UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2011

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

| Pennsylvania |

|

25-1435979 |

| (State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

One PNC Plaza, 249 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2707

(Address of principal executive offices, including zip code)

(412) 762-2000

(Registrants telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90

days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act). Yes ¨ No x

As of July 29, 2011, there were 526,240,991 shares of the registrants common stock ($5 par value) outstanding.

THE PNC FINANCIAL SERVICES GROUP,

INC.

Cross-Reference Index to Second Quarter 2011 Form 10-Q

FINANCIAL REVIEW

CONSOLIDATED FINANCIAL HIGHLIGHTS

THE PNC FINANCIAL SERVICES GROUP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dollars in millions, except per share data |

|

Three months ended

June 30 |

|

|

Six months ended

June 30 |

|

| Unaudited |

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

| FINANCIAL RESULTS (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income

|

|

$ |

2,150 |

|

|

$ |

2,435 |

|

|

$ |

4,326 |

|

|

$ |

4,814 |

|

| Noninterest income

|

|

|

1,452 |

|

|

|

1,477 |

|

|

|

2,907 |

|

|

|

2,861 |

|

| Total revenue

|

|

|

3,602 |

|

|

|

3,912 |

|

|

|

7,233 |

|

|

|

7,675 |

|

| Noninterest expense

|

|

|

2,176 |

|

|

|

2,002 |

|

|

|

4,246 |

|

|

|

4,115 |

|

| Pretax, pre-provision earnings from continuing operations (b)

|

|

|

1,426 |

|

|

|

1,910 |

|

|

|

2,987 |

|

|

|

3,560 |

|

| Provision for credit losses

|

|

|

280 |

|

|

|

823 |

|

|

|

701 |

|

|

|

1,574 |

|

| Income from continuing operations before income taxes and noncontrolling interests (pretax earnings)

|

|

$ |

1,146 |

|

|

$ |

1,087 |

|

|

$ |

2,286 |

|

|

$ |

1,986 |

|

| Income from continuing operations before noncontrolling interests

|

|

$ |

912 |

|

|

$ |

781 |

|

|

$ |

1,744 |

|

|

$ |

1,429 |

|

| Income from discontinued operations, net of income taxes (c)

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

45 |

|

| Net income

|

|

$ |

912 |

|

|

$ |

803 |

|

|

$ |

1,744 |

|

|

$ |

1,474 |

|

| Less:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to noncontrolling interests

|

|

|

(1 |

) |

|

|

(9 |

) |

|

|

(6 |

) |

|

|

(14 |

) |

| Preferred stock dividends, including TARP (d)

|

|

|

24 |

|

|

|

25 |

|

|

|

28 |

|

|

|

118 |

|

| Preferred stock discount accretion and redemptions, including redemption of TARP

preferred stock discount accretion (d)

|

|

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

251 |

|

| Net income attributable to common shareholders (d)

|

|

$ |

888 |

|

|

$ |

786 |

|

|

$ |

1,721 |

|

|

$ |

1,119 |

|

| Diluted earnings per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations

|

|

$ |

1.67 |

|

|

$ |

1.43 |

|

|

$ |

3.24 |

|

|

$ |

2.06 |

|

| Discontinued operations (c)

|

|

|

|

|

|

|

.04 |

|

|

|

|

|

|

|

.09 |

|

| Net income

|

|

$ |

1.67 |

|

|

$ |

1.47 |

|

|

$ |

3.24 |

|

|

$ |

2.15 |

|

| Cash dividends declared per common share

|

|

$ |

.35 |

|

|

$ |

.10 |

|

|

$ |

.45 |

|

|

$ |

.20 |

|

| PERFORMANCE RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (e)

|

|

|

3.93 |

% |

|

|

4.35 |

% |

|

|

3.93 |

% |

|

|

4.29 |

% |

| Noninterest income to total revenue

|

|

|

40 |

|

|

|

38 |

|

|

|

40 |

|

|

|

37 |

|

| Efficiency

|

|

|

60 |

|

|

|

51 |

|

|

|

59 |

|

|

|

54 |

|

| Return on:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shareholders equity

|

|

|

11.44 |

|

|

|

11.52 |

|

|

|

11.29 |

|

|

|

8.63 |

|

| Average assets

|

|

|

1.40 |

|

|

|

1.22 |

|

|

|

1.34 |

|

|

|

1.12 |

|

See page 59 for a glossary of certain terms used in this Report.

Certain prior period amounts have been reclassified to conform with the current period presentation, which we believe is more meaningful to readers of our consolidated financial statements.

| (a) |

The Executive Summary and Consolidated Income Statement Review portions of the Financial Review section of this Report provide information regarding items impacting the

comparability of the periods presented. |

| (b) |

We believe that pretax, pre-provision earnings from continuing operations, a non-GAAP measure, is useful as a tool to help evaluate our ability to provide for credit

costs through operations. |

| (c) |

Includes results of operations for PNC Global Investment Servicing Inc. (GIS). We sold GIS effective July 1, 2010. See Sale of PNC Global Investment Servicing in

the Executive Summary section of the Financial Review section of this Report and Note 2 Acquisition and Divestiture Activity in the Notes To Consolidated Financial Statements of this Report for additional information. |

| (d) |

We redeemed the Series N (TARP) Preferred Stock on February 10, 2010. In connection with the redemption, we accelerated the accretion of the remaining issuance

discount on the Series N Preferred Stock and recorded a corresponding reduction in retained earnings of $250 million in the first quarter of 2010. This resulted in a one-time, noncash reduction in net income attributable to common shareholders and

related basic and diluted earnings per share. The impact on diluted earnings per share was $.49 for the six months ended June 30, 2010. Total dividends declared during the first six months of 2010 included $89 million on the Series N Preferred

Stock. |

| (e) |

Calculated as annualized taxable-equivalent net interest income divided by average earning assets. The interest income earned on certain earning assets is completely or

partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of net interest margins for all earning assets, we use net interest income

on a taxable-equivalent basis in calculating net interest margin by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under

generally accepted accounting principles (GAAP) in the Consolidated Income Statement. The taxable-equivalent adjustments to net interest income for the three months ended June 30, 2011 and June 30, 2010 were $25 million and $19 million,

respectively. The taxable-equivalent adjustments to net interest income for the six months ended June 30, 2011 and June 30, 2010 were $49 million and $37 million, respectively. |

