EX-99.1

Published on December 5, 2023

The PNC Financial Services Group Goldman Sachs Financial Services Conference December 5, 2023 Exhibit 99.1

Cautionary Statement Regarding Forward-Looking and non-GAAP Financial Information This presentation is not intended as a full business or financial review and should be viewed in the context of all of the information made available by PNC in its SEC filings and on our corporate website. The presentation contains forward-looking statements regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations, including sustainability strategy. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward- looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix. We provide greater detail regarding these and other factors in our 2022 Form 10-K, our subsequent From 10-Qs, and our other subsequent SEC filings. Our forward-looking statements may also be subject to risks and uncertainties including those we may discuss in this presentation or in our SEC filings. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake any obligation to update those statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this information and the related reconciliations may be useful to investors, analysts, regulators and others to help understand and evaluate our financial results, and with respect to adjusted metrics, because we believe they better reflect the ongoing financial results and trends of our businesses and increase comparability of period-to-period results. We may also use annualized, pro forma, estimated or third party numbers for illustrative or comparative purposes only. These may not reflect actual results. References to our corporate website are to www.pnc.com under “About Us - Investor Relations.” Our SEC filings are available both on our corporate website and on the SEC’s website at www.sec.gov. We include web addresses here as inactive textual references only. Information on these websites is not part of this presentation. 1

