EX-99.1

Published on November 8, 2024

Driving Growth Through National Expansion BancAnalysts Association of Boston Conference November 8, 2024 Exhibit 99.1

Regarding Forward-Looking and non-GAAP Financial Information This presentation is not intended as a full business or financial review and should be viewed in the context of all of the information made available by PNC in its SEC filings and on our corporate website. The presentation contains forward-looking statements regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations, including sustainability strategy. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix. We provide greater detail regarding these as well as other factors in our 2023 Form 10-K, our subsequent Form 10-Qs, and our other subsequent SEC filings. Our forward-looking statements may also be subject to risks and uncertainties including those we may discuss in this presentation or in our SEC filings. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake any obligation to update those statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. We include non-GAAP financial information in this presentation. Reconciliations for such financial information may be found in our presentation, in these slides, including the Appendix, in other materials on our corporate website, and in our SEC filings. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this information and the related reconciliations may be useful to investors, analysts, regulators and others to help understand and evaluate our financial results, and with respect to adjusted metrics, because we believe they better reflect the ongoing financial results and trends of our businesses and increase comparability of period-to-period results. We may also use annualized, pro forma, estimated or third party numbers for illustrative or comparative purposes only. These may not reflect actual results. References to our corporate website are to www.pnc.com under “About Us - Investor Relations.” Our SEC filings are available both on our corporate website and on the SEC’s website at www.sec.gov. We include web addresses here as inactive textual references only. Information on these websites is not part of this presentation. 2 Cautionary Statement

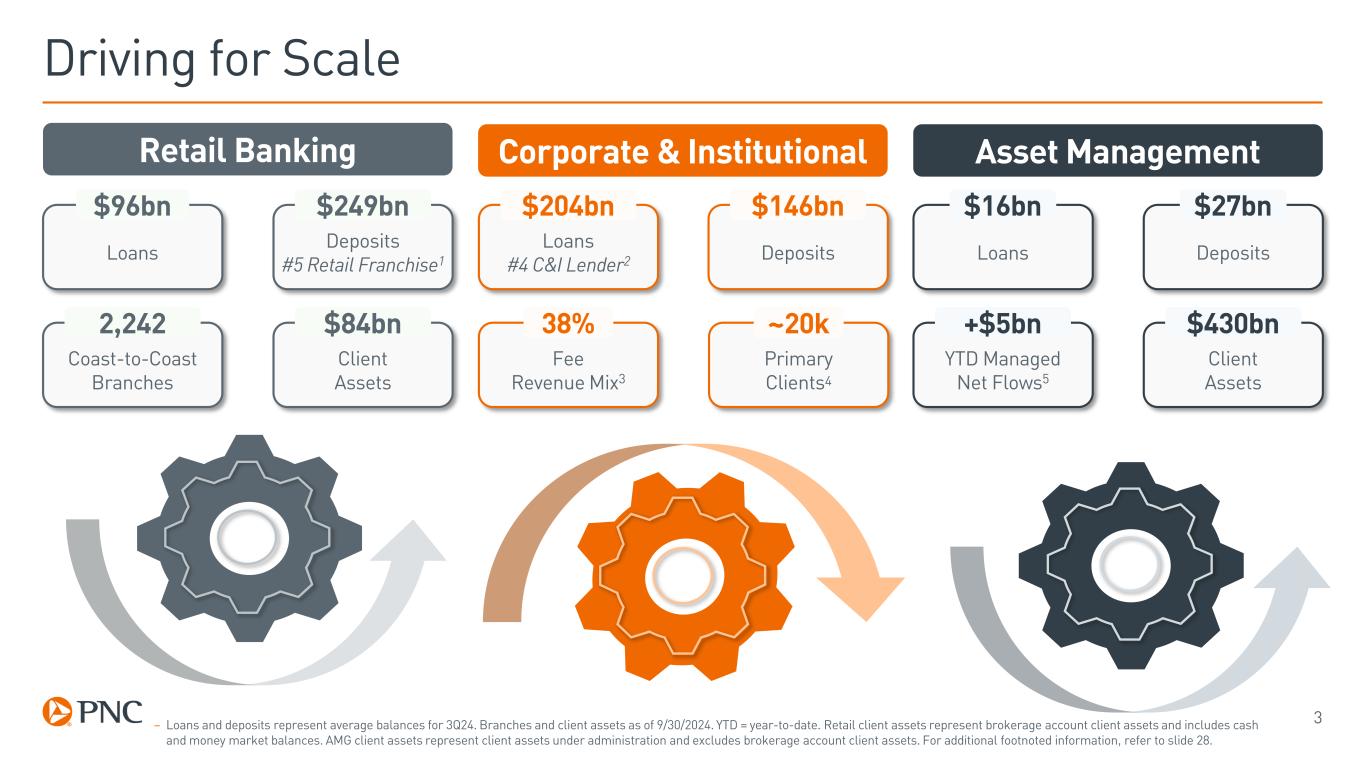

3 Driving for Scale Retail Banking Corporate & Institutional Asset Management Loans $96bn Deposits #5 Retail Franchise1 $249bn Client Assets $84bn Coast-to-Coast Branches 2,242 Loans #4 C&I Lender2 $204bn Deposits $146bn Fee Revenue Mix3 38% Loans $16bn Deposits $27bn Client Assets $430bn YTD Managed Net Flows5 +$5bn Primary Clients4 ~20k – Loans and deposits represent average balances for 3Q24. Branches and client assets as of 9/30/2024. YTD = year-to-date. Retail client assets represent brokerage account client assets and includes cash and money market balances. AMG client assets represent client assets under administration and excludes brokerage account client assets. For additional footnoted information, refer to slide 28.

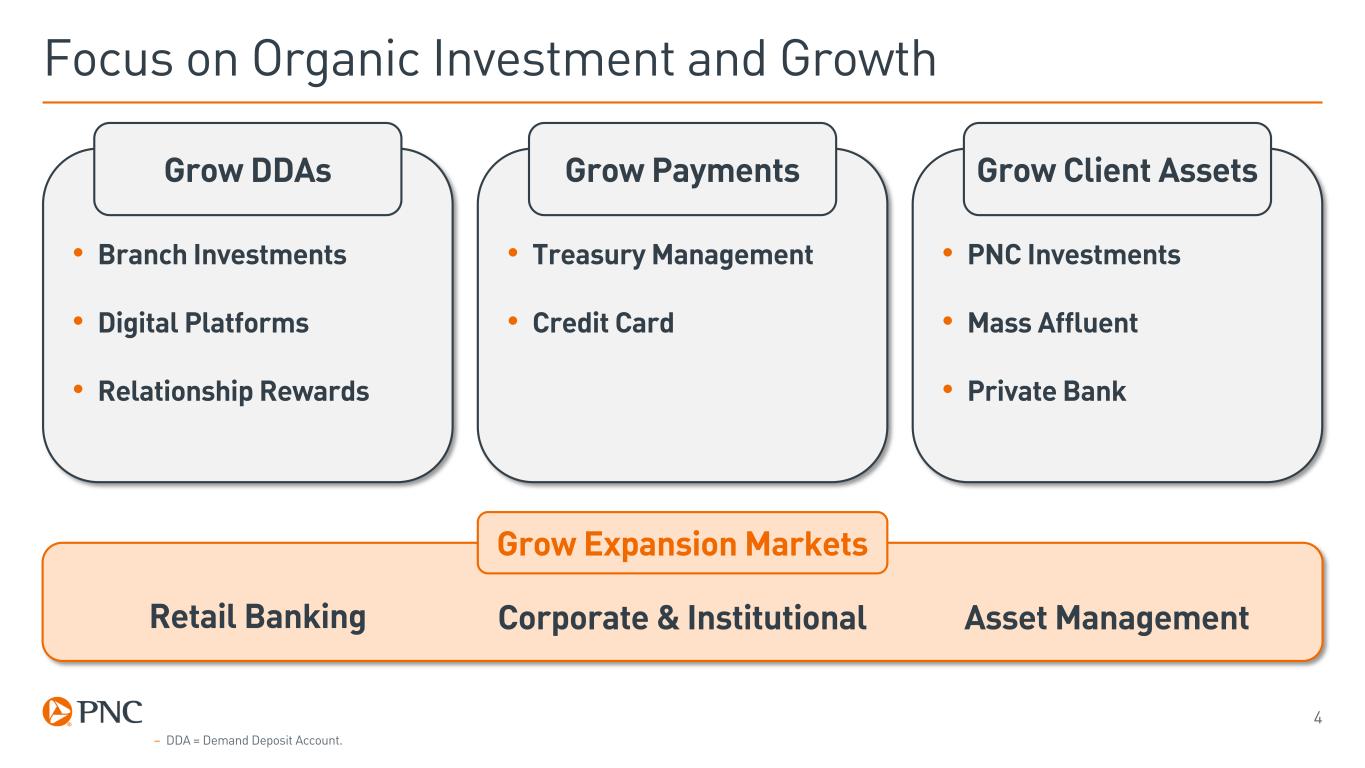

4 Focus on Organic Investment and Growth • Branch Investments • Digital Platforms • Relationship Rewards • Treasury Management • Credit Card • PNC Investments • Mass Affluent • Private Bank Grow DDAs Grow Payments Grow Client Assets Grow Expansion Markets – DDA = Demand Deposit Account. Retail Banking Corporate & Institutional Asset Management

