SUMMARY ANNUAL REPORT

Published on March 24, 2005

CONTENTS}

| Consolidated Financial Highlights |

1 | |

| To Our Shareholders |

2 | |

| Driven |

7 | |

| Accelerate |

8 | |

| Build |

12 | |

| Solve |

16 | |

| Trust |

20 | |

| Commit |

24 | |

| Board of Directors & Executive Management |

29 | |

| Condensed Consolidated Statement of Income |

30 | |

| Condensed Consolidated Balance Sheet |

31 | |

| Report of Independent Registered Public Accounting Firm |

32 | |

| Results of Businesses - Summary and Reconciliation to Total Consolidated Results |

33 | |

| Cautionary Statement |

34 | |

| Corporate Information |

35 | |

| PNC Bank Regional Offices |

36 | |

On the cover

PNC business bankers Don Paterson and Sherrylynn Marshall at PNCs Eastwick Center in Philadelphia.

CONSOLIDATED FINANCIAL HIGHLIGHTS}

The PNC Financial Services Group, Inc.

| Year ended December 31 Dollars in millions, except per share data |

2004 |

2003 |

2002 |

2001(a) |

2000 |

|||||||||||||||

| Summary of Operations |

||||||||||||||||||||

| Net interest income |

$ | 1,969 | $ | 1,996 | $ | 2,197 | $ | 2,262 | $ | 2,164 | ||||||||||

| Provision for credit losses |

52 | 177 | 309 | 903 | 136 | |||||||||||||||

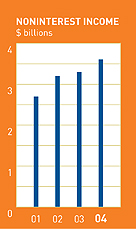

| Noninterest income |

3,563 | 3,257 | 3,197 | 2,652 | 2,950 | |||||||||||||||

| Noninterest expense |

3,735 | 3,476 | 3,227 | 3,414 | 3,103 | |||||||||||||||

| Income from continuing operations before minority and noncontrolling interests and income taxes |

1,745 | 1,600 | 1,858 | 597 | 1,875 | |||||||||||||||

| Minority and noncontrolling interests in income of consolidated entities |

10 | 32 | 37 | 33 | 27 | |||||||||||||||

| Income taxes |

538 | 539 | 621 | 187 | 634 | |||||||||||||||

| Income from continuing operations |

1,197 | 1,029 | 1,200 | 377 | 1,214 | |||||||||||||||

| (Loss) Income from discontinued operations, net of tax |

(16 | ) | 5 | 65 | ||||||||||||||||

| Income before cumulative effect of accounting change |

1,197 | 1,029 | 1,184 | 382 | 1,279 | |||||||||||||||

| Cumulative effect of accounting change, net of tax |

(28 | ) | (5 | ) | ||||||||||||||||

| Net income |

$ | 1,197 | $ | 1,001 | $ | 1,184 | $ | 377 | $ | 1,279 | ||||||||||

| Per Common Share |

||||||||||||||||||||

| Diluted earnings (loss) |

||||||||||||||||||||

| Continuing operations |

$ | 4.21 | $ | 3.65 | $ | 4.20 | $ | 1.26 | $ | 4.09 | ||||||||||

| Discontinued operations |

(.05 | ) | .02 | .22 | ||||||||||||||||

| Before cumulative effect of accounting change |

4.21 | 3.65 | 4.15 | 1.28 | 4.31 | |||||||||||||||

| Cumulative effect of accounting change |

(.10 | ) | (.02 | ) | ||||||||||||||||

| Net income |

$ | 4.21 | $ | 3.55 | $ | 4.15 | $ | 1.26 | $ | 4.31 | ||||||||||

| Book value (at December 31) |

$ | 26.41 | $ | 23.97 | $ | 24.03 | $ | 20.54 | $ | 21.88 | ||||||||||

| Cash dividends declared |

$ | 2.00 | $ | 1.94 | $ | 1.92 | $ | 1.92 | $ | 1.83 | ||||||||||

| Selected Ratios From Continuing Operations |

||||||||||||||||||||

| Net interest margin |

3.22 | % | 3.64 | % | 3.99 | % | 3.84 | % | 3.64 | % | ||||||||||

| Efficiency(b) |

68 | 66 | 60 | 70 | 61 | |||||||||||||||

| Selected Ratios From Net Income |

||||||||||||||||||||

| Return on |

||||||||||||||||||||

| Average common shareholders equity |

16.82 | 15.06 | 18.83 | 5.65 | 21.63 | |||||||||||||||

| Average assets |

1.59 | 1.49 | 1.78 | .53 | 1.68 | |||||||||||||||

| Loans to deposits |

82 | 80 | 79 | 80 | 106 | |||||||||||||||

| Leverage(c) |

7.6 | 8.2 | 8.1 | 6.8 | 8.0 | |||||||||||||||

| Common shareholders equity to total assets |

9.36 | 9.73 | 10.32 | 8.35 | 9.07 | |||||||||||||||

Certain prior-period amounts have been reclassified to conform with the current year presentation.

| (a) | Results for 2001 reflected the cost of actions taken during the year to accelerate the repositioning of PNCs institutional lending business and other strategic initiatives. Charges recognized in connection with these actions totaled $1.2 billion pretax and reduced 2001 net income by $768 million or $2.65 per diluted share. |

| (b) | Computed as noninterest expense divided by the sum of net interest income and noninterest income. |

| (c) | The leverage ratio represents tier 1 capital divided by adjusted average total assets as defined by regulatory capital requirements for bank holding companies. |

For more information regarding certain factors that could cause actual results to differ materially from historical performance or from those anticipated in forward-looking statements, see the Cautionary Statement on page 34 and in our 2004 Annual Report on Form 10-K.

| 2004 PNC Summary Annual Report | 1 |

TO OUR SHAREHOLDERS}

At December 31

I am pleased to report that your company had an excellent year in 2004 and is well positioned to thrive in the years ahead. We are driven by a vision of PNC as an industry leader devoted to best-in-class customer service and delivering strong growth with moderate risk and we are focused on bringing this vision to reality.

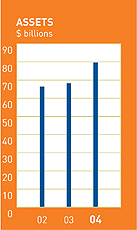

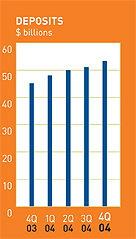

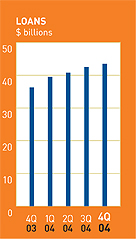

In 2004 we earned $1.2 billion, a 20 percent increase over 2003. We made steady gains across customer segments, which led to a 14 percent increase in average loans and a 12 percent increase in average deposits. Our total assets grew to $80 billion, an increase of 17 percent over 2003. Asset quality improved dramatically. And assets under management increased eight percent, while total assets serviced increased 13 percent, to $1.8 trillion.

In addition to this earnings and balance sheet growth, we made substantial capital investments to expand the franchise. We successfully integrated New Jersey-based United National Bancorp early in 2004. In July, we announced the still-pending acquisition of Riggs National Corporation, a move that will give us entrée into the extremely lucrative Washington, D.C. metropolitan marketplace. And in January 2005 BlackRock, our asset management company, closed its acquisition of SSRM Holdings, Inc.; that transaction pushed assets under management at BlackRock to almost $400 billion.