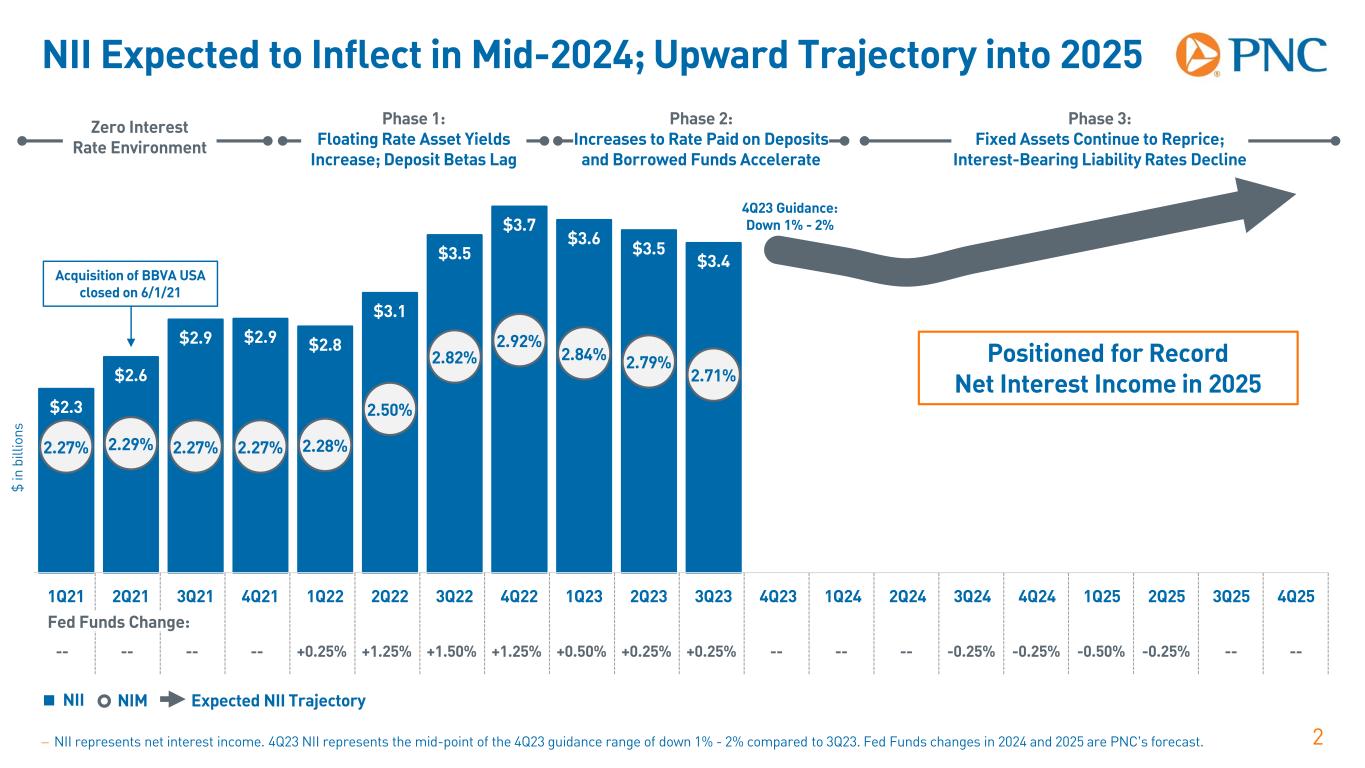

NII Expected to Inflect in Mid-2024; Upward Trajectory into 2025 2 $2.3 $2.6 $2.9 $2.9 $2.8 $3.1 $3.5 $3.7 $3.6 $3.5 $3.4 2.27% 2.29% 2.27% 2.27% 2.28% 2.50% 2.82% 2.92% 2.84% 2.79% 2.71% 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 +0.25% +1.25% +1.50% +0.50% +0.25%+1.25% +0.25% -- -- -- -0.25% -0.25% -0.50% -0.25% NII Expected NII TrajectoryNIM − NII represents net interest income. 4Q23 NII represents the mid-point of the 4Q23 guidance range of down 1% - 2% compared to 3Q23. Fed Funds changes in 2024 and 2025 are PNC’s forecast. 4Q23 Guidance: Down 1% - 2% Phase 1: Floating Rate Asset Yields Increase; Deposit Betas Lag Phase 2: Increases to Rate Paid on Deposits and Borrowed Funds Accelerate Phase 3: Fixed Assets Continue to Reprice; Interest-Bearing Liability Rates Decline $ in b ill io ns -------- ---- Zero Interest Rate Environment Fed Funds Change: Acquisition of BBVA USA closed on 6/1/21 Positioned for Record Net Interest Income in 2025

