ELECTRONIC PRESENTATION SLIDES FOR EARNINGS RELEASE CONFERENCE CALL

Published on April 21, 2011

The PNC

Financial Services Group, Inc. First Quarter 2011

Earnings Conference Call

April 21, 2011

Exhibit 99.2

*

*

*

*

* |

2

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

This

presentation

includes

snapshot

information

about

PNC

used

by

way

of

illustration.

It

is

not

intended

as

a

full

business

or

financial

review

and

should

be

viewed

in

the

context

of

all

of

the

information

made

available

by

PNC

in

its

SEC

filings.

The

presentation

also

contains

forward-looking

statements

regarding

our

outlook

or

expectations

for

earnings,

revenues,

expenses,

capital

levels,

liquidity

levels,

asset

quality

and/or

other

matters

regarding

or

affecting

PNC

and

its

future

business

and

operations.

Forward-looking

statements

are

necessarily

subject

to

numerous

assumptions,

risks

and

uncertainties,

which

change

over

time.

The

forward-looking

statements

in

this

presentation

are

qualified

by

the

factors

affecting

forward-looking

statements

identified

in

the

more

detailed

Cautionary

Statement

included

in

the

Appendix,

which

is

included

in

the

version

of

the

presentation

materials

posted

on

our

corporate

website

at

www.pnc.com/investorevents.

We

provide

greater

detail

regarding

some

of

these

factors

in

our

2010

Form

10-K,

including

in

the

Risk

Factors

and

Risk

Management

sections

of

that

report,

and

in

our

subsequent

SEC

filings

(accessible

on

the

SECs

website

at

www.sec.gov

and

on

or

through

our

corporate

website

at

www.pnc.com/secfilings).

We

have

included

web

addresses

here

and

elsewhere

in

this

presentation

as

inactive

textual

references

only.

Information

on

these

websites

is

not

part

of

this

presentation.

Future

events

or

circumstances

may

change

our

outlook

or

expectations

and

may

also

affect

the

nature

of

the

assumptions,

risks

and

uncertainties

to

which

our

forward-looking

statements

are

subject.

The

forward-looking

statements

in

this

presentation

speak

only

as

of

the

date

of

this

presentation.

We

do

not

assume

any

duty

and

do

not

undertake

to

update

those

statements.

In

this

presentation,

we

will

sometimes

refer

to

adjusted

results

to

help

illustrate

the

impact

of

certain

types

of

items,

such

as

our

third

quarter

2010

gain

related

to

the

sale

of

PNC

Global

Investment

Servicing

Inc.

(GIS).

This

information

supplements

our

results

as

reported

in

accordance

with

GAAP

and

should

not

be

viewed

in

isolation

from,

or

a

substitute

for,

our

GAAP

results.

We

believe

that

this

additional

information

and

the

reconciliations

we

provide

may

be

useful

to

investors,

analysts,

regulators

and

others

as

they

evaluate

the

impact

of

these

respective

items

on

our

results

for

the

periods

presented

due

to

the

extent

to

which

the

items

are

not

indicative

of

our

ongoing

operations.

We

may

also

provide

information

on

pretax

pre-provision

earnings

(total

revenue

less

noninterest

expense),

as

we

believe

that

pretax

pre-provision

earnings,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

ability

to

provide

for

credit

costs

through

operations.

Where

applicable,

we

provide

GAAP

reconciliations

for

such

additional

information.

In

certain

discussions,

we

may

also

provide

information

on

yields

and

margins

for

all

interest-earning

assets

calculated

using

net

interest

income

on

a

taxable-equivalent

basis

by

increasing

the

interest

income

earned

on

tax-exempt

assets

to

make

it

fully

equivalent

to

interest

income

earned

on

taxable

investments.

We

believe

this

adjustment

may

be

useful

when

comparing

yields

and

margins

for

all

earning

assets.

We

may

also

use

annualized,

proforma,

estimated

or

third

party

numbers

for

illustrative

or

comparative

purposes

only.

These

may

not

reflect

actual

results.

This

presentation

may

also

include

discussion

of

other

non-GAAP

financial

measures,

which,

to

the

extent

not

so

qualified

therein

or

in

the

Appendix,

is

qualified

by

GAAP

reconciliation

information

available

on

our

corporate

website

at

www.pnc.com

under

About

PNCInvestor

Relations. |

3

Todays Discussion

1Q11 strategic achievements

strong results and

capital actions

Building momentum in our businesses

client

growth and new product launches

Key financial take-aways

strong balance sheet,

strong earnings and solid returns

2011 outlook remains positive

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company. |

4

Significant 1Q11 Achievements

PNC Is Positioned to Deliver Even Greater Shareholder Value.

PNC Is Positioned to Deliver Even Greater Shareholder Value.

1Q11 financial

summary

Net income

Diluted EPS from

net income

Return on

average assets

$832 million

$1.57

1.29%

Delivered strong financial results through the execution of our business model

Record capital levels

-

Increased quarterly common stock dividend 250% to $0.35 per share for 2Q11

-

Confirmed 25 million share repurchase program; plan to repurchase up to $500

million

in

2011

Businesses continued to grow clients, deepen relationships and launch new

products

Continued to maintain a high quality balance sheet, poised to support client

growth

Actively managed our risk positions toward a moderate profile

1Q11 highlights

(1) Subject to market and general economic conditions, economic and regulatory capital

conditions, alternative uses of capital, regulatory and contractual limitations, and

