UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2009

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file

number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

| Pennsylvania |

|

25-1435979 |

| (State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.) |

One PNC Plaza, 249 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2707

(Address of principal executive offices, including zip code)

(412) 762-2000

(Registrants telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act).

Yes ¨ No x

As of July 31, 2009, there were 461,402,998 shares of the registrants common stock ($5 par

value) outstanding.

The PNC Financial Services Group, Inc.

Cross-Reference Index to Second Quarter 2009 Form 10-Q

FINANCIAL REVIEW

CONSOLIDATED FINANCIAL HIGHLIGHTS

THE PNC FINANCIAL SERVICES GROUP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dollars in millions, except per share data |

|

Three months ended June 30 |

|

|

Six months ended June 30 |

|

| Unaudited |

|

2009 (a) |

|

|

2008 |

|

|

2009 (a) |

|

|

2008 |

|

| FINANCIAL PERFORMANCE (b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income

|

|

$ |

2,182 |

|

|

$ |

977 |

|

|

$ |

4,487 |

|

|

$ |

1,831 |

|

| Noninterest income

|

|

|

1,805 |

|

|

|

1,062 |

|

|

|

3,371 |

|

|

|

2,029 |

|

| Total revenue

|

|

|

3,987 |

|

|

|

2,039 |

|

|

|

7,858 |

|

|

|

3,860 |

|

| Noninterest expense

|

|

|

2,658 |

|

|

|

1,103 |

|

|

|

4,986 |

|

|

|

2,138 |

|

| Pretax, pre-provision earnings

|

|

$ |

1,329 |

|

|

$ |

936 |

|

|

$ |

2,872 |

|

|

$ |

1,722 |

|

| Provision for credit losses

|

|

$ |

1,087 |

|

|

$ |

186 |

|

|

$ |

1,967 |

|

|

$ |

337 |

|

| Net income

|

|

$ |

207 |

|

|

$ |

517 |

|

|

$ |

737 |

|

|

$ |

901 |

|

| Net income attributable to common shareholders |

|

$ |

65 |

|

|

$ |

505 |

|

|

$ |

525 |

|

|

$ |

882 |

|

| Diluted earnings per common share

|

|

$ |

.14 |

|

|

$ |

1.45 |

|

|

$ |

1.16 |

|

|

$ |

2.54 |

|

| Cash dividends declared per common share

|

|

$ |

.10 |

|

|

$ |

.66 |

|

|

$ |

.76 |

|

|

$ |

1.29 |

|

| Total preferred dividends declared

|

|

$ |

119 |

|

|

|

|

|

|

$ |

170 |

|

|

|

|

|

| TARP Capital Purchase Program preferred dividends

|

|

$ |

95 |

|

|

|

|

|

|

$ |

142 |

|

|

|

|

|

| Impact of TARP Capital Purchase Program preferred dividends per common share

|

|

$ |

.21 |

|

|

|

|

|

|

$ |

.32 |

|

|

|

|

|

| SELECTED RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (c)

|

|

|

3.60 |

% |

|

|

3.47 |

% |

|

|

3.70 |

% |

|

|

3.28 |

% |

| Noninterest income to total revenue

|

|

|

45 |

|

|

|

52 |

|

|

|

43 |

|

|

|

53 |

|

| Efficiency (d)

|

|

|

67 |

|

|

|

54 |

|

|

|

63 |

|

|

|

55 |

|

| Return on:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shareholders equity

|

|

|

1.52 |

% |

|

|

14.33 |

% |

|

|

5.72 |

% |

|

|

12.59 |

% |

| Average assets

|

|

|

.30 |

|

|

|

1.47 |

|

|

|

.53 |

|

|

|

1.29 |

|

See page 56 for a glossary of certain terms used in this Report.

Certain prior period amounts have been reclassified to conform with the current period presentation, which we believe is more meaningful to readers of our consolidated

financial statements.

| (a) |

Results for the three months ended and six months ended June 30, 2009 include the impact of National City, which we acquired on December 31, 2008.

|

| (b) |

The Executive Summary and Consolidated Income Statement Review portions of the Financial Review section of this Report provide information regarding items impacting the

comparability of the periods presented. |

| (c) |

Calculated as annualized taxable-equivalent net interest income divided by average earning assets. The interest income earned on certain earning assets is completely or partially

exempt from Federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of margins for all earning assets, we use net interest income on a

taxable-equivalent basis in calculating net interest margin by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP in

the Consolidated Income Statement. The taxable-equivalent adjustments to net interest income for the three months ended June 30, 2009 and June 30, 2008 were $16 million and $10 million, respectively. The taxable-equivalent adjustments to

net interest income for the six months ended June 30, 2009 and June 30, 2008 were $31 million and $19 million, respectively. |

| (d) |

Calculated as noninterest expense divided by total revenue. |

1

CONSOLIDATED FINANCIAL HIGHLIGHTS (CONTINUED)

(a)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited |

|

June 30 2009 (b)

|

|

|

December 31

2008 (b) |

|

|

June 30 2008

|

|

| BALANCE SHEET DATA (dollars in millions, except per share

data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets

|

|

$ |

279,754 |

|

|

$ |

291,081 |

|

|

$ |

142,771 |

|

| Loans

|

|

|

165,009 |

|

|

|

175,489 |

|

|

|

73,040 |

|

| Allowance for loan and lease losses

|

|

|

4,569 |

|

|

|

3,917 |

|

|

|

988 |

|

| Investment securities

|

|

|

49,969 |

|

|

|

43,473 |

|

|

|

31,032 |

|

| Loans held for sale

|

|

|

4,662 |

|

|

|

4,366 |

|

|

|

2,288 |

|

| Goodwill and other intangible assets

|

|

|

12,890 |

|

|

|

11,688 |

|

|

|

9,928 |

|

| Equity investments

|

|

|

8,168 |

|

|

|

8,554 |

|

|

|

6,376 |

|

| Deposits

|

|

|

190,439 |

|

|

|

192,865 |

|

|

|

84,689 |

|

| Borrowed funds

|

|

|

44,681 |

|

|

|

52,240 |

|

|

|

32,472 |

|

| Shareholders equity

|

|

|

27,294 |

|

|

|

25,422 |

|

|

|

15,108 |

|

| Common shareholders equity

|

|

|

19,363 |

|

|

|

17,490 |

|

|

|

14,602 |

|

| Accumulated other comprehensive loss

|

|

|

3,101 |

|

|

|

3,949 |

|

|

|

1,227 |

|

| Book value per common share

|

|

|

42.00 |

|

|

|

39.44 |

|

|

|

42.17 |

|

| Common shares outstanding (millions)

|

|

|

461 |

|

|

|

443 |

|

|

|

346 |

|

| Loans to deposits

|

|

|

87 |

% |

|

|

91 |

% |

|

|

86 |

% |

|

|

|

|

| ASSETS ADMINISTERED (billions)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Managed

|

|

$ |

98 |

|

|

$ |

103 |

|

|

$ |

67 |

|

| Nondiscretionary

|

|

|

124 |

|

|

|

125 |

|

|

|

110 |

|

|

|

|

|

| FUND ASSETS SERVICED (billions)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounting/administration net assets