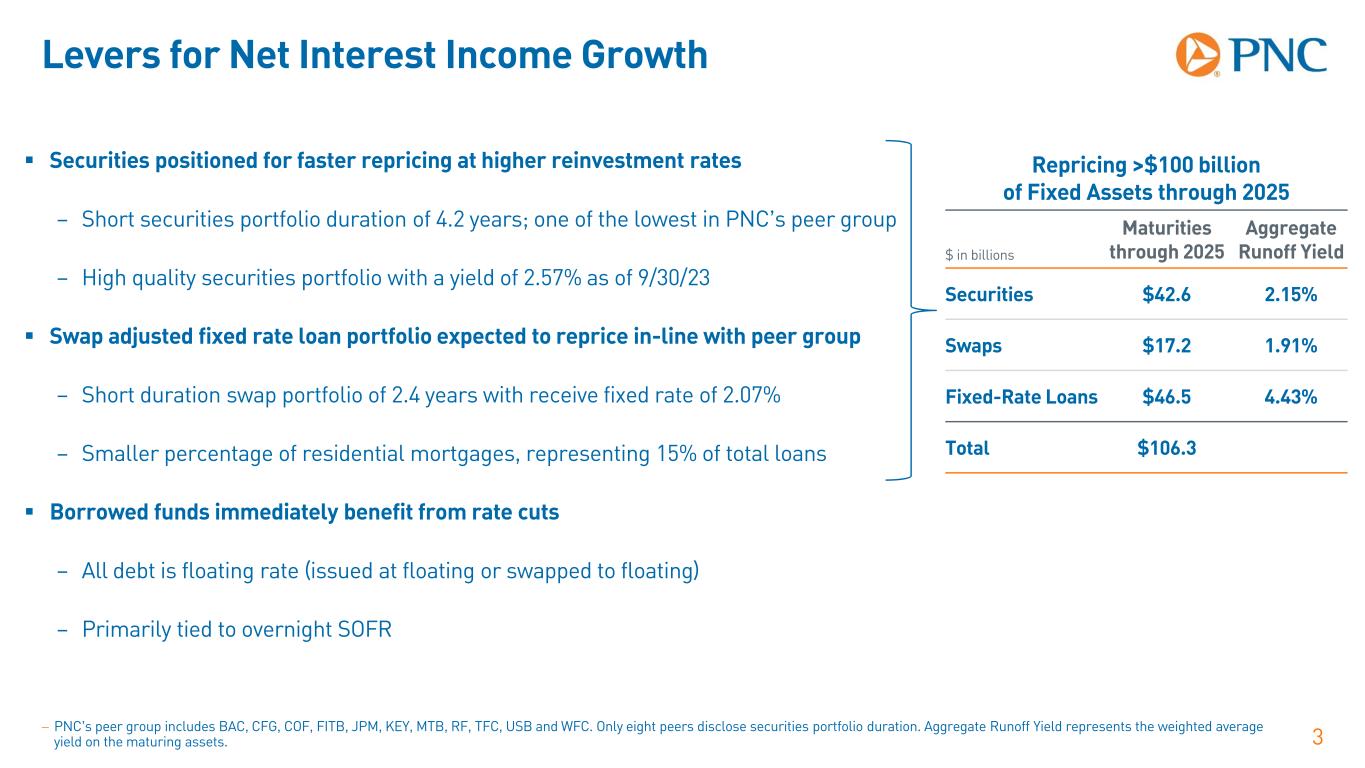

Levers for Net Interest Income Growth 3− PNC’s peer group includes BAC, CFG, COF, FITB, JPM, KEY, MTB, RF, TFC, USB and WFC. Only eight peers disclose securities portfolio duration. Aggregate Runoff Yield represents the weighted average yield on the maturing assets. Securities positioned for faster repricing at higher reinvestment rates – Short securities portfolio duration of 4.2 years; one of the lowest in PNC’s peer group – High quality securities portfolio with a yield of 2.57% as of 9/30/23 Swap adjusted fixed rate loan portfolio expected to reprice in-line with peer group – Short duration swap portfolio of 2.4 years with receive fixed rate of 2.07% – Smaller percentage of residential mortgages, representing 15% of total loans Borrowed funds immediately benefit from rate cuts – All debt is floating rate (issued at floating or swapped to floating) – Primarily tied to overnight SOFR Repricing >$100 billion of Fixed Assets through 2025 $ in billions Maturities through 2025 Aggregate Runoff Yield Securities $42.6 2.15% Swaps $17.2 1.91% Fixed-Rate Loans $46.5 4.43% Total $106.3

