10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on November 7, 2005

Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2005

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 25-1435979 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

One PNC Plaza, 249 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2707

(Address of principal executive offices)

(Zip Code)

(412) 762-2000

(Registrants telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

As of October 31, 2005, there were 292,235,497 shares of the registrants common stock ($5 par value) outstanding.

Table of Contents

The PNC Financial Services Group, Inc.

Cross-Reference Index to 2005 Third Quarter Form 10-Q

|

Pages |

||

| PART I FINANCIAL INFORMATION |

||

| Item 1. Financial Statements (Unaudited). |

39-60 | |

| 39 | ||

| 40 | ||

| 41 | ||

| 42 | ||

| 46 | ||

| 47 | ||

| 48 | ||

| 49 | ||

| 50 | ||

| 50 | ||

| Note 8 Certain Employee Benefit And Stock-Based Compensation Plans |

51 | |

| 52 | ||

| 54 | ||

| 55 | ||

| 56 | ||

| 57 | ||

| 59 | ||

| 60 | ||

| Average Consolidated Balance Sheet And Net Interest Analysis |

61-62 | |

| Item 2. Managements Discussion and Analysis of Financial Condition and Results of Operations. |

1-38,61-62 | |

| 1-2 | ||

| 3 | ||

| 7 | ||

| 11 | ||

| Off-Balance Sheet Arrangements And Variable Interest Entities |

15 | |

| 16 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 25 | ||

| 35 | ||

| 35 | ||

| 37 | ||

| Item 3. Quantitative and Qualitative Disclosures About Market Risk. |

25-34 | |

| Item 4. Controls and Procedures. |

35 | |

| PART II OTHER INFORMATION |

||

| Item 1. Legal Proceedings. |

63 | |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds. |

63 | |

| Item 5. Other Information. |

63 | |

| Item 6. Exhibits. |

64 | |

| 64 | ||

| 65 | ||

Table of Contents

CONSOLIDATED FINANCIAL HIGHLIGHTS

THE PNC FINANCIAL SERVICES GROUP, INC.

| Dollars in millions, except per share data Unaudited |

Three months ended September 30 |

Nine months ended September 30 |

||||||||||||||

|

2005 |

2004 |

2005 |

2004 |

|||||||||||||

| FINANCIAL PERFORMANCE |

||||||||||||||||

| Revenue |

||||||||||||||||

| Net interest income (taxable-equivalent basis) (a) |

$ | 566 | $ | 498 | $ | 1,619 | $ | 1,480 | ||||||||

| Noninterest income |

1,113 | 838 | 3,011 | 2,659 | ||||||||||||

| Total revenue |

$ | 1,679 | $ | 1,336 | $ | 4,630 | $ | 4,139 | ||||||||

| Net income |

$ | 334 | $ | 258 | $ | 970 | $ | 890 | ||||||||

| Per common share |

||||||||||||||||

| Diluted earnings |

$ | 1.14 | $ | .91 | $ | 3.35 | $ | 3.13 | ||||||||

| Cash dividends declared |

$ | .50 | $ | .50 | $ | 1.50 | $ | 1.50 | ||||||||

| SELECTED RATIOS |

||||||||||||||||

| Net interest margin |

2.96 | % | 3.19 | % | 2.99 | % | 3.22 | % | ||||||||

| Noninterest income to total revenue |

67 | 63 | 65 | 64 | ||||||||||||

| Efficiency |

69 | 74 | 69 | 68 | ||||||||||||

| Return on |

||||||||||||||||

| Average common shareholders equity |

16.13 | % | 14.42 | % | 16.49 | % | 16.86 | % | ||||||||

| Average assets |

1.45 | 1.36 | 1.48 | 1.60 | ||||||||||||

See page 35 for a glossary of certain terms used in this Report.

Certain prior period amounts included in these Consolidated Financial Highlights have been reclassified to conform with the current period presentation.

| (a) | The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than a taxable investment. To provide more meaningful comparisons of yields and margins for all interest-earning assets, we have increased the interest income earned on tax-exempt assets to make it fully equivalent to interest income on other taxable investments. This adjustment is not permitted under generally accepted accounting principles (GAAP) on the Consolidated Income Statement. |

The following is a reconciliation of net interest income as reported in the Consolidated Income Statement to net interest income on a taxable-equivalent basis (in millions):

|

Three months ended September 30 |

Nine months ended September 30 |

|||||||||||

|

2005 |

2004 |

2005 |

2004 |

|||||||||

| Net interest income, GAAP basis |

$ | 559 | $ | 491 | $ | 1,599 | $ | 1,466 | ||||

| Taxable-equivalent adjustment |

7 | 7 | 20 | 14 | ||||||||

| Net interest income, taxable-equivalent basis |

$ | 566 | $ | 498 | $ | 1,619 | $ | 1,480 | ||||

1

Table of Contents

| Unaudited |

September 30 2005 |

December 31 2004 |

September 30 2004 |

|||||||||

| BALANCE SHEET DATA (dollars in millions, except per share data) |

||||||||||||

| Assets |

$ | 93,241 | $ | 79,723 | $ | 77,298 | ||||||

| Loans, net of unearned income |

50,510 | 43,495 | 42,480 | |||||||||

| Allowance for loan and lease losses |

634 | 607 | 581 | |||||||||

| Securities |

20,658 | 16,761 | 16,824 | |||||||||

| Loans held for sale |

2,377 | 1,670 | 1,582 | |||||||||

| Deposits |

60,214 | 53,269 | 51,162 | |||||||||

| Borrowed funds |

18,374 | 11,964 | 12,919 | |||||||||

| Allowance for unfunded loan commitments and letters of credit |

79 | 75 | 96 | |||||||||

| Shareholders equity |

8,317 | 7,473 | 7,312 | |||||||||

| Common shareholders equity |

8,309 | 7,465 | 7,304 | |||||||||

| Book value per common share |

28.54 | 26.41 | 25.89 | |||||||||

| Common shares outstanding (millions) |

291 | 283 | 282 | |||||||||

| Loans to deposits |

84 | % | 82 | % | 83 | % | ||||||

| ASSETS UNDER MANAGEMENT (billions) |

$ | 469 | $ | 383 | $ | 362 | ||||||

| FUND ASSETS SERVICED (billions) |

||||||||||||

| Accounting/administration net assets |

$ | 793 | $ | 721 | $ | 667 | ||||||

| Custody assets |

475 | 451 | 418 | |||||||||

| CAPITAL RATIOS |

||||||||||||

| Tier 1 Risk-based |

8.4 | % | 9.0 | % | 9.0 | % | ||||||

| Total Risk-based |

12.5 | 13.0 | 12.5 | |||||||||

| Leverage |

7.1 | 7.6 | 7.7 | |||||||||

| Tangible common |

4.9 | 5.7 | 5.6 | |||||||||

| Common shareholders equity to assets |

8.91 | 9.36 | 9.45 | |||||||||

| ASSET QUALITY RATIOS |

||||||||||||

| Nonperforming assets to loans, loans held for sale and foreclosed assets |

.29 | % | .39 | % | .42 | % | ||||||

| Nonperforming loans to loans |

.25 | .33 | .35 | |||||||||

| Net charge-offs to average loans (for the three months ended) |

.12 | .13 | .12 | |||||||||

| Allowance for loan and lease losses to loans |

1.26 | 1.40 | 1.37 | |||||||||

| Allowance for loan and lease losses to nonperforming loans |

499 | 424 | 393 | |||||||||

2

Table of Contents

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review should be read together with our unaudited Consolidated Financial Statements and unaudited Statistical Information included elsewhere in this Report and Items 6, 7, 8 and 9A of our 2004 Annual Report on Form 10-K (2004 Form 10-K). We have reclassified certain prior period amounts to conform with the current year presentation. For information regarding certain business and regulatory risks, see the Risk Factors and Risk Management sections in this Financial Review and Items 1 and 7 of our 2004 Form 10-K. Also, see the Cautionary Statement Regarding Forward-Looking Information and Critical Accounting Policies And Judgments sections in this Financial Review for certain other factors that could cause actual results or future events to differ materially from those anticipated in the forward-looking statements included in this Report or from historical performance. See Note 13 Business Segments in the Notes To Consolidated Financial Statements included in Part I, Item 1 of this Report for a reconciliation of total business segment earnings to total PNC consolidated net income as reported on a generally accepted accounting principles (GAAP) basis.