|

|

$ |

774 |

|

|

$ |

839 |

|

|

$ |

988 |

|

| Custody assets

|

|

|

399 |

|

|

|

379 |

|

|

|

471 |

|

|

|

|

|

| CAPITAL RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 risk-based (c)

|

|

|

10.5 |

% |

|

|

9.7 |

% |

|

|

8.2 |

% |

| Tier 1 common

|

|

|

5.3 |

|

|

|

4.8 |

|

|

|

5.7 |

|

| Total risk-based (c)

|

|

|

14.1 |

|

|

|

13.2 |

|

|

|

11.9 |

|

| Leverage (c) (d)

|

|

|

9.1 |

|

|

|

17.5 |

|

|

|

7.3 |

|

| Common shareholders equity to assets

|

|

|

6.9 |

|

|

|

6.0 |

|

|

|

10.2 |

|

|

|

|

|

| ASSET QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total loans

|

|

|

2.44 |

% |

|

|

.95 |

% |

|

|

.95 |

% |

| Nonperforming assets to total loans and foreclosed and other assets

|

|

|

2.74 |

|

|

|

1.24 |

|

|

|

1.00 |

|

| Nonperforming assets to total assets

|

|

|

1.62 |

|

|

|

.75 |

|

|

|

.51 |

|

| Net charge-offs to average loans (for the three months ended)

|

|

|

1.89 |

|

|

|

1.09 |

|

|

|

.62 |

|

| Allowance for loan and lease losses to total loans

|

|

|

2.77 |

|

|

|

2.23 |

|

|

|

1.35 |

|

| Allowance for loan and lease losses to nonperforming loans

|

|

|

113 |

|

|

|

236 |

|

|

|

142 |

|

| (a) |

The Executive Summary and Consolidated Balance Sheet Review portions of the Financial Review section of this Report provide information regarding items impacting the comparability

of the periods presented. |

| (b) |

Includes the impact of National City, which we acquired on December 31, 2008. |

| (c) |

The regulatory minimums are 4.0% for Tier 1, 8.0% for Total, and 4.0% for Leverage ratios. The well-capitalized levels are 6.0% for Tier 1, 10.0% for Total, and 5.0% for Leverage

ratios. |

| (d) |

The ratio as of December 31, 2008 did not reflect any impact of National City on PNCs adjusted average total assets. |

2

FINANCIAL REVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review should be

read together with our unaudited Consolidated Financial Statements and unaudited Statistical Information included elsewhere in this Report and with Items 6, 7, 8 and 9A of our 2008 Annual Report on Form 10-K (2008 Form 10-K). We have reclassified

certain prior period amounts to conform with the current period presentation, which we believe is more meaningful to readers of our consolidated financial statements. For information regarding certain business and regulatory risks, see the Risk

Management section in this Financial Review and Items 1A and 7 of our 2008 Form 10-K and Item 1A included in Part II of this Report. Also, see the Cautionary Statement Regarding Forward-Looking Information and Critical Accounting Policies And

Judgments sections in this Financial Review for certain other factors that could cause actual results or future events to differ, perhaps materially, from historical performance and those anticipated in the forward-looking statements included in

this Report. See Note 19 Segment Reporting in the Notes To Consolidated Financial Statements included in Part I, Item 1 of this Report for a reconciliation of total business segment earnings to total PNC consolidated net income as reported on a

generally accepted accounting principles (GAAP) basis.

Effective July 1, 2009, the Financial Accounting Standards Board (FASB)

issued Statement of Financial Accounting Standards No. (SFAS) 168, The FASB Accounting Standards Codification TM and the Hierarchy of Generally Accepted Accounting Principles a replacement of FASB Statement No. 162 (FASB ASC 105-10, Generally Accepted Accounting

Principles). The FASB Accounting Standards Codification TM (FASB ASC) will be the

single source of authoritative nongovernmental US GAAP. The FASB ASC will be effective for financial statements that cover interim and annual periods ending after September 15, 2009. Other than resolving certain minor inconsistencies in current

GAAP, the FASB ASC is not intended to change GAAP, but rather to make it easier to review and research GAAP applicable to a particular transaction or specific accounting issue. Technical references to GAAP included in this Report are provided under

the new FASB ASC structure with the prior terminology included parenthetically the first time it appears.

EXECUTIVE SUMMARY

THE PNC FINANCIAL

SERVICES GROUP, INC.

PNC is one of the largest diversified financial services companies in the United

States and is headquartered in Pittsburgh, Pennsylvania.

As further described in Note 2 Acquisitions and Divestitures in our 2008 Form 10-K, on

December 31, 2008, PNC acquired National City Corporation (National City). Our consolidated financial statements for the second quarter and first half of 2009 reflect the impact of National City.

PNC has businesses engaged in retail banking, corporate and institutional banking, asset management, residential mortgage banking and global investment servicing,

providing many of its products and services nationally and others in PNCs primary geographic markets located in Pennsylvania, Ohio, New Jersey, Michigan, Maryland, Illinois, Indiana, Kentucky, Florida, Missouri, Virginia, Delaware, Washington,

D.C., and Wisconsin. PNC also provides certain investment servicing internationally.

We expect to incur total merger and integration costs of

approximately $1.2 billion pretax in connection with the acquisition of National City. This total includes $575 million pretax recognized in the fourth quarter of 2008 and $176 million pretax recognized in the first six months of 2009, including

$125 million pretax in the second quarter. The transaction is expected to result in the reduction of approximately $1.2 billion of combined company annualized

noninterest expense through the elimination of operational and administrative redundancies.

We are in the process of integrating the businesses and operations of National City with those of PNC.

KEY STRATEGIC GOALS

We manage our company for the long term and are focused on

returning to a moderate risk profile while maintaining strong capital and liquidity positions, investing in our markets and products, and embracing our corporate responsibility to the communities where we do business.

Our strategy to enhance shareholder value centers on driving pre-tax, pre-provision earnings that exceed credit costs by achieving growth in revenue from our balance

sheet and diverse business mix that exceeds growth in expenses controlled through disciplined cost management. The primary drivers of revenue growth are the acquisition, expansion and retention of customer relationships. We strive to expand our

customer base by offering convenient banking options and leading technology solutions, providing a broad range of fee-based and credit products and services, focusing on customer service, and through a significantly enhanced branding initiative. We

may also grow revenue through appropriate and targeted acquisitions and, in certain businesses, by expanding into new geographical markets.

We are focused

on our strategies for quality growth. We are committed to returning to a moderate risk profile characterized by disciplined credit management and limited

3

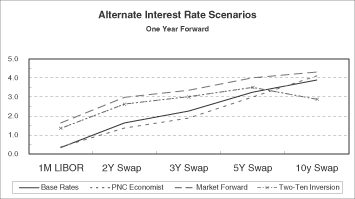

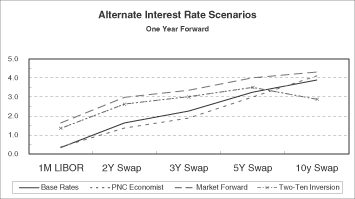

exposure to earnings volatility resulting from interest rate fluctuations and the shape of the interest rate yield curve. Our actions have created a

well-positioned and strong balance sheet, strong liquidity and investment flexibility to adjust, where appropriate and permissible, to changing interest rates and market conditions.

