ELECTRONIC PRESENTATION SLIDES FOR EARNINGS RELEASE CONFERENCE CALL

Published on January 17, 2013

The PNC

Financial Services Group, Inc. Fourth Quarter and Full Year 2012

Earnings Conference Call

January 17, 2013

Exhibit 99.2 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

This presentation includes snapshot information about PNC used by way of

illustration. It is not intended as a full business or financial review and

should be viewed in the context of all of the information made available by PNC in its SEC filings. The presentation also contains forward-

looking statements regarding our outlook for earnings, revenues, expenses, capital levels and

ratios, liquidity levels, asset levels, asset quality, financial position, and other

matters regarding or affecting PNC and its future business and operations. Forward-looking statements are

necessarily subject to numerous assumptions, risks and uncertainties, which change over

time. The forward-looking statements in this presentation are qualified by

the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the

Appendix, which is included in the version of the presentation materials posted on our

corporate website at www.pnc.com/investorevents and in our SEC filings. We

provide greater detail regarding these as well as other factors in our 2011 Form 10-K, as amended by Amendment No. 1

thereto, and 2012 Form 10-Qs, including in the Risk Factors and Risk Management sections

and in the Legal Proceedings and Commitments and Guarantees Notes of the Notes to

Consolidated Financial Statements in those reports, and in our subsequent SEC filings. Our forward-looking

statements may also be subject to other risks and uncertainties, including those we may

discuss in this presentation or in SEC filings, accessible on the SECs website at

www.sec.gov and on PNCs corporate website at www.pnc.com/secfilings. We have included web addresses in this

presentation as inactive textual references only. Information on these websites is not

part of this presentation. Future events or circumstances may change our outlook

and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are

subject. Forward-looking statements in this presentation speak only as of the date

of this presentation. We do not assume any duty and do not undertake to update

those statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking

statements, as well as from historical performance.

In this presentation, we may sometimes refer to adjusted results to help illustrate the impact

of certain types of items, such as provisions for residential mortgage repurchase

obligations, gains on sales of a portion of our VISA shares, non-cash charges related to redemptions of trust

preferred securities, expenses for residential mortgage foreclosure-related matters,

goodwill impairment charge and integration costs. This information supplements our

results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our

GAAP results. We believe that this additional information and the reconciliations we

provide may be useful to investors, analysts, regulators and others to help evaluate

the impact of these respective items on our operations. We may also provide information on the components of net

interest income (purchase accounting accretion and the core remainder) and the impact of

purchase accounting accretion on net interest margin. We believe that core net interest

margin (net interest margin less (annualized purchase accounting accretion divided by average interest-earning

assets)), a non-GAAP measure, is useful as a tool to help evaluate the impact of purchase

accounting accretion on net interest margin. Where applicable, we provide GAAP

reconciliations for such additional information, including in the slides, the Appendix and/or other slides and materials

on our corporate website at www.pnc.com/investorevents and in our SEC filings. In

certain discussions, we may also provide information on yields and margins for all

interest-earning assets calculated using net interest income on a taxable-equivalent basis by increasing the interest

income earned on tax-exempt assets to make it fully equivalent to interest income earned

on taxable investments. We believe this adjustment may be useful when comparing

yields and margins for all earning assets. We may also use annualized, proforma, estimated or third party

numbers for illustrative or comparative purposes only. These may not reflect actual

results. This presentation may also include discussion of other non-GAAP financial measures, which,

to the extent not so qualified therein or in the Appendix, is qualified by GAAP

reconciliation information available on our corporate website at www.pnc.com under About PNCInvestor

Relations.

|

3

Significant 2012 Achievements

PNC Is Well-Positioned to Continue to Create Shareholder Value.

2012 financial

summary

Net income

Diluted EPS from

net income

Return on average

assets

$3.0 billion

$5.30

1.02%

1.31%

(adjusted)

(1)

Exceptional customer growth across our businesses resulted in strong loan, deposit and

revenue growth

Grew commercial and consumer loans

Investment in Southeast markets showing early cross-sales and fee income results

Overall credit quality improved

Expenses reflect overall business investments including Southeast expansion partially

offset by continuous improvement initiatives

Capital

and

liquidity

remained

strong

well

positioned

to

achieve

Basel

III

goals

2012 highlights

(1) Return on average assets adjusted for the following select items: provision for

residential mortgage repurchase obligations; gains on sales of VISA Class B

common shares; goodwill impairment charge for Residential Mortgage Banking segment; expenses for

residential mortgage foreclosure matters; noncash charges for unamortized discounts related to

redemption of trust preferred securities; and integration costs. Further

information provided in Appendix.

