PRESENTATION MATERIALS

Published on December 12, 2007

The PNC

Financial Services Group, Inc. Goldman Sachs Financial Services CEO Conference 2007 New York December 12, 2007 Exhibit 99.1 |

This

presentation contains forward-looking statements regarding our outlook or expectations relating to PNCs future business, operations, financial condition, financial performance and asset quality. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix, which is included in the version of the presentation materials posted on our corporate website at www.pnc.com/investorevents. We provide greater detail regarding these factors in our 2006 Form 10-K, including in the Risk Factors and Risk Management sections, and in our current quarter 2007 Form 10-Q and other SEC reports (accessible on the SECs website at www.sec.gov and on or through our corporate website). Future events or circumstances may change our outlook or expectations and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. The forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake to update those statements. In this presentation, we will sometimes refer to adjusted results to help illustrate the impact of the deconsolidation of BlackRock near the end of third quarter 2006 and the impact of certain types of items. Adjusted results reflect, as applicable, the following types of adjustments: (1) 2006 and earlier periods reflect the impact of the deconsolidation of BlackRock by adjusting as if we had recorded our BlackRock investment on the equity method prior to its deconsolidation; (2) adjusting the 2006 periods to exclude the impact of the third quarter 2006 gain on the BlackRock/MLIM transaction and losses on the repositioning of PNCs securities and mortgage loan portfolios; (3) adjusting fourth quarter 2006 and the 2007 periods to exclude the net mark-to-market adjustments on PNCs remaining BlackRock LTIP shares obligation and, as applicable, the gain PNC recognized in first quarter 2007 in connection with the companys transfer of BlackRock shares to satisfy a portion of its BlackRock LTIP shares obligation; (4) adjusting all 2007 and 2006 periods to exclude, as applicable, integration costs related to acquisitions and to the BlackRock/MLIM transaction; and (5) adjusting, as appropriate, for the tax impact of these adjustments. We have provided these adjusted amounts and reconciliations so that investors, analysts, regulators and others will be better able to evaluate the impact of these items on our results for the periods presented, in addition to providing a basis of comparability for the impact of the BlackRock deconsolidation given the magnitude of the impact of deconsolidation on various components of our income statement and balance sheet. We believe that information as adjusted for the impact of the specified items may be useful due to the extent to which these items are not indicative of our ongoing operations as the result of our management activities on those operations. While we have not provided other adjustments for the periods discussed, this is not intended to imply that there could not have been other similar types of adjustments, but any such adjustments would not have been similar in magnitude to the amount of the adjustments shown. In certain discussions, we may also provide revenue information on a taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. We believe this adjustment may be useful when comparing yields and margins for all earning assets. This presentation may also include a discussion of other non-GAAP financial measures, which, to the extent not so qualified therein or in the Appendix, is qualified by GAAP reconciliation information available on our corporate website at www.pnc.com under About PNC Investor Relations. Cautionary Statement Regarding Forward-Looking Information and Adjusted Information |

Performance

validates business model Investing for the future Differentiation to drive growth PNCs Differentiation |

Growing Our

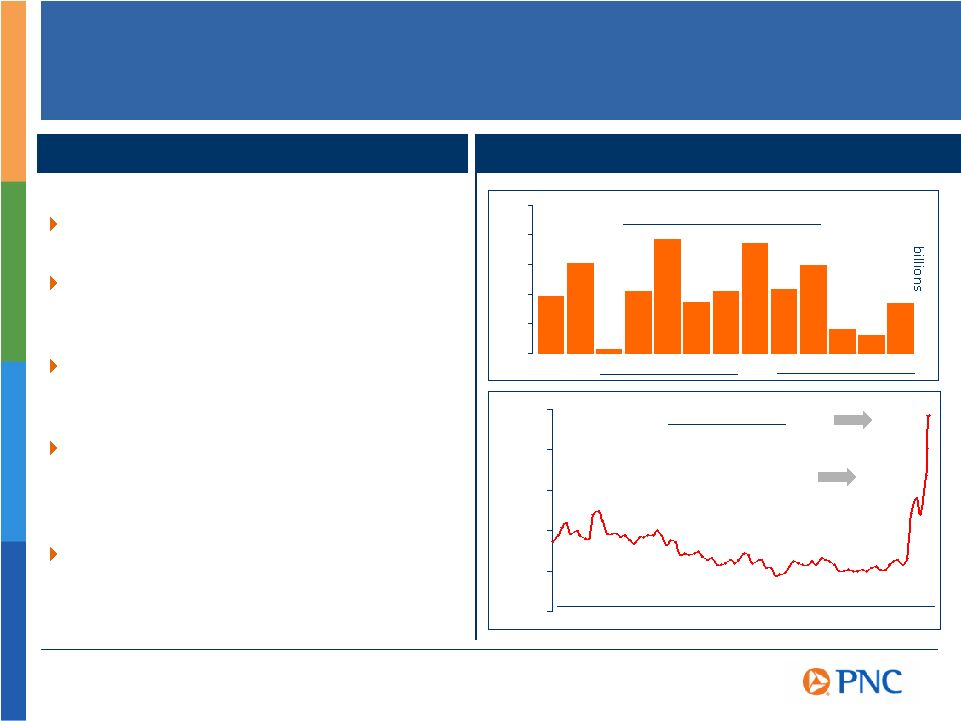

Balance Sheet As of September 30 $77B $93B $98B $131B Peer net loan CAGR 14% (1) Peer reflects CAGR of the average of the super-regional banks identified in the Appendix

other than PNC. $51B $42B $60B $50B $65B $48B $78B $65B Peer deposit CAGR 10% Peer asset CAGR 11% Net loans Deposits Assets 1 1 1 |

