EX-4.14

Published on February 21, 2024

Exhibit 4.14 DESCRIPTION OF THE REGISTRANT’S SECURITIES REGISTERED PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 In this Exhibit 4.11, when we refer to “PNC,” “we,” “us,” or “our” or when we otherwise refer to ourselves, we mean The PNC Financial Services Group, Inc., excluding, unless otherwise expressly stated or the context requires, our subsidiaries. We have two classes of securities registered under Section 12 of the Securities Exchange Act of 1934, as amended (the “Act”): (1) our Common Stock; and (2) $1.80 Cumulative Convertible Preferred Stock - Series B, par value $1.00. DESCRIPTION OF COMMON STOCK General We are authorized to issue 800,000,000 shares of our common stock, par value $5.00 per share. The following summary is not complete. You should refer to the applicable provisions of the following for a complete statement of the terms and rights of the common stock: • Our Amended and Restated Articles of Incorporation (the “Articles of Incorporation”), which you can find as Exhibit 3.1 to our Annual Report on Form 10-K for the year ended December 31, 2008, including the statements with respect to shares pursuant to which certain outstanding series of preferred stock were issued, • an amendment to the Articles of Incorporation, which you can find as Exhibit 3.1.6 to our Current Report on Form 8-K filed November 20, 2015, • the statement with respect to shares governing our Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series O, which you can find as Exhibit 3.1 to our Current Report on Form 8-K filed July 27, 2011, • the statement with respect to shares governing our Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series P, which you can find as Exhibit 3.1 to our Current Report on Form 8-K filed April 24, 2012, • the statement with respect to shares governing our 5.375% Non-Cumulative Perpetual Preferred Stock, Series Q, which you can find as Exhibit 3.1 to our Current Report on Form 8-K filed September 21, 2012, • the statement with respect to shares governing our Non-Cumulative Perpetual Preferred Stock, Series R, which you can find as Exhibit 3.1 to our Current Report on Form 8-K filed May 7, 2013, • the statement with respect to shares governing our Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series S, which you can find as Exhibit 3.1 to our Current Report on Form 8-K filed November 1, 2016, • the statement with respect to shares governing our 3.400% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series T, which you can find as Exhibit 3.1 to our Current Report on Form 8-K filed September 13, 2021, • the statement with respect to shares governing our 6.000% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series U, which you can find as Exhibit 3.1 to our Current Report on Form 8-K filed April 26, 2022,

2 • the statement with respect to shares governing our 6.200% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series V, which you can find as Exhibit 3.1 to our Current Report on Form 8-K filed August 19, 2022, • the statement with respect to shares governing our 6.250% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series W, which you can find as Exhibit 3.1 to our Current Report on Form 8-K filed February 7, 2023, and • the Pennsylvania Business Corporation Law (the “PBCL”). Holders of common stock are entitled to one vote per share on all matters submitted to shareholders. Holders of common stock have neither cumulative voting rights nor any preemptive rights for the purchase of additional shares of any class of our stock, and are not subject to liability for further calls or assessments. The common stock does not have any sinking fund, conversion or redemption provisions. In the event of dissolution or winding up of our affairs, holders of common stock will be entitled to share ratably in all assets remaining after payments to all creditors and payments required to be made in respect of outstanding preferred stock (including accrued and unpaid dividends thereon) have been made. The Board may, except as otherwise required by applicable law or the rules of the NYSE, cause the issuance of authorized shares of common stock without shareholder approval to such persons and for such consideration as the Board may determine in connection with acquisitions by us or for other corporate purposes. Computershare Trust Company, N.A., Canton, MA, is the transfer agent and registrar for our common stock. The shares of common stock are listed on the NYSE under the symbol “PNC.” The outstanding shares of common stock are validly issued, fully paid and nonassessable, and the holders of the common stock are not subject to any liability as shareholders. Dividends and Other Payments Holders of our common stock are only entitled to receive such dividends as the Board or a duly authorized committee thereof may declare out of funds legally available for such payments. The payment of future dividends is subject to the discretion of the Board, which will consider, among other factors, economic and market conditions, our financial condition and operating results, and other factors, including contractual restrictions and applicable government regulations and policies (such as those relating to the ability of bank and non-bank subsidiaries to pay dividends to the parent company and regulatory capital limitations). The amount of our dividends is also currently subject to the results of the supervisory assessment of capital adequacy and capital planning processes undertaken by the Board of Governors of the Federal Reserve System (the “Federal Reserve”) and our primary bank regulator as part of the Federal Reserve’s Comprehensive Capital Analysis and Review process. The Federal Reserve has the power to prohibit us from paying dividends without its approval. We are incorporated in Pennsylvania and governed by the PBCL. Under the PBCL, we cannot pay dividends if, after giving effect to the dividend payments, we would be unable to pay our debts as they become due in the usual course of our business or our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time as of which the dividend is measured, to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving the dividends. Subject to certain important exceptions, the terms of certain of our outstanding series of preferred stock and capital securities prohibit us from declaring or paying dividends or distributions on or redeeming, purchasing, acquiring or making a liquidation payment with respect to our common stock unless all accrued and unpaid dividends for all completed dividend periods with respect to such preferred stock or capital security, as applicable, have been paid.

3 In addition, we have outstanding junior subordinated debentures associated with certain capital securities, the terms of which permit us to defer interest payments on the debentures for up to five years. At any time when we have deferred interest payments on these debentures or if we are aware of any event that would be an event of default under the indenture governing those securities, subject to certain important exceptions, we may not declare or pay any dividends or distributions on, redeem, purchase, acquire or a make a liquidation payment with respect to any of our common stock. Dividends from our subsidiary bank are the primary source of funds for payment of dividends to our shareholders, and there are statutory limits on the amount of dividends that our subsidiary bank can pay to us without regulatory approval. We are a holding company that conducts substantially all of our operations through our banking subsidiaries and other subsidiaries. As a result, our ability to make dividend payments on the common stock depends primarily on certain federal regulatory considerations and the receipt of dividends and other distributions from our subsidiaries. There are various legal and regulatory restrictions on the ability of our banking subsidiaries to pay dividends or make other payments to us, and those restrictions can vary among the different subsidiaries based on performance, capital and other factors. Further information concerning dividend restrictions and other factors that could limit our ability to pay dividends, including restrictions on loans, dividends or advances from bank subsidiaries to the parent company are included in our Annual Report on Form 10-K. Other Provisions The Articles of Incorporation and our Amended and Restated Bylaws (the “Bylaws”) contain various provisions that may discourage or delay attempts to gain control of PNC. The Bylaws include provisions: • authorizing the Board to fix the size of the Board between five and 25 directors, • authorizing directors to fill vacancies on the Board occurring between annual shareholder meetings, including vacancies resulting from an increase in the number of directors, • authorizing only the Board, the Chairman of the Board or the Chief Executive Officer to call a special meeting of shareholders, • providing advance notice requirements for director nominations and business to be properly brought before a shareholder meeting, and • authorizing a majority of the Board to alter, amend, add to or repeal the Bylaws. The Articles of Incorporation vest the authority to make, amend and repeal the Bylaws in the Board, subject to the power of our shareholders to change any such action. Provisions of Pennsylvania law also could make it more difficult for a third party to acquire control of PNC or have the effect of discouraging a third party from attempting to control PNC. The PBCL allows Pennsylvania corporations to elect to either be covered or not be covered by certain “anti-takeover” provisions. We have elected in the Bylaws not to be covered by Subchapter G of Chapter 25 of the PBCL, which would otherwise enable existing shareholders of PNC in certain circumstances to block the voting rights of an acquiring person who makes or proposes to make a control-share acquisition. We have also opted out of the protection of Subchapter H of Chapter 25 of the PBCL, which would otherwise enable us to recover certain payments made to shareholders who have evidenced an intent to acquire control of PNC. However, the following provisions of the PBCL do apply to us: • shareholders are not entitled to call a special meeting (Section 2521), • unless the Articles of Incorporation provide otherwise (which as of the date hereof they do not), action by shareholder consent must be unanimous (Section 2524), • shareholders are not entitled to propose an amendment to the Articles of Incorporation (Section 2535),