|

4

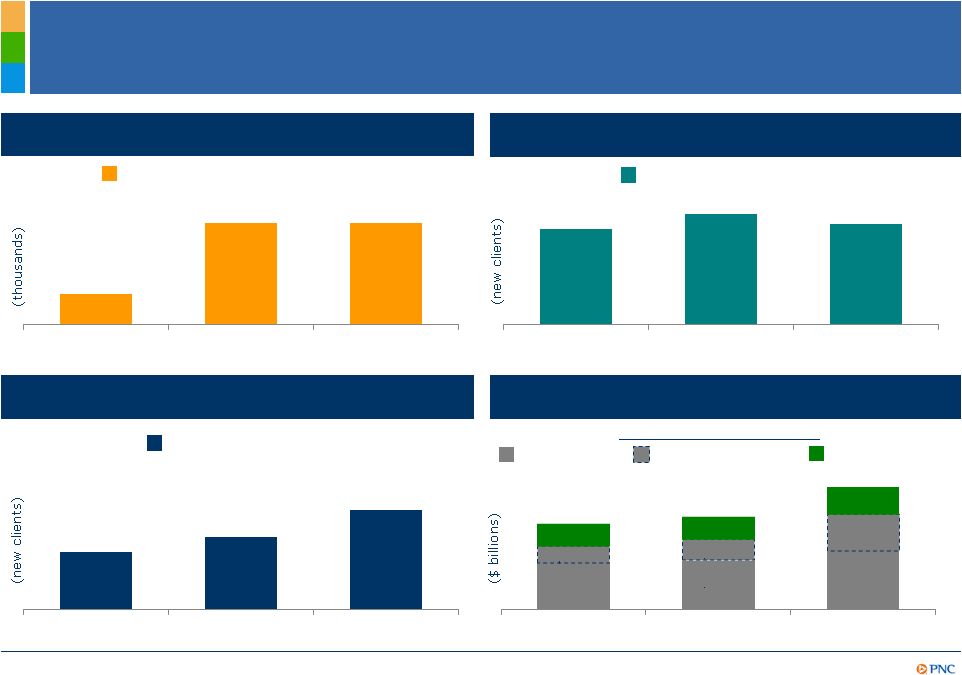

Growing Customers

Long-Term Revenue Potential

Purchase

(4)

Net

organic

checking

relationships

(1)

New primary clients

(2)

New primary clients

(3)

Refinancing

Total

loan

originations

$10.5

$11.4

$15.2

HARP refinancing

75

255

254

2010

2011

2012

1,012

1,165

1,061

2010

2011

2012

1,220

1,541

2,117

2010

2011

2012

$5.7

$6.0

$7.2

$2.0

$2.6

$4.5

$2.8

$2.8

$3.5

2010

2011

2012

Retail Banking

Corporate Banking

Asset Management Group

Residential Mortgage

(1) Net organic checking relationship growth refers to new consumer and small business

accounts exclusive of accounts acquired through acquisition. (2) A Corporate Banking

primary client is defined as a corporate banking relationship with annual revenue generation of

$50,000 or more or, within corporate banking, a commercial banking client relationship with

annual revenue generation of $10,000 or more. (3) An Asset Management Group primary

client is defined as a client relationship with annual revenue generation of $10,000 or

more. (4) A mortgage with a borrower as part of a residential real estate purchase

transaction.

|

5

Financial Performance

4Q12 Linked Quarter

Highlights

Continued strong loan growth including in asset-based lending, healthcare, public

finance, real estate and automobile lending

Reported revenues

stable -

increased by 5% excluding impact of residential

mortgage repurchase provision

(1)

NII increase of 1% supported by stable Core NII

Noninterest income grew 10% excluding impact of residential mortgage

repurchase provision

(2)

Provision elevated primarily due to a larger loan portfolio and reduced reserve

release in commercial lending

Higher noninterest expenses primarily related to residential mortgage-related

costs and other charges

(3)

Capital and liquidity remained strong

4Q12 financial

summary

Net income

Diluted EPS from

net income

EPS impact of

select items

Return on average

assets

$719 million

$1.24

$0.47

0.95%

1.28% (adjusted)

(5)

(4)

(1) Further information provided in Appendix. (2) Reported noninterest income declined

3%. Further information provided in Appendix. (3) See slide 9 for additional

detail. (4) Select items are listed in Note 1 of slide 3. Further details regarding select

items provided in Appendix. (5) Return on average assets adjusted for the select items

listed in Note 1 of slide 3. Further information provided in Appendix.

