 | Change | ||||||||||||||

| Dollars in millions |

2016 | 2015 | $ | % | ||||||||||||

| Deposits |

||||||||||||||||

| Money market |

$ | 105,849 | $ | 118,079 | $ | (12,230 | ) | (10 | )% | |||||||

| Demand |

96,799 | 90,038 | 6,761 | 8 | % | |||||||||||

| Savings |

36,956 | 20,375 | 16,581 | 81 | % | |||||||||||

| Time deposits |

17,560 | 20,510 | (2,950 | ) | (14 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

257,164 | 249,002 | 8,162 | 3 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Borrowed funds |

||||||||||||||||

| FHLB borrowings |

17,549 | 20,108 | (2,559 | ) | (13 | )% | ||||||||||

| Bank notes and senior debt |

22,972 | 21,298 | 1,674 | 8 | % | |||||||||||

| Subordinated debt |

8,009 | 8,556 | (547 | ) | (6 | )% | ||||||||||

| Other |

4,176 | 4,570 | (394 | ) | (9 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total borrowed funds |

52,706 | 54,532 | (1,826 | ) | (3 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total funding sources |

$ | 309,870 | $ | 303,534 | $ | 6,336 | 2 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

Total deposits increased in the comparison mainly due to strong growth in demand and savings deposits which reflected in part a shift from money market deposits to relationship-based savings products. Total borrowed funds decreased in the comparison due to maturities of FHLB borrowings, partially offset by higher bank notes and senior debt.

See the Liquidity and Capital Management portion of the Risk Management section of this Item 7 for additional information regarding our 2016 capital and liquidity activities.

Shareholders Equity

Total shareholders equity as of December 31, 2016 grew $1.0 billion compared to December 31, 2015 due to an increase in retained earnings and higher capital surplus, which included the issuance of Series S preferred stock, partially offset by common share repurchases of $2.0 billion and a decrease in accumulated other comprehensive income primarily related to net unrealized securities losses. The growth in retained earnings resulted from 2016 net income of $4.0 billion, reduced by $1.3 billion of common and preferred dividends declared. Common shares outstanding were 485 million and 504 million at December 31, 2016, and December 31, 2015, respectively, reflecting repurchases of 22.8 million shares during 2016.

BUSINESS SEGMENTS REVIEW

Effective for the first quarter of 2017, as a result of changes to how we manage our businesses, we realigned our segments and, accordingly, have changed the basis of presentation of our segments, resulting in four reportable business segments:

| | Retail Banking |

| | Corporate & Institutional Banking |

| | Asset Management Group |

| | BlackRock |

Our changes in business segment presentation resulting from the realignment included the following:

| | The Residential Mortgage Banking segment was combined into Retail Banking as a result of our strategic initiative to transform the home lending process by integrating mortgage and home equity lending to enhance product capability and speed of delivery for a better customer experience and to improve efficiency. In conjunction with this shift, residential mortgages previously reported within the Other category were also moved to Retail Banking. |

| | The Non-Strategic Assets Portfolio segment was eliminated. The segments remaining consumer assets were moved to the Other category as they are unrelated to the ongoing strategy of any segment, while its commercial assets were transferred to Corporate & Institutional Banking in order to continue the relationships we have with those customers. |

| | A portion of business banking clients was moved from Retail Banking to Corporate & Institutional Banking to facilitate enhanced product offerings to meet the financial needs of our business banking clients. |

Net interest income in business segment results reflects our internal funds transfer pricing methodology. Assets receive a funding charge and liabilities and capital receive a funding credit based on a transfer pricing methodology that incorporates product repricing characteristics, tenor and other factors. Effective for the first quarter of 2017, we made certain adjustments to our internal funds transfer pricing methodology primarily relating to weighted average lives of certain non-maturity deposits based on our recent historical experience. These changes in methodology affected business segment results, primarily adversely impacting net interest income for Corporate & Institutional Banking and Retail Banking, offset by increased net interest income in the Other category.

9

All periods presented were revised to conform to the new segment alignment and to our change in internal funds transfer pricing methodology.

Business segment results and a description of each business are included in Note 22 Segment Reporting included in the Notes To Consolidated Financial Statements in Item 8 of this Report. Certain amounts included in this Business Segments Review differ from those amounts shown in Note 22, primarily due to the presentation in this Item 7 of business net interest revenue on a taxable-equivalent basis. Note 22 presents results of businesses for 2016, 2015 and 2014.

