UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2010

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission file number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

| Pennsylvania |

|

25-1435979 |

| (State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer Identification No.) |

One PNC Plaza, 249 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2707

(Address of principal executive offices, including zip code)

(412) 762-2000

(Registrants telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No

¨

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes x No

¨

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

Large accelerated

filer x Accelerated

filer ¨ Non-accelerated

filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No

x

As of July 30, 2010, there were 525,399,769 shares of the

registrants common stock ($5 par value) outstanding.

The PNC Financial Services Group, Inc.

Cross-Reference Index to Second Quarter 2010 Form 10-Q

FINANCIAL REVIEW

CONSOLIDATED FINANCIAL HIGHLIGHTS

THE PNC FINANCIAL SERVICES GROUP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dollars in millions, except per share data |

|

Three months ended June 30 |

|

|

Six months ended June 30 |

|

| Unaudited |

|

2010 |

|

|

2009 |

|

|

2010 |

|

|

2009 |

|

| FINANCIAL RESULTS (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income

|

|

$ |

2,435 |

|

|

$ |

2,193 |

|

|

$ |

4,814 |

|

|

$ |

4,513 |

|

| Noninterest income

|

|

|

1,477 |

|

|

|

1,610 |

|

|

|

2,861 |

|

|

|

2,976 |

|

| Total revenue

|

|

|

3,912 |

|

|

|

3,803 |

|

|

|

7,675 |

|

|

|

7,489 |

|

| Noninterest expense

|

|

|

2,002 |

|

|

|

2,492 |

|

|

|

4,115 |

|

|

|

4,650 |

|

| Pretax, pre-provision earnings (b)

|

|

$ |

1,910 |

|

|

$ |

1,311 |

|

|

$ |

3,560 |

|

|

$ |

2,839 |

|

| Provision for credit losses

|

|

$ |

823 |

|

|

$ |

1,087 |

|

|

$ |

1,574 |

|

|

$ |

1,967 |

|

| Income from continuing operations before noncontrolling interests

|

|

$ |

781 |

|

|

$ |

195 |

|

|

$ |

1,429 |

|

|

$ |

715 |

|

| Income from discontinued operations, net of income taxes (c)

|

|

$ |

22 |

|

|

$ |

12 |

|

|

$ |

45 |

|

|

$ |

22 |

|

| Net income

|

|

$ |

803 |

|

|

$ |

207 |

|

|

$ |

1,474 |

|

|

$ |

737 |

|

| Net income attributable to common shareholders (d) |

|

$ |

786 |

|

|

$ |

65 |

|

|

$ |

1,119 |

|

|

$ |

525 |

|

| Diluted earnings per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations

|

|

$ |

1.43 |

|

|

$ |

.11 |

|

|

$ |

2.06 |

|

|

$ |

1.11 |

|

| Discontinued operations (c)

|

|

|

.04 |

|

|

|

.03 |

|

|

|

.09 |

|

|

|

.05 |

|

| Net income

|

|

$ |

1.47 |

|

|

$ |

.14 |

|

|

$ |

2.15 |

|

|

$ |

1.16 |

|

| Cash dividends declared per common share

|

|

$ |

.10 |

|

|

$ |

.10 |

|

|

$ |

.20 |

|

|

$ |

.76 |

|

| Total preferred dividends declared, including TARP

|

|

$ |

25 |

|

|

$ |

119 |

|

|

$ |

118 |

|

|

$ |

170 |

|

| TARP Capital Purchase Program preferred dividends (d)

|

|

|

|

|

|

$ |

95 |

|

|

$ |

89 |

|

|

$ |

142 |

|

| Impact of TARP Capital Purchase Program preferred dividends per diluted common share

|

|

|

|

|

|

$ |

.21 |

|

|

$ |

.17 |

|

|

$ |

.32 |

|

| Redemption of TARP preferred stock discount accretion (d)

|

|

|

|

|

|

|

|

|

|

$ |

250 |

|

|

|

|

|

| PERFORMANCE RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest income to total revenue

|

|

|

38 |

% |

|

|

42 |

% |

|

|

37 |

% |

|

|

40 |

% |

| Efficiency

|

|

|

51 |

|

|

|

66 |

|

|

|

54 |

|

|

|

62 |

|

| From net income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (e)

|

|

|

4.35 |

% |

|

|

3.60 |

% |

|

|

4.29 |

% |

|

|

3.70 |

% |

| Return on:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shareholders equity

|

|

|

11.52 |

|

|

|

1.52 |

|

|

|

8.63 |

|

|

|

5.72 |

|

| Average assets

|

|

|

1.22 |

|

|

|

.30 |

|

|

|

1.12 |

|

|

|

.53 |

|

See page 52 for a glossary of certain terms used in this Report.

Certain prior period amounts have been reclassified to conform with the current period presentation, which we believe is more meaningful to readers of our

consolidated financial statements.

| (a) |

The Executive Summary and Consolidated Income Statement Review portions of the Financial Review section of this Report provide information regarding items impacting the

comparability of the periods presented. |

| (b) |

We believe that pretax, pre-provision earnings, a non-GAAP measure, is useful as a tool to help evaluate our ability to provide for credit costs through operations.

|

| (c) |

Includes results of operations for PNC Global Investment Servicing Inc. (GIS) for all periods presented. We entered into a definitive agreement to sell GIS in February

2010, and closed the sale on July 1, 2010. See Sale of PNC Global Investment Servicing in the Executive Summary section of the Financial Review section of this Report and Note 2 Divestiture in the Notes To Consolidated Financial Statements of

this Report for additional information. |

| (d) |

We redeemed the Series N (TARP) Preferred Stock on February 10, 2010. In connection with the redemption, we accelerated the accretion of the remaining issuance

discount on the Series N Preferred Stock and recorded a corresponding reduction in retained earnings of $250 million in the first quarter of 2010. This resulted in a one-time, noncash reduction in net income attributable to common shareholders and

related basic and diluted earnings per share. |

| (e) |

Calculated as annualized taxable-equivalent net interest income divided by average earning assets. The interest income earned on certain earning assets is completely or

partially exempt from Federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of margins for all earning assets, we use net interest income on a

taxable-equivalent basis in calculating net interest margin by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP in

the Consolidated Income Statement. The taxable-equivalent adjustments to net interest income for the three months ended June 30, 2010 and June 30, 2009 were $19 million and $16 million, respectively. The taxable-equivalent adjustments to

net interest income for the six months ended June 30, 2010 and June 30, 2009 were $37 million and $31 million, respectively. |

