SLIDE PRESENTATION

Published on October 24, 2008

Investor

Presentation Acquisition of National City Corporation October 24, 2008 Exhibit 99.2 |

2 Cautionary Statement Regarding Forward-Looking Information This presentation contains forward-looking statements regarding our outlook or expectations with respect to the planned acquisition of National City Corporation (National City), the expected costs to be incurred in connection with the acquisition, National Citys future performance and consequences of its integration into PNC, and the impact of the transaction on PNC's future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. The forward- looking statements in this presentation speak only as of the date of the presentation, and each of PNC and National City assumes no duty, and does not undertake, to update them. Actual results or future events could differ, possibly materially, from those that we anticipated in these forward-looking statements. These forward-looking statements are subject to the principal risks and uncertainties applicable to the respective businesses of PNC and National City generally that are disclosed in the 2007 Form 10-K and in current year Form 10-Qs and 8-Ks of PNC and National City (accessible on the SEC's Web site at www.sec.gov and on PNC's Web site at www.pnc.com and on National City's Web site at www.nationalcity.com, respectively). In addition, forward-looking statements in this presentation are subject to the following risks and uncertainties related both to the acquisition transaction itself and to the integration of the acquired business into PNC after closing: Completion of the transaction is dependent on, among other things, receipt of regulatory and shareholder approvals, the timing of which cannot be predicted with precision at this point and which may not be received at all. The impact of the completion of the transaction on PNC's financial statements will be affected by the timing of the transaction, including in particular the ability to complete the acquisition in the fourth quarter of 2008. The transaction may be substantially more expensive to complete (including the integration of National City's businesses) and the anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events. Our ability to achieve anticipated results from this transaction is dependent on the state of the economic and financial markets going forward, which have been under significant stress recently. Specifically, we may incur more credit losses from National Citys loan portfolio than expected. Other issues related to achieving anticipated financial results include the possibility that deposit attrition may be greater than expected. Litigation and governmental investigations currently pending against National City, as well as others that may be filed as a result of this transaction or otherwise, could impact the timing or realization of anticipated benefits to PNC. The integration of National City's business and operations into PNC, which will include conversion of National City's different systems and procedures, may take longer than anticipated or be more costly than anticipated or have unanticipated adverse results relating to National City's or PNC's existing businesses. PNC's ability to integrate National City successfully may be adversely affected by the fact that this transaction will result in PNC entering several markets where PNC does not currently have any meaningful retail presence. |

3 Overview Fixed exchange ratio - Total consideration of $5.6 billion (which approximates National Citys market capitalization as of the close of business on October 23, 2008), fixed number of approximately 92 million PNC shares - 0.0392 PNC shares for each National City share - $2.23 per National City share ; a $384 million cash payment for warrants (1) As of October 23, 2008 based on PNC closing price of $56.88 per share and 2.036 billion NCC

common shares outstanding plus 305 million Ratchet shares. PNC to acquire 100% of National City resulting in 5 largest U.S. deposit franchise - Financially compelling structure - Approved for $7.7 billion of TARP preferred stock, resulting in post acquisition Tier 1 Capital ratio of approximately 10% - Due diligence complete - Regulatory and shareholder approval required; anticipated closing by December 31, 2008 Leverage PNCs successful business model, technology and execution capabilities Transaction Highlights Key Terms $1.2 billion annual expense reduction, 10% of combined expense base Merger and integration costs of $2.3 billion, including a $1.8 billion conforming credit

allowance adjustment Accretive to earnings in year 2, estimated IRR 15%+ Estimated Impact Assessment th 1 1 |

