EX-99.2

Published on April 14, 2022

The PNC Financial Services Group First Quarter 2022 Earnings Conference Call April 14, 2022 Exhibit 99.2

Cautionary Statement Regarding Forward-Looking and non-GAAP Financial Information Our earnings conference call presentation is not intended as a full business or financial review and should be viewed in the context of all of the information made available by PNC in its SEC filings and on our corporate website. The presentation contains forward-looking statements regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations. Forward- looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix. We provide greater detail regarding these as well as other factors in our 2021 Form 10-K and in our other subsequent SEC filings. Our forward-looking statements may also be subject to risks and uncertainties including those we may discuss in this presentation or in our SEC filings. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake any obligation to update those statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. We include non-GAAP financial information in this presentation. Non-GAAP financial information includes adjusted financial metrics such as fee income, tangible book value, pretax, pre-provision earnings, net interest margin, return on tangible common equity, and other adjusted metrics (including adjustments for merger and integration costs). Reconciliations for such financial information may be found in our presentation, in these slides, including the Appendix, in other materials on our corporate website, and in our SEC filings. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this information and the related reconciliations may be useful to investors, analysts, regulators and others to help understand and evaluate our financial results, and with respect to adjusted metrics, because we believe they better reflect the ongoing financial results and trends of our businesses and increase comparability of period-to-period results. We may also use annualized, pro forma, estimated or third party numbers for illustrative or comparative purposes only. These may not reflect actual results. References to our corporate website are to www.pnc.com under “About Us - Investor Relations.” Our SEC filings are available both on our corporate website and on the SEC’s website at www.sec.gov. We include web addresses here as inactive textual references only. Information on these websites is not part of this presentation. 1

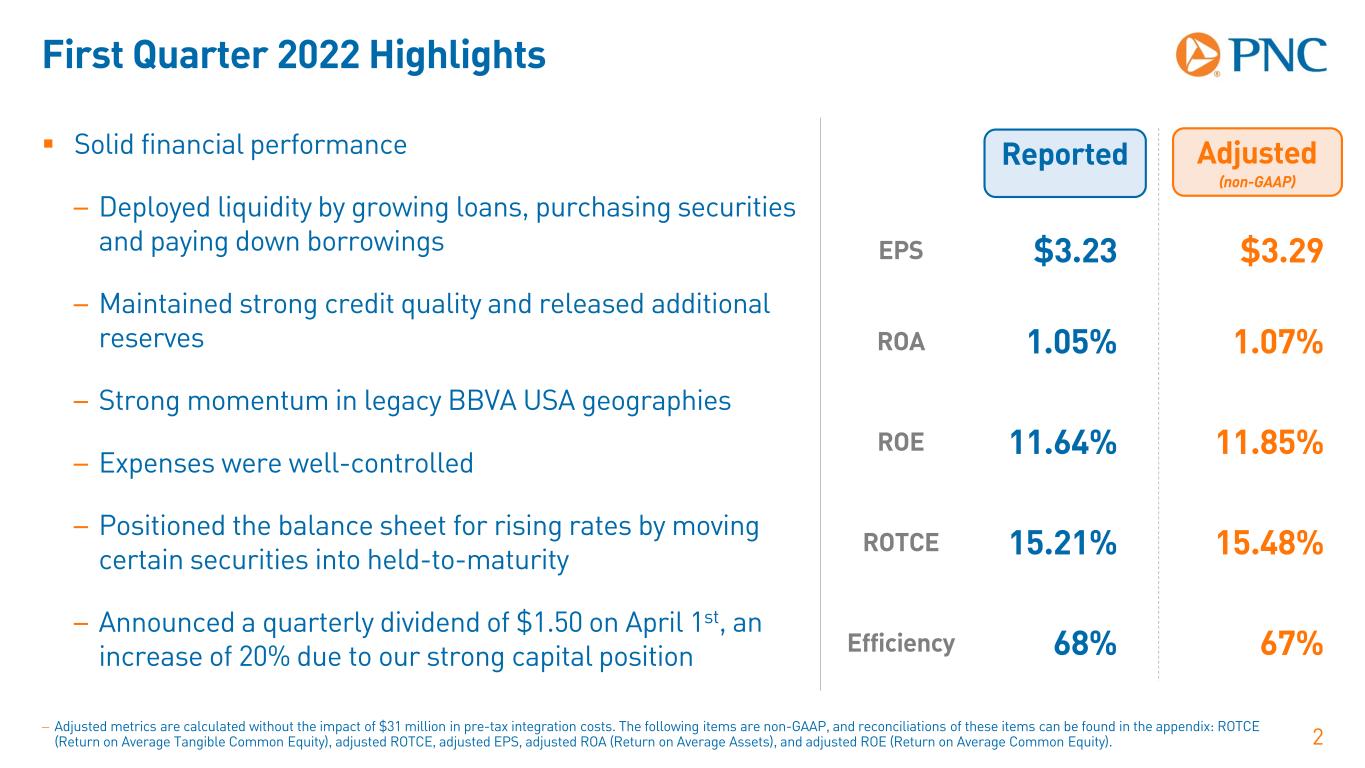

First Quarter 2022 Highlights 2− Adjusted metrics are calculated without the impact of $31 million in pre-tax integration costs. The following items are non-GAAP, and reconciliations of these items can be found in the appendix: ROTCE (Return on Average Tangible Common Equity), adjusted ROTCE, adjusted EPS, adjusted ROA (Return on Average Assets), and adjusted ROE (Return on Average Common Equity). Solid financial performance – Deployed liquidity by growing loans, purchasing securities and paying down borrowings – Maintained strong credit quality and released additional reserves – Strong momentum in legacy BBVA USA geographies – Expenses were well-controlled – Positioned the balance sheet for rising rates by moving certain securities into held-to-maturity – Announced a quarterly dividend of $1.50 on April 1st, an increase of 20% due to our strong capital position Adjusted (non-GAAP) Reported ROA ROE ROTCE Efficiency 1.05% 11.64% 15.21% 68% EPS $3.23 1.07% 11.85% 15.48% 67% $3.29

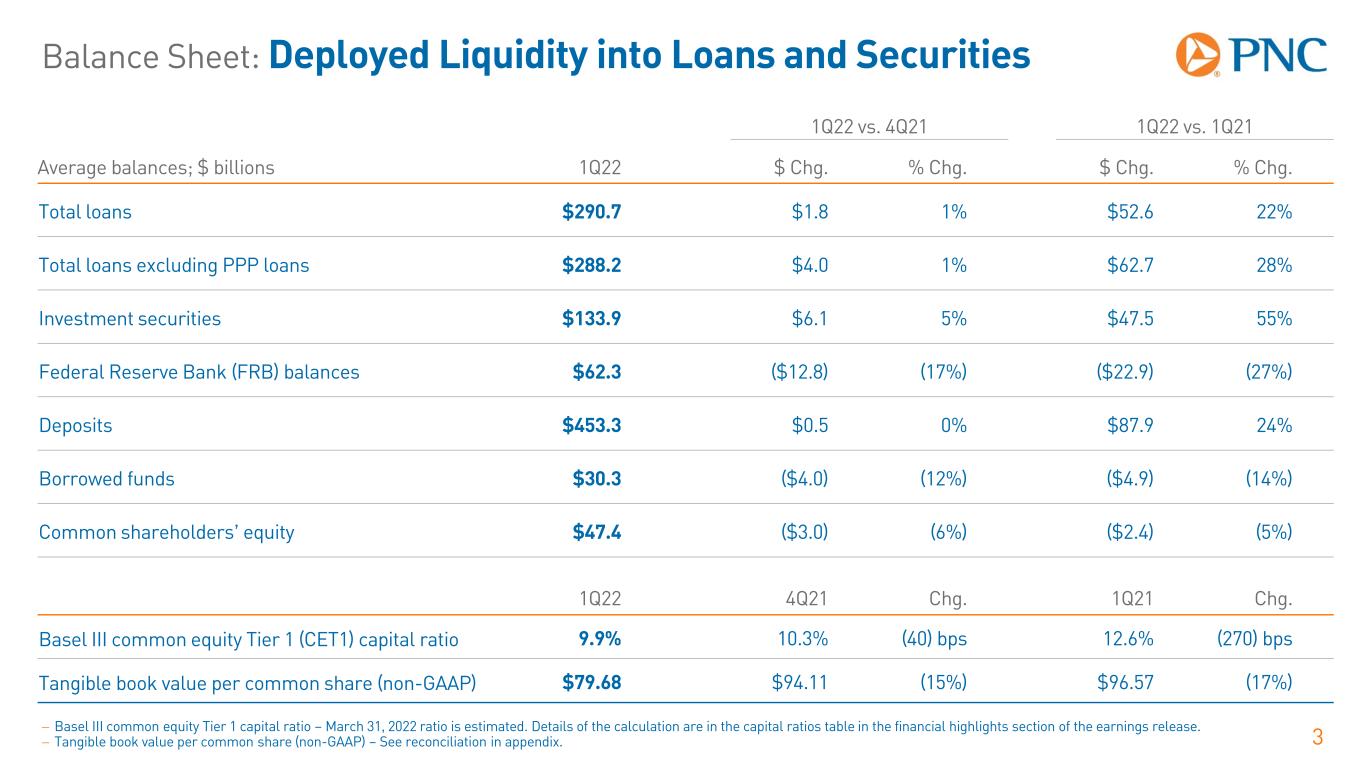

Balance Sheet: Deployed Liquidity into Loans and Securities 3 1Q22 vs. 4Q21 1Q22 vs. 1Q21 Average balances; $ billions 1Q22 $ Chg. % Chg. $ Chg. % Chg. Total loans $290.7 $1.8 1% $52.6 22% Total loans excluding PPP loans $288.2 $4.0 1% $62.7 28% Investment securities $133.9 $6.1 5% $47.5 55% Federal Reserve Bank (FRB) balances $62.3 ($12.8) (17%) ($22.9) (27%) Deposits $453.3 $0.5 0% $87.9 24% Borrowed funds $30.3 ($4.0) (12%) ($4.9) (14%) Common shareholders’ equity $47.4 ($3.0) (6%) ($2.4) (5%) 1Q22 4Q21 Chg. 1Q21 Chg. Basel III common equity Tier 1 (CET1) capital ratio 9.9% 10.3% (40) bps 12.6% (270) bps Tangible book value per common share (non-GAAP) $79.68 $94.11 (15%) $96.57 (17%) − Basel III common equity Tier 1 capital ratio – March 31, 2022 ratio is estimated. Details of the calculation are in the capital ratios table in the financial highlights section of the earnings release. − Tangible book value per common share (non-GAAP) – See reconciliation in appendix.