Total business segment financial results differ from total consolidated net income. The impact of these differences is reflected in the Other category in the business segment tables. Other includes residual activities that do not meet the criteria for disclosure as a separate reportable business, such as gains or losses related to BlackRock transactions, integration costs, asset and liability management activities including net securities gains or losses, other-than-temporary impairment of investment securities and certain trading activities, exited businesses, certain non-strategic runoff consumer loan portfolios, private equity investments, intercompany eliminations, most corporate overhead, tax adjustments that are not allocated to business segments and differences between business segment performance reporting and financial statement reporting (GAAP), including the presentation of net income attributable to noncontrolling interests as the segments results exclude their portion of net income attributable to noncontrolling interests.

Retail Banking (Unaudited)

Table 9: Retail Banking Table

| Year ended December 31 | Change | |||||||||||||||

| Dollars in millions, except as noted |

2016 | 2015 | $ | % | ||||||||||||

| Income Statement |

||||||||||||||||

| Net interest income |

$ | 4,511 | $ | 4,308 | $ | 203 | 5 | % | ||||||||

| Noninterest income |

2,693 | 2,781 | (88 | ) | (3 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

7,204 | 7,089 | 115 | 2 | % | |||||||||||

| Provision for credit losses |

297 | 253 | 44 | 17 | % | |||||||||||

| Noninterest expense |

5,291 | 5,444 | (153 | ) | (3 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Pretax earnings |

1,616 | 1,392 | 224 | 16 | % | |||||||||||

| Income taxes |

593 | 508 | 85 | 17 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Earnings |

$ | 1,023 | $ | 884 | $ | 139 | 16 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Average Balance Sheet |

||||||||||||||||

| Loans held for sale |

$ | 942 | $ | 1,111 | $ | (169 | ) | (15 | )% | |||||||

| Loans |

||||||||||||||||

| Consumer |

||||||||||||||||

| Home equity |

$ | 26,204 | $ | 27,657 | $ | (1,453 | ) | (5 | )% | |||||||

| Automobile |

11,248 | 10,433 | 815 | 8 | % | |||||||||||

| Education |

5,562 | 6,307 | (745 | ) | (12 | )% | ||||||||||

| Credit cards |

4,889 | 4,527 | 362 | 8 | % | |||||||||||

| Other |

1,789 | 1,881 | (92 | ) | (5 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total consumer |

49,692 | 50,805 | (1,113 | ) | (2 | )% | ||||||||||

| Commercial and commercial real estate |

11,410 | 12,011 | (601 | ) | (5 | )% | ||||||||||

| Residential mortgage |

10,682 | 9,618 | 1,064 | 11 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total loans |

$ | 71,784 | $ | 72,434 | $ | (650 | ) | (1 | )% | |||||||

| Total assets |

$ | 85,871 | $ | 86,977 | $ | (1,106 | ) | (1 | )% | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Deposits |

||||||||||||||||

| Noninterest-bearing demand |

$ | 28,364 | $ | 25,106 | $ | 3,258 | 13 | % | ||||||||

| Interest-bearing demand |

38,584 | 36,005 | 2,579 | 7 | % | |||||||||||

| Money market |

44,855 | 53,520 | (8,665 | ) | (16 | )% | ||||||||||

| Savings |

27,340 | 14,358 | 12,982 | 90 | % | |||||||||||

| Certificates of deposit |

14,770 | 16,488 | (1,718 | ) | (10 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

$ | 153,913 | $ | 145,477 | $ | 8,436 | 6 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Performance Ratios |

||||||||||||||||

| Return on average assets |

1.19 | % | 1.02 | % | ||||||||||||

| Noninterest income to total revenue |

37 | % | 39 | % | ||||||||||||

| Efficiency |

73 | % | 77 | % | ||||||||||||

|

|

|

|

|

|||||||||||||

10

| Change | ||||||||||||||||

| Dollars in millions, except as noted |

2016 | 2015 | $ | % | ||||||||||||

| Supplemental Noninterest Income Information |

|

|||||||||||||||

| Consumer services |

$ | 1,061 | $ | 1,015 | $ | 46 | 5 | % | ||||||||

| Brokerage |

$ | 295 | $ | 284 | $ | 11 | 4 | % | ||||||||

| Residential mortgage |

$ | 567 | $ | 566 | $ | 1 | | |||||||||

| Service charges on deposits |

$ | 639 | $ | 623 | $ | 16 | 3 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Residential Mortgage Information |