1

CONSOLIDATED FINANCIAL HIGHLIGHTS

(CONTINUED) (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited |

|

June 30

2011 |

|

|

December 31

2010 |

|

|

June 30

2010 |

|

| Balance Sheet Data (dollars in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets

|

|

$ |

263,117 |

|

|

$ |

264,284 |

|

|

$ |

261,695 |

|

| Loans (b) (c)

|

|

|

150,319 |

|

|

|

150,595 |

|

|

|

154,342 |

|

| Allowance for loan and lease losses (b)

|

|

|

4,627 |

|

|

|

4,887 |

|

|

|

5,336 |

|

| Interest-earning deposits with banks (b)

|

|

|

4,508 |

|

|

|

1,610 |

|

|

|

5,028 |

|

| Investment securities (b)

|

|

|

59,414 |

|

|

|

64,262 |

|

|

|

53,717 |

|

| Loans held for sale (c)

|

|

|

2,679 |

|

|

|

3,492 |

|

|

|

2,756 |

|

| Goodwill and other intangible assets

|

|

|

10,594 |

|

|

|

10,753 |

|

|

|

12,138 |

|

| Equity investments (b)

|

|

|

9,776 |

|

|

|

9,220 |

|

|

|

10,159 |

|

| Noninterest-bearing deposits

|

|

|

52,683 |

|

|

|

50,019 |

|

|

|

44,312 |

|

| Interest-bearing deposits

|

|

|

129,208 |

|

|

|

133,371 |

|

|

|

134,487 |

|

| Total deposits

|

|

|

181,891 |

|

|

|

183,390 |

|

|

|

178,799 |

|

| Transaction deposits

|

|

|

137,109 |

|

|

|

134,654 |

|

|

|

125,712 |

|

| Borrowed funds (b)

|

|

|

35,176 |

|

|

|

39,488 |

|

|

|

40,427 |

|

| Shareholders equity

|

|

|

32,235 |

|

|

|

30,242 |

|

|

|

28,377 |

|

| Common shareholders equity

|

|

|

31,588 |

|

|

|

29,596 |

|

|

|

27,725 |

|

| Accumulated other comprehensive income (loss)

|

|

|

69 |

|

|

|

(431 |

) |

|

|

(442 |

) |

| Book value per common share

|

|

|

60.02 |

|

|

|

56.29 |

|

|

|

52.77 |

|

| Common shares outstanding (millions)

|

|

|

526 |

|

|

|

526 |

|

|

|

525 |

|

| Loans to deposits

|

|

|

83 |

% |

|

|

82 |

% |

|

|

86 |

% |

|

|

|

|

| Assets Under Administration (billions)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Discretionary assets under management

|

|

$ |

109 |

|

|

$ |

108 |

|

|

$ |

99 |

|

| Nondiscretionary assets under administration

|

|

|

110 |

|

|

|

104 |

|

|

|

100 |

|

| Total assets under administration

|

|

|

219 |

|

|

|

212 |

|

|

|

199 |

|

|

|

|

|

| Capital Ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 common

|

|

|

10.5 |

% |

|

|

9.8 |

% |

|

|

8.3 |

% |

| Tier 1 risk-based (d)

|

|

|

12.8 |

|

|

|

12.1 |

|

|

|

10.7 |

|

| Total risk-based (d)

|

|

|

16.2 |

|

|

|

15.6 |

|

|

|

14.3 |

|

| Leverage (d)

|

|

|

11.0 |

|

|

|

10.2 |

|

|

|

9.1 |

|

| Common shareholders equity to assets

|

|

|

12.0 |

|

|

|

11.2 |

|

|

|

10.6 |

|

|

|

|

|

| Asset Quality Ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total loans

|

|

|

2.57 |

% |

|

|

2.97 |

% |

|

|

3.31 |

% |

| Nonperforming assets to total loans, OREO and foreclosed assets

|

|

|

2.97 |

|

|

|

3.39 |

|

|

|

3.70 |

|

| Nonperforming assets to total assets

|

|

|

1.70 |

|

|

|

1.94 |

|

|

|

2.19 |

|

| Net charge-offs to average loans (for the three months ended) (annualized)

|

|

|

1.11 |

|

|

|

2.09 |

|

|

|

2.18 |

|

| Allowance for loan and lease losses to total loans

|

|

|

3.08 |

|

|

|

3.25 |

|

|

|

3.46 |

|

| Allowance for loan and lease losses to nonperforming loans (e)

|

|

|

120 |

|

|

|

109 |

|

|

|

104 |

|

| (a) |

The Executive Summary and Consolidated Balance Sheet Review portions of the Financial Review section of this Report provide information regarding items impacting the

comparability of the periods presented. |

| (b) |

Amounts include consolidated variable interest entities. See Consolidated Balance Sheet in Part I, Item 1 of this Report for additional information. Also includes

our equity interest in BlackRock under Equity investments. |

| (c) |

Amounts include assets for which we have elected the fair value option. See Consolidated Balance Sheet in Part I, Item 1 of this Report for additional information.

|

| (d) |

The minimum US regulatory capital ratios under Basel I are 4.0% for Tier 1 risk-based, 8.0% for Total risk-based, and 4.0% for Leverage. The well-capitalized levels are

6.0% for Tier 1 risk-based, 10.0% for Total risk-based, and 5.0% for Leverage. |

| (e) |

The allowance for loan and lease losses includes impairment reserves attributable to purchased impaired loans. Nonperforming loans do not include purchased impaired

loans or loans held for sale and, effective in 2011, do not include nonperforming residential real estate loans accounted for under the fair value option. |

2

FINANCIAL REVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review, including the Consolidated Financial Highlights, should be read together with our unaudited Consolidated Financial Statements

and unaudited Statistical Information included elsewhere in this Report and with Items 6, 7, 8 and 9A of our 2010 Annual Report on Form 10-K (2010 Form 10-K). We have reclassified certain prior period amounts to conform with the current period

presentation, which we believe is more meaningful to readers of our consolidated financial statements. For information regarding certain business and regulatory risks, see the following sections as they appear in this Report, in our 2010 Form 10-K,

and in our first quarter 2011 Form 10-Q: the Risk Management section of the Financial Review portion of the respective report; Item 1A Risk Factors included in the respective report; and the Legal Proceedings and Commitments and Guarantees

Notes of the Notes to Consolidated Financial Statements included in the respective report. Also, see the Cautionary Statement Regarding Forward-Looking Information and Critical Accounting Estimates And Judgments sections in this Financial Review for

certain other factors that could cause actual results or future events to differ, perhaps materially, from historical performance and those anticipated in the forward-looking statements included in this Report. See Note 18 Segment Reporting in the

Notes To Consolidated Financial Statements included in Part I, Item 1 of this Report for a reconciliation of total business segment earnings to total PNC consolidated net income from continuing operations before noncontrolling interests as

reported on a generally accepted accounting principles (GAAP) basis.

EXECUTIVE SUMMARY

PNC is one of the largest diversified financial services companies in the United States and is headquartered in Pittsburgh, Pennsylvania.

PNC has businesses engaged in retail banking, corporate and institutional banking, asset management, and residential mortgage banking, providing many of

its products and services nationally and others in PNCs primary geographic markets located in Pennsylvania, Ohio, New Jersey, Michigan, Maryland, Illinois, Indiana, Kentucky, Florida, Virginia, Missouri, Delaware, Washington, D.C., and

Wisconsin. PNC also provides certain products and services internationally.

KEY STRATEGIC

GOALS

We manage our company for the long term and are focused on managing toward a moderate risk profile while

maintaining strong capital and liquidity positions, investing in our markets and products, and embracing our corporate responsibility to the communities where we do business.

Our strategy to enhance shareholder value centers on driving growth in pre-tax, pre-provision earnings by achieving growth in revenue from our balance sheet and diverse business mix that exceeds growth in

expenses controlled through disciplined cost management.