We also continue to be focused on building capital in the current environment characterized by economic and regulatory uncertainty. See the Funding and Capital Sources section of the Consolidated Balance Sheet Review

section and the Liquidity Risk Management section of this Financial Review regarding certain restrictions on dividends and common share repurchases resulting from PNCs participation on December 31, 2008 in the US Department of the

Treasurys Troubled Asset Relief Program (TARP) Capital Purchase Program and other regulatory restrictions on dividend capacity.

On March 1,

2009, our board of directors decided to reduce PNCs quarterly common stock dividend from $.66 to $.10 per share. Accordingly, the board of directors declared a quarterly common stock cash dividend of $.10 per share in April and July 2009. Our

Board recognizes the importance of the dividend to our shareholders. While our overall capital and liquidity positions are strong, extreme economic and market deterioration and the changing regulatory environment drove this difficult but prudent

decision. This proactive measure will help us build capital by approximately $1 billion annually, further strengthen our balance sheet and enable us to continue to serve our customers.

SUPERVISORY CAPITAL ASSESSMENT PROGRAM

(STRESS TESTS)

On May 7, 2009, the Board of Governors of the Federal Reserve System

announced the results of the stress tests conducted by banking regulators under the Supervisory Capital Assessment Program with respect to the 19 largest bank holding companies. As a result of this test, the Federal Reserve concluded that PNC was

well capitalized but that, in order to provide a greater cushion against the risk that economic conditions over the next two years are worse than currently anticipated, PNC needed to augment the composition of its capital by increasing the common

shareholders equity component of Tier 1 capital. In May 2009 we raised $624 million in new common equity at market prices through the issuance of 15 million shares of common stock. In connection with the Supervisory Capital Assessment

Program, we submitted a capital plan which was accepted by the Federal Reserve.

RECENT MARKET AND

INDUSTRY DEVELOPMENTS

Since the middle of 2007 and with a heightened level of activity during the past 12 months,

there has been unprecedented turmoil, volatility and illiquidity in worldwide financial markets, accompanied by uncertain prospects for the overall national economy, which is currently in the midst of a

severe recession. In addition, there have been dramatic changes in the competitive landscape of the financial services industry during this time.

Recent efforts by the Federal government, including the US Department of the Treasury, the Federal Reserve, the FDIC, and the Securities and Exchange Commission, to

stabilize and restore confidence in the financial services industry have impacted and will likely continue to impact PNC and our stakeholders. These efforts, which will continue to evolve, include the Emergency Economic Stabilization Act of 2008,

the American Recovery and Reinvestment Act of 2009, and other legislative, administrative and regulatory initiatives, including the US Treasurys TARP Capital Purchase Program, the FDICs Temporary Liquidity Guarantee Program (TLGP) and

the Federal Reserves Commercial Paper Funding Facility (CPFF).

These programs, some of which are further described in Item 7 of our 2008 Form

10-K, include the following:

TARP Capital Purchase Program On December 31, 2008, PNC issued to the US Treasury $7.6 billion of

preferred stock together with a related warrant to purchase shares of common stock of PNC, in accordance with the terms of the TARP Capital Purchase Program. Funds from this sale count as Tier 1 capital. Holders of this preferred stock are entitled

to a cumulative cash dividend at the annual rate per share of 5% of the liquidation preference per year for the first five years after its issuance. After December 31, 2013, if these shares are still outstanding, the annual dividend rate will

increase to 9% per year. We plan to redeem the US Treasurys investment as soon as appropriate in a shareholder-friendly manner, subject to approval by our banking regulators. We do not contemplate exchanging any of the shares of preferred

stock issued to the US Treasury under the TARP Capital Purchase Program for shares of mandatorily convertible preferred stock.

Further information on

these securities is included in Note 19 Shareholders Equity included in our Notes to Consolidated Financial Statements within Item 8 of our 2008 Form 10-K.

FDIC Temporary Liquidity Guarantee Program (TLGP) In December 2008, PNC Funding Corp issued fixed and floating rate senior notes totaling $2.9 billion under the FDICs TLGP-Debt Guarantee Program.

In March 2009, PNC Funding Corp issued floating rate senior notes totaling $1.0 billion under this program. Each of these series of senior notes is guaranteed by the FDIC and is backed by the full faith and credit of the United States through

June 30, 2012.

Since October 14, 2008, both PNC Bank, National Association (PNC Bank, N.A.) and National City Bank have participated in the

TLGP-Transaction Account Guarantee Program. Under this program, through December 31, 2009, all non-interest bearing transaction accounts are fully guaranteed by the FDIC for the entire amount in the account. Coverage

4

under this program is in addition to, and separate from, the coverage available under the FDICs general deposit insurance rules.

Federal Reserve Commercial Paper Funding Facility (CPFF) Effective October 28, 2008, Market Street Funding LLC (Market Street) was approved to

participate in the Federal Reserves CPFF. The CPFF commitment to purchase up to $5.4 billion of three-month Market Street commercial paper expires on October 30, 2009. Market Street had no borrowings under this facility at June 30,

2009. On June 25, 2009, the CPFF program was extended to February 1, 2010.

Public-Private Investment Fund Programs (PPIFs) On

March 23, 2009, the US Treasury and the FDIC announced that they will establish the Legacy Loans Program (LLP) to remove troubled loans and other assets from banks. The FDIC will provide oversight for the formation, funding, and operation of

new PPIFs that will purchase loans and other assets from depository institutions. The LLP will attract private capital through an FDIC debt guarantee and Treasury equity co-investment. All FDIC-insured depository institutions will be eligible to

participate in the program.

On March 23, 2009, the US Treasury also announced the establishment of the Legacy Securities PPIFs, which are designed to

address issues raised by troubled assets. These Legacy Securities PPIFs are specifically focused on legacy securities and are part of a plan that directs both equity capital and debt financing into the market for legacy assets. This program is

designed to draw in private capital to these markets by providing matching equity capital from the US Treasury and debt financing from the Federal Reserve via the Term Asset-Backed Loan Facility (TALF) and the US Treasury.

PNC is in the process of determining to what extent, if any, it will participate in these programs.

Home Affordable Modification Program (HAMP) As part of its effort to stabilize the US housing market, in March 2009 the Obama Administration published detailed guidelines implementing the Home Affordable

Modification Program (HAMP), and authorized servicers to begin loan modifications. PNC began participating in the HAMP for all GSE mortgages in May, and for non-GSE mortgages in July, and plans to evaluate participation in the Second Lien Program as

the US Treasury announces additional details.

****

In June 2009 the US Treasury issued a report entitled Financial Regulatory Reform: A New Foundation which outlined five key objectives:

| |

|

|

Promote robust supervision and regulation of financial firms,

|

| |

|

|

Establish comprehensive supervision of financial markets,

|

| |

|

|

Protect consumers and investors from financial abuse,

|

| |

|

|

Provide the US government with the tools it needs to manage financial crises, and

|

| |

|

|

Raise international regulatory standards and improve international cooperation.

|

To implement the proposals set forth in the US Treasury report, as well as to provide economic stimulus and financial market stability and to enhance the liquidity and solvency of financial institutions and markets,

the US Congress and federal banking agencies have announced, and are continuing to develop, additional legislation, regulations and programs. These proposals include changes in or additions to the statutes or regulations related to existing

programs, including those described above.

