EX-99.1

Published on January 16, 2024

The PNC Financial Services Group Fourth Quarter 2023 Earnings Conference Call January 16, 2024 Exhibit 99.1

Cautionary Statement Regarding Forward-Looking and non-GAAP Financial Information Our earnings conference call presentation is not intended as a full business or financial review and should be viewed in the context of all of the information made available by PNC in its SEC filings and on our corporate website. The presentation contains forward-looking statements regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations, including sustainability strategy. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward- looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix. We provide greater detail regarding these and other factors in our 2022 Form 10-K, our subsequent From 10-Qs, and our other subsequent SEC filings. Our forward-looking statements may also be subject to risks and uncertainties including those we may discuss in this presentation or in our SEC filings. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake any obligation to update those statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. We include non-GAAP financial information in this presentation. Reconciliations for such financial information may be found in our presentation, in these slides, including the Appendix, in other materials on our corporate website, and in our SEC filings. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this information and the related reconciliations may be useful to investors, analysts, regulators and others to help understand and evaluate our financial results, and with respect to adjusted metrics, because we believe they better reflect the ongoing financial results and trends of our businesses and increase comparability of period-to-period results. We may also use annualized, pro forma, estimated or third party numbers for illustrative or comparative purposes only. These may not reflect actual results. References to our corporate website are to www.pnc.com under “About Us - Investor Relations.” Our SEC filings are available both on our corporate website and on the SEC’s website at www.sec.gov. We include web addresses here as inactive textual references only. Information on these websites is not part of this presentation. 1

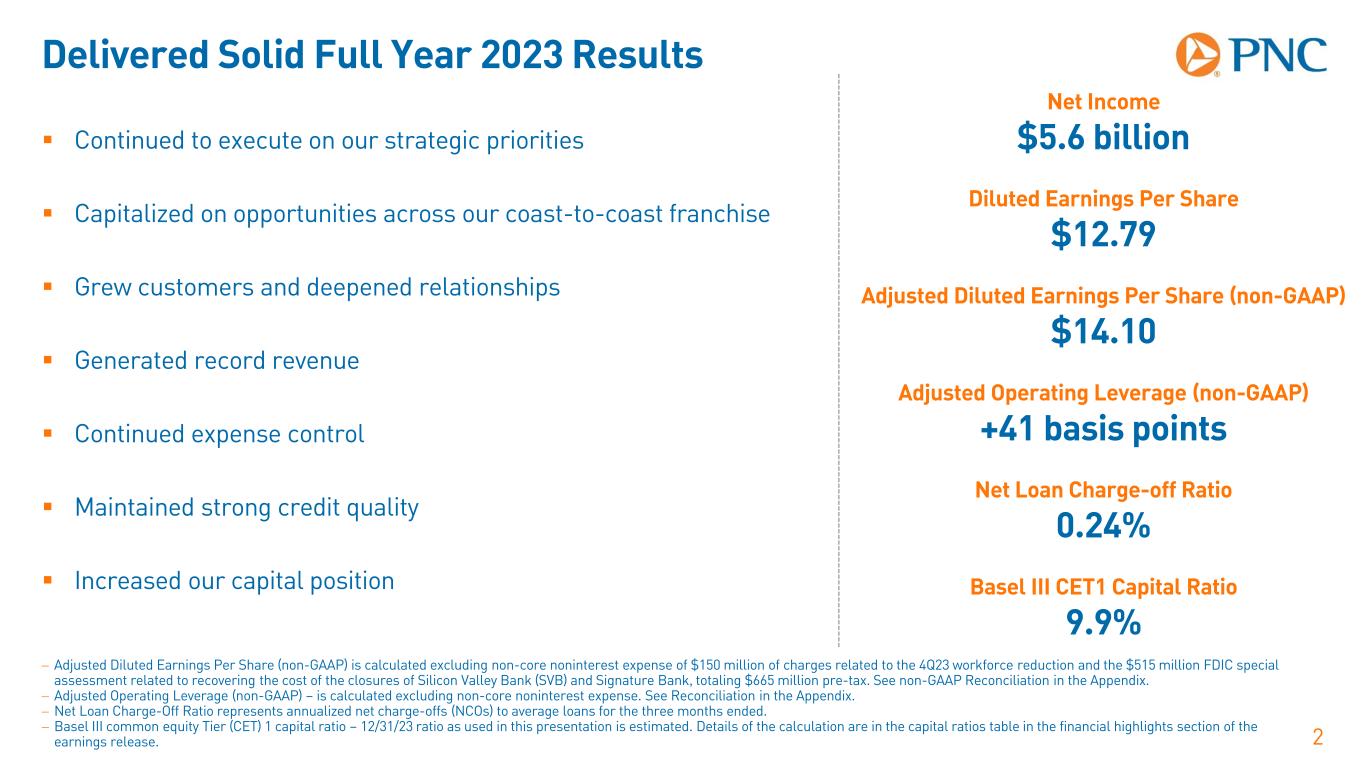

Delivered Solid Full Year 2023 Results 2 Continued to execute on our strategic priorities Capitalized on opportunities across our coast-to-coast franchise Grew customers and deepened relationships Generated record revenue Continued expense control Maintained strong credit quality Increased our capital position Net Income $5.6 billion Diluted Earnings Per Share $12.79 Adjusted Operating Leverage (non-GAAP) +41 basis points Net Loan Charge-off Ratio 0.24% − Adjusted Diluted Earnings Per Share (non-GAAP) is calculated excluding non-core noninterest expense of $150 million of charges related to the 4Q23 workforce reduction and the $515 million FDIC special assessment related to recovering the cost of the closures of Silicon Valley Bank (SVB) and Signature Bank, totaling $665 million pre-tax. See non-GAAP Reconciliation in the Appendix. − Adjusted Operating Leverage (non-GAAP) – is calculated excluding non-core noninterest expense. See Reconciliation in the Appendix. − Net Loan Charge-Off Ratio represents annualized net charge-offs (NCOs) to average loans for the three months ended. − Basel III common equity Tier (CET) 1 capital ratio – 12/31/23 ratio as used in this presentation is estimated. Details of the calculation are in the capital ratios table in the financial highlights section of the earnings release. Basel III CET1 Capital Ratio 9.9% Adjusted Diluted Earnings Per Share (non-GAAP) $14.10

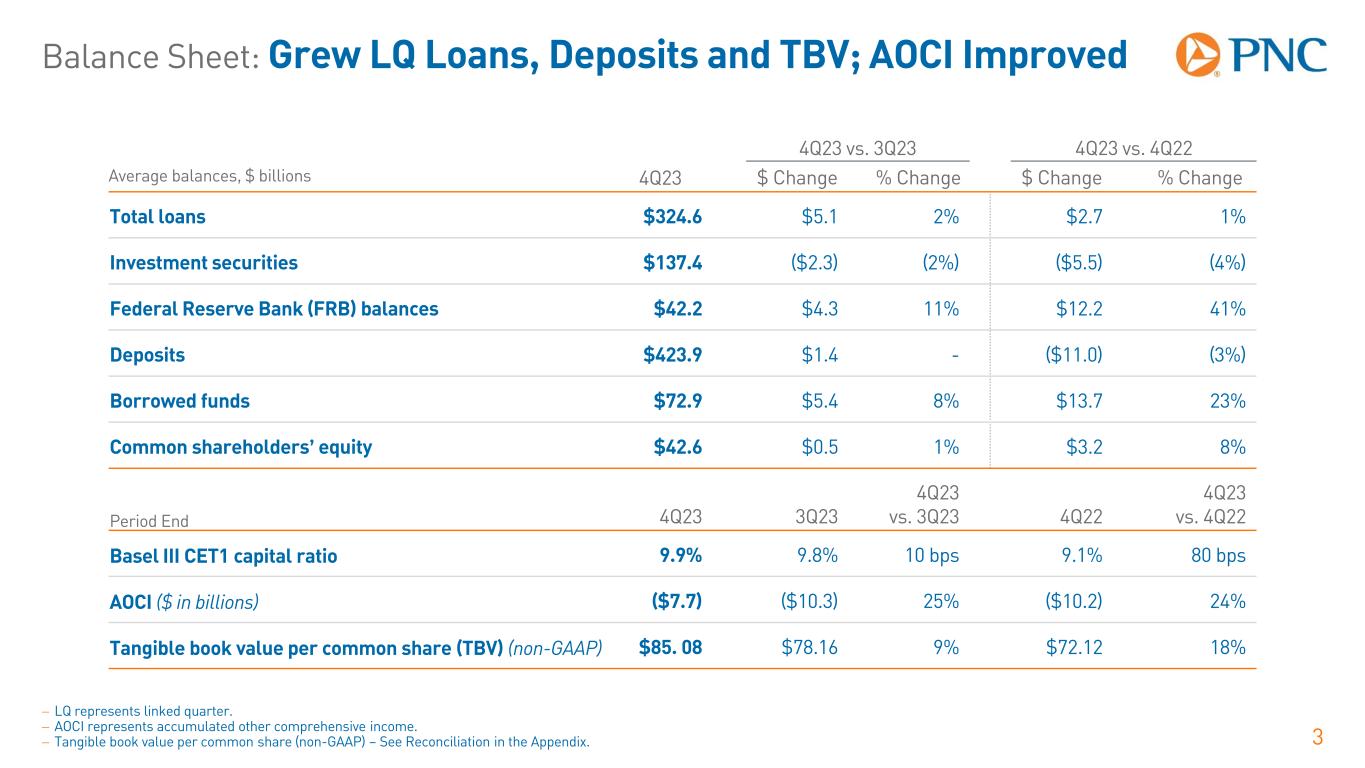

Balance Sheet: Grew LQ Loans, Deposits and TBV; AOCI Improved 3 4Q23 vs. 3Q23 4Q23 vs. 4Q22 Average balances, $ billions 4Q23 $ Change % Change $ Change % Change Total loans $324.6 $5.1 2% $2.7 1% Investment securities $137.4 ($2.3) (2%) ($5.5) (4%) Federal Reserve Bank (FRB) balances $42.2 $4.3 11% $12.2 41% Deposits $423.9 $1.4 - ($11.0) (3%) Borrowed funds $72.9 $5.4 8% $13.7 23% Common shareholders’ equity $42.6 $0.5 1% $3.2 8% Period End 4Q23 3Q23 4Q23 vs. 3Q23 4Q22 4Q23 vs. 4Q22 Basel III CET1 capital ratio 9.9% 9.8% 10 bps 9.1% 80 bps AOCI ($ in billions) ($7.7) ($10.3) 25% ($10.2) 24% Tangible book value per common share (TBV) (non-GAAP) $85. 08 $78.16 9% $72.12 18% − LQ represents linked quarter. − AOCI represents accumulated other comprehensive income. − Tangible book value per common share (non-GAAP) – See Reconciliation in the Appendix.

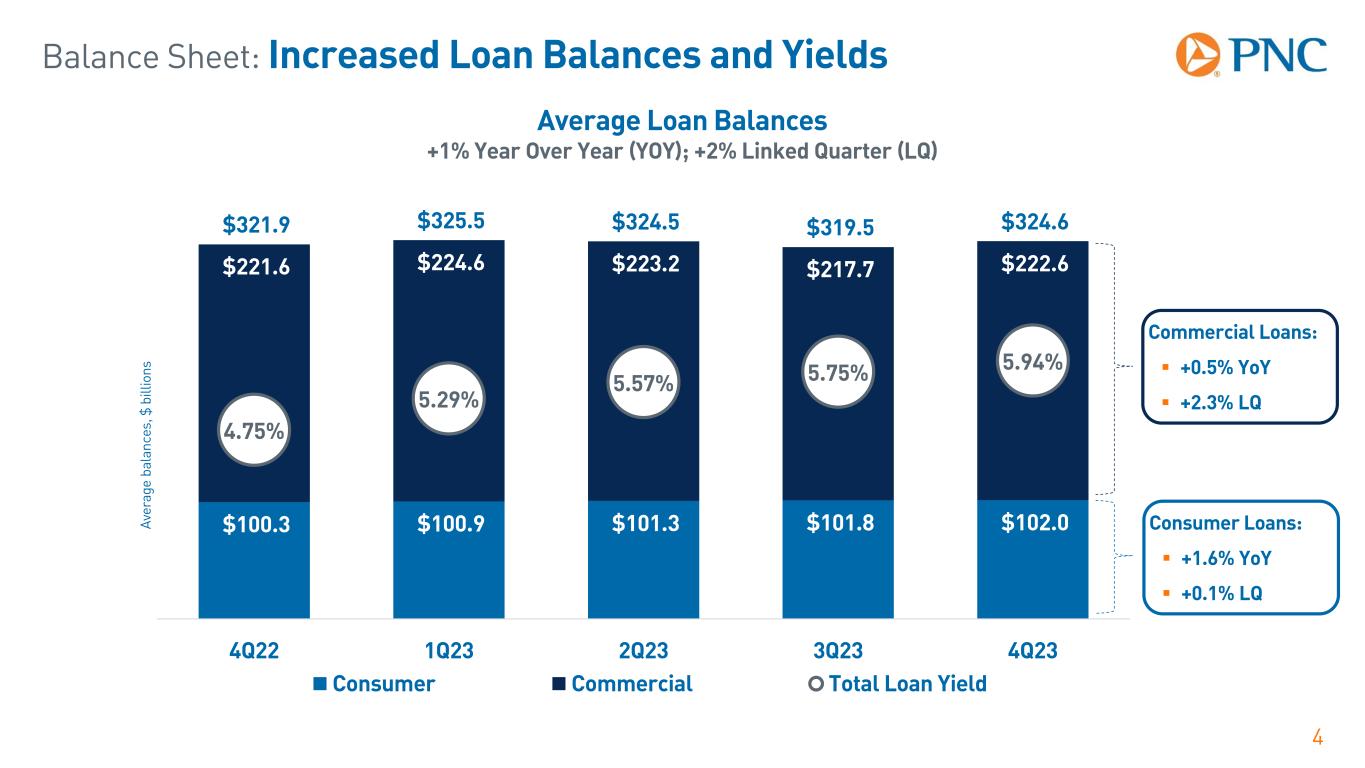

Balance Sheet: Increased Loan Balances and Yields 4 Av er ag e ba la nc es , $ b ill io ns $100.3 $100.9 $101.3 $101.8 $102.0 $221.6 $224.6 $223.2 $217.7 $222.6 $321.9 $325.5 $324.5 $319.5 $324.6 4.75% 5.29% 5.57% 5.75% 5.94% 4Q22 1Q23 2Q23 3Q23 4Q23 Consumer Commercial Total Loan Yield Commercial Loans: +0.5% YoY +2.3% LQ Consumer Loans: +1.6% YoY +0.1% LQ Average Loan Balances +1% Year Over Year (YOY); +2% Linked Quarter (LQ)