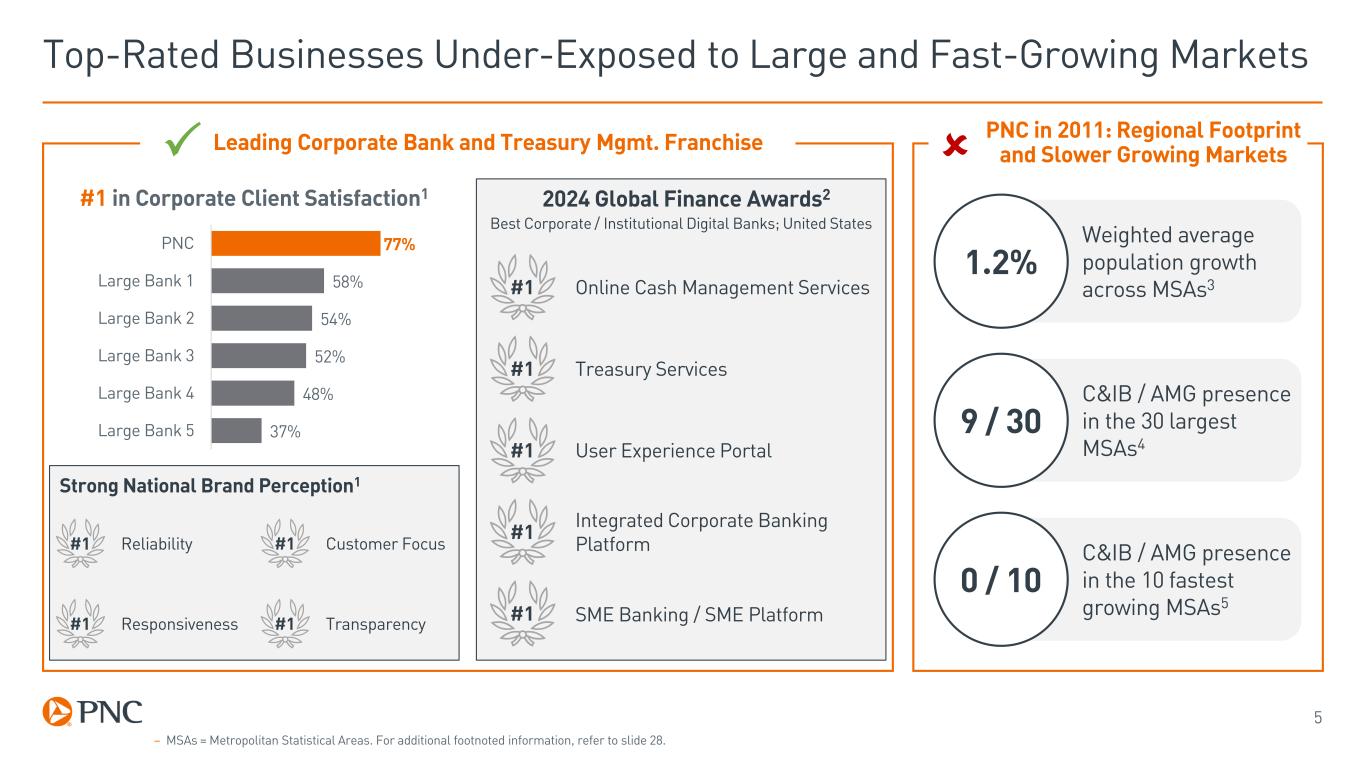

5 Top-Rated Businesses Under-Exposed to Large and Fast-Growing Markets 77% 58% 54% 52% 48% 37% PNC Large Bank 1 Large Bank 2 Large Bank 3 Large Bank 4 Large Bank 5 #1 in Corporate Client Satisfaction1 #1 #1 Reliability Responsiveness #1 #1 Customer Focus Transparency Strong National Brand Perception1 Weighted average population growth across MSAs3 1.2% C&IB / AMG presence in the 30 largest MSAs4 9 / 30 C&IB / AMG presence in the 10 fastest growing MSAs5 0 / 10 PNC in 2011: Regional Footprint and Slower Growing MarketsLeading Corporate Bank and Treasury Mgmt. Franchise – MSAs = Metropolitan Statistical Areas. For additional footnoted information, refer to slide 28. 2024 Global Finance Awards2 #1 Online Cash Management Services Treasury Services#1 User Experience Portal#1 Integrated Corporate Banking Platform#1 SME Banking / SME Platform#1 Best Corporate / Institutional Digital Banks; United States

6 Expanding Into Larger and Faster Growing Markets Bank / Branch Acquisitions Organic Market Build-Outs Seattle NashvilleKansas City Minneapolis Denver Las Vegas Phoenix Dallas Houston Boston Portland Successful Expansion Through Build Or Buy San Diego (Branch Acquisition)

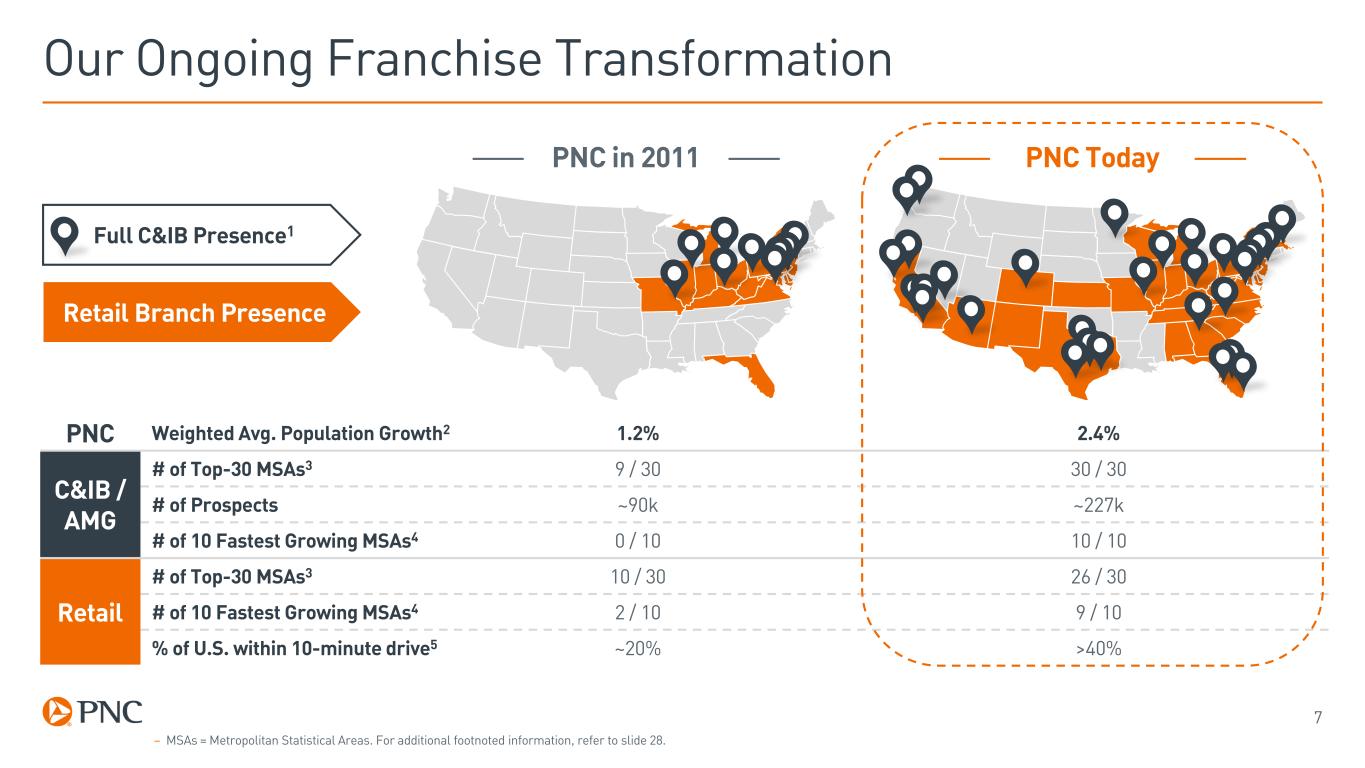

7 Our Ongoing Franchise Transformation PNC Weighted Avg. Population Growth2 1.2% 2.4% C&IB / AMG # of Top-30 MSAs3 9 / 30 30 / 30 # of Prospects ~90k ~227k # of 10 Fastest Growing MSAs4 0 / 10 10 / 10 Retail # of Top-30 MSAs3 10 / 30 26 / 30 # of 10 Fastest Growing MSAs4 2 / 10 9 / 10 % of U.S. within 10-minute drive5 ~20% >40% PNC in 2011 PNC Today Retail Branch Presence Full C&IB Presence1 – MSAs = Metropolitan Statistical Areas. For additional footnoted information, refer to slide 28.

8 PNC Expansion Markets – Current Profile Nashville Miami Dallas Austin Birmingham San Diego San Francisco Denver Building Our Brand in Expansion Markets – AUM = Assets under management. Average loans and average deposits as of 3Q24. AUM, branches and ATMs as of 9/30/2024. For definition of PNC Expansion Markets refer to definition 1 on slide 28. For additional footnoted information, refer to slide 29. Expansion Markets Overview $64 billion Average Loans (non-GAAP)1 $109 billion Average deposits (non-GAAP)1 $24 billion AUM (non-GAAP)2 ~930 Branches ~1,950 ATMs

9 Consistent Expansion Markets Playbook • Leverage Regional President model to become deeply entrenched in communities • Hire top local talent and combine with relocated PNC bankers • Retain client-facing top talent • Rigorous client selection and grow with the great ones • Drive value-added strategy • Build relationships, don’t just book loans • Deliver great service • Be patient, persistent and consistent

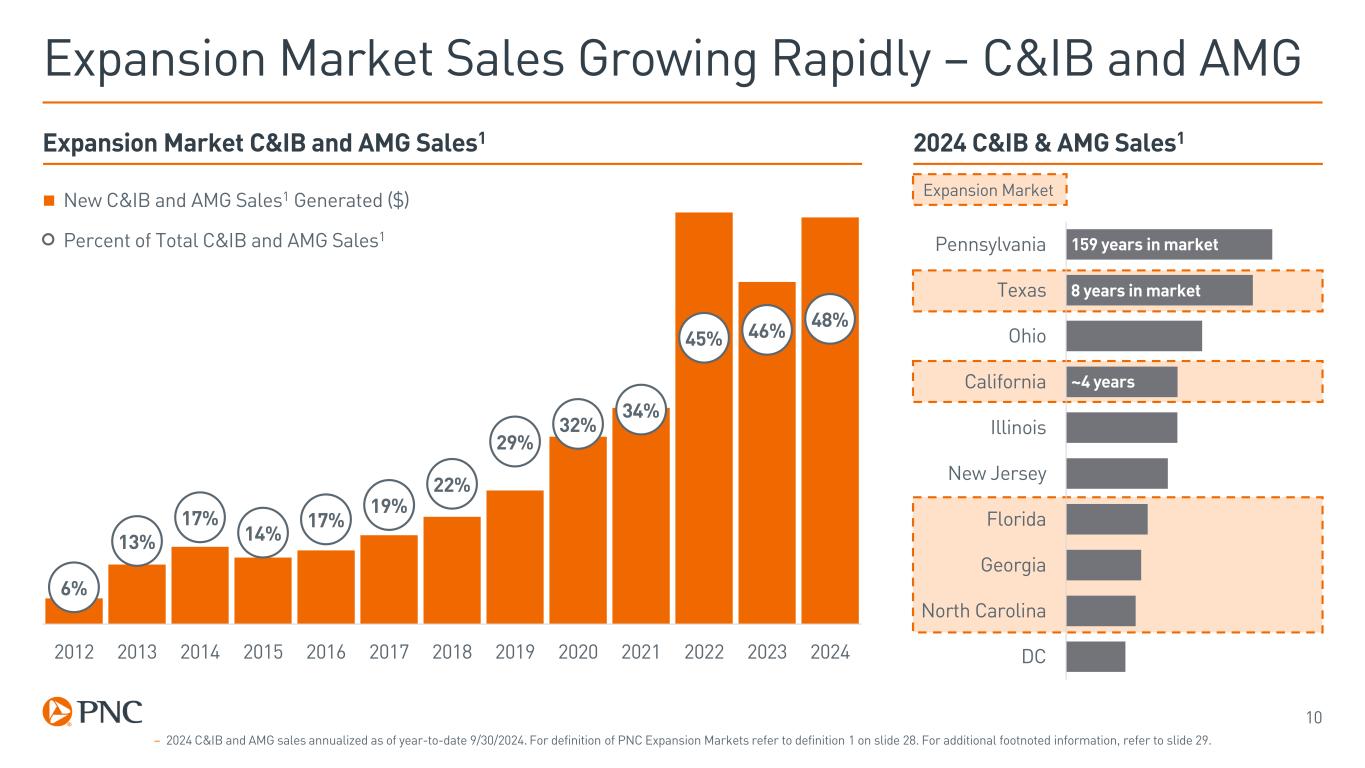

10 Expansion Market Sales Growing Rapidly – C&IB and AMG Expansion Market C&IB and AMG Sales1 2024 C&IB & AMG Sales1 48% 52% 6% 13% 17% 14% 17% 19% 22% 29% 32% 34% 45% 46% 48% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 – 2024 C&IB and AMG sales annualized as of year-to-date 9/30/2024. For definition of PNC Expansion Markets refer to definition 1 on slide 28. For additional footnoted information, refer to slide 29. Percent of Total C&IB and AMG Sales1 New C&IB and AMG Sales1 Generated ($) Pennsylvania Texas Ohio California Illinois New Jersey Florida Georgia North Carolina DC 8 years in market 159 years in market ~4 years Expansion Market

