EX-99.1

Published on July 18, 2023

The PNC Financial Services Group Second Quarter 2023 Earnings Conference Call July 18, 2023 Exhibit 99.1

Cautionary Statement Regarding Forward-Looking and non-GAAP Financial Information Our earnings conference call presentation is not intended as a full business or financial review and should be viewed in the context of all of the information made available by PNC in its SEC filings and on our corporate website. The presentation contains forward-looking statements regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations, including sustainability strategy. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward- looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix. We provide greater detail regarding these and other factors in our 2022 Form 10-K, our first quarter 2023 Form 10-Q, and our other subsequent SEC filings. Our forward-looking statements may also be subject to risks and uncertainties including those we may discuss in this presentation or in our SEC filings. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake any obligation to update those statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. We include non-GAAP financial information in this presentation. Non-GAAP financial information includes adjusted financial metrics such as tangible book value per common share, pretax, pre-provision earnings, net interest margin, common equity tier 1 ratio (including AOCI), and tangible common equity ratio. Reconciliations for such financial information may be found in our presentation, in these slides, including the Appendix, in other materials on our corporate website, and in our SEC filings. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this information and the related reconciliations may be useful to investors, analysts, regulators and others to help understand and evaluate our financial results, and with respect to adjusted metrics, because we believe they better reflect the ongoing financial results and trends of our businesses and increase comparability of period-to-period results. We may also use annualized, pro forma, estimated or third party numbers for illustrative or comparative purposes only. These may not reflect actual results. References to our corporate website are to www.pnc.com under “About Us - Investor Relations.” Our SEC filings are available both on our corporate website and on the SEC’s website at www.sec.gov. We include web addresses here as inactive textual references only. Information on these websites is not part of this presentation. 1

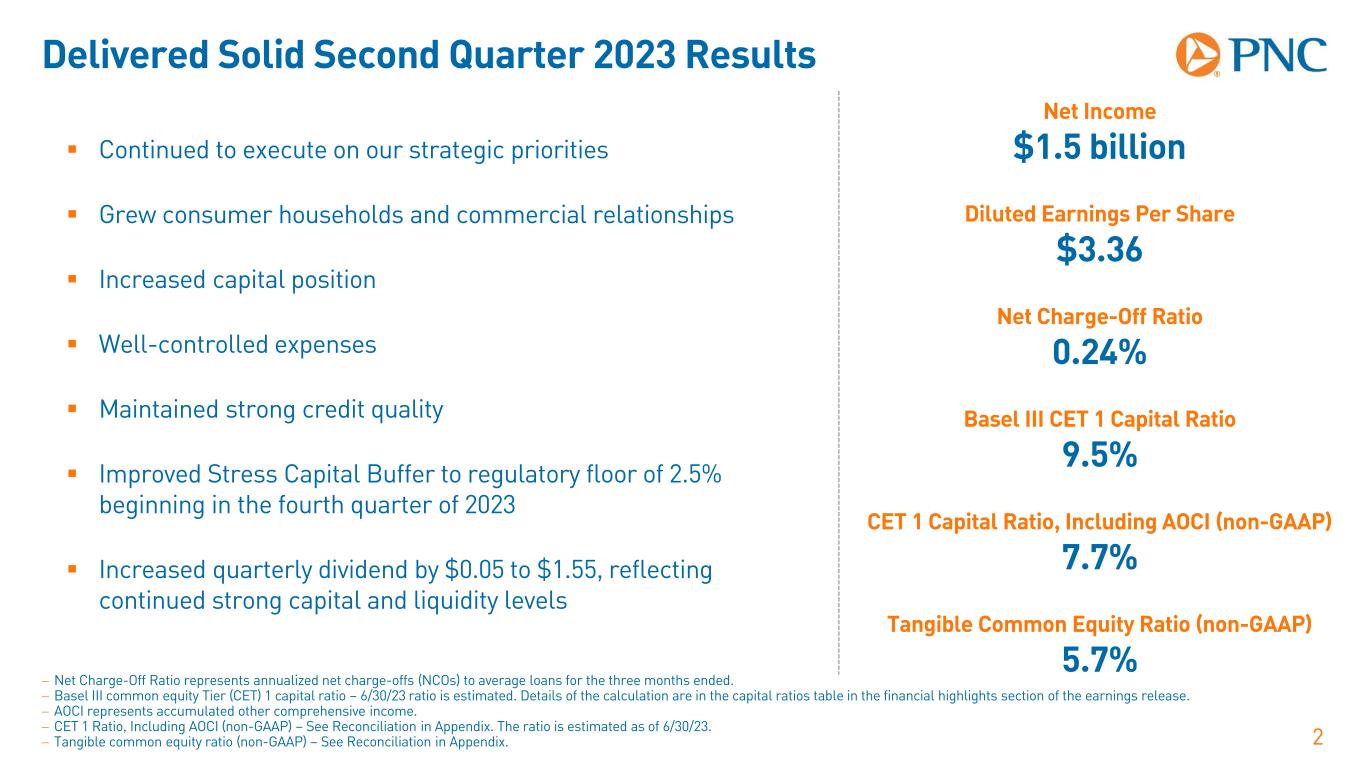

Delivered Solid Second Quarter 2023 Results 2 Continued to execute on our strategic priorities Grew consumer households and commercial relationships Increased capital position Well-controlled expenses Maintained strong credit quality Improved Stress Capital Buffer to regulatory floor of 2.5% beginning in the fourth quarter of 2023 Increased quarterly dividend by $0.05 to $1.55, reflecting continued strong capital and liquidity levels Net Income $1.5 billion Diluted Earnings Per Share $3.36 Basel III CET 1 Capital Ratio 9.5% CET 1 Capital Ratio, Including AOCI (non-GAAP) 7.7% Net Charge-Off Ratio 0.24% − Net Charge-Off Ratio represents annualized net charge-offs (NCOs) to average loans for the three months ended. − Basel III common equity Tier (CET) 1 capital ratio – 6/30/23 ratio is estimated. Details of the calculation are in the capital ratios table in the financial highlights section of the earnings release. − AOCI represents accumulated other comprehensive income. − CET 1 Ratio, Including AOCI (non-GAAP) – See Reconciliation in Appendix. The ratio is estimated as of 6/30/23. − Tangible common equity ratio (non-GAAP) – See Reconciliation in Appendix. Tangible Common Equity Ratio (non-GAAP) 5.7%

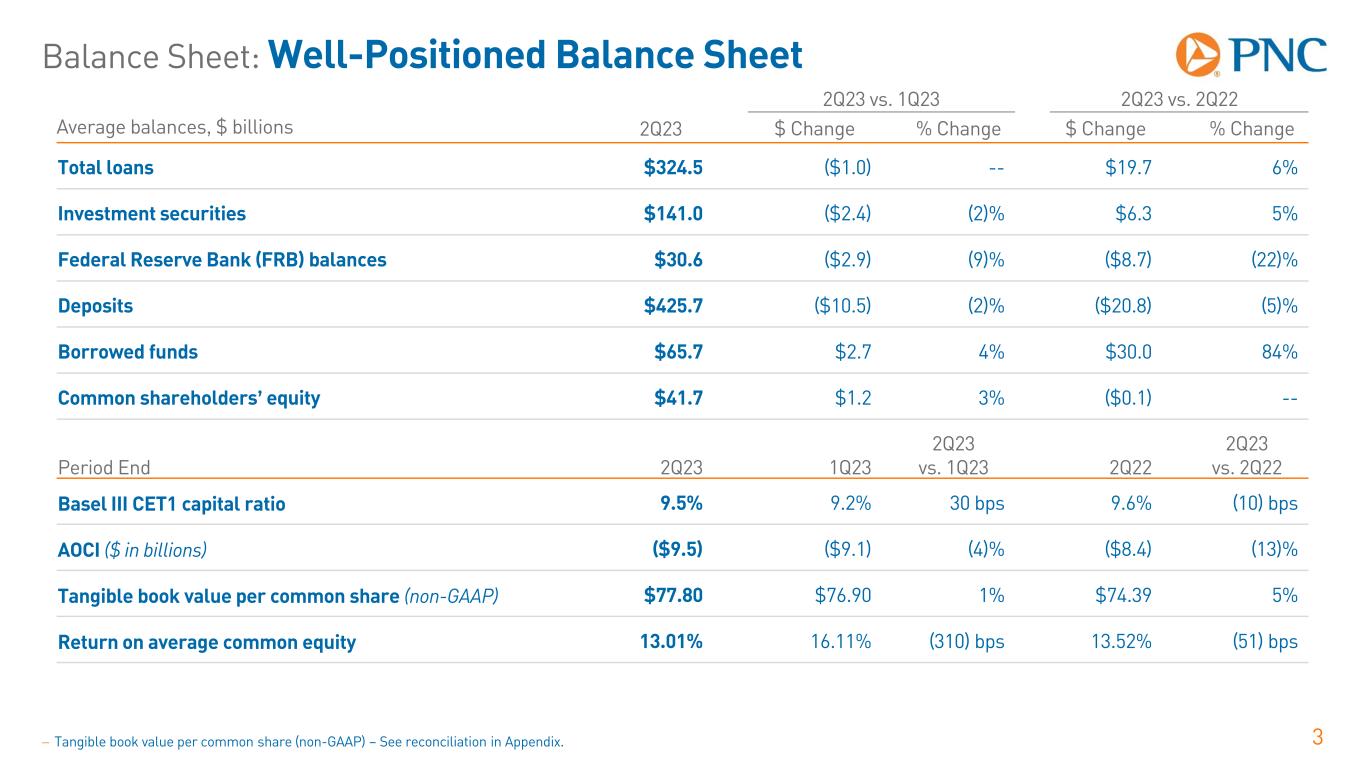

Balance Sheet: Well-Positioned Balance Sheet 3 2Q23 vs. 1Q23 2Q23 vs. 2Q22 Average balances, $ billions 2Q23 $ Change % Change $ Change % Change Total loans $324.5 ($1.0) -- $19.7 6% Investment securities $141.0 ($2.4) (2)% $6.3 5% Federal Reserve Bank (FRB) balances $30.6 ($2.9) (9)% ($8.7) (22)% Deposits $425.7 ($10.5) (2)% ($20.8) (5)% Borrowed funds $65.7 $2.7 4% $30.0 84% Common shareholders’ equity $41.7 $1.2 3% ($0.1) -- Period End 2Q23 1Q23 2Q23 vs. 1Q23 2Q22 2Q23 vs. 2Q22 Basel III CET1 capital ratio 9.5% 9.2% 30 bps 9.6% (10) bps AOCI ($ in billions) ($9.5) ($9.1) (4)% ($8.4) (13)% Tangible book value per common share (non-GAAP) $77.80 $76.90 1% $74.39 5% Return on average common equity 13.01% 16.11% (310) bps 13.52% (51) bps − Tangible book value per common share (non-GAAP) – See reconciliation in Appendix.