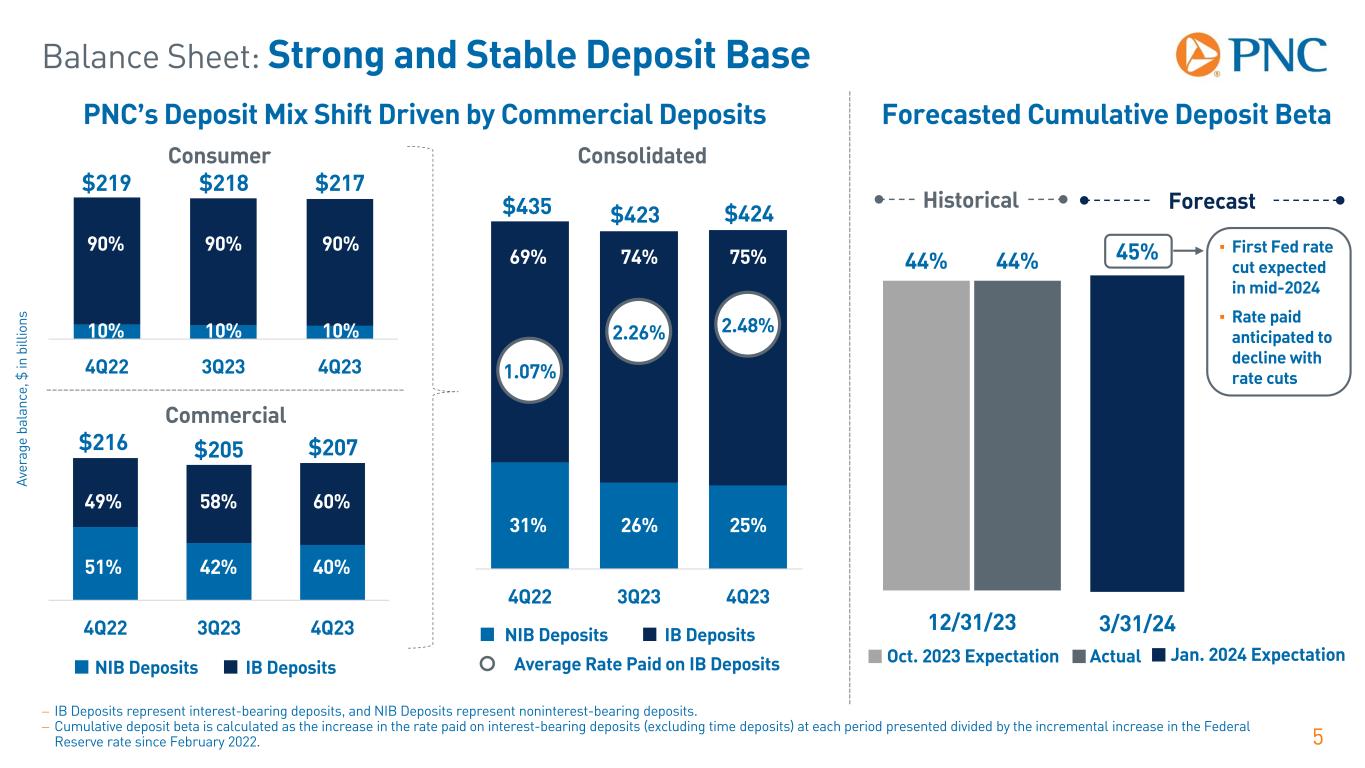

1.07% 2.26% 2.48% 4Q22 3Q23 4Q23 Balance Sheet: Strong and Stable Deposit Base 5 − IB Deposits represent interest-bearing deposits, and NIB Deposits represent noninterest-bearing deposits. − Cumulative deposit beta is calculated as the increase in the rate paid on interest-bearing deposits (excluding time deposits) at each period presented divided by the incremental increase in the Federal Reserve rate since February 2022. PNC’s Deposit Mix Shift Driven by Commercial Deposits 4Q22 3Q23 4Q23 4Q22 3Q23 4Q23 Consumer Commercial Consolidated IB DepositsNIB Deposits IB DepositsNIB Deposits $219 $217 $216 $205 $435 $424 Av er ag e ba la nc e, $ in b ill io ns Forecasted Cumulative Deposit Beta $423 $218 $207 Average Rate Paid on IB Deposits 44% 44% 12/31/23 45% 3/31/24 Jan. 2024 ExpectationActualOct. 2023 Expectation 51% 49% 42% 58% 40% 60% 10% 90% 10% 90% 10% 90% 31% 69% 26% 74% 25% 75% Historical Forecast ▪ First Fed rate cut expected in mid-2024 ▪ Rate paid anticipated to decline with rate cuts

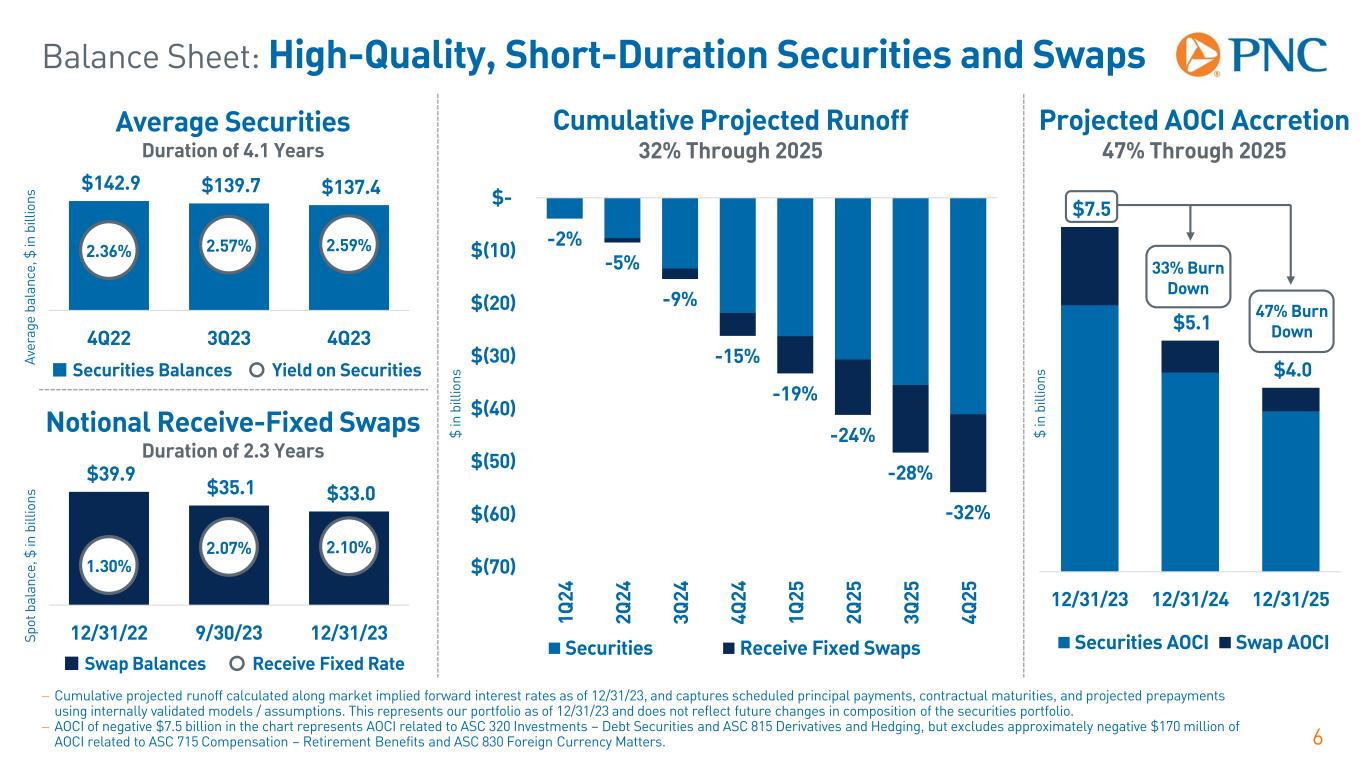

Balance Sheet: High-Quality, Short-Duration Securities and Swaps 6 Average Securities Duration of 4.1 Years $142.9 $139.7 $137.4 2.36% 2.57% 2.59% 4Q22 3Q23 4Q23 Notional Receive-Fixed Swaps Duration of 2.3 Years -2% -5% -9% -15% -19% -24% -28% -32% $(70) $(60) $(50) $(40) $(30) $(20) $(10) $- 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 4Q 25 Securities Receive Fixed Swaps Cumulative Projected Runoff 32% Through 2025 Projected AOCI Accretion 47% Through 2025 $7.5 $5.1 $4.0 12/31/23 12/31/24 12/31/25 Securities AOCI Swap AOCI − Cumulative projected runoff calculated along market implied forward interest rates as of 12/31/23, and captures scheduled principal payments, contractual maturities, and projected prepayments using internally validated models / assumptions. This represents our portfolio as of 12/31/23 and does not reflect future changes in composition of the securities portfolio. − AOCI of negative $7.5 billion in the chart represents AOCI related to ASC 320 Investments – Debt Securities and ASC 815 Derivatives and Hedging, but excludes approximately negative $170 million of AOCI related to ASC 715 Compensation – Retirement Benefits and ASC 830 Foreign Currency Matters. Securities Balances Yield on Securities Swap Balances Receive Fixed Rate Sp ot b al an ce , $ in b ill io ns Av er ag e ba la nc e, $ in b ill io ns 33% Burn Down 47% Burn Down $ in b ill io ns $ in b ill io ns $39.9 $35.1 $33.0 1.30% 2.07% 2.10% 12/31/22 9/30/23 12/31/23

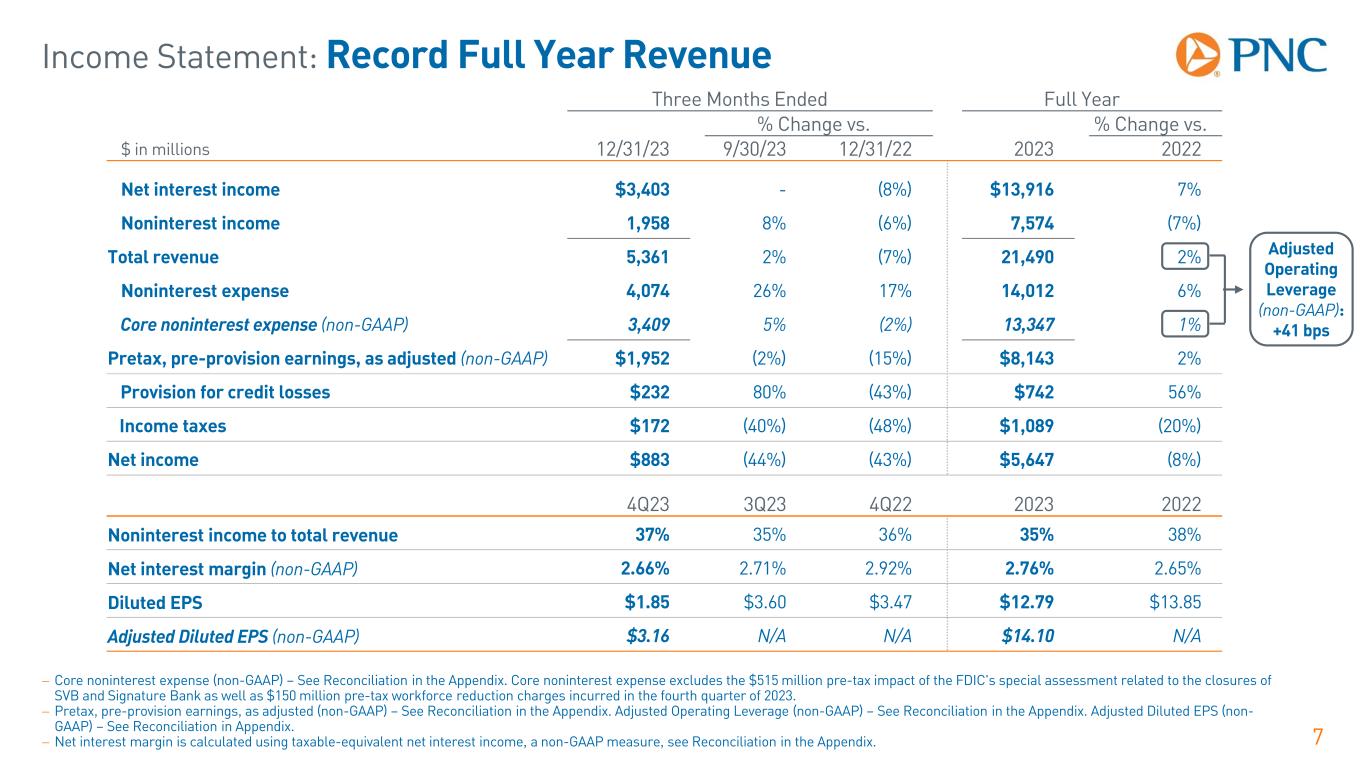

Income Statement: Record Full Year Revenue 7 − Core noninterest expense (non-GAAP) – See Reconciliation in the Appendix. Core noninterest expense excludes the $515 million pre-tax impact of the FDIC's special assessment related to the closures of SVB and Signature Bank as well as $150 million pre-tax workforce reduction charges incurred in the fourth quarter of 2023. − Pretax, pre-provision earnings, as adjusted (non-GAAP) – See Reconciliation in the Appendix. Adjusted Operating Leverage (non-GAAP) – See Reconciliation in the Appendix. Adjusted Diluted EPS (non- GAAP) – See Reconciliation in Appendix. − Net interest margin is calculated using taxable-equivalent net interest income, a non-GAAP measure, see Reconciliation in the Appendix. Three Months Ended Full Year % Change vs. % Change vs. $ in millions 12/31/23 9/30/23 12/31/22 2023 2022 Net interest income $3,403 - (8%) $13,916 7% Noninterest income 1,958 8% (6%) 7,574 (7%) Total revenue 5,361 2% (7%) 21,490 2% Noninterest expense 4,074 26% 17% 14,012 6% Core noninterest expense (non-GAAP) 3,409 5% (2%) 13,347 1% Pretax, pre-provision earnings, as adjusted (non-GAAP) $1,952 (2%) (15%) $8,143 2% Provision for credit losses $232 80% (43%) $742 56% Income taxes $172 (40%) (48%) $1,089 (20%) Net income $883 (44%) (43%) $5,647 (8%) 4Q23 3Q23 4Q22 2023 2022 Noninterest income to total revenue 37% 35% 36% 35% 38% Net interest margin (non-GAAP) 2.66% 2.71% 2.92% 2.76% 2.65% Diluted EPS $1.85 $3.60 $3.47 $12.79 $13.85 Adjusted Diluted EPS (non-GAAP) $3.16 N/A N/A $14.10 N/A Adjusted Operating Leverage (non-GAAP): +41 bps

