SLIDE PRESENTATION AND RELATED MATERIAL FOR GOLDMAN SACHS INVESTOR

Published on December 7, 2004

EXHIBIT 99.1

The PNC Financial Services Group, Inc.

Goldman Sachs

Bank CEO Conference

New York, NY

December 7, 2004

Cautionary Statement Regarding Forward-Looking Information

This presentation contains forward-looking statements regarding our outlook or expectations relating to PNCs future business, operations, financial condition, financial performance and asset quality. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties.

The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the written materials we distributed at this conference and in the version of the presentation materials posted on our corporate website at www.pnc.com, as well as those factors previously disclosed in our 2003 Form 10-K and other SEC reports (accessible on the SECs website at www.sec.gov and on our corporate website).

Future events or circumstances may change our outlook or expectations and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. The forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake to update those statements.

This presentation may also include a discussion of non-GAAP financial measures, which, to the extent not so qualified therein, is qualified by GAAP reconciliation information available on our corporate website at www.pnc.com under For Investors.

2004 Accomplishments

Improved returns on capital

Increased client acquisition and retention

Continued strong asset quality trends

Maintained balance sheet flexibility

Integrated United Trust successfully

Financial Highlights

Nine Months Ended September 30, 2004

Net income $890 million

EPS $3.13

ROCE 16.9%

Noninterest income to total revenue 64%

Loans to deposits 83%

Building on Our Strengths and Seizing Our Opportunities

What were good at

Growing low-cost deposit relationships

Generating loans

Maintaining strong risk profile

Expanding differentiated set of fee-based businesses nationally and internationally