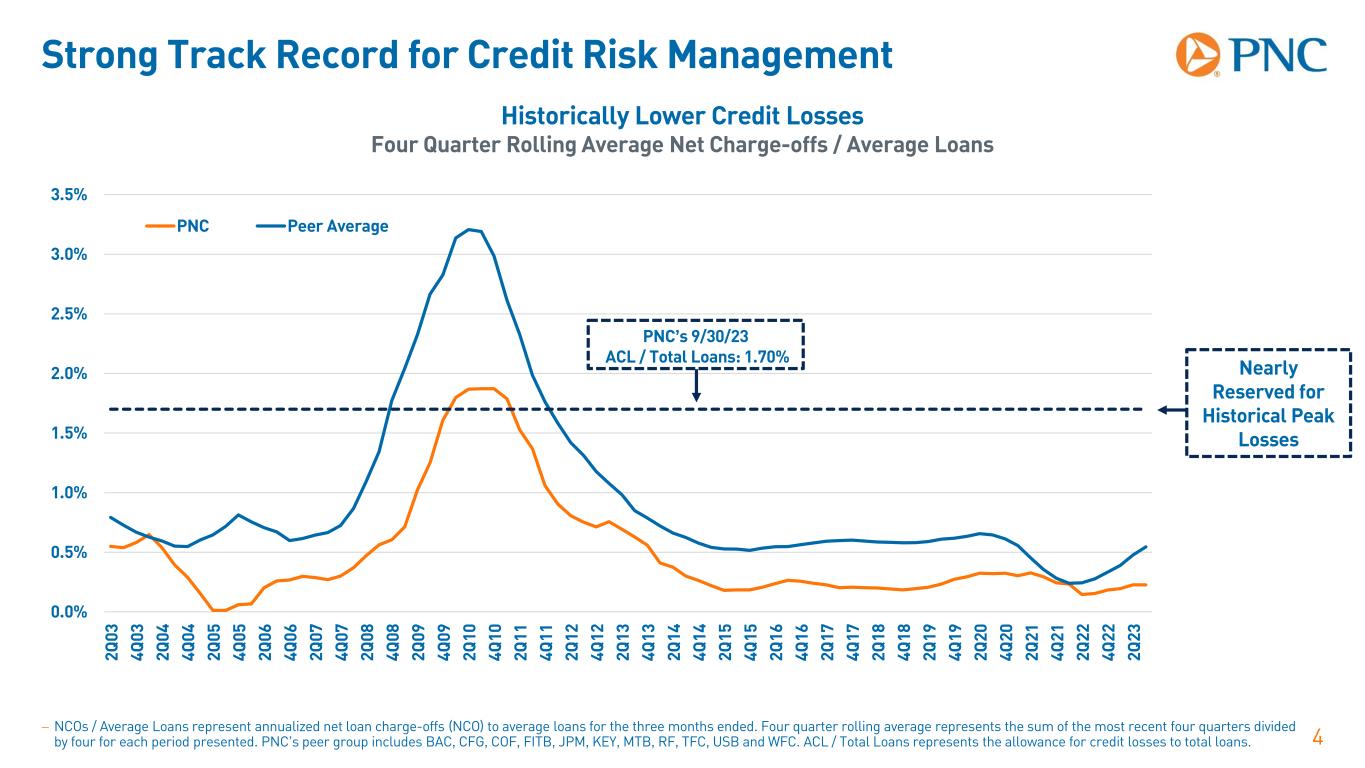

Strong Track Record for Credit Risk Management 4− NCOs / Average Loans represent annualized net loan charge-offs (NCO) to average loans for the three months ended. Four quarter rolling average represents the sum of the most recent four quarters divided by four for each period presented. PNC’s peer group includes BAC, CFG, COF, FITB, JPM, KEY, MTB, RF, TFC, USB and WFC. ACL / Total Loans represents the allowance for credit losses to total loans. 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 2Q 03 4Q 03 2Q 04 4Q 04 2Q 05 4Q 05 2Q 06 4Q 06 2Q 07 4Q 07 2Q 08 4Q 08 2Q 09 4Q 09 2Q 10 4Q 10 2Q 11 4Q 11 2Q 12 4Q 12 2Q 13 4Q 13 2Q 14 4Q 14 2Q 15 4Q 15 2Q 16 4Q 16 2Q 17 4Q 17 2Q 18 4Q 18 2Q 19 4Q 19 2Q 20 4Q 20 2Q 21 4Q 21 2Q 22 4Q 22 2Q 23 PNC Peer Average Historically Lower Credit Losses Four Quarter Rolling Average Net Charge-offs / Average Loans PNC’s 9/30/23 ACL / Total Loans: 1.70% Nearly Reserved for Historical Peak Losses