Prudent management of our balance sheet underpinned our growth in 2004. For the past several years, I have emphasized in this space that PNC would resist the temptation of undue interest rate risk, that we would forego short-term profits to ensure that we could avoid the value-destroying impact of interest rate volatility. In 2004, those commitments were rewarded: While many of our competitors suffered from rising interest rates, we did not.

| 2 |

2004 PNC Summary Annual Report |

We have built a powerful engine for growth. Now our challenge, both simple and complex, is execution.

James E. Rohr

Chairman and Chief Executive Officer (right)

Joseph C. Guyaux

President (center)

William S. Demchak

Vice Chairman and Chief Financial Officer (left)

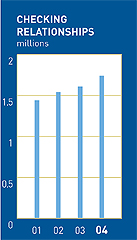

Strength across businesses

Across all of our business segments, 2004 was a year of progress and growth. In the community bank, an eight percent increase in checking account relationships the keystone of broader customer relationships significantly outpaced the population growth of our primary banking region, and our renewed emphasis on small business banking produced exceptional results. We charged branch managers to call on more small business prospects and added more dedicated sales people, which contributed to a 13 percent increase in relationships and a 65 percent increase in small business loan production.

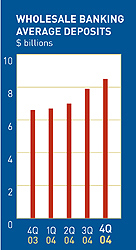

The wholesale business experienced dramatic improvements in asset quality, leading to a significantly reduced provision, and made substantial gains across customer segments. Several fee-based products within Wholesale produced strong growth, including record revenues from Midland Loan Services.

| 2004 PNC Summary Annual Report | 3 |

At quarter end

First, we will make PNC a far more efficient operator; we will do all we can to streamline our organization so that nothing interferes with the service we provide our customers or our ability to attract profitable new relationships.

Our wealth and asset management businesses made important strides. PNC Advisors increased its earnings by 19 percent and successfully transitioned its business model to a relationship management approach, giving clients a single contact point for all of their dealings with PNC. BlackRock, our asset management subsidiary, had an excellent year, increasing assets under management to $342 billion at year end thanks to strong new mandates, global expansion and market appreciation.

And our processing business, PFPC, produced exceptional results given the stiff challenges it faced, including weak equity market trading volumes, price compression in many products and investigations of the mutual fund industry. Our success came primarily from an aggressive push into new markets we increased offshore assets serviced by more than a third, for example and disciplined cost control.

The road ahead

Our achievements in 2004, however outstanding, are by now long in the past. I am eager, as are all of my colleagues at PNC, to move forward. We have built a powerful engine for growth. Now our challenge, both simple and complex, is execution.

Our business mix provides sustainable diversity of revenues from fees and interest, and from a broad range of products and services. We win business across wide swaths of the world: with retail banking customers in our six-state region, with secured lending and real estate clients around the country, with asset management and processing clients across continents. And our resources capital and assets are as well managed as ever. In short, we have created our own potential.

Here is how we will realize it. First, we will make PNC a far more efficient operator; we will do all we can to streamline our organization so that nothing interferes with the service we provide our customers or our ability to attract profitable new relationships. This perseverance on behalf of the customer will be a unifying theme at PNC; we will rededicate ourselves to solving customer problems, to helping our customers build their businesses, to earning the trust of all of our constituents and to delivering to our customers the full and formidable power of PNC.

| 4 |

2004 PNC Summary Annual Report |

At quarter end

For us to act as a unified company on behalf of our customers, we must change, and we have, as this report comes to you, begun the process of making PNC leaner and more responsive. I am leading an aggressive efficiency initiative with goals of maximizing revenue opportunities and finding ways to cut costs. We have asked people at all levels across the organization to take a hard look at how they operate, and we will implement the ideas our teams generate during the balance of this year.

Second, we will claim the advantage of our size. Our industry has experienced steady consolidation for many years, and with recent mergers we have seen the advent of the trillion-dollar bank. In consolidation lies opportunity we compete against fewer banks for our core middle-market customers, for example and in our size lies possibility unavailable to the mega-banks. We are big enough, we have enough resources, to compete for the business we choose to pursue, but we are also small enough to be nimble and quick to respond to our customers needs. A more efficient PNC will be a formidable competitor against firms large and small.

Third, we will continue to manage our balance sheet with a focus on creating long-term value. We have developed a highly sophisticated set of tools including an index against which we can measure our performance and daily balance sheet valuation reporting that allows us to make fast, well informed, risk-appropriate investment decisions.

Fourth, we will understand our customers and prospects better. We have developed a very robust database of information that delivers knowledge about our customers to the fingertips of our employees sitting alongside those customers. In 2005, we will further this competency by completing a rigorous program aimed at identifying our market opportunities across products and regions.

Finally, we will continue to innovate and invest. Over the past several years, we have generated myriad new products, including the highly successful BlackRock Solutions® and Treasury Managements A/R Advantage, and we will push our people to create further innovations in the years ahead. We will also continue to invest in the profitable expansion of our existing businesses, and we will continue to seek acquisitions in high-growth markets.

| 2004 PNC Summary Annual Report | 5 |

Delivering for all of our constituents

Banking is a mature and highly competitive industry, which means that achieving organic revenue growth is a constant challenge. I believe PNC has the resources the people, the capital, the technology, the market presence and the drive necessary to achieve risk-adjusted growth rates that exceed our peer group average. I believe we can deliver more of that revenue growth to the bottom line by improving our operating efficiency. And I believe strong shareholder returns will follow the performance we expect to achieve.

The communities in which we do business will continue to benefit from our success also. Through programs like PNC Grow Up Great, our 10-year, $100 million initiative to help prepare young children for school, and through The PNC Foundations continuous work, PNC makes its communities better for the long term.

Finally, our team the many thousands of PNC people around the country and overseas both generates and benefits from our growth. We will continue to do all we can to help our employees balance their professional and personal lives; we will continue to guide them along rewarding career paths; and we will continue to encourage them to act in service to their communities.

I would like to thank all of you our customers, our shareholders, our employees and our board of directors for your dedication to PNCs success and for your ongoing confidence in our company. I trust that all of you share my enthusiasm for PNCs future.

| Sincerely, |

| /s/ JAMES E. ROHR |

| James E. Rohr |

| Chairman and Chief Executive Officer |

| 6 |

2004 PNC Summary Annual Report |

DRIVEN}

PNC is a highly diversified financial services company. Our revenues come from a wide range of business sources from community banking to wealth and asset management; from mutual fund processing to corporate banking and from markets as widespread as Philadelphia and Luxembourg, Los Angeles and Louisville. The force that unifies our breadth is the drive to provide customers with the best service available. We understand that the hallmarks of a successful, growing company shareholder returns, satisfied employees, enduring commitments to our communities all derive from our success at attracting and satisfying customers. At PNC, we are driven, every day, by the needs of every one of our customers.

ACCELERATE}

The ambition of every business owner is to grow his or her company to grow faster than the competition and to accelerate that growth. At PNC, we fuel the progress of American business by providing a broad range of financing options, and by forming enduring relationships so that we can serve companies like Small World Kids and help stimulate their growth. Pictured at right are Small World Kids President and CEO Debra Fine [right], CFO Bob Rankin [left] and COO John Nelson [center].

| 8 |

2004 PNC Summary Annual Report |

ACCELERATE}

Wholesale Growth

Nearly half of PNCs revenue in the Wholesale Banking segment and nearly two-thirds of our consolidated revenue comes from noninterest sources, which is a good proxy for the success of our fee-based businesses. Several fee-based product lines produced exceptional results in 2004, highlighted by record revenue at Midland Loan Services and good performance from Treasury Management and Capital Markets. These fee-based products within a traditionally credit-driven segment of our company provide important earnings diversification.