The primary drivers of revenue growth are the acquisition, expansion and retention

of customer relationships. We strive to expand our customer base by offering convenient banking options and leading technology solutions, providing a broad range of fee-based and credit products and services, focusing on customer service, and

through a significantly enhanced branding initiative. This strategy is designed to give our consumer customers choices based on their needs. Rather than striving to optimize fee revenue in the short term, our approach is focused on effectively

growing targeted market share and share of wallet. We may also grow revenue

through appropriate and targeted acquisitions and, in certain businesses, by expanding into new geographical markets.

We are focused on our strategies for quality growth. We are committed to a moderate risk philosophy characterized by disciplined credit management and limited exposure to earnings volatility resulting

from interest rate fluctuations and the shape of the interest rate yield curve. We made substantial progress in transitioning our balance sheet over the past two years, working to return to our moderate risk profile throughout our expanded

franchise. Our actions have created a well-positioned balance sheet, strong bank level liquidity and investment flexibility to adjust, where appropriate and permissible, to changing interest rates and market conditions.

PENDING ACQUISITION OF RBC BANK (USA)

On June 19, 2011, PNC entered into a definitive agreement to acquire RBC Bank (USA), the US retail banking subsidiary of Royal Bank of Canada. RBC

Bank (USA) has approximately $25 billion of assets and 424 branches in North Carolina, Florida, Alabama, Georgia, Virginia and South Carolina. The transaction is expected to add approximately $19 billion of deposits and $16 billion of loans to

PNCs Consolidated Balance Sheet and to close in March 2012, subject to customary closing conditions, including regulatory approvals. Note 2 Acquisition and Divestiture Activity in the Notes To Consolidated Financial Statements of this Report

and our Current Report on Form 8-K dated June 19, 2011 contain additional information regarding this pending acquisition.

PENDING ACQUISITION OF FLAGSTAR BRANCHES

On July 26, 2011, PNC signed a definitive agreement to acquire 27 branches in metropolitan Atlanta, Georgia from Flagstar Bank, FSB, a subsidiary of

Flagstar Bancorp, Inc., and assume approximately $240 million of deposits associated with those branches based on balances as of June 30, 2011. Under the agreement, PNC will purchase 21 branches and lease six branches located in a seven-county

area primarily

3

north of Atlanta. Acquired real estate and fixed assets associated with the branches will be purchased for net book value, of approximately $42 million. No deposit premium will be paid and no

loans will be acquired in the transaction, which is expected to close in December 2011 subject to customary closing conditions, including regulatory approvals.

2011 CAPITAL ACTIONS

Our ability to take certain

capital actions has been subject to the results of the supervisory assessment of capital adequacy undertaken by the Board of Governors of the Federal Reserve System (Federal Reserve) and our primary bank regulators as part of the capital adequacy

assessment of the 19 bank holding companies that participate in the Supervisory Capital Assessment Program. As we announced on March 18, 2011, the Federal Reserve accepted the capital plan that we had previously submitted for their review and

did not object to our capital actions.

On July 27, 2011, we issued one million depositary shares, each representing

a 1/100th interest in a share of our Fixed-to-Floating

Rate Non-Cumulative Perpetual Preferred Stock, Series O, in an underwritten public offering resulting in gross proceeds to us before commissions and expenses of $1 billion. We intend to use the net proceeds from this offering for general corporate

purposes, including funding for the pending RBC Bank (USA) acquisition.

On April 7, 2011, consistent with our capital plan submitted to

the Federal Reserve, our Board of Directors approved an increase to PNCs quarterly common stock dividend from $.10 per common share to $.35 per common share, which was paid on May 5, 2011. Additionally, also consistent with that capital

plan, our Board of Directors also confirmed that PNC may begin to purchase common stock under its existing 25 million share repurchase program in open market or privately negotiated transactions. We have placed on hold our plans to repurchase

up to $500 million of common stock during the remainder of 2011 until we obtain regulatory approval for the RBC Bank (USA) acquisition, and will reevaluate share repurchase plans at that time. The discussion of capital within the Consolidated

Balance Sheet Review section of this Financial Review includes additional information regarding our common stock repurchase program.

RECENT MARKET AND INDUSTRY DEVELOPMENTS

There have been numerous legislative and regulatory developments and dramatic changes in the competitive landscape of our industry over the last several

years.

The United States and other governments have undertaken major reform of the regulatory oversight structure of the financial services

industry, including engaging in new efforts to impose requirements designed to protect consumers and investors from financial abuse. We expect to face further increased regulation of our industry as a result of current and future initiatives

intended to provide economic stimulus,

financial market stability and enhanced regulation of financial services companies and to enhance the liquidity and solvency of financial institutions and markets. We also expect in many cases

more intense scrutiny from our bank supervisors in the examination process and more aggressive enforcement of regulations on both the federal and state levels. Compliance with regulations and other supervisory initiatives will likely increase our

costs and reduce our revenue, and may limit our ability to pursue certain desirable business opportunities.

The Dodd-Frank Wall Street Reform

and Consumer Protection Act (Dodd-Frank) mandates the most wide-ranging overhaul of financial industry regulation in decades. Dodd-Frank was signed into law on July 21, 2010. Although Dodd-Frank and other reforms will affect a number of the

areas in which we do business, it is not clear at this time the full extent of the adjustments that will be required and the extent to which we will be able to adjust our businesses in response to the requirements. Many parts of the law are now in

effect and others are now in the implementation stage, which is likely to continue for several years. The law requires that regulators, some of which are new regulatory bodies created by Dodd-Frank, draft, review and approve more than 300

implementing regulations and conduct numerous studies that are likely to lead to more regulations, a process that, while well underway, is proceeding somewhat slower than originally anticipated, thus extending the uncertainty surrounding the

ultimate impact of Dodd-Frank on us.

A number of reform provisions are likely to significantly impact the ways in which banks and bank

holding companies, including PNC, do business. We provide additional information on a number of these provisions (including new consumer protection regulation, enhanced capital requirements, limitations on investment in and sponsorship of funds,

risk retention by securitization participants, new regulation of derivatives, potential applicability of state consumer protection laws, and limitations on interchange fees) and some of their potential impacts on PNC in Item 1A Risk Factors

included in Part II of this Report.

RESIDENTIAL MORTGAGE FORECLOSURE MATTERS

Beginning in the third quarter of 2010, mortgage foreclosure documentation practices among US financial institutions received

heightened attention by regulators and the media. PNCs US market share for residential servicing based on retail origination volume is approximately 1.6%. The vast majority of our servicing business is on behalf of other investors, principally

the Federal Home Loan Mortgage Corporation (FHLMC) and the Federal National Mortgage Association (FNMA). Following the initial reports regarding these practices, we conducted an internal review of our foreclosure procedures. Based upon our review,

we believe that PNC has systems designed to ensure that no foreclosure proceeds unless the loan is genuinely in default.

4

Similar to other banks, however, we identified issues regarding some of our foreclosure practices.

Accordingly, after implementing a delay in pursuing individual foreclosures, we have been moving forward in most jurisdictions on such matters under procedures designed to address as appropriate any documentation issues. We are also proceeding with

new foreclosures under enhanced procedures designed as part of this review to minimize the risk of errors related to the processing of documentation in foreclosure cases.