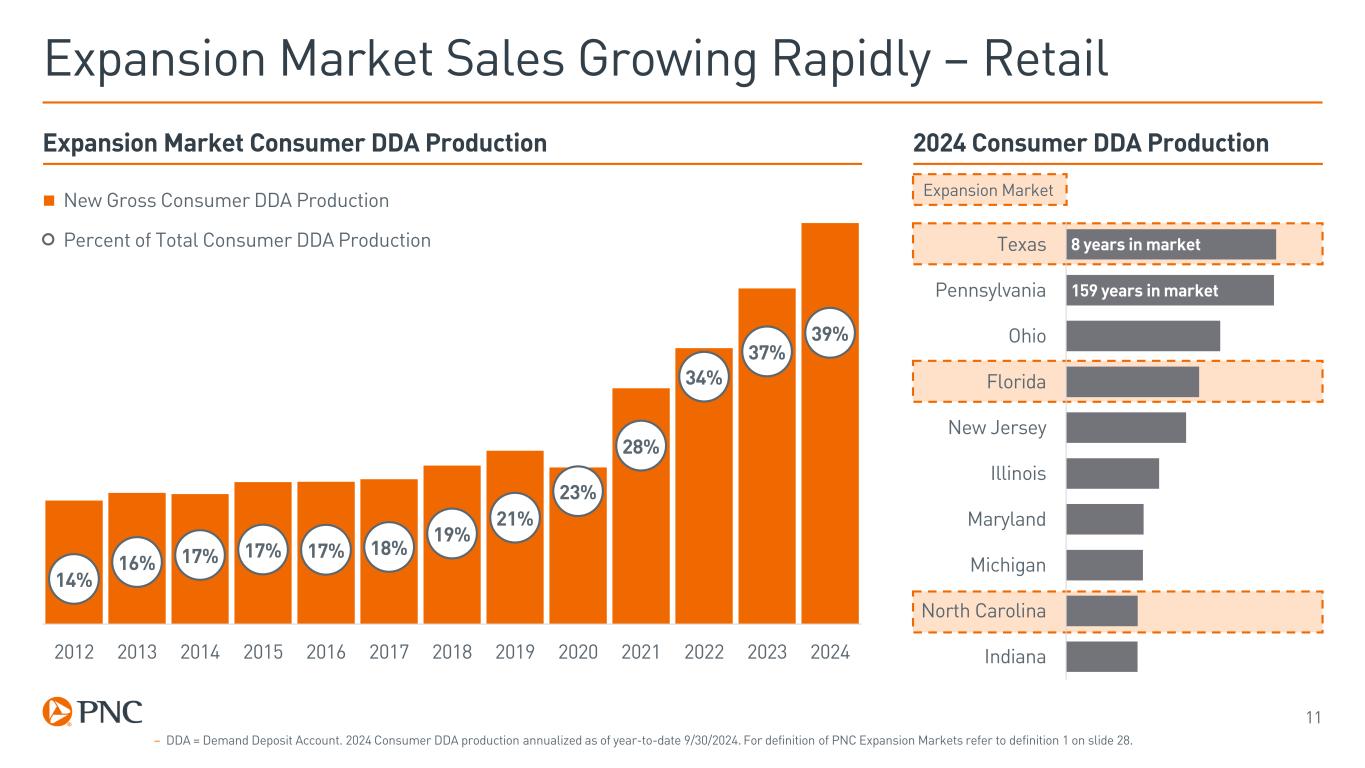

11 Expansion Market Sales Growing Rapidly – Retail Expansion Market Consumer DDA Production 2024 Consumer DDA Production 56% 14% 16% 17% 17% 17% 18% 19% 21% 23% 28% 34% 37% 39% 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 – DDA = Demand Deposit Account. 2024 Consumer DDA production annualized as of year-to-date 9/30/2024. For definition of PNC Expansion Markets refer to definition 1 on slide 28. Percent of Total Consumer DDA Production New Gross Consumer DDA Production Texas Pennsylvania Ohio Florida New Jersey Illinois Maryland Michigan North Carolina Indiana 159 years in market 8 years in market Expansion Market

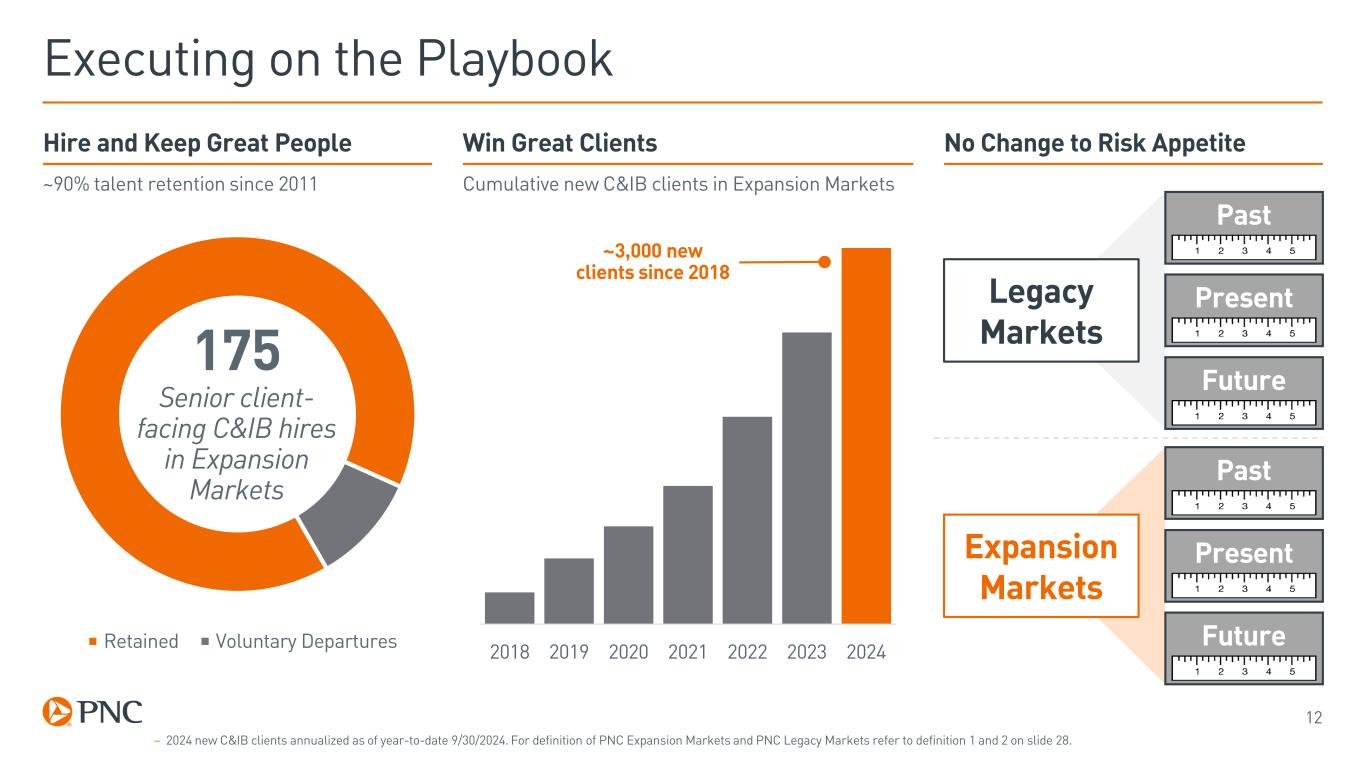

12 Executing on the Playbook No Change to Risk AppetiteHire and Keep Great People – 2024 new C&IB clients annualized as of year-to-date 9/30/2024. For definition of PNC Expansion Markets and PNC Legacy Markets refer to definition 1 and 2 on slide 28. ~90% talent retention since 2011 Retained Voluntary Departures 175 Senior client- facing C&IB hires in Expansion Markets 2018 2019 2020 2021 2022 2023 2024 Win Great Clients Cumulative new C&IB clients in Expansion Markets ~3,000 new clients since 2018 Past Present Future Legacy Markets Expansion Markets Past Present Future