potential impact on credit ratings. 1 |

5

Focused on Growing Our Businesses

Retail Banking

Corporate & Institutional Banking

Asset Management

Residential Mortgage

Grew checking relationships by 56,000

during 1Q11

Reached a definitive agreement to acquire 19

branches and approximately $350 million of

deposits from BankAtlantic Bancorp in the

Tampa, Florida area

1

Launched new deposit products line-up and

new credit card products

Beginning to see growth in loans and

commitments and increased utilization

-

Average loans increased $1.2 billion in 1Q11

vs. 4Q10

On track to reach goal of adding 1,000 new

clients in 2011

Good pipeline activity in treasury management,

M&A advisory and syndications

Grew assets under administration to $219

billion at March 31, 2011

Continued aggressive hiring to drive growth

across the footprint

Investing in innovation and technology

piloting Wealth Insight tool

Loan originations of $3.2 billion up 60% from

1Q10, but down from 4Q10

1Q11 servicing fees up 9% and loans sales

revenue up 27% vs. 4Q10

Positive operating leverage

2

(1) Subject to customary closing conditions. (2) A period to period dollar or percentage

change when revenue growth exceeds expense growth. PNC is a 2011 Gallup Great Workplace

Award Winner. PNC is a 2011 Gallup Great Workplace Award Winner.

|

6

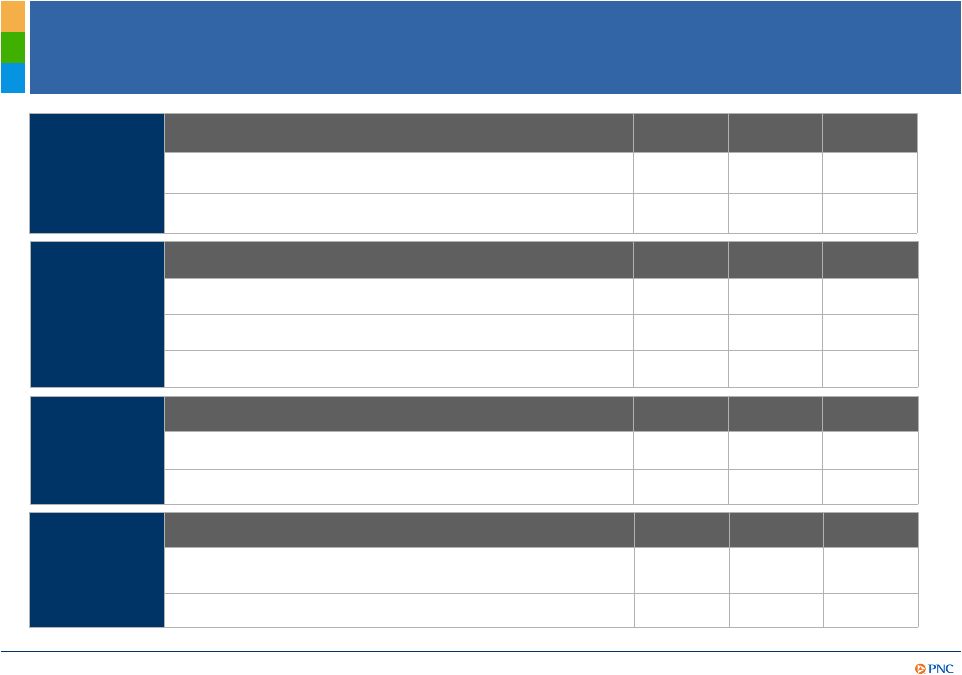

Financial Performance

Strong

Earnings

1Q11

4Q10

1Q10

Net income ($

millions)

$832

$820

$671

Earnings per diluted share

$1.57

$1.50

$0.66

Valuation

Drivers

1Q11

4Q10

1Q10

Tier 1 common capital ratio¹

10.3%

9.8%

7.9%

Book value per common share

$58.01

$56.29

$50.32

Operating

Leverage

1Q11

4Q10

1Q10

Revenue ($

millions)

$3,631

$3,903

$3,763

Provision ($

millions)

$421

$442

$751

Noninterest expense

($ millions)

$2,070

$2,340

$2,113

Performance

Measures

1Q11

4Q10

1Q10

Return on average assets

1.29%

1.23%

1.02%

Return

on

Tier

1

common

capital

1,3

15.4%

15.4%

15.5%

(1)

1Q11

Tier

1

common

capital

ratio

is

estimated.

(2)

At

period

end.

(3)

Return

on

Tier

1

common

capital

calculated

as

annualized

net

income

divided

by

Tier

1

common

capital.

Further

information

is

provided

in

the

Appendix.

2 |

7

A Higher Quality, Differentiated Balance Sheet

Category (billions)

Mar. 31,

2011

Dec. 31,

2010

Investment securities

$61.0

$64.3

Core

commercial

loans

62.0

60.7

Core

commercial

real

estate

15.8

16.4

Core

consumer

loans

57.7

58.7

Distressed

loans²

13.9

14.8

Total loans

149.4

150.6

Other assets

49.0

49.4

Total assets

$259.4

$264.3

Transaction deposits

$134.5

$134.7

Retail CDs, time, savings

47.5

48.7

Total deposits

182.0

183.4

Borrowed funds, other

46.3

50.7

Preferred equity

.6

.6

Common equity

30.5

29.6

Total liabilities and equity

$259.4

$264.3

Securities impacted by principal

prepayments and sales

Core commercial loan growth offset

by continued distressed runoff and

soft consumer loan demand

Continued reduction in high cost

brokered and retail CDs

Core funded

loans to deposits

ratio of 82%

Strengthened common equity

Highlights

(1)

Excludes

loans

assigned

to

the

Distressed

Assets

Portfolio

business

segment.