The Federal Reserve and the Office of the Comptroller of the Currency (OCC), together with the FDIC and others, conducted a publicly-disclosed interagency horizontal review of residential mortgage

servicing operations at PNC and thirteen other federally regulated mortgage servicers. As a result of that review, in April 2011 PNC entered into a consent order with the Federal Reserve and PNC Bank, National Association (PNC Bank) entered into a

consent order with the OCC. Collectively, these consent orders describe certain foreclosure-related practices and controls that the regulators found to be deficient and require PNC and PNC Bank to, among other things, develop and implement plans and

programs to enhance PNCs residential mortgage servicing and foreclosure processes, retain an independent consultant to review certain residential mortgage foreclosure actions, take certain remedial actions, and oversee compliance with the

orders and the new plans and programs. The two orders do not foreclose the potential for civil money penalties from either of these regulators.

Other governmental, legislative and regulatory inquiries on this topic are ongoing, and may result in significant additional actions, penalties or other

remedies.

For additional information, including with respect to some of these other ongoing governmental, legislative and regulatory

inquiries, please see Note 16 Legal Proceedings and Note 17 Commitments and Guarantees in the Notes To Consolidated Financial Statements in this Report and our Current Report on Form 8-K dated April 14, 2011.

KEY FACTORS AFFECTING FINANCIAL PERFORMANCE

Our financial performance is substantially affected by a number of external factors outside of our control, including the following:

| |

|

|

General economic conditions, including the speed and stamina of the moderate economic recovery in general and on our customers in particular,

|

| |

|

|

The level of, and direction, timing and magnitude of movement in, interest rates and the shape of the interest rate yield curve,

|

| |

|

|

The functioning and other performance of, and availability of liquidity in, the capital and other financial markets,

|

| |

|

|

Loan demand, utilization of credit commitments and standby letters of credit, and asset quality,

|

| |

|

|

Customer demand for non-loan products and services,

|

| |

|

|

Changes in the competitive and regulatory landscape and in counterparty creditworthiness and performance as the financial services industry

restructures in the current environment,

|

| |

|

|

The impact of the extensive reforms enacted in the Dodd-Frank legislation and other legislative, regulatory and administrative initiatives, including

those outlined elsewhere in this Report, and

|

| |

|

|

The impact of market credit spreads on asset valuations.

|

In addition, our success will depend, among other things, upon:

| |

|

|

Further success in the acquisition, growth and retention of customers,

|

| |

|

|

Continued development of the geographic markets related to our recent acquisitions, including full deployment of our product offerings,

|

| |

|

|

Progress towards closing the pending RBC Bank (USA) and Flagstar branches acquisitions,

|

| |

|

|

A sustained focus on expense management,

|

| |

|

|

Managing the distressed assets portfolio and other impaired assets,

|

| |

|

|

Improving our overall asset quality and continuing to meet evolving regulatory capital standards,

|

| |

|

|

Continuing to maintain and grow our deposit base as a low-cost funding source,

|

| |

|

|

Prudent risk and capital management related to our efforts to return to our desired moderate risk profile,

|

| |

|

|

Actions we take within the capital and other financial markets, and

|

| |

|

|

The impact of legal and regulatory contingencies.

|

SALE OF PNC GLOBAL INVESTMENT SERVICING

On July 1, 2010, we sold PNC Global Investment Servicing Inc. (GIS), a leading provider of processing, technology and business intelligence services to asset managers, broker-dealers and financial

advisors worldwide, for $2.3 billion in cash pursuant to a definitive agreement entered into on February 2, 2010. The pretax gain recorded in the third quarter of 2010 related to this sale was $639 million, or $328 million after taxes.

Results of operations of GIS through June 30, 2010 are presented as income from discontinued operations, net of income taxes, on our

Consolidated Income Statement in this Report. Once we entered into the sales agreement, GIS was no longer a reportable business segment. See Note 2 Acquisition and Divestiture Activity in our Notes To Consolidated Financial Statements in this

Report.

5

INCOME STATEMENT HIGHLIGHTS

| |

|

|

Strong earnings for the second quarter of 2011 reflected improved credit quality and client sales and revenue momentum.

|

| |

|

|

Net interest income of $2.2 billion and net interest margin of 3.93% for the second quarter both declined compared with the second quarter of 2010,

reflecting a lower yield on interest-earning assets resulting from lower purchase accounting accretion, soft loan demand and the low interest rate environment.

|

| |

|

|

Noninterest income of $1.5 billion for the second quarter reflected lower service charges on deposits from the impact of Regulation E rules pertaining

to overdraft fees, partially offset by higher asset management fees.

|

| |

|

|

The provision for credit losses of $280 million for the second quarter declined from $823 million in the second quarter of 2010 as overall credit

quality continued to improve.

|

| |

|

|

Noninterest expense of $2.2 billion for the second quarter of 2011 increased $174 million compared with the second quarter of 2010 primarily due the

impact of second quarter 2010 benefits from the reversal of certain accrued liabilities, with $73 million associated with a franchise tax settlement and $47 million associated with an indemnification liability for certain Visa litigation.

|

| |

|

|

A decline in the effective tax rate to 20.4% for the second quarter compared with 28.2% for the second quarter of 2010 was primarily attributable to a

reversal of certain deferred tax liabilities.

|

CREDIT QUALITY HIGHLIGHTS

| |

|

|

Credit quality further improved in the second quarter of 2011. Nonperforming assets declined $642 million, or 13%, to $4.5 billion at June 30,

2011 compared with December 31, 2010. Accruing loans past due decreased 8% to $4.1 billion from $4.5 billion at December 31, 2010. Net charge-offs totaled $947 million for the first half of 2011 compared with $1.5 billion for the first

half of 2010, a decline of 38%. Second quarter 2011 net charge-offs declined to $414 million compared with $840 million in the second quarter of 2010. The allowance for loan and lease losses was 3.08% of total loans and 120% of nonperforming loans

as of June 30, 2011.

|

BALANCE SHEET HIGHLIGHTS

| |

|

|

We continued our momentum in acquiring new clients and deepening customer relationships during the second quarter of 2011 with our innovative products

and services, distribution network and cross sell expertise. Retail banking checking relationships grew organically by 74,000 during the second quarter of 2011 compared with 10,000 during second quarter of 2010. Corporate banking is on track to

exceed its goal of adding 1,000 new primary clients in 2011.

|

| |

|

Asset management sales referrals from PNCs retail, corporate and commercial bankers for the first half of 2011 were double those in first half 2010.

|

| |

|

|

Total loans of $150 billion at June 30, 2011 were about flat compared with December 31, 2010 as a result of growth in commercial loans

largely from new client acquisition and increased utilization from existing clients partially offset by declines in commercial real estate and consumer loans. Loans and commitments originated and renewed totaled approximately $38 billion in the

second quarter of 2011, including $1 billion of small business loans.

|

| |

|

|

Total deposits were $182 billion at June 30, 2011, down slightly from December 31, 2010. Higher cost retail certificates of deposit continued

to decline with a net reduction of 4% in the second quarter, offset by growth in noninterest-bearing demand deposits.

|

| |

|

|

PNCs high quality balance sheet remained core funded with a loan to deposit ratio of 83% at June 30, 2011 and a strong liquidity position to

support growth.

|

| |

|

|

PNC had strong capital levels at June 30, 2011 with a Tier 1 common capital ratio of 10.5% at June 30, 2011, an increase from 9.8% at

December 31, 2010.

|

| |

|

|

PNC successfully completed the acquisition and conversion of 19 branches and $324 million of deposits from BankAtlantic in the Tampa, Florida area, on

June 6, 2011.

|

Our Consolidated Income Statement and Consolidated Balance Sheet Review sections of this Financial

Review describe in greater detail the various items that impacted our results for the first six months of 2011 and 2010.

