UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2008

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file

number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

| Pennsylvania |

|

25-1435979 |

| (State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.) |

One PNC Plaza, 249 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2707

(Address of principal executive offices, including zip code)

(412) 762-2000

(Registrants telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act).

Yes ¨ No x

As of October 31, 2008, there were 348,141,589 shares of the registrants common stock ($5 par value) outstanding.

The PNC Financial Services Group, Inc.

Cross-Reference Index to Third Quarter 2008 Form 10-Q

FINANCIAL REVIEW

CONSOLIDATED FINANCIAL HIGHLIGHTS

THE PNC FINANCIAL SERVICES GROUP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dollars in millions, except per share data |

|

Three months ended

September 30 |

|

|

Nine months ended

September 30 |

|

| Unaudited |

|

2008 |

|

|

2007 |

|

|

2008 |

|

|

2007 |

|

| FINANCIAL PERFORMANCE (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income

|

|

$ |

1,000 |

|

|

$ |

761 |

|

|

$ |

2,831 |

|

|

$ |

2,122 |

|

| Noninterest income

|

|

|

654 |

|

|

|

990 |

|

|

|

2,683 |

|

|

|

2,956 |

|

| Total revenue

|

|

$ |

1,654 |

|

|

$ |

1,751 |

|

|

$ |

5,514 |

|

|

$ |

5,078 |

|

| Noninterest expense

|

|

$ |

1,142 |

|

|

$ |

1,099 |

|

|

$ |

3,299 |

|

|

$ |

3,083 |

|

| Net income

|

|

$ |

248 |

|

|

$ |

407 |

|

|

$ |

1,130 |

|

|

$ |

1,289 |

|

| Per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

|

|

$ |

.71 |

|

|

$ |

1.19 |

|

|

$ |

3.24 |

|

|

$ |

3.85 |

|

| Cash dividends declared

|

|

$ |

.66 |

|

|

$ |

.63 |

|

|

$ |

1.95 |

|

|

$ |

1.81 |

|

| SELECTED RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (b)

|

|

|

3.46 |

% |

|

|

3.00 |

% |

|

|

3.34 |

% |

|

|

3.00 |

% |

| Noninterest income to total revenue

|

|

|

40 |

|

|

|

57 |

|

|

|

49 |

|

|

|

58 |

|

| Efficiency (c)

|

|

|

69 |

|

|

|

63 |

|

|

|

60 |

|

|

|

61 |

|

| Return on

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shareholders equity

|

|

|

7.13 |

% |

|

|

11.25 |

% |

|

|

10.63 |

% |

|

|

12.62 |

% |

| Average assets

|

|

|

.69 |

|

|

|

1.27 |

|

|

|

1.07 |

|

|

|

1.44 |

|

See page 41 for a glossary of certain terms used in this Report.

Certain prior period amounts have been reclassified to conform with the current period presentation.

| (a) |

The Executive Summary and Consolidated Income Statement Review portions of the Financial Review section of this Report provide information regarding items impacting the

comparability of the periods presented. |

| (b) |

Calculated as annualized taxable-equivalent net interest income divided by average earning assets. The interest income earned on certain earning assets is completely or partially

exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of margins for all earning assets, we use net interest income on a

taxable-equivalent basis in calculating net interest margin by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP in

the Consolidated Income Statement. The taxable-equivalent adjustments to net interest income for the three months ended September 30, 2008 and September 30, 2007 were $9 million and $6 million, respectively. The taxable-equivalent

adjustments to net interest income for the nine months ended September 30, 2008 and September 30, 2007 were $28 million and $20 million, respectively. |

| (c) |

Calculated as noninterest expense divided by total revenue. |

1

CONSOLIDATED FINANCIAL HIGHLIGHTS

(CONTINUED) (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited |

|

September 30

2008 |

|

|

December 31

2007 |

|

|

September 30

2007 |

|

| BALANCE SHEET DATA (dollars in millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets

|

|

$ |

145,610 |

|

|

$ |

138,920 |

|

|

$ |

131,366 |

|

| Loans, net of unearned income

|

|

|

75,184 |

|

|

|

68,319 |

|

|

|

65,760 |

|

| Allowance for loan and lease losses

|

|

|

1,053 |

|

|

|

830 |

|

|

|

717 |

|

| Securities available for sale

|

|

|

31,031 |

|

|

|

30,225 |

|

|

|

28,430 |

|

| Loans held for sale

|

|

|

1,922 |

|

|

|

3,927 |

|

|

|

3,004 |

|

| Goodwill and other intangibles

|

|

|

9,921 |

|

|

|

9,551 |

|

|

|

8,935 |

|

| Equity investments

|

|

|

6,735 |

|

|

|

6,045 |

|

|

|

5,975 |

|

| Deposits

|

|

|

84,984 |

|

|

|

82,696 |

|

|

|

78,409 |

|

| Borrowed funds

|

|

|

32,139 |

|

|

|

30,931 |

|

|

|

27,453 |

|

| Shareholders equity

|

|

|

14,218 |

|

|

|

14,854 |

|

|

|

14,539 |

|

| Common shareholders equity

|

|

|

13,712 |

|

|

|

14,847 |

|

|

|

14,532 |

|

| Book value per common share

|

|

|

39.44 |

|

|

|

43.60 |

|

|

|

43.12 |

|

| Common shares outstanding (millions)

|

|

|

348 |

|

|

|

341 |

|

|

|

337 |

|

| Loans to deposits

|

|

|

88 |

% |

|

|

83 |

% |

|

|

84 |

% |

|

|

|

|

| ASSETS ADMINISTERED (billions)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Managed

|

|

$ |

63 |

|

|

$ |

73 |

|

|

$ |

77 |

|

| Nondiscretionary

|

|

|

106 |

|

|

|

113 |

|

|

|

112 |

|

|

|

|

|

| FUND ASSETS SERVICED (billions)

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounting/administration net assets

|

|

$ |

907 |

|

|

$ |

990 |

|

|

$ |

922 |

|

| Custody assets

|

|

|

415 |

|

|

|

500 |

|

|

|

497 |

|

|

|

|

|

| CAPITAL RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 risk-based (b)

|

|

|

8.2 |

% |

|

|

6.8 |

% |

|

|

7.5 |

% |

| Total risk-based (b)

|

|

|

11.9 |

|

|

|

10.3 |

|

|

|

10.9 |

|

| Leverage (b)

|

|

|

7.2 |

|

|

|

6.2 |

|

|

|

6.8 |

|

| Tangible common equity

|

|

|

3.6 |

|

|

|

4.7 |

|

|

|

5.2 |

|

| Common shareholders equity to assets

|

|

|

9.4 |

|

|

|

10.7 |

|

|

|

11.1 |

|

|

|

|

|

| ASSET QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| Nonperforming loans to total loans

|

|

|

1.12 |

% |

|

|

.66 |

% |

|

|

.40 |

% |

| Nonperforming assets to total loans and foreclosed assets

|

|

|

1.16 |

|

|

|

.72 |

|

|

|

.46 |

|

| Nonperforming assets to total assets

|

|

|

.60 |

|

|

|

.36 |

|

|

|

.23 |

|

| Net charge-offs to average loans (for the three months ended)

|

|

|

.66 |

|

|

|

.49 |

|

|

|

.30 |

|

| Allowance for loan and lease losses to total loans

|

|

|

1.40 |

|

|

|

1.21 |

|

|

|

1.09 |

|

| Allowance for loan and lease losses to nonperforming loans

|

|

|

125 |

|

|

|

183 |

|

|

|

274 |

|

| (a) |

The Executive Summary and Consolidated Balance Sheet Review portions of the Financial Review section of this Report provide information regarding items impacting the comparability

of the periods presented. |

| (b) |

The regulatory minimums are 4.0% for Tier 1, 8.0% for Total, and 4.0% for Leverage ratios. The well-capitalized levels are 6.0% for Tier 1, 10.0% for Total, and 5.0% for Leverage

ratios. |

2

FINANCIAL REVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review should be read together with our unaudited Consolidated Financial Statements and unaudited Statistical Information included elsewhere in this