||||||||||||||||

| Residential mortgage servicing statistics (in billions, except as noted) (a) |

||||||||||||||||

| Serviced portfolio balance (b) |

$ | 125 | $ | 123 | $ | 2 | 2 | % | ||||||||

| Serviced portfolio acquisitions |

$ | 19 | $ | 29 | $ | (10 | ) | (34 | )% | |||||||

| MSR asset value (b) |

$ | 1.2 | $ | 1.1 | $ | .1 | 9 | % | ||||||||

| MSR capitalization value (in basis points) (b) |

94 | 86 | 8 | 9 | % | |||||||||||

| Servicing income: (in millions) |

||||||||||||||||

| Servicing fees, net (c) |

$ | 192 | $ | 178 | $ | 14 | 8 | % | ||||||||

| Mortgage servicing rights valuation, net of economic hedge |

$ | 92 | $ | 89 | $ | 3 | 3 | % | ||||||||

| Residential mortgage loan statistics |

||||||||||||||||

| Loan origination volume (in billions) |

$ | 10.6 | $ | 10.5 | $ | .1 | 1 | % | ||||||||

| Loan sale margin percentage |

3.17 | % | 3.32 | % | ||||||||||||

| Percentage of originations represented by: |

||||||||||||||||

| Purchase volume (d) |

40 | % | 45 | % | ||||||||||||

| Refinance volume |

60 | % | 55 | % | ||||||||||||

|

|

|

|

|

|||||||||||||

| Other Information (b) |

||||||||||||||||

| Customer-related statistics (average) |

||||||||||||||||

| Non-teller deposit transactions (e) |

49 | % | 43 | % | ||||||||||||

| Digital consumer customers (f) |

58 | % | 52 | % | ||||||||||||

| Credit-related statistics |

||||||||||||||||

| Nonperforming assets (g) |

$ | 1,257 | $ | 1,325 | $ | (68 | ) | (5 | )% | |||||||

| Net charge-offs |

$ | 351 | $ | 347 | $ | 4 | 1 | % | ||||||||

| Other statistics |

||||||||||||||||

| ATMs |

9,024 | 8,956 | 68 | 1 | % | |||||||||||

| Branches (h) |

2,520 | 2,616 | (96 | ) | (4 | )% | ||||||||||

| Universal branches (i) |

526 | 359 | 167 | 47 | % | |||||||||||

| Brokerage account client assets (in billions) (j) |

$ | 44 | $ | 43 | $ | 1 | 2 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| (a) | Represents mortgage loan servicing balances for third parties and the related income. |

| (b) | Presented as of December 31, except for customer-related statistics, which are averages for the year ended, and net charge-offs, which are for the year ended. |

| (c) | Servicing fees net of impact of decrease in MSR value due to passage of time, including the impact from both regularly scheduled loan prepayments and loans that were paid down or paid off during the period. |

| (d) | Mortgages with borrowers as part of residential real estate purchase transactions. |

| (e) | Percentage of total consumer and business banking deposit transactions processed at an ATM or through our mobile banking application. |

| (f) | Represents consumer checking relationships that process the majority of their transactions through non-teller channels. |

| (g) | Includes nonperforming loans of $1.2 billion at both December 31, 2016 and December 31, 2015. |

| (h) | Excludes stand-alone mortgage offices and satellite offices (e.g., drive-ups, electronic branches and retirement centers) that provide limited products and/or services. |

| (i) | Included in total branches, represents branches operating under our Universal model. |

| (j) | Includes cash and money market balances. |

11

Retail Banking earned $1.0 billion in 2016 compared with $884 million for 2015. The increase in earnings was driven by higher net interest income and a decrease in noninterest expense, partially offset by lower noninterest income and increased provision for credit losses.

Net interest income increased in 2016 compared to 2015 due to growth in deposit balances and improved interest rate spread on the value of deposits, partially offset by lower loan balances and interest rate spread compression on the value of loans.

The decline in noninterest income compared to the prior year reflected the impact of lower net gains on sales of Visa Class B common shares in 2016 of $32 million compared with net gains of $166 million in 2015. Net gains on Visa sales include derivative fair value adjustments related to swap agreements with purchasers of Visa Class B common shares in connection with all prior sales to date.

Other forms of noninterest income grew in the comparison, reflecting execution on our strategy to provide diverse product and service offerings. Higher transaction volumes in 2016 contributed to consumer service fee growth from payment-related products, specifically in debit and credit card, as well as increased service charges on deposits and brokerage fees.