THE PNC FINANCIAL SERVICES GROUP, INC.

PNC is one of the largest diversified financial services companies in the United States, operating businesses engaged in consumer banking, institutional banking, asset management and global fund processing services. We operate directly and through numerous subsidiaries, providing many of our products and services nationally and others in our primary geographic markets in Pennsylvania, New Jersey, Delaware, Ohio, Kentucky and the Washington, D.C. area. We also provide certain asset management and global fund processing services internationally.

KEY STRATEGIC GOALS

Our strategy to enhance shareholder value centers on achieving growth in our various businesses underpinned by prudent management of risk, capital and expenses. In each of our business segments, the primary drivers of growth are the acquisition, expansion and retention of customer relationships. We strive to achieve such growth in our customer base by providing convenient banking options, leading technological systems and a broad range of asset management products and services. We also intend to grow through appropriate and targeted acquisitions and, in certain businesses, by expanding into new geographical markets.

In recent years, we have managed our interest rate risk to achieve a moderate risk profile with limited exposure to earnings volatility resulting from interest rate fluctuations. Our actions have created a balance sheet characterized by strong asset quality and significant flexibility to take advantage, where appropriate, of changing interest rates and to adjust to changing market conditions.

On October 11, 2005, we acquired Harris Williams & Co. (Harris Williams), one of the nations largest firms focused on providing merger and acquisition advisory and related services to middle market companies, including private equity firms and private and public companies. This acquisition should provide opportunities for commercial lending as well as wealth management and capital markets business growth. We expect Harris Williams to be accretive to our earnings immediately.

As previously reported, we successfully completed our acquisition of Riggs National Corporation (Riggs), a Washington, D.C.-based banking company, in May 2005. The transaction gives us a substantial presence on which to build a market leading franchise in the affluent Washington metropolitan area. We include additional information on Riggs, as well as the first quarter 2005 acquisition of SSRM Holdings, Inc. (SSRM) by our majority-owned subsidiary, BlackRock, Inc. (BlackRock), in Note 2 Acquisitions in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report.

THE ONE PNC INITIATIVE

The One PNC initiative, which began in January 2005, is an ongoing, company-wide initiative with goals of moving closer to the customer, improving our overall efficiency and targeting resources to more value-added activities. PNC expects to realize $400 million of total pretax earnings benefit by 2007 from this initiative. As a result of this intensive process, we have reorganized our banking businesses to reduce bureaucracy and to better serve our customer base. The initiative has resulted in a simplified and a more centrally managed organization. As further described in our Current Report on Form 8-K dated September 30, 2005, our banking businesses have been reorganized into two units, Consumer Banking and Institutional Banking, and we have aligned our reporting accordingly. We include further details on this change under Business Segment Highlights in this Financial Review.

PNC plans to achieve approximately $300 million of cost savings initiatives through a combination of workforce reduction and other efficiency initiatives. Of the approximately 3,000 positions to be eliminated, approximately 1,800 had been eliminated as of September 30, 2005. We estimate that these changes will result in employee severance and other implementation costs of up to $85 million, including $44 million recognized during the third quarter of 2005. We expect that the remaining charges will be incurred during the fourth quarter of 2005 and through 2006.

In addition, PNC intends to achieve at least $100 million in net revenue growth through the implementation of various pricing and business growth enhancements driven by the One PNC initiative. Initiatives to achieve this growth are progressing according to plan. We expect to begin realizing a net financial benefit from the program in the fourth quarter of 2005, with a more significant impact in 2006.

KEY FACTORS AFFECTING FINANCIAL PERFORMANCE

Our financial performance is substantially affected by several external factors outside of our control, including:

| | General economic conditions, |

| | Loan demand and utilization of credit commitments, |

| | Interest rates, and the shape of the interest rate yield curve, |

3

Table of Contents

| | The performance of the capital markets, and |

| | Customer demand for other products and services. |

In addition to changes in general economic conditions, including the direction, timing and magnitude of movement in interest rates and the performance of the capital markets, our success for the remainder of 2005 and in 2006 will depend, among other things, upon:

| | Further success in the acquisition, growth and retention of customers, |

| | Successful execution of the One PNC initiative, |

| | Growth in market share across businesses, |

| | A sustained focus on expense management and improved efficiency, |

| | Maintaining strong overall asset quality, and |

| | Prudent risk and capital management. |

SUMMARY FINANCIAL RESULTS

|

Three months ended |

Nine months ended |

|||||||||||||||

| In millions, except for per share data |

Sept. 30 2005 |

Sept. 30 2004 |

Sept. 30 2005 |

Sept. 30 2004 |

||||||||||||

| Net income |

$ | 334 | $ | 258 | $ | 970 | $ | 890 | ||||||||

| Diluted earnings per share |

$ | 1.14 | $ | .91 | $ | 3.35 | $ | 3.13 | ||||||||

| Return on |

||||||||||||||||

| Average common shareholders equity |

16.13 | % | 14.42 | % | 16.49 | % | 16.86 | % | ||||||||

| Average assets |

1.45 | % | 1.36 | % | 1.48 | % | 1.60 | % | ||||||||

Results for the first nine months of 2005 included the impact of the following items:

| | Implementation costs recognized in the third quarter totaling $29 million after-tax, or $.10 per diluted share, related to the One PNC initiative; |

| | Integration costs of $19 million after-tax, or $.07 per diluted share, comprised of provision for credit losses, noninterest expense and deferred taxes, related to the acquisition of Riggs; and |

| | The reversal of deferred tax liabilities that benefited earnings by $45 million, or $.16 per diluted share, in the first quarter related to our previously reported transfer of ownership in BlackRock from PNC Bank, National Association (PNC Bank, N.A.) to PNC Bancorp, Inc. that took place in January 2005. |

Results for the first nine months and third quarter of 2004 reflected the impact of a charge totaling $42 million after taxes, or $.15 per diluted share, associated with initial expense recognition for the 2002 BlackRock Long-Term Retention and Incentive Plan (LTIP) during the third quarter of that year. We recognized after-tax LTIP charges of $23 million, or $.08 per diluted share, in the first nine months of 2005, including $8 million in the third quarter of 2005.

Our third quarter 2005 performance included the following accomplishments:

| | Taxable-equivalent net interest income increased $68 million, or 14%, compared with the third quarter of 2004 as increased earning assets and higher yields on assets more than offset a decrease in the net interest margin. |

| | Average loans increased $7.7 billion, or 18%, compared with the third quarter of 2004, driven by targeted sales efforts and the impact of Riggs. |

| | Average deposits increased $9.2 billion, or 18%, compared with the prior year third quarter, driven by higher certificates of deposit, money market and demand deposit balances, including the impact of Riggs. Average interest-bearing deposits increased 21% and average demand and other noninterest-bearing deposits increased 10% compared with the third quarter of 2004. |

| | Noninterest income increased 33% compared with the third quarter of 2004 driven by higher asset management fees, increased banking fees, higher trading revenues and higher equity management revenue. These factors were partially offset by net securities losses in the third quarter of 2005 compared with net securities gains in the third quarter of 2004. |

| | Noninterest expense rose $175 million, or 18%, in the third quarter of 2005 compared with the prior year third quarter. Noninterest expense for the third quarter of 2005 included $211 million of BlackRock operating expenses (including $16 million of LTIP expenses), $44 million of One PNC initiative charges, and $47 million of Riggs expenses. Third quarter 2004 noninterest expense included $190 million of BlackRock operating expenses (including $96 million of LTIP charges). |

| | Asset quality remained very strong. The ratio of nonperforming loans to total loans fell to .25% at September 30, 2005 from .35% at September 30, 2004 and the ratio of nonperforming assets to total assets declined to .17% from .24% in the same comparison. |

BALANCE SHEET HIGHLIGHTS

Total assets were $93.2 billion at September 30, 2005. Total average assets were $87.4 billion for the first nine months of 2005 compared with $74.1 billion for the first nine months of 2004. This increase was primarily attributable to a $11.0 billion increase in interest-earning assets. An increase of $6.6 billion in average loans was the primary factor for the increase in average interest-earning assets. In addition, average total securities increased $3.0 billion in the first nine months of 2005 compared with the prior year period. We do not expect balance sheet growth to continue at this pace.