And the opportunities/challenges we see

Managing rising credit costs

Enhancing asset yields

Improving efficiency

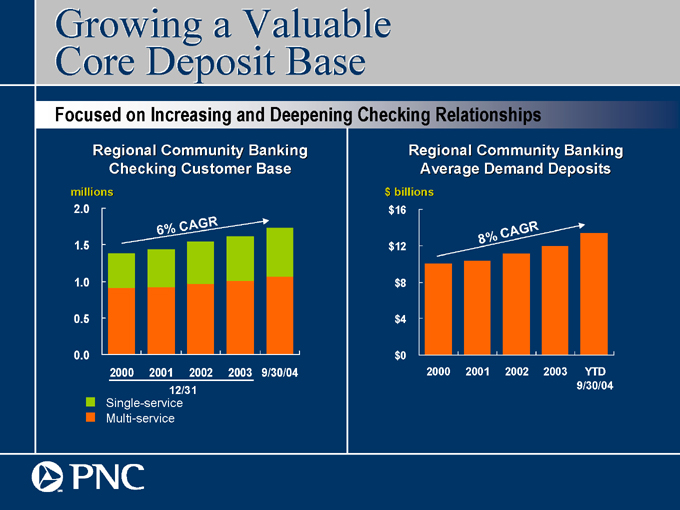

Growing a Valuable Core Deposit Base

Focused on Increasing and Deepening Checking Relationships

millions

2.0 1.5 1.0 0.5 0.0

6% CAGR

2000 2001 2002 2003 9/30/04

12/31

Single-service

Multi-service

Regional Community Banking Average Demand Deposits

$ billions

$16 $12 $8 $4 $0

8% CAGR

2000 2001 2002 2003 YTD 9/30/4

Regional Community Banking Checking Customer Base

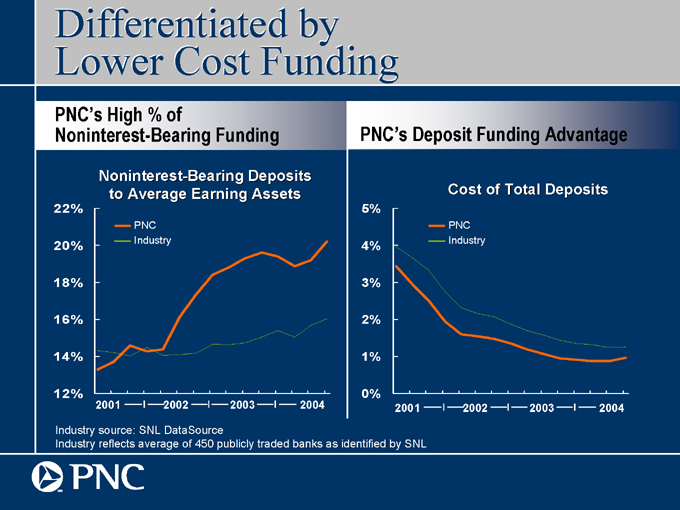

Differentiated by Lower Cost Funding

PNCs High% of Noninterest-Bearing Funding

Noninterest-Bearing Deposits to Average Earning Assets

2001 2002 2003 2004

22% 20% 18% 16% 14% 12%

PNC

Industry

PNCs Deposit Funding Advantage

Cost of Total Deposits

2001 2002 2003 2004

5% 4% 3% 2% 1% 0%

PNC

Industry

Industry source: SNL DataSource

Industry reflects average of 450 publicly traded banks as identified by SNL

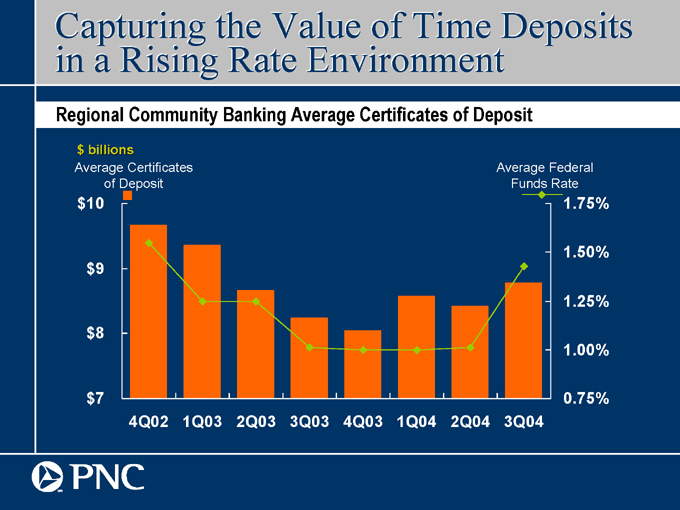

Capturing the Value of Time Deposits in a Rising Rate Environment

Regional Community Banking Average Certificates of Deposit

$ billions

Average Certificates of Deposit

$10 $9 $8 $7

Average Federal Funds Rate

1.75% 1.50% 1.25% 1.00% 0.75%

4Q02 1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04

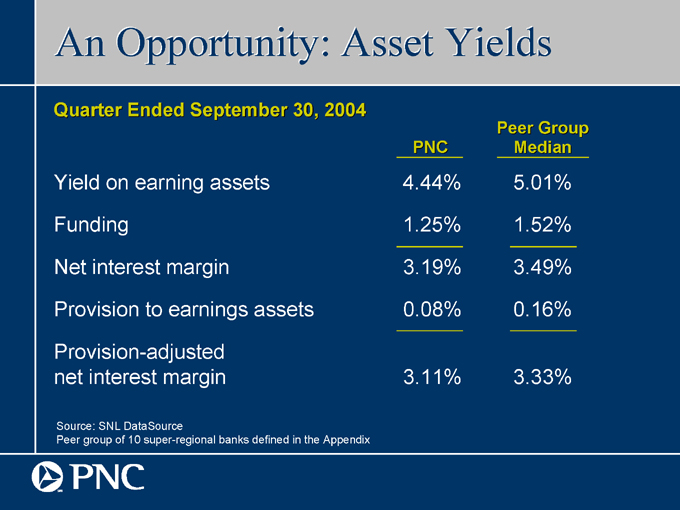

An Opportunity: Asset Yields

Quarter Ended September 30, 2004

PNC Peer Group Median

Yield on earning assets 4.44% 5.01%

Funding 1.25% 1.52%

Net interest margin 3.19% 3.49%

Provision to earnings assets 0.08% 0.16%

Provision-adjusted net interest margin 3.11% 3.33%

Source: SNL DataSource

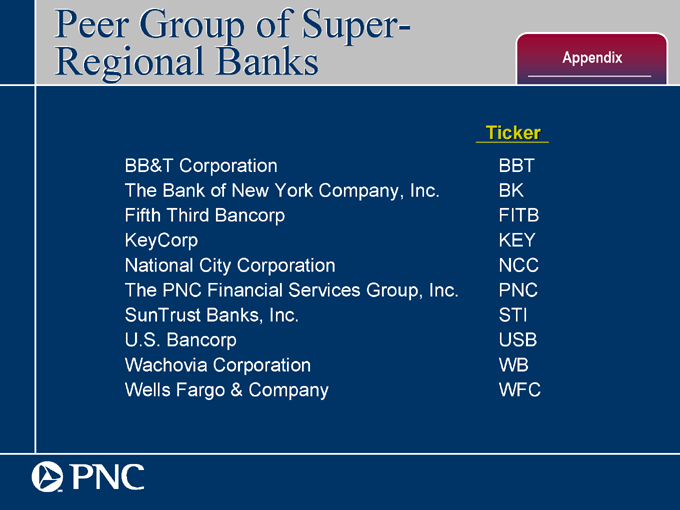

Peer group of 10 super-regional banks defined in the Appendix

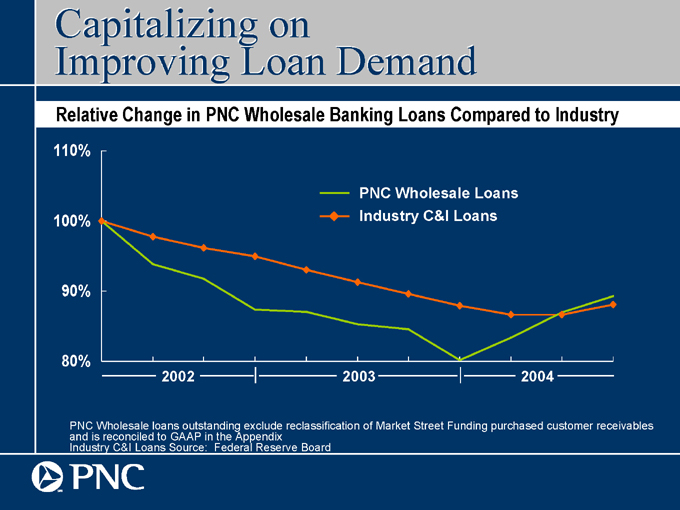

Capitalizing on Improving Loan Demand

Relative Change in PNC Wholesale Banking Loans Compared to Industry

PNC Wholesale Loans

Industry C&I Loans

2002 2003 2004

110% 100% 90% 80%

PNC Wholesale loans outstanding exclude reclassification of Market Street Funding purchased customer receivables and is reconciled to GAAP in the Appendix

