EX-10.1

Published on March 27, 2025

THE PNC FINANCIAL SERVICES GROUP, INC. EXECUTIVE SEVERANCE PLAN and SUMMARY PLAN DESCRIPTION March 21, 2025 Exhibit 10.1

INTRODUCTION The PNC Financial Services Group, Inc. (the “Company” or “PNC”), by action of the Human Resources Committee of the Board (the “Committee”), has established The PNC Financial Services, Inc. Executive Severance Plan (the “Plan”), effective March 21, 2025, for the benefit of its eligible employees. The Company has delegated all authority to establish, maintain, and administer arrangements such as the Plan to the Committee, and the Committee may take any action that the Company, as Plan sponsor, may take with respect to the Plan. The Plan is designed to give the Committee a basis to provide severance benefits on a discretionary basis to a select group of management or highly compensated employees whose employment terminates in accordance with the terms of the Plan. This document is designed to serve as both the Plan document and the summary plan description for the Plan. Your legal rights and obligations are determined solely by the provisions of the Plan, as interpreted by the Committee in its sole discretion. The Committee has the sole discretion to determine whether you may be considered eligible for benefits under the Plan. Nothing in the Plan will be construed to give you the right to receive severance benefits or to continue in the employment of the Company. The Plan is unfunded, has no trustee and is administered by the Committee. The Plan is intended to be an “employee welfare benefit plan” within the meaning of Section 3(1) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), 29 U.S.C. §1002(1), and 29 C.F.R. §2510.3-2(b). The Plan is intended to be a “separation pay plan” under Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), in accordance with the regulations issued thereunder and related guidance, and shall be maintained, interpreted and administered accordingly. To the extent not superseded by federal law, the Plan will be construed in accordance with Pennsylvania law. Please review the section entitled “Amendment and Termination of the Plan” regarding the Committee’s reservation of rights to amend or terminate the Plan. Nobody speaking on behalf of the Plan or the Company can alter the terms of the Plan. This Plan document and SPD do not create a contract of employment between you and the Company. COVERAGE In order to be eligible to participate in the Plan you must be selected for participation by the Committee and you must sign and return the acknowledgement of participation agreement (in which you agree, among other things, to provide 60 days’ notice of your voluntary resignation from employment, even though you are not eligible to receive plan benefits as a result of a voluntary resignation) in the form prescribed by the Committee (the “Acknowledgement”). The date you are selected for participation is the “Participation Date”. Your “Notification Date” is the date you are told by the Company that your employment is being terminated without “Cause” (as defined in Schedule A), the date that you tell the Company of your intention to terminate employment for “Good Reason” (as defined in Schedule A). Your “Notice Period” will be the date between your Notification Date and your termination date, and you will continue to be paid salary and eligible to receive benefits during the Notice Period while your employment continues during the Notice Period. Your termination date will occur on the last day of the Notice Period; provided; however; that, the Committee (or its delegate or designee, as applicable), in its sole discretion, may direct you not to report to work during the Notice Period or may shorten or waive the Notice Period.

2 ELIGIBILITY A. When You Are Eligible for Severance Benefits The Company may make severance payments to you if the Committee determines, in its sole and exclusive discretion, that you are covered under the Plan and have incurred an involuntary termination of employment as set forth on Schedule A. In order to receive severance benefits, you must meet all of the following requirements: 1. be a Group 1 Executive (or comparable successor group of Company executives), as defined in PNC’s policies and practices, and an executive officer of the Company for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (such individual a “Covered Executive”). 2. be notified by the Committee in writing of your eligibility for benefits under the Plan and have signed and returned the Acknowledgement. 3. continue to work during the Notice Period; 4. sign and not revoke the Release (as defined below) within the requisite time periods specified in the Release. For the avoidance of doubt, eligibility for severance benefits is expressly conditioned on both the execution of a Company provided general waiver and release, which will generally be in the form attached to the Plan as Exhibit I, and which may be updated from time to time by the Company without the need for a formal Plan amendment (the “Release”), and the expiration, without revocation by you, of any revocation period provided in such Release. B. When You Are Not Eligible for Severance Benefits Notwithstanding the foregoing, even if you meet all of the requirements described in “When You Are Eligible For Severance Benefits” above, you are not eligible for severance benefits upon any ineligible termination, including but not limited to the following circumstances: 1. You voluntarily resign before the designated termination date established by the Company (i.e., before the end of the Notice Period). 2. You are discharged by the Company prior to your termination date established by the Company for reasons determined by the Company, in its sole discretion, including, but not limited to, a termination of employment for “Cause”. 3. Prior to or on your termination date established by the Company, you die or become Disabled (as defined in Schedule A). 4. You leave the employment of the Company under any other circumstances not specifically described in “When You Are Eligible For Severance Benefits” above. 5. The Company determines, before or after termination of employment, that you violated any terms or conditions relating to your employment or termination of employment or any policies of the Company.

