SLIDE PRESENTATION

Published on January 26, 2005

EXHIBIT 99.1

PNC

The PNC Financial Services Group, Inc.

Smith Barney Citigroup

Financial Services Conference

New York, NY

January 26, 2005

Cautionary Statement Regarding

Forward-Looking Information

This presentation contains forward-looking statements regarding our outlook or expectations relating to PNCs future business, operations, financial condition, financial performance and asset quality. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties.

The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the written materials we distributed at this conference and in the version of the presentation materials posted on our corporate website at www.pnc.com, as well as those factors previously disclosed in our 2003 Form 10-K, our 2004 Form 10-Qs, and other SEC reports (accessible on the SECs website at www.sec.gov and on our corporate website).

Future events or circumstances may change our outlook or expectations and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. The forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake to update those statements.

This presentation may also include a discussion of non-GAAP financial measures, which, to the extent not so qualified therein, is qualified by GAAP reconciliation information available on our corporate website at www.pnc.com under For Investors.

PNC

Todays Discussion

2004 accomplishments

Current environment and our 2005 opportunities

Summary

PNC

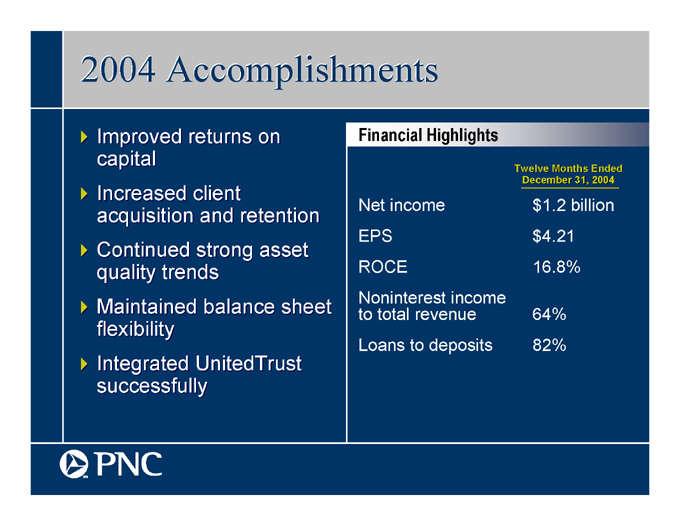

2004 Accomplishments

Improved returns on capital

Increased client acquisition and retention

Continued strong asset quality trends

Maintained balance sheet flexibility

Integrated UnitedTrust successfully

Financial Highlights

Twelve Months Ended

December 31, 2004

Net income $1.2 billion

EPS $4.21

ROCE 16.8%

Noninterest income to total revenue 64%

Loans to deposits 82%

PNC

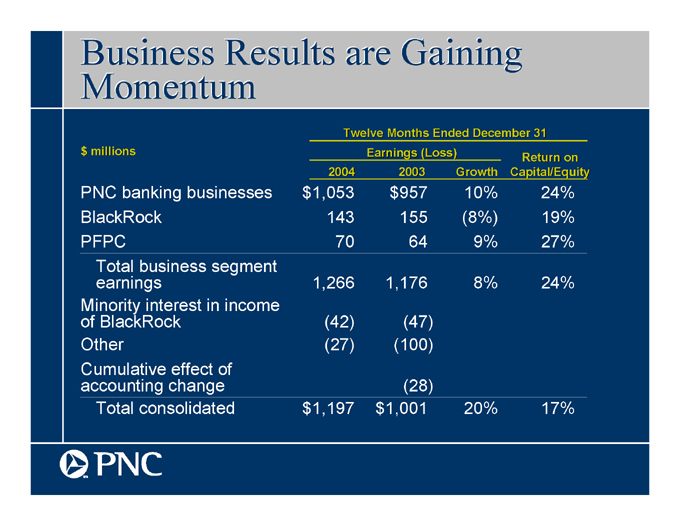

Business Results are Gaining

Momentum

Twelve Months Ended December 31

$ millions

Earnings (Loss)

2003

2004

Growth

Return on Capital/Equity

PNC banking businesses $1,053 $957 10% 24%

BlackRock 143 155 (8)% 19%

PFPC 70 64 9% 27%

Total business segment earnings 1,266 1,176 8% 24%

Minority interest in income of BlackRock (42) (47)

Other (27) (100)

Cumulative effect of accounting change (28)