(2)

Represents

loans

assigned

to

the

Distressed

Assets

Portfolio

business

segment.

1

1

1 |

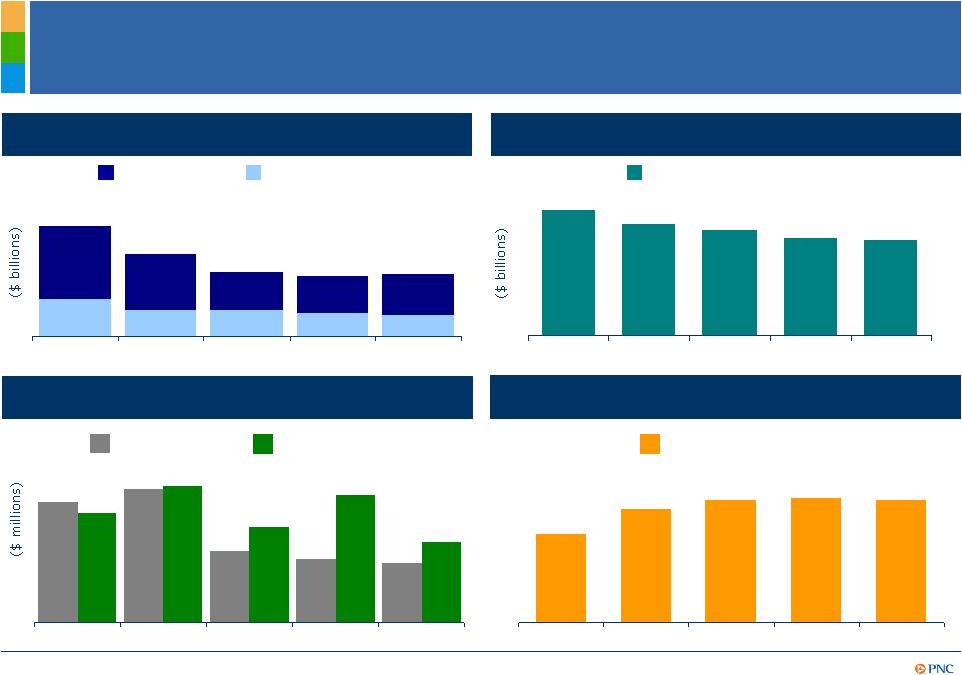

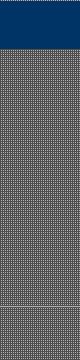

8

Credit Trends Continue to Improve

$751

$486

$442

$421

$840

$614

$791

$823

$691

$533

1Q10

2Q10

3Q10

4Q10

1Q11

Provision

Net charge-offs

Allowance to NPLs

104%

92%

108%

109%

108%

1Q10

2Q10

3Q10

4Q10

1Q11

Provision and net charge-offs

Coverage

Accruing

loans

past

due

1,2

30-89 Days

90 Days +

Nonperforming

loans

1,3

$2.5

$1.9

$1.4

$1.4

$1.4

$.8

$.6

$.6

$.5

$.5

1Q10

2Q10

3Q10

4Q10

1Q11

1Q10

2Q10

3Q10

4Q10

1Q11

Total nonperforming loans

$5.8

$5.1

$4.8

$4.5

As of quarter end except net charge-offs, which are for the quarter. (1) Loans acquired

from National City that were impaired are not included as they were recorded at

estimated fair value when acquired and are currently considered performing loans due to the accretion of interest in

purchase accounting. (2) Excludes loans that are government insured/guaranteed, primarily

residential mortgages. (3) Does not include loans held for sale or foreclosed and other

assets. $4.4 |

9

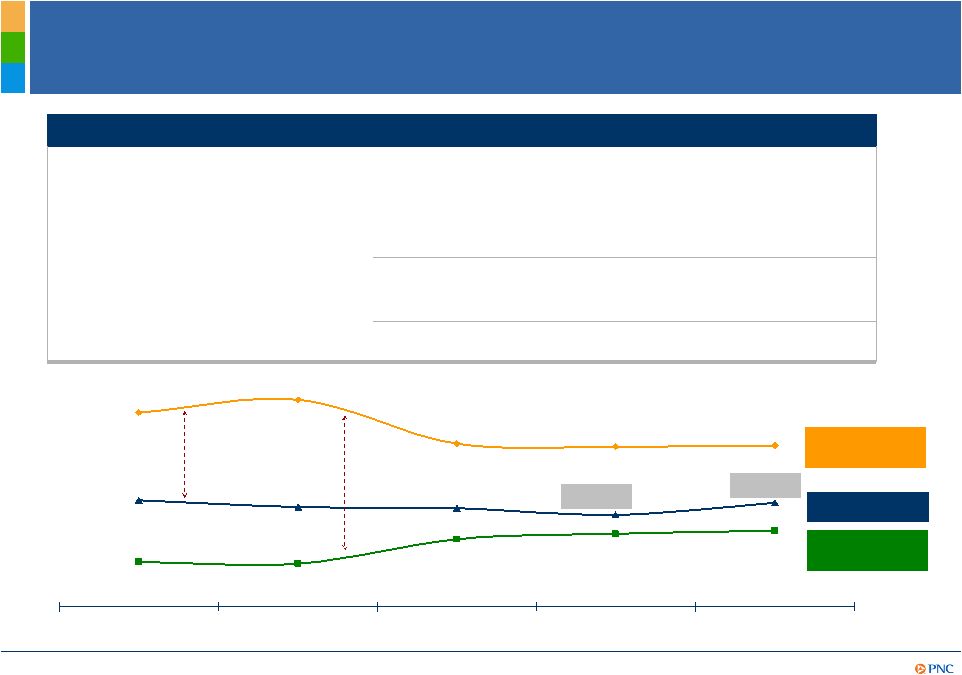

3.94%

3.96%

4.35%

3.93%

4.24%

3.43%

3.32%

3.38%

3.39%

3.45%

3.18%

2.88%

3.15%

3.10%

2.90%

1Q10

2Q10

3Q10

4Q10

1Q11

Net interest

margin

Provision-

adjusted NIM

5

Core

1

and

Provision-Adjusted

2

Net

Interest

Income

Trends

(1)

Core

net

interest

income

is

total

net

interest

income,

as

reported,

less

related

purchase

accounting

accretion

(scheduled

and

cash

recoveries).