3 Notwithstanding any provision of the Plan to the contrary, the Committee, in its sole discretion and acting as the Plan sponsor, reserves the right to (a) establish additional eligibility requirements and conditions, (b) determine whether an employee satisfies the eligibility requirements for coverage under the Plan, (c) award severance benefits to a terminated employee who is not otherwise eligible, (d) deny benefits to you if you are otherwise eligible, (e) award benefits to any terminated employee in a greater or lesser amount than provided for in the Plan, or (f) pay out benefits in a manner or on a schedule other than provided for in the Plan. PLAN BENEFITS You may be eligible for a severance pay and other benefits based upon your years of service, compensation, or any other factors determined to be relevant by the Committee. The amount of severance benefits will be determined in accordance with Schedule A. Severance payments will be made from the general assets of the Company. Unless otherwise provided herein, any severance payments made under this Plan shall be made in accordance with the terms of Schedule A, provided you (i) sign and do not revoke the Release; and (ii) comply with all applicable covenants and any other requirement in the Plan and Schedule A. The actual date of the severance payments will be determined by the Company, in its sole discretion. It is important that you contact the Plan Administrator whenever there are changes to your personal information relevant to the Plan, such an address change or change in the bank account where the benefits are sent. If the Plan Administrator cannot find you when benefits are due to be paid, it cannot make payments in a timely manner. Severance payments under this Plan will be in addition to any amounts accrued and owing to you as of the date of termination, such as your final paycheck for your service through the termination date and payment for vacation if and to the extent payable at or following termination under a Company paid time off or leave policy. Severance payments will not be used or considered in the computation or accrual of benefits under any other benefit plan or program except to the extent explicitly permitted in such plan or program. Severance payments under this Plan will be reduced by amounts required to be withheld by the Company under all federal, state and local tax or other applicable laws, and by any amount paid or to be paid by, or on behalf of, the Company in compliance with any WARN obligation or obligation under a similar state or local law (other than state unemployment compensation; benefits under this plan are intended to supplement any benefits available under a state unemployment compensation program). With respect to amounts paid under the Plan that are not subject to Code Section 409A and the regulations promulgated thereunder (“Section 409A”), the Committee reserves the right to make reductions in accordance with applicable law for any monies owed to the Company by you or the value of Company property that you have retained in your possession. With respect to amounts paid under the Plan that are subject to Section 409A, the Committee reserves the right to make reductions in accordance with applicable law for any monies owed to the Company by you or the value of the Company property that you have retained in your possession; provided, however, that such reductions cannot exceed $5,000 in the aggregate in any Company fiscal year. Any amounts payable under this Plan shall not be duplicative of any other severance benefits, and to the extent you have executed an individually negotiated agreement with the Company relating to severance benefits that is in effect on your termination date, no amounts will be due hereunder unless you acknowledge and agree that the severance benefits, if any, provided under this Plan are in lieu of, and not in addition to, any severance benefits provided under the terms of such individually

4 negotiated agreement and you acknowledge and agree to waive entitlement to any such severance benefits provided thereunder. COMPLIANCE WITH SECTION 409A The Plan is intended to comply with applicable law. To the extent the Employee has a termination of employment that constitutes an involuntary termination as described under Treasury Regulations Section 1.409A-1(n)(2), the Plan is intended to meet the requirements of the “short term deferral” exception, the “separation pay” plan exemption and other exceptions under Code Section 409A and the regulations promulgated thereunder. Notwithstanding any provision in the Plan to the contrary, distributions from the Plan may only be made in a manner, and upon an event, permitted by Code Section 409A, including the requirement that deferred compensation payable to a “specified employee” of a publicly traded company due to a separation from service be postponed for six months after the separation from service. If any payment or benefit cannot be provided or made at the time specified herein without incurring penalties under Code Section 409A, then such benefit or payment will be provided in full at the earliest time thereafter when such penalties will not be imposed. For purposes of Code Section 409A, a series of installment payments under the Plan shall be treated as a single payment. In the event that the Plan provides for the payment of any amount within a specified period of time, the actual date of payment of such amount shall be determined by the Company in its sole discretion. If the maximum period during which you have the ability to consider and revoke the Release would span two calendar years, then, regardless of when you sign the Release and the revocation period expires, payments will be made or commence no earlier than the beginning of the second of such calendar years. To the extent that any provision of the Plan would cause a conflict with the applicable requirements of Code Section 409A, or would cause the administration of the Plan to fail to satisfy the applicable requirements of Code Section 409A, such provision shall be deemed null and void to the extent permitted by applicable law. CLAIMS PROCEDURE A. Adverse Benefit Determinations You or your beneficiary (“Claimant”) may make a claim for benefits under the Plan by completing and filing a written claim with the Claims Administrator. If the Claims Administrator denies a claim in whole or in part, the Claims Administrator will provide notice to the Claimant, in writing, within 90 days after the claim is filed, unless the Claims Administrator determines that an extension of time for processing is required. In the event that the Claims Administrator determines that such an extension is required, written notice of the extension shall be furnished to the Claimant prior to the termination of the initial 90-day period. The extension shall not exceed a period of 90 days from the end of the initial period of time and the extension notice shall indicate the special circumstances requiring an extension of time and the date by which the Claims Administrator expects to render the benefit decision. The written notice of a denial of a claim shall set forth, in a manner calculated to be understood by the Claimant: 1. the specific reason or reasons for the denial; 2. reference to the specific Plan provisions on which the denial is based;

5 3. a description of any additional material or information necessary for the Claimant to perfect the claim and an explanation as to why such information is necessary; and 4. an explanation of the Plan’s claims procedure and the time limits applicable to such procedures, including a statement of the claimant’s right to bring a civil action under section 502(a) of ERISA following an adverse benefit determination on appeal. B. Appeal of Adverse Benefit Determinations The Claimant or his or her duly authorized representative shall have an opportunity to appeal a claim denial to the Claims Administrator for a full and fair review. The Claimant or his or her duly authorized representative may: 1. request a review upon written notice to the Claims Administrator within 60 days after receipt of a notice of the denial of a claim for benefits; 2. submit written comments, documents, records, and other information relating to the claim for benefits; and 3. examine the Plan and obtain, upon request and without charge, copies of all documents, records, and other information relevant to the Claimant’s claim for benefits. The Claims Administrator’s review shall take into account all comments, documents, records, and other information submitted by the Claimant relating to the claim, without regard to whether such information was submitted or considered by the Claims Administrator in the initial benefit determination. A determination on the review by the Claims Administrator will be made not later than 60 days after receipt of a request for review, unless the Claims Administrator determines that an extension of time for processing is required. In the event that the Claims Administrator determines that such an extension is required, written notice of the extension shall be furnished to Claimant prior to the termination of the initial 60-day period. The extension shall not exceed a period of 60 days from the end of the initial period and the extension notice shall indicate the special circumstances requiring an extension of time and the date on which the Claims Administrator expects to render the determination on review. The written determination of the Claims Administrator shall set forth, in a manner calculated to be understood by the Claimant: 1. the specific reason or reasons for the decision; 2. reference to the specific Plan provisions on which the decision is based; 3. the Claimant’s right to receive, upon request and without charge, reasonable access to, and copies of, all documents, records and other information relevant to the claim for benefits; and 4. a statement of the Claimant’s right to bring a civil action under section 502(a) of ERISA.

