SLIDE PRESENTATION AND RELATED MATERIAL

Published on April 27, 2004

EXHIBIT 99.1

The PNC Financial Services Group, Inc. Annual Meeting of Shareholders April 27, 2004

PNC James E. Rohr Chairman and Chief Executive Officer

PNC

Forward-Looking Information

Forward-looking statements are necessarily subject The forward-looking statements in this PNC assumes no and on PNCs website). duty and does not undertake to update them. This presentation may also include a discussion on non-GAAP financial measures, which, to the extent not so qualified therein, is qualified by GAAP reconciliation information in the version of these slides posted on PNCs website, in PNCs 2003 Annual Report on Form 10-K or otherwise available on PNCs website.

This presentation contains forward-looking statements with respect to PNCs outlook or expectations relating to its future business, operations, financial condition, financial performance and asset quality. to numerous assumptions, risks and uncertainties. The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the version of these slides posted on PNCs website at www.pnc.com and in PNCs 2003 Annual Report on Form 10-K (accessible on the SECs website at www.sec.gov Future events or circumstances may change PNCs outlook or expectations and may also affect the nature of the assumptions, risks and uncertainties to which the forward-looking statements are subject. presentation speak only as of the date of this presentation, and

2003 Highlights

Earned $1billion Generated 15% return on equity Total stockholder return: 36 percent Successful acquisition of United National

GROW PNC

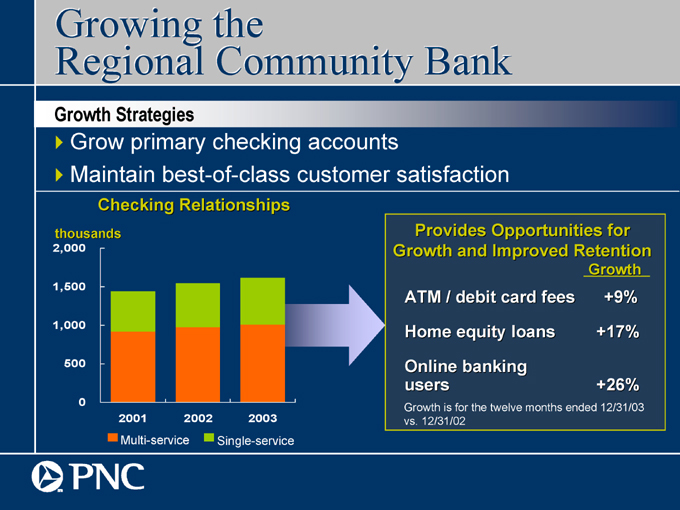

Growing theRegional Community Bank

Growth Strategies Grow primary checking accounts Maintain best-of-class customer satisfaction

Checking Relationships

Provides Opportunities for Growth and Improved Retention

Growth

ATM / debit card fees +9%

Home equity loans +17%

Online banking users +26%

Growth is for the twelve months ended 12/31/03 vs. 12/31/02

PNC Joseph C. Guyaux President

Integrating United National

Adding scale in a key market

United brought PNC $2.2 billion in deposits and $1.9 billion in loans

Added 47 branches

New Jersey is among the fastest-growing and wealthiest states

Integrating United National

A successful integration

Smooth systems conversion

Excellent customer retention

Lower than expected one-time expenses

Realizing synergies

United customers accessing more services

Demand deposits account sales, loan applications and total deposit exceeding expectations