A SMALL WORLD GROWS

Small World Toys, based in Culver City, California, had been manufacturing and distributing high quality toys for 30 years when, in May 2004, it was purchased from a private owner and then became a public company, Small World Kids.

The companys two divisions, Small World Toys and SW Express, sell toys that promote healthy minds and bodies under several well-known brands, including IQ Baby, Puzzibilities, All About Baby and Active Edge.

As a public company, growth was imperative for Small World Kids, and when its leaders saw an opportunity to add the complementary brand Neurosmith to its stable, PNC Business Credit stepped in with an attractive $16.5 million credit facility to support the acquisition, as well as Small Worlds existing operations. The result: an ambitious company had its opportunity to grow, and PNC Business Credit had earned another important long-term relationship.

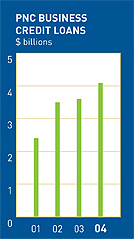

Business Credit reach

PNC Business Credits success on behalf of Small World Kids provides one snapshot from a year of remarkable growth for this business unit, which now manages more than $10 billion in commitments. PNC Business Credit closed 118 deals in 2004, an increase of 27 percent over the prior year.

Much of this growth can be attributed to the expanding national scope of the business unit, which operates from 25 offices from New York to Chicago to Los Angeles, and to a primary advantage the unit has over many of its competitors: It can rely on PNCs broad product range, including merger and acquisition advice, debt underwriting and treasury management, to win clients. Armed with this array of products and a national prospect list, the expanded PNC Business Credit sales force can deliver creative, fast action to a growing customer base.

| 10 |

2004 PNC Summary Annual Report |

PNC is devoted to understanding our needs and objectives, and that effort on our behalf has helped us accelerate our growth. Our new credit facility gives us increased operating flexibility and supports our acquisition strategy. We are very pleased with the working relationship we have established with PNC.

Debra Fine, President and CEO, Small World Kids, Inc.

At December 31

Accelerating PNCs growth

The expanded marketplace in which PNC Business Credit operates reflects a primary element of our overall strategy for growth: We are constantly seeking new markets for new and existing products across all of our businesses.

In 2004, for example, PFPC, our mutual fund processing segment, grew its offshore assets serviced by 36 percent and its alternative assets serviced by 45 percent. BlackRock increased its client base across products and around the world. And we continued to build on the success of innovative treasury management technology, including A/R Advantage, our lockbox management system.

These product and market enhancements are being augmented by strategic capital investments and commitments, including the acquisition of United National Bancorp, which closed on January 1, 2004 and added to our presence in New Jersey and eastern Pennsylvania, the pending acquisition of Washington, D.C.-based Riggs National Corporation, and BlackRocks acquisition of SSRM Holdings, Inc. on January 31, 2005.

| 2004 PNC Summary Annual Report | 11 |

BUILD}

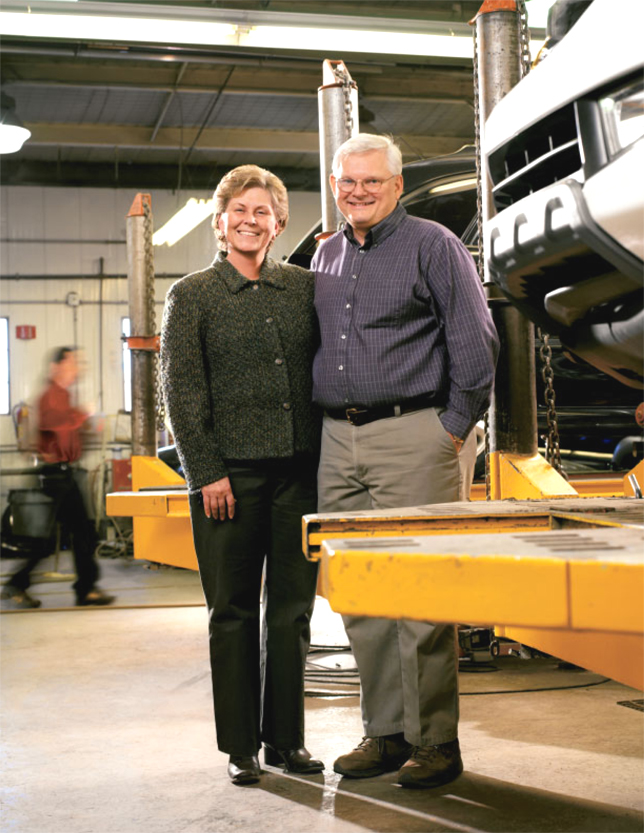

At PNC, we understand that small business owners face unique challenges and worries. Many of their livelihoods are dependent on a single location, and so they suffer from bad weather or road construction or an increase in the price of a raw material. Thats why we treat small business customers more like consumers we manage each small business relationship with a high degree of individual service so that we can help meet the individual needs of each business. In short, we build relationships so that our customers, like Al and Joyce Kollinger (right), can build their businesses.

| 12 |

2004 PNC Summary Annual Report |

BUILD}

At December 31

AUTO SHOPS GROWTH NO ACCIDENT

Al and Joyce Kollinger, owners of Kollinger Auto Body Inc. just north of Pittsburgh, were not necessarily looking for a new bank when PNC came calling a few years ago.

A short time later, though, the Kollingers had moved all of their bank accounts business and personal to PNC and had encouraged their children to switch to PNC as well. Why? PNC offered an attractive way for the Kollingers, whose business repairs approximately 125 vehicles per month, to consolidate three outstanding loans and add a new term loan to finance the purchase of new equipment. From there, the story is all about a relationship PNCs small business representatives were in regular contact with the Kollingers, offering the kind of trusted advice that owners of small businesses require.

Small businesses, large momentum

PNC serves thousands of small businesses like Kollinger Auto Body, and our roster of clients is growing rapidly. In 2004, we added to our sales force by hiring new representatives as well as charging branch managers with spending more time calling on small business customers. Those efforts, coupled with offers of free business checking, contributed to a 13 percent increase in small business relationships during the year, which led to a significant increase in deposits from this customer segment. And we realize further value by growing relationships once business owners have opened an initial account; for example, in 2004, small business loan production increased 65 percent over 2003.

We anticipate further growth in the small business area as we push into new markets and win more clients within our existing areas and product set. We plan to expand the geographic reach of our Small Business Administration lending business, and we plan to focus on specific high-growth industries, including healthcare, where we have differentiating expertise.

| 14 |

2004 PNC Summary Annual Report |

Our PNC banker was so professional and knowledgeable that we moved all of our personal and business accounts, as well as our childrens accounts, to PNC. Our banker constantly works very hard to help us continue building our business and manage our personal finances.

Al and Joyce Kollinger, Owners, Kollinger Auto Body Inc.