2004

2005 2006 2007 Delivering the Bottom Line 2004 2005 2006 2007 For the Nine Months Ended September 30 $890MM $970MM $1.12B (as adjusted, $2.22B as reported) $1.34B (as adjusted, $1.29B as reported) (1) As adjusted. As reported net income CAGR 13%; diluted earnings per share CAGR 7%. Adjusted net income and diluted earnings per share for the nine months ended September 30, 2006 and 2007 are reconciled to GAAP figures in the Appendix. (2) Peer reflects CAGR of the average of the super-regional banks identified in the Appendix other than PNC. Peer net income CAGR 7% For the Nine Months Ended September 30 $3.13 $3.35 $3.77 (as adjusted, $7.46 as reported) $4.00 (as adjusted, $3.85 as reported) Peer diluted EPS CAGR 1% Diluted Earnings Per Share Net Income 2 2 |

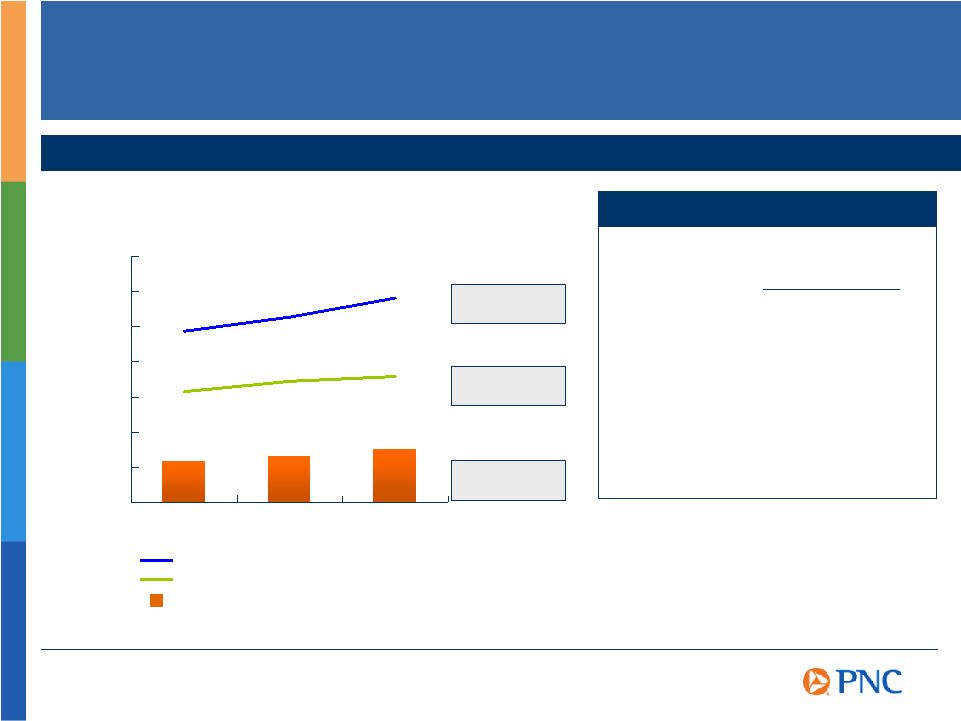

$0 $1 $2 $3 $4 $5 $6 $7 2004 2005 2006 Revenue 9% Creating Positive Operating Leverage Generating Capital by Growing Revenues Faster Than Expenses billions Compound Annual Growth Rate (2004 2006) Adjusted Revenue (as reported $5.5 billion, $6.3 billion, $8.6 billion for 2004, 2005, 2006, respectively) Adjusted Noninterest Expense (as reported $3.7 billion, $4.3 billion, $4.4 billion for 2004, 2005, 2006,

respectively) Adjusted Net Income (as reported $1.2 billion, $1.3 billion, $2.6 billion for 2004, 2005, 2006,

respectively) Net Income 12% $1.2 $1.3 $1.5 Expense 7% Revenue

+20% Expense

+15% Net

Income +19% Trend

Continues¹

(1) As reported: revenue (28%), expense (11%),

net income (42%). Adjusted amounts are reconciled to GAAP in the Appendix. Nine months ended September 30, as adjusted 2007 vs 2006 |

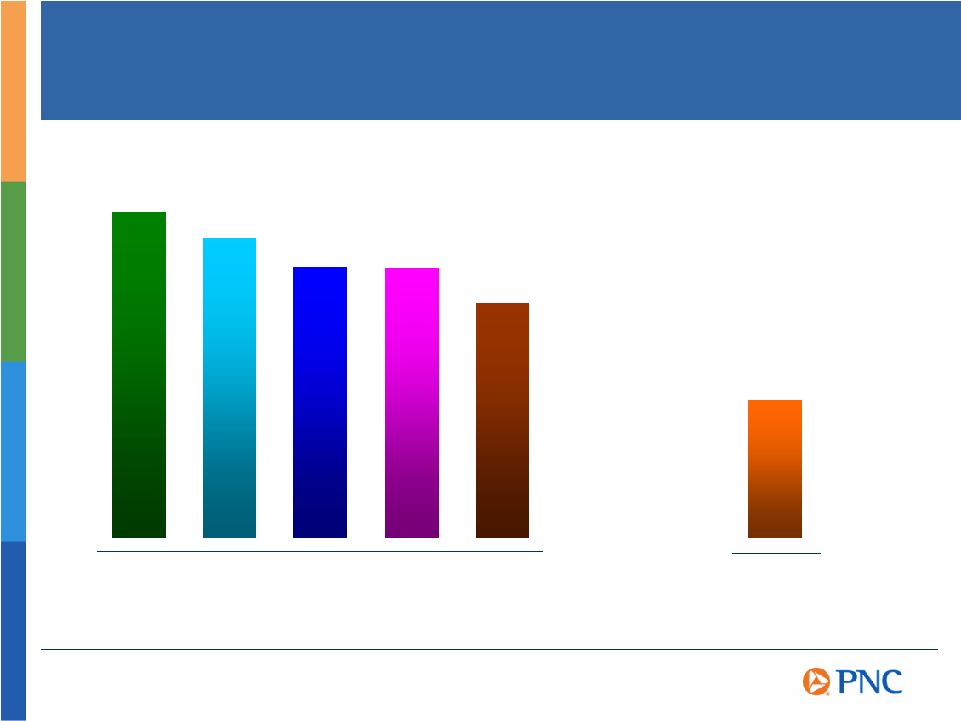

WB 0.19 % RF 0.27 PNC 0.30 CMA 0.32 STI 0.35 KEY 0.35 BBT 0.41 USB 0.54 NCC 0.54 FITB 0.60 WFC 1.02 USB 318 % PNC 251 RF 182 CMA 176 BBT 171 KEY 168 WFC 142 WB 117 FITB 117 NCC 113 STI 93 Credit Discipline Reflected in Reserves and Losses Proactively Assessing Credits For the three months ended September 30, 2007. Source: SNL DataSource, PNC as reported

