EX-99.1

Published on November 7, 2013

Exhibit 99.1

The PNC Financial Services Group, Inc.

BancAnalysts Association of Boston

November 7, 2013 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

This presentation includes snapshot

information about PNC used by way of illustration. It is not intended as a full business or

financial review and should be viewed in the context of all of the information made

available by PNC in its SEC filings. The presentation also contains

forward-looking

statements

regarding

our

outlook

for

earnings,

revenues,

expenses,

capital

levels

and

ratios,

liquidity

levels,

asset

levels,

asset quality, financial position, and other matters regarding or affecting PNC and its future

business and operations. Forward-looking statements are necessarily subject to

numerous assumptions, risks and uncertainties, which change over time. The forward-looking

statements in this presentation are qualified by the factors affecting forward-looking

statements identified in the more detailed Cautionary Statement included in the

Appendix, which is included in the version of the presentation materials posted on our corporate website at

www.pnc.com/investorevents, and in our SEC filings. We provide greater detail regarding these

as well as other factors in our 2012 Form 10-K and our 2013 Form 10-Qs,

including in the Risk Factors and Risk Management sections and in the Legal Proceedings and Commitments

and Guarantees Notes of the Notes To Consolidated Financial Statements in those reports, and

in our subsequent SEC filings. Our forward- looking statements may also be subject

to other risks and uncertainties, including those we may discuss in this presentation or in SEC

filings, accessible on the SECs website at www.sec.gov and on PNCs corporate

website at www.pnc.com/secfilings. We have included web addresses in this presentation

as inactive textual references only. Information on those websites is not part of this presentation. Future

events or circumstances may change our outlook and may also affect the nature of the

assumptions, risks and uncertainties to which our forward-looking statements are

subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We

do not assume any duty and do not undertake to update those statements. Actual results or

future events could differ, possibly materially, from those anticipated in

forward-looking statements, as well as from historical performance. In

this

presentation,

we

may

sometimes

refer

to

adjusted

results

to

help

illustrate

the

impact

of

certain

types

of

items.

This

information

supplements our results as reported in accordance with GAAP and should not be viewed in

isolation from, or as a substitute for, our GAAP results. We believe that this

additional information and the reconciliations we provide may be useful to investors, analysts, regulators and

others to help evaluate the impact of these respective items on our operations. We may also

provide information on return on tangible capital as well as return on capital to help

illustrate the impact of goodwill on that ratio and on tangible book value per share (calculated as

book value per share less total intangible assets, other than servicing rights, per share).

Where applicable, we provide GAAP reconciliations for such additional information,

including in the slides, the Appendix and/or other slides and materials on our corporate website at

www.pnc.com/investorevents and in our SEC filings. We may also use annualized, proforma,

estimated or third party numbers for illustrative or comparative purposes only. These

may not reflect actual results.

This presentation may also include discussion of other non-GAAP financial measures, which,

to the extent not so qualified therein or in the Appendix, is qualified by GAAP

reconciliation information available on our corporate website at www.pnc.com under About PNCInvestor

Relations. |

3

YTD13 Performance Summary

YTD13 financial

summary

Net income

Diluted EPS

from net

income

Return on

average assets

$3.2 billion

$5.55

1.40%

Grew loans and fee income

Maintained expense discipline

Continued improvement in overall credit quality

Demonstrated progress on strategic priorities

Strengthened capital position

Highlights |

4

Redefine the Retail

Banking business

Drive growth in

acquired &

underpenetrated

markets

Capture more

investable assets

Build a stronger

Residential

Mortgage business

Manage expenses

Well-Positioned to Deliver Long-Term Value

Targeted

Outcomes

(1)

Increase

fee income

Expand

market share

Deepen

relationships

Improve operating

efficiencies

Strategic Priorities

(1) Refer to Cautionary Statement in the Appendix, including economic and other assumptions.

Does not take into account impact of potential legal and regulatory contingencies.

|

5

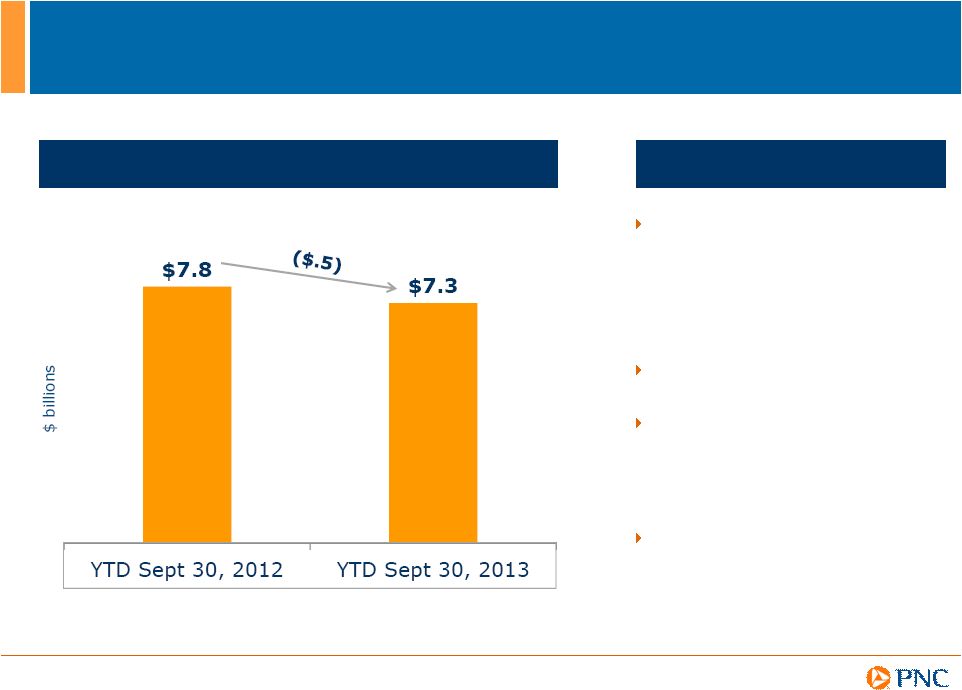

Noninterest Expense Trend

Executing Our Expense Objectives

We continue to focus on

expense savings initiatives

through PNCs Continuous

Improvement Program

YTD expenses down 6% for

the first time since 2010

Over 650 ideas are delivering

value in 2013

Process improvement efforts

begun in 2013 or beginning in

2014 should continue to be a

driver of future expense

reductions

Expense savings support

investment in our businesses

and infrastructure

Highlights |

Corporate

& Institutional Banking (C&IB)

