EX-99.2

Published on July 15, 2022

Exhibit 99.2

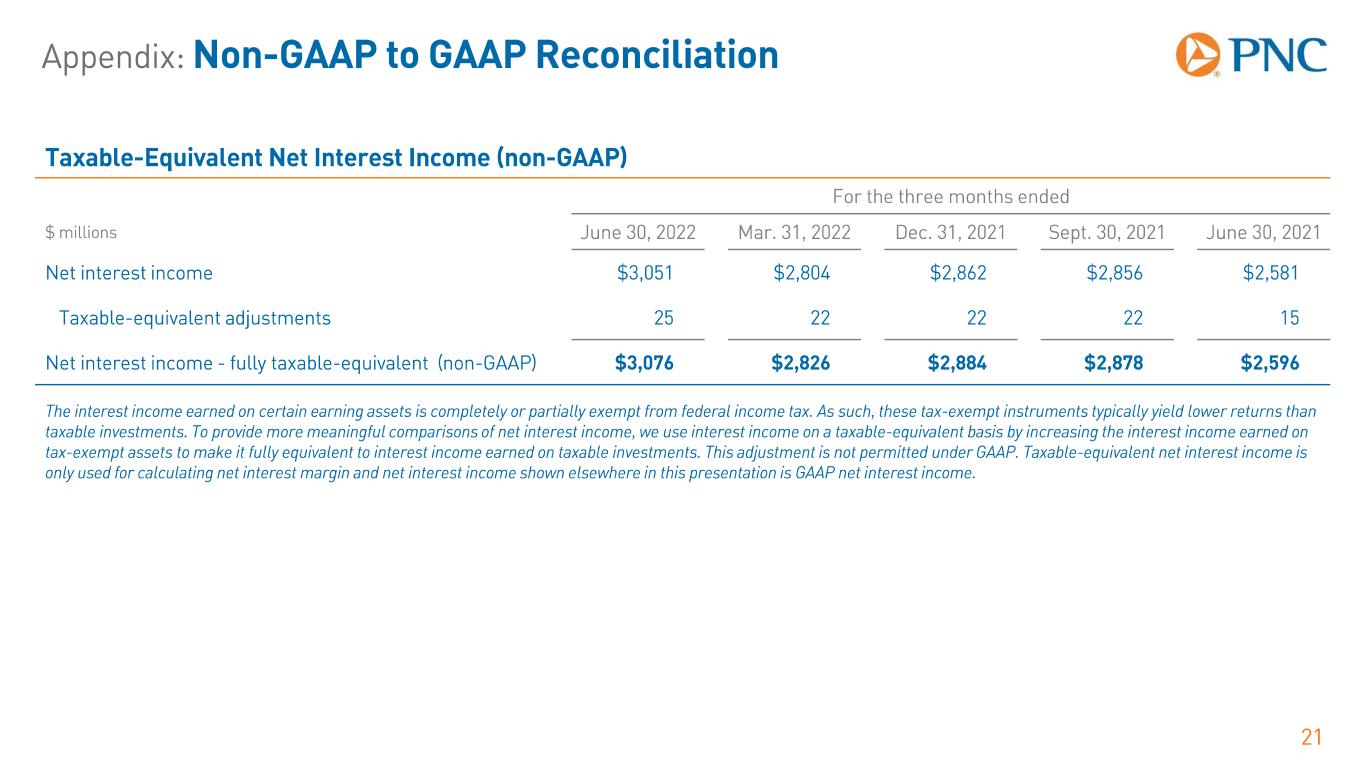

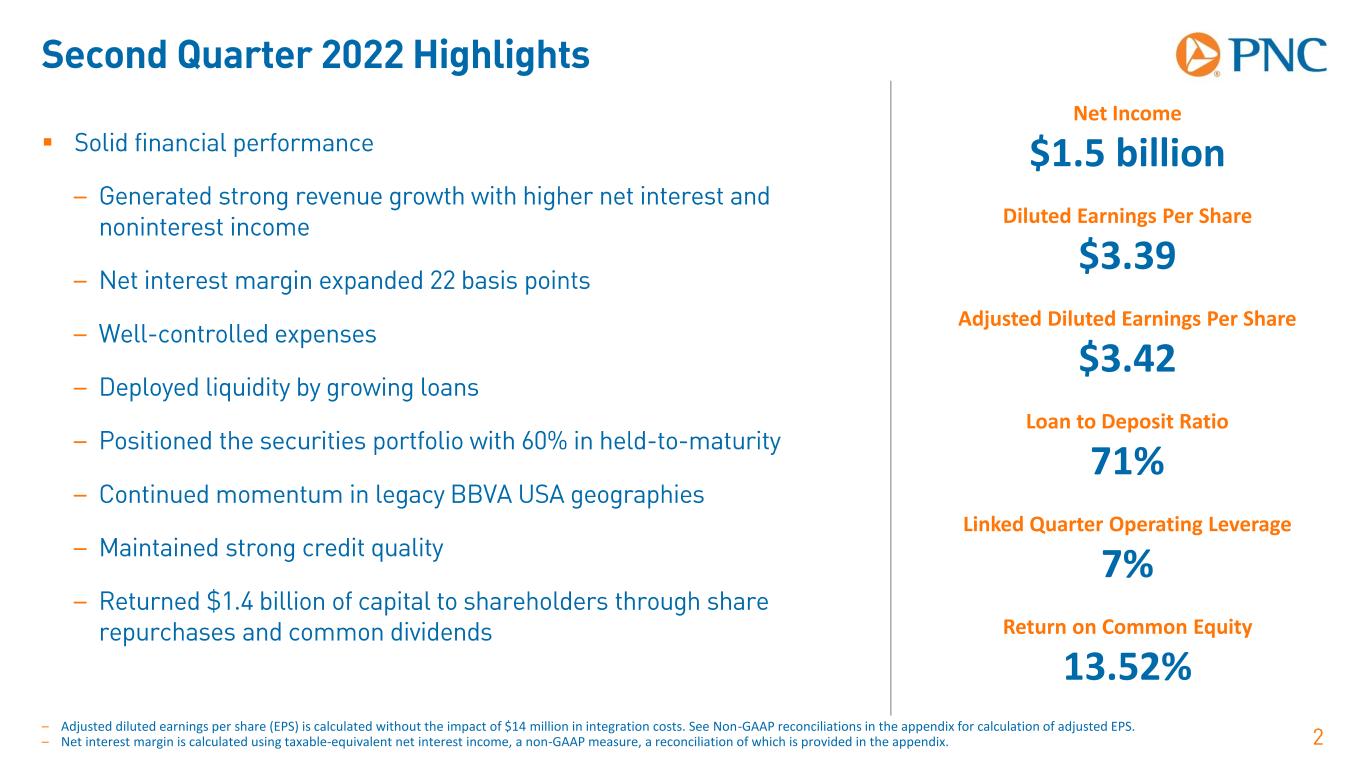

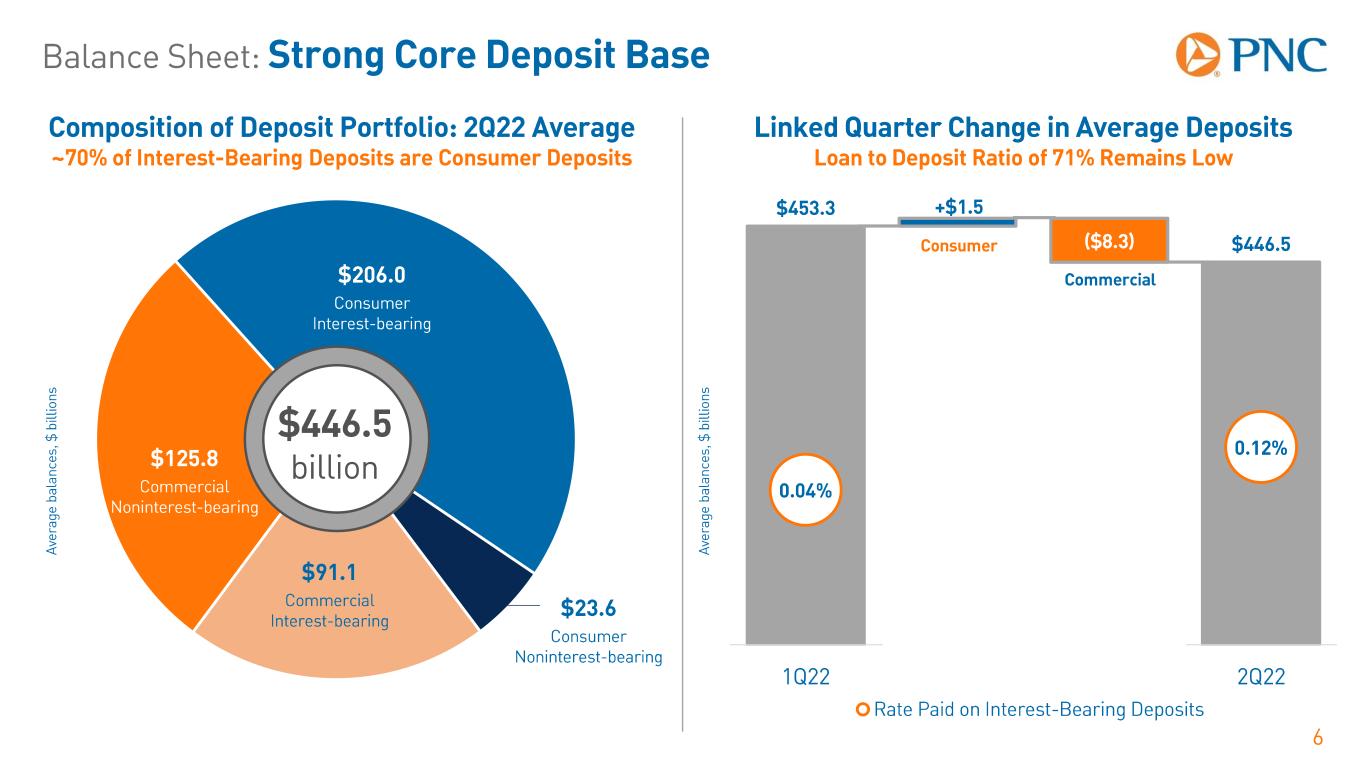