Report and with Items 6, 7, 8 and 9A of our 2007 Annual Report on Form 10-K (2007 Form 10-K). We have reclassified certain prior period amounts to conform with the current period presentation. For information regarding certain business

and regulatory risks, see the Risk Management section in this Financial Review and Items 1A and 7 of our 2007 Form 10-K and Item 1A included in Part II of this Report. Also, see the Cautionary Statement Regarding Forward-Looking Information and

Critical Accounting Policies And Judgments sections in this Financial Review for certain other factors that could cause actual results or future events to differ, perhaps materially, from historical performance and those anticipated in the

forward-looking statements included in this Report. See Note 16 Segment Reporting in the Notes To Consolidated Financial Statements included in Part I, Item 1 of this Report for a reconciliation of total business segment earnings to total PNC

consolidated net income as reported on a generally accepted accounting principles (GAAP) basis.

EXECUTIVE SUMMARY

THE PNC FINANCIAL

SERVICES GROUP, INC.

PNC is one of the largest diversified financial services companies in the United

States based on assets, with businesses engaged in retail banking, corporate and institutional banking, asset management, and global investment servicing. We provide many of our products and services nationally and others in our primary geographic

markets located in Pennsylvania, New Jersey, Washington, DC, Maryland, Virginia, Ohio, Kentucky and Delaware. We also provide certain investment servicing internationally.

KEY STRATEGIC GOALS

We manage our company for the long term by

focusing on maintaining a moderate risk profile and strong capital and liquidity positions, investing in our markets and products, and embracing our corporate responsibility to the communities where we do business.

Our strategy to enhance shareholder value centers on driving positive operating leverage by achieving growth in revenue from our balance sheet and diverse business mix

that exceeds growth in expenses controlled through disciplined cost management. In each of our business segments, the primary drivers of revenue growth are the acquisition, expansion and retention of customer relationships. We strive to expand our

customer base by offering convenient banking options and leading technology solutions, providing a broad range of fee-based and credit products and services, focusing on customer service, and through a significantly enhanced branding initiative. We

may also grow revenue through appropriate and targeted acquisitions and, in certain businesses, by expanding into new geographical markets.

We are focused

on our strategies for quality growth. We remain committed to maintaining a moderate risk profile characterized by disciplined credit management and limited exposure to earnings volatility resulting from interest rate fluctuations and the shape of

the interest rate yield curve. Our actions have created a well-positioned and strong balance sheet, ample liquidity and investment flexibility to adjust, where appropriate and permissible, to changing interest rates and market conditions.

We continue to be disciplined in investing capital in our businesses while returning a portion to shareholders through dividends and share repurchases when appropriate.

See the Funding and Capital Sources section of the Consolidated Balance Sheet Review section of this Financial Review regarding certain restrictions on dividends and common share repurchases resulting from PNCs participation in the US

Treasurys Troubled Asset Relief Program (TARP) Capital Purchase Program.

RECENT MARKET

AND INDUSTRY DEVELOPMENTS

Starting in the middle of 2007, and with a heightened level of activity

during the third quarter of 2008 and through the present, there has been unprecedented turmoil, volatility and illiquidity in worldwide financial markets, accompanied by uncertain prospects for the overall national economy. In addition, there have

been dramatic changes in the competitive landscape of the financial services industry during this time.

Recent efforts by the Federal government,

including the Treasury Department, the Federal Reserve, the FDIC, the Securities and Exchange Commission and others, to stabilize and restore confidence in the financial services industry have impacted and will likely continue to impact PNC and our

stakeholders. These efforts, which will continue to evolve, include the Emergency Economic Stabilization Act of 2008 and other legislative, administrative and regulatory initiatives, including the US Treasurys TARP and TARP Capital Purchase

Program, the Federal Reserves Commercial Paper Funding Facility (CPFF), and the FDICs Temporary Liquidity Guarantee Program (TLGP).

The TARP Capital Purchase Program encourages US financial institutions to build capital through the sale to the US Treasury of senior preferred shares of stock to increase the flow of financing to US businesses and

consumers and to support the US economy. The Federal Reserve established the CPFF to provide a liquidity backstop to US issuers of commercial paper and thereby improve liquidity in short-term funding markets and thus increase the availability of

credit for businesses and households. The FDICs TLGP is designed to strengthen confidence and encourage liquidity in the banking

3

system by (1) guaranteeing newly issued senior unsecured debt of eligible institutions, including FDIC-insured banks and thrifts, as well as certain

holding companies (the Debt Guarantee Program), and (2) providing full deposit insurance coverage for non-interest bearing deposit transaction accounts in FDIC-insured institutions, regardless of the dollar amount (the Transaction Account

Guarantee Program). PNC has been approved to participate in the TARP Capital Purchase Program and will participate in the FDICs Transaction Account Guarantee Program. PNC is evaluating whether it will participate in the FDICs Debt

Guarantee Program. Effective October 28, 2008, Market Street Funding LLC (Market Street) was approved to participate in the Federal Reserves CPFF.

It is also possible that the US Congress and federal banking agencies, as part of their efforts to enhance the liquidity and solvency of financial institutions and markets and otherwise enhance the regulation of

financial institutions and markets, will announce additional legislation, regulations or programs. These additional actions may take the form of changes in or additions to the statutes or regulations related to existing programs, including those

described above. It is not possible at this time to predict the ultimate impact of these actions on PNCs business plans and strategies.

PLANNED ACQUISITION OF NATIONAL CITY

On October 24,

2008, we entered into a definitive agreement with National City Corporation (National City) for PNC to acquire National City for approximately $5.9 billion in cash and common stock. Consideration includes approximately $5.5 billion of

PNC common stock (based on a five-day average share price including the announcement date), with a fixed exchange ratio of 0.0392 share of PNC common stock for each share of National City common stock, and $384 million of cash payable to certain

warrant holders. The transaction is currently expected to close by December 31, 2008 and is subject to customary closing conditions, including the approval of regulators and the shareholders of both PNC and National City.

National City, headquartered in Cleveland, Ohio, is one of the nations largest commercial banking organizations based on assets. At September 30, 2008,

National City had total assets of approximately $145 billion and total deposits of approximately $96 billion. National City operates through an extensive network in Ohio, Florida, Illinois, Indiana, Kentucky, Michigan, Missouri, Pennsylvania and

Wisconsin and also conducts selected consumer lending businesses and other financial services on a nationwide basis. Its primary businesses include commercial and retail banking, mortgage financing and servicing, consumer finance and asset

management.