4 • certain transactions with interested shareholders (such as mergers or sales of assets between PNC and a shareholder) where the interested shareholder is a party to the transaction or is treated differently from other shareholders require approval by a majority of the disinterested shareholders (Section 2538), • a five-year moratorium exists on certain business combinations with a 20% or more shareholder (Sections 2551-2556), and • shareholders have a right to “put” their shares to a 20% shareholder at a “fair value” for a reasonable period after the 20% stake is acquired (Sections 2541-2547). In addition, in certain instances the ability of the Board to issue authorized but unissued shares of common stock and preferred stock may have an anti-takeover effect. The existence of the above provisions could result in PNC being less attractive to a potential acquirer, or result in our shareholders receiving less for their shares of common stock than otherwise might be available if there is a takeover attempt. The ability of a third party to acquire PNC is also limited under applicable banking regulations. The Bank Holding Company Act of 1956 (the “Bank Holding Company Act”) requires any “bank holding company” (as defined in the Bank Holding Company Act) to obtain the approval of the Federal Reserve prior to acquiring more than 5% of our voting securities. Any person other than a bank holding company is required to obtain prior approval of the Federal Reserve to acquire 10% or more of our voting securities under the Change in Bank Control Act of 1978. Any person (other than an individual) that seeks to acquire 25% or more of our voting securities, control one third or more of PNC’s total equity (as defined under the regulations implementing the Bank Holding Company Act), or that would own or control more than 5% of our voting securities and have other relationships that would, pursuant to Federal Reserve regulations or rulings, provide the holder a “controlling influence” over PNC, also must obtain the prior approval of the Federal Reserve under the Bank Holding Company Act and, if approved, is then subject to regulation as a bank holding company under the Bank Holding Company Act. Furthermore, while we do not have a shareholder rights plan currently in effect, under Pennsylvania law the Board can adopt a shareholder rights plan without stockholder approval. If adopted, a shareholder rights plan could result in substantial dilution to a person or group that attempts to acquire PNC on terms not approved by the Board. DESCRIPTION OF PREFERRED STOCK General Our authorized capital stock includes 20,000,000 shares of preferred stock, par value $1.00 per share, as reflected in the Articles of Incorporation. The following summary does not purport to be complete and is qualified in its entirety by reference to the pertinent sections of the Articles of Incorporation and any statements with respect to shares for any series of preferred stock. You should read the Articles of Incorporation, which includes the designations relating to each series of preferred stock. We have seven outstanding series of preferred stock: • $1.80 Cumulative Convertible Preferred Stock, Series B, with a per share liquidation preference of $40.00 (“Series B Preferred Stock”) (38,542 authorized), • Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series R, with a per share liquidation preference of $100,000 (“Series R Preferred Stock”) (5,000 authorized), • Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series S, with a per share liquidation preference of $100,000 (“Series S Preferred Stock”) (5,250 authorized), and