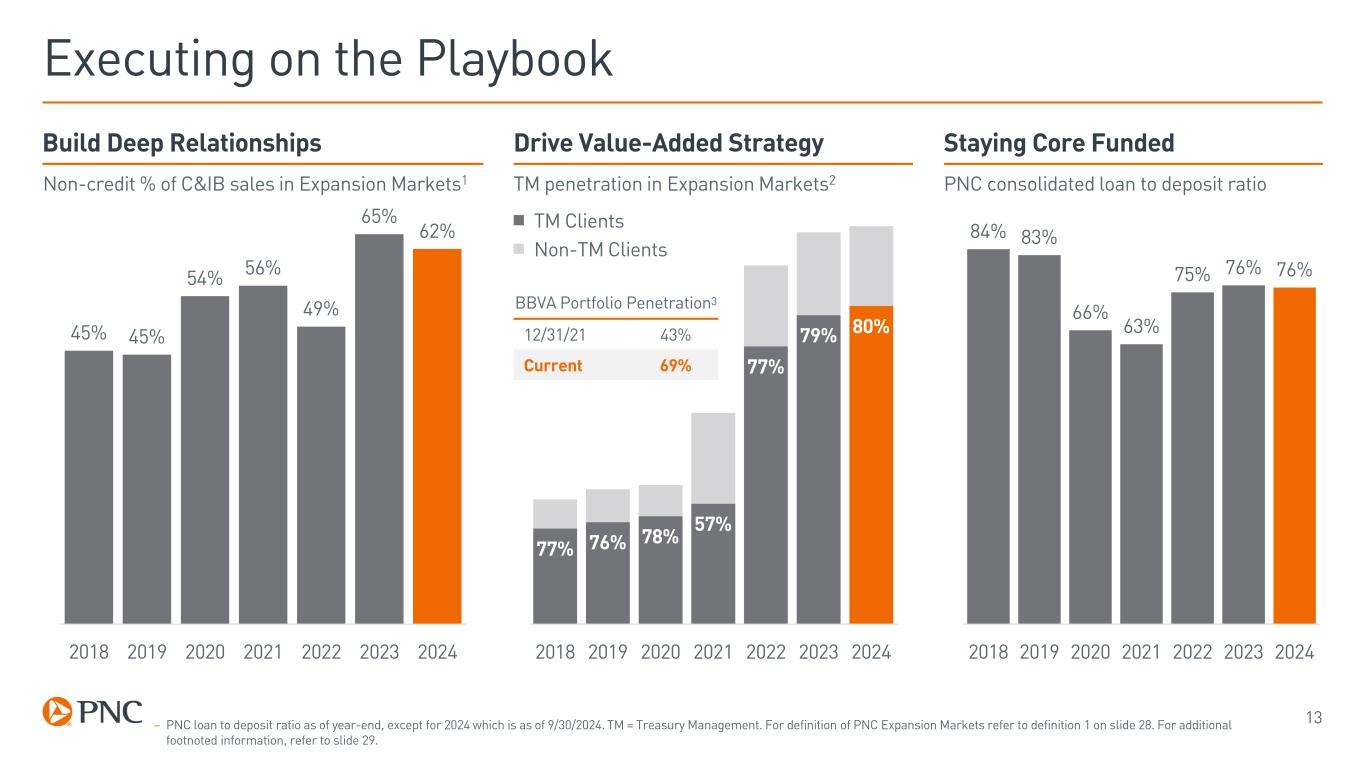

45% 45% 54% 56% 49% 65% 62% 2018 2019 2020 2021 2022 2023 2024 13 Executing on the Playbook Build Deep Relationships Non-credit % of C&IB sales in Expansion Markets1 77% 76% 78% 57% 77% 79% 80% 2018 2019 2020 2021 2022 2023 2024 Drive Value-Added Strategy TM penetration in Expansion Markets2 TM Clients Non-TM Clients BBVA Portfolio Penetration3 12/31/21 43% Current 69% Staying Core Funded – PNC loan to deposit ratio as of year-end, except for 2024 which is as of 9/30/2024. TM = Treasury Management. For definition of PNC Expansion Markets refer to definition 1 on slide 28. For additional footnoted information, refer to slide 29. 84% 83% 66% 63% 75% 76% 76% 2018 2019 2020 2021 2022 2023 2024 PNC consolidated loan to deposit ratio

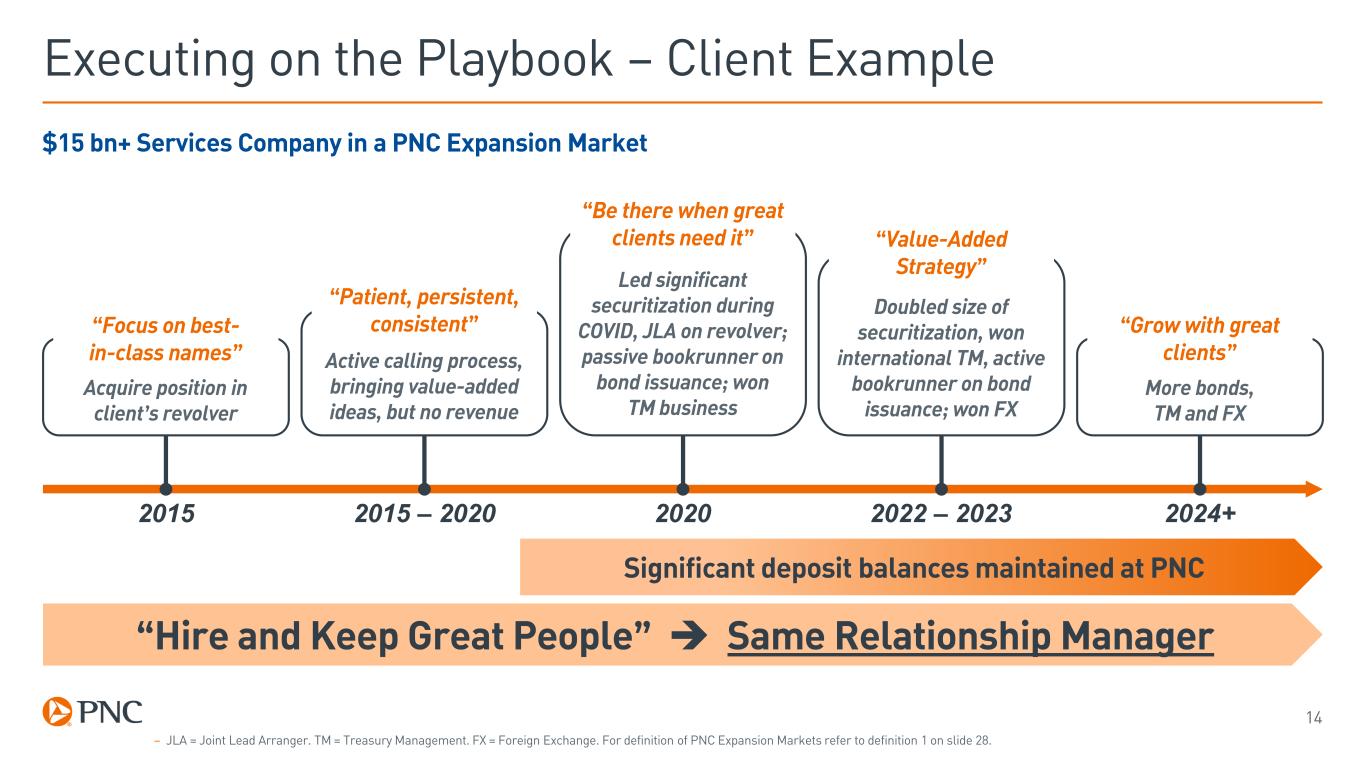

14 Executing on the Playbook – Client Example Active calling process, bringing value-added ideas, but no revenue “Patient, persistent, consistent” Led significant securitization during COVID, JLA on revolver; passive bookrunner on bond issuance; won TM business “Be there when great clients need it” More bonds, TM and FX “Grow with great clients” Acquire position in client’s revolver “Focus on best- in-class names” Doubled size of securitization, won international TM, active bookrunner on bond issuance; won FX “Value-Added Strategy” 2015 2015 – 2020 2020 2022 – 2023 2024+ “Hire and Keep Great People” Same Relationship Manager Significant deposit balances maintained at PNC $15 bn+ Services Company in a PNC Expansion Market – JLA = Joint Lead Arranger. TM = Treasury Management. FX = Foreign Exchange. For definition of PNC Expansion Markets refer to definition 1 on slide 28.

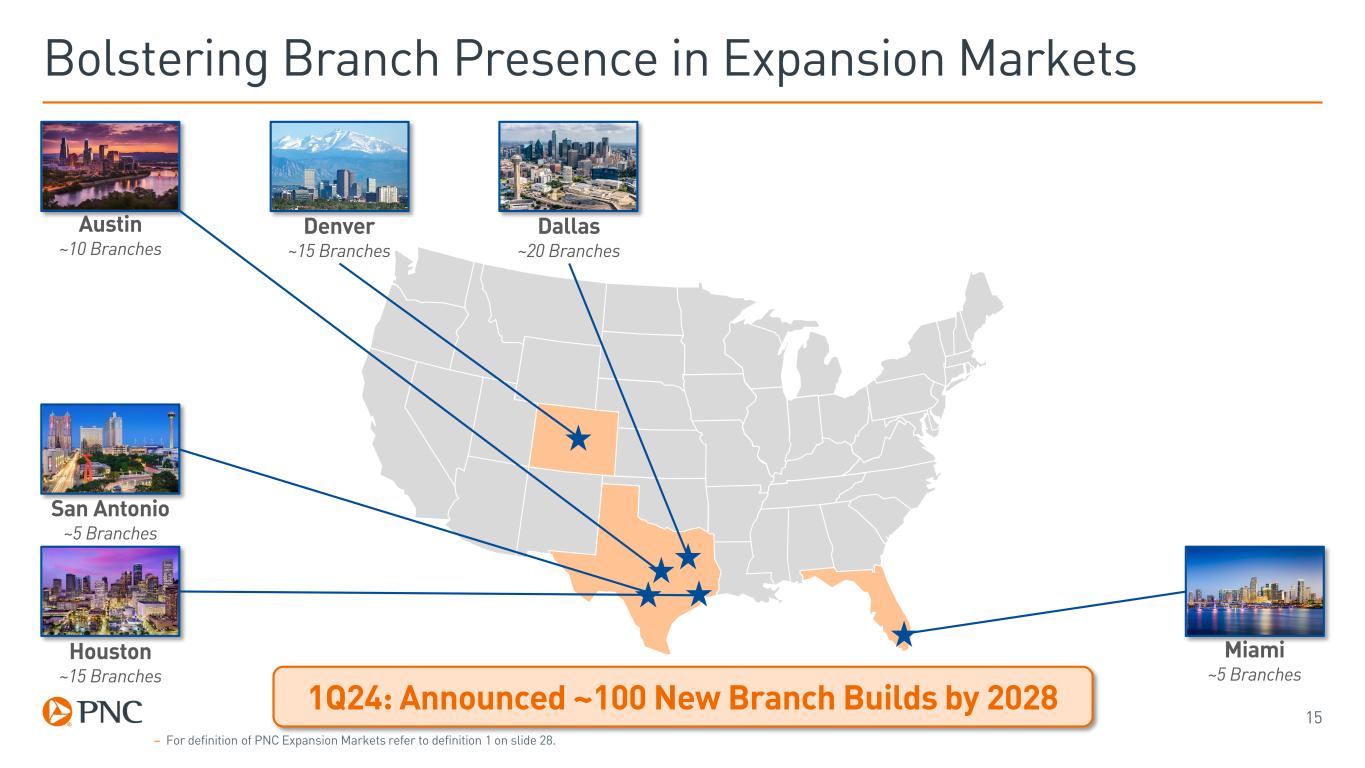

15 Bolstering Branch Presence in Expansion Markets Houston ~15 Branches San Antonio ~5 Branches Austin ~10 Branches Denver ~15 Branches Dallas ~20 Branches Miami ~5 Branches – For definition of PNC Expansion Markets refer to definition 1 on slide 28. 1Q24: Announced ~100 New Branch Builds by 2028

16 Bolstering Branch Presence in Expansion Markets Houston ~15 Branches San Antonio ~5 Branches Phoenix ~10 Branches Austin ~10 Branches Denver ~15 Branches Dallas ~20 Branches Atlanta ~25 Branches Charlotte ~25 Branches Raleigh ~10 Branches Orlando ~15 Branches Tampa ~20 Branches Today: Increasing New Branch Builds to >200 by 2029 Miami ~40 Branches – For definition of PNC Expansion Markets refer to definition 1 on slide 28.

