SLIDE PRESENTATION - 2006 ANNUAL MEETING OF SHAREHOLDERS

Published on April 25, 2006

The PNC

Financial Services Group, Inc. Annual Meeting of Shareholders April 25, 2006 Exhibit 99.1 |

James E.

Rohr Chairman and Chief Executive Officer |

This presentation contains forward-looking statements regarding our outlook or

expectations relating to PNCs future business, operations, financial

condition, financial performance and asset quality.

Forward-looking statements are necessarily subject to numerous

assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation are qualified by the factors

affecting forward-looking statements identified in the more detailed

Cautionary Statement included in the version of the presentation materials

posted on our corporate website at www.pnc.com. We provide

greater detail regarding those factors in our 2005 Form 10-K, including

the Risk Factors and Risk Management sections, and in our other SEC reports (accessible on the SECs website at www.sec.gov and on or through our corporate

website). Future events or circumstances may change our outlook or expectations and may also

affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. The forward-looking statements in this presentation

speak only as of the date of this presentation. We do not assume any

duty and do not undertake to update those statements. This presentation may also include a discussion of non-GAAP financial measures,

which, to the extent not so qualified therein, is qualified by GAAP

reconciliation information available on our corporate website at www.pnc.com

under For Investors. Cautionary Statement Regarding Forward-Looking Information |

2005

Accomplishments Financial Highlights Earned record $1.3 billion Reported 16.6% return on average common equity Stock outperformed S&P and 10-bank peer group* 11.6% total shareholder return for 2005 Key Strategies Customer at the center of everything we do Focused on operating leverage Risk management as a differentiator Disciplined and effective capital management * Peer Group of 10 super-regional banks is identified in 2006 Proxy and

Appendix |

Generating Continued Growth $0 $20 $40 $60 $80 $100 2003 2004 2005 $0 $1 $2 $3 $4 $5 $6 $7 2003 2004 2005 $0.0 $0.5 $1.0 $1.5 2003 2004 2005 Dollars in billions Record $89 billion Record $6.3 billion Record $1.3 billion Revenue Average Assets Earnings |

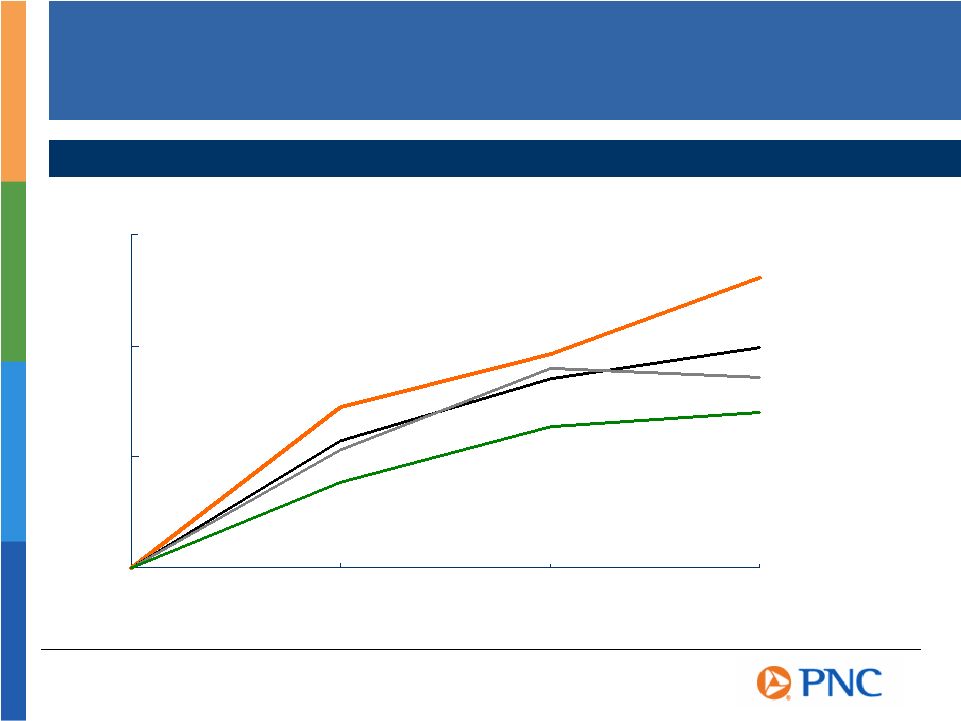

$100 $125 $150 $175 Comparison of Cumulative Three-Year Total Return (INCLUDES REINVESTMENT OF DIVIDENDS) PNC S&P 500 Peer Group * 12/31/02 12/31/03 12/31/04 12/31/05 S&P 500 Banks Value of $100 Investment Relative Total Return Performance * Peer Group of 10 super-regional banks is identified in 2006 Proxy and

