ELECTRONIC PRESENTATION SLIDES

Published on May 23, 2011

The PNC

Financial Services Group, Inc. Barclays London Conference

May 23, 2011

Exhibit 99.1 |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information |

3

Todays Discussion

PNCs powerful franchise and proven business

model are designed to deliver strong results

Delivered strong financial performance and

positioned for even greater shareholder value

Client momentum is building across our businesses

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company. |

4

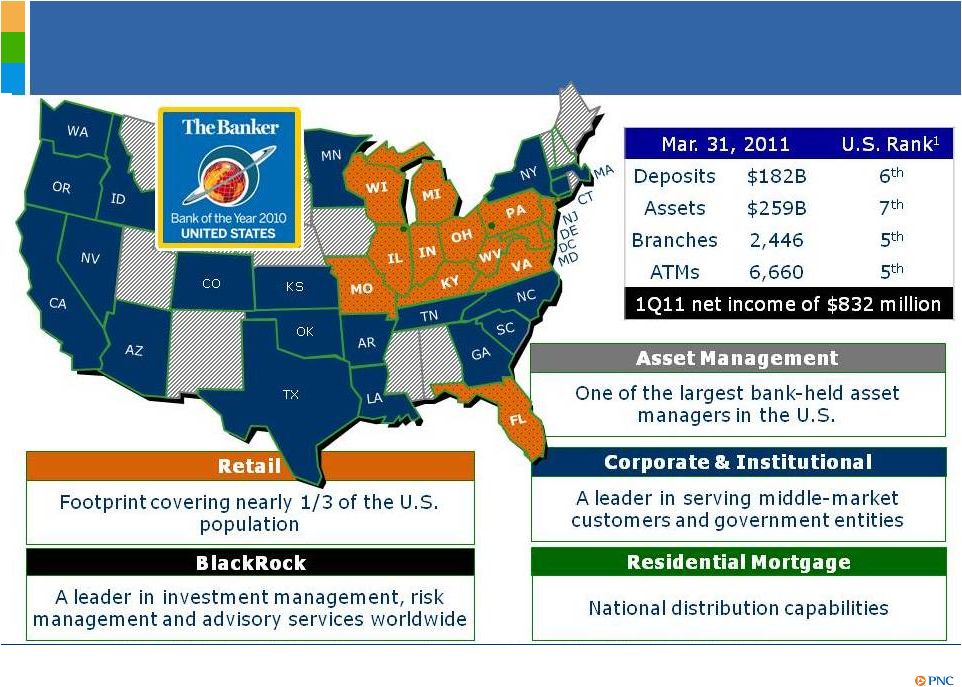

PNCs Powerful Franchise

(1) Rankings source: SNL DataSource; Banks headquartered in U.S. Assets rank excludes

Morgan Stanley and Goldman Sachs. |

5

PNCs Successful Business Model

Staying core funded and disciplined in our deposit pricing

Returning to a moderate risk profile

Leveraging customer relationships and our strong brand to

grow high quality, diverse revenue streams

Focus

on

creating

positive

operating

leverage

1

while

investing

in innovation

Remaining disciplined with our capital

Executing on our strategies

(1) A period to period dollar or percentage change when revenue growth exceeds expense

growth. |

6

A Higher Quality, Differentiated Balance Sheet

Change from:

Category (billions)

Mar. 31,

2011

Dec. 31,

2010

Dec. 31,

2008

Investment securities

$61

($3)

$18

Core commercial loans¹

62

1

(12)

Core commercial real estate¹

16

(1)

(6)

Core consumer loans¹

58

(1)

5

Distressed portfolio loans²

14

(1)

(13)

Total loans

149

(1)

(26)

Other assets

49

(1)

(24)

Total assets

$259

($5)

($32)

Transaction deposits

$135

$--

$24

Retail CDs, time, savings

47

(1)

(35)

Total deposits

182

($1)

($11)

Borrowed funds, other

46

(5)

(27)

Preferred equity

1

--

(7)

Common equity

30

1

13

Total liabilities and equity

$259

($5)

($32)

Core commercial loan growth over

year end 2010 offset by continued

distressed runoff and soft

consumer loan demand

Continued reduction and repricing

of high cost brokered and retail

CDs

Core funded

loans to deposits

ratio of 82%

Significant reduction in borrowed

funds

Strengthened common equity

Highlights

Designed to

Deliver

Strong

Results

(1) Excludes loans assigned to the Distressed Assets Portfolio business segment. (2)

Represents loans assigned to the Distressed Assets Portfolio business segment.

|

7

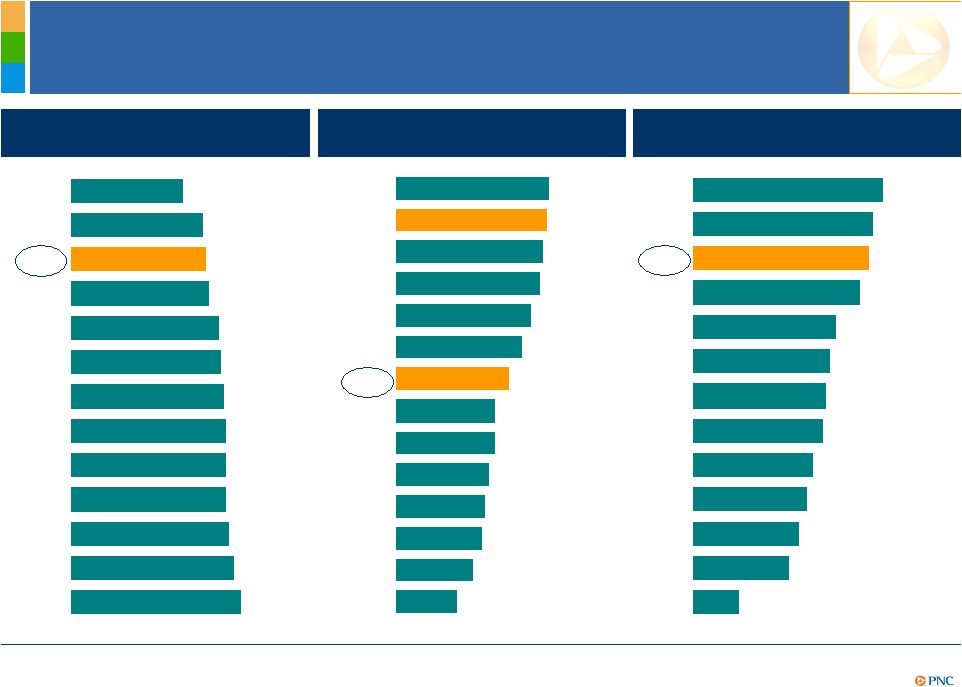

Relative Balance Sheet Strength

1Q11 loans/deposits

68%

80%

82%

84%

90%

91%

93%

94%

94%

94%

96%

99%

103%

JPM

KEY

PNC

RF

WFC

BAC

STI

CMA

USB

FITB

BBT

COF

MTB

1Q11 Tier 1 common ratio

1Q11 reserves/loans

4.34%

4.29%

4.16%

4.08%

3.84%

3.56%

3.19%

2.80%

2.80%

2.64%

2.52%

2.44%

2.17%

1.73%

JPM

PNC

BAC

COF

RF

FITB

PNC

KEY

WFC

USB

BBT

STI

CMA

MTB

10.7%

10.4%

10.3%

10.0%

9.3%

9.1%

9.0%

8.9%

8.6%

8.4%

8.2%

7.9%

6.4%

KEY

CMA

PNC

JPM

BBT

STI

FITB

WFC

BAC

COF

USB

RF

MTB

Includes purchased

impaired loan marks¹

Designed to

Deliver

Strong

Results

Peer Source: SNL DataSource and company reports. Ratios as of quarter end. (1) 1Q11