(2)

Reflects

cash

received

in

excess

of

recorded

investment

from

sales

or

payoffs

of

impaired

commercial

loans.

(3)

Provision-

adjusted

net

interest

income

is

total

net

interest

income,

as

reported,

less

provision.

(4)

Net

interest

margin

less

(annualized

purchase

accounting

accretion/average

interest-earning

assets).

(5)

Net

interest

margin

less

(annualized

provision/average

interest-earnings

assets).

Further

information

on

(4)

and

(5)

is

provided

in

the

Appendix.

(millions)

1Q10

2Q10

3Q10

4Q10

1Q11

Core

NII

$1,939

$1,895

$1,890

$1,857

$1,895

Scheduled purchase accounting

accretion

365

376

214

211

200

Cash

recoveries

75

164

111

133

81

Total NII

$2,379

$2,435

$2,215

$2,201

$2,176

Provision

751

823

486

442

421

Provision-adjusted

NII

$1,628

$1,612

$1,729

$1,759

$1,755

Core NIM

4

Purchase

accounting

accretion

Provision

2

3

1 |

10

Client Growth and Sales Momentum Provide

Opportunities to Increase Noninterest Revenue

Highlights

(millions)

1Q10

2Q10

3Q10

4Q10

1Q11

Asset

management

1

$259

$243

$249

$303

$263

Consumer services

296

315

328

322

311

Corporate services

268

261

183

370

217

Residential

mortgage

147

179

216

157

195

Deposit service

charges

200

209

164

132

123

BlackRock

transaction gain

-

-

-

160

-

Other

2

214

270

243

258

346

Total noninterest

income

$1,384

$1,477

$1,383

$1,702

$1,455

Asset management fees impacted in

comparison by higher 4Q10 BlackRock

contribution. Strong Asset Management

Group contribution in 1Q11

Consumer services increased in 1Q11

versus 1Q10 due to customer growth and

increased volume; seasonal decline

versus 4Q10

Corporate services impacted by

commercial MSR impairment in 1Q11

versus recovery in 4Q10; strong M&A

advisory fees in 4Q10

Residential mortgage improved primarily

due to higher loan sales revenue and net

MSR hedging gains

Deposit service charges reflect

regulatory³

impact versus 1Q10 and

seasonal declines versus 4Q10

Other revenue increased versus 4Q10 due

to lower repurchase reserves in 1Q11

(1) Asset management fees include the Asset Management Group and

BlackRock (2) Other

includes net gains on sales of securities, net other-

than-temporary impairments, and other. (3) Regulatory impact reflects

Regulation E. |

11

WellControlled Expenses While Investing for Growth

Highlights

$2,002

638

65

168

172

$959

2Q10

$2,158

789

81

152

177

$959

3Q10

$2,070

681

40

167

193

$989

1Q11

$2,340

$2,113

Total noninterest

expense

194

187

Occupancy

176

172

Equipment

70

50

Marketing

748

$956

1Q10

Other

Personnel

(millions)

868

$1,032

4Q10

Personnel expense declined versus 4Q10

primarily due to lower incentive

compensation

Marketing expense declined in 1Q11 due

to elevated costs associated with

launching in new markets in 2010

Other expense declined primarily due to

higher mortgage foreclosure expenses in

Q4

Expenses performed better than

expected in 1Q11 due to reversal of a

portion of indemnification liability for

Visa litigation of $38 million

PNC is Committed to Disciplined Expense Management.