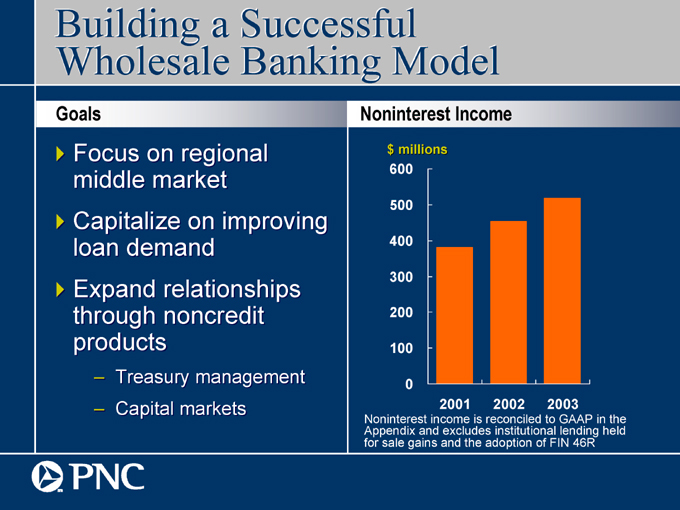

Building a Successful Wholesale Banking Model

Goals

Focus on regional middle market

Capitalize on improving loan demand

Expand relationships through noncredit products

Treasury management

Capital markets

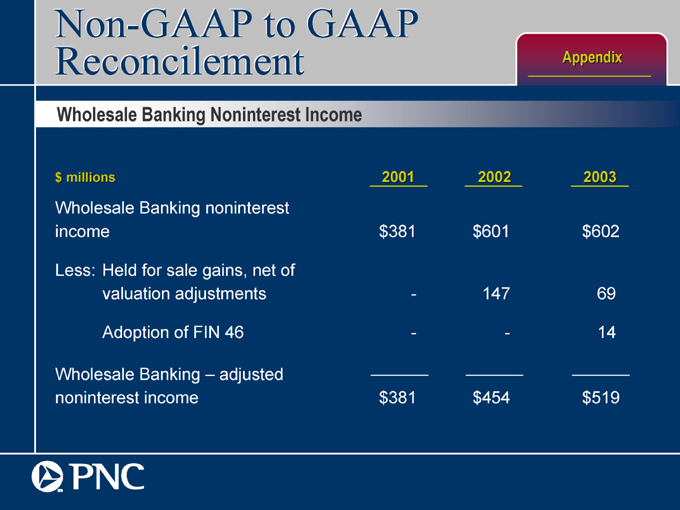

Noninterest Income

Noninterest income is reconciled to GAAP in the Appendix and excludes institutional lending held for sale gains and the adoption of FIN 46R

Generating Momentumat PNC Advisors

Goals

Build on momentum in migration to open architecture account management

Build on strong sales momentum

Realize synergies from United National acquisition

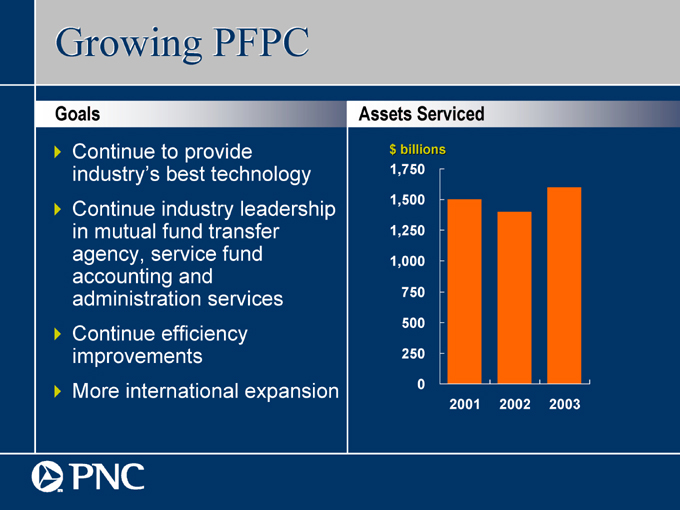

Growing PFPC

Goals

Continue to provide industrys best technology

Continue industry leadership in mutual fund transfer agency, service fund accounting and administration services