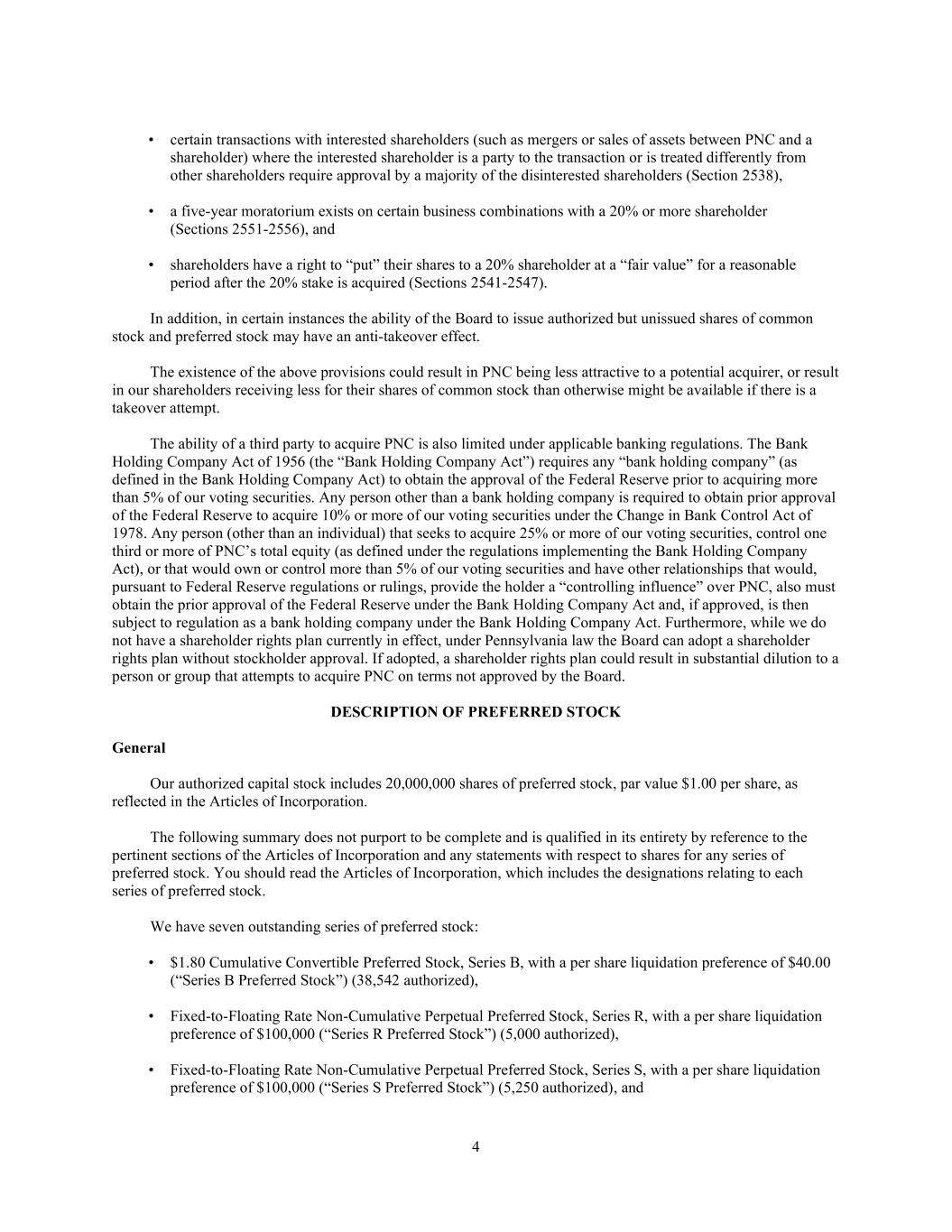

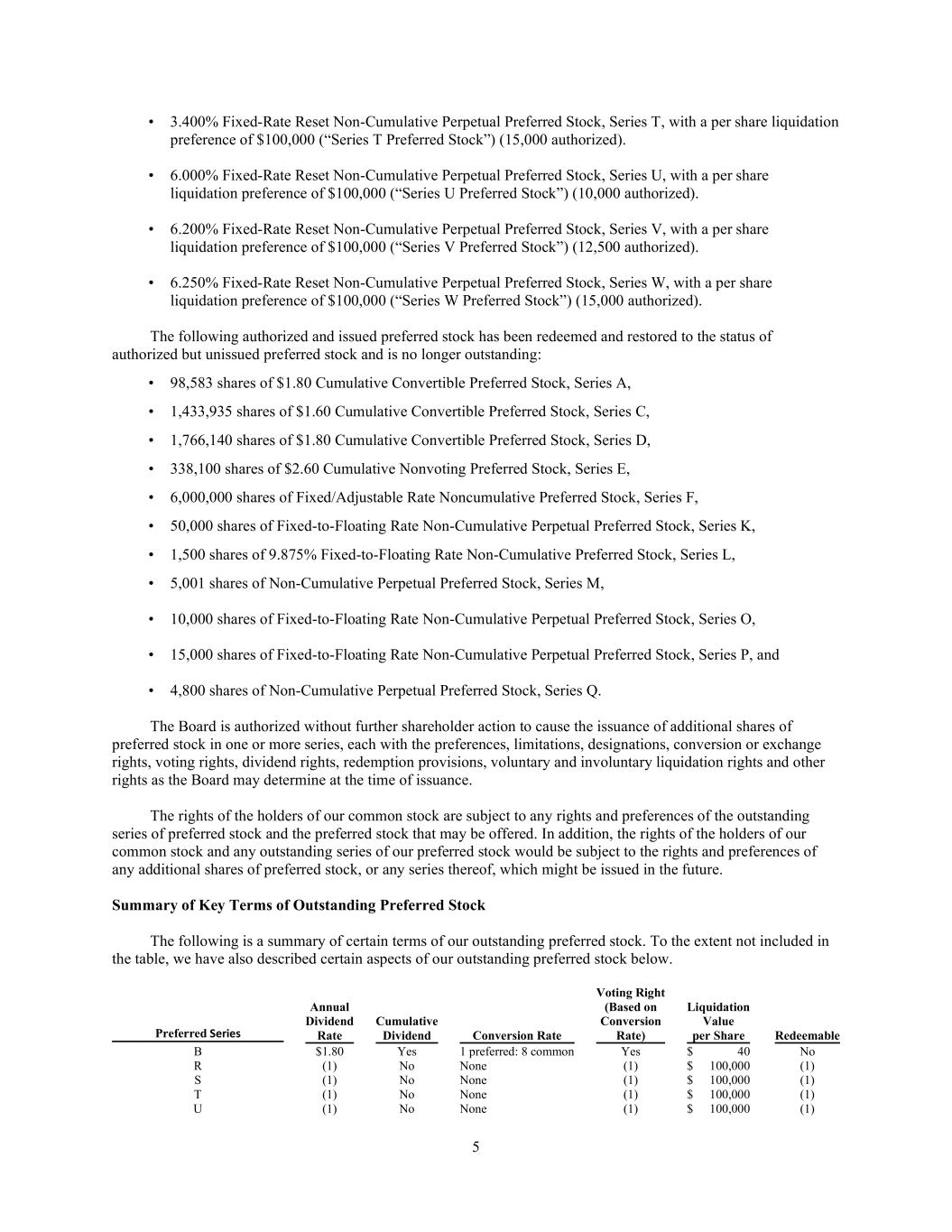

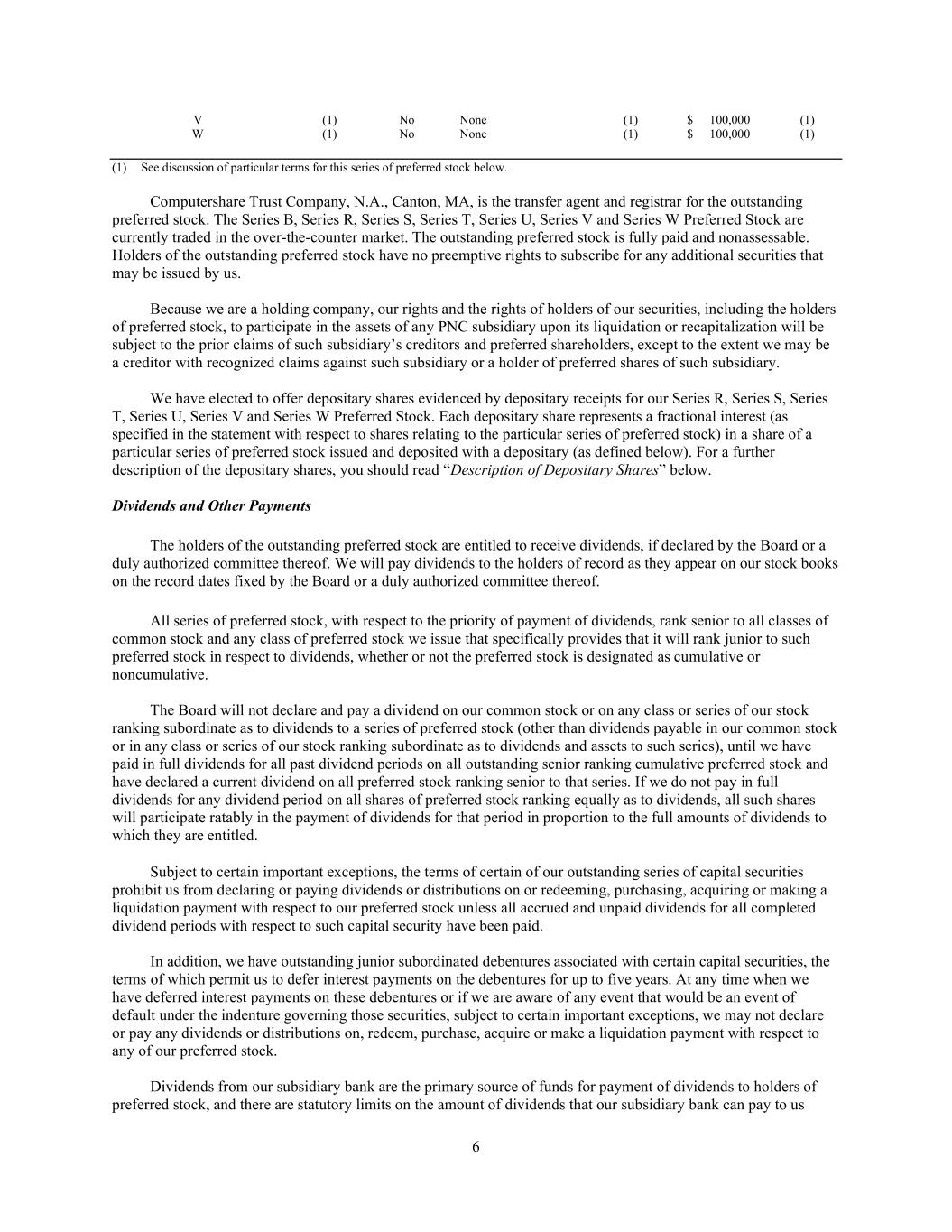

5 • 3.400% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series T, with a per share liquidation preference of $100,000 (“Series T Preferred Stock”) (15,000 authorized). • 6.000% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series U, with a per share liquidation preference of $100,000 (“Series U Preferred Stock”) (10,000 authorized). • 6.200% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series V, with a per share liquidation preference of $100,000 (“Series V Preferred Stock”) (12,500 authorized). • 6.250% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series W, with a per share liquidation preference of $100,000 (“Series W Preferred Stock”) (15,000 authorized). The following authorized and issued preferred stock has been redeemed and restored to the status of authorized but unissued preferred stock and is no longer outstanding: • 98,583 shares of $1.80 Cumulative Convertible Preferred Stock, Series A, • 1,433,935 shares of $1.60 Cumulative Convertible Preferred Stock, Series C, • 1,766,140 shares of $1.80 Cumulative Convertible Preferred Stock, Series D, • 338,100 shares of $2.60 Cumulative Nonvoting Preferred Stock, Series E, • 6,000,000 shares of Fixed/Adjustable Rate Noncumulative Preferred Stock, Series F, • 50,000 shares of Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series K, • 1,500 shares of 9.875% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series L, • 5,001 shares of Non-Cumulative Perpetual Preferred Stock, Series M, • 10,000 shares of Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series O, • 15,000 shares of Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series P, and • 4,800 shares of Non-Cumulative Perpetual Preferred Stock, Series Q. The Board is authorized without further shareholder action to cause the issuance of additional shares of preferred stock in one or more series, each with the preferences, limitations, designations, conversion or exchange rights, voting rights, dividend rights, redemption provisions, voluntary and involuntary liquidation rights and other rights as the Board may determine at the time of issuance. The rights of the holders of our common stock are subject to any rights and preferences of the outstanding series of preferred stock and the preferred stock that may be offered. In addition, the rights of the holders of our common stock and any outstanding series of our preferred stock would be subject to the rights and preferences of any additional shares of preferred stock, or any series thereof, which might be issued in the future. Summary of Key Terms of Outstanding Preferred Stock The following is a summary of certain terms of our outstanding preferred stock. To the extent not included in the table, we have also described certain aspects of our outstanding preferred stock below. Preferred Series Annual Dividend Rate Cumulative Dividend Conversion Rate Voting Right (Based on Conversion Rate) Liquidation Value per Share Redeemable B $1.80 Yes 1 preferred: 8 common Yes $ 40 No R (1) No None (1) $ 100,000 (1) S (1) No None (1) $ 100,000 (1) T (1) No None (1) $ 100,000 (1) U (1) No None (1) $ 100,000 (1)