We expect to incur merger and integration costs of approximately $2.3 billion in connection with the acquisition of National City. The

transaction is expected to result in the reduction of approximately $1.2 billion of acquired company noninterest expense through the elimination of operational and administrative redundancies.

Our Current Reports on Form 8-K filed October 24, 2008 and October 30, 2008 contain additional information regarding our planned acquisition of National City.

TARP CAPITAL PURCHASE PROGRAM

Also on October 24, 2008, PNC announced it will participate in the TARP Capital Purchase Program. PNC plans to issue to the US Treasury $7.7 billion of preferred stock together with related warrants to purchase

shares of common stock of PNC in accordance with the terms of the TARP Capital Purchase Program, subject to standard closing requirements. A portion of the $7.7 billion amount assumes the consummation of the acquisition of National City. Funds from

this sale will count as Tier 1 capital and the warrants will qualify as tangible common equity. The US Treasurys term sheet describing the TARP Capital Purchase Program and standard forms of agreements are available on the US Treasurys

website at http://www.ustreas.gov.

KEY FACTORS AFFECTING FINANCIAL

PERFORMANCE

Our financial performance is substantially affected by several external factors outside of our control including the

following, some of which may be affected by legislative, regulatory and administrative initiatives of the Federal government outlined above:

| |

|

|

General economic conditions, including the length and severity of an anticipated recession,

|

| |

|

|

The level of, and direction, timing and magnitude of movement in interest rates, and the shape of the interest rate yield curve,

|

| |

|

|

The functioning and other performance of, and availability of liquidity in, the capital and other financial markets,

|

| |

|

|

Loan demand, utilization of credit commitments and standby letters of credit, and asset quality,

|

| |

|

|

Customer demand for other products and services,

|

| |

|

|

Changes in the competitive landscape and in counterparty creditworthiness and performance as the financial services industry restructures in the current

environment,

|

| |

|

|

Movement of customer deposits from lower to higher rate accounts or to investment alternatives, and

|

| |

|

|

The impact of market credit spreads on asset valuations.

|

In addition, our success will depend, among other things, upon:

| |

|

|

Further success in the acquisition, growth and retention of customers,

|

| |

|

|

Progress toward closing and integrating the planned National City acquisition,

|

| |

|

|

Continued development of the markets related to our other recent acquisitions, including full deployment of our product offerings,

|

| |

|

|

A sustained focus on expense management and creating positive operating leverage,

|

4

| |

|

|

Maintaining solid overall asset quality,

|

| |

|

|

Continuing to maintain our solid deposit base,

|

| |

|

|

Prudent risk and capital management, and

|

| |

|

|

Actions we take within the capital and other financial markets.

|

OTHER 2008 ACQUISITION AND DIVESTITURE ACTIVITY

On April 4, 2008, we acquired Lancaster, Pennsylvania-based Sterling Financial Corporation (Sterling) for approximately 4.6 million shares of PNC common stock and $224 million in cash. Sterling

was a banking and financial services company with approximately $3.2 billion in assets, $2.7 billion in deposits, and 65 branches in south-central Pennsylvania, northern Maryland and northern Delaware. The Sterling technology systems and bank

charter conversions were completed during the third quarter of 2008 and we realized the anticipated cost savings related to these activities.

On

March 31, 2008, we sold J.J.B. Hilliard, W.L. Lyons, LLC (Hilliard Lyons), a Louisville, Kentucky-based wholly-owned subsidiary of PNC and a full-service brokerage and financial services provider, to Houchens Industries, Inc. We

recognized an after-tax gain of $23 million in the first quarter of 2008 in connection with this divestiture. Business segment information for the periods presented in this report reflects the reclassification of results for Hilliard Lyons,

including the gain on the sale of this business, from the Retail Banking business segment to Other.

SUMMARY

FINANCIAL RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Nine months ended |

|

| In millions, except per share data |

|

Sept. 30

2008 |

|

|

Sept. 30

2007 |

|

|

Sept. 30

2008 |

|

|

Sept. 30

2007 |

|

| Net income

|

|

$ |

248 |

|

|

$ |

407 |

|

|

$ |

1,130 |

|

|

$ |

1,289 |

|

| Diluted earnings per share

|

|

$ |

.71 |

|

|

$ |

1.19 |

|

|

$ |

3.24 |

|

|

$ |

3.85 |

|

| Return on

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shareholders equity

|

|

|

7.13 |

% |

|

|

11.25 |

% |

|

|

10.63 |

% |

|

|

12.62 |

% |

| Average assets

|

|

|

.69 |

% |

|

|

1.27 |

% |

|

|

1.07 |

% |

|

|

1.44 |

% |

Highlights of the third quarter of 2008 included the following:

| |

|

|

We continued to be well capitalized. The Tier 1 risk-based capital ratio was 8.2% at September 30, 2008. In October 2008, the PNC board of directors declared a

quarterly common stock cash dividend of 66 cents a share.

|

| |

|

|

We maintained a strong liquidity position and our franchise continued to generate deposits. Average deposits for the third quarter increased 8% compared with the

third quarter of 2007, funding nearly 80% of loan growth. As a result, we remained core funded with a loan to deposit ratio of 88% at September 30, 2008.

|

| |

|

|

Credit quality continued to be manageable in a challenging economic environment. Net charge-offs for the third quarter of 2008 were $122 million, or .66% of average

loans, compared with $49 million,

|

| |

or .30%, for the third quarter of 2007. The provision for credit losses for the third quarter of 2008 was $190 million compared with $65 million for the

third quarter of 2007. As a result, the ratio of the allowance for loan and lease losses to total loans increased to 1.40% at September 30, 2008 from 1.09% at September 30, 2007.

|

| |

|

|

Securities available for sale were $31.0 billion at September 30, 2008, or 21% of total assets. The portfolio was comprised of well-diversified, high quality

securities with US government agency mortgage-backed securities representing 39% of the portfolio. The remaining securities were primarily non-US government agency mortgage-backed or asset-backed and 95% of these had AAA-equivalent ratings, on

average.

|

| |

|

|

We expanded the number of customers we serve, accelerating growth in checking relationships by adding 36,000 net new consumer and business checking relationships

through organic growth in the third quarter of 2008.

|

| |

|

|

Average loans for the third quarter of 2008 increased 13% over third quarter of 2007. We continued to make credit available to our customers.

|

| |

|

|

Net interest income increased 31% in the third quarter of 2008 compared with the third quarter of 2007 due to higher earning assets and lower funding costs. The net

interest margin was 3.46% compared with 3.00% in the year ago quarter.

|

| |

|

|

Noninterest income for the third quarter of 2008 included revenue growth from many sources of client-based fees. Noninterest income was negatively affected by the

continued widening of credit spreads and lack of market liquidity resulting in valuation losses of $82 million on commercial mortgage loans held for sale, other-than-temporary impairment charges of $74 million on preferred stock in the Federal Home

Loan Mortgage Corporation (FHLMC) and Federal National Mortgage Association (FNMA) in addition to other-than-temporary impairments on other securities that were offset by securities gains, as well as a charge of $51 million

relating to PNCs BlackRock long-term incentive plan (LTIP) shares obligation due to an increase in the share price of BlackRock common stock.

|

| |

|

|

Noninterest expense remained well controlled as investments in growth initiatives were tempered by disciplined expense management. Noninterest expense increased 4%

in the third quarter of 2008 compared with the third quarter of 2007.

|

In addition, we created positive year-to-date operating leverage

by growing revenue while controlling noninterest expense. Revenue growth of 9% in the first nine months of 2008 compared with the same period in 2007 exceeded noninterest expense growth of 7% for the same periods.