reserves/loans would be 4.29% if adjusted to include the remaining marks on purchased

impaired loans. Further information is provided in the Appendix. Others have made acquisitions and have

marks on purchased impaired loans. No adjustments have been made for those peers.

|

8

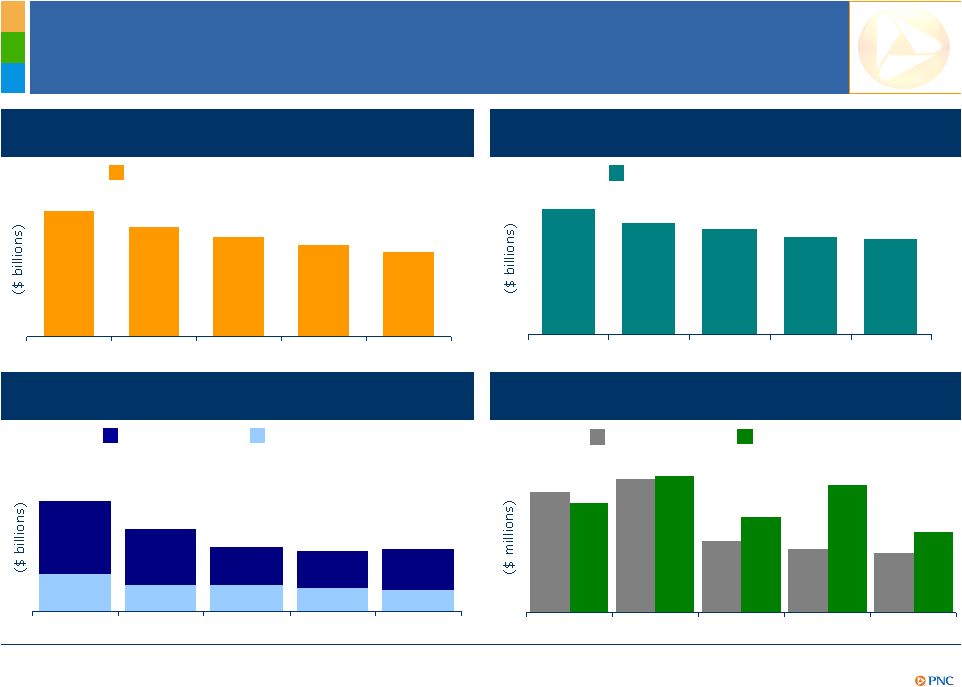

Credit Trends Continue to Improve

$751

$486

$442

$421

$840

$614

$791

$823

$691

$533

1Q10

2Q10

3Q10

4Q10

1Q11

Accruing

loans

past

due

1,2

Provision and net charge-offs

Criticized commercial loans

30-89 Days

90 Days +

Nonperforming

loans

1,3

$2.5

$1.9

$1.4

$1.4

$1.4

$.8

$.6

$.6

$.5

$.5

1Q10

2Q10

3Q10

4Q10

1Q11

1Q10

2Q10

3Q10

4Q10

1Q11

Total nonperforming loans

$5.8

$5.1

$4.8

$4.5

$4.4

Designed to

Deliver

Strong

Results

$16.4

$18.8

$15.0

$13.7

$12.7

1Q10

2Q10

3Q10

4Q10

1Q11

Criticized Commercial loans

4

Provision

Net charge-offs

As of quarter end except net charge-offs, which are for the quarter. (1) Loans acquired

from National City that were impaired are not included as they were recorded at

estimated fair value when acquired and are currently considered performing loans due to the accretion of interest in

purchase accounting. (2) Excludes loans that are government insured/guaranteed, primarily

residential mortgages. (3) Does not include loans held for sale or foreclosed and other

assets. (4) Criticized loans are ones that we consider special mention, substandard or doubtful. |

9

(6)

(5)

(4)

(3)

(2)

(1)

0

1

2

3

4

0%

1%

2%

3%

4%

5%

6%

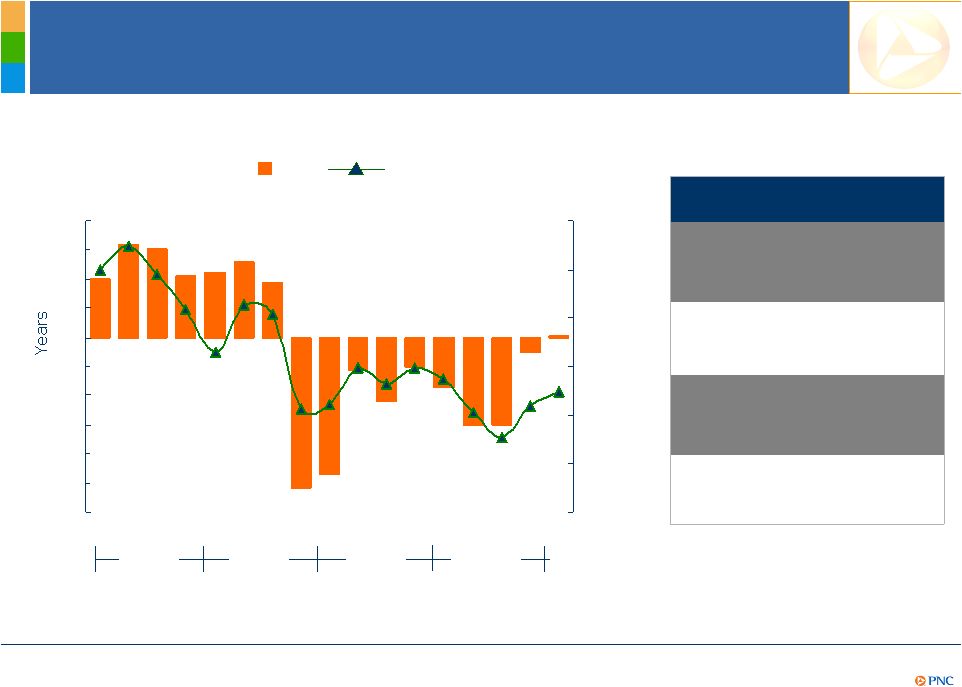

PNCs Balance Sheet Is Positioned for Higher

Interest Rates

PNC Duration of Equity

(At Quarter End)

5-Yr LIBOR Swaps

(At Quarter End)

2007

2008

2009

PNC 1Q11 NII Sensitivity

Effect on NII in 1st

year from

gradual interest rate change

over following 12 months

100 bps increase

+1.1%

100 bps decrease

(0.9%)¹

Effect on NII in 2nd

year from

gradual interest rate change

over preceding 12 months

100 bps increase

+3.4%

100 bps decrease

(3.4%)¹

Q1

Q2

Q3

Q4

2010

(1) Given the inherent limitations in certain of these measurement tools and techniques,

results become less meaningful as interest rates approach zero.