AVERAGE CONSOLIDATED BALANCE SHEET HIGHLIGHTS

Various seasonal and other factors impact our period-end balances whereas average balances are generally more indicative of underlying business trends

apart from the impact of acquisitions, divestitures and consolidations of variable interest entities. The Consolidated Balance Sheet Review section of this Financial Review provides information on changes in selected Consolidated Balance Sheet

categories at June 30, 2011 compared with December 31, 2010.

Total average assets were $261.8 billion for the first six months of

2011 compared with $265.7 billion for the first six months of 2010. Average interest-earning assets were $222.4 billion for the first six months of 2011, compared with $225.8 billion in the first six months of 2010. In both comparisons, the declines

were primarily driven by a $6.8 billion decrease in average total loans partially offset by a $4.3 billion increase in average total investment securities. The overall decline in average loans reflected soft customer loan demand, loan repayments,

dispositions and net charge-offs. The increase in total investment securities reflected net investments of excess liquidity in high quality securities primarily agency residential mortgage-backed securities.

6

Average total loans decreased $6.8 billion, to $150.0 billion for the first six months of 2011 compared

with the first six months of 2010. The decrease in average total loans primarily reflected declines in commercial real estate of $4.5 billion and residential real estate of $3.7 billion, partially offset by a $2.2 billion increase in commercial

loans. Commercial real estate loans declined due to loan sales, paydowns, and charge-offs. The decrease in residential real estate was impacted by portfolio management activities, paydowns and net charge-offs. Commercial loans increased due to a

combination of new client acquisition and improved utilization. Loans represented 67% of average interest-earning assets for the first six months of 2011 and 69% of average interest-earning assets for the first six months of 2010.

Average securities available for sale increased $4.0 billion, to $53.1 billion, in the first six months of 2011 compared with the first six months of

2010. Average agency residential mortgage-backed securities increased $6.4 billion and other debt securities increased $1.6 billion in the comparison while US Treasury and government agency securities decreased $3.0 billion and non-agency

residential mortgage-backed securities declined $1.9 billion. The impact of purchases of high quality agency residential mortgage-backed securities and other debt was partially offset by paydowns of other security types.

Average securities held to maturity increased $.3 billion, to $7.2 billion, in the first six months of 2011 compared with the first six months of 2010.

The increases of $1.0 billion in commercial mortgage-backed securities and $.6 billion in residential mortgage-backed securities more than offset a $1.3 billion decrease in asset-backed securities in the comparison.

Total investment securities comprised 27% of average interest-earning assets for the first six months of 2011 and 25% for the first six months of 2010.

Average noninterest-earning assets totaled $39.4 billion in the first six months of 2011 compared with $40.0 billion in the first six months

of 2010.

Average total deposits were $180.8 billion for the current year-to-date compared with $182.7 billion for the prior year-to-date.

Average deposits declined from the prior year period primarily as a result of decreases of $9.6 billion in average retail certificates of deposit and $.5 billion in average other time deposits, which were partially offset by increases of $5.3

billion in average noninterest-bearing deposits, $1.8 billion in average demand deposits and $1.1 billion in average savings deposits. Total deposits at June 30, 2011 were $181.9 billion compared with $183.4 billion at December 31, 2010

and are further discussed within the Consolidated Balance Sheet Review section of this Report.

Average total deposits represented 69% of

average total assets for the first six months of both 2011 and 2010.

Average transaction deposits were $133.9 billion for the first six months of 2011 compared with $126.6

billion for the first six months of 2010. The ongoing planned reduction of high-cost and primarily non-relationship certificates of deposit is part of our overall deposit strategy that is focused on growing demand and other transaction deposits as

cornerstone products of customer relationships and a lower-cost, stable funding source. Furthermore, core checking accounts are critical to our strategy of expanding our payments business.

Average borrowed funds were $36.7 billion for the current year-to-date compared with $41.7 billion for the prior year-to-date. Maturities of Federal Home Loan Bank (FHLB) borrowings drove the decline

compared with the first half of 2010. Total borrowed funds at June 30, 2011 were $35.2 billion compared with $39.5 billion at December 31, 2010 and are further discussed within the Consolidated Balance Sheet Review section of this

Financial Review. The Liquidity Risk Management portion of the Risk Management section of this Financial Review includes additional information regarding our sources and uses of borrowed funds.

BUSINESS SEGMENT HIGHLIGHTS

Total business segment earnings were $1.4 billion for the first six months of 2011 and $1.3 billion for the first six months of 2010. Highlights of results for the second quarters of 2011 and 2010 are

included below. The Business Segments Review section of this Financial Review includes a Results of Business-Summary table and further analysis of our business segment results over the first six months of 2011 and 2010 including presentation

differences from Note 18 Segment Reporting in our Notes To Consolidated Financial Statements of this Report.

We provide a reconciliation of

total business segment earnings to PNC consolidated income from continuing operations before noncontrolling interests as reported on a GAAP basis in Note 18 Segment Reporting in our Notes To Consolidated Financial Statements of this Report.

Retail Banking

Retail

Banking earned $26 million in the first six months of 2011 compared with earnings of $104 million for the same period a year ago. Earnings declined from the prior year as lower revenues from the impact of Regulation E rules related to overdraft fees

and a low interest rate environment were partially offset by a lower provision for credit losses. Retail Banking continued to maintain its focus on growing customers and deposits, improving customer and employee satisfaction, investing in the

business for future growth, and disciplined expense management during this period of market and economic uncertainty.

Retail Banking earned

$44 million for the second quarter of 2011 compared with earnings of $80 million for second quarter 2010. The decrease from the prior year second quarter

7

was a result of lower revenue from the impact of Regulation E rules related to overdraft fees, lower net interest income and higher noninterest expense somewhat offset by a lower provision for

credit losses and higher consumer service fees.

Corporate & Institutional Banking

Corporate & Institutional Banking earned $880 million in the first six months of 2011 compared with $816 million in the first six months of 2010.

The increase in earnings was due to a decrease in the provision for credit losses, somewhat offset by declines in net interest income and revenue from commercial mortgage banking activities. We continued to focus on adding new clients and increased

our cross selling to serve our clients needs, particularly in the western markets, and remained committed to strong expense discipline.

Corporate & Institutional Banking earned $448 million in both the second quarter of 2011 and the second quarter of 2010. While earnings were

flat in the comparison, lower net interest income and higher noninterest expense were offset by a lower provision for credit losses and higher noninterest income.

Asset Management Group

Asset Management Group earned $91 million in the first six months

of 2011 compared with $66 million in the first six months of 2010. Earnings for the first half of 2011 reflected a benefit from the provision for credit losses and growth in noninterest income as assets under administration increased to $219

billion, a 10% increase over June 30, 2010. The business remained focused on its core strategies to drive growth, including: increasing channel penetration; investing in higher growth geographies; and investing in differentiated client facing

technology.