Michael P. Lyons

EVP, Head of Corporate & Institutional Banking |

7

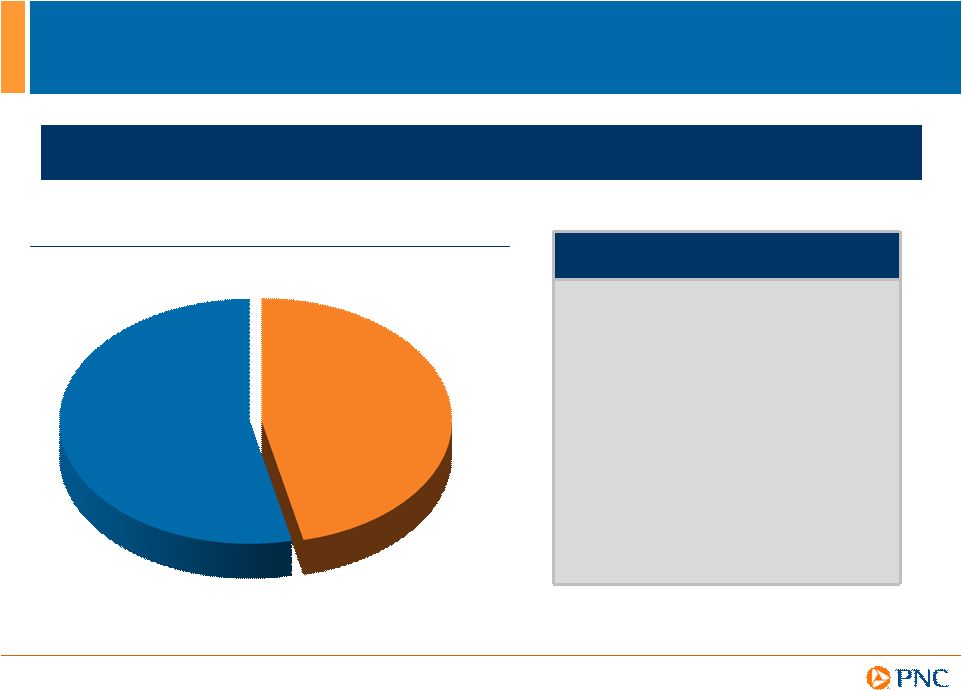

C&IB Overview

Corporate &

Institutional

Banking

60%

Contribution to PNC Earnings of $3.9B

(1)

C&IB serves large corporations, middle-market businesses, governments, and

not-for- profit institutions with annual revenues of $10 million and

above (1) As of or for the trailing twelve month period ended

9/30/13. (2) Allocated capital refers to capital which is allocated to our

business segments using our risk-based economic capital model, including consideration of

the goodwill at those business segments as well as the diversification of risk among

the business segments. (3) Efficiency ratio calculated as noninterest expense divided by

total revenue.

Financial Highlights

(1)

Net income

$2.3B

Return on average

allocated capital

(2)

24%

Efficiency ratio

(3)