It is not possible at this time to predict the ultimate impact of these actions on PNCs business plans

and strategies.

KEY FACTORS AFFECTING FINANCIAL PERFORMANCE

Our financial performance is substantially affected by several external factors outside of our control including the following, some of which may

be affected by legislative, regulatory and administrative initiatives, such as the Federal government initiatives outlined above:

| |

|

|

General economic conditions, including the length and severity of the current recession,

|

| |

|

|

The level of, and direction, timing and magnitude of movement in, interest rates and the shape of the interest rate yield curve,

|

| |

|

|

The functioning and other performance of, and availability of liquidity in, the capital and other financial markets,

|

| |

|

|

Loan demand, utilization of credit commitments and standby letters of credit, and asset quality,

|

| |

|

|

Customer demand for other products and services,

|

| |

|

|

Changes in the competitive and regulatory landscape and in counterparty creditworthiness and performance as the financial services industry restructures in the

current environment, and

|

| |

|

|

The impact of market credit spreads on asset valuations.

|

In addition, our success will depend, among other things, upon:

| |

|

|

Further success in the acquisition, growth and retention of customers,

|

| |

|

|

Progress toward integrating the National City acquisition,

|

| |

|

|

Continued development of the geographic markets related to our recent acquisitions, including full deployment of our product offerings,

|

| |

|

|

A sustained focus on expense management, including achieving our cost savings targets associated with our National City integration, and creating positive pre-tax,

pre-provision earnings,

|

5

| |

|

|

Managing the distressed assets portfolio and other impaired assets,

|

| |

|

|

Maintaining our overall asset quality and continuing to meet evolving regulatory capital standards,

|

| |

|

|

Continuing to maintain our deposit base,

|

| |

|

|

Prudent risk and capital management leading to a return to our desired moderate risk profile, and

|

| |

|

|

Actions we take within the capital and other financial markets.

|

SUMMARY FINANCIAL RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30

|

|

|

Six months ended

June 30

|

|

|

|

|

2009 |

|

|

2008 |

|

|

2009 |

|

|

2008 |

|

| Net income, in millions

|

|

$ |

207 |

|

|

$ |

517 |

|

|

$ |

737 |

|

|

$ |

901 |

|

| Diluted earnings per common share

|

|

$ |

.14 |

|

|

$ |

1.45 |

|

|

$ |

1.16 |

|

|

$ |

2.54 |

|

| Return on:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shareholders equity

|

|

|

1.52 |

% |

|

|

14.33 |

% |

|

|

5.72 |

% |

|

|

12.59 |

% |

| Average assets

|

|

|

.30 |

% |

|

|

1.47 |

% |

|

|

.53 |

% |

|

|

1.29 |

% |

Highlights of the second quarter of 2009 included the following:

| |

|

|

We grew retail customer accounts and increased average transaction deposits by $6.6 billion during the quarter, further strengthening our liquidity position and

core funding level to an 87% loan to deposit ratio at June 30, 2009. We reduced brokered certificates of deposit as reflected in the $5.4 billion decline in average other time deposits, substantially reducing the overall cost of deposit

funding.

|

| |

|

|

We remain committed to responsible lending, essential to economic recovery. Loans and commitments of approximately $29 billion were originated and renewed during

the second quarter as we continued to make credit available.

|

| |

|

|

We raised $624 million in new common equity at market prices through the issuance of 15 million shares of common stock in May 2009.

|

| |

|

|

Capital levels continued to strengthen. During the quarter we added 50 basis points to the Tier 1 risk-based capital ratio, which was 10.5% at June 30, 2009,

and added 40 basis points to the Tier 1 common equity ratio, which was 5.3% at June 30, 2009.

|

| |

|

|

Pretax, pre-provision earnings of $1.3 billion exceeded credit costs of $1.1 billion. Total revenue was $4.0 billion for the quarter, reflecting the diversification

of our revenue streams and the strength of noninterest income sources. Expenses remained well controlled and increased primarily due to a special FDIC assessment and integration costs related to the National City acquisition.

|

| |

|

|

As expected, credit quality continued to deteriorate during the second quarter reflecting the weakened

|

| |

|

economy, but at a slower rate. We increased credit loss reserves by $261 million, strengthening the allowance for loan and lease losses to $4.6 billion at

June 30, 2009 and the ratio of allowance for loan and lease losses to total loans to 2.77% at that date. Net charge-offs to average loans increased to 1.89% for the second quarter of 2009. The increase in net charge-offs was anticipated given

the $2.8 billion of reserves for expected losses established for National City loans on acquisition date.

|

| |

|

|

The acquisition of National City continued to exceed expectations.

|

| |

|

|

The transaction was accretive to first half earnings and is expected to be accretive for full year 2009.

|

| |

|

|

Cost savings in the first half of 2009 reached an annualized level of approximately $500 million, ahead of plan and tracking to achieve the two-year goal of

reducing combined company annualized noninterest expense by $1.2 billion.

|

| |

|

|

Plans are in place for the required divestiture of 61 branches in the third quarter of 2009.

|

| |

|

|

Integration activities are proceeding on schedule. National City customers will begin to be converted to the PNC platform in November 2009.

|

| |

|

|

The combined company remains focused on delivering the PNC brand for client and business growth.

|

Our Consolidated Income Statement Review section of this Financial Review describes in greater detail the various items that impacted our results for the second quarter

and first half of 2009 and 2008.

AVERAGE CONSOLIDATED BALANCE SHEET

HIGHLIGHTS

Various seasonal and other factors impact our period-end balances whereas average balances are generally more indicative

of underlying business trends apart from the impact of recent acquisitions.

Our Average Consolidated Balance Sheet for the first six months of 2009

included the impact of National City, which was the primary driver of increases compared with the first six months of 2008. The Consolidated Balance Sheet Review section of this Financial Review provides information on changes in selected

Consolidated Balance Sheet categories at June 30, 2009 compared with December 31, 2008.

Total average assets were $280.9 billion for the first

half of 2009 compared with $141.0 billion for the first half of 2008. Total average assets for the first six months of 2009 included $133.0 billion related to National City.

6

Average interest-earning assets were $243.7 billion for the first six months of 2009, including $121.6 billion related to National City, compared with $112.3 billion in the first six months of 2008. An increase of $100.3 billion in loans,

including $96.5 billion related to National City, and a $15.9 billion increase in securities available for sale, including $12.4 billion related to National City, were reflected in the increase in average interest-earning assets. In addition,

securities held to maturity, including those transferred by PNC in the fourth quarter of 2008 from the available for sale portfolio, averaged $3.6 billion in the first six months of 2009.

Average noninterest-earning assets totaled $37.1 billion in the first half of 2009 compared with $28.7 billion in the prior year first half. For the first half of 2009,

average noninterest-earning assets related to National City totaled $11.5 billion.

The increase in average total loans, which includes the impact of

National City as indicated above, reflected growth in commercial loans of $35.1 billion, consumer loans of $32.5 billion, commercial real estate loans of $16.4 billion and residential mortgage loans of $12.6 billion. Loans represented 70% of average

interest-earning assets for the first six months of 2009 and 63% for the first six months of 2008.