5

Our Consolidated Income Statement Review section of this Financial Review describes in greater detail the various items that impacted our results for the

third quarter and first nine months of 2008 and 2007.

BALANCE SHEET HIGHLIGHTS

Total assets were $145.6 billion at September 30, 2008 compared with $138.9 billion at December 31, 2007. Total average assets were $141.7 billion for the first

nine months of 2008 compared with $119.5 billion for the first nine months of 2007. This increase reflected an $18.5 billion increase in average interest-earning assets and a $3.6 billion increase in average noninterest-earning assets. An increase

of $11.0 billion in loans and a $6.1 billion increase in securities available for sale were the primary factors for the increase in average interest-earning assets.

The increase in average noninterest-earning assets for the first nine months of 2008 reflected an increase in average goodwill of $1.9 billion primarily related to the acquisition of Sterling on April 4, 2008,

Yardville National Bancorp (Yardville) on October 26, 2007 and Mercantile Bankshares Corporation (Mercantile) on March 2, 2007.

The impact of the Sterling, Yardville and Mercantile acquisitions is also reflected in our year-over-year increases in average total loans, average securities available for sale and average total deposits described further below.

Average total loans were $71.8 billion for the first nine months of 2008 and $60.9 billion in the first nine months of 2007. The increase in average total

loans included growth in commercial loans of $5.5 billion, consumer loans of $2.6 billion, commercial real estate loans of $2.0 billion and residential mortgage loans of $.9 billion. Loans represented 63% of average interest-earning assets for the

first nine months of 2008 and 64% for the first nine months of 2007.

Average securities available for sale totaled $31.7 billion for the first nine months

of 2008 and $25.6 billion for the first nine months of 2007. Average residential and commercial mortgage-backed securities increased $4.8 billion on a combined basis in the comparison. In addition, asset-backed securities increased $1.0 billion in

the first nine months of 2008 compared with the prior year nine-month period. Securities available for sale comprised 28% of average interest-earning assets for the first nine months of 2008 and 27% for the first nine months of 2007.

Average total deposits were $83.5 billion for the first nine months of 2008, an increase of $8.0 billion over the first nine months of 2007. Average deposits grew from

the prior year period primarily as a result of increases in money market balances, other time deposits, time deposits in foreign offices, and demand and other noninterest-bearing deposits.

Average total deposits represented 59% of average total assets for the first nine months of 2008 and 63% for the first nine

months of 2007. Average transaction deposits were $54.8 billion for the first nine months of 2008 compared with $50.0 billion for the first nine months of

2007.

Average borrowed funds were $31.8 billion for the first nine months of 2008 and $21.1 billion for the first nine months of 2007. Increases of $8.4

billion in Federal Home Loan Bank borrowings and $1.3 billion in other borrowed funds drove the increase compared with the first nine months of 2007.

Shareholders equity totaled $14.2 billion at September 30, 2008 compared with $14.9 billion at December 31, 2007. See the Consolidated Balance Sheet Review section of this Financial Review for additional information.

BUSINESS SEGMENT HIGHLIGHTS

Total business segment earnings were $904 million for the first nine months of 2008 and $1.278 billion for the first nine months of 2007. Third quarter 2008 business segment earnings of $241 million decreased $191

million compared with the third quarter of 2007. Results for 2008 were impacted by a lower assigned revenue value for deposits in the current interest rate environment, the impact of valuation adjustments on certain illiquid assets, and a higher

provision for credit losses. Notwithstanding these factors, our business segments made significant progress in growing loans and deposits, adding customers and investing in products and services.

Highlights of results for the third quarter and first nine months of 2008 and 2007 are included below. The Business Segments Review section of this Financial Review

includes further analysis of our business segment results over these periods.

We provide a reconciliation of total business segment earnings to total PNC

consolidated net income as reported on a GAAP basis in Note 16 Segment Reporting in the Notes To Consolidated Financial Statements in this Report.

Retail Banking

Retail Bankings earnings were $414 million for the first nine months of 2008 compared with $665 million for the same

period in 2007. The 38% decline in earnings over the prior year was primarily driven by increases in the provision for credit losses and expenses.

Retail

Bankings earnings were $79 million for the third quarter of 2008 compared with $246 million for the same period in 2007. The decline from the prior year third quarter was driven by an increase in the provision for credit losses and higher

noninterest expense.

Corporate & Institutional Banking

Corporate & Institutional Banking earned $208 million in the first nine months of 2008 compared with $341 million in the first nine months of 2007. Earnings in 2008 were impacted by pretax valuation losses of

$238 million on commercial mortgage loans held for sale. Increases in the provision for credit losses and noninterest expenses were offset by higher net interest income.

6

For the third quarter of 2008, earnings from Corporate & Institutional Banking totaled $72 million compared with $87 million for the third quarter of 2007. Lower earnings in the third quarter of 2008 reflected a decline in revenue

largely driven by valuation losses on commercial mortgage loans held for sale. Higher noninterest expense in the comparison was substantially offset by lower provision for credit losses.

BlackRock

Our BlackRock business segment earned $185 million for the first nine months of 2008, a 5% increase

compared with $176 million for the first nine months of 2007. Earnings from our BlackRock business segment totaled $56 million for the third quarter of 2008 compared with $66 million for the third quarter of 2007. BlackRocks operating income

decreased in the third quarter of 2008 largely as a result of market declines and massive disruption in the US money markets.

Global Investment

Servicing

Global Investment Servicing, formerly PFPC, earned $97 million for the first nine months of 2008 and $96 million for the first nine months of

2007. Earnings from Global Investment Servicing totaled $34 million in the third quarter of 2008 compared with $33 million in the third quarter of 2007. While servicing revenue growth was realized through new business, organic growth, and the

completion of two acquisitions in December 2007, increased costs related to this growth and the acquisitions largely offset the increases in both comparisons.

Other

Other earnings for the first nine months of 2008 totaled $226 million compared with earnings of $11 million for the first

nine months of 2007.

The following factors contributed to the higher earnings for Other for the first nine months of 2008:

| |

|

|

Growth in net interest income related to asset and liability management activities,

|

| |

|

|

The third quarter 2008 reversal of a legal contingency reserve established in connection with an acquisition due to a settlement,

|

| |

|

|

Higher gains from PNCs LTIP shares obligation in 2008,

|

| |

|

|

The first quarter 2008 gain on the sale of Hilliard Lyons, and

|

| |

|

|

The first quarter 2008 partial reversal of the Visa indemnification liability.

|

The benefits of these items were partially offset by lower trading results and by equity management losses in the year-to-date comparison.

For the third quarter of 2008, Other earnings totaled $7 million compared with a net loss of $25 million in the third quarter of 2007. Growth in net interest income related to asset and liability

management activities and the third quarter 2008 reversal of a legal contingency reserve referred to above, partially offset by lower trading results, higher net securities losses and equity management losses, drove the increase in this comparison.