3Q07 Managing the Risk 3Q07 Net Charge-offs to Average Loans Reserves to Nonperforming Assets |

PNC 58 % USB 52 FITB 48 WFC 46 WB 42 STI 42 BBT 42 KEY 41 RF 39 NCC 37 CMA 30 Building a Diversified Business Mix High Fee Income Contribution YTD07 (1) For the nine months ended September 30, 2007. (2) As of September 30, 2007. (3)

Reconciled to GAAP in the Appendix. Source: SNL DataSource, PNC as reported

Less Net Interest Income Dependent Noninterest Income to Total Revenue¹

50% without PFPC and BlackRock³

PNC 84 % RF 101 STI 104 BBT 104 WB 106 KEY 108 WFC 108 FITB 110 NCC 114 CMA 118 USB 121 Loans to Deposits²

3Q07 |

Performance

validates business model Investing for the future Differentiation to drive growth PNCs Differentiation |

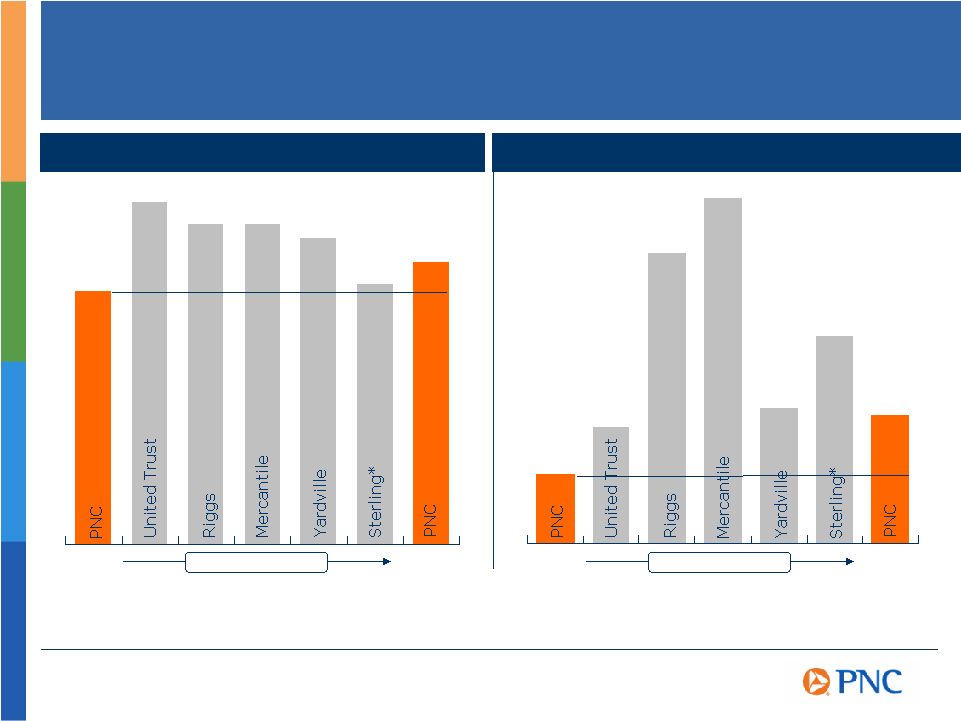

Projected

5-Year Population Growth $60,949 $56,250 $69,270 $54,620 $73,965 $69,363 $66,273 Median Household Income Improving Our Demographics 3.7% 6.0% 2.0% 3.4% 8.4% 10.0% 3.9% 2003 Proforma Acquisitions 2003 Proforma Acquisitions Amounts based on data at time of acquisition announcement. United Trust data reflects demographics of footprint counties weighted by households. Mercantile, Yardville and Sterling data reflect demographics of footprint counties of that company, or by MSA in the case of Riggs, weighted by deposits. PNC 2003 and PNC Proforma amounts reflect demographics, weighted by deposits, of PNCs 68 county footprint and 105 county footprint, respectively, including the impact of PNCs ongoing branch optimization process. PNC and Mercantile headquarter offices excluded for purposes of deposit weighting. Source: SNL DataSource. *Pending. |