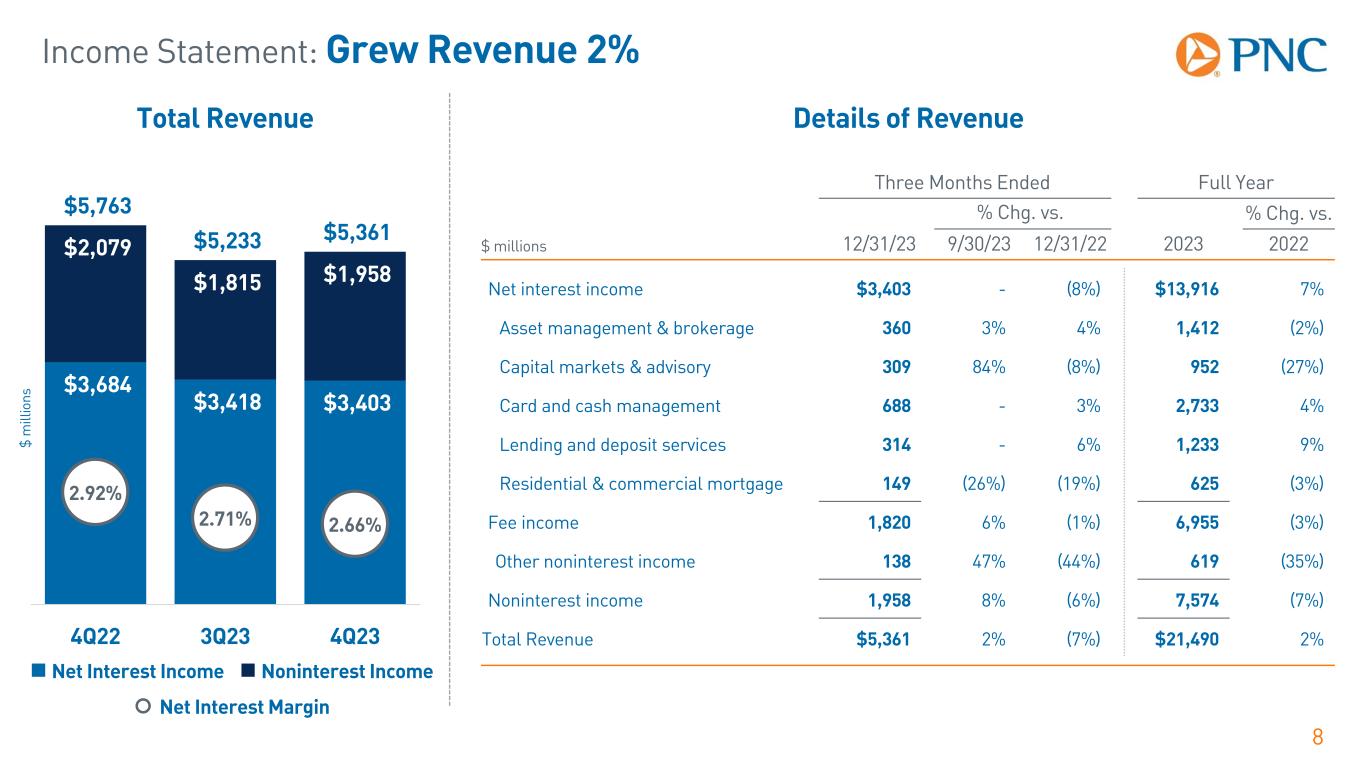

Income Statement: Grew Revenue 2% 8 $ m ill io ns Total Revenue $3,684 $3,418 $3,403 $2,079 $1,815 $1,958 $5,763 $5,233 $5,361 2.92% 2.71% 2.66% 4Q22 3Q23 4Q23 Details of Revenue Net Interest Income Net Interest Margin Noninterest Income Three Months Ended Full Year % Chg. vs. % Chg. vs. $ millions 12/31/23 9/30/23 12/31/22 2023 2022 Net interest income $3,403 - (8%) $13,916 7% Asset management & brokerage 360 3% 4% 1,412 (2%) Capital markets & advisory 309 84% (8%) 952 (27%) Card and cash management 688 - 3% 2,733 4% Lending and deposit services 314 - 6% 1,233 9% Residential & commercial mortgage 149 (26%) (19%) 625 (3%) Fee income 1,820 6% (1%) 6,955 (3%) Other noninterest income 138 47% (44%) 619 (35%) Noninterest income 1,958 8% (6%) 7,574 (7%) Total Revenue $5,361 2% (7%) $21,490 2%

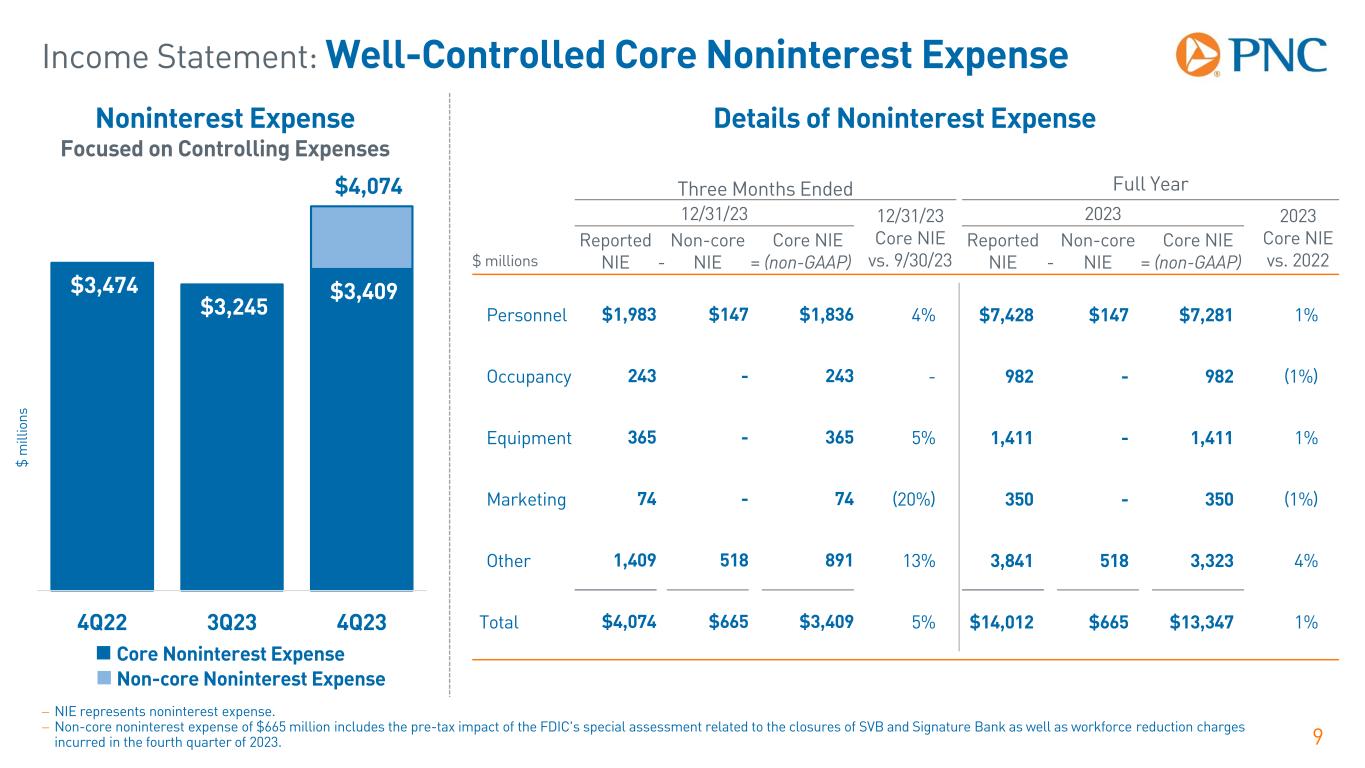

Income Statement: Well-Controlled Core Noninterest Expense 9 Noninterest Expense Focused on Controlling Expenses $3,474 $3,245 $3,409 $4,074 4Q22 3Q23 4Q23 Details of Noninterest Expense $ m ill io ns Three Months Ended Full Year 12/31/23 12/31/23 Core NIE vs. 9/30/23 2023 2023 Core NIE vs. 2022$ millions Reported NIE - Non-core NIE = Core NIE (non-GAAP) Reported NIE - Non-core NIE = Core NIE (non-GAAP) Personnel $1,983 $147 $1,836 4% $7,428 $147 $7,281 1% Occupancy 243 - 243 - 982 - 982 (1%) Equipment 365 - 365 5% 1,411 - 1,411 1% Marketing 74 - 74 (20%) 350 - 350 (1%) Other 1,409 518 891 13% 3,841 518 3,323 4% Total $4,074 $665 $3,409 5% $14,012 $665 $13,347 1% Core Noninterest Expense Non-core Noninterest Expense − NIE represents noninterest expense. − Non-core noninterest expense of $665 million includes the pre-tax impact of the FDIC's special assessment related to the closures of SVB and Signature Bank as well as workforce reduction charges incurred in the fourth quarter of 2023.

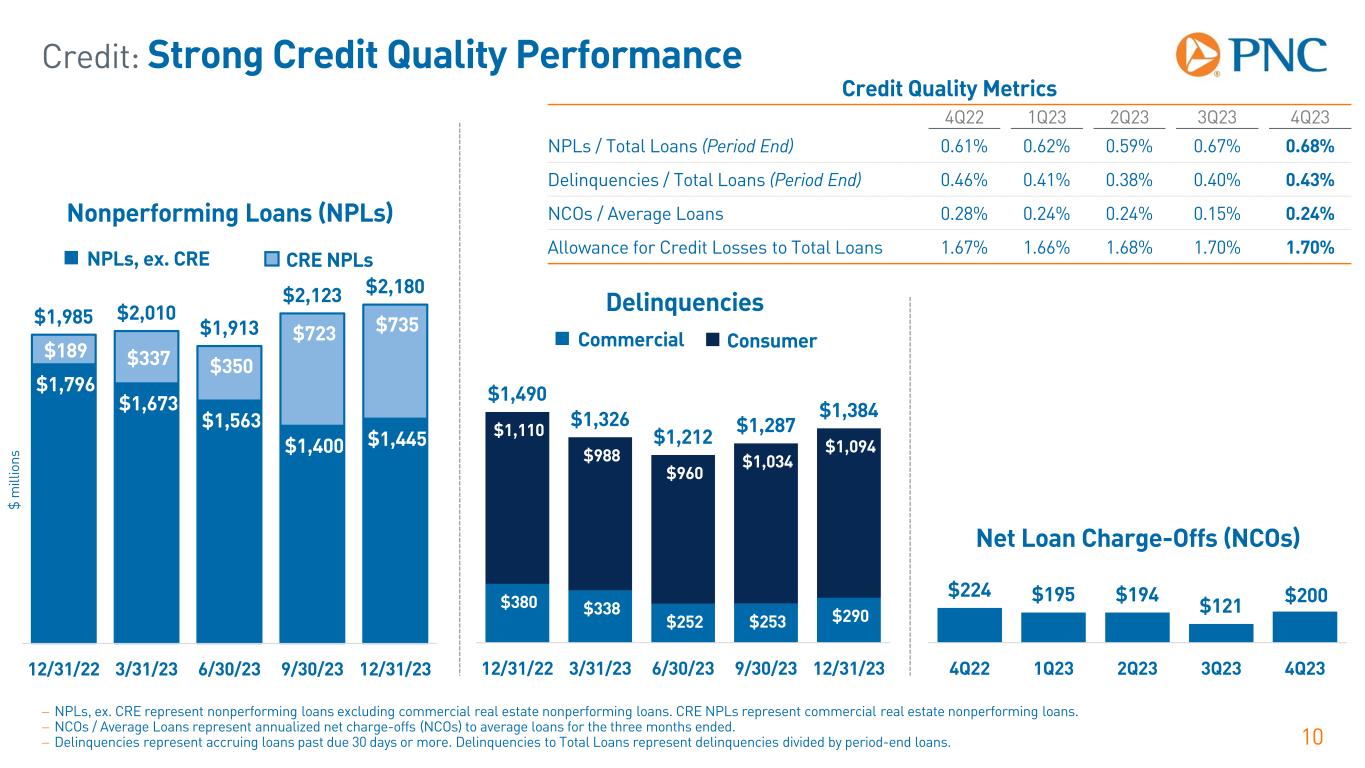

$200$224 $195 $194 $121 4Q22 1Q23 2Q23 3Q23 4Q23 Credit: Strong Credit Quality Performance 10 − NPLs, ex. CRE represent nonperforming loans excluding commercial real estate nonperforming loans. CRE NPLs represent commercial real estate nonperforming loans. − NCOs / Average Loans represent annualized net charge-offs (NCOs) to average loans for the three months ended. − Delinquencies represent accruing loans past due 30 days or more. Delinquencies to Total Loans represent delinquencies divided by period-end loans. $380 $338 $252 $253 $290 $1,110 $988 $960 $1,034 $1,094 $1,490 $1,326 $1,212 $1,287 $1,384 12/31/22 3/31/23 6/30/23 9/30/23 12/31/23 $1,796 $1,673 $1,563 $1,400 $1,445 $189 $337 $350 $723 $735 $1,985 $2,010 $1,913 $2,123 $2,180 12/31/22 3/31/23 6/30/23 9/30/23 12/31/23 Nonperforming Loans (NPLs) Delinquencies Net Loan Charge-Offs (NCOs) Credit Quality Metrics 4Q22 1Q23 2Q23 3Q23 4Q23 NPLs / Total Loans (Period End) 0.61% 0.62% 0.59% 0.67% 0.68% Delinquencies / Total Loans (Period End) 0.46% 0.41% 0.38% 0.40% 0.43% NCOs / Average Loans 0.28% 0.24% 0.24% 0.15% 0.24% Allowance for Credit Losses to Total Loans 1.67% 1.66% 1.68% 1.70% 1.70% $ m ill io ns NPLs, ex. CRE CRE NPLs Commercial Consumer