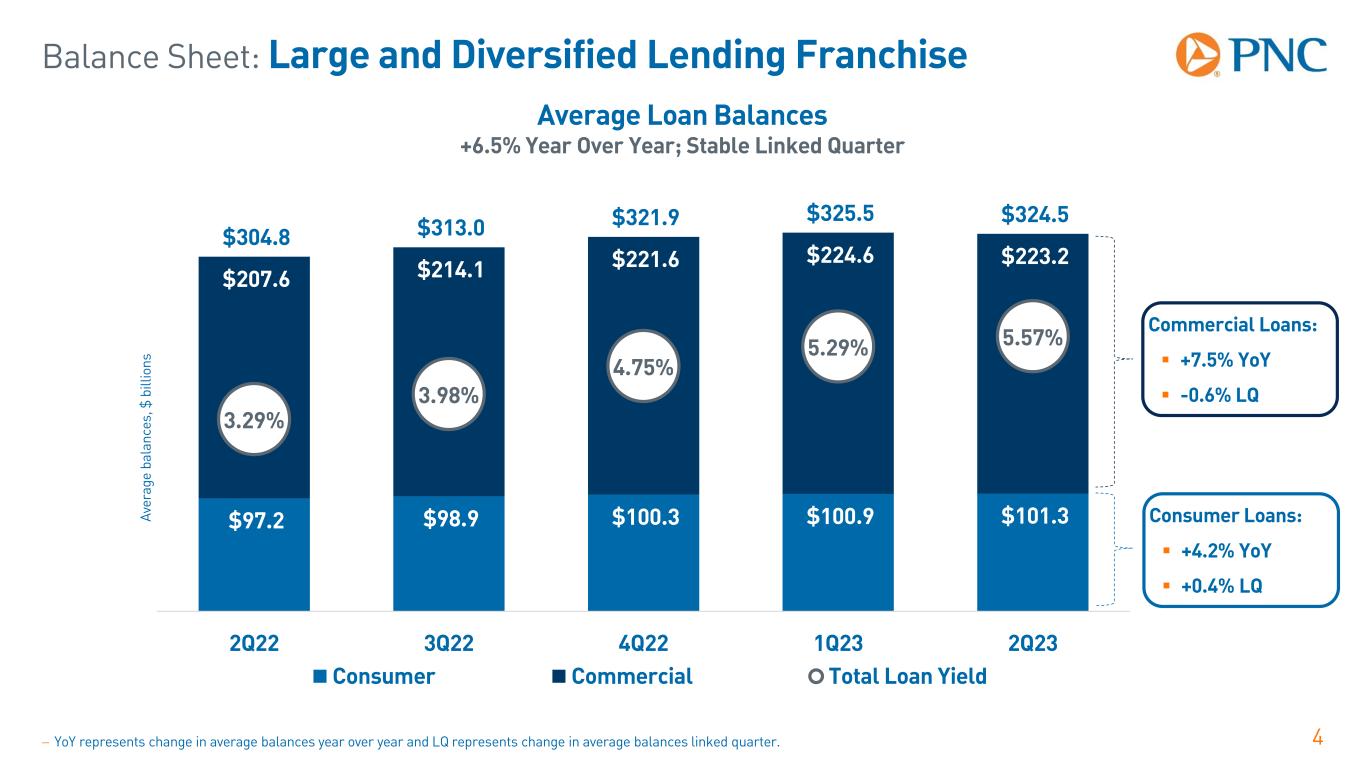

Balance Sheet: Large and Diversified Lending Franchise 4 Av er ag e ba la nc es , $ b ill io ns $97.2 $98.9 $100.3 $100.9 $101.3 $207.6 $214.1 $221.6 $224.6 $223.2 $304.8 $313.0 $321.9 $325.5 $324.5 3.29% 3.98% 4.75% 5.29% 5.57% 2Q22 3Q22 4Q22 1Q23 2Q23 Consumer Commercial Total Loan Yield − YoY represents change in average balances year over year and LQ represents change in average balances linked quarter. Commercial Loans: +7.5% YoY -0.6% LQ Consumer Loans: +4.2% YoY +0.4% LQ Average Loan Balances +6.5% Year Over Year; Stable Linked Quarter

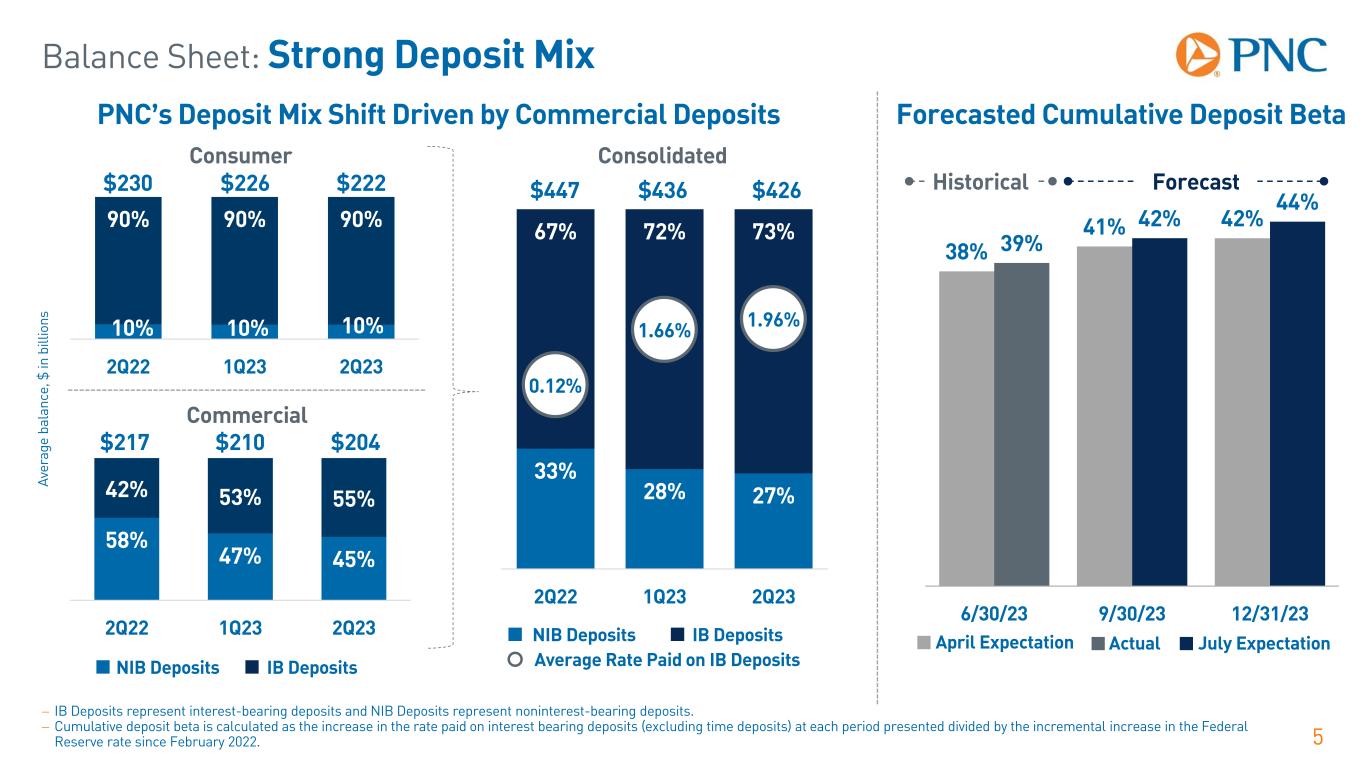

33% 28% 27% 67% 72% 73% 0.12% 1.66% 1.96% 2Q22 1Q23 2Q23 Balance Sheet: Strong Deposit Mix 5 − IB Deposits represent interest-bearing deposits and NIB Deposits represent noninterest-bearing deposits. − Cumulative deposit beta is calculated as the increase in the rate paid on interest bearing deposits (excluding time deposits) at each period presented divided by the incremental increase in the Federal Reserve rate since February 2022. PNC’s Deposit Mix Shift Driven by Commercial Deposits 10% 10% 10% 90% 90% 90% 2Q22 1Q23 2Q23 58% 47% 45% 42% 53% 55% 2Q22 1Q23 2Q23 Consumer Commercial Consolidated IB DepositsNIB Deposits IB DepositsNIB Deposits $230 $222 $217 $210 $447 $426 Av er ag e ba la nc e, $ in b ill io ns Forecasted Cumulative Deposit Beta $436$226 $204 Average Rate Paid on IB Deposits 38% 41% 42% 39% 42% 44% 6/30/23 9/30/23 12/31/23 Historical July ExpectationActualApril Expectation Forecast

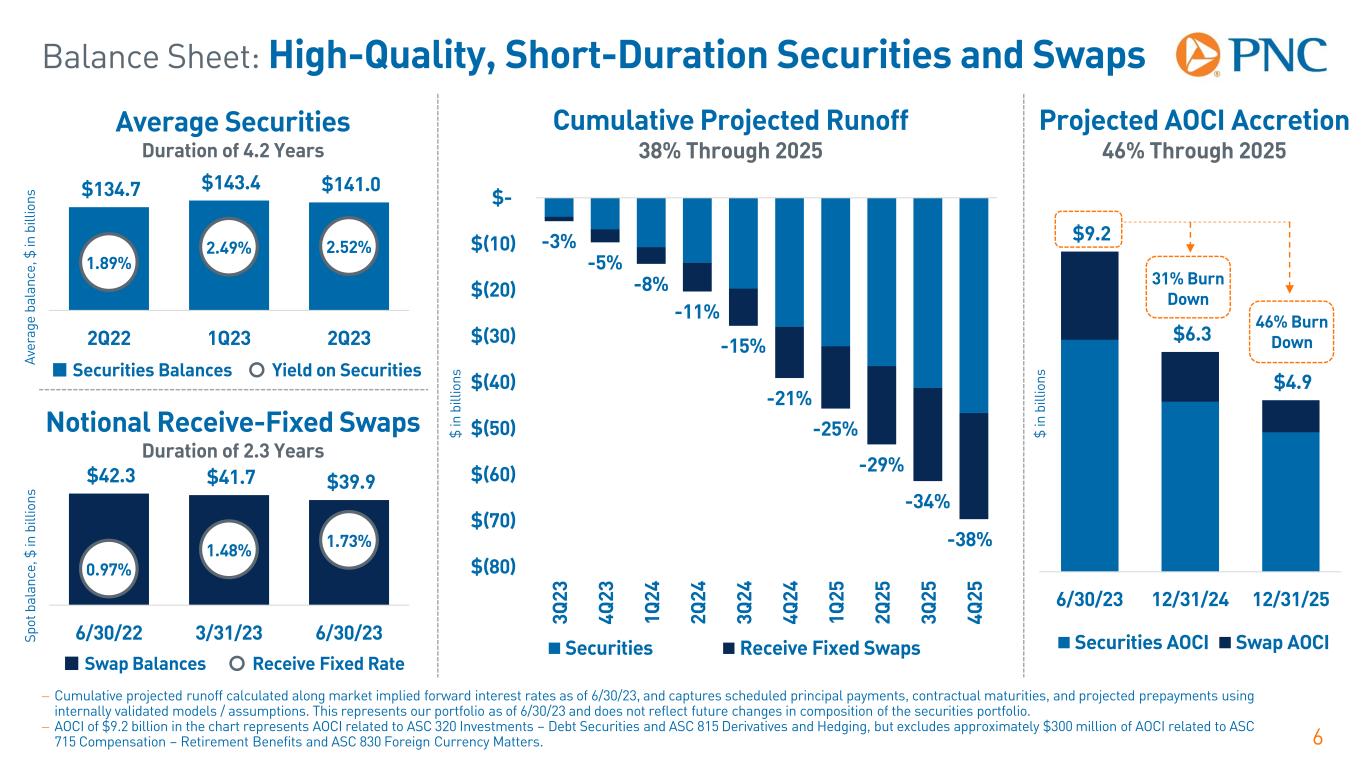

Balance Sheet: High-Quality, Short-Duration Securities and Swaps 6 Average Securities Duration of 4.2 Years $134.7 $143.4 $141.0 1.89% 2.49% 2.52% 2Q22 1Q23 2Q23 $42.3 $41.7 $39.9 0.97% 1.48% 1.73% 6/30/22 3/31/23 6/30/23 Notional Receive-Fixed Swaps Duration of 2.3 Years -3% -5% -8% -11% -15% -21% -25% -29% -34% -38% $(80) $(70) $(60) $(50) $(40) $(30) $(20) $(10) $- 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 4Q 25 Securities Receive Fixed Swaps Cumulative Projected Runoff 38% Through 2025 Projected AOCI Accretion 46% Through 2025 $9.2 $6.3 $4.9 6/30/23 12/31/24 12/31/25 Securities AOCI Swap AOCI − Cumulative projected runoff calculated along market implied forward interest rates as of 6/30/23, and captures scheduled principal payments, contractual maturities, and projected prepayments using internally validated models / assumptions. This represents our portfolio as of 6/30/23 and does not reflect future changes in composition of the securities portfolio. − AOCI of $9.2 billion in the chart represents AOCI related to ASC 320 Investments – Debt Securities and ASC 815 Derivatives and Hedging, but excludes approximately $300 million of AOCI related to ASC 715 Compensation – Retirement Benefits and ASC 830 Foreign Currency Matters. Securities Balances Yield on Securities Swap Balances Receive Fixed Rate Sp ot b al an ce , $ in b ill io ns Av er ag e ba la nc e, $ in b ill io ns 31% Burn Down 46% Burn Down $ in b ill io ns $ in b ill io ns

