ELECTRONICS SLIDES

Published on July 19, 2005

Exhibit 99.3

The PNC Financial Services Group, Inc.

Second Quarter 2005 Earnings Conference Call

July 19, 2005

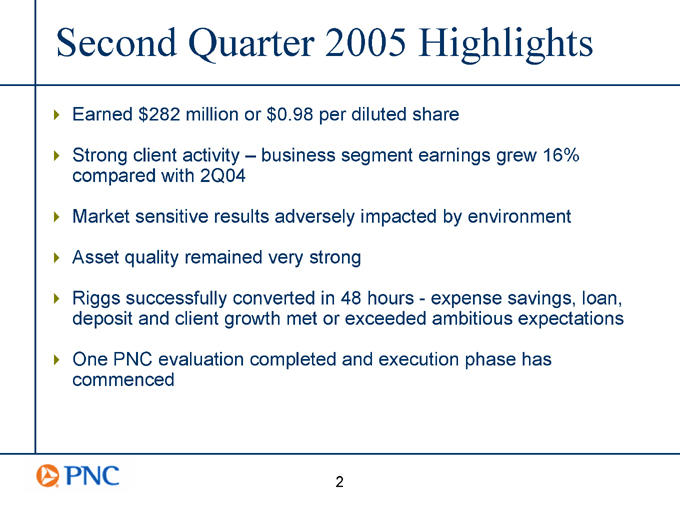

Second Quarter 2005 Highlights

Earned $282 million or $0.98 per diluted share

Strong client activity business segment earnings grew 16% compared with 2Q04

Market sensitive results adversely impacted by environment

Asset quality remained very strong

Riggs successfully converted in 48 hoursexpense savings, loan, deposit and client growth met or exceeded ambitious expectations

One PNC evaluation completed and execution phase has commenced

2

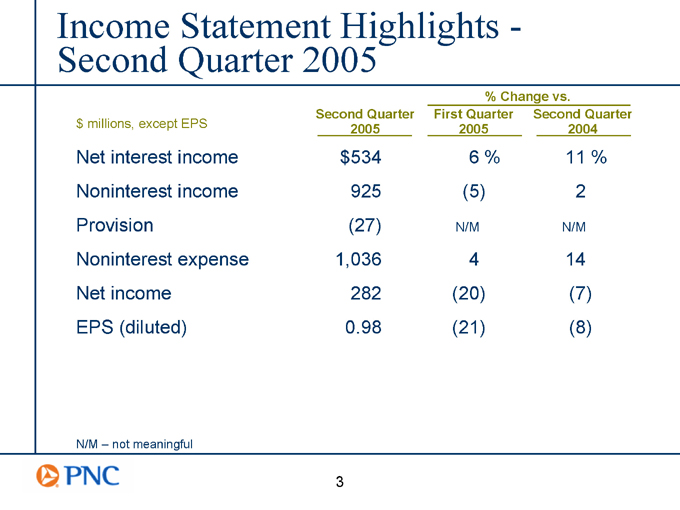

Income Statement Highlights -Second Quarter 2005

% Change vs.

Second Quarter First Quarter Second Quarter

$millions, except EPS 2005 2005 2004

Net interest income $534 6 % 11 %

Noninterest income 925 (5) 2

Provision (27) N/M N/M

Noninterest expense 1,036 4 14

Net income 282 (20) (7)

EPS (diluted) 0.98 (21) (8)

N/M not meaningful

3

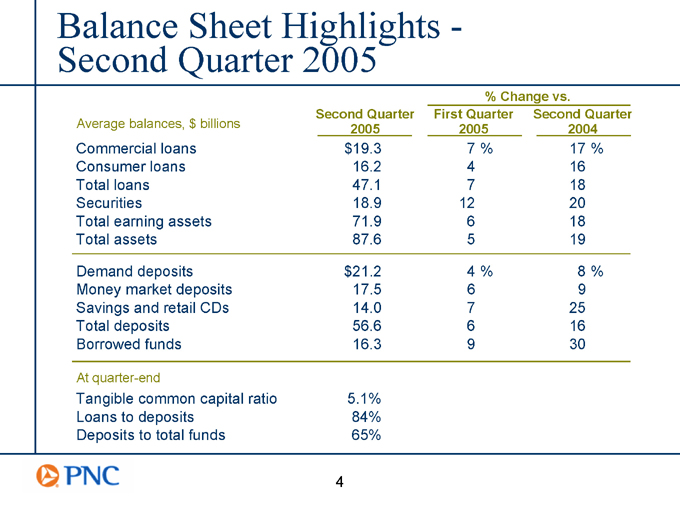

Balance Sheet Highlights -Second Quarter 2005

% Change vs.

Second Quarter First Quarter Second Quarter

Average balances, $billions 2005 2005 2004

Commercial loans $19.3 7% 17%

Consumer loans 16.2 4 16

Total loans 47.1 7 18

Securities 18.9 12 20

Total earning assets 71.9 6 18

Total assets 87.6 5 19

Demand deposits $21.2 4% 8%

Money market deposits 17.5 6 9

Savings and retail CDs 14.0 7 25

Total deposits 56.6 6 16

Borrowed funds 16.3 9 30

At quarter-end

Tangible common capital ratio 5.1%

Loans to deposits 84%

Deposits to total funds 65%

4

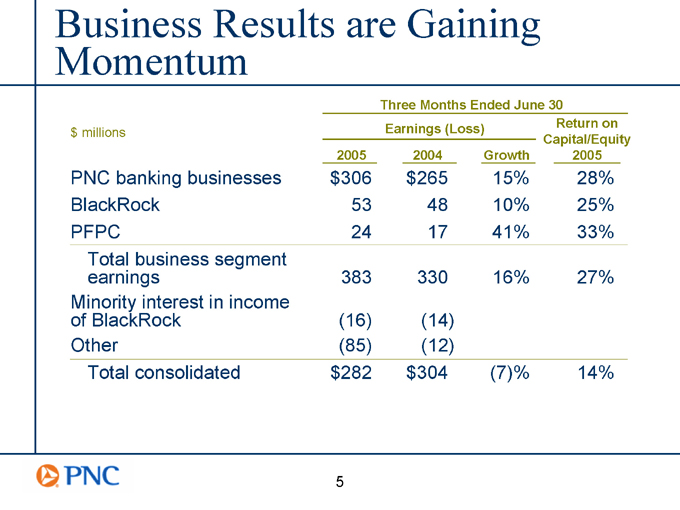

Business Results are Gaining Momentum

Three Months Ended June 30

Earnings (Loss) Return on

$millions

Capital/Equity

2005 2004 Growth 2005

PNC banking businesses $306 $265 15% 28%

BlackRock 53 48 10% 25%

PFPC 24 17 41% 33%

Total business segment

earnings 383 330 16% 27%

Minority interest in income

of BlackRock (16) (14)

Other (85) (12)

Total consolidated $282 $304 (7)% 14%

5

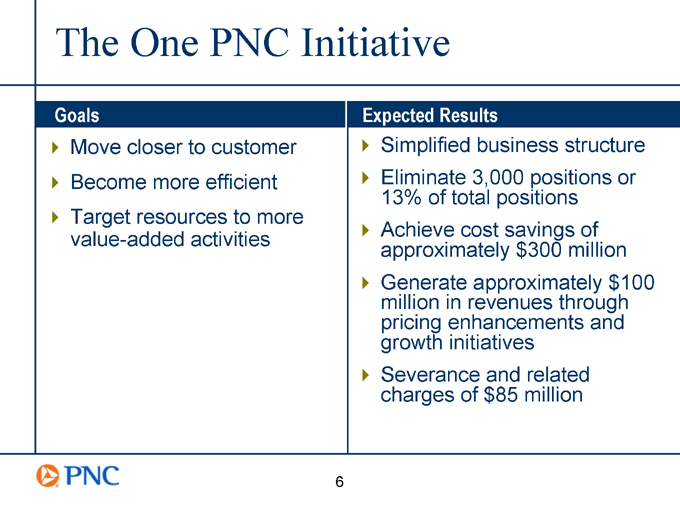

The One PNC Initiative

Goals

Move closer to customer Become more efficient Target resources to more value-added activities

Expected Results

Simplified business structure Eliminate 3,000 positions or 13% of total positions Achieve cost savings of approximately $300 million Generate approximately $100 million in revenues through pricing enhancements and growth initiatives Severance and related charges of $85 million

6

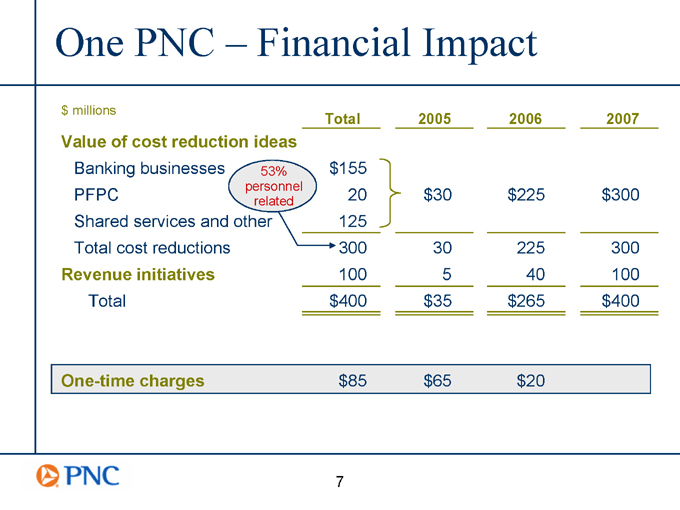

One PNC Financial Impact

$millions

Total 2005 2006 2007

Value of cost reduction ideas

Banking businesses

PFPC $155

20 $30 $225 $300

Shared services and other 125

Total cost reductions 300 30 225 300

Revenue initiatives 100 5 40 100

Total $400 $35 $265 $400

One-time charges $85 $65 $20

53% personnel related

7

Cautionary Statement Regarding Forward-Looking Information

We make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses and/or other matters regarding or affecting PNC that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, outlook, estimate, forecast, project and other similar words and expressions.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements. Actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance.

In addition to factors that we have disclosed in our 2004 annual report on Form 10-K, our first quarter 2005 report on Form 10-Q, and in other reports that we file with the SEC (accessible on the SECs website at www.sec.gov and on or through PNCs corporate website at www.pnc.com), PNCs forward-looking statements are subject to, among others, the following risks and uncertainties, which could cause actual results or future events to differ materially from those that we anticipated in our forward-looking statements or from our historical performance: changes in political, economic or industry conditions, the interest rate environment, or the financial and capital markets (including as a result of actions of the Federal Reserve Board affecting interest rates, the money supply, or otherwise reflecting changes in monetary policy), which could affect: (a) credit quality and the extent of our credit losses; (b) the extent of funding of our unfunded loan commitments and letters of credit; (c) our allowances for loan and lease losses and unfunded loan commitments and letters of credit; (d) demand for our credit or fee-based products and services; (e) our net interest income; (f) the value of assets under management and assets serviced, of private equity investments, of other debt and equity investments, of loans held for sale, or of other on-balance sheet or off-balance sheet assets; or (g) the availability and terms of funding necessary to meet our liquidity needs;

the impact on us of legal and regulatory developments, including the following: (a) the resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to tax laws; and (e) changes in accounting policies and principles, with the impact of any such developments possibly affecting our ability to operate our businesses or our financial condition or results of operations or our reputation, which in turn could have an impact on such matters as business generation and retention, our ability to attract and retain management, liquidity and funding;

the impact on us of changes in the nature and extent of our competition;

the introduction, withdrawal, success and timing of our business initiatives and strategies;

8

Cautionary Statement Regarding Forward-Looking Information (continued) customer acceptance of our products and services, and our customers borrowing, repayment, investment and deposit practices;

the impact on us of changes in the extent of customer or counterparty delinquencies, bankruptcies or defaults, which could affect, among other things, credit and asset quality risk and our provision for credit losses;

the ability to identify and effectively manage risks inherent in our businesses;

how we choose to redeploy available capital, including the extent and timing of any share repurchases and acquisitions or other investments in our businesses;

the impact, extent and timing of technological changes, the adequacy of intellectual property protection, and costs associated with obtaining rights in intellectual property claimed by others;

the timing and pricing of any sales of loans or other financial assets held for sale; our ability to obtain desirable levels of insurance and to successfully submit claims under applicable insurance policies; the relative and absolute investment performance of assets under management; and

the extent of terrorist activities and international hostilities, increases or continuations of which may adversely affect the economy and financial and capital markets generally or us specifically.

Our future results are likely to be affected significantly by the results of the implementation of our One PNC initiative, as discussed in this presentation. Generally, the amounts of our anticipated cost savings and revenue enhancements are based to some extent on estimates and assumptions regarding future business performance and expenses, and these estimates and assumptions may prove to be inaccurate in some respects. Some or all of the above factors may cause the anticipated expense savings and revenue enhancements from that initiative not to be achieved in their entirety, not to be accomplished within the expected time frame, or to result in implementation charges beyond those currently contemplated or some other unanticipated adverse impact.

Furthermore, the implementation of cost savings ideas may have unintended impacts on our ability to attract and retain business and customers, while revenue enhancement ideas may not be successful in the marketplace or may result in unintended costs. Assumed attrition required to achieve workforce reductions may not come in the right places or at the right times to meet planned goals.

In addition, we grow our business from time to time by acquiring other financial services companies. Acquisitions in general present us with a number of risks and uncertainties related both to the acquisition transactions themselves and to the integration of the acquired businesses into PNC after closing. In particular, acquisitions may be substantially more expensive to complete (including the integration of the acquired company) and the anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to achieve than expected. As a regulated financial institution, our

9

Cautionary Statement Regarding Forward-Looking Information (continued) pursuit of attractive acquisition opportunities could be negatively impacted due to regulatory delays or other regulatory issues. Regulatory and/or legal issues of an acquired business may cause reputational harm to PNC following the acquisition and integration of the acquired business into ours and may result in additional future costs and expenses arising as a result of those issues. Recent acquisitions, including our acquisition of Riggs National Corporation, continue to present the integration and other post-closing risks and uncertainties described above.

You can find additional information on the foregoing risks and uncertainties and additional factors that could affect the results anticipated in our forward-looking statements or from our historical performance in the reports that we file with the SEC. You can access our SEC reports on the SECs website at www.sec.gov and on or through our corporate website at www.pnc.com.

Also, risks and uncertainties that could affect the results anticipated in forward-looking statements or from historical performance relating to our majority-owned subsidiary BlackRock, Inc. are discussed in more detail in BlackRocks filings with the SEC, accessible on the SECs website and on or through BlackRocks website at www.blackrock.com.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs actual or anticipated results.

10