ELECTRONIC PRESENTATION SLIDES

Published on June 20, 2011

Investor

Presentation PNC Announces Agreement to Buy

RBC Bank (USA)

June 20, 2011

Exhibit 99.2

*

*

*

*

*

*

*

*

*

*

*

*

* |

2

Cautionary Statement Regarding Forward-Looking

Information

This

presentation

contains

forward-looking

statements

regarding

our

outlook

or

expectations

with

respect

to

the

planned

acquisition

of

RBC

Bank

(USA),

the

expected

costs

to

be

incurred

in

connection

with

the

acquisition,

RBC

Bank

(USA)s

future

performance

and

consequences

of

its

integration

into

PNC,

and

the

impact

of

the

transaction

on

PNCs

future

performance.

Forward-looking

statements

are

subject

to

numerous

assumptions,

risks

and

uncertainties,

which

change

over

time.

The

forward-looking

statements

in

this

presentation

speak

only

as

of

the

date

of

the

presentation,

and

PNC

assumes

no

duty,

and

does

not

undertake,

to

update

them.

Actual

results

or

future

events

could

differ,

possibly

materially,

from

those

that

we

anticipated

in

these

forward-looking

statements.

These

forward-looking

statements

are

subject

to

the

principal

risks

and

uncertainties

applicable

to

PNCs

businesses

generally

that

are

disclosed

in

PNCs

2010

Form

10-K

and

2011

Form

10-Qs,

including

in

the

Risk

Factors

and

Risk

Management

sections

of

those

reports,

and

in

PNCs

subsequent

SEC

filings

(accessible

on

the

SECs

website

at

www.sec.gov

and

on

PNCs

corporate

website

at

www.pnc.com/secfilings).

We

have

included

these

web

addresses

as

inactive

textual

references

only.

Information

on

these

websites

is

not

part

of

this

document.

Any

annualized,

proforma,

estimated,

third

party

or

consensus

numbers

in

this

presentation

are

used

for

illustrative

or

comparative

purposes

only

and

may

not

reflect

actual

results.

Any

consensus

earnings

estimates

are

calculated

based

on

the

earnings

projections

made

by

analysts

who

cover

that

company.

The

analysts

opinions,

estimates

or

forecasts

(and

therefore

the

consensus

earnings

estimates)

are

theirs

alone,

are

not

those

of

PNC

or

its

management,

and

may

not

reflect

PNCs,

RBC

Bank

(USA)s,

or

other

companys

actual

or

anticipated

results.

In

addition,

forward-looking

statements

in

this

presentation

are

subject

to

the

following

risks

and

uncertainties

related

both

to

the

acquisition

transaction

itself

and

to

the

integration

of

the

acquired

business

into

PNC

after

closing:

Completion

of

the

transaction

is

dependent

on,

among

other

things,

receipt

of

regulatory

and

other

applicable

approvals,

the

timing

of

which

cannot

be

predicted

with

precision

at

this

point

and

which

may

not

be

received

at

all.

The

impact

of

the

completion

of

the

transaction

on

PNCs

financial

statements

will

be

affected

by

the

timing

of

the

transaction.

The

transaction

may

be

substantially

more

expensive

to

complete

(including

the

integration

of

RBC

Bank

(USA)s

businesses)

and

the

anticipated

benefits,

including

anticipated

cost

savings

and

strategic

gains,

may

be

significantly

harder

or

take

longer

to

achieve

than

expected

or

may

not

be

achieved

in

their

entirety

as

a

result

of

unexpected

factors

or

events.

Our

ability

to

achieve

anticipated

results

from

this

transaction

is

dependent

on

the

state

of

the

economic

and

financial

markets

going

forward,

which

have

been

under

significant

stress

recently.

Specifically,

we

may

incur

more

credit

losses

from

RBC

Bank

(USA)s

loan

portfolio

than

expected.

Other

issues

related

to

achieving

anticipated

financial

results

include

the

possibility

that

deposit

attrition

may

be

greater

than

expected.

Litigation

and

governmental

investigations

that

may

be

filed

or

commenced,

as

a

result

of

this

transaction

or

otherwise,

could

impact

the

timing

or

realization

of

anticipated

benefits

to

PNC.