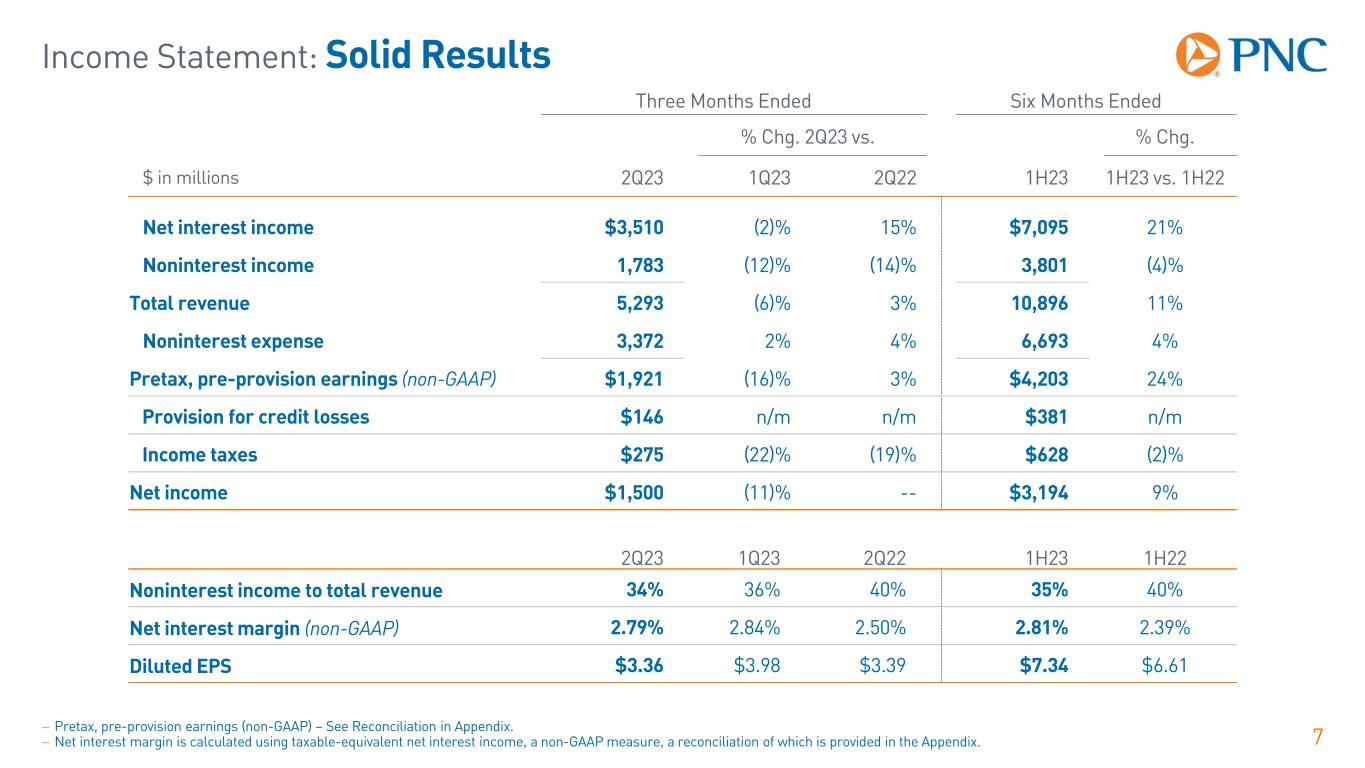

Income Statement: Solid Results 7− Pretax, pre-provision earnings (non-GAAP) – See Reconciliation in Appendix. − Net interest margin is calculated using taxable-equivalent net interest income, a non-GAAP measure, a reconciliation of which is provided in the Appendix. Three Months Ended Six Months Ended % Chg. 2Q23 vs. % Chg. $ in millions 2Q23 1Q23 2Q22 1H23 1H23 vs. 1H22 Net interest income $3,510 (2)% 15% $7,095 21% Noninterest income 1,783 (12)% (14)% 3,801 (4)% Total revenue 5,293 (6)% 3% 10,896 11% Noninterest expense 3,372 2% 4% 6,693 4% Pretax, pre-provision earnings (non-GAAP) $1,921 (16)% 3% $4,203 24% Provision for credit losses $146 n/m n/m $381 n/m Income taxes $275 (22)% (19)% $628 (2)% Net income $1,500 (11)% -- $3,194 9% 2Q23 1Q23 2Q22 1H23 1H22 Noninterest income to total revenue 34% 36% 40% 35% 40% Net interest margin (non-GAAP) 2.79% 2.84% 2.50% 2.81% 2.39% Diluted EPS $3.36 $3.98 $3.39 $7.34 $6.61

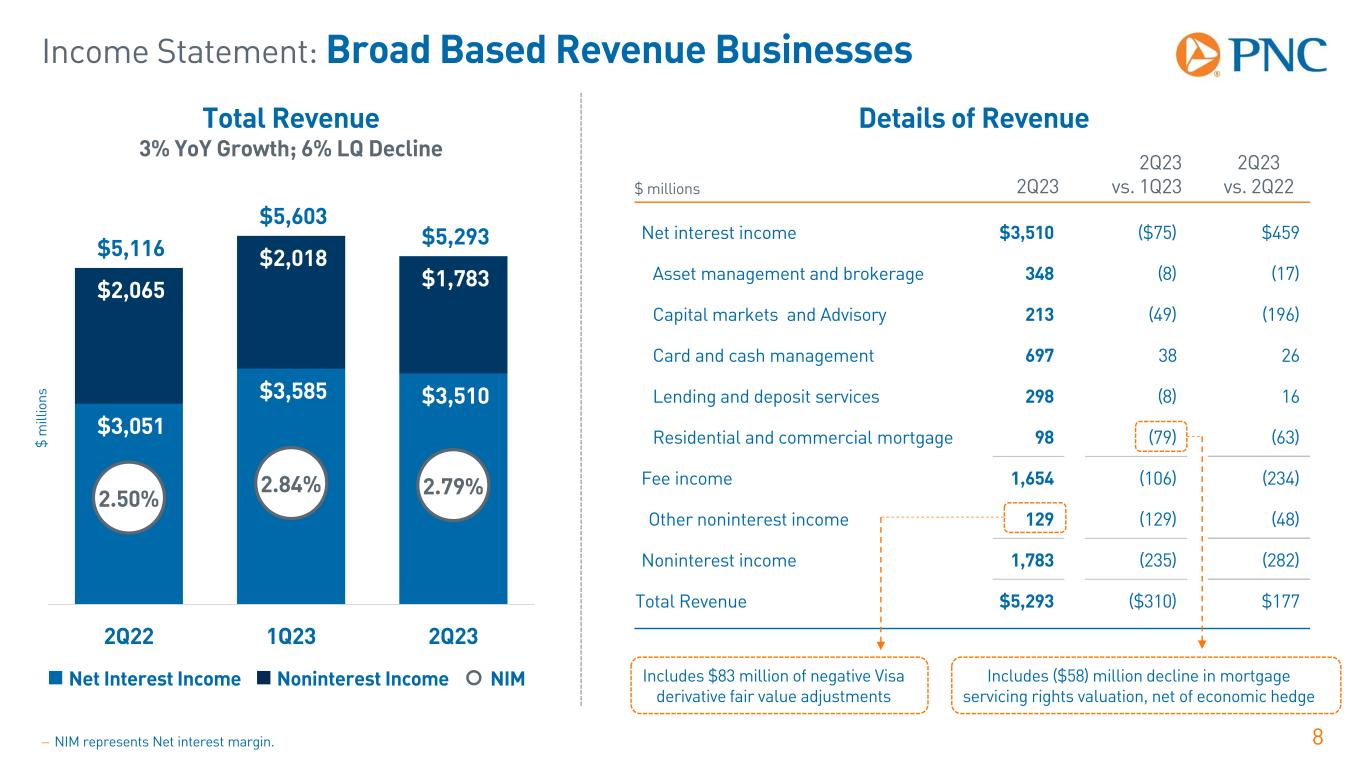

Income Statement: Broad Based Revenue Businesses 8 $ m ill io ns Total Revenue 3% YoY Growth; 6% LQ Decline $3,051 $3,585 $3,510 $2,065 $2,018 $1,783 $5,116 $5,603 $5,293 2.50% 2.84% 2.79% 2Q22 1Q23 2Q23 Details of Revenue Net Interest Income NIMNoninterest Income $ millions 2Q23 2Q23 vs. 1Q23 2Q23 vs. 2Q22 Net interest income $3,510 ($75) $459 Asset management and brokerage 348 (8) (17) Capital markets and Advisory 213 (49) (196) Card and cash management 697 38 26 Lending and deposit services 298 (8) 16 Residential and commercial mortgage 98 (79) (63) Fee income 1,654 (106) (234) Other noninterest income 129 (129) (48) Noninterest income 1,783 (235) (282) Total Revenue $5,293 ($310) $177 Includes $83 million of negative Visa derivative fair value adjustments Includes ($58) million decline in mortgage servicing rights valuation, net of economic hedge − NIM represents Net interest margin.

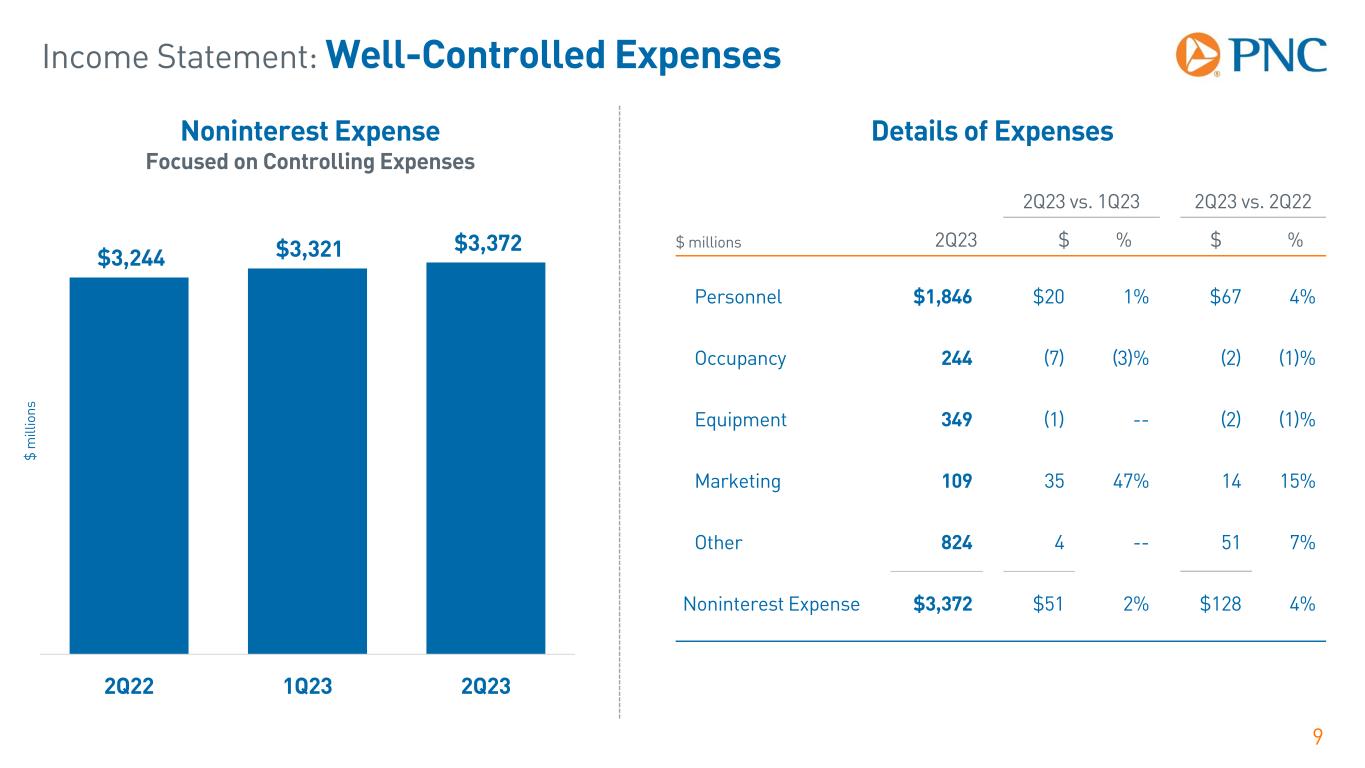

Income Statement: Well-Controlled Expenses 9 Noninterest Expense Focused on Controlling Expenses $3,244 $3,321 $3,372 2Q22 1Q23 2Q23 Details of Expenses $ m ill io ns 2Q23 vs. 1Q23 2Q23 vs. 2Q22 $ millions 2Q23 $ % $ % Personnel $1,846 $20 1% $67 4% Occupancy 244 (7) (3)% (2) (1)% Equipment 349 (1) -- (2) (1)% Marketing 109 35 47% 14 15% Other 824 4 -- 51 7% Noninterest Expense $3,372 $51 2% $128 4%