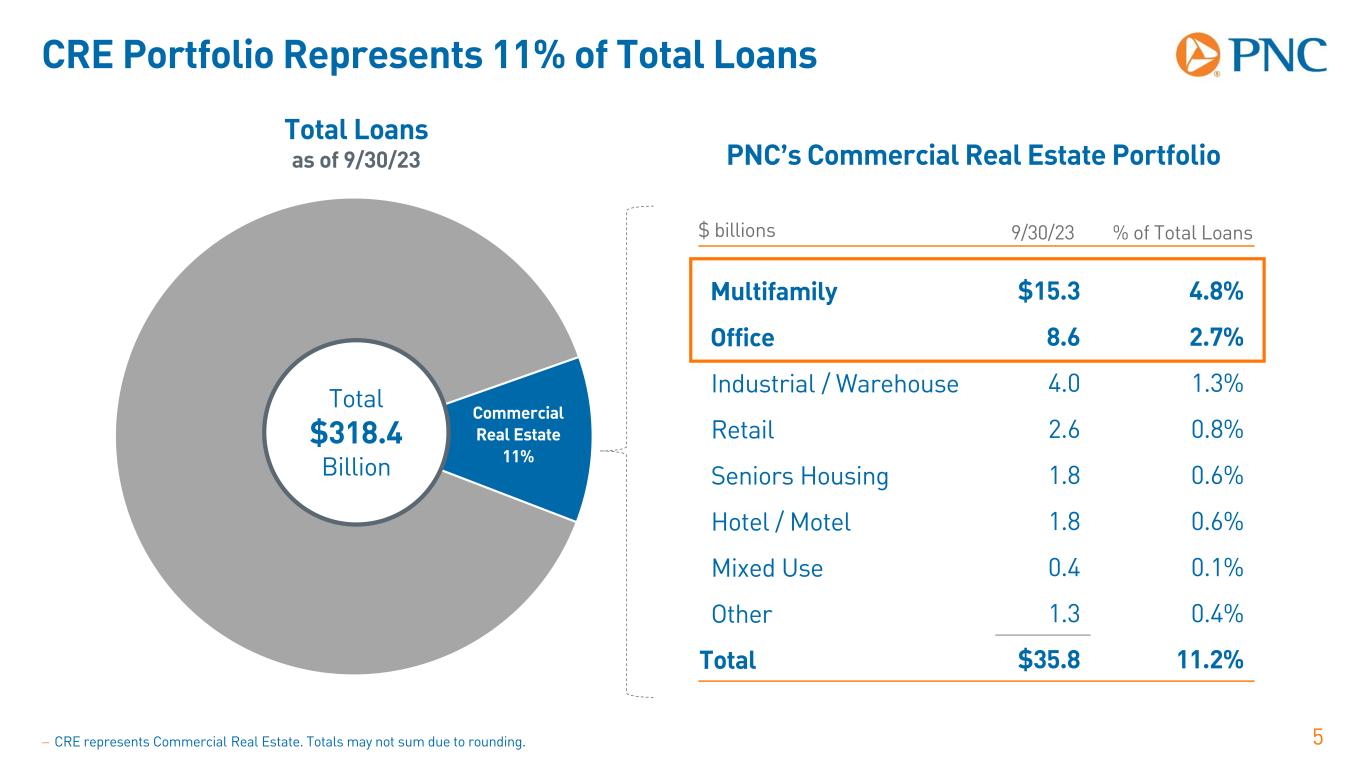

CRE Portfolio Represents 11% of Total Loans 5 Commercial Real Estate 11% Total $318.4 Billion PNC’s Commercial Real Estate Portfolio Total Loans as of 9/30/23 $ billions 9/30/23 % of Total Loans Multifamily $15.3 4.8% Office 8.6 2.7% Industrial / Warehouse 4.0 1.3% Retail 2.6 0.8% Seniors Housing 1.8 0.6% Hotel / Motel 1.8 0.6% Mixed Use 0.4 0.1% Other 1.3 0.4% Total $35.8 11.2% − CRE represents Commercial Real Estate. Totals may not sum due to rounding.

