ELECTRONIC PRESENTATION SLIDES FOR EARNINGS RELEASE

Published on July 22, 2010

The

PNC Financial Services Group, Inc. Second Quarter 2010

Earnings Conference Call

July 22, 2010

Exhibit 99.2 |

2

Cautionary Statement Regarding Forward-Looking

Information

and Adjusted Information

This

presentation

includes

snapshot

information

about

PNC

used

by

way

of

illustration.

It

is

not

intended

as

a

full

business

or

financial

review

and

should

be

viewed

in

the

context

of

all

of

the

information

made

available

by

PNC

in

its

SEC

filings.

The

presentation

also

contains

forward-looking

statements

regarding

our

outlook

or

expectations

relating

to

PNCs

future

business,

operations,

financial

condition,

financial

performance,

capital

and

liquidity

levels,

and

asset

quality.

Forward-looking

statements

are

necessarily

subject

to

numerous

assumptions,

risks

and

uncertainties,

which change

over

time.

The

forward-looking

statements

in

this

presentation

are

qualified

by

the

factors

affecting

forward-looking

statements

identified

in

the

more

detailed

Cautionary

Statement

included

in

the

Appendix,

which

is

included

in

the

version

of

the

presentation

materials

posted

on

our

corporate

website

at

www.pnc.com/investorevents.

We

provide

greater

detail

regarding

some

of

these

factors

in

our

2009

Form

10-K

and

1st

quarter

2010

Form

10-Q,

including

in

the

Risk

Factors

and

Risk

Management

sections

of

those

reports,

and

in

our

subsequent

SEC

filings

(accessible

on

the

SECs

website

at

www.sec.gov

and

on

or

through

our

corporate

website

at

www.pnc.com/secfilings).

We

have

included

web

addresses

here

and

elsewhere

in

this

presentation

as

inactive

textual

references

only.

Information

on

these

websites

is

not

part

of

this

document.

Future

events

or

circumstances

may

change

our

outlook

or

expectations

and

may

also

affect

the

nature

of

the

assumptions,

risks

and

uncertainties to

which

our

forward-

looking

statements

are

subject.

The

forward-looking

statements

in

this

presentation

speak

only

as

of

the

date

of

this

presentation.

We

do

not

assume

any

duty

and

do

not

undertake

to

update

those

statements.

In

this

presentation,

we

will

sometimes

refer

to

adjusted

results

to

help

illustrate

the

impact

of

certain

types

of

items,

such

as

the

acceleration

of

accretion

of

the

remaining

issuance

discount

on

our

TARP

preferred

stock

in

connection

with

the

first

quarter

2010

redemption

of

such

stock,

our

fourth

quarter

2009

gain

related

to

BlackRocks

acquisition

of

Barclays

Global

Investors

(the

BLK/BGI

gain),

and

integration

costs

in

the

2010

and

2009

periods.

This

information

supplements

our

results

as

reported

in

accordance

with

GAAP

and

should

not

be

viewed

in

isolation

from,

or

a

substitute

for,

our

GAAP

results.

We

believe

that

this

additional

information

and

the

reconciliations

we

provide

may

be

useful

to

investors,

analysts,

regulators

and

others

as

they

evaluate

the

impact

of

these

respective

items

on

our

results

for

the

periods

presented

due

to

the

extent

to

which

the

items

are

not

indicative

of

our

ongoing

operations.

In

certain

discussions,

we

may

also

provide

information

on

yields

and

margins

for

all

interest-earning

assets

calculated

using

net

interest

income

on a

taxable-

equivalent

basis

by

increasing

the

interest

income

earned

on

tax-exempt

assets

to

make

it

fully

equivalent

to

interest

income

earned

on

taxable

investments.

We

believe

this

adjustment

may

be

useful

when

comparing

yields

and

margins

for

all

earning

assets.

We

may

also

provide

information

on

pretax

pre-provision

earnings

(total

revenue

less

noninterest

expense),

as

we

believe

that

pretax

pre-provision

earnings

is

useful

as

a

tool

to

help

evaluate

the

ability

to

provide

for

credit

costs

through

operations.