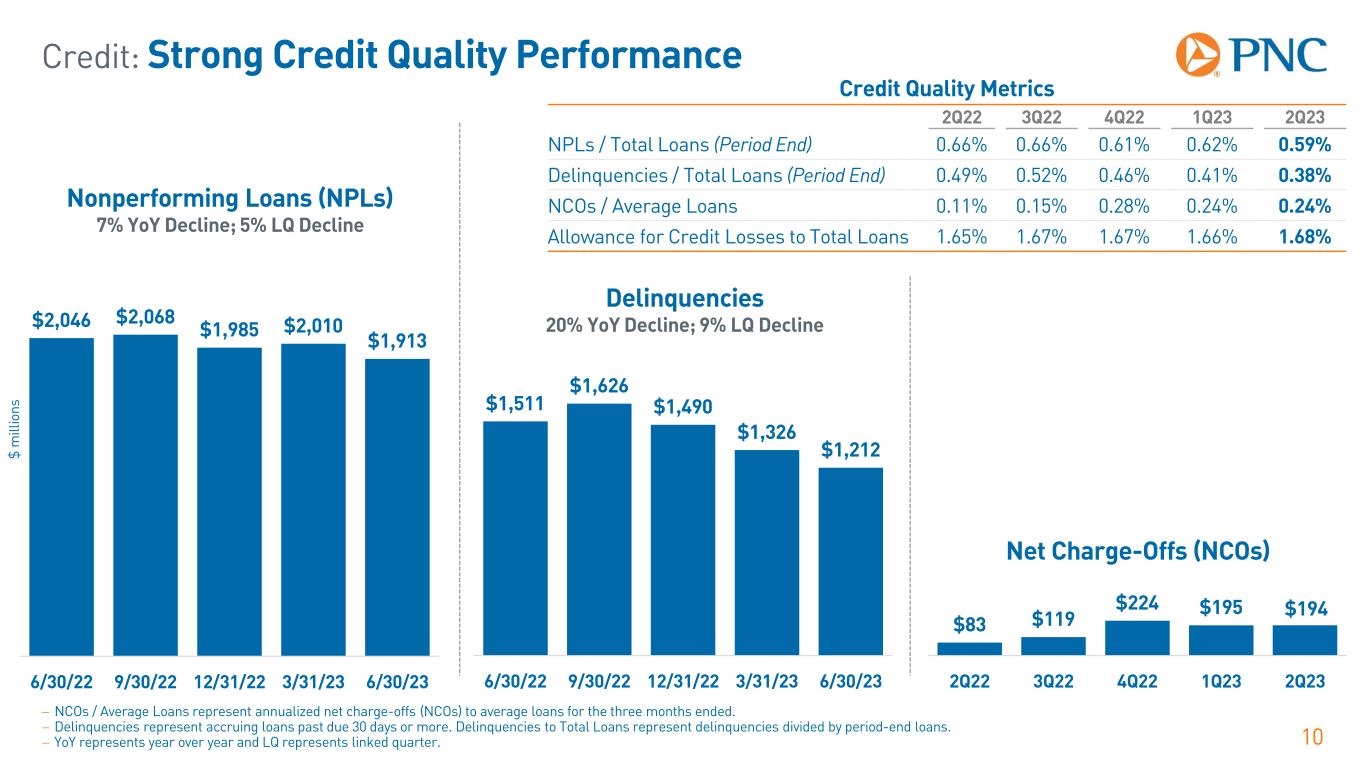

Credit: Strong Credit Quality Performance 10 − NCOs / Average Loans represent annualized net charge-offs (NCOs) to average loans for the three months ended. − Delinquencies represent accruing loans past due 30 days or more. Delinquencies to Total Loans represent delinquencies divided by period-end loans. − YoY represents year over year and LQ represents linked quarter. $1,511 $1,626 $1,490 $1,326 $1,212 6/30/22 9/30/22 12/31/22 3/31/23 6/30/23 $2,046 $2,068 $1,985 $2,010 $1,913 6/30/22 9/30/22 12/31/22 3/31/23 6/30/23 Nonperforming Loans (NPLs) 7% YoY Decline; 5% LQ Decline Delinquencies 20% YoY Decline; 9% LQ Decline Net Charge-Offs (NCOs) $194 $83 $119 $224 $195 2Q22 3Q22 4Q22 1Q23 2Q23 Credit Quality Metrics 2Q22 3Q22 4Q22 1Q23 2Q23 NPLs / Total Loans (Period End) 0.66% 0.66% 0.61% 0.62% 0.59% Delinquencies / Total Loans (Period End) 0.49% 0.52% 0.46% 0.41% 0.38% NCOs / Average Loans 0.11% 0.15% 0.28% 0.24% 0.24% Allowance for Credit Losses to Total Loans 1.65% 1.67% 1.67% 1.66% 1.68% $ m ill io ns

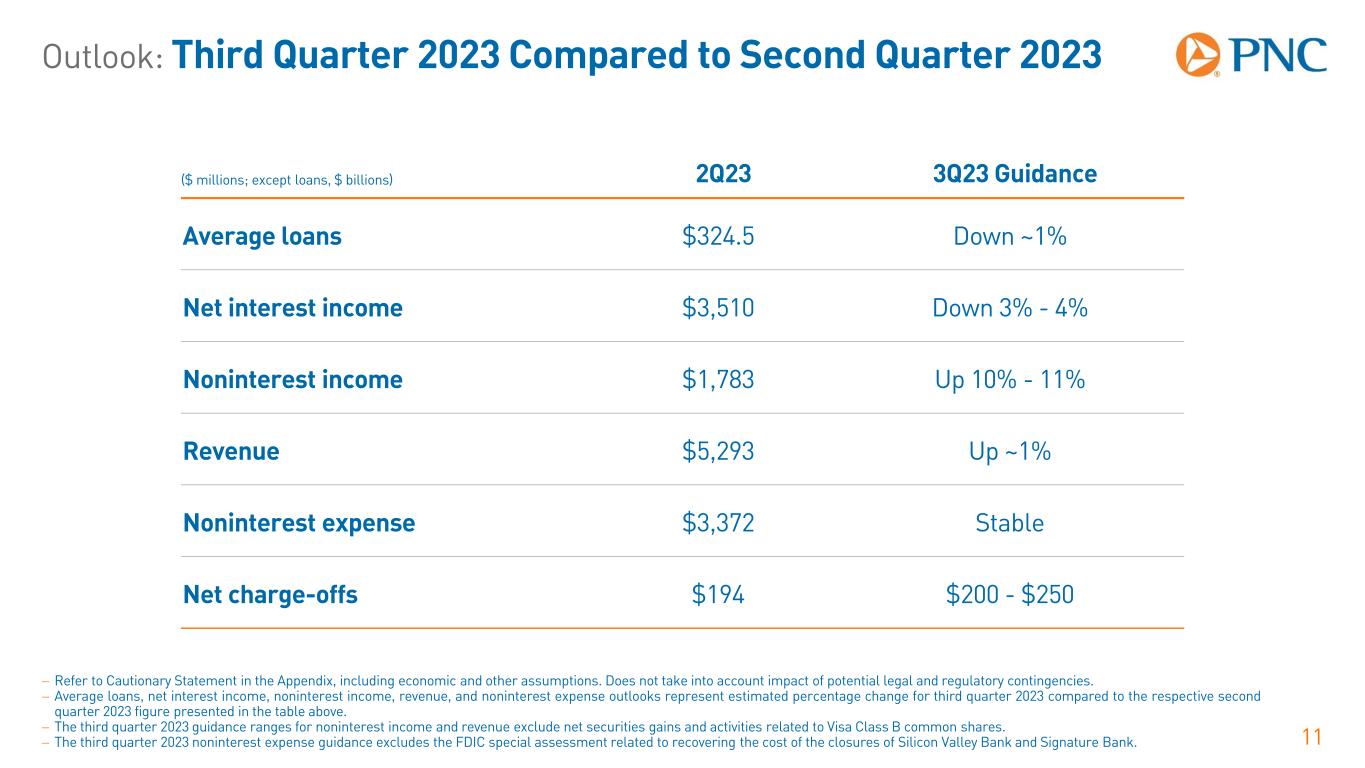

Outlook: Third Quarter 2023 Compared to Second Quarter 2023 11 − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies. − Average loans, net interest income, noninterest income, revenue, and noninterest expense outlooks represent estimated percentage change for third quarter 2023 compared to the respective second quarter 2023 figure presented in the table above. − The third quarter 2023 guidance ranges for noninterest income and revenue exclude net securities gains and activities related to Visa Class B common shares. − The third quarter 2023 noninterest expense guidance excludes the FDIC special assessment related to recovering the cost of the closures of Silicon Valley Bank and Signature Bank. ($ millions; except loans, $ billions) 2Q23 3Q23 Guidance Average loans $324.5 Down ~1% Net interest income $3,510 Down 3% - 4% Noninterest income $1,783 Up 10% - 11% Revenue $5,293 Up ~1% Noninterest expense $3,372 Stable Net charge-offs $194 $200 - $250

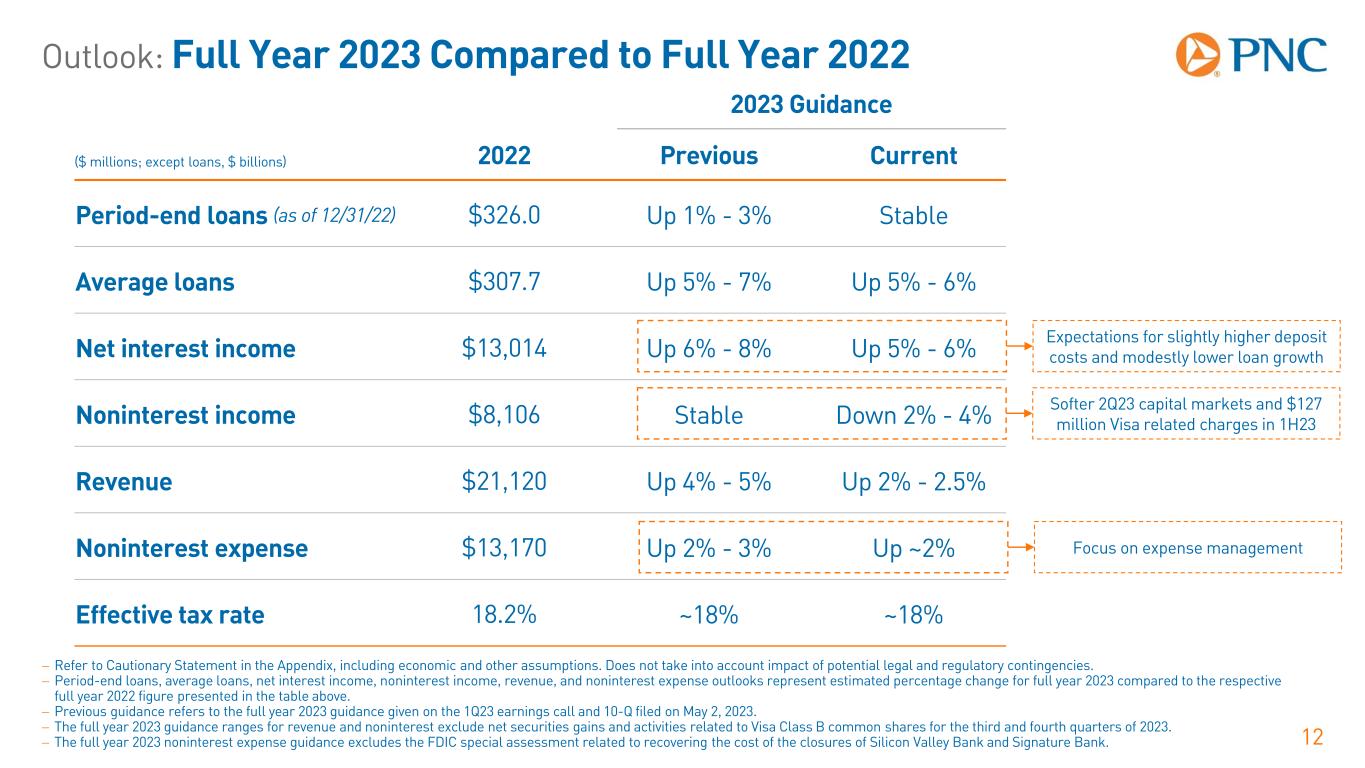

Outlook: Full Year 2023 Compared to Full Year 2022 12 − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies. − Period-end loans, average loans, net interest income, noninterest income, revenue, and noninterest expense outlooks represent estimated percentage change for full year 2023 compared to the respective full year 2022 figure presented in the table above. − Previous guidance refers to the full year 2023 guidance given on the 1Q23 earnings call and 10-Q filed on May 2, 2023. − The full year 2023 guidance ranges for revenue and noninterest exclude net securities gains and activities related to Visa Class B common shares for the third and fourth quarters of 2023. − The full year 2023 noninterest expense guidance excludes the FDIC special assessment related to recovering the cost of the closures of Silicon Valley Bank and Signature Bank. 2023 Guidance ($ millions; except loans, $ billions) 2022 Previous Current Period-end loans (as of 12/31/22) $326.0 Up 1% - 3% Stable Average loans $307.7 Up 5% - 7% Up 5% - 6% Net interest income $13,014 Up 6% - 8% Up 5% - 6% Noninterest income $8,106 Stable Down 2% - 4% Revenue $21,120 Up 4% - 5% Up 2% - 2.5% Noninterest expense $13,170 Up 2% - 3% Up ~2% Effective tax rate 18.2% ~18% ~18% Expectations for slightly higher deposit costs and modestly lower loan growth Softer 2Q23 capital markets and $127 million Visa related charges in 1H23 Focus on expense management