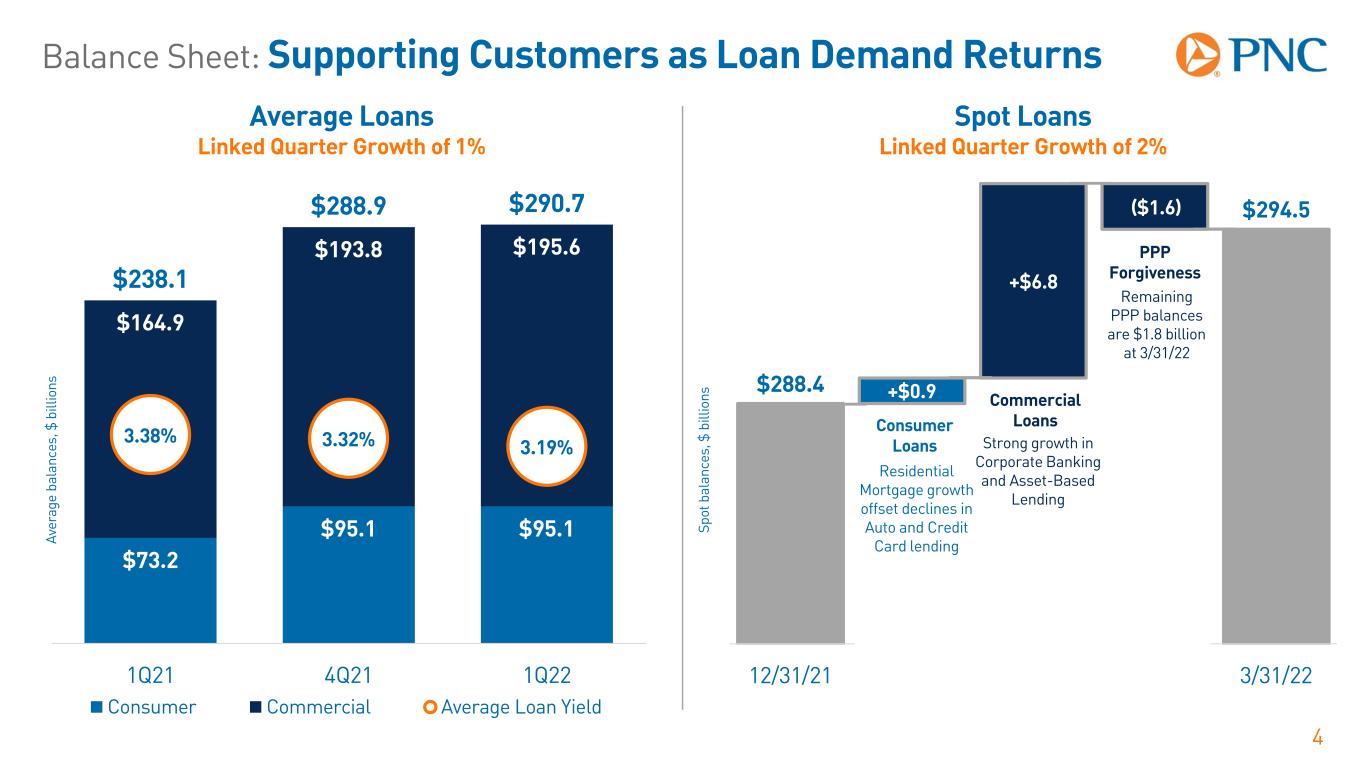

Balance Sheet: Supporting Customers as Loan Demand Returns 4 +$0.9 +$6.8 ($1.6) $288.4 $294.5 280 282 284 286 288 290 292 294 296 12/31/21 Consumer Commercial PPP 3/31/22 Av er ag e ba la nc es , $ b ill io ns c Spot Loans Linked Quarter Growth of 2% Sp ot b al an ce s, $ b ill io ns Average Loans Linked Quarter Growth of 1% PPP Forgiveness Commercial LoansConsumer Loans $73.2 $95.1 $95.1 $164.9 $193.8 $195.6 $238.1 $288.9 $290.7 3.38% 3.32% 3.19% 0.00 % 1.00 % 2.00 % 3.00 % 4.00 % 5.00 % 6.00 % 7.00 % 0 50 100 150 200 250 300 1Q21 4Q21 1Q22 Consumer Commercial Average Loan Yield Residential Mortgage growth offset declines in Auto and Credit Card lending Strong growth in Corporate Banking and Asset-Based Lending Remaining PPP balances are $1.8 billion at 3/31/22

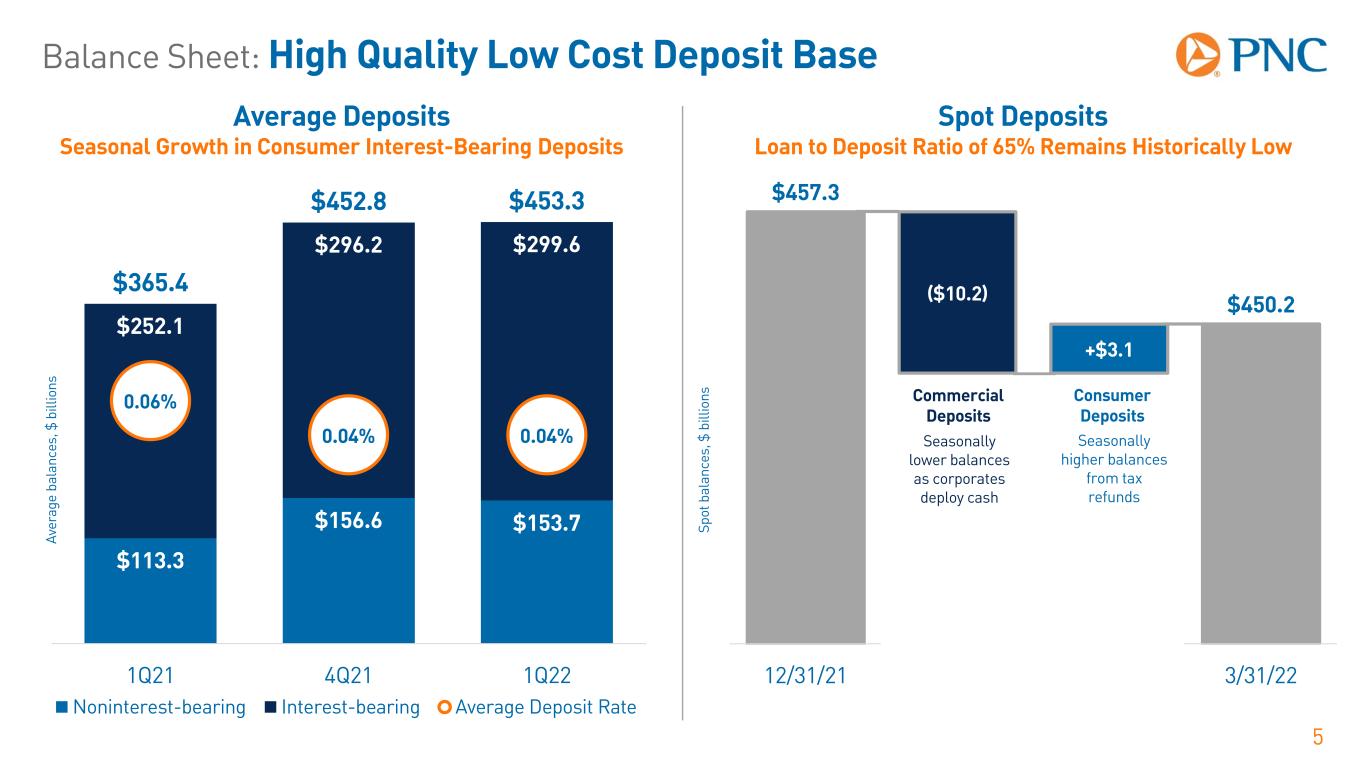

Balance Sheet: High Quality Low Cost Deposit Base 5 ($10.2) +$3.1 $457.3 $450.2 430 435 440 445 450 455 460 12/31/21 NIB IB 3/31/22 c Spot Deposits Loan to Deposit Ratio of 65% Remains Historically Low Sp ot b al an ce s, $ b ill io ns Average Deposits Seasonal Growth in Consumer Interest-Bearing Deposits Consumer Deposits Commercial Deposits $113.3 $156.6 $153.7 $252.1 $296.2 $299.6 $365.4 $452.8 $453.3 0.06% 0.04% 0.04% -0 .10% -0 .05% 0.00 % 0.05 % 0.10 % 0.15 % -3 5 15 65 115 165 215 265 315 365 415 465 1Q21 4Q21 1Q22 Noninterest-bearing Interest-bearing Average Deposit Rate Seasonally higher balances from tax refunds Seasonally lower balances as corporates deploy cash Av er ag e ba la nc es , $ b ill io ns