Total consolidated $1,197 $1,001 20% 17%

PNC

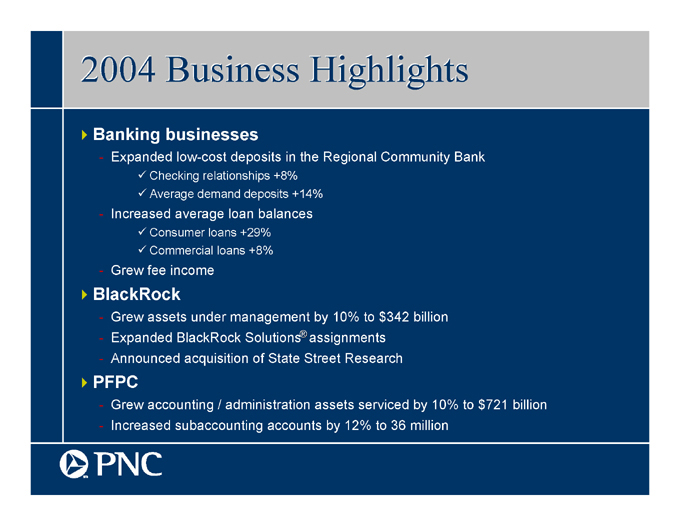

2004 Business Highlights

Banking businesses

Expanded low-cost deposits in the Regional Community Bank

Checking relationships +8%

Average demand deposits +14%

Increased average loan balances

Consumer loans +29%

Commercial loans +8%

Grew fee income

BlackRock

Grew assets under management by 10% to $342 billion

Expanded BlackRock Solutions® assignments

Announced acquisition of State Street Research

PFPC

Grew accounting / administration assets serviced by 10% to $721 billion

Increased subaccounting accounts by 12% to 36 million

PNC

Todays Discussion

2004 accomplishments

Current environment and our 2005 opportunities

Summary

PNC

Current Environment

Higher interest rates

Flatter yield curve

Reduced mortgage production

Regulatory and compliance requirements

Increased provisioning

PNC

Building on Our Strengths and

Seizing Our Opportunities

What were good at

Growing low-cost deposit relationships

Generating loans

Maintaining a moderate risk profile

Expanding differentiated set of fee-based businesses nationally and internationally

And the opportunities/challenges we see

Managing rising credit costs

Enhancing asset yields

Improving efficiency

PNC

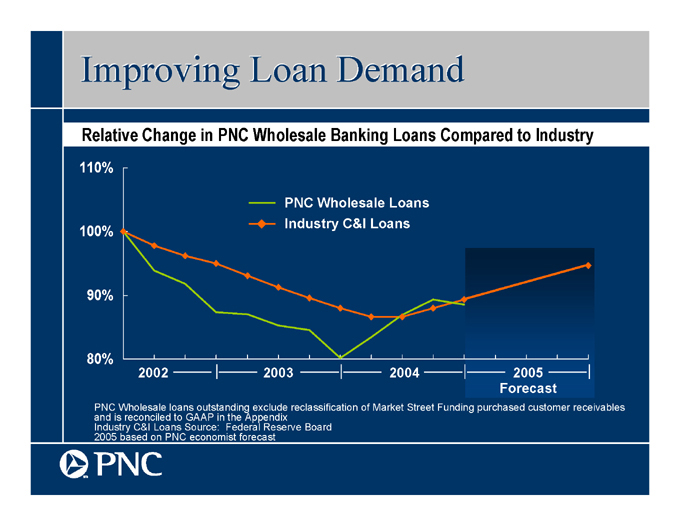

Improving Loan Demand

Relative Change in PNC Wholesale Banking Loans Compared to Industry

110%

PNC Wholesale Loans

Industry C&I Loans

100%

90%

80%

2002

2003

2004

2005

Forecast

PNC Wholesale loans outstanding exclude reclassification of Market Street Funding purchased customer receivables and is reconciled to GAAP in the Appendix