The

integration

of

RBC

Bank

(USA)s

business

and

operations

into

PNC,

which

will

include

conversion

of

RBC

Bank

(USA)s

different

systems

and

procedures,

may

take

longer

than

anticipated

or

be

more

costly

than

anticipated

or

have

unanticipated

adverse

results

relating

to

RBC

Bank

(USA)s

or

PNCs

existing

businesses.

PNCs

ability

to

integrate

RBC

Bank

(USA)

successfully

may

be

adversely

affected

by

the

fact

that

this

transaction

will

result

in

PNC

entering

several

markets

where

PNC

does

not

currently

have

any

meaningful

retail

presence. |

3

Strategic Rationale

Opportunity to deliver PNCs products and services to

new commercial, wealth management and retail

customers

Fairly priced market expansion into demographically

attractive growth markets

Demonstrated ability to successfully integrate and grow

underperforming franchises

RBC Bank (USA) has quality branch network and

human capital to leverage PNCs sales and service

model |

4

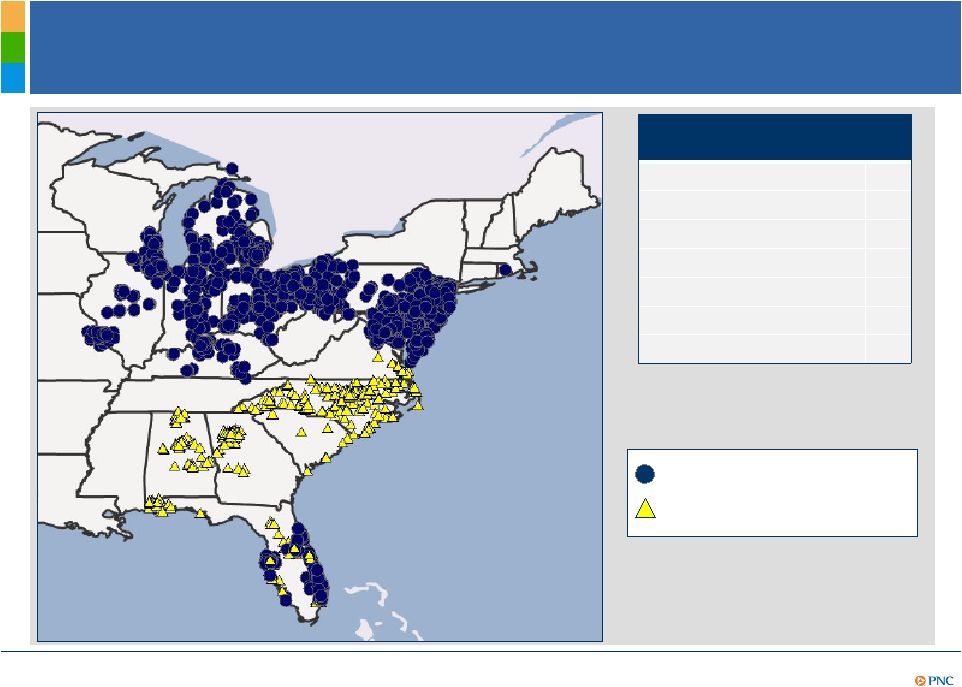

Extends East Coast Branch Network into Faster

Growing Markets

Source: SNL Financial, as of June 2010.