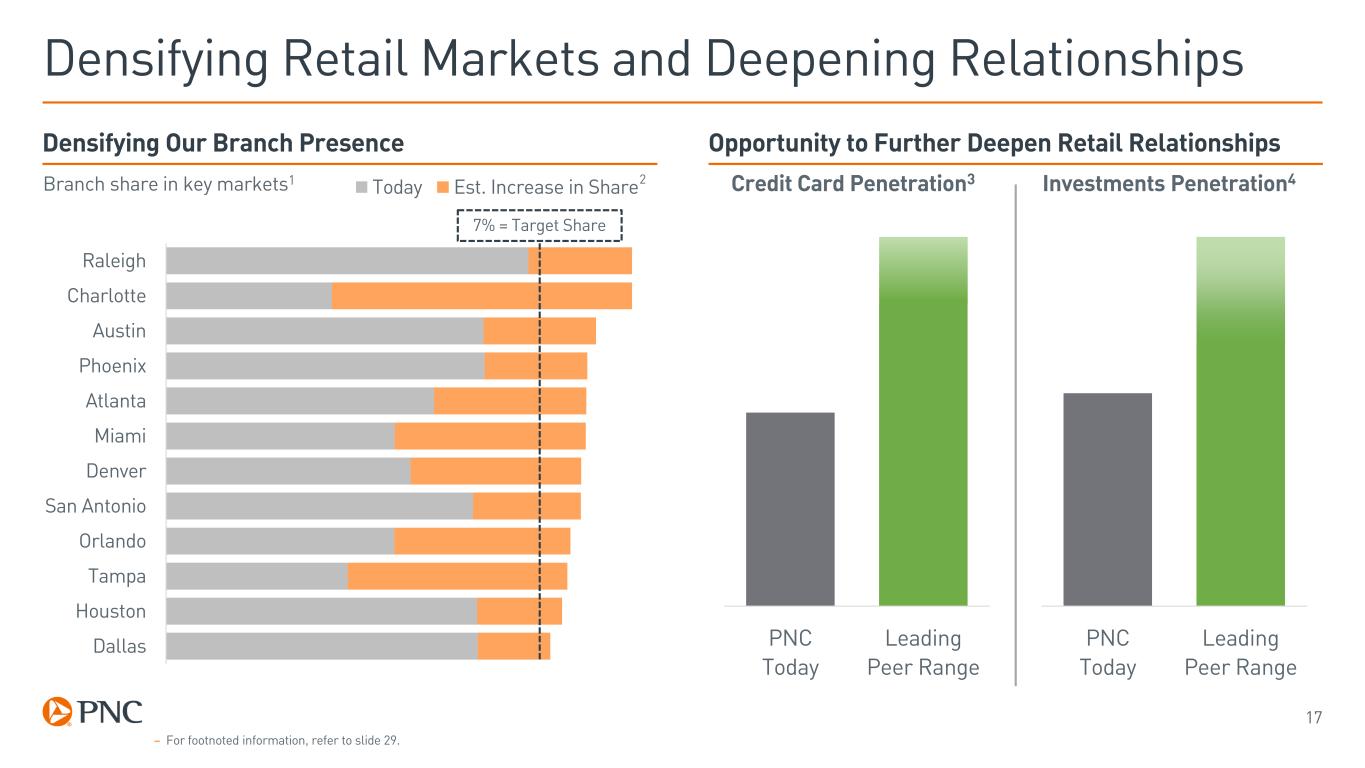

Dallas Houston Tampa Orlando San Antonio Denver Miami Atlanta Phoenix Austin Charlotte Raleigh Today Est. Increase in Share 17 Densifying Retail Markets and Deepening Relationships Densifying Our Branch Presence Opportunity to Further Deepen Retail Relationships Branch share in key markets1 – For footnoted information, refer to slide 29. PNC Today Leading Peer Range PNC Today Leading Peer Range Credit Card Penetration3 Investments Penetration42 7% = Target Share

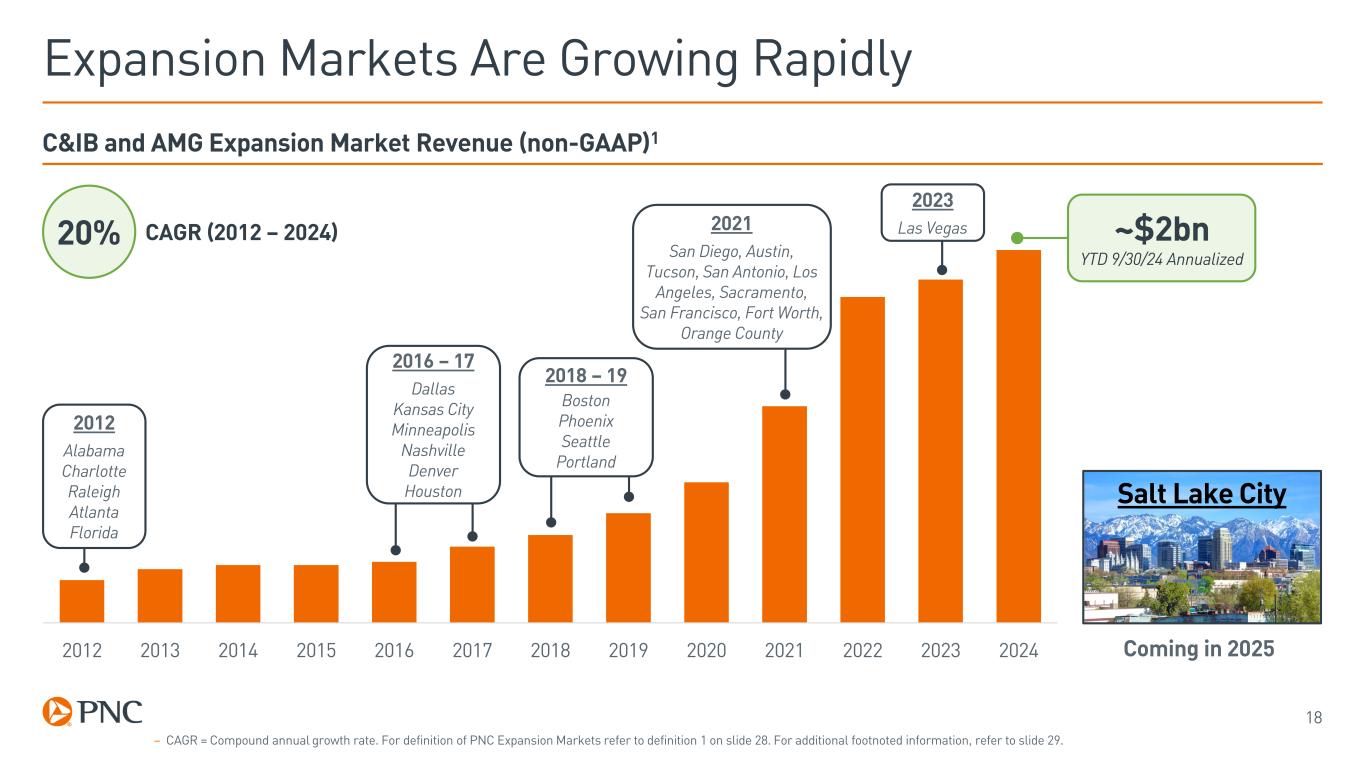

18 Expansion Markets Are Growing Rapidly 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2012 Alabama Charlotte Raleigh Atlanta Florida 2016 – 17 Dallas Kansas City Minneapolis Nashville Denver Houston 2021 San Diego, Austin, Tucson, San Antonio, Los Angeles, Sacramento, San Francisco, Fort Worth, Orange County 2023 Las Vegas 2018 – 19 Boston Phoenix Seattle Portland C&IB and AMG Expansion Market Revenue (non-GAAP)1 – CAGR = Compound annual growth rate. For definition of PNC Expansion Markets refer to definition 1 on slide 28. For additional footnoted information, refer to slide 29. Salt Lake City Coming in 2025 ~$2bn YTD 9/30/24 Annualized 20% CAGR (2012 – 2024)

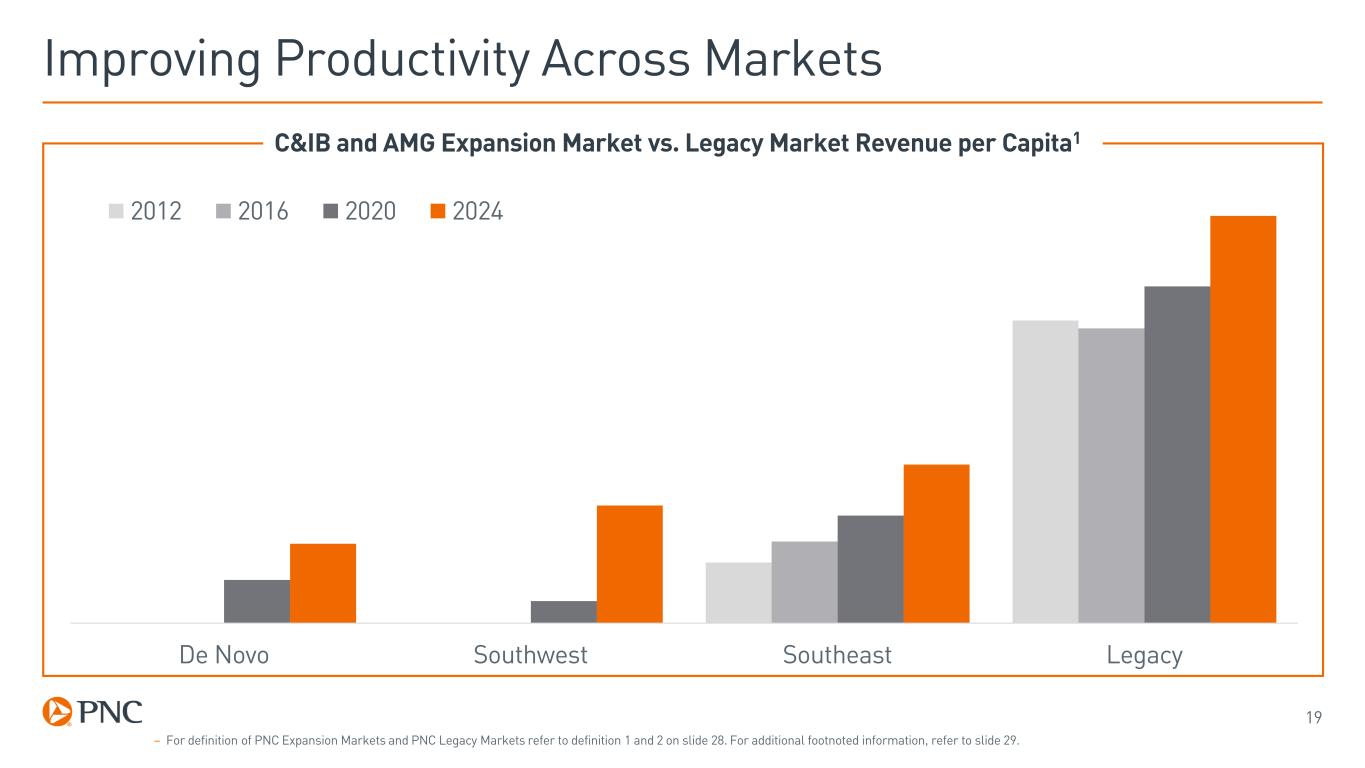

19 Improving Productivity Across Markets De Novo Southwest Southeast Legacy 2012 2016 2020 2024 C&IB and AMG Expansion Market vs. Legacy Market Revenue per Capita1 – For definition of PNC Expansion Markets and PNC Legacy Markets refer to definition 1 and 2 on slide 28. For additional footnoted information, refer to slide 29.