Q1

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q2

Q1

2011

Designed to

Deliver

Strong

Results |

10

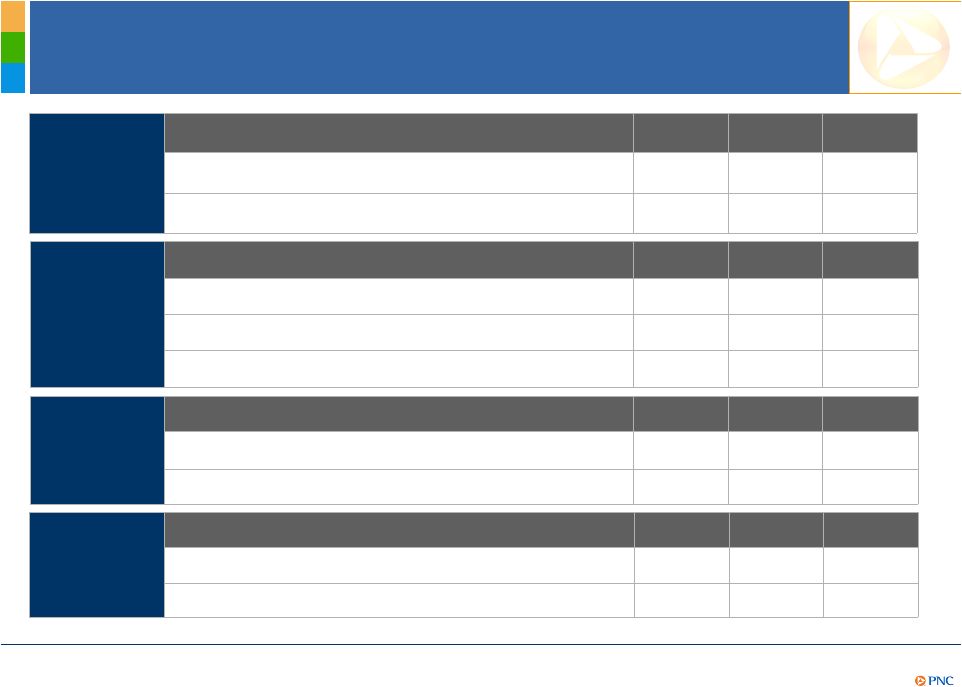

Financial Performance

Strong

Earnings

1Q11

4Q10

1Q10

Net income ($

millions)

$832

$820

$671

Earnings per diluted share

$1.57

$1.50

$0.66

Valuation

Drivers

1Q11

4Q10

1Q10

Tier 1 common capital ratio

10.3%

9.8%

7.9%

Book value per common share¹

$58.01

$56.29

$50.32

Operating

Leverage

1Q11

4Q10

1Q10

Revenue ($

millions)

$3,631

$3,903

$3,763

Provision ($

millions)

$421

$442

$751

Noninterest expense

($ millions)

$2,070

$2,340

$2,113

Performance

Measures

1Q11

4Q10

1Q10

Return on average assets

1.29%

1.23%

1.02%

Return on Tier 1 common capital¹

15.4%

15.4%

15.5%

(1)

Return

on

Tier

1

common

capital

calculated

as

annualized

net

income

divided

by

Tier

1

common

capital.

Further

information

is

provided

in

the

Appendix.