Industry C&I Loans Source: Federal Reserve Board

2005 based on PNC economist forecast

PNC

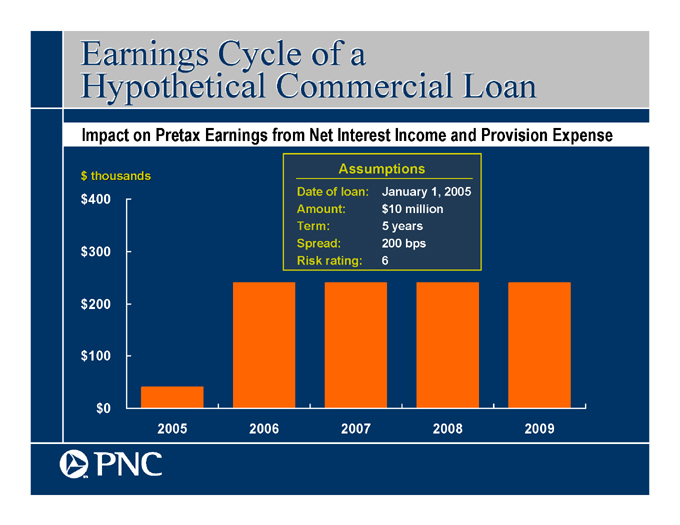

Earnings Cycle of a

Hypothetical Commercial Loan

Impact on Pretax Earnings from Net Interest Income and Provision Expense

$ thousands

$400

$300

$200

$100

$0

2005

2006

2007

2008

2009

Assumptions

Date of loan: January 1, 2005

Amount: $10 million

Term: 5 years

Spread: 200 bps

Risk rating: 6

PNC

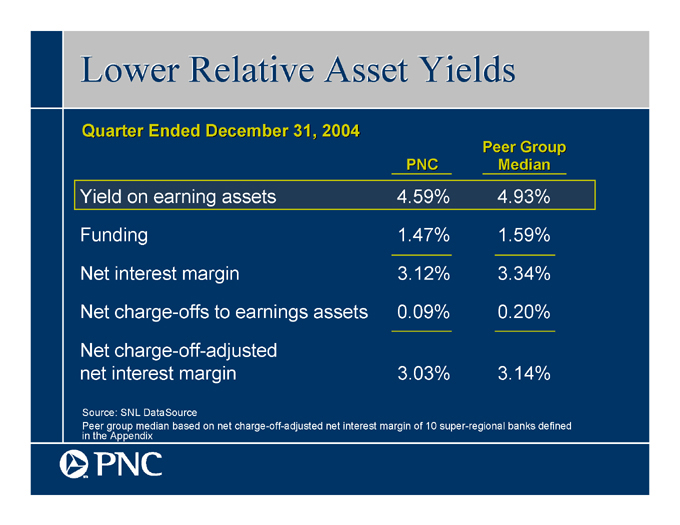

Lower Relative Asset Yields

Quarter Ended December 31, 2004

PNC

Peer Group

Median

Yield on earning assets 4.59% 4.93%

Funding 1.47% 1.59%

Net interest margin 3.12% 3.34%

Net charge-offs to earnings assets 0.09% 0.20%

Net charge-off-adjusted

net interest margin 3.03% 3.14%

Source: SNL DataSource

Peer group median based on net charge-off-adjusted net interest margin of 10 super-regional banks defined in the Appendix