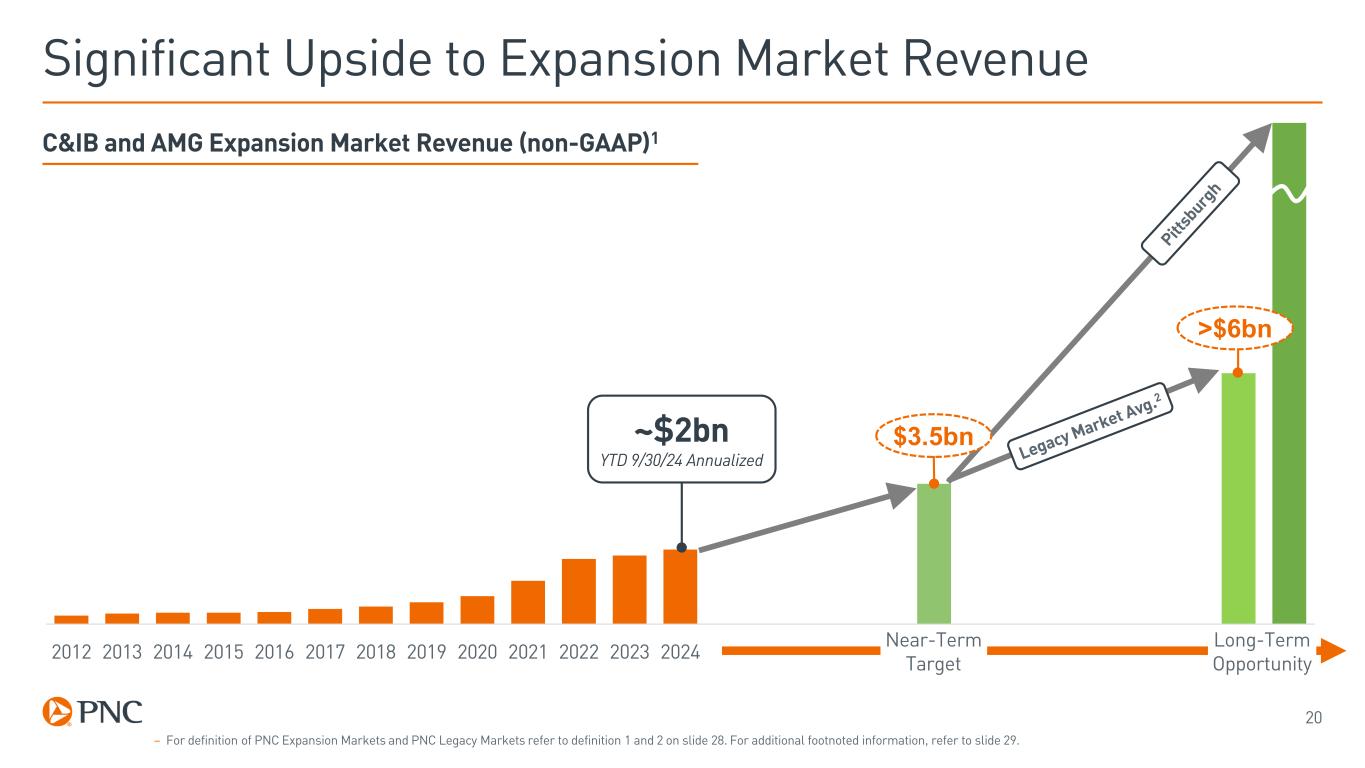

20 Significant Upside to Expansion Market Revenue 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Near-Term Target Long-Term Opportunity $3.5bn >$6bn – For definition of PNC Expansion Markets and PNC Legacy Markets refer to definition 1 and 2 on slide 28. For additional footnoted information, refer to slide 29. C&IB and AMG Expansion Market Revenue (non-GAAP)1 ~$2bn YTD 9/30/24 Annualized

21 National Expansion Key Takeaways Relatively Low Risk Organic Strategy with Attractive Returns Significant Incremental Organic Revenue Opportunity Accelerating Retail Expansion With Incremental Upside National Expansion Supports Sustained Long-Term Growth for PNC

Appendix: Cautionary Statement 22 Regarding Forward-Looking Information We make statements in this presentation, and we may from time to time make other statements, regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting us and our future business and operations, including our sustainability strategy, that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,” “estimate,” “goal,” “will,” “should” and other similar words and expressions. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements speak only as of the date made. We do not assume any duty and do not undertake any obligation to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. Our forward-looking statements are subject to the following principal risks and uncertainties. • Our businesses, financial results and balance sheet values are affected by business and economic conditions, including: − Changes in interest rates and valuations in debt, equity and other financial markets, − Disruptions in the U.S. and global financial markets, − Actions by the Federal Reserve Board, U.S. Treasury and other government agencies, including those that impact money supply, market interest rates and inflation, − Changes in customer behavior due to changing business and economic conditions or legislative or regulatory initiatives, − Changes in customers', suppliers' and other counterparties' performance and creditworthiness, − Impacts of sanctions, tariffs and other trade policies of the U.S. and its global trading partners, − Impacts of changes in federal, state and local governmental policy, including on the regulatory landscape, capital markets, taxes, infrastructure spending and social programs, − Our ability to attract, recruit and retain skilled employees, and − Commodity price volatility.

Appendix: Cautionary Statement 23 Regarding Forward-Looking Information • Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting. These statements are based on our views that: − Job and income gains will continue to support consumer spending growth in the near term, but PNC’s baseline forecast is for slower economic growth at the end of 2024 and in the first half of 2025 as high interest rates remain a drag on the economy. − Real GDP growth this year and next will be close to trend at around 2%, and the unemployment rate will remain somewhat above 4% through the rest of 2024 and in 2025. Inflation will continue to slow as wage pressures abate, gradually moving back to the Federal Reserve’s 2% long-term objective. − With slowing inflation PNC expects two additional federal funds rate cuts of 25 basis points each at the Federal Open Market Committee’s remaining meetings in 2024, with the rate ending this year in a range between 4.25% and 4.50%. PNC expects several federal funds rate cuts in 2025 as inflation continues to ease. • PNC's ability to take certain capital actions, including returning capital to shareholders, is subject to PNC meeting or exceeding minimum capital levels, including a stress capital buffer established by the Federal Reserve Board in connection with the Federal Reserve Board's Comprehensive Capital Analysis and Review (CCAR) process. • PNC's regulatory capital ratios in the future will depend on, among other things, PNC's financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of PNC's balance sheet. In addition, PNC's ability to determine, evaluate and forecast regulatory capital ratios, and to take actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent at least in part on the development, validation and regulatory review of related models and the reliability of and risks resulting from extensive use of such models. • Legal and regulatory developments could have an impact on our ability to operate our businesses, financial condition, results of operations, competitive position, reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business generation and retention, liquidity, funding, and ability to attract and retain employees. These developments could include: − Changes to laws and regulations, including changes affecting oversight of the financial services industry, changes in the enforcement and interpretation of such laws and regulations, and changes in accounting and reporting standards. − Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries resulting in monetary losses, costs, or alterations in our business practices, and potentially causing reputational harm to PNC. − Results of the regulatory examination and supervision process, including our failure to satisfy requirements of agreements with governmental agencies. − Costs associated with obtaining rights in intellectual property claimed by others and of adequacy of our intellectual property protection in general.

Appendix: Cautionary Statement 24 Regarding Forward-Looking Information • Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory capital and liquidity standards. • Our reputation and business and operating results may be affected by our ability to appropriately meet or address environmental, social or governance targets, goals, commitments or concerns that may arise. • We grow our business in part through acquisitions and new strategic initiatives. Risks and uncertainties include those presented by the nature of the business acquired and strategic initiative, including in some cases those associated with our entry into new businesses or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, the integration of the acquired businesses into PNC after closing or any failure to execute strategic or operational plans. • Competition can have an impact on customer acquisition, growth and retention and on credit spreads and product pricing, which can affect market share, deposits and revenues. Our ability to anticipate and respond to technological changes can also impact our ability to respond to customer needs and meet competitive demands. • Business and operating results can also be affected by widespread manmade, natural and other disasters (including severe weather events), health emergencies, dislocations, geopolitical instabilities or events, terrorist activities, system failures or disruptions, security breaches, cyberattacks, international hostilities, or other extraordinary events beyond PNC's control through impacts on the economy and financial markets generally or on us or our counterparties, customers or third-party vendors and service providers specifically. We provide greater detail regarding these as well as other factors in our 2023 Form 10-K and in our subsequent Form 10-Qs, including in the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments Notes of the Notes To Consolidated Financial Statements in those reports, and in our other subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss elsewhere in this news release or in our SEC filings, accessible on the SEC's website at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual references only. Information on these websites is not part of this document.

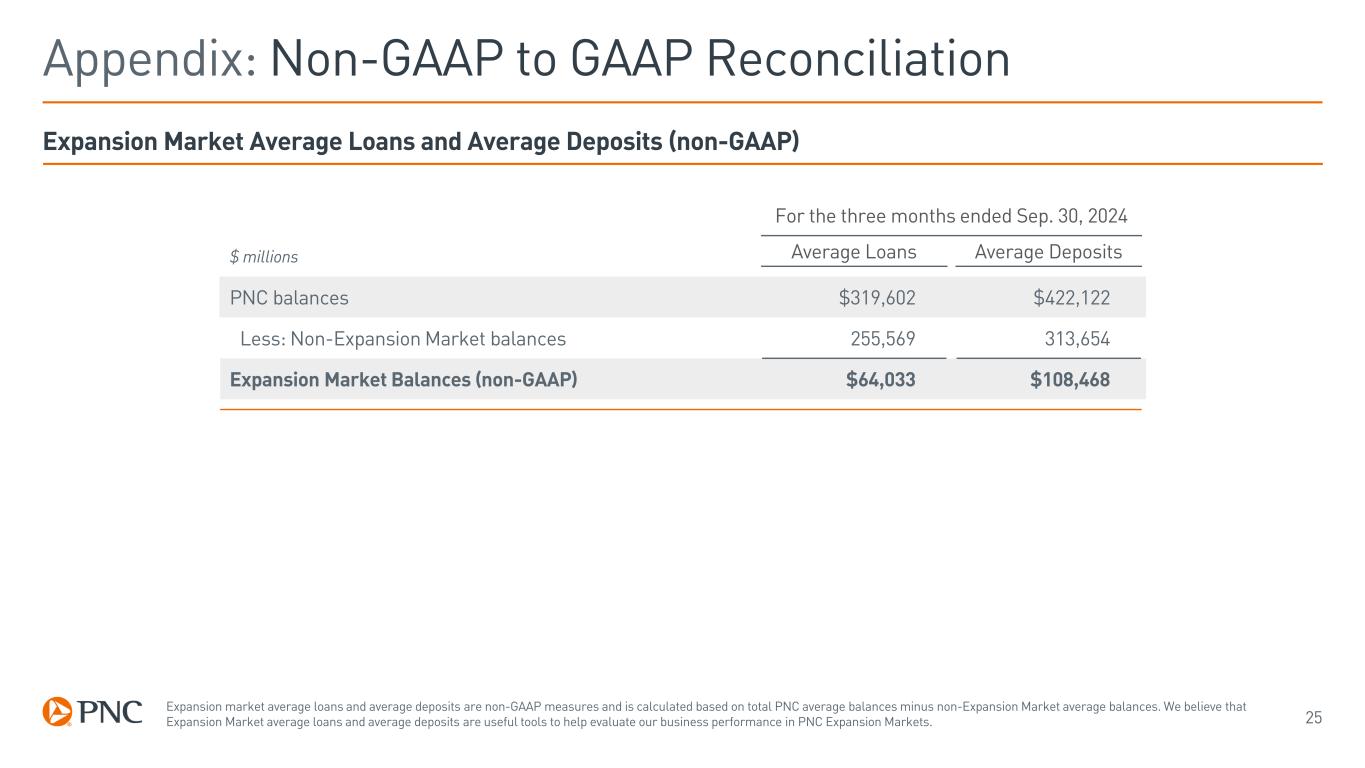

Appendix: Non-GAAP to GAAP Reconciliation 25 Expansion market average loans and average deposits are non-GAAP measures and is calculated based on total PNC average balances minus non-Expansion Market average balances. We believe that Expansion Market average loans and average deposits are useful tools to help evaluate our business performance in PNC Expansion Markets. Expansion Market Average Loans and Average Deposits (non-GAAP) For the three months ended Sep. 30, 2024 $ millions Average Loans Average Deposits PNC balances $319,602 $422,122 Less: Non-Expansion Market balances 255,569 313,654 Expansion Market Balances (non-GAAP) $64,033 $108,468