The decline in noninterest expense in the comparison was due to lower legal reserves, a decrease in personnel expense, lower residential mortgage foreclosure-related expense, lower marketing expense, and reduced branch network expenses as a result of network transformation and transaction migration to lower cost digital and ATM channels.

Provision for credit losses increased compared to 2015, reflecting overall credit portfolio performance.

The deposit strategy of Retail Banking is to remain disciplined on pricing and focused on growing and retaining relationship-based balances, executing on market specific deposit growth strategies, and providing a source of low-cost funding and liquidity to PNC. In 2016, average total deposits increased compared to 2015, driven by growth in savings deposits reflecting in part a shift from money market deposits to relationship-based savings products. Additionally, demand deposit categories increased, partially offset by a decline in certificates of deposit due to the net runoff of maturing accounts.

Retail Banking continued to focus on a relationship-based lending strategy. The decrease in average total loans in 2016 compared to 2015 was due to a decline in home equity and commercial loans, as well as runoff of certain portions of the portfolios, as more fully described below.

| | Average home equity loans decreased as pay-downs and payoffs on loans exceeded new originated volume. Retail Bankings home equity loan portfolio is relationship based, with over 97% of the portfolio attributable to borrowers in our primary geographic footprint. The weighted-average updated FICO scores for this portfolio were 746 at December 31, 2016 and 752 at December 31, 2015. |

| | Average commercial and commercial real estate loans declined as pay-downs and payoffs on loans exceeded new volume. |

| | Average residential mortgages increased as a result of new volumes exceeding portfolio liquidations. |

| | Average automobile loans, which consisted of both direct and indirect auto loans, increased primarily due to portfolio growth in previously underpenetrated markets. |

| | Average credit card balances increased as a result of organic growth. |

| | In 2016, average loan balances for the education and other loan portfolios declined $837 million, or 10%, compared to 2015, driven by declines in the government guaranteed education and indirect other portfolios, which are primarily runoff portfolios. |

Nonperforming assets decreased compared to December 31, 2015 driven by declines in both consumer and commercial nonperforming loans.

Retail Banking continues to enhance the customer experience with refinements to product offerings that drive product value for consumers and small businesses. We are focused on meeting the financial needs of our customers by providing a broad range of liquidity, banking and investment products.

Retail Banking continued to focus on the strategic priority of transforming the customer experience through transaction migration, branch network transformation, home lending transformation, and multi-channel engagement and service strategies.

| | In 2016, approximately 58% of consumer customers used non-teller channels for the majority of their transactions compared with 52% for 2015. |

| | Deposit transactions via ATM and mobile channels increased to 49% of total deposit transactions in 2016 compared with 43% for 2015. |

| | We had a network of 2,520 branches and 9,024 ATMs at December 31, 2016. Approximately 21% of the branch network operates under the universal model. |

| | Instant debit card issuance, which enables us to print a customers debit card in minutes, was available in 2,207 branches, or 88% of the branch network, as of December 31, 2016. |

| | Mortgage loan originations increased 1% compared to 2015. Loans continue to be originated primarily through direct channels under Federal National Mortgage Association (FNMA), Federal Home Loan Mortgage Corporation (FHLMC) and Federal Housing Administration (FHA)/Department of Veterans Affairs agency guidelines. |

12

Corporate & Institutional Banking (Unaudited)

Table 10: Corporate & Institutional Banking Table

| Year ended December 31 | Change | |||||||||||||||

| Dollars in millions, except as noted |

2016 | 2015 | $ | % | ||||||||||||

| Income Statement |

||||||||||||||||

| Net interest income |

$ | 3,312 | $ | 3,274 | $ | 38 | 1 | % | ||||||||

| Noninterest income |

2,035 | 1,947 | 88 | 5 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

5,347 | 5,221 | 126 | 2 | % | |||||||||||

| Provision for credit losses |

177 | 78 | 99 | 127 | % | |||||||||||

| Noninterest expense |

2,222 | 2,187 | 35 | 2 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Pretax earnings |

2,948 | 2,956 | (8 | ) | | |||||||||||

| Income taxes |

1,039 | 1,064 | (25 | ) | (2 | )% | ||||||||||

|

|

|

|

|

|||||||||||||

| Earnings |

$ | 1,909 | $ | 1,892 | $ | 17 | 1 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Average Balance Sheet |

||||||||||||||||

| Loans held for sale |

$ | 868 | $ | 966 | $ | (98 | ) | (10 | )% | |||||||

| Loans |

||||||||||||||||

| Commercial |

$ | 88,934 | $ | 86,046 | $ | 2,888 | 3 | % | ||||||||

| Commercial real estate |

26,677 | 23,208 | 3,469 | 15 | % | |||||||||||

| Equipment lease financing |

7,463 | 7,570 | (107 | ) | (1 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total commercial lending |