This

presentation

may

also

include

discussion

of

other

non-GAAP

financial

measures,

which,

to

the

extent

not

so

qualified

therein

or

in

the

Appendix,

is

qualified

by

GAAP

reconciliation

information

available

on

our

corporate

website

at

www.pnc.com

under

About

PNCInvestor

Relations. |

3

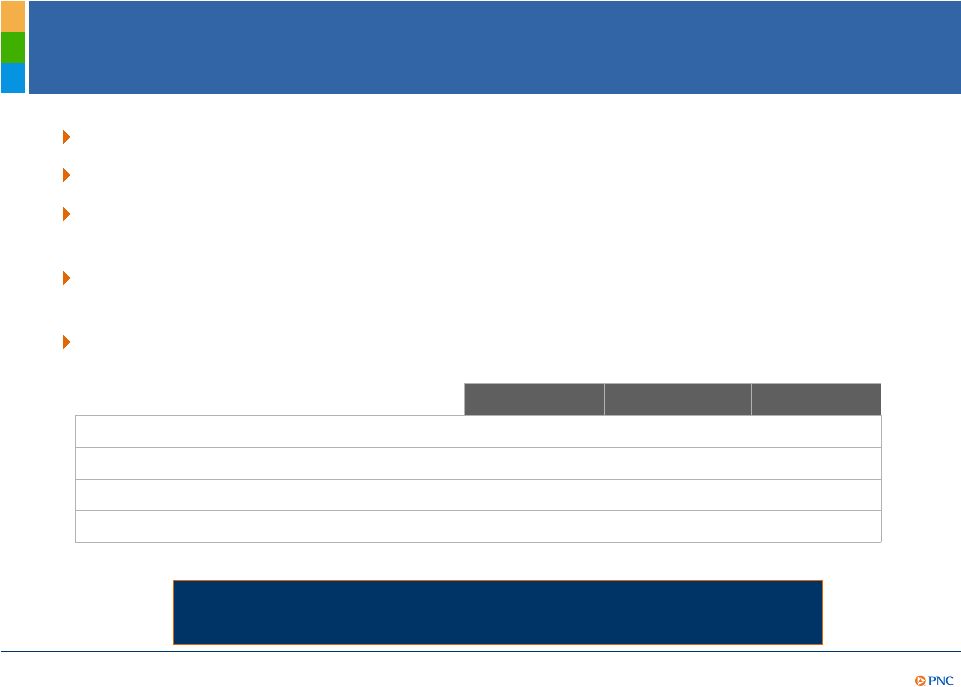

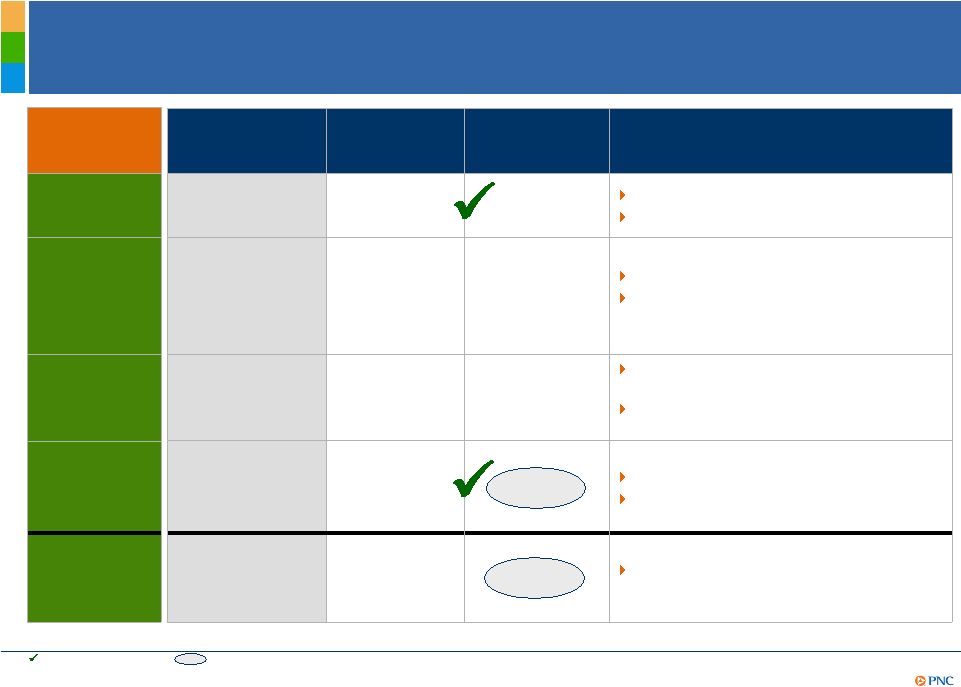

Significant 2Q10 Achievements

Delivered strong financial results

Balance sheet remains well-positioned

Businesses continued to perform well; continued to grow clients and deepen

relationships

Successfully completed the conversion of more than 6 million customers and 1,300

branches across 9 states from National City Bank to PNC

Closed the sale of PNC Global Investment Servicing

1

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company.