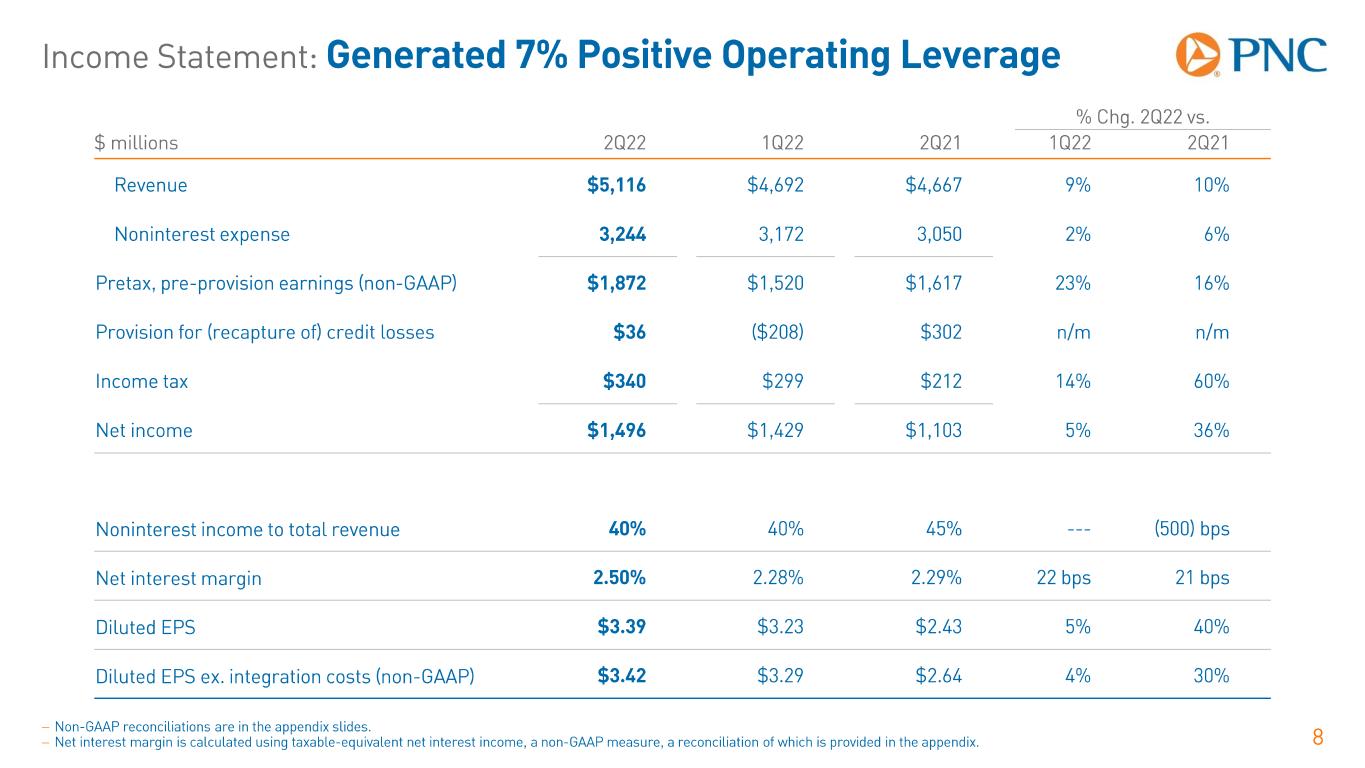

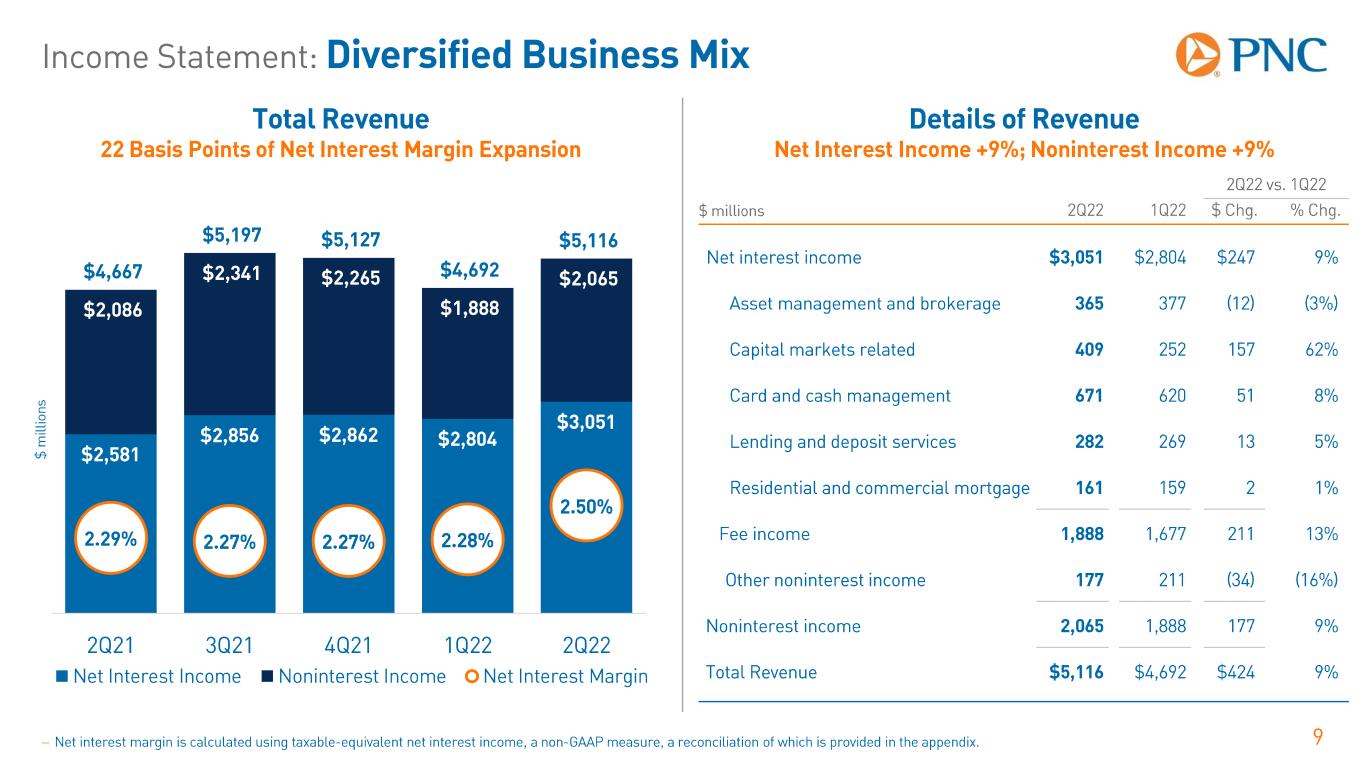

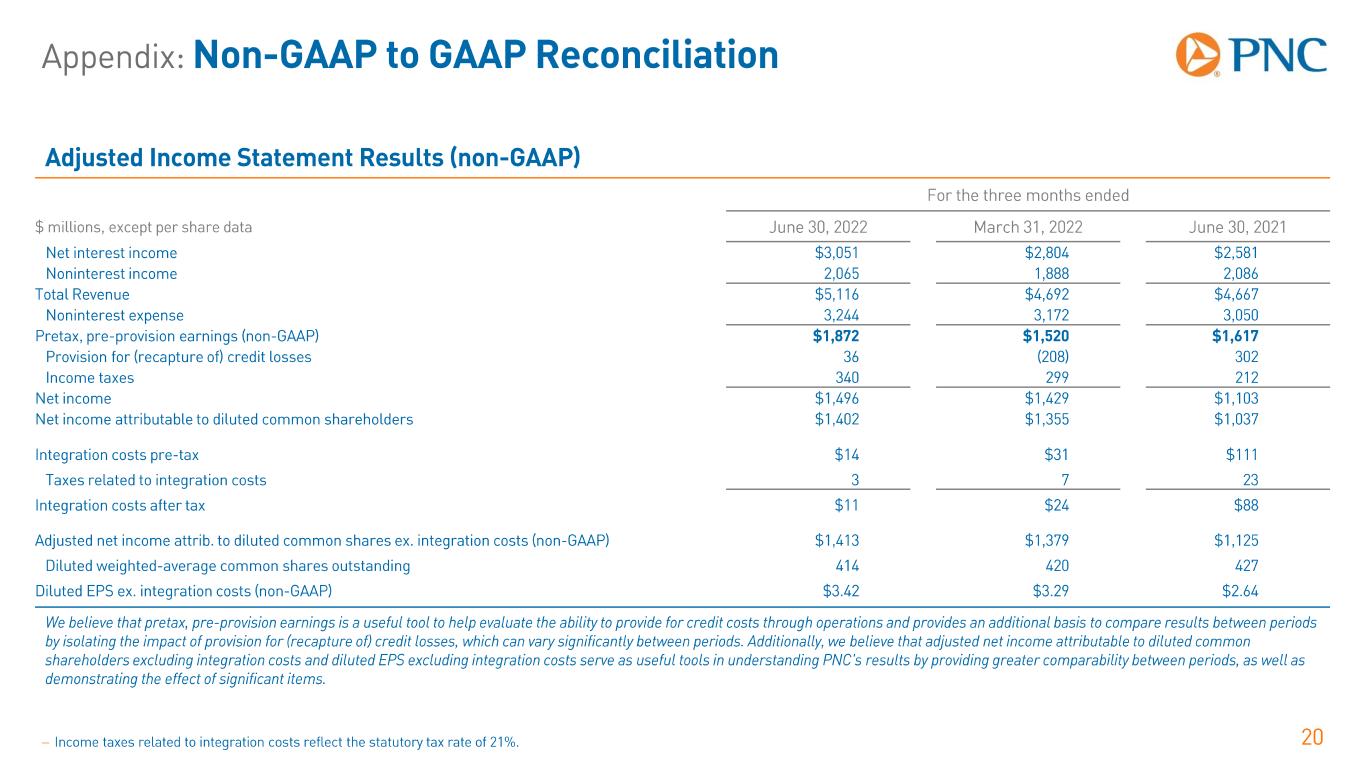

▪ – – – – – – – – Net Income $1.5 billion Diluted Earnings Per Share $3.39 Loan to Deposit Ratio 71% Linked Quarter Operating Leverage 7% Return on Common Equity 13.52% – Adjusted diluted earnings per share (EPS) is calculated without the impact of $14 million in integration costs. See Non-GAAP reconciliations in the appendix for calculation of adjusted EPS. – Net interest margin is calculated using taxable-equivalent net interest income, a non-GAAP measure, a reconciliation of which is provided in the appendix. Adjusted Diluted Earnings Per Share $3.42