Asset Management Group earned $48 million in the second quarter of 2011 compared with $27 million in the second quarter of 2010.

Higher earnings for the 2011 quarter were driven by a benefit from the provision for credit losses and growth in noninterest income partially offset by an increase in noninterest expense from investments in the business in the comparison. Overall

second quarter results benefited from strong sales and significant referrals from other PNC lines of business.

Residential Mortgage

Banking

Residential Mortgage Banking earned $126 million in the first six months of 2011 compared with $169 million in the first six

months of 2010. Earnings declined from the prior year period

primarily as a result of higher noninterest expense, lower net interest income, a benefit from the provision for credit losses in the first six months of 2010, and lower servicing fees partially

offset by increased loan sales revenue.

Residential Mortgage Banking earned $55 million in the second quarter of 2011 compared with $91

million in the second quarter of 2010. The decline in earnings primarily resulted from higher noninterest expense and lower net interest income.

BlackRock

Our BlackRock business segment earned $179 million in the first six months of

2011 and $154 million in the first six months of 2010. Second quarter 2011 business segment earnings from BlackRock were $93 million compared with $77 million in the second quarter of 2010. Higher earnings at BlackRock for the second quarter of 2011

compared to the second quarter of 2010 were primarily due to the effect of growth in investment advisory fees related to growth in long-term assets under management.

Distressed Assets Portfolio

This business segment consists primarily of assets acquired

with acquisitions and had earnings of $109 million for the first six months of 2011 compared with a loss of $6 million in the first six months of 2010. The increase was driven primarily by a lower provision for credit losses partially offset by a

decline in net interest income.

Distressed Assets Portfolio segment had earnings of $84 million for the second quarter of 2011 compared with

a loss of $79 million for the second quarter of 2010. The increase primarily resulted from a lower provision for loan losses.

Other

Other reported earnings of $333 million for the six months of 2011 compared with earnings of $126 million for the first six

months of 2010. The increase in earnings over the first six months of 2010 primarily reflected the impact of integration costs incurred in the 2010 period, the benefit of the lower effective tax rate in the 2011 period and lower net

other-than-temporary impairments (OTTI) in the 2011 period.

Other reported earnings of $140 million in the second quarter of 2011

and $137 million in the second quarter of 2010.

8

CONSOLIDATED INCOME STATEMENT

REVIEW

Our Consolidated Income Statement is presented in Part I, Item 1 of this Report.

Net income for the first six months of 2011 was $1.7 billion compared with $1.5 billion for the first six months of 2010. Net income for the second

quarter of 2011 was $912 million compared with $803 million for the second quarter of 2010. Strong earnings for the first half and second quarter of 2011 reflect improved credit quality, client sales and revenue momentum.

Total revenue for the first six months of 2011 was $7.2 billion compared with $7.7 billion for the first six months of 2010. Total revenue for the second

quarter of 2011 was $3.6 billion compared with $3.9 billion for the second quarter of 2010. The decline in both comparisons reflected lower net interest income in the 2011 periods attributable to purchase accounting.

NET INTEREST INCOME AND NET INTEREST

MARGIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

June 30 |

|

|

Six months ended

June 30 |

|

| Dollars in millions |

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

| Net interest income

|

|

$ |

2,150 |

|

|

$ |

2,435 |

|

|

$ |

4,326 |

|

|

$ |

4,814 |

|

| Net interest margin

|

|

|

3.93 |

% |

|

|

4.35 |

% |

|

|

3.93 |

% |

|

|

4.29 |

% |

Changes in net interest income and margin result from the interaction of the volume and composition of interest-earning

assets and related yields, interest-bearing liabilities and related rates paid, and noninterest-bearing sources of funding. See the Statistical Information (Unaudited) Average Consolidated Balance Sheet And Net Interest Analysis section of

this Report for additional information.

The decreases in net interest income and net interest margin compared with both the second quarter of

2010 and the first six months of 2010 were primarily attributable to lower purchase accounting accretion. A decline in loan balances and the low interest rate environment, partially offset by lower funding costs, also contributed to the decrease in

each period.

The net interest margin was 3.93% for the first six months of 2011 and 4.29% for the first six months of 2010. The following

factors impacted the comparison:

| |

|

|

A 49 basis point decrease in the yield on interest-earning assets. The yield on loans, the largest portion of our earning assets, decreased 44 basis

points.

|

| |

|

|

These factors were partially offset by an 11 basis point decline in the rate accrued on interest-bearing liabilities. The rate accrued on

interest-bearing deposits, the largest component, decreased 21 basis points, the impact of which was partially offset by a

|

| |

|

29 basis point increase in the rate accrued on total borrowed funds.

|

The net interest margin was 3.93% for the second quarter of 2011 and 4.35% for the second quarter of 2010. The following factors impacted the comparison:

| |

|

|

A 49 basis point decrease in the yield on interest-earning assets. The yield on loans, the largest portion of our earning assets, decreased 47 basis

points.

|

| |

|

|

These factors were partially offset by a 3 basis point decline in the rate accrued on interest-bearing liabilities. The rate accrued on

interest-bearing deposits, the largest component, decreased 16 basis points, the impact of which was partially offset by a 58 basis point increase in the rate accrued on total borrowed funds.

|

We expect that our purchase accounting accretion will decline by approximately $700 million for full year 2011 compared with 2010. Excluding the impact

of this factor, we expect our net interest income and net interest margin to be stable for full year 2011 compared with 2010. Approximately $11.3 billion of higher cost retail consumer CDs are scheduled to mature in the second half of 2011 at a

weighted-average rate of about 1.74%. We expect that these will be redeemed or re-priced at a lower rate, which will benefit our funding costs.

NONINTEREST INCOME

Summary

Noninterest income totaled $2.9 billion for the first six months of both

2011 and 2010 and was $1.5 billion for the second quarter of both 2011 and 2010. Noninterest income for the second quarter of 2011 reflected lower service charges on deposits from the impact of Regulation E rules pertaining to overdraft fees,

partially offset by higher asset management fees.

Additional Analysis

Asset management revenue increased $49 million to $551 million in the first six months of 2011 compared with the first six months of 2010. Asset management revenue was $288 million in the second quarter

of 2011 compared with $243 million in the second quarter of 2010. These increases in the comparisons were driven by higher equity earnings from our BlackRock investment and by higher equity markets, successful client retention, growth in new clients

and strong sales performance. Discretionary assets under management at June 30, 2011 totaled $109 billion compared with $99 billion at June 30, 2010.

For the first half of 2011, consumer services fees totaled $644 million compared with $611 million in the first half of 2010. Consumer services fees were $333 million in the second quarter of 2011

compared with $315 million in the second quarter of 2010. The increases reflected higher volume-related transaction fees, such as debit and credit cards and merchant services.

9

Corporate services revenue totaled $445 million in the first six months of 2011 and $529 million in the

first six months of 2010. Corporate services revenue was $228 million in the second quarter of 2011 compared with $261 million in the second quarter of 2010. Commercial mortgage servicing revenue declined in both comparisons due to higher mortgage

servicing rights impairment charges and lower ancillary fee income. Corporate services fees include the noninterest component of treasury management fees, which continued to be a strong contributor to revenue.