|

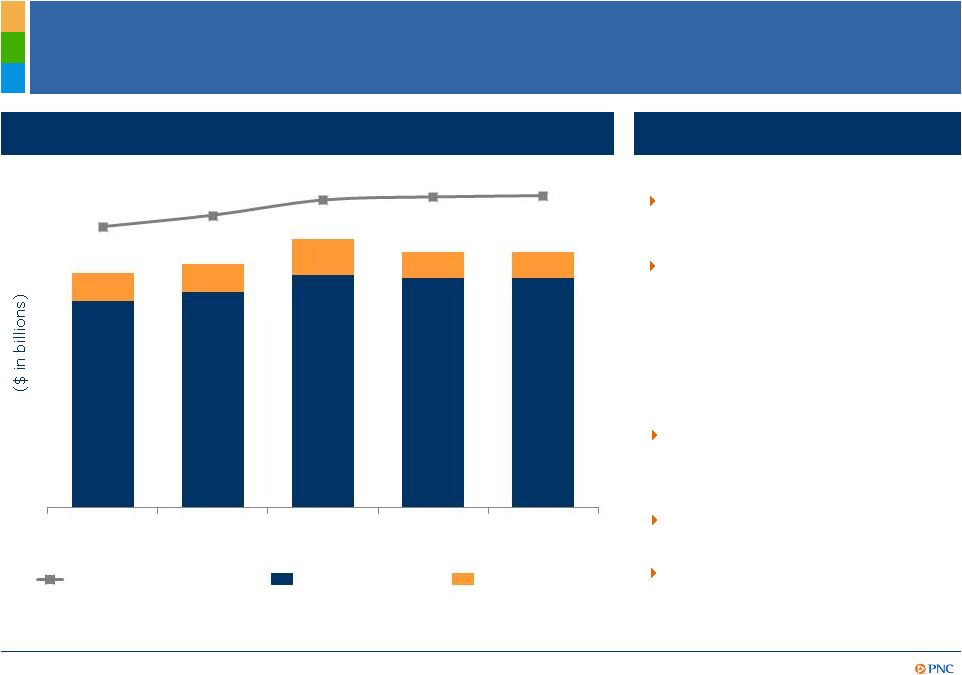

Loan Growth

Delivered Stable Core NII Highlights

Increase in average interest

earning assets driven by loan

growth

Loan growth supported NII

increase of 1%:

Five quarter trend

$2.2

$2.3

$2.5

$2.4

Core NII

(1)

PAA

Linked quarter:

Full Year 2012:

$2.4

First

Quarter

2013

Outlook

(3)

:

Expect NII to decline

approximately 2-3% when

compared to 4Q12 due to decline

in PAA

(2)

6

$1.9

$2.0

$2.2

$2.2

$2.2

$0.3

$0.3

$0.3

$0.2

$0.2

$228.4

$237.7

$250.1

$252.6

$253.6

4Q11

1Q12

2Q12

3Q12

4Q12

Avg. interest

earning assets

Core NII

1

increased 12% primarily

due to Southeast expansion,

organic loan growth and lower

funding costs

PAA

(2)

remained relatively stable

Core NII

(1)

remained stable

PAA

2

increased primarily as a

result of higher cash recoveries

on impaired loans

2

(1) Core net interest income is total net interest income, as reported, less related purchase

accounting accretion (scheduled and cash recoveries). (2) Purchase accounting accretion

(PAA) includes scheduled purchase accounting accretion and cash recoveries. Cash recoveries

reflect cash received in excess of recorded investment from sales or payoffs of impaired

commercial loans. See Appendix for additional details regarding Core NII and PAA.

(3) Refer to Cautionary Statement in the Appendix, including economic and other assumptions.

|

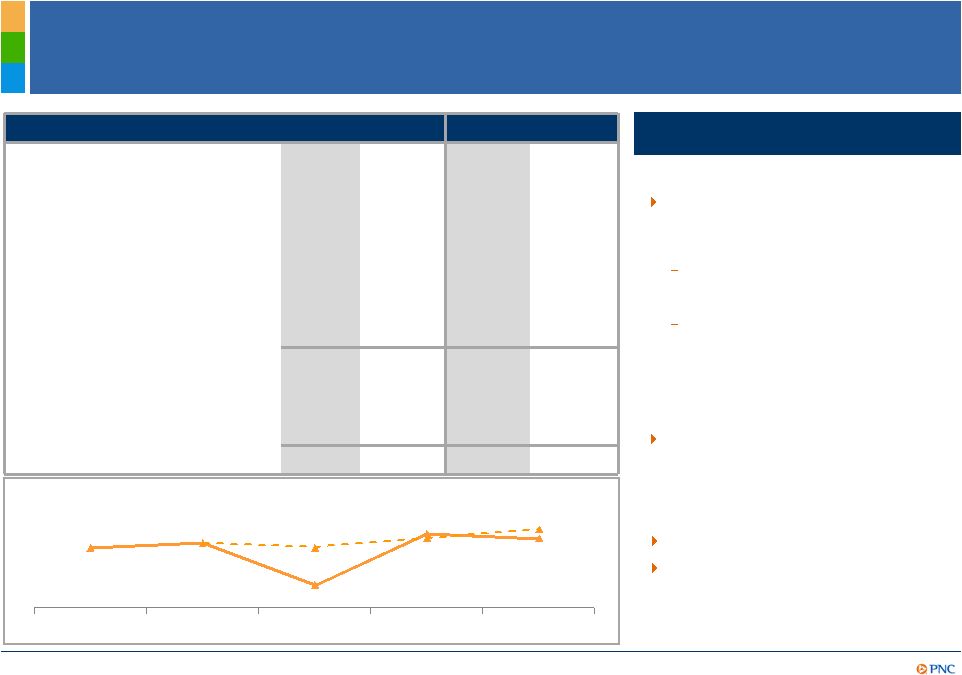

Client Growth

and Sales Driving Noninterest Income Growth

Highlights

Noninterest income increased 10%

excluding impact of residential

mortgage repurchase provision

(4)

Noninterest income to total

revenue adjusted increased to

42%

(3)

Linked quarter:

(millions)

4Q12

3Q12

FY12

FY11

Asset management

(1)

$302

$305

$1,169

$1,088

Consumer services

294

288

1,136

1,243

Corporate services

349

295

1,166

898

Residential mortgage banking

(2)

254

264

1,045

815

Deposit service charges

150

152

573

534

Net gains on sales of securities

less net OTTI

30

16

93

97

Other

520

406

1,451

1,053

Noninterest income other

than repurchase obligation

provision

$1,899

$1,726

$6,633

$5,728

Provision for residential

mortgage repurchase

obligations

(254)

(37)

(761)

(102)

Total noninterest income

$1,645

$1,689

$5,872

$5,626

Full Year 2012:

Noninterest income increased 4%

Noninterest income increased 11%

excluding impact of residential

mortgage repurchase provisions

and VISA gains

(5)

38%

(3)

42%

(3)

40%

(3)

Noninterest income to total revenue

7

38%

39%

30%

41%

40%

4Q11

1Q12

2Q12

3Q12

4Q12

(1) Asset management includes the Asset Management Group and BlackRock. (2) Residential

mortgage banking is Residential mortgage other than provision for residential mortgage

repurchase obligations. (3) Noninterest income and total revenue each adjusted for impact of

residential mortgage repurchase provision and gain on sale of VISA shares, as applicable.