Average residential mortgage-backed securities

increased $14.2 billion compared with the first half of 2008. Average US Treasury and government agencies securities increased $2.6 billion and average state and municipal securities increased $.8 billion in the comparison. These increases were

largely as a result of the National City acquisition and were partially offset by declines of $1.2 billion in average commercial mortgage-backed securities and $1.1 billion in average asset-backed securities compared with the prior year first half.

Investment securities comprised 21% of average interest-earning assets for the first half of 2009 and 27% for the first half of 2008.

Average total

deposits were $192.5 billion for the first six months of 2009, including $104.0 billion related to National City, compared with $82.8 billion for the first six months of 2008. Average deposits grew from the prior year period primarily as a result of

increases in retail certificates of deposit, money market balances, and demand and other noninterest-bearing deposits. Average total deposits represented 69% of average total assets for the first six months of 2009 and 59% for the first six months

of 2008.

Average transaction deposits were $116.8 billion for the first half of 2009, including $51.4 billion related to National City, compared with

$54.1 billion for the first half of 2008.

Average borrowed funds were $47.0 billion for the first six months of 2009, including $19.7 billion related to

National City, compared with $31.6 billion for the first six months of 2008.

BUSINESS SEGMENT

HIGHLIGHTS

In the first quarter of 2009, we made changes to our business organization structure and management reporting in

conjunction with the acquisition of National City. As a result, we now have seven reportable business segments which include:

| |

|

|

Corporate & Institutional Banking

|

| |

|

|

Residential Mortgage Banking

|

| |

|

|

Global Investment Servicing

|

| |

|

|

Distressed Assets Portfolio

|

Business segment

results for the second quarter and first half of 2008 have been reclassified to reflect current methodologies and current business and management structure and present prior periods on the same basis.

Total business segment earnings were $1.193 billion for the first six months of 2009 and $665 million for the first six months of 2008. Second quarter 2009 business

segment earnings totaled $488 million compared with $376 million for the second quarter of 2008. Highlights of results for the second quarter and first half of 2009 and 2008 are included below. The Business Segments Review section of this Financial

Review includes further analysis of our business segment results over these periods.

We provide a reconciliation of total business segment earnings to

total PNC consolidated net income as reported on a GAAP basis in Note 19 Segment Reporting.

Retail Banking

Retail Bankings earnings were $110 million for the first six months of 2009 compared with $218 million for the same period in 2008. For the second quarter of 2009,

Retail Bankings earnings were $60 million compared with $81 million for the second quarter of 2008. Results for 2009 include revenues and expenses associated with business acquired with National City. Results were challenged in this

environment by ongoing credit deterioration, a lower value assigned to our deposits, reduced consumer spending and increased FDIC insurance costs. Retail Banking continues to maintain its focus on customer and deposit growth, employee and customer

satisfaction, investing in the business for future growth, as well as disciplined expense management during this period of market and economic uncertainty.

Corporate & Institutional Banking

Corporate & Institutional Banking earned $470 million in the first six months of 2009,

including $111 million in the second quarter, compared with $184 million and $159 million, respectively, for the same periods in 2008. Results for 2009 included revenues and expenses associated with business acquired with National City. For the

first half of 2009, total revenue of $2.6 billion was strong, driven primarily by net

7

interest income. Noninterest expense was tightly managed, and earnings were impacted by the provision for credit losses, indicative of deteriorating credit

quality and the weakened economy. For second quarter 2009, the increase in the provision for credit losses drove the decline in earnings.

Asset

Management Group

Asset Management Groups earnings were $47 million for the first six months of 2009 compared with $71 million for the same period

in 2008. The 34% decline in earnings over the prior year was driven by an increased provision for credit losses. Despite the significant earnings impact from the increased provision for credit losses, the business remained focused on client sales

and service, expense management and the National City integration resulting in pretax, pre-provision earnings growth of 20% over the first half of 2008.

Earnings for the Asset Management Group totaled $8 million for the second quarter of 2009 compared with $34 million for the second quarter of 2008. An increase of $45 million in the provision for credit losses drove the decline in earnings.

Residential Mortgage Banking

Residential Mortgage

Banking earned $309 million for the six months ended June 30, 2009, including $88 million in the second quarter, driven by strong loan origination activity and net mortgage servicing rights hedging gains. This business segment consists

primarily of activities acquired with National City.

BlackRock

Our BlackRock business segment earned $77 million in the first six months of 2009 and $129 million in the first six months of 2008. Second quarter 2009 business segment earnings from BlackRock were $54 million compared with $69 million in

the second quarter of 2008. Lower equity markets in 2009, particularly in the first quarter, impacted BlackRocks results.

Global Investment

Servicing

Global Investment Servicing earned $22 million for the first six months of 2009 compared with $63 million for the same period of 2008. For

the second quarter of 2009, Global Investment Servicing earned $12 million compared with $33 million for the second quarter of 2008. Results for 2009 were negatively impacted by declines in asset values, fund redemptions, and account closures as a

result of the deterioration of the financial markets and the establishment of a legal contingency reserve.

Distressed Assets Portfolio

This business segment consists primarily of assets acquired with National City. The Distressed Assets Portfolio had earnings of $158 million for the first six months

of 2009, including $155 million in the second quarter.

Earnings for the first half of 2009 included net interest income

of $626 million which was driven by higher yielding loans from the National City acquisition. The provision for credit losses was $289 million, which reflected general credit quality deterioration, although the consumer portfolio experienced some

stabilization during the second quarter. Noninterest expense was $135 million for the first six months of 2009, comprised primarily of costs associated with foreclosed assets and servicing costs.

Other

Other reported a net loss of $456 million for the

first half of 2009 compared with earnings of $236 million for the first half of 2008. The loss for 2009 included the after-tax impact of other-than-temporary impairment charges and alternative investment writedowns, integration costs related

primarily to the National City acquisition, a special FDIC assessment, and equity management losses. These items were somewhat offset by a gain related to PNCs BlackRock LTIP shares obligation in the first quarter and net gains on sales of

securities. Our discussion of BlackRock in the Business Segments Review section of this Report describes our investment in BlackRocks new Series C Preferred Stock, the accounting for which offsets the impact of the gains or losses related to

PNCs BlackRock LTIP shares obligation beginning February 27, 2009. Earnings for 2008 reflected net securities gains and the partial reversal of the Visa indemnification liability, partially offset by trading losses.

Other reported a net loss of $281 million for the second quarter of 2009 compared with earnings of $141 million for the second quarter of 2008. The net loss

in the 2009 quarter was primarily due to the special FDIC assessment and National City integration costs.

CONSOLIDATED INCOME STATEMENT REVIEW

Our

Consolidated Income Statement is presented in Part I, Item 1 of this Report.

Net income for the first six months of 2009 was $737 million and for the

first six months of 2008 was $901 million. Net income for the second quarter of 2009 was $207 million compared with net income of $517 million for the second quarter of 2008. Our Consolidated Income Statement for the second quarter and first six

months of 2009 includes operating results of National City. As a result, the substantial increase in all income statement comparisons to the comparable 2008 periods, except as noted, are primarily due to the operating results of National City.