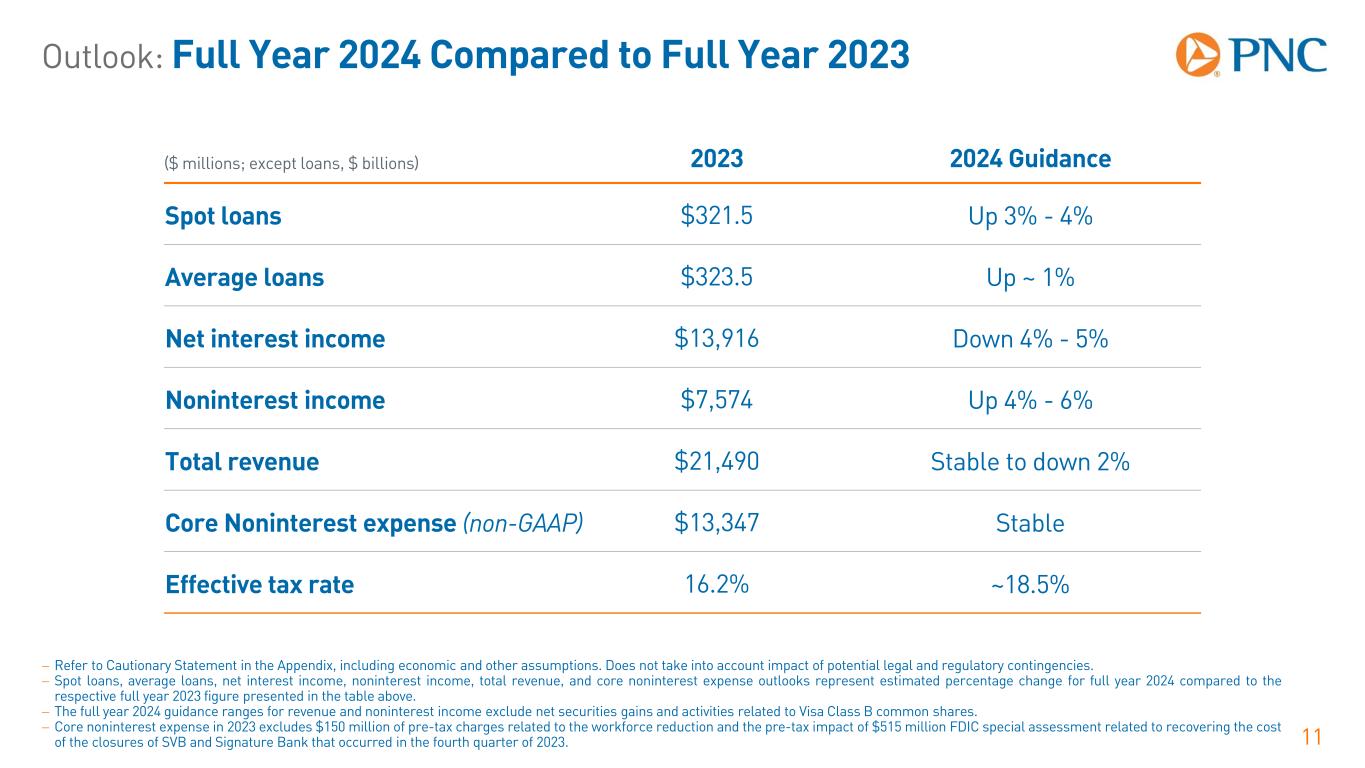

Outlook: Full Year 2024 Compared to Full Year 2023 11 − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies. − Spot loans, average loans, net interest income, noninterest income, total revenue, and core noninterest expense outlooks represent estimated percentage change for full year 2024 compared to the respective full year 2023 figure presented in the table above. − The full year 2024 guidance ranges for revenue and noninterest income exclude net securities gains and activities related to Visa Class B common shares. − Core noninterest expense in 2023 excludes $150 million of pre-tax charges related to the workforce reduction and the pre-tax impact of $515 million FDIC special assessment related to recovering the cost of the closures of SVB and Signature Bank that occurred in the fourth quarter of 2023. ($ millions; except loans, $ billions) 2023 2024 Guidance Spot loans $321.5 Up 3% - 4% Average loans $323.5 Up ~ 1% Net interest income $13,916 Down 4% - 5% Noninterest income $7,574 Up 4% - 6% Total revenue $21,490 Stable to down 2% Core Noninterest expense (non-GAAP) $13,347 Stable Effective tax rate 16.2% ~18.5%

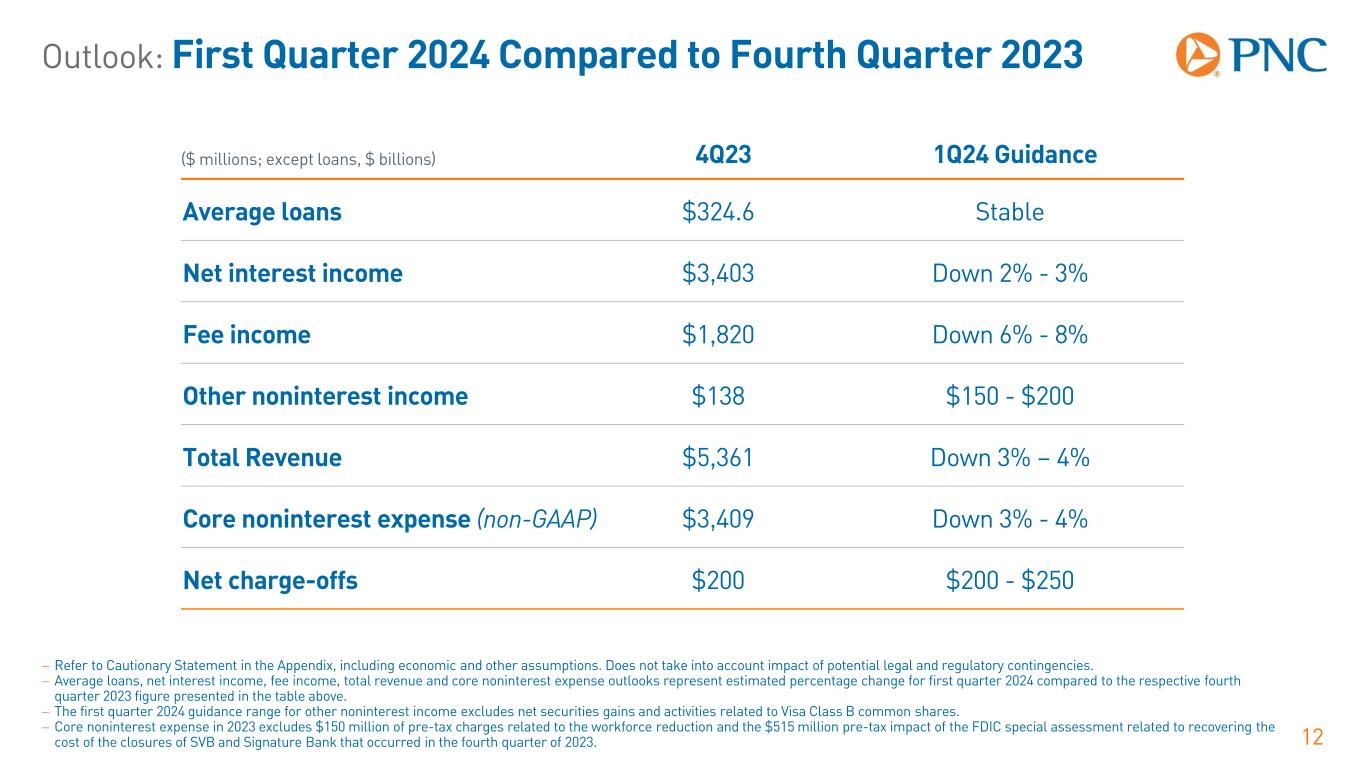

Outlook: First Quarter 2024 Compared to Fourth Quarter 2023 12 − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies. − Average loans, net interest income, fee income, total revenue and core noninterest expense outlooks represent estimated percentage change for first quarter 2024 compared to the respective fourth quarter 2023 figure presented in the table above. − The first quarter 2024 guidance range for other noninterest income excludes net securities gains and activities related to Visa Class B common shares. − Core noninterest expense in 2023 excludes $150 million of pre-tax charges related to the workforce reduction and the $515 million pre-tax impact of the FDIC special assessment related to recovering the cost of the closures of SVB and Signature Bank that occurred in the fourth quarter of 2023. ($ millions; except loans, $ billions) 4Q23 1Q24 Guidance Average loans $324.6 Stable Net interest income $3,403 Down 2% - 3% Fee income $1,820 Down 6% - 8% Other noninterest income $138 $150 - $200 Total Revenue $5,361 Down 3% – 4% Core noninterest expense (non-GAAP) $3,409 Down 3% - 4% Net charge-offs $200 $200 - $250

Appendix: Cautionary Statement Regarding Forward-Looking Information 13 We make statements in this presentation, and we may from time to time make other statements, regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting us and our future business and operations, including our sustainability strategy, that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,” “estimate,” “goal,” “will,” “should” and other similar words and expressions. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements speak only as of the date made. We do not assume any duty and do not undertake any obligation to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. Our forward-looking statements are subject to the following principal risks and uncertainties. Our businesses, financial results and balance sheet values are affected by business and economic conditions, including: − Changes in interest rates and valuations in debt, equity and other financial markets, − Disruptions in the U.S. and global financial markets, − Actions by the Federal Reserve Board, U.S. Treasury and other government agencies, including those that impact money supply, market interest rates and inflation, − Changes in customer behavior due to changing business and economic conditions or legislative or regulatory initiatives, − Changes in customers’, suppliers’ and other counterparties’ performance and creditworthiness, − Impacts of sanctions, tariffs and other trade policies of the U.S. and its global trading partners, − Impacts of changes in federal, state and local governmental policy, including on the regulatory landscape, capital markets, taxes, infrastructure spending and social programs, − Our ability to attract, recruit and retain skilled employees, and − Commodity price volatility.

Appendix: Cautionary Statement Regarding Forward-Looking Information 14 Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our views that: − Economic growth accelerated in the first three quarters of 2023, but Federal Reserve monetary policy tightening to slow inflation is weighing on interest-rate sensitive industries. Sectors where interest rates play an outsized role, such as business investment and consumer spending on durable goods, will contract in 2024. − PNC’s baseline outlook is for a mild recession starting in mid-2024, with a small contraction in real GDP of less than 1%, lasting into late 2024. The unemployment rate will increase throughout 2024, peaking at close to 5% in early 2025. Inflation will slow with weaker demand, moving back to the Federal Reserve's 2% objective by the second half of 2024. − PNC expects the federal funds rate to remain unchanged in the near term, between 5.25% and 5.50% through mid-2024, with federal funds rate cuts starting in mid-2024 in response to the recession. PNC’s ability to take certain capital actions, including returning capital to shareholders, is subject to PNC meeting or exceeding minimum capital levels, including a stress capital buffer established by the Federal Reserve Board in connection with the Federal Reserve Board’s Comprehensive Capital Analysis and Review (CCAR) process. PNC’s regulatory capital ratios in the future will depend on, among other things, the company’s financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of PNC’s balance sheet. In addition, PNC’s ability to determine, evaluate and forecast regulatory capital ratios, and to take actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent at least in part on the development, validation and regulatory review of related models and the reliability of and risks resulting from extensive use of such models. Legal and regulatory developments could have an impact on our ability to operate our businesses, financial condition, results of operations, competitive position, reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business generation and retention, liquidity, funding, and ability to attract and retain employees. These developments could include: − Changes to laws and regulations, including changes affecting oversight of the financial services industry, changes in the enforcement and interpretation of such laws and regulations, and changes in accounting and reporting standards. − Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries resulting in monetary losses, costs, or alterations in our business practices, and potentially causing reputational harm to PNC. − Results of the regulatory examination and supervision process, including our failure to satisfy requirements of agreements with governmental agencies. − Costs associated with obtaining rights in intellectual property claimed by others and of adequacy of our intellectual property protection in general.

Appendix: Cautionary Statement Regarding Forward-Looking Information 15 Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory capital and liquidity standards. Our reputation and business and operating results may be affected by our ability to appropriately meet or address environmental, social or governance targets, goals, commitments or concerns that may arise. We grow our business in part through acquisitions and new strategic initiatives. Risks and uncertainties include those presented by the nature of the business acquired and strategic initiative, including in some cases those associated with our entry into new businesses or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, the integration of the acquired businesses into PNC after closing or any failure to execute strategic or operational plans. Competition can have an impact on customer acquisition, growth and retention and on credit spreads and product pricing, which can affect market share, deposits and revenues. Our ability to anticipate and respond to technological changes can also impact our ability to respond to customer needs and meet competitive demands. Business and operating results can also be affected by widespread manmade, natural and other disasters (including severe weather events), health emergencies, dislocations, geopolitical instabilities or events, terrorist activities, system failures or disruptions, security breaches, cyberattacks, international hostilities, or other extraordinary events beyond PNC’s control through impacts on the economy and financial markets generally or on us or our counterparties, customers or third-party vendors and service providers specifically. We provide greater detail regarding these as well as other factors in our 2022 Form 10-K and subsequent Form 10-Qs, including in the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments Notes of the Notes To Consolidated Financial Statements in those reports, and in our other subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss elsewhere in this news release or in our SEC filings, accessible on the SEC’s website at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual references only. Information on these websites is not part of this document.