Further information provided in Appendix. (4) Noninterest income declined 3% on a

reported basis. (5) Further information provided in Appendix. Provision for

residential mortgage repurchase obligations of $254

million in 4Q12

Partially offset by increases in

Corporate and Consumer services

and higher other income including

commercial mortgage banking

activity |

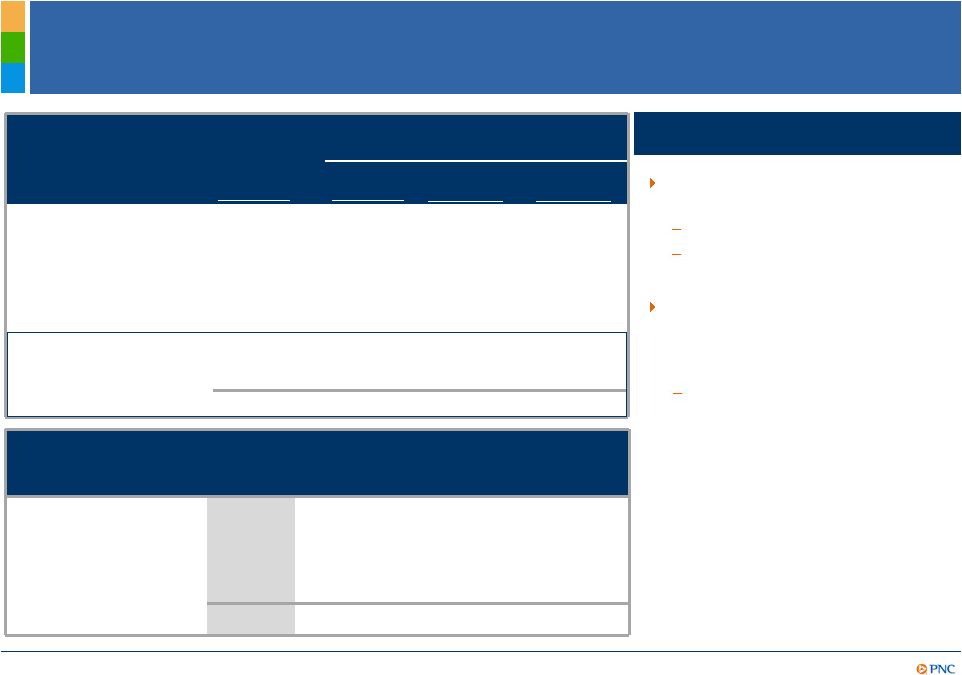

8

Residential Mortgage Repurchase Obligations

Summary of Changes in Residential Mortgage Repurchase Reserve

($ millions)

4Q12

3Q12

2Q12

1Q12

4Q11

Beginning Reserve

$421

$462

$101

$83

$85

Provision

254

37

438

32

36

RBC Bank (USA)

-

-

-

26

-

Losses

(61)

(78)

(77)

(40)

(38)

Ending Balance

$614

$421

$462

$101

$83

Expected elevated levels of GSE-

related repurchase demands

As a result, PNC added provision of

approximately $254 million to

residential mortgage repurchase

reserves in 4Q12

Key Statistics

Total

Portfolio

GSEs

($ billions)

Total

Portfolio

06-08

Vintages

04-05

Vintages

Original UPB

$388

$217

$57

$60

Remaining UPB

92

58

12

12

Life-to-date demands

4.2

2.6

1.9

0.3

Life-to-date

repurchases

2.5

1.5

1.1

0.2

Life-to-date losses

1.4

0.8

0.5

0.1

Future expected losses

0.6

0.5

0.3

0.2

Total expected losses

$2.0

$1.3

$0.8

$0.3

4Q12 highlights

Primarily 2004-2005 vintages

Reserve harmonizes GSE-

related repurchase demands

Reserved to cover expected

total lifetime losses of $2.0

billion |

9

Focused on Expense Management While Investing for

Growth

(millions)

4Q12

3Q12

FY12

FY11

Personnel

$1,216

$1,171

$4,617

$3,966

Occupancy

226

212

827

738

Equipment

194

185

735

661

Marketing

70

74

279

249

Other

1,123

1,008

4,124

3,491

Total noninterest expense

$2,829

$2,650

$10,582

$9,105

Residential mortgage foreclosure-

related matters

(91)

(53)

(225)

(324)

Goodwill impairment charge

(45)

-

(45)

-

Integration costs

(35)

(35)

(267)

(42)

Trust preferred securities

redemption-related charges

(70)

(95)

(295)

(198)

Noninterest expense, adjusted

$2,588

$2,467

$9,750

$8,541

Noninterest expense increased

$179 million due to:

Highlights

Linked quarter:

Full Year 2012:

Noninterest expense increase of

16% reflects:

2012

Continuous

Improvement

Initiatives

financial

impact

(1)

First

Quarter

2013

Outlook

(2)

:

Expect noninterest expense to

decline approximately $300 million

or 11% when compared to 4Q12

+

$0

$250

$500

1Q12

1H12

FY12

$101

$246

$550

Residential mortgage-related

charges (higher foreclosure-

related charges and goodwill

charge)

Adjustments to accruals

primarily for deferred loan

origination costs

Contribution to PNC Foundation

RBC Bank (USA) acquisition

Higher integration, trust

preferred securities

redemption-related charges

and overall business

investments

(1) Continuous improvement cost save initiatives related to legacy PNCs efficiency

initiatives and RBC Bank (USA). (2) Refer to Cautionary Statement in the Appendix,

including economic and other assumptions. Does not take into account the impact of potential legal and

regulatory contingencies.

|

10

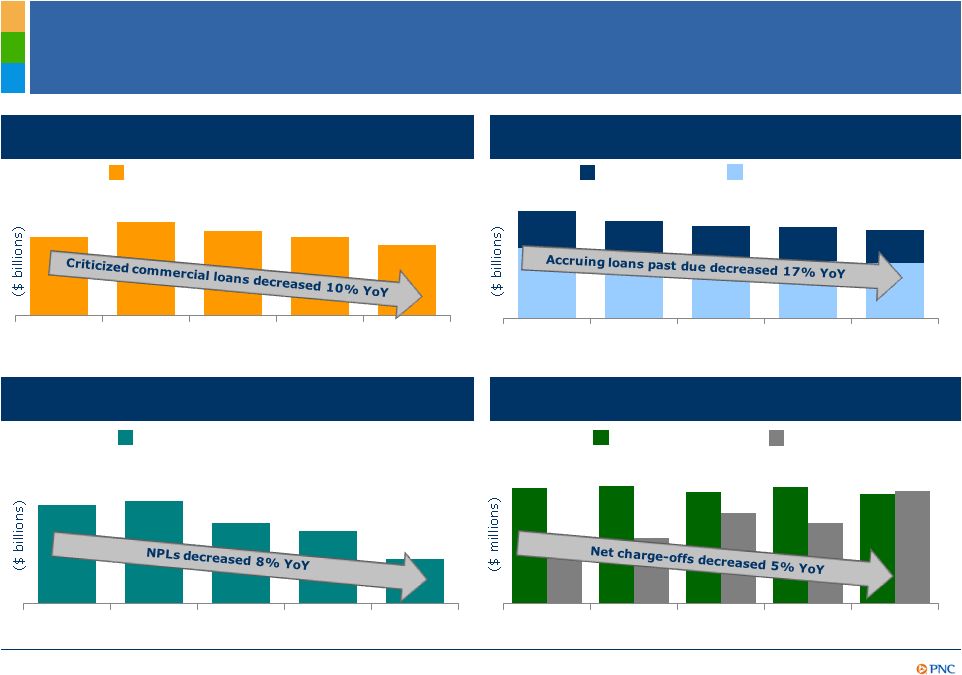

Credit Trends Continue to Improve

30-89 Days

90 Days +

Criticized Commercial loans

(1)

Total nonperforming loans

Provision

Net charge-offs

Criticized commercial loans

Accruing

loans

past

due

(2,3)

Nonperforming

loans

(2,4)

Provision and net charge-offs

$9.9

$11.8

$10.7

$9.9

$8.9

4Q11

1Q12

2Q12

3Q12

4Q12

$3.0

$2.6

$2.5

$2.5

$2.4

$1.6

$1.5

$1.4

$1.4

$1.4

4Q11

1Q12

2Q12

3Q12

4Q12

$3.6

$3.6

$3.5

$3.4

$3.3

4Q11

1Q12

2Q12

3Q12

4Q12

$327

$333

$315

$331

$310

$190

$185

$256

$228

$318

4Q11

1Q12

2Q12

3Q12

4Q12

As of quarter end except net charge-offs and provision, which are for the quarter. (1)

Criticized loans are ones that we consider special mention,

substandard or doubtful. (2) Loans acquired from National City or RBC Bank (USA) that were impaired are not included as they

were recorded at estimated fair value when acquired and are currently considered performing

loans due to the accretion of interest in purchase accounting. (3) Includes loans that

are government guaranteed/insured, primarily residential mortgages. These loans totaled $2.7 billion in

4Q12. (4) Does not include loans held for sale or foreclosed and other assets. Effective in

2011, excludes residential real estate loans accounted for under the fair value option.

|

11

Strong Capital and Liquidity Position

Basel I Tier 1 common capital ratio of 9.6%

(1)

Increased 10 bps due to retained earnings growth

Basel III Tier 1 estimated pro forma common capital ratio was 7.3% as of

December

31,

2012

without

benefit

of

phase-ins

(2)

(goal

is

to

be

within

a

range

of

8.0-8.5% by year-end 2013)

Capital priorities:

Build capital to support client growth and business investment

Improve the quality of capital

Maintain appropriate capital in light of economic uncertainty

Return excess capital to shareholders, subject to regulatory approval

Lower cost of equity by effectively managing risk and capital

Strong liquidity position

Parent company two year liquidity coverage

(3)

of 180%

Well-positioned for Basel liquidity coverage ratio rules

4Q12 highlights

(1) Estimated at December 31, 2012. (2) Based on current understanding of Basel III NPRs and

estimates of Basel II (with proposed modifications) risk-weighted assets. Includes

application of Basel II.5. Subject to further regulatory clarity and development,

validation and regulatory approval of Basel models. (3) Parent company liquidity coverage defined as liquid assets

divided by funding obligations within a two year period.

|

12

Cautionary Statement Regarding Forward-Looking

Information

Our businesses, financial results and balance sheet values are affected by business and

economic conditions, including the following:

o

Changes in interest rates and valuations in debt, equity and other financial markets.

o

Disruptions in the liquidity and other functioning of U.S. and global financial markets.

o

The impact on financial markets and the economy of any changes in the credit ratings of U.S.