RBC Bank (USA) branches

by state

North Carolina

180

Florida

83

Alabama

78

Georgia

61

Virginia

13

South Carolina

9

Total

424

PNC branches

RBC Bank (USA) branches |

5

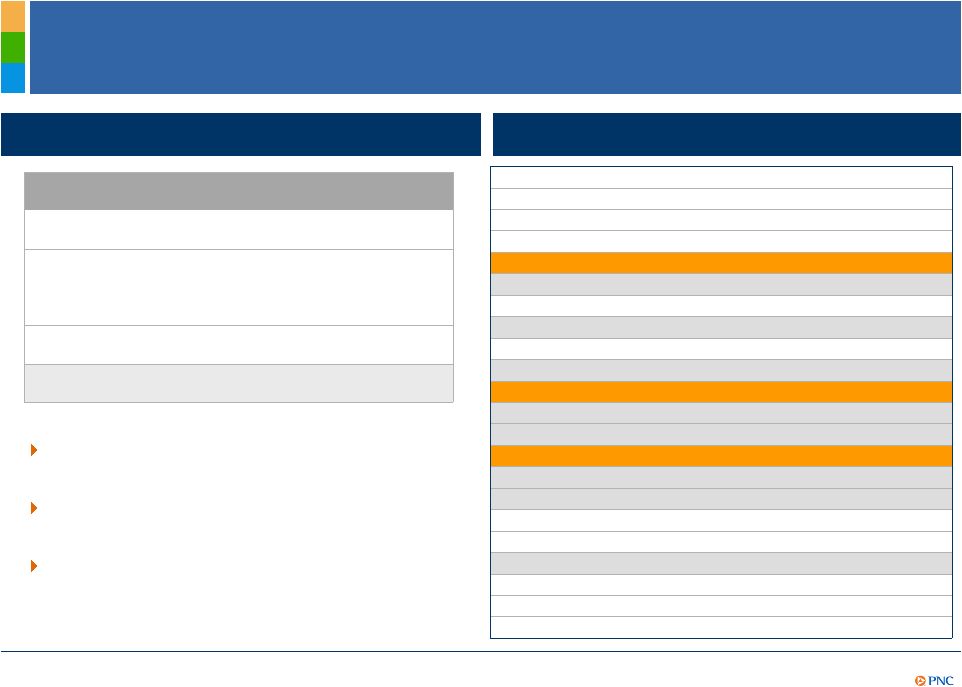

Opportunity to Capture More Deposit Share in

Demographically Attractive Markets

(1) Source: SNL DataSource. (2) Top 20 states based on wealth holders with >$1.5 million

in net worth. Source: IRS Statistics of Income

Division, August 2008. (3) Deposit rank based on share of deposits in state. Source: SNL

DataSource as of June 30, 2010.

wealthy markets

Projected 5-year growth¹

Population

HH income

PNC

1.2%

13.3%

RBC Bank (USA)

6.5%

12.6%

Proforma PNC

1.7%

13.2%

U.S. average

3.9%

12.4%

PNCs proforma retail footprint covers 11 of

the top 20 wealthiest states²

PNC has

demonstrated the ability to grow and attract customers in all its markets

PNC continues to leverage its suite of

innovative products and services to deepen

customer relationships

Proforma

State²

Branches

Deposits( $bn)