Continue efficiency improvements

More international expansion

Assets Serviced

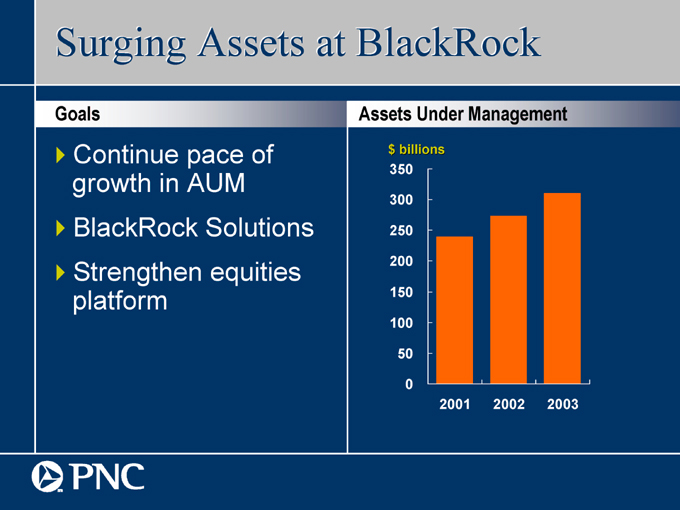

Surging Assets at BlackRock

Goals

Continue pace of growth in AUM

BlackRock Solutions

Strengthen equities platform

Assets Under Management

The Outlook for 2004

Stronger economy

Rising interest rates

Growth in our core businesses

Continued focus on balance sheet and risk

PNC William S. Demchak Vice Chairman and Chief Financial Officer

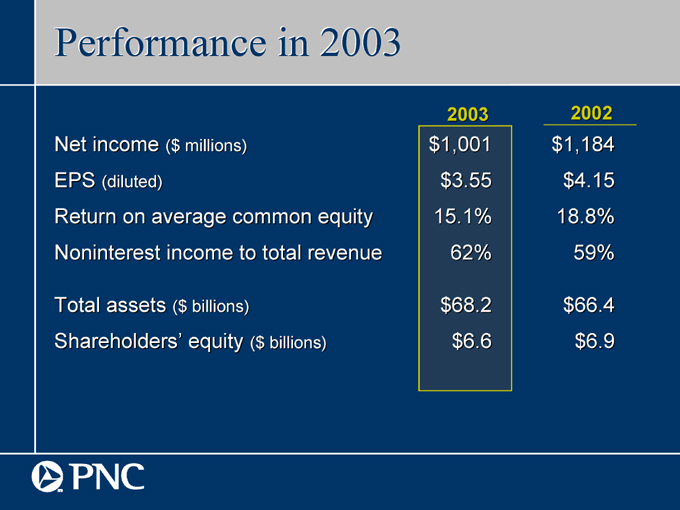

Performance in

2003 2002

Net income ($millions) $1,001 $1,184

EPS (diluted) $3.55 $4.15

Return on average common equity 15.1% 18.8%

Noninterest income to total revenue 62% 59%

Total assets ($billions) $68.2 $66.4

Shareholders equity ($billions) $6.6 $6.9

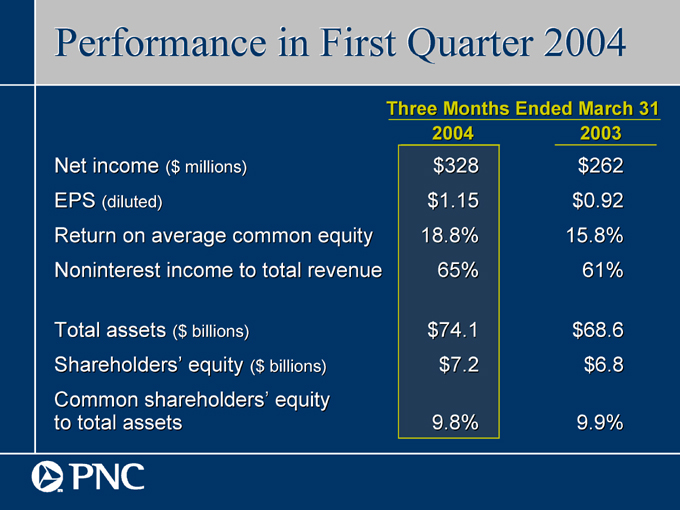

Performance in First Quarter 2004

Three Months Ended March 31

2004 2003

Net income ($millions) $328 $262

EPS (diluted) $1.15 $0.92

Return on average common equity18.8% 15.8%

Noninterest income to total revenue 65% 61%

Total assets ($billions) $74.1 $68.6

Shareholders equity ($billions) $7.2 $6.8

Common shareholders equity to total assets 9.8% 9.9%

2003: A Year of Accomplishment

Stock outperformed peer group and S&P36 percent total shareholder return

Increased annual dividend to $2.00 a share

Added customers in every business

Upgraded by rating agencies and regulators

Ended year with higher capital and excellent credit quality

Strong risk management and corporate governance

Recognition from numerous external organizations

Our Employees

One team working to grow PNC

Very low turnover relative to competitors

PNC honored again by Working Mother as one of the top places to work magazine

Our Communities

Committed to improving the places where we live

1 million hours of volunteer service since 1999

PNC Grow Up Great

$100 million program

1 million employee volunteer hours

Ensuring the success of our communities for years to come

PNC Ever day is an opportunity to do more./sm/

Appendix

Cautionary Statement RegardingForward-Looking Information

This presentation and other statements that the Corporation may make may contain forward-looking statements with respect to the Corporations outlook or expectations for earnings, revenues, expenses, capital levels, asset quality or other future financial or business performance, strategies or expectations, or the impact of legal, regulatory or supervisory matters on the Corporations business operations or performance. Forward-looking statements are typically identified by words or phrases such as believe, feel, expect, anticipate, intend, outlook, estimate, forecast, project, position, target, assume, achievable, potential, strategy, goal, objective, plan, aspiration, outcome, continue, remain, maintain, seek, strive, trend, and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could, might, can, may or similar expressions.

The Corporation cautions that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made, and the Corporation assumes no duty and does not undertake to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements and future results could differ materially from historical performance.