Residential mortgage revenue totaled $358 million in the first half of 2011 and $326 million in the first half of 2010. Second quarter 2011 residential

mortgage revenue totaled $163 million compared with $179 million in the second quarter of 2010. Higher loans sales revenue drove the year-to-date comparison, while lower net hedging gains on mortgage servicing rights were reflected in the quarterly

decline.

Service charges on deposits totaled $254 million for the first six months of 2011 and $409 million for the first six months of 2010.

Service charges on deposits totaled $131 million for the second quarter of 2011 and $209 million for second quarter of 2010. The decline in both comparisons resulted primarily from the impact of Regulation E rules pertaining to overdraft fees.

Net gains on sales of securities totaled $119 million for the first half of 2011 and $237 million for the first half of 2010. Net gains on

sales of securities were $82 million for the second quarter of 2011 and $147 million for second quarter of 2010.

The net credit component of

OTTI of securities recognized in earnings was a loss of $73 million in the six months of 2011, including $39 million in the second quarter, compared with losses of $210 million and $94 million, respectively for the same periods in 2010.

Other noninterest income totaled $609 million for the first six months of 2011 compared with $457 million for the first six months of 2010. Other

noninterest income totaled $266 million for second quarter of 2011 compared with $217 million for second quarter of 2010. Both increases over the comparable 2010 periods were driven by several individually insignificant items.

Other noninterest income typically fluctuates from period to period depending on the nature and magnitude of transactions completed. Further details

regarding our trading activities are included in the Market Risk Management Trading Risk portion of the Risk Management section of this Financial Review, further details regarding equity and alternative investments are included in the Market

Risk Management-Equity And Other Investment Risk section and further details regarding gains or losses related to our equity investment in BlackRock are included in the Business Segments Review section.

Looking to full year 2011, we see opportunities for growth in our fee-based revenues resulting from client

growth and depth in our expanded franchise. At the same time, we will see the continued impact of ongoing regulatory reforms. Revenue is likely to decline compared with 2010 from the impact of the rules set forth in Regulation E related to overdraft

fees and the Dodd-Frank limits related to interchange rates on debit card transactions. Regulation E, which became effective July 1, 2010, is expected to have an incremental negative impact to 2011 revenues of approximately $200 million based on

expected 2011 transaction volumes. The Dodd-Frank limits related to interchange rates on debit cards will be effective October 1, 2011 and are expected to have a negative incremental impact of approximately $75 million in 2011 and an additional

incremental reduction in future periods annual revenue of approximately $175 million based on expected 2011 transaction volumes. Excluding the expected incremental negative impact of these two regulatory changes, we expect noninterest income

for full year 2011 to increase in the low-to-mid single digits (in terms of percentages) compared with 2010.

PRODUCT

REVENUE

In addition to credit and deposit products for commercial customers, Corporate & Institutional Banking

offers other services, including treasury management, capital markets-related products and services, and commercial real estate loan servicing.

Treasury management revenue, which includes fees as well as net interest income from customer deposit balances, totaled $593 million for the first six

months of 2011 and $595 million for the first six months of 2010. For the second quarter of 2011, treasury management revenue was $292 million compared with $299 million for the second quarter of 2010. Declining deposit spreads offset increases in

core processing products, such as lockbox and information reporting, and in growth products such as commercial card and healthcare related services.

Revenue from capital markets-related products and services totaled $304 million in the first half of 2011 compared with $285 million in the first half of 2010. Second quarter 2011 revenue was $165 million

compared with $124 million for the second quarter of 2010. Both comparisons were driven by improved valuations on customer derivatives and sales volumes.

Commercial mortgage banking activities include revenue derived from commercial mortgage servicing (including net interest income and noninterest income from loan servicing and ancillary services, net of

commercial mortgage servicing rights amortization, and commercial mortgage servicing rights valuations), and revenue derived from commercial mortgage loans intended for sale and related hedges (including loan origination fees, net interest income,

valuation adjustments and gains or losses on sales).

10

Commercial mortgage banking activities resulted in revenue of $53 million in the first six months of 2011

compared with $162 million in the first six months of 2010. For the second quarter of 2011, revenue from commercial mortgage banking activities totaled $12 million compared with $47 million for the second quarter of 2010. Higher amortization and

impairment charges in 2011 were due primarily to decreased interest rates and related prepayments by borrowers. Impairments totaled $75 million in the first half of 2011, including $40 million for the second quarter. The comparable amounts for 2010

were $18 million and $14 million, respectively. The six months of 2010 included a higher level of ancillary commercial mortgage servicing fees and revenue from a duplicative agency servicing operation that was sold in the second quarter of last year

which contributed to the year-over-year decrease. Improved valuations on commercial mortgage loans held for sale benefited both comparisons.

PROVISION FOR CREDIT LOSSES

The provision for credit losses totaled $.7 billion for the first six months of 2011 compared with $1.6 billion for the first six months of 2010. The

provision for credit losses totaled $280 million for the second quarter of 2011 compared with $823 million for the second quarter of 2010. The decline in both comparisons was driven by overall credit quality improvement and continuation of actions

to reduce exposure levels.

The Credit Risk Management portion of the Risk Management section of this Financial Review includes additional

information regarding factors impacting the provision for credit losses.

We anticipate an overall improvement in credit migration for full

year 2011 and a continued reduction in our nonperforming loans assuming modest GDP growth. As a result, we expect that our full year 2011 provision for credit losses will be at least $1 billion less than our full year 2010 provision for credit

losses assuming budgeted loan growth projections.

NONINTEREST EXPENSE

Noninterest expense was $4.2 billion for the first six months of 2011 and $4.1 billion for the first six months of 2010. Noninterest expense totaled $2.2

billion for the second quarter of 2011 compared with $2.0 billion for the second quarter of 2010. The increase in noninterest expense compared with the second quarter of 2010 was primarily due to the impact of second quarter of 2010 benefits from

the reversal of certain accrued liabilities, with $73 million associated with a franchise tax settlement and $47 million associated with an indemnification liability for certain Visa litigation, and various small increases in expenses incurred in

the second quarter of 2011 partially offset by the impact of integration costs during the second quarter of 2010. Integration costs included in noninterest expense totaled $213 million for the first half of 2010, including $100 million in the second

quarter of that year. Noninterest expense for the first half of 2011 included higher personnel and occupancy expense and, in the second quarter, a charge of approximately $40 million related to accruals for legal contingencies primarily associated

with pending lawsuits offset in part by anticipated insurance recoveries.

Apart from the possible impact of legal and regulatory

contingencies we expect that total noninterest expense for full year 2011 will be flat compared with full year 2010. This expectation reflects the shift in the deposit insurance base calculations from deposits to average assets less Tier 1 capital

which was effective April 1, 2011 under Dodd-Frank. The difference in premium is not material.