1

CONSOLIDATED FINANCIAL HIGHLIGHTS

(CONTINUED) (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited |

|

June 30

2010 |

|

|

December 31

2009 |

|

|

June 30

2009 |

|

| BALANCE SHEET DATA (dollars in millions, except per share

data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets

|

|

$ |

261,695 |

|

|

$ |

269,863 |

|

|

$ |

279,754 |

|

| Loans (b) (c)

|

|

|

154,342 |

|

|

|

157,543 |

|

|

|

165,009 |

|

| Allowance for loan and lease losses (b)

|

|

|

5,336 |

|

|

|

5,072 |

|

|

|

4,569 |

|

| Interest-earning deposits with banks (b)

|

|

|

5,028 |

|

|

|

4,488 |

|

|

|

10,190 |

|

| Investment securities (b)

|

|

|

53,717 |

|

|

|

56,027 |

|

|

|

49,969 |

|

| Loans held for sale (c)

|

|

|

2,756 |

|

|

|

2,539 |

|

|

|

4,662 |

|

| Goodwill and other intangible assets

|

|

|

12,138 |

|

|

|

12,909 |

|

|

|

12,890 |

|

| Equity investments (b)

|

|

|

10,159 |

|

|

|

10,254 |

|

|

|

8,168 |

|

| Noninterest-bearing deposits

|

|

|

44,312 |

|

|

|

44,384 |

|

|

|

41,806 |

|

| Interest-bearing deposits

|

|

|

134,487 |

|

|

|

142,538 |

|

|

|

148,633 |

|

| Total deposits

|

|

|

178,799 |

|

|

|

186,922 |

|

|

|

190,439 |

|

| Transaction deposits

|

|

|

125,712 |

|

|

|

126,244 |

|

|

|

120,324 |

|

| Borrowed funds (b)

|

|

|

40,427 |

|

|

|

39,261 |

|

|

|

44,681 |

|

| Shareholders equity

|

|

|

28,377 |

|

|

|

29,942 |

|

|

|

27,294 |

|

| Common shareholders equity

|

|

|

27,725 |

|

|

|

22,011 |

|

|

|

19,363 |

|

| Accumulated other comprehensive loss

|

|

|

442 |

|

|

|

1,962 |

|

|

|

3,101 |

|

| Book value per common share

|

|

|

52.77 |

|

|

|

47.68 |

|

|

|

42.00 |

|

| Common shares outstanding (millions)

|

|

|

525 |

|

|

|

462 |

|

|

|

461 |

|

| Loans to deposits

|

|

|

86 |

% |

|

|

84 |

% |

|

|

87 |

% |

|

|

|

|

| ASSETS UNDER ADMINISTRATION (billions)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Discretionary assets under management

|

|

$ |

99 |

|

|

$ |

103 |

|

|

$ |

98 |

|

| Nondiscretionary assets under administration

|

|

|

100 |

|

|

|

102 |

|

|

|

124 |

|

| Total assets under administration

|

|

$ |

199 |

|

|

$ |

205 |

|

|

$ |

222 |

|

|

|

|

|

| CAPITAL RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 risk-based (d) (e)

|

|

|

10.7 |

% |

|

|

11.4 |

% |

|

|

10.5 |

% |

| Tier 1 common (e)

|

|

|

8.3 |

|

|

|

6.0 |

|

|

|

5.3 |

|

| Total risk-based (d)

|

|

|

14.3 |

|

|

|

15.0 |

|

|

|

14.1 |

|

| Leverage (d)

|

|

|

9.1 |

|

|

|

10.1 |

|

|

|

9.1 |

|

| Common shareholders equity to assets

|

|

|

10.6 |

|

|

|

8.2 |

|

|

|

6.9 |

|

|

|

|

|

| ASSET QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total loans

|

|

|

3.31 |

% |

|

|

3.60 |

% |

|

|

2.52 |

% |

| Nonperforming assets to total loans and foreclosed and other assets

|

|

|

3.81 |

|

|

|

3.99 |

|

|

|

2.81 |

|

| Nonperforming assets to total assets

|

|

|

2.26 |

|

|

|

2.34 |

|

|

|

1.66 |

|

| Net charge-offs to average loans (for the three months ended) (annualized)

|

|

|

2.18 |

|

|

|

2.09 |

|

|

|

1.89 |

|

| Allowance for loan and lease losses to total loans

|

|

|

3.46 |

|

|

|

3.22 |

|

|

|

2.77 |

|

| Allowance for loan and lease losses to nonperforming loans (f)

|

|

|

104 |

|

|

|

89 |

|

|

|

110 |

|

| (a) |

The Executive Summary and Consolidated Balance Sheet Review portions of the Financial Review section of this Report provide information regarding items impacting the

comparability of the periods presented. |

| (b) |

Amounts include consolidated variable interest entities. Some June 30, 2010 amounts include consolidated variable interest entities that we consolidated effective

January 1, 2010 based on guidance in ASC 810, Consolidation. See Consolidated Balance Sheet in Part I, Item 1 of this Report for additional information. |

| (c) |

Amounts include items for which we have elected the fair value option. See Consolidated Balance Sheet in Part I, Item 1 of this Report for additional information.

|

| (d) |

The regulatory minimums are 4.0% for Tier 1 risk-based, 8.0% for Total risk-based, and 4.0% for Leverage capital ratios. The well-capitalized levels are 6.0% for Tier 1

risk-based, 10.0% for Total risk-based, and 5.0% for Leverage capital ratios. |

| (e) |

Our Tier 1 risk-based capital ratio and our Tier 1 common capital ratio would have been 11.3% and 9.0%, respectively, at June 30, 2010 had they included the net

impact of the July 1, 2010 sale of GIS. A reconciliation of these ratios reflecting the estimated impact of the sale of GIS to the ratios set forth in the table above is included in the Risk-Based Capital portion of the Financial Review section

of this Report. We believe that the disclosure of these ratios reflecting the estimated impact of the sale of GIS provides additional meaningful information regarding the risk-based capital ratios at that date and the impact of this event on these

ratios. |

| (f) |

Nonperforming loans do not include purchased impaired loans or loans held for sale. Allowance for loan and lease losses includes impairment reserves attributable to

purchased impaired loans. |

2

FINANCIAL REVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review, including the Consolidated Financial Highlights, should be read together with our unaudited Consolidated Financial Statements

and unaudited Statistical Information included elsewhere in this Report and with Items 6, 7, 8 and 9A of our 2009 Annual Report on Form 10-K (2009 Form 10-K). We have reclassified certain prior period amounts to conform with the current period

presentation, which we believe is more meaningful to readers of our consolidated financial statements. For information regarding certain business and regulatory risks, see the Risk Management section in this Financial Review and Items 1A and 7 of

our 2009 Form 10-K and Item 1A included in Part II of this Report. Also, see the Cautionary Statement Regarding Forward-Looking Information and Critical Accounting Estimates And Judgments sections in this Financial Review for certain other

factors that could cause actual results or future events to differ, perhaps materially, from historical performance and those anticipated in the forward-looking statements included in this Report. See Note 19 Segment Reporting in the Notes To

Consolidated Financial Statements included in Part I, Item 1 of this Report for a reconciliation of total business segment earnings to total PNC consolidated net income from continuing operations before noncontrolling interests as reported on a

generally accepted accounting principles (GAAP) basis.

EXECUTIVE SUMMARY

THE PNC FINANCIAL SERVICES GROUP, INC.

PNC is one of the largest diversified financial services companies in the United States and is headquartered in Pittsburgh, Pennsylvania.

PNC has businesses engaged in retail banking, corporate and institutional banking, asset management, and residential mortgage banking, providing many of

its products and services nationally and others in PNCs primary geographic markets located in Pennsylvania, Ohio, New Jersey, Michigan, Maryland, Illinois, Indiana, Kentucky, Florida, Virginia, Missouri, Delaware, Washington, D.C., and

Wisconsin.