CONSOLIDATED INCOME STATEMENT REVIEW

Our Consolidated Income Statement is presented in Part I, Item 1 of this Report. Net income for the first nine months of 2008 was $1.130 billion and for the first

nine months of 2007 was $1.289 billion. Net income for the third quarter of 2008 was $248 million compared with net income of $407 million for the third quarter of 2007. Total revenue for the first nine months of 2008 increased 9% compared with the

first nine months of 2007. We created positive operating leverage in the year-to-date comparison as total noninterest expense increased 7% in the comparison.

NET INTEREST INCOME AND NET INTEREST MARGIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Nine months ended |

|

| Dollars in millions |

|

Sept. 30

2008 |

|

|

Sept. 30

2007 |

|

|

Sept. 30

2008 |

|

|

Sept. 30

2007 |

|

| Net interest income

|

|

$ |

1,000 |

|

|

$ |

761 |

|

|

$ |

2,831 |

|

|

$ |

2,122 |

|

| Net interest margin

|

|

|

3.46 |

% |

|

|

3.00 |

% |

|

|

3.34 |

% |

|

|

3.00 |

% |

Changes in net interest income and margin result from the interaction of the volume and composition of

interest-earning assets and related yields, interest-bearing liabilities and related rates paid, and noninterest-bearing sources of funding. See the Statistical Information Average Consolidated Balance Sheet And Net Interest Analysis section

of this Report for additional information.

The 33% increase in net interest income for the first nine months of 2008 compared with the first nine months

of 2007 was favorably impacted by the $18.5 billion, or 20%, increase in average interest-earning assets and a decrease in funding costs. Similarly, the 31% increase in net interest income for the third quarter of 2008 compared with the third

quarter of 2007 reflected the $14.4 billion, or 14%, increase in average interest-earning assets over this period and a decrease in funding costs. Wider net interest margins also benefited the 2008 periods in both the third quarter and first nine

months comparisons. The reasons driving the higher interest-earning assets in these comparisons are further discussed in the Balance Sheet Highlights portion of the Executive Summary section of this Financial Review.

We expect net interest income growth will be approximately 30% for full year 2008 compared with 2007, assuming our current expectations for interest rates and economic

conditions. We include our current economic assumptions underlying our forward-looking statements in the Cautionary Statement Regarding Forward-Looking Information section of this Financial Review.

The net interest margin was 3.34% for the first nine months of 2008 and 3.00% for the first nine months of 2007. The following factors impacted the comparison:

| |

|

|

A decrease in the rate paid on interest-bearing liabilities of 134 basis points. The rate paid on

|

7

| |

interest-bearing deposits, the single largest component, decreased 117 basis points.

|

| |

|

|

These factors were partially offset by a 71 basis point decrease in the yield on interest-earning assets. The yield on loans, the single largest component,

decreased 98 basis points.

|

| |

|

|

In addition, the impact of noninterest-bearing sources of funding decreased 29 basis points due to lower interest rates and a lower proportion of

noninterest-bearing sources of funding to interest-earning assets.

|

The net interest margin was 3.46% for the third quarter of 2008 and

3.00% for the third quarter of 2007. The following factors impacted the comparison:

| |

|

|

A decrease in the rate paid on interest-bearing liabilities of 170 basis points. The rate paid on interest-bearing deposits, the single largest component, decreased

147 basis points.

|

| |

|

|

These factors were partially offset by a 95 basis point decrease in the yield on interest-earning assets. The yield on loans, the single largest component,

decreased 136 basis points.

|

| |

|

|

In addition, the impact of noninterest-bearing sources of funding decreased 29 basis points due to lower interest rates and a lower proportion of

noninterest-bearing sources of funding to interest-earning assets.

|

For comparing to the broader market, during the first nine months of

2008 the average federal funds rate was 2.40% compared with 5.20% for the first nine months of 2007. The average federal funds rate was 1.96% for the third quarter of 2008 compared with 5.09% for the third quarter of 2007.

We believe that net interest margins for our industry will continue to be impacted by competition for high quality loans and deposits and customer migration from lower

to higher rate deposit or other products. We expect our net interest margin to improve for full year 2008 compared with 2007.

NONINTEREST INCOME

Summary First Nine Months

Noninterest income totaled $2.683 billion for the first nine months of 2008 compared with $2.956 billion for the first nine months of 2007.

Noninterest income for the first nine months of 2008 included the following:

| |

|

|

Valuation losses related to our commercial mortgage loans held for sale of $238 million,

|

| |

|

|

Income from Hilliard Lyons totaling $164 million, including the first quarter gain of $114 million from the sale of this business,

|

| |

|

|

A first quarter gain of $95 million related to the redemption of a portion of our Visa Class B common shares related to Visas March 2008 initial public

offering,

|

| |

|

|

Other investment losses of $81 million,

|

| |

|

|

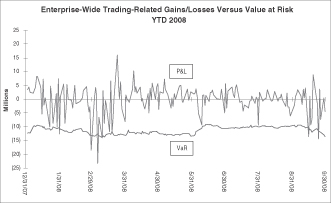

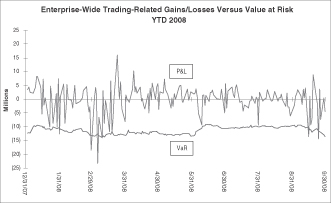

Trading losses of $77 million,

|

| |

|

|

Gains of $69 million related to our BlackRock LTIP shares adjustment,

|

| |

|

|

A third quarter $61 million reversal of a legal contingency reserve established in connection with an acquisition due to a settlement, and

|

| |

|

|

Net securities losses of $34 million.

|

Noninterest

income for the first nine months of 2007 included the following:

| |

|

|

Income from Hilliard Lyons totaling $171 million,

|

| |

|

|

Trading income of $114 million, and

|

| |

|

|

Equity management gains of $81 million.

|

Apart from

the impact of these items, noninterest income increased $134 million, or 5%, for the first nine months of 2008 compared with the first nine months of 2007.

Summary Third Quarter

Noninterest income totaled $654 million for the third quarter of 2008 compared with $990 million for

the third quarter of 2007.

Noninterest income for the third quarter of 2008 included the following:

| |

|

|

Valuation losses related to our commercial mortgage loans held for sale of $82 million,

|

| |

|

|

Net securities losses of $74 million,

|

| |

|

|

The $61 million reversal of a legal contingency reserve referred to above,

|

| |

|

|

Other investment losses of $55 million,

|

| |

|

|

Trading losses of $54 million,

|

| |

|

|

A loss of $51 million related to our BlackRock LTIP shares adjustment, and

|

| |

|

|

Equity management losses of $24 million.

|

Noninterest income for the third quarter of 2007 included the following:

| |

|

|

Income from Hilliard Lyons of $58 million,

|

| |

|

|

A loss of $50 million related to our BlackRock LTIP shares adjustment,

|

| |

|

|

Equity management gains of $47 million, and

|

| |

|

|

Trading income of $33 million.

|

Apart from the

impact of these items, noninterest income increased $31 million, or 3%, in this comparison.