Community banking grows

Small business bankings progress is one element in the excellent 2004 results for our largest business segment, Regional Community Banking. Checking customer relationships increased eight percent in 2004, to more than 1.7 million, and drove a seven percent increase in average deposits. These statistics indicate success at both acquiring and retaining customers, while our loan growth indicates our ability to sell additional products to existing customers. Average loans in the Regional Community Bank increased by 30 percent in 2004, driven primarily by a $2.5 billion increase in home equity loans.

The community banks year was highlighted by the acquisition of United National Bancorp on January 1, 2004, adding 47 branches in the fast-growing New Jersey and eastern Pennsylvania marketplace. The integration of United was highly successful; the earnings generated by the former United franchise met our expectations.

We understand that community banking is both intensely local and increasingly borderless. We know that success will be defined by our ability to serve our neighbors in each of our 774 branches and through our network of more than 3,500 automated teller machines. But our customers also rely upon our best-in-class online banking options so that they can bank with us from around the corner or around the world.

$342 billion

BlackRock Booming

BlackRock, our asset management subsidiary, experienced remarkable growth in 2004 despite turbulent fixed income market conditions. Assets under management at BlackRock grew to $342 billion, a 10 percent increase over 2003, and sales of the firms proprietary risk analytics tool, BlackRock Solutions, increased substantially. BlackRock made further progress when, on January 31, 2005, it acquired SSRM Holdings, Inc., the holding company of State Street Research & Management and SSR Realty Advisors. The acquisition added approximately $55 billion in equity, fixed income and real estate assets under management to BlackRock.

| 2004 PNC Summary Annual Report | 15 |

SOLVE}

Our customers view us as one company: corporate customers, checking customers, wealth management clients they all think of themselves as PNC customers, not customers of a single business unit and so we come together, more than 23,000 strong, to serve them as one company. That means we listen to customers, hear their needs, and then work to create solutions derived from our full expertise and product set. Royal Castle Companies and its principal, Elliot Stone (right), needed just such a creative and unified approach from their bankers for the new Villas del Lago development in Miami.

| 16 |

2004 PNC Summary Annual Report |

SOLVE}

At quarter end

MULTI-FAMILY, MULTI-PRODUCT

At PNC Real Estate Finance, providing a full range of financing solutions is more than just a claim. Royal Castle Companies learned that first hand as the developer searched for a lender to finance the construction of a 288-unit affordable housing development in Miami.

From pre-development financing to a finished product, the Villas del Lago project was served by a creative combination of financing solutions from the array of debt and equity products offered by PNC Real Estate Finance. These products and services, from $2 million in pre-construction financing to a $9 million construction loan to $13 million in equity financing, were combined into a package that resolved a highly complex financing challenge for Royal Castle.

Royal Castle was one win among many in 2004 for PNC Real Estate Finance. Total commercial real estate and related loans increased to $3.5 billion in 2004, a 6 percent increase, even as we maintained our prudent approach to risk management. The forces of improving commercial real estate market conditions and a growing PNC business unit combined to create momentum for our real estate finance business as it moved into 2005.

| 18 |

2004 PNC Summary Annual Report |

Our PNC bankers came up with the best option for us. They combined multiple financing products to develop a creative solution to the complex financing needs of our Villas del Lago development in Miami. I know I can rely on PNC for intelligent, efficient options for Royal Castles future projects.

Elliot Stone, Principal, Royal Castle Companies

Delivering a unified PNC

PNC is an organization of more than 23,000 employees, with $80 billion in assets and offices around the country and overseas. But we are committed to delivering to each of our customers a unified approach that taps the full range of our expertise. In practice, that means that when a consumer checking customer seeks financing for a new business idea, we work to serve that need seamlessly. When the CEO of a corporate client needs a wealth management plan, PNC Advisors steps in to assist. And when a small business grows into a middle market business, the customer experiences no disruption in service from PNC.

Part of our ability to offer such comprehensive service comes from our clear understanding of our customers. We have developed a robust database of information so that our employees have access to the information they need to serve our customers.

We intend to move even closer to our customers throughout the course of 2005, as we undertake an initiative to become more efficient in our service to reduce corporate elements that do not contribute to our ability to meet customer needs.

Overarching success at PFPC

PFPC, our mutual fund processing company, achieved remarkable success in 2004. In a market environment challenged by weak equity trading volumes, investigations into the mutual fund industry and fierce competition that exerted downward pressure on prices, PFPC nevertheless produced nine percent earnings growth and increased its total assets serviced to $1.8 trillion, a 13 percent increase over 2003. Gains in offshore and alternative assets, as well as disciplined cost control, contributed to PFPCs success.

| 2004 PNC Summary Annual Report | 19 |

TRUST}

Our growing customer franchise, our returns for shareholders, our service to employees, our support for the communities in which we do business these all depend upon trust. We have positioned our balance sheet for soundness, for prudent risk-taking for trustworthiness. We have implemented corporate governance policies and procedures to help ensure we are among the best in class. And we work hard, every day and at every interaction, to instill in our customers trust in PNC. Gerry Walts (pictured) trusts PNC Advisors with all of her financial services needs.

| 20 |

2004 PNC Summary Annual Report |

TRUST}

At December 31

COMPREHENSIVE ADVICE

Gerry Walts relationship with PNC began years ago when she opened a checking account.

Then, in 2002, the PNC Advisors team in Louisville, near Ms. Walts home, offered to structure a comprehensive wealth management plan that would consolidate her financial services from three providers to one. Today, Ms. Walts entrusts her wealth management, her trust and estate planning and all of her banking needs to PNC. She stays with us for many reasons because of her close working relationship with her PNC team, because of the coherent and sensible plan developed for her but most of all because she trusts PNC to help her manage her financial life.

Growth at PNC Advisors

Among the many types of relationships we have with our clients, the PNC Advisors client relationship is perhaps most dependent upon trust. But trust is only the first element of a successful wealth management relationship. We understand that wealthy individuals have myriad options for wealth management, and so we know we must provide a differentiated value proposition.

One way we do that is by understanding the needs and concerns of our clients and prospects. We listen closely and constantly to each of our clients, and we deliver comprehensive, customized service through a local team of professionals. Our clients know their financial advisors, and they know we possess both the expertise and the range of products necessary to meet their needs.

In 2004, we enhanced PNC Advisors by offering separately managed accounts for equity holdings and by enhancing our relationship management approach. The latter change, which we believe will make the business significantly more competitive, streamlines our interactions with clients, who now have a single contact point for all of their business with PNC.

| 22 |

2004 PNC Summary Annual Report |

I needed a comprehensive wealth management plan that would cover not only my needs, but also the needs of my children and grandchildren. The PNC people have earned my trust by staying at my side as they developed a wide-ranging plan to help me manage all of my finances.

Gerry Walts, PNC Advisors client, Jeffersonville, Indiana

A culture of responsibility

The trust we earn from our customers is underpinned by the culture of responsibility that runs through our entire organization. Our corporate governance policies are rigorous and our systems robust; we are often considered among the best in our peer group in this regard.

Good corporate governance is more than a values statement; it is more than appearances. We devote substantial resources to regulatory compliance and to highly positive, productive working relationships with our regulators. And we follow methodical, thorough processes to produce our public disclosure and to comply with new regulatory requirements, including the Sarbanes-Oxley Act.