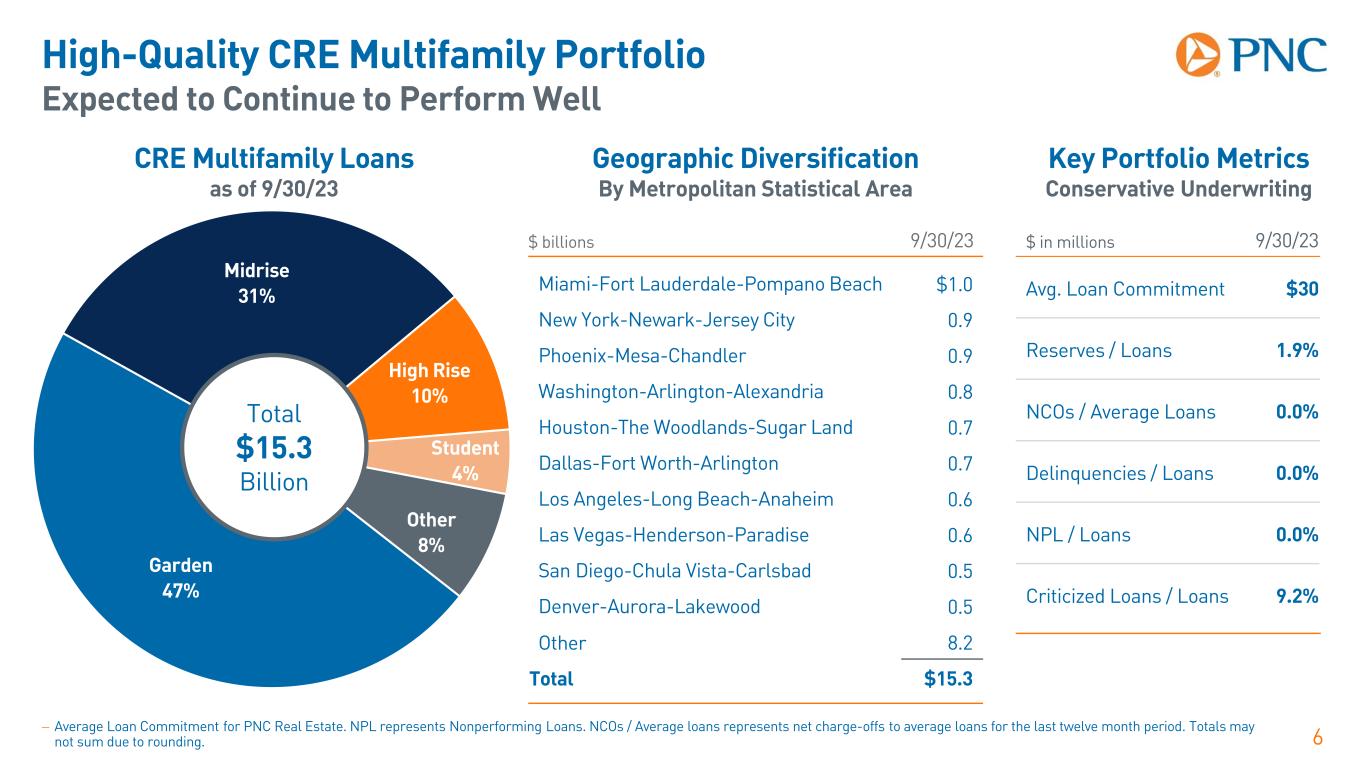

High-Quality CRE Multifamily Portfolio Expected to Continue to Perform Well 6 Garden 47% Midrise 31% High Rise 10% Student 4% Other 8% Total $15.3 Billion CRE Multifamily Loans as of 9/30/23 Geographic Diversification By Metropolitan Statistical Area $ billions 9/30/23 Miami-Fort Lauderdale-Pompano Beach $1.0 New York-Newark-Jersey City 0.9 Phoenix-Mesa-Chandler 0.9 Washington-Arlington-Alexandria 0.8 Houston-The Woodlands-Sugar Land 0.7 Dallas-Fort Worth-Arlington 0.7 Los Angeles-Long Beach-Anaheim 0.6 Las Vegas-Henderson-Paradise 0.6 San Diego-Chula Vista-Carlsbad 0.5 Denver-Aurora-Lakewood 0.5 Other 8.2 Total $15.3 $ in millions 9/30/23 Avg. Loan Commitment $30 Reserves / Loans 1.9% NCOs / Average Loans 0.0% Delinquencies / Loans 0.0% NPL / Loans 0.0% Criticized Loans / Loans 9.2% Key Portfolio Metrics Conservative Underwriting − Average Loan Commitment for PNC Real Estate. NPL represents Nonperforming Loans. NCOs / Average loans represents net charge-offs to average loans for the last twelve month period. Totals may not sum due to rounding.