PNC

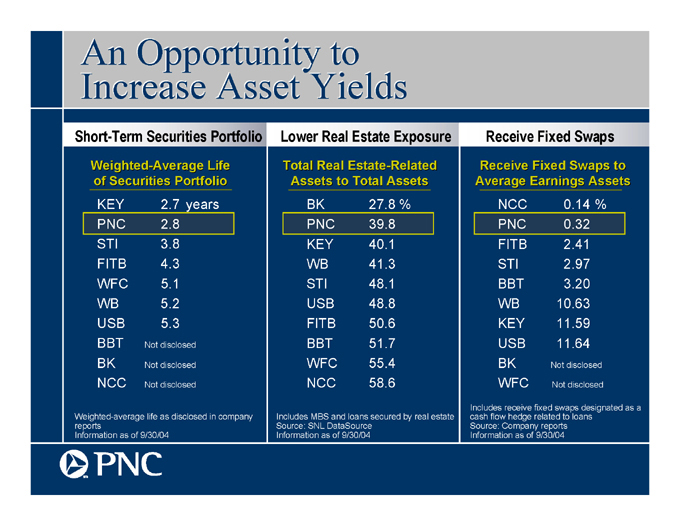

An Opportunity to

Increase Asset Yields

Short-Term Securities Portfolio

Lower Real Estate Exposure

Receive Fixed Swaps

Weighted-Average Life

of Securities Portfolio

Total Real Estate-Related

Assets to Total Assets

Receive Fixed Swaps to

Average Earnings Assets

NCC 0.14%

PNC 0.32

FITB 2.41

STI 2.97

BBT 3.20

WB 10.63

KEY 11.59

USB 11.64

BK Not disclosed

WFC Not disclosed

BK 27.8%

PNC 39.8

KEY 40.1

WB 41.3

STI 48.1

USB 48.8

FITB 50.6

BBT 51.7

WFC 55.4

NCC 58.6

KEY 2.7 years

PNC 2.8

STI 3.8

FITB 4.3

WFC 5.1

WB 5.2

USB 5.3

BBT Not disclosed

BK Not disclosed

NCC Not disclosed

Includes receive fixed swaps designated as a cash flow hedge related to loans

Source: Company reports

Information as of 9/30/04

Weighted-average life as disclosed in company reports

Information as of 9/30/04

Includes MBS and loans secured by real estate

Source: SNL DataSource

Information as of 9/30/04

PNC

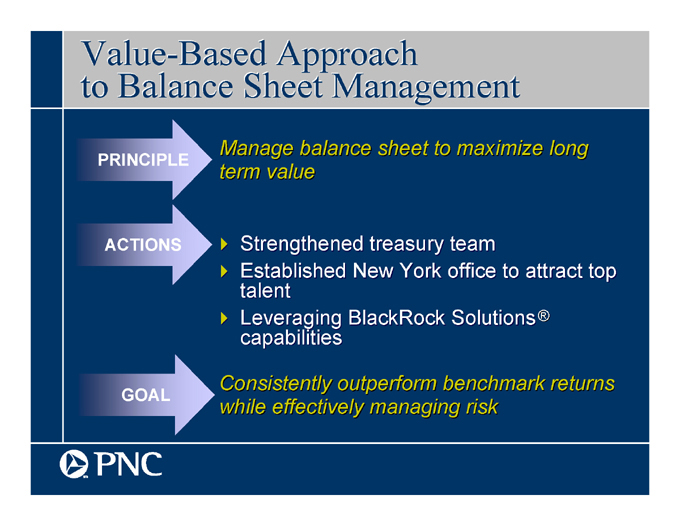

Value-Based Approach to Balance Sheet Management

PRINCIPLE

Manage balance sheet to maximize long term value

ACTIONS

Strengthened treasury team

Established New York office to attract top talent

Leveraging BlackRock Solutions® capabilities

GOAL

Consistently outperform benchmark returns while effectively managing risk

PNC

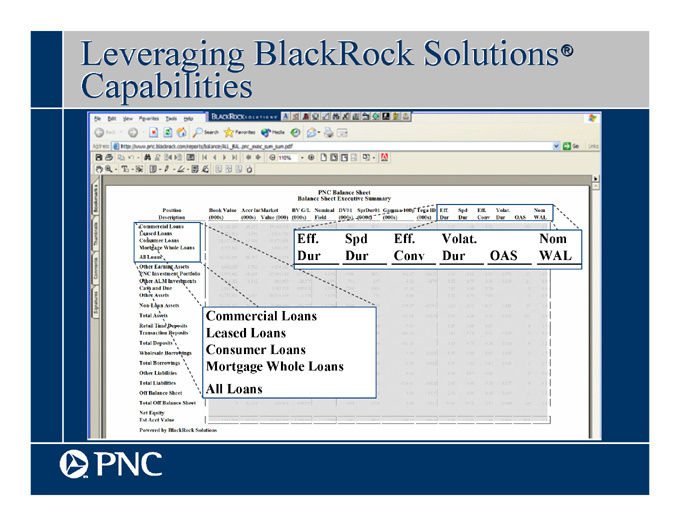

Leveraging BlackRock Solutions® Capabilities

PNC Balance Sheet

Balance Sheet Executive Summary

Position Description

Book Value (000s)

Accr Int Market (000s)

Value (000)

BV G/L (000s)

Nominal Field

DV01 (000s)

SprDur01 (000s)

Gamma 100p (000s)

Tega ID (000s)