In our daily business operations, we manage our balance sheet with caution and prudence; we use sophisticated risk management tools, and we avoid taking potentially value-destroying interest rate risk simply to generate short-term profits. And as we continually improve our interactions with customers, our employees undergo regular ethics training to help ensure that we protect the privacy and trust of our customers.

| 2004 PNC Summary Annual Report | 23 |

COMMIT}

Community service is a deeply ingrained value at PNC. Our employees have committed well over a million hours of volunteer service to their communities over the past decade because they and we as a company know that the long-term vitality of the places where we do business is both a solemn responsibility and good sense. Put simply, we succeed only if our communities succeed, and our communities succeed only if their corporate citizens contribute to their strength.

| 24 |

2004 PNC Summary Annual Report |

COMMIT}

4,000

PNC employee volunteers for PNC Grow Up Great.

COMMITTED FOR THE LONG TERM

We serve our communities on many levels: from the day-after-day work our employees perform at local schools and hospitals to the $3.4 million we and our employees contributed to the United Way in 2004; from our dedication to good work through the Community Reinvestment Act to our efforts to help communities harmed by natural disasters; from The PNC Foundations $11 million in grants in 2004 to the benefit that gives employees 40 paid hours per year to perform volunteer work related to early childhood development.

Helping kids Grow Up Great

The most visible of our programs is PNC Grow Up Great, a 10-year, $100 million program to help prepare young children from birth to age five for school. We believe PNC Grow Up Great is the most comprehensive corporate-based school readiness program in the country, and its ultimate goal is to help produce stronger, smarter and healthier children, families and communities. PNC Grow Up Great invests in grants, advocacy, television and print content, communications and volunteerism with a focus on the whole child, including cognitive, social and emotional abilities. The program and its partners, Sesame Workshop and Family Communications, Inc., the producers of Mister Rogers Neighborhood, are working to improve the school readiness of children in all the communities PNC serves.

PNC employees have embraced PNC Grow Up Great, and they are making its goals reality. More than 4,000 employees have registered to perform volunteer work related to the program, and we intend to contribute a million hours to our communities children over the 10-year course of PNC Grow Up Great.

| 26 |

2004 PNC Summary Annual Report |

Responding when we are needed

Our people are eager to help when their communities and others around the world are in need. In September 2004, when flooding disrupted thousands of lives across Pennsylvania, PNC responded quickly to help. Though several of our branches were damaged, our employees found ways to get the buildings open for business and to help ease the burden on our communities. We further assisted the victims of the flooding by offering $150 million in low-cost loans and $250,000 in grants to help people rebuild their lives.

Thousands of miles away from Pittsburgh, we reached out to help the Indian Ocean communities ravaged by the December 2004 tsunamis. We extended a corporate pledge to the American Red Cross and matched our employees donations to tsunami relief organizations.

We are just as committed to serving longer-term needs. In October 2004, for example, we announced an economic development program for medium-sized and small businesses in New Jersey. In conjunction with the New Jersey Economic Development Authority, we offered up to $100 million in low-cost loans to give qualified local entrepreneurs and business people incentive to invest in their communities. The program was extremely well received, and many areas in New Jersey are now benefiting from PNCs dedication to their future.

The scope of our commitment to our communities is a clear sign that PNC has been and will continue to be an excellent corporate citizen.

| 2004 PNC Summary Annual Report | 27 |

PNC}

We are driven to lead your company to industry leadership in the years ahead. We have made substantial progress over the past three years improving our customer satisfaction, rebuilding our risk management teams and processes, growing our fee-based businesses and our balance sheet but our vision is not complete. From here, we must accelerate our growth, and we intend to achieve that goal by attracting and satisfying customers across all of our businesses.

| 28 |

2004 PNC Summary Annual Report |

BOARD OF DIRECTORS & EXECUTIVE MANAGEMENT}

Board of Directors

Paul W. Chellgren (3, 4, 7)

Retired Chairman and

Chief Executive Officer

Ashland Inc. (energy company);

Adjunct Professor

Northern Kentucky University

Robert N. Clay (4, 5)

President and

Chief Executive Officer

Clay Holding Company (investments)

J. Gary Cooper (1, 2)

Chairman and

Chief Executive Officer

Commonwealth National Bank

(community banking)

George A. Davidson, Jr. (1, 2, 3)

Retired Chairman

Dominion Resources, Inc.

(public utility holding company)

Richard B. Kelson (1, 4)

Executive Vice President and

Chief Financial Officer

Alcoa Inc.

(producer of primary aluminum, fabricated aluminum, and alumina)

Bruce C. Lindsay (1, 2, 6)

Chairman and

Managing Member

2117 Associates, LLC

(advisory company)

Anthony A. Massaro (4, 5, 7)

Retired Chairman and

Chief Executive Officer

Lincoln Electric Holdings, Inc.

(full-line manufacturer of welding and cutting products)

Thomas H. OBrien (4)

Retired Chairman

The PNC Financial Services Group, Inc.

Jane G. Pepper (2, 6)

President

Pennsylvania Horticultural Society

(nonprofit membership organization)

James E. Rohr (2, 3, 6)

Chairman and

Chief Executive Officer

The PNC Financial Services Group, Inc.

Lorene K. Steffes (2, 3, 5, 6)

Independent business advisor and consultant

Dennis F. Strigl (3, 6, 7)

President and

Chief Executive Officer

Verizon Wireless, Inc.

(wireless telecommunications)

Stephen G. Thieke (1, 3, 4)

Retired Chairman

Risk Management Committee

JP Morgan Incorporated

(financial and investment banking services)

Thomas J. Usher (3, 5, 7)

Chairman

United States Steel Corporation

(integrated steelmaker)

Milton A. Washington (2, 7)

President and

Chief Executive Officer

Allegheny Housing Rehabilitation

Corporation

(housing rehabilitation and construction)

Helge H. Wehmeier (5, 6)

Retired Chairman and

Chief Executive Officer

Bayer Corporation

(healthcare, crop protection and chemical)

| (1) | Audit |

| (2) | Credit |

| (3) | Executive |

| (4) | Finance |

| (5) | Nominating & Governance |

| (6) | Operations & Technology |

| (7) | Personnel & Compensation |

Executive Management

James E. Rohr

Chairman and

Chief Executive Officer

Joseph C. Guyaux

President

William S. Demchak

Vice Chairman and

Chief Financial Officer

William C. Mutterperl

Vice Chairman

Laurence D. Fink

Chairman and

Chief Executive Officer

BlackRock

Joan L. Gulley

Chief Executive Officer

PNC Advisors

Neil F. Hall

Chief Executive Officer

Regional Community Banking

Michael J. Hannon

Chief Credit Policy Officer

Vance Williams LaVelle

Chief Marketing Officer

Helen P. Pudlin

General Counsel

William E. Rosner

Chief Human Resources Officer

Timothy G. Shack

Chief Information Officer

The PNC Financial Services Group, Inc.

Chairman and Chief Executive Officer

PFPC

Thomas K. Whitford

Chief Risk Officer

John J. Wixted, Jr.