SALE OF PNC GLOBAL INVESTMENT SERVICING

On July 1, 2010, we sold PNC Global Investment Servicing Inc. (GIS), a leading provider of processing, technology and business

intelligence services to asset managers, broker-dealers and financial advisors worldwide, for $2.3 billion in cash pursuant to a definitive agreement entered into on February 2, 2010. The estimated after-tax gain of $335 million related to this

sale will be recognized in the third quarter of 2010. The sale is expected to add $1.4 billion to regulatory capital and improve Tier 1 risk-based and Tier 1 common capital ratios by approximately 60 basis points and 70 basis points, respectively.

Results of operations of GIS are presented as income from discontinued operations, net of income taxes, on our Consolidated Income Statement

for the periods presented in this Report. Once we entered into the sales agreement, GIS was no longer a reportable business segment.

Further

information regarding the GIS sale is included in Note 2 Divestiture in our Notes To Consolidated Financial Statements in this Report.

NATIONAL CITY INTEGRATION COSTS

A summary of pretax merger and integration costs in connection with our December 31, 2008 acquisition of National City Corporation (National City)

follows.

NATIONAL CITY INTEGRATION COSTS

|

|

|

|

|

|

|

|

|

|

|

| In millions |

|

Second

Quarter |

|

First Six

Months |

|

Full

Year

|

|

| 2010

|

|

$ |

100 |

|

$ |

213 |

|

$ |

343 |

(a) |

| 2009

|

|

$ |

125 |

|

$ |

177 |

|

$ |

421 |

|

| 2008

|

|

|

|

|

|

|

|

$ |

575 |

(b) |

| (b) |

Includes $504 million conforming provision for credit losses. |

The transaction is expected to result in the reduction of more than $1.8 billion of combined company annualized noninterest expense through the

elimination of operational and administrative redundancies. We have completed the customer and branch conversions to our technology platforms and continue to integrate the businesses and operations of National City with those of PNC.

KEY STRATEGIC GOALS

We manage our company for the long term and are focused on re-establishing a moderate risk profile while maintaining strong capital and liquidity

positions, investing in our markets and products, and embracing our corporate responsibility to the communities where we do business.

Our

strategy to enhance shareholder value centers on driving pre-tax, pre-provision earnings in excess of credit costs by achieving growth in revenue from our balance sheet and diverse business mix that exceeds growth in expenses controlled through

disciplined cost management. The primary drivers of revenue growth are the acquisition, expansion and retention of customer relationships. We strive to expand our customer base by offering convenient banking options and leading technology solutions,

providing a broad range of fee-based and credit products and services, focusing on customer service, and through a significantly enhanced branding initiative. We may also grow revenue through appropriate and targeted acquisitions and, in certain

businesses, by expanding into new geographical markets.

We are focused on our strategies for quality growth. We are committed to

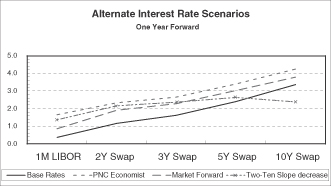

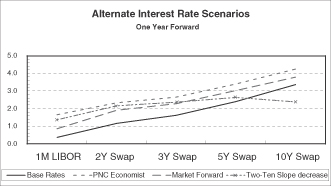

re-establishing a moderate risk profile

3

characterized by disciplined credit management and limited exposure to earnings volatility resulting from interest rate fluctuations and the shape of the interest rate yield curve. We made

substantial progress in transitioning our balance sheet throughout 2009 and in the first six months of 2010, working to institute our moderate risk philosophy throughout our expanded franchise. Our actions have created a well-positioned balance

sheet, strong bank level liquidity and investment flexibility to adjust, where appropriate and permissible, to changing interest rates and market conditions.

We also continue to be focused on building capital in the current environment characterized by economic and regulatory uncertainty. See the Funding and

Capital Sources section of the Consolidated Balance Sheet Review section and the Liquidity Risk Management section of this Financial Review.

RECENT MARKET AND INDUSTRY DEVELOPMENTS

The economic turmoil that began in the middle of 2007 and continued through most of 2008 has now settled into a slow economic recovery with, at this time,

somewhat uncertain prospects. This has been accompanied by dramatic changes in the competitive landscape of the financial services industry and a wholesale reformation of the legislative and regulatory landscape with the passage of the Dodd-Frank

Wall Street Reform and Consumer Protection Act (Dodd-Frank), which was signed into law by President Obama on July 21, 2010.

Dodd-Frank is extensive, complicated and comprehensive legislation that impacts practically all aspects of a banking organization. Dodd-Frank will

negatively impact revenue and increase both the direct and indirect costs of doing business for PNC, as it includes provisions that could increase regulatory fees and deposit insurance assessments and impose heightened capital and prudential

standards, while at the same time impacting the nature and costs of PNCs businesses, including consumer lending, private equity investment, derivatives transactions, interchange fees on debit card transactions, and asset securitizations.

Until such time as the regulatory agencies issue proposed and final regulations implementing the numerous provisions of Dodd-Frank, a process

that will extend at least over the next 12 months and might last several years, PNC will not be able to fully assess the impact the legislation will have on its businesses. However, we believe that the expected changes will be manageable for PNC and

will have a smaller impact on us than many Wall Street banks.

Items 1 and 7 of our 2009 Form 10-K include information regarding efforts over

the past 18 months by the Federal government, including the US Congress, the US Department of the Treasury, the Federal Reserve, the FDIC, and the Securities and Exchange Commission, to stabilize and restore confidence in the financial services

industry that have impacted and will likely continue to impact PNC and our

stakeholders. These efforts, which will continue to evolve, include the Emergency Economic Stabilization Act of 2008, the American Recovery and Reinvestment Act of 2009, Dodd-Frank and other

legislative, administrative and regulatory initiatives.

Developments during the first half of 2010 related to these matters are summarized

below.

TARP Capital Purchase Program

We redeemed the Series N (TARP) Preferred Stock on February 10, 2010. In connection with the redemption, we accelerated the accretion of the

remaining issuance discount on the Series N Preferred Stock and recorded a corresponding reduction in retained earnings of $250 million in the first quarter of 2010. This resulted in a one-time, noncash reduction in net income attributable to common

shareholders and related basic and diluted earnings per share. See Repurchase of Outstanding TARP Preferred Stock and Sale by US Treasury of TARP Warrant in Note 14 Total Equity And Other Comprehensive Income in the Notes To Consolidated Financial

Statements in this Report for additional information.

FDIC Temporary Liquidity Guarantee Program

The FDICs TLGP is designed to strengthen confidence and encourage liquidity in the banking system by:

| |

|

|

Guaranteeing newly issued senior unsecured debt of eligible institutions, including FDIC-insured banks and thrifts, as well as certain holding

companies (TLGP-Debt Guarantee Program), and

|

| |

|

|

Providing full deposit insurance coverage for non-interest bearing transaction accounts in FDIC-insured institutions, regardless of the dollar amount

(TLGP-Transaction Account Guarantee Program).

|

PNC did not issue any securities under the TLGP-Debt Guarantee Program during

the first six months of 2010.

From October 14, 2008 through December 31, 2009, PNC Bank, National Association (PNC Bank, N.A.)

participated in the TLGP-Transaction Account Guarantee Program. Beginning January 1, 2010, PNC Bank, N.A. is no longer participating in this program, but Dodd-Frank extends the program for all banks for two years, beginning December 31,

2010.