Rank³

California

New York

Florida

216

$8.0

10

Illinois

198

$15.7

4

Texas

Pennsylvania

510

$58.2

1

Massachusetts

New Jersey

334

$19.0

5

Georgia

61

$2.8

8

Michigan

244

$15.3

3

Ohio

418

$25.6

2

North Carolina

180

$8.9

5

Virginia

96

$2.6

11

Maryland

230

$10.2

3

Connecticut

Washington

Wisconsin

25

$1.4

11

Colorado

Wyoming

Arizona

RBC Bank (USA) brings high growth and

|

6

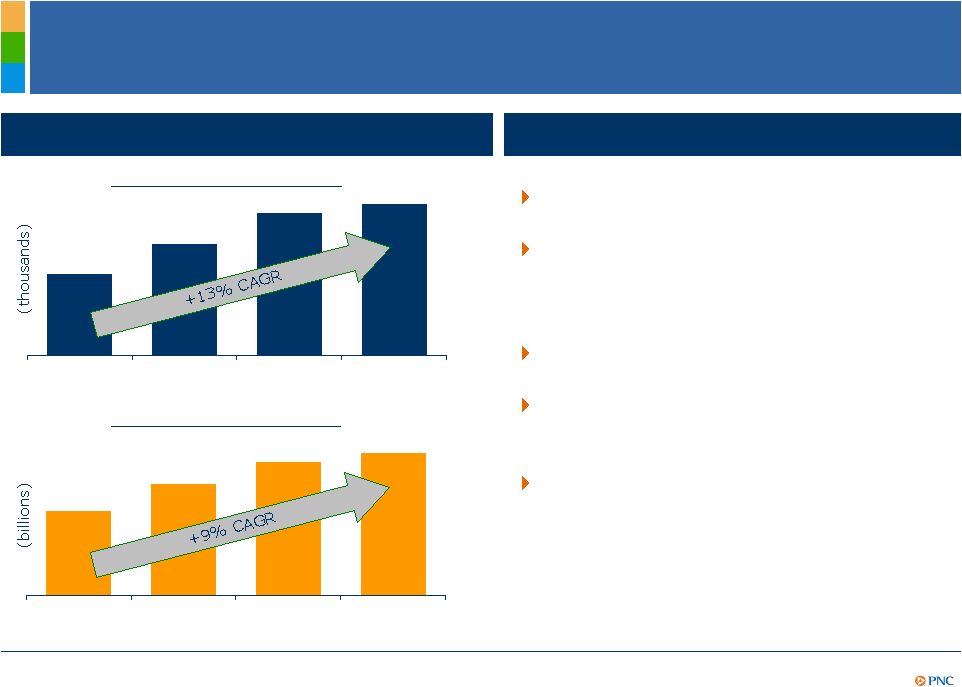

PNCs Proven Capabilities to Grow Retail Banking

Relationships in Acquired Markets

Greater Maryland/Washington, D.C. market

growth

Growth strategies

Increase brand awareness

Introduce innovative products-

Virtual

Wallet, University and Workplace

Banking

Increase share of wallet

Expand branch distribution network

and channels

Deliver exceptional customer service

(1)Total retail deposits adjusted to exclude CDs and IRAs. (2) 2011 reflects amounts as of

March 31, 2011. 497

483

430

382

2008

2009

2010

2011

Total DDA Households

2

Total Retail

Deposits¹

$10.6

$10.3

$9.6

$8.7

2008

2009

2010

2011

2 |

7

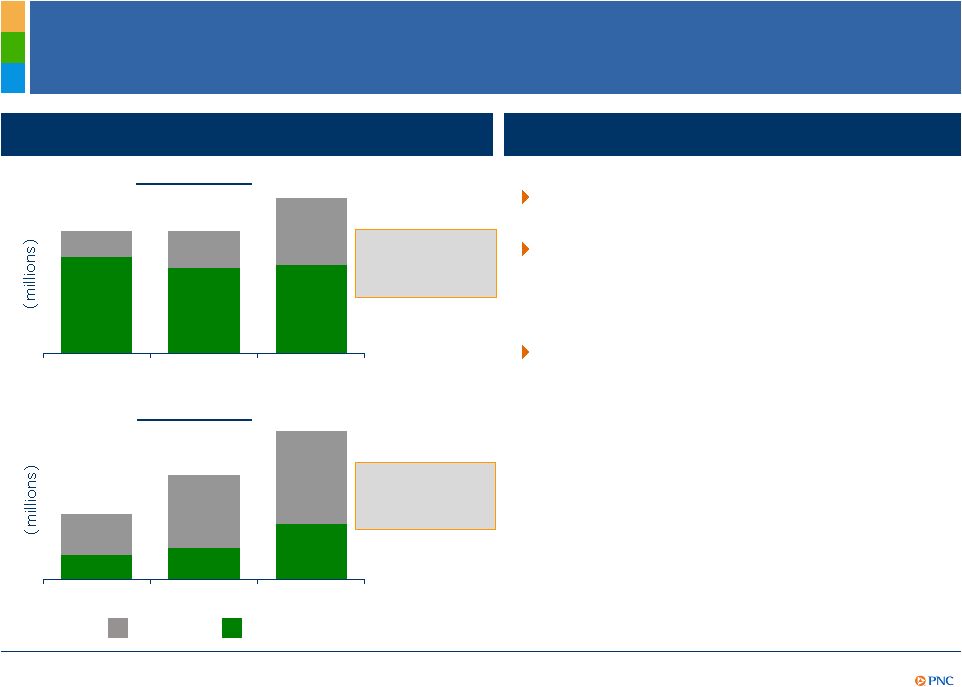

Demonstrated Ability to Grow C&IB and AMG in New

Markets and Cross-Sell Innovative Products

(1) Year over year market revenue growth. (2) Year over year total new primary client growth.