Chief Compliance and Regulatory Officer

| 2004 PNC Summary Annual Report | 29 |

CONDENSED CONSOLIDATED STATEMENT OF INCOME}

The PNC Financial Services Group, Inc.

| Year ended December 31 In millions |

2004 |

2003 |

|||||

| Interest Income |

|||||||

| Loans and fees on loans |

$ | 2,043 | $ | 1,962 | |||

| Securities and other |

709 | 750 | |||||

| Total interest income |

2,752 | 2,712 | |||||

| Interest Expense |

|||||||

| Deposits |

484 | 457 | |||||

| Borrowed funds |

299 | 259 | |||||

| Total interest expense |

783 | 716 | |||||

| Net interest income |

1,969 | 1,996 | |||||

| Provision for credit losses |

52 | 177 | |||||

| Net interest income less provision for credit losses |

1,917 | 1,819 | |||||

| Noninterest Income |

|||||||

| Asset management |

994 | 861 | |||||

| Fund servicing |

817 | 762 | |||||

| Service charges on deposits |

252 | 239 | |||||

| Brokerage |

219 | 184 | |||||

| Consumer services |

264 | 251 | |||||

| Corporate services |

473 | 485 | |||||

| Equity management gains (losses) |

67 | (25 | ) | ||||

| Net securities gains |

55 | 116 | |||||

| Other |

422 | 384 | |||||

| Total noninterest income |

3,563 | 3,257 | |||||

| Noninterest Expense |

|||||||

| Compensation |

1,755 | 1,480 | |||||

| Employee benefits |

309 | 324 | |||||

| Net occupancy |

267 | 282 | |||||

| Equipment |

290 | 276 | |||||

| Marketing |

87 | 64 | |||||

| Other |

1,027 | 1,050 | |||||

| Total noninterest expense |

3,735 | 3,476 | |||||

| Income before minority and noncontrolling interests and income taxes |

1,745 | 1,600 | |||||

| Minority and noncontrolling interests |

10 | 32 | |||||

| Income taxes |

538 | 539 | |||||

| Income before cumulative effect of accounting change |

1,197 | 1,029 | |||||

| Cumulative effect of accounting change, net of tax |

(28 | ) | |||||

| Net income |

$ | 1,197 | $ | 1,001 | |||

| 30 |

2004 PNC Summary Annual Report |

CONDENSED CONSOLIDATED BALANCE SHEET}

The PNC Financial Services Group, Inc.

| At December 31 In millions, except par value |

2004 |

2003 |

||||||

| Assets |

||||||||

| Cash and due from banks |

$ | 3,230 | $ | 2,968 | ||||

| Federal funds sold, resale agreements and other short term investments |

3,483 | 2,596 | ||||||

| Loans held for sale |

1,670 | 1,400 | ||||||

| Securities available for sale and held to maturity |

16,761 | 15,690 | ||||||

| Loans, net of unearned income of $902 and $1,009 |

43,495 | 36,303 | ||||||

| Allowance for loan and lease losses |

(607 | ) | (632 | ) | ||||

| Net loans |

42,888 | 35,671 | ||||||

| Goodwill and other intangible assets |

3,355 | 2,707 | ||||||

| Other |

8,336 | 7,136 | ||||||

| Total assets |

$ | 79,723 | $ | 68,168 | ||||

| Liabilities |

||||||||

| Deposits |

||||||||

| Noninterest-bearing |

$ | 12,915 | $ | 11,505 | ||||

| Interest-bearing |

40,354 | 33,736 | ||||||

| Total deposits |

53,269 | 45,241 | ||||||

| Borrowed funds |

||||||||

| Federal funds purchased and repurchase agreements |

1,595 | 1,250 | ||||||

| Bank notes and senior debt |

2,383 | 2,823 | ||||||

| Subordinated debt |

4,050 | 3,729 | ||||||

| Commercial paper |

2,251 | 2,226 | ||||||

| Other borrowed funds |

1,685 | 1,425 | ||||||

| Total borrowed funds |

11,964 | 11,453 | ||||||

| Allowance for unfunded loan commitments and letters of credit |

75 | 91 | ||||||

| Accrued expenses and other |

6,438 | 4,276 | ||||||

| Total liabilities |

71,746 | 61,061 | ||||||

| Minority and noncontrolling interests in consolidated entities |

504 | 462 | ||||||

| Shareholders Equity |

||||||||

| Preferred stock(a) |

||||||||

| Common stock $5 par value |

||||||||

| Authorized 800 shares, issued 353 shares |

1,764 | 1,764 | ||||||

| Capital surplus |

1,265 | 1,108 | ||||||

| Retained earnings |

8,273 | 7,642 | ||||||

| Deferred compensation expense |

(51 | ) | (29 | ) | ||||

| Accumulated other comprehensive (loss) income |

(54 | ) | 60 | |||||

| Common stock held in treasury at cost: 70 and 76 shares |

(3,724 | ) | (3,900 | ) | ||||

| Total shareholders equity |

7,473 | 6,645 | ||||||

| Total liabilities, minority and noncontrolling interests and shareholders equity |

$ | 79,723 | $ | 68,168 | ||||

| (a) | Less than $.5 million at each date. |

| 2004 PNC Summary Annual Report | 31 |

Report of INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM}

To the Board of Directors and Shareholders of

The PNC Financial Services Group, Inc.

Pittsburgh, Pennsylvania

We have audited the consolidated balance sheet of The PNC Financial Services Group, Inc. and subsidiaries (the Company) as of December 31, 2004 and 2003, and the related consolidated statements of income, shareholders equity, and cash flows for each of the three years in the period ended December 31, 2004. We also have audited managements assessment of the effectiveness of the Companys internal control over financial reporting and the effectiveness of the Companys internal control over financial reporting as of December 31, 2004. Such consolidated financial statements, managements assessment of the effectiveness of the Companys internal control over financial reporting and our reports thereon dated February 28, 2005, expressing unqualified opinions (which are not included herein) are included in the Form 10-K for the year ended December 31, 2004. The accompanying condensed consolidated financial statements are the responsibility of the Companys management. Our responsibility is to express an opinion on such condensed consolidated financial statements in relation to the complete consolidated financial statements.

In our opinion, the information set forth in the accompanying condensed consolidated balance sheet as of December 31, 2004 and 2003, and the related condensed consolidated statement of income for the years then ended, is fairly stated in all material respects in relation to the basic consolidated financial statements from which it has been derived.

Deloitte & Touche LLP

February 28, 2005

| 2004 PNC Summary Annual Report | 32 |

RESULTS OF BUSINESSES - Summary and Reconciliation to Total Consolidated Results}

The PNC Financial Services Group, Inc.