6 V (1) No None (1) $ 100,000 (1) W (1) No None (1) $ 100,000 (1) (1) See discussion of particular terms for this series of preferred stock below. Computershare Trust Company, N.A., Canton, MA, is the transfer agent and registrar for the outstanding preferred stock. The Series B, Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock are currently traded in the over-the-counter market. The outstanding preferred stock is fully paid and nonassessable. Holders of the outstanding preferred stock have no preemptive rights to subscribe for any additional securities that may be issued by us. Because we are a holding company, our rights and the rights of holders of our securities, including the holders of preferred stock, to participate in the assets of any PNC subsidiary upon its liquidation or recapitalization will be subject to the prior claims of such subsidiary’s creditors and preferred shareholders, except to the extent we may be a creditor with recognized claims against such subsidiary or a holder of preferred shares of such subsidiary. We have elected to offer depositary shares evidenced by depositary receipts for our Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock. Each depositary share represents a fractional interest (as specified in the statement with respect to shares relating to the particular series of preferred stock) in a share of a particular series of preferred stock issued and deposited with a depositary (as defined below). For a further description of the depositary shares, you should read “Description of Depositary Shares” below. Dividends and Other Payments The holders of the outstanding preferred stock are entitled to receive dividends, if declared by the Board or a duly authorized committee thereof. We will pay dividends to the holders of record as they appear on our stock books on the record dates fixed by the Board or a duly authorized committee thereof. All series of preferred stock, with respect to the priority of payment of dividends, rank senior to all classes of common stock and any class of preferred stock we issue that specifically provides that it will rank junior to such preferred stock in respect to dividends, whether or not the preferred stock is designated as cumulative or noncumulative. The Board will not declare and pay a dividend on our common stock or on any class or series of our stock ranking subordinate as to dividends to a series of preferred stock (other than dividends payable in our common stock or in any class or series of our stock ranking subordinate as to dividends and assets to such series), until we have paid in full dividends for all past dividend periods on all outstanding senior ranking cumulative preferred stock and have declared a current dividend on all preferred stock ranking senior to that series. If we do not pay in full dividends for any dividend period on all shares of preferred stock ranking equally as to dividends, all such shares will participate ratably in the payment of dividends for that period in proportion to the full amounts of dividends to which they are entitled. Subject to certain important exceptions, the terms of certain of our outstanding series of capital securities prohibit us from declaring or paying dividends or distributions on or redeeming, purchasing, acquiring or making a liquidation payment with respect to our preferred stock unless all accrued and unpaid dividends for all completed dividend periods with respect to such capital security have been paid. In addition, we have outstanding junior subordinated debentures associated with certain capital securities, the terms of which permit us to defer interest payments on the debentures for up to five years. At any time when we have deferred interest payments on these debentures or if we are aware of any event that would be an event of default under the indenture governing those securities, subject to certain important exceptions, we may not declare or pay any dividends or distributions on, redeem, purchase, acquire or make a liquidation payment with respect to any of our preferred stock. Dividends from our subsidiary bank are the primary source of funds for payment of dividends to holders of preferred stock, and there are statutory limits on the amount of dividends that our subsidiary bank can pay to us