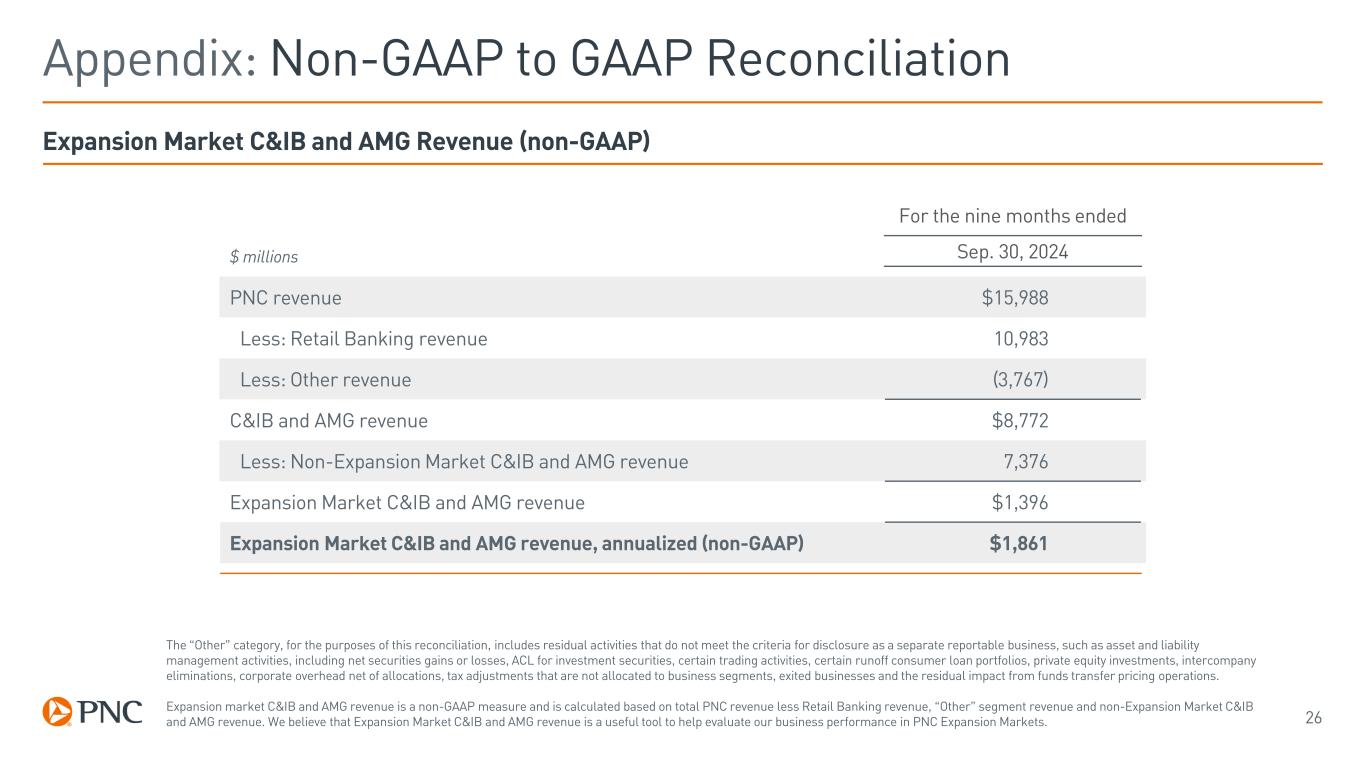

Appendix: Non-GAAP to GAAP Reconciliation 26 The “Other” category, for the purposes of this reconciliation, includes residual activities that do not meet the criteria for disclosure as a separate reportable business, such as asset and liability management activities, including net securities gains or losses, ACL for investment securities, certain trading activities, certain runoff consumer loan portfolios, private equity investments, intercompany eliminations, corporate overhead net of allocations, tax adjustments that are not allocated to business segments, exited businesses and the residual impact from funds transfer pricing operations. Expansion market C&IB and AMG revenue is a non-GAAP measure and is calculated based on total PNC revenue less Retail Banking revenue, “Other” segment revenue and non-Expansion Market C&IB and AMG revenue. We believe that Expansion Market C&IB and AMG revenue is a useful tool to help evaluate our business performance in PNC Expansion Markets. Expansion Market C&IB and AMG Revenue (non-GAAP) For the nine months ended $ millions Sep. 30, 2024 PNC revenue $15,988 Less: Retail Banking revenue 10,983 Less: Other revenue (3,767) C&IB and AMG revenue $8,772 Less: Non-Expansion Market C&IB and AMG revenue 7,376 Expansion Market C&IB and AMG revenue $1,396 Expansion Market C&IB and AMG revenue, annualized (non-GAAP) $1,861

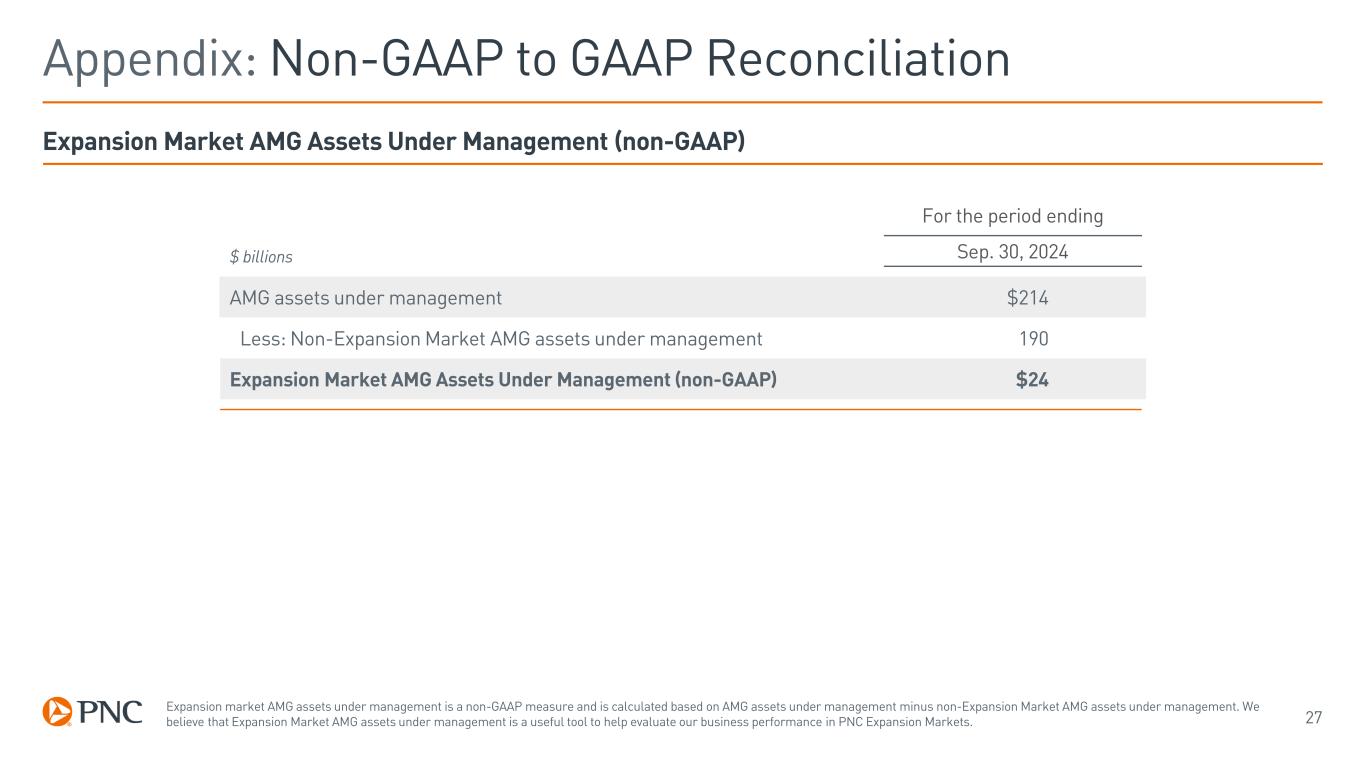

Appendix: Non-GAAP to GAAP Reconciliation 27 Expansion market AMG assets under management is a non-GAAP measure and is calculated based on AMG assets under management minus non-Expansion Market AMG assets under management. We believe that Expansion Market AMG assets under management is a useful tool to help evaluate our business performance in PNC Expansion Markets. Expansion Market AMG Assets Under Management (non-GAAP) For the period ending $ billions Sep. 30, 2024 AMG assets under management $214 Less: Non-Expansion Market AMG assets under management 190 Expansion Market AMG Assets Under Management (non-GAAP) $24