Total revenue for the first six months of 2009 was $7.9 billion compared with $3.9 billion for the first six months of 2008. Total revenue for the second

quarter of 2009 increased 3% to $4.0 billion from $3.9 billion for the first quarter of 2009.

8

NET INTEREST INCOME AND NET INTEREST MARGIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months

ended June 30 |

|

|

Six months ended

June 30 |

|

| Dollars in millions |

|

2009 |

|

|

2008 |

|

|

2009 |

|

|

2008 |

|

| Net interest income

|

|

$ |

2,182 |

|

|

$ |

977 |

|

|

$ |

4,487 |

|

|

$ |

1,831 |

|

| Net interest margin

|

|

|

3.60 |

% |

|

|

3.47 |

% |

|

|

3.70 |

% |

|

|

3.28 |

% |

In addition to the impact of National City during 2009, changes in net interest income and margin result from the

interaction of the volume and composition of interest-earning assets and related yields, interest-bearing liabilities and related rates paid, and noninterest-bearing sources of funding. See the Statistical Information Average Consolidated

Balance Sheet And Net Interest Analysis section of this Report for additional information.

The increase in net interest income for the second quarter and

first six months of 2009 compared with the respective 2008 periods reflected the increase in average interest-earning assets due to National City and the improvement in the net interest margin described below.

We expect net interest income and net interest margin for the remainder of 2009 to be flat to down compared with the first six months of 2009 as the effect of the

maturities and paydowns of higher-yielding assets will be partially offset by interest-bearing deposit re-pricing, assuming our current expectations for interest rates and economic conditions. We include our current economic assumptions underlying

our forward-looking statements in the Cautionary Statement Regarding Forward-Looking Information section of this Financial Review.

The net interest margin

was 3.70% for the first half of 2009 and 3.28% for the first half of 2008. The following factors impacted the comparison:

| |

|

|

A decrease in the rate paid on interest-bearing liabilities of 104 basis points. The rate paid on interest-bearing deposits, the largest component, decreased 115

basis points.

|

| |

|

|

These factors were partially offset by a 55 basis point decrease in the yield on interest-earning assets. The yield on loans, which represented a larger portion of

our earning assets in the first six months of 2009, decreased 49 basis points.

|

| |

|

|

In addition, the impact of noninterest-bearing sources of funding decreased 7 basis points due to lower interest rates and a lower proportion of noninterest-bearing

sources of funding to interest-earning assets.

|

The net interest margin was 3.60% for the second quarter of 2009 and 3.47% for the second

quarter of 2008. The following factors impacted the comparison:

| |

|

|

A decrease in the rate paid on interest-bearing liabilities of 82 basis points. The rate paid on interest-bearing deposits, the largest component, decreased 95

basis points.

|

| |

|

|

These factors were partially offset by a 65 basis point decrease in the yield on interest-earning assets. The yield on loans, which represented a larger portion of

our earning assets in the second quarter of 2009, decreased 54 basis points.

|

| |

|

|

In addition, the impact of noninterest-bearing sources of funding decreased 4 basis points due to lower interest rates and a lower proportion of noninterest-bearing

sources of funding to interest-earning assets.

|

For comparing to the broader market, the average Federal funds rate was .18% for the

first half of 2009 compared with 2.62% for the first half of 2008. The average Federal funds rate was .18% for the second quarter of 2009 compared with 2.09% for the second quarter of 2008.

NONINTEREST INCOME

Summary

Noninterest income totaled $3.4 billion for the first six months of 2009, including $1.9 billion related to National City,

compared with $2.0 billion for the first six months of 2008. Our noninterest income streams are well diversified and grew 15% in the second quarter of 2009 compared with the first quarter of 2009.

Noninterest income for the first half of 2009 included the following:

| |

|

|

Net credit-related other-than-temporary impairments on debt and equity securities of $304 million,

|

| |

|

|

Gains on hedges of residential mortgage servicing rights of $260 million,

|

| |

|

|

Net gains on sales of securities of $238 million.

|

| |

|

|

Net losses on private equity and alternative investments of $151 million, and

|

| |

|

|

Gains of $103 million related to our BlackRock LTIP shares adjustment in the first quarter.

|

Noninterest income for the first half of 2008 included the impact of the following:

| |

|

|

Income from Hilliard Lyons totaling $164 million, including the first quarter gain of $114 million from the sale of this business,

|

| |

|

|

Valuation and sale losses related to our commercial mortgage loans held for sale, net of hedges, of $138 million,

|

| |

|

|

Gains of $120 million related to our BlackRock LTIP shares adjustment, and

|

| |

|

|

A first quarter gain of $95 million related to the redemption of a portion of our Visa Class B common shares related to Visas March 2008 initial public

offering.

|

Noninterest income totaled $1.8 billion for the second quarter of 2009, including $.9 billion related to National City,

compared with $1.1 billion for the second quarter of 2008. The second quarter of 2009 included net gains on sales of

9

securities of $182 million and net credit-related other-than-temporary impairments on debt and equity securities of $155 million. The second quarter of 2008

included a gain of $80 million related to our BlackRock LTIP shares adjustment.

Additional Analysis

Fund servicing fees totaled $392 million in the first six months of 2009 compared with $462 million in the first six months of 2008. For the second quarter of 2009, fund

servicing fees were $193 million compared with $234 million in the second quarter of 2008. Asset management revenue was $397 million in the first half of 2009 compared with $409 million in the first half of 2008. Asset management revenue was $208

million in the second quarter of 2009 compared with $197 million in the second quarter of 2008.

Fund servicing fees and asset management revenue were

negatively impacted by declines in asset values associated with the lower equity markets during the first six months of 2009, particularly during the first quarter.

Assets managed at June 30, 2009 totaled $98 billion, including National City assets under management, compared with $67 billion at June 30, 2008.

Global Investment Servicing provided fund accounting/ administration services for $774 billion of net fund investment assets and provided custody services for $399

billion of fund investment assets at June 30, 2009, compared with $988 billion and $471 billion, respectively, at June 30, 2008. The decrease in assets serviced in the comparison was due to declines in asset values and fund outflows

resulting from market conditions.

For the first six months of 2009, consumer services fees totaled $645 million compared with $319 million in the first

six months of 2008. Consumer service fees were $329 million for the second quarter of 2009 compared with $149 million for the second quarter of 2008. Consumer service fees in the 2009 periods reflected the impact of National City which more than

offset reduced merchant and brokerage transaction volumes related to the economy.

Corporate services revenue totaled $509 million in the first half of

2009 and $349 million in the first half of 2008. For the second quarter of 2009, corporate services revenue totaled $264 million compared with $185 million for the second quarter of 2008. Corporate services fees include treasury management fees,

which continued to be a strong contributor to revenue.

Residential mortgage fees totaled $676 million in the first six months of 2009, including $245

million in the second quarter. Strong mortgage refinancing volumes, especially in the first quarter, and $260 million of net hedging gains of mortgage servicing rights occurred in the first six months of 2009. Net hedging gains were $58 million in

the second quarter. It is

unlikely that we will repeat this strong six-month performance in future periods, particularly the servicing rights hedging gains and loan origination

volumes. Additionally, we do not expect refinance and application volumes to be as strong in the second half of 2009 compared with the first half of 2009.