Industry C&I Loans Source: Federal Reserve Board

Well Positioned for Rising Interest Rates

Lower Mortgage Exposure

Short-Term Securities Portfolio

Weighted-Average Life of Securities Portfolio

KEY 2.7 years

PNC 2.8

STI 3.8

FITB 4.3

WFC 5.1

WB 5.2

USB 5.3

BBT Not disclosed

BK Not disclosed

NCC Not disclosed

Weighted-average life as disclosed in company reports

Information as of 9/30/04

Total Mortgage-Related Assets to Total Assets

BK 26.2%

PNC 39.3

KEY 40.2

WB 41.8

STI 46.4

USB 48.4

FITB 50.2

BB&T 51.4

WFC 56.5

NCC 61.8

Includes MBS and loans secured by real estate Source: SNL DataSource

Information as of 6/30/04

Core Funded

Loans to Deposits

BK 64%

WB 69

PNC 83

BBT 101

STI 102

FITB 102

WFC 104

USB 108

KEY 112

NCC 127

Source: SNL DataSource

Information as of 9/30/04

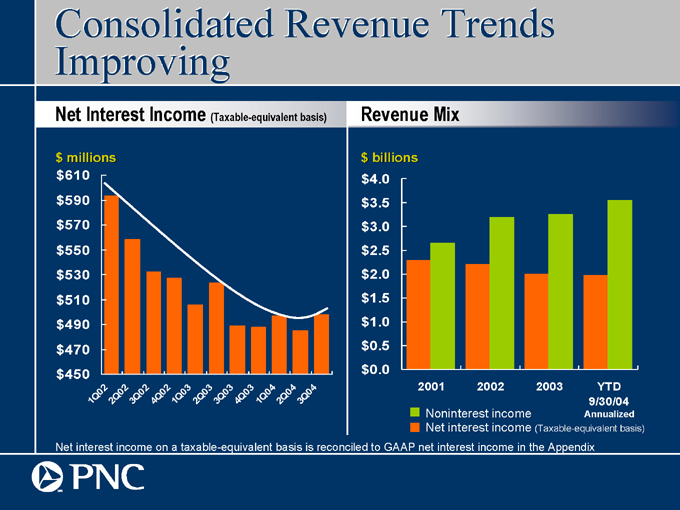

Consolidated Revenue Trends Improving

Net Interest Income (Taxable-equivalent basis)

$ millions

$610 $590 $570 $550 $530 $510 $490 $470 $450

1Q02 2Q02 3Q02 4Q02 1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04

Revenue Mix

$ billions

$4.0 $3.5 $3.0 $2.5 $2.0 $1.5 $1.0 $0.5 $0.0

2001 2002 2003 YTD 9/30/04 Annualized

Noninterest income

Net interest income (Taxable-equivalent basis)

Net interest income on a taxable-equivalent basis is reconciled to GAAP net interest income in the Appendix

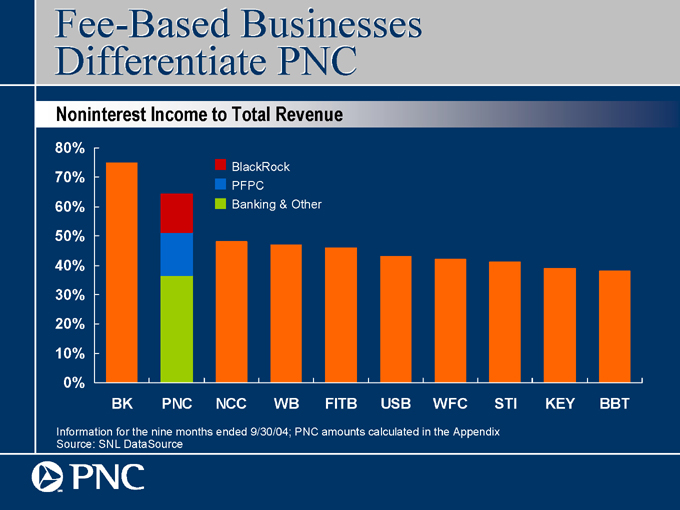

Fee-Based Businesses Differentiate PNC

Noninterest Income to Total Revenue

80% 70% 60% 50% 40% 30% 20% 10% 0%

BK PNC NCC WB FITB USB WFC STI KEY BBT

Information for the nine months ended 9/30/04; PNC amounts calculated in the Appendix

Source: SNL DataSource

BlackRock

PFPC

Banking & Other

BlackRock A Growth Engine

Earnings

$ millions

$200 $150 $100 $50 $0

2002 2003 2004

Nine Months Ended September 30

2004 excludes $57 million after-tax impact from LTIP charge and is reconciled to GAAP in the Appendix

Assets under management

$ billions

$400 $300 $200 $100 $0

$246 $294 $52 $323 $375

9/30/02 9/30/03 9/30/04

Assets under management

Proforma including State Street Research

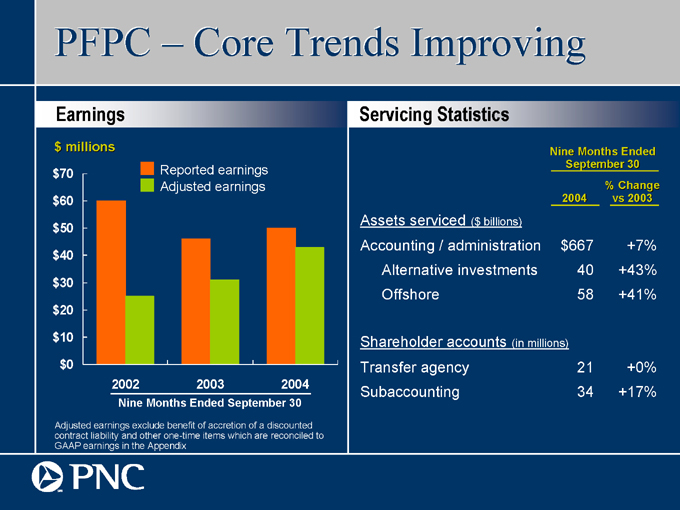

PFPC Core Trends Improving

Earnings

$ millions

Reported earnings

Adjusted earnings

$70 $60 $50 $40 $30 $20 $10 $0

2002 2003 2004

Nine Months Ended September 30

Servicing Statistics

Nine Months Ended September 30

2004 % Change vs 2003

Assets serviced ($ billions)