36%

Loans

$99.3B

Deposits

$69.9B

NPAs to loans

.96%

Headcount

4,716

(1) |

8

Go to market locally and nationally as one organization

Leverage Regional President structure

Deliver superior customer service

Minimize turnover in client-facing personnel

Full complement of traditional banking products and services

Outsized capabilities in treasury management, asset-based

lending, commercial loan servicing, middle-market syndications,

middle-market M&A advisory services

Intentional product gaps

Strategy and Go-to-Market Approach

To be the leading relationship-based provider of credit and related

products and services through the cycles

Strategy

Approach

Products |

9

Well-Positioned into the Financial Crisis |

10

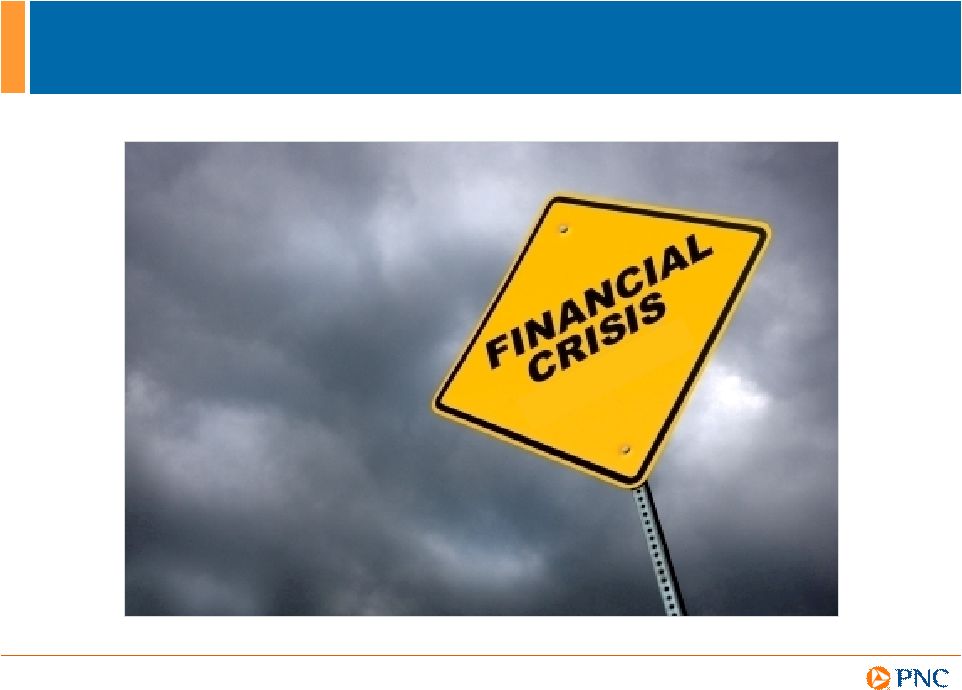

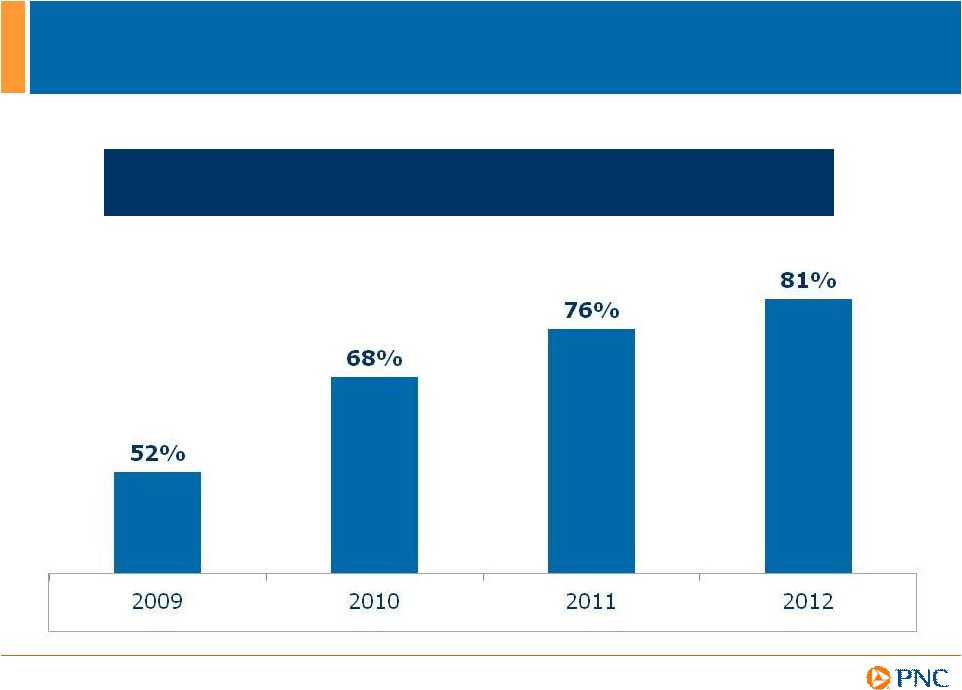

Significant New Primary Clients

(1) A Corporate Banking primary client is defined as a corporate

banking relationship with annual revenue generation of $50,000 or

more or, within Corporate Banking, a Commercial Banking client relationship with annual

revenue generation of $10,000 or more. New Corporate Banking Primary Clients

(1)

Won

(1) |

11

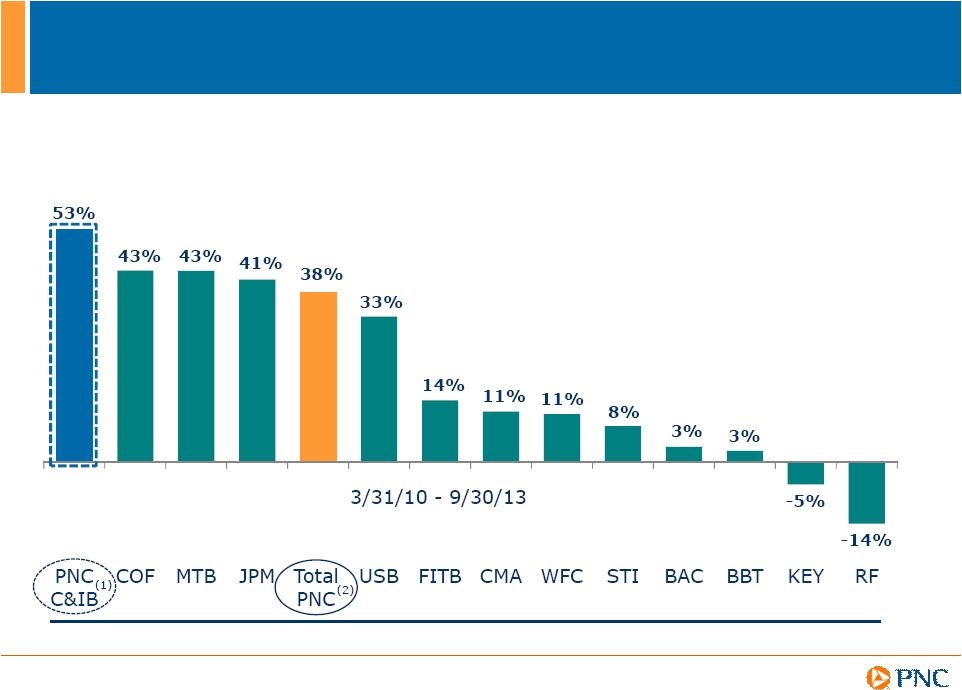

Strong Commercial Loan Growth

(1) C&IB commercial loan balances include commercial, commercial

real estate and equipment lease financing within the C&IB segment. Balances for certain

PNC commercial loan customers are reflected in PNC business segments other than

C&IB; in particular, small business customer loans are reflected in the Retail Banking segment. Excluding Southeast markets loan balances, C&IB

commercial loan growth for 9/30/13 compared to 3/31/10 was 44%. See Appendix for

reconciliation. (2) PNCs consolidated commercial loan balances include commercial, commercial real estate and

equipment lease financing across all segments. Peer Source: SNL Datasource except BBT, BAC, COF

and JPM, which are from company reports. JPM and COF loan growth reflect commercial banking

segment reported in company reports. BAC loan growth reflects U.S. commercial loan balances

only, as reported in its company reports. BBT reflects total commercial loans from company reports. |

12

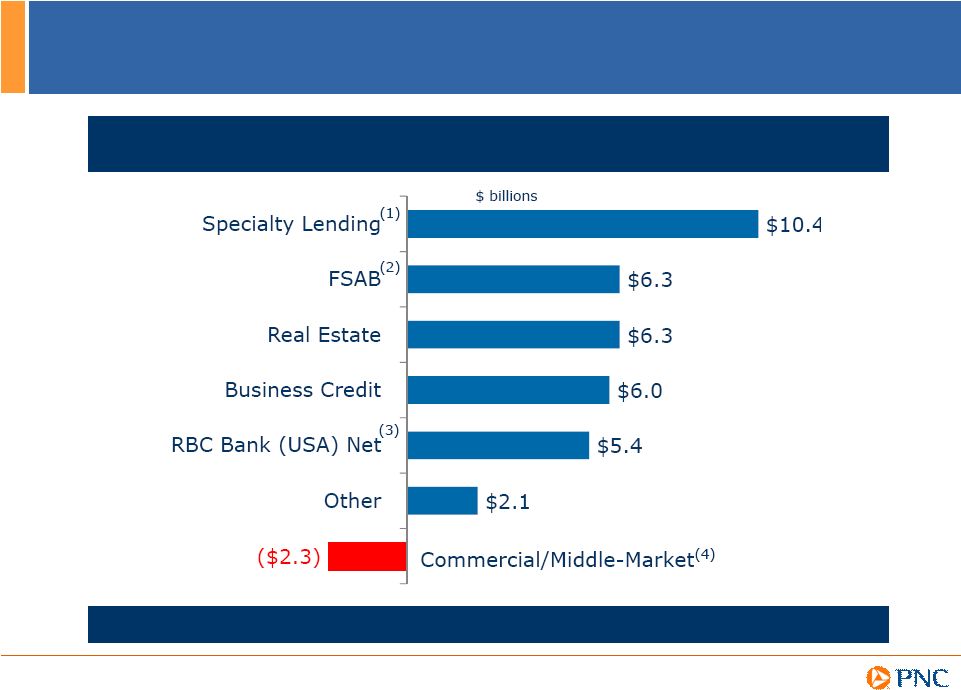

Loan Growth Driven by Specialty Areas

(1)

Specialty

Lending

includes

Healthcare,

Public

Finance,

Large

Corporate

and

Diversified

Industries

Group.