Appendix: Cautionary Statement Regarding Forward-Looking Information 13 We make statements in this presentation, and we may from time to time make other statements, regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting us and our future business and operations, including our sustainability strategy, that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,” “estimate,” “goal,” “will,” “should” and other similar words and expressions. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements speak only as of the date made. We do not assume any duty and do not undertake any obligation to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. Our forward-looking statements are subject to the following principal risks and uncertainties. Our businesses, financial results and balance sheet values are affected by business and economic conditions, including: − Changes in interest rates and valuations in debt, equity and other financial markets, − Disruptions in the U.S. and global financial markets, − Actions by the Federal Reserve Board, U.S. Treasury and other government agencies, including those that impact money supply, market interest rates and inflation, − Changes in customer behavior due to changing business and economic conditions or legislative or regulatory initiatives, − Changes in customers’, suppliers’ and other counterparties’ performance and creditworthiness, − Impacts of sanctions, tariffs and other trade policies of the U.S. and its global trading partners, − A continuation of recent turmoil in the banking industry, responsive measures to mitigate and manage it and related supervisory and regulatory actions and costs, − Impacts of changes in federal, state and local governmental policy, including on the regulatory landscape, capital markets, taxes, infrastructure spending and social programs, − PNC’s ability to attract, recruit and retain skilled employees, and − Commodity price volatility.

Appendix: Cautionary Statement Regarding Forward-Looking Information 14 Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our views that: − The economy continues to expand in the first half of 2023, but economic growth is slowing in response to the ongoing Federal Reserve monetary policy tightening to slow inflation. This has led to large increases in both short- and long-term interest rates. With much higher mortgage rates, the housing market is already in contraction, with steep drops in existing home sales and single-family housing starts, and a modest decline in house prices. Other sectors where interest rates play an outsized role, such as business investment and consumer spending on durable goods, will contract over 2023. − PNC’s baseline outlook is for a mild recession starting in late 2023 or early 2024, with a small contraction in real GDP of less than 1%, lasting into mid-2024. The unemployment rate will increase in the second half of this year, ending 2023 at above 4%, and then peak slightly above 5% in early 2025. Inflation will slow with weaker demand, moving back to the Federal Reserve's 2% objective by this time next year. − PNC expects one additional 25 basis point increase to the federal funds rate this summer, with the federal funds rate remaining between 5.25% and 5.50% through March 2024, when PNC expects federal funds rate cuts in response to the recession contemplated by our outlook. PNC’s ability to take certain capital actions, including returning capital to shareholders, is subject to PNC meeting or exceeding a stress capital buffer established by the Federal Reserve Board in connection with the Federal Reserve Board’s Comprehensive Capital Analysis and Review (CCAR) process. PNC’s regulatory capital ratios in the future will depend on, among other things, the company’s financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of PNC’s balance sheet. In addition, PNC’s ability to determine, evaluate and forecast regulatory capital ratios, and to take actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent at least in part on the development, validation and regulatory review of related models and the reliability of and risks resulting from extensive use of such models. Legal and regulatory developments could have an impact on our ability to operate our businesses, financial condition, results of operations, competitive position, reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business generation and retention, liquidity, funding, and ability to attract and retain employees. These developments could include:

Appendix: Cautionary Statement Regarding Forward-Looking Information 15 − Changes to laws and regulations, including changes affecting oversight of the financial services industry; changes in the enforcement and interpretation of such laws and regulations; and changes in accounting and reporting standards. − Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries resulting in monetary losses, costs, or alterations in our business practices, and potentially causing reputational harm to PNC. − Results of the regulatory examination and supervision process, including our failure to satisfy requirements of agreements with governmental agencies. − Costs associated with obtaining rights in intellectual property claimed by others and of adequacy of our intellectual property protection in general. Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory capital and liquidity standards. Our reputation and business and operating results may be affected by our ability to appropriately meet or address environmental, social or governance targets, goals, commitments or concerns that may arise. We grow our business in part through acquisitions and new strategic initiatives. Risks and uncertainties include those presented by the nature of the business acquired and strategic initiative, including in some cases those associated with our entry into new businesses or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, the integration of the acquired businesses into PNC after closing or any failure to execute strategic or operational plans. Competition can have an impact on customer acquisition, growth and retention and on credit spreads and product pricing, which can affect market share, deposits and revenues. Our ability to anticipate and respond to technological changes can also impact our ability to respond to customer needs and meet competitive demands. Business and operating results can also be affected by widespread manmade, natural and other disasters (including severe weather events); health emergencies; dislocations; geopolitical instabilities or events; terrorist activities; system failures or disruptions; security breaches; cyberattacks; international hostilities; or other extraordinary events beyond PNC’s control through impacts on the economy and financial markets generally or on us or our counterparties, customers or third-party vendors and service providers specifically. We provide greater detail regarding these as well as other factors in our 2022 Form 10-K and in our first quarter 2023 Form 10-Q, including in the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments Notes of the Notes To Consolidated Financial Statements in those reports, and in our other subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss elsewhere in this news release or in our SEC filings, accessible on the SEC’s website at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual references only. Information on these websites is not part of this document.

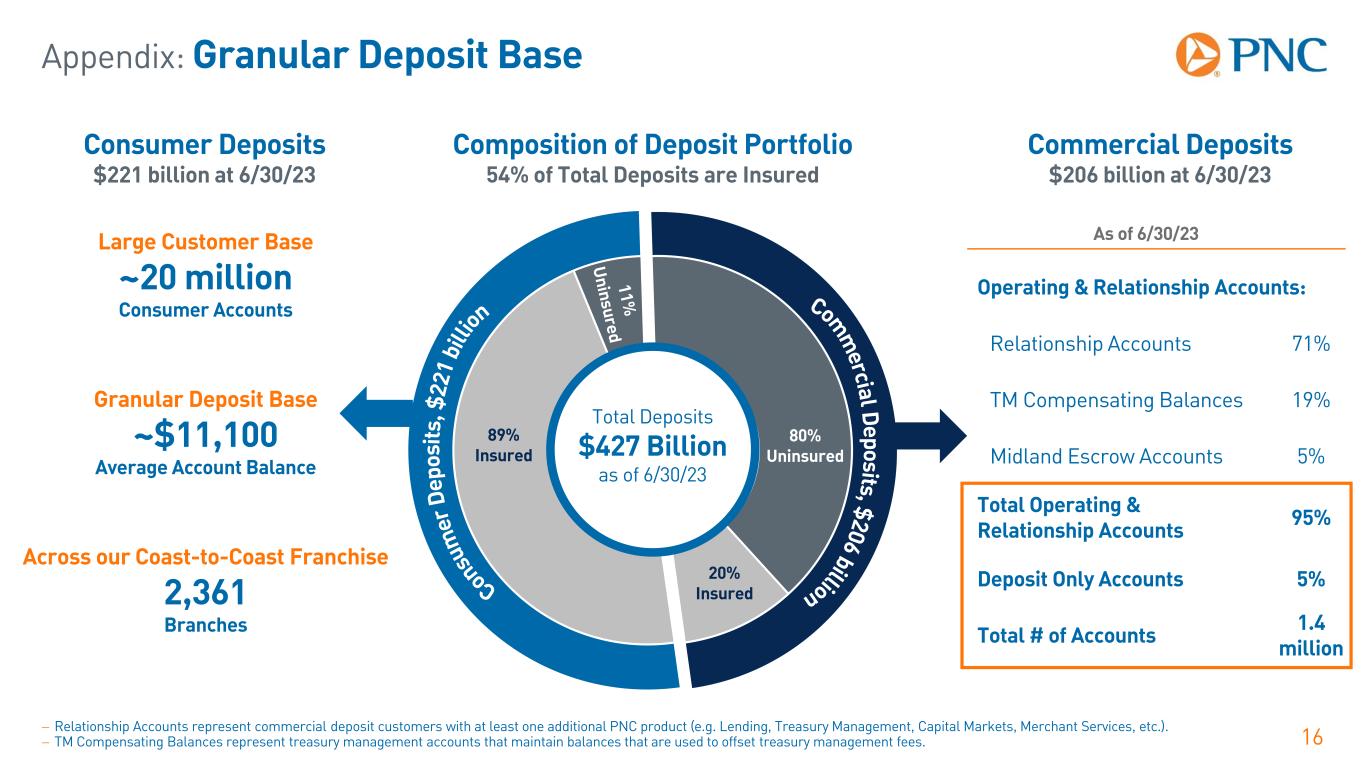

Appendix: Granular Deposit Base 16 Composition of Deposit Portfolio 54% of Total Deposits are Insured Total Deposits $427 Billion as of 6/30/23 Commercial Deposits $206 billion at 6/30/23 89% Insured 20% Insured 80% Uninsured Consumer Deposits $221 billion at 6/30/23 Granular Deposit Base ~$11,100 Average Account Balance Large Customer Base ~20 million Consumer Accounts Across our Coast-to-Coast Franchise 2,361 Branches − Relationship Accounts represent commercial deposit customers with at least one additional PNC product (e.g. Lending, Treasury Management, Capital Markets, Merchant Services, etc.). − TM Compensating Balances represent treasury management accounts that maintain balances that are used to offset treasury management fees. As of 6/30/23 Operating & Relationship Accounts: Relationship Accounts 71% TM Compensating Balances 19% Midland Escrow Accounts 5% Total Operating & Relationship Accounts 95% Deposit Only Accounts 5% Total # of Accounts 1.4 million