6 No person may bring an action for any alleged wrongful denial of Plan benefits in a court of law unless the claims procedures set forth above are exhausted and a final determination is made by the Claims Administrator. If the Claimant or other interested person challenges a decision of the Claims Administrator, a review by the court of law will be limited to the facts, evidence and issues presented to the Claims Administrator during the claims procedure set forth above. Facts and evidence that become known to the Claimant or other interested person after having exhausted the claims procedure must be brought to the attention of the Claims Administrator for reconsideration of the claims determination. Issues not raised with the Claims Administrator will be deemed waived. Any claims or lawsuit must be brought no later than three months after the earliest of: (1) the date the first benefit payment was made or allegedly due; (2) the date the request for a benefit from the Plan was first formally denied, in whole or in part; or (3) the earliest date the Claimant knew or should have known the material facts on which the lawsuit is based (the three-month claims period). However, if the Claimant starts the claims and appeals procedure and submit the claim to the Claims Administrator within the three-month claims period, the deadline for the Claimant to file a lawsuit will not expire until the later of: (1) the last day of the three-month claims period; or (2) three months after the final notice of denial of the appealed claim is sent to the Claimant by the Claims Administrator. Any claim or action filed under the administrative claims and appeals procedure described in the Plan or any lawsuit against the Plan is time-barred after the end of the later of: (1) the three-month claims period; or (2) if the Claimant starts the claims and appeals procedure within the three-month claims period, three months following exhaustion of the administrative claims and appeals procedures. The courts of competent jurisdiction in Pittsburgh, Pennsylvania will have exclusive jurisdiction for all claims, actions and other proceedings involving or relating to the Plan, the Claims Administrator, or any party in interest, including by way of example and without limitation, a claim or action (a) to recover benefits allegedly due under the Plan or by reason of any law; (b) to enforce rights under the Plan; (c) to clarify rights to future benefits under the Plan; or (d) that seeks a remedy, ruling, or judgment of any kind against the Plan, the Claims Administrator, or a party in interest. BURDEN OF PROOF REGARDING RECORDS The records of the Company with respect to length of employment, employment history, compensation, absences from employment and all other relevant matters may be conclusively relied on by the Committee or the Claims Administrator for purposes of determining your eligibility or entitlement to Plan benefits, the amount of Plan benefits payable to you, the appropriate timing of payment of Plan benefits to you, and so forth. If you are claiming benefits under the Plan and believe those records are incorrect, you may provide documentation supporting your to the Committee or Claims Administrator (as applicable) for review and consideration. However, the decision of the Committee or Claims Administrator (as applicable with respect to any records dispute shall be final and binding on all parties. The Company, the Committee, the Claims Administrator, and all other persons or entities associated with the operation of the Plan and the provision of benefits thereunder, may reasonably rely on the truth, accuracy and completeness of all data provided by you or your beneficiary, including, without limitation, data with respect to age, health and marital status. Furthermore, the Company, the Committee, and the Claims Administrator may reasonably rely on all consents, elections and designations filed with the Plan or those associated with the operation of the Plan by you, your beneficiary, or the representatives of such persons without duty to inquire into the genuineness of any such consent, election or designation. None of the aforementioned persons or entities associated with the operation of the Plan and the benefits provided under the Plan shall

7 have any duty to inquire into any such data, and all may rely on such data being current to the date of reference, it being the duty of the you and your beneficiaries to advise the appropriate parties of any change in such data. PLAN ADMINISTRATION BY THE COMMITTEE Except to the extent otherwise required by the Committee’s charter, the Committee may delegate its authority under the Plan to an individual or another committee. The Committee (or its delegate, as applicable) will be the sole judge of the application and interpretation of the Plan, and will have the discretionary authority to construe the provisions of the Plan, to resolve disputed issues of fact, and to make determinations regarding eligibility for benefits (other than determinations under “Eligibility” that are reserved to the Committee as Plan sponsor). The Committee (or its delegate, as applicable), including, without limitation, when acting as the Claims Administrator, has the discretionary authority to interpret the Plan, resolve any issue of law or fact, correct any defect, reconcile any inconsistency, or supply any omission with respect to the Plan. The decisions of the Committee (or its delegate, as applicable), including, without limitation, when acting as the Claims Administrator, in all matters relating to the Plan that are within the scope of his/her authority (including, but not limited to, Plan interpretations and disputed issues of fact) will be final and binding on all parties. The Committee has delegated to the Chief Executive Officer and the Chief Human Resources Officer, each acting individually, the authority to manage the day-to-day administration of the Plan, as well as any authority that is consistent with the Executive Compensation Procedure, including, but not limited to, the ability to waive the Notice Period for any individual, except that neither the Chief Executive Officer nor the Chief Human Resources Officer may waive a Notice Period applicable to himself/herself. AMENDMENT AND TERMINATION OF THE PLAN The Committee reserves the right to amend or terminate the Plan, in whole or in part, at any time and for any reason. An amendment to, or termination of, the Plan may discontinue any further payments to you. In the event that the Committee has made a payment that is determined to be more than the amount you are entitled to under the Plan, the Committee has the right to: (1) require you to return the overpayment upon request; or (2) reduce future payments made on your behalf or on behalf of your beneficiary by the amount of the overpayment. These rights do not affect any other rights the Plan may have with respect to such an overpayment. To the extent any payments under the Plan are (1) subject to PNC’s Incentive Compensation Adjustment and Clawback policy, PNC’s Dodd-Frank Recoupment Policy, or any similar policy in effect at the time of your termination of employment (“Adjustment Policy”) or (2) related to amounts that were subject to the Adjustment Policy as of the Participation Date (including cash payments relating to equity-based awards subject to the Adjustment Policy that were forfeited as a result of your termination of employment), the terms of the Adjustment Policy will continue to apply.