Eff. Dur

Spd Dur

Eff. Conv

Volat. Dur

OAS

Nom WAL

Commercial Loans

Leased Loans

Consumer Loans

Mortgage Whole Loans

All Loans

Other Earning Assets

PNC Investment Portfolio

Other ALM Investments

Cash and Due

Other Assets

Non-Loan Assets

Total Assets

Retail Time Deposits

Trasanction Deposits

Total Deposits

Wholesale Borrowings

Total Borrowings

Other Liabilities

Total Liabilities

Off Balance Sheet

Total Off Balance Sheet

Net Equity

Est Acct Value

Powered by BlackRock Solutions

Commercial Loans

Leased Loans

Consumer Loans

Mortgage Whole Loans

All Loans

Eff. Dur

Spd Dur

Eff. Conv

Volat. Dur

OAS

Nom WAL

PNC

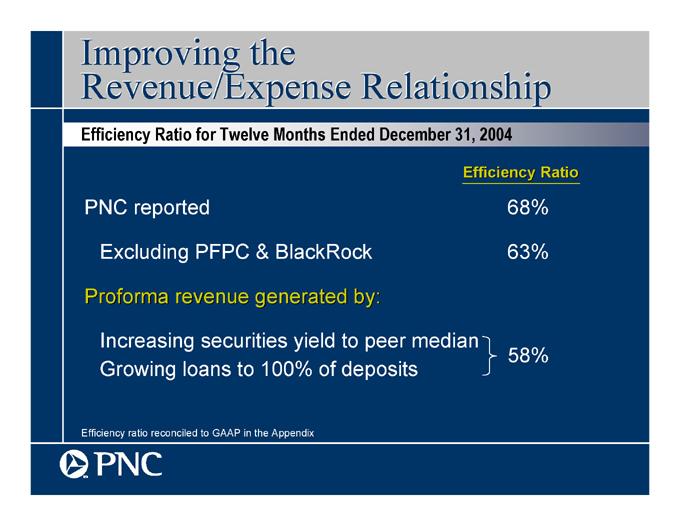

Improving the Revenue/Expense Relationship

Efficiency Ratio for Twelve Months Ended December 31, 2004

Efficiency Ratio

PNC reported 68%

Excluding PFPC & BlackRock 63%

Proforma revenue generated by:

Increasing securities yield to peer median

Growing loans to 100% of deposits

58%

Efficiency ratio reconciled to GAAP in the Appendix

PNC

Improving Efficiency

Approach

Team-oriented, company-wide process to identify efficiency improvement opportunities

Outcome

Drive PNC closer to the customer

Reallocate resources to value-added activities

Make processes more efficient

PNC

Todays Discussion

2004 accomplishments

Current environment and our 2005 opportunities

Summary

PNC

PNC

Every day is an opportunity to do more.sm

Appendix

Cautionary Statement Regarding Forward-Looking Information

We make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses, capital levels, asset quality or other future financial or business performance, strategies or expectations, or the impact of legal, regulatory or supervisory matters on our business operations or performance, that are forward-looking statements. Forward-looking statements are typically identified by words or phrases such as believe, feel, expect, anticipate, intend, outlook, estimate, forecast, project, position, target, assume, achievable, potential, strategy, goal, objective, plan, aspiration, outcome, continue, remain, maintain, seek, strive, trend, and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could, might, can, may or similar expressions.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Our forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements. Actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance.

The factors that we have previously disclosed in our SEC reports (accessible on our corporate website at www.pnc.com and on the SECs website at www.sec.gov) and the following risks & uncertainties, among others, could cause actual results or future events to differ materially from those that we anticipated in our forward-looking statements or from our historical performance:

(1) changes in political, economic or industry conditions, the interest rate environment or financial and capital markets (including as a result of actions of the Federal Reserve Board affecting interest rates or the money supply or otherwise reflecting changes in monetary policy), which could affect: (a) credit quality and the extent of our credit losses; (b) the extent of funding of our unfunded loan commitments and letters of credit; (c) our allowances for loan and lease losses and unfunded loan commitments and letters of credit; (d) demand for our credit or fee-based products and services; (e) our net interest income; (f) the value of assets under management and assets serviced, of private equity investments, of other debt and equity investments, of loans held for sale, or of other on-balance sheet or off-balance sheet assets or liabilities; or (g) the availability and terms of funding necessary to meet our liquidity needs;

(2) the impact on us of legal and regulatory developments (including the following: (a) the resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to tax laws; and (e) changes in accounting policies and principles), with the impact of any such developments possibly affecting our ability to operate our businesses or our financial condition or results of operations or our reputation, which in turn could have an impact on such matters as business generation and retention, our ability to attract and retain management, liquidity and funding;