EFFECTIVE

TAX RATE

The effective tax rate was 23.7% in the first half of 2011 compared with 28.0% in the first

half of 2010. For the second quarter of 2011, our effective tax rate was 20.4% compared with 28.2% for the second quarter of 2010. The decline in the effective tax rate in both comparisons was primarily driven by a $54 million benefit related to the

reversal of deferred tax liabilities associated with adjustments to the tax basis of an asset during the second quarter of 2011. We anticipate that the effective tax rate will be approximately 27% for the second half of 2011.

11

CONSOLIDATED BALANCE SHEET

REVIEW

SUMMARIZED BALANCE SHEET DATA

|

|

|

|

|

|

|

|

|

| In millions |

|

June 30

2011 |

|

|

Dec. 31

2010 |

|

| Assets

|

|

|

|

|

|

|

|

|

| Loans

|

|

$ |

150,319 |

|

|

$ |

150,595 |

|

| Investment securities

|

|

|

59,414 |

|

|

|

64,262 |

|

| Cash and short-term investments

|

|

|

12,805 |

|

|

|

10,437 |

|

| Loans held for sale

|

|

|

2,679 |

|

|

|

3,492 |

|

| Goodwill and other intangible assets

|

|

|

10,594 |

|

|

|

10,753 |

|

| Equity investments

|

|

|

9,776 |

|

|

|

9,220 |

|

| Other, net

|

|

|

17,530 |

|

|

|

15,525 |

|

| Total assets

|

|

$ |

263,117 |

|

|

$ |

264,284 |

|

| Liabilities

|

|

|

|

|

|

|

|

|

| Deposits

|

|

$ |

181,891 |

|

|

$ |

183,390 |

|

| Borrowed funds

|

|

|

35,176 |

|

|

|

39,488 |

|

| Other

|

|

|

11,177 |

|

|

|

8,568 |

|

| Total liabilities

|

|

|

228,244 |

|

|

|

231,446 |

|

| Total shareholders equity

|

|

|

32,235 |

|

|

|

30,242 |

|

| Noncontrolling interests

|

|

|

2,638 |

|

|

|

2,596 |

|

| Total equity

|

|

|

34,873 |

|

|

|

32,838 |

|

| Total liabilities and equity

|

|

$ |

263,117 |

|

|

$ |

264,284 |

|

The summarized balance sheet data above is based upon our Consolidated Balance Sheet in this Report.

The decline in total assets at June 30, 2011 compared with December 31, 2010 was primarily due to lower investment securities, partially offset

by an increase in interest-earning deposits with banks.

An analysis of changes in selected balance sheet categories follows.

LOANS

A summary

of the major categories of loans outstanding follows. Outstanding loan balances reflect unearned income, unamortized discount and premium, and purchase discounts and premiums totaling $2.5 billion at June 30, 2011 and $2.7 billion at

December 31, 2010. The balances do not include future accretable net interest (i.e., the difference between the undiscounted expected cash flows and the carrying value of the loan) on the purchased impaired loans.

Loans decreased $.3 billion as of June 30, 2011 compared with December 31, 2010. Growth in commercial loans of $3.4 billion was offset by

declines of $1.6 billion in commercial real estate loans, $1 billion of residential real estate loans and $.8 billion of home equity loans compared with year end. Commercial loans increased due to a combination of new client acquisition and improved

utilization. Commercial real estate loans declined due to loan sales, paydowns, and charge-offs. The decrease in residential real estate was impacted by paydowns, loans sales, and charge-offs. Home equity loans

declined in the second quarter as paydowns, charge-offs, and portfolio management activities exceeded new loan production and draws on existing lines.

Loans represented 57% of total assets at June 30, 2011 and December 31, 2010. Commercial lending represented 54% of the loan portfolio at

June 30, 2011 and 53% at December 31, 2010. Consumer lending represented 46% at June 30, 2011 and 47% at December 31, 2010.

Commercial real estate loans represented 6% of total assets at June 30, 2011 and 7% of total assets at December 31, 2010.

Details Of Loans

|

|

|

|

|

|

|

|

|

| In millions |

|

Jun. 30

2011 |

|

|

Dec. 31

2010 |

|

| Commercial

|

|

|

|

|

|

|

|

|

| Retail/wholesale trade

|

|

$ |

10,952 |

|

|

$ |

9,901 |

|

| Manufacturing

|

|

|

10,426 |

|

|

|

9,334 |

|

| Service providers

|

|

|

8,984 |

|

|

|

8,866 |

|

| Real estate related (a)

|

|

|

7,515 |

|

|

|

7,500 |

|

| Financial services

|

|

|

5,206 |

|

|

|

4,573 |

|

| Health care

|

|

|

4,115 |

|

|

|

3,481 |

|

| Other industries

|

|

|

11,422 |

|

|

|

11,522 |

|

| Total commercial

|

|

|

58,620 |

|

|

|

55,177 |

|

| Commercial real estate

|

|

|

|

|

|

|

|

|

| Real estate projects

|

|

|

11,086 |

|

|

|

12,211 |

|

| Commercial mortgage

|

|

|

5,233 |

|

|

|

5,723 |

|

| Total commercial real estate

|

|

|

16,319 |

|

|

|

17,934 |

|

| Equipment lease financing

|

|

|

6,210 |

|

|

|

6,393 |

|

| TOTAL COMMERCIAL LENDING (b)

|

|

|

81,149 |

|

|

|

79,504 |

|

| Consumer

|

|

|

|

|

|

|

|

|

| Home equity

|

|

|

|

|

|

|

|

|

| Lines of credit

|

|

|

22,838 |

|

|

|

23,473 |

|

| Installment

|

|

|

10,541 |

|

|

|

10,753 |

|

| Residential real estate

|

|

|

|

|

|

|

|

|

| Residential mortgage

|

|

|

14,302 |

|

|

|

15,292 |

|

| Residential construction

|

|

|

680 |

|

|

|

707 |

|

| Credit card

|

|

|

3,754 |

|

|

|

3,920 |

|

| Other consumer

|

|

|

|

|

|

|

|

|

| Education

|

|

|

8,816 |

|

|

|

9,196 |

|

| Automobile

|

|

|

3,705 |

|

|

|

2,983 |

|

| Other

|

|

|

4,534 |

|

|

|

4,767 |

|

| TOTAL CONSUMER LENDING

|

|

|

69,170 |

|

|

|

71,091 |

|

| Total loans

|

|

$ |

150,319 |

|

|

$ |

150,595 |

|

| (a) |

Includes loans to customers in the real estate and construction industries. |

| (b) |

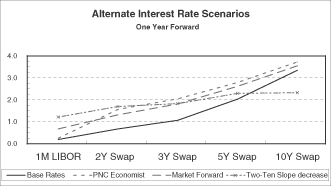

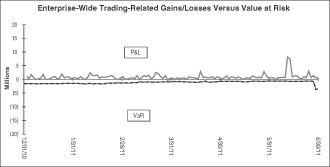

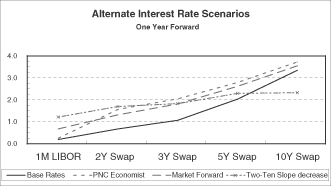

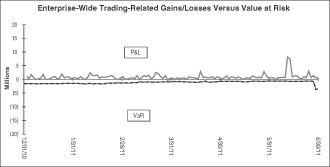

Construction loans with interest reserves, and A/B Note restructurings are not significant to PNC. |