Treasury obligations and other U.S. government- backed debt, as well as issues

surrounding the level of U.S. and European government debt and concerns regarding the creditworthiness of

certain sovereign governments, supranationals and financial institutions in Europe.

o

Actions by Federal Reserve, U.S. Treasury and other government agencies, including those that

impact money supply and market interest rates.

o

Changes in customers, suppliers and other counterparties performance and

creditworthiness.

o

Slowing or failure of the current moderate economic expansion.

o

Continued effects of aftermath of recessionary conditions and uneven spread of positive

impacts of recovery on the economy and our counterparties, including adverse impacts on

levels of unemployment, loan utilization rates, delinquencies, defaults and counterparty ability to

meet credit and other obligations.

o

Changes in customer preferences and behavior, whether due to changing business and economic

conditions, legislative and regulatory initiatives, or other factors.

This

presentation includes snapshot information about PNC used by way of illustration and is not intended as a full business or financial review. It

should not be viewed in isolation but rather in the context of all of the information made

available by PNC in its SEC filings. We also make statements in this presentation, and

we may from time to time make other statements, regarding our outlook for earnings, revenues,

expenses, capital levels and ratios, liquidity levels, asset levels, asset quality, financial

position, and other matters regarding or affecting PNC and its future business and

operations that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking

statements are typically identified by words such as believe, plan,

expect, anticipate, see, look, intend, outlook, project, forecast,

estimate, goal, will, should and other similar

words and expressions. Forward-looking statements are subject to numerous assumptions, risks

and uncertainties, which change over time.

Forward-looking statements speak only as of the date made. We do not assume any duty

and do not undertake to update forward-looking statements. Actual results or

future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical

performance.

Our forward-looking statements are subject to the following principal risks and

uncertainties.

Our forward-looking financial statements are subject to the risk that

economic and financial market conditions will be substantially different than we are

currently expecting. These statements are based on our current view that the moderate economic expansion will persist and interest rates

will remain very low in 2013, despite drags from Federal fiscal restraint and a European

recession. These forward-looking statements also do not, unless otherwise

indicated, take into account the impact of potential legal and regulatory contingencies.

PNCs regulatory capital ratios in the future will depend on, among other things, the

companys financial performance, the scope and terms of final capital regulations

then in effect (particularly those implementing the Basel Capital Accords), and management actions affecting the composition of

PNCs balance sheet. In addition, PNCs ability to determine, evaluate and

forecast regulatory capital ratios, and to take actions (such as capital distributions)

based on actual or forecasted capital ratios, will be dependent on the ongoing development, validation and regulatory approval of

related models.

Appendix |

13

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

Legal and regulatory developments could have an impact on our ability to operate our

businesses, financial condition, results of operations, competitive position,

reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business

generation and retention, liquidity, funding, and ability to attract and retain

management. These developments could include:

o

Changes resulting from legislative and regulatory reforms, including major reform of the

regulatory oversight structure of the financial services industry and changes to laws

and regulations involving tax, pension, bankruptcy, consumer protection, and other industry

aspects, and changes in accounting policies and principles. We will be impacted by

extensive reforms provided for in the Dodd-Frank Wall Street Reform and Consumer

Protection Act (the Dodd-Frank Act) and otherwise growing out of the recent financial crisis, the

precise nature, extent and timing of which, and their impact on us, remains uncertain.

o

Changes to regulations governing bank capital and liquidity standards, including due to the

Dodd-Frank Act and to Basel-related initiatives.

o

Unfavorable resolution of legal proceedings or other claims and regulatory and other

governmental investigations or other inquiries. In addition to matters relating

to PNCs business and activities, such matters may include proceedings, claims, investigations, or

inquiries relating to pre-acquisition business and activities of acquired companies, such

as National City. These matters may result in monetary judgments or settlements

or other remedies, including fines, penalties, restitution or alterations in our business practices,

and in additional expenses and collateral costs, and may cause reputational harm to PNC.

o

Results of the regulatory examination and supervision process, including our failure to

satisfy requirements of agreements with governmental agencies.

o

Impact on business and operating results of any costs associated with obtaining rights in

intellectual property claimed by others and of adequacy of our intellectual property

protection in general.

Business and operating results are affected by our ability to identify and effectively manage

risks inherent in our businesses, including, where appropriate, through effective use

of third-party insurance, derivatives, and capital management techniques, and to meet evolving

regulatory capital standards. In particular, our results currently depend on our ability

to manage elevated levels of impaired assets.

Business and operating results also include impacts relating to our equity interest in

BlackRock, Inc. and rely to a significant extent on information provided to us by

BlackRock. Risks and uncertainties that could affect BlackRock are discussed in more detail by BlackRock in its

SEC filings.