Public-Private Investment Fund Programs (PPIFs)

PNC did not participate in these programs during the first six months of 2010.

Home Affordable Modification Program (HAMP)

PNC began participating in HAMP for GSE mortgages in May 2009 and for non-GSE mortgages in July 2009, and intends to begin participation in the Second

Lien Program in August 2010. HAMP is scheduled to terminate as of December 31, 2012.

4

Home Affordable Refinance Program (HARP)

PNC began participating in HARP in May 2009. The program terminated as of June 10, 2010.

As noted above, Dodd-Frank and its implementation, as well as other statutory and regulatory initiatives that will be ongoing, will introduce numerous

regulatory changes over the next several years. While we believe that we are well positioned to navigate through this process, we cannot predict the ultimate impact of these actions on PNCs business plans and strategies.

KEY FACTORS AFFECTING FINANCIAL PERFORMANCE

Our financial performance is substantially affected by several external factors outside of our control including the following:

| |

|

|

General economic conditions, including the speed and stamina of the moderate economic recovery that began last year in general and on our customers in

particular,

|

| |

|

|

The level of, and direction, timing and magnitude of movement in, interest rates and the shape of the interest rate yield curve,

|

| |

|

|

The functioning and other performance of, and availability of liquidity in, the capital and other financial markets,

|

| |

|

|

Loan demand, utilization of credit commitments and standby letters of credit, and asset quality,

|

| |

|

|

Customer demand for other products and services,

|

| |

|

|

Changes in the competitive and regulatory landscape and in counterparty creditworthiness and performance as the financial services industry

restructures in the current environment,

|

| |

|

|

The impact of the extensive reforms enacted in the Dodd-Frank legislation and other legislative, regulatory and administrative initiatives, including

those outlined above, and

|

| |

|

|

The impact of market credit spreads on asset valuations.

|

In addition, our success will depend, among other things, upon:

| |

|

|

Further success in the acquisition, growth and retention of customers,

|

| |

|

|

Completion of the integration of the National City acquisition,

|

| |

|

|

Continued development of the geographic markets related to our recent acquisitions, including full deployment of our product offerings,

|

| |

|

|

A sustained focus on expense management, including achieving our cost savings targets associated with our National City integration, and creating

positive pretax, pre-provision earnings,

|

| |

|

|

Managing the distressed assets portfolio and other impaired assets,

|

| |

|

|

Improving our overall asset quality and continuing to meet evolving regulatory capital standards,

|

| |

|

|

Continuing to maintain and grow our deposit base as a low-cost funding source,

|

| |

|

|

Prudent risk and capital management related to our efforts to re-establish our desired moderate risk profile, and

|

| |

|

|

Actions we take within the capital and other financial markets.

|

SUMMARY FINANCIAL RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

June 30 |

|

|

Six months ended

June 30 |

|

|

|

|

2010 |

|

|

2009 |

|

|

2010 |

|

|

2009 |

|

| Net income, in millions

|

|

$ |

803 |

|

|

$ |

207 |

|

|

$ |

1,474 |

|

|

$ |

737 |

|

| Diluted earnings per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations

|

|

$ |

1.43 |

|

|

$ |

.11 |

|

|

$ |

2.06 |

|

|

$ |

1.11 |

|

| Discontinued operations

|

|

|

.04 |

|

|

|

.03 |

|

|

|

.09 |

|

|

|

.05 |

|

| Net income

|

|

$ |

1.47 |

|

|

$ |

.14 |

|

|

$ |

2.15 |

|

|

$ |

1.16 |

|

| Return from net income on:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shareholders equity

|

|

|

11.52 |

% |

|

|

1.52 |

% |

|

|

8.63 |

% |

|

|

5.72 |

% |

| Average assets

|

|

|

1.22 |

% |

|

|

.30 |

% |

|

|

1.12 |

% |

|

|

.53 |

% |

Income Statement Highlights

| |

|

|

Strong earnings in the second quarter of 2010 were driven by higher revenue, lower expenses and stabilizing credit quality. Pretax, pre-provision

earnings for the second quarter of 2010 were $1.9 billion compared with $1.3 billion for the second quarter of 2009.

|

| |

|

|

Total revenue increased to $3.9 billion and was derived from well-diversified sources. Net interest income increased over the second quarter of 2009

due to lower funding costs while noninterest income decreased primarily due to lower residential mortgage revenues.

|

| |

|

|

Noninterest expense of $2.0 billion declined compared with the second quarter of 2009 reflecting disciplined expense management, additional

acquisition-related cost savings and the reversal of certain accrued liabilities.

|

Balance Sheet Highlights

| |

|

|

We remain committed to responsible lending to support economic growth. Loans and commitments originated and renewed totaled approximately $40 billion

in the second quarter and $72 billion for the first half of 2010. At June 30, 2010, loans totaled $154 billion and decreased $2.9 billion during the quarter primarily due to loan repayments, dispositions and net charge-offs that exceeded

customer loan demand.

|

| |

|

|

The average rate paid on deposits declined by 10 basis points to .71% in the second quarter of 2010 from .81% in the first quarter primarily due to

repricing certificates of deposit and other time

|

5

| |

|

deposits which decreased $3.1 billion or 6% during the second quarter. Total deposits declined by $3.7 billion during the quarter to $179 billion at June 30, 2010.

|

| |

|

|

We remained core funded with a loan to deposit ratio of 86% at June 30, 2010 providing a strong bank liquidity position to support growth.

|

| |

|

|

PNCs Tier 1 common capital ratio grew to 8.3% at June 30, 2010 and on a pro forma basis would have been an estimated 9.0% based on the sale

of GIS on July 1, 2010. Further details regarding the pro forma impact of the sale of GIS are provided in the Risk-Based Capital portion of our Consolidated Balance Sheet Review section of this Financial Review.

|

Credit Quality Highlights

| |

|

|

Credit quality showed signs of stabilization during the second quarter of 2010. Nonperforming assets declined by $636 million in the quarter to $5.9

billion as of June 30, 2010. Accruing loans past due improved during the quarter. The allowance for loan and lease losses was $5.3 billion, or 3.46% of total loans and 104% of nonperforming loans, as of June 30, 2010. Net charge-offs to

average loans of 2.18% compared favorably to industry ratios.

|

| |

|

|

Sales of residential mortgage and brokered home equity loans from the distressed assets portfolio with unpaid principal balances of approximately $2.0

billion at June 30, 2010 are expected to close in the third quarter of 2010. As a result, we recorded an additional provision for credit losses of $109 million and net charge-offs of $75 million in the second quarter of 2010.

|

Integration Highlights

| |

|

|

We successfully completed the National City conversion of 16 million accounts, 6 million customers and 1,300 branches in nine states in one

of the largest branch conversions in US banking history. PNC achieved acquisition cost savings of $1.6 billion on an annualized basis in the second quarter of 2010, well ahead of the original target amount and schedule, and established a new goal of

$1.8 billion by the end of 2010.

|

Our Consolidated Income Statement and Consolidated Balance Sheet Review sections of this

Financial Review describe in greater detail the various items that impacted our results for the second quarter and first half of 2010 and 2009.