(1)

Transaction

closed

on

July

1,

2010.

(2)

1Q10

adjusted

for

the

impact

of

the

accelerated

accretion

of

the

remaining

issuance

discount

in

connection

with

the

redemption

of

our

TARP

preferred

stock.

Both

quarters

adjusted

for

after-tax

integration

costs.

Further

information

is

provided

in

the

Appendix.

$2.91

$1.31

$1.60

Adjusted diluted EPS

2

$2.15

$.66

$1.47

Diluted EPS from net income

1.12%

1.02%

1.22%

Return on average assets

Net income

$1.5 billion

$671 million

$803 million

2Q10

YTD10

1Q10 |

4

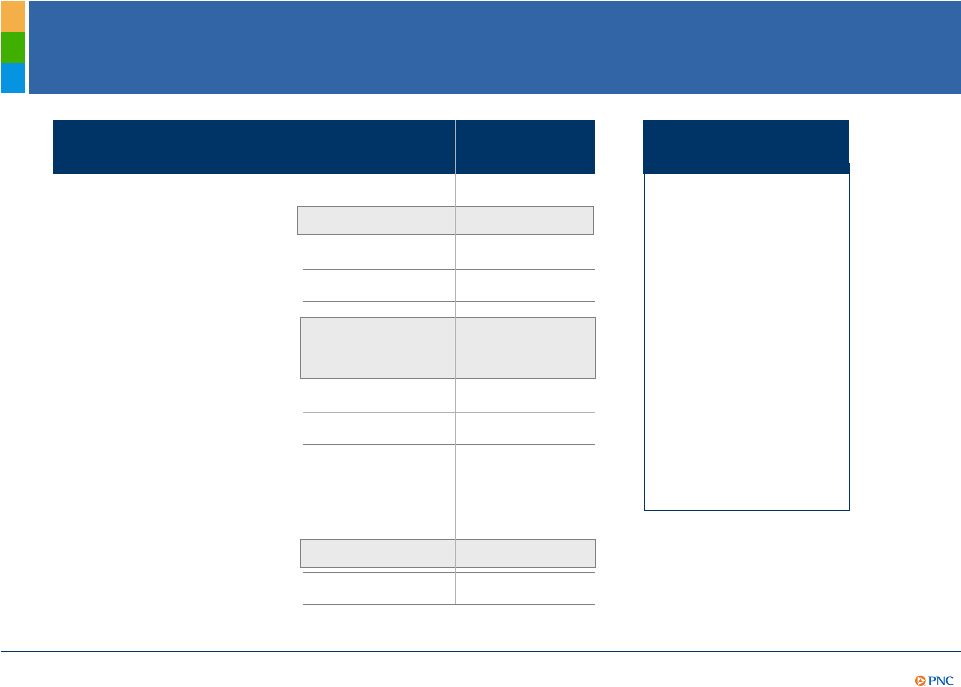

Higher Quality, Differentiated Balance Sheet

$265.4

26.5

.6

13.3

$42.5

$182.5

10.7

45.4

$126.4

$265.4

50.5

157.3

$57.6

March 31,

2010

14.1

Other

.6

Preferred equity

$261.7

Total liabilities and equity

$40.5

Borrowed funds

10.4

Other time/savings

$178.8

Total deposits

27.7

Common equity

42.7

Retail CDs

$125.7

Transaction deposits

53.7

Other assets

154.3

Total loans

$261.7

Total assets

$53.7

June 30, 2010

Investment securities

Category (billions)

Loans/assets

59%

Investment

securities/assets

21%

Loans/deposits

86%

Duration of equity

1

(3.0) years

June 30, 2010

key statistics

(1) Estimated. |

5

Key Take-Aways

$1.7

$1.9

Pretax

pre-provision

earnings

2

(billions)

Strong earnings

$1.60

$1.47

2Q10

1Q10

$1.31

Adjusted

earnings

per

diluted

common

share

1

$.66

Reported earnings per diluted common share

2%

(8%)

Nonperforming loans -

change from prior quarter

Stabilization of

credit quality,

reserve level

adequacy

101%

$823

2Q10

1Q10

92%

Allowance

for

loan

and

lease

losses

3

to

NPLs

$751

Provision for credit losses

(millions)

Improvement in

the quality of our

capital structure

9.0%

4

8.4%

4

2Q10

1Q10

Proforma

Tier

1

common

ratio

5

7.9%

Tier 1 common ratio

(1)

1Q10

adjusted

for

the

impact

of

the

accelerated

accretion

of

the

remaining

issuance

discount

in

connection

with

the

redemption

of

our

TARP

preferred

stock.