Our 2012 acquisition of RBC Bank (USA) presents us with risks and uncertainties related to the

integration of the acquired businesses into PNC, including:

o

Anticipated benefits of the transaction, including cost savings and strategic gains, may be

significantly harder or take longer to achieve than expected or may not be achieved in

their entirety as a result of unexpected factors or events.

o

Our ability to achieve anticipated results from this transaction is dependent also on the

extent of credit losses in the acquired loan portfolios and the extent of deposit

attrition, in part related to the state of economic and financial markets. Also, litigation and

regulatory and other governmental investigations that may be filed or commenced relating to

the pre-acquisition business and activities of RBC Bank (USA) could impact the

timing or realization of anticipated benefits to PNC.

o

Integration of RBC Bank (USA)s business and operations into PNC may take longer than

anticipated or be substantially more costly than anticipated or have unanticipated

adverse results relating to RBC Bank (USA)s or PNCs existing businesses. PNCs ability to

integrate RBC Bank (USA) successfully may be adversely affected by the fact that this

transaction results in PNC entering several geographic markets where PNC did not

previously have any meaningful retail presence.

|

14

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

In addition to the RBC Bank (USA) transaction, we grow our business in part by acquiring from

time to time other financial services companies, financial services assets and related

deposits and other liabilities. These other acquisitions often present risks and

uncertainties analogous to those presented by the RBC Bank (USA) transaction.

Acquisition risks include those presented by the nature of the business acquired as

well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, and the

integration of the acquired businesses into PNC after closing.

Competition can have an impact on customer acquisition, growth and retention and on credit

spreads and product pricing, which can affect market share, deposits and

revenues. Industry restructuring in the current environment could also impact our business and

financial performance through changes in counterparty creditworthiness and performance and in

the competitive and regulatory landscape. Our ability to anticipate and respond

to technological changes can also impact our ability to respond to customer needs and

meet competitive demands.

Business and operating results can also be affected by widespread natural and other disasters,

dislocations, terrorist activities or international hostilities through impacts on the

economy and financial markets generally or on us or our counterparties specifically.

We provide greater detail regarding these as well as other factors in our 2011 Form 10-K,

as amended by Amendment No. 1 thereto, and our 2012 Form 10-Qs, including in the

Risk Factors and Risk Management sections and the Legal Proceedings and Commitments and

Guarantees Notes of the Notes to Consolidated Financial Statements in those reports, and in our subsequent SEC filings. Our

forward-looking statements may also be subject to other risks and uncertainties, including

those we may discuss elsewhere in this presentation or in SEC filings, accessible on

the SECs website at www.sec.gov and on our corporate website at www.pnc.com/secfilings.

We have included these web addresses as inactive textual references only. Information on

these websites is not part of this document. Any annualized, proforma, estimated, third party or consensus numbers in this presentation are

used for illustrative or comparative purposes only and may not reflect actual

results. Any consensus earnings estimates are calculated based on the earnings projections

made by analysts who cover that company. The analysts opinions, estimates or

forecasts (and therefore the consensus earnings estimates) are theirs alone, are not

those of PNC or its management, and may not reflect PNCs or other companys actual or

anticipated results.

|

15

Non-GAAP to GAAP Reconcilement

In millions

Adjustments,

pretax

Income taxes

(benefit) (a)

Net income

Average Assets

Return on Avg.

Assets

Net income and return on avg. assets, as reported

$719

$302,131

0.95%

Adjustments:

Gain on sale of Visa Class B common shares

$(130)

$(45)

($85)

Residential mortgage repurchase obligations

$254

$89

$165

Trust preferred securities redemption charge

$70

$24

$46

Residential Mortgage foreclosure-related matters

$91

$31

$60

Goodwill impairment charge for Residential Mortgage

$45

$0

$45

Integration costs

$35

$12

$23

Net income and return on avg. assets, as adjusted

$973

$302,131

1.28%

In millions

Adjustments,

pretax

Income taxes

(benefit) (a)

Net income

Average Assets

Return on Avg.

Assets

Net income and return on avg. assets, as reported

$3,001

$295,025

1.02%

Adjustments:

Gains on sales of Visa Class B common shares

$(267)

$(93)

($174)

Residential mortgage repurchase obligations

$761

$266

$495

Trust preferred securities redemption charge

$295

$103

$192

Residential Mortgage foreclosure-related matters

$225

$79

$146

Goodwill impairment charge for Residential Mortgage

$45

$0

$45

Integration costs

$267

$93

$174

Net income and return on avg. assets, as adjusted

$3,879

$295,025

1.31%

For the three months ended Dec. 31, 2012

For the twelve months ended Dec. 31, 2012

PNC believes that information adjusted for the impact of certain items may be useful to help

evaluate the impact of these respective items on our operations.

(a) Income taxes calculated using a statutory federal income tax rate of 35%, excluding the

goodwill impairment charge which was considered non-deductible for tax purposes.