AVERAGE CONSOLIDATED BALANCE SHEET HIGHLIGHTS

Various seasonal and other factors impact our period-end balances whereas average balances are generally more indicative of underlying business trends

apart from the impact of acquisitions, divestitures or consolidations of variable interest entities.

The Consolidated Balance Sheet Review section of this Financial Review provides information on changes in

selected Consolidated Balance Sheet categories at June 30, 2010 compared with December 31, 2009.

Total average assets were $265.7

billion for the first six months of 2010 compared with $280.9 billion for the first six months of 2009.

Average interest-earning assets were

$225.8 billion for the first half of 2010, compared with $243.7 billion in the first half of 2009. A decrease of $14.5 billion in loans was reflected in the decrease in average interest-earning assets.

Average noninterest-earning assets totaled $40.0 billion in the first six months of 2010 compared with $37.1 billion in the prior year period.

The decrease in average total loans reflected a decline in commercial loans of $10.5 billion and commercial real estate loans of $3.8

billion. Loans represented 69% of average interest-earning assets for the first six months of 2010 and 70% for the first six months of 2009.

Average securities available for sale increased $2.4 billion, to $49.0 billion, in the first half of 2010 compared with the first half of 2009. Average

US Treasury and government agencies securities increased $5.4 billion compared with the first six months of 2009 while average other debt securities increased $1.4 billion in the comparison. These increases were partially offset by a decline of $3.9

billion in average residential mortgage-backed securities compared with the prior year period.

Average securities held to maturity increased

$3.3 billion, to $7.0 billion, in the first six months of 2010 compared with the first six months of 2009. The increase reflected purchases of asset-backed and non-agency commercial mortgage-backed securities, the transfer of securities from the

available for sale portfolio, and the impact of the Market Street Funding LLC (Market Street) consolidation effective January 1, 2010.

Total investment securities comprised 25% of average interest-earning assets for the first six months of 2010 and 21% for the first six months of 2009.

Average total deposits were $182.7 billion for the first half of 2010 compared with $192.5 billion for the first half of 2009. Average

deposits declined from the prior year period primarily as a result of decreases in retail certificates of deposit and other time deposits, which were partially offset by increases in money market balances, demand and other noninterest-bearing

deposits. Average total deposits represented 69% of average total assets for the first six months of both 2010 and 2009.

6

Average transaction deposits were $126.6 billion for the first six months of 2010 compared with $116.8

billion for the first six months of 2009.

Average borrowed funds were $41.7 billion for the first half of 2010 compared with $47.0 billion

for the first half of 2009. A $7.4 billion decline in Federal Home Loan Bank borrowings drove the decline in the comparison, partially offset by higher average commercial paper borrowings that reflected the consolidation of Market Street.

LINE OF BUSINESS HIGHLIGHTS

We have six reportable business segments:

| |

|

|

Corporate & Institutional Banking

|

| |

|

|

Residential Mortgage Banking

|

| |

|

|

Distressed Assets Portfolio

|

Total business segment earnings were $1.294 billion for the first six months of 2010 and $1.178 billion for the first six months of 2009. Highlights of

results for the first six months and second quarter of 2010 and 2009 are included below. The Business Segments Review section of this Financial Review includes a Results of Business-Summary table and further analysis of our business segment results

over the first six months of 2010 and 2009 including presentation differences from Note 19 Segment Reporting.

We provide a reconciliation of

total business segment earnings to PNC consolidated income from continuing operations before noncontrolling interests as reported on a GAAP basis in Note 19 Segment Reporting.

Retail Banking

Retail Banking earned

$109 million for the first six months of 2010 compared with earnings of $111 million for the same period a year ago. Earnings declined from the prior year due primarily to lower revenues as a result of lower interest credits assigned to deposits and

a decline in fees which were partially offset by well-managed expenses. In addition, credit costs were up slightly from the prior year. Retail Banking continued to maintain its focus on growing customers and deposits, customer and employee

satisfaction, investing in the business for future growth, as well as disciplined expense management during this period of market and economic uncertainty.

Retail Banking earned $85 million in the second quarter of 2010 and $61 million in the second quarter of 2009. The higher earnings for 2010 resulted from

lower credit costs and well-managed expenses partially offset by lower interest credits assigned to deposits and a decline in fees.

Corporate & Institutional Banking

Corporate & Institutional Banking earned $803 million in the first six months of 2010 compared with $466 million in the

first six months of 2009. Significantly higher earnings for the first half of 2010 reflected a lower provision for credit losses and lower noninterest expense which more than offset a decline in

net interest income compared with the 2009 period.

Corporate & Institutional Banking earned $443 million in the second quarter of

2010 compared with $107 million in the second quarter of 2009. Earnings increased in the comparison primarily due to a lower provision for credit losses and higher net interest income in the second quarter of 2010, partially offset by a decline in

noninterest income.

Asset Management Group

Asset Management Group earned $68 million for the first half of 2010 compared with $47 million for the same period in 2009. Assets under administration

were $199 billion at June 30, 2010. The first six months of 2010 reflected a lower provision for credit losses, lower expenses from disciplined expense management and higher noninterest income. These improvements were partially offset by a

decrease in net interest income from lower yields on loans.

Earnings for Asset Management Group totaled $29 million for the second quarter of

2010 compared with $8 million for the second quarter of 2009. The increase in earnings from the prior year quarter reflected a lower provision for credit losses, lower expenses and growth in asset management fees.

Residential Mortgage Banking

Residential Mortgage Banking earned $174 million for the first half of 2010 compared with $319 million in the first half of 2009. Earnings decreased from

the six months of 2009 primarily due to reduced loan sales revenue and lower net hedging gains on mortgage servicing rights, partially offset by lower noninterest expense. Residential Mortgage Banking earned $92 million in the second quarter of both

2010 and 2009.

BlackRock

Our BlackRock business segment earned $154 million in the first half of 2010 and $77 million in the first half of 2009. Second quarter 2010 business

segment earnings from BlackRock were $77 million compared with $54 million in the second quarter of 2009. Improved capital market conditions and the benefits of BlackRocks December 2009 acquisition of Barclays Global Investors (BGI)

contributed to higher earnings at BlackRock.

Distressed Assets Portfolio

The Distressed Assets Portfolio had a loss of $14 million for the first six months of 2010, compared with earnings of $158 million for the first six

months of 2009. A $280 million increase in the provision for credit losses drove the decrease in earnings in the comparison.

For the second

quarter of 2010, Distressed Assets Portfolio had a loss of $86 million compared with earnings of $155

7

million for the second quarter of 2009 as the provision for credit losses increased $374 million.

Other

Other reported

earnings of $135 million for the first half of 2010 compared with a net loss of $463 million for the first half of 2009. The net loss for the 2009 period included higher other-than-temporary impairment (OTTI) charges compared with the 2010 period,

alternative investment writedowns, a $133 million special FDIC assessment, and equity management losses.

Other reported earnings

of $141 million for the second quarter of 2010 compared with a net loss of $282 million for the second quarter of 2009. The increase compared with the prior year quarter reflected the reversal of certain accrued liabilities, higher positive impact

of net securities gains, lower OTTI charges on securities, higher results from private equity and alternative investments and lower integration costs. The net loss in the 2009 quarter also included the special FDIC assessment.