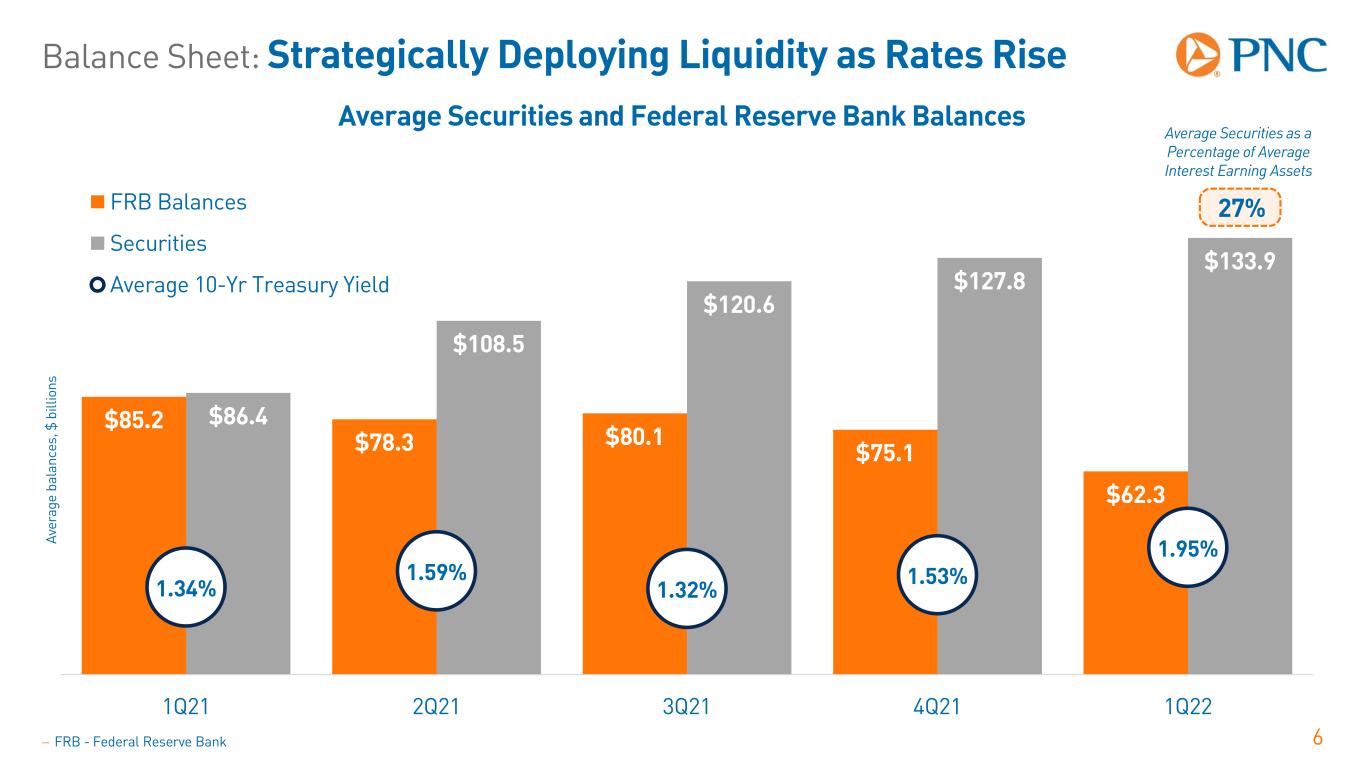

Balance Sheet: Strategically Deploying Liquidity as Rates Rise 6 Average Securities and Federal Reserve Bank Balances $85.2 $78.3 $80.1 $75.1 $62.3 $86.4 $108.5 $120.6 $127.8 $133.9 1.34% 1.59% 1.32% 1.53% 1.95% 0.00 % 1.00 % 2.00 % 3.00 % 4.00 % 5.00 % 6.00 % 7.00 % 8.00 % 0 20 40 60 80 100 120 140 160 1Q21 2Q21 3Q21 4Q21 1Q22 FRB Balances Securities Average 10-Yr Treasury Yield Average Securities as a Percentage of Average Interest Earning Assets 27% − FRB - Federal Reserve Bank Av er ag e ba la nc es , $ b ill io ns

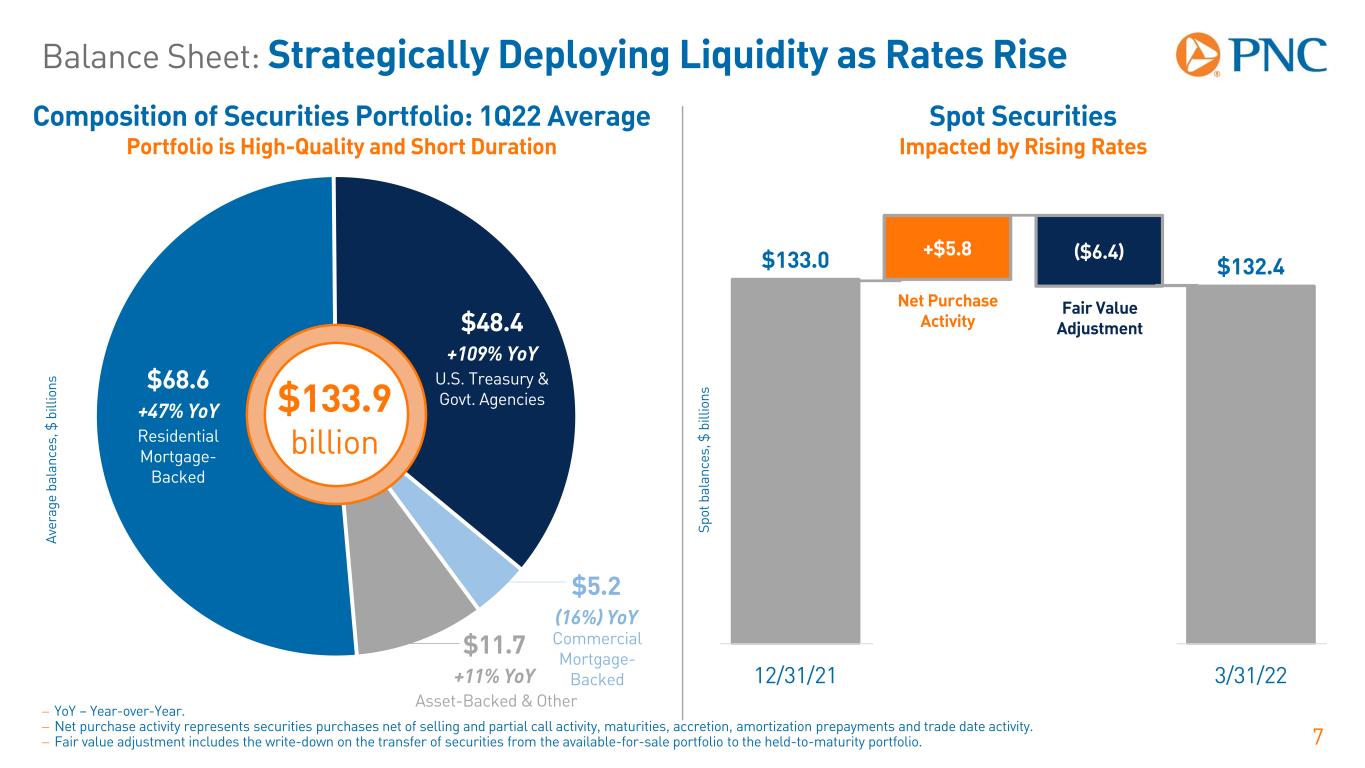

Balance Sheet: Strategically Deploying Liquidity as Rates Rise 7 +$5.8 ($6.4)$133.0 $132.4 100 105 110 115 120 125 130 135 140 12/31/21 Purchases Valuation 3/31/22 Fair Value Adjustment Net Purchase Activity − YoY – Year-over-Year. − Net purchase activity represents securities purchases net of selling and partial call activity, maturities, accretion, amortization prepayments and trade date activity. − Fair value adjustment includes the write-down on the transfer of securities from the available-for-sale portfolio to the held-to-maturity portfolio. Spot Securities Impacted by Rising Rates Sp ot b al an ce s, $ b ill io ns Av er ag e ba la nc es , $ b ill io ns Composition of Securities Portfolio: 1Q22 Average Portfolio is High-Quality and Short Duration $133.9 billion $68.6 +47% YoY Residential Mortgage- Backed $48.4 +109% YoY U.S. Treasury & Govt. Agencies $11.7 +11% YoY Commercial Mortgage- Backed Asset-Backed & Other $5.2 (16%) YoY