$0

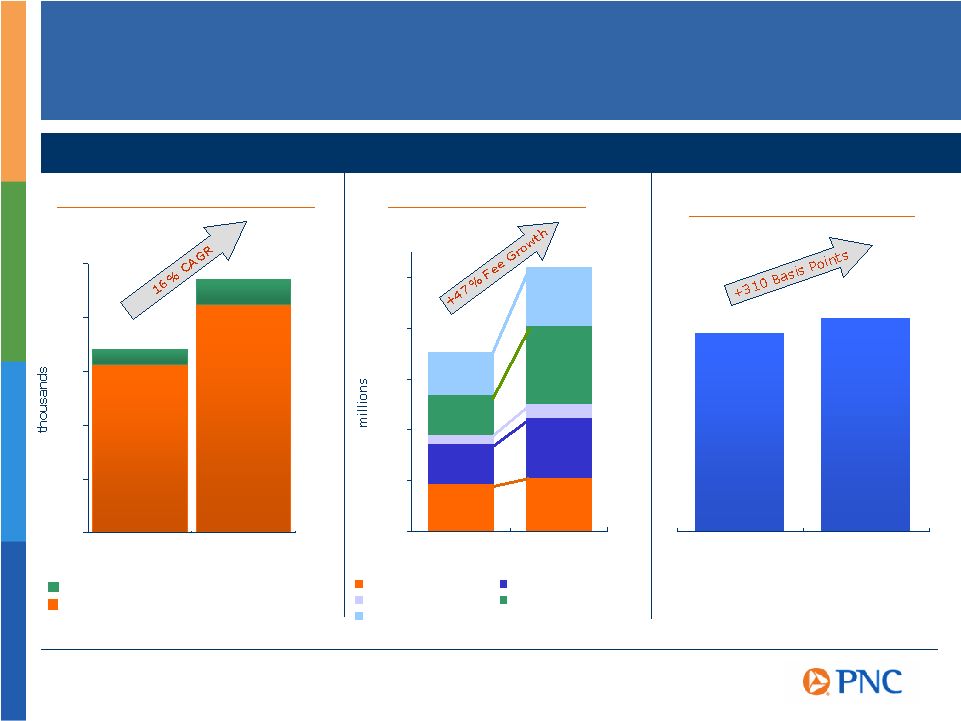

$4 $8 $12 $16 $20 1Q06 3Q07 Asset Management Service Charges Brokerage Corporate Services Consumer and Other Executing in the Greater Washington Area (GWA)

40.5% 43.6% 0 25 50 75 100 125 Deepening Relationships and Growing Noninterest Income*

GWA noninterest income to total revenue PNC - GWA Retail Relationships (1) Riggs transaction completed May 2005 PNC GWA Region *Excludes the impact of Mercantile June 30 2005¹

Sept 30 2007 PNC - GWA Fee Growth +14% +48% +45% +96% +38% GWA business checking relationships GWA consumer checking relationships 1Q06 3Q07 |

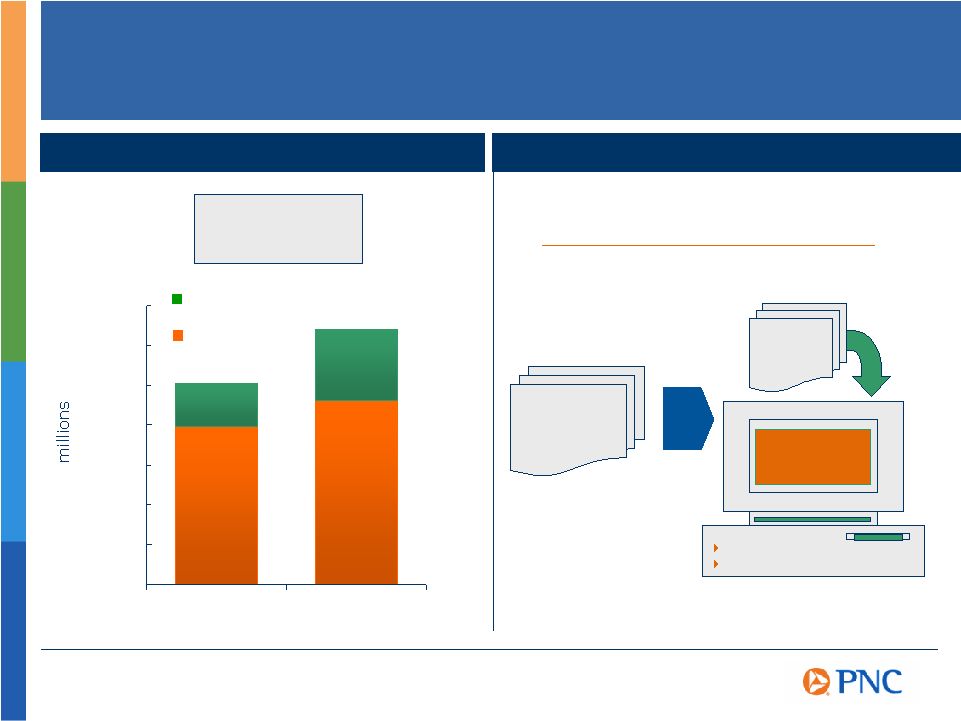

Transforming

the Business Model High Growth Product Focus Albridge Solutions, Inc. To

Integrated Provider Leveraging Our Global Fund Servicing Platform From Processor Unified client views Performance reporting $0 $100 $200 $300 $400 $500 $600 $700 Emerging Product Revenue Core Product Revenue Sept 04 Sept 07 21% 28% 72% 79% Emerging product revenue 3-yr CAGR 18% For the nine months ended |