(2)

FSAB

refers

to

Financial

Services

Advisory

&

Banking.

(3)

Loans

acquired

in

RBC

Bank

(USA)

transaction,

net

of

run-off.

(4)

Commercial/Middle-

Market

includes

companies

within

the

Retail

Banking

footprint

with

annual

sales

between

$10

million

and

$500

million.

Change in C&IB Loans Outstanding

3/31/10-

9/30/13

Total Change in C&IB Loans: $34.2B or 53% |

13

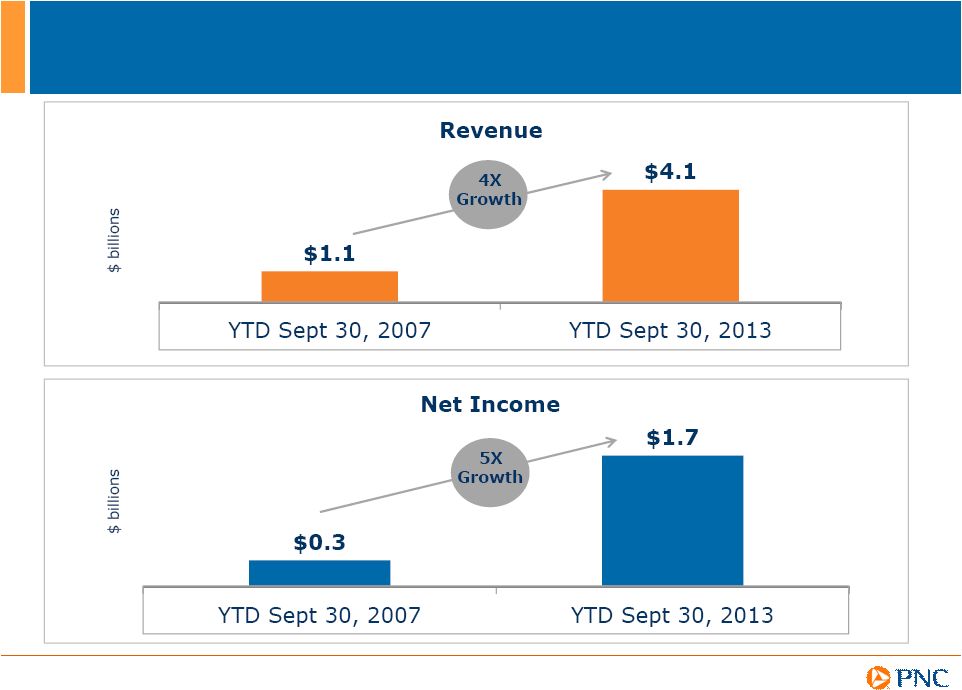

Strong Performance Through the Crisis |

14

Scale

Asset-based Lender

(1)

Servicer of Commercial and

Multifamily loans

(2)

Wholesale lockbox volume

processor

(3)

Bank-affiliated leasing company

Commercial & Industrial lender

Middle Market Loan Syndications

Bookrunner

Purchasing Card issuer

Commercial Real Estate/Multifamily

lender

(8)

Franchise is Well-Positioned Today

Quality

TNS National Choice Award Winner for

Commercial and Business Banking

Middle Market Investment Bank of the

year

(10)

National Award Winner for Middle-

Market Treasury Management in

Overall Satisfaction, Product

Capabilities and Accuracy of

Operation

(11)

Midland Loan Services: highest

primary, master and special servicer

ratings from Fitch, S&P and

Morningstar

Top

3

#2

#4

#5

#5

#6

#3

#7

See Source Notes (1) through (11) in Appendix for details.

(4)

(5)

(6)

(7)

(9) |

15

Fragmented Industry

PNC Market Share

Top 10 Banks

Share of total

Corporate

Lending

(5)

39%

Other 6,930

banks

(5)

61%

Industry Market Share

Commercial

&

Industrial

(1)

Commercial

Real

Estate

(1)

Asset

Based

Lending

(2)

Leasing

(3)

3%

2%

15%

6%

Purchasing

Card Issuer

Volume

(4)

6%

(1) Source: FDIC, June 30, 2013. (2) Source: Commercial Finance Association, September 30,

2013. (3) Source: Monitor, 2012. (4) Purchasing Card market share based on Purchase

volume. Source: Nilson Report, July 2013. (5) Represents market share of the top 10

banks by assets in total Corporate lending and other banks, respectively. Source: FDIC, June

