SLIDE PRESENTATION

Published on December 23, 2008

The PNC

Financial Services Group, Inc. Special Shareholders Meeting Proposed Acquisition of National City Corporation December 23, 2008 Exhibit 99.1 ** ** * ** ** ** ** ** ** ** ** ** ** ** ** ** ** ** * |

James E.

Rohr Chairman and Chief Executive Officer ** ** ** ** ** * * * * * * * * * * |

Cautionary

Statement Regarding Forward-Looking Information This presentation contains forward-looking statements regarding our outlook or expectations with respect to the planned acquisition of National City Corporation (National City or NCC), the expected costs to be incurred in connection with the acquisition, National Citys future performance and consequences of its integration into PNC, and the impact of the transaction on PNC's future performance. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward- looking statements in this presentation speak only as of the date of the presentation. We do not assume any duty and do not undertake to update these statements. Future events or circumstances may change our outlook or expectations and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Actual results could differ, possibly materially, from those that we anticipated in these forward-looking statements. These forward-looking statements are subject to the principal risks and uncertainties applicable to the respective businesses of PNC and National City generally that are disclosed in the 2007 Form 10-K and in current year Form 10-Qs and 8-Ks of PNC and National City (accessible on the SEC's Web site at www.sec.gov and on PNC's Web site at www.pnc.com and on National City's Web site at www.nationalcity.com, respectively). We have included these web addresses as inactive textual references only. Information on these websites is not part of this document. In addition, forward-looking statements in this presentation are subject to a number of risks and uncertainties related both to the acquisition transaction itself and to the integration of the acquired business into PNC after closing, including the following: Completion of the transaction is dependent on customary closing conditions. The impact of the completion of the transaction on PNC's financial statements will be affected by the timing of the transaction, including in particular the ability to complete the acquisition in the fourth quarter of 2008. The transaction may be substantially more expensive to complete (including the required divestitures and the integration of National City's businesses) and the anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events. Our ability to achieve anticipated results from this transaction is dependent on the state going forward of the economic and financial markets, which have been under significant stress recently. Specifically, we may incur more credit losses from National Citys loan portfolio than expected. Other issues related to achieving anticipated financial results include the possibility that deposit attrition or attrition in key client, partner, and other relationships may be greater than expected. Litigation and governmental investigations currently pending against National City, as well as others that may be filed or commenced as a result of this transaction or otherwise, could impact the timing or realization of anticipated benefits to PNC. Our ability to achieve anticipated results is also dependent on our ability to bring National Citys systems, operating models, and controls into conformity with ours and to do so on our planned time schedule. The integration of National City's business and operations into PNC, which will include conversion

of National City's different systems and procedures, may take longer than anticipated or be more costly than anticipated or have unanticipated adverse results relating to National City's or PNC's existing businesses. PNC's ability to integrate National City successfully may be adversely affected by the fact that this transaction will result in PNC entering several markets where PNC does not currently have any meaningful retail presence. |

National City

Acquisition Overview Estimated GAAP EPS accretive beginning in 2010, internal rate of return in excess of 15% PNC continues to maintain strong liquidity and capital position Conservative cost savings estimate, no revenue synergies included Presents a unique opportunity to invest for the long-term Significantly expands PNCs banking franchise Creates a leading distribution network Extends strong presence in high net worth markets Enhances scale of Corporate & Institutional Banking platform Deepens product capabilities Strategic Position Financially Compelling Focus on PNCs competencies in repositioning NCC balance sheet to meet our desired risk profile Implement PNCs established enterprise risk management philosophy Leverage integration capabilities (Mercantile, Riggs, Sterling, Yardville) Instill PNCs continuous improvement culture (One PNC) Appoint strong leadership Integration Execution The PNC Business Model Will Continue Creating a Formidable, Long-Term Franchise. (1) Pending acquisition of National City is subject to customary closing conditions. Pending NCC Acquisition 1 |