Both

quarters

adjusted

for

after-tax

integration

costs.

Further

information

is

provided

in

the

Appendix.

(2)

Total

revenue

less

noninterest

expense.

Further

information

is

provided

in

the

Appendix.

(3)

Includes

impairment

reserves

attributable

to

purchased

impaired

loans.

NPLs

do

not

include

purchased

impaired

loans

or

loans

held

for

sale.

See

notes

to

slide

8.

(4)

Estimated.

(5)

Proforma

ratio

reflects

the

estimated

impact

of

the

sale

of

PNC

Global

Investment

Servicing,

which

closed

on

July

1,

2010.

Further

information

is

provided

in

the

Appendix. |

6

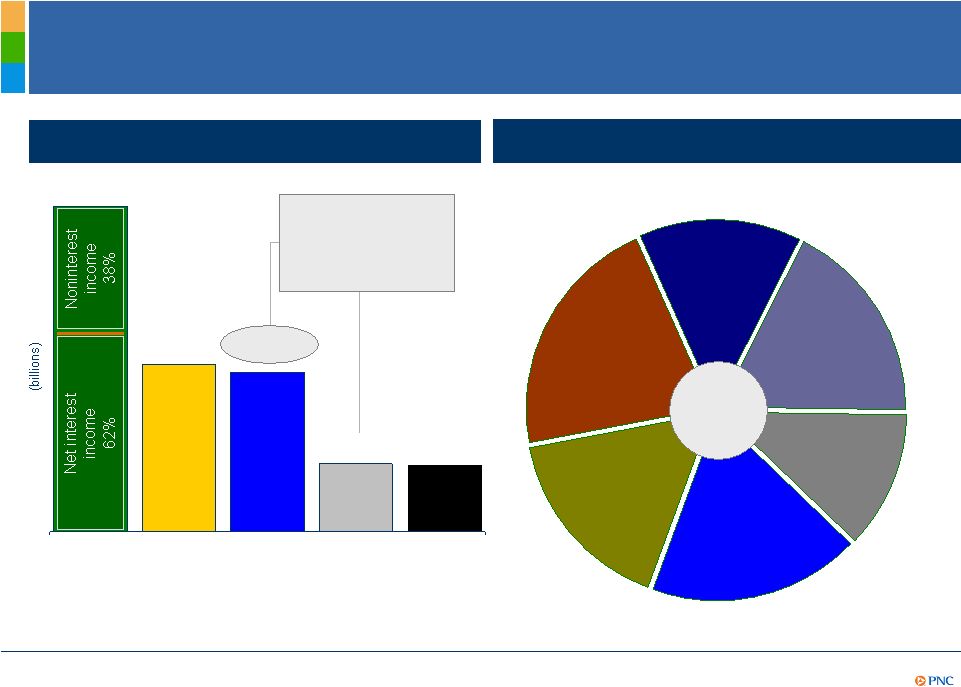

Pretax Pre-Provision Earnings

1

More Than

Doubled Credit Costs

$3.9

$2.0

$1.9

$.8

2Q10

2Q10 noninterest income mix

(1) Total revenue less noninterest expense. (2) For the six months ended June

30, 2010, total revenue was $7.675 billion, noninterest expense was $4.115 billion