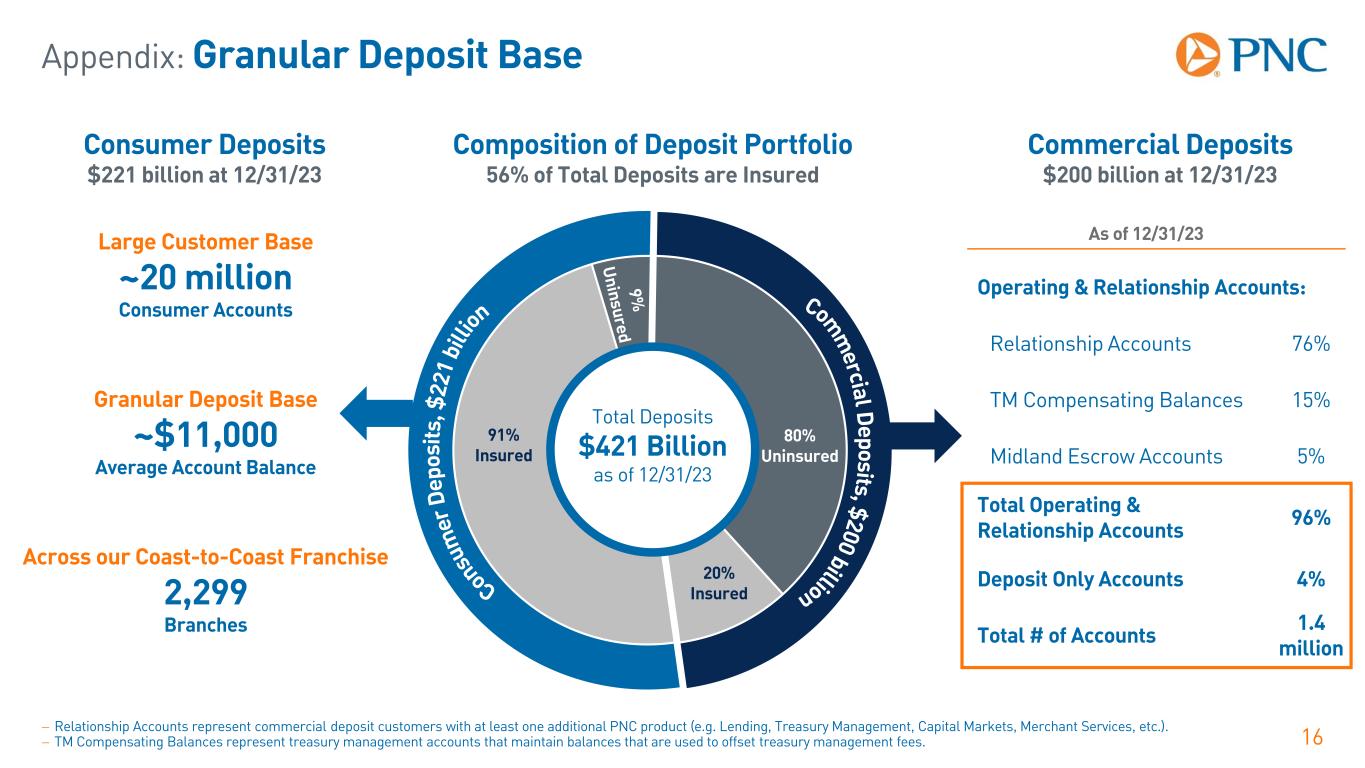

Appendix: Granular Deposit Base 16 Composition of Deposit Portfolio 56% of Total Deposits are Insured Total Deposits $421 Billion as of 12/31/23 Commercial Deposits $200 billion at 12/31/23 91% Insured 20% Insured 80% Uninsured Consumer Deposits $221 billion at 12/31/23 Granular Deposit Base ~$11,000 Average Account Balance Large Customer Base ~20 million Consumer Accounts Across our Coast-to-Coast Franchise 2,299 Branches − Relationship Accounts represent commercial deposit customers with at least one additional PNC product (e.g. Lending, Treasury Management, Capital Markets, Merchant Services, etc.). − TM Compensating Balances represent treasury management accounts that maintain balances that are used to offset treasury management fees. As of 12/31/23 Operating & Relationship Accounts: Relationship Accounts 76% TM Compensating Balances 15% Midland Escrow Accounts 5% Total Operating & Relationship Accounts 96% Deposit Only Accounts 4% Total # of Accounts 1.4 million

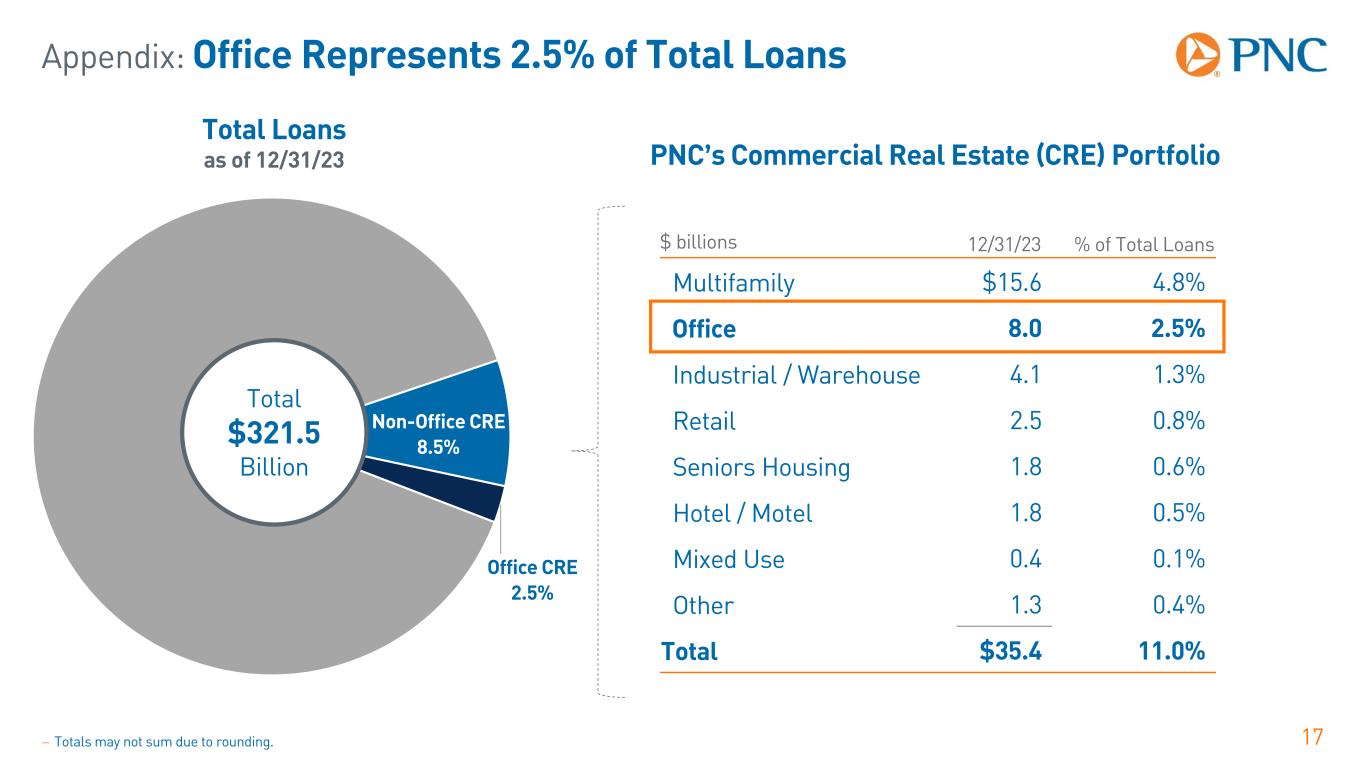

Appendix: Office Represents 2.5% of Total Loans 17 Non-Office CRE 8.5% Office CRE 2.5% Total $321.5 Billion PNC’s Commercial Real Estate (CRE) Portfolio Total Loans as of 12/31/23 $ billions 12/31/23 % of Total Loans Multifamily $15.6 4.8% Office 8.0 2.5% Industrial / Warehouse 4.1 1.3% Retail 2.5 0.8% Seniors Housing 1.8 0.6% Hotel / Motel 1.8 0.5% Mixed Use 0.4 0.1% Other 1.3 0.4% Total $35.4 11.0% − Totals may not sum due to rounding.

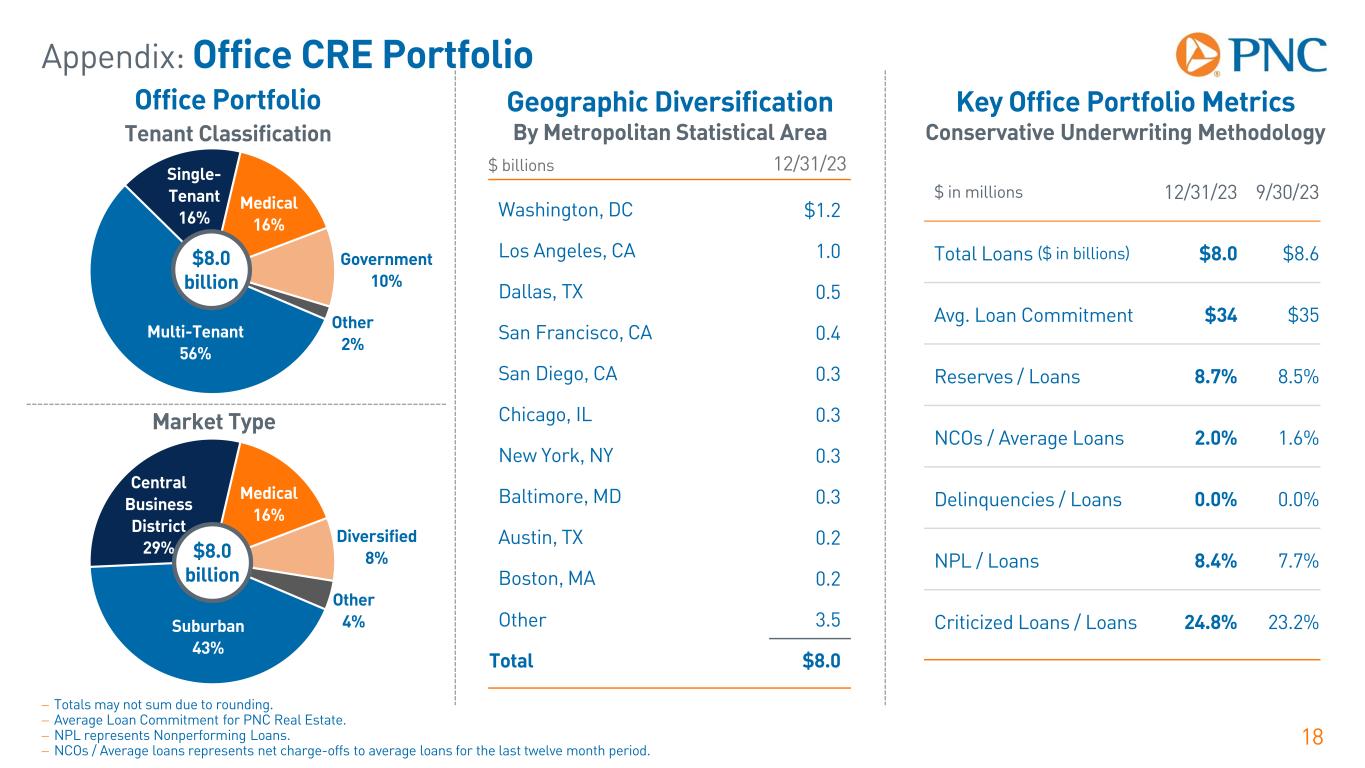

Appendix: Office CRE Portfolio 18 Office Portfolio Multi-Tenant 56% Single- Tenant 16% Medical 16% Government 10% Other 2% $8.0 billion Geographic Diversification By Metropolitan Statistical Area Key Office Portfolio Metrics Conservative Underwriting Methodology Suburban 43% Central Business District 29% Medical 16% Diversified 8% Other 4% $8.0 billion Tenant Classification Market Type $ billions 12/31/23 Washington, DC $1.2 Los Angeles, CA 1.0 Dallas, TX 0.5 San Francisco, CA 0.4 San Diego, CA 0.3 Chicago, IL 0.3 New York, NY 0.3 Baltimore, MD 0.3 Austin, TX 0.2 Boston, MA 0.2 Other 3.5 Total $8.0 $ in millions 12/31/23 9/30/23 Total Loans ($ in billions) $8.0 $8.6 Avg. Loan Commitment $34 $35 Reserves / Loans 8.7% 8.5% NCOs / Average Loans 2.0% 1.6% Delinquencies / Loans 0.0% 0.0% NPL / Loans 8.4% 7.7% Criticized Loans / Loans 24.8% 23.2% − Totals may not sum due to rounding. − Average Loan Commitment for PNC Real Estate. − NPL represents Nonperforming Loans. − NCOs / Average loans represents net charge-offs to average loans for the last twelve month period.