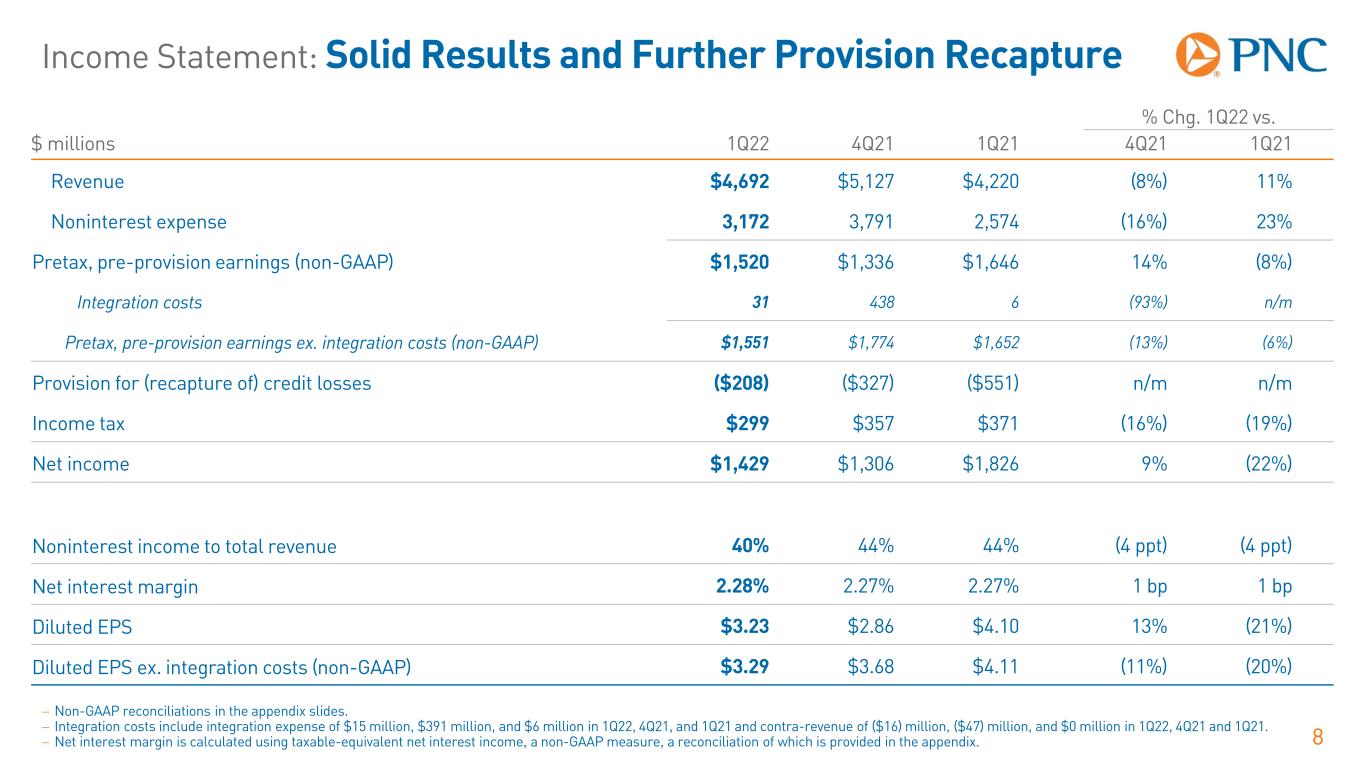

Income Statement: Solid Results and Further Provision Recapture 8 − Non-GAAP reconciliations in the appendix slides. − Integration costs include integration expense of $15 million, $391 million, and $6 million in 1Q22, 4Q21, and 1Q21 and contra-revenue of ($16) million, ($47) million, and $0 million in 1Q22, 4Q21 and 1Q21. − Net interest margin is calculated using taxable-equivalent net interest income, a non-GAAP measure, a reconciliation of which is provided in the appendix. % Chg. 1Q22 vs. $ millions 1Q22 4Q21 1Q21 4Q21 1Q21 Revenue $4,692 $5,127 $4,220 (8%) 11% Noninterest expense 3,172 3,791 2,574 (16%) 23% Pretax, pre-provision earnings (non-GAAP) $1,520 $1,336 $1,646 14% (8%) Integration costs 31 438 6 (93%) n/m Pretax, pre-provision earnings ex. integration costs (non-GAAP) $1,551 $1,774 $1,652 (13%) (6%) Provision for (recapture of) credit losses ($208) ($327) ($551) n/m n/m Income tax $299 $357 $371 (16%) (19%) Net income $1,429 $1,306 $1,826 9% (22%) Noninterest income to total revenue 40% 44% 44% (4 ppt) (4 ppt) Net interest margin 2.28% 2.27% 2.27% 1 bp 1 bp Diluted EPS $3.23 $2.86 $4.10 13% (21%) Diluted EPS ex. integration costs (non-GAAP) $3.29 $3.68 $4.11 (11%) (20%)

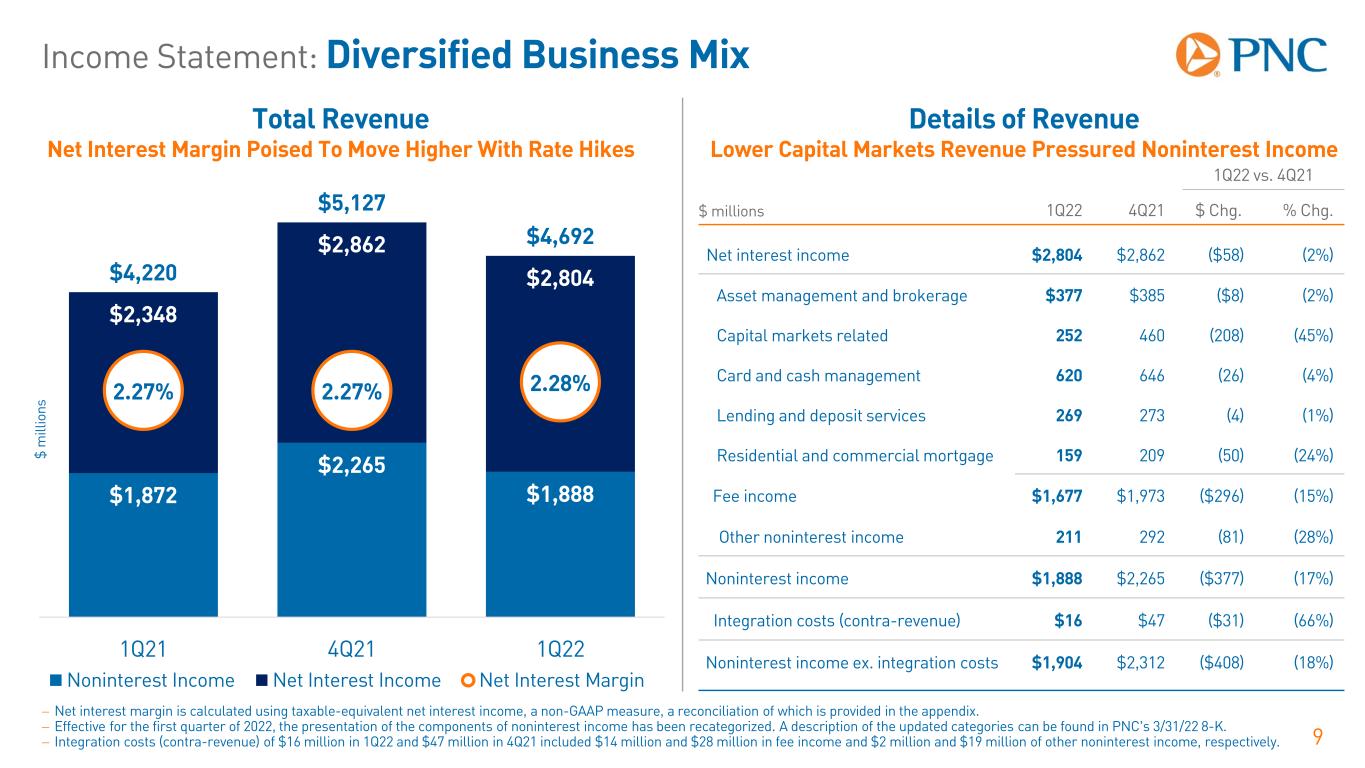

Income Statement: Diversified Business Mix 9 Total Revenue Net Interest Margin Poised To Move Higher With Rate Hikes $1,872 $2,265 $1,888 $2,348 $2,862 $2,804$4,220 $5,127 $4,692 2.27% 2.27% 2.28% 2.00 % 2.10 % 2.20 % 2.30 % 2.40 % 2.50 % 0 100 0 200 0 300 0 400 0 500 0 600 0 1Q21 4Q21 1Q22 Noninterest Income Net Interest Income Net Interest Margin Details of Revenue Lower Capital Markets Revenue Pressured Noninterest Income 1Q22 vs. 4Q21 $ millions 1Q22 4Q21 $ Chg. % Chg. Net interest income $2,804 $2,862 ($58) (2%) Asset management and brokerage $377 $385 ($8) (2%) Capital markets related 252 460 (208) (45%) Card and cash management 620 646 (26) (4%) Lending and deposit services 269 273 (4) (1%) Residential and commercial mortgage 159 209 (50) (24%) Fee income $1,677 $1,973 ($296) (15%) Other noninterest income 211 292 (81) (28%) Noninterest income $1,888 $2,265 ($377) (17%) Integration costs (contra-revenue) $16 $47 ($31) (66%) Noninterest income ex. integration costs $1,904 $2,312 ($408) (18%) $ m ill io ns − Net interest margin is calculated using taxable-equivalent net interest income, a non-GAAP measure, a reconciliation of which is provided in the appendix. − Effective for the first quarter of 2022, the presentation of the components of noninterest income has been recategorized. A description of the updated categories can be found in PNC’s 3/31/22 8-K. − Integration costs (contra-revenue) of $16 million in 1Q22 and $47 million in 4Q21 included $14 million and $28 million in fee income and $2 million and $19 million of other noninterest income, respectively.