Delivered

Strong

Financial

Performance |

11

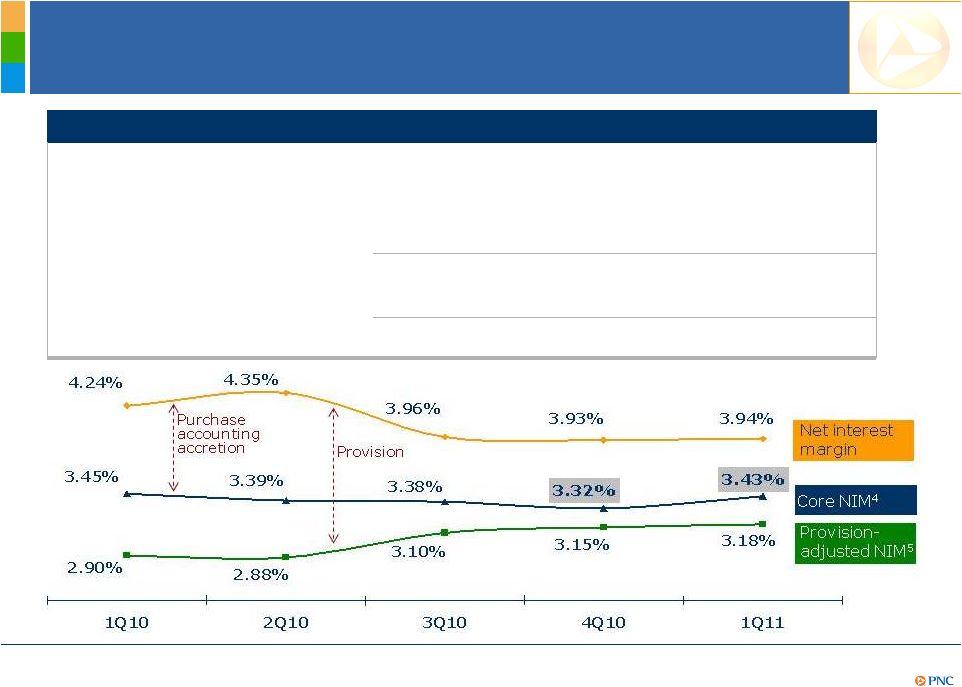

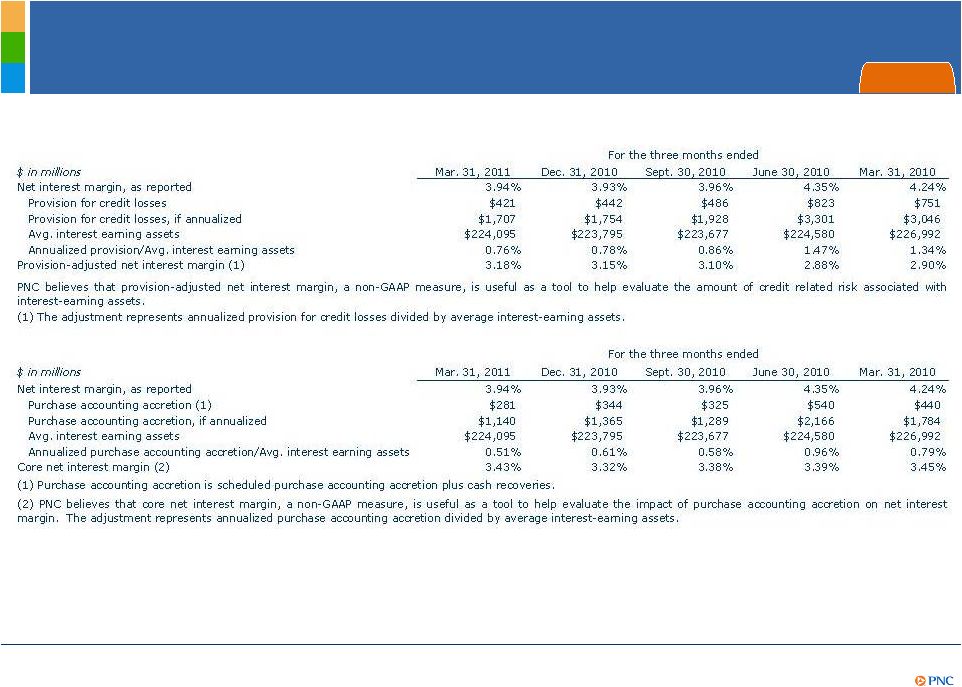

Core

1

and Provision-Adjusted

2

Net Interest

Income Trends

(millions)

1Q10

2Q10

3Q10

4Q10

1Q11

Core NII¹

$1,939

$1,895

$1,890

$1,857

$1,895

Scheduled purchase accounting

accretion

365

376

214

211

200

Cash recoveries²

75

164

111

133

81

Total NII

$2,379

$2,435

$2,215

$2,201

$2,176

Provision

751

823

486

442

421

Provision-adjusted NII³

$1,628

$1,612

$1,729

$1,759

$1,755

Delivered

Strong

Financial

Performance

(1) Core net interest income is total net interest income, as reported, less related purchase

accounting accretion (scheduled and cash recoveries). (2) Reflects cash received in

excess of recorded investment from sales or payoffs of impaired commercial loans. (3) Provision-

adjusted net interest income is total net interest income, as reported, less provision. (4)

Net interest margin less (annualized purchase accounting accretion/average

interest-earning assets). (5) Net interest margin less (annualized provision/average interest-earnings assets).

Further information on (4) and (5) is provided in the Appendix.

|

12

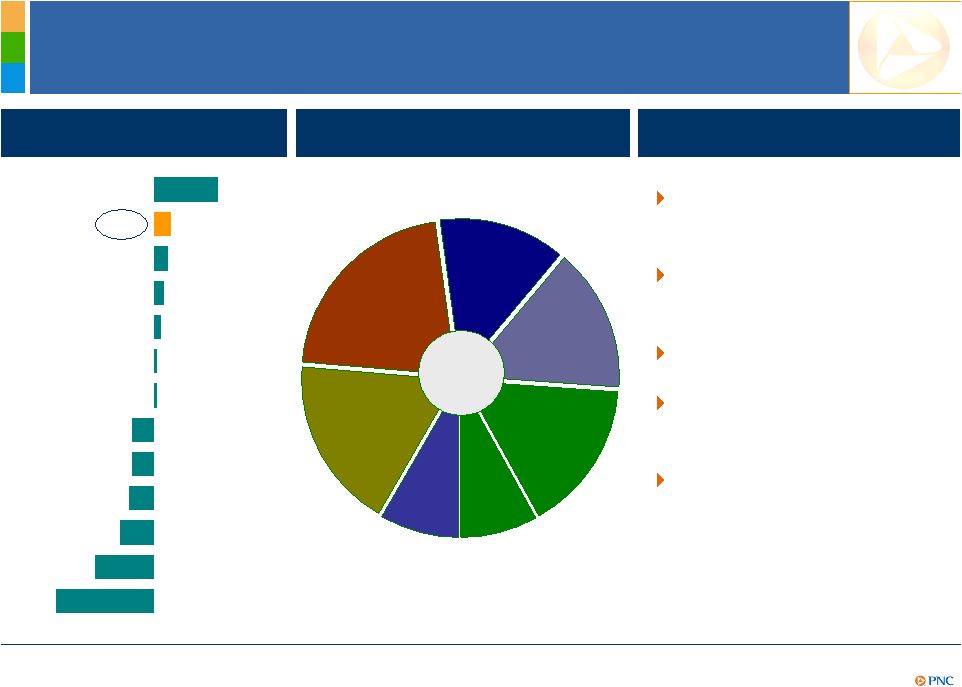

Diversified Sources of Fee Income

1Q

YoY change in

noninterest income

18%

5%

4%

3%

2%

1%

1%

-6%

-6%

-7%

-9%

-16%

-27%

COF

JPM

WFC

FITB

BBT

BAC

STI

PNC

CMA

KEY

MTB

RF

USB

Noninterest income

Mar. 31, 2011

Client expansion and

deepening relationships

Introduction of innovative

new products

Expanded distribution

Enhancing sales and

service model

Work to manage impact

of ongoing regulatory

reforms

$1.5B

Asset

management

Consumer

services

Corporate

services

Deposit

service

charges

18%

21%

13%

15%

8%

Other

1

16%

Residential

Mortgage

Peer source: SNL DataSource. Noninterest income is from continuing operations. (1) Other in