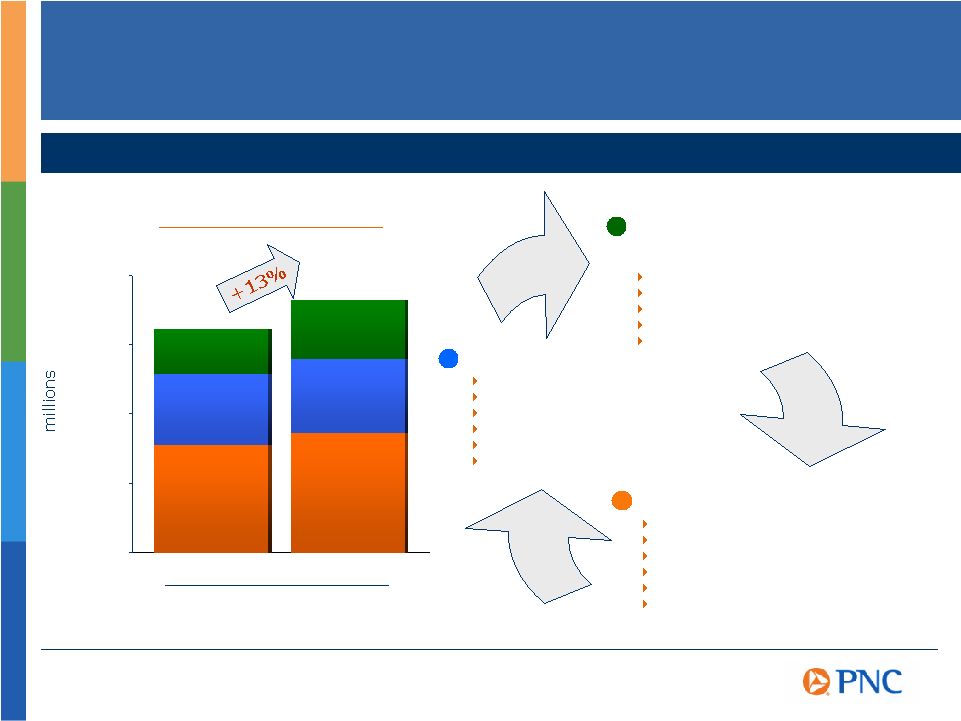

Leveraging

Corporate & Institutional Relationships to Grow Noninterest Income $0 $200 $400 $600 $800 Major Product Revenue¹

(1) Represents consolidated PNC amounts 2006 2007 For the nine months ended Capital Markets Treasury Management Midland Loan Services Commercial Loan Servicing CMBS Servicing Portfolio Institutional Servicing Portfolio Agency Servicing Portfolio Construction Loan Administration Government Services Foreign exchange Derivatives Loan syndications M&A advisory services Securities underwriting Securities sales and trading Cash and investment management Receivables management Disbursement services Funds transfer services Information reporting Global trade services Deepening Relationships with Fee Based Products and Services |

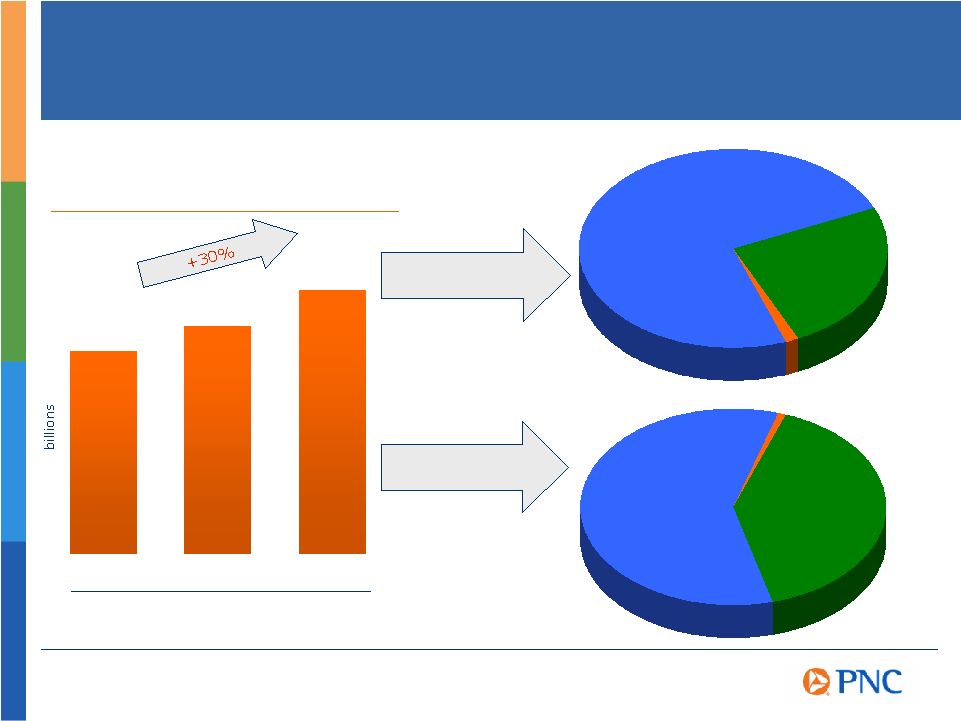

Leveraging

Corporate & Institutional Banking Channels to Grow Low Cost Deposits 3Q06 4Q06 3Q07 Corporate & Institutional Banking Average Deposits Total deposits $13.6 billion Treasury Management 74% Midland 25% Other 1% Midland 40% Treasury Management 59% For the three months ended $10.5B $11.8B $13.6B Noninterest bearing $7.2 billion |

$0

$10 $20 $30 $40 $50 Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep

Oct Nov 2006 CMBS Originations A Strategic Business with Unprecedented Liquidity Issues and Spread Widening Focused on risk adjusted returns, supports our servicing activity High quality HFS credit portfolio consistent with moderate risk profile Unprecedented market volatility across entire non-government and non-agency markets As of November 30, 2007, commercial mortgages held for sale were approximately $1.5B with $55 million of losses Committed to the business 0 25 50 75 100 125 Market Volatility Impact on CMBS 10 Year, AAA Spread over swaps, bps CMBS Spreads Nov 07 +121 2001 2002 2003

2004 2005 2006 2007 US CMBS Securitizations Context Sept 07 +65 Source: Commercial Mortgage Alert 2007 |

Performance

validates business model Investing for the future Differentiation to drive growth PNCs Differentiation |

Foster

Innovation Strengthen the brand Engage Employees Create a sense of urgency PNCs Differentiation Focus on Execution |

Brand Equity

Contribution to Market Cap Home Appliances Motor Vehicles Restaurants Toiletries/ Cosmetics Retailers Banks 16.1% 14.8% 13.3% 13.3% 11.5% 6.8% Source: CoreBrand |

Foster

Innovation Strengthen the brand Engage Employees Create a sense of urgency PNCs Differentiation Focus on Execution |

Performance

validates business model Investing for the future Differentiation to drive growth Summary |