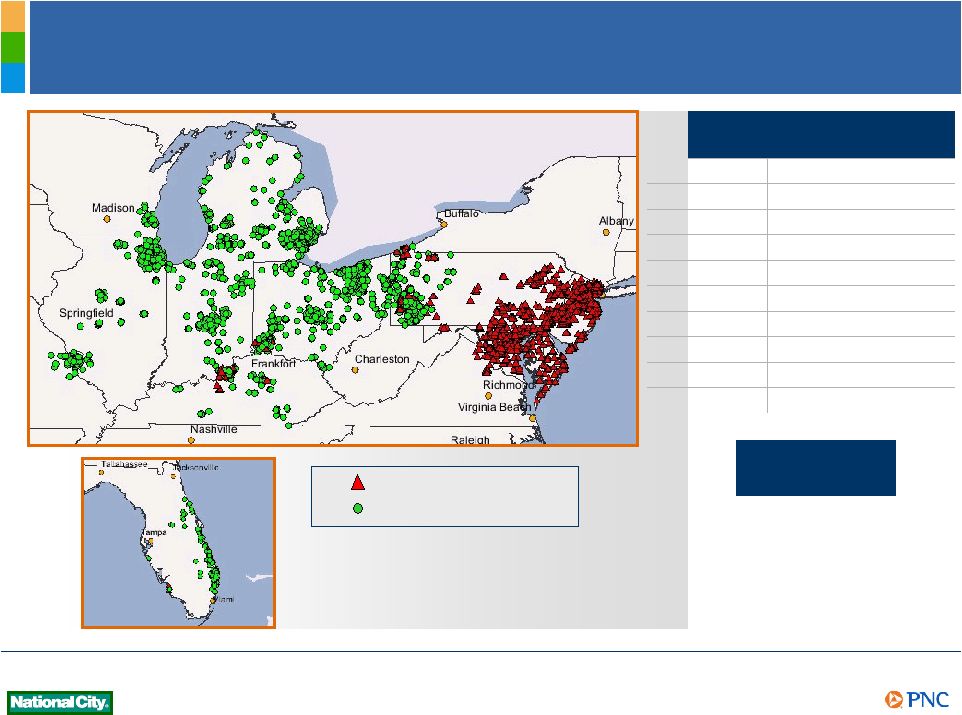

4 1 Bank of America/Merrill Lynch $720 2 Wells Fargo/Wachovia 711 3 JP Morgan/Washington Mutual 649 4 Citigroup 224 5 Proforma PNC 180 6 US Bancorp 128 7 SunTrust 116 - National City 98 8 Royal Bank of Scotland 95 9 Regions 87 10 BB&T 86 - PNC 82 1 Wells Fargo/Wachovia 6,779 2 Bank of America/Merrill Lynch 6,208 3 JP Morgan/Washington Mutual 5,462 4 Proforma PNC 2,747 5 US Bancorp 2,611 6 Regions 1,939 7 SunTrust 1,774 8 Royal Bank of Scotland 1,639 - National City 1,570 9 BB&T 1,496 10 Fifth Third 1,357 - PNC 1,177 A Leader in Deposits and Distribution U.S. Branch Rank (#) U.S. Deposit Rank ($) Source: SNL Financial, Branch data as of October 23, 2008; deposit data as of June 30, 2008;

proforma for announced acquisitions. |

5 A Broad Distribution Network 5 8% $11.9B 270 MI 4 9% $2.5B 47 DE 4 4% $14.4B 187 IL $17.8B $2.5B $8.7B $9.6B $8.0B $36.9B $56.8B Deposits Combined 8% 11% 10% 10% 13% 16% 22% Share 4 3 2 2 1 1 1 Rank 330 NJ 29 DC 185 IN 202 MD 172 KY 464 OH 617 PA Branches PNC branches NCC branches Total Branches 2,747 Source: SNL Financial, Branch data as of October 23, 2008; deposit data as of June 30,

2008. |

6 Implementing the PNC Business Model Commitment to a moderate risk profile Ability to grow high quality, diverse revenue streams Focus on continuous improvement Disciplined approach to capital management Strong execution Exit non-core portfolios and liquidate low return asset classes Leverage PNCs sales culture and product capabilities Capture expense synergies and rationalize cost structure (One PNC) Instill risk-adjusted return culture at transaction level Leverage proven ability to implement the model as with past transactions (Riggs, Mercantile) PNC Model Action Plan |