8 GENERAL INFORMATION 1. Plan Name: The PNC Financial Services, Inc. Executive Severance Plan 2. Plan Number: 536 3. Employer/Plan Sponsor: The PNC Financial Services Group, Inc. The Tower at PNC Plaza 300 Fifth Avenue Pittsburgh, PA 15222 4. Employer Identification Number: 25-1435979 5. Type of Plan: Welfare Benefit – Severance Pay Plan – Top Hat Plan 6. Plan Administrator: The PNC Financial Services Group, Inc. Human Resources Committee of the Board c/o Employee Relations Information Center One PNC Plaza 249 Fifth Avenue, 22nd Floor Pittsburgh, PA 15222 7. Claims Administrator The PNC Financial Services Group, Inc. Human Resources Committee of the Board (or its delegate) c/o Employee Relations Information Center One PNC Plaza 249 Fifth Avenue, 22nd Floor Pittsburgh, PA 15222 8. Agent for Service of Process: Service of legal process can be made on the Plan Administrator. 9. Sources of Contributions: The Plan is unfunded, and all benefits are paid from the general assets of the Company. 10. Type of Administration: The Plan is administered by the Committee. 11. Plan Year: The Plan’s fiscal records are kept on a fiscal year basis ending each December 31. ERISA RIGHTS STATEMENT [QUOTED FROM DEPARTMENT OF LABOR REGULATIONS] As a participant in the Plan, you are entitled to certain rights and protections under ERISA. ERISA provides that all Plan participants shall be entitled to:

9 Receive Information about Your Plan and Benefits • Examine, without charge, at the Plan Administrator’s office and at other specified locations, such as worksites and union halls, all documents governing the plan, including insurance contracts and collective bargaining agreements, and a copy of the latest annual report (Form 5500 Series) filed by the plan with the U.S. Department of Labor and available at the Public Disclosure Room of the Employee Benefits Security Administration. • Obtain, upon written request to the Plan Administrator, copies of documents governing the operation of the Plan, including insurance contracts and collective bargaining agreements, and copies of the latest annual report (Form 5500 Series) and updated summary plan description. The Plan Administrator may make a reasonable charge for the copies. Enforce Your Rights If your claim for a benefit is denied or ignored, in whole or in part, you have a right to know why this was done, to obtain copies of documents relating to the decision without charge, and to appeal any denial, all within certain time schedules. Under ERISA, there are steps you can take to enforce the above rights. For instance, if you request materials from the plan and do not receive them within 30 days, you may file suit in a federal court. In such a case, the court may require the Plan Administrator to provide the materials and pay you up to $110 a day until you receive the materials, unless the materials were not sent because of reasons beyond the control of the administrator. If you have a claim for benefits which is denied or ignored, in whole or in part, you may file suit in a state or federal court. If it should happen that you are discriminated against for asserting your rights, you may seek assistance from the U.S. Department of Labor, or you may file suit in a federal court. The court will decide who should pay court costs and legal fees. If you are successful, the court may order the person you have sued to pay these costs and fees. If you lose, the court may order you to pay these costs and fees, for example, if it finds your claim is frivolous. Assistance with Your Questions If you have any questions about your Plan, you should contact the Plan Administrator. If you have any questions about this statement or about your rights under ERISA, you should contact the nearest office of the Employee Benefits Security Administration, U.S. Department of Labor, listed in your telephone directory or the Division of Technical Assistance and Inquiries, Employee Benefits Security Administration, U.S. Department of Labor, 200 Constitution Avenue NW, Washington, D.C. 20210. You may also obtain certain publications about your rights and responsibilities under ERISA by calling the publication hotline of the Employee Benefits Security Administration.

Exhibit I FORM OF CONFIDENTIAL SETTLEMENT AGREEMENT AND RELEASE OF CLAIMS

2 FORM OF CONFIDENTIAL SEPARATION AGREEMENT AND GENERAL RELEASE OF CLAIMS1 This Confidential Separation Agreement and General Release of Claims (“Agreement”) will confirm the terms of your separation from that employment in connection with PNC under The PNC Financial Services Group, Inc. Executive Severance Plan (the “Plan”). As used in this Agreement, “PNC” refers, both individually and collectively, to The PNC Financial Services Group, Inc., its subsidiaries and affiliates, their predecessors, successors and assigns, and each of their directors, officers, employees and agents. The terms to which we have agreed are as follows: 1. Your last day of employment with PNC will be [____] (“Separation Date”). 2. In exchange for the promises you make in this Agreement, including the restrictive covenant obligations incorporated herein by reference (paragraph 3) and the waiver and release (paragraph 9), PNC has agreed to make the following payments to you pursuant to this Agreement and the Plan: [____] 3. You acknowledge that a condition for your receipt of the severance benefits in this Agreement and set forth in paragraph 2 is your continued compliance with the restrictive covenants set forth in your equity award agreements under PNC’s incentive award plan (the “Equity Awards”). These provisions set forth in the Equity Awards, including, without limitation, the non- solicitation, no-hire and confidentiality provisions are incorporated herein by reference and deemed part of this Agreement. 4. You understand and agree that, both during and after your employment with PNC, except as required by law and subject to the retained rights described in paragraphs 11-13 below, you must maintain the confidentiality of all information and knowledge acquired by you during your employment with PNC, which belongs to PNC or its customers, and which has not been published, disseminated or otherwise become a matter of general public knowledge. This includes non-public information about PNC’s or its customers’ businesses, operations, finances, customers, employees, whether in written form or committed to memory. For the avoidance of doubt, you may reveal your post-employment restrictions as contained in this Agreement and as contained in your Equity Awards to your provider of talent transition services and potential future employers without violating any confidentiality restrictions. 5. You acknowledge and agree that, except as otherwise required by law or as permitted under paragraphs 11-13 of this Agreement, you will refrain from making any comments or engaging in publicity or any other action or activity which could reasonably be expected to adversely affect the personal or professional reputation of PNC or any of its current or former directors, officers or employees. PNC hereby agrees to advise members of the board and executive officers to refrain from making any comments that could reasonably be expected to adversely affect your personal or professional reputation. You should direct all reference requests from prospective employers or others to PNC’s third party administrator, “The Work Number” (1-800-367-5690 or www.theworknumber.com). PNC’s standard policy and practice is that it will not provide references or respond to inquiries from potential employers or other third parties regarding your 1 Subject to updates for compliance with applicable laws or PNC policy changes.