Cautionary

Statement Regarding Forward-Looking Information Appendix We make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses and/or other matters regarding or affecting PNC that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, outlook, estimate, forecast, will, project and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance. Our forward-looking statements are subject to the following principal risks and uncertainties. We provide greater detail regarding some of these factors in our Form 10-K for the year ended December 31, 2006, including in the Risk Factors and Risk Management sections of that report, and in our current quarter 2007 Form 10-Q and other SEC reports. Our forward-looking statements may also be subject to other risks and uncertainties, including those that we may discuss elsewhere in this presentation or in our filings with the SEC, accessible on the SECs website at www.sec.gov and on or through our corporate website at www.pnc.com under About PNC Investor Relations Financial Information. Our businesses and financial results are affected by business and economic conditions, both generally and specifically in the principal markets in which we operate. In particular, our businesses and financial results may be impacted by: Changes in interest rates and valuations in the debt, equity and other financial markets. Disruptions in the liquidity and other functioning of financial markets, including such disruptions in the markets for real estate and other assets commonly securing financial products. Actions by the Federal Reserve and other government agencies, including those that impact money supply and market interest rates. Changes in our customers, suppliers and other counterparties performance in general and their creditworthiness in particular. Changes in customer preferences and behavior, whether as a result of changing business and economic conditions or other factors. A continuation of recent turbulence in significant portions of the global financial markets could impact our performance, both directly by affecting our revenues and the value of our assets and liabilities and indirectly by affecting the economy generally. Our operating results are affected by our liability to provide shares of BlackRock common stock to help fund certain BlackRock long-term incentive plan (LTIP) programs, as our LTIP liability is adjusted quarterly (marked-to-market) based on changes in BlackRocks common stock price and the number of remaining committed shares, and we recognize gain or loss on such shares at such times as shares are transferred for payouts under the LTIP programs. Competition can have an impact on customer acquisition, growth and retention, as well as on our credit spreads and product pricing, which can affect market share, deposits and revenues. |

Our ability to implement our business initiatives and strategies could affect our financial performance over the next several years. Legal and regulatory developments could have an impact on our ability to operate our businesses or our financial condition or results of operations or our competitive position or reputation. Reputational impacts, in turn, could affect matters such as business generation and retention, our ability to attract and retain management, liquidity, and funding. These legal and regulatory developments could include: (a) the unfavorable resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to laws and regulations involving tax, pension, education lending, and the protection of confidential customer information; and (e) changes in accounting policies and principles. Our business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through the effective use of third-party insurance, derivatives, and capital management techniques. Our ability to anticipate and respond to technological changes can have an impact on our ability to respond to customer needs and to meet competitive demands. The adequacy of our intellectual property protection, and the extent of any costs associated with obtaining rights in intellectual property claimed by others, can impact our business and operating results. Our business and operating results can also be affected by widespread natural disasters, terrorist activities or international hostilities, either as a result of the impact on the economy and capital and other financial markets generally or on us or on our customers, suppliers or other counterparties specifically. Also, risks and uncertainties that could affect the results anticipated in forward-looking statements or from historical performance relating to our equity interest in BlackRock, Inc. are discussed in more detail in BlackRocks 2006 Form 10-K, including in the Risk Factors section, and in BlackRocks other filings with the SEC, accessible on the SECs website and on or through BlackRocks website at www.blackrock.com. We grow our business from time to time by acquiring other financial services companies, including our pending Sterling Financial Corporation (Sterling) acquisition. Acquisitions in general present us with risks other than those presented by the nature of the business acquired. In particular, acquisitions may be substantially more expensive to complete (including as a result of costs incurred in connection with the integration of the acquired company) and the anticipated benefits (including anticipated cost savings and strategic gains) may be significantly harder or take longer to achieve than expected. In some cases, acquisitions involve our entry into new businesses or new geographic or other markets, and these situations also present risks resulting from our inexperience in these new areas. As a regulated financial institution, our pursuit of attractive acquisition opportunities could be negatively impacted due to regulatory delays or other regulatory issues. Regulatory and/or legal issues related to the pre-acquisition operations of an acquired business may cause reputational harm to PNC following the acquisition and integration of the acquired business into ours and may result in additional future costs arising as a result of those issues. Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs, Sterlings or other companys actual or anticipated results. Cautionary Statement Regarding Forward-Looking Information (continued)

Appendix |

The

PNC Financial Services Group, Inc. and Sterling Financial Corporation will be filing a proxy statement/prospectus and other relevant documents concerning the merger with the United States Securities and Exchange Commission (the SEC). WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents free of charge at the SECs web site at http://www.sec.gov. In addition, documents filed with the SEC by The PNC Financial Services Group, Inc. will be available free of charge from Shareholder Relations at (800) 843-2206. Documents filed with the SEC by Sterling Financial Corporation will be available free of charge from Sterling Financial Corporation by contacting Shareholder Relations at (877) 248-6420. The directors, executive officers, and certain other members of management and employees of Sterling Financial Corporation are participants in the solicitation of proxies in favor of the merger from the shareholders of Sterling Financial Corporation. Information about the directors and executive officers of Sterling Financial Corporation is included in the proxy statement for its May 8, 2007 annual meeting of shareholders, which was filed with the SEC on April 2, 2007. Additional information regarding the interests of such participants will be included in the proxy statement/prospectus and the other relevant documents filed with the SEC when they become available. Additional Information About The PNC/Sterling Financial Corporation Transaction Appendix |

CMBS

Supplemental Information Appendix PNC CMBS Portfolio Spread Volatility 0 2 4 6 8 10 12 14 10 Year, AAA CMBS vs swaps, bps Weekly CMBS Spread Volatility (03/29/05 12/04/07) 2005 2006

2007 Source: JPMorgan 08/01/07 11/19/07 High quality portfolio -Internal assessment of 85%+

AAA equivalent -Modest level of kick-outs

-Weighted average loan to

value of 72% with conservative escrows -Average debt service

coverage of 1.3x with 90%+ amortizing loans versus common trend of extended term interest-only financing |