PNC is Committed to Disciplined Expense Management. |

12

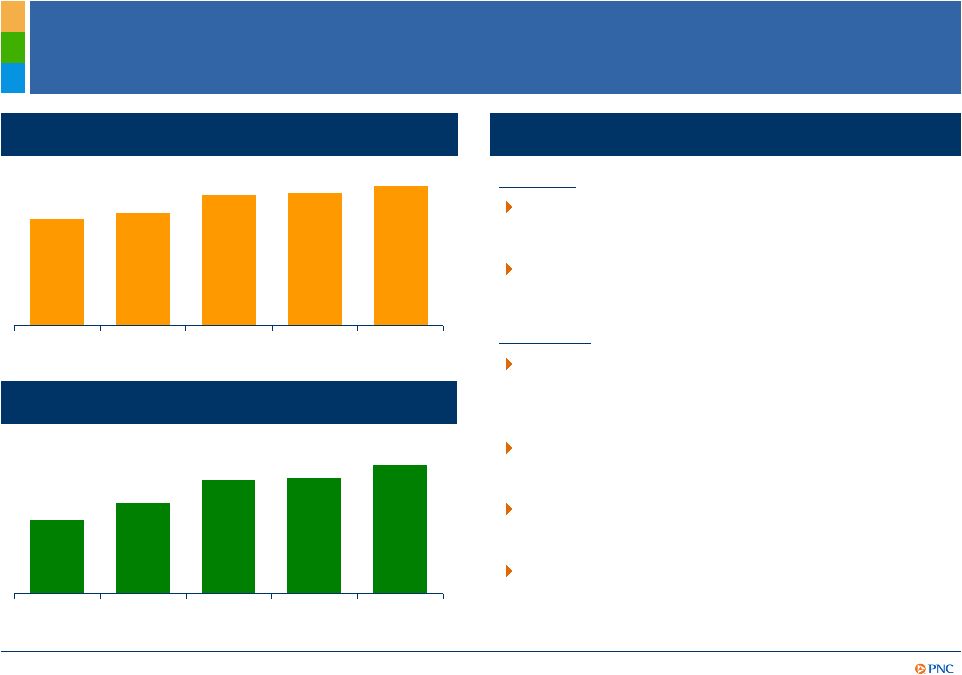

Strengthened Capital to Record Levels

Tier 1 common ratio and book value per share as of quarter end. (1) Estimated. (2) See note

(1) on Slide 4. PNCs capital management actions / priorities

Actions:

Increased quarterly common stock dividend

250% to $0.35

for 2Q11

Confirmed share repurchase program; plan

to

repurchase

up

to

$500

million

in

2011

2

Priorities:

Maintain ample capacity to meet the needs

of our clients and support organic business

growth

Continue to invest in innovative products

and services

Deploy capital for acquisitions that meet

our strategic criteria

Ensure capital adequacy in times of

uncertainty and regulatory compliance

10.3%

9.8%

9.6%

8.3%

7.9%

1Q10

2Q10

3Q10

4Q10

1Q11¹

Tier 1 common ratio

$58.01

$56.29

$55.91

$52.77

$50.32

1Q10

2Q10

3Q10

4Q10

1Q11

Book value per share |

13

Generating Solid Returns on a

Higher Quality Balance Sheet

ROAA highlights

Declining credit costs more than offsetting

reductions in purchase accounting accretion

Average assets declined $4.6 billion since

1Q10

3Q10

benefitted

from

gain

on

sale

of

GIS

2

Impact of higher earnings more than offset

by increased Tier 1 common capital

Tier 1 common capital increased 25% since

1Q10

3Q10

benefitted

from

gain

on

sale

of

GIS

2

1.29%

1.23%

1.65%

1.22%

1.02%

1Q10

2Q10

3Q10

4Q10

1Q11

Return on average assets

Return

on

Tier

1

common

capital

1

15.4%

15.4%

21.4%

17.7%

15.5%

1Q10

2Q10

3Q10

4Q10

1Q11

(1) 1Q11 Tier 1 common capital is estimated. Return on Tier 1 common capital calculated as

annualized net income divided by Tier 1

common capital. (2) See Appendix for 3Q10 returns as adjusted for the $328 million

after-tax gain on the sale of GIS. Further information on (1) and (2) is provided

in the Appendix. Return on Tier 1 common capital highlights

|

14

Outlook

1

Full

Year

2011

vs.

2010

Balance Sheet

Income Statement

Commercial loan growth is expected

Continue to shift deposit mix towards transaction accounts

Core NII expected to increase by more than $100 million

Purchase accounting accretion expected to decline by $700 million, resulting in

lower NII

Provision expected to decline by at least $800 million

Provision-adjusted NII and margin expected to increase

Noninterest income expected to increase in the low-to-mid single digits,

excluding the expected incremental negative impact of approximately $400

million due to overdraft and interchange regulatory limits

Noninterest

expenses

expected

to

decline

2

(1) Refer to assumptions in the Cautionary Statement in the Appendix. (2) Subject to legal and

regulatory contingencies. See Note 22 Legal Proceedings included in Item 8 and Risk

Factors Item 1A of PNCs 2010 Form 10-K. |

15

Summary

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company.

1Q11 strategic achievements

strong results and

capital actions

Building momentum in our businesses

client

growth and new product launches

Key financial take-aways

strong balance sheet,

strong earnings and solid returns

2011 outlook remains positive |

16

Cautionary Statement Regarding Forward-Looking

Information

Appendix

This

presentation

includes

snapshot

information

about

PNC

used

by

way

of

illustration

and

is

not

intended

as

a

full

business

or

financial

review.

It

should

not

be

viewed

in

isolation

but

rather

in

the

context

of

all

of

the

information

made

available

by

PNC

in

its

SEC

filings.

We

also

make

statements

in

this

presentation,

and

we

may

from

time

to

time

make

other

statements,

regarding

our

outlook

or

expectations

for

earnings,

revenues,

expenses,

capital

levels,

liquidity

levels,

asset

quality

and/or

other

matters

regarding

or

affecting

PNC

and

its

future

business

and

operations

that

are

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act.

Forward-looking

statements

are

typically

identified

by

words

such

as

believe,

plan,

expect,

anticipate,

intend,

outlook,

estimate,

forecast,

will,

should,

project,

goal

and

other

similar

words

and

expressions.

Forward-looking

statements

are

subject

to

numerous

assumptions,

risks

and

uncertainties,

which

change

over

time.

Forward-looking

statements

speak

only

as

of

the

date

they

are

made.

We

do

not

assume

any

duty

and

do

not

undertake

to

update

our

forward-

looking

statements.

Actual

results

or

future

events

could

differ,

possibly

materially,

from

those

that

we

anticipated

in

our

forward-looking

statements,

and

future

results

could

differ

materially

from

our

historical

performance.

Our

forward-looking

statements

are

subject

to

the

following

principal

risks

and

uncertainties.