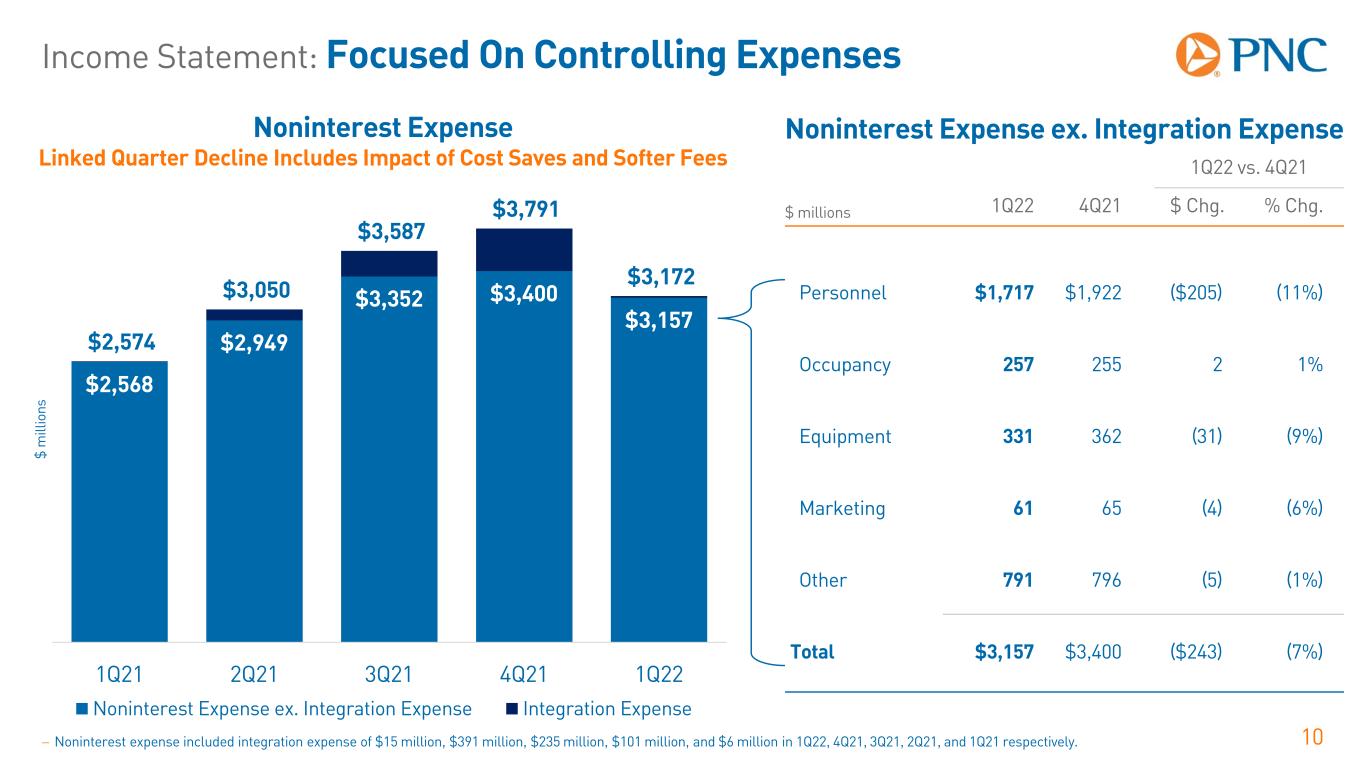

Income Statement: Focused On Controlling Expenses 10 $2,568 $2,949 $3,352 $3,400 $3,157 $2,574 $3,050 $3,587 $3,791 $3,172 1Q21 2Q21 3Q21 4Q21 1Q22 Noninterest Expense ex. Integration Expense Integration Expense Noninterest Expense Linked Quarter Decline Includes Impact of Cost Saves and Softer Fees Noninterest Expense ex. Integration Expense 1Q22 vs. 4Q21 $ millions 1Q22 4Q21 $ Chg. % Chg. Personnel $1,717 $1,922 ($205) (11%) Occupancy 257 255 2 1% Equipment 331 362 (31) (9%) Marketing 61 65 (4) (6%) Other 791 796 (5) (1%) Total $3,157 $3,400 ($243) (7%) − Noninterest expense included integration expense of $15 million, $391 million, $235 million, $101 million, and $6 million in 1Q22, 4Q21, 3Q21, 2Q21, and 1Q21 respectively. $ m ill io ns

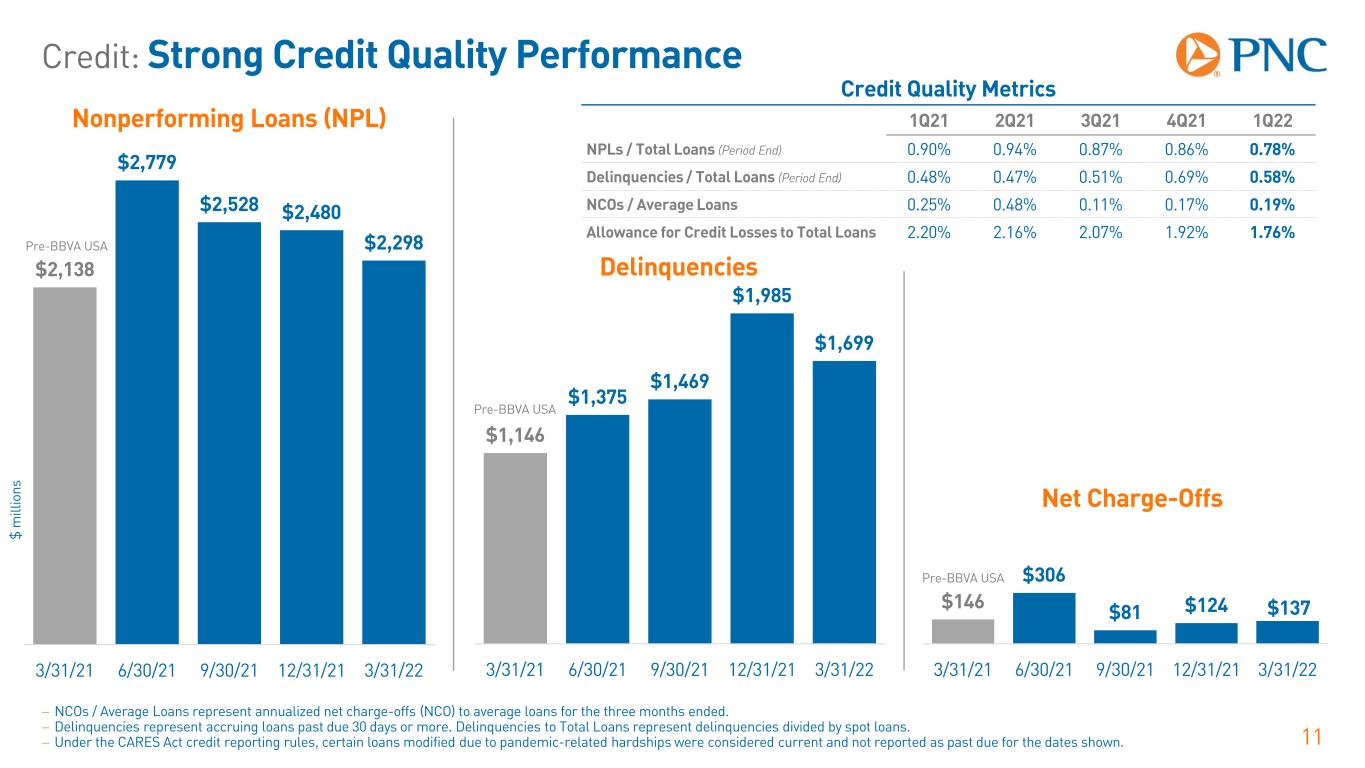

Credit: Strong Credit Quality Performance 11 − NCOs / Average Loans represent annualized net charge-offs (NCO) to average loans for the three months ended. − Delinquencies represent accruing loans past due 30 days or more. Delinquencies to Total Loans represent delinquencies divided by spot loans. − Under the CARES Act credit reporting rules, certain loans modified due to pandemic-related hardships were considered current and not reported as past due for the dates shown. $1,146 $1,375 $1,469 $1,985 $1,699 3/31/21 6/30/21 9/30/21 12/31/21 3/31/22 $2,138 $2,779 $2,528 $2,480 $2,298 3/31/21 6/30/21 9/30/21 12/31/21 3/31/22 $ m ill io ns Nonperforming Loans (NPL) Delinquencies Net Charge-Offs $137$146 $306 $81 $124 3/31/21 6/30/21 9/30/21 12/31/21 3/31/22 Credit Quality Metrics 1Q21 2Q21 3Q21 4Q21 1Q22 NPLs / Total Loans (Period End) 0.90% 0.94% 0.87% 0.86% 0.78% Delinquencies / Total Loans (Period End) 0.48% 0.47% 0.51% 0.69% 0.58% NCOs / Average Loans 0.25% 0.48% 0.11% 0.17% 0.19% Allowance for Credit Losses to Total Loans 2.20% 2.16% 2.07% 1.92% 1.76% Pre-BBVA USA Pre-BBVA USA Pre-BBVA USA