this chart includes net gains on sales of securities, net OTTI and remaining

other. Growth strategies

Equity

Mgmt/

Trading

9%

Delivered

Strong

Financial

Performance |

13

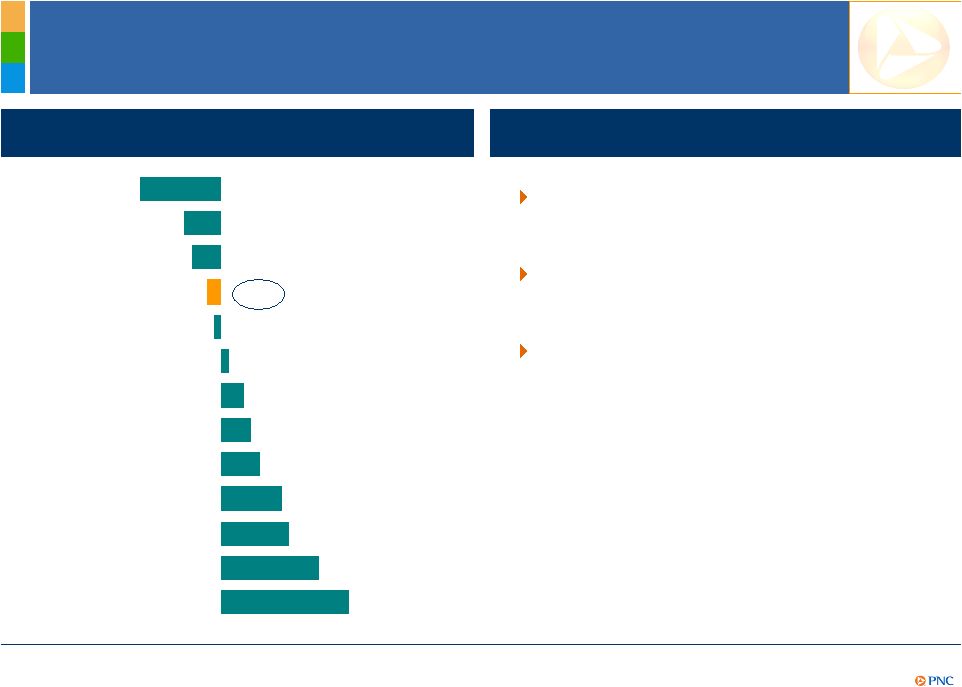

Focus on Well-Managed Expenses

Expense management strategies

Expense management is subject to legal and regulatory contingencies. See Note 16 Legal

included in Part I, Item 1 of PNCs 1Q11 Form 10-Q. Also refer to the economic

assumptions in the Cautionary Statement in the Appendix. YoY change in noninterest

expense -11%

-5%

-4%

-2%

-1%

1%

3%

4%

5%

8%

9%

13%

17%

KEY

FITB

RF

PNC

JPM

MTB

CMA

BBT

WFC

USB

STI

BAC

COF

Focusing on continuous improvement

dedicated resources

Balancing need for growth with pace

of investment

Investing in talent and innovative

products for future growth

Delivered

Strong

Financial

Performance |

14

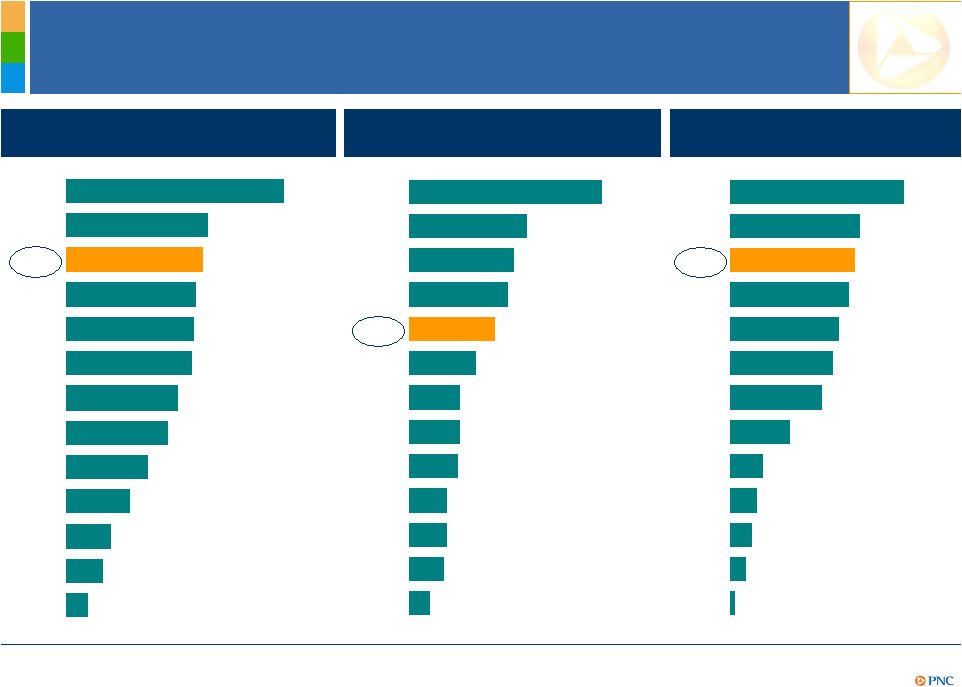

Delivering Strong Returns

1Q11 return on average assets

1Q11 return on Tier 1 common

capital¹

1.34%

1.29%

1.23%

1.21%

1.19%

1.06%

0.96%

0.77%

0.60%

0.43%

0.35%

2.05%

0.21%

COF

USB

PNC

WFC

MTB

KEY

JPM

FITB

CMA

BBT

STI

BAC

RF

Peer

Source:

SNL

DataSource

and

company

reports.

(1)

Return

on

Tier

1

common

capital

calculated

as

annualized

net

income

divided

by

Tier

1

common

capital.

Further

information

is

provided

in

the

Appendix.

(2)

As

of

May

9,

2011;

Annualized

dividend

yield

calculated

as

annualized

dividend

divided

by

market

price.

34.5%

21.0%

18.8%

17.7%

15.4%

12.0%

9.1%

9.1%

8.7%

6.8%

6.7%

6.2%

3.8%

COF

USB

JPM

WFC

PNC

FITB

MTB

KEY

BBT

CMA

BAC

STI

RF

2.4%

2.3%

2.2%

2.0%

1.9%

1.7%

1.1%

0.6%

0.5%

0.4%

0.3%

3.2%

0.1%

MTB

BBT

PNC

JPM

USB

FITB

WFC

CMA

RF

KEY

COF

BAC

STI

Delivered

Strong

Financial

Performance

Annualized dividend yield²

|

15

Outlook

1

Full Year 2011 vs. 2010

Balance Sheet

Income Statement

Commercial loan growth is expected

Continue to shift deposit mix towards transaction accounts

Core NII expected to increase by $100 million or more

Purchase accounting accretion expected to decline by as much as $700 million,

resulting in lower NII

Provision expected to decline by at least $800 million

Provision-adjusted NII and margin expected to increase

Noninterest income expected to increase in the low-to-mid single digits,

excluding the expected incremental negative impact of approximately $400

million due to overdraft and interchange regulatory limits

Noninterest expenses expected to decline, subject to legal and regulatory

contingencies²

(1) Refer to the Cautionary Statement in the Appendix. (2) See Note 22 Legal Proceedings