Appendix |

16

Non-GAAP to GAAP Reconcilement

For the three months ended

In millions

Jun. 30, 2012

Sep. 30, 2012

Dec. 31, 2012

Total noninterest income, as reported

$1,097

$1,689

$1,645

Total revenue, as reported

$3,623

$4,088

$4,069

Adjustments:

Provision for residential mortgage repurchase obligations

438

37

254

Gain on sale of Visa Class B common shares

-

(137)

(130)

Total noninterest income, as adjusted

$1,535

$1,589

$1,769

Total revenue, as adjusted

$4,061

$3,988

$4,193

Total noninterest income to total revenue, as reported

30%

41%

40%

Total noninterest income to total revenue, as adjusted

38%

40%

42%

PNC believes that information adjusted for the impact of certain items may be useful to help

evaluate the impact of those items on our operations.

In millions

Dec. 31, 2012

Sep. 30, 2012

% change

Total revenue, as reported

$4,069

$4,088

0%

Adjustments:

Provision for residential mortgage repurchase obligations

254

37

Total revenue, as adjusted

$4,323

$4,125

5%

For the three months ended

PNC believes that information adjusted for the impact of certain items may be useful to help

evaluate the impact of those items on our operations.

In millions

Dec. 31, 2012

Sep. 30, 2012

Jun. 30, 2012

Mar. 31, 2012

Dec. 31, 2011

Dec. 31, 2012

Dec. 31, 2011

% change

Core NII

$2,151

$2,154

$2,183

$2,028

$1,943

$8,516

$7,581

12%

Purchase accounting accretion

273

245

343

263

256

1,124

1,119

Total NII

$2,424

$2,399

$2,526

$2,291

$2,199

$9,640

$8,700

11%

PNC believes core net interest income and purchase accounting accretion are useful in

evaluating the components of net interest income. For the three months ended

For the twelve months ended

Appendix |

17

Non-GAAP to GAAP Reconcilement

In millions

Dec. 31, 2012

Sep. 30, 2012

% change

Total noninterest income, as reported

$1,645

$1,689

-3%

Adjustments:

Provision for residential mortgage repurchase obligations

254

37

Total noninterest income, as adjusted

$1,899

$1,726

10%

In millions

Dec. 31, 2012

Sep. 30, 2012

% change

Total noninterest income, as reported

$1,645

$1,689

-3%

Adjustments:

Provision for residential mortgage repurchase obligations

254

37

Gain on sale of Visa Class B common shares

(130)

(137)

Total noninterest income, as adjusted

$1,769

$1,589

11%

In millions

Dec. 31, 2012

Dec. 31, 2011

% change

Total noninterest income, as reported

$5,872

$5,626

4%

Adjustments:

Provision for residential mortgage repurchase obligations

761

102

Gain on sale of Visa Class B common shares

(267)

-

Total noninterest income, as adjusted

$6,366

$5,728

11%

For the three months ended

For the twelve months ended

PNC believes that information adjusted for the impact of certain items may be useful to help

evaluate the impact of those items on our operations.

PNC believes that information adjusted for the impact of certain items may be useful to help

evaluate the impact of those items on our operations.

For the three months ended

PNC believes that information adjusted for the impact of certain items may be useful to help

evaluate the impact of those items on our operations.

Appendix |

18

Non-GAAP to GAAP Reconcilement

For the year ended

In millions, except per share data

Dec. 31, 2012

Sep. 30, 2012

Jun. 30, 2012

Mar. 31, 2012

Dec. 31, 2011

Dec. 31, 2012

Dec. 31, 2011

Noninterest Income

Provision for residential mortgage repurchase

obligations (Pre-tax)

$254

$37

$438

$32

$36

$761

$102

After-tax

$165

$24

$284

$21

$23

$495

$66

Impact on diluted earnings per share

($0.31)

($0.05)

($0.54)

($0.04)

($0.04)

($0.93)

($0.13)

Gains on sales of Visa Class B

common

shares (Pre-tax)

$130

$137

$267

After-tax

$85

$89

$174

Impact on diluted earnings per share

$0.16

$0.17

$0.33

Noninterest Expense

Goodwill impairment charge for Residential Mortgage

Banking segment (Pre-tax)

$45

$45

After-tax

$45

$45

Impact on diluted earnings per share

($0.08)

($0.08)

Expenses for residential

mortgage

foreclosure-related matters (Pre-tax)

$91

$53

$43

$38

$240

$225

$324

After-tax

$60

$34

$28

$25

$156

$146

$210

Impact on diluted earnings per share

($0.11)

($0.06)

($0.05)

($0.05)

($0.30)

($0.28)

($0.40)

Noncash charges for unamortized discounts related

to redemption of trust preferred securities (Pre-tax)

$70

$95

$130

$198

$295

$198

After-tax

$46

$61

$85

$129

$192

$129

Impact on diluted earnings per share

($0.09)

($0.12)

($0.16)

($0.24)

($0.36)

($0.24)

Integration costs (Pre-tax)

$35

$35

$52

$145

$28

$267

$42

After-tax

$23

$23

$34

$94

$18

$174

$27

Impact on diluted earnings per share

($0.04)

($0.04)

($0.06)

($0.18)

($0.04)

($0.33)

($0.05)

Total impact of selected items on diluted

earnings per share

($0.47)

($0.10)

($0.81)

($0.27)

($0.62)

($1.65)

($0.82)

For the three months ended

(1) In calculating impact on diluted earnings per share in the table above, after-tax

amounts for the income statement items were calculated using a statutory federal income

tax rate of 35%, excluding the goodwill impairment charge which was considered nondeductible for income tax purposes.

Appendix |