| (Unaudited) (a) Year ended December 31 In millions |

2004 |

2003 |

||||||

| Earnings |

||||||||

| Banking businesses |

||||||||

| Regional Community Banking |

$ | 504 | $ | 477 | ||||

| Wholesale Banking |

443 | 391 | ||||||

| PNC Advisors |

106 | 89 | ||||||

| Total banking businesses |

1,053 | 957 | ||||||

| Asset management and processing businesses |

||||||||

| BlackRock(b) |

143 | 155 | ||||||

| PFPC |

70 | 64 | ||||||

| Total asset management and processing businesses |

213 | 219 | ||||||

| Total business segment earnings |

1,266 | 1,176 | ||||||

| Minority interest in income of BlackRock |

(42 | ) | (47 | ) | ||||

| Other |

(27 | ) | (100 | ) | ||||

| Results before cumulative effect of accounting change |

1,197 | 1,029 | ||||||

| Cumulative effect of accounting change |

(28 | ) | ||||||

| Total consolidated earnings |

$ | 1,197 | $ | 1,001 | ||||

| Revenue (c) |

||||||||

| Banking businesses |

||||||||

| Regional Community Banking |

$ | 2,073 | $ | 1,892 | ||||

| Wholesale Banking |

1,271 | 1,282 | ||||||

| PNC Advisors |

629 | 615 | ||||||

| Total banking businesses |

3,973 | 3,789 | ||||||

| Asset management and processing businesses |

||||||||

| BlackRock |

725 | 598 | ||||||

| PFPC |

814 | 762 | ||||||

| Total asset management and processing businesses |

1,539 | 1,360 | ||||||

| Total business segment revenue |

5,512 | 5,149 | ||||||

| Other |

40 | 114 | ||||||

| Total consolidated revenue |

$ | 5,552 | $ | 5,263 | ||||

| (a) | See our Current Report on Form 8-K dated April 5, 2004 regarding changes to the presentation of the results of our businesses. Our business segment information is presented based on our management accounting practices and our management structure. We refine our methodologies from time to time as our management accounting practices are enhanced and our businesses change. |

| (b) | BlackRock results for 2004 reflect after-tax charges totaling $66 million for BlackRocks 2002 Long-Term Retention and Incentive Program. |

| (c) | Business segment revenue is presented on a taxable-equivalent basis except for BlackRock and PFPC. BlackRock began reporting revenue on a taxable-equivalent basis in 2004. BlackRock for 2003 and PFPC for both years are presented on a book (GAAP) basis. The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than a taxable investment. In order to provide more meaningful comparisons of yields and margins for all earning assets, we have increased the interest income earned on tax-exempt assets to make them fully equivalent to other taxable interest income investments. The following is a reconciliation of total consolidated revenue on a book (GAAP) basis to total consolidated revenue on a taxable-equivalent basis (in millions): |

|

2004 |

2003 |

|||||

| Total consolidated revenue, book (GAAP) basis |

$ | 5,532 | $ | 5,253 | ||

| Taxable-equivalent adjustment |

20 | 10 | ||||

| Total consolidated revenue, taxable-equivalent basis |

$ | 5,552 | $ | 5,263 | ||

| 2004 PNC Summary Annual Report | 33 |

CAUTIONARY STATEMENT Regarding Forward-Looking Information }

The PNC Financial Services Group, Inc.

We make statements in this Summary Annual Report, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses and/or other matters regarding or affecting PNC that are forward-looking statements. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, outlook, estimate, forecast, project, and other similar words and expressions.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements. Actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance.

In addition to factors that we disclose in our 2004 Annual Report on Form 10-K and other SEC reports (accessible on the SECs website at www.sec.gov and on or through PNCs corporate website at www.pnc.com) and those that we discuss elsewhere in this document, PNCs forward-looking statements are subject to, among others, the following risks and uncertainties, which could cause actual results or future events to differ materially from those that we anticipated in our forward-looking statements or from our historical performance:

| | Changes in political, economic or industry conditions, the interest rate environment or the financial and capital markets (including as a result of actions of the Federal Reserve Board affecting interest rates, the money supply or otherwise reflecting changes in monetary policy), which could affect: (a) credit quality and the extent of our credit losses; (b) the extent of funding of our unfunded loan commitments and letters of credit; (c) our allowances for loan and lease losses and unfunded loan commitments and letters of credit; (d) demand for our credit or fee-based products and services; (e) our net interest income; (f) the value of assets under management and assets serviced, of private equity investments, of other debt and equity investments, of loans held for sale, or of other on-balance sheet or off-balance sheet assets; or (g) the availability and terms of funding necessary to meet our liquidity needs; |

| | The impact on us of legal and regulatory developments, including the following: (a) the resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to tax laws; and (e) changes in accounting policies and principles, with the impact of any such developments possibly affecting our ability to operate our businesses or our financial condition or results of operations or our reputation, which in turn could have an impact on such matters as business generation and retention, our ability to attract and retain management, liquidity and funding; |

| | The impact on us of changes in the nature or extent of our competition; |

| | The introduction, withdrawal, success and timing of our business initiatives and strategies; |

| | Customer acceptance of our products and services, and our customers borrowing, repayment, investment and deposit practices; |

| | The impact on us of changes in the extent of customer or counterparty delinquencies, bankruptcies or defaults, which could affect, among other things, credit and asset quality risk and our provision for credit losses; |

| | The ability to identify and effectively manage risks inherent in our businesses; |

| | How we choose to redeploy available capital, including the extent and timing of any share repurchases and acquisitions or other investments in our businesses; |

| | The impact, extent and timing of technological changes, the adequacy of intellectual property protection, and costs associated with obtaining rights in intellectual property claimed by others; |

| | The timing and pricing of any sales of loans or other financial assets held for sale; |

| | Our ability to obtain desirable levels of insurance and to successfully submit claims under applicable insurance policies; |

| | The relative and absolute investment performance of assets under management; |

| | The extent of terrorist activities and international hostilities, increases or continuations of which may adversely affect the economy and financial and capital markets generally or us specifically; and |

| | Issues related to the completion of our pending acquisition of Riggs National Corporation and the integration of the remaining Riggs businesses into PNC, including the following: |

| | Completion of the transaction is dependent on, among other things, receipt of stockholder and regulatory approvals and regulatory waivers the timing of which cannot be predicted with precision at this point and which may not be received at all; |

| | Successful completion of the transaction and our ability to realize the benefits that we anticipate from the acquisition also depend on the nature of any future developments with respect to Riggs regulatory and legal issues, the ability to comply with the terms of all current or future requirements (including any related action plan) resulting from these issues, and the extent of future costs and expenses arising as a result of these issues, including the impact of increased litigation risk and any claims for indemnification or advancement of costs; |

| | Riggs regulatory and legal issues may cause reputational harm to PNC following the acquisition and integration of its business into ours; |

| | The transaction may be materially more expensive to complete than anticipated as a result of unexpected factors or events; |

| | The integration into PNC of the Riggs business and operations that we acquire, which will include conversion of Riggs different systems and procedures, may take longer or be more costly than anticipated and may have unanticipated adverse results relating to Riggs or PNCs existing businesses; |

| | It may take longer than expected to realize the anticipated cost savings of the acquisition, and the anticipated cost savings may not be achieved in their entirety; and |

| | The anticipated strategic and other benefits of the acquisition to PNC are dependent in part on the future performance of Riggs business, and there can be no assurance as to actual future results, which could be affected by various factors, including the risks and uncertainties generally related to the performance of PNCs and Riggs businesses (with respect to Riggs, you may review Riggs SEC reports, which are accessible on the SECs website at www.sec.gov) or due to factors related to the acquisition of Riggs and the process of integrating Riggs business at closing into PNC. |

In addition to the pending Riggs acquisition, we grow our business from time to time by acquiring other financial services companies. Other acquisitions generally present similar risks to those described above relating to the Riggs transaction. We could also be prevented from pursuing attractive acquisition opportunities due to regulatory restraints.

You can find additional information on the foregoing risks and uncertainties and additional factors that could affect results anticipated in our forward-looking statements or from historical performance in the reports that we file with the SEC. You can access our SEC reports on the SECs website at www.sec.gov or on or through our corporate website at www.pnc.com.