Footnotes and Definitions Definitions 1. PNC Expansion Markets: refer collectively to PNC’s Southeast, Southwest and De Novo markets, excluding the business operations of PNC’s national businesses. Southeast markets include PNC markets in the states of Florida, Georgia, North Carolina and South Carolina. These markets were acquired or heavily influenced by the BankAtlantic branch and RBC Bank (USA) acquisitions of 2011 and 2012, respectively. Southwest markets include PNC markets in the states of Alabama, Arizona, California, Colorado, Nevada, New Mexico and Texas. These markets were acquired or heavily influenced by the BBVA USA acquisition in 2021. De Novo markets include PNC markets in the states of Massachusetts, Minnesota, Oregon, Tennessee, Washington, Kansas and for C&IB and AMG only, the metropolitan statistical area of Kansas City. De Novo markets reflect markets that PNC has opened organically since 2012 and are otherwise not included in the Southeast or Southwest markets. PNC’s national businesses include PNC Business Credit, PNC Real Estate, PNC Asset Backed Finance, PNC’s advisory businesses and PNC’s Residential Mortgage business 2. PNC Legacy Markets: refer to all PNC markets not included in the definition of PNC Expansion Markets and also exclude PNC’s national businesses. Legacy markets include PNC markets in the states of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, Missouri, New Jersey, New York, Ohio, Pennsylvania, Virginia, West Virginia, Wisconsin, and the District of Columbia. Legacy markets exclude C&IB and AMG presences in the metropolitan statistical area of Kansas City. Refer to footnote 1 on slide 8 for the definition of PNC’s national businesses. Slide 3 - Driving for Scale 1. Source: FDIC 2024 Summary of Deposits per S&P Global Market Intelligence; applies a $500 million deposit cap to PNC and industry branches; includes all commercial banks, savings banks and savings institutions as defined by the FDIC. 2. Source: Company call reports. Ranking based on commercial and industrial loans outstanding as of 6/30/2024 for the top 100 U.S. commercial banks. 3. C&IB fee revenue represents C&IB noninterest income as a percentage of total C&IB revenue for the year-to-date period ending 9/30/2024. 4. Primary clients represent clients in C&IB’s Commercial Banking, Public Finance and all other C&IB businesses with trailing twelve-month revenue of at least $10k, $25k and $50k, respectively. 5. YTD managed net flows represents the change in AMG assets under management for the year-to-date period ending 9/30/2024, excluding market impacts. Slide 5 - Top-Rated Businesses Under-Exposed to Large and Fast-Growing Markets 1. Source: Barlow Research Associates, Inc. 2024 Middle Market Banking Annual Report as of August 2024. 2. Source: Global Finance 2024 World’s Best Corporate / Institutional Digital Bank Awards in North America by Regional Sub-category. 3. Source: PNC historical estimates. 4. Source: S&P Global Market Intelligence. 30 largest MSAs represent top-30 MSAs ranked by 2024 population. 5. Source: S&P Global Market Intelligence. 10 fastest growing MSAs represents the 10 MSAs with the highest estimated population growth from 2024 to 2029, within the 30 largest MSAs by population as of 2024. Slide 7 - Our Ongoing Franchise Transformation 1. Full C&IB Presence reflects the top-30 MSAs by 2024 population in which PNC has a physical presence with a Regional President and provides a complete set of products and services. 2. Source: S&P Global Market Intelligence and PNC historical estimates. Weighted Average Population Growth for PNC in 2011 based on PNC historical estimates. Weighted Average Population Growth for PNC Today sourced from S&P Global Market Intelligence and reflects estimated population growth from 2024 to 2029 in MSAs with a PNC branch presence as of 6/30/2024, weighted by PNC’s branch count in each MSA as of 6/30/2024. 3. Source: S&P Global Market Intelligence. Top-30 MSAs represent top-30 MSAs ranked by 2024 population. 4. Source: S&P Global Market Intelligence. 10 fastest growing MSAs represents the 10 MSAs with the highest estimated population growth from 2024 to 2029, within the Top-30 MSAs by population as of 2024. 5. Based on PNC estimates. 10-minute drive calculated as percentage of the U.S. Population who live within a 10-minute drive of the nearest PNC branch location. Drive time is calculated using Environmental Systems Research Institute, Inc. (ESRI) based on current street networks and traffic volumes. Includes all individuals in the same census block group if any part of the group is within the 10-minute drive time. 28

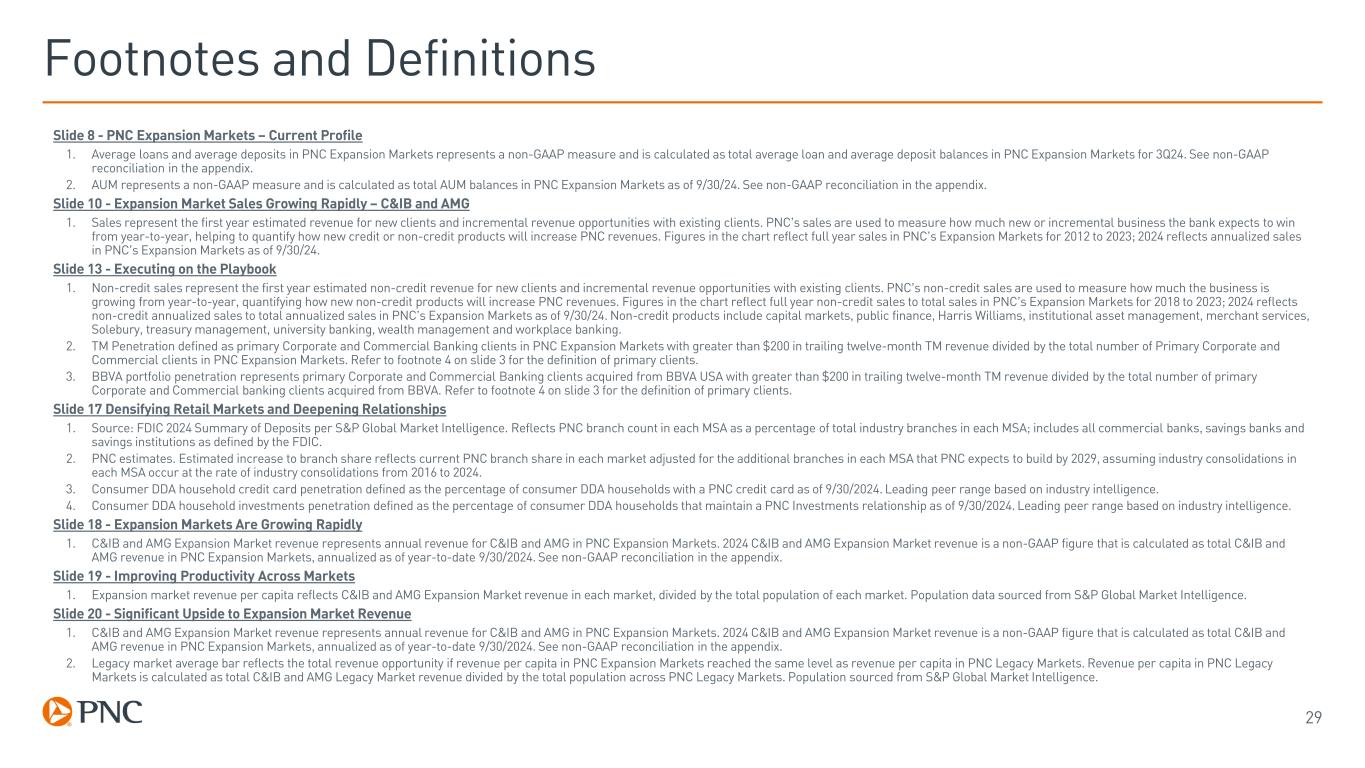

Footnotes and Definitions Slide 8 - PNC Expansion Markets – Current Profile 1. Average loans and average deposits in PNC Expansion Markets represents a non-GAAP measure and is calculated as total average loan and average deposit balances in PNC Expansion Markets for 3Q24. See non-GAAP reconciliation in the appendix. 2. AUM represents a non-GAAP measure and is calculated as total AUM balances in PNC Expansion Markets as of 9/30/24. See non-GAAP reconciliation in the appendix. Slide 10 - Expansion Market Sales Growing Rapidly – C&IB and AMG 1. Sales represent the first year estimated revenue for new clients and incremental revenue opportunities with existing clients. PNC’s sales are used to measure how much new or incremental business the bank expects to win from year-to-year, helping to quantify how new credit or non-credit products will increase PNC revenues. Figures in the chart reflect full year sales in PNC’s Expansion Markets for 2012 to 2023; 2024 reflects annualized sales in PNC’s Expansion Markets as of 9/30/24. Slide 13 - Executing on the Playbook 1. Non-credit sales represent the first year estimated non-credit revenue for new clients and incremental revenue opportunities with existing clients. PNC’s non-credit sales are used to measure how much the business is growing from year-to-year, quantifying how new non-credit products will increase PNC revenues. Figures in the chart reflect full year non-credit sales to total sales in PNC’s Expansion Markets for 2018 to 2023; 2024 reflects non-credit annualized sales to total annualized sales in PNC’s Expansion Markets as of 9/30/24. Non-credit products include capital markets, public finance, Harris Williams, institutional asset management, merchant services, Solebury, treasury management, university banking, wealth management and workplace banking. 2. TM Penetration defined as primary Corporate and Commercial Banking clients in PNC Expansion Markets with greater than $200 in trailing twelve-month TM revenue divided by the total number of Primary Corporate and Commercial clients in PNC Expansion Markets. Refer to footnote 4 on slide 3 for the definition of primary clients. 3. BBVA portfolio penetration represents primary Corporate and Commercial Banking clients acquired from BBVA USA with greater than $200 in trailing twelve-month TM revenue divided by the total number of primary Corporate and Commercial banking clients acquired from BBVA. Refer to footnote 4 on slide 3 for the definition of primary clients. Slide 17 Densifying Retail Markets and Deepening Relationships 1. Source: FDIC 2024 Summary of Deposits per S&P Global Market Intelligence. Reflects PNC branch count in each MSA as a percentage of total industry branches in each MSA; includes all commercial banks, savings banks and savings institutions as defined by the FDIC. 2. PNC estimates. Estimated increase to branch share reflects current PNC branch share in each market adjusted for the additional branches in each MSA that PNC expects to build by 2029, assuming industry consolidations in each MSA occur at the rate of industry consolidations from 2016 to 2024. 3. Consumer DDA household credit card penetration defined as the percentage of consumer DDA households with a PNC credit card as of 9/30/2024. Leading peer range based on industry intelligence. 4. Consumer DDA household investments penetration defined as the percentage of consumer DDA households that maintain a PNC Investments relationship as of 9/30/2024. Leading peer range based on industry intelligence. Slide 18 - Expansion Markets Are Growing Rapidly 1. C&IB and AMG Expansion Market revenue represents annual revenue for C&IB and AMG in PNC Expansion Markets. 2024 C&IB and AMG Expansion Market revenue is a non-GAAP figure that is calculated as total C&IB and AMG revenue in PNC Expansion Markets, annualized as of year-to-date 9/30/2024. See non-GAAP reconciliation in the appendix. Slide 19 - Improving Productivity Across Markets 1. Expansion market revenue per capita reflects C&IB and AMG Expansion Market revenue in each market, divided by the total population of each market. Population data sourced from S&P Global Market Intelligence. Slide 20 - Significant Upside to Expansion Market Revenue 1. C&IB and AMG Expansion Market revenue represents annual revenue for C&IB and AMG in PNC Expansion Markets. 2024 C&IB and AMG Expansion Market revenue is a non-GAAP figure that is calculated as total C&IB and AMG revenue in PNC Expansion Markets, annualized as of year-to-date 9/30/2024. See non-GAAP reconciliation in the appendix. 2. Legacy market average bar reflects the total revenue opportunity if revenue per capita in PNC Expansion Markets reached the same level as revenue per capita in PNC Legacy Markets. Revenue per capita in PNC Legacy Markets is calculated as total C&IB and AMG Legacy Market revenue divided by the total population across PNC Legacy Markets. Population sourced from S&P Global Market Intelligence. 29