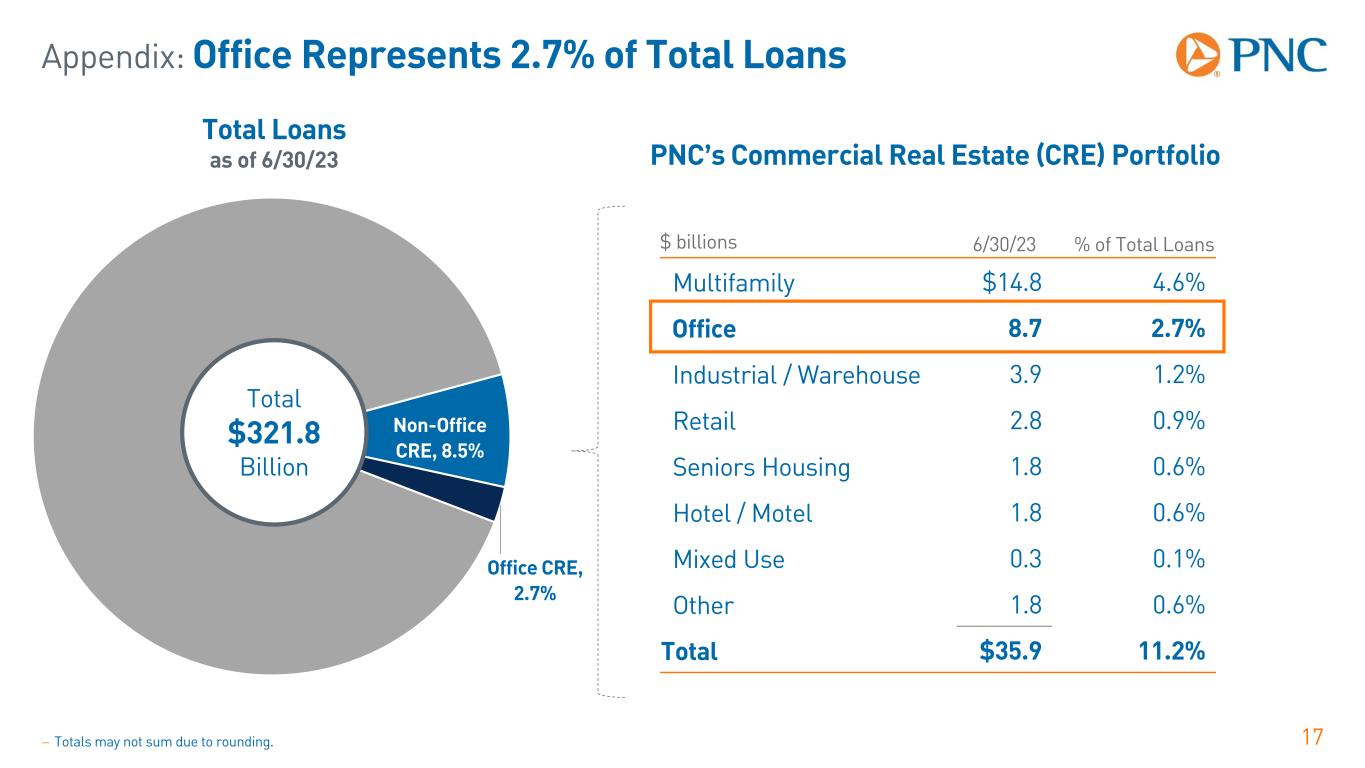

Appendix: Office Represents 2.7% of Total Loans 17 Non-Office CRE, 8.5% Office CRE, 2.7% Total $321.8 Billion PNC’s Commercial Real Estate (CRE) Portfolio Total Loans as of 6/30/23 $ billions 6/30/23 % of Total Loans Multifamily $14.8 4.6% Office 8.7 2.7% Industrial / Warehouse 3.9 1.2% Retail 2.8 0.9% Seniors Housing 1.8 0.6% Hotel / Motel 1.8 0.6% Mixed Use 0.3 0.1% Other 1.8 0.6% Total $35.9 11.2% − Totals may not sum due to rounding.

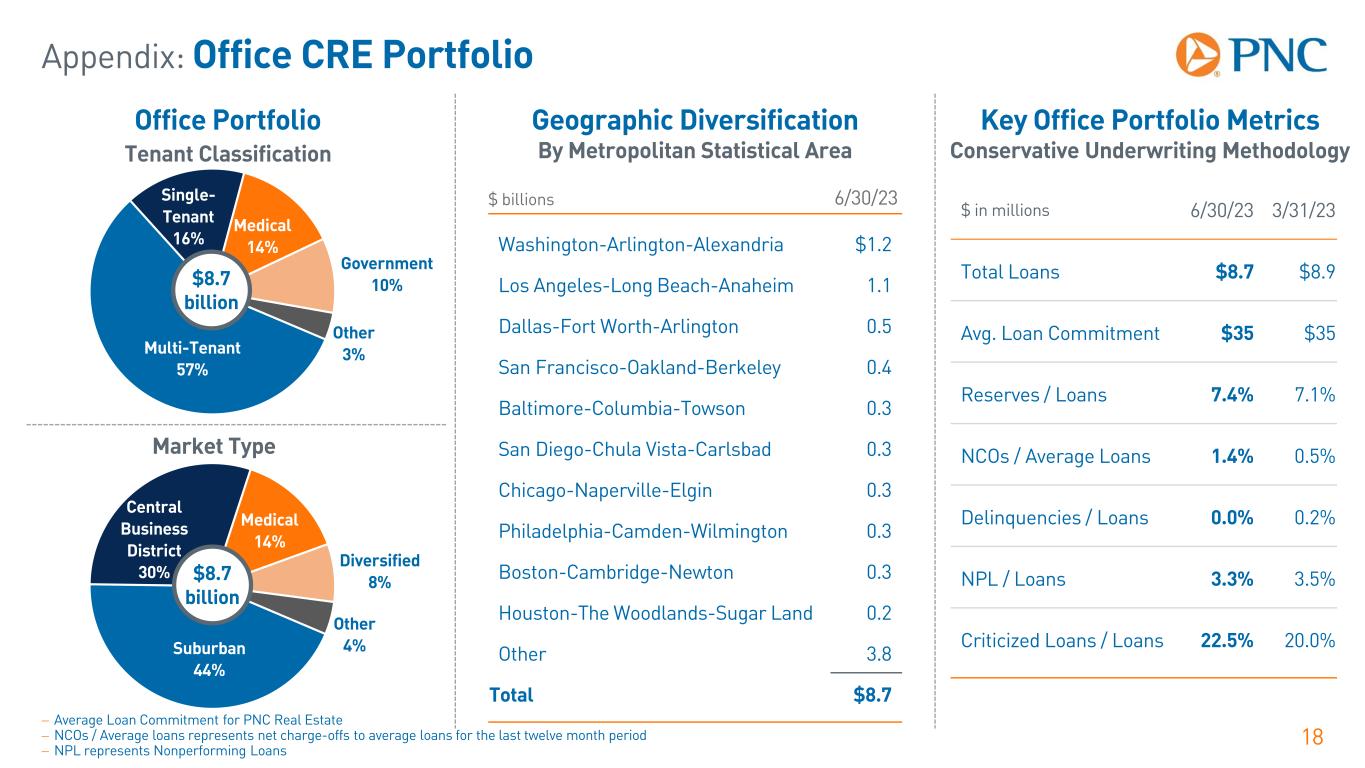

Appendix: Office CRE Portfolio 18 Office Portfolio Multi-Tenant 57% Single- Tenant 16% Medical 14% Government 10% Other 3% $8.7 billion Geographic Diversification By Metropolitan Statistical Area Key Office Portfolio Metrics Conservative Underwriting Methodology Suburban 44% Central Business District 30% Medical 14% Diversified 8% Other 4% $8.7 billion Tenant Classification Market Type $ billions 6/30/23 Washington-Arlington-Alexandria $1.2 Los Angeles-Long Beach-Anaheim 1.1 Dallas-Fort Worth-Arlington 0.5 San Francisco-Oakland-Berkeley 0.4 Baltimore-Columbia-Towson 0.3 San Diego-Chula Vista-Carlsbad 0.3 Chicago-Naperville-Elgin 0.3 Philadelphia-Camden-Wilmington 0.3 Boston-Cambridge-Newton 0.3 Houston-The Woodlands-Sugar Land 0.2 Other 3.8 Total $8.7 $ in millions 6/30/23 3/31/23 Total Loans $8.7 $8.9 Avg. Loan Commitment $35 $35 Reserves / Loans 7.4% 7.1% NCOs / Average Loans 1.4% 0.5% Delinquencies / Loans 0.0% 0.2% NPL / Loans 3.3% 3.5% Criticized Loans / Loans 22.5% 20.0% − Average Loan Commitment for PNC Real Estate − NCOs / Average loans represents net charge-offs to average loans for the last twelve month period − NPL represents Nonperforming Loans

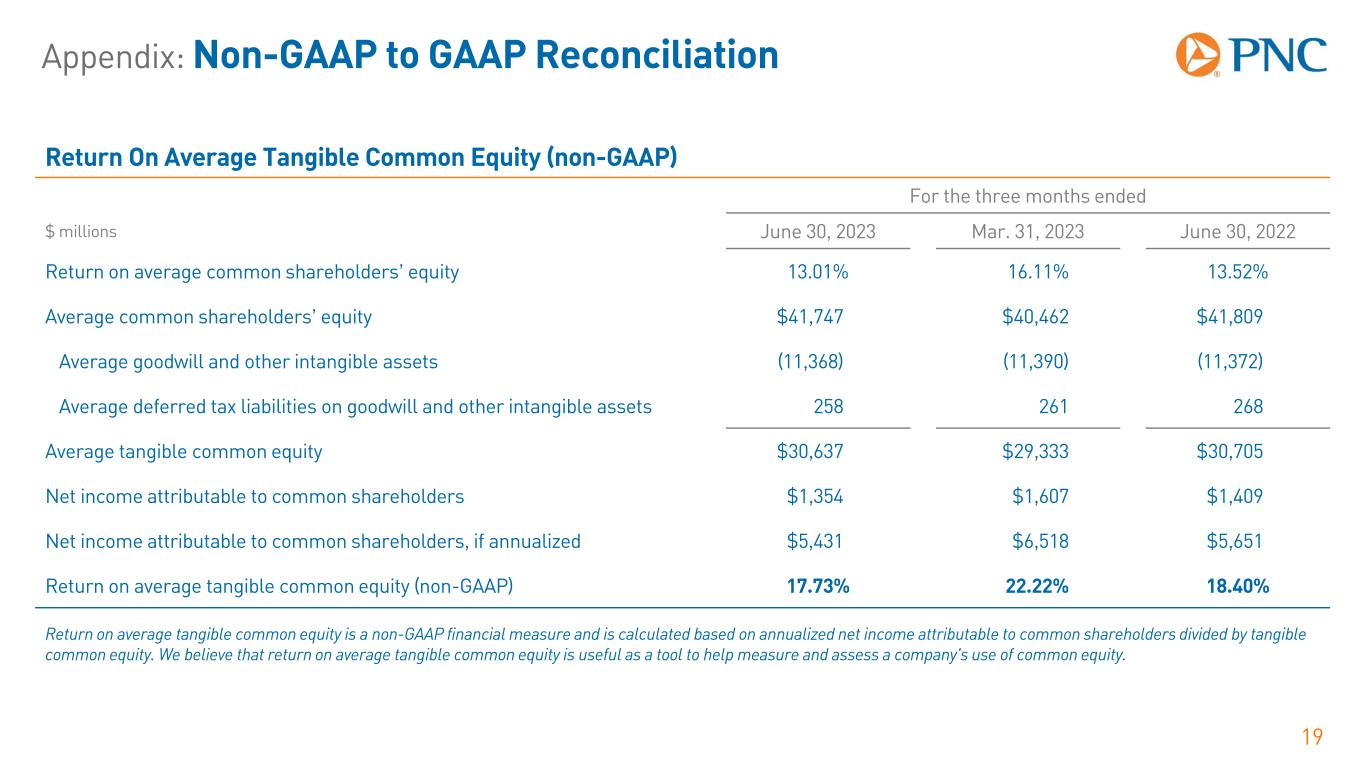

Appendix: Non-GAAP to GAAP Reconciliation 19 Return On Average Tangible Common Equity (non-GAAP) For the three months ended $ millions June 30, 2023 Mar. 31, 2023 June 30, 2022 Return on average common shareholders’ equity 13.01% 16.11% 13.52% Average common shareholders’ equity $41,747 $40,462 $41,809 Average goodwill and other intangible assets (11,368) (11,390) (11,372) Average deferred tax liabilities on goodwill and other intangible assets 258 261 268 Average tangible common equity $30,637 $29,333 $30,705 Net income attributable to common shareholders $1,354 $1,607 $1,409 Net income attributable to common shareholders, if annualized $5,431 $6,518 $5,651 Return on average tangible common equity (non-GAAP) 17.73% 22.22% 18.40% Return on average tangible common equity is a non-GAAP financial measure and is calculated based on annualized net income attributable to common shareholders divided by tangible common equity. We believe that return on average tangible common equity is useful as a tool to help measure and assess a company's use of common equity.