CONSOLIDATED INCOME STATEMENT REVIEW

Our Consolidated Income Statement is presented in Part I, Item 1 of this Report.

Net income for the first six months of 2010 was $1,474 million compared with $737 million for the first six months of 2009. Net income for the second

quarter of 2010 was $803 million compared with $207 million for the second quarter of 2009. Total revenue for the first six months of 2010 was $7.7 billion compared with $7.5 billion for the first six months of 2009. Total revenue for the second

quarter of 2010 increased 3% to $3.9 billion from $3.8 billion for the second quarter of 2009. We expect total revenue for full year 2010 to be relatively consistent with the level for full year 2009 apart from the impact of the $1.1 billion pretax

gain we recognized in the fourth quarter of 2009 in connection with BlackRocks acquisition of BGI.

NET

INTEREST INCOME AND NET INTEREST MARGIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

June 30 |

|

|

Six months ended

June 30 |

|

| Dollars in millions |

|

2010 |

|

|

2009 |

|

|

2010 |

|

|

2009 |

|

| Net interest income

|

|

$ |

2,435 |

|

|

$ |

2,193 |

|

|

$ |

4,814 |

|

|

$ |

4,513 |

|

| Net interest margin

|

|

|

4.35 |

% |

|

|

3.60 |

% |

|

|

4.29 |

% |

|

|

3.70 |

% |

Changes in net interest income and margin result from the interaction of the volume and composition of interest-earning assets and related yields,

interest-bearing liabilities and related rates paid, and noninterest-bearing sources of funding. See the Statistical Information Average Consolidated Balance Sheet And Net Interest Analysis section of this Report for additional information.

The increase in net interest income for the first half of 2010 compared with the first half of 2009

primarily resulted from the impact of lower deposit and borrowing costs somewhat offset by lower revenue from our investment securities portfolio and lower loan volume. Our deposit strategy included the retention and repricing at lower rates of

relationship-based certificates of deposit and the planned run off of maturing non-relationship certificates of deposit.

We have

approximately $14 billion of relationship-based certificates of deposit with an average rate of more than 2% that are scheduled to mature during the remainder of 2010. Assuming interest rates stay low, we believe that we will continue to reprice

these deposits and lower our funding costs even further. This assumes our current expectations for interest rates and economic conditions we include our current economic assumptions underlying our forward-looking statements in the Cautionary

Statement Regarding Forward-Looking Information section of this Financial Review.

The net interest margin was 4.29% for the first six months

of 2010 and 3.70% for the first six months of 2009. The following factors impacted the comparison:

| |

|

|

A decrease in the rate accrued on interest-bearing liabilities of 71 basis points. The rate accrued on interest-bearing deposits, the largest

component, decreased 59 basis points.

|

| |

|

|

The yield on loans, which represented the largest portion of our earning assets in the first six months of 2010, increased 7 basis points but was more

than offset by the decline in yield on investment securities.

|

| |

|

|

In addition, the impact of noninterest-bearing sources of funding decreased 11 basis points primarily due to the decline in interest rates.

|

The net interest margin was 4.35% for the second quarter of 2010 and 3.60% for the second quarter of 2009. The following

factors impacted the comparison:

| |

|

|

A decrease in the rate accrued on interest-bearing liabilities of 67 basis points. The rate accrued on interest-bearing deposits, the largest

component, decreased 54 basis points.

|

| |

|

|

A 19 basis point increase in the yield on interest-earning assets. The yield on loans increased 36 basis points and was partially offset by the net

impact of changes in other interest-earning assets.

|

| |

|

|

In addition, the impact of noninterest-bearing sources of funding decreased 11 basis points primarily due to the decline in interest rates.

|

We expect the yield on interest-earning assets to decline, which will put pressure on our net interest income and net

interest margin in the second half of 2010. For the third quarter of 2010, we expect net interest income and net interest margin to be lower than the second quarter of 2010 due to lower purchase accounting accretion, continued soft loan demand and

the low interest rate environment. See page 14 for

8

a discussion of certain corrections reflected in second quarter 2010 results that impacted net interest income and net interest margin.

NONINTEREST INCOME

Summary

Noninterest income

totaled $2.861 billion for the first six months of 2010, a decline of $115 million or 4% compared with the first six months of 2009. A decrease in residential mortgage loan sales revenue and net hedging gains on mortgage servicing rights was the

primary factor in the first half comparison, partially offset by higher other noninterest income and asset management fees along with lower OTTI charges. In addition, the 2009 period included gains of $103 million related to our BlackRock LTIP

shares adjustment in the first quarter of that year.

Noninterest income totaled $1.477 billion for the second quarter of 2010, a decline of

$133 million or 8% compared with $1.610 billion for the second quarter of 2009. The decline compared with the second quarter of 2009 was primarily due to lower residential mortgage loan sales revenue and customer-related trading income somewhat

offset by improved results on private equity and alternative investments and lower OTTI charges.

Additional Analysis

Asset management revenue was $502 million in the first six months of 2010 compared with $397 million in the first six months of 2009.

Asset management revenue was $243 million in the second quarter of 2010 compared with $208 million in the second quarter of 2009. These increases reflected higher equity earnings from our BlackRock investment, improved equity markets and client

growth. Assets managed at June 30, 2010 totaled $99 billion compared with $98 billion at June 30, 2009.

For the first half of 2010,

consumer services fees totaled $611 million compared with $645 million in the first half of 2009. Consumer services fees were $315 million for the second quarter of 2010 compared with $329 million for the second quarter of 2009. Lower consumer

service fees for 2010 in both comparisons reflected lower brokerage fees and the impact of the consolidation of the securitized credit card portfolio, partially offset by higher volume-related transaction fees. As further discussed in the Retail

Banking section of the Business Segments Review portion of this Financial Review, we expect that the Credit CARD Act of 2009 will negatively impact full year 2010 revenues by approximately $65 million.

Corporate services revenue totaled $529 million in the first six months of 2010 and $509 million in the first six months of 2009. Corporate services

revenue declined slightly in the second quarter of 2010, to $261 million, compared with $264 million for the second quarter of 2009. The increase in the six-month comparison was primarily due to higher commercial mortgage special servicing ancillary

income

partially offset by higher impairment of mortgage servicing rights. Corporate services fees include the noninterest component of treasury management fees, which continued to be a strong

contributor to revenue.

Residential mortgage revenue totaled $326 million in the first half of 2010 compared with $676 million in the first

half of 2009. Second quarter 2010 residential mortgage revenue totaled $179 million compared with $245 million in the second quarter of 2009. The decline in both comparisons reflected reduced loan sales revenue given the strong loan origination

refinance volume in the 2009 period and lower net hedging gains on mortgage servicing rights in the six month comparison.

Service charges on

deposits totaled $409 million for the first six months of 2010 and $466 million for the first six months of 2009. Service charges on deposits totaled $209 million for the second quarter of 2010 compared with $242 million for the second quarter of

2009. The decrease in both instances was due to lower overdraft charges and required branch divestitures in the third quarter of 2009. As further discussed in the Retail Banking section of the Business Segments Review portion of this Financial

Review, we expect that the new Regulation E rules related to overdraft charges will negatively impact our second half 2010 revenue by an estimated $145 million.