7 without regulatory approval. We are a holding company that conducts substantially all of our operations through our banking subsidiaries and other subsidiaries. As a result, our ability to make dividend payments on the preferred stock depends primarily on certain federal regulatory considerations and the receipt of dividends and other distributions from our subsidiaries. There are various legal and regulatory restrictions on the ability of our banking subsidiaries to pay dividends or make other payments to us, and those restrictions can vary among the different subsidiaries based on performance, capital and other factors. Series B Preferred Stock Dividends. Holders of outstanding Series B Preferred Stock are entitled to cumulative dividends at the annual rate set forth above in the table titled “Summary of Key Terms of Outstanding Preferred Stock,” which are payable quarterly when and as declared by the Board. Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock Dividends. Dividends on shares of the Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock are not mandatory. Holders of such series of preferred stock are entitled to receive, when, as, and if declared by the Board or a duly authorized committee thereof, out of assets legally available for the payment of dividends under Pennsylvania law, non- cumulative cash dividends based on the liquidation preference of such series of preferred stock at a rate equal to: • In the case of the Series R Preferred Stock, 4.850% per annum for each semi-annual dividend period from the issue date of the depositary shares to, but excluding, June 1, 2023, payable in arrears on June 1 and December 1 of each year, and three-month LIBOR plus a spread of 3.04% per annum for each quarterly dividend period from June 1, 2023 to but excluding September 1, 2023, and adjusted three-month CME Term SOFR plus 3.04% per annum for each quarterly dividend period from September 1, 2023 through the redemption date of the Series R Preferred Stock, if any, payable in arrears on March 1, June 1, September 1 and December 1 of each year. Adjusted three-month CME Term SOFR is equal to three-month CME Term SOFR plus 0.26161%. • In the case of the Series S Preferred Stock, 5.000% per annum for each semi-annual dividend period from the issue date of the depositary shares to, but excluding, November 1, 2026, payable in arrears on May 1 and November 1 of each year, and adjusted three-month CME Term SOFR plus a spread of 3.30% per annum for each quarterly dividend period from November 1, 2026 through the redemption date of the Series S Preferred Stock, if any, payable in arrears on February 1, May 1, August 1 and November 1 of each year. Adjusted three-month CME Term SOFR is equal to three-month CME Term SOFR plus 0.26161%. • In the case of the Series T Preferred Stock, 3.400% per annum for each quarterly dividend period from the issue date of the depositary shares to, but excluding, September 15, 2026, and the five-year U.S. Treasury rate plus a spread of 2.595% per annum for each quarterly dividend period from September 15, 2026 through the redemption date of the Series T Preferred Stock, if any, payable in arrears on March 15, June 15, September 15 and December 15 of each year. • In the case of the Series U Preferred Stock, 6.000% per annum for each quarterly dividend period from the issue date of the depositary shares to, but excluding, May 15, 2027, and the five-year U.S. Treasury rate plus a spread of 3.000% per annum for each quarterly dividend period from May 15, 2027 through the redemption date of the Series U Preferred Stock, if any, payable in arrears on February 15, May 15, August 15 and November 15 of each year. • In the case of the Series V Preferred Stock, 6.200% per annum for each quarterly dividend period from the issue date of the depositary shares to, but excluding, September 15, 2027, and the five-year U.S. Treasury rate plus a spread of 3.238% per annum for each quarterly dividend period from September 15, 2027 through the redemption date of the Series V Preferred Stock, if any, payable in arrears on March 15, June 15, September 15 and December 15 of each year. • In the case of the Series W Preferred Stock, 6.250% per annum for each quarterly dividend period from the issue date of the depositary shares to, but excluding, March 15, 2030, and the seven-year U.S. Treasury rate plus a spread of 2.808% per annum for each quarterly dividend period from March 15, 2030 through

8 the redemption date of the Series W Preferred Stock, if any, payable in arrears on March 15, June 15, September 15 and December 15 of each year. In the event we issue additional shares of any such series of preferred stock after the original issue date, dividends on such shares will accrue from the original issue date of such additional shares, or in the case of the Series T, Series U, Series V and Series W Preferred Stock, if such additional shares are issued after the first dividend payment date for such series of preferred stock, dividends on such additional shares will accrue from the date on which such shares are issued (if it is a dividend payment date) or the dividend payment date next preceding the date on which such shares are issued. A dividend period for any such series of preferred stock is the period from and including a dividend payment date to, but excluding, the next dividend payment date. Dividends payable on any such series of preferred stock for the period in which the interest rate is fixed, and in the case of the Series T, Series U, Series V and Series W Preferred Stock, also for the period in which the interest rate is based on the five-year U.S. Treasury rate in the case of the Series T, Series U and Series V Preferred Stock and the seven-year U.S. Treasury rate in the case of the Series W Preferred Stock, are computed on the basis of a 360-day year consisting of twelve 30-day months. Dividends payable on any such series of preferred stock for any period in which the interest rate is based on three-month LIBOR or adjusted three-month CME Term SOFR will be computed based on the actual number of days in a dividend period and a 360-day year. Dollar amounts resulting from that calculation will be rounded to the nearest cent, with one-half cent being rounded upward. Dividends on any such series of preferred stock will cease to accrue on the redemption date, if any, as described below under “Redemption by PNC,” unless we default in the payment of the redemption price of the shares called for redemption. Dividends on shares of Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock are not cumulative. Accordingly, if the Board or a duly authorized committee thereof does not declare a dividend payable in respect of any dividend period before the related dividend payment date, such dividend will not accrue and we will have no obligation to pay a dividend for that dividend period on the dividend payment date or at any future time, whether or not dividends on such series of preferred stock are declared for any future dividend period. During a dividend period with respect to each of the Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock, so long as any share of such series remains outstanding, unless in each case of clause (i) through (iii) below the full dividends for the preceding dividend period on all outstanding shares of Series R, Series S, Series T, Series U, Series V or Series W Preferred Stock, as applicable, have been declared and paid or declared and a sum sufficient for the payment thereof has been set aside, (i) no dividend will be declared or paid or set aside for payment and no distribution will be declared or made or set aside for payment on any junior stock (other than (a) a dividend payable solely in such junior stock or (b) any dividend in connection with the implementation of a shareholders’ rights plan, or the redemption or repurchase of any rights under any such plan), (ii) no shares of junior stock will be repurchased, redeemed or otherwise acquired for consideration by us (other than (a) as a result of a reclassification of such junior stock for or into other junior stock, (b) the exchange or conversion of one share of such junior stock for or into another share of junior stock, (c) through the use of the proceeds of a substantially contemporaneous sale of other shares of junior stock, (d) purchases, redemptions or other acquisitions of shares of such junior stock in connection with any employment contract, benefit plan or other similar arrangement with or for the benefit of employees, officers, directors or consultants, (e) purchases of shares of such junior stock pursuant to a contractually binding requirement to buy such junior stock existing prior to the preceding dividend period, including under a contractually binding stock repurchase plan, or (f) the purchase of fractional interests in shares of such junior stock pursuant to the conversion or exchange provisions of such stock or the security being converted or exchanged), nor will any monies be paid to or made available for a sinking fund for the redemption of any such securities by us, and (iii) no shares of parity stock will be repurchased, redeemed or otherwise acquired for consideration by us other than pursuant to pro rata offers to purchase all, or a pro rata portion, of the applicable series of preferred stock and such parity stock, except by conversion into or exchange for junior stock. As used in this description, (i) “junior stock” means our common stock and any other class or series of our stock hereafter authorized over which the Series R, Series S, Series T, Series U, Series V or Series W Preferred Stock, as applicable, has preference or priority in the payment of dividends or in the distribution of assets on any liquidation, dissolution or winding up of PNC and (ii) “parity stock” means any other class or series of our stock that ranks on parity with the Series R, Series S, Series T, Series U, Series V or Series W Preferred Stock, as applicable,