30, 2013. |

16

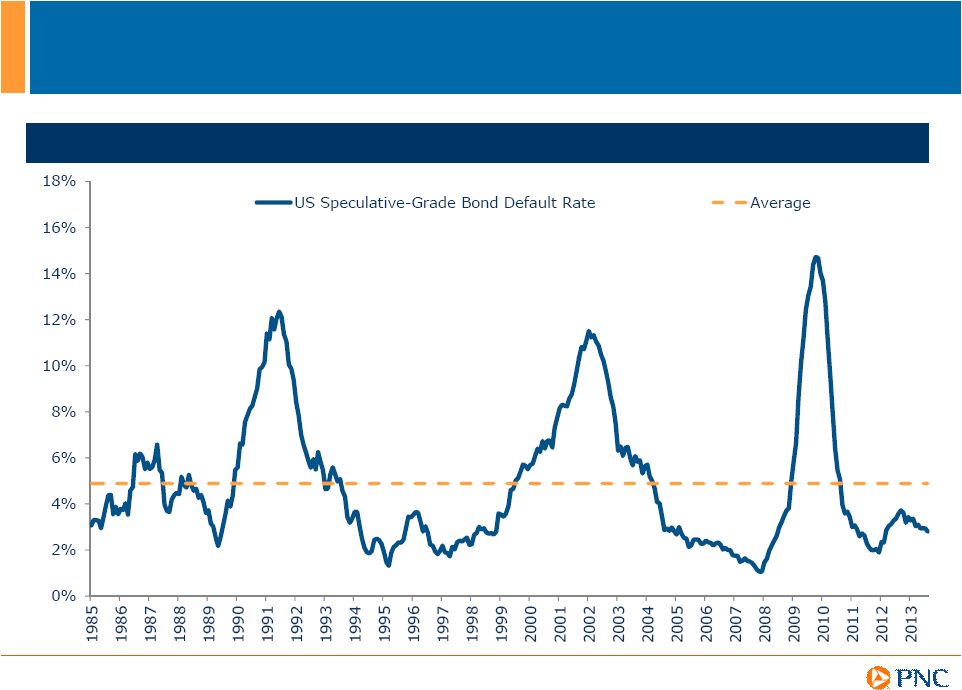

Highly Cyclical Business

Corporate Credit Losses

Moodys Speculative-Grade Bond Default Rate |

17

Clients in great financial shape, but cautious

Revolver utilization low; client cash balances high

Credit losses near cyclical lows

Banks, nonbanks and capital markets aggressively seeking

commercial assets

Pricing compressed, tenor up, terms looser

Difficult to generate required returns on loan-only deals

Current External Market Conditions |

18

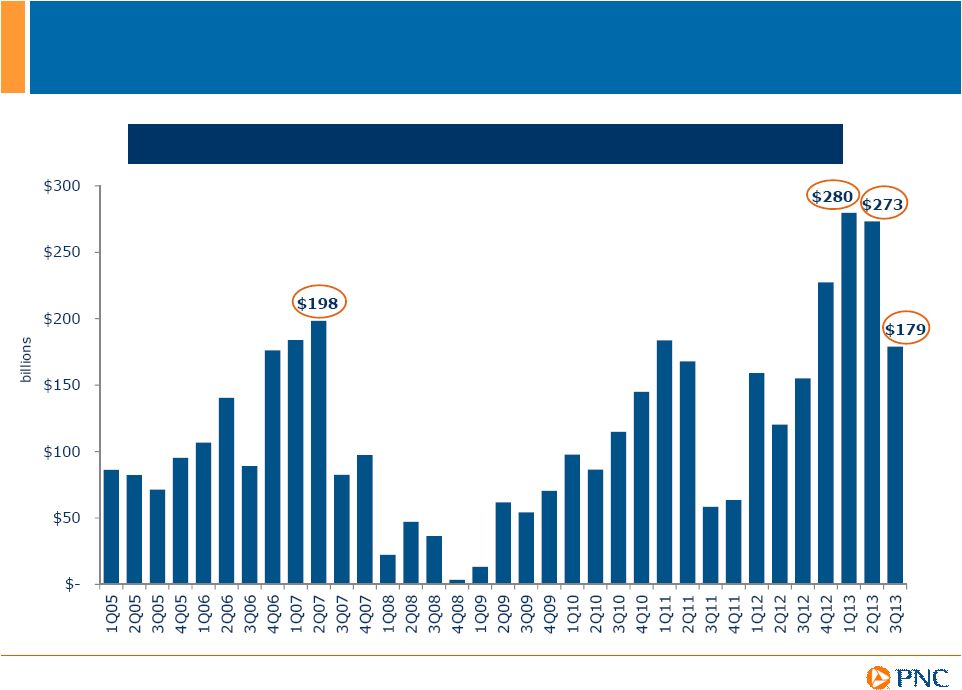

Capital Markets Near Record Highs

Institutional Term Loans + High Yield Bond Issuance

Source: Thomson Reuters LPC. |

19

No Change in Risk Appetite

Past

Present

Future

C&IB Risk Appetite Box |

20

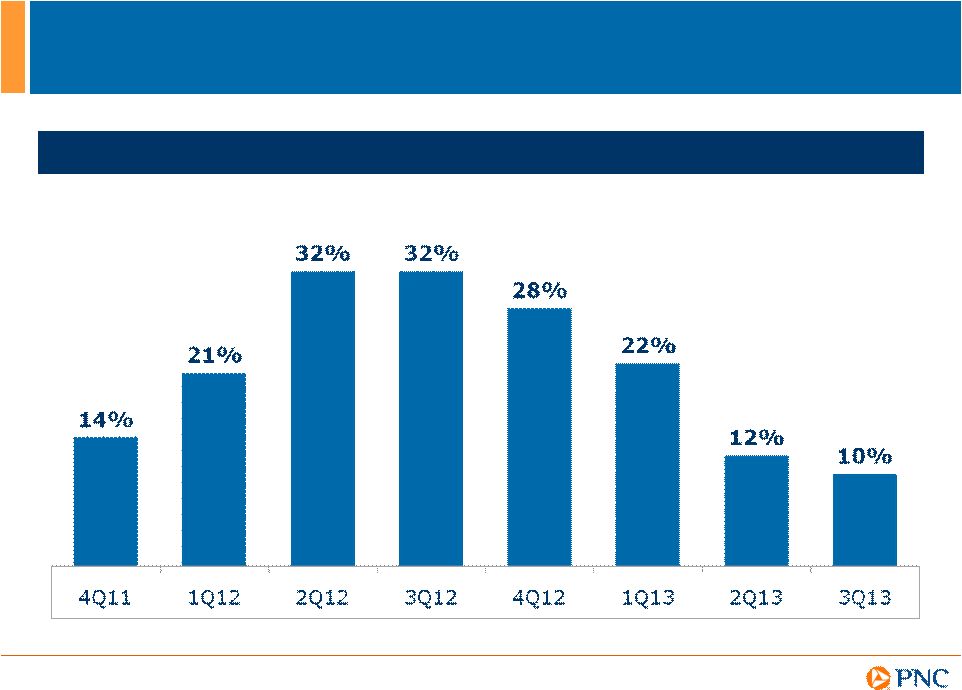

So Our Growth is Slowing

C&IB Year-Over-Year Growth in Average Loans

C&IB average loan balance was $62.7 billion for the three months

ended December 31, 2010. |

21

Not the First Time We Have Navigated this

Environment

Slides from Bill Demchaks

November 2006 BAAB Presentation |

22

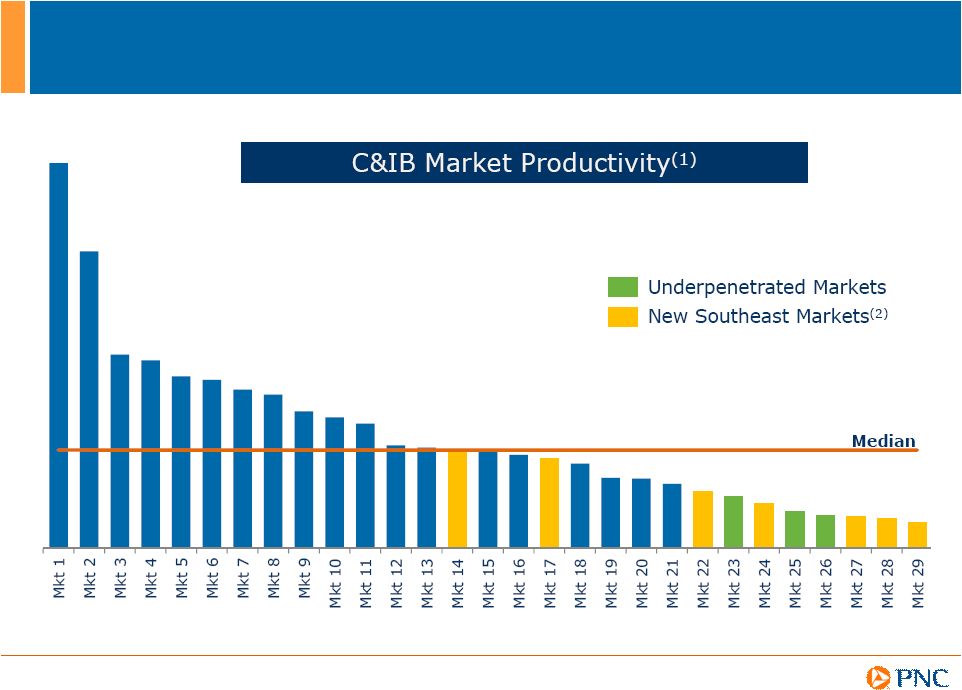

Significant Revenue Upside from Bringing All Markets

to Potential

(1) Productivity calculated as YTD September 30, 2013 pre-provision profits divided by MSA

population. (2) Southeast markets are in the states of Alabama, Georgia, North

Carolina, South Carolina and Florida. |

23

Proven Success in Increasing Cross-Sell

Sales Per Corporate Banking Relationship Manager

Western Markets as a % of Eastern Markets

(1)

(1) Western markets primarily NCC and Eastern markets primarily PNC.

(1) |

24

North

Carolina

South

Carolina

Georgia

Alabama

Florida

Strategic rationale confirmed

Hiring completed / top-tier team

Early results ahead of plan

Strong receptivity to PNC name

Primary clients added YTD13 +30% Y/Y

Avg loans of $6B + 11% 3Q13 Y/Y

Brand recognition increased to 52%

Led or joint led 22 loan syndications

Markets less than ½

as productive as legacy

markets

(2)

Southeast Markets Update

C&IB Highlights

(1) PNC brand awareness was 29% at March 2012 and 52% at June 2013, a 79% increase. Source:

TNS Consumer Brand & Advertising Performance Research. (2) See Slide 22, including

Notes. (1) |

25

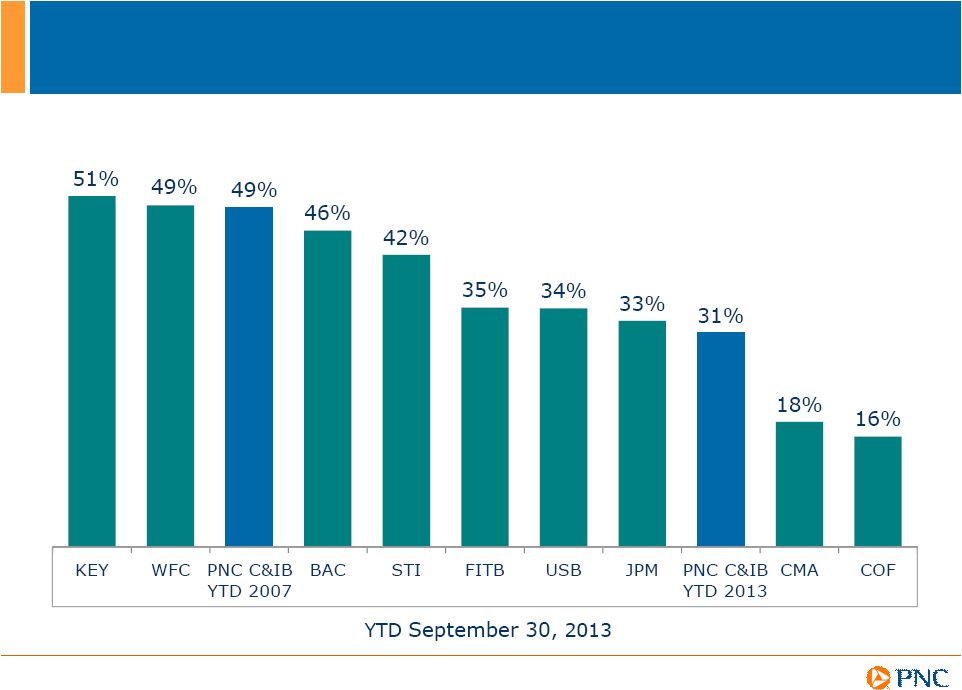

Fee Income Levels

Ratios

in

chart

above

were

calculated