We

provide

greater

detail

regarding

some

of

these

factors

in

our

2010

Form

10-K,

including

in

the

Risk

Factors

and

Risk

Management

sections

of

that

report,

and

in

our

subsequent

SEC

filings.

Our

forward-looking

statements

may

also

be

subject

to

other

risks

and

uncertainties,

including

those

that

we

may

discuss

elsewhere

in

this

presentation

or

in

our

filings

with

the

SEC,

accessible

on

the

SECs

website

at

www.sec.gov

and

on

or

through

our

corporate

website

at

www.pnc.com/secfilings.

We

have

included

these

web

addresses

as

inactive

textual

references

only.

Information

on

these

websites

is

not

part

of

this

document.

Our

businesses

and

financial

results

are

affected

by

business

and

economic

conditions,

both

generally

and

specifically

in

the

principal

markets

in

which

we

operate.

In

particular,

our

businesses

and

financial

results

may

be

impacted

by:

o

Changes

in

interest

rates

and

valuations

in

the

debt,

equity

and

other

financial

markets.

o

Disruptions

in

the

liquidity

and

other

functioning

of

financial

markets,

including

such

disruptions

in

the

markets

for

real

estate

and

other

assets

commonly

securing

financial

products.

o

Actions

by

the

Federal

Reserve

and

other

government

agencies,

including

those

that

impact

money

supply

and

market

interest

rates.

o

Changes

in

our

customers,

suppliers

and

other

counterparties

performance

in

general

and

their

creditworthiness

in

particular.

o

A

slowing

or

failure

of

the

moderate

economic

recovery

that

began

in

mid-2009

and

continued

throughout

2010

and

into

2011.

o

Continued

effects

of

the

aftermath

of

recessionary

conditions

and

the

uneven

spread

of

the

positive

impacts

of

the

recovery

on

the

economy

in

general

and

our

customers

in

particular,

including

adverse

impact

on

loan

utilization

rates

as

well

as

delinquencies,

defaults

and

customer

ability

to

meet

credit

obligations.

o

Changes

in

levels

of

unemployment.

o

Changes

in

customer

preferences

and

behavior,

whether

as

a

result

of

changing

business

and

economic

conditions,

climate-related

physical

changes

or

legislative

and

regulatory

initiatives,

or

other

factors.

Turbulence

in

significant

portions

of

the

US

and

global

financial

markets

could

impact

our

performance,

both

directly

by

affecting

our

revenues

and

the

value

of

our

assets

and

liabilities

and

indirectly

by

affecting

our

counterparties

and

the

economy

generally. |

17

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

We

will

be

impacted

by

the

extensive

reforms

provided

for

in

the

Dodd-Frank

Wall

Street

Reform

and

Consumer

Protection

Act

(Dodd-Frank

Act)

and

ongoing

reforms

impacting

the

financial

institutions

industry

generally.

Further,

as

much

of

the

Dodd-Frank

Act

will

require

the

adoption

of

implementing

regulations

by

a

number

of

different

regulatory

bodies,

the

precise

nature,

extent

and

timing

of

many

of

these

reforms

and

the

impact

on

us

is

still

uncertain.

Financial

industry

restructuring

in

the

current

environment

could

also

impact

our

business

and

financial

performance

as

a

result

of

changes

in

the

creditworthiness

and

performance

of

our

counterparties

and

by

changes

in

the

competitive

and

regulatory

landscape.

Our

results

depend

on

our

ability

to

manage

current

elevated

levels

of

impaired

assets.

Given

current

economic

and

financial

market

conditions,

our

forward-looking

financial

statements

are

subject

to

the

risk

that

these

conditions

will

be

substantially

different

than

we

are

currently

expecting.

These

statements

are

based

on

our

current

view

that

the

moderate

economic

recovery

that

began

in

mid-2009

and

continued

throughout

2010

will

transition

into

a

self-sustaining

economic

expansion

in

2011

pushing

the

unemployment

rate

lower

amidst

continued

low

interest

rates.

Legal

and

regulatory

developments

could

have

an

impact

on

our

ability

to

operate

our

businesses

or

our

financial

condition

or

results

of

operations

or

our

competitive

position

or

reputation.

Reputational

impacts,

in

turn,

could

affect

matters

such

as

business

generation

and

retention,

our

ability

to

attract

and

retain

management,

liquidity,

and

funding.

These

legal

and

regulatory

developments

could

include:

o

Changes

resulting

from

legislative

and

regulatory

responses

to

the

current

economic

and

financial

industry

environment.

o

Other

legislative

and

regulatory

reforms,

including

broad-based

restructuring

of

financial

industry

regulation

(such

as

that

under

the

Dodd-Frank

Act)

as

well

as

changes

to

laws

and

regulations

involving

tax,

pension,

bankruptcy,

consumer

protection,

and

other

aspects

of

the

financial

institution

industry.

o

Unfavorable

resolution

of

legal

proceedings

or

other

claims

and

regulatory

and

other

governmental

investigations

or

other

inquiries.

In

addition

to

matters

relating

to

PNCs

business

and

activities,

such

matters

may

also

include

proceedings,

claims,

investigations,

or

inquiries

relating

to

pre-acquisition

business

and

activities

of

acquired

companies,

such

as

National

City.