included in Item 8 and Risk Factors Item 1A of PNCs 2010 Form 10-K and Note

16 Legal Proceedings in PNCs 1Q11 Form 10-Q. Positioned

for Greater

Shareholder

Value |

16

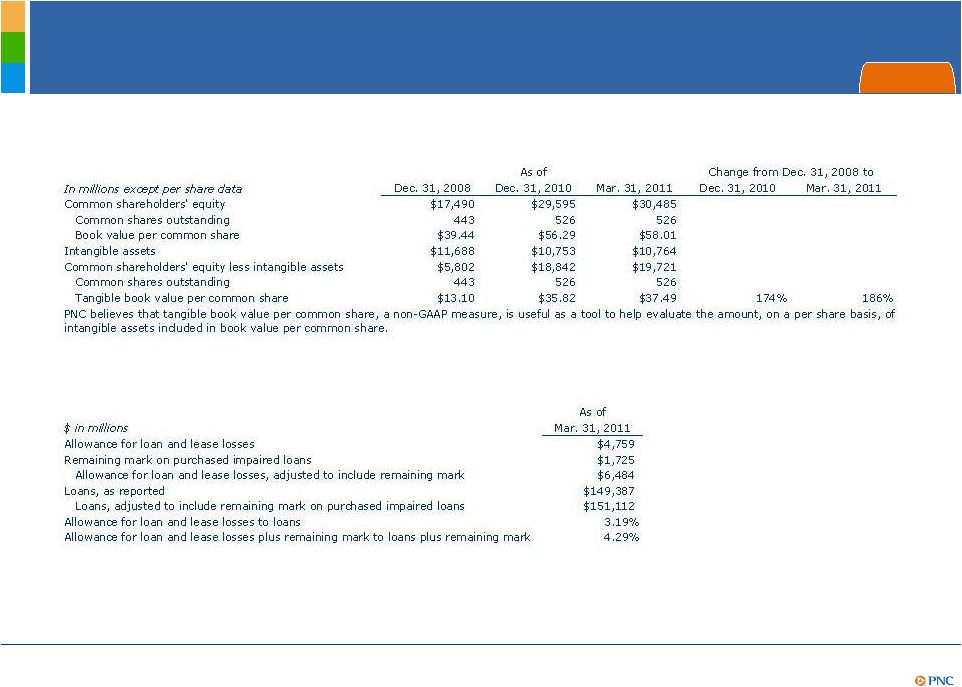

A Demonstrated Ability to Achieve

Greater Shareholder Value

Achieving greater shareholder value

As of quarter end. (1) Tangible book value per share calculated as book value per share less

total intangible assets per share. PNC believes that tangible book value, a

non-GAAP measure, is useful as a tool to help evaluate the amount, on a per share basis, of intangible assets

included in book value per common share. Further information is provided in the

Appendix. 4Q08

1Q11

4Q08

1Q11

Book value per share

Tangible book value per share¹

$39.44

$58.01

$13.10

$37.49

4Q08

1Q11

Stock price

$49.00

$62.99

Positioned

for Greater

Shareholder

Value |

17

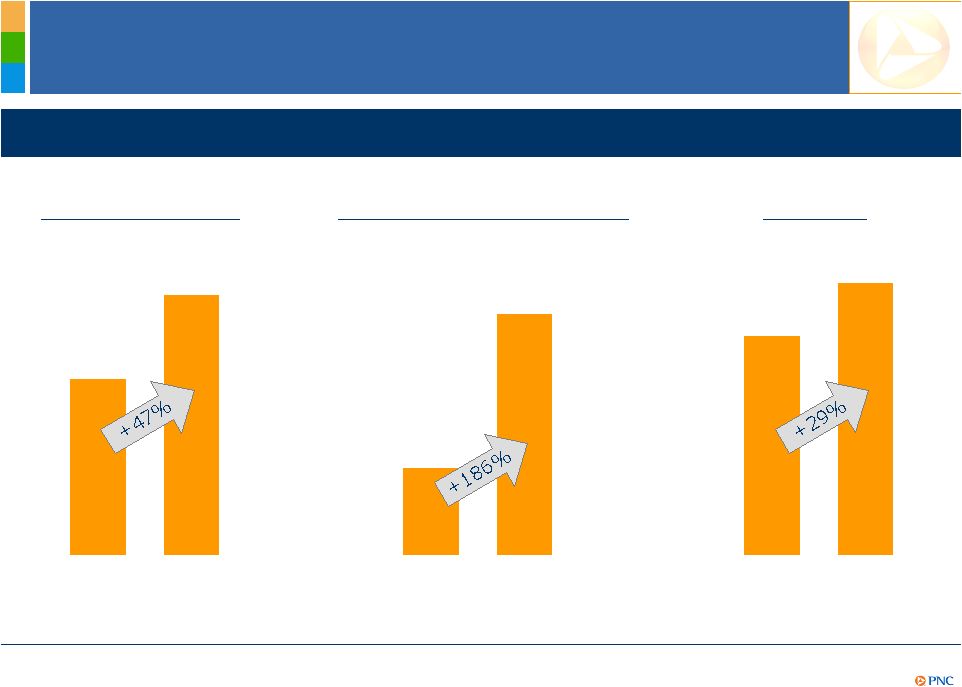

Strong Momentum

Retail Banking

Growth in

Checking relationships

Growth in Online bill

payment active customers

Retail Banking

Mix of checking relationships

12/31/10

Goal

Free checking

Relationship checking

Recent

results

(one month

post launch)