Non-GAAP

to GAAP Reconcilement Earnings Summary Nine Months Ended Appendix NINE MONTHS ENDED In millions, except per share data Adjustments, Net Diluted Adjustments, Net Diluted Pretax Income EPS Pretax Income EPS Net income, as reported $1,289 $3.85 $2,219 $7.46 Adjustments: BlackRock LTIP (a) $(1) (1) Integration costs (b) 72 49 .15 $91 39 .13 Gain on BlackRock/MLIM transaction (c) (2,078) (1,293) (4.35) Securities portfolio rebalancing loss (c) 196 127 .43 Mortgage loan portfolio repositioning loss (c) 48 31 .10 Net income, as adjusted $1,337 $4.00 $1,123 $3.77 September 30 NINE MONTHS ENDED 2004 2005 2006 2007 CAGR Net income, as reported $890 $970 $2,219 $1,289 13% Net income, as adjusted 890 970 1,123 1,337 15% Diluted earnings per share, as reported 3.13 3.35 7.46 3.85 7% Diluted earnings per share, as adjusted $3.13 $3.35 $3.77 $4.00 9% (c) Included in noninterest income on a pretax basis. September 30, 2007 September 30, 2006 (a) Includes the impact of the gain recognized in connection with PNC's transfer of BlackRock shares to satisfy a portion of PNC's BlackRock LTIP shares obligation and the net mark-to-market adjustment on PNC's remaining BlackRock LTIP shares obligation.

(b) In addition to acquisition integration costs related to recent or pending PNC acquisitions reflected in the 2007 period presented, both the 2007 and the 2006 periods presented include BlackRock/MLIM transaction integration costs. BlackRock/MLIM transaction integration costs recognized by PNC for the first nine months of 2007 were included in noninterest income as a negative component of the "Asset management" line item, which includes the impact of PNC's equity earnings from PNC's investment in BlackRock. The first nine months of 2006 BlackRock/MLIM transaction integration costs were included

in noninterest expense. |

Non-GAAP

to GAAP Reconcilement Income Statement Summary For the Nine Months Ended September 30 Appendix NINE MONTHS ENDED In millions As Reported Adjustments As Adjusted (a) As Reported Adjustments As Adjusted (b) Net interest income $2,122 $2,122 $1,679 ($10) $1,669 Net interest income: % Change As Reported % Change As Adjusted Loans 806 806 682 (10) 672 18% 20% Deposits 1,316 1,316 997 997 32% 32% Noninterest Income 2,956 $4 2,960 5,358 (2,777) 2,581 (45%) 15% Total revenue 5,078 4 5,082 7,037 (2,787) 4,250 (28%) 20% Loan net interest income as a % of total revenue 15.9% 15.9% 9.7% 15.8% Deposit net interest income as a % of total revenue 25.9% 25.9% 14.2% 23.5% Noninterest income as a % of total revenue 58.2% 58.2% 76.1% 60.7% Provision for credit losses 127 127 82 82 Noninterest income 2,956 4 2,960 5,358 (2,777) 2,581 Noninterest expense 3,083 (67) 3,016 3,474 (856) 2,618 (11%) 15% Income before minority interest and income taxes 1,868 71 1,939 3,481 (1,931) 1,550 Minority interest in income of BlackRock 47 (47) Income taxes 579 23 602 1,215 (788) 427 Net income $1,289 $48 $1,337 $2,219 ($1,096) $1,123 (42%) 19% OPERATING LEVERAGE - NINE MONTHS ENDED As Reported As Adjusted Total revenue (28%) 20% Noninterest expense (11%) 15% Operating leverage (17%) 5% (a) Amounts adjusted to exclude the impact of the following pretax items: (1) the gain of $83 million recognized in connection with PNC's transfer of BlackRock shares to satisfy a portion of our BlackRock LTIP shares obligation, (2) the net mark-to-market adjustment totaling $82 million on our remaining BlackRock LTIP shares obligation, and (3) acquisition and BlackRock/MLIM transaction integration costs totaling $72 million. The net tax impact of these items is

reflected in the adjustment to income taxes. (b) Amounts adjusted to exclude the impact of the following pretax items: (1) the gain of $2.078 billion on the BlackRock/MLIM transaction, (2) the loss of $196 million on the securities portfolio rebalancing, (3) BlackRock/MLIM transaction integration costs of $91 million for the first nine months of 2006, and (4) the mortgage loan portfolio repositioning loss of $48 million. The net tax impact of these items is reflected in the adjustment to income taxes. We believe that information as adjusted for the impact of these items may be useful due to the extent to which these items are not indicative of our ongoing operations as the result of our management activities. Additionally, the amounts are also adjusted as if we had recorded our investment in BlackRock on the equity method. We believe that providing amounts adjusted as if we had recorded our investment in BlackRock on the equity method for all periods presented helps provide a basis of comparability for the impact of the BlackRock deconsolidation given the magnitude of the

impact on various components of our consolidated income statement. 2006 to 2007

Change September 30, 2007 September 30, 2006 |

Non-GAAP

to GAAP Reconcilement Income Statement Summary For the Three Months Ended Appendix For the three months ended September 30, 2007 PNC PNC In millions As Reported Adjustments (a) As Adjusted Reported Adjusted Net interest income $761 $761 Loan net interest income 294 294 5% 5% Deposit net interest income 467 467 2% 2% Provision for credit losses 65 65 Net interest income less provision for credit losses 696 696 Asset management 204 $2 206 Other 786 50 836 Total noninterest income 990 52 1,042 2% 7% Compensation and benefits 553 (16) 537 Other 546 (25) 521 Total noninterest expense 1,099 (41) 1,058 6% 3% Income before income taxes 587 93 680 Income taxes 180 31 211 Net income $407 $62 $469 (4%) 8% For the three months ended June 30, 2007 PNC PNC In millions As Reported Adjustments (b) As Adjusted Net interest income $738 $738 Loan net interest income 280 280 Deposit net interest income 458 458 Provision for credit losses 54 54 Net interest income less provision for credit losses 684 684 Asset management 190 $1 191 Other 785 1 786 Total noninterest income 975 2 977 Compensation and benefits 544 (9) 535 Other 496 (6) 490 Total noninterest expense 1,040 (15) 1,025 Income before income taxes 619 17 636 Income taxes 196 6 202 Net income $423 $11 $434 % Change vs. June 30, 2007 (a) Includes the impact of the following items on a pretax basis: $50 million net loss related to our BlackRock LTIP shares obligation and $43 million of acquisition and BlackRock/MLIM transaction integration costs. The net tax impact of these items is reflected