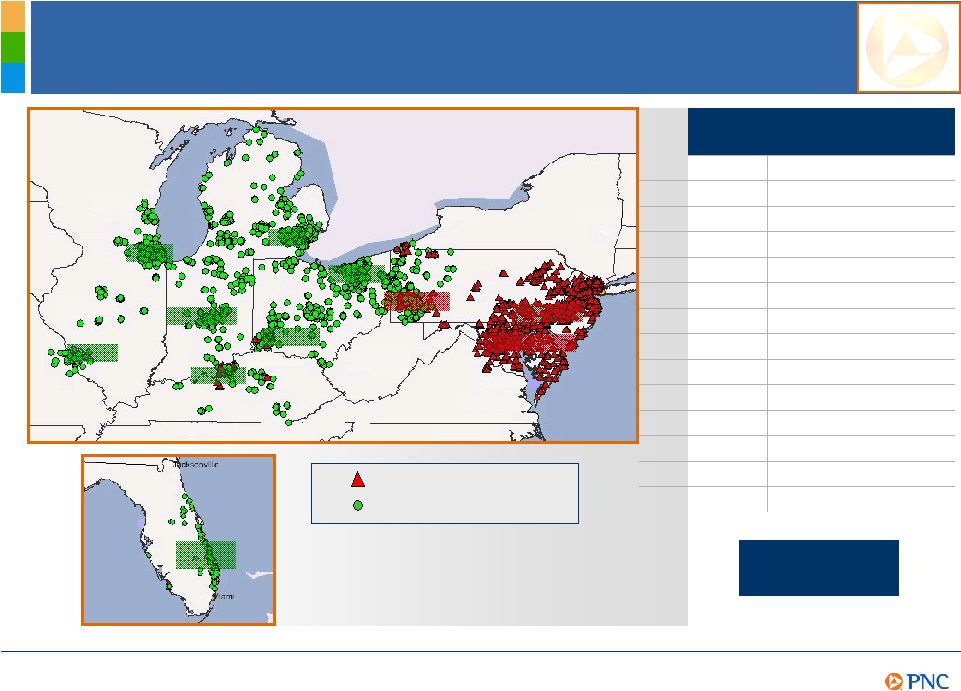

A Leading

Market Share Across Our Footprint 13 1 1.8B 58 VA 10 1 1.4B 25 WI 10 1 5.4B 105 FL 8 2 2.2B 56 MO 5 8 11.9B 270 MI 4 9 2.5B 47 DE 4 4 14.4B 187 IL 17.8B 2.5B 8.7B 9.6B 8.0B 36.9B $56.8B Deposits Combined 8 11 10 10 13 16 22% Share 4 3 2 2 1 1 1 Rank 330 NJ 29 DC 185 IN 202 MD 172 KY 464 OH 617 PA Branches PNC branches NCC branches Total Branches 2,747 Source: SNL Financial, Branch data as of October 23, 2008; deposit data as of June 30, 2008; none of anticipated branch divestitures or closings assumed. (1) In connection with regulatory approvals, PNC has agreed to divest 61 of NCCs branches in Western Pennsylvania with deposits of approximately $4.1 billion as of June 30, 2008. Chicago Chicago Philadelphia Philadelphia Pittsburgh Pittsburgh Cleveland Cleveland Washington, DC Washington, DC St. Louis St. Louis Cincinnati Cincinnati Indianapolis Indianapolis Detroit Detroit West Palm West Palm Beach Beach Louisville Louisville Pending NCC Acquisition 1 |

Executive

Leadership Team PNCs Executives Are Recognized Leaders in the Financial Services Industry. Joe Guyaux Retail Banking Bill Demchak Corporate & Institutional Banking Asset and Liability Management Rob Reilly Private Banking and Asset Management Tim Shack Global Investment Servicing Technology and Operations Pete Classen Eastern Markets Phil Rice Western Markets Jim Rohr Chairman & CEO Rick Johnson Chief Financial Officer Mike Hannon Chief Risk Officer Joan Gulley Chief Human Resources Officer Helen Pudlin General Counsel Mike Little General Auditor Tom Whitford Integration Shelley Seifert Jon Gorney Tim Shack Pending NCC Acquisition |

Summary

Strong strategic fit that creates a leading deposit banking franchise Opportunity to apply PNCs established and successful business model to a broader marketplace Financially compelling transaction Proven track record of successful execution Pending NCC Acquisition |