123,074 | 116,824 | 6,250 | 5 | % | |||||||||||

| Consumer |

424 | 869 | (445 | ) | (51 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total loans |

$ | 123,498 | $ | 117,693 | $ | 5,805 | 5 | % | ||||||||

| Total assets |

$ | 140,309 | $ | 133,754 | $ | 6,555 | 5 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Deposits |

||||||||||||||||

| Noninterest-bearing demand |

$ | 48,072 | $ | 49,946 | $ | (1,874 | ) | (4 | )% | |||||||

| Money market |

22,543 | 23,241 | (698 | ) | (3 | )% | ||||||||||

| Interest-bearing demand and other |

13,943 | 10,403 | 3,540 | 34 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

$ | 84,558 | $ | 83,590 | $ | 968 | 1 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Performance Ratios |

||||||||||||||||

| Return on average assets |

1.36 | % | 1.41 | % | ||||||||||||

| Noninterest income to total revenue |

38 | % | 37 | % | ||||||||||||

| Efficiency |

42 | % | 42 | % | ||||||||||||

|

|

|

|

|

|||||||||||||

| Other Information |

||||||||||||||||

| Commercial loan servicing portfolio (in billions) (a) (b) |

$ | 487 | $ | 447 | $ | 40 | 9 | % | ||||||||

| Consolidated revenue from: (c) |

||||||||||||||||

| Treasury Management (d) |

$ | 1,348 | $ | 1,166 | $ | 182 | 16 | % | ||||||||

| Capital Markets (d) |

$ | 808 | $ | 813 | $ | (5 | ) | (1 | )% | |||||||

| Commercial mortgage banking activities |

||||||||||||||||

| Commercial mortgage loans held for sale (e) |

$ | 127 | $ | 140 | $ | (13 | ) | (9 | )% | |||||||

| Commercial mortgage loan servicing income (f) |

248 | 250 | (2 | ) | (1 | )% | ||||||||||

| Commercial mortgage servicing rights valuation, net of economic hedge (g) |

44 | 28 | 16 | 57 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 419 | $ | 418 | $ | 1 | | |||||||||

| Net carrying amount of commercial mortgage servicing rights (a) |

$ | 576 | $ | 526 | $ | 50 | 10 | % | ||||||||

| Average Loans (by C&IB business) |

||||||||||||||||

| Corporate Banking |

$ | 51,392 | $ | 50,375 | $ | 1,017 | 2 | % | ||||||||

| Real Estate |

36,493 | 31,312 | 5,181 | 17 | % | |||||||||||

| Business Credit |

14,763 | 14,615 | 148 | 1 | % | |||||||||||

| Equipment Finance |

11,826 | 11,584 | 242 | 2 | % | |||||||||||

| Commercial Banking |

7,159 | 7,685 | (526 | ) | (7 | )% | ||||||||||

| Other |

1,865 | 2,122 | (257 | ) | (12 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total average loans |

$ | 123,498 | $ | 117,693 | $ | 5,805 | 5 | % | ||||||||

| Credit-related statistics |

||||||||||||||||

| Nonperforming assets (a) (h) |

$ | 691 | $ | 584 | $ | 107 | 18 | % | ||||||||

| Net charge-offs |

$ | 180 | $ | 21 | $ | 159 | * | |||||||||

|

|

|

|

|

|

|

|||||||||||

* - Not meaningful.

| (a) | As of December 31. |

| (b) | Represents loans serviced for PNC and others. |

| (c) | Represents consolidated amounts. See the additional revenue discussion regarding treasury management, capital markets-related products and services, and commercial mortgage banking activities in the Product Revenue section of the Corporate & Institutional Banking portion of this Business Segments Review section. |

| (d) | Includes amounts reported in net interest income, corporate service fees and other noninterest income. |

| (e) | Includes other noninterest income for valuations on commercial mortgage loans held for sale and related commitments, derivative valuations, origination fees, gains on sale of loans held for sale and net interest income on loans held for sale. |

| (f) | Includes net interest income and noninterest income (primarily in corporate services fees) from loan servicing net of reduction in commercial mortgage servicing rights due to time decay and payoffs. Commercial mortgage servicing rights valuation, net of economic hedge is shown separately. |

| (g) | Amounts reported in corporate service fees. |

| (h) | Includes nonperforming loans of $.6 billion at December 31, 2016 and $.5 billion at December 31, 2015. |

13

Corporate & Institutional Banking earned $1.9 billion in both 2016 and 2015. Earnings remained stable as higher revenue was offset by an increase in the provision for credit losses. We continue to focus on building client relationships with appropriate risk-return profiles.