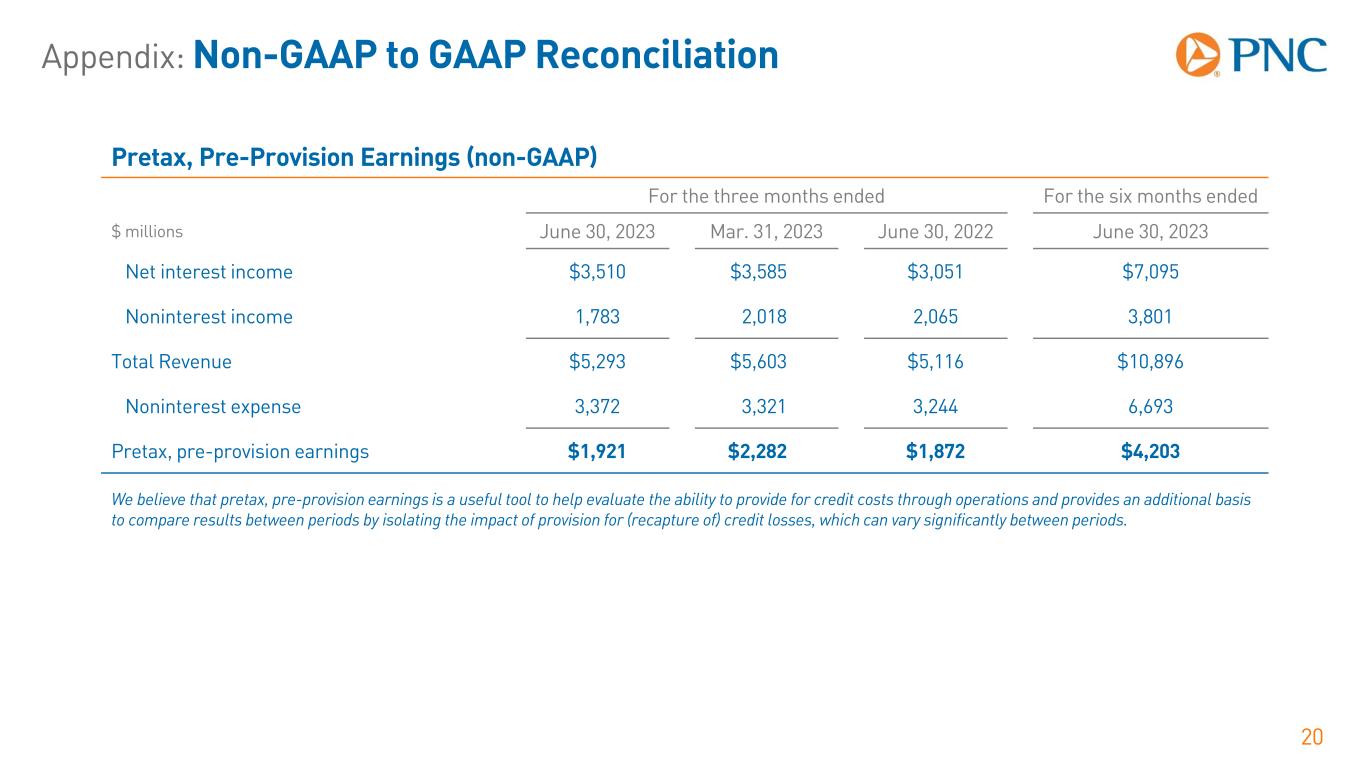

Appendix: Non-GAAP to GAAP Reconciliation 20 Pretax, Pre-Provision Earnings (non-GAAP) For the three months ended For the six months ended $ millions June 30, 2023 Mar. 31, 2023 June 30, 2022 June 30, 2023 Net interest income $3,510 $3,585 $3,051 $7,095 Noninterest income 1,783 2,018 2,065 3,801 Total Revenue $5,293 $5,603 $5,116 $10,896 Noninterest expense 3,372 3,321 3,244 6,693 Pretax, pre-provision earnings $1,921 $2,282 $1,872 $4,203 We believe that pretax, pre-provision earnings is a useful tool to help evaluate the ability to provide for credit costs through operations and provides an additional basis to compare results between periods by isolating the impact of provision for (recapture of) credit losses, which can vary significantly between periods.

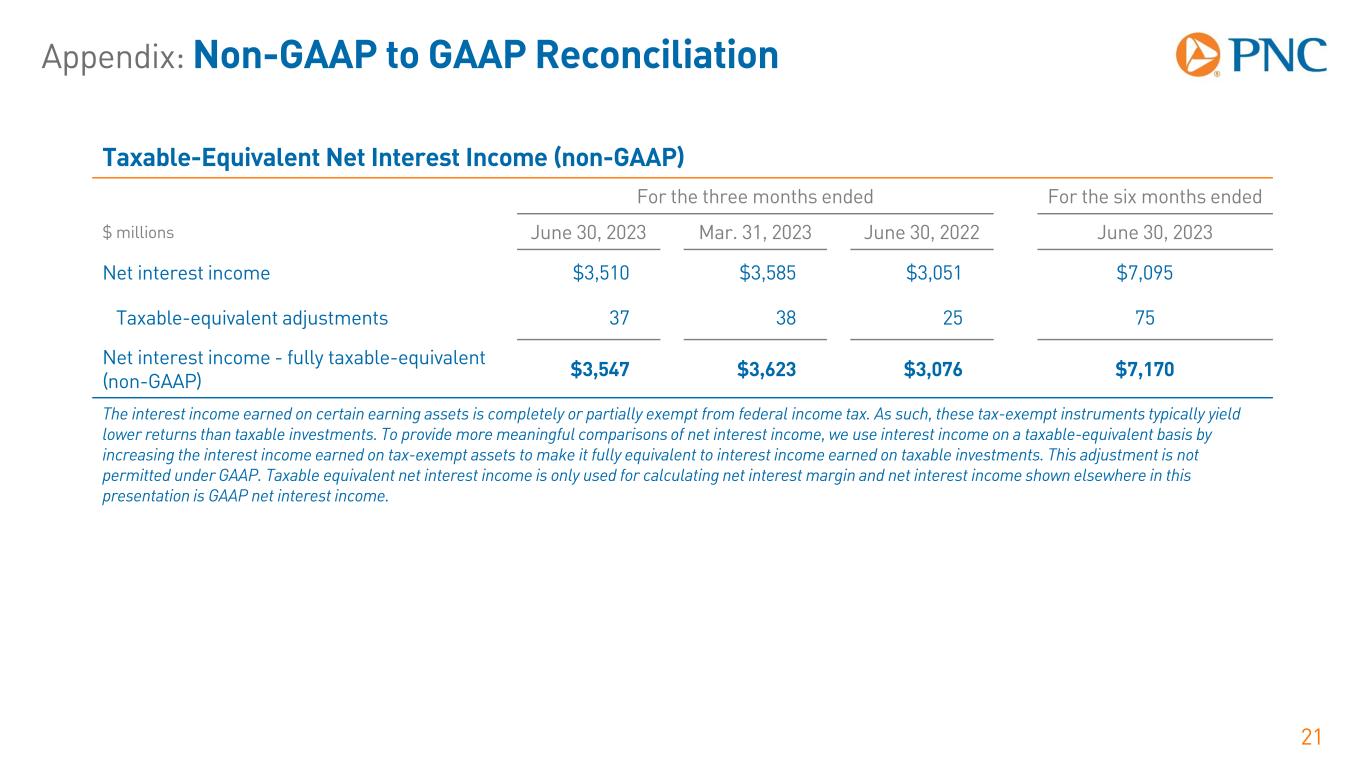

Appendix: Non-GAAP to GAAP Reconciliation 21 Taxable-Equivalent Net Interest Income (non-GAAP) For the three months ended For the six months ended $ millions June 30, 2023 Mar. 31, 2023 June 30, 2022 June 30, 2023 Net interest income $3,510 $3,585 $3,051 $7,095 Taxable-equivalent adjustments 37 38 25 75 Net interest income - fully taxable-equivalent (non-GAAP) $3,547 $3,623 $3,076 $7,170 The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of net interest income, we use interest income on a taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP. Taxable equivalent net interest income is only used for calculating net interest margin and net interest income shown elsewhere in this presentation is GAAP net interest income.

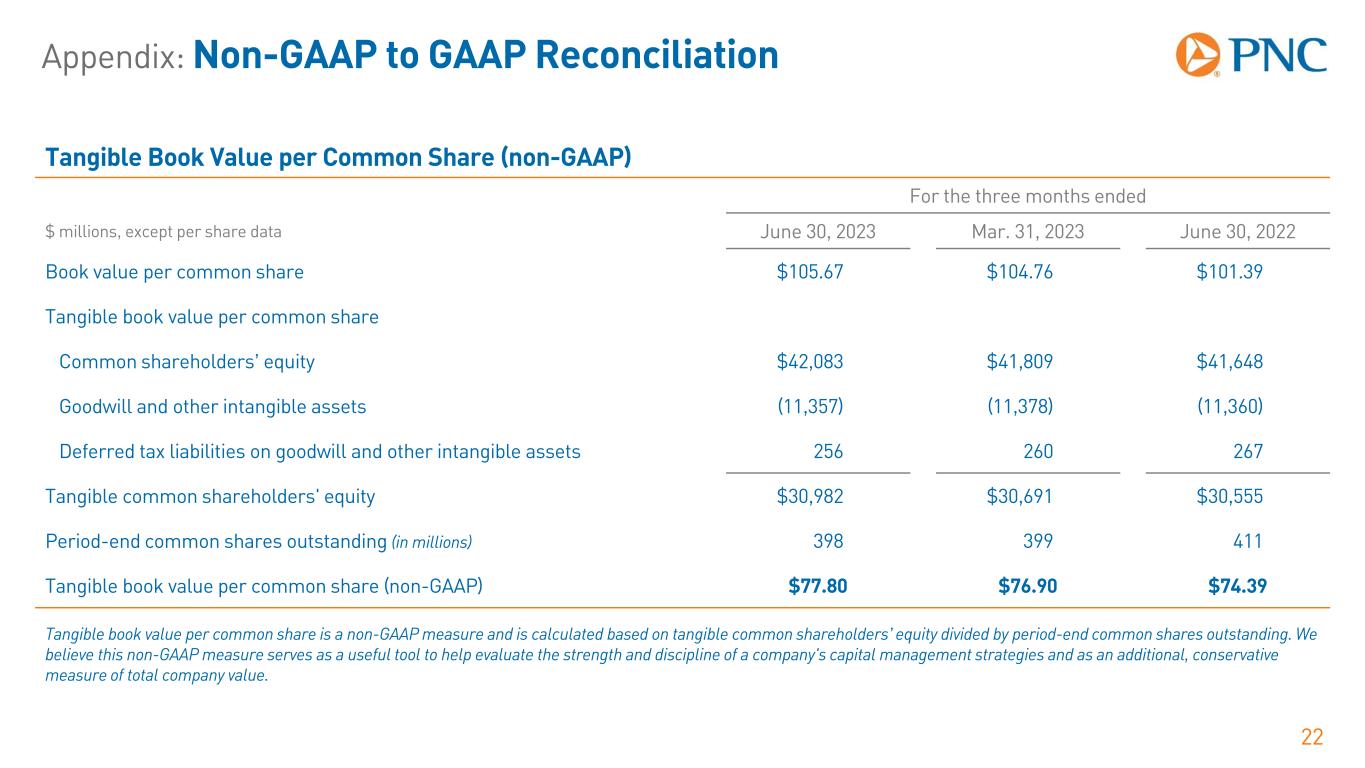

Appendix: Non-GAAP to GAAP Reconciliation 22 Tangible Book Value per Common Share (non-GAAP) For the three months ended $ millions, except per share data June 30, 2023 Mar. 31, 2023 June 30, 2022 Book value per common share $105.67 $104.76 $101.39 Tangible book value per common share Common shareholders’ equity $42,083 $41,809 $41,648 Goodwill and other intangible assets (11,357) (11,378) (11,360) Deferred tax liabilities on goodwill and other intangible assets 256 260 267 Tangible common shareholders' equity $30,982 $30,691 $30,555 Period-end common shares outstanding (in millions) 398 399 411 Tangible book value per common share (non-GAAP) $77.80 $76.90 $74.39 Tangible book value per common share is a non-GAAP measure and is calculated based on tangible common shareholders’ equity divided by period-end common shares outstanding. We believe this non-GAAP measure serves as a useful tool to help evaluate the strength and discipline of a company's capital management strategies and as an additional, conservative measure of total company value.