3 PNC employment, but will verify, through The Work Number, only your dates of employment and last position held. If you provide authorization, The Work Number will also release compensation information for the current and previous two calendar years. 6. During and after separation from your employment, you agree to reasonably cooperate with PNC, its subsidiaries and affiliates, at any level, and any of their officers, directors, shareholders, or employees: (a) concerning requests for information about the business of PNC or its subsidiaries or affiliates or your involvement and participation therein; (b) in connection with any investigation or review by PNC or any federal, state or local regulatory, quasi- regulatory or self-governing authority (including, without limitation, the Securities and Exchange Commission) as any such investigation or review relates to events or occurrences that transpired while you were employed by PNC; and (c) with respect to transition and succession matters. Your cooperation shall include, but not be limited to (taking into account your personal and professional obligations, including those to any new employer or entity to which you provide services), being available to meet and speak with officers or employees of PNC or its counsel at reasonable times and locations, executing accurate and truthful documents and taking such other actions as may reasonably be requested by PNC or its counsel to effectuate the foregoing. PNC agrees to reimburse you for all reasonable expenses incurred with respect to any obligations arising under this paragraph. 7. On or before your Separation Date, you must return all PNC property including any identification cards, stationery, secure IDs, credit cards, keys, computers and any related equipment, files, records, documents, manuals, software, data and any other items or information belonging to PNC or its customers, shareholders, officers, directors or employees. This also includes any files or records that are electronically stored on a personal computer or any other storage device. 8. You agree to the following representations, and recognize that each of them is an important consideration for PNC’s willingness to enter into this Agreement with you: a. You have carefully read and understand each provision in this Agreement and have been advised that you may discuss with an attorney of your choosing whether to accept and sign this Agreement, and have been given the opportunity to consult with such attorney; b. You have been given at least 21 days after receipt of the original version of this Agreement to consider whether to sign it, and you waive any right to an extension of that time based on any revisions to this Agreement after discussions with your attorney or PNC; c. You are aware that you may change your mind and revoke this Agreement at any time during the seven days after you sign the Agreement, in which case the entire Agreement will be void and you will not be entitled to the payments and benefits describe in this Agreement; d. You understand and agree that, if you revoke this Agreement and receive a payment in error, you will repay the full amount within 30 days of receipt.

4 e. Before signing this Agreement, you have complied with your obligation under PNC’s Code of Business Conduct and Ethics to report all potential violations of law, regulation and PNC’s internal compliance policies and procedures; f. You acknowledge that certain payments and benefits provided by this Agreement are payments and benefits you would not be entitled to receive except for this Agreement, and that they fully compensate you for any claims covered by the general waiver and release in paragraph 9; and g. You acknowledge that no promises or representations except those contained in this Agreement have been made to you in connection with your continued employment or separation from employment, and such continued employment and separation are governed exclusively by the terms of this Agreement. 9. General Waiver and Release. In exchange for the payments and benefits offered by PNC, you: a. Fully, irrevocably and unconditionally release and forever discharge PNC and any of its predecessor or affiliate companies and each and all of their officers, directors, agents, representatives, employees and shareholders, and their successors and assigns, and all persons acting by, through, under, for or in concert with them (hereinafter individually or collectively, the “Released Parties”) from any and all charges, complaints and liability for claims of any kind or nature, known or unknown which you now have or could claim to have regarding events that occurred on or before the expiration of the revocation period set forth in paragraph 8(c) above (hereinafter referred to as a “Claim” or “Claims”), including, without limitation, Claims of or based on negligence, intentional torts, breach of contract (implied, oral or written), violation of federal, state or local laws that prohibit discrimination or retaliation, the Age Discrimination in Employment Act of 1967 (“ADEA”), any employee welfare benefit or pension plan governed by the Employee Retirement Income Security Act of 1974, as amended, the Civil Rights Act of 1964, as amended, the Older Workers Benefit Protection Act, as amended, the Americans with Disabilities Act, as amended, Section 503 of the Rehabilitation Act of 1973, the Family and Medical Leave Act, as amended, and other laws or violations of laws enforced by any federal, state or local agency regarding harassment, wages, insurance, leave, privacy or any other matter, and any other theory or recovery under federal, state or local laws, including all statutory, regulatory or common law Claims arising from or in any way connected with your employment or service with PNC. You further waive any Claim or right to payment of attorneys' fees or expenses; and b. To the extent permitted by law, you agree not to commence, directly or indirectly, any action, suit, or proceeding based upon any Claims released in this Agreement, except that you may bring a Claim to enforce this Agreement or under the ADEA to challenge the release of Claims under the ADEA set forth above. You further agree that: (1) if you commence an action or proceeding in violation of this

5 Agreement, you shall be liable for the reasonable attorneys’ fees and costs incurred by PNC as a result; and (2) if any such action or proceeding is commenced, in whole or in part, on your behalf by any third person, entity or agency in any forum, including without limitation in a class or collective action against any of the Released Parties, you waive any Claim or right in connection with such action or proceeding to any resulting money damages or other personal, legal or equitable relief awarded by any court or governmental authority. 10. The general waiver and release in paragraph 9 above does not apply to or prohibit claims under or for: • retaliation under Section 806 of the Sarbanes-Oxley Act; • Section 23 of the Commodity Exchange Act; • Section 21F of the Securities Exchange Act of 1934; • Section 1057 of the Dodd-Frank Wall Street Reform and Consumer Protection Act; • the Fair Labor Standards Act, as amended; • the ADEA, challenging the validity of the waiver and release contained in paragraph 9 above; • workers’ compensation benefits; • unemployment compensation benefits; • rights to COBRA continuation; • vested retirement benefits; • indemnification (whether statutory, contractual or otherwise) that you would be entitled to in connection with the performance of your duties during your employment with PNC; or • any other claims that cannot be released as a matter of law. 11. Nothing in this Agreement, including the confidentiality provisions (paragraphs 3) and the general waiver and release (paragraph 9), is intended to discourage or limit you from affirmatively reporting to, communicating with, participating in investigations or proceedings conducted by, or providing information or documents not subject to legal or other applicable privilege to any federal, state or local government agency or commission regarding possible violations of law or regulation, including but not limited to the Securities and Exchange Commission, the Commodity Futures Trading Commission, the Equal Employment Opportunity Commission, the National Labor Relations Board, or the Occupational Safety and Health Administration. You further understand and agree that you are not required to contact or receive consent from or provide prior notice to PNC before engaging in such communications with a government agency or commission. 12. By signing this Agreement, you waive the right to receive damages or other relief, whether equitable or legal, from any charge or action you may file, or which is filed on your behalf with a government agency, but it will not limit your ability to receive an incentive award authorized under federal statute or regulation for information provided to the Securities and Exchange Commission or other federal or state regulatory or law enforcement agency, if applicable.