by

dividing

noninterest

income

by

total

revenue.

Peers

selected

based

on

business

segments

comparable to PNCs

C&IB business. MTB and RF disclose their respective C&IB business segment in their

10-Qs which were not yet available for 3Q13 when this chart was prepared. BBT does

not have a comparable business segment to PNCs C&IB business segment. Peer

data for YTD September 30, 2013, from company reports. PNC data provided for YTD

September 30, 2007 and YTD September 30, 2013. |

26

Be More Efficient

C&IB Noninterest Expense

Highlights

Significant opportunity for

us to do things more

efficiently

Focus on core processes

Currently in midst of

significant review of our

commercial credit process

Not curtailing investments |

27

Key Takeaways

Grew C&IB earnings 5x through the crisis and gained significant share

Well-positioned today

Traditional and resilient business model

Current environment challenging

reminiscent of 2006-07

Our post-crisis growth is slowing

Corporate Banking business is highly cyclical

Attractive near-term and long-term growth opportunities

Consistent business model and risk appetite

Bring underpenetrated markets to full potential

Build a leading Southeast franchise

Cross-sell

Capitalize on the cycles

Low market shares |

28

Cautionary Statement Regarding Forward-Looking

Information

Appendix |

29

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

PNCs ability to take certain capital actions, including paying dividends and any plans to increase common stock dividends,

repurchase

common stock under

current or future programs, or issue or redeem preferred stock or other regulatory capital instruments, is subject to

the review of such proposed actions by the Federal Reserve as part of PNCs comprehensive

capital plan for the applicable period in connection

with

the

regulators

Comprehensive

Capital

Analysis

and

Review

(CCAR)

process

and

to

the

acceptance

of

such

capital

plan

and

non-objection to such capital actions by the Federal Reserve

PNCs regulatory capital ratios in the future will depend on, among other things, the companys financial performance, the scope and terms

of final capital regulations then in effect (particularly those implementing the Basel Capital

Accords), and management actions affecting the composition

of

PNCs

balance

sheet.