Net interest income increased modestly compared with 2015, reflecting the impacts of higher average loans and interest rate spread expansion on deposits, as well as interest rate spread compression on loans.

Growth in noninterest income in the comparison was driven by higher treasury management fees, an equity investment gain in 2016, increased fees from underwriting activities and higher structuring fees on asset securitizations. These increases were partially offset by lower merger and acquisition advisory fees.

Overall credit quality in 2016 remained relatively stable, except for deterioration related to certain energy related loans, which was the primary driver for the increase in provision for credit losses, net charge-offs and nonperforming assets in the year over year comparisons. Increased provision for credit losses also reflected the impact of continued loan growth.

Noninterest expense increased nominally in the comparison reflecting disciplined expense management.

Average loans increased in 2016 compared with 2015 due to strong growth in Real Estate:

| | PNC Real Estate provides banking, financing and servicing solutions for commercial real estate clients across the country. Higher average loans for this business were primarily due to growth in both commercial real estate and commercial lending. |

| | Corporate Banking provides lending, treasury management and capital markets-related products and services to midsized and large corporations, government and not-for-profit entities. Average loans for this business increased in the comparison reflecting increased lending to large corporate clients partially offset by the impact of capital and liquidity management activities. |

| | PNC Business Credit provides asset-based lending. The loan portfolio is relatively high yielding, with acceptable risk as the loans are mainly secured by short-term assets. Average loans for this business increased in the comparison due to new originations. |

| | PNC Equipment Finance provides equipment financing solutions for clients throughout the U.S. and Canada. Average loans, including commercial loans and finance leases, and operating leases were $12.6 billion in 2016, compared with $12.4 billion in 2015. |

| | Commercial Banking provides lending, treasury management and capital markets-related products and services to smaller corporations and businesses. Average loans for this business decreased in the comparison primarily due to the impact of capital management activities. |

Average deposits increased modestly compared with 2015, as growth in other deposits, driven by interest-bearing demand deposit growth, was mostly offset by decreases in noninterest-bearing demand deposits and money market deposits.

Growth in the commercial loan servicing portfolio was reflected by servicing additions from new and existing customers exceeding portfolio run-off.

Product Revenue

In addition to credit and deposit products for commercial customers, Corporate & Institutional Banking offers other services, for customers of all business segments, including treasury management, capital markets-related products and services, and commercial mortgage banking activities. On a consolidated basis, the revenue from these other services is included in net interest income, corporate service fees and other noninterest income. From a segment perspective, the majority of the revenue and expense related to these services is reflected in the Corporate & Institutional Banking segment results and the remainder is reflected in the results of other businesses. The Other Information section in Table 10 includes the consolidated revenue to PNC for these services. A discussion of the consolidated revenue from these services follows.

Treasury management revenue consists of fees and net interest income from customer deposit balances. Compared with 2015, revenue from treasury management increased driven by liquidity-related revenue associated with customer deposit balances and interest rate spread expansion.

Capital markets-related products and services include foreign exchange, derivatives, securities, loan syndications, mergers and acquisitions advisory and equity capital markets advisory related services. Revenue from capital markets-related products and services decreased slightly in the comparison as both lower merger and acquisition advisory fees and loan syndication fees were mostly offset by increased fees from underwriting activities and higher structuring fees on asset securitizations.

Commercial mortgage banking activities include revenue derived from commercial mortgage servicing (including net interest income and noninterest income) and revenue derived from commercial mortgage loans held for sale and related hedges. Total commercial mortgage banking activities increased marginally in the comparison as a higher benefit from commercial mortgage servicing rights valuation, net of economic hedge, was mostly offset by lower revenue from commercial mortgage loans held for sale.