Average total loans were $46.9 billion for the first nine months of 2005 and $40.2 billion in the first nine months of 2004. This increase was driven by continued improvements in market loan demand and targeted sales efforts across our banking businesses, as well as the Riggs acquisition. The increase in average total loans reflected growth in commercial loans of approximately $2.6 billion, consumer loans of approximately $2.4 billion and residential mortgages of approximately $2.0 billion, partially offset by a $.6 billion decline in lease financing loans. During the second quarter of 2004, we sold our vehicle leasing portfolio as more fully described in our 2004 Form 10-K.

4

Table of Contents

Loans represented 65% of average interest-earning assets for the first nine months of 2005 and 66% for the first nine months of 2004.

Average securities totaled $18.8 billion for the first nine months of 2005 and $15.8 billion for the first nine months of 2004. Of this increase, $2.1 billion was attributable to increases in mortgage-backed, asset-backed and other debt securities. The increase in the 2005 period also reflected the impact of Riggs. Securities comprised 26% of average interest-earning assets for the first nine months of 2005 and 2004.

Average total deposits were $56.6 billion for the first nine months of 2005, an increase of $7.6 billion over the first nine months of 2004. The increase in average total deposits was driven primarily by the impact of higher certificates of deposit, money market account and noninterest-bearing deposit balances, and by higher Eurodollar deposits. The increase in the 2005 period also reflected the impact of Riggs. Average total deposits represented 65% of total sources of funds for the first nine months of 2005 and 66% for the first nine months of 2004. Average transaction deposits were $38.7 billion for the first nine months of 2005 compared with $35.5 billion for the first nine months of 2004.

Average borrowed funds were $16.2 billion for the first nine months of 2005 and $12.5 billion for the first nine months of 2004. The following contributed to this increase:

| | Our issuance of $500 million of subordinated bank notes in September 2005, senior bank note issuances totaling $500 million in July 2005 and $75 million in August 2005, $1 billion of Federal Home Loan Bank advances in June 2005, $700 million of senior notes and $350 million of senior bank notes in March 2005, $500 million of subordinated bank notes in December 2004, and $500 million of senior bank notes in September 2004, |

| | The assumption of approximately $345 million of subordinated debt with the Riggs acquisition, |

| | BlackRocks issuance of $250 million of convertible debentures in February 2005, and |

| | An increase in short-term borrowings to fund asset growth. |

These increases were partially offset by senior bank note maturities in May 2005, subordinated debt maturities in April 2005, and senior debt maturities in October 2004.

Shareholders equity totaled $8.3 billion at September 30, 2005, compared with $7.5 billion at December 31, 2004. See the Consolidated Balance Sheet Review section of this Financial Review for additional information.

BUSINESS SEGMENT HIGHLIGHTS

Total business segment earnings for the first nine months of 2005 were $1.095 billion compared with $921 million for the first nine months of 2004. Total business segment earnings were $383 million for the third quarter of 2005 and $265 million for the third quarter of 2004. A summary of results for both the first nine months and third quarter of 2005 compared with the prior year periods follows. Further analysis of business segment results for the nine-month comparison is found on pages 16 through 23.

During the third quarter of 2005 we reorganized our banking businesses into two units, Consumer Banking and Institutional Banking, aligning our reporting with our client base and with the organizational changes we made in connection with the One PNC initiative. The Consumer Banking business segment comprises consumer and small business customers. The Institutional Banking business segment includes middle market and corporate customers. Amounts previously reported under Regional Community Banking, Wholesale Banking and PNC Advisors have been reclassified to reflect this new reporting structure. Intercompany eliminations and other adjustments made to combine Regional Community Banking and PNC Advisors for prior periods were not significant. Our Current Report on Form 8-K dated September 30, 2005 contains additional information regarding this new reporting structure.

Consumer Banking

Consumer Banking earnings for the first nine months of 2005 totaled $487 million compared with $443 million for the first nine months of 2004. Continued organic customer growth and the Riggs acquisition have driven a growing balance sheet and a 5% revenue increase. These positive results, combined with a sustained focus on expense management and credit quality, drove the 10% increase in earnings.

Earnings from Consumer Banking totaled $176 million for the third quarter of 2005 compared with $158 million for the third quarter of 2004. The 11% increase in earnings compared with the third quarter of 2004 was driven by improved taxable-equivalent net interest income and fee income, continued customer and balance sheet growth and a sustained focus on expense management. Checking relationships as of September 30, 2005 grew 10% compared with September 30, 2004, while average loans grew 15% and average deposits grew 13% for the third quarter of 2005 compared with the third quarter of 2004.

Institutional Banking

Earnings from Institutional Banking were $372 million for the first nine months of 2005 and $335 million for the first nine months of 2004. In addition to the impact of higher taxable-equivalent net interest income driven by loan growth, the increased earnings compared with a year ago reflected the benefit of a higher negative provision for credit losses resulting from a $53 million loan recovery recorded during the second quarter of 2005. Those factors were partially offset by lower net gains from institutional loans held for sale.

Institutional Banking earned $118 million for the third quarter of 2005 compared with $100 million for the third quarter of 2004. The higher earnings compared with the prior year quarter resulted from higher net gains on commercial mortgage loan sales, higher fees related to commercial mortgage servicing activities, increased client-related trading and other capital markets revenues and higher taxable-equivalent net interest income.

BlackRock

BlackRock earnings totaled $161 million for the first nine months of 2005 compared with $93 million for the first nine months of 2004. Earnings for the first nine months of 2005 included $44 million of pretax LTIP expenses and nonrecurring pretax expenses of $9 million associated with the

5

Table of Contents

SSRM acquisition. Results for both the first nine months and third quarter of 2004 included a $91 million pretax impact of the LTIP charge recorded in the third quarter of that year representing the initial expense recognition for the LTIP. In addition, results for the first nine months of 2004 included a $9 million net income benefit recognized during the first quarter of that year associated with the resolution of an audit performed by New York State on state income tax returns filed from 1998 through 2001.

BlackRock reported earnings of $61 million for the third quarter of 2005 compared with a net loss of $10 million for the third quarter of 2004. In addition to the comparative impact of the LTIP charge in the third quarter of 2004 referred to above, higher earnings in the 2005 quarter reflected higher advisory fees driven by a growing base of assets under management as well as strong sales of the BlackRock Solutions® risk analytics platform. These factors more than offset the increase in expense due to higher staffing levels following the SSRM acquisition, higher incentive compensation, including $14 million of pretax LTIP expenses, and higher general and administrative expense. BlackRocks assets under management increased to a record $428 billion at September 30, 2005 compared with $342 billion at December 31, 2004, primarily due to the SSRM acquisition and new business.

PNC owns approximately 70% of BlackRock and we consolidate BlackRock into our financial statements. Accordingly, approximately 30% of BlackRocks earnings are recognized as minority interest expense in the Consolidated Income Statement. BlackRock financial information included in the Financial Review section of this Report is presented on a stand-alone basis. The market value of our BlackRock shares was approximately $4.0 billion at September 30, 2005 while the book value at that date was approximately $660 million.

PFPC

PFPC earnings totaled $75 million for the first nine months of 2005 and $50 million for the first nine months of 2004. Earnings from PFPC totaled $28 million for the third quarter of 2005 and $17 million for the third quarter of 2004. Higher earnings for both 2005 periods were attributable to improved operating leverage and strong performances from custody services, securities lending and managed account services operations, as well as reduced intercompany debt financing costs. In addition, earnings for the third quarter of 2005 included a $3 million tax benefit that was identified as part of the One PNC initiative. PFPCs accounting/administration net fund assets increased 19% and custody fund assets increased 14% as of September 30, 2005 compared with the balances at September 30, 2004. The increases were driven by new business and asset inflows from existing customers, as well as comparatively favorable market conditions.