The factors previously disclosed in the Corporations SEC reports (accessible on PNCs website at www.pnc.com and on the SECs website at www.sec.gov) and the following factors, among others, could cause actual results or future events to differ materially from those anticipated in forward-looking statements or from historical performance:

(1) changes in political, economic or industry conditions, the interest rate environment or financial and capital markets (including as a result of actions of the Federal Reserve Board affecting interest rates, money supply or otherwise reflecting changes in monetary policy), which could affect: (a) credit quality and the extent of credit losses; (b) the extent of funding of unfunded loan commitments and letters of credit; (c) allowances for credit losses and unfunded loan commitments and letters of credit; (d) demand for credit or fee-based products and services; (e) net interest income; (f) value of assets under management and assets serviced, of private equity investments, of other debt and equity investments, of loans held for sale, or of other on-balance sheet and off-balance sheet assets; or (g) the availability and terms of funding necessary to meet PNCs liquidity needs;

(2) the impact of legal and regulatory developments (including (a) the resolution of legal proceedings or regulatory and other governmental inquiries; (b) increased litigation risk from recent regulatory and other governmental developments; (c) the results of regulatory examination process, PNCs failure to satisfy the requirements of agreements with governmental agencies, and regulators future use of supervisory and enforcement tools; (d) legislative and regulatory reforms, including changes to tax law; and (e) changes in accounting policies and principles), with the impact of any such developments possibly affecting the ability of PNC to operate its businesses, PNCs financial condition, results of operations, or reputation, which in turn could have an impact on such matters as business generation and retention, the ability to attract and retain management, liquidity and funding;

(3) the impact of changes in the nature or extent of competition;

(4) the introduction, withdrawal, success and timing of business initiatives and strategies;

(5) customer acceptance of PNCs products and services and their borrowing, repayment, investment and deposit practices;

(6) the impact of changes in the extent of customer or counterparty delinquencies, bankruptcies or defaults that could affect, among other things, credit and asset quality risk and the provision for credit losses;

Cautionary Statement RegardingForward-Looking Information

(continued)

(7) the ability to identify and effectively manage risks inherent in PNCs business;

(8) how PNC chooses to redeploy available capital, including the extent and timing of any share repurchases and acquisitions or other investments in PNC businesses;

(9) the impact, extent and timing of technological changes, the adequacy of intellectual property protection and costs associated with obtaining rights in intellectual property claimed by others;

(10) the timing and pricing of any sales of loans or other financial assets held for sale;

(11) the ability of PNC to obtain desirable levels of insurance and whether or not insurance coverage for claims by PNC is denied;

(12) relative and absolute investment performance of assets under management; and

(13) the extent of terrorist activities and international hostilities, increases or continuations of which may adversely affect the economy and financial and capital markets generally or PNC specifically.

In addition, PNCs forward-looking statements are also subject to risks and uncertainties related to the United National Bancorp acquisition and the expected consequences of the integration of its business into that of PNC, including the following: (a) the integration of United Nationals business and operations into PNC, which will include conversion of UnitedTrust Banks different systems and procedures, may take longer than anticipated or be more costly than anticipated or have unanticipated adverse results relating to PNCs businesses, including those acquired in the acquisition; (b) the anticipated cost savings of the acquisition may take longer than expected to be realized, may not be achieved, or may not be achieved in their entirety; and (c) the anticipated benefits to PNC are dependent in part on the performance of United Nationals business in the future, and there can be no assurance as to actual future results, which could be impacted by various factors, including the risks and uncertainties generally related to the performance of PNCs and United Nationals businesses (with respect to United National, see United Nationals SEC reports, also accessible on the SECs website) or due to factors related to the acquisition of United National and the process of integrating it into PNC. Any future mergers, acquisitions, restructurings, divestitures or related transactions will also be subject to similar risks and uncertainties related to the ability to realize expected cost savings or revenue enhancements or to implement integration plans.

In addition, risks and uncertainties that could affect the results anticipated in forward-looking statements or from historical performance that involve BlackRock are discussed in more detail and additional factors are identified in BlackRocks SEC reports, accessible on the SECs website and on BlackRocks website at www.blackrock.com

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNCs actual or anticipated results.

Non-GAAP to GAAP Reconcilement

Appendix

Wholesale Banking Noninterest Income

$millions 2001 2002 2003

Wholesale Banking noninterest income $381 $601 $602

Less: Held for sale gains, net of valuation adjustments - 147 69

Adoption of FIN 46- 14

Wholesale Banking adjusted noninterest income $381 $454 $519