6 13. Regardless of any other provision in this Agreement, you may be entitled to immunity and protection from retaliation under the Defend Trade Secrets Act of 2016 for disclosing trade secrets under certain limited circumstances, as set forth in PNC’s Defend Trade Secrets Act policy. 14. All prior agreements between you and PNC, whether written or oral, are superseded by this Agreement and are no longer valid with the exception of: (a) the Code of Business Conduct and Ethics; (b) any equity, deferred compensation, restrictive covenant, or other agreement containing promises made by you that extend beyond your last day of employment, including as incorporated herein; or (c) as contained in an authorized and signed written document which specifically states that it is not superseded by this Agreement. This Agreement cannot be amended or modified in any way except by written agreement entered into and signed by the authorized representatives of you and PNC. 15. You and PNC agree that if any portion of this Agreement (other than the general waiver and release in paragraph 9) is determined by a court to be invalid or unenforceable for any reason, that determination will not affect the remaining terms of this Agreement. To the extent any portion of the Agreement found to be invalid or unenforceable can be modified to make it valid and enforceable, it shall be deemed to be so modified. To the extent the offending provision cannot be modified and still comport with the parties' intent, it shall be deemed deleted from the Agreement. 16. You agree that if you breach any of your obligations under this Agreement, including the agreement not to sue, you shall return any and all amounts that have been provided to you under this Agreement, and PNC will make no further payments to you under this Agreement. You further understand and agree that PNC may seek any other relief it is entitled to under this Agreement or applicable law as a result of your breach of the Agreement. 17. Any dispute or claim arising out of or relating to this Agreement may be brought only in the Court of Common Pleas of Allegheny County, Pennsylvania, or in the federal court for the Western District of Pennsylvania, as appropriate, which shall apply Pennsylvania Law in the interpretation of the Agreement. Both you and PNC also waive any right to trial by jury with regard to any action arising under or in connection with this Agreement. 18. Neither this Agreement, nor any of the rights, obligations or interests arising under the Agreement may be assigned to another person or entity without the prior written consent of the parties. 19. You agree that you are solely responsible for any applicable taxes (including, without limitation, income and excise taxes), penalties and interest that you incur in connection with the payments and benefits under this Agreement. If any such withholding is required prior to the time amounts are payable to you hereunder or if such amounts are not sufficient to satisfy such obligation in full, the withholding will be taken from other compensation then payable to you or as otherwise determined by PNC. This Agreement is intended to comply with or be exempt from Section 409A of the Internal Revenue Code of 1986, as amended, and related regulations and guidance (collectively “Code Section 409A”). PNC will have discretion to interpret this Agreement and any associated documents in any manner that creates an exemption from (or compliance with) the requirements of Code Section 409A. Severance benefits under this Agreement are intended to be exempt from Code Section 409A under the “short-term deferral” exception, to the maximum

7 extent applicable, and then under the “separation pay” exception, to the maximum extent applicable. For purposes of Code Section 409A, each payment hereunder shall be treated as a separate payment and the right to a series of installment payments under this Agreement shall be treated as a right to a series of separate payments. To the extent a payment under this Agreement is subject to (and not exempt from) Code Section 409A: a. Whenever a payment under this Agreement specifies a payment period with reference to a number of days (for example, “payment shall be made within forty-five (45) days of your Separation Date”), the actual date of payment within the specified period shall be at the sole discretion of PNC. b. You cannot, directly or indirectly, designate the calendar year of any payment to be made under this Agreement. c. Notwithstanding anything in this Agreement to the contrary, if you are considered a “specified employee” for purposes of Code Section 409A and if payment of any amounts under this Agreement is required to be delayed for a period of six months after separation from service pursuant to Code Section 409A, payment of such amounts shall be delayed as required by Code Section 409A, and the accumulated amounts shall be paid in a lump sum payment within ten days after the end of the six- month period. If you die during the postponement period prior to the payment of benefits, the amounts withheld on account of Code Section 409A shall be paid to the personal representative of your estate within 45 days after the date of your death. d. All reimbursements and in-kind benefits provided under this Agreement shall be made or provided in accordance with the requirements of Section 409A of the Code, including, where applicable, the requirement that (i) any reimbursement is for expenses incurred during the period of time specified in this Agreement, (ii) the amount of expenses eligible for reimbursement, or in kind benefits provided, during a calendar year may not affect the expenses eligible for reimbursement, or in kind benefits to be provided, in any other calendar year, (iii) the reimbursement of an eligible expense will be made no later than the last day of the calendar year following the year in which the expense is incurred, and (iv) the right to reimbursement or in kind benefits is not subject to liquidation or exchange for another benefit. If you concur with the terms and conditions of this Agreement, please sign, date and return it to me no later than [___]. You should keep a copy for your records. Sincerely, The PNC Financial Services Group, Inc. AGREED: ___________________________________ ___________________________ [______], For Myself and Dated My Heirs, Personal Representatives and Assigns