Accounting / administration $667 +7%

Alternative investments 40 +43%

Offshore 58 +41%

Shareholder accounts (in millions)

Transfer agency 21 +0%

Subaccounting 34 +17%

Adjusted earnings exclude benefit of accretion of a discounted contract liability and other one-time items which are reconciled to GAAP earnings in the Appendix

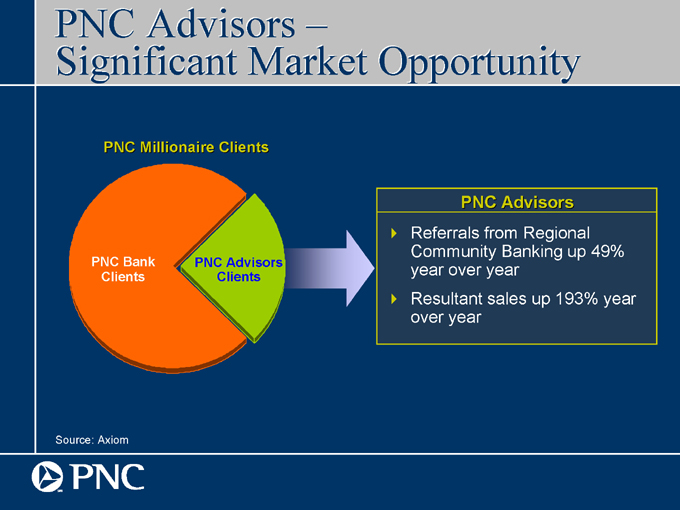

PNC Advisors Significant Market Opportunity

PNC Millionaire Clients

PNC Bank Clients

PNC Advisors Clients

PNC Advisors

Referrals from Regional Community Banking up 49% year over year

Resultant sales up 193% year over year

Source: Axiom

Treasury Management

Winning Clients with Value-Added Technology Products

PNC Product Growth vs Industry

2003 vs 2002

Industry PNC

P-Card purchase volume 20% 38%

Electronic data interchange revenue 12% 23%

B2B lockbox revenue (1)% 15%

Source for industry growth in P-Card is Visa U.S.A.

Source for industry growth in electronic data interchange and B2B lockbox is Ernst & Young annual survey of the top 100 banks in Treasury Management

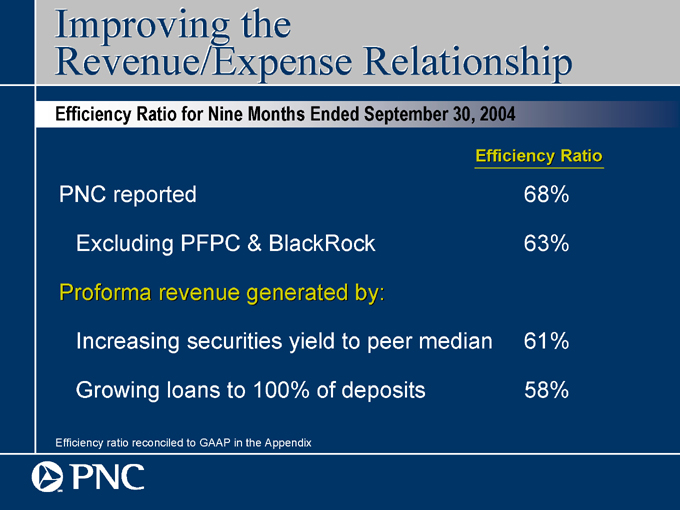

Improving the Revenue/Expense Relationship

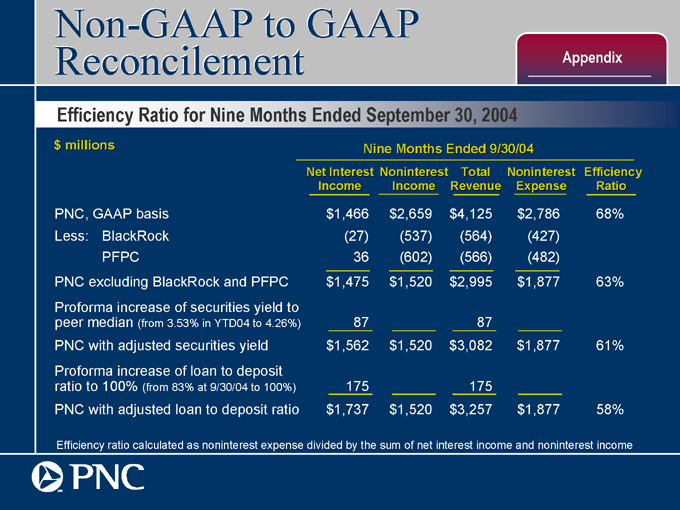

Efficiency Ratio for Nine Months Ended September 30, 2004

Efficiency Ratio

PNC reported 68%

Excluding PFPC & BlackRock 63%

Proforma revenue generated by:

Increasing securities yield to peer median 61%

Growing loans to 100% of deposits 58%

Efficiency ratio reconciled to GAAP in the Appendix

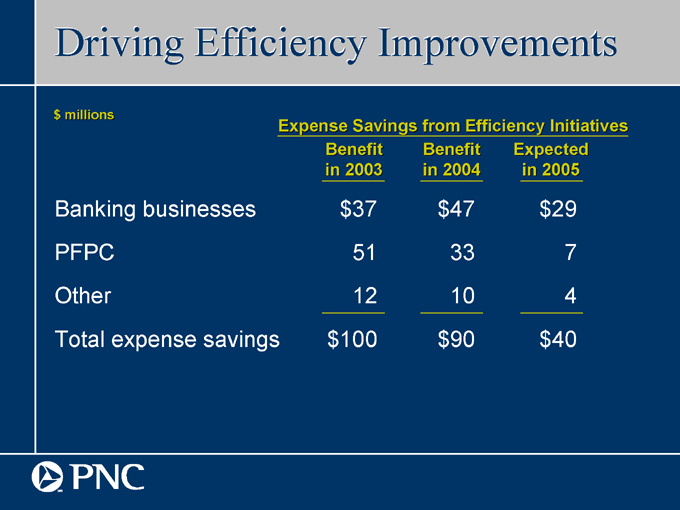

Driving Efficiency Improvements

$ millions

Expense Savings from Efficiency Initiatives

Benefit in 2003 Benefit in 2004 Expected in 2005

Banking businesses $37 $47 $29

PFPC 51 33 7

Other 12 10 4

Total expense savings $100 $90 $40

Summary

Weve accomplished a great deal in 2004

Our businesses have executable plans to drive growth

Were well positioned for rising interest rates

Appendix

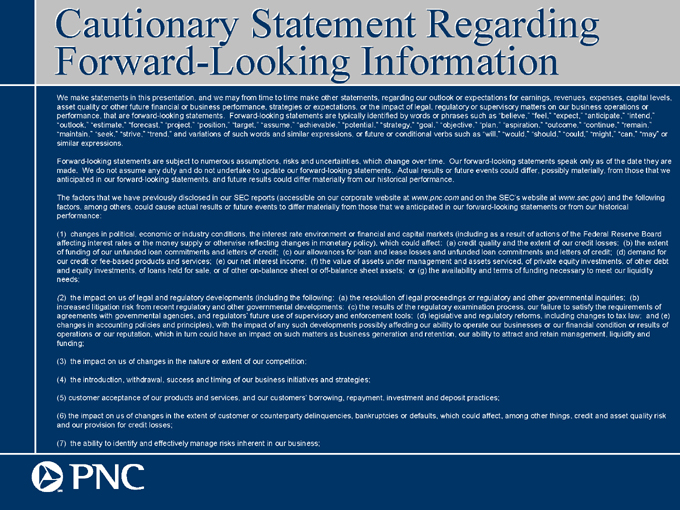

Cautionary Statement Regarding Forward-Looking Information

We make statements in this presentation, and we may from time to time make other statements, regarding our outlook or expectations for earnings, revenues, expenses, capital levels, asset quality or other future financial or business performance, strategies or expectations, or the impact of legal, regulatory or supervisory matters on our business operations or performance, that are forward-looking statements. Forward-looking statements are typically identified by words or phrases such as believe, feel, expect, anticipate, intend, outlook, estimate, forecast, project, position, target, assume, achievable, potential, strategy, goal, objective, plan, aspiration, outcome, continue, remain, maintain, seek, strive, trend, and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could, might, can, may or similar expressions.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Our forward-looking statements speak only as of the date they are made. We do not assume any duty and do not undertake to update our forward-looking statements. Actual results or future events could differ, possibly materially, from those that we anticipated in our forward-looking statements, and future results could differ materially from our historical performance.

The factors that we have previously disclosed in our SEC reports (accessible on our corporate website at www.pnc.com and on the SECs website at www.sec.gov) and the following factors, among others, could cause actual results or future events to differ materially from those that we anticipated in our forward-looking statements or from our historical performance:

(1) changes in political, economic or industry conditions, the interest rate environment or financial and capital markets (including as a result of actions of the Federal Reserve Board affecting interest rates or the money supply or otherwise reflecting changes in monetary policy), which could affect: (a) credit quality and the extent of our credit losses; (b) the extent of funding of our unfunded loan commitments and letters of credit; (c) our allowances for loan and lease losses and unfunded loan commitments and letters of credit; (d) demand for our credit or fee-based products and services; (e) our net interest income; (f) the value of assets under management and assets serviced, of private equity investments, of other debt and equity investments, of loans held for sale, or of other on-balance sheet or off-balance sheet assets; or (g) the availability and terms of funding necessary to meet our liquidity needs;

(2) the impact on us of legal and regulatory developments (including the following: (a) the resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of the regulatory examination process, our failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of

supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to tax law; and (e) changes in accounting policies and principles), with the impact of any such developments possibly affecting our ability to operate our businesses or our financial condition or results of operations or our reputation, which in turn could have an impact on such matters as business generation and retention, our ability to attract and retain management, liquidity and funding;

(3) the impact on us of changes in the nature or extent of our competition;

(4) the introduction, withdrawal, success and timing of our business initiatives and strategies;

(5) customer acceptance of our products and services, and our customers borrowing, repayment, investment and deposit practices;

(6) the impact on us of changes in the extent of customer or counterparty delinquencies, bankruptcies or defaults, which could affect, among other things, credit and asset quality risk and our provision for credit losses;

(7) the ability to identify and effectively manage risks inherent in our business;