Also, BlackRocks SEC reports (accessible on the SECs website or on BlackRocks website at www.blackrock.com) discuss in more detail those risks and uncertainties that involve BlackRock that could affect the results anticipated in forward-looking statements or from historical performance. You may review the BlackRock SEC reports for a more detailed discussion of those risks and uncertainties and additional factors as they may affect BlackRock.

| 34 |

2004 PNC Summary Annual Report |

CORPORATE INFORMATION}

The PNC Financial Services Group, Inc.

Corporate Headquarters

The PNC Financial Services Group, Inc.

One PNC Plaza

249 Fifth Avenue

Pittsburgh, Pennsylvania 15222-2707

412-762-2000

Stock Listing

The PNC Financial Services Group, Inc.s common stock is listed on the New York Stock Exchange under the symbol PNC. At the close of business on February 28, 2005, there were 45,495 common shareholders of record.

Internet Information

The PNC Financial Services Group, Inc.s financial reports and information about its products and services are available on the Internet at www.pnc.com.

Financial Information

We are subject to the informational requirements of the Securities Exchange Act of 1934. Therefore, we file annual, quarterly and current reports as well as proxy materials with the Securities and Exchange Commission (SEC). You may obtain copies of these and other filings, including exhibits, electronically at the SECs internet website at www.sec.gov or on or through PNCs corporate internet website at www.pnc.com in the For Investors section. Copies may also be obtained without charge by contacting Shareholder Services at 800-982-7652 or via e-mail at web.queries@computer-share.com.

Corporate Governance at PNC

Information about our Board and its committees and corporate governance at PNC is available in the corporate governance section of the For Investors page of PNCs corporate website at www.pnc.com. Shareholders who would like to request printed copies of the PNC Code of Business Conduct and Ethics or our Corporate Governance Guidelines or the charters of our Boards Audit, Nominating and Governance, or Personnel and Compensation Committees (all of which are posted on the PNC website) may do so by sending their requests to Thomas R. Moore, Corporate Secretary, at corporate headquarters at the above address. Copies will be provided without charge to shareholders.

Inquiries

For financial services call 888-PNC-2265. Individual shareholders should contact Shareholder Services at 800-982-7652.

Analysts and institutional investors should contact William H. Callihan, Senior Vice President, Director of Investor Relations, at 412-762-8257 or via e-mail at investor.relations@pnc.com.

News media representatives and others seeking general information should contact Brian Goerke, Director of External Communications, at 412-762-4550 or via e-mail at corporate.communications@pnc.com.

Trust Proxy Voting

Reports of 2004 nonroutine proxy voting by the trust divisions of The PNC Financial Services Group, Inc. are available by writing to Thomas R. Moore, Corporate Secretary, at corporate headquarters.

Annual Shareholders Meeting

All shareholders are invited to attend The PNC Financial Services Group, Inc. annual meeting on Tuesday, April 26, 2005, at 11 a.m., Eastern Time, at One PNC Plaza, 249 Fifth Avenue, Pittsburgh, Pennsylvania 15222.

Common Stock Prices/Dividends Declared

The table below sets forth by quarter the range of high and low sale and quarter-end closing prices for The PNC Financial Services Group, Inc. common stock and the cash dividends declared per common share.

Dividend Policy

Holders of The PNC Financial Services Group, Inc. common stock are entitled to receive dividends when declared by the Board of Directors out of funds legally available. The Board presently intends to continue the policy of paying quarterly cash dividends. However, future dividends will depend on earnings, the financial condition of The PNC Financial Services Group, Inc. and other factors, including applicable government regulations and policies and contractual restrictions.

Dividend Reinvestment and Stock Purchase Plan

The PNC Financial Services Group, Inc. Dividend Reinvestment and Stock Purchase Plan enables holders of common and preferred stock to purchase additional shares of common stock conveniently and without paying brokerage commissions or service charges. A prospectus and enrollment form may be obtained by contacting Shareholder Services at 800-982-7652.

Registrar and Transfer Agent

Computershare Investor Services, LLC

2 North LaSalle Street

Chicago, IL 60602

800-982-7652

|

High |

Low |

Close |

Cash Dividends Declared |

|||||||||

| 2004 Quarter |

||||||||||||

| First |

$ | 59.79 | $ | 52.68 | $ | 55.42 | $ | .50 | ||||

| Second |

56.00 | 50.70 | 53.08 | .50 | ||||||||

| Third |

54.22 | 48.90 | 54.10 | .50 | ||||||||

| Fourth |

57.64 | 50.70 | 57.44 | .50 | ||||||||

| Total |

$ | 2.00 | ||||||||||

| 2003 Quarter |

||||||||||||

| First |

$ | 45.95 | $ | 41.63 | $ | 42.38 | $ | .48 | ||||

| Second |

50.11 | 42.06 | 48.81 | .48 | ||||||||

| Third |

50.17 | 46.41 | 47.58 | .48 | ||||||||

| Fourth |

55.55 | 47.63 | 54.73 | .50 | ||||||||

| Total |

$ | 1.94 | ||||||||||

| 2004 PNC Summary Annual Report | 35 |

PNC BANK REGIONAL OFFICES}

The PNC Financial Services Group, Inc.

1-800-PNC-BANK (1-800-762-2265)

PNC Bank, Central & Northern New Jersey

Two Tower Center Boulevard

East Brunswick, NJ 08816

Regional President:

Thomas C. Gregor

PNC Bank, Central Pennsylvania

4242 Carlisle Pike

Camp Hill, PA 17011

Regional President:

Dennis P. Brenckle

PNC Bank, Delaware

222 Delaware Avenue

Wilmington, DE 19801

Regional President:

Connie Bond Stuart

PNC Bank, Lehigh Valley

1660 Valley Center Parkway

Bethlehem, PA 18017

Regional President:

Warren R. Gerleit

PNC Bank, Kentucky & Indiana

500 West Jefferson Street

Louisville, KY 40296

Regional President:

Michael N. Harreld

PNC Bank, Naples

3003 Tamiami Trail North

Naples, FL 34103

Regional President:

Robert T. Saltarelli

PNC Bank, Northeast Pennsylvania

201 Penn Avenue

Scranton, PA 18503

Regional President:

Peter J. Danchak

PNC Bank, Northwest Pennsylvania

901 State Street

Erie, PA 16501

Regional President:

Marlene D. Mosco

PNC Bank, Ohio & Northern Kentucky

201 East Fifth Street

Cincinnati, OH 45202

Regional President:

John T. Taylor

PNC Bank, Philadelphia & Southern New Jersey

1600 Market Street

Philadelphia, PA 19103

Regional President:

J. William Mills, III

PNC Bank, Pittsburgh

249 Fifth Avenue

Pittsburgh, PA 15222

Regional President:

Sylvan M. Holzer

PNC Bank, Vero Beach

3001 Ocean Drive

Vero Beach, FL 32963

Regional President:

Kevin J. Grady

| 36 |

2004 PNC Summary Annual Report |

The PNC Financial Services Group, Inc.

One PNC Plaza

249 Fifth Avenue

Pittsburgh, PA 15222-2707

| 2004 PNC Summary Annual Report | 37 |