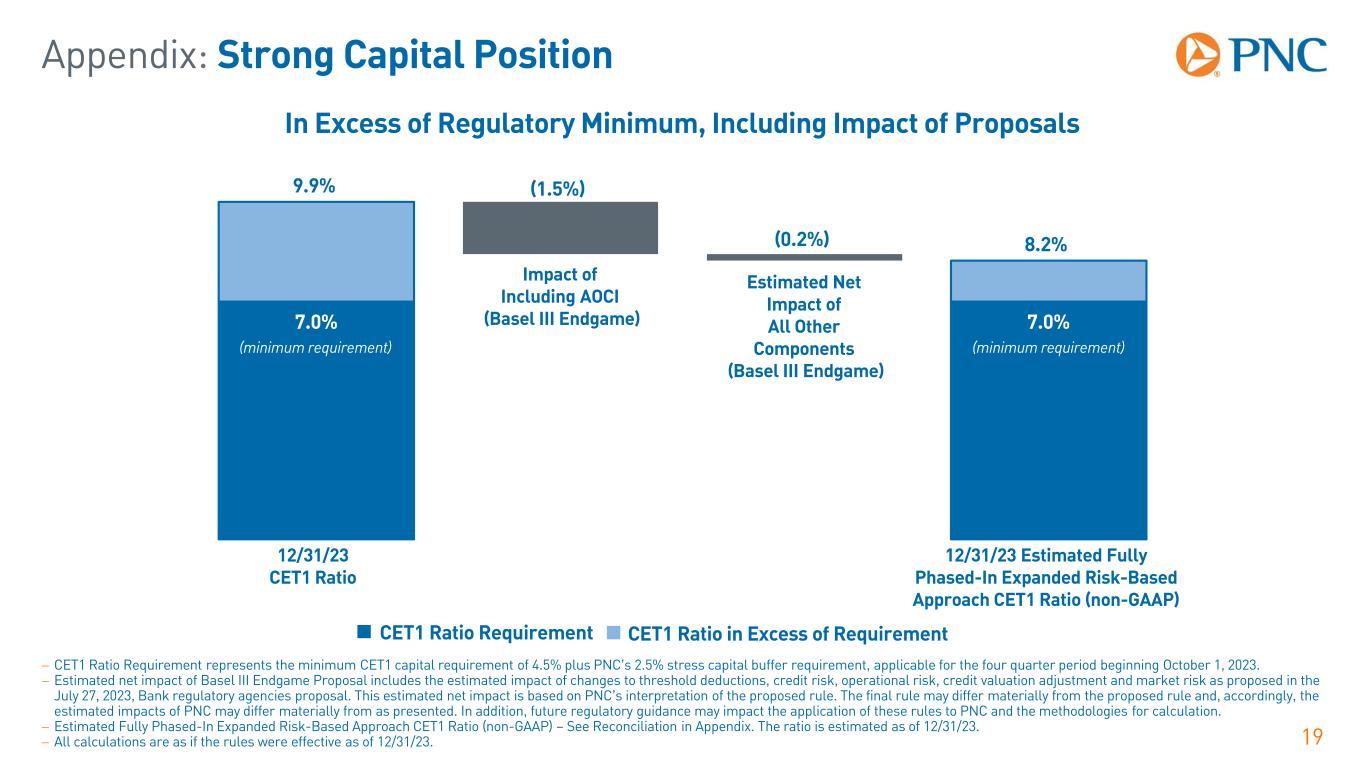

Appendix: Strong Capital Position 19 7.0% 7.0% In Excess of Regulatory Minimum, Including Impact of Proposals − CET1 Ratio Requirement represents the minimum CET1 capital requirement of 4.5% plus PNC’s 2.5% stress capital buffer requirement, applicable for the four quarter period beginning October 1, 2023. − Estimated net impact of Basel III Endgame Proposal includes the estimated impact of changes to threshold deductions, credit risk, operational risk, credit valuation adjustment and market risk as proposed in the July 27, 2023, Bank regulatory agencies proposal. This estimated net impact is based on PNC’s interpretation of the proposed rule. The final rule may differ materially from the proposed rule and, accordingly, the estimated impacts of PNC may differ materially from as presented. In addition, future regulatory guidance may impact the application of these rules to PNC and the methodologies for calculation. − Estimated Fully Phased-In Expanded Risk-Based Approach CET1 Ratio (non-GAAP) – See Reconciliation in Appendix. The ratio is estimated as of 12/31/23. − All calculations are as if the rules were effective as of 12/31/23. Impact of Including AOCI (Basel III Endgame) CET1 Ratio Requirement CET1 Ratio in Excess of Requirement 9.9% (1.5%) (minimum requirement) (0.2%) Estimated Net Impact of All Other Components (Basel III Endgame) 8.2% (minimum requirement) 12/31/23 Estimated Fully Phased-In Expanded Risk-Based Approach CET1 Ratio (non-GAAP) 12/31/23 CET1 Ratio

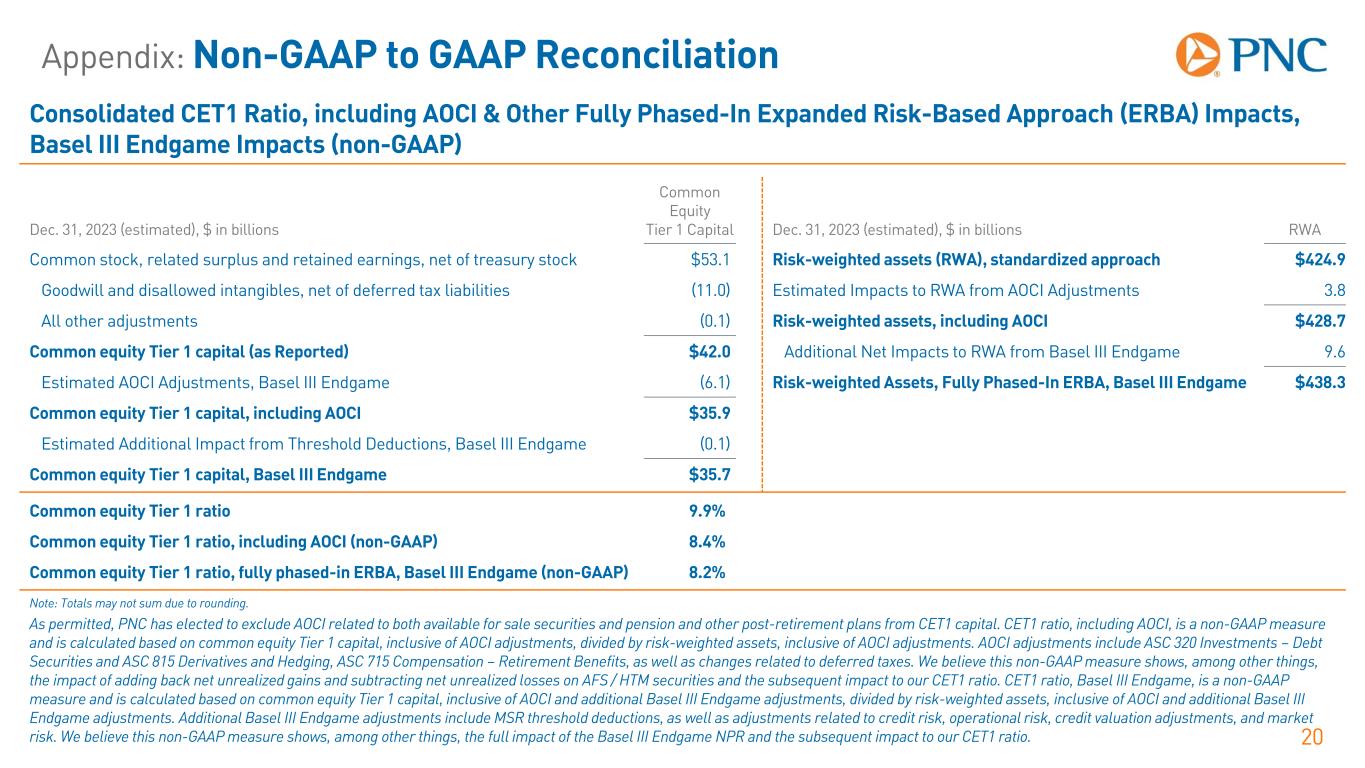

Appendix: Non-GAAP to GAAP Reconciliation 20 Consolidated CET1 Ratio, including AOCI & Other Fully Phased-In Expanded Risk-Based Approach (ERBA) Impacts, Basel III Endgame Impacts (non-GAAP) Dec. 31, 2023 (estimated), $ in billions Common Equity Tier 1 Capital Dec. 31, 2023 (estimated), $ in billions RWA Common stock, related surplus and retained earnings, net of treasury stock $53.1 Risk-weighted assets (RWA), standardized approach $424.9 Goodwill and disallowed intangibles, net of deferred tax liabilities (11.0) Estimated Impacts to RWA from AOCI Adjustments 3.8 All other adjustments (0.1) Risk-weighted assets, including AOCI $428.7 Common equity Tier 1 capital (as Reported) $42.0 Additional Net Impacts to RWA from Basel III Endgame 9.6 Estimated AOCI Adjustments, Basel III Endgame (6.1) Risk-weighted Assets, Fully Phased-In ERBA, Basel III Endgame $438.3 Common equity Tier 1 capital, including AOCI $35.9 Estimated Additional Impact from Threshold Deductions, Basel III Endgame (0.1) Common equity Tier 1 capital, Basel III Endgame $35.7 Common equity Tier 1 ratio 9.9% Common equity Tier 1 ratio, including AOCI (non-GAAP) 8.4% Common equity Tier 1 ratio, fully phased-in ERBA, Basel III Endgame (non-GAAP) 8.2% Note: Totals may not sum due to rounding. As permitted, PNC has elected to exclude AOCI related to both available for sale securities and pension and other post-retirement plans from CET1 capital. CET1 ratio, including AOCI, is a non-GAAP measure and is calculated based on common equity Tier 1 capital, inclusive of AOCI adjustments, divided by risk-weighted assets, inclusive of AOCI adjustments. AOCI adjustments include ASC 320 Investments – Debt Securities and ASC 815 Derivatives and Hedging, ASC 715 Compensation – Retirement Benefits, as well as changes related to deferred taxes. We believe this non-GAAP measure shows, among other things, the impact of adding back net unrealized gains and subtracting net unrealized losses on AFS / HTM securities and the subsequent impact to our CET1 ratio. CET1 ratio, Basel III Endgame, is a non-GAAP measure and is calculated based on common equity Tier 1 capital, inclusive of AOCI and additional Basel III Endgame adjustments, divided by risk-weighted assets, inclusive of AOCI and additional Basel III Endgame adjustments. Additional Basel III Endgame adjustments include MSR threshold deductions, as well as adjustments related to credit risk, operational risk, credit valuation adjustments, and market risk. We believe this non-GAAP measure shows, among other things, the full impact of the Basel III Endgame NPR and the subsequent impact to our CET1 ratio.

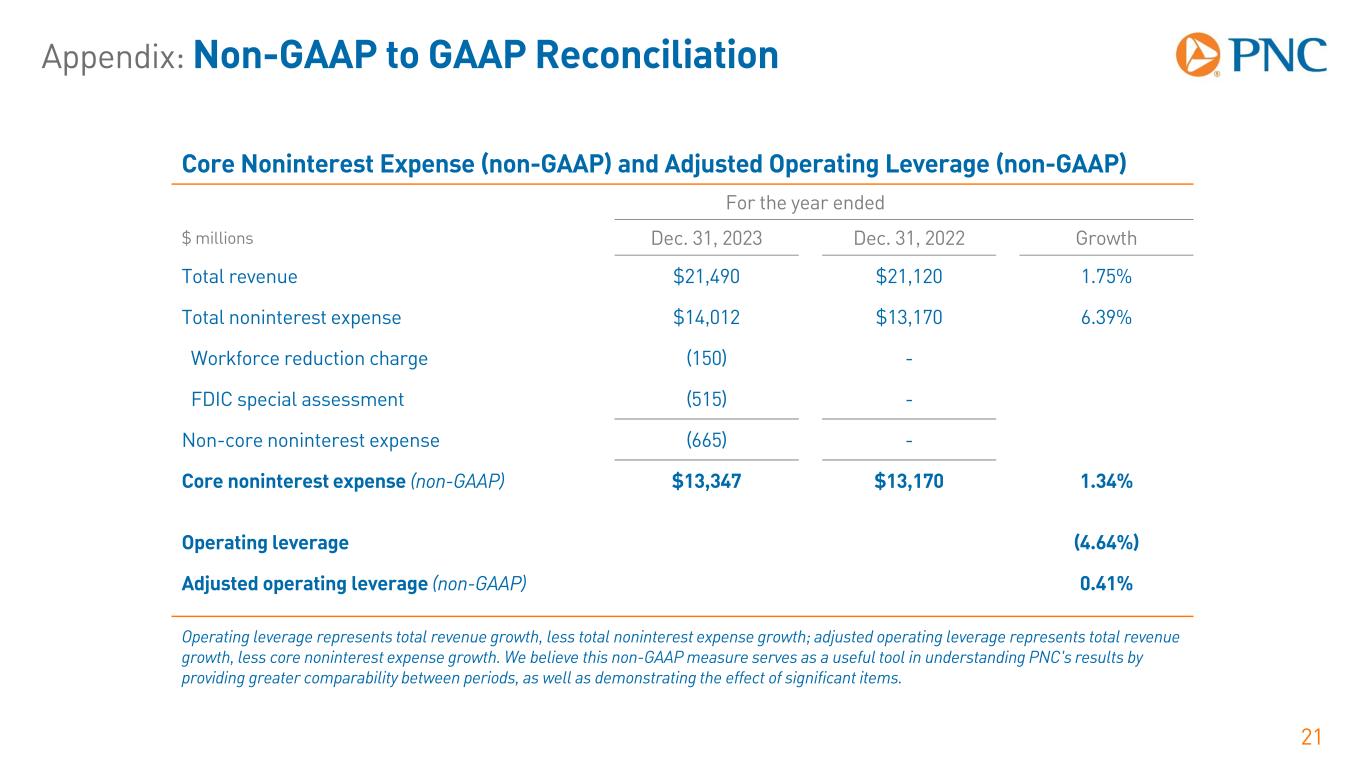

Appendix: Non-GAAP to GAAP Reconciliation 21 Core Noninterest Expense (non-GAAP) and Adjusted Operating Leverage (non-GAAP) For the year ended $ millions Dec. 31, 2023 Dec. 31, 2022 Growth Total revenue $21,490 $21,120 1.75% Total noninterest expense $14,012 $13,170 6.39% Workforce reduction charge (150) - FDIC special assessment (515) - Non-core noninterest expense (665) - Core noninterest expense (non-GAAP) $13,347 $13,170 1.34% Operating leverage (4.64%) Adjusted operating leverage (non-GAAP) 0.41% Operating leverage represents total revenue growth, less total noninterest expense growth; adjusted operating leverage represents total revenue growth, less core noninterest expense growth. We believe this non-GAAP measure serves as a useful tool in understanding PNC's results by providing greater comparability between periods, as well as demonstrating the effect of significant items.