14

Asset Management Group (Unaudited)

Table 11: Asset Management Group Table

| Year ended December 31 | Change | |||||||||||||||

| Dollars in millions, except as noted |

2016 | 2015 | $ | % | ||||||||||||

| Income Statement |

||||||||||||||||

| Net interest income |

$ | 300 | $ | 292 | $ | 8 | 3 | % | ||||||||

| Noninterest income |

851 | 869 | (18 | ) | (2 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

1,151 | 1,161 | (10 | ) | (1 | )% | ||||||||||

| Provision for credit losses (benefit) |

(6 | ) | 9 | (15 | ) | (167 | )% | |||||||||

| Noninterest expense |

825 | 846 | (21 | ) | (2 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Pretax earnings |

332 | 306 | 26 | 8 | % | |||||||||||

| Income taxes |

122 | 112 | 10 | 9 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Earnings |

$ | 210 | $ | 194 | $ | 16 | 8 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Average Balance Sheet |

||||||||||||||||

| Loans |

||||||||||||||||

| Consumer |

$ | 5,436 | $ | 5,655 | $ | (219 | ) | (4 | )% | |||||||

| Commercial and commercial real estate |

754 | 880 | (126 | ) | (14 | )% | ||||||||||

| Residential mortgage |

1,058 | 919 | 139 | 15 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total loans |

$ | 7,248 | $ | 7,454 | $ | (206 | ) | (3 | )% | |||||||

| Total assets |

$ | 7,707 | $ | 7,920 | $ | (213 | ) | (3 | )% | |||||||

|

|

|

|

|

|

|

|||||||||||

| Deposits |

||||||||||||||||

| Noninterest-bearing demand |

$ | 1,431 | $ | 1,272 | $ | 159 | 13 | % | ||||||||

| Interest-bearing demand |

4,013 | 4,144 | (131 | ) | (3 | )% | ||||||||||

| Money market |

4,128 | 5,161 | (1,033 | ) | (20 | )% | ||||||||||

| Savings |

2,303 | 361 | 1,942 | 538 | % | |||||||||||

| Other |

275 | 277 | (2 | ) | (1 | )% | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

$ | 12,150 | $ | 11,215 | $ | 935 | 8 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Performance Ratios |

||||||||||||||||

| Return on average assets |

2.72 | % | 2.45 | % | ||||||||||||

| Noninterest income to total revenue |

74 | % | 75 | % | ||||||||||||

| Efficiency |

72 | % | 73 | % | ||||||||||||

|

|

|

|

|

|||||||||||||

| Other Information |

||||||||||||||||

| Nonperforming assets (a) (b) |

$ | 53 | $ | 53 | | | ||||||||||

| Net charge-offs |

$ | 9 | $ | 13 | $ | (4 | ) | (31 | )% | |||||||

|

|

|

|

|

|

|

|||||||||||

| Client Assets Under Administration (in billions) (a) (c) (d) |

||||||||||||||||

| Discretionary client assets under management |

$ | 137 | $ | 134 | $ | 3 | 2 | % | ||||||||

| Nondiscretionary client assets under administration |

129 | 125 | 4 | 3 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 266 | $ | 259 | $ | 7 | 3 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Discretionary client assets under management |

||||||||||||||||

| Personal |

$ | 85 | $ | 85 | | | ||||||||||

| Institutional |

52 | 49 | $ | 3 | 6 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 137 | $ | 134 | $ | 3 | 2 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| Equity |

$ | 73 | $ | 72 | $ | 1 | 1 | % | ||||||||

| Fixed Income |

39 | 40 | (1 | ) | (3 | )% | ||||||||||

| Liquidity/Other |

25 | 22 | 3 | 14 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 137 | $ | 134 | $ | 3 | 2 | % | ||||||||

|

|

|

|

|

|

|

|||||||||||

| (a) | As of December 31. |

| (b) | Includes nonperforming loans of $46 million at December 31, 2016 and $48 million at December 31, 2015. |

| (c) | Excludes brokerage account client assets. |

| (d) | As a result of certain investment advisory services performed by one of our registered investment advisors, certain assets are reported as both discretionary client assets under management and nondiscretionary client assets under administration. The amount of such assets was approximately $9 billion at December 31, 2016 and $6 billion at December 31, 2015. |

Asset Management Group earned $210 million in 2016 compared to $194 million in 2015. Earnings increased due to declines in noninterest expense and provision for credit losses, as well as an increase in net interest income, partially offset by a decrease in noninterest income.

The decline in revenue in the comparison was driven by lower noninterest income, partially offset by higher net interest income. The decline in noninterest income reflected the impact from a $30 million trust settlement in 2015, which was partially offset by new sales production and stronger average equity markets. Increased net interest income in the comparison was primarily due to higher average deposit balances, partially offset by a decrease in loan balances.

15

The reduction in noninterest expense in 2016 compared to the prior year was primarily attributable to lower compensation expense. Asset Management Group remains focused on disciplined expense management as it invests in strategic growth opportunities.