These

matters

may

result

in

monetary

judgments

or

settlements

or

other

remedies,

including

fines,

penalties,

restitution

or

alterations

in

our

business

practices

and

in

additional

expenses

and

collateral

costs.

o

The

results

of

the

regulatory

examination

and

supervision

process,

including

our

failure

to

satisfy

the

requirements

of

agreements

with

governmental

agencies.

o

Changes

in

accounting

policies

and

principles.

o

Changes

resulting

from

legislative

and

regulatory

initiatives

relating

to

climate

change

that

have

or

may

have

a

negative

impact

on

our

customers

demand

for

or

use

of

our

products

and

services

in

general

and

their

creditworthiness

in

particular.

o

Changes

to

regulations

governing

bank

capital,

including

as

a

result

of

the

Dodd-Frank

Act

and

of

the

Basel

III

initiatives.

Our

business

and

operating

results

are

affected

by

our

ability

to

identify

and

effectively

manage

risks

inherent

in

our

businesses,

including,

where

appropriate,

through

the

effective

use

of

third-party

insurance,

derivatives,

and

capital

management

techniques,

and

by

our

ability

to

meet

evolving

regulatory

capital

standards.

The

adequacy

of

our

intellectual

property

protection,

and

the

extent

of

any

costs

associated

with

obtaining

rights

in

intellectual

property

claimed

by

others,

can

impact

our

business

and

operating

results.

Our

ability

to

anticipate

and

respond

to

technological

changes

can

have

an

impact

on

our

ability

to

respond

to

customer

needs

and

to

meet

competitive

demands.

Our

ability

to

implement

our

business

initiatives

and

strategies

could

affect

our

financial

performance

over

the

next

several

years. |

18

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

Competition can have an impact on customer acquisition, growth and retention, as well as

on our credit spreads and product pricing, which can affect

market

share,

deposits

and

revenues.

Our

business

and

operating

results

can

also

be

affected

by

widespread

disasters,

terrorist

activities

or

international

hostilities,

either

as

a

result

of

the

impact

on

the

economy

and

capital

and

other

financial

markets

generally

or

on

us

or

on

our

customers,

suppliers

or

other

counterparties

specifically.

Also,

risks

and

uncertainties

that

could

affect

the

results

anticipated

in

forward-looking

statements

or

from

historical

performance

relating

to

our

equity

interest

in

BlackRock,

Inc.

are

discussed

in

more

detail

in

BlackRocks

filings

with

the

SEC,

including

in

the

Risk

Factors

sections

of

BlackRocks

reports.

BlackRocks

SEC

filings

are

accessible

on

the

SECs

website

and

on

or

through

BlackRocks

website

at

www.blackrock.com.

This

material

is

referenced

for

informational

purposes

only

and

should

not

be

deemed

to

constitute

a

part

of

this

document.

We

grow

our

business

in

part

by

acquiring

from

time

to

time

other

financial

services

companies,

financial

services

assets

and

related

deposits.

Acquisitions

present

us

with

risks

in

addition

to

those

presented

by

the

nature

of

the

business

acquired.

These

include

risks

and

uncertainties

relate

d

both to

the

acquisition

transactions

themselves

and

to

the

integration

of

the

acquired

businesses

into

PNC

after

closing.

Acquisitions

may

be

substantially

more

expensive

to

complete

(including

unanticipated

costs

incurred

in

connection

with

the

integration

of

the

acquired

company)

and

the

anticipated

benefits

(including

anticipated

cost

savings

and

strategic

gains)

may

be

significantly

harder

or

take

longer

to

achieve

than

expected.

Acquisitions

may

involve

our

entry

into

new

businesses

or

new

geographic

or

other

markets,

and

these

situations

also

present

risks

resulting

from

our

inexperience

in

those

new

areas.

As

a

regulated

financial

institution,

our

pursuit

of

attractive

acquisition

opportunities

could

be

negatively

impacted

due

to

regulatory

delays

or

other

regulatory

issues.

In

addition,

regulatory

and/or

legal

issues

relating

to

the

pre-acquisition

operations

of

an

acquired

business

may

cause

reputational

harm

to

PNC

following

the

acquisition

and

integration

of

the

acquired

business

into

ours

and

may

result

in

additional

future

costs

or

regulatory

limitations

arising

as

a

result

of

those

issues.

Any

annualized,

proforma,

estimated,

third

party

or

consensus

numbers

in

this

presentation

are

used

for

illustrative

or

comparative

purposes

only

and

may

not

reflect

actual

results.

Any

consensus

earnings

estimates

are

calculated

based

on

the

earnings

projections

made

by

analysts

who

cover

that

company.

The

analysts

opinions,

estimates

or

forecasts

(and

therefore

the

consensus

earnings

estimates)

are

theirs

alone,

are

not

those

of

PNC

or

its

management,

and

may

not

reflect

PNCs

or

other

companys

actual

or

anticipated

results. |

19

Non-GAAP to GAAP Reconcilement

Appendix

In millions

Adjustments,

pretax

Income taxes

(benefit)1

Net income

Average

Assets

Return on Avg.

Assets

Net income and return on avg. assets, as reported

$832

Reported net income, if annualized

$3,374

$262,554

1.29%

In millions

Adjustments,

pretax

Income taxes

(benefit)1

Net income

Average

Assets

Return on Avg.

Assets

Net income and return on avg. assets, as reported

$820

Reported net income, if annualized

$3,253

$263,558

1.23%

In millions

Adjustments,

pretax

Income taxes

(benefit)1

Net income

Average

Assets

Return on Avg.

Assets

Net income and return on avg. assets, as reported

$1,103

Reported net income, if annualized

$4,376

$264,579

1.65%

Adjustments:

Gain on sale of GIS

($639)

$311

(328)

Adjusted net income

$775

Adjusted net income, if annualized

$3,075

$264,579

1.16%

For the three months ended March 31, 2011

For the three months ended December 31, 2010

For the three months ended September 30, 2010

PNC

believes

that

information

adjusted

for

the

impact

of

certain

items

may

be

useful

due

to

the

extent

to

which

the

items

are

not

indicative of our ongoing operations.