and provision was $1.574 billion. Further information is provided in the

Appendix. Asset

management

$243

Consumer services

$315

Corporate services

$261

Residential

mortgage

$179

Deposit

service

charges

$209

17%

21%

14%

18%

12%

Other

$270

18%

Categories in millions

Total

revenue

Noninterest

expense

Pretax

pre-provision

earnings¹

Provision

$.8

Net

income

YTD

2010 pretax pre-

provision

earnings

1,2

of $3.6 billion

exceeded provision

by 2.26x

$1.5

billion |

7

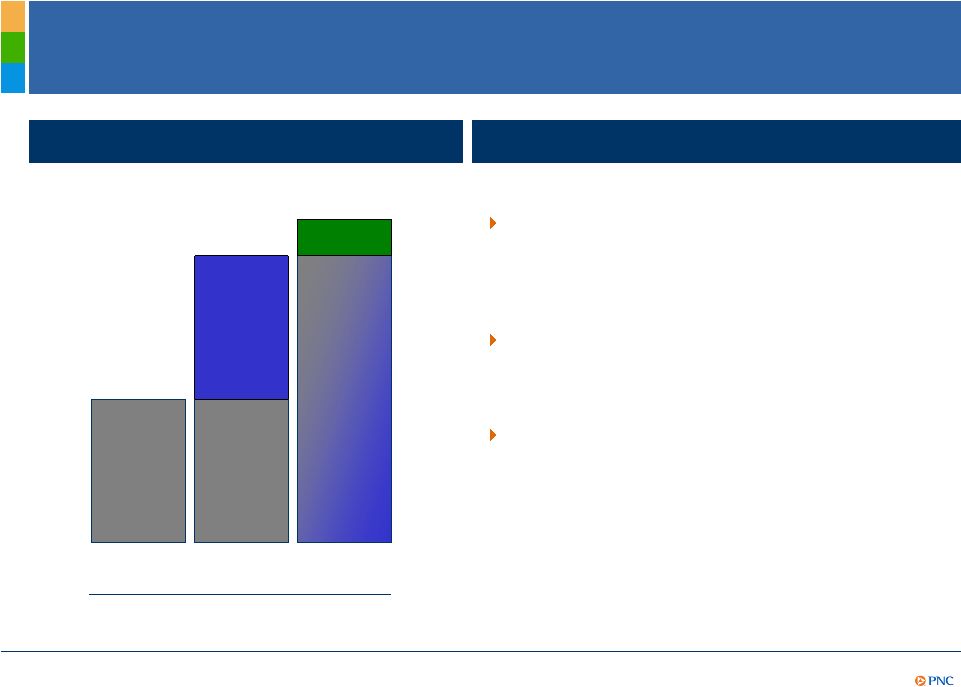

Initial Cost Save Objectives Exceeded

New Target of $1.8 Billion

Highlights

Successfully captured $1.6 billion in annualized

acquisition-related cost savings through 2Q10,

well ahead of our original target amount and

schedule

Established a new goal of $1.8 billion in

annualized acquisition-related cost saves by the

end of 2010

Continued to successfully manage expense

base in 2Q10 while investing for the future

$800

million

captured in

2009

$800

million

captured

through

2Q10

PNC acquisition-related cost saves

annualized

12/31/08

12/31/09

1/1/10

6/30/10

New goal

4Q10

$1.8 billion

$1.6 billion |

8

Overall Credit Quality Continued to Stabilize

(1)

Excludes

loans

that

are

government

insured/guaranteed,

primarily

residential

mortgages.

(2)

Loans

acquired

from

National

City

that

were

impaired

are

not

included

as

they

were

recorded

at

estimated

fair

value

when

acquired

and

are

currently

considered

performing

loans

due

to

the

accretion

of

interest

in

purchase

accounting.

Does

not

include

loans

held

for

sale

or

foreclosed

and

other

assets.

(3)

Net

charge-offs

to

average

loans

percentages

are

annualized.

(4)

Includes

impairment

reserves

attributable

to

purchased

impaired

loans.

110%

94%

89%

92%

101%

Allowance/NPLs²

$1,087

$914

$1,049

$751

$823

Provision for credit losses

27%

3.46%

2.18%

$840

(8%)

$5,281

$647

$1,780

2Q10

1.89%

1.59%

2.09%

1.77%

NCOs/average loans³

$795

$650

$835

$691

Total net charge-offs

Credit costs and net

charge-offs (millions,

except %)

28%

3.38%

2%

$5,761

$846

$2,482

1Q10

40%

23%

11%

Change from prior quarter

32%

3.22%

$5,671

$884

$2,388

4Q09

Allowance

4

and marks on

purchased impaired

loans

2.77%

2.99%

Allowance/loans

38%

37%

Marks as a % of outstanding

purchased impaired loans

Nonperforming loans²

(millions, except %)

Accruing loans past

due

1,2

(millions)