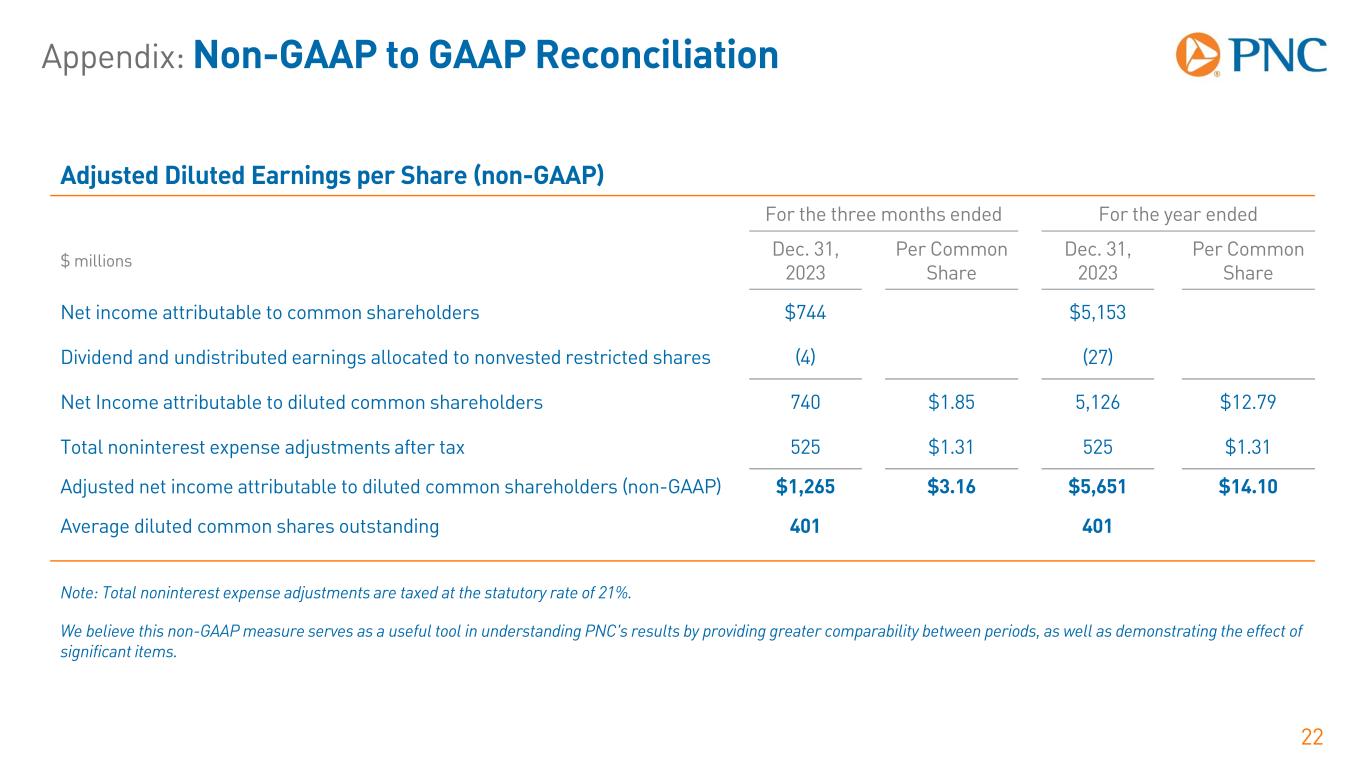

Appendix: Non-GAAP to GAAP Reconciliation 22 Adjusted Diluted Earnings per Share (non-GAAP) For the three months ended For the year ended $ millions Dec. 31, 2023 Per Common Share Dec. 31, 2023 Per Common Share Net income attributable to common shareholders $744 $5,153 Dividend and undistributed earnings allocated to nonvested restricted shares (4) (27) Net Income attributable to diluted common shareholders 740 $1.85 5,126 $12.79 Total noninterest expense adjustments after tax 525 $1.31 525 $1.31 Adjusted net income attributable to diluted common shareholders (non-GAAP) $1,265 $3.16 $5,651 $14.10 Average diluted common shares outstanding 401 401 Note: Total noninterest expense adjustments are taxed at the statutory rate of 21%. We believe this non-GAAP measure serves as a useful tool in understanding PNC's results by providing greater comparability between periods, as well as demonstrating the effect of significant items.

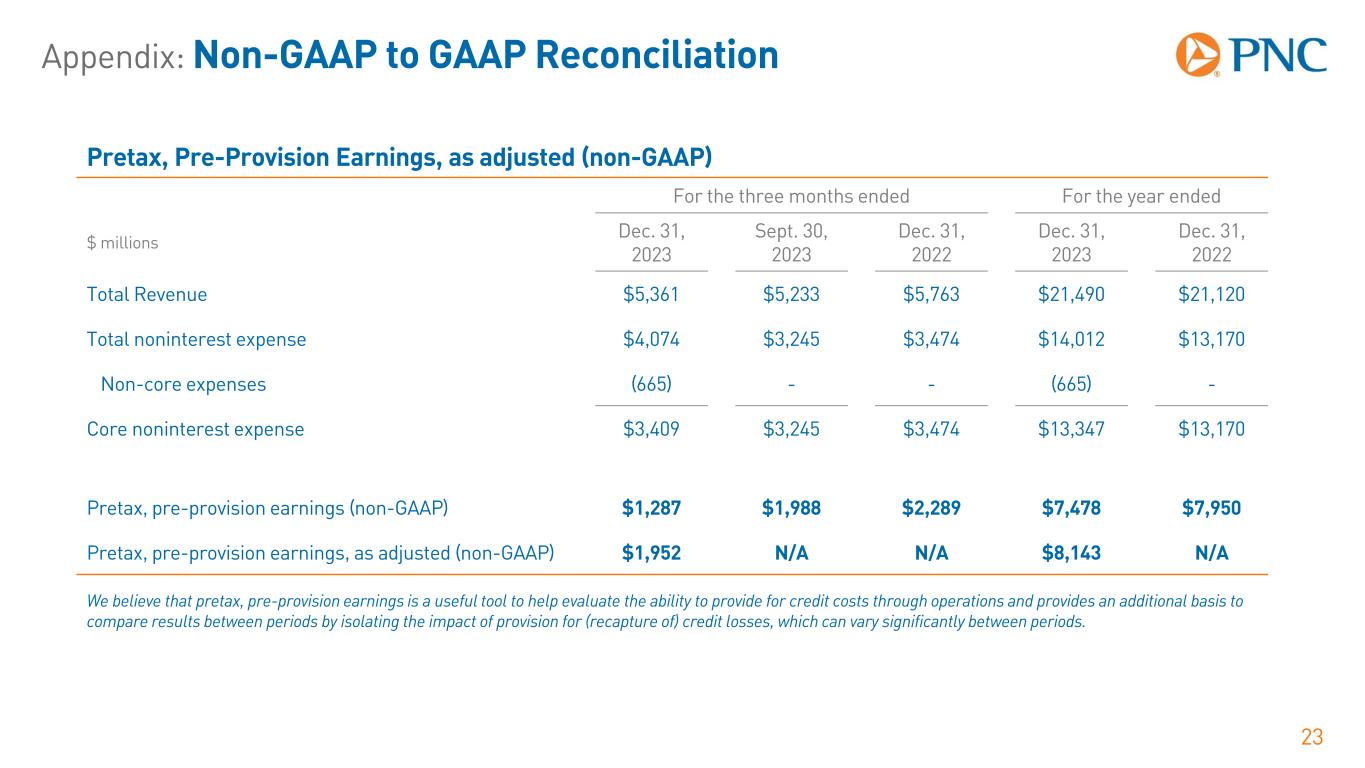

Appendix: Non-GAAP to GAAP Reconciliation 23 Pretax, Pre-Provision Earnings, as adjusted (non-GAAP) For the three months ended For the year ended $ millions Dec. 31, 2023 Sept. 30, 2023 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2022 Total Revenue $5,361 $5,233 $5,763 $21,490 $21,120 Total noninterest expense $4,074 $3,245 $3,474 $14,012 $13,170 Non-core expenses (665) - - (665) - Core noninterest expense $3,409 $3,245 $3,474 $13,347 $13,170 Pretax, pre-provision earnings (non-GAAP) $1,287 $1,988 $2,289 $7,478 $7,950 Pretax, pre-provision earnings, as adjusted (non-GAAP) $1,952 N/A N/A $8,143 N/A We believe that pretax, pre-provision earnings is a useful tool to help evaluate the ability to provide for credit costs through operations and provides an additional basis to compare results between periods by isolating the impact of provision for (recapture of) credit losses, which can vary significantly between periods.

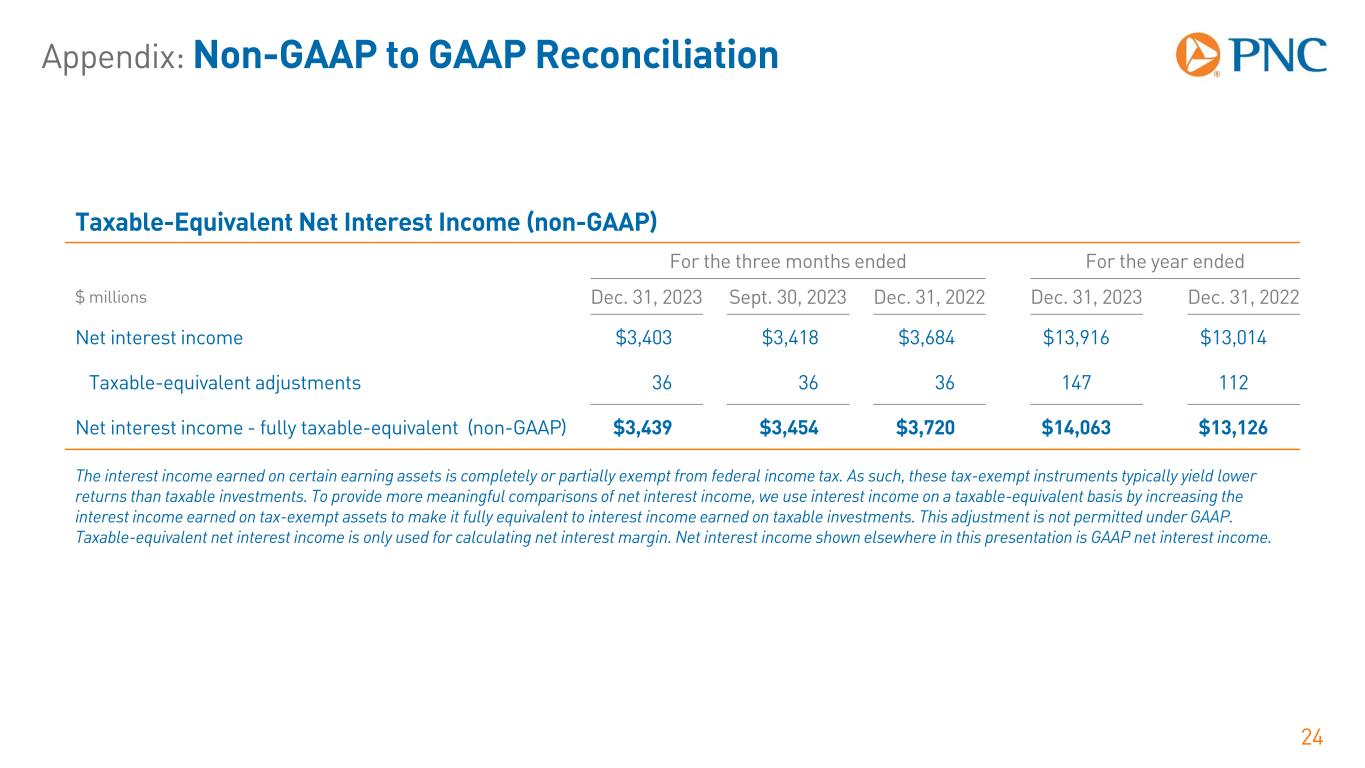

Appendix: Non-GAAP to GAAP Reconciliation 24 Taxable-Equivalent Net Interest Income (non-GAAP) For the three months ended For the year ended $ millions Dec. 31, 2023 Sept. 30, 2023 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2022 Net interest income $3,403 $3,418 $3,684 $13,916 $13,014 Taxable-equivalent adjustments 36 36 36 147 112 Net interest income - fully taxable-equivalent (non-GAAP) $3,439 $3,454 $3,720 $14,063 $13,126 The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of net interest income, we use interest income on a taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP. Taxable-equivalent net interest income is only used for calculating net interest margin. Net interest income shown elsewhere in this presentation is GAAP net interest income.

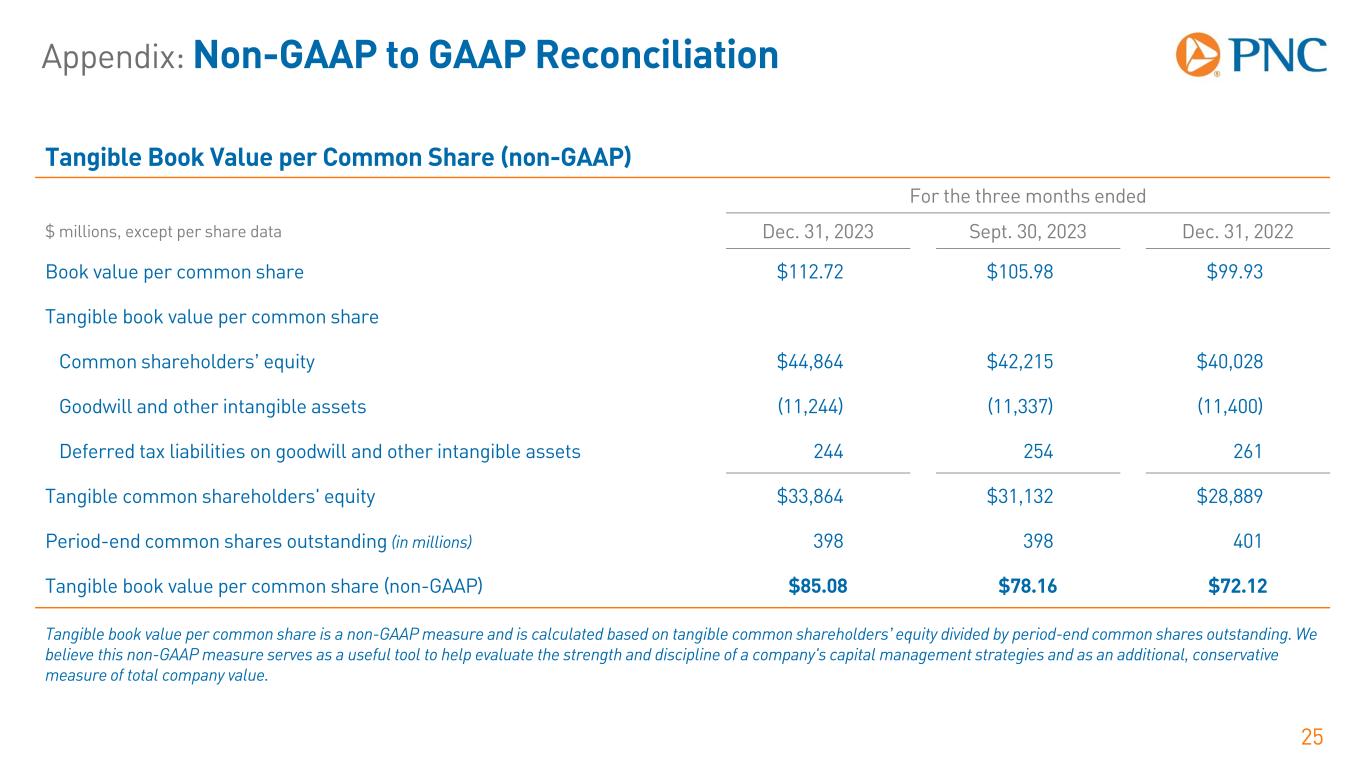

Appendix: Non-GAAP to GAAP Reconciliation 25 Tangible Book Value per Common Share (non-GAAP) For the three months ended $ millions, except per share data Dec. 31, 2023 Sept. 30, 2023 Dec. 31, 2022 Book value per common share $112.72 $105.98 $99.93 Tangible book value per common share Common shareholders’ equity $44,864 $42,215 $40,028 Goodwill and other intangible assets (11,244) (11,337) (11,400) Deferred tax liabilities on goodwill and other intangible assets 244 254 261 Tangible common shareholders' equity $33,864 $31,132 $28,889 Period-end common shares outstanding (in millions) 398 398 401 Tangible book value per common share (non-GAAP) $85.08 $78.16 $72.12 Tangible book value per common share is a non-GAAP measure and is calculated based on tangible common shareholders’ equity divided by period-end common shares outstanding. We believe this non-GAAP measure serves as a useful tool to help evaluate the strength and discipline of a company's capital management strategies and as an additional, conservative measure of total company value.