(1)

Calculated

using

a

marginal

federal

income

tax

rate

of

35%

and

includes

applicable

income

tax

adjustments.

The

after-tax

gain

on

the

sale of GIS also reflects the impact of state income taxes. |

20

Non-GAAP to GAAP Reconcilement

Appendix

In millions

Mar. 31, 2011

Dec. 31, 2010

Sept. 30, 2010

June 30, 2010

Mar. 31, 2010

Tier 1 common capital

$21,970

$21,188

$20,437

$18,173

$17,562

Reported net income

832

820

1,103

803

671

Reported net income, if annualized

3,374

3,253

4,376

3,221

2,721

Adjustments:

After-tax gain on sale of GIS

(328)

Adjusted net income

775

Adjusted net income, if annualized

3,075

Return on tier 1 common capital

15.4%

15.4%

21.4%

17.7%

15.5%

Adjusted return on tier 1 common capital

15.0%

As of or for the three months ended

PNC

believes

that

return

on

tier

1

common

capital

is

useful

as

a

tool

to

help

measure

and

assess

a

company's

use

of

common

equity

and

that

such

information

adjusted

for

the

impact

of

the

GIS

gain

may

be

useful

due

to

the

extent

to

which

that

item

is

not

indicative

of

our

ongoing

operations.

After-tax

adjustments

are

calculated

using

a

marginal

federal

income

tax

rate

of

35%

and

include

applicable

income

tax

adjustments.

The

after-tax

gain

on

the

sale

of

GIS

also

reflects

the

impact

of

state

income

taxes.

The

pre-tax

gain

on

the

sale

of

GIS

was

$639 million.

In millions

Adjustments,

pretax

Income taxes

(benefit)1

Net income

Average

Assets

Return on Avg.

Assets

Net income and return on avg. assets, as reported

$803

Reported net income, if annualized

$3,221

$264,366

1.22%

In millions

Adjustments,

pretax

Income taxes

(benefit)1

Net income

Average

Assets

Return on Avg.

Assets

Net income and return on avg. assets, as reported

$671

Reported net income, if annualized

$2,721

$267,148

1.02%

PNC

believes

that

information

adjusted

for

the

impact

of

certain

items

may

be

useful

due

to

the

extent

to

which

the

items

are

not

indicative of our ongoing operations.

(1) Calculated using a marginal federal income tax rate of 35% and includes applicable income

tax adjustments. For the three months ended March 31, 2010

For the three months ended June 30, 2010 |

21

Non-GAAP to GAAP Reconcilement

Appendix

For the three months ended

$ in millions

Mar. 31, 2011

Dec. 31, 2010

Sept. 30, 2010

June 30, 2010

Mar. 31, 2010

Net interest margin, as reported

3.94%

3.93%

3.96%

4.35%

4.24%

Provision for credit losses

$421

$442

$486

$823

$751

Provision for credit losses, if annualized

$1,707

$1,754

$1,928

$3,301

$3,046

Avg. interest earning assets

$224,095

$223,795

$223,677

$224,580

$226,992

Annualized provision/Avg. interest earning assets

0.76%

0.78%

0.86%

1.47%

1.34%

Provision-adjusted net interest margin (1)

3.18%

3.15%

3.10%

2.88%

2.90%

For the three months ended

$ in millions

Mar. 31, 2011

Dec. 31, 2010

Sept. 30, 2010

June 30, 2010

Mar. 31, 2010

Net interest margin, as reported

3.94%

3.93%

3.96%

4.35%

4.24%

Purchase accounting accretion (1)

$281

$344

$325

$540

$440

Purchase accounting accretion, if annualized

$1,140

$1,365

$1,289

$2,166

$1,784

Avg. interest earning assets

$224,095

$223,795

$223,677

$224,580

$226,992

Annualized purchase accounting accretion/Avg. interest earning assets

0.51%

0.61%

0.58%

0.96%

0.79%

Core net interest margin (2)

3.43%

3.32%

3.38%

3.39%

3.45%

PNC

believes

that

provision-adjusted

net

interest

margin,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

amount

of

credit

related

risk

associated

with

interest-earning assets.

(1) The adjustment represents annualized provision for credit losses divided by average

interest-earning assets. (1) Purchase accounting accretion is scheduled purchase

accounting accretion plus cash recoveries. (2)

PNC

believes

that

core

net

interest

margin,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

impact

of

purchase

accounting

accretion

on

net

interest

margin. The adjustment represents annualized purchase accounting accretion divided by

average interest-earning assets. |

22

Non-GAAP to GAAP Reconcilement

Appendix

In millions except per share data

Dec. 31, 2008

Dec. 31, 2010

Mar. 31, 2011

Dec. 31, 2010

Mar. 31, 2011

Common shareholders' equity

$17,490

$29,595

$30,485

Common shares outstanding

443

526

526

Book value per common share

$39.44

$56.29

$58.01

Intangible assets

$11,688

$10,753

$10,764

Common shareholders' equity less intangi

$5,802

$18,842

$19,721

Common shares outstanding

443

526

526

Tangible book value per common share

$13.10

$35.82

$37.49

174%

186%

As of

Change from Dec. 31, 2008 to

PNC

believes

that

tangible

book

value

per

common

share,

a

non-GAAP

measure,

is

useful

as

a

tool

to

help

evaluate

the

amount,

on

a

per

share basis, of intangible assets included in book value per common share.

|

23

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC

Ticker |