$2,195

$2,380

30

89 days

$1,043

$875

90 days or more

$4,156

$5,126

Total nonperforming loans

2Q09

3Q09 |

9

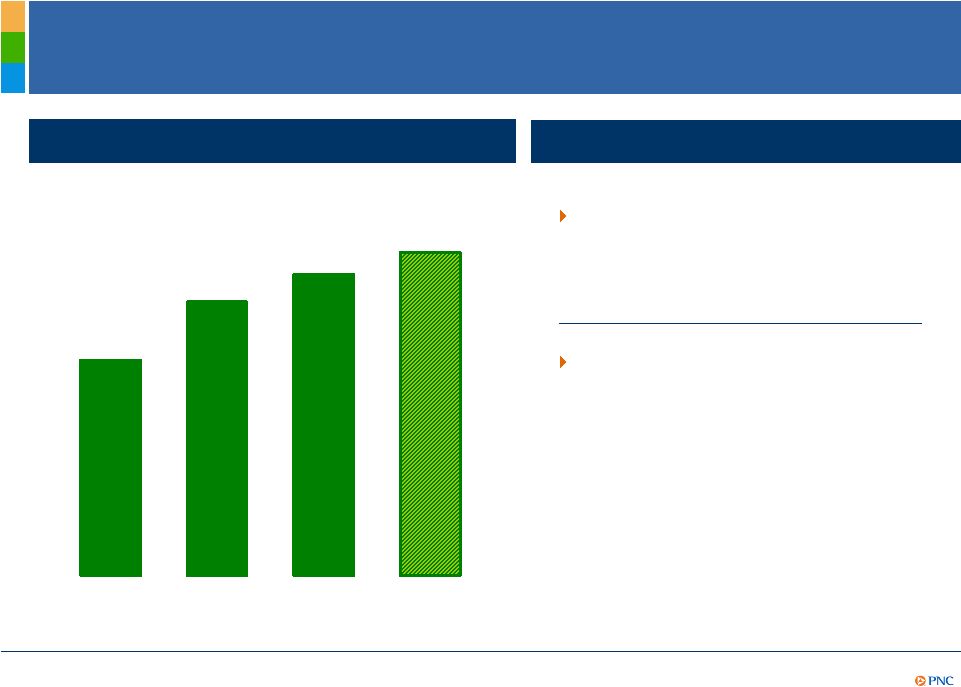

Further Improvement in Quality of Capital Structure

Tier 1 common capital ratio

Ratios

as

of

quarter

end.

(1)

Estimated.

(2)

Proforma

ratio

reflects

the

estimated

impact

of

the

sale

of

PNC

Global

Investment

Servicing,

which

closed

on

July

1,

2010.

Further

information

is

provided

in

the

Appendix.

(3)

Tier

1

risk-based

capital

ratio

was

10.5%

and

Tier

1

common

capital

ratio

was

5.3%

as

of

2Q09.

Estimated

Tier

1

risk-based

capital

ratio

as

of

2Q10

was

10.8%.