Outlook: Second Quarter 2022 Compared to First Quarter 2022 12 − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies. − Average loans, net interest income, noninterest income, revenue, and noninterest expense outlooks represent estimated percentage change for second quarter 2022 compared to the respective first quarter 2022 figure presented in the table above. − The range for noninterest income excludes net securities gains and activities related to Visa Class B common shares. ($ millions; except average loans, $ billions) 1Q22 2Q22 Guidance Average loans $290.7 Up 2 – 3% Net interest income $2,804 Up 10 – 12% Noninterest income $1,888 Up 6 – 8% Revenue $4,692 Up 9 – 11% Noninterest expense $3,172 Up 3 – 5% Net charge-offs $137 $125 - $175 million

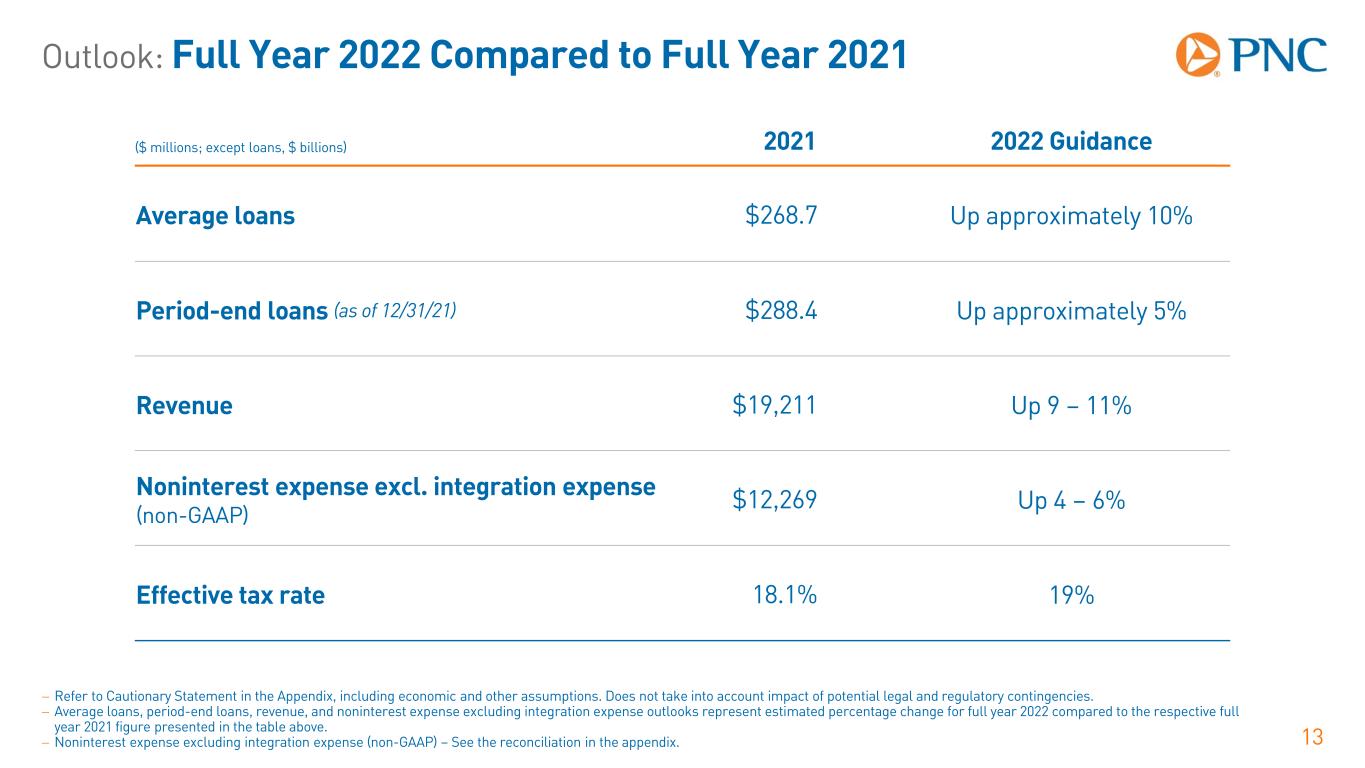

Outlook: Full Year 2022 Compared to Full Year 2021 13 − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies. − Average loans, period-end loans, revenue, and noninterest expense excluding integration expense outlooks represent estimated percentage change for full year 2022 compared to the respective full year 2021 figure presented in the table above. − Noninterest expense excluding integration expense (non-GAAP) – See the reconciliation in the appendix. ($ millions; except loans, $ billions) 2021 2022 Guidance Average loans $268.7 Up approximately 10% Period-end loans (as of 12/31/21) $288.4 Up approximately 5% Revenue $19,211 Up 9 – 11% Noninterest expense excl. integration expense (non-GAAP) $12,269 Up 4 – 6% Effective tax rate 18.1% 19%

Appendix: Cautionary Statement Regarding Forward-Looking Information 14 This presentation includes “snapshot” information about PNC used by way of illustration and is not intended as a full business or financial review. It should not be viewed in isolation but rather in the context of all of the information made available by PNC in its SEC filings. We also make statements in this presentation, and we may from time to time make other statements, regarding our outlook for financial performance, such as earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations that are forward- looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,” “estimate,” “goal,” “will,” “should” and other similar words and expressions. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements speak only as of the date made. We do not assume any duty and do not undertake any obligation to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against placing undue reliance on any forward-looking statements. Our forward-looking statements are subject to the following principal risks and uncertainties. Our businesses, financial results and balance sheet values are affected by business and economic conditions, including: − Changes in interest rates and valuations in debt, equity and other financial markets, − Disruptions in the U.S. and global financial markets, − Actions by the Federal Reserve Board, U.S. Treasury and other government agencies, including those that impact money supply, and market interest rates and inflation, − Changes in customer behavior due to changing business and economic conditions or legislative or regulatory initiatives, − Changes in customers’, suppliers’ and other counterparties’ performance and creditworthiness, − Impacts of tariffs and other trade policies of the U.S. and its global trading partners, − The length and extent of the economic impacts of the COVID-19 pandemic, − Impacts of changes in federal, state and local governmental policy, including on the regulatory landscape, capital markets, taxes, infrastructure spending and social programs, and − Commodity price volatility.

Appendix: Cautionary Statement Regarding Forward-Looking Information 15 Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our view that: − The U.S. economy continues to recover from the pandemic-caused recession in the first half of 2020. Growth is likely to remain above the economy’s long-run average throughout this year. Consumer spending growth will remain solid in 2022 due to good underlying fundamentals. − Supply-chain difficulties will gradually ease over the course of 2022. Labor shortages will remain a constraint this year, although strong wage growth will support consumer spending. − Inflation accelerated in the second half of 2021 to its fastest pace in decades due to strong demand but limited supplies coming out of the pandemic for some goods and services. Higher energy prices are adding to inflationary pressures in the first half of 2022. Inflation will slow in the second half of 2022 as pandemic-related supply and demand imbalances recede and energy prices stabilize. However, inflation will also broaden throughout the economy due to wage growth. Inflation will end 2022 above the Federal Reserve’s long-run objective of 2%. − PNC expects the Federal Open Market Committee (FOMC) to raise the federal funds rate by 0.50% in May, 0.25% in June, 0.50% in July, 0.25% in September and 0.25% in December to reach a range of 2.00% to 2.25% by the end of the year. The FOMC will then further increase the federal funds rate in 2023. Also, the Federal Reserve will start to reduce its balance sheet in the next few months. − Uncertainty about the outlook has increased with the Russian invasion of Ukraine. It has created upside risk to inflation this year, which could lead the FOMC to tighten more aggressively than currently anticipated. In addition, risks to growth are to the downside. The likelihood of a recession in late 2022 or 2023 has increased. PNC's ability to take certain capital actions, including returning capital to shareholders, is subject to PNC meeting or exceeding a stress capital buffer established by the Federal Reserve Board in connection with the Federal Reserve Board's Comprehensive Capital Analysis and Review (CCAR) process. PNC’s regulatory capital ratios in the future will depend on, among other things, the company’s financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of PNC’s balance sheet. In addition, PNC’s ability to determine, evaluate and forecast regulatory capital ratios, and to take actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent at least in part on the development, validation and regulatory review of related models. Legal and regulatory developments could have an impact on our ability to operate our businesses, financial condition, results of operations, competitive position, reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business generation and retention, liquidity, funding, and ability to attract and retain management. These developments could include: − Changes to laws and regulations, including changes affecting oversight of the financial services industry, consumer protection, bank capital and liquidity standards, pension, bankruptcy and other industry aspects, and changes in accounting policies and principles. − Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries. These matters may result in monetary judgments or settlements or other remedies, including fines, penalties, restitution or alterations in our business practices, and in additional expenses and collateral costs, and may cause reputational harm to PNC.