in the adjustment to income taxes. (b) Includes the impact of the following items on a pretax basis: $16 million of acquisition and BlackRock/MLIM transaction integration costs and $1 million net loss related to our BlackRock LTIP shares obligation. The net tax impact of these items is

reflected in the adjustment to income taxes. |

Non-GAAP

to GAAP Reconcilement Income Statement Summary 2004 to 2006 Appendix BlackRock For the year ended December 31, 2006 PNC Deconsolidation and BlackRock PNC In millions As Reported Adjustments (a) Other Adjustments Equity Method As Adjusted Net interest income $2,245 $(10) $2,235 Provision for credit losses 124 124 Noninterest income 6,327 $(1,812) (1,087) $144 3,572 Noninterest expense 4,443 (91) (765) 3,587 Income before minority interest and income taxes 4,005 (1,721) (332) 144 2,096 Minority interest in income of BlackRock 47 18 (65) Income taxes 1,363 (658) (130) 7 582 Net income $2,595 $(1,081) $(137) $137 $1,514 For the year ended December 31, 2005 BlackRock PNC Deconsolidation and BlackRock PNC In millions As Reported Other Adjustments Equity Method As Adjusted Net interest income $2,154 $(12) $2,142 Provision for credit losses 21 21 Noninterest income 4,173 (1,214) $163 3,122 Noninterest expense 4,306 (853) 3,453 Income before minority interest and income taxes 2,000 (373) 163 1,790 Minority interest in income of BlackRock 71 (71) Income taxes 604 (150) 11 465 Net income $1,325 $(152) $152 $1,325 (a) Includes the impact of the following items, all on a pretax basis, and adjustment for the tax impact thereof: $2,078 million gain on BlackRock/MLIM transaction, $196 million securities portfolio rebalancing loss, $101 million of BlackRock/MLIM transaction integration costs, $48 million mortgage loan portfolio repositioning loss, and $12 million net loss related to our BlackRock LTIP shares obligation.

|

Non-GAAP

to GAAP Reconcilement Income Statement Summary 2004 to 2006 (continued) Appendix For the year ended December 31, 2004 BlackRock PNC Deconsolidation and BlackRock PNC In millions As Reported Other Adjustments Equity Method As Adjusted Net interest income $1,969 $(14) $1,955 Provision for credit losses 52 52 Noninterest income 3,572 (745) $101 2,928 Noninterest expense 3,712 (564) 3,148 Income before minority interest and income taxes 1,777 (195) 101 1,683 Minority interest in income of BlackRock 42 (42) Income taxes 538 (59) 7 486 Net income $1,197 $(94) $94 $1,197 CAGR In millions 2004 2005 2006 As Adjusted Adjusted net interest income $1,955 $2,142 $2,235 Adjusted noninterest income 2,928 3,122 3,572 Adjusted total revenue 4,883 5,264 5,807 9% Adjusted noninterest expense 3,148 3,453 3,587 7% Adjusted net income $1,197 $1,325 $1,514 12% In millions 2004 2005 2006 CAGR Net interest income, as reported $1,969 $2,154 $2,245 Noninterest income, as reported 3,572 4,173 6,327 Total revenue, as reported 5,541 6,327 8,572 24% Noninterest expense, as reported 3,712 4,306 4,443 9% Net income, as reported $1,197 $1,325 $2,595 47% |

Non-GAAP

to GAAP Reconcilement Business Segments Appendix Nine Months Ending September 30, 2007 Dollars in millions Retail Banking Corporate & Institutional Banking Other Banking and Other BlackRock PFPC Total Net interest income (expense) $1,517 $571 $48 $2,136 ($14) $2,122 Noninterest income 1,280 558 260 2,098 $227 631 2,956 Total Revenue $2,797 $1,129 $308 $4,234 $227 $617 $5,078 Noninterest income as a % of total revenue 46% 49% 84% 50% 100% 102% 58% Dollars in millions 2007 % of Segments 2006 % Change Retail Banking $678 53% $581 17% Corporate & Institutional Banking 341 26% 328 4% BlackRock (a) 176 14% 137 28% PFPC 96 7% 93 3% Total business segment earnings 1,291 1,139 Other (a)(b) (2) 1,080 Total consolidated net income $1,289 $2,219 Nine Months Ending September 30 Earnings (Loss) (a) For our segment reporting presentation in management's discussion and analysis, after-tax BlackRock/MLIM transaction integration costs totaling $4 million and $56 million for the nine months ended September 30, 2007 and September 30, 2006 have been reclassified from BlackRock to "Other." "Other" for the first nine months of 2007 also includes $45 million of after-tax Mercantile acquisition integration costs. (b) "Other" for the first nine months of 2006 included the $2,078 million pre-tax, or

$1,293 million after-tax, gain on the BlackRock/MLIM transaction recorded in the

third quarter of 2006. |

The PNC

Financial Services Group, Inc. PNC BB&T Corporation BBT Comerica CMA Fifth Third Bancorp FITB KeyCorp KEY National City Corporation NCC Regions Financial RF SunTrust Banks, Inc. STI U.S. Bancorp USB Wachovia Corporation WB Wells Fargo & Company WFC Ticker Peer Group of Super-Regional Banks Appendix |