In

addition,

PNCs

ability

to

determine,

evaluate

and

forecast

regulatory

capital

ratios,

and

to

take

actions (such as capital distributions) based on actual or forecasted capital ratios, will be

dependent on the ongoing development, validation and regulatory approval of related

models. Legal

and

regulatory

developments

could

have

an

impact

on

our

ability

to

operate

our

businesses,

financial

condition,

results

of

operations,

competitive

position,

reputation,

or

pursuit

of

attractive

acquisition

opportunities.

Reputational

impacts

could

affect

matters

such

as

business generation and retention, liquidity, funding, and ability to attract and retain

management. These developments could include: Changes resulting from legislative and regulatory reforms, including major reform of the regulatory oversight structure of the

financial services industry and changes to laws and regulations involving tax, pension,

bankruptcy, consumer protection, and other industry aspects, and changes in accounting

policies and principles. We will be impacted by extensive reforms provided for in the

Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank

Act) and otherwise growing out of the recent financial crisis, the precise

nature, extent and timing of which, and their impact on us, remains uncertain.

Changes to regulations governing bank

capital and liquidity standards, including due to the Dodd-Frank Act and to Basel-related

initiatives.

Unfavorable resolution of legal

proceedings or other claims and regulatory and other governmental investigations or other inquiries.

In

addition

to

matters

relating

to

PNCs

business

and

activities,

such

matters

may

include

proceedings,

claims,

investigations,

or

inquiries relating to pre-acquisition business and activities of acquired companies, such

as National City. These matters may result in monetary judgments or settlements

or other remedies, including fines, penalties, restitution or alterations in our business

practices, and in additional expenses and collateral costs, and may cause reputational harm to

PNC. Results of the regulatory

examination and supervision process, including our failure to satisfy requirements of agreements with

governmental agencies.

Impact

on

business

and

operating

results

of

any

costs

associated

with

obtaining

rights

in

intellectual

property

claimed

by

others

and of adequacy of our intellectual property protection in general.

|

30

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

Business and operating results are affected by our ability to identify and effectively

manage risks inherent in our businesses, including, where

appropriate,

through

effective

use

of

third-party

insurance,

derivatives,

and

capital

management

techniques,

and

to

meet

evolving

regulatory capital standards. In particular, our results currently depend on our ability

to manage elevated levels of impaired assets. Business

and

operating

results

also

include

impacts

relating

to

our

equity

interest

in

BlackRock,

Inc.

and

rely

to

a

significant

extent

on

information provided to us by BlackRock. Risks and uncertainties that could affect

BlackRock are discussed in more detail by BlackRock in its SEC filings.

We grow our business in part by acquiring from time to time other financial services

companies, financial services assets and related deposits and other liabilities.

Acquisition risks and uncertainties include those presented by the nature of the business acquired, including

in some cases those associated with our entry into new businesses or new geographic or other

markets and risks resulting from our inexperience in those new areas, as well as risks

and uncertainties related to the acquisition transactions themselves, regulatory issues, and

the integration of the acquired businesses into PNC after closing.

Competition can have an impact on customer acquisition, growth and retention and on

credit spreads and product pricing, which can affect market share, deposits and

revenues. Industry restructuring in the current environment could also impact our business and financial

performance

through

changes

in

counterparty

creditworthiness

and

performance

and

in

the

competitive

and

regulatory

landscape.

Our

ability to anticipate and respond to technological changes can also impact our ability to

respond to customer needs and meet competitive demands.

Business and operating results can also be affected by widespread natural and other

disasters, dislocations, terrorist activities, cyberattacks

or

international

hostilities

through

impacts

on

the

economy

and

financial

markets

generally

or

on

us

or

our

counterparties

specifically.

We provide greater detail regarding these as well as other factors in our 2012 Form

10-K and our 2013 Form 10-Qs, including in the Risk Factors and Risk

Management sections and the Legal Proceedings and Commitments and Guarantees Notes of the Notes To Consolidated

Financial

Statements

in

those

reports,

and

in

our

subsequent

SEC

filings.

Our

forward-looking

statements

may

also

be

subject

to

other

risks and uncertainties, including those we may discuss elsewhere in this presentation or in

SEC filings, accessible on the SECs website at www.sec.gov and on our corporate

website at www.pnc.com/secfilings. We have included these web addresses as inactive textual

references only. Information on these websites is not part of this document.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are

used for illustrative or comparative purposes

only

and

may

not

reflect

actual

results.

Any

consensus

earnings

estimates

are

calculated

based

on

the

earnings

projections

made

by

analysts

who

cover

that

company.

The

analysts

opinions,

estimates

or

forecasts

(and

therefore

the

consensus

earnings

estimates)

are

theirs alone, are not those of PNC or its management, and may not reflect PNCs or other

companys actual or anticipated results. |

31

Notes

Appendix

Source Notes For Slide 14

(1) Commercial Finance Association, September 30, 2013.

(2) Mortgage Bankers Association, 2012.

(3) Ernst & Young 2012 Cash Management Services Survey.

(4) Monitor

, 2012.

(5) FDIC based on outstandings as of June 30, 2013.

(6) Loan Pricing Corporation. Trailing nine months from September 30, 2013.

(7) Nilson Report, July 2013.

(8) FDIC based on outstandings as of June 30, 2013.

(9) Awarded April 10, 2013. Commercial is for companies with revenues up to $50 million.

(10) Mergers and Acquisitions Journal,

2012.