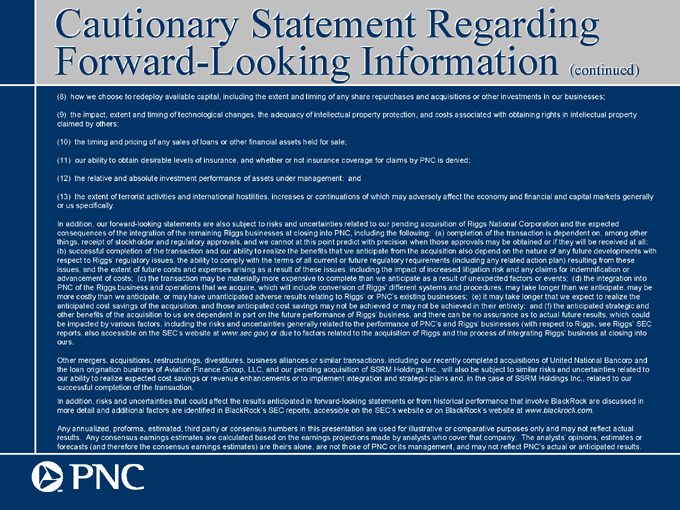

Cautionary Statement Regarding Forward-Looking Information (continued)

(8) how we choose to redeploy available capital, including the extent and timing of any share repurchases and acquisitions or other investments in our businesses;

(9) the impact, extent and timing of technological changes, the adequacy of intellectual property protection, and costs associated with obtaining rights in intellectual property claimed by others;

(10) the timing and pricing of any sales of loans or other financial assets held for sale;

(11) our ability to obtain desirable levels of insurance, and whether or not insurance coverage for claims by PNC is denied;

(12) the relative and absolute investment performance of assets under management; and

(13) the extent of terrorist activities and international hostilities, increases or continuations of which may adversely affect the economy and financial and capital markets generally or us specifically.

In addition, our forward-looking statements are also subject to risks and uncertainties related to our pending acquisition of Riggs National Corporation and the expected consequences of the integration of the remaining Riggs businesses at closing into PNC, including the following: (a) completion of the transaction is dependent on, among other things, receipt of stockholder and regulatory approvals, and we cannot at this point predict with precision when those approvals may be obtained or if they will be received at all; (b) successful completion of the transaction and our ability to realize the benefits that we anticipate from the acquisition also depend on the nature of any future developments with respect to Riggs regulatory issues, the ability to comply with the terms of all current or future regulatory requirements (including any related action plan) resulting from these issues, and the extent of future costs and expenses arising as a result of these issues, including the impact of increased litigation risk and any claims for indemnification or advancement of costs; (c) the transaction may be materially more expensive to complete than we anticipate as a result of unexpected factors or events; (d) the integration into PNC of the Riggs business and operations that we acquire, which will include conversion of Riggs different systems and procedures, may take longer than we anticipate, may be more costly than we anticipate, or may have unanticipated adverse results relating to Riggs or PNCs existing businesses; (e) it may take longer that we expect to realize the anticipated cost savings of the acquisition, and those anticipated cost savings may not be achieved or may not be achieved in their entirety; and (f) the anticipated strategic and other benefits of the acquisition to us are dependent in part on the future performance of Riggs business, and there can be no assurance as to actual future results, which could be impacted by various factors, including the risks and uncertainties generally related to the performance of PNCs and Riggs businesses (with

respect to Riggs, see Riggs SEC reports, also accessible on the SECs website at www.sec.gov) or due to factors related to the acquisition of Riggs and the process of integrating Riggs business at closing into ours.

Other mergers, acquisitions, restructurings, divestitures, business alliances or similar transactions, including our recently completed acquisitions of United National Bancorp and the loan origination business of Aviation Finance Group, LLC, and our pending acquisition of SSRM Holdings Inc., will also be subject to similar risks and uncertainties related to our ability to realize expected cost savings or revenue enhancements or to implement integration and strategic plans and, in the case of SSRM Holdings Inc., related to our successful completion of the transaction.

In addition, risks and uncertainties that could affect the results anticipated in forward-looking statements or from historical performance that involve BlackRock are discussed in more detail and additional factors are identified in BlackRocks SEC reports, accessible on the SECs website or on BlackRocks website at www.blackrock.com.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs actual or anticipated results.

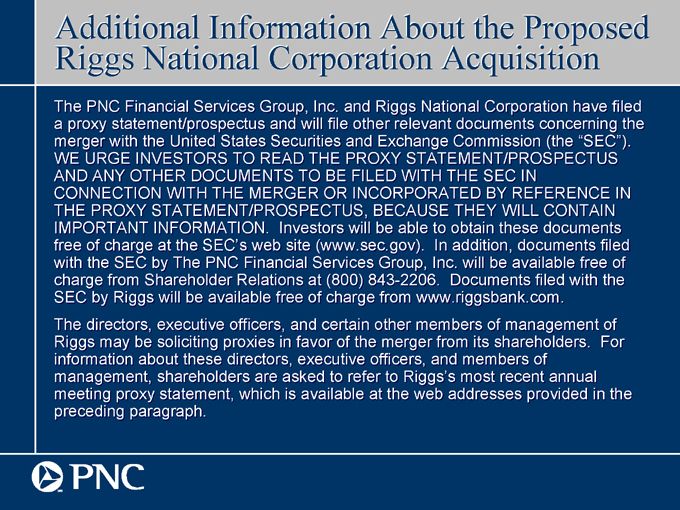

Additional Information About the Proposed Riggs National Corporation Acquisition

The PNC Financial Services Group, Inc. and Riggs National Corporation have filed a proxy statement/prospectus and will file other relevant documents concerning the merger with the United States Securities and Exchange Commission (the SEC). WE URGE INVESTORS TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents free of charge at the SECs web site (www.sec.gov). In addition, documents filed with the SEC by The PNC Financial Services Group, Inc. will be available free of charge from Shareholder Relations at (800) 843-2206. Documents filed with the SEC by Riggs will be available free of charge from www.riggsbank.com.