Additional Analysis

Fund servicing fees increased $75 million, to $695 million, in the first nine months of 2008 compared with the first nine months of 2007. Fund servicing fees totaled $233

million in the third quarter of 2008 compared with $208 million in the third quarter of 2007. The increases in both comparisons primarily resulted from the December 2007 acquisition of Albridge Solutions Inc. and growth in Global Investment

Servicings offshore operations.

8

Global Investment Servicing provided fund accounting/ administration services for $907 billion of net fund investment assets and provided custody services

for $415 billion of fund investment assets at September 30, 2008, compared with $922 billion and $497 billion, respectively, at September 30, 2007. The decrease in assets serviced was due to declines in asset values and fund outflows

resulting primarily from market conditions in the third quarter of 2008.

Asset management fees totaled $589 million in the first nine months of 2008, an

increase of $30 million compared with the first nine months of 2007. Higher equity earnings from our BlackRock investment in 2008 and our March 2007 acquisition of Mercantile impacted the nine-month comparison. For the third quarter of 2008, asset

management fees totaled $180 million compared with $204 million in the third quarter of 2007. The effect on fees of a $14 billion decrease in assets managed related to wealth management and the Hilliard Lyons divestiture and lower equity earnings

from BlackRock were reflected in the decline during the third quarter of 2008 compared with the prior year third quarter. Assets managed at September 30, 2008 totaled $63 billion compared with $77 billion at September 30, 2007. The

Hilliard Lyons sale and the impact of comparatively lower equity markets in the first nine months of 2008 drove the decline in assets managed.

Consumer

services fees declined $41 million, to $472 million, for the first nine months of 2008 compared with the first nine months of 2007. For the third quarter of 2008, consumer services fees totaled $153 million compared with $177 million in the third

quarter of 2007. In both comparisons, the sale of Hilliard Lyons more than offset the benefits of increased volume-related fees, including debit card, credit card, brokerage and merchant revenues.

Corporate services revenue totaled $547 million in the first nine months of 2008 compared with $533 million in the first nine months of 2007. Corporate services revenue

totaled $198 million in both the third quarter of 2008 and 2007. Higher revenue from treasury management and other fees, partially offset by lower merger and acquisition advisory fees and mortgage servicing fees, net of amortization, were the

primary factors in the year-to-date increase.

Service charges on deposits grew $13 million, to $271 million, in the first nine months of 2008 compared

with the first nine months of 2007. Service charges on deposits totaled $97 million for the third quarter of 2008 and $89 million for the third quarter of 2007. The impact of our expansion into new markets contributed to the increase in both

comparisons.

Net securities losses totaled $34 million for the first nine months of 2008 compared with net securities losses of $4 million in the first

nine months of 2007. Net securities losses were $74 million for the third quarter of 2008 and $2 million for the third quarter of 2007. Losses for the third quarter of 2008 included other-than-temporary impairment charges of

$74 million on our investment in preferred stock of FHLMC and FNMA in addition to other-than-temporary impairments on other securities that were offset by

securities gains.

Other noninterest income totaled $143 million for the first nine months of 2008 compared with $477 million for the first nine months of

2007.

Other noninterest income for the first nine months of 2008 included the $114 million gain from the sale of Hilliard Lyons, the $95 million gain from

the redemption of a portion of our investment in Visa related to their March 2008 initial public offering, gains of $69 million related to our BlackRock LTIP shares adjustment and the $61 million reversal of a legal contingency reserve referred to

above. The impact of these items was partially offset by valuation losses related to our commercial mortgage loans held for sale of $238 million, and trading losses of $77 million.

Trading income of $114 million and equity management gains of $81 million were included in other noninterest income for the first nine months of 2007.

For the third quarter of 2008, other noninterest income was a negative $133 million compared with $116 million for the third quarter of 2007.

Other noninterest income for the third quarter of 2008 included valuation losses related to our commercial mortgage loans held for sale of $82 million, trading losses of $54 million and equity management losses of $24

million. The impact of these items was partially offset by the $61 million reversal of a legal contingency reserve. Other noninterest income for the third quarter of 2007 included equity management gains of $47 million and trading income of $33

million.

Additional information regarding our transactions related to Visa is included in Note 15 Commitments And Guarantees in the Notes To Consolidated

Financial Statements included in this Report. Further details regarding our trading activities are included in the Market Risk Management Trading Risk portion of the Risk Management section of this Financial Review and further details

regarding equity management are included in the Market Risk Management Equity and Other Investment Risk section.

Other noninterest income typically

fluctuates from period to period depending on the nature and magnitude of transactions completed.

We expect that total revenue growth will exceed 10% for

full year 2008 compared with full year 2007, assuming our current expectations for interest rates and economic conditions. We also expect to create positive operating leverage for full year 2008 with a percentage growth in total revenue relative to

9

2007 that will exceed the percentage growth in noninterest expense from 2007, excluding any potential impact on expenses of our planned acquisition of

National City.

PRODUCT REVENUE

In addition to credit and deposit products for commercial customers, Corporate & Institutional Banking offers other services, including treasury management and capital markets-related products and services

and commercial mortgage loan servicing, that are marketed by several businesses to commercial and retail customers across PNC.

Treasury management

revenue, which includes fees as well as net interest income from customer deposit balances, increased 17% to $403 million in the first nine months of 2008 compared with $345 million for the first nine months of 2007. For the third quarter of 2008,

treasury management revenue increased 13% to $137 million compared with $121 million in the third quarter of 2007. These increases were primarily related to the impact of our expansion into new markets and strong growth in commercial payment card

services and in cash and liquidity management products.

Revenue from capital markets-related products and services totaled $260 million in the first nine

month of 2008 compared with $216 million in the first nine months of 2007. Revenue totaled $80 million for the third quarter of 2008 compared with $73 million for the third quarter of 2007. These increases were primarily driven by strong customer

interest rate derivative and foreign exchange activity partially offset by a decline in merger and acquisition advisory fees.

Commercial mortgage banking

activities include revenue derived from loan originations, commercial mortgage servicing (including net interest income and noninterest income from loan servicing and ancillary services), gains, valuation adjustments, net interest income on loans

held for sale, and related commitments and hedges.

Commercial mortgage banking activities resulted in revenue of $8 million in the first nine months of

2008 compared with $206 million in the first nine months of 2007. The first nine months of 2008 included valuation losses of $238 million on commercial mortgage loans held for sale due to the impact of an illiquid market during most of the first

nine months of 2008. The 2007 period reflected significant securitization activity. In addition, commercial mortgage servicing revenue declined $14 million while net interest income from commercial mortgage loans held for sale increased $51 million

in the nine-month comparison due to higher loans held for sale balances.

For the third quarter of 2008, revenue from commercial mortgage banking

activities totaled negative $1 million compared with $66 million in the third quarter of 2007. The decrease reflected an $82 million negative valuation adjustment in the third quarter of 2008. In addition,

commercial mortgage servicing revenue declined $10 million while net interest income from commercial mortgage loans held for sale increased $15 million in

the quarter comparison due to higher loans held for sale balances.