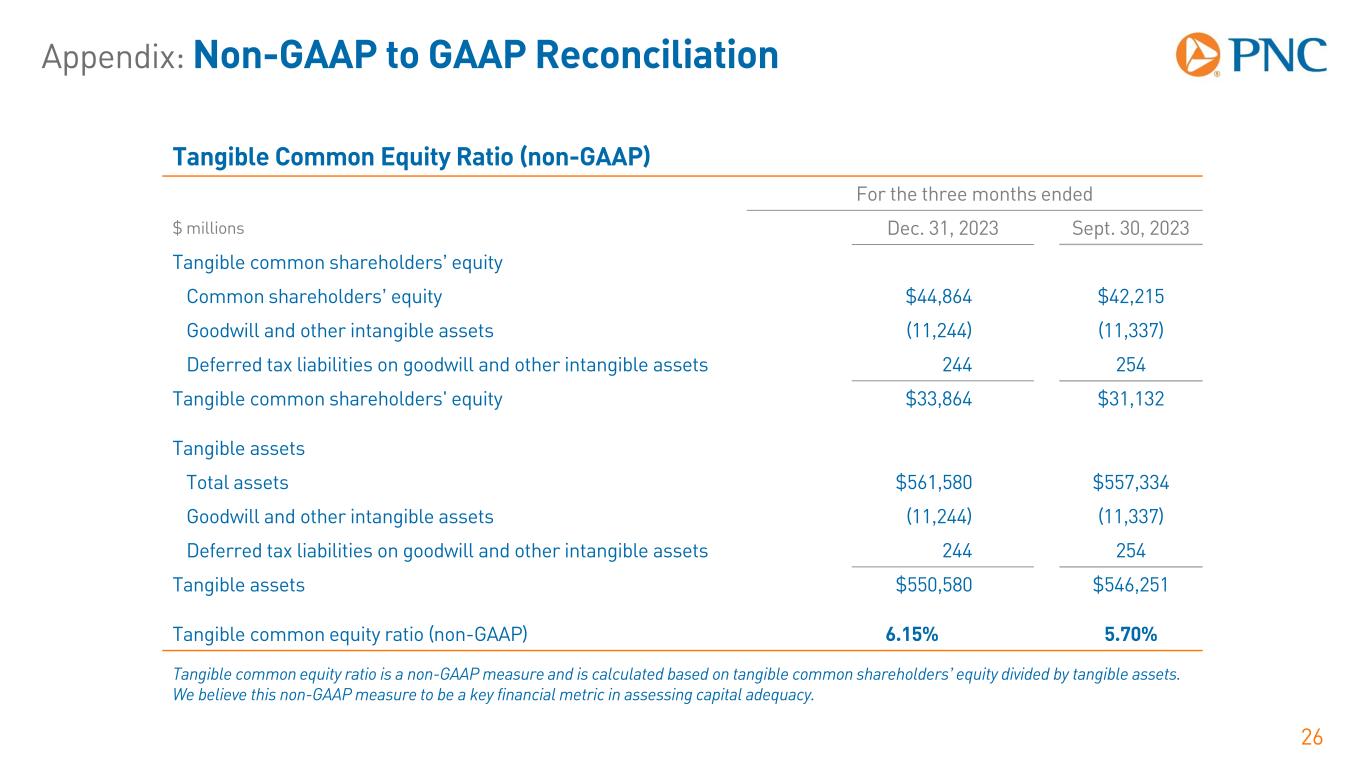

Appendix: Non-GAAP to GAAP Reconciliation 26 Tangible Common Equity Ratio (non-GAAP) For the three months ended $ millions Dec. 31, 2023 Sept. 30, 2023 Tangible common shareholders’ equity Common shareholders’ equity $44,864 $42,215 Goodwill and other intangible assets (11,244) (11,337) Deferred tax liabilities on goodwill and other intangible assets 244 254 Tangible common shareholders' equity $33,864 $31,132 Tangible assets Total assets $561,580 $557,334 Goodwill and other intangible assets (11,244) (11,337) Deferred tax liabilities on goodwill and other intangible assets 244 254 Tangible assets $550,580 $546,251 Tangible common equity ratio (non-GAAP) 6.15% 5.70% Tangible common equity ratio is a non-GAAP measure and is calculated based on tangible common shareholders’ equity divided by tangible assets. We believe this non-GAAP measure to be a key financial metric in assessing capital adequacy.

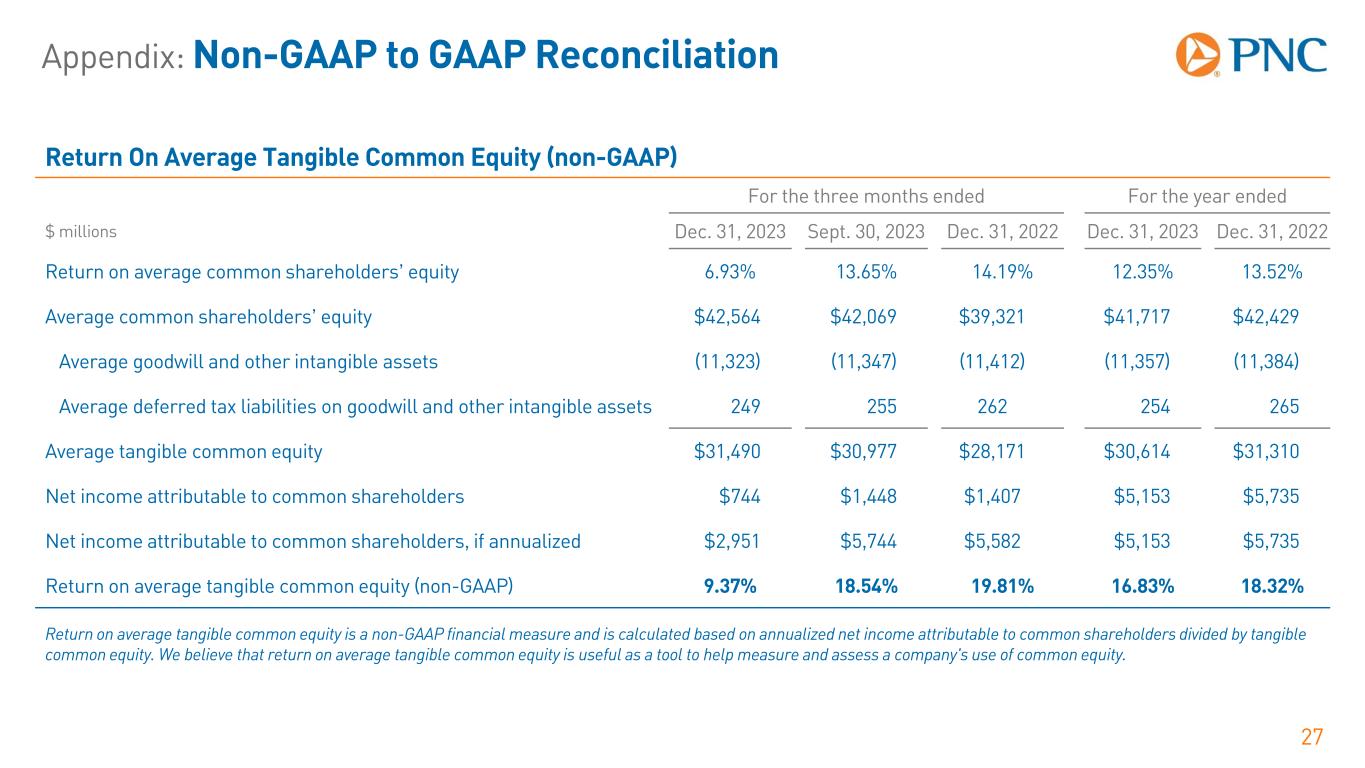

Appendix: Non-GAAP to GAAP Reconciliation 27 Return On Average Tangible Common Equity (non-GAAP) For the three months ended For the year ended $ millions Dec. 31, 2023 Sept. 30, 2023 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2022 Return on average common shareholders’ equity 6.93% 13.65% 14.19% 12.35% 13.52% Average common shareholders’ equity $42,564 $42,069 $39,321 $41,717 $42,429 Average goodwill and other intangible assets (11,323) (11,347) (11,412) (11,357) (11,384) Average deferred tax liabilities on goodwill and other intangible assets 249 255 262 254 265 Average tangible common equity $31,490 $30,977 $28,171 $30,614 $31,310 Net income attributable to common shareholders $744 $1,448 $1,407 $5,153 $5,735 Net income attributable to common shareholders, if annualized $2,951 $5,744 $5,582 $5,153 $5,735 Return on average tangible common equity (non-GAAP) 9.37% 18.54% 19.81% 16.83% 18.32% Return on average tangible common equity is a non-GAAP financial measure and is calculated based on annualized net income attributable to common shareholders divided by tangible common equity. We believe that return on average tangible common equity is useful as a tool to help measure and assess a company's use of common equity.

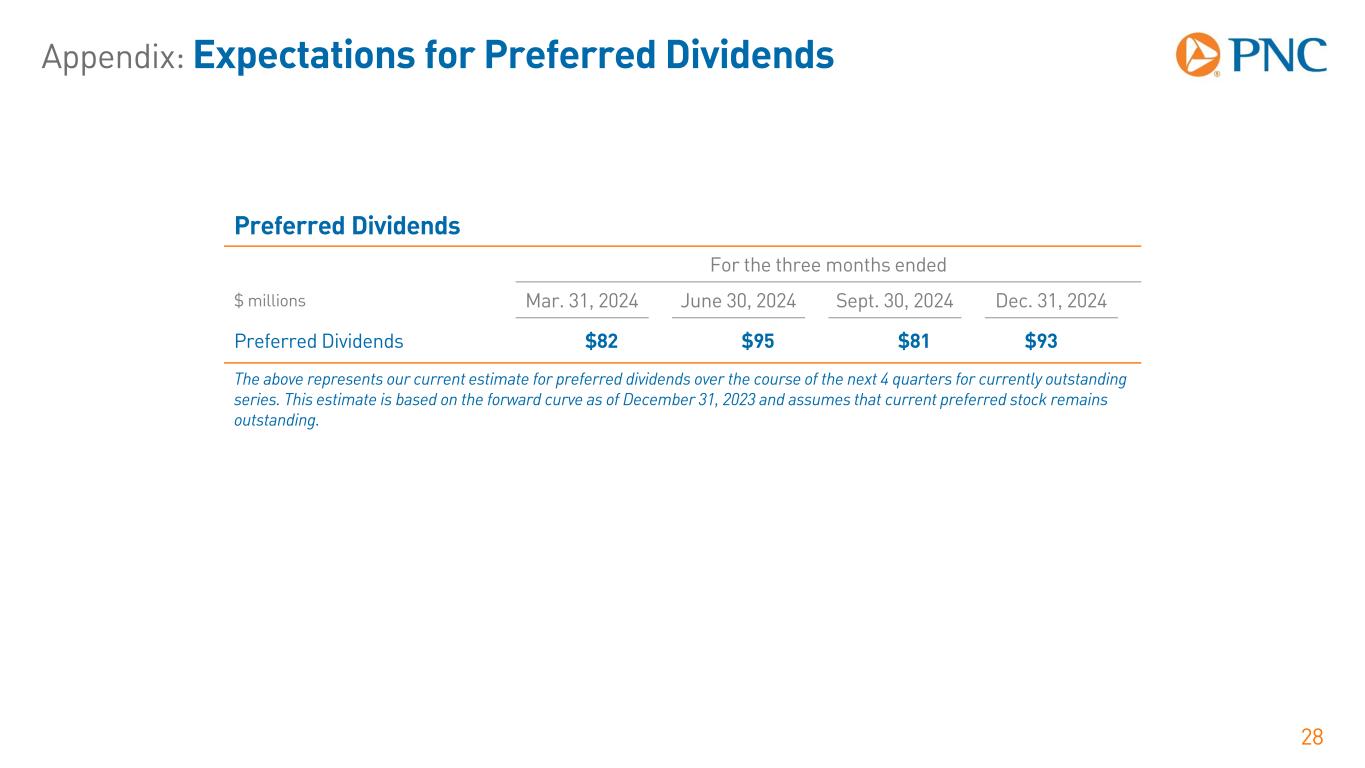

Appendix: Expectations for Preferred Dividends 28 Preferred Dividends For the three months ended $ millions Mar. 31, 2024 June 30, 2024 Sept. 30, 2024 Dec. 31, 2024 Preferred Dividends $82 $95 $81 $93 The above represents our current estimate for preferred dividends over the course of the next 4 quarters for currently outstanding series. This estimate is based on the forward curve as of December 31, 2023 and assumes that current preferred stock remains outstanding.