10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on August 5, 2005

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2005

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-09718

The PNC Financial Services Group, Inc.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 25-1435979 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

One PNC Plaza, 249 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2707

(Address of principal executive offices)

(Zip Code)

(412) 762-2000

(Registrants telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

Yes x No ¨

As of July 29, 2005, there were 290,758,058 shares of the registrants common stock ($5 par value) outstanding.

The PNC Financial Services Group, Inc.

Cross-Reference Index to 2005 Second Quarter Form 10-Q

|

Pages |

||

| PART I FINANCIAL INFORMATION |

||

| Item 1. Financial Statements (Unaudited). |

38-58 | |

| 38 | ||

| 39 | ||

| 40 | ||

| Notes To Consolidated Financial Statements |

||

| 41 | ||

| 45 | ||

| 45 | ||

| 46 | ||

| 47 | ||

| 48 | ||

| 49 | ||

| 49 | ||

| Note 9 Certain Employee Benefit And Stock-Based Compensation Plans |

50 | |

| 51 | ||

| 52 | ||

| 53 | ||

| 54 | ||

| 55 | ||

| 57 | ||

| 58 | ||

| Statistical Information |

||

| Average Consolidated Balance Sheet And Net Interest Analysis |

59-60 | |

| Item 2. Managements Discussion and Analysis of Financial Condition and Results of Operations. |

1-37, 59-60 | |

| 1-2 | ||

| Financial Review |

||

| 3 | ||

| 7 | ||

| 10 | ||

| 14 | ||

| 15 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 24 | ||

| 34 | ||

| 34 | ||

| 36 | ||

| Item 3. Quantitative and Qualitative Disclosures About Market Risk. |

24-33 | |

| Item 4. Controls and Procedures. |

34 | |

| PART II OTHER INFORMATION |

||

| 61 | ||

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds. |

62 | |

| 62 | ||

| 62 | ||

| 63 | ||

CONSOLIDATED FINANCIAL HIGHLIGHTS

THE PNC FINANCIAL SERVICES GROUP, INC.

| Dollars in millions, except per |

Three months ended June 30 |

Six months ended June 30 |

||||||||||||||

|

2005 |

2004 |

2005 |

2004 |

|||||||||||||

| FINANCIAL PERFORMANCE |

||||||||||||||||

| Revenue |

||||||||||||||||

| Net interest income (taxable-equivalent basis) (a) |

$ | 541 | $ | 485 | $ | 1,053 | $ | 982 | ||||||||

| Noninterest income |

925 | 910 | 1,898 | 1,821 | ||||||||||||

| Total revenue |

$ | 1,466 | $ | 1,395 | $ | 2,951 | $ | 2,803 | ||||||||

| Net income |

$ | 282 | $ | 304 | $ | 636 | $ | 632 | ||||||||

| Per common share |

||||||||||||||||

| Diluted earnings |

$ | .98 | $ | 1.07 | $ | 2.22 | $ | 2.22 | ||||||||

| Cash dividends declared |

$ | .50 | $ | .50 | $ | 1.00 | $ | 1.00 | ||||||||

| SELECTED RATIOS |

||||||||||||||||

| Return on |

||||||||||||||||

| Average common shareholders equity |

14.34 | % | 17.41 | % | 16.68 | % | 18.13 | % | ||||||||

| Average assets |

1.29 | 1.66 | 1.50 | 1.73 | ||||||||||||

| Net interest margin |

3.00 | 3.18 | 3.01 | 3.24 | ||||||||||||

| Noninterest income to total revenue |

63 | 65 | 65 | 65 | ||||||||||||

| Efficiency |

71 | 65 | 69 | 65 | ||||||||||||

See page 34 for a glossary of certain terms used in this Report.

Certain prior period amounts included in these Consolidated Financial Highlights have been reclassified to conform with the current period presentation.

| (a) | The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than a taxable investment. To provide more meaningful comparisons of yields and margins for all earning assets, we have increased the interest income earned on tax-exempt assets to make it fully equivalent to interest income on other taxable investments. The following is a reconciliation of net interest income as reported in the Consolidated Income Statement to net interest income on a taxable-equivalent basis (in millions): |

|

Three months ended June 30 |

Six months ended June 30 |

|||||||||||

|

2005 |

2004 |

2005 |

2004 |

|||||||||

| Net interest income, GAAP basis |

$ | 534 | $ | 481 | $ | 1,040 | $ | 975 | ||||

| Taxable-equivalent adjustment |

7 | 4 | 13 | 7 | ||||||||

| Net interest income, taxable-equivalent basis |

$ | 541 | $ | 485 | $ | 1,053 | $ | 982 | ||||

1

| Unaudited |

June 30 2005 |

December 31 2004 |

June 30 2004 |

|||||||||

| BALANCE SHEET DATA (dollars in millions, except per share data) |

||||||||||||

| Assets |

$ | 90,794 | $ | 79,723 | $ | 73,119 | ||||||

| Loans, net of unearned income |

49,317 | 43,495 | 40,835 | |||||||||

| Allowance for loan and lease losses |

628 | 607 | 593 | |||||||||

| Securities |

20,437 | 16,761 | 14,954 | |||||||||

| Loans held for sale |

2,275 | 1,670 | 1,457 | |||||||||

| Deposits |

58,673 | 53,269 | 49,994 | |||||||||

| Borrowed funds |

18,206 | 11,964 | 10,937 | |||||||||

| Allowance for unfunded loan commitments and letters of credit |

84 | 75 | 84 | |||||||||

| Shareholders equity |

8,243 | 7,473 | 7,064 | |||||||||

| Common shareholders equity |

8,235 | 7,465 | 7,056 | |||||||||

| Book value per common share |

28.35 | 26.41 | 25.01 | |||||||||

| Common shares outstanding (millions) |

290 | 283 | 282 | |||||||||

| Loans to deposits |

84 | % | 82 | % | 82 | % | ||||||

| ASSETS UNDER MANAGEMENT (billions) |

$ | 456 | $ | 383 | $ | 350 | ||||||

| FUND ASSETS SERVICED (billions) |

||||||||||||

| Accounting/administration net assets |

$ | 766 | $ | 721 | $ | 665 | ||||||

| Custody assets |

462 | 451 | 416 | |||||||||

| CAPITAL RATIOS |

||||||||||||

| Tier 1 Risk-based |

8.3 | % | 9.0 | % | 9.1 | % | ||||||

| Total Risk-based |

11.9 | 13.0 | 12.9 | |||||||||

| Leverage |

7.2 | 7.6 | 7.7 | |||||||||

| Tangible common |

5.0 | 5.7 | 5.6 | |||||||||

| Common shareholders equity to assets |

9.07 | 9.36 | 9.65 | |||||||||

| ASSET QUALITY RATIOS |

||||||||||||

| Nonperforming assets to loans, loans held for sale and foreclosed assets |

.32 | % | .39 | % | .49 | % | ||||||

| Nonperforming loans to loans |

.27 | .33 | .41 | |||||||||

| Net charge-offs (recoveries) to average loans (for the three months ended) (a) |

(.32 | ) | .13 | .26 | ||||||||

| Allowance for loan and lease losses to loans |

1.27 | 1.40 | 1.45 | |||||||||

| Allowance for loan and lease losses to nonperforming loans |

476 | 424 | 351 | |||||||||

| (a) | This ratio reflects the impact of a $53 million loan recovery during the second quarter of 2005. Excluding the impact of this recovery, the ratio of net charge-offs to average loans for the second quarter of 2005 would have been .13%. |

2

FINANCIAL REVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

This Financial Review should be read together with our unaudited Consolidated Financial Statements and unaudited Statistical Information included elsewhere in this Report and Items 6, 7, 8 and 9A of our 2004 Annual Report on Form 10-K (2004 Form 10-K). We have reclassified certain prior period amounts to conform with the current year presentation. For information regarding certain business and regulatory risks, see the Risk Factors and Risk Management sections in this Financial Review and Items 1 and 7 of our 2004 Form 10-K. Also, see the Cautionary Statement Regarding Forward-Looking Information and Critical Accounting Policies And Judgments sections in this Financial Review for certain other factors that could cause actual results or future events to differ materially from those anticipated in the forward-looking statements included in this Report or from historical performance. See Note 14 Business Segments in the Notes To Consolidated Financial Statements included in Part I, Item 1 of this Report for a reconciliation of total business segment earnings to total PNC consolidated earnings as reported on a generally accepted accounting principles (GAAP) basis.

THE PNC FINANCIAL SERVICES GROUP, INC.

PNC is one of the largest diversified financial services companies in the United States, operating businesses engaged in regional community banking, wholesale banking, wealth management, asset management and global fund processing services. We operate directly and through numerous subsidiaries, providing many of our products and services nationally and others in our primary geographic markets in Pennsylvania, New Jersey, Delaware, Ohio, Kentucky and the Washington, D.C. area. We also provide certain asset management and global fund processing services internationally.

KEY STRATEGIC GOALS

Our strategy to enhance shareholder value centers on achieving growth in our lines of business underpinned by prudent management of risk, capital and expenses. In each of our business segments, the primary drivers of growth are the acquisition, expansion and retention of customer relationships. We strive to achieve such growth in our customer base by providing convenient banking options, leading technological systems and a broad range of asset management products and services. We also intend to grow through appropriate and targeted acquisitions and, in certain businesses, by expanding into new geographical markets.

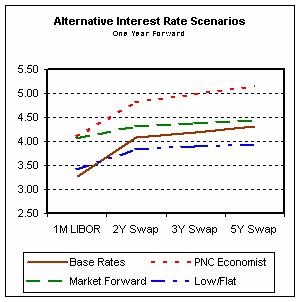

In recent years, we have managed our interest rate risk to achieve a moderate risk profile with limited exposure to earnings volatility resulting from interest rate fluctuations. Our actions have created a balance sheet characterized by strong asset quality and significant flexibility to take advantage, where appropriate, of changing interest rates and to adjust to changing market conditions. We anticipate that interest rates will continue to rise in 2005 and that the overall impact of a rise in long-term interest rates will be beneficial to us.

On May 13, 2005, we successfully completed our acquisition of Riggs National Corporation (Riggs), a Washington, D.C. based banking company. The transaction gives us a substantial presence on which to build a market leading franchise in the affluent Washington metropolitan area. In connection with the acquisition, Riggs shareholders received an aggregate of approximately $297 million in cash and 6.6 million shares of PNC common stock. Our Consolidated Balance Sheet at June 30, 2005 includes $2.8 billion of loans, net of unearned income, and $3.5 billion of deposits, including $0.8 billion of brokered certificates of deposit, related to Riggs. We include additional information on Riggs, as well as the first quarter 2005 acquisition of SSRM Holdings, Inc. (SSRM) by our majority-owned subsidiary, BlackRock, Inc. (BlackRock), in Note 2 Acquisitions in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report.

THE ONE PNC INITIATIVE

The One PNC initiative, which began in January 2005, is an ongoing, company-wide review of business practices with goals of moving closer to the customer, improving our overall efficiency and targeting resources to more value-added activities. As a result of this intensive process, we plan to reorganize our banking businesses to reduce bureaucracy and to better serve our customer base. The initiative will result in a simplified and a more centrally managed organization. Our banking businesses will be divided into two units, consumer and institutional. Consumer banking will comprise consumer and small business banking as well as wealth management. The institutional unit will include our middle market and corporate businesses as well as business credit, capital markets, real estate finance and leasing.

PNC plans to achieve approximately $300 million in cost savings on an annual run-rate basis compared with the fourth quarter of 2004 through a combination of workforce reduction and other efficiency initiatives. Approximately 3,000 positions will be eliminated, with approximately half of those to be achieved through attrition and elimination of open positions. We estimate that these changes will result in employee severance and other implementation costs of approximately $85 million, the majority of which will be recorded beginning in the third quarter of 2005 and continuing through 2006.

In addition, PNC intends to achieve at least $100 million in revenue growth through the implementation of various pricing and business growth enhancements driven by the One PNC initiative.

Implementation of ideas generated through the One PNC initiative has begun and will continue through the second quarter of 2007, with a majority of the implementation of plans to be started in 2005. We expect to start realizing a net financial benefit from the program beginning in 2006.

3

KEY FACTORS AFFECTING FINANCIAL PERFORMANCE

Our financial performance is substantially affected by several external factors outside of our control, including:

| | General economic conditions, |

| | Loan demand, |

| | Interest rates, and the shape of the interest rate yield curve, |

| | The performance of the capital markets, and |

| | Customer demand for other products and services. |

In addition to changes in general economic conditions, including the direction, timing and magnitude of movement in interest rates and the performance of the capital markets, our success for the remainder of 2005 will depend, among other things, upon:

| | Further success in the acquisition, growth and retention of customers, |

| | Successful commencement of implementation of the One PNC initiative, |

| | Growth in market share across businesses, |

| | Disciplined expense control and improved efficiency, |

| | Maintaining strong overall asset quality, and |

| | Prudent risk and capital management. |

SUMMARY FINANCIAL RESULTS

Consolidated net income for the first six months of 2005 was $636 million, or $2.22 per diluted share, compared with $632 million, or $2.22 per diluted share, for the first six months of 2004. Return on average common shareholders equity was 16.68% for the first half of 2005 compared with 18.13% for the first half of 2004. Return on average assets was 1.50% for the first six months of 2005 compared with 1.73% for the first six months of 2004.

Consolidated net income for the second quarter of 2005 was $282 million, or $.98 per diluted share, compared with net income of $304 million, or $1.07 per diluted share, for the second quarter of 2004. Return on average common shareholders equity was 14.34% for the second quarter of 2005 and 17.41% for the second quarter of 2004. Return on average assets was 1.29% for the second quarter of 2005 compared with 1.66% for the second quarter of 2004.

Earnings for the second quarter and first half of 2005 included integration costs and dilution from operations of $18 million after-tax, or $.08 per diluted share, related to the acquisition of Riggs.

As previously reported, in January 2005 our ownership in BlackRock was transferred from PNC Bank, National Association (PNC Bank, N.A.) to PNC Bancorp, Inc., our intermediate bank holding company. The transfer was effected primarily to give BlackRock more operating flexibility, particularly in connection with its acquisition of SSRM. As a result of the transfer, certain deferred tax liabilities recorded by PNC were reversed in the first quarter of 2005 in accordance with Statement of Financial Accounting Standards No. (SFAS) 109, Accounting for Income Taxes. The reversal of deferred tax liabilities benefited our earnings by $45 million, or approximately $.16 per diluted share, in the first quarter of 2005.

Our second quarter 2005 performance included the following accomplishments:

| | The acquisition of Riggs was completed on Friday, May 13, 2005. A successful conversion of all Riggs customers to PNCs systems was completed over the following weekend. Loan and deposit balances in PNCs new Washington, D.C. region met our expectations, and early trends on new customer acquisitions are encouraging. |

| | Taxable-equivalent net interest income increased 12% compared with the second quarter of 2004 as a result of increased earning assets and higher yields on assets. |

| | Average total loans increased $7.1 billion, or 18%, compared with the second quarter of 2004, driven by targeted sales efforts to capitalize on increased market demand. Four percent of the growth was attributable to the Riggs acquisition. |

| | Average total deposits increased $7.6 billion, or 16%, compared with the prior year second quarter, driven by higher certificates of deposit, money market and demand deposit balances, and higher Eurodollar borrowings. The Riggs acquisition accounted for 4% of the growth, including the impact of brokered certificates of deposit. Average interest-bearing deposits increased 17%, while average demand and other noninterest-bearing deposits increased 11%, compared with the second quarter of 2004. |

| | Noninterest income increased 2% compared with a year ago driven by a 33% increase in asset management fees and higher fund servicing revenue. These factors were mostly offset by net securities losses compared with gains in the second quarter of 2004, lower gains on institutional loans held for sale, lower trading revenue and lower equity management gains. |

| | Noninterest expense rose $126 million, or 14%, in the second quarter of 2005 compared with the prior year second quarter. However, apart from the $38 million impact of Riggs and an increase of $66 million in operating expenses at BlackRock in 2005 and $8 million of costs incurred in the second quarter of 2004 related to the sale of our vehicle leasing business, noninterest expense rose only 3% in the comparison. Noninterest expense increased 4% compared with the first quarter of 2005 driven by the Riggs acquisition. Apart from the impact of the Riggs and SSRM acquisitions, expenses were flat compared with the first quarter of 2005 due to disciplined expense control. |

| | Asset quality remained very strong. The ratio of nonperforming loans to total loans fell to .27% at June 30, 2005 from .41% at June 20, 2004 and the ratio of nonperforming assets to total assets fell to .18% from .29% in the same comparison. |

4

BALANCE SHEET HIGHLIGHTS

Total average assets were $85.5 billion for the first six months of 2005 compared with $73.4 billion for the first six months of 2004. This increase was primarily attributable to a $9.5 billion increase in interest-earning assets. An increase of $6.1 billion in average loans was the primary factor for the increase in average interest-earning assets. In addition, average total securities increased $1.9 billion in the first half of 2005 compared with the prior year first half.

Average total loans were $45.6 billion for the first half of 2005 and $39.5 billion in the first half of 2004. This increase was driven by continued improvements in market loan demand and targeted sales efforts across our banking businesses, as well as the Riggs acquisition. The increase in average total loans reflected growth in consumer loans of approximately $2.6 billion, commercial loans of approximately $2.5 billion and residential mortgages of approximately $1.7 billion, partially offset by a $.7 billion decline in lease financing loans. During the second quarter of 2004, we sold our vehicle leasing portfolio as more fully described in our 2004 Form 10-K.

Loans represented 65% of average interest-earning assets for both the first half of 2005 and the first half of 2004.

Average securities totaled $17.9 billion for the first six months of 2005 and $16.0 billion for the first six months of 2004. Of this increase, $1.4 billion was attributable to increases in mortgage-backed, asset-backed and other debt securities. Securities comprised 26% of average interest-earning assets for both the first six months of 2005 and the first six months of 2004.

Funding cost is affected by the volume and type of funding sources that we have as well as the rates that we pay on those sources. Average total deposits were $55.0 billion for the first six months of 2005, an increase of $6.8 billion over the first six months of 2004. The increase in average total deposits was driven primarily by the impact of higher certificates of deposit, money market account and noninterest-bearing deposit balances, and by higher Eurodollar deposits. Average total deposits represented 64% of total sources of funds for the first six months of 2005 and 66% for the first six months of 2004. Average transaction deposits were $37.8 billion for the first half of 2005 compared with $35.2 billion for the first half of 2004.

Average borrowed funds were $15.7 billion for the first six months of 2005 and $12.9 billion for the first six months of 2004. The following contributed to this increase:

| | Our issuance of $1 billion of Federal Home Loan Bank advances in June 2005, $500 million of senior bank notes in September 2004, $500 million of subordinated bank notes in December 2004 and $700 million of senior notes and $350 million of senior bank notes in March 2005, |

| | The assumption of approximately $345 million of subordinated debt with the Riggs acquisition, |

| | BlackRocks issuance of $250 million of convertible debentures in February 2005, and |

| | An increase in short-term borrowings to fund asset growth. |

These increases were partially offset by senior bank note maturities in May 2005 and in the first quarter of 2004 and senior and subordinated debt maturities in April 2005 and during the last half of 2004.

Shareholders equity totaled $8.2 billion at June 30, 2005, compared with $7.5 billion at December 31, 2004. See the Consolidated Balance Sheet Review section of this Financial Review for additional information.

BUSINESS SEGMENT HIGHLIGHTS

Total business segment earnings for the first six months of 2005 were $712 million compared with $656 million for the first six months of 2004. Total business segment earnings were $383 million for the second quarter of 2005 and $330 million for the second quarter of 2004. A summary of results for both the first half and second quarter of 2005 compared with the prior year periods follows. Further analysis of business segment results for the six-month periods is found on pages 15 through 22.

Regional Community Banking

Regional Community Banking earnings for the first half of 2005 totaled $258 million compared with $227 million for the first half of 2004. Continued organic customer growth and the Riggs acquisition have driven a growing balance sheet and a 4% revenue increase. These positive results combined with slightly lower expenses and a lower provision for credit losses drove the 14% increase in earnings over last year.

Earnings from Regional Community Banking totaled $137 million for the second quarter of 2005 compared with $125 million for the second quarter of 2004. The 10% increase in earnings compared with the prior year quarter was driven by continued customer and balance sheet growth and a sustained focus on expense management. Checking relationships as of June 30, 2005 grew 9% compared with June 30, 2004, while total average loans grew 15% and average demand deposits grew 7% for the second quarter of 2005 compared with the second quarter of 2004.

Wholesale Banking

Earnings from Wholesale Banking were $254 million for the first six months of 2005 and $235 million for the first six months of 2004. In addition to the impact of higher taxable-equivalent net interest income driven by loan growth, the increased earnings compared with a year ago reflected the benefit of a higher negative provision for credit losses resulting from a $53 million loan recovery recorded during the second quarter of 2005. Those factors were partially offset by lower net gains from institutional loans held for sale.

Wholesale Banking earned $144 million for the second quarter of 2005 compared with $113 million for the second quarter of 2004. The higher earnings compared with the prior year quarter reflected the benefit of a negative provision for credit losses of $48 million in the second quarter of 2005, primarily as a result of the $53 million loan recovery referred to above, compared with an $8 million provision in the second quarter of 2004. The provision benefit and higher taxable-equivalent net interest income in the 2005 quarter were partially offset by lower net gains on institutional loans held for sale in 2005.

5

PNC Advisors

Earnings from PNC Advisors totaled $53 million for the first six months of 2005 and $58 million for the first six months of 2004. Earnings for the first half of 2004 included a $7 million after-tax gain recognized from the sale of certain investment consulting activities of the Hawthorn unit. Excluding the impact of this gain, the increase in earnings in the first half of 2005 primarily reflected disciplined expense control and higher asset management fees that more than offset a decline in client-related trading revenue.

PNC Advisors earned $25 million in the second quarter of 2005 and $27 million in the second quarter of 2004. The lower earnings compared with the prior year quarter reflected higher expenses associated with various one-time items partially offset by higher investment management revenue and taxable-equivalent net interest income.

BlackRock

BlackRock earnings totaled $100 million for the first half of 2005 compared with $103 million for the first half of 2004. Lower earnings for the first six months of 2005 compared with the prior year period reflected $30 million of pretax LTIP expenses in the first half of 2005 and nonrecurring pretax expenses of $9 million associated with the SSRM acquisition recognized in the first quarter of 2005. In addition, results for the first half of 2004 included a $9 million net income benefit recognized during the first quarter of that year associated with the resolution of an audit performed by New York State on state income tax returns filed from 1998 through 2001.

BlackRock reported earnings of $53 million for the second quarter of 2005 compared with $48 million for the second quarter of 2004. The higher earnings in the 2005 quarter were primarily due to higher investment advisory and administration fees driven by a growing base of assets under management that more than offset the increase in expense due to higher staffing levels following the SSRM acquisition, higher incentive compensation, including $16 million of pretax LTIP expenses, and higher general and administrative expense reported in the 2005 quarter. BlackRocks assets under management grew to $414 billion at June 30, 2005 compared with $342 billion at December 31, 2004, due to the SSRM acquisition and new business.

PNC owns approximately 70% of BlackRock and we consolidate BlackRock into our financial statements. Accordingly, approximately 30% of BlackRocks earnings are recognized as minority interest expense in the Consolidated Income Statement. BlackRock financial information included in the Financial Review section of this Report is presented on a stand-alone basis. The market value of our BlackRock shares was approximately $3.6 billion at June 30, 2005 while the book value at that date was $.6 billion.

PFPC

PFPC earnings totaled $47 million for the first half of 2005 and $33 million for the first half of 2004. Earnings from PFPC totaled $24 million for the second quarter of 2005 and $17 million for the second quarter of 2004. Higher earnings for both 2005 periods were attributable to disciplined expense control, improved operating leverage, and strong performance from key PFPC business units, as well as reduced intercompany debt financing costs. PFPCs accounting/administration net fund assets increased 15% and custody fund assets increased 11% as of June 30, 2005 compared with the balances at June 30, 2004. The increases were driven by new business and asset inflows from existing customers, as well as comparatively favorable market conditions.

Other

For the first six months of 2005, Other reported a net loss of $46 million compared with earnings of $6 million for the first six months of 2004. The decrease from the first half of 2004 reflected the impact of Riggs acquisition integration costs totaling $19 million after-tax in 2005 and $35 million of net securities losses in 2005 compared with $29 million of net securities gains in the prior year first half. In addition, Other for the first half of 2004 included the impact of the $22 million after-tax gain on the sale of our modified coinsurance contracts. These factors were partially offset by the benefit of the $45 million deferred tax liability reversal related to our investment in BlackRock in the first quarter of 2005, as described further above under Summary Financial Results.

Other for the second quarter of 2005 reflected a net loss of $85 million compared with a net loss of $12 million in the second quarter of 2004. Second quarter 2005 results include the impact of the nonrecurring Riggs costs referred to above. In addition, the higher net loss compared with the second quarter of 2004 reflected $26 million in net securities losses in the 2005 quarter compared with $14 million of net securities gains a year ago, as well as lower equity management gains and lower trading revenue in the 2005 quarter.

6

CONSOLIDATED INCOME STATEMENT REVIEW

NET INTEREST INCOME AND NET INTEREST MARGIN

Changes in net interest income and margin result from the interaction of the volume and composition of interest-earning assets and related yields, interest-bearing liabilities and related rates paid, and noninterest-bearing sources.

See Statistical Information-Average Consolidated Balance Sheet And Net Interest Analysis included on pages 59 and 60 of this Report for additional information.

Taxable-equivalent net interest income totaled $1.053 billion for the first half of 2005 and $982 million for the first half of 2004. Taxable-equivalent net interest income totaled $541 million for the second quarter of 2005 compared with $485 million for the second quarter of 2004. The increase in taxable-equivalent net interest income in both comparisons reflected the impact of higher average interest-earning assets in 2005. Our Consolidated Financial Highlights section included in this Financial Review provides a reconciliation of net interest income as reported under GAAP to net interest income presented on a taxable-equivalent basis.

The net interest margin for the first six months of 2005 was 3.01% compared with 3.24% for the first six months of 2004. The following factors contributed to the decline in net interest margin:

| | An increase in the average rate paid on deposits of 78 basis points for the first half of 2005 compared with the first half of 2004. The average rate paid on money market accounts, the largest single component of interest-bearing deposits, increased 115 basis points, reflecting the increase in short-term interest rates that began in mid-2004. |

| | An increase in the average rate paid on borrowed funds of 115 basis points for the first six months of 2005 compared with the first six months of 2004. |

| | In the comparison, the yield on interest-earning assets increased only 52 basis points. |

| | Higher balances of trading assets, which negatively affected the overall yield on interest-earning assets. |

The net interest margin for the second quarter of 2005 was 3.00% compared with 3.18% for the second quarter of 2004. The following factors contributed to the decline in net interest margin:

| | An increase in the average rate paid on deposits of 90 basis points for the second quarter of 2005 compared with the second quarter of 2004. The average rate paid on money market accounts, the largest single component of interest-bearing deposits, increased 130 basis points, reflecting the increase in short-term interest rates that began in mid-2004. |

| | An increase in the average rate paid on borrowed funds of 127 basis points for the second quarter of 2005 compared with the year ago quarter. |

| | In the comparison, the yield on interest-earning assets increased only 69 basis points. |

| | Higher balances of trading assets. |

In both the first half and second quarter comparisons, the factors outlined above more than offset the effect of higher average yields on securities and loans and the increased benefit of noninterest-bearing sources of funds in 2005.

PROVISION FOR CREDIT LOSSES

The provision for credit losses decreased $39 million, to a negative provision of $19 million, for the first half of 2005 compared with the first half of 2004. For the second quarter of 2005, the provision for credit losses declined $35 million compared with the prior year quarter. The decline in the provision for credit losses in both comparisons was primarily due to a $53 million loan recovery in the second quarter of 2005 resulting from a litigation settlement, in addition to continued improvement in asset quality. The improved credit quality reflected both a decline in nonperforming loans and a reduction in problems related to performing credits. The favorable impact of these factors on the provision was partially offset by the impact of total average loan growth in both the first six months and second quarter of 2005 compared with the respective prior year periods.

We expect loan growth to continue to impact the provision during the remainder of 2005. See Allowance for Loan And Lease Losses And Unfunded Loan Commitments And Letters Of Credit in the Credit Risk Management portion of the Risk Management section of this Financial Review for additional information regarding factors impacting the provision for credit losses.

NONINTEREST INCOME

Summary

Noninterest income was $1.898 billion for the first six months of 2005 compared with $1.821 billion for the first six months of 2004. For the second quarter of 2005, noninterest income totaled $925 million compared with $910 million for the second quarter of 2004. Noninterest income in both comparisons with 2004 benefited from higher asset management fees primarily due to BlackRocks acquisition of SSRM in early 2005, along with higher fund servicing fees, consumer services fees and service charges on deposits. These improvements were partially offset by lower corporate services revenue, lower other noninterest income, and net securities losses in the 2005 periods compared with net securities gains in the corresponding 2004 periods. In addition, noninterest income for the second quarter of 2005 was negatively impacted by a decline in equity management gains compared with the second quarter of 2004.

Noninterest income for the first half of 2004 included the following pretax gains:

| | A first quarter $34 million gain related to the sale of our modified coinsurance contracts, |

| | A second quarter $13 million gain recognized in connection with BlackRocks sale of its interest in Trepp LLC, and |

| | A first quarter $10 million gain related to the sale of certain investment consulting activities of the Hawthorn unit of PNC Advisors. |

Our 2004 Form 10-K more fully describes these three transactions.

Additional analysis

Combined asset management and fund servicing fees amounted to $1.087 billion for the first half of 2005 compared

7

with $909 million for the first half of 2004. For the second quarter of 2005, combined asset management and fund servicing fees were $553 million compared with $452 million in the prior year second quarter. The increases in both comparisons reflected the impact of the first quarter 2005 SSRM acquisition and other growth in assets managed and serviced.

Assets under management at June 30, 2005 totaled $456 billion compared with $350 billion at June 30, 2004. The acquisition of SSRM added $50 billion of assets under management during the first quarter of 2005. PFPC provided fund accounting/administration services for $766 billion of net fund investment assets and provided custody services for $462 billion of fund investment assets at June 30, 2005, compared with $665 billion and $416 billion, respectively, at June 30, 2004. These increases were driven by new business and asset inflows from existing customers, as well as comparatively favorable market conditions.

Service charges on deposits increased $4 million for both the first six months and second quarter of 2005 compared with the corresponding prior year periods. Although growth in service charges has been limited due to our offering of free checking in both the consumer and small business channels, free checking has positively impacted customer demand and demand deposit growth as well as other consumer related fees.

Brokerage fees declined slightly in the first half of 2005 compared with the year ago first half primarily due to weaker retail trading and were essentially flat for the second quarter of 2005 compared with the second quarter of 2004.

Consumer services fees increased $10 million, to $140 million, in the first six months of 2005 compared with the first six months of 2004. For the second quarter of 2005, consumer services fees increased $7 million compared with the prior year second quarter. Higher fees in both comparisons reflected additional fees from debit card transactions primarily due to higher volumes, partially offset by the impact of the sale of certain out-of-footprint ATMs. In addition, the increase during the second quarter of 2005 reflected the impact of Riggs.

Corporate services revenue declined $29 million for the first half of 2005 compared with the prior year first half and decreased $11 million for the second quarter of 2005 compared with the second quarter of 2004. These declines reflected lower net gains in excess of valuation adjustments related to our liquidation of institutional loans held for sale, which declined $41 million in the first half comparison and $15 million in the second quarter comparison. Our liquidation of institutional loans held for sale is essentially complete. These decreases were partially offset by the impact of higher fees in both 2005 comparisons related to commercial mortgage servicing activities and, in the six-month comparison, by higher capital markets revenues.

Equity management (private equity) net gains on portfolio investments totaled $44 million for the first six months of 2005 and $42 million for the first six months of 2004. Such gains totaled $12 million for the second quarter of 2005 compared with $35 million for the second quarter of 2004.

Net securities losses amounted to $35 million for the first half of 2005 compared with net securities gains of $29 million in the first half of 2004. For the second quarter of 2005, net securities losses totaled $26 million, compared with net securities gains of $14 million in the prior year quarter. Our discussion under the Consolidated Balance Sheet Review section of this Report of actions taken during the second quarter of 2005 regarding our securities portfolio provides additional information on the 2005 net securities losses.

Other noninterest income decreased $22 million, to $200 million, in the first six months of 2005 compared with the first six months of 2004. Other noninterest income for the first half of 2005 included a $10 million settlement received in connection with a PFPC contractual matter during the first quarter of 2005 and an $8 million increase in trading revenue compared with the prior year first half. These factors were more than offset by the impact of the gains related to the three 2004 sale transactions described under the Summary section above.

Other noninterest income declined $24 million in the second quarter of 2005 compared with the second quarter of 2004. The $13 million pretax gain related to the Trepp LLC sale in 2004 referred to above impacted the second quarter comparison. Other noninterest income typically fluctuates from period to period depending on the nature and magnitude of transactions completed.

PRODUCT REVENUE

Wholesale Banking offers treasury management and capital markets-related products and services, commercial loan servicing and equipment leasing products that are marketed by several businesses across PNC.

Treasury management revenue, which includes fees as well as revenue from customer deposit balances, totaled $200 million for the first six months of 2005 and $179 million for the first six months of 2004. For the second quarter of 2005, revenue totaled $103 million compared with $91 million in the second quarter of 2004. The increased revenue in both 2005 periods reflected the longer term nature of treasury management deposits along with the rising interest rate environment, strong deposit growth, continued expansion and client utilization of commercial card services and a steady increase in business-to-business processing volumes.

Consolidated revenue from capital markets was $71 million for the first half of 2005, an increase of $2 million compared with the first half of 2004. Increases in loan syndication fees and client-related trading revenue drove the increase in capital markets revenue for the first half of 2005 compared with the prior year first half. Consolidated revenue from capital markets totaled $29 million for the second quarter of 2005 and $37 million for the prior year second quarter. This decline was driven by lower trading results.

Midland Loan Services offers servicing and technology solutions for the commercial real estate finance industry. Midlands revenue, which includes fees as well as revenue from servicing deposit balances, totaled $59 million for the first six months of 2005 and $51 million for the first six months of 2004. Midlands revenue totaled $29 million for the second quarter of 2005 compared with $26 million for the second quarter of 2004. The revenue growth was driven primarily by growth in the commercial mortgage servicing portfolio and related services.

8

Consolidated revenue from equipment leasing products was $36 million for the first half of 2005 and $42 million for the first half of 2004. The decline was due to the interest cost of funding the potential tax exposure on the cross-border leasing portfolio. See Cross-Border Leases and Related Tax and Accounting Matters in the Consolidated Balance Sheet Review section of this Financial Review for further information. For the second quarter of 2005, consolidated revenue from equipment leasing products was $18 million compared with $21 million in the prior year quarter.

As a component of our advisory services to clients, we provide a select set of insurance products to fulfill specific customer financial needs. Primary insurance offerings include:

| | Annuities, |

| | Credit life, |

| | Health, |

| | Disability, and |

| | Commercial lines coverage. |

Client segments served by these insurance solutions include those in PNC Advisors, Regional Community Banking and Wholesale Banking. Insurance products are sold by PNC-licensed insurance agents and through licensed third-party arrangements. We recognized revenue from these products of $31 million in the first six months of 2005 and $33 million in the first six months of 2004. Revenue for the second quarter of 2005 totaled $17 million compared with $18 million for the second quarter of 2004.

Additionally, through our subsidiary companies, PNC Insurance Corp. and Alpine Indemnity Limited, we act as a reinsurer for consumer credit insurance provided to customers of our subsidiaries. We also write, assume and cede insurance for property, workers compensation, commercial general liability and automobile liability of PNC and its affiliates.

In the normal course of business PNC Insurance Corp. and Alpine Indemnity Limited maintain insurance reserves for reported claims and for claims incurred but not reported based on actuarial assessments.

NONINTEREST EXPENSE

Year-to-date June 30, 2005 and 2004

Total noninterest expense was $2.035 billion for the first six months of 2005, an increase of $230 million compared with the first six months of 2004. The efficiency ratio was 69% for the first half of 2005 compared with 65% for the first half of 2004.

Noninterest expense for the first six months of 2005 included the following:

| | An increase of $137 million in BlackRock operating expenses that reflected the impact of costs associated with the first quarter 2005 SSRM acquisition and charges related to the BlackRock LTIP awards. See the discussion under the heading 2002 BlackRock Long-Term Retention and Incentive Plan in this Financial Review for additional information on the latter expenses; and |

| | Costs totaling approximately $40 million resulting from our second quarter acquisition of Riggs, including approximately $15 million of integration costs. The impact of these costs was reflected in several noninterest expense line items in the Consolidated Income Statement. |

Noninterest expense for the first six months of 2004 included the following:

| | Conversion-related and other nonrecurring costs totaling approximately $11 million related to our acquisition of United National Bancorp, Inc. (United National); |

| | Expenses totaling $8 million in connection with the sale of our vehicle leasing business; and |

| | A $6 million impairment charge on an intangible asset related to the orderly liquidation of a particular fund managed by BlackRock. |

Apart from the impact of the items described above, noninterest expense increased $78 million, or 4%, in the first half of 2005 compared with the same period in 2004. The higher expenses were driven by increased sales incentives and the increased impact of expensing stock options. See Note 1 Accounting Policies in our Notes To Consolidated Financial Statements under Item 1 of this Report for additional information on our accounting for employee and director stock options.

Average full-time equivalent employees totaled approximately 24,100 in the first six months of 2005 and 23,700 for the first six months of 2004. This increase was primarily attributable to increases related to our Riggs acquisition and BlackRocks acquisition of SSRM, partially offset by a decline in other Regional Community Banking businesses.

Second quarter 2005 and 2004

Total noninterest expense was $1.036 billion for the second quarter of 2005 and $910 million for the second quarter of 2004. The efficiency ratio was 71% for the second quarter of 2005 compared with 65% for the prior year quarter.

Noninterest expense for the second quarter of 2005 included the Riggs-related expenses totaling $38 million described above, $17 million of LTIP charges and $50 million of increases in BlackRock operating expenses, while expenses for the second quarter of 2004 included $8 million in connection with the sale of our vehicle leasing business in that period. Apart from the impact of these items, noninterest expense for the second quarter of 2005 increased $29 million, or 3%, over the prior year second quarter.

We expect noninterest expense for the remainder of 2005 to include implementation costs related to the One PNC initiative.

EFFECTIVE TAX RATE

Our effective tax rate for the first half of 2005 was 29.4% compared with 33.1% for the first half of 2004. The decrease in the effective rate for the first six months of 2005 was primarily attributable to the impact of the reversal of deferred tax liabilities in connection with the transfer of our ownership in BlackRock to our intermediate bank holding company. This transaction reduced our first quarter 2005 tax provision by $45 million, or $.16 per diluted share. See Note 2 Acquisitions included in the Notes To Consolidated Financial Statements in Item 1 of this Report for additional information. The effective tax rate for the first six months of 2004 was favorably impacted by the $9 million tax benefit recorded in the first quarter of 2004 as a result of resolving a BlackRock New York State audit.

For the second quarter of 2005, our effective tax rate was 35.3% compared with 33.4% for the second quarter of 2004. The second quarter 2005 effective tax rate reflects a $6 million increase in deferred state income taxes, net of the federal income tax benefit, related to the Riggs acquisition.

9

CONSOLIDATED BALANCE SHEET REVIEW

BALANCE SHEET DATA

| In millions |

June 30 2005 |

December 31 2004 |

||||

| Assets |

||||||

| Loans, net of unearned income |

$ | 49,317 | $ | 43,495 | ||

| Securities available for sale and held to maturity |

20,437 | 16,761 | ||||

| Loans held for sale |

2,275 | 1,670 | ||||

| Other |

18,765 | 17,797 | ||||

| Total assets |

$ | 90,794 | $ | 79,723 | ||

| Liabilities |

||||||

| Funding sources |

$ | 76,879 | $ | 65,233 | ||

| Other |

5,165 | 6,513 | ||||

| Total liabilities |

82,044 | 71,746 | ||||

| Minority and noncontrolling interests in consolidated entities |

507 | 504 | ||||

| Total shareholders equity |

8,243 | 7,473 | ||||

| Total liabilities, minority and noncontrolling interests, and shareholders equity |

$ | 90,794 | $ | 79,723 | ||

Our Consolidated Balance Sheet is presented in Part I, Item 1 on page 39 of this Report.

Higher total assets at June 30, 2005 compared with the balance at December 31, 2004 were driven by the impact of the Riggs acquisition, loan growth resulting from continued improvements in market loan demand and higher securities balances that reflected short-term investing opportunities.

An analysis of changes in certain balance sheet categories follows.

LOANS, NET OF UNEARNED INCOME

Loans increased $5.8 billion, to $49.3 billion at June 30, 2005, compared with the balance at December 31, 2004. The impact of our Riggs acquisition added $2.8 billion of loans as of June 30, 2005. Improvements in market loan demand, in addition to targeted sales efforts across our banking businesses, drove the increase in total loans.

Details Of Loans

| In millions |

June 30 2005 |

December 31 2004 |

||||||

| Commercial |

||||||||

| Retail/wholesale |

$ | 5,295 | $ | 4,961 | ||||

| Manufacturing |

4,498 | 3,944 | ||||||

| Other service providers |

2,198 | 1,787 | ||||||

| Real estate related |

2,520 | 2,104 | ||||||

| Financial services |

1,374 | 1,145 | ||||||

| Health care |

671 | 560 | ||||||

| Other |

3,447 | 2,937 | ||||||

| Total commercial |

20,003 | 17,438 | ||||||

| Commercial real estate |

||||||||

| Real estate projects |

2,030 | 1,460 | ||||||

| Mortgage |

806 | 520 | ||||||

| Total commercial real estate |

2,836 | 1,980 | ||||||

| Equipment lease financing |

3,668 | 3,907 | ||||||

| Total commercial lending |

26,507 | 23,325 | ||||||

| Consumer |

||||||||

| Home equity |

13,531 | 12,734 | ||||||

| Automobile |

874 | 836 | ||||||

| Other |

2,165 | 2,036 | ||||||

| Total consumer |

16,570 | 15,606 | ||||||

| Residential mortgage |

6,508 | 4,772 | ||||||

| Vehicle lease financing |

124 | 189 | ||||||

| Other |

455 | 505 | ||||||

| Unearned income |

(847 | ) | (902 | ) | ||||

| Total, net of unearned income |

$ | 49,317 | $ | 43,495 | ||||

| Supplement Loan Information |

||||||||

| Loans excluding conduit |

$ | 47,125 | $ | 41,243 | ||||

| Market Street Funding Corporation conduit |

2,192 | 2,252 | ||||||

| Total loans |

$ | 49,317 | $ | 43,495 | ||||

As the table above indicates, the loans that we hold continued to be diversified among numerous industries and types of businesses. The loans that we hold are also diversified across the geographic areas where we do business.

Commercial Lending Exposure (a)(b)

|

June 30 2005 |

December 31 2004 |

|||||

| Investment grade or equivalent |

||||||

| $50 million or greater |

17 | % | 16 | % | ||

| $25 million to < $50 million |

16 | % | 16 | % | ||

| <$25 million |

16 | % | 15 | % | ||

| Non-investment grade |

||||||

| $50 million or greater |

2 | % | 2 | % | ||

| $25 million to < $50 million |

12 | % | 11 | % | ||

| <$25 million |

37 | % | 40 | % | ||

| Total |

100 | % | 100 | % | ||

| (a) | These statistics exclude the loans of Market Street Funding Corporation. The facilities extended by Market Street represent pools of granular obligations, structured to avoid excessive concentration of credit risk such that they attract an investment grade rating. |

| (b) | Exposure represents the sum of all loans, leases, commitments and letters of credit. |

Commercial loans are the largest category of credits and are the most sensitive to changes in assumptions and judgments underlying the determination of the allowance for loan and lease losses. We have allocated approximately $523 million, or 83%, of the total allowance for loan and lease losses at June 30, 2005 to the commercial loan category. This allocation also considers other relevant factors such as:

| | Actual versus estimated losses, |

| | Regional and national economic conditions, |

| | Business segment and portfolio concentrations, |

10

| | Industry competition and consolidation, |

| | The impact of government regulations, and |

| | Risk of potential estimation or judgmental errors, including the accuracy of risk ratings. |

Net Unfunded Credit Commitments

| In millions |

June 30 2005 |

December 31 2004 |

||||

| Commercial |

$ | 22,887 | $ | 20,969 | ||

| Consumer |

8,900 | 7,655 | ||||

| Commercial real estate |

2,206 | 1,199 | ||||

| Other |

384 | 483 | ||||

| Total |

$ | 34,377 | $ | 30,306 | ||

Commitments to extend credit represent arrangements to lend funds or provide liquidity subject to specified contractual conditions. Commercial commitments are reported net of participations, assignments and syndications, primarily to financial institutions, totaling $6.5 billion at June 30, 2005 and $6.7 billion at December 31, 2004.

The increase in consumer net unfunded commitments at June 30, 2005 compared with the balance at December 31, 2004 was primarily due to net unfunded commitments related to growth in home equity loans.

Unfunded credit commitments related to Market Street Funding Corporation totaled $906 million at June 30, 2005 and $962 million at December 31, 2004 and are included in the preceding table primarily within the Commercial and Consumer categories. See the Off-Balance Sheet Arrangements And Consolidated VIEs section of this Financial Review and Note 7 Variable Interest Entities in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report for further information regarding Market Street.

In addition to credit commitments, our net outstanding standby letters of credit totaled $3.7 billion at both June 30, 2005 and December 31, 2004. Standby letters of credit commit us to make payments on behalf of our customers if specified future events occur.

Cross-Border Leases and Related Tax and Accounting Matters

The equipment lease portfolio totaled $3.7 billion at June 30, 2005 and included approximately $1.7 billion of cross-border leases. Cross-border leases are primarily leveraged leases of equipment located in foreign countries, primarily in western Europe and Australia. We no longer enter into cross-border lease transactions.

Aggregate residual value at risk on the total commercial lease portfolio at June 30, 2005 was $1.1 billion. We have taken steps to mitigate $.6 billion of this residual risk, including residual value insurance coverage with third parties, third party guarantees, and other actions. Approximately $.5 billion of this risk was unmitigated at June 30, 2005.

The American Jobs Creation Act of 2004 (AJCA) limits the tax deductions that may be taken in a given year related to certain lease transactions, including the types of cross-border lease transactions that we have previously entered into. However, AJCA impacts only cross-border lease transactions entered into after March 12, 2004. All of our cross-border lease transactions were entered into prior to this date and are therefore not affected by AJCA. While only transactions entered into after March 12, 2004 are specifically impacted, AJCA is clear that no inference should be drawn as to the proper tax treatment of transactions entered into on or before this date. Thus, the tax treatment of existing transactions is still subject to challenge by the IRS.

Upon completing examination of our 1998-2000 consolidated federal income tax returns, on June 20, 2005 the IRS provided us with an examination report which proposes increases in our tax liability, principally arising from adjustments to several of our cross-border lease transactions.

The proposed adjustments would reverse the tax treatment of these transactions as we reported them on our filed tax returns. We believe the method we used to report these transactions is supported by appropriate tax law and have filed a protest of the IRS examination findings with the IRS appeals office. While we cannot predict with certainty the result of filing the protest, any resolution would most likely involve a change in the timing of tax deductions which, in turn, depending on the exact resolution, could significantly impact the economics of these transactions. The IRS is also beginning an audit of our 2001-2003 consolidated federal income tax returns. We expect them to again make adjustments to the cross-border lease transactions referred to above as well as to new cross-border lease transactions entered in those years. We believe our reserves for these exposures were adequate at June 30, 2005.

Further, the Financial Accounting Standards Board (FASB) has issued a proposed staff position to consider whether any change in the timing of tax benefits associated with these types of transactions should result in a recalculation under SFAS 13, Accounting for Leases, and whether a lessor should re-evaluate the classification of a leveraged lease when a recalculation of the lease is performed. If the FASB ultimately adopts the guidance as proposed, a cumulative adjustment in the period of change which could be material and future adjustments to earnings could be required. However, under the leverage leasing accounting rules, any reductions in earnings would be recovered in future years over the remaining lives of the leases.

In addition to the transactions referred to above, three lease-to-service contract transactions that we were party to were structured as partnerships for tax purposes. These partnerships are under audit by the IRS. However, we do not believe that our exposure from these transactions is material to our consolidated results of operations or financial position.

11

SECURITIES

Details Of Securities

| In millions |

Amortized Cost |

Fair Value |

||||

| June 30, 2005 (a) |

||||||

| SECURITIES AVAILABLE FOR SALE |

||||||

| Debt securities |

||||||

| U.S. Treasury and government agencies |

$ | 4,363 | $ | 4,353 | ||

| Mortgage-backed |

12,921 | 12,851 | ||||

| Commercial mortgage-backed |

1,325 | 1,330 | ||||

| Asset-backed |

1,468 | 1,465 | ||||

| State and municipal |

169 | 170 | ||||

| Other debt |

99 | 99 | ||||

| Corporate stocks and other |

169 | 169 | ||||

| Total securities available for sale |

$ | 20,514 | $ | 20,437 | ||

| December 31, 2004 |

||||||

| SECURITIES AVAILABLE FOR SALE |

||||||

| Debt securities |

||||||

| U.S. Treasury and government agencies |

$ | 4,735 | $ | 4,722 | ||

| Mortgage-backed |

8,506 | 8,433 | ||||

| Commercial mortgage-backed |

1,380 | 1,370 | ||||

| Asset-backed |

1,910 | 1,901 | ||||

| State and municipal |

175 | 176 | ||||

| Other debt |

33 | 33 | ||||

| Corporate stocks and other |

123 | 125 | ||||

| Total securities available for sale |

$ | 16,862 | $ | 16,760 | ||

| SECURITIES HELD TO MATURITY |

||||||

| Debt securities |

||||||

| Asset-backed |

$ | 1 | $ | 1 | ||

| Total securities held to maturity |

$ | 1 | $ | 1 | ||

| (a) | Securities held to maturity at June 30, 2005 were less than $1 million. |

Securities represented 23% of total assets at June 30, 2005 and 21% of total assets at December 31, 2004. The increase in total securities compared with December 31, 2004 was primarily due to the acquisition of Riggs and normal portfolio activity.

At June 30, 2005, the securities available for sale balance included a net unrealized loss of $77 million, which represented the difference between fair value and amortized cost. The comparable amount at December 31, 2004 was a net unrealized loss of $102 million. The decrease in the net unrealized loss at June 30, 2005 reflected the sales of securities during the second quarter of 2005 as discussed below and the change in portfolio mix, partially offset by the impact of increases in interest rates during the first six months of 2005.

We evaluate our portfolio of securities available for sale in light of changing market conditions and other factors and, where appropriate, take steps intended to improve our overall positioning.

During April 2005, the front-end of the yield curve rallied sharply. In our view, this market movement was not adequately reflective of a potential further rise in short-term interest rates given recent inflation trends and the expected Federal Open Market Committee tightening action on May 3, 2005.

As a result, in late April 2005, we performed a balance sheet review and decided to adjust our securities and other earning assets positions to address the following objectives:

| | Further reduce exposure to an anticipated rise in short-term interest rates, and |

| | Improve future net interest income levels without adding to duration risk. |

To achieve these objectives, in late April and early May 2005, we sold $2.1 billion of securities available for sale and terminated $1.0 billion of resale agreements that were most sensitive to extension risk due to rising short-term interest rates. We also purchased $2.1 billion of securities with higher yields and lower extension risk. These transactions resulted in realized net securities and other losses of approximately $31 million, which are included in our results of operations for the second quarter and first six months of 2005.

The fair value of securities available for sale decreases when interest rates increase and vice versa. Further increases in interest rates after June 30, 2005, if sustained, will adversely impact the fair value of securities available for sale going forward compared with the balance at June 30, 2005. Net unrealized gains and losses in the securities available for sale portfolio are included in shareholders equity as accumulated other comprehensive income or loss, net of tax.

The expected weighted-average life of securities available for sale was 3 years at June 30, 2005 and 2 years and 8 months at December 31, 2004.

We estimate that the effective duration of securities available for sale is 2.1 years for an immediate 50 basis points parallel increase in interest rates and 1.7 years for an immediate 50 basis points parallel decrease in interest rates.

LOANS HELD FOR SALE

Education loans held for sale totaled $1.5 billion at June 30, 2005 and $1.1 billion at December 31, 2004 and represented the majority of our loans held for sale at each date. We classify substantially all of our education loans as loans held for sale. Generally, we sell education loans when the loans are placed into repayment status. Gains on sales of education loans are reflected in the Other noninterest income line item in our Consolidated Income Statement and in the results for the Regional Community Banking business segment.

Our liquidation of institutional loans held for sale resulted in net gains in excess of valuation adjustments of $2 million in the second quarter of 2005 and $4 million for the first six months of 2005. The corresponding amounts for 2004 were $17 million and $45 million. These gains are reflected in the Corporate Services line item in our Consolidated Income Statement and in the results of the Wholesale Banking business segment. As the liquidation of institutional loans held for sale is essentially complete, any additional gains or losses in the future will be minimal.

OTHER ASSETS

The increase of $1.0 billion in Assets-Other in the preceding Balance Sheet Data table includes the impact of an increase in goodwill and other intangible assets. Goodwill and other intangible assets recognized in connection with the Riggs acquisition totaled $498 million. Goodwill and other intangible assets recorded in connection with the SSRM acquisition totaled $316 million. See Note 6 Goodwill And Other Intangible Assets in the Notes To Consolidated Financial Statements for further information.

12

CAPITAL AND FUNDING SOURCES

Details Of Funding Sources

| In millions |

June 30 2005 |

December 31 2004 |

||||

| Deposits |

||||||

| Money market |

$ | 23,031 | $ | 21,250 | ||

| Demand |

16,419 | 15,996 | ||||

| Retail certificates of deposit |

11,714 | 9,969 | ||||

| Savings |

2,719 | 2,851 | ||||

| Other time |

2,707 | 833 | ||||

| Time deposits in foreign offices |

2,083 | 2,370 | ||||

| Total deposits |

58,673 | 53,269 | ||||

| Borrowed funds |

||||||

| Federal funds purchased |

2,701 | 219 | ||||

| Repurchase agreements |

2,042 | 1,376 | ||||

| Bank notes and senior debt |

2,920 | 2,383 | ||||

| Subordinated debt |

4,105 | 4,050 | ||||

| Commercial paper |

3,998 | 2,251 | ||||

| Other borrowed funds |

2,440 | 1,685 | ||||

| Total borrowed funds |

18,206 | 11,964 | ||||

| Total |

$ | 76,879 | $ | 65,233 | ||

Various seasonal and other factors impact our period-end deposit balances whereas average balances (discussed under Balance Sheet Highlights above) are more indicative of underlying business trends. The increase in deposits as of June 30, 2005 reflected the impact of the Riggs acquisition, which added $3.5 billion, including $.8 billion of brokered certificates of deposit, as well as sales and retention efforts related to core deposits.

Higher borrowed funds at June 30, 2005 were driven in part by the following:

| | The issuance of $1 billion of Federal Home Loan Bank advances in June 2005, |

| | Our issuance of $700 million of senior debt and $350 million of senior bank notes in March 2005, |

| | BlackRocks $250 million convertible debenture issuance in February 2005 in connection with its SSRM acquisition, |

| | The assumption of approximately $345 million of subordinated debt with the acquisition of Riggs, and |

| | Higher short-term borrowings to fund asset growth. |

These factors were partially offset by maturities of $750 million of senior bank notes and $350 million of subordinated debt during the second quarter of 2005.

Capital

We manage our capital position by making adjustments to our balance sheet size and composition, issuing debt and equity instruments, making treasury stock transactions, maintaining dividend policies and retaining earnings.

The increase of $.8 billion in total shareholders equity at June 30, 2005 compared with December 31, 2004 reflected the impact of earnings and the issuance of shares from treasury in connection with the Riggs acquisition.

Common shares outstanding at June 30, 2005 were 290.5 million, an increase of 7.9 million over December 31, 2004. We issued approximately 6.6 million shares of common stock during the second quarter of 2005 in connection with the Riggs acquisition.

We did not purchase any common shares during the second quarter of 2005 under our current common stock repurchase program. During the first half of 2005, we purchased .5 million common shares at a total cost of $26 million under both our prior and current common stock repurchase programs. Our current program will remain in effect until fully utilized or until modified, superseded or terminated. The extent and timing of additional share repurchases under this program will depend on a number of factors including, among others, market and general economic conditions, economic and regulatory capital considerations, alternative uses of capital, and the potential impact on our credit rating. The impact on our capital of the Riggs and SSRM acquisitions has restricted and will continue to restrict share purchases over the next several quarters.

Risk-Based Capital

| Dollars in millions |

June 30 2005 |

December 31 2004 |

||||||

| Capital components |

||||||||

| Shareholders equity |

||||||||

| Common |

$ | 8,235 | $ | 7,465 | ||||

| Preferred |

8 | 8 | ||||||

| Trust preferred capital securities (a) |

1,417 | 1,194 | ||||||

| Minority interest |

288 | 226 | ||||||

| Goodwill and other intangibles |

(3,893 | ) | (3,112 | ) | ||||

| Net unrealized securities losses |

50 | 66 | ||||||

| Net unrealized gains on cash flow hedge derivatives |

(5 | ) | (6 | ) | ||||

| Equity investments in nonfinancial companies |

(45 | ) | (32 | ) | ||||

| Other, net |

(15 | ) | (15 | ) | ||||

| Tier 1 risk-based capital |

6,040 | 5,794 | ||||||

| Subordinated debt |

1,886 | 1,924 | ||||||

| Eligible allowance for credit losses |

713 | 683 | ||||||

| Total risk-based capital |

$ | 8,639 | $ | 8,401 | ||||

| Assets |

||||||||

| Risk-weighted assets, including off-balance sheet instruments and market risk equivalent assets |

$ | 72,900 | $ | 64,539 | ||||

| Adjusted average total assets |

83,686 | 75,757 | ||||||

| Capital ratios |

||||||||

| Tier 1 risk-based |

8.3 | % | 9.0 | % | ||||

| Total risk-based |

11.9 | 13.0 | ||||||

| Leverage |

7.2 | 7.6 | ||||||

| Tangible common |

5.0 | 5.7 | ||||||

| (a) | See Note 18 Capital Securities Of Subsidiary Trusts in the Notes To Consolidated Financial Statements in our 2004 Form 10-K regarding the deconsolidation of trust preferred securities at December 31, 2003 under GAAP. However, these securities remained a component of Tier 1 risk-based capital at June 30, 2005 and December 31, 2004 based upon guidance provided to bank holding companies from the Federal Reserve. |

The access to, and cost of, funding new business initiatives including acquisitions, the ability to engage in expanded business activities, the ability to pay dividends, the level of deposit insurance costs, and the level and nature of regulatory oversight depend, in part, on a financial institutions capital strength. The declines in the capital ratios at June 30, 2005 compared with the ratios at December 31, 2004 were primarily caused by the addition of goodwill and other intangibles associated with the Riggs and SSRM acquisitions. At June 30, 2005, each of our banking subsidiaries was considered well-capitalized based on regulatory capital ratio requirements.

13

OFF-BALANCE SHEET ARRANGEMENTS AND CONSOLIDATED VIES

We engage in a variety of activities that involve unconsolidated entities or that are otherwise not reflected in our Consolidated Balance Sheet that are generally referred to as off-balance sheet arrangements. Further information on these types of activities is included in Note 15 Commitments And Guarantees included in the Notes To Consolidated Financial Statements in Part I, Item 1 of this Report.

As discussed in our 2004 Form 10-K, we are involved with various entities in the normal course of business that may be deemed to be variable interest entities (VIEs). We consolidated certain VIEs effective in 2004 and 2003 for which we were determined to be the primary beneficiary. These consolidated VIEs and relationships with PNC are described in our 2004 Form 10-K under this same heading in Part I, Item 7 and in Note 2 Variable Interest Entities in the Notes To Consolidated Financial Statements included in Part II, Item 8 of that Report.

At June 30, 2005, the aggregate assets and debt of VIEs that we have consolidated in our financial statements are as follows:

Consolidated VIEs PNC Is Primary Beneficiary

| In millions |

Aggregate Assets |

Aggregate Debt |

||||

| June 30, 2005 |

||||||

| Market Street Funding Corporation |

$ | 2,550 | $ | 2,550 | ||

| Partnership interests in low income housing projects |

483 | 483 | ||||

| Other |

13 | 11 | ||||

| Total consolidated VIEs |

3,046 | 3,044 | ||||

| December 31, 2004 |

||||||

| Market Street Funding Corporation |

$ | 2,167 | $ | 2,167 | ||

| Partnership interests in low income housing projects |

504 | 504 | ||||

| Other |

13 | 10 | ||||

| Total consolidated VIEs |

$ | 2,684 | $ | 2,681 | ||

We also hold significant variable interests in other VIEs that have not been consolidated because we are not considered the primary beneficiary. Information on these VIEs follows:

Non-Consolidated VIEs - Significant Variable Interests

| In millions |

Aggregate Assets |

Aggregate Debt |

PNC Risk of Loss (b) |

||||||

| June 30, 2005 |

|||||||||

| Collateralized debt obligations (a) |

$ | 5,691 | $ | 5,211 | $ | 53 | |||

| Private investment funds (a) |

4,530 | 1,351 | 13 | ||||||

| Other partnership interests in low income housing projects |

37 | 28 | 4 | ||||||

| Total significant variable interests |

$ | 10,258 | $ | 6,590 | $ | 70 | |||

| December 31, 2004 |

|||||||||

| Collateralized debt obligations (a) |

$ | 3,152 | $ | 2,700 | $ | 33 | |||

| Private investment funds (a) |

1,872 | 125 | 24 | ||||||

| Other partnership interests in low income housing projects |

37 | 28 | 4 | ||||||

| Total significant variable interests |

$ | 5,061 | $ | 2,853 | $ | 61 | |||

| (a) | Held by BlackRock. |

| (b) | Includes both PNCs risk of loss and BlackRocks risk of loss, limited to PNCs ownership interest in BlackRock. |

The increase in collateralized debt obligations at June 30, 2005 compared with December 31, 2004 reflected the impact of BlackRocks first quarter 2005 acquisition of SSRM.

We also have subsidiaries that invest in and act as the investment manager for a private equity fund that is organized as a limited partnership as part of our equity management activities. The fund invests in private equity investments to generate capital appreciation and profits. As permitted by FASB Interpretation No. 46 (Revised 2003), Consolidation of Variable Interest Entities, we have deferred applying the provisions of the interpretation for this entity pending further action by the FASB. Information on this entity follows:

Investment Company Accounting Deferred Application

| In millions |

Aggregate Assets |

Aggregate Equity |

PNC Risk of Loss |

||||||

| Private Equity Fund |

|||||||||

| June 30, 2005 |

$ | 94 | $ | 94 | $ | 24 | |||

| December 31, 2004 |

$ | 78 | $ | 76 | $ | 20 | |||

14

We operate five major businesses engaged in providing banking, asset management and global fund processing services. Banking businesses include regional community banking (consumer/small business), wholesale banking (corporate/institutional) and wealth management.

Our treasury management activities, which include cash and investment management, receivables management, disbursement services, funds transfer services, information reporting, and global trade services; capital markets products, which include foreign exchange, derivatives, loan syndications, and securities underwriting and distribution; commercial loan servicing; and equipment leasing products are offered through Wholesale Banking and marketed by several businesses across PNC.