PROVISION FOR CREDIT

LOSSES

The provision for credit losses totaled $527 million for the first nine months of 2008 compared with $127 million for the

first nine months of 2007. The provision for credit losses for the third quarter of 2008 totaled $190 million compared with $65 million for the third quarter of 2007. The higher provision in both comparisons was driven by general credit quality

migration, especially in the residential real estate development portion of our commercial real estate portfolio and related sectors, and in home equity loans. Total residential real estate development outstandings were approximately $1.8 billion at

September 30, 2008 compared with $2.1 billion at December 31, 2007. Growth in our total credit exposure also contributed to the higher provision amounts in both comparisons.

Our planned acquisition of National City may result in an additional provision for credit losses, which would be recorded at closing, to conform the National City loan reserving methodology with ours. Given this

transaction and continued credit deterioration, management is no longer in a position to provide guidance for the provision for credit losses for full year 2008.

The Credit Risk Management portion of the Risk Management section of this Financial Review includes additional information regarding factors impacting the provision for credit losses.

NONINTEREST EXPENSE

Total

noninterest expense was $3.299 billion for the first nine months of 2008 and $3.083 billion for the first nine months of 2007. Noninterest expense totaled $1.142 billion for the third quarter of 2008 compared with $1.099 billion for the third

quarter of 2007.

Higher noninterest expense in both the third quarter and first nine month comparisons with 2007 primarily resulted from investments in

growth initiatives, including acquisitions, partially offset by the impact of the sale of Hilliard Lyons and disciplined expense management.

Integration

costs included in noninterest expense totaled $41 million for the first nine months of 2008 and $67 million for the first nine months of 2007. Integration costs in the third quarter of 2008 totaled $14 million compared with $41 million in the third

quarter of 2007.

Noninterest expense for the first nine months of 2008 included the benefit of the first quarter 2008 reversal of $43 million of

10

the $82 million Visa indemnification liability that we established in the fourth quarter of 2007. Additional information regarding our transactions related

to Visa is included in Note 15 Commitments And Guarantees in the Notes To Consolidated Financial Statements included in this Report.

We expect noninterest

expense to grow at a low-to-mid single digit percentage for full year 2008 compared with 2007, excluding any potential impact of our planned acquisition of National City.

PERIOD-END EMPLOYEES

|

|

|

|

|

|

|

| |

|

September 30

2008

|

|

December 31

2007

|

|

September 30

2007

|

| Full-time

|

|

25,223 |

|

25,480 |

|

24,811 |

| Part-time

|

|

2,906 |

|

2,840 |

|

2,823 |

|

|

|

| Total

|

|

28,129 |

|

28,320 |

|

27,634 |

EFFECTIVE TAX RATE

Our effective tax rate was 33.1% for the first nine months of 2008 and 31.0% for the first nine months of 2007. The higher effective tax rate for the first nine months of

2008 was due to taxes associated with the gain on the sale of Hilliard Lyons.

CONSOLIDATED

BALANCE SHEET REVIEW

SUMMARIZED BALANCE SHEET

DATA

|

|

|

|

|

|

|

| In millions |

|

September 30

2008 |

|

December 31

2007 |

| Assets

|

|

|

|

|

|

|

| Loans, net of unearned income

|

|

$ |

75,184 |

|

$ |

68,319 |

| Securities available for sale

|

|

|

31,031 |

|

|

30,225 |

| Cash and short-term investments

|

|

|

7,752 |

|

|

10,425 |

| Loans held for sale

|

|

|

1,922 |

|

|

3,927 |

| Equity investments

|

|

|

6,735 |

|

|

6,045 |

| Goodwill and other intangible assets

|

|

|

9,921 |

|

|

9,551 |

| Other

|

|

|

13,065 |

|

|

10,428 |

| |

| Total assets

|

|

$ |

145,610 |

|

$ |

138,920 |

| Liabilities

|

|

|

|

|

|

|

| Funding sources

|

|

$ |

117,123 |

|

$ |

113,627 |

| Other

|

|

|

12,199 |

|

|

8,785 |

| |

| Total liabilities

|

|

|

129,322 |

|

|

122,412 |

| Minority and noncontrolling interests in consolidated entities

|

|

|

2,070 |

|

|

1,654 |

| Total shareholders equity

|

|

|

14,218 |

|

|

14,854 |

| |

| Total liabilities, minority and noncontrolling interests, and shareholders

equity

|

|

$ |

145,610 |

|

$ |

138,920 |

The summarized balance sheet data above is based upon our Consolidated Balance Sheet that is presented in Part I,

Item 1 of this Report.

Various seasonal and other factors impact our period-end balances whereas average balances (discussed under the Balance Sheet Highlights section of this Financial Review

above and included in the Statistical Information section of this Report) are more indicative of underlying business trends.

An analysis of changes in

certain balance sheet categories follows.

LOANS, NET OF UNEARNED INCOME

Loans increased $6.9 billion, to $75.2 billion, at September 30, 2008 compared with the balance at December 31, 2007. In February 2008,

we transferred the education loans in our held for sale portfolio to the loan portfolio as further described in the Loans Held For Sale section of this Consolidated Balance Sheet Review.

Details Of Loans

|

|

|

|

|

|

|

|

|

| In millions |

|

September 30

2008 |

|

|

December 31

2007 |

|

| Commercial

|

|

|

|

|

|

|

|

|

| Retail/wholesale

|

|

$ |

6,138 |

|

|

$ |

5,973 |

|

| Manufacturing

|

|

|

5,656 |

|

|

|

4,705 |

|

| Other service providers

|

|

|

3,914 |

|

|

|

3,529 |

|

| Real estate related (a)

|

|

|

6,155 |

|

|

|

5,425 |

|

| Financial services

|

|

|

1,595 |

|

|

|

1,268 |

|

| Health care

|

|

|

1,630 |

|

|

|

1,446 |

|

| Other

|

|

|

7,323 |

|

|

|

6,261 |

|

| Total commercial

|

|

|

32,411 |

|

|

|

28,607 |

|

| Commercial real estate

|

|

|

|

|

|

|

|

|

| Real estate projects

|

|

|

6,622 |

|

|

|

6,114 |

|

| Mortgage

|

|

|

3,047 |

|

|

|

2,792 |

|

| Total commercial real estate

|

|

|

9,669 |

|

|

|

8,906 |

|

| Lease financing

|

|

|

3,553 |

|

|

|

3,500 |

|

| Total commercial lending

|

|

|

45,633 |

|

|

|

41,013 |

|

| Consumer

|

|

|

|

|

|

|

|

|

| Home equity

|

|

|

14,892 |

|

|

|

14,447 |

|

| Education

|

|

|

2,648 |

|

|

|

132 |

|

| Automobile

|

|

|

1,606 |

|

|

|

1,513 |

|

| Other

|

|

|

2,260 |

|

|

|

2,234 |

|

| Total consumer

|

|

|

21,406 |

|

|

|

18,326 |

|

| Residential mortgage

|

|

|

8,757 |

|

|

|

9,557 |

|

| Other

|

|

|

298 |

|

|

|

413 |

|

| Unearned income

|

|

|

(910 |

) |

|

|

(990 |

) |

| Total, net of unearned income

|

|

$ |

75,184 |

|

|

$ |

68,319 |

|

| (a) |

Includes loans to customers in the real estate and construction industries. |

Total loans represented 52% of total assets at September 30, 2008 and 49% of total assets at December 31, 2007.