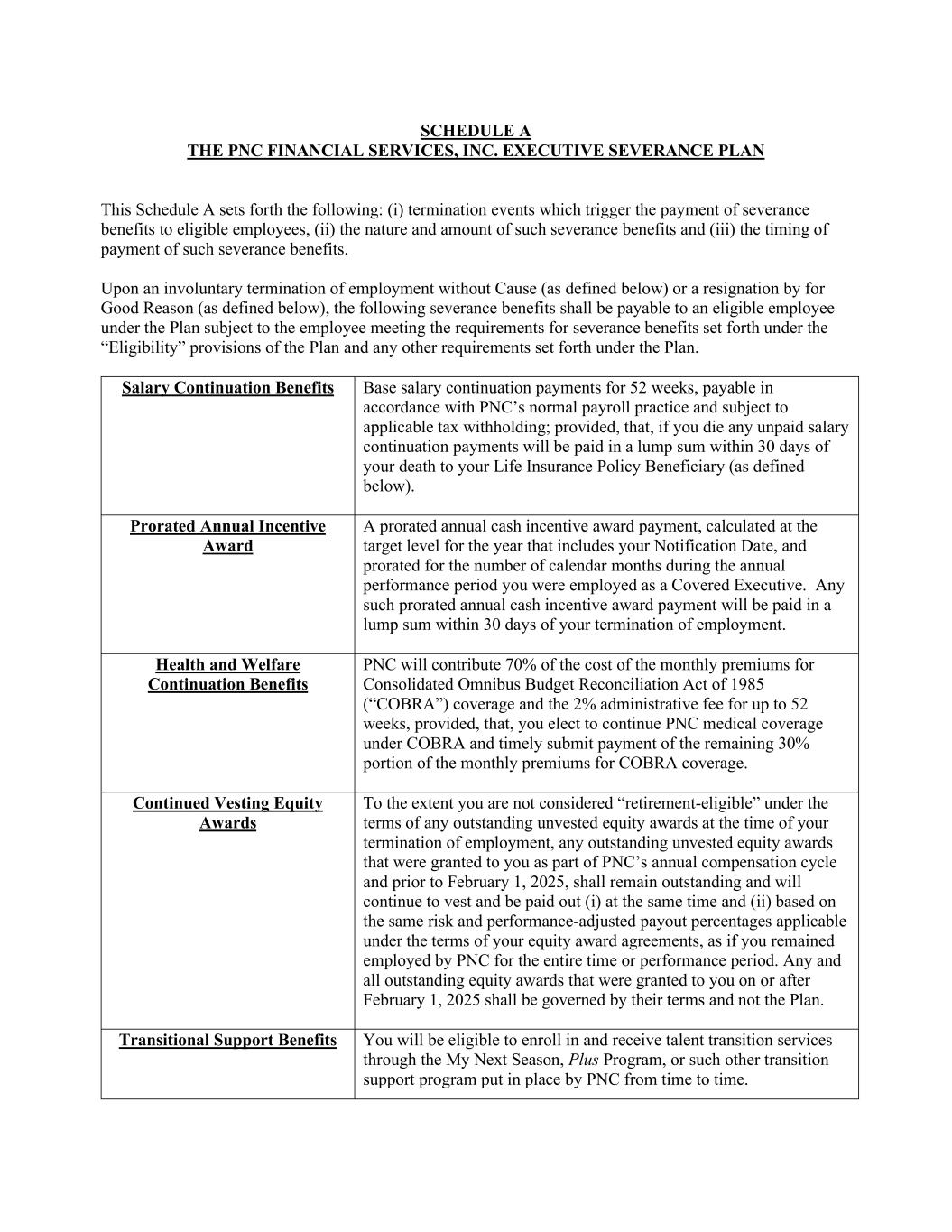

SCHEDULE A THE PNC FINANCIAL SERVICES, INC. EXECUTIVE SEVERANCE PLAN This Schedule A sets forth the following: (i) termination events which trigger the payment of severance benefits to eligible employees, (ii) the nature and amount of such severance benefits and (iii) the timing of payment of such severance benefits. Upon an involuntary termination of employment without Cause (as defined below) or a resignation by for Good Reason (as defined below), the following severance benefits shall be payable to an eligible employee under the Plan subject to the employee meeting the requirements for severance benefits set forth under the “Eligibility” provisions of the Plan and any other requirements set forth under the Plan. Salary Continuation Benefits Base salary continuation payments for 52 weeks, payable in accordance with PNC’s normal payroll practice and subject to applicable tax withholding; provided, that, if you die any unpaid salary continuation payments will be paid in a lump sum within 30 days of your death to your Life Insurance Policy Beneficiary (as defined below). Prorated Annual Incentive Award A prorated annual cash incentive award payment, calculated at the target level for the year that includes your Notification Date, and prorated for the number of calendar months during the annual performance period you were employed as a Covered Executive. Any such prorated annual cash incentive award payment will be paid in a lump sum within 30 days of your termination of employment. Health and Welfare Continuation Benefits PNC will contribute 70% of the cost of the monthly premiums for Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”) coverage and the 2% administrative fee for up to 52 weeks, provided, that, you elect to continue PNC medical coverage under COBRA and timely submit payment of the remaining 30% portion of the monthly premiums for COBRA coverage. Continued Vesting Equity Awards To the extent you are not considered “retirement-eligible” under the terms of any outstanding unvested equity awards at the time of your termination of employment, any outstanding unvested equity awards that were granted to you as part of PNC’s annual compensation cycle and prior to February 1, 2025, shall remain outstanding and will continue to vest and be paid out (i) at the same time and (ii) based on the same risk and performance-adjusted payout percentages applicable under the terms of your equity award agreements, as if you remained employed by PNC for the entire time or performance period. Any and all outstanding equity awards that were granted to you on or after February 1, 2025 shall be governed by their terms and not the Plan. Transitional Support Benefits You will be eligible to enroll in and receive talent transition services through the My Next Season, Plus Program, or such other transition support program put in place by PNC from time to time.