Net gains on sales of securities totaled $237 million for the first half of 2010 and $238 million for the first half of 2009. Second quarter net gains on

sales of securities were $147 million in 2010 and $182 million in 2009.

The net credit component of OTTI of securities recognized in earnings

was a loss of $210 million in the first six months of 2010, including $94 million in the second quarter, compared with losses of $304 million and $155 million, respectively, for the same periods in 2009. We anticipate ongoing improvement in OTTI as

the economy stabilizes and begins to recover.

Other noninterest income totaled $457 million for the first half of 2010 compared with $349

million for the first half of 2009. The first six months of 2010 included net gains on private equity and alternative investments of $140 million and trading income of $78 million. Amounts for the first six months of 2009 included gains of $103

million related to our equity investment in BlackRock, net losses on private equity and alternative investments of $151 million and trading income of $80 million.

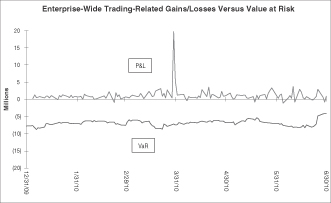

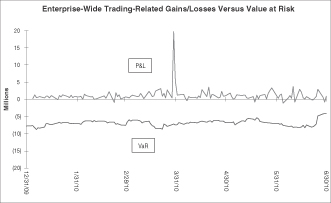

Other noninterest income for the second quarter of 2010 totaled $217 million compared with $295 million for the second quarter of 2009. Lower customer

trading income was a primary factor in the quarterly decline.

Other noninterest income typically fluctuates from period to period depending

on the nature and magnitude of transactions completed. Further details regarding our trading activities are

9

included in the Market Risk Management Trading Risk portion of the Risk Management section of this Financial Review, further details regarding private equity and alternative investments

are included in the Market Risk Management-Equity And Other Investment Risk section and further details regarding gains or losses related to our equity investment in BlackRock are included in the Business Segments Review section.

We believe that as the economy recovers, there are greater opportunities for growth in client-related fee-based income. We also expect that the

conversions of National City branches to the PNC platform, completed in June 2010, will create more product cross-selling opportunities.

PRODUCT REVENUE

In addition to credit and deposit products for commercial customers, Corporate & Institutional Banking offers other services, including treasury

management and capital markets-related products and services that are marketed by several businesses to commercial and retail customers.

Treasury management revenue, which includes fees as well as net interest income from customer deposit balances, totaled $600 million for the first six

months of 2010, an increase of $40 million or 7% compared with the first six months of 2009. For the second quarter of 2010, treasury management revenue was $302 million, an increase of $18 million or 6% compared with the second quarter of 2009.

This increase was primarily related to deposit growth and continued growth in legacy offerings such as purchasing cards and services provided to the Federal government and healthcare customers.

Revenue from capital markets-related products and services totaled $292 million in the first half of 2010 compared with $191 million in the first half of

2009, an increase of $101 million or 53%. Higher gains on loan sales, underwriting, mergers and acquisition advisory fees, and syndications fees contributed to the improved results. Second quarter 2010 revenue was $128 million compared with $148

million for the second quarter of 2009, a decline of $20 million or 14%. Second quarter 2010 results reflect increased adverse impact of counterparty credit risk on valuations of customer derivative positions. This was partially offset by increased

mergers and acquisition advisory fees and syndications fees.

Commercial mortgage banking activities include revenue derived from commercial

mortgage servicing (including net interest income and noninterest income from loan servicing and ancillary services), and revenue derived from commercial mortgage loans intended for sale and related hedges (including loan origination fees, net

interest income, valuation adjustments and gains or losses on sales).

Commercial mortgage banking activities resulted in revenue of $162

million in the first six months of 2010, a decrease of $71 million or 30% compared with the first six months of 2009. For the second quarter of 2010, revenue from

commercial mortgage banking activities totaled $47 million, a decrease of $92 million or 66% compared with the second quarter of 2009. These decreases were primarily due to valuations associated

with commercial mortgage loans held for sale, net of hedges, higher impairment of mortgage servicing rights, and the sale during the second quarter 2010 of a duplicative agency servicing operation acquired with National City. These decreases were

partially offset by higher special servicing revenue.

PROVISION FOR CREDIT

LOSSES

The provision for credit losses totaled $1.6 billion for the first six months of 2010 compared with $2.0 billion

for the first six months of 2009. For the second quarter of 2010, the provision for credit losses totaled $823 million compared with $1.1 billion for the second quarter of 2009. The lower provision in both comparisons reflected credit quality that

showed further signs of stabilization during the second quarter of 2010.

Sales of residential mortgage and brokered home equity loans from

the Distressed Assets Portfolio business segment with unpaid principal balances of approximately $2.0 billion at June 30, 2010 are expected to close in the third quarter of 2010. As a result, PNC recorded an additional provision for credit

losses of $109 million and net charge-offs of $75 million in the second quarter of 2010.

The Credit Risk Management portion of the Risk

Management section of this Financial Review includes additional information regarding factors impacting the provision for credit losses.

We

believe that our provision for credit losses in the second half of 2010 may be lower than the first half of 2010. Future provision levels will depend primarily on the level of nonperforming loans, our related coverage ratios, the pace of economic

recovery and the nature of regulatory reforms.

NONINTEREST EXPENSE

Noninterest expense for the first six months of 2010 was $4.1 billion compared with $4.7 billion for the first six months of 2009, a decline of $535

million or 12%. Noninterest expense totaled $2.0 billion in the second quarter of 2010 compared with $2.5 billion in the second quarter of 2009, a decrease of $490 million or 20%. Lower noninterest expense in both comparisons was primarily due to

the impact of higher cost savings related to the National City acquisition and the reversal of certain accrued liabilities in the second quarter of 2010, with $73 million associated with a franchise tax settlement and $47 million associated with an

indemnification for certain Visa litigation. We expect noninterest expense to be higher in the third quarter of 2010 relative to the second quarter of 2010 due to the reversal of these accrued liabilities recorded in the second quarter of 2010. We

also recorded a special FDIC assessment, intended to build the FDICs Deposit Insurance Fund, of $133 million in the second quarter of 2009.

10

See National City Integration Costs in the Executive Summary section of this Financial Review

for details of integration costs incurred, including through the first half of 2010 and 2009.

We achieved National City acquisition cost

savings of $1.6 billion on an annualized basis in the second quarter of 2010, higher and earlier than the original goal of $1.2 billion, and established a new annualized acquisition cost savings goal of $1.8 billion by the end of 2010.

EFFECTIVE TAX RATE

The effective tax rate was 28.0% for the first six months of 2010 compared with 18.0% for the first six months of 2009. For the second quarter of 2010,

our effective tax rate was 28.2% compared with 12.9% for the second quarter of 2009. The effective tax rate was lower in 2009 primarily as a result of relatively equal levels of favorable permanent differences (tax exempt income, tax credits and

dividend received deductions) on lower pretax income in 2009.

In July 2010, we received a favorable IRS letter ruling resolving a tax

position taken on a previous return which will result in a tax benefit of approximately $89 million. The impact of this ruling will be recognized in the third quarter of 2010 and is expected to result in a reduction of the full year effective tax

rate from 28% as of June 30, 2010 to a range of 25% to 26%.