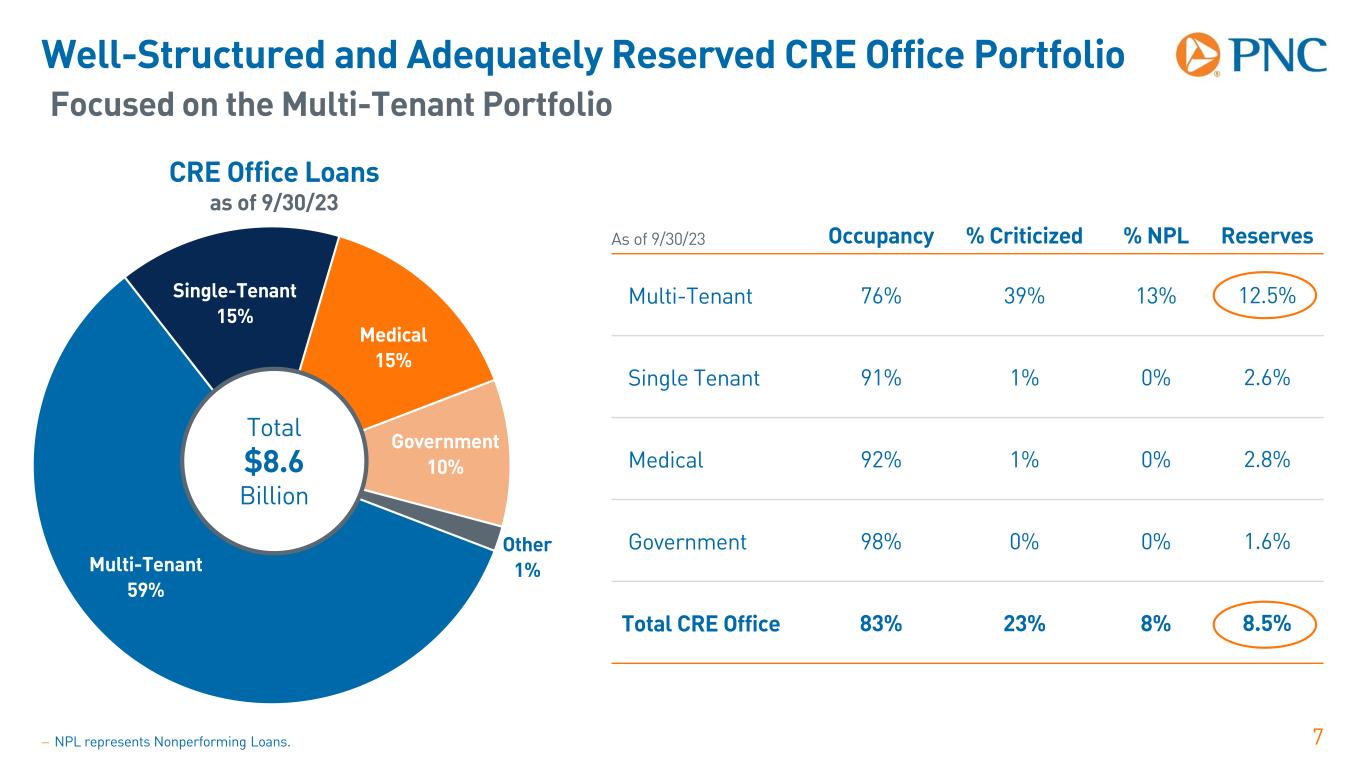

Well-Structured and Adequately Reserved CRE Office Portfolio Focused on the Multi-Tenant Portfolio 7 As of 9/30/23 Occupancy % Criticized % NPL Reserves Multi-Tenant 76% 39% 13% 12.5% Single Tenant 91% 1% 0% 2.6% Medical 92% 1% 0% 2.8% Government 98% 0% 0% 1.6% Total CRE Office 83% 23% 8% 8.5% Multi-Tenant 59% Single-Tenant 15% Medical 15% Government 10% Other 1% Total $8.6 Billion CRE Office Loans as of 9/30/23 − NPL represents Nonperforming Loans.

Appendix: Cautionary Statement Regarding Forward-Looking Information 8 We make statements in this news release and related conference call, and we may from time to time make other statements, regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting us and our future business and operations, including our sustainability strategy, that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,” “estimate,” “goal,” “will,” “should” and other similar words and expressions. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements speak only as of the date made. We do not assume any duty and do not undertake any obligation to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. Our forward-looking statements are subject to the following principal risks and uncertainties. Our businesses, financial results and balance sheet values are affected by business and economic conditions, including: − Changes in interest rates and valuations in debt, equity and other financial markets, − Disruptions in the U.S. and global financial markets, − Actions by the Federal Reserve Board, U.S. Treasury and other government agencies, including those that impact money supply, market interest rates and inflation, − Changes in customer behavior due to changing business and economic conditions or legislative or regulatory initiatives, − Changes in customers’, suppliers’ and other counterparties’ performance and creditworthiness, − Impacts of sanctions, tariffs and other trade policies of the U.S. and its global trading partners, − Impacts of changes in federal, state and local governmental policy, including on the regulatory landscape, capital markets, taxes, infrastructure spending and social programs, − Our ability to attract, recruit and retain skilled employees, and − Commodity price volatility.