Cautionary

Statement Regarding Forward-Looking Information Appendix This presentation includes snapshot information about PNC used by way of illustration and is not intended as a full business or financial review. It should not be viewed in isolation but rather in the context of all of the information made available by PNC in its SEC filings. We also make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses and/or other matters regarding or affecting PNC that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, outlook, estimate, forecast, will, project, target, potential and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance. Our forward-looking statements are subject to the following principal risks and uncertainties. We provide greater detail regarding some of these factors in our 2007 Form 10-K and our 2008 Form 10-Qs, including in the Risk Factors and Risk Management sections of those reports, and in our other SEC reports. Our forward-looking statements may also be subject to other risks and uncertainties, including those that we may discuss elsewhere in this presentation or in our filings with the SEC, accessible on the SECs website at www.sec.gov and on or through our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual references only. Information on these websites is not part of this document. Our businesses and financial results are affected by business and economic conditions, both generally and specifically in the principal markets in which we operate. In particular, our businesses and financial results may be impacted by: Changes in interest rates and valuations in the debt, equity and other financial markets. Disruptions in the liquidity and other functioning of financial markets, including such disruptions in the markets for real estate and other assets commonly securing financial products. Actions by the Federal Reserve and other government agencies, including those that impact money supply and market interest rates. Changes in our customers, suppliers and other counterparties performance in general and their creditworthiness in particular. Changes in customer preferences and behavior, whether as a result of changing business and economic conditions or other factors. Changes resulting from the newly enacted Emergency Economic Stabilization Act of 2008, including conditions imposed as a result of our participation in the Capital Purchase Program. A continuation of recent turbulence in significant portions of the US and global financial markets, particularly if it worsens, could impact our performance, both directly by affecting our revenues and the value of our assets and liabilities and indirectly by affecting our counterparties and the economy generally. Our business and financial performance could be impacted as the financial industry restructures in the current environment, both by changes in the creditworthiness and performance of our counterparties and by changes in the competitive landscape. Given current economic and financial market conditions, our forward-looking financial statements are subject to the risk that these conditions will be substantially different than we are currently expecting. These statements are based on our current expectations that interest rates will remain low through 2009 with continued wide market credit spreads, and our view that national economic conditions currently point toward a significant recession followed by a subdued recovery. |

Cautionary

Statement Regarding Forward-Looking Information (continued)

Appendix Our operating results are affected by our liability to provide shares of BlackRock common stock to help fund certain BlackRock long-term incentive plan (LTIP) programs, as our LTIP liability is adjusted quarterly (marked-to-market) based on changes in BlackRocks common stock price and the number of remaining committed shares, and we recognize gain or loss on such shares at such times as shares are transferred for payouts under the LTIP programs. Legal and regulatory developments could have an impact on our ability to operate our businesses or our financial condition or results of operations or our competitive position or reputation. Reputational impacts, in turn, could affect matters such as business generation and retention, our ability to attract and retain management, liquidity, and funding. These legal and regulatory developments could include: (a) the unfavorable resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to laws and regulations involving tax, pension, education lending, the protection of confidential customer information, and other aspects of the financial institution industry; and (e) changes in accounting policies and principles. Our issuance of securities to the United States Treasury may limit our ability to return capital to our shareholders and is dilutive to our common shares. If we are unable previously to redeem the shares, the dividend rate increases substantially after five years. Our business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through the effective use of third-party insurance, derivatives, and capital management techniques. The adequacy of our intellectual property protection, and the extent of any costs associated with obtaining rights in intellectual property claimed by others, can impact our business and operating results. Our ability to anticipate and respond to technological changes can have an impact on our ability to respond to customer needs and to meet competitive demands. Our ability to implement our business initiatives and strategies could affect our financial performance over the next several years. Competition can have an impact on customer acquisition, growth and retention, as well as on our credit spreads and product pricing, which can affect market share, deposits and revenues. Our business and operating results can also be affected by widespread natural disasters, terrorist activities or international hostilities, either as a result of the impact on the economy and capital and other financial markets generally or on us or on our customers, suppliers or other counterparties specifically. Also, risks and uncertainties that could affect the results anticipated in forward-looking statements or from historical performance relating to our equity interest in BlackRock, Inc. are discussed in more detail in BlackRocks filings with the SEC, including in the Risk Factors sections of BlackRocks reports. BlackRocks SEC filings are accessible on the SECs website and on or through BlackRocks website at www.blackrock.com. This material is referenced for informational purposes only and should not be deemed to constitute a part of this presentation. In addition, our planned acquisition of National City Corporation (National City) presents us with a number of risks and uncertainties related both to the acquisition transaction itself and to the integration of the acquired businesses into PNC after closing. These risks and uncertainties include the following: Completion of the transaction is dependent on customary closing conditions. The impact of the completion of the transaction on PNCs financial statements will be affected by the timing of the transaction, including in particular the ability to complete the acquisition in the fourth quarter of 2008. |