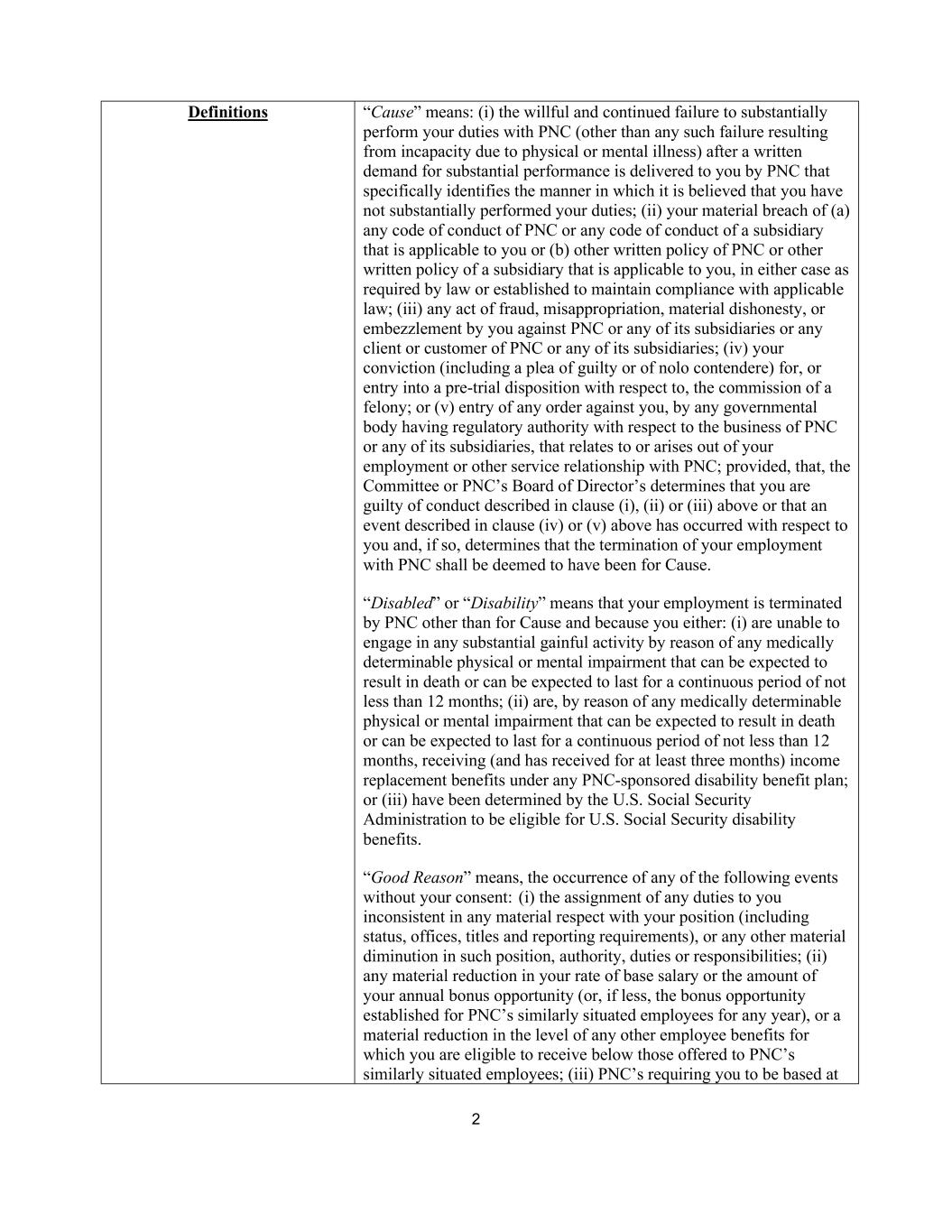

2 Definitions “Cause” means: (i) the willful and continued failure to substantially perform your duties with PNC (other than any such failure resulting from incapacity due to physical or mental illness) after a written demand for substantial performance is delivered to you by PNC that specifically identifies the manner in which it is believed that you have not substantially performed your duties; (ii) your material breach of (a) any code of conduct of PNC or any code of conduct of a subsidiary that is applicable to you or (b) other written policy of PNC or other written policy of a subsidiary that is applicable to you, in either case as required by law or established to maintain compliance with applicable law; (iii) any act of fraud, misappropriation, material dishonesty, or embezzlement by you against PNC or any of its subsidiaries or any client or customer of PNC or any of its subsidiaries; (iv) your conviction (including a plea of guilty or of nolo contendere) for, or entry into a pre-trial disposition with respect to, the commission of a felony; or (v) entry of any order against you, by any governmental body having regulatory authority with respect to the business of PNC or any of its subsidiaries, that relates to or arises out of your employment or other service relationship with PNC; provided, that, the Committee or PNC’s Board of Director’s determines that you are guilty of conduct described in clause (i), (ii) or (iii) above or that an event described in clause (iv) or (v) above has occurred with respect to you and, if so, determines that the termination of your employment with PNC shall be deemed to have been for Cause. “Disabled” or “Disability” means that your employment is terminated by PNC other than for Cause and because you either: (i) are unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months; (ii) are, by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, receiving (and has received for at least three months) income replacement benefits under any PNC-sponsored disability benefit plan; or (iii) have been determined by the U.S. Social Security Administration to be eligible for U.S. Social Security disability benefits. “Good Reason” means, the occurrence of any of the following events without your consent: (i) the assignment of any duties to you inconsistent in any material respect with your position (including status, offices, titles and reporting requirements), or any other material diminution in such position, authority, duties or responsibilities; (ii) any material reduction in your rate of base salary or the amount of your annual bonus opportunity (or, if less, the bonus opportunity established for PNC’s similarly situated employees for any year), or a material reduction in the level of any other employee benefits for which you are eligible to receive below those offered to PNC’s similarly situated employees; (iii) PNC’s requiring you to be based at

3 any office or location outside of a fifty (50)-mile radius from the office where you were employed on the date you sign the Acknowledgment; (iv) any action or inaction that constitutes a material breach by PNC of any agreement entered into between you and PNC; or (v) the failure by PNC to require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of PNC to assume expressly and agree to perform this Plan in the same manner and to the same extent that PNC would be required to perform it if no such succession had taken place. Notwithstanding the foregoing, none of the events described above shall constitute Good Reason unless and until (i) you first notify PNC in writing describing in reasonable detail the condition which constitutes Good Reason within 90 days of its initial occurrence, (ii) PNC fails to cure such condition within 30 days after receipt of such written notice, and (iii) you terminate employment within two years of its initial occurrence. “Life Insurance Policy Beneficiary” means the party or parties designated as beneficiary(ies) on your PNC basic life insurance policy, as such policy was most recently in effect for you before your death (the “Life Insurance Policy”); provided that (i) if you designated more than one beneficiary on your Life Insurance Policy, the lump sum payment will be split and paid to your designated beneficiaries in the same allocation percentage as you elected on your Life Insurance Policy; (ii) if you die without a designated beneficiary on your Life Insurance Policy, any unpaid salary continuation will be distributed in a lump sum to your estate; and (iii) if you designated multiple beneficiaries on your Life Insurance Policy and one of the beneficiaries dies before the payment is made, the payment that would have been made to that beneficiary will be made to your estate.