Appendix: Cautionary Statement Regarding Forward-Looking Information 9 Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our views that: − Economic growth accelerated in the first half of 2023, but ongoing Federal Reserve monetary policy tightening to slow inflation is weighing on interest-rate sensitive industries. Sectors where interest rates play an outsized role, such as business investment and consumer spending on durable goods, will contract into 2024. − PNC’s baseline outlook is for a mild recession starting in the first half of 2024, with a small contraction in real GDP of less than 1%, lasting into the second half of 2024. The unemployment rate will increase through the rest of 2023 and throughout 2024, peaking at close to 5% in early 2025. Inflation will slow with weaker demand, moving back to the Federal Reserve’s 2% objective by mid-2024. − PNC expects the federal funds rate to remain unchanged in the near term, between 5.25% and 5.50% through mid-2024, when PNC expects federal funds rate cuts in response to the recession. PNC’s ability to take certain capital actions, including returning capital to shareholders, is subject to PNC meeting or exceeding a stress capital buffer established by the Federal Reserve Board in connection with the Federal Reserve Board’s Comprehensive Capital Analysis and Review (CCAR) process. PNC’s regulatory capital ratios in the future will depend on, among other things, the company’s financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of PNC’s balance sheet. In addition, PNC’s ability to determine, evaluate and forecast regulatory capital ratios, and to take actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent at least in part on the development, validation and regulatory review of related models and the reliability of and risks resulting from extensive use of such models. Legal and regulatory developments could have an impact on our ability to operate our businesses, financial condition, results of operations, competitive position, reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business generation and retention, liquidity, funding, and ability to attract and retain employees. These developments could include:

Appendix: Cautionary Statement Regarding Forward-Looking Information 10 − Changes to laws and regulations, including changes affecting oversight of the financial services industry, changes in the enforcement and interpretation of such laws and regulations, and changes in accounting and reporting standards. − Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries resulting in monetary losses, costs, or alterations in our business practices, and potentially causing reputational harm to PNC. − Results of the regulatory examination and supervision process, including our failure to satisfy requirements of agreements with governmental agencies. − Costs associated with obtaining rights in intellectual property claimed by others and of adequacy of our intellectual property protection in general. Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory capital and liquidity standards. Our reputation and business and operating results may be affected by our ability to appropriately meet or address environmental, social or governance targets, goals, commitments or concerns that may arise. We grow our business in part through acquisitions and new strategic initiatives. Risks and uncertainties include those presented by the nature of the business acquired and strategic initiative, including in some cases those associated with our entry into new businesses or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, the integration of the acquired businesses into PNC after closing or any failure to execute strategic or operational plans. Competition can have an impact on customer acquisition, growth and retention and on credit spreads and product pricing, which can affect market share, deposits and revenues. Our ability to anticipate and respond to technological changes can also impact our ability to respond to customer needs and meet competitive demands. Business and operating results can also be affected by widespread manmade, natural and other disasters (including severe weather events), health emergencies, dislocations, geopolitical instabilities or events, terrorist activities, system failures or disruptions, security breaches, cyberattacks, international hostilities, or other extraordinary events beyond PNC’s control through impacts on the economy and financial markets generally or on us or our counterparties, customers or third-party vendors and service providers specifically. We provide greater detail regarding these as well as other factors in our 2022 Form 10-K and subsequent 10-Qs, including in the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments Notes of the Notes To Consolidated Financial Statements in those reports, and in our other subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss elsewhere in this news release or in our SEC filings, accessible on the SEC’s website at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual references only. Information on these websites is not part of this document.