100%

0%

Growth strategies

Expand market share and

share of wallet by

providing customers with

more choices and rewards

Focus on winning in the

payments space

Launch of integrated

deposit products

Enhance credit card

offerings

Expand branch distribution

network and channels

2Q10

3Q10

4Q10

1Q11

+10

+49

+27

+56

2Q10

3Q10

4Q10

1Q11

+44

+72

+35

+52

Building

Momentum |

18

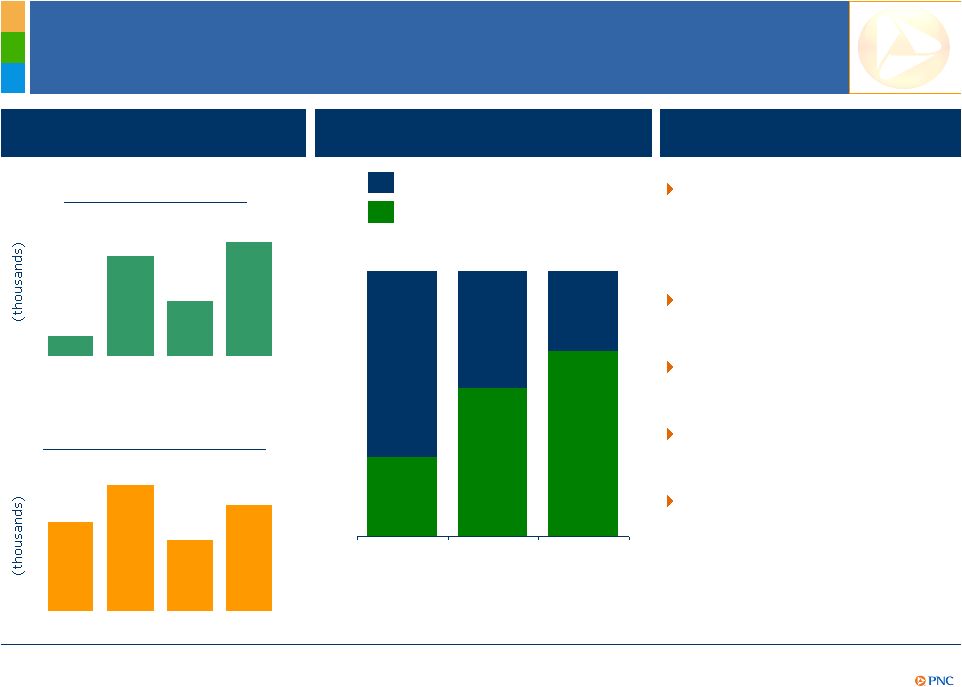

Strong Momentum

Asset Management Group

Referral sales¹

+126%

$105B

1Q10 1Q11

1Q11 vs. 1Q10

Assets under management

$110B

Equity

Fixed income

Liquidity/other

+$6B

+$1B

($2B)

Growth strategies

Expanding distribution and talent in

newly acquired and high growth

markets

Leveraging cross-sell opportunities

from Retail and Corporate bank referral

network

Investing in innovation and technology

piloting Wealth Insight tool

Asset Management Group

Building

Momentum

(1) Referral sales are new sales to clients who were referred to AMG by Retail Banking or

Corporate and Institutional Banking. |

19

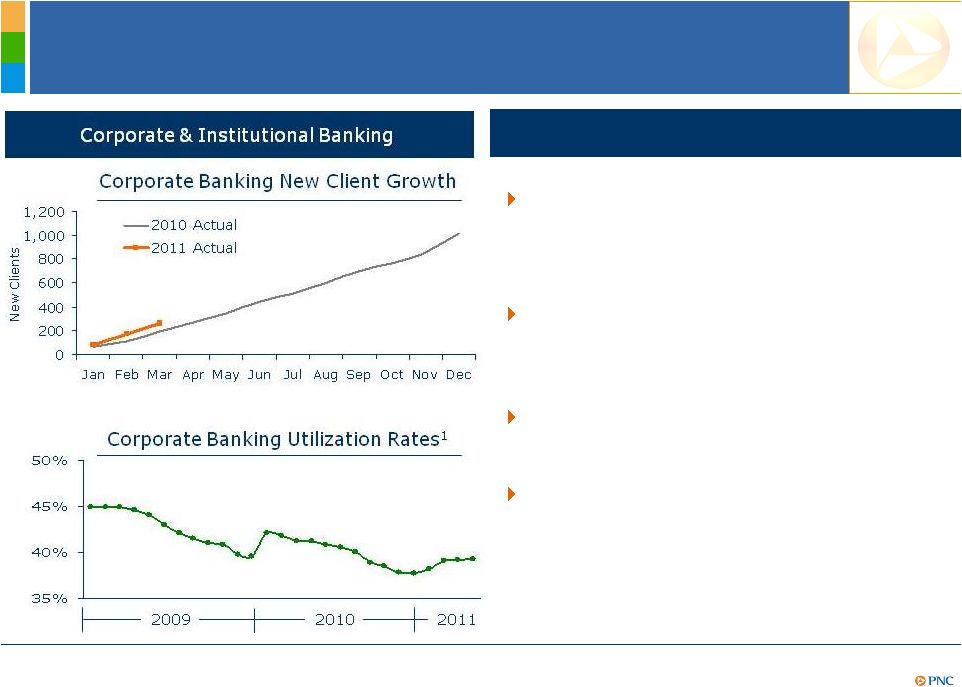

Strong Momentum

Corporate & Institutional Banking

Growth strategies

Continue to add new clients across the

footprint

-

Goal of 1,000 for 2011

Leverage PNCs loan syndication

capabilities as a leader in the middle-

market

Deepening relationships by delivering

all of PNC to our clients

Focus on total relationship return

65%

59%

53%

54%

Strong Momentum

Corporate & Institutional Banking

Building

Momentum

(1) Corporate Banking Utilization rates reflect the consolidation of Market Street Funding