(3) 2011 represents revenue growth for

the five months ended May 31, 2011, annualized.

$14

$20

$35

$46

$44

$50

2009

2010

2011³

Total market revenue growth¹

for C&IB and AMG

Chicago

Fee

NII

$64

$64

$81

New clients up

48% over

YTD10²

$12

$21

$27

$16

$9

$7

2009

2010

2011

Florida

$19

$30

$43

New clients up

24% over

YTD10²

Growth strategies

Leverage cross-sell opportunities

Expand PNCs loan syndication

capabilities as a differentiated leader

in middle market

Deliver innovative treasury

management and capital markets

products

3 |

8

Significant New Commercial Market Opportunity

(1) Top 10 MSAs ranked by deposit size. Small businesses defined

as businesses with sale up to $20 million, Mid-market defined as

businesses with sale between $20 million and $50 million, and Corporate defined as businesses

with sale greater than $50 million. (2) Small Businesses total sales is unavailable.

Source: SNL Financial and OneSource. PNCs Top 10

MSAs¹

RBC Bank (USA)s Top 10

MSAs¹

# of

Businesses

Total Sales

($ billions)

# of

Businesses

% of PNCs

Top 10

Total Sales

($ billions)

Small Businesses

1,373,556

NA²

506,749

37%

NA²

Mid-Market

14,013

$435

3,922

28%

$123

Corporate

6,687

$6,092

1,999

30%

$1,046

RBC Bank (USA) substantially increases target commercial clients

RBC Bank (USA) substantially increases target commercial clients

|

9

Compelling Transaction

(1) The total consideration is comprised of a fixed dollar amount (subject to adjustment at

close for net tangible asset value delivered), including cash and, at PNCs

option, common stock. The amount of PNC stock will not exceed $1 billion or cause Royal Bank of Canadas

ownership of PNC common stock to exceed 4.9%. (2) As of April 30, 2011. (3) Gross of allowance

for loan losses of $755 million, therefore incremental mark of $1,488 million. As of

April 30, 2011. (4) Estimated. (5) As of April 2011. Excludes $150 million for goodwill expense.

Transaction Summary

Transaction total value

$3.45 billion

1

Internal rate of return

4

19%+

Accretion

4

End of year 2013 or sooner

Compelling Financial Terms:

Price to tangible book

2

Discount to tangible book of $112 million; currently 97%

Deposit premium

2

(0.6%)

Annual expense reduction

4

$230

million

(27%

of

RBC

Bank

(USA)s

annualized

expense

base

5

)

Merger and integration costs

4

$322 million

Due diligence

Completed

Loan marks

3,4

Total loan marks: 12.5%, 48% of NPLs

Closing conditions

Regulatory approvals and customary conditions

Anticipated closing

March 2012 |

10

Value-Added Acquisition Positions

PNC Well for the Future

PNC remains core funded with a proforma loan to deposit

ratio of 82%

Credit risk remains manageable given loan marks of 12.5%

and demonstrated distressed loan management capabilities

PNC remains well positioned regarding Basel III

implementation

Drawing upon our NCC branch conversion experience, all

conversions will occur simultaneously with closing

Expense savings achievable |

11

Summary

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company.

Opportunity to deliver PNCs products and services to

new commercial, wealth management and retail

customers

Fairly priced market expansion into demographically

attractive growth markets

Demonstrated ability to successfully integrate and grow

underperforming franchises

RBC Bank (USA) has quality branch network and

human capital to leverage PNCs sales and service

model |

12

Combined Balance Sheet

(1) Gives effect to excluded assets and liabilities and estimated purchase accounting

adjustments. Source: Royal Bank of Canada. (2) Assumes

$1.0 billon of PNC common stock issued to the Royal Bank of Canada and $1 billion preferred

stock issuance. (3) Includes loans held for sale. Appendix

1

2

3

($ billions)