4Q09

2Q10

1

7.9%

Highlights

Improved quality of capital

-

Common

as

a

%

of

Tier

1

capital

3

increased to 78%

1

from 50% in

2Q09

Capital priorities

-

Maintain strong capital levels

-

Support our clients

-

Invest in our businesses

-

Return capital to shareholders

when appropriate

9.0%

Pro-

forma

1,2

6.0%

1Q10

8.4% |

10

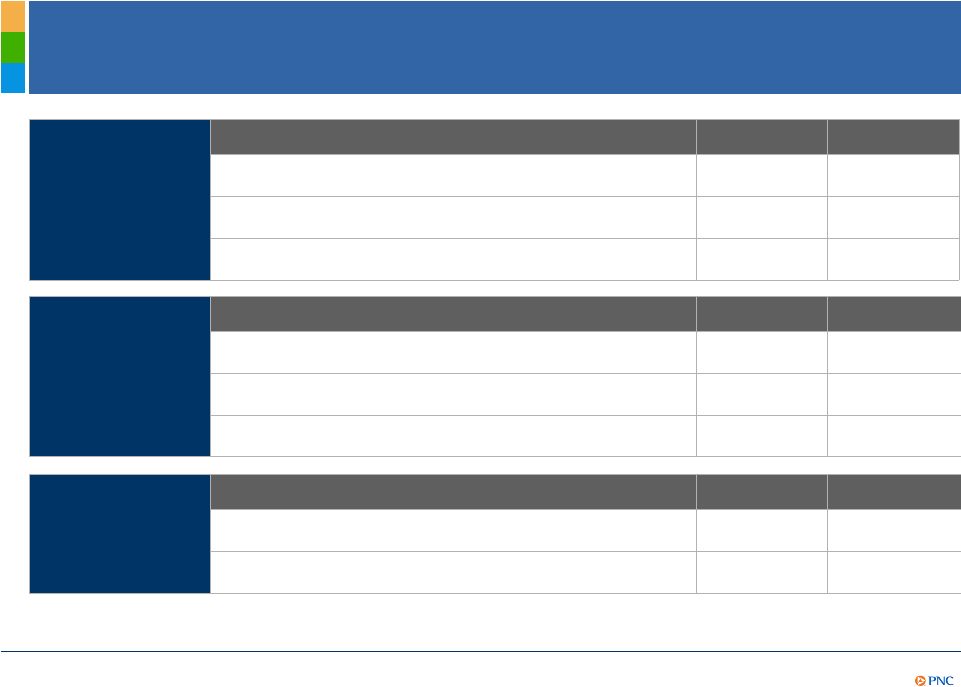

Framework for Success

Execute on and deliver the PNC business

model

Capitalize on integration opportunities

Emphasize continuous improvement culture

Leverage credit that meets our risk/return

criteria

Focus on cross selling PNCs deep product

offerings

Focus front door

on risk-adjusted returns

Leverage back door

credit liquidation

capabilities

Maximize credit portfolio value

Reposition deposit gathering strategies

Action Plans

1.12%

$1.6 billion

37%

2.0%

86%

June 30, 2010

1.50%+

$1.8 billion

>50%

0.3%-0.5%

80%-90%

Strategic

Objective

Return on average

assets

(six months ended)

Key Metrics

Loans to deposits

ratio

(as of)

Provision to average

loans

(provision for six months

ended, annualized)

Noninterest

income/total revenue

(six months ended)

Acquisition-related

cost savings

(2Q10 annualized run rate)

Executing our

strategies

PNC Business

Model

Staying core

funded

Returning to a

moderate risk

profile

Growing high

quality, diverse

revenue streams

Creating positive

operating

leverage

=

original

goal

achieved.

=

new

goal

established

in

2Q10;

original

goals

for

annualized

acquisition-related

cost

savings

and

return

on

average

assets

were

$1.2

billion

and

1.30%+,

respectively. |

11

Summary

PNC Continues to Build a Great Company.

PNC Continues to Build a Great Company.

The continued execution of PNCs business model

resulted in a strong first half of 2010

The completed National City branch conversions

position PNC to achieve substantial revenue growth

PNC is well-positioned to achieve its strategic financial

objectives |

12

Cautionary Statement Regarding Forward-Looking Information

Appendix |

13

Cautionary Statement Regarding Forward-Looking Information

(continued)

Appendix |

14

Cautionary Statement Regarding Forward-Looking Information

(continued)

Appendix |

15

Impact of Sale of PNC Global Investment Servicing

1

1.1

Net intangible assets

1.3

Goodwill and other intangible assets

Elimination of net intangible assets:

Less:

(1.7)

Book equity / intercompany debt

(billions)

$1.4

(0.2)

0.3

(0.3)

0.6

$2.3

Estimated PNC tangible capital improvement

Eligible deferred income taxes on goodwill and

other intangible assets

After-tax gain

Income taxes

Pretax gain

Sales price

Estimated gain and capital enhancement

Appendix

(1) The transaction closed on July 1, 2010. |

16

Risk-Based Capital Ratios

9.7%

4.8%

Ratios

as

of

December

31,

2008

3

1.4

1.4

Net

impact

of

July

1,

2010

sale

of

GIS

2

11.4%

9.0%

Proforma

ratios

as

of

June

30,

2010

1

$24.8

$19.7

Proforma

10.8%

8.4%

Ratios

as

of

June

30,

2010

1

$18.3

Tier 1 common

$23.4

June 30, 2010 -

Capital

Tier 1 risk-based

$ in billions

(1)

Estimated.

(2)

The

sale

of

PNC

Global

Investment

Servicing

(GIS)

closed

on

July

1,

2010.

We

believe

that

the

disclosure

of

these

ratios

reflecting

the

impact

of

the

sale

of

GIS

provides

additional

meaningful

information

regarding

the

risk-based

capital

ratios

at

that

date

and

the

impact

of

this

event

on

these

ratios.

(3)

December

31,

2008

is

the

closing

date

of

our

acquisition

of

National

City.

Appendix |

17

Non-GAAP to GAAP Reconcilement

Appendix

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common shareholders

Diluted EPS from

net income

Net income and diluted EPS, as reported

$803

$786

$1.47

Adjustments:

Integration costs

$100

($35)

65

65

.13

Net income and diluted EPS, as adjusted

$868

$851

$1.60

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common shareholders

Diluted EPS from

net income

Net income and diluted EPS, as reported

$671

$333

$.66

Adjustments:

Integration costs

$113

($40)

73

73

.15

TARP preferred stock accelerated discount accretion

2

250

.50

Net income and diluted EPS, as adjusted

$744

$656

$1.31

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common shareholders

Diluted EPS from

net income

Net income and diluted EPS, as reported

$207

$65

$.14

Adjustments:

Integration costs

$125

($34)

91

91

.20

Net income and diluted EPS, as adjusted

$298

$156

$.34

For the three months ended June 30, 2009

(1) Calculated using a marginal federal income tax rate of 35% and includes

applicable income tax adjustments. (2) Represents accelerated accretion of

the remaining issuance discount on redemption of the TARP preferred stock in February 2010.

PNC

believes

that

information

adjusted

for

the

impact

of

certain

items

may

be

useful

due

to

the

extent

to

which

the

items

are

not

indicative

of

our

ongoing

operations.

For the three months ended March 31, 2010

For the three months ended June 30, 2010 |

18

Non-GAAP to GAAP Reconcilement

Appendix

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common shareholders

Diluted EPS from

net income

Net income and diluted EPS, as reported

$1,474

$1,119

$2.15

Adjustments:

Integration costs

$213

($75)

138

138

.27

TARP preferred stock accelerated discount accretion

2

250

.49

Net income and diluted EPS, as adjusted

$1,612

$1,507

$2.91

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common shareholders

Diluted EPS from

net income

Net income and diluted EPS, as reported

$737

$525

$1.16

Adjustments:

Integration costs

$177

($52)

125

125

.28

Net income and diluted EPS, as adjusted

$862

$650

$1.44

For the six months ended June 30, 2009

(1) Calculated using a marginal federal income tax rate of 35% and includes

applicable income tax adjustments. (2) Represents accelerated accretion of

the remaining issuance discount on redemption of the TARP preferred stock in February 2010.

PNC

believes

that

information

adjusted

for

the

impact

of

certain

items

may

be

useful

due

to

the

extent

to

which

the

items

are

not

indicative

of

our

ongoing

operations.

For the six months ended June 30, 2010

Three months ended

Six months ended

June 30, 2010

March 31, 2010

June 30, 2010

in millions

Total revenue

$3,912

$3,763

$7,675

Noninterest expense

2,002

2,113

4,115

Pretax pre-provision earnings

$1,910

$1,650

$3,560

Provision

$823

$751

$1,574

Excess of pretax pre-provision earnings over provision

$1,087

$899

$1,986

Pretax pre-provision earnings/provision

2.32

2.20

2.26

PNC believes that pretax pre-provision earnings is useful as a tool to help

evaluate the ability to provide for credit costs through operations. |

19

Non-GAAP to GAAP Reconcilement

Appendix

In millions except per share data

Adjustments,

pretax

Income taxes

(benefit)

1

Net income

Net income

attributable to

common shareholders

Diluted EPS from

net income

Net income and diluted EPS, as reported

$1,107

$1,011

$2.17

Adjustments:

Gain on BlackRock/BGI transaction

($1,076)

$389

(687)

(687)

(1.49)

Integration costs

155

(54)

101

101

.22

Net income and diluted EPS, as adjusted

$521

$425

$.90

(1)

Calculated

using

a

marginal

federal

income

tax

rate

of

35%.

The

after-tax

gain

on

the

BlackRock/BGI

transaction

also

reflects

the

impact

of

state

income

taxes.

For the three months ended December 31, 2009

PNC

believes

that

information

adjusted

for

the

impact

of

certain

items

may

be

useful

due

to

the

extent

to

which

the

items

are

not

indicative

of

our

ongoing

operations. |

20

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC

Ticker |