Other

For the first nine months of 2005, Other reported a net loss of $76 million compared with a net loss of $4 million for the first nine months of 2004. The higher net loss in the first nine months of 2005 was primarily due to the following:

| | Net securities losses amounting to $24 million after-tax in 2005 compared with $29 million of after-tax net securities gains in the prior year period, |

| | Third quarter 2005 implementation costs related to the One PNC initiative totaling $29 million after-tax, |

| | Riggs acquisition integration costs recognized in 2005 totaling $19 million after-tax in 2005, and |

| | The impact of the $22 million after-tax gain on the sale of our modified coinsurance contracts recognized in 2004. |

These factors were partially offset by the first quarter 2005 benefit of the $45 million deferred tax liability reversal related to our investment in BlackRock, as described further above under Summary Financial Results, and higher trading revenue and equity management gains in the first nine months of 2005.

Other for the third quarter of 2005 reflected a net loss of $30 million compared with a net loss of $10 million in the third quarter of 2004. Third quarter 2005 results included the impact of implementation costs related to the One PNC initiative referred to above, partially offset by higher revenue from trading activities in the 2005 third quarter compared with the prior year quarter.

6

Table of Contents

CONSOLIDATED INCOME STATEMENT REVIEW

NET INTEREST INCOME AND NET INTEREST MARGIN

|

Three months ended |

Nine months ended |

|||||||||||||||

| Dollars in millions |

Sept. 30 2005 |

Sept. 30 2004 |

Sept. 30 2005 |

Sept. 30 2004 |

||||||||||||

| Taxable-equivalent net interest income |

$ | 566 | $ | 498 | $ | 1,619 | $ | 1,480 | ||||||||

| Net interest margin |

2.96 | % | 3.19 | % | 2.99 | % | 3.22 | % | ||||||||

We provide a reconciliation of net interest income as reported under GAAP to net interest income presented on a taxable-equivalent basis in the Consolidated Financial Highlights section on page 1 of this Report.

Changes in net interest income and margin result from the interaction of the volume and composition of interest-earning assets and related yields, interest-bearing liabilities and related rates paid, and noninterest-bearing sources. See Statistical Information-Average Consolidated Balance Sheet And Net Interest Analysis included on pages 61 and 62 of this Report for additional information.

The increase in taxable-equivalent net interest income in both comparisons above reflected the impact of higher average interest-earning assets in 2005 driven by organic growth and the Riggs acquisition, partially offset by higher costs of deposits.

The following factors contributed to the decline in net interest margin for the first nine months of 2005 compared with the first nine months of 2004:

| | An increase in the average rate paid on deposits of 88 basis points for the first nine months of 2005 compared with the 2004 period. The average rate paid on money market accounts, the largest single component of interest-bearing deposits, increased 128 basis points, reflecting the increase in short-term interest rates that began in mid-2004. |

| | An increase in the average rate paid on borrowed funds of 123 basis points for the first nine months of 2005 compared with the first nine months of 2004. |

| | By comparison, the yield on interest-earning assets increased only 62 basis points. |

| | Higher balances of interest-earning trading assets, which negatively affected the overall yield on interest-earning assets. |

The following factors contributed to the decline in net interest margin for the third quarter of 2005 compared with the prior year third quarter:

| | An increase in the average rate paid on deposits of 106 basis points for the third quarter of 2005 compared with the third quarter of 2004. The average rate paid on money market accounts, the largest single component of interest-bearing deposits, increased 150 basis points, reflecting the increase in short-term interest rates that began in mid-2004. |

| | An increase in the average rate paid on borrowed funds of 134 basis points for the third quarter of 2005 compared with the prior year quarter. |

| | By comparison, the yield on interest-earning assets increased only 79 basis points. |

| | Higher balances of interest-earning trading assets. |

In both the first nine months and third quarter comparisons, the factors outlined above more than offset the effect of the increased benefit of noninterest-bearing sources of funds in 2005.

While we expect our net interest margin to remain relatively stable in 2006, we also expect an increase in taxable-equivalent net interest income in 2006 compared with 2005.

PROVISION FOR CREDIT LOSSES

The provision for credit losses decreased $36 million, to a negative provision of $3 million, for the first nine months of 2005 compared with the first nine months of 2004. The decline in the provision for credit losses was primarily due to the benefit of a $53 million loan recovery in the second quarter of 2005 resulting from a litigation settlement, in addition to continued improvement in asset quality. The improved credit quality reflected a decline in nonperforming loans. The favorable impact of these factors on the provision was partially offset by the impact of total average loan growth in the first nine months of 2005 compared with the prior year period.

For the third quarter of 2005, the provision for credit losses increased $3 million, to $16 million, compared with the prior year quarter. This increase reflected the impact of total average loan growth in 2005 that more than offset improved asset quality.

We expect loan growth to continue to impact the provision during the remainder of 2005 and into 2006. In addition, we do not expect to sustain asset quality at its current level. However, based on the assets we currently hold and current business trends and activities, we believe that overall asset quality will remain strong for at least the near term. See the Credit Risk Management portion of the Risk Management section of this Financial Review for additional information regarding factors impacting the provision for credit losses.

NONINTEREST INCOME

Summary

Noninterest income was $3.011 billion for the first nine months of 2005, an increase of $352 million compared with the first nine months of 2004. For the third quarter of 2005, noninterest income totaled $1.113 billion compared with $838 million for the third quarter of 2004. In both comparisons with 2004, higher asset management fees was the largest factor in the increases, driven largely by BlackRocks acquisition of SSRM in January 2005. In addition, noninterest income in both 2005 periods reflected increases in all other major categories other than net securities losses in the 2005 periods compared with gains in the 2004 periods and slightly lower corporate services revenue in the nine-month comparison.

Additional analysis

Combined asset management and fund servicing fees amounted to $1.669 billion for the first nine months of 2005 compared with $1.352 billion for the first nine months of

7

Table of Contents

2004. For the third quarter of 2005, combined asset management and fund servicing fees were $582 million compared with $443 million in the prior year third quarter. The increases in both comparisons reflected the impact of the first quarter 2005 SSRM acquisition and other growth in assets managed and serviced.

Assets under management at September 30, 2005 totaled $469 billion compared with $362 billion at September 30, 2004. The acquisition of SSRM added $50 billion of assets under management during the first quarter of 2005. PFPC provided fund accounting/administration services for $793 billion of net fund investment assets and provided custody services for $475 billion of fund investment assets at September 30, 2005, compared with $667 billion and $418 billion, respectively, at September 30, 2004. These increases were driven by new business and asset inflows from existing customers, as well as comparatively favorable market conditions.

Service charges on deposits increased $12 million for the first nine months of 2005 and $8 million for the third quarter of 2005 compared with the corresponding prior year periods. Although growth in service charges has been limited due to our offering of free checking in both the consumer and small business channels, free checking has positively impacted customer and demand deposit growth as well as other deposit-related fees.

Brokerage fees increased $2 million, to $168 million, for the first nine months of 2005 compared with the prior year period. For the third quarter of 2005, brokerage fees increased $4 million, to $56 million, compared with the third quarter of 2004. The increase in both comparisons was primarily due to higher mutual fund-related revenues during 2005.

Consumer services fees increased $19 million, to $215 million, in the first nine months of 2005 compared with the first nine months of 2004. For the third quarter of 2005, consumer services fees increased $9 million compared with the prior year quarter. Higher fees in both comparisons reflected additional fees from debit card transactions primarily due to higher volumes and the Riggs acquisition, partially offset by lower ATM surcharge revenue from changing customer behavior and a strategic decision to reduce the out-of-footprint ATM network.

Corporate services revenue declined $2 million for the first nine months of 2005 compared with the first nine months of 2004 and increased $27 million in the third quarter of 2005 compared with the third quarter of 2004. Lower net gains in excess of valuation adjustments related to our liquidation of institutional loans held for sale impacted the nine-month comparison with a $44 million decline and the third quarter comparison with a $3 million decline. Our liquidation of institutional loans held for sale is essentially complete. The first nine months and third quarter of 2005 each benefited by the impact of higher net gains on commercial mortgage loan sales, higher fees related to commercial mortgage servicing activities, increased loan syndication fees and higher capital markets revenues compared with the respective prior year periods.

Equity management (private equity) net gains on portfolio investments totaled $80 million for the first nine months of 2005 and $58 million for the first nine months of 2004. Such gains totaled $36 million for the third quarter of 2005 compared with $16 million for the third quarter of 2004.

Net securities losses amounted to $37 million for the first nine months of 2005 compared with net securities gains of $45 million in the first nine months of 2004. For the third quarter of 2005, net securities losses totaled $2 million, compared with net securities gains of $16 million in the prior year quarter. Our discussion under the Consolidated Balance Sheet Review section of this Financial Review of actions taken during the second quarter of 2005 regarding our securities portfolio provides additional information on the 2005 net securities losses.

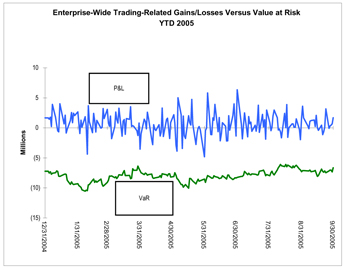

Noninterest revenue from trading activities totaled $108 million for the first nine months of 2005 and $69 million for the first nine months of 2004. For the third quarter of 2005, noninterest revenue from trading activities was $47 million, compared with $16 million in the prior year third quarter. We provide additional information on our trading activities under Market Risk Management Trading Risk in the Risk Management section of this Financial Review.

Other noninterest income increased $25 million, to $258 million, in the first nine months of 2005 compared with the first nine months of 2004. Other noninterest income typically fluctuates from period to period depending on the nature and magnitude of transactions completed. Other noninterest income for the first nine months of 2005 included a $16 million gain related to a contribution of BlackRock stock to the PNC Foundation, a transaction that also impacted noninterest expense; a $10 million settlement received in connection with a PFPC contractual matter during the first quarter of 2005; income related to the 2005 SSRM acquisition; and higher dividends and other income related to equity investments. These factors more than offset the impact of the following pretax gains in 2004, as described in more detail in our 2004 Form 10-K:

| | A first quarter $34 million gain related to the sale of our modified coinsurance contracts, |

| | A second quarter $13 million gain recognized in connection with BlackRocks sale of its interest in Trepp LLC, and |

| | A first quarter $10 million gain related to the sale of certain investment consulting activities of the Hawthorn unit of Consumer Banking. |

Other noninterest income increased $55 million in the third quarter of 2005 compared with the third quarter of 2004. Additional income in 2005 related to the SSRM acquisition was the primary reason for the increase, along with the $16 million gain related to the PNC Foundation contribution referred to above.

PRODUCT REVENUE

Institutional Banking offers treasury management and capital markets-related products and services, commercial loan servicing and equipment leasing products that are marketed by several businesses across PNC.

8

Table of Contents

Treasury management revenue, which includes fees as well as revenue from customer deposit balances, totaled $305 million for the first nine months of 2005 and $274 million for the first nine months of 2004. For the third quarter of 2005, consolidated revenue totaled $105 million compared with $95 million in the third quarter of 2004. The increased revenue in both 2005 periods reflected the longer-term nature of treasury management deposits along with the rising interest rate environment, strong deposit growth, continued expansion and client utilization of commercial card services and a steady increase in business-to-business processing volumes. The acquisition of Riggs also contributed to the revenue growth in 2005, particularly in the third quarter.

Consolidated revenue from capital markets was $113 million for the first nine months of 2005, compared with $96 million in the first nine months of 2004. Consolidated revenue from capital markets totaled $42 million for the third quarter of 2005 and $27 million for the prior year third quarter. Increases in loan syndication fees and client-related trading revenue drove the increase in capital markets revenue in both comparisons.

Midland Loan Services offers servicing, real estate advisory and technology solutions for the commercial real estate finance industry. Midlands revenue, which includes fees as well as revenue from servicing portfolio deposit balances, totaled $94 million for the first nine months of 2005 and $81 million for the first nine months of 2004. Midlands revenue totaled $35 million for the third quarter of 2005 compared with $30 million for the third quarter of 2004. The revenue growth was primarily driven by growth in the commercial mortgage servicing portfolio and related services.

Consolidated revenue from equipment leasing products was $52 million for the first nine months of 2005 and $63 million for the first nine months of 2004. For the third quarter of 2005, consolidated revenue from equipment leasing products was $16 million compared with $21 million in the prior year quarter. The declines in both comparisons were primarily due to the interest cost of funding the potential tax exposure on the cross-border leasing portfolio. See Cross-Border Leases and Related Tax and Accounting Matters in the Consolidated Balance Sheet Review section of this Financial Review for further information.

As a component of our advisory services to clients, we provide a select set of insurance products to fulfill specific customer financial needs. Primary insurance offerings include:

| | Annuities, |

| | Credit life, |

| | Health, |

| | Disability, and |

| | Commercial lines coverage. |

Client segments served by these insurance solutions include those in Consumer Banking and Institutional Banking. Insurance products are sold by PNC-licensed insurance agents and through licensed third-party arrangements. We recognized revenue from these products of $46 million in the first nine months of 2005 and $50 million in the first nine months of 2004. Revenue for the third quarter of 2005 totaled $15 million compared with $17 million for the third quarter of 2004. The decrease in both comparisons reflected a decline in annuity fee revenue.

Through our subsidiary company, PNC Insurance Corp., we act as a reinsurer for consumer credit insurance provided to customers of our subsidiaries. Additionally, through PNC Insurance Corp. and Alpine Indemnity Limited, we write, assume and cede insurance for property, workers compensation, commercial general liability and automobile liability of PNC and its affiliates.

In the normal course of business PNC Insurance Corp. and Alpine Indemnity Limited maintain insurance reserves for reported claims and for claims incurred but not reported based on actuarial assessments.

NONINTEREST EXPENSE

Year-to-date September 30, 2005 and 2004

Total noninterest expense was $3.191 billion for the first nine months of 2005, an increase of $405 million compared with the first nine months of 2004. The efficiency ratio was 69% for the first nine months of 2005 compared with 68% for the first nine months of 2004.

Noninterest expense for the first nine months of 2005 included the following:

| | An increase of $207 million in BlackRock operating expenses, excluding the LTIP expenses detailed below, that reflected the impact of costs resulting from the first quarter 2005 SSRM acquisition and other investments to fund growth; |

| | Costs totaling approximately $87 million resulting from our second quarter acquisition of Riggs, including approximately $15 million of integration costs; |

| | BlackRock LTIP charges of $48 million; |

| | Implementation costs totaling $44 million related to the One PNC initiative; and |

| | A $20 million contribution of BlackRock stock to the PNC Foundation. |

The impact of the Riggs and One PNC initiative costs was reflected in several noninterest expense items in the Consolidated Income Statement.

Noninterest expense for the first nine months of 2004 included a $96 million charge associated with the BlackRock LTIP and conversion-related and other nonrecurring costs totaling approximately $11 million related to our acquisition of United National Bancorp, Inc.

Apart from the impact of these items, noninterest expense increased $106 million, or 4%, in the first nine months of 2005 compared with the same period in 2004. The higher expenses were driven by increased sales incentives and the increased impact of expensing stock options. See Note 1 Accounting Policies in our Notes To Consolidated Financial Statements under Part I, Item 1 of this Report for additional information on our accounting for employee and director stock options.

9

Table of Contents

Third quarter 2005 and 2004

Total noninterest expense was $1.156 billion for the third quarter of 2005 and $981 million for the third quarter of 2004. The efficiency ratio was 69% for the third quarter of 2005 compared with 74% for the prior year quarter.

Noninterest expense for the third quarter of 2005 included the following:

| | An increase of $101 million in BlackRock operating expenses excluding LTIP, |

| | Approximately $47 million of Riggs-related expenses, |

| | One PNC initiative implementation charges totaling $44 million, |

| | A $20 million BlackRock stock contribution to the PNC Foundation, and |

| | $16 million of BlackRock LTIP charges. |

Expenses for the third quarter of 2004 included the $96 million BlackRock LTIP charge referred to previously. Apart from the impact of these items, noninterest expense for the third quarter of 2005 increased $43 million, or 5%, over the prior year quarter.

Excluding costs associated with acquisitions next year, such as the costs added as a result of the Harris Williams acquisition, we expect that total noninterest expense for full-year 2006 will be comparable to our anticipated total noninterest expense for full-year 2005.

Period-end employees totaled 25,369 at September 30, 2005 (comprised of 23,811 full-time and 1,558 part-time) compared with 25,874 at June 30, 2005 (comprised of 24,397 full-time and 1,477 part-time) and 24,218 at December 31, 2004 (comprised of 22,742 full-time and 1,476 part-time). The majority of our part-time employees are in Consumer Banking. The declines compared with June 30, 2005 were primarily due to the impact of the One PNC initiative. The increase compared with year-end 2004 was primarily attributable to increases related to our Riggs acquisition and BlackRocks acquisition of SSRM, partially offset by a decline in other areas.

EFFECTIVE TAX RATE

Our effective tax rate for the first nine months of 2005 was 29.7% compared with 31.5% for the first nine months of 2004. The decrease in the effective rate for the first nine months of 2005 was primarily attributable to the impact of the reversal of deferred tax liabilities in connection with the transfer of our ownership in BlackRock to our intermediate bank holding company. This transaction reduced our first quarter 2005 tax provision by $45 million, or $.16 per diluted share. See Note 2 Acquisitions included in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report for additional information. This reduction in the effective tax rate for the first nine months of 2005 was partially offset by a $6 million increase in deferred state income taxes, net of the federal income tax benefit, related to the Riggs acquisition recorded during the second quarter.

The effective tax rate for the first nine months of 2004 was favorably impacted by the $9 million tax benefit recorded in the first quarter of 2004 as a result of resolving a BlackRock New York State audit and a $14 million third quarter 2004 reduction in income tax expense following our determination that we no longer required an income tax reserve related to bank-owned life insurance.

For the third quarter of 2005, our effective tax rate was 30.4% compared with 26.9% for the third quarter of 2004. The effective tax rate for each quarter was lower than would otherwise be expected for the following reasons:

| | The third quarter 2005 effective tax rate was impacted by adjustments related to completion of our 2004 federal income tax return; the effect of contributing BlackRock stock to the PNC Foundation; and a decrease in the tax rate at PFPC resulting from changes in the way income is apportioned for state tax purposes. These items in the aggregate totaled $17 million. |

| | The third quarter 2004 effective tax rate included the $14 million item referred to in the nine-month comparison above. |

10

Table of Contents

CONSOLIDATED BALANCE SHEET REVIEW

BALANCE SHEET DATA

| In millions |

September 30 2005 |

December 31 2004 |

||||

| Assets |

||||||

| Loans, net of unearned income |

$ | 50,510 | $ | 43,495 | ||

| Securities available for sale and held to maturity |

20,658 | 16,761 | ||||

| Loans held for sale |

2,377 | 1,670 | ||||

| Other |

19,696 | 17,797 | ||||

| Total assets |

$ | 93,241 | $ | 79,723 | ||

| Liabilities |

||||||

| Funding sources |

$ | 78,588 | $ | 65,233 | ||

| Other |

5,741 | 6,513 | ||||

| Total liabilities |

84,329 | 71,746 | ||||

| Minority and noncontrolling interests in consolidated entities |

595 | 504 | ||||

| Total shareholders equity |

8,317 | 7,473 | ||||

| Total liabilities, minority and noncontrolling interests, and shareholders equity |

$ | 93,241 | $ | 79,723 | ||

Our Consolidated Balance Sheet is presented in Part I, Item 1 on page 40 of this Report.

Higher total assets at September 30, 2005 compared with the balance at December 31, 2004 were driven by the impact of the Riggs acquisition, loan growth resulting from continued improvements in market loan demand and higher securities balances that reflected normal portfolio activity.

An analysis of changes in certain balance sheet categories follows.

LOANS, NET OF UNEARNED INCOME

Loans increased $7.0 billion, to $50.5 billion at September 30, 2005, compared with the balance at December 31, 2004. The impact of our Riggs acquisition added $2.7 billion of loans as of September 30, 2005. Improvements in market loan demand, in addition to targeted sales efforts across our banking businesses, drove the remainder of the increase in total loans.

Details Of Loans

| In millions |

September 30 2005 |

December 31 2004 |

||||||

| Commercial |

||||||||

| Retail/wholesale |

$ | 5,114 | $ | 4,961 | ||||

| Manufacturing |

4,321 | 3,944 | ||||||

| Other service providers |

2,173 | 1,787 | ||||||

| Real estate related |

2,492 | 2,104 | ||||||

| Financial services |

1,297 | 1,145 | ||||||

| Health care |

608 | 560 | ||||||

| Other |

4,098 | 2,937 | ||||||

| Total commercial |

20,103 | 17,438 | ||||||

| Commercial real estate |

||||||||

| Real estate projects |

2,147 | 1,460 | ||||||

| Mortgage |

779 | 520 | ||||||

| Total commercial real estate |

2,926 | 1,980 | ||||||

| Equipment lease financing |

3,721 | 3,907 | ||||||

| Total commercial lending |

26,750 | 23,325 | ||||||

| Consumer |

||||||||

| Home equity |

13,722 | 12,734 | ||||||

| Automobile |

931 | 836 | ||||||

| Other |

2,232 | 2,036 | ||||||

| Total consumer |

16,885 | 15,606 | ||||||

| Residential mortgage |

7,156 | 4,772 | ||||||

| Vehicle lease financing |

101 | 189 | ||||||

| Other |

474 | 505 | ||||||

| Unearned income |

(856 | ) | (902 | ) | ||||

| Total, net of unearned income |

$ | 50,510 | $ | 43,495 | ||||

| Supplement Loan Information |

||||||||

| Loans excluding conduit |

$ | 47,889 | $ | 41,243 | ||||

| Market Street Funding Corporation conduit |

2,621 | 2,252 | ||||||

| Total loans |

$ | 50,510 | $ | 43,495 | ||||

| As the table above indicates, the loans that we hold continued to be diversified among numerous industries and types of businesses. The loans that we hold are also diversified across the geographic areas where we do business. | ||||||||

| Commercial Lending Exposure (a)(b) | ||||||||

|

September 30 2005 |

December 31 2004 |

|||||||

| Investment grade or equivalent |

||||||||

| $50 million or greater |

16 | % | 16 | % | ||||

| $25 million to < $50 million |

16 | % | 16 | % | ||||

| <$25 million |

16 | % | 15 | % | ||||

| Non-investment grade |

||||||||

| $50 million or greater |

2 | % | 2 | % | ||||

| $25 million to < $50 million |

13 | % | 11 | % | ||||

| <$25 million |

37 | % | 40 | % | ||||

| Total |

100 | % | 100 | % | ||||

| (a) | These statistics exclude the loans of Market Street Funding Corporation. The facilities extended by Market Street represent pools of granular obligations, structured to avoid excessive concentration of credit risk such that they attract an investment grade rating. See Note 15 Subsequent Events in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report regarding the October 2005 deconsolidation of Market Street. |

| (b) | Exposure represents the sum of all loans, leases, commitments and letters of credit. |

11

Table of Contents

Commercial loans are the largest category of credits and are the most sensitive to changes in assumptions and judgments underlying the determination of the allowance for loan and lease losses. We have allocated approximately $509 million, or 80%, of the total allowance for loan and lease losses at September 30, 2005 to the commercial loan category. This allocation also considers other relevant factors such as:

| | Actual versus estimated losses, |

| | Regional and national economic conditions, |

| | Business segment and portfolio concentrations, |

| | Industry competition and consolidation, |

| | The impact of government regulations, and |

| | Risk of potential estimation or judgmental errors, including the accuracy of risk ratings. |

Net Unfunded Credit Commitments

| In millions |

September 30 2005 |

December 31 2004 |

||||

| Commercial |

$ | 23,100 | $ | 20,969 | ||

| Consumer |

9,268 | 7,655 | ||||

| Commercial real estate |

2,290 | 1,199 | ||||

| Other |

603 | 483 | ||||

| Total |

$ | 35,261 | $ | 30,306 | ||

Commitments to extend credit represent arrangements to lend funds or provide liquidity subject to specified contractual conditions. Commercial commitments are reported net of participations, assignments and syndications, primarily to financial institutions, totaling $6.8 billion at September 30, 2005 and $6.7 billion at December 31, 2004.

The increase in consumer net unfunded commitments at September 30, 2005 compared with the balance at December 31, 2004 was primarily due to net unfunded commitments related to growth in home equity loans.

Unfunded credit commitments related to Market Street Funding Corporation totaled $1.0 billion at September 30, 2005 and $962 million at December 31, 2004 and are included in the preceding table primarily within the Commercial and Consumer categories. See the Off-Balance Sheet Arrangements And Variable Interest Entities section of this Financial Review and Note 6 Variable Interest Entities and Note 15 Subsequent Events in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report for further information regarding Market Street.

In addition to credit commitments, our net outstanding standby letters of credit totaled $3.8 billion at September 30, 2005 and $3.7 billion at December 31, 2004. Standby letters of credit commit us to make payments on behalf of our customers if specified future events occur.

Cross-Border Leases and Related Tax and Accounting Matters

The equipment lease portfolio totaled $3.7 billion at September 30, 2005 and included approximately $1.7 billion of cross-border leases. Cross-border leases are primarily leveraged leases of equipment located in foreign countries, primarily in western Europe and Australia. We no longer enter into cross-border lease transactions.

Aggregate residual value at risk on the total commercial lease portfolio at September 30, 2005 was $1.1 billion. We have taken steps to mitigate $.6 billion of this residual risk, including residual value insurance coverage with third parties, third party guarantees, and other actions.

Upon completing examination of our 1998-2000 consolidated federal income tax returns, on June 20, 2005 the IRS provided us with an examination report which proposes increases in our tax liability, principally arising from adjustments to several of our cross-border lease transactions.

The proposed adjustments would reverse the tax treatment of these transactions as we reported them on our filed tax returns. We believe the method we used to report these transactions is supported by appropriate tax law and have filed a protest of the IRS examination findings with the IRS appeals office. While we cannot predict with certainty the result of filing the protest, any resolution would most likely involve a change in the timing of tax deductions which, in turn, depending on the exact resolution, could significantly impact the economics of these transactions. The IRS has begun an audit of our 2001-2003 consolidated federal income tax returns. We expect them to again make adjustments to the cross-border lease transactions referred to above as well as to new cross-border lease transactions entered into during those years. We believe our reserves for these exposures were adequate at September 30, 2005.

Further, the Financial Accounting Standards Board (FASB) has issued a proposed staff position to consider whether any change in the timing of tax benefits associated with these types of transactions should result in a recalculation under Statement of Financial Accounting Standards No. (SFAS) 13, Accounting for Leases, and whether a lessor should re-evaluate the classification of a leveraged lease when a recalculation of the lease is performed. If the FASB ultimately adopts the guidance as proposed, a cumulative adjustment in the period of change which could be material and future adjustments to earnings could be required. However, under the leveraged leasing accounting rules, any reductions in earnings from the change in timing of tax deductions should be recovered in future years.

In addition to the transactions referred to above, three lease-to-service contract transactions that we were party to were structured as partnerships for tax purposes. These partnerships are under audit by the IRS. However, we do not believe that our exposure from these transactions is material to our consolidated results of operations or financial position.

12

Table of Contents

SECURITIES

Details Of Securities

| In millions |

Amortized Cost |

Fair Value |

||||

| September 30, 2005 (a) |

||||||

| SECURITIES AVAILABLE FOR SALE |

||||||

| Debt securities |

||||||

| U.S. Treasury and government agencies |

$ | 4,376 | $ | 4,319 | ||

| Mortgage-backed |

13,030 | 12,843 | ||||

| Commercial mortgage-backed |

1,663 | 1,636 | ||||

| Asset-backed |

1,523 | 1,517 | ||||

| State and municipal |

163 | 163 | ||||

| Other debt |

87 | 86 | ||||

| Corporate stocks and other |

93 | 94 | ||||

| Total securities available for sale |

$ | 20,935 | $ | 20,658 | ||

| December 31, 2004 |

||||||

| SECURITIES AVAILABLE FOR SALE |

||||||

| Debt securities |

||||||

| U.S. Treasury and government agencies |

$ | 4,735 | $ | 4,722 | ||

| Mortgage-backed |

8,506 | 8,433 | ||||

| Commercial mortgage-backed |

1,380 | 1,370 | ||||

| Asset-backed |

1,910 | 1,901 | ||||

| State and municipal |

175 | 176 | ||||

| Other debt |

33 | 33 | ||||

| Corporate stocks and other |

123 | 125 | ||||

| Total securities available for sale |

$ | 16,862 | $ | 16,760 | ||

| SECURITIES HELD TO MATURITY |

||||||

| Debt securities |

||||||

| Asset-backed |

$ | 1 | $ | 1 | ||

| Total securities held to maturity |

$ | 1 | $ | 1 | ||

| (a) | Securities held to maturity at September 30, 2005 were less than $1 million. |

Securities represented 22% of total assets at September 30, 2005 and 21% of total assets at December 31, 2004. The increase in total securities compared with December 31, 2004 was primarily due to the acquisition of Riggs and normal portfolio activity.

At September 30, 2005, the securities available for sale balance included a net unrealized loss of $277 million, which represented the difference between fair value and amortized cost. The comparable amount at December 31, 2004 was a net unrealized loss of $102 million. The increase in the net unrealized loss at September 30, 2005 reflected the impact of increases in interest rates during the first nine months of 2005, partially offset by the sales of securities during the second quarter of 2005 as discussed below.

We evaluate our portfolio of securities available for sale in light of changing market conditions and other factors and, where appropriate, take steps intended to improve our overall positioning.

As described in more detail in our second quarter 2005 Form 10-Q, in late April and early May 2005 we sold $2.1 billion of securities available for sale and terminated $1.0 billion of resale agreements that were most sensitive to extension risk due to rising short-term interest rates. We also purchased $2.1 billion of securities with higher yields and lower extension risk. These transactions resulted in realized net securities and other losses of approximately $31 million, which are included in our results of operations for the first nine months of 2005.

The fair value of securities available for sale decreases when interest rates increase and vice versa. Further increases in interest rates after September 30, 2005, if sustained, will adversely impact the fair value of securities available for sale going forward compared with the balance at September 30, 2005. Net unrealized gains and losses in the securities available for sale portfolio are included in shareholders equity as accumulated other comprehensive income or loss, net of tax.

The expected weighted-average life of securities available for sale was 3 years and 11 months at September 30, 2005 and 2 years and 8 months at December 31, 2004.

We estimate that at September 30, 2005 the effective duration of securities available for sale is 2.6 years for an immediate 50 basis points parallel increase in interest rates and 2.3 years for an immediate 50 basis points parallel decrease in interest rates. Comparable amounts at December 31, 2004 were 2.7 years and 2.3 years, respectively.

LOANS HELD FOR SALE

Education loans held for sale totaled $1.7 billion at September 30, 2005 and $1.1 billion at December 31, 2004 and represented the majority of our loans held for sale at each date. We classify substantially all of our education loans as loans held for sale. Generally, we sell education loans when the loans are placed into repayment status. Gains on sales of education loans are reflected in the Other noninterest income line item in our Consolidated Income Statement and in the results for the Consumer Banking business segment.

See Institutional Banking in the Business Segments Review section of this Financial Review regarding net gains in excess of valuation adjustments related to our remaining institutional loans held for sale.

OTHER ASSETS

The increase of $1.9 billion in Assets-Other in the preceding Balance Sheet Data table includes the impact of an increase in goodwill and other intangible assets. Goodwill and other intangible assets recognized in connection with the Riggs acquisition totaled $507 million. Goodwill and other intangible assets recorded in connection with the SSRM acquisition totaled $311 million. See Note 5 Goodwill And Other Intangible Assets in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report for further information.