PNC

RBC Bank (USA)

Proforma PNC

ASSETS

3/31/2011

4/30/2011

3/31/2011

Investments

66.8

4.7

71.5

Loans, net

147.6

15.7

163.3

Other Assets

35.9

3.4

39.3

Intangible Assets, excluding MSRs

9.0

1.0

10.0

Total Assets

259.4

24.8

284.1

LIABILITIES

Deposits

182.0

19.4

201.4

Funding

35.0

3.0

38.0

Other Liabilities

8.7

0.3

9.0

Total Liabilities

225.7

22.8

248.4

EQUITY

Equity

33.7

2.0

35.7

Total Liabilities & Equity

259.4

24.8

284.1 |

13

RBC Bank (USA) Loan Portfolio Assessment

(1) Gross of allowance for loan losses of $755 million, therefore incremental mark of $1,488

million. (2) Source: Royal Bank of Canada. Appendix

1

2

Estimated

($ in millions)

Balance as of

Credit Mark

Rate Mark

Total Mark

Loan Category

4/30/2011

$

%

$

%

$

%

Performing:

Commercial:

C&I

3,477

125

3.6%

35

1.0%

159

4.6%

Owner Occupied

2,973

137

4.6%

1

0.0%

137

4.6%

CRE & Construction

3,202

167

5.2%

68

2.1%

235

7.4%

Consumer:

Mortgage

1,855

122

6.6%

0

0.0%

122

6.6%

Home Equity

3,670

496

13.5%

-9

-0.2%

487

13.3%

Other

806

171

21.2%

-30

-3.7%

141

17.5%

Total Performing

15,983

1,218

7.6%

64

0.4%

1,283

8.0%

Non Accrual:

Commercial:

C&I

165

66

40.0%

13

8.1%

79

48.1%

Owner Occupied

460

162

35.3%

40

8.7%

203

44.0%

CRE & Construction

1,101

402

36.5%

94

8.6%

496

45.0%

Consumer:

Mortgage

137

71

52.3%

9

6.4%

80

58.7%

Home Equity

68

48

71.0%

3

3.9%

51

74.9%

Other

69

48

69.2%

3

4.1%

51

73.3%

Total Non Accural

2,000

798

39.9%

162

8.1%

960

48.0%

Total Loan Mark

17,984

2,016

11.2%

226

1.3%

2,242

12.5% |

14

Valuation Comparables Based on Recent

Transactions

Appendix

(1) Includes repayment of targets TARP outstanding where applicable. (2) TBV adjusted by

tax adjusted credit mark net of reserves (35% tax rate). (3) As reported by company

where available, otherwise core deposit amounts per SNL Financial. (4) Includes transaction expense.

(5) Assumes

midpoint mark. Source: SNL Financial and company filings.

Buyer

Target

Announce

Date

Announced

Deal Value

($M)

P/TBV

P/ Adj. TBV

Core

Deposit

Premium

Valley National Bancorp

State Bancorp Inc.

4/28/11

$259

216%

252%

11.7%

Brookline Bancorp Inc.

Bancorp Rhode Island Inc.

4/20/11

$234

201%

NA

11.8%

Susquehanna Bancshares, Inc.

Abington Bancorp, Inc.

1/26/11

$268

122%

133%

8.2%

People's United Financial Inc.

Danvers Bancorp Inc.

1/21/11

$493

186%

190%

13.9%

Comerica Inc.

Sterling Bancshares Inc.

1/18/11

$1,027

234%

374%

17.0%

Hancock Holding Co.

Whitney Holding Corp.

12/22/10

$1,796

200%

239%

11.6%

BMO Financial Group

Marshall & Ilsley Corp.

12/17/10

$5,803

138%

285%

4.9%

M&T Bank Corp.

Wilmington Trust Corp.

11/1/10

$681

192%

2,613%

4.7%

First Niagara Financial Group

NewAlliance Bancshares Inc.

8/19/10

$1,500

163%

176%

14.0%

Median

192%

245%

11.7%

PNC

RBC Bank (USA)

6/20/11

$3,450

97%

126%

(0.6%)

2

3

1

5

4 |