9 in the payment of dividends and in the distribution of assets on any liquidation, dissolution or winding up of PNC. The following series of preferred stock are considered parity stock: Series B, Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock. When dividends are not paid in full upon the shares of Series R, Series S, Series T, Series U, Series V or Series W Preferred Stock, as applicable, and any parity stock, all dividends declared upon shares of such series of preferred stock and any parity stock will be declared on a proportional basis so that the amount of dividends declared per share will bear to each other the same ratio that accrued dividends for such series of preferred stock, and accrued dividends, including any accumulations, on any parity stock, bear to each other for the then-current dividend period. Dividends on the Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock will not be declared, paid or set aside for payment to the extent such act would cause us to fail to comply with the laws and regulations applicable to us, including applicable regulatory capital rules. Subject to the foregoing, and not otherwise, dividends (payable in cash, stock or otherwise), as may be determined by the Board or a duly authorized committee thereof, may be declared and paid on our common stock and any other stock ranking equally with or junior to any of the Series R, Series S, Series T, Series U, Series V or Series W Preferred Stock from time to time out of any assets legally available for such payment, and the holders of Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock shall not be entitled to participate in any such dividend. Voting Except as provided herein or in the applicable statement with respect to shares, or as required by applicable law, the holders of preferred stock are not entitled to vote. Except as otherwise required by law or provided by the Board and described in the applicable statement with respect to shares, holders of preferred stock having voting rights and holders of common stock vote together as one class. Holders of preferred stock do not have cumulative voting rights. We are not required to obtain any consent of the holders of preferred stock of a given series in connection with the authorization, designation, increase or issuance of any shares of preferred stock that rank junior or equal to the preferred stock of such series with respect to dividends and liquidation rights. Right to Elect Two Directors upon Nonpayment. If we fail to pay, or declare and set apart for payment, dividends on outstanding shares of preferred stock of a series for six quarterly dividend periods, or their equivalent, whether or not consecutive, the number of directors on the Board will be increased by two at the first annual meeting of shareholders held thereafter, and at such meeting and each subsequent annual meeting until cumulative dividends payable for all past dividend periods and continuous noncumulative dividends for at least one year on all outstanding shares of preferred stock of such series entitled thereto shall have been paid, or declared and set apart for payment, in full, the holders of outstanding shares of preferred stock of all series will have the right, voting together as a class, to elect such two additional directors to the Board to hold office for a term of one year. Upon such payment, or such declaration and setting apart for payment, in full, the terms of the two additional directors so elected will terminate and the number of directors on the Board will be reduced by two, and such voting rights of the holders of shares of preferred stock will end, subject to an increase in the number of directors on the Board as described above and the revesting of such voting right in the event of each and every additional failure in the payment of dividends for six quarterly dividend periods, or their equivalent, whether or not consecutive, as described above. Under regulations adopted by the Federal Reserve, if the holders of preferred stock of any series become entitled to vote for the election of directors because dividends on such series are in arrears as described above, that series may then be deemed a “class of voting securities” and a holder (other than an individual) of 25% or more of such series, a holder of control of one third or more of PNC’s total equity (as defined under the regulations implementing the Bank Holding Company Act), or a holder of 5% or more if it otherwise exercises a “controlling influence” over PNC may then be subject to regulation as a bank holding company in accordance with the Bank Holding Company Act. In addition, when the series is deemed a class of voting securities, any other bank holding company may be required to obtain the prior approval of the Federal Reserve to acquire or retain more than 5% of that series, and any person other than a bank holding company may be required to obtain the prior approval of the Federal Reserve to acquire or retain 10% or more of that series.

10 Voting Rights under Pennsylvania Law. The PBCL attaches mandatory voting rights to preferred stock in connection with certain amendments to the Articles of Incorporation, under which the holders of preferred stock of a particular series would be entitled to vote as a class if the amendment would: • authorize the Board to fix and determine the relative rights and preferences, as between series, of any preferred or special class, • make any change in the preferences, limitations or special rights (other than preemptive rights or the right to vote cumulatively) of the shares of a class or series adverse to the class or series, • authorize a new class or series of shares having a preference as to dividends or assets which is senior to the shares of a class or series, • increase the number of authorized shares of any class or series having a preference as to dividends or assets which is senior in any respect to the shares of a class or series, or • make the outstanding shares of a class or series redeemable by a method that is not pro rata, by lot or otherwise equitable. Holders of outstanding shares of preferred stock are also entitled under Pennsylvania law to vote as a class on a plan of merger that effects any change in the Articles of Incorporation if the holders would have been entitled to a class vote under the statutory provision relating to the adoption of articles amendments discussed above. Series B Preferred Stock Voting. Holders of outstanding Series B Preferred Stock are entitled to a number of votes equal to the number of full shares of common stock into which their preferred stock is convertible. Unless we receive the consent of the holders of at least two-thirds of the outstanding shares of preferred stock of all series, we will not: • create or increase the authorized number of shares of any class of stock ranking senior to the preferred stock as to dividends or assets, or • change the preferences, qualifications, privileges, limitations, restrictions or special or relative rights of the preferred stock in any material respect adverse to the holders of the preferred stock. Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock Voting. Except as described above or otherwise herein or in the applicable statement with respect to shares, or as required by applicable law, holders of the Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock have no voting rights. So long as any shares of the Series R, Series S, Series T, Series U, Series V or Series W Preferred Stock, as applicable, remain outstanding, the affirmative vote or consent of the holders of at least two-thirds of all outstanding shares of the series, voting separately as a class, shall be required to: • authorize, increase the authorized amount of or issue shares of any class or series of stock ranking senior to such series of preferred stock with respect to dividends or the distribution of assets upon liquidation, dissolutions or winding up of PNC, • issue any obligation or security convertible into or evidencing the right to purchase any class or series of stock ranking senior to such series of preferred stock with respect to payment of dividends or the distribution of assets upon liquidation, dissolution or winding up of PNC, • amend the provisions of the Articles of Incorporation so as to adversely affect the powers, preferences, privileges or rights of such series of preferred stock, taken as a whole, provided, however, that any increase in the amount of the authorized or issued shares of such series of preferred stock or authorized common stock or preferred stock or the creation and issuance, or an increase in the authorized or issued amount, of other series of preferred stock ranking equally with or junior to such series of preferred stock with respect