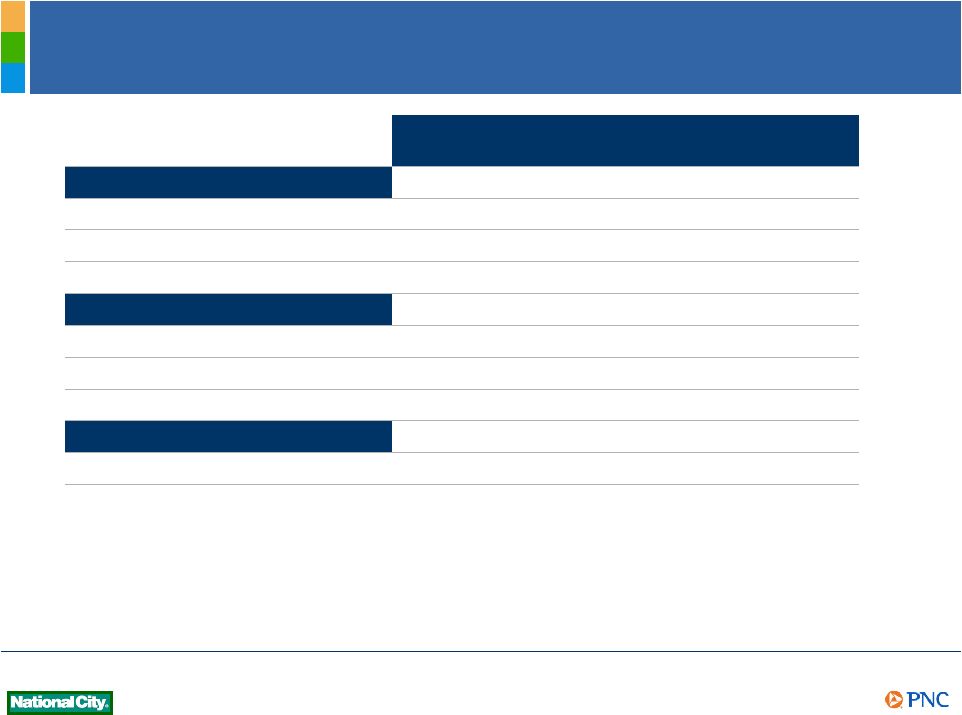

7 National City Loan Portfolio Assessment 17.5% $19.9 $113.4 Total Loans Est. lifetime losses, market value and other adjustments¹

Balance (billions) 6.1% 49.0% 60.9% 27.9% 47.1% 52.5% 43.5% 12.0% 8.5% 0.1 11.0 2.2 0.6 1.0 5.3 2.0 4.0 $4.7 2.1 Total Other Loans 22.5 Total Impaired/Liquidating Portfolio 3.5 Commercial Construction Residential 2.3 Rec Finance/Indirect Auto 2.2 Conforming Mortgage Construction 10.0 Home Equity Indirect 4.5 Non-conforming Mortgage 33.3 Total Consumer $55.4 Total Commercial Loan balances as of August 31, 2008. (1) To be included in purchase accounting or post

acquisition financial results over time. |

8 PNC Has Demonstrated Success Integrating Balance Sheets into Our Model 3Q07 3Q08 Checking Relationships (thousands) 286 298 3Q07 3Q08 Average Loans (billions) $12.4 $11.6 3Q07 3Q08 Average Deposits (billions) $12.0 $10.4 Instilling the PNC Model - Reduce higher risk credit exposure - Reduce non- relationship based, high cost deposit balances - At the same time, grow relationships Former Mercantile Market |

9 Capital Impact 3.5% 3.6% Tangible common equity Assets 10.0% 8.2% Tier 1 risk-based $20B $9B $24B $242B $271B $281B Proforma $14B Total common equity Ratios $5B Tangible common equity $10B Tier 1 capital Capital $118B Risk weighted assets $137B Tangible assets $146B Total assets 09/30/08 PNC Gives affect to both the acquisition and the inclusion of TARP preferred stock.

|

10

Summary Creates a leading deposit banking franchise Financially compelling transaction Application of PNCs established and successful business model Proven track record of successful execution |

11

The PNC Financial Services Group, Inc. and National City Corporation will be filing a joint proxy statement/prospectus and other relevant documents concerning the merger with the United States Securities and Exchange Commission (the "SEC"). WE URGE INVESTORS TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents free of charge at the SEC's Web site (www.sec.gov). In addition, documents filed with the SEC by The PNC Financial Services Group, Inc. will be available free of charge from Shareholder Relations at (800) 843-2206. Documents filed with the SEC by National City Corporation will be available free of charge from National City by contacting Investor Relations at (800) 622- 4204. The directors, executive officers, and certain other members of management and employees of National City are participants in the solicitation of proxies in favor of the merger from the shareholders of National City. Information about the directors and executive officers of National City is included in the proxy statement for its 2008 annual meeting of shareholders, which was filed with the SEC on March 7, 2008. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the proxy statement for National City's September 15, 2008 special meeting of shareholders, which was filed with the SEC on August 4, 2008. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they become available. The directors, executive officers, and certain other members of management and employees of PNC are participants in the solicitation of proxies in favor of the merger from the shareholders of PNC. Information about the directors and executive officers of PNC is included in the proxy statement for its 2008 annual meeting of shareholders, which was filed with the SEC on March 28, 2008. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they become available. Additional Information About The PNC/National City Corporation Transaction |