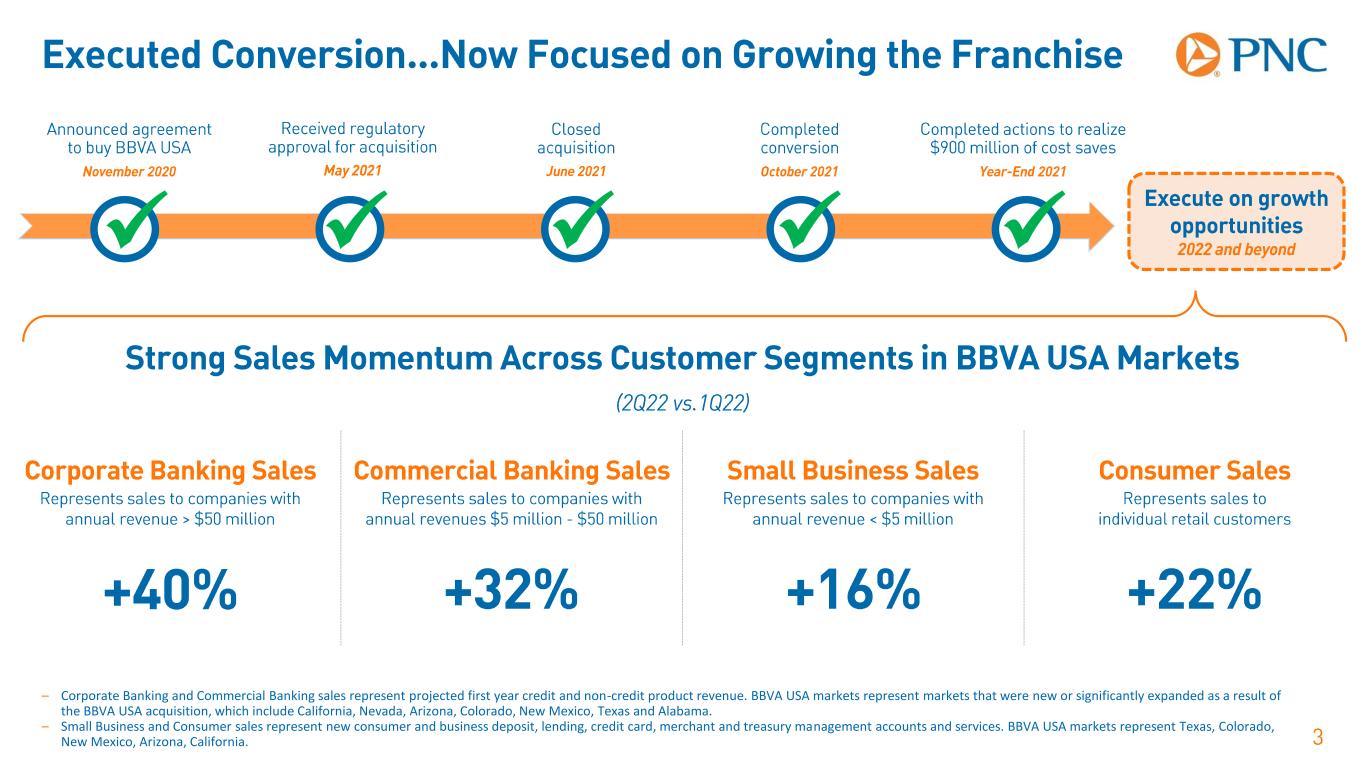

✓ ✓ ✓ ✓ ✓ – Corporate Banking and Commercial Banking sales represent projected first year credit and non-credit product revenue. BBVA USA markets represent markets that were new or significantly expanded as a result of the BBVA USA acquisition, which include California, Nevada, Arizona, Colorado, New Mexico, Texas and Alabama. – Small Business and Consumer sales represent new consumer and business deposit, lending, credit card, merchant and treasury management accounts and services. BBVA USA markets represent Texas, Colorado, New Mexico, Arizona, California.