(3) the impact on us of changes in the nature or extent of our competition;

(4) the introduction, withdrawal, success and timing of our business initiatives and strategies;

(5) customer acceptance of our products and services, and our customers borrowing, repayment, investment and deposit practices;

(6) the impact on us of changes in the extent of customer or counterparty delinquencies, bankruptcies or defaults, which could affect, among other things, credit and asset quality risk and our provision for credit losses;

(7) the ability to identify and effectively manage risks inherent in our business;

PNC

Cautionary Statement Regarding

Forward-Looking Information (continued)

(8) how we choose to redeploy available capital, including the extent and timing of any share repurchases and acquisitions or other investments in our businesses;

(9) the impact, extent and timing of technological changes, the adequacy of intellectual property protection, and costs associated with obtaining rights in intellectual property claimed by others;

(10) the timing and pricing of any sales of loans or other financial assets held for sale;

(11) our ability to obtain desirable levels of insurance, and whether or not insurance coverage for claims by PNC is denied;

(12) the relative and absolute investment performance of assets under management; and

(13) the extent of terrorist activities and international hostilities, increases or continuations of which may adversely affect the economy and financial and capital markets generally or us specifically.

In addition, our forward-looking statements are also subject to risks and uncertainties related to our pending acquisition of Riggs National Corporation and the expected consequences of the integration of the remaining Riggs businesses at closing into PNC, including the following: (a) completion of the transaction is dependent on, among other things, receipt of stockholder and regulatory approvals, and we cannot at this point predict with precision when those approvals may be obtained or if they will be received at all; (b) successful completion of the transaction and our ability to realize the benefits that we anticipate from the acquisition also depend on the nature of any future developments with respect to Riggs regulatory issues, the ability to comply with the terms of all current or future regulatory requirements (including any related action plan) resulting from these issues, and the extent of future costs and expenses arising as a result of these issues, including the impact of increased litigation risk and any claims for indemnification or advancement of costs; (c) the transaction may be materially more expensive to complete than we anticipate as a result of unexpected factors or events; (d) the integration into PNC of the Riggs business and operations that we acquire, which will include conversion of Riggs different systems and procedures, may take longer than we anticipate, may be more costly than we anticipate, or may have unanticipated adverse results relating to Riggs or PNCs existing businesses; (e) it may take longer that we expect to realize the anticipated cost savings of the acquisition, and those anticipated cost savings may not be achieved or may not be achieved in their entirety; and (f) the anticipated strategic and other benefits of the acquisition to us are dependent in part on the future performance of Riggs business, and there can be no assurance as to actual future results, which could be impacted by various factors, including the risks and uncertainties generally related to the performance of PNCs and Riggs businesses (with respect to Riggs, see Riggs SEC reports, which are accessible on the SECs website at www.sec.gov) or due to factors related to the acquisition of Riggs and the process of integrating Riggs business at closing into ours.

Other mergers, acquisitions, restructurings, divestitures, business alliances or similar transactions, including our completed acquisitions of United National Bancorp and the loan origination business of Aviation Finance Group, LLC, and our pending acquisition of SSRM Holdings, Inc., will also be subject to similar risks and uncertainties related to our ability to realize expected cost savings or revenue enhancements or to implement integration and strategic plans and, in the case of SSRM Holdings Inc., related to our successful completion of the transaction.

In addition, risks and uncertainties that could affect the results anticipated in forward-looking statements or from historical performance that involve BlackRock are discussed in more detail and additional factors are identified in BlackRocks SEC reports, accessible on the SECs website or on BlackRocks website at www.blackrock.com.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs actual or anticipated results.

PNC

Additional Information About the Proposed

Riggs National Corporation Acquisition

The PNC Financial Services Group, Inc. and Riggs National Corporation have filed a proxy statement/prospectus and will file other relevant documents concerning the merger with the United States Securities and Exchange Commission (the SEC). WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents free of charge at the SECs web site (www.sec.gov). In addition, documents filed with the SEC by The PNC Financial Services Group, Inc. will be available free of charge from Shareholder Relations at (800) 843-2206. Documents filed with the SEC by Riggs will be available free of charge from www.riggsbank.com.

The directors, executive officers, and certain other members of management of Riggs may be soliciting proxies in favor of the merger from its shareholders. For information about these directors, executive officers, and members of management, shareholders are asked to refer to Riggss most recent annual meeting proxy statement, which is available at the web addresses provided in the preceding paragraph.