Service charges on deposits totaled $466 million for the first half of 2009 and $174 million for the first half of 2008. Service charges on deposits totaled $242 million for the second quarter of 2009 compared with $92 million for the

second quarter of 2008. In both comparisons, service charges on deposits held firm as checking account growth offset declining customer transaction amounts and volumes.

Net gains on sales of securities totaled $238 million for the first six months of 2009 and $49 million for the first six months of 2008. Second quarter net gains on sales of securities were $182 million in 2009 and $8

million in 2008. Second quarter 2009 securities gains related primarily to sales of agency residential mortgage-backed securities.

The net credit

component of other-than-temporary impairments of securities recognized in earnings was a loss of $304 million in the first half of 2009, including $155 million in the second quarter.

Other noninterest income totaled $352 million for the first six months of 2009 compared with $276 million for the first six months of 2008.

Other noninterest income for the first six months of 2009 included gains of $103 million related to our equity investment in BlackRock and net losses on private equity and alternative investments of $151 million as

referred to above. Other noninterest income for the first six months of 2008 included gains of $120 million related to our equity investment in BlackRock, the $114 million gain from the sale of Hilliard Lyons, and the $95 million Visa gain referred

to in the Summary section above. The impact of these items more than offset losses related to our commercial mortgage loans held for sale, net of hedges, of $138 million in the 2008 period.

Other noninterest income for the second quarter of 2009 totaled $297 million compared with $206 million for the second quarter of 2008. The second quarter of 2008

included an $80 million gain related to our BlackRock LTIP shares adjustment.

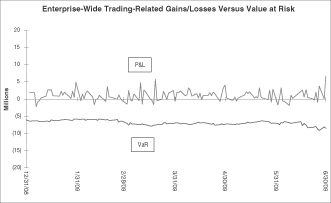

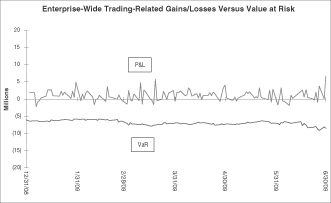

Other noninterest income typically fluctuates from period to period

depending on the nature and magnitude of transactions completed. Further details regarding our trading activities are included in the Market Risk Management Trading Risk portion of the Risk Management section of this Financial Review, further

details regarding private equity and alternative investments are included in the Market Risk Management-Equity and Other Investment Risk section and further details regarding gains or losses related to our equity investment in BlackRock are included

in the Business Segments Review section.

10

PRODUCT REVENUE

In addition to credit and deposit products for commercial customers,

Corporate & Institutional Banking offers other services, including treasury management and capital markets-related products and services and commercial mortgage banking activities, that are marketed by several businesses to commercial and

retail customers across PNC.

Treasury management revenue, which includes fees as well as net interest income from customer deposit balances, totaled $559

million for the first half of 2009 and $274 million for the first half of 2008. For the second quarter of 2009, treasury management revenue was $285 million compared with $137 million for the second quarter of 2008. In addition to the impact of

National City, these increases were primarily related to deposit growth and continued growth in legacy offerings such as purchasing cards and services provided to the Federal government and healthcare customers.

Revenue from capital markets-related products and services totaled $190 million in the first six months of 2009 compared with $180 million in the first six months of

2008. Second quarter 2009 revenue was $148 million compared with $104 million for the second quarter of 2008. The impact of National City-related revenue in both comparisons helped to offset declines in merger and acquisition revenues reflecting the

difficult financing environment.

Commercial mortgage banking activities include revenue derived from commercial mortgage servicing (including net interest

income and noninterest income from loan servicing and ancillary services), and revenue derived from commercial mortgage loans intended for sale and related hedges (including loan origination fees, net interest income, valuation adjustments and gains

or losses on sales).

Commercial mortgage banking activities resulted in revenue of $233 million in the first half of 2009 compared with $11 million in the

first half of 2008. For the second quarter of 2009, revenue from commercial mortgage banking activities totaled $139 million compared with $105 million for the second quarter of 2008. The first six months of 2009 included gains of $34 million on

commercial mortgage loans held for sale, net of hedges. Losses of $138 million on commercial mortgage loans held for sale, net of hedges, reduced revenue for the first six months of 2008.

PROVISION FOR CREDIT LOSSES

The provision for credit losses totaled $2.0

billion for the first six months of 2009 compared with $337 million for the first six months of 2008. For the second quarter of 2009, the provision for credit losses totaled $1.1 billion compared with $186 million for the second quarter of 2008. The

provisions for credit losses for the first half and second quarter of 2009 were in excess of net charge-offs of $1.2 billion and $795 million, respectively, due to required increases to our allowance for loan and lease losses reflecting continued

deterioration in the credit markets and the resulting increase in nonperforming loans.

The Credit Risk Management portion of the Risk Management section

of this Financial Review includes additional information regarding factors impacting the provision for credit losses.

NONINTEREST

EXPENSE

Noninterest expense for the first six months of 2009 was $5.0 billion compared with $2.1 billion in the first six months of

2008. Noninterest expense totaled $2.7 billion in the second quarter of 2009 compared with $1.1 billion in the second quarter of 2008. The increases in both comparisons were substantially related to National City. We also recorded a special FDIC

assessment of $133 million in the second quarter of 2009. This assessment was intended to build the FDICs Deposit Insurance Fund.

Integration costs

totaled $177 million in the first half of 2009 compared with $27 million in the first half of 2008. Integration costs in the second quarter of 2009 totaled $125 million compared with $13 million in the second quarter of 2008.

Annualized National City acquisition cost savings of approximately $500 million were realized by the second quarter of 2009, on track to achieve our $600 million goal

for 2009 and the $1.2 billion two-year goal of reducing combined company annualized noninterest expense.

EFFECTIVE TAX

RATE

Our effective tax rate was 18.6% for the first half of 2009 and 34.9% for the first half of 2008. For the second quarter of

2009, our effective tax rate was 14.5% compared with 31.1% for the second quarter of 2008. Both 2009 effective tax rates were significantly lower than the statutory rate due to the relationship of pretax income to tax credits and earnings that are

not subject to tax.

11

CONSOLIDATED BALANCE SHEET REVIEW

SUMMARIZED BALANCE SHEET DATA

|

|

|

|

|

|

|

| In millions |

|

June 30 2009

|

|

Dec. 31 2008

|

| Assets

|

|

|

|

|

|

|

| Loans

|

|

$ |

165,009 |

|

$ |

175,489 |

| Investment securities

|

|

|

49,969 |

|

|

43,473 |

| Cash and short-term investments

|

|

|

18,620 |

|

|

23,936 |

| Loans held for sale

|

|

|

4,662 |

|

|

4,366 |

| Equity investments

|

|

|

8,168 |

|

|

8,554 |

| Goodwill

|

|

|

9,206 |

|

|

8,868 |

| Other intangible assets

|

|

|

3,684 |

|

|

2,820 |

| Other

|

|

|

20,436 |

|

|

23,575 |

| Total assets

|

|

$ |

279,754 |

|

$ |

291,081 |

| Liabilities

|

|

|

|

|

|

|

| Deposits

|

|

$ |

190,439 |

|

$ |

192,865 |

| Borrowed funds

|

|

|

44,681 |

|

|

52,240 |

| Other

|

|

|

15,167 |

|

|

18,328 |

| Total liabilities

|

|

|

250,287 |

|

|

263,433 |

| Total shareholders equity

|

|

|

27,294 |

|

|

25,422 |

| Noncontrolling interests

|

|

|

2,173 |

|

|

2,226 |

| Total equity

|

|

|

29,467 |

|

|

27,648 |

| Total liabilities and equity

|

|

$ |

279,754 |

|

$ |

291,081 |

The summarized balance sheet data above is based upon our Consolidated Balance Sheet in Part I, Item 1 of

this Report.