Our total loan

portfolio continued to be diversified among numerous industries and types of businesses. The loans that we hold are also concentrated in, and diversified across, our principal geographic markets.

Approximately $1.8 billion of the $6.6 billion of real estate projects loans at September 30, 2008 were in residential real

11

estate development. These represented approximately 2% of total loans and less than 2% of total assets at September 30, 2008. Approximately $2.1 billion

of the $6.1 billion of real estate projects loans at December 31, 2007 were in residential real estate development.

Our home equity loan outstandings

totaled $14.9 billion at September 30, 2008. In this portfolio, we consider the higher risk loans to be those with a recent FICO credit score of less than or equal to 660 and a loan-to-value ratio greater than or equal to 90%. We had $581

million or approximately 4% of the total portfolio in this grouping at September 30, 2008. Consistent with the entire home equity portfolio, approximately 93% of these higher-risk loans are located in our geographic footprint. In our $8.8

billion residential mortgage portfolio, loans with a recent FICO credit score of less than or equal to 660 and a loan-to-value ratio greater than 90% totaled $156 million and comprised approximately 2% of this portfolio at September 30, 2008.

Commercial lending outstandings in the table above are the largest category and are the most sensitive to changes in assumptions and judgments underlying

the determination of the allowance for loan and lease losses. We have allocated approximately $928 million, or 88%, of the total allowance for loan and lease losses at September 30, 2008 to these loans. We allocated $109 million, or 10%, of the

remaining allowance at that date to consumer loans and $16 million, or 2%, to all other loans. This allocation also considers other relevant factors such as:

| |

|

|

Actual versus estimated losses,

|

| |

|

|

Regional and national economic conditions,

|

| |

|

|

Business segment and portfolio concentrations,

|

| |

|

|

The impact of government regulations, and

|

| |

|

|

Risk of potential estimation or judgmental errors, including the accuracy of risk ratings.

|

Net Unfunded Credit Commitments

|

|

|

|

|

|

|

| In millions |

|

September 30

2008 |

|

December 31

2007 |

| Commercial

|

|

$ |

42,424 |

|

$ |

39,171 |

| Consumer

|

|

|

11,496 |

|

|

10,875 |

| Commercial real estate

|

|

|

2,337 |

|

|

2,734 |

| Other

|

|

|

837 |

|

|

567 |

| Total

|

|

$ |

57,094 |

|

$ |

53,347 |

Unfunded commitments are concentrated in our primary geographic markets. Commitments to extend credit represent

arrangements to lend funds or provide liquidity subject to specified contractual conditions. Commercial commitments reported net of participations, assignments and syndications totaled $7.6 billion at September 30, 2008 and $8.9 billion at

December 31, 2007.

Unfunded liquidity facility commitments and standby bond purchase agreements totaled $7.8 billion at September 30,

2008 and $9.4 billion at December 31, 2007 and are included in the preceding table primarily within the Commercial and Consumer

categories. The decrease from December 31, 2007 was primarily due to a decline in Market Street commitments.

In addition to credit commitments, our

net outstanding standby letters of credit totaled $5.8 billion at September 30, 2008 and $4.8 billion at December 31, 2007. Standby letters of credit commit us to make payments on behalf of our customers if specified future events occur.

SECURITIES AVAILABLE FOR SALE

|

|

|

|

|

|

|

| In millions |

|

Amortized

Cost |

|

Fair Value |

| September 30, 2008

|

|

|

|

|

|

|

| Debt securities

|

|

|

|

|

|

|

| Residential mortgage-backed

|

|

$ |

23,734 |

|

$ |

21,172 |

| Commercial mortgage-backed

|

|

|

5,952 |

|

|

5,541 |

| Asset-backed

|

|

|

3,491 |

|

|

2,927 |

| US Treasury and government agencies

|

|

|

32 |

|

|

33 |

| State and municipal

|

|

|

810 |

|

|

750 |

| Other debt

|

|

|

257 |

|

|

219 |

| Corporate stocks and other

|

|

|

389 |

|

|

389 |

| Total securities available for sale

|

|

$ |

34,665 |

|

$ |

31,031 |

| December 31, 2007

|

|

|

|

|

|

|

| Debt securities

|

|

|

|

|

|

|

| Residential mortgage-backed

|

|

$ |

21,147 |

|

$ |

20,952 |

| Commercial mortgage-backed

|

|

|

5,227 |

|

|

5,264 |

| Asset-backed

|

|

|

2,878 |

|

|

2,770 |

| US Treasury and government agencies

|

|

|

151 |

|

|

155 |

| State and municipal

|

|

|

340 |

|

|

336 |

| Other debt

|

|

|

85 |

|

|

84 |

| Corporate stocks and other

|

|

|

662 |

|

|

664 |

| Total securities available for sale

|

|

$ |

30,490 |

|

$ |

30,225 |

Securities available for sale represented 21% of total assets at September 30, 2008 and 22% of total assets

at December 31, 2007.

At September 30, 2008, securities available for sale included a net pretax unrealized loss of $3.6 billion, which

represented the difference between fair value and amortized cost. The comparable amount at December 31, 2007 was a net unrealized loss of $265 million. The fair value of securities available for sale is impacted by interest rates, credit

spreads, and market volatility and illiquidity. We believe that substantially all of the decline in value of these securities is attributable to changes in market credit spreads and market illiquidity and not from deterioration in the credit quality

of individual securities or underlying collateral, where applicable. If the current issues affecting the US housing market were to continue for the foreseeable future or worsen, or if market volatility and illiquidity were to continue or worsen, or

if market interest rates were to increase

12

appreciably, the valuation of our available for sale securities portfolio could continue to be adversely affected. See Note 4 Securities in the Notes To

Consolidated Financial Statements included in this Report for further information.

Net unrealized gains and losses in the securities available for sale

portfolio are included in shareholders equity as accumulated other comprehensive income or loss, net of tax.

The expected weighted-average life of

securities available for sale (excluding corporate stocks and other) was 4 years and 8 months at September 30, 2008 and 3 years and 6 months at December 31, 2007.

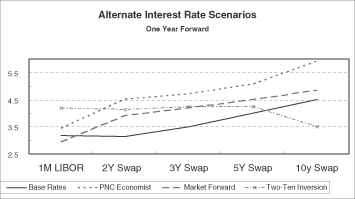

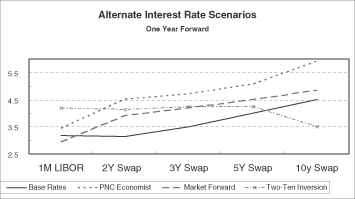

We estimate that at September 30, 2008 the effective duration of securities available for sale was 3.2 years for an immediate 50 basis points parallel increase in interest rates and 3.1 years for an immediate 50

basis points parallel decrease in interest rates. Comparable amounts at December 31, 2007 were 2.8 years and 2.5 years, respectively.

LOANS HELD FOR SALE

|

|

|

|

|

|

|

| In millions |

|

September 30

2008 |

|

December 31

2007 |

| Commercial mortgage

|

|

$ |

1,505 |

|

$ |

2,116 |

| Residential mortgage

|

|

|

99 |

|

|

117 |

| Education

|

|

|

|

|

|

1,525 |

| Other

|

|

|

318 |

|

|

169 |