− −

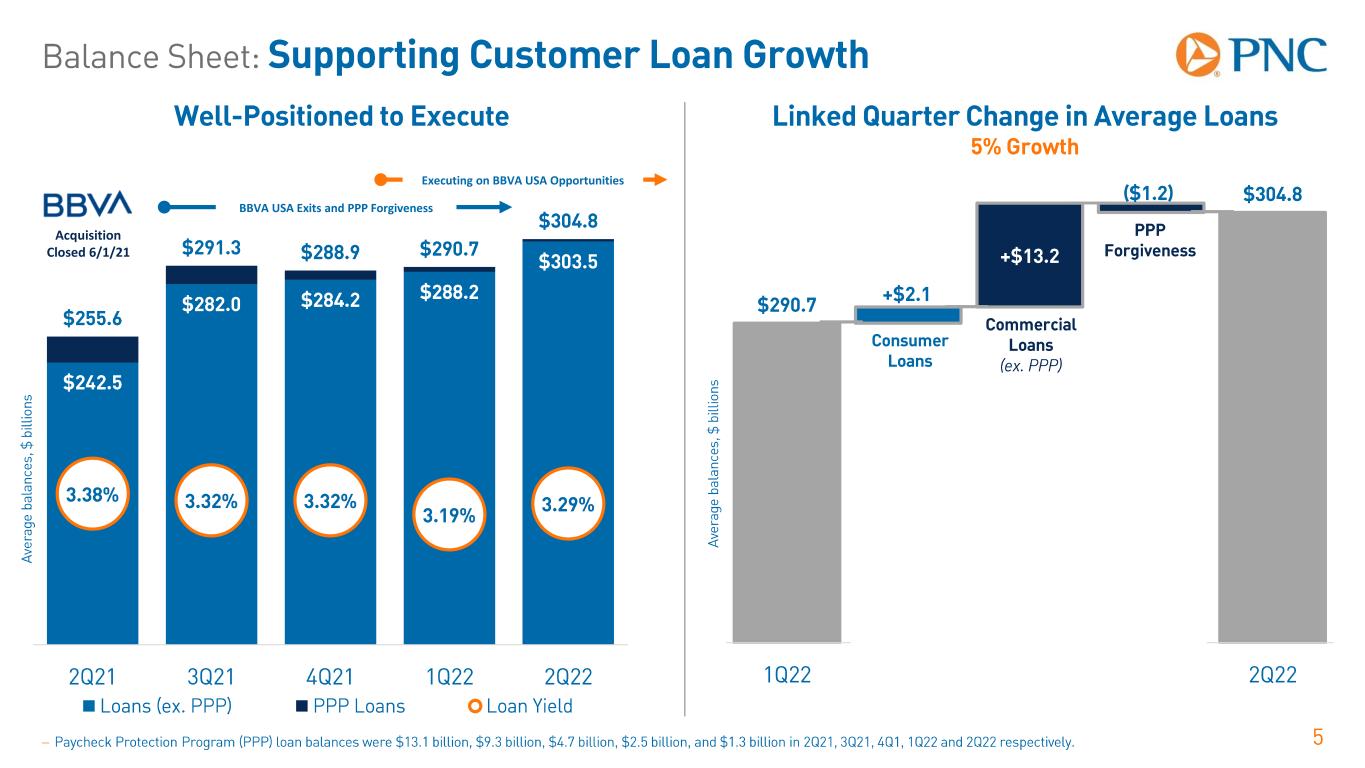

BBVA USA Exits and PPP Forgiveness Executing on BBVA USA Opportunities − Acquisition Closed 6/1/21

− − −

− −

−

−

− − −

− − −

− − −

▪ − − − − − − − − − −

▪ − − − − − ▪ ▪

▪ − − − − ▪ ▪ ▪ ▪

− − −

−