(11) Greenwich Survey National category 2012. |

32

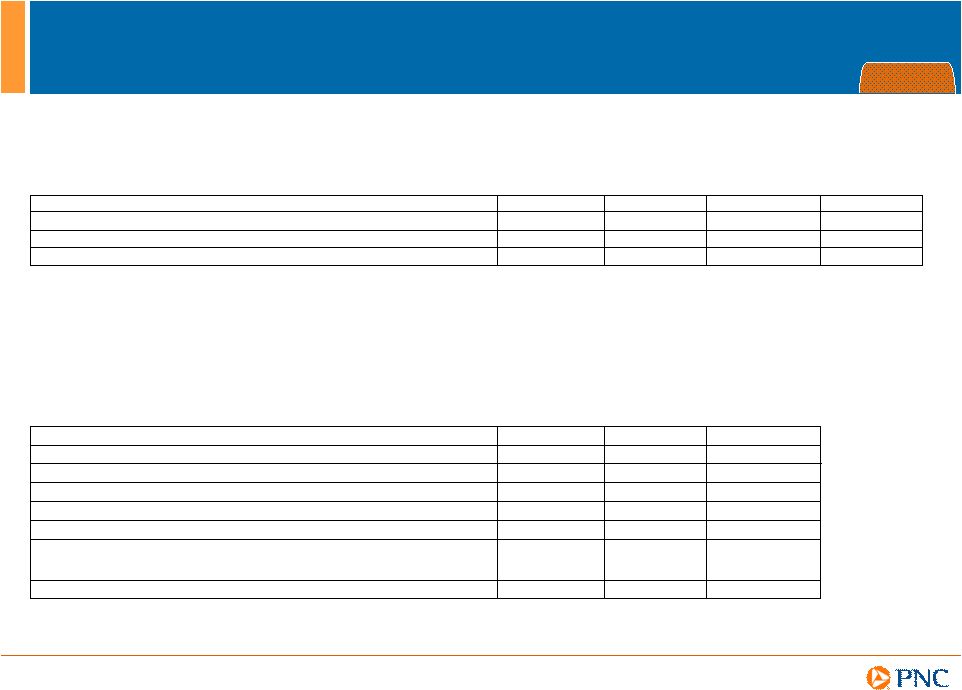

Estimated Pro forma Basel III Tier I Common Capital

Appendix

Basel I Tier 1 Common Capital Ratio

Dollars in millions

Sept. 30, 2013

June 30, 2013

December 31, 2012

Sept. 30, 2012

Basel I Tier 1 common capital

$27,540

$26,668

$24,951

$24,382

Basel I risk-weighted assets

266,698

264,750

260,847

257,297

Basel I Tier 1 common capital ratio

10.3%

10.1%

9.6%

9.5%

Estimated Pro forma Basel III Tier 1 Common Capital Ratio (b)

Dollars in millions

Sept. 30, 2013

June 30, 2013

December 31, 2012

Basel I Tier 1 common capital

$27,540

$26,668

$24,951

Less regulatory capital adjustments:

Basel III quantitative limits

(2,011)

(2,224)

(2,330)

Accumulated other comprehensive income (a)

(231)

(241)

276

All other adjustments

(49)

(283)

(396)

Estimated Basel III Tier 1 common capital

$25,249

$23,920

$22,501

Estimated Basel III risk-weighted assets

289,063

290,838

301,006

Pro forma Basel III Tier 1 common capital ratio

8.7%

8.2%

7.5%

(a) Represents net adjustments related to accumulated other comprehensive income for available

for sale securities and pension and other postretirement benefit plans. (b) Pro forma

Basel III Tier 1 common capital ratio estimate not provided in 3Q12. We provide

information below regarding PNCs pro forma fully phased-in Basel III Tier 1 common capital ratio and how it differs from the Basel I

Tier 1 common capital ratio. This Basel III ratio, which is calculated using PNC's estimated

risk-weighted assets under the Basel III advanced approaches, will replace the

current Basel I ratio for this regulatory metric when PNC exits the parallel run qualification phase. The Federal

Reserve Board announced final rules implementing Basel III on July 2, 2013. Our estimate of

Basel III capital information set forth below is based on our current understanding of

the final Basel III rules. Tier 1 common capital as defined under the Basel III rules

differs materially from Basel I. For example, under Basel III, significant common stock

investments in unconsolidated financial institutions, mortgage servicing rights and deferred tax assets must be deducted from capital to the

extent they individually exceed 10%, or in the aggregate exceed 15%, of the institution's

adjusted Tier 1 common capital. Also, Basel I regulatory capital excludes certain other

comprehensive income related to both available for sale securities and pension and other

postretirement plans, whereas under Basel III these items are a component of PNC's capital.

Basel III risk-weighted assets were estimated under the advanced approaches

included in the Basel III rules and application of Basel II.5, and reflect credit, market and operational risk.

PNC utilizes this capital ratio estimate to assess its Basel III capital position (without the

benefit of phase-ins), including comparison to similar estimates made by other

financial institutions. This Basel III capital estimate is likely to be impacted by any additional regulatory guidance,

continued analysis by PNC as to the application of the rules to PNC, and the ongoing

evolution, validation and regulatory approval of PNC's models integral to the

calculation of advanced approaches risk-weighted assets. |

33

Non-GAAP to GAAP Reconcilement

Appendix

$ in millions

Trailing 12 Months - Actual

September 30, 2013

June 30, 2013

March 31, 2013

December 31, 2012

C&IB reported net income

$2,344

$542

$612

$541

$649

Annualized net income

$2,344

$2,151

$2,453

$2,195

$2,581

C&IB average allocated capital (1)

$9,590

$9,489

$9,495

$9,588

$9,787

Return on average allocated capital

24%

23%

26%

23%

26%

C&IB average allocated capital (1)

$9,590

$9,489

$9,495

$9,588

$9,787

C&IB average goodwill

$3,215

$3,215

$3,215

$3,214

$3,214

Total average tangible capital

$6,375

$6,274

$6,280

$6,374

$6,573

Return on average tangible capital

37%

34%

39%

34%

39%

(1) Allocated capital refers to capital which is allocated to our business segments using our

risk-based economic capital model, including consideration

of the goodwill at those business segments as well as the diversification of risk among the business segments.

PNC believes that return on average tangible capital, a non-GAAP measure, is useful as a

tool to help better evaluate the growth of a business apart from the amount of goodwill

considered in the allocation of capital which is used in the calculation of return on average allocated capital.

For

the three months ended |

34

Non-GAAP to GAAP Reconcilement

Appendix

As of

In millions except per share data

Dec. 31, 2007

Dec. 31, 2012

% Change

Common shareholders' equity

$14,847

$35,413

Common shares outstanding

341

528

Book value per common share

$43.60

$67.05

54%

Goodwill and other intangible assets, other than servicing rights (1)

$8,850

$9,798

Common shareholders' equity less intangible assets

$5,997

$25,615

Common shares outstanding

341

528

Tangible book value per common share

$17.59

$48.51

176%

(1) Servicing rights were $701 million and $1,071 at December 31, 2007 and December 31, 2012,

respectively. PNC

believes

that

tangible

book

value

per

common

share,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the amount, on a per share basis, of goodwill and other intangible assets included in book

value per common share. Sept. 30, 2013

March 31, 2010

% Change

In millions

C&IB loan balance, as reported

$99,337

$65,137

53%

Southeast

(1)

markets loan balance

$6,055

$208

C&IB loan balance, excluding Southeast

(1)

markets

$93,282

$64,929

44%

(1) AL, FL, NC, SC and GA.

As of |

35

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC |