425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on April 26, 2005

Filed by The PNC Financial Services Group, Inc.

Pursuant to Rule 425 under the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Riggs National Corporation

Commission File No. 000-09756

On April 26, 2005, James E. Rohr, Chairman and Chief Executive Officer of The PNC Financial Services Group, Inc. (the Corporation), and other executives of the Corporation spoke at the Corporations 2005 Annual Meeting of Shareholders. This presentation was accompanied by a series of electronic slides that included information pertaining to financial and business performance and strategies. A copy of those slides and related material was previously furnished on April 26, 2005 by PNC on a Current Report on Form 8-K.

The PNC Financial Services Group, Inc.

Annual Meeting of Shareholders

April 26, 2005

James E. Rohr

Chairman and

Chief Executive Officer

Cautionary Statement Regarding Forward-Looking Information

This presentation contains forward-looking statements regarding our outlook or expectations relating to PNCs future business, operations, financial condition, financial performance and asset quality. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties.

The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the version of the presentation materials posted on our corporate website at www.pnc.com, as well as those factors previously disclosed in our 2004 Form 10-K and other SEC reports (accessible on the SECs website at www.sec.gov and on or through our corporate website).

Future events or circumstances may change our outlook or expectations and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. The forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake to update those statements.

This presentation may also include a discussion of non-GAAP financial measures, which, to the extent not so qualified therein, is qualified by GAAP reconciliation information available on our corporate website at www.pnc.com under For Investors.

2004 Accomplishments

Earned $1.2 billion

Reported 17% ROE

Realized strong balance sheet growth

Completed successful integration of UnitedTrust

Announced SSRM Holdings, Inc. acquisition

- Closed in January 2005

Announced Riggs Bank acquisition

- Anticipate closing in May 2005

Commitment to Our Four Constituencies

Shareholders

Improved returns

Invested in growth opportunities

Focused on improving efficiency

Customers

Enhanced customer experience

Grew clients across all businesses

Introduced innovative products

Employees

Improved employee satisfaction

Recognized as 100 Best Companies for Working Mothers

- Working Mother magazine

Communities

PNC Grow Up Great

PNC Foundation

The Road Ahead

Commitment to convenience for customers

Successful expansion to Washington, DC

Commitment to efficiency

Continued risk discipline

Well positioned for 2005 and beyond

Joseph C. Guyaux

President

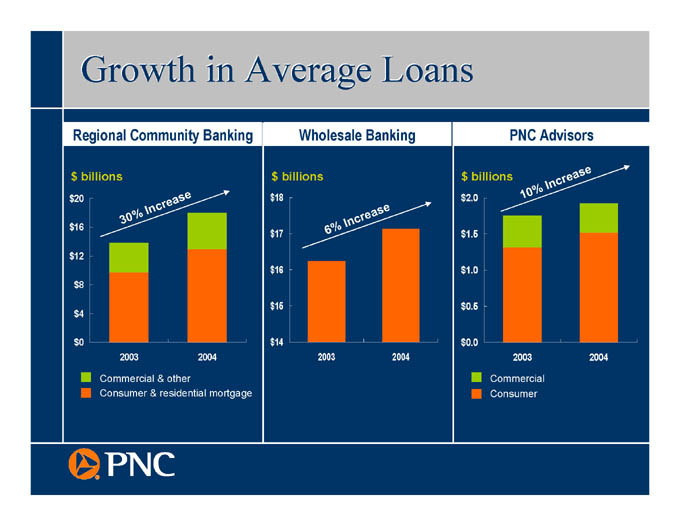

Growth in Average Loans

Regional Community Banking

Wholesale Banking

PNC Advisors

$ billions

$ billions

$ billions

10% Increase

30% Increase

6% Increase

Commercial & other

Consumer & residential mortgage

Commercial

Consumer

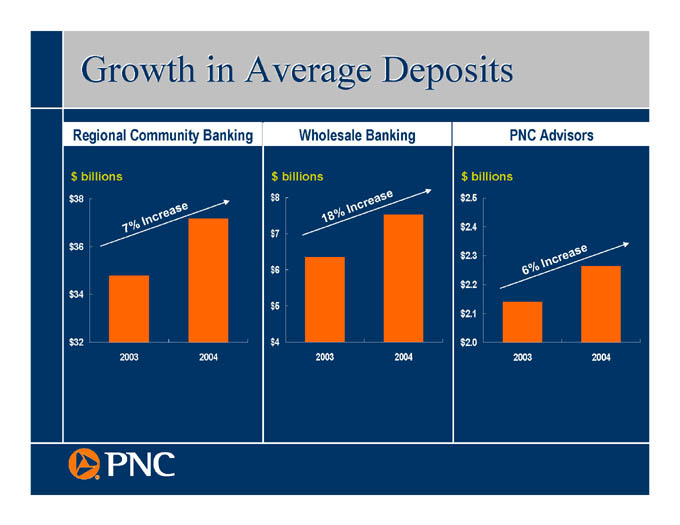

Growth in Average Deposits

PNC Advisors

Wholesale Banking

Regional Community Banking

$ billions

$ billions

$ billions

18% Increase

7% Increase

6% Increase

Expanding Presence in Growing Markets

Integrated UnitedTrust successfully

Expanding to Washington, DC

NY

PNC Branch Locations

Erie

PA

Pittsburgh

Newark

OH

IN

Philadelphia

NJ

Cincinnati

MD

Washington, DC

Riggs Franchise

KY

DE

Louisville

WV

VA

Lexington

Source: SNL Financial

William S. Demchak

Vice Chairman and

Chief Financial Officer

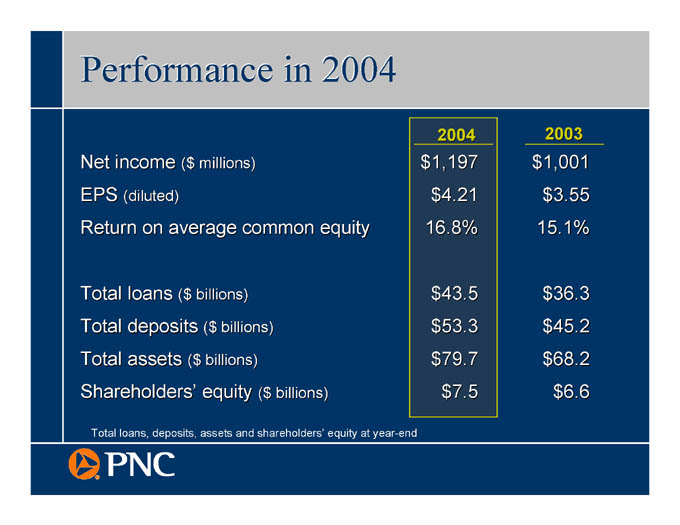

Performance in 2004

2003

2004

Net income ($ millions) $1,197 $1,001

EPS (diluted) $4.21 $3.55

Return on average common equity 16.8% 15.1%

Total loans ($ billions) $43.5 $36.3

Total deposits ($ billions) $53.3 $45.2

Total assets ($ billions) $79.7 $68.2

Shareholders equity ($ billions) $7.5 $6.6

Total loans, deposits, assets and shareholders equity at year-end

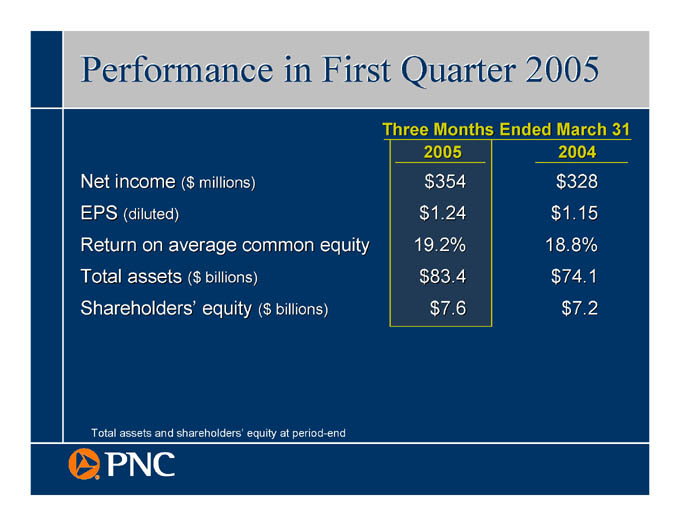

Performance in First Quarter 2005

Three Months Ended March 31

2004

2005

Net income ($ millions) $354 $328

EPS (diluted) $1.24 $1.15

Return on average common equity 19.2% 18.8%

Total assets ($ billions) $83.4 $74.1

Shareholders equity ($ billions) $7.6 $7.2

Total assets and shareholders equity at period-end

Balance Sheet Positioning

Sophisticated risk management

Investment flexibility

Well positioned for changing interest rates

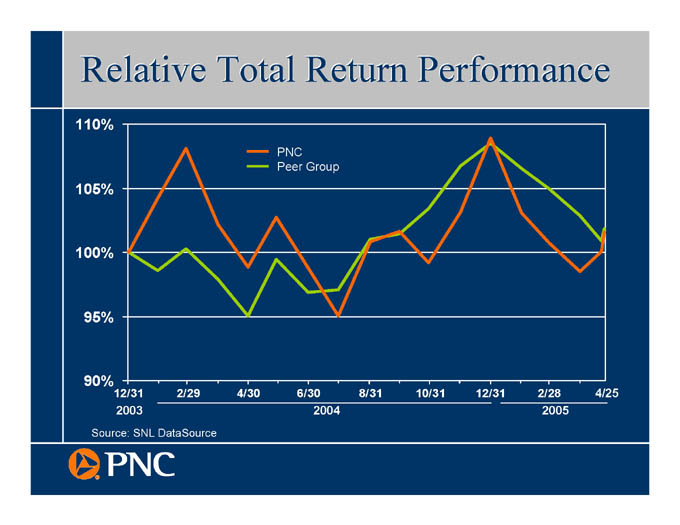

Relative Total Return Performance

PNC

Peer Group

4/25

2003

2004

2005

Source: SNL DataSource

PNC

Appendix

Cautionary Statement Regarding

Forward-Looking Information

We make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses and/or other matters regarding or affecting PNC that are forward-looking statements. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, outlook, estimate, forecast, project and other similar words and expressions.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements. Actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance.

In addition to factors that we have disclosed in our 2004 Annual Report on Form 10-K and in other SEC reports (accessible on the SECs website at www.sec.gov and on or through PNCs corporate website at www.pnc.com), PNCs forward-looking statements are subject to, among others, the following risks and uncertainties, which could cause actual results or future events to differ materially from those that we anticipated in our forward-looking statements or from our historical performance:

Changes in political, economic or industry conditions, the interest rate environment, or the financial and capital markets (including as a result of actions of the Federal Reserve Board affecting interest rates, the money supply, or otherwise reflecting changes in monetary policy), which could affect: (a) credit quality and the extent of our credit losses; (b) the extent of funding of our unfunded loan commitments and letters of credit; (c) our allowances for loan and lease losses and unfunded loan commitments and letters of credit; (d) demand for our credit or fee-based products and services; (e) our net interest income; (f) the value of assets under management and assets serviced, of private equity investments, of other debt and equity investments, of loans held for sale, or of other on-balance sheet or off-balance sheet assets; or (g) the availability and terms of funding necessary to meet our liquidity needs;

The impact on us of legal and regulatory developments, including the following: (a) the resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to tax laws; and (e) changes in accounting policies and principles, with the impact of any such developments possibly affecting our ability to operate our businesses or our financial condition or results of operations or our reputation, which in turn could have an impact on such matters as business generation and retention, our ability to attract and retain management, liquidity and funding;

The impact on us of changes in the nature or extent of our competition;

The introduction, withdrawal, success and timing of our business initiatives and strategies;

Cautionary Statement Regarding

Forward-Looking Information (continued)

Customer acceptance of our products and services, and our customers borrowing, repayment, investment and deposit practices;

The impact on us of changes in the extent of customer or counterparty delinquencies, bankruptcies or defaults, which could affect, among other things, credit and asset quality risk and our provision for credit losses;

The ability to identify and effectively manage risks inherent in our businesses;

How we choose to redeploy available capital, including the extent and timing of any share repurchases and acquisitions or other investments in our businesses;

The impact, extent and timing of technological changes, the adequacy of intellectual property protection, and costs associated with obtaining rights in intellectual property claimed by others;

The timing and pricing of any sales of loans or other financial assets held for sale;

Our ability to obtain desirable levels of insurance and to successfully submit claims under applicable insurance policies;

The relative and absolute investment performance of assets under management;

The extent of terrorist activities and international hostilities, increases or continuations of which may adversely affect the economy and financial and capital markets generally or us specifically; and

Issues related to the completion of our pending acquisition of Riggs National Corporation and the integration of the remaining Riggs businesses into PNC, including the following:

Completion of the transaction is dependent on, among other things, receipt of stockholder and regulatory approvals and regulatory waivers, the timing of which cannot be predicted with precision at this point and which may not be received at all;

Successful completion of the transaction and our ability to realize the benefits that we anticipate from the acquisition also depend on the nature of any future developments with respect to Riggs regulatory and legal issues, the ability to comply with the terms of all current or future requirements (including any related action plan) resulting from these issues, and the extent of future costs and expenses arising as a result of these issues, including the impact of increased litigation risk and any claims for indemnification or advancement of costs;

Riggs regulatory and legal issues may cause reputational harm to PNC following the acquisition and integration of its business into ours;

Cautionary Statement Regarding

Forward-Looking Information (continued)

The transaction may be materially more expensive to complete than anticipated as a result of unexpected factors or events;

The integration into PNC of the Riggs business and operations that we acquire, which will include conversion of Riggs different systems and procedures, may take longer or be more costly than anticipated and may have unanticipated adverse results relating to Riggs or PNCs existing businesses;

It may take longer than expected to realize the anticipated cost savings of the acquisition, and the anticipated cost savings may not be achieved in their entirety; and

The anticipated strategic and other benefits of the acquisition to PNC are dependent in part on the future performance of Riggs business, and we can provide no assurance as to actual future results, which could be affected by various factors, including the risks and uncertainties generally related to the performance of PNCs and Riggs businesses (with respect to Riggs, you may review Riggs SEC reports, which are accessible on the SECs website at www.sec.gov) or due to factors related to the acquisition of Riggs and the process of integrating Riggs business at closing into PNC.

In addition to the pending Riggs acquisition, we grow our business from time to time by acquiring other financial services companies. Other acquisitions generally present similar risks to those described above relating to the Riggs transaction. We could also be prevented from pursuing attractive acquisition opportunities due to regulatory restraints.

You can find additional information on the foregoing risks and uncertainties and additional factors that could affect results anticipated in our forward-looking statements or from our historical performance in the reports that we file with the SEC. You can access our SEC reports on the SECs website at www.sec.gov or on or through our corporate website at www.pnc.com.

Also, BlackRocks SEC reports (accessible on the SECs website or on or through BlackRocks website at www.blackrock.com) discuss in more detail those risks and uncertainties that involve BlackRock that could affect the results anticipated in forward-looking statements or from historical performance. You may review the BlackRock SEC reports for a more detailed discussion of those risks and uncertainties and additional factors as they may affect BlackRock.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs actual or anticipated results.

Additional Information About the Proposed

Riggs National Corporation Acquisition

The PNC Financial Services Group, Inc. and Riggs National Corporation have filed a proxy statement/prospectus and will file other relevant documents concerning the merger with the United States Securities and Exchange Commission (the SEC). WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents free of charge at the SECs web site (www.sec.gov). In addition, documents filed with the SEC by The PNC Financial Services Group, Inc. will be available free of charge from Shareholder Relations at (800) 843-2206. Documents filed with the SEC by Riggs will be available free of charge from www.riggsbank.com.

The directors, executive officers, and certain other members of management of Riggs may be soliciting proxies in favor of the merger from its shareholders. For information about these directors, executive officers, and members of management, shareholders are asked to refer to Riggs most recent annual meeting proxy statement, which is available at the web addresses provided in the preceding paragraph.

Peer Group of Super-

Regional Banks

Ticker

BB&T Corporation BBT

The Bank of New York Company, Inc. BK

Fifth Third Bancorp FITB

KeyCorp KEY

National City Corporation NCC

The PNC Financial Services Group, Inc. PNC

SunTrust Banks, Inc. STI

U.S. Bancorp USB

Wachovia Corporation WB

Wells Fargo & Company WFC