Cautionary

Statement Regarding Forward-Looking Information (continued)

Appendix The transaction may be substantially more expensive to complete (including the required divestitures and the integration of National Citys businesses) and the anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events. Our ability to achieve anticipated results from this transaction is dependent on the state going forward of the economic and financial markets, which have been under significant stress recently. Specifically, we may incur more credit losses from National Citys loan portfolio than expected. Other issues related to achieving anticipated financial results include the possibility that deposit attrition or attrition in key client, partner and other relationships may be greater than expected. Litigation and governmental investigations currently pending against National City, as well as others that may be filed or commenced as a result of this transaction or otherwise, could impact the timing or realization of anticipated benefits to PNC or otherwise adversely impact our financial results. Our ability to achieve anticipated results is also dependent on our ability to bring National Citys systems, operating models, and controls into conformity with ours and to do so on our planned time schedule. The integration of National Citys business and operations into PNC, which will include conversion of National Citys different systems and procedures, may take longer than anticipated or be more costly than anticipated or have unanticipated adverse results relating to National Citys or PNCs existing businesses. PNCs ability to integrate National City successfully may be adversely affected by the fact that this transaction will result in PNC entering several markets where PNC does not currently have any meaningful retail presence. In addition to the planned National City transaction, we grow our business from time to time by acquiring other financial services companies. Acquisitions in general present us with risks, in addition to those presented by the nature of the business acquired, similar to some or all of those described above relating to the National City acquisition. Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs, National Citys, or other companys actual or anticipated results. |

Additional

Information and Where to Find It Appendix The proposed merger will be submitted to National Citys and PNCs shareholders for their consideration. PNC has filed a Registration Statement on Form S-4 with the Securities and Exchange Commission (the SEC), which includes a joint proxy statement/prospectus of PNC and National City that also constitutes a prospectus of PNC. PNC and National City have mailed the joint proxy statement/prospectus to their respective shareholders, and each of the companies plans to file with the SEC other relevant documents concerning the proposed merger. Shareholders and other investors are urged to read the joint proxy statement/prospectus (which was first mailed to PNC and National City shareholders on or about November 24, 2008) as well as any other relevant documents to be filed with the SEC in connection with the proposed merger or incorporated by reference into the joint proxy statement/prospectus (and any amendments or supplements to those documents), because they will contain important information. You may obtain a free copy of these documents, as well as other filings containing information about National City and PNC, at the SECs website (http://www.sec.gov) and at the companies respective websites, www.nationalcity.com/investorrelations and www.pnc.com/secfilings. Copies of these documents and the SEC filings incorporated by reference in the joint proxy statement/prospectus can also be obtained, free of charge, by directing a request to Jill Hennessey, National City Corporation, Senior Vice President, Investor Relations, Department 2229, P.O. Box 5756, Cleveland, OH 44101-0756, (800) 622-4204; or to PNC Financial Services Group, Inc, Shareholder Relations at (800) 843-2206 or via e-mail at investor.relations@pnc.com. National City and PNC and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of PNC or National City in connection with the proposed merger. Information about the directors and executive officers of National City is set forth in the proxy statement for National Citys 2008 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 7, 2008. Information about the directors and executive officers of PNC is set forth in the proxy statement for PNCs 2008 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 28, 2008. Additional information regarding the interests of those participants and other persons who may be deemed participants in the merger may be obtained by reading the joint proxy statement/prospectus. You may obtain free copies of these documents as described in the preceding paragraph. |