PNC

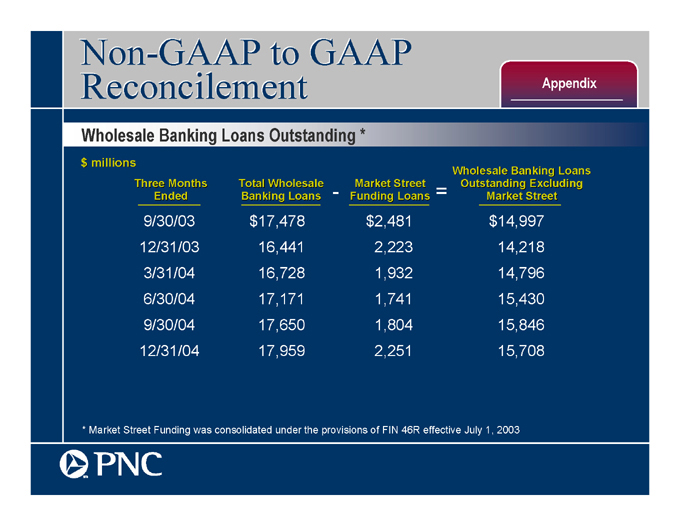

Non-GAAP to GAAP Reconcilement

Appendix

Wholesale Banking Loans Outstanding *

$ millions

Wholesale Banking Loans

Outstanding Excluding

Market Street

Market Street Funding Loans

Total Wholesale

Banking Loans

=

-

9/30/03 $17,478 $2,481 $14,997

12/31/03 16,441 2,223 14,218

3/31/04 16,728 1,932 14,796

6/30/04 17,171 1,741 15,430

9/30/04 17,650 1,804 15,846

12/31/04 17,959 2,251 15,708

Three Months

Ended

* Market Street Funding was consolidated under the provisions of FIN 46R effective July 1, 2003

PNC

Non-GAAP to GAAP

Reconcilement

Appendix

Efficiency Ratio

Twelve Months Ended 12/31/04

$ millions

Efficiency

Ratio

Total

Revenue

Noninterest

Expense

PNC, GAAP basis $5,532 $3,735 68%

Less: BlackRock (761) (559)

PFPC (763) (646)

PNC excluding BlackRock and PFPC $4,008 $2,530 63%

Proforma increase of securities yield to

peer median (from 3.61% in FY04 to 4.22%) 97

Proforma increase of loan to deposit

ratio to 100% (from 82% at 12/31/04 to 100%) 225

PNC with adjusted securities yield and

loan to deposit ratio $4,330 $2,530 58%

Efficiency ratio calculated as noninterest expense divided by the sum of net interest income and noninterest income

PNC

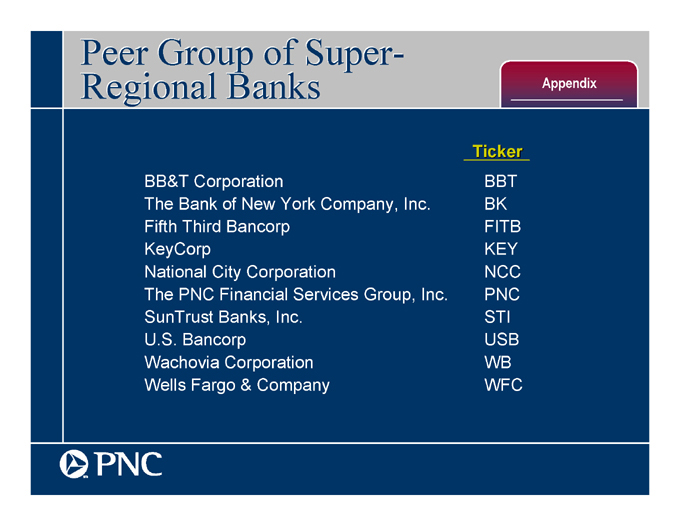

Peer Group of Super-Regional Banks

Appendix

Ticker

BB&T Corporation BBT

The Bank of New York Company, Inc. BK

Fifth Third Bancorp FITB

KeyCorp KEY

National City Corporation NCC

The PNC Financial Services Group, Inc. PNC

SunTrust Banks, Inc. STI

U.S. Bancorp USB

Wachovia Corporation WB

Wells Fargo & Company WFC

PNC