11 to the payment of dividends (whether such dividends are cumulative or non-cumulative) or the distribution of assets upon liquidation, dissolution or winding up of PNC will not be deemed to adversely affect the powers, preferences, privileges or rights of such series of preferred stock, or • consolidate with or merge into any other entity unless (i) the shares of such series of preferred stock outstanding at the time of such consolidation or merger are converted into or exchanged for preference securities having such rights, preferences, privileges and voting powers, taken as a whole, as are not materially less favorable to the holders thereof than the rights, preferences, privileges and voting powers of such series of preferred stock, taken as a whole, or (ii) in the case of the Series T, Series U, Series V and Series W Preferred Stock only, such shares remain outstanding. The foregoing voting provisions will not apply if, at or prior to the time when the act with respect to which such vote would otherwise be required shall be effected, all outstanding shares of Series R, Series S, Series T, Series U, Series V or Series W Preferred Stock, as applicable, shall have been redeemed or called for redemption upon proper notice and sufficient funds shall have been set aside by us for the benefit of the holders of such series of preferred stock to effect such redemption. Liquidation of PNC In the event of the voluntary or involuntary liquidation, dissolution or winding up of PNC, the holders of each outstanding series of preferred stock will be entitled to receive liquidating distributions before any distribution of assets is made to the holders of our common stock or any other class or series of shares ranking junior to that series, in the amount fixed by the Board for that series and described in the applicable statement with respect to shares, plus, if dividends on that series are cumulative, accrued and unpaid dividends. Subject to certain important exceptions, the terms of certain of our outstanding capital securities prohibit us from making a liquidation payment with respect to our preferred stock unless all accrued and unpaid dividends for all completed dividend periods with respect to that capital security have been paid. In addition, we have outstanding junior subordinated debentures associated with certain capital securities, the terms of which permit us to defer interest payments on the debentures for up to five years. At any time when we have deferred interest payments on these debentures or if we are aware of any event that would be an event of default under the indenture governing those securities, subject to certain important exceptions, we may not make a liquidation payment with respect to any of our preferred stock. Redemption by PNC Subject to certain important exceptions, the terms of certain of our outstanding capital securities prohibit us from redeeming our preferred stock unless all accrued and unpaid dividends for all completed dividend periods with respect to that capital security have been paid. In addition, we have outstanding junior subordinated debentures associated with certain capital securities, the terms of which permit us to defer interest payments on the debentures for up to five years. At any time when we have deferred interest payments on these debentures or if we are aware of any event that would be an event of default under the indenture governing those securities, subject to certain important exceptions, we may not redeem any of our preferred stock. Redemption of preferred stock is generally subject to compliance with applicable regulatory capital rules, including any applicable approvals. Series B Preferred Stock Redemption. The Series B Preferred Stock are not currently redeemable nor entitled to the benefit of any retirement or sinking fund to be applied to the purchase or redemption of such shares. Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock Redemption. The Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock are not subject to any mandatory redemption, sinking fund or other similar provisions, and the holders of such series of preferred stock have no right to require the

12 redemption or repurchase of such series of preferred stock (or any depositary shares representing such series of preferred stock). The Series R Preferred Stock is redeemable at our option, in whole or in part, from time to time, on any dividend payment date on or after June 1, 2023, at a redemption price equal to $100,000 per share (equivalent to $1,000 per depositary share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends. The Series S Preferred Stock is redeemable at our option, in whole or in part, from time to time, on any dividend payment date on or after November 1, 2026, at a redemption price equal to $100,000 per share (equivalent to $1,000 per depositary share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends. The Series T Preferred Stock is redeemable at our option, in whole or in part, from time to time, on any dividend payment date on or after September 15, 2026, at a redemption price equal to $100,000 per share (equivalent to $1,000 per depositary share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends. The Series U Preferred Stock is redeemable at our option, in whole or in part, from time to time, on any dividend payment date on or after May 15, 2027, at a redemption price equal to $100,000 per share (equivalent to $1,000 per depositary share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends. The Series V Preferred Stock is redeemable at our option, in whole or in part, from time to time, on any dividend payment date on or after September 15, 2027, at a redemption price equal to $100,000 per share (equivalent to $1,000 per depositary share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends. The Series W Preferred Stock is redeemable at our option, in whole or in part, from time to time, on any dividend payment date on or after March 15, 2030, at a redemption price equal to $100,000 per share (equivalent to $1,000 per depositary share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends. We may redeem shares of the Series R, Series S, Series T, Series U, Series V or Series W Preferred Stock at any time within 90 days following the occurrence of a regulatory capital treatment event (as defined below), in whole but not part, at a redemption price equal to $100,000 per share of preferred stock (equivalent to $1,000 per depositary share in the case of the Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock), plus any declared and unpaid dividends, and in the case of the Series R and Series S Preferred Stock any accrued and unpaid dividends on the shares of preferred stock called for redemption up to the redemption date, or in the case of the Series T, Series U, Series V and Series W Preferred Stock, an amount equal to the partial dividend that would have accrued from the prior scheduled dividend payment date to the redemption date. A “regulatory capital treatment event” means the good faith determination by us that as a result of (i) any amendment to, or change in, the laws or regulations of the United States or any political subdivision of or in the United States that is enacted or becomes effective after the initial issuance of any share of the applicable series of preferred stock; (ii) any proposed change in those laws or regulations that is announced after the initial issuance of any share of the applicable series of preferred stock; or (iii) any official administrative decision or judicial decision or administrative action or other official pronouncement interpreting or applying those laws or regulations that is announced after the initial issuance of any share of the applicable series of preferred stock, there is more than an insubstantial risk that we will not be entitled to treat the full liquidation value of the shares of the applicable series of preferred stock then outstanding as “additional Tier 1 capital” (or its equivalent) for purposes of the regulatory capital rules of the Federal Reserve (or, as and if applicable, the regulatory capital regulations of any appropriate successor federal banking agency), as then in effect and applicable, for as long as any share of the applicable series of preferred stock is outstanding. Redemption of the Series R, Series S, Series T, Series U, Series V or Series W Preferred Stock, as applicable, is subject to our receipt of any required prior approvals from the Federal Reserve and to the satisfaction of any