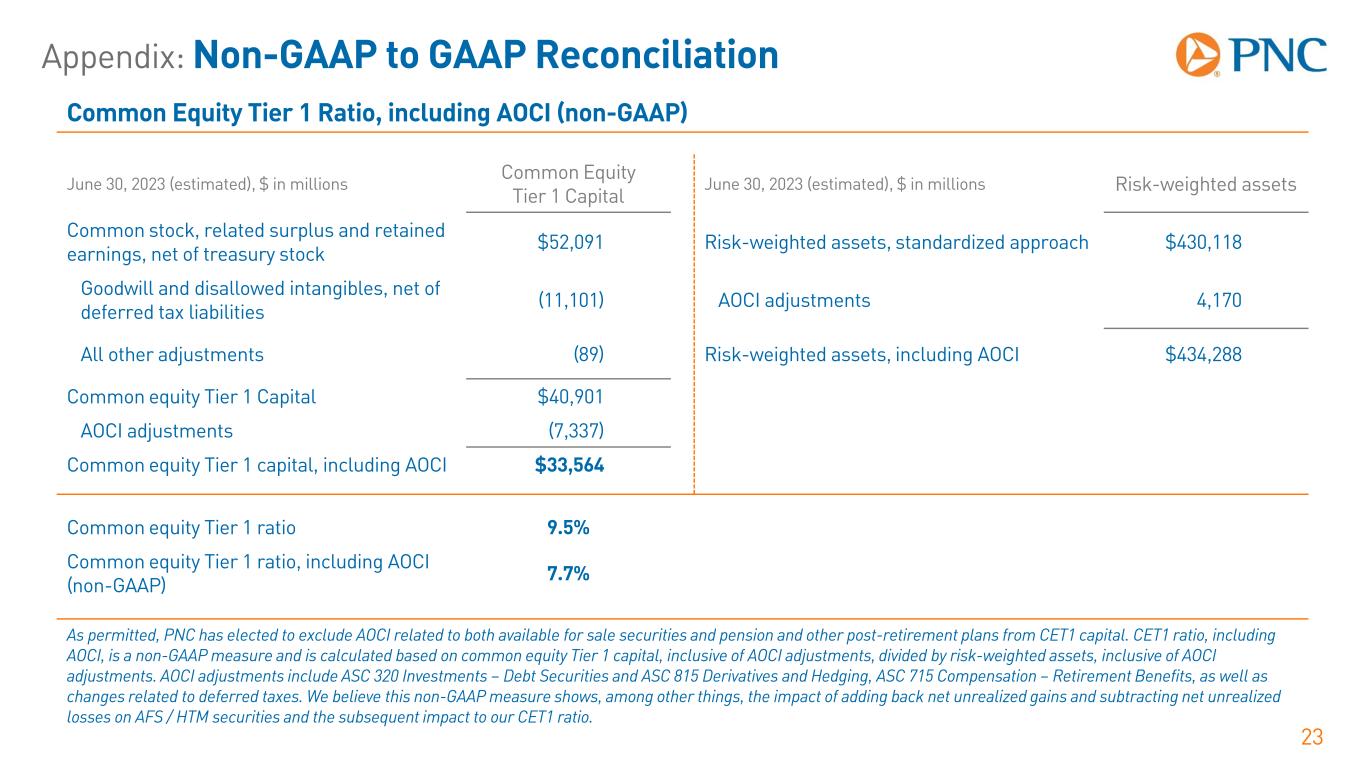

Appendix: Non-GAAP to GAAP Reconciliation 23 Common Equity Tier 1 Ratio, including AOCI (non-GAAP) June 30, 2023 (estimated), $ in millions Common Equity Tier 1 Capital June 30, 2023 (estimated), $ in millions Risk-weighted assets Common stock, related surplus and retained earnings, net of treasury stock $52,091 Risk-weighted assets, standardized approach $430,118 Goodwill and disallowed intangibles, net of deferred tax liabilities (11,101) AOCI adjustments 4,170 All other adjustments (89) Risk-weighted assets, including AOCI $434,288 Common equity Tier 1 Capital $40,901 AOCI adjustments (7,337) Common equity Tier 1 capital, including AOCI $33,564 Common equity Tier 1 ratio 9.5% Common equity Tier 1 ratio, including AOCI (non-GAAP) 7.7% As permitted, PNC has elected to exclude AOCI related to both available for sale securities and pension and other post-retirement plans from CET1 capital. CET1 ratio, including AOCI, is a non-GAAP measure and is calculated based on common equity Tier 1 capital, inclusive of AOCI adjustments, divided by risk-weighted assets, inclusive of AOCI adjustments. AOCI adjustments include ASC 320 Investments – Debt Securities and ASC 815 Derivatives and Hedging, ASC 715 Compensation – Retirement Benefits, as well as changes related to deferred taxes. We believe this non-GAAP measure shows, among other things, the impact of adding back net unrealized gains and subtracting net unrealized losses on AFS / HTM securities and the subsequent impact to our CET1 ratio.

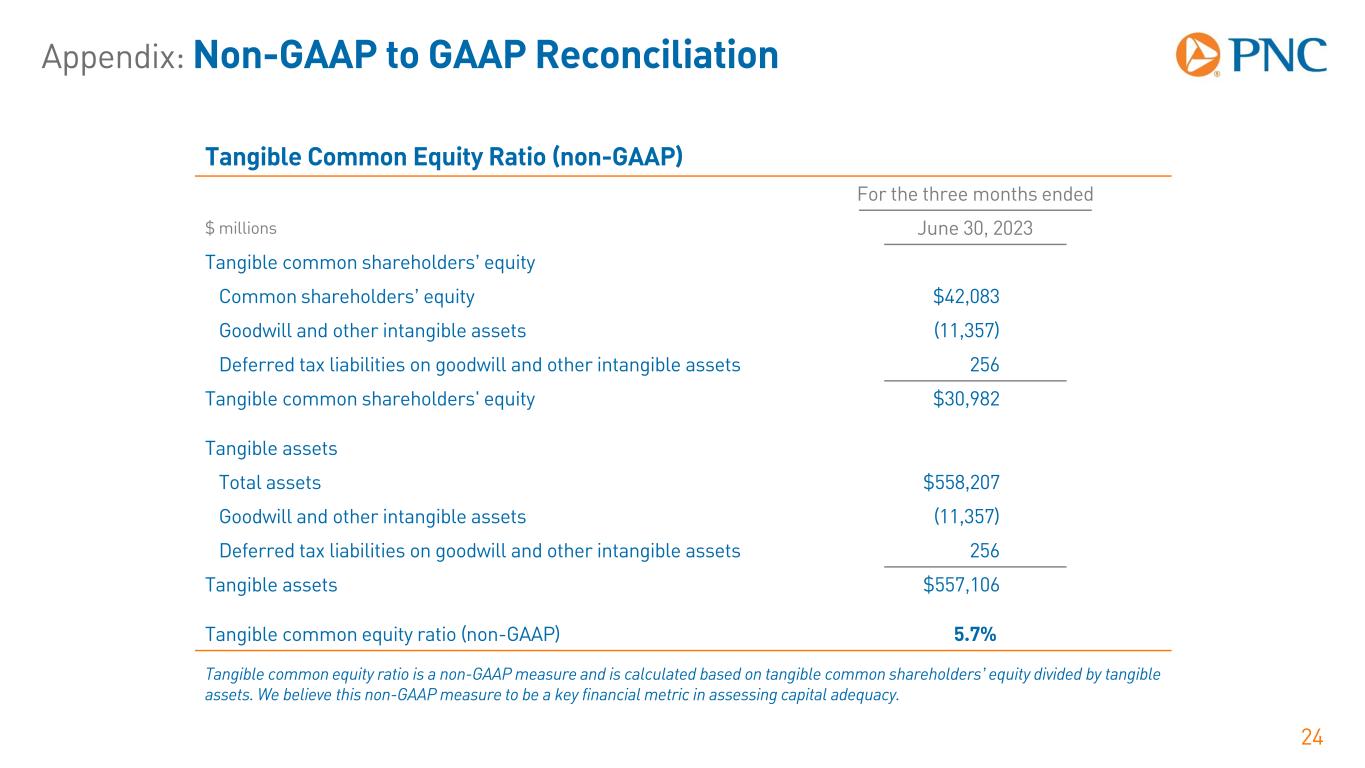

Appendix: Non-GAAP to GAAP Reconciliation 24 Tangible Common Equity Ratio (non-GAAP) For the three months ended $ millions June 30, 2023 Tangible common shareholders’ equity Common shareholders’ equity $42,083 Goodwill and other intangible assets (11,357) Deferred tax liabilities on goodwill and other intangible assets 256 Tangible common shareholders' equity $30,982 Tangible assets Total assets $558,207 Goodwill and other intangible assets (11,357) Deferred tax liabilities on goodwill and other intangible assets 256 Tangible assets $557,106 Tangible common equity ratio (non-GAAP) 5.7% Tangible common equity ratio is a non-GAAP measure and is calculated based on tangible common shareholders’ equity divided by tangible assets. We believe this non-GAAP measure to be a key financial metric in assessing capital adequacy.

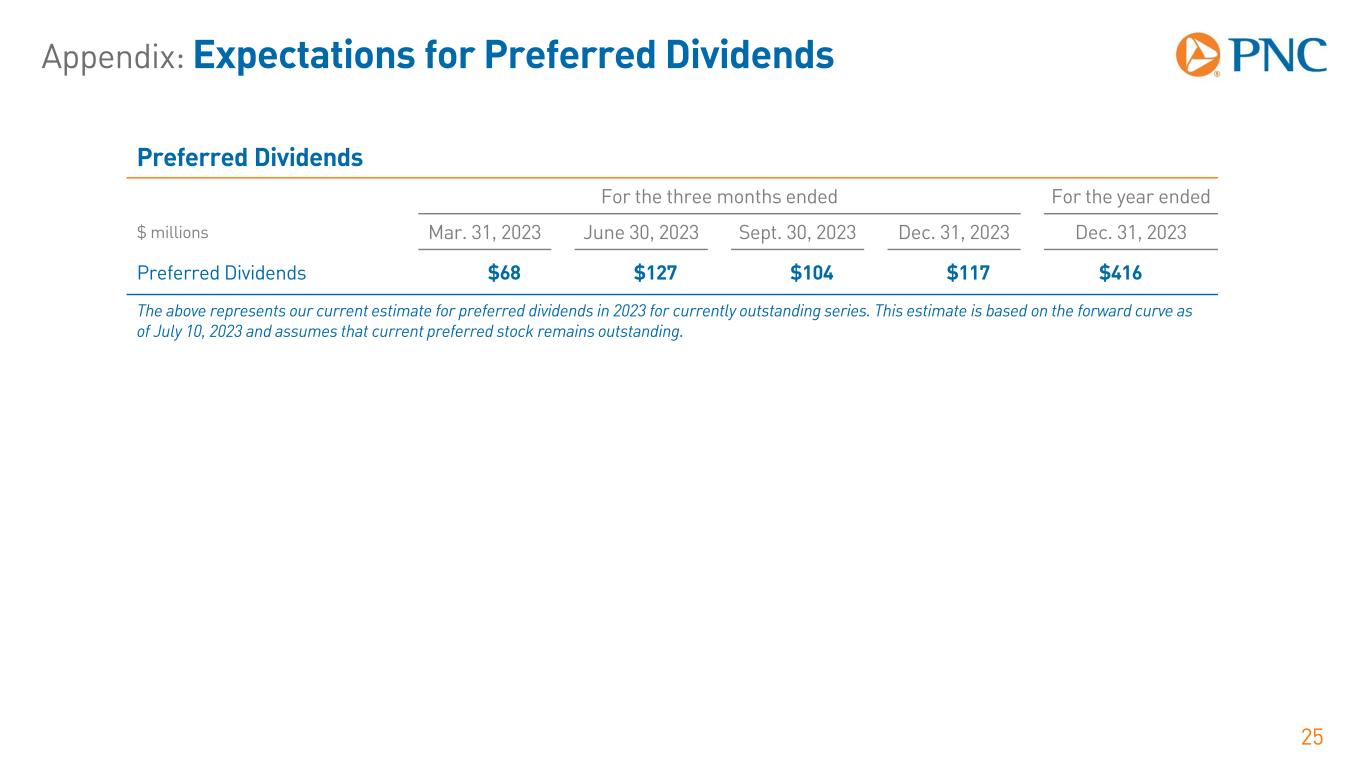

Appendix: Expectations for Preferred Dividends 25 Preferred Dividends For the three months ended For the year ended $ millions Mar. 31, 2023 June 30, 2023 Sept. 30, 2023 Dec. 31, 2023 Dec. 31, 2023 Preferred Dividends $68 $127 $104 $117 $416 The above represents our current estimate for preferred dividends in 2023 for currently outstanding series. This estimate is based on the forward curve as of July 10, 2023 and assumes that current preferred stock remains outstanding.