Appendix: Cautionary Statement Regarding Forward-Looking Information 16 − Results of the regulatory examination and supervision process, including our failure to satisfy requirements of agreements with governmental agencies. − Impact on business and operating results of any costs associated with obtaining rights in intellectual property claimed by others and of adequacy of our intellectual property protection in general. Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory capital and liquidity standards. We grow our business in part through acquisitions and new strategic initiatives. Risks and uncertainties include those presented by the nature of the business acquired and strategic initiative, including in some cases those associated with our entry into new businesses or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, and the integration of the acquired businesses into PNC after closing. Many of these risks and uncertainties are present in our acquisition and integration of BBVA USA Bancshares, Inc., including its U.S. banking subsidiary, BBVA USA. Competition can have an impact on customer acquisition, growth and retention and on credit spreads and product pricing, which can affect market share, deposits and revenues. Our ability to anticipate and respond to technological changes can also impact our ability to respond to customer needs and meet competitive demands. Business and operating results can also be affected by widespread natural and other disasters, pandemics, dislocations, terrorist activities, system failures, security breaches, cyberattacks or international hostilities through impacts on the economy and financial markets generally or on us or our counterparties specifically. We provide greater detail regarding these as well as other factors in our 2021 Form 10-K, including in the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments Notes of the Notes To Consolidated Financial Statements in those reports, and in our other subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss elsewhere in this presentation or in our SEC filings, accessible on the SEC’s website at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual references only. Information on these websites is not part of this document.

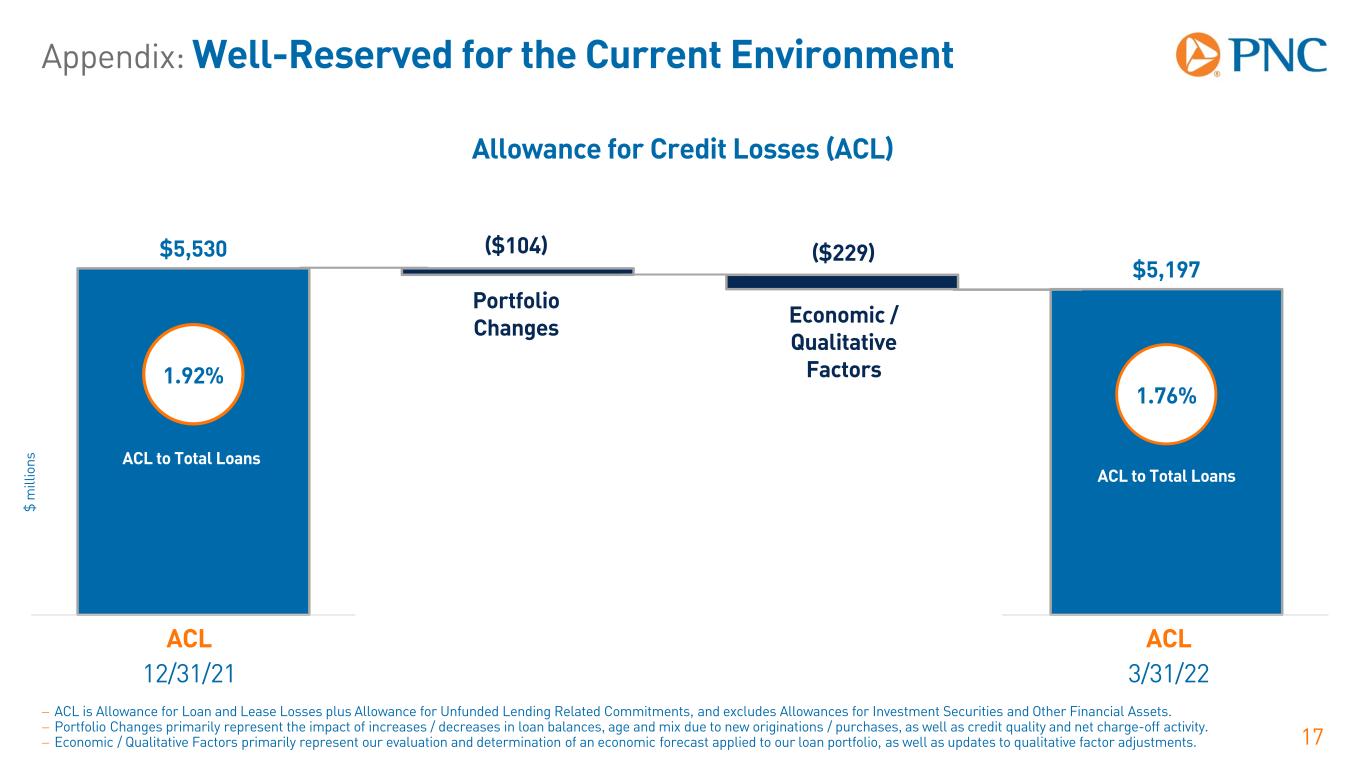

Appendix: Well-Reserved for the Current Environment 17 Allowance for Credit Losses (ACL) $ m ill io ns ($104) ($229)$5,530 $5,197 1.92% 1.76% 0.00 % 0.50 % 1.00 % 1.50 % 2.00 % 2.50 % 3.00 % 3.50 % 4.00 % 0 100 0 200 0 300 0 400 0 500 0 600 0 700 0 800 0 6/30/2021 Portfolio Econ 9/30/2021 Portfolio Changes Economic / Qualitative Factors − ACL is Allowance for Loan and Lease Losses plus Allowance for Unfunded Lending Related Commitments, and excludes Allowances for Investment Securities and Other Financial Assets. − Portfolio Changes primarily represent the impact of increases / decreases in loan balances, age and mix due to new originations / purchases, as well as credit quality and net charge-off activity. − Economic / Qualitative Factors primarily represent our evaluation and determination of an economic forecast applied to our loan portfolio, as well as updates to qualitative factor adjustments. ACL to Total Loans ACL to Total Loans ACL 12/31/21 ACL 3/31/22

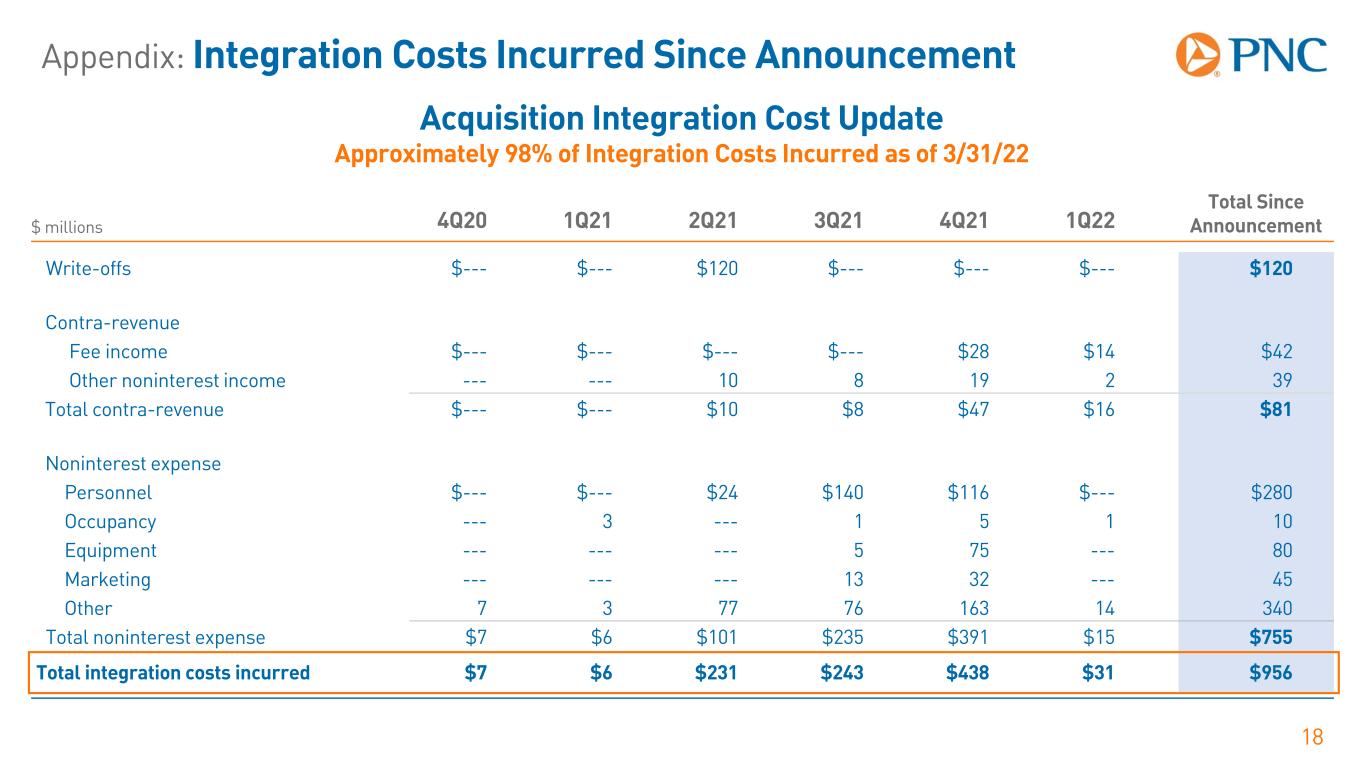

Appendix: Integration Costs Incurred Since Announcement 18 Acquisition Integration Cost Update Approximately 98% of Integration Costs Incurred as of 3/31/22 Total Since Announcement$ millions 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 Write-offs $--- $--- $120 $--- $--- $--- $120 Contra-revenue Fee income $--- $--- $--- $--- $28 $14 $42 Other noninterest income --- --- 10 8 19 2 39 Total contra-revenue $--- $--- $10 $8 $47 $16 $81 Noninterest expense Personnel $--- $--- $24 $140 $116 $--- $280 Occupancy --- 3 --- 1 5 1 10 Equipment --- --- --- 5 75 --- 80 Marketing --- --- --- 13 32 --- 45 Other 7 3 77 76 163 14 340 Total noninterest expense $7 $6 $101 $235 $391 $15 $755 Total integration costs incurred $7 $6 $231 $243 $438 $31 $956