13

Table of Contents

CAPITAL AND FUNDING SOURCES

Details Of Funding Sources

| In millions |

September 30 2005 |

December 31 2004 |

||||

| Deposits |

||||||

| Money market |

$ | 25,552 | $ | 21,250 | ||

| Demand |

16,566 | 15,996 | ||||

| Retail certificates of deposit |

12,522 | 9,969 | ||||

| Savings |

2,470 | 2,851 | ||||

| Other time |

1,911 | 833 | ||||

| Time deposits in foreign offices |

1,193 | 2,370 | ||||

| Total deposits |

60,214 | 53,269 | ||||

| Borrowed funds |

||||||

| Federal funds purchased |

1,477 | 219 | ||||

| Repurchase agreements |

2,054 | 1,376 | ||||

| Bank notes and senior debt |

3,475 | 2,383 | ||||

| Subordinated debt |

4,506 | 4,050 | ||||

| Commercial paper |

3,447 | 2,251 | ||||

| Other borrowed funds |

3,415 | 1,685 | ||||

| Total borrowed funds |

18,374 | 11,964 | ||||

| Total |

$ | 78,588 | $ | 65,233 | ||

Various seasonal and other factors impact our period-end deposit balances whereas average balances (discussed under the Balance Sheet Highlights section of this Financial Review above) are more indicative of underlying business trends. The increase in deposits as of September 30, 2005 reflected the impact of the Riggs acquisition as well as sales and retention efforts related to core deposits.

Higher borrowed funds at September 30, 2005 were driven in part by the following:

| | Our issuance of $500 million of subordinated bank notes in September 2005, |

| | Senior bank note issuances totaling $500 million in July 2005 and $75 million in August 2005, |

| | The issuance of $1 billion of Federal Home Loan Bank advances in June 2005, |

| | Our issuance of $700 million of senior debt and $350 million of senior bank notes in March 2005, |

| | BlackRocks $250 million convertible debenture issuance in February 2005 primarily in connection with its SSRM acquisition, |

| | The assumption of approximately $345 million of subordinated debt with the acquisition of Riggs, and |

| | Higher short-term borrowings to fund asset growth. |

These factors were partially offset by maturities of $750 million of senior bank notes and $350 million of subordinated debt during the first nine months of 2005.

Capital

We manage our capital position by making adjustments to our balance sheet size and composition, issuing debt and equity instruments, making treasury stock transactions, maintaining dividend policies and retaining earnings.

The increase of $.8 billion in total shareholders equity at September 30, 2005 compared with December 31, 2004 reflected the impact of earnings and the issuance of shares from treasury in connection with the Riggs acquisition.

Common shares outstanding at September 30, 2005 were 291.1 million, an increase of 8.5 million over December 31, 2004. We issued approximately 6.6 million shares of common stock during the second quarter of 2005 in connection with the Riggs acquisition.

We purchased .5 million common shares at a total cost of $26 million under both our prior and current common stock repurchase programs during the first nine months of 2005, all of which occurred during the first quarter. Our current program will remain in effect until fully utilized or until modified, superseded or terminated. The extent and timing of additional share repurchases under this program will depend on a number of factors including, among others, market and general economic conditions, economic and regulatory capital considerations, alternative uses of capital, and the potential impact on our credit rating. The impact on our capital of the Riggs and SSRM acquisitions, when combined with the capital requirements to expand our business, has restricted and will continue to restrict share repurchases over the next several quarters.

Risk-Based Capital

| Dollars in millions |

September 30 2005 |

December 31 2004 |

||||||

| Capital components |

||||||||

| Shareholders equity |

||||||||

| Common |

$ | 8,309 | $ | 7,465 | ||||

| Preferred |

8 | 8 | ||||||

| Trust preferred capital securities (a) |

1,417 | 1,194 | ||||||

| Minority interest |

271 | 226 | ||||||

| Goodwill and other intangibles |

(3,927 | ) | (3,112 | ) | ||||

| Net unrealized securities losses |

180 | 66 | ||||||

| Net unrealized losses (gains) on cash flow hedge derivatives |

15 | (6 | ) | |||||

| Equity investments in nonfinancial companies |

(42 | ) | (32 | ) | ||||

| Other, net |

(12 | ) | (15 | ) | ||||

| Tier 1 risk-based capital |

6,219 | 5,794 | ||||||

| Subordinated debt |

2,315 | 1,924 | ||||||

| Eligible allowance for credit losses |

714 | 683 | ||||||

| Total risk-based capital |

$ | 9,248 | $ | 8,401 | ||||

| Assets |

||||||||

| Risk-weighted assets, including off-balance sheet instruments and market risk equivalent assets |

$ | 73,832 | $ | 64,539 | ||||

| Adjusted average total assets |

87,350 | 75,757 | ||||||

| Capital ratios |

||||||||

| Tier 1 risk-based |

8.4 | % | 9.0 | % | ||||

| Total risk-based |

12.5 | 13.0 | ||||||

| Leverage |

7.1 | 7.6 | ||||||

| Tangible common |

4.9 | 5.7 | ||||||

| (a) | See Note 18 Capital Securities Of Subsidiary Trusts in the Notes To Consolidated Financial Statements in our 2004 Form 10-K regarding the deconsolidation of trust preferred securities at December 31, 2003 under GAAP. However, these securities remained a component of Tier 1 risk-based capital at September 30, 2005 and December 31, 2004 based upon guidance provided to bank holding companies from the Federal Reserve. |

The access to, and cost of, funding new business initiatives including acquisitions, the ability to engage in expanded business activities, the ability to pay dividends, the level of deposit insurance costs, and the level and nature of regulatory oversight depend, in part, on a financial institutions capital strength. The declines in the capital ratios at September 30, 2005 compared with the ratios at December 31, 2004 were primarily caused by the addition of goodwill and other intangible assets associated with the Riggs and SSRM acquisitions. At September 30, 2005, each of our banking subsidiaries was considered well-capitalized based on regulatory capital ratio requirements.

14

Table of Contents

OFF-BALANCE SHEET ARRANGEMENTS AND VARIABLE INTEREST ENTITIES

We engage in a variety of activities that involve unconsolidated entities or that are otherwise not reflected in our Consolidated Balance Sheet that are generally referred to as off-balance sheet arrangements. Further information on these types of activities is included in Note 14 Commitments And Guarantees included in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report.

As discussed in our 2004 Form 10-K, we are involved with various entities in the normal course of business that may be deemed to be variable interest entities (VIEs). We consolidated certain VIEs effective in 2004 and 2003 for which we were determined to be the primary beneficiary. These consolidated VIEs and relationships with PNC are described in our 2004 Form 10-K under this same heading in Part I, Item 7 and in Note 2 Variable Interest Entities in the Notes To Consolidated Financial Statements included in Part II, Item 8 of that report.

At September 30, 2005, the aggregate assets and debt of VIEs that we have consolidated in our financial statements are as follows:

Consolidated VIEs PNC Is Primary Beneficiary

| In millions |

Aggregate Assets |

Aggregate Debt |

||||

| September 30, 2005 |

||||||

| Market Street Funding Corporation (a) |

$ | 3,007 | $ | 3,007 | ||

| Partnership interests in low income housing projects |

705 | 705 | ||||

| Other |

28 | 25 | ||||

| Total consolidated VIEs |

$ | 3,740 | $ | 3,737 | ||

| December 31, 2004 |

||||||

| Market Street Funding Corporation |

$ | 2,167 | $ | 2,167 | ||

| Partnership interests in low income housing projects |

504 | 504 | ||||

| Other |

13 | 10 | ||||

| Total consolidated VIEs |

$ | 2,684 | $ | 2,681 | ||

| (a) | In October 2005, Market Street Funding Corporation was restructured as a limited liability company and issued a subordinated note to an unrelated third party investor. This transaction resulted in PNC no longer being the primary beneficiary of Market Street. Consequently, we will no longer consolidate Market Street. See Note 15 Subsequent Events in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report for further information. |

We also hold significant variable interests in other VIEs that have not been consolidated because we are not considered the primary beneficiary. Information on these VIEs follows:

Non-Consolidated VIEs - Significant Variable Interests

| In millions |

Aggregate Assets |

Aggregate Debt |

PNC Risk of Loss (b) |

||||||