The directors, executive officers, and certain other members of management of Riggs may be soliciting proxies in favor of the merger from its shareholders. For information about these directors, executive officers, and members of management, shareholders are asked to refer to Riggss most recent annual meeting proxy statement, which is available at the web addresses provided in the preceding paragraph.

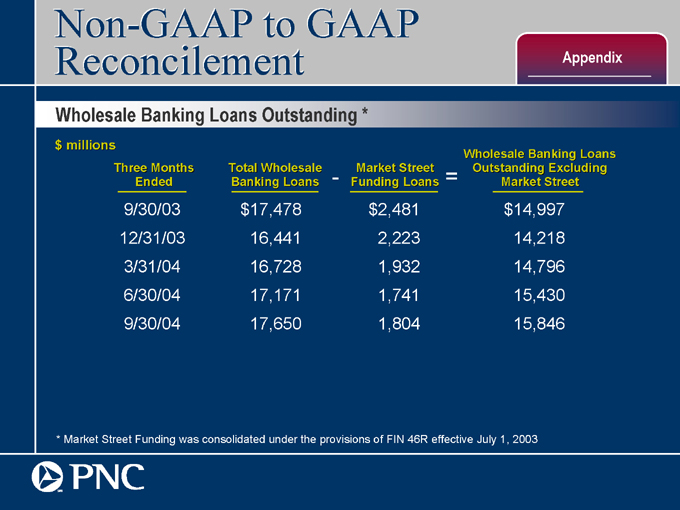

Non-GAAP to GAAP Reconcilement

Appendix

Wholesale Banking Loans Outstanding *

$ millions

Three Months Ended Total Wholesale Banking LoansMarket Street Funding Loans = Wholesale Banking Loans Outstanding Excluding Market Street

9/30/03 $17,478 $2,481 $14,997

12/31/03 16,441 2,223 14,218

3/31/04 16,728 1,932 14,796

6/30/04 17,171 1,741 15,430

9/30/04 17,650 1,804 15,846

* Market Street Funding was consolidated under the provisions of FIN 46R effective July 1, 2003

Non-GAAP to GAAP Reconcilement

Appendix

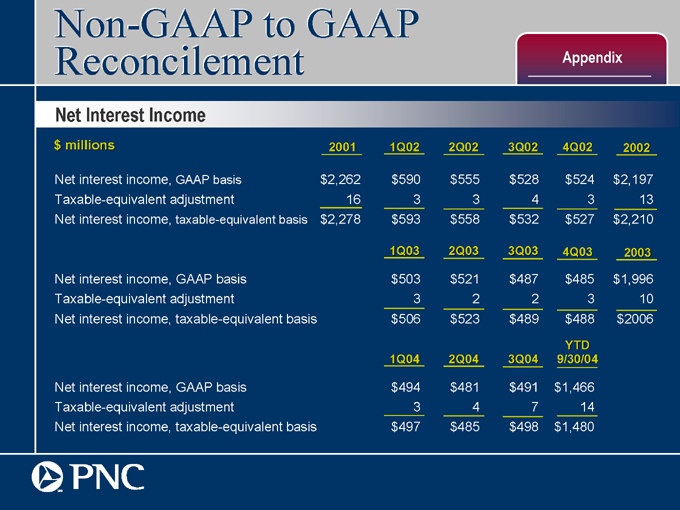

Net Interest Income

$ millions

2001 1Q02 3Q02 2Q02 4Q02 2002

Net interest income, GAAP basis $2,262 $590 $555 $528 $524 $2,197

Taxable-equivalent adjustment 16 3 3 4 3 13

Net interest income, taxable-equivalent basis $2,278 $593 $558 $532 $527 $2,210

1Q03 3Q03 2Q03 4Q03 2003

Net interest income, GAAP basis $503 $521 $487 $485 $1,996

Taxable-equivalent adjustment 3 2 2 3 10

Net interest income, taxable-equivalent basis $506 $523 $489 $488 $2006

1Q04 3Q04 2Q04 YTD 9/30/04

Net interest income, GAAP basis $494 $481 $491 $1,466

Taxable-equivalent adjustment 3 4 7 14

Net interest income, taxable-equivalent basis $497 $485 $498 $1,480

Non-GAAP to GAAP Reconcilement

Appendix

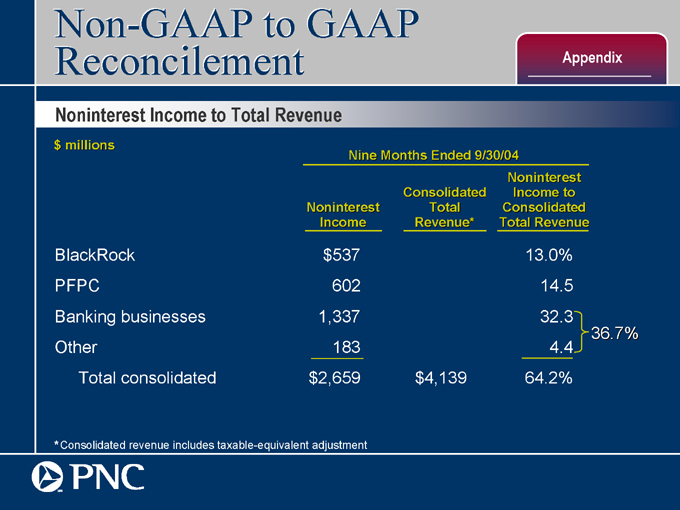

Noninterest Income to Total Revenue

Nine Months Ended 9/30/04

$ millions

Noninterest Income Consolidated Total Revenue* Noninterest Income to Consolidated Total Revenue