Corporation beginning January 2010. |

20

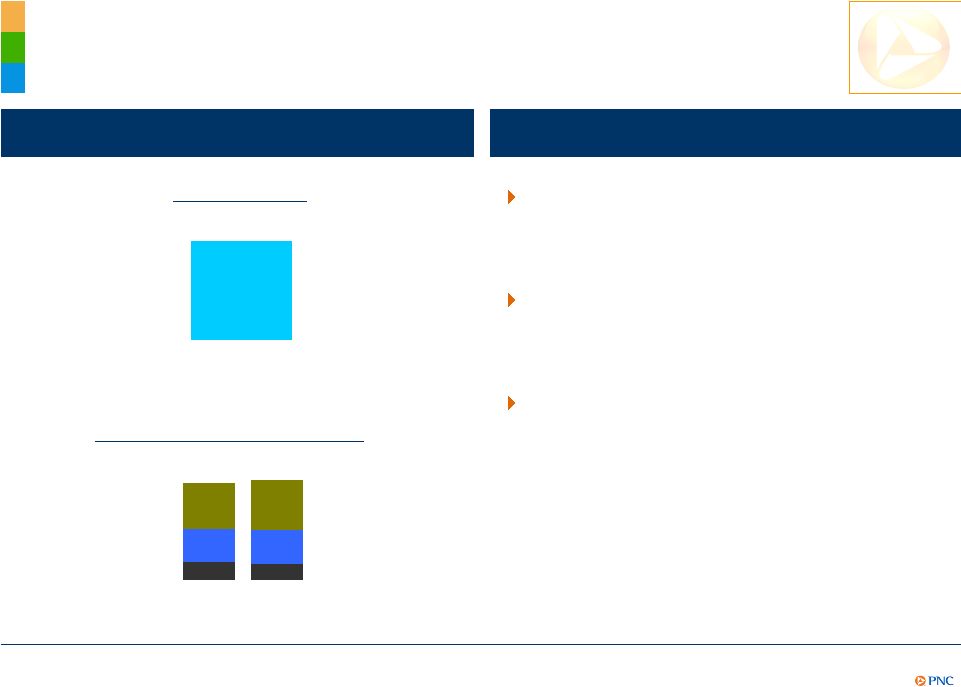

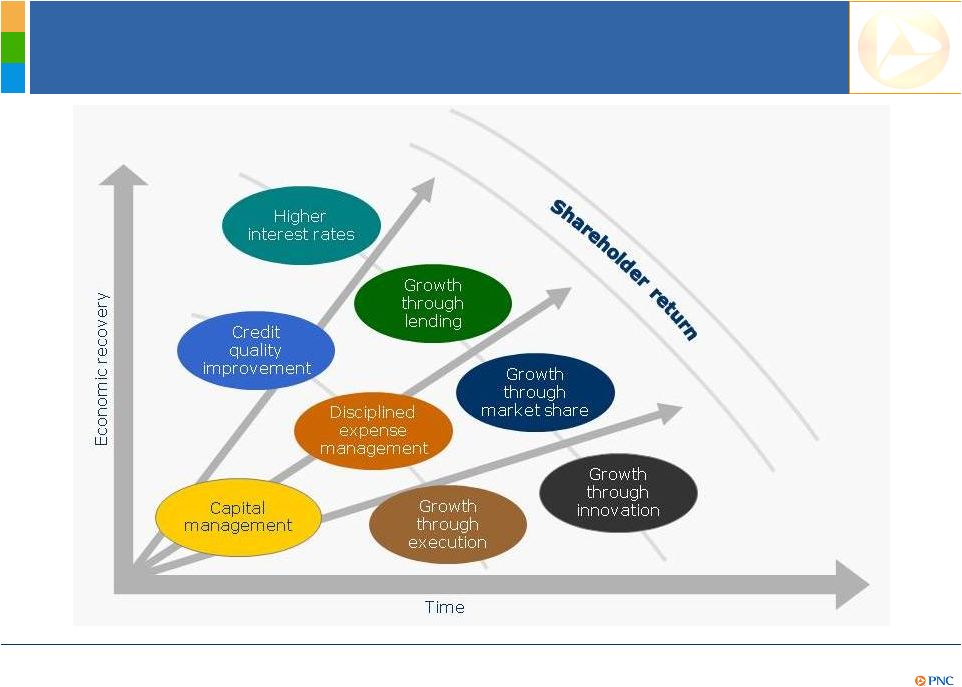

PNCs Growth Opportunities

Building

Momentum |

21

Summary

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company.

PNCs powerful franchise and proven business

model are designed to deliver strong results

Delivered strong financial performance and

positioned for even greater shareholder value

Client momentum is building across our businesses |

22

Cautionary Statement Regarding Forward-Looking

Information

Appendix |

23

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix |

24

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix |

25

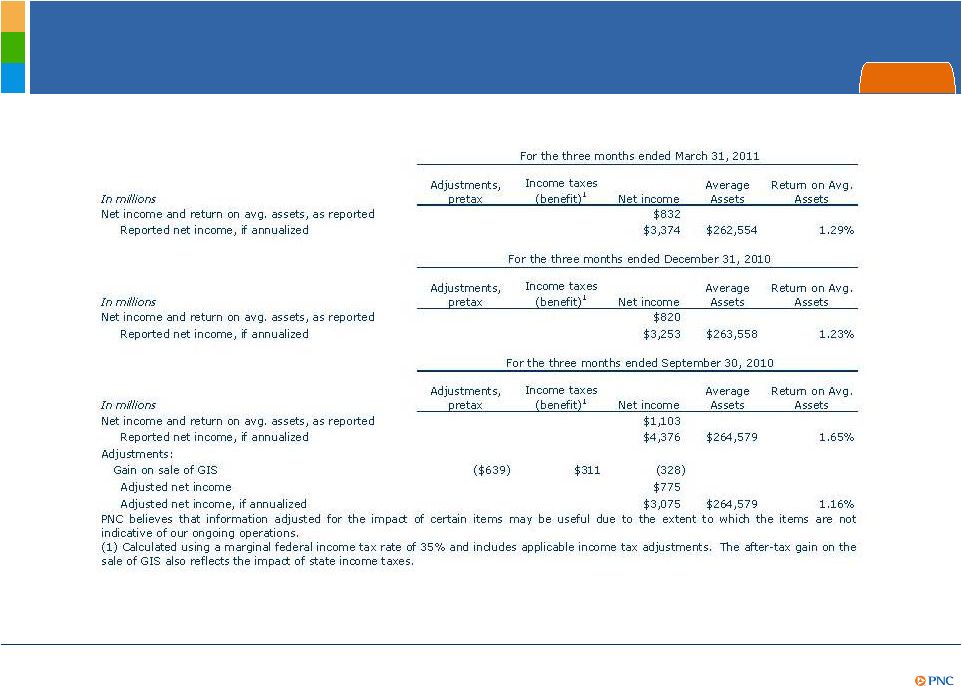

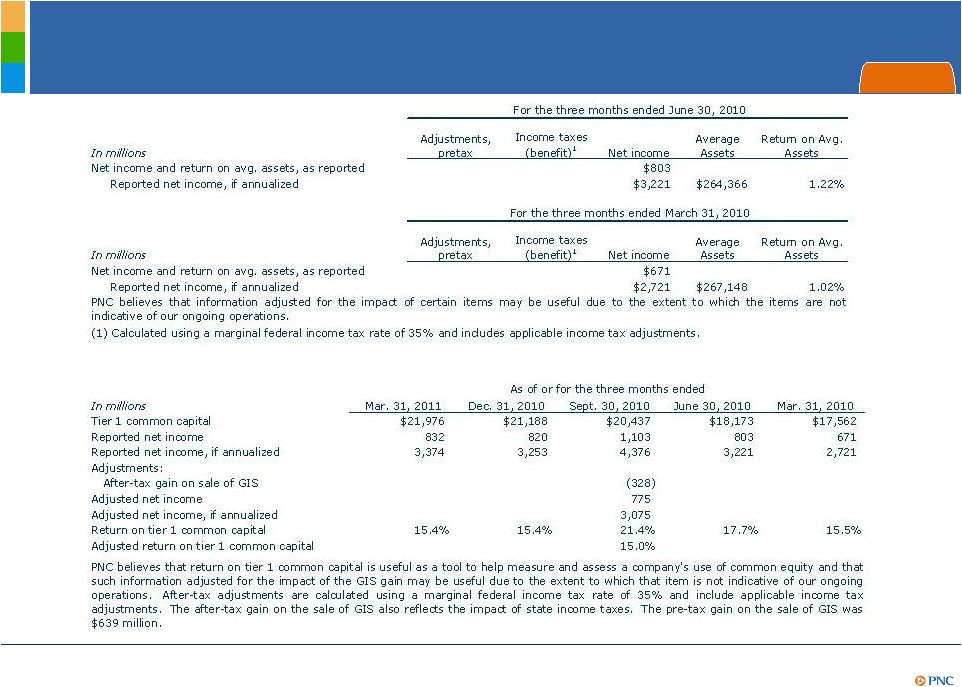

Non-GAAP to GAAP Reconcilement

Appendix |

26

Non-GAAP to GAAP Reconcilement

Appendix |

27

Non-GAAP to GAAP Reconcilement

Appendix |

28

Non-GAAP to GAAP Reconcilement

Appendix |

29

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC

Ticker |