Asset Management Groups strategy is focused on growing investable assets by continually evolving the client experience and products and services. The business offers an open architecture platform with a full array of investment products and banking solutions. Key growth opportunities include: maximizing front line productivity, ensuring a relationship-based approach with other lines of business partners, and optimizing market presence across our footprint.

Wealth Management and Hawthorn have nearly 100 offices operating in seven out of the ten most affluent states in the U.S. with a majority co-located with retail banking branches. The businesses provide customized investments, wealth planning, trust and estate administration and private banking solutions to affluent individuals and ultra-affluent families.

Institutional Asset Management provides advisory, custody, and retirement administration services to institutional clients such as corporations, unions, municipalities, non-profits, foundations, and endowments. The business also offers PNC proprietary mutual funds and investment strategies. Institutional Asset Management is strengthening its partnership with Corporate & Institutional Banking to drive growth and is focused on building retirement capabilities and expanding product solutions for all customers.

The increase in assets under administration in the comparison to the prior year reflected growth in discretionary client assets under management, which was driven by higher equity markets.

BlackRock (Unaudited)

Table 13: BlackRock Table

Information related to our equity investment in BlackRock follows:

| Year ended December 31 | ||||||||

| Dollars in millions |

2016 | 2015 | ||||||

| Business segment earnings (a) |

$ | 532 | $ | 548 | ||||

| PNCs economic interest in BlackRock (b) |

22 | % | 22 | % | ||||

| (a) | Includes our share of BlackRocks reported GAAP earnings and additional income taxes on those earnings incurred by us. |

| (b) | At December 31. |

| December 31 | December 31 | |||||||

| In billions |

2016 | 2015 | ||||||

| Carrying value of our investment in BlackRock (c) |

$ | 7.0 | $ | 6.7 | ||||

| Market value of our investment in BlackRock (d) |

13.4 | 12.0 | ||||||

| (c) | We account for our investment in BlackRock under the equity method of accounting, exclusive of a related deferred tax liability of $2.3 billion at December 31, 2016 and $2.2 billion at December 31, 2015. Our voting interest in BlackRock common stock was approximately 21% at December 31, 2016. |

| (d) | Does not include liquidity discount. |

In addition to our investment in BlackRock reflected in Table 13, at December 31, 2016, we held approximately .8 million shares of BlackRock Series C Preferred Stock valued at $232 million, which are available to fund our obligation in connection with certain BlackRock long-term incentive plan (LTIP) programs. We account for the BlackRock Series C Preferred Stock at fair value, which offsets the impact of marking-to-market the obligation to deliver these shares to BlackRock. The fair value amount of the BlackRock Series C Preferred Stock is included on our Consolidated Balance Sheet within Other assets. Additional information regarding the valuation of the BlackRock Series C Preferred Stock is included in Note 6 Fair Value, and additional information regarding our BlackRock LTIP share obligations is included in Note 12 Stock Based Compensation Plans, both of which are in the Notes To Consolidated Financial Statements in Item 8 of this Report.

See Note 23 Subsequent Events in Item 8 of this Report for information on our February 1, 2017 transfer of .5 million shares of Series C Preferred Stock to BlackRock to satisfy a portion of our LTIP obligation.

2015 VERSUS 2014

Consolidated Income Statement Review

Summary Results

Net income for 2015 of $4.1 billion, or $7.39 per diluted common share, decreased compared to 2014 net income of $4.2 billion, or $7.30 per diluted common share. A decrease in revenue of 1% was partially offset by reductions in noninterest expense and the provision for credit losses. Lower revenue was driven by a 3% decrease in net interest income, offset in part by a 1% increase in noninterest income reflecting strong fee income growth.

16

Net Interest Income

Net interest income was $8.3 billion in 2015 and decreased by $247 million, or 3%, compared with 2014 due to lower purchase accounting accretion and lower interest-earning asset yields driven by the low rate environment, partially offset by commercial and commercial real estate loan growth and higher securities balances. The decline also reflected the impact from the second quarter 2014 correction to reclassify certain commercial facility fees from net interest income to noninterest income.

Net interest margin was 2.74% in 2015 and 3.08% in 2014. The decrease was driven by a 32 basis point decline in the yield on total interest-earning assets, which was principally due to the impact of increasing the companys liquidity position, lower loan and securities yields, and lower benefit from purchase accounting accretion. The decline also included the impact of the second quarter 2014 correction to reclassify certain commercial facility fees.

Noninterest Income