13 conditions set forth in the capital guidelines of the Federal Reserve applicable to the redemption of such series of preferred stock. Conversion Series B Preferred Stock. Holders of outstanding Series B Preferred Stock currently are entitled to the conversion privileges set forth above in the table titled “Summary of Key Terms of Outstanding Preferred Stock.” Series B Preferred Stock is convertible into our common stock (unless called for redemption and not converted within the time allowed therefor) at any time at the option of the holder. No adjustment will be made for dividends on preferred stock converted or on common stock issuable upon conversion. The conversion rate of Series B Preferred Stock will be adjusted in certain events, including payment of stock dividends on, or splits or combinations of, the common stock or issuance to holders of common stock of rights to purchase common stock at a price per share less than 90% of current market price as defined in the Articles of Incorporation. Appropriate adjustments in the conversion provisions also will be made in the event of certain reclassifications, consolidations or mergers or the sale of substantially all of the assets of PNC. Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock Conversion. The Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock are not currently entitled to any conversion privileges. DESCRIPTION OF DEPOSITARY SHARES We have elected to offer fractional interests in the Series R, Series S, Series T, Series U, Series V and Series W Preferred Stock, rather than whole shares of preferred stock as follows: Depositary Shares, each representing a 1/100 interest in a share of Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series R, Depositary Shares, each representing a 1/100 interest in a share of Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series S, Depositary Shares, each representing a 1/100 interest in a share of 3.400% Fixed-Rate Reset Non- Cumulative Perpetual Preferred Stock, Series T, Depositary Shares, each representing a 1/100 interest in a share of 6.000% Fixed-Rate Reset Non- Cumulative Perpetual Preferred Stock, Series U, Depositary Shares, each representing a 1/100 interest in a share of 6.200% Fixed-Rate Reset Non- Cumulative Perpetual Preferred Stock, Series V, and Depositary Shares, each representing a 1/100 interest in a share of 6.250% Fixed-Rate Reset Non- Cumulative Perpetual Preferred Stock, Series W. We have provided for the issuance by a depositary to the public of receipts for depositary shares, and each of these depositary shares represents a fraction of a share of a particular series of preferred stock. The shares of any series of preferred stock represented by the depositary shares are deposited pursuant to a deposit agreement between us and a depositary selected by us. The depositary is a bank or trust company and will have its principal office in the United States and a combined capital and surplus of at least $50,000,000. The statement with respect to shares relating to a series of depositary shares will set forth the name and address of the depositary. Subject to the terms of the deposit agreement, each owner of a depositary share will be entitled, in proportion to the applicable fractional interest in a share of preferred stock represented by such depositary share, to all the rights and preferences of the preferred stock represented thereby, including any dividend, voting, redemption, conversion and liquidation rights. The depositary shares are evidenced by depositary receipts issued under the deposit agreement. Dividends and Other Distributions

14 The depositary will distribute any cash dividends or other cash distributions received in respect of the preferred stock to the record holders of depositary shares relating to the underlying preferred stock in proportion to the number of depositary shares held by the holders. If we make a distribution other than in cash, the depositary will distribute any property received by it to the record holders of depositary shares entitled to those distributions, unless the depositary determines that the distribution cannot be made proportionally among those holders or that it is not feasible to make a distribution. In that event, the depositary may, with our approval, sell the property and distribute the net proceeds from the sale to the holders of the depositary shares in proportion to the number of depositary shares they hold. Redemption of Depositary Shares Whenever we redeem shares of preferred stock held by the depositary, the depositary will redeem, as of the same redemption date, the number of depositary shares representing the shares of preferred stock so redeemed. If fewer than all of the outstanding depositary shares are to be redeemed, the depositary will select the depositary shares to be redeemed pro rata or by lot as may be determined by the depositary. The redemption price per depositary share will be equal to the applicable fraction of the redemption price per share payable with respect to that series of preferred stock. Depositary shares called for redemption will no longer be outstanding after the applicable redemption date, and all rights of the holders of such depositary shares will cease, except the right to receive any money or other property upon surrender to the depositary of the depositary receipts evidencing those depositary shares. Voting the Preferred Stock Upon receipt of notice of any meeting at which the holders of preferred stock are entitled to vote, the depositary will mail the information contained in the notice of meeting to the record holders of depositary shares representing shares of such preferred stock. Each record holder of such depositary shares on the record date, which will be the same date as the record date for the preferred stock, may instruct the depositary to vote the amount of the preferred stock represented by the holder’s depositary shares. To the extent possible, the depositary will vote the amount of the preferred stock represented by such depositary shares in accordance with the instructions it receives. We will agree to take all reasonable actions that the depositary determines are necessary to enable the depositary to vote as instructed. If the depositary does not receive specific instructions from the holders of any depositary shares representing such preferred stock, it will not vote the amount of the preferred stock represented by such depositary shares. Conversion of Preferred Stock If a series of preferred stock represented by the depositary shares is convertible into shares of our common stock or any other class of our capital securities, we will accept the delivery of depositary receipts to convert such preferred stock using the same procedures as those for delivery of certificates for such preferred stock. If the depositary shares represented by a depositary receipt are to be converted in part only, the depositary will issue a new depositary receipt or depositary receipts for the depositary shares that are not converted. Amendment and Termination of the Deposit Agreement We and the depositary may amend the form of depositary receipt evidencing the depositary shares and any provision of the deposit agreement at any time. However, any amendment that materially and adversely alters the rights of the holders of depositary shares will not be effective unless the amendment has been approved by the holders of at least a majority of the depositary shares then outstanding. Except as may be otherwise provided in the applicable deposit agreement, we or the depositary may terminate the deposit agreement only if (i) all outstanding depositary shares have been redeemed or (ii) there has been a final distribution of the underlying preferred stock in connection with any liquidation, dissolution or winding up of PNC. Charges of Depositary

15 We will pay all transfer and other taxes and governmental charges arising solely from the existence of the depositary arrangements. We will also pay charges of the depositary in connection with the initial deposit of the preferred stock and the initial issuance of the depositary shares, all withdrawals of shares of preferred stock by holders of depositary shares, and any redemption or exchange of the preferred stock at our option. Holders of depositary shares will pay other transfer and other taxes and governmental charges and such other charges as are expressly provided in the deposit agreement to be for their accounts. Resignation and Removal of Depositary The depositary may resign at any time by delivering to us notice of its election to do so, and we may remove the depositary at any time by delivering to the depositary notice of such removal. Any such resignation or removal will take effect only upon the appointment of a successor depositary and such successor depositary’s acceptance of its appointment. The successor depositary must be a bank or trust company having its principal office in the United States and having a combined capital and surplus of at least $50,000,000. Miscellaneous The depositary will forward to the holders of depositary shares all reports and communications that we deliver to the depositary and that we are required to furnish to the holders of the preferred stock. Neither we nor the depositary will be liable if we are prevented or delayed by law or any circumstance beyond our control in performing our obligations under the deposit agreement. Our obligations and the obligations of the depositary under the deposit agreement will be limited to performance in good faith of our respective duties under the deposit agreement. Neither we nor the depositary will be obligated to appear in, prosecute or defend any action, suit or other legal proceeding relating to any depositary shares or preferred stock unless satisfactory indemnity is furnished. Both we and the depositary may rely upon written advice of counsel or accountants, or upon information provided by holders of preferred stock or depositary shares or other persons believed by us in good faith to be competent, and on any written notice, request, direction or document believed by us to be genuine and to have been signed or presented by the proper party or parties. The depositary may also rely on information provided by us.