BlackRock $537 13.0%

PFPC 602 14.5

Banking businesses 1,337 32.3

Other 183 4.4

Total consolidated $2,659 $4,139 64.2%

36.7%

*Consolidated revenue includes taxable-equivalent adjustment

Non-GAAP to GAAP Reconcilement

Appendix

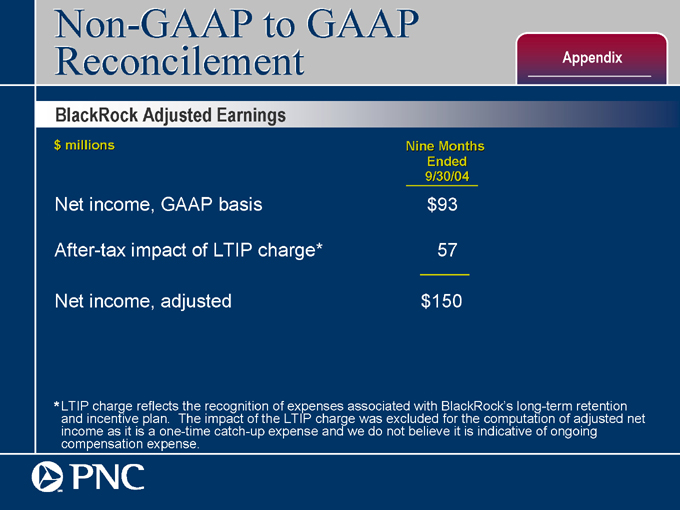

BlackRock Adjusted Earnings

$ millions

Nine Months Ended 9/30/04

Net income, GAAP basis $93

After-tax impact of LTIP charge* 57

Net income, adjusted $150

*LTIP charge reflects the recognition of expenses associated with BlackRocks long-term retention and incentive plan. The impact of the LTIP charge was excluded for the computation of adjusted net income as it is a one-time catch-up expense and we do not believe it is indicative of ongoing compensation expense.

Non-GAAP to GAAP Reconcilement

Appendix

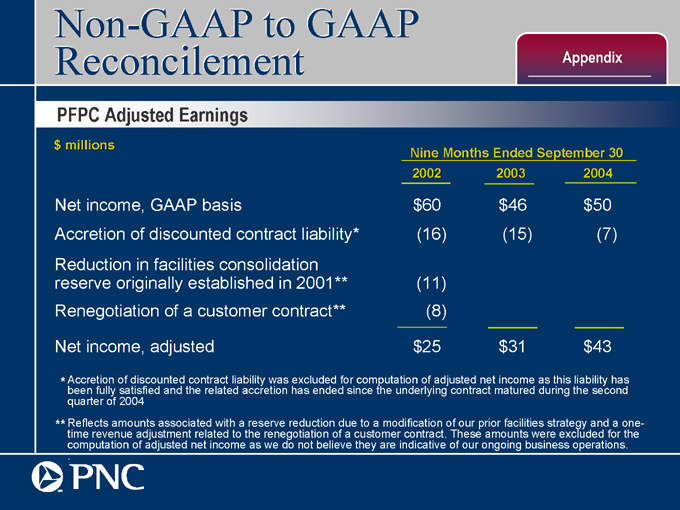

PFPC Adjusted Earnings

$ millions

Nine Months Ended September 30

2002 2003 2004

Net income, GAAP basis $60 $46 $50

Accretion of discounted contract liability* (16) (15) (7)

Reduction in facilities consolidation

reserve originally established in 2001** (11)

Renegotiation of a customer contract** (8)

Net income, adjusted $25 $31 $43

* Accretion of discounted contract liability was excluded for computation of adjusted net income as this liability has been fully satisfied and the related accretion has ended since the underlying contract matured during the second quarter of 2004

** Reflects amounts associated with a reserve reduction due to a modification of our prior facilities strategy and a one-time revenue adjustment related to the renegotiation of a customer contract. These amounts were excluded for the computation of adjusted net income as we do not believe they are indicative of our ongoing business operations.

Non-GAAP to GAAP Reconcilement

Appendix

Efficiency Ratio for Nine Months Ended September 30, 2004

$ millions

Nine Months Ended 9/30/04

Net Interest Income Noninterest Income Noninterest Expense Total Revenue Efficiency Ratio

PNC, GAAP basis $1,466 $2,659 $4,125 $2,786 68%

Less: BlackRock (27) (537) (564) (427)

PFPC 36 (602) (566) (482)

PNC excluding BlackRock and PFPC $1,475 $1,520 $2,995 $1,877 63%

Proforma increase of securities yield to

peer median (from 3.53% in YTD04 to 4.26%) 87 87

PNC with adjusted securities yield $1,562 $1,520 $3,082 $1,877 61%

Proforma increase of loan to deposit

ratio to 100% (from 83% at 9/30/04 to 100%) 175 175

PNC with adjusted loan to deposit ratio $1,737 $1,520 $3,257 $1,877 58%

Efficiency ratio calculated as noninterest expense divided by the sum of net interest income and noninterest income

Appendix

Peer Group of Super-Regional Banks

Ticker

BB&T Corporation BBT

The Bank of New York Company, Inc. BK

Fifth Third Bancorp FITB

KeyCorp KEY

National City Corporation NCC

The PNC Financial Services Group, Inc. PNC

SunTrust Banks, Inc. STI

U.S. Bancorp USB

Wachovia Corporation WB

Wells Fargo & Company WFC