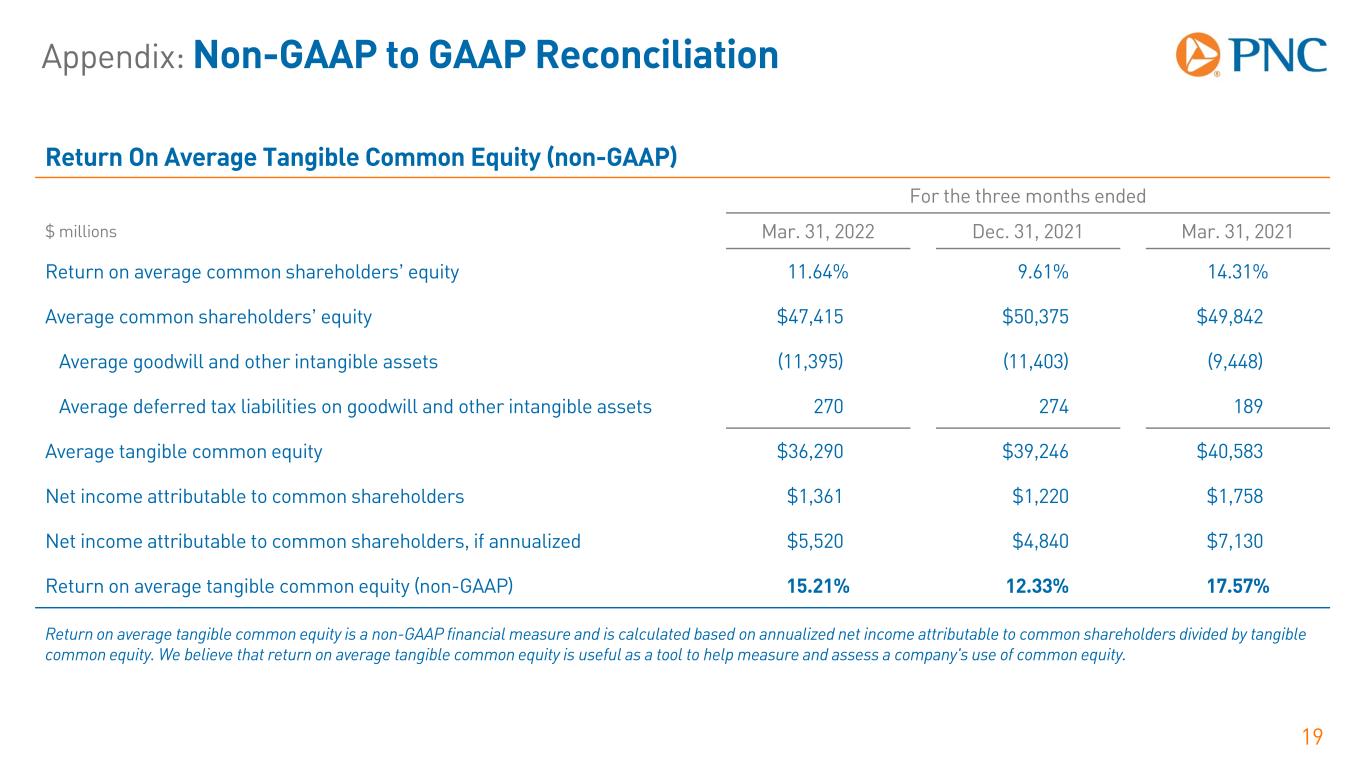

Appendix: Non-GAAP to GAAP Reconciliation 19 Return On Average Tangible Common Equity (non-GAAP) For the three months ended $ millions Mar. 31, 2022 Dec. 31, 2021 Mar. 31, 2021 Return on average common shareholders’ equity 11.64% 9.61% 14.31% Average common shareholders’ equity $47,415 $50,375 $49,842 Average goodwill and other intangible assets (11,395) (11,403) (9,448) Average deferred tax liabilities on goodwill and other intangible assets 270 274 189 Average tangible common equity $36,290 $39,246 $40,583 Net income attributable to common shareholders $1,361 $1,220 $1,758 Net income attributable to common shareholders, if annualized $5,520 $4,840 $7,130 Return on average tangible common equity (non-GAAP) 15.21% 12.33% 17.57% Return on average tangible common equity is a non-GAAP financial measure and is calculated based on annualized net income attributable to common shareholders divided by tangible common equity. We believe that return on average tangible common equity is useful as a tool to help measure and assess a company's use of common equity.

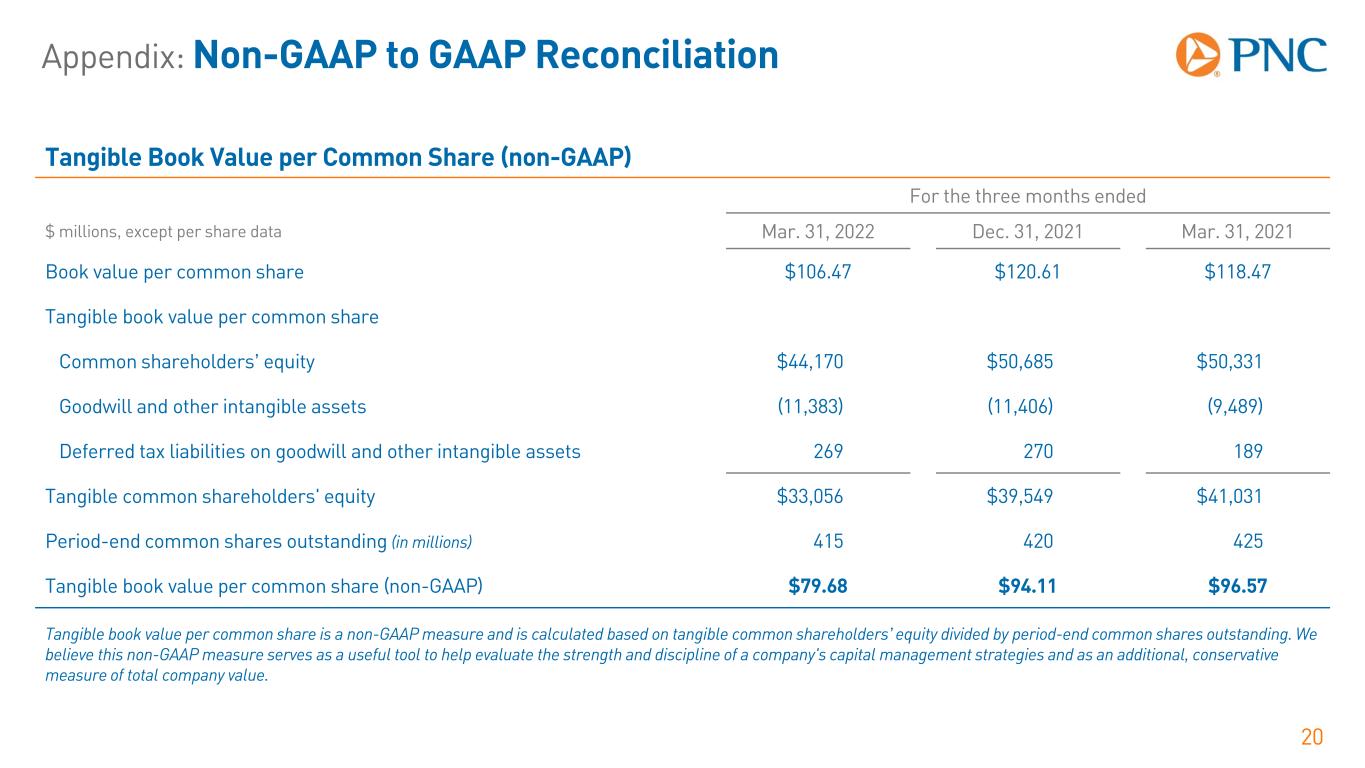

Appendix: Non-GAAP to GAAP Reconciliation 20 Tangible Book Value per Common Share (non-GAAP) For the three months ended $ millions, except per share data Mar. 31, 2022 Dec. 31, 2021 Mar. 31, 2021 Book value per common share $106.47 $120.61 $118.47 Tangible book value per common share Common shareholders’ equity $44,170 $50,685 $50,331 Goodwill and other intangible assets (11,383) (11,406) (9,489) Deferred tax liabilities on goodwill and other intangible assets 269 270 189 Tangible common shareholders' equity $33,056 $39,549 $41,031 Period-end common shares outstanding (in millions) 415 420 425 Tangible book value per common share (non-GAAP) $79.68 $94.11 $96.57 Tangible book value per common share is a non-GAAP measure and is calculated based on tangible common shareholders’ equity divided by period-end common shares outstanding. We believe this non-GAAP measure serves as a useful tool to help evaluate the strength and discipline of a company's capital management strategies and as an additional, conservative measure of total company value.