Appendix |

Commitment to

Our Constituencies Focused on teamwork Strong benefits program Working Mother magazine recognition Shareholders Best 1 and 3 year total shareholder returns of 10-bank peer group Invested in growth opportunities Managed risk/reward Customers High customer satisfaction ratings Significantly improved the customer experience Products & processes focused on ease & convenience Employees Communities Grow Up Great wins Reading is Fundamental award PNC Foundation contributed $11 million Employees volunteered more than 1 million hours |

PNC Receives

National Recognition Recognized by Reading is Fundamental for supporting

childrens literacy through PNC Grow Up Great Fortune magazines Americas Most Admired Companies PNC ranked 5 th among super-regional banks Earned prestigious Presidential E award for export service Reaffirmed as part of KLDs Domini 400 Social Index Named to Training magazines Training Top 100 list for the second consecutive year |

First Quarter

2006 Highlights Reported net income of $354 million Return on average common equity was 16.67% Increased second quarter dividend by 10% to $2.20 per share annualized 2006 year-to-date total shareholder return of 14.53% BlackRock announced agreement to merge with Merrill Lynchs investment management business and PNC expects to report an after-tax gain of approximately $1.6 billion |

We make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses and/or other matters regarding or affecting PNC that are forward-looking

statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, outlook, estimate, forecast, project and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and

uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update

our forward-looking statements. Actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking

statements, and future results could differ materially from our historical performance. Our forward-looking statements are subject to the following principal risks and

uncertainties. We provide greater detail regarding these factors in our Form 10-K for the year ended December 31, 2005, including in the Risk Factors and Risk Management

sections. Our forward-looking statements may also be subject to other risks and uncertainties including those that we may discuss elsewhere in this presentation or in our filings with the SEC, accessible on the SECs website at www.sec.gov and on or through our corporate website at www.pnc.com. Our business and operating results are affected by business and economic conditions

generally or specifically in the principal markets in which we do business. We are affected by changes in our customers financial performance, as well as changes in customer preferences and behavior,

including as a result of changing economic conditions The value of our assets and liabilities as well as our overall financial performance

are affected by changes in interest rates or in valuations in the debt and

equity markets. Actions by the Federal Reserve and other government agencies, including those that impact money supply and market interest rates, can affect our activities and financial results. Competition can have an impact on customer acquisition, growth and retention, as well

as on our credit spreads and product pricing, which can affect market

share, deposits and revenues. Our ability to implement our One PNC initiative, as well as other business initiatives

and strategies we may pursue, could affect our financial performance over

the next several years. Our ability to grow successfully through acquisitions is impacted by a number of risks

and uncertainties related both to the acquisition transactions themselves

and to the integration of the acquired businesses into PNC after closing. These uncertainties are present in transactions such as the pending acquisition by BlackRock of Merrill Lynchs investment management

business. Cautionary Statement Regarding Forward-Looking Information |

Legal and regulatory developments could have an impact on our ability to operate our

businesses or our financial condition or results of operations or our

competitive position or reputation. Reputational impacts, in turn, could affect matters such as business generation and retention, our ability to attract and retain management, liquidity and funding. These developments could

include: (a) the resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent

regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms,

including changes to laws and regulations involving tax, pension, and the protection of confidential customer information; and (e) changes in accounting

policies and principles. Our business and operating results are affected by our ability to identify and

effectively manage risks inherent in our businesses, including, where appropriate, through the effective use of third-party insurance and capital

management techniques. Our ability to anticipate and respond to technological changes can have an impact on

our ability to respond to customer needs and to meet competitive

demands. The adequacy of our intellectual property protection, and the extent of any costs associated with obtaining rights in intellectual property claimed by others, can also impact our business and operating results.

Our business and operating results can be affected by widespread natural disasters, terrorist activities or international hostilities, either as a result of the impact on the economy and financial and capital markets generally or on us or on

our customers, suppliers or other counterparties specifically. Also, risks

and uncertainties that could affect the results anticipated in forward-looking statements or from historical performance relating to our majority-owned subsidiary BlackRock, Inc. are discussed in more detail in BlackRocks 2005 Form

10-K, including in the Risk Factors section, and in BlackRocks other filings with the SEC, accessible on the SECs website and on or through BlackRocks

website at www.blackrock.com Any annualized, proforma, estimated, third party

or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on

the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs actual or anticipated results. Cautionary Statement Regarding Forward-Looking Information (continued)

|

BB&T Corporation BBT The Bank of New York Company, Inc. BK Fifth Third Bancorp FITB KeyCorp KEY National City Corporation NCC The PNC Financial Services Group, Inc. PNC SunTrust Banks, Inc. STI U.S. Bancorp USB Wachovia Corporation WB Wells Fargo & Company WFC Ticker 2005 Peer Group of Super-Regional Banks Appendix |