CONSOLIDATED

BALANCE SHEET

REVIEW

SUMMARIZED BALANCE SHEET DATA

|

|

|

|

|

|

|

| In millions |

|

June 30

2010 |

|

Dec. 31

2009

|

| Assets

|

|

|

|

|

|

|

| Loans

|

|

$ |

154,342 |

|

$ |

157,543 |

| Investment securities

|

|

|

53,717 |

|

|

56,027 |

| Cash and short-term investments

|

|

|

11,677 |

|

|

13,290 |

| Loans held for sale

|

|

|

2,756 |

|

|

2,539 |

| Goodwill and other intangible assets

|

|

|

12,138 |

|

|

12,909 |

| Equity investments

|

|

|

10,159 |

|

|

10,254 |

| Other

|

|

|

16,906 |

|

|

17,301 |

| Total assets

|

|

$ |

261,695 |

|

$ |

269,863 |

| Liabilities

|

|

|

|

|

|

|

| Deposits

|

|

$ |

178,799 |

|

$ |

186,922 |

| Borrowed funds

|

|

|

40,427 |

|

|

39,261 |

| Other

|

|

|

11,479 |

|

|

11,113 |

| Total liabilities

|

|

|

230,705 |

|

|

237,296 |

| Total shareholders equity

|

|

|

28,377 |

|

|

29,942 |

| Noncontrolling interests

|

|

|

2,613 |

|

|

2,625 |

| Total equity

|

|

|

30,990 |

|

|

32,567 |

| Total liabilities and equity

|

|

$ |

261,695 |

|

$ |

269,863 |

The summarized balance sheet data above is based upon our Consolidated Balance Sheet in Part I, Item 1

of this Report.

The decline in total assets at June 30, 2010 compared with December 31, 2009 was primarily due to decreases in

loans and investment securities as more fully discussed below.

Total assets and liabilities at June 30, 2010 included $5.3 billion and

$4.4 billion, respectively related to Market Street and a credit card securitization trust as more fully described in the Off-Balance Sheet Arrangements And Variable Interest Entities section of this Financial Review and Note 3 Loan Sale and

Servicing Activities and Variable Interest Entities in the Notes To Consolidated Financial Statements of this Report.

An analysis of changes

in selected balance sheet categories follows.

LOANS

A summary of the major categories of loans outstanding follows. Outstanding loan balances reflect unearned income, unamortized discount and premium, and

purchase discounts and premiums totaling $2.8 billion at June 30, 2010 and $3.2 billion at December 31, 2009. The balances do not include accretable net interest on the purchased impaired loans.

Loans decreased $3.2 billion, or 2%, as of June 30, 2010 compared with December 31, 2009. An increase in loans of $3.5 billion from

consolidating Market Street and the securitized credit card portfolio was more than offset by the impact of soft customer loan demand combined with loan repayments and payoffs in the distressed assets portfolio. However, we believe that the pace of

loan demand contraction appears to be slowing in the third quarter of 2010.

Loans represented 59% of total assets at June 30, 2010 and

58% of total assets at December 31, 2009. Commercial lending represented 53% of the loan portfolio and consumer lending represented 47% at June 30, 2010.

Commercial real estate loans represented 8% of total assets at June 30, 2010 and 9% of total assets at December 31, 2009.

11

Details Of Loans

|

|

|

|

|

|

|

| In millions |

|

June 30

2010 |

|

Dec. 31

2009

|

| Commercial

|

|

|

|

|

|

|

| Retail/wholesale

|

|

$ |

9,576 |

|

$ |

9,515 |

| Manufacturing

|

|

|

9,728 |

|

|

9,880 |

| Other service providers

|

|

|

8,289 |

|

|

8,256 |

| Real estate related (a)

|

|

|

7,269 |

|

|

7,403 |

| Financial services

|

|

|

4,302 |

|

|

3,874 |

| Health care

|

|

|

3,099 |

|

|

2,970 |

| Other

|

|

|

11,969 |

|

|

12,920 |

| Total commercial

|

|

|

54,232 |

|

|

54,818 |

| Commercial real estate

|

|

|

|

|

|

|

| Real estate projects

|

|

|

13,914 |

|

|

15,582 |

| Commercial mortgage

|

|

|

6,450 |

|

|

7,549 |

| Total commercial real estate

|

|

|

20,364 |

|

|

23,131 |

| Equipment lease financing

|

|

|

6,630 |

|

|

6,202 |

| TOTAL COMMERCIAL LENDING (b)

|

|

|

81,226 |

|

|

84,151 |

| Consumer

|

|

|

|

|

|

|

| Home equity

|

|

|

|

|

|

|

| Lines of credit

|

|

|

23,901 |

|

|

24,236 |

| Installment

|

|

|

11,060 |

|

|

11,711 |

| Education

|

|

|

8,867 |

|

|

7,468 |

| Automobile

|

|

|

2,697 |

|

|

2,013 |

| Credit card and other unsecured lines of credit

|

|

|

4,920 |

|

|

3,536 |

| Other

|

|

|

3,834 |

|

|

4,618 |

| Total consumer

|

|

|

55,279 |

|

|

53,582 |

| Residential real estate

|

|

|

|

|

|

|

| Residential mortgage

|

|

|

16,618 |

|

|

18,190 |

| Residential construction

|

|

|

1,219 |

|

|

1,620 |

| Total residential real estate

|

|

|

17,837 |

|

|

19,810 |

| TOTAL CONSUMER LENDING

|

|

|

73,116 |

|

|

73,392 |

| Total loans

|

|

$ |

154,342 |

|

$ |

157,543 |

| (a) |

Includes loans to customers in the real estate and construction industries. |

| (b) |

Construction loans with interest reserves, A Note/B Note restructurings and guaranteed commercial loans are not significant to PNC. |

Total loans above include purchased impaired loans related to National City amounting to $9.1 billion, or 6% of total loans, at June 30, 2010, and

$10.3 billion, or 7% of total loans, at December 31, 2009.

We are committed to providing credit and liquidity to qualified borrowers.

Total loan originations and new commitments and renewals totaled $72 billion for the first six months of 2010, including $40 billion in the second quarter. Included in these amounts were originations for first mortgages of $4.3 billion and $2.3

billion, respectively.

Our loan portfolio continued to be diversified among numerous industries and types of businesses. The loans that we

hold are also concentrated in, and diversified across, our principal geographic markets.

Commercial lending is the largest category and is

the most sensitive to changes in assumptions and judgments underlying

the determination of the allowance for loan and lease losses. We have allocated $3.2 billion, or 60%, of the total allowance for loan and lease losses at June 30, 2010 to these loans. We

allocated $2.1 billion, or 40%, of the total allowance at that date to consumer lending. This allocation also considers other relevant factors such as:

| |

|

|

Actual versus estimated losses,

|

| |

|

|

Regional and national economic conditions,

|

| |

|

|

Business segment and portfolio concentrations,

|

| |

|

|

The impact of government regulations, and

|

| |

|

|

Risk of potential estimation or judgmental errors, including the accuracy of risk ratings.

|

Higher Risk Loans

Our loan

portfolio contains higher risk loans that are more likely to result in credit losses. We established specific and pooled reserves on the total commercial lending category, including higher risk loans, of $3.2 billion at June 30, 2010. This