The decline in total assets at June 30, 2009 compared with December 31, 2008 was primarily due to weak loan demand and lower cash

and short-term investments, somewhat offset by an increase in lower risk investment securities.

An analysis of changes in selected balance sheet

categories follows.

LOANS

A

summary of the major categories of loans outstanding follows. Outstanding loan balances reflect unearned income, unamortized discount and premium, and purchase discounts and premiums totaling $3.4 billion at June 30, 2009 and $4.1 billion at

December 31, 2008, respectively.

Loans decreased $10.5 billion, or 6%, as of June 30, 2009 compared with December 31, 2008. Loans

represented 59% of total assets at June 30, 2009 and 60% of total assets at December 31, 2008.

Commercial lending represented 55% of the loan

portfolio and consumer lending represented 45% at June 30, 2009. Commercial lending declined 10% at June 30, 2009 compared with December 31, 2008. Commercial loans, which comprised 66% of total commercial lending, declined due to

reduced demand for new loans, lower utilization levels and paydowns as clients continued to deleverage their balance sheets. Consumer lending decreased slightly at June 30, 2009 from

December 31, 2008. Increases in education and residential mortgage loans were more than offset by a decline in home equity installment loans and

residential construction loans.

Details Of Loans

|

|

|

|

|

|

|

| In millions |

|

June 30 2009

|

|

Dec. 31 2008

|

| Commercial

|

|

|

|

|

|

|

| Retail/wholesale

|

|

$ |

10,141 |

|

$ |

11,482 |

| Manufacturing

|

|

|

11,595 |

|

|

13,263 |

| Other service providers

|

|

|

8,491 |

|

|

9,038 |

| Real estate related (a)

|

|

|

8,346 |

|

|

9,107 |

| Financial services

|

|

|

5,078 |

|

|

5,194 |

| Health care

|

|

|

3,045 |

|

|

3,201 |

| Other

|

|

|

13,898 |

|

|

17,935 |

| Total commercial

|

|

|

60,594 |

|

|

69,220 |

| Commercial real estate

|

|

|

|

|

|

|

| Real estate projects

|

|

|

16,542 |

|

|

17,176 |

| Commercial mortgage

|

|

|

8,323 |

|

|

8,560 |

| Total commercial real estate

|

|

|

24,865 |

|

|

25,736 |

| Equipment lease financing

|

|

|

6,092 |

|

|

6,461 |

| TOTAL COMMERCIAL LENDING

|

|

|

91,551 |

|

|

101,417 |

| Consumer

|

|

|

|

|

|

|

| Home equity

|

|

|

|

|

|

|

| Lines of credit

|

|

|

24,373 |

|

|

24,024 |

| Installment

|

|

|

12,346 |

|

|

14,252 |

| Education

|

|

|

5,340 |

|

|

4,211 |

| Automobile

|

|

|

1,784 |

|

|

1,667 |

| Credit card and other unsecured lines of credit

|

|

|

3,261 |

|

|

3,163 |

| Other

|

|

|

4,833 |

|

|

5,172 |

| Total consumer

|

|

|

51,937 |

|

|

52,489 |

| Residential real estate

|

|

|

|

|

|

|

| Residential mortgage

|

|

|

19,342 |

|

|

18,783 |

| Residential construction

|

|

|

2,179 |

|

|

2,800 |

| Total residential real estate

|

|

|

21,521 |

|

|

21,583 |

| TOTAL CONSUMER LENDING

|

|

|

73,458 |

|

|

74,072 |

| Total loans (b)

|

|

$ |

165,009 |

|

$ |

175,489 |

| (a) |

Includes loans to customers in the real estate and construction industries. |

| (b) |

Includes FASB ASC 310-30, Receivables Loans and Debt Securities Acquired with Deteriorated Credit Quality (AICPA SOP 03-3), purchased impaired loans related to

National City, adjusted to reflect additional loan impairments effective December 31, 2008, amounting to $12.5 billion at June 30, 2009 and $12.9 billion at December 31, 2008. |

Our loan portfolio continued to be diversified among numerous industries and types of businesses. The loans that we hold are also concentrated in, and diversified

across, our principal geographic markets.

Our home equity lines and installment loans outstanding totaled $36.7 billion at June 30, 2009. In this

portfolio, we consider the higher risk loans to be those with a recent FICO credit score of less than or equal to 660 and a loan-to-value ratio greater than or equal to 90%. We had $1.2 billion or approximately 3% of the total portfolio in this

grouping at June 30, 2009.

12

In our $19.3 billion residential mortgage portfolio, loans with a recent FICO credit score of less than or equal to 660 and a loan-to-value ratio greater than 90% totaled $1.8 billion and comprised approximately 9% of this portfolio at

June 30, 2009.

Commercial lending is the largest category and is the most sensitive to changes in assumptions and judgments underlying the

determination of the allowance for loan and lease losses. We have allocated $3.2 billion, or 70%, of the total allowance for loan and lease losses at June 30, 2009 to these loans. We allocated $1.4 billion, or 30%, of the remaining allowance at

that date to consumer lending. This allocation also considers other relevant factors such as:

| |

|

|

Actual versus estimated losses,

|

| |

|

|

Regional and national economic conditions,

|

| |

|

|

Business segment and portfolio concentrations,

|

| |

|

|

The impact of government regulations, and

|

| |

|

|

Risk of potential estimation or judgmental errors, including the accuracy of risk ratings.

|

Valuation of FASB ASC 310-30 (SOP 03-3) Purchased Impaired Loans

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Original December 31, 2008

|

|

|

Revised

December 31, 2008 |

|

| Dollars in billions |

|

Balance |

|

|

Fair Value

Mark |

|

|

Balance |

|

|

Fair Value

Mark |

|

| Commercial and commercial real estate loans:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unpaid principal balance

|

|

$ |

4.0 |

|

|

|

|

|

$ |

6.3 |

|

|

|

|

| Fair value mark

|

|

|

(2.2 |

) |

|

(55 |

)% |

|

|

(3.4 |

) |

|

(54 |

)% |

| Net investment

|

|

|

1.8 |

|

|

|

|

|

|

2.9 |

|

|

|

|

| Consumer and residential mortgage loans:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unpaid principal balance

|

|

|

15.3 |

|

|

|

|

|

|

15.6 |

|

|

|

|

| Fair value mark

|

|

|

(5.2 |

) |

|

(34 |

)% |

|

|

(5.6 |

) |

|

(36 |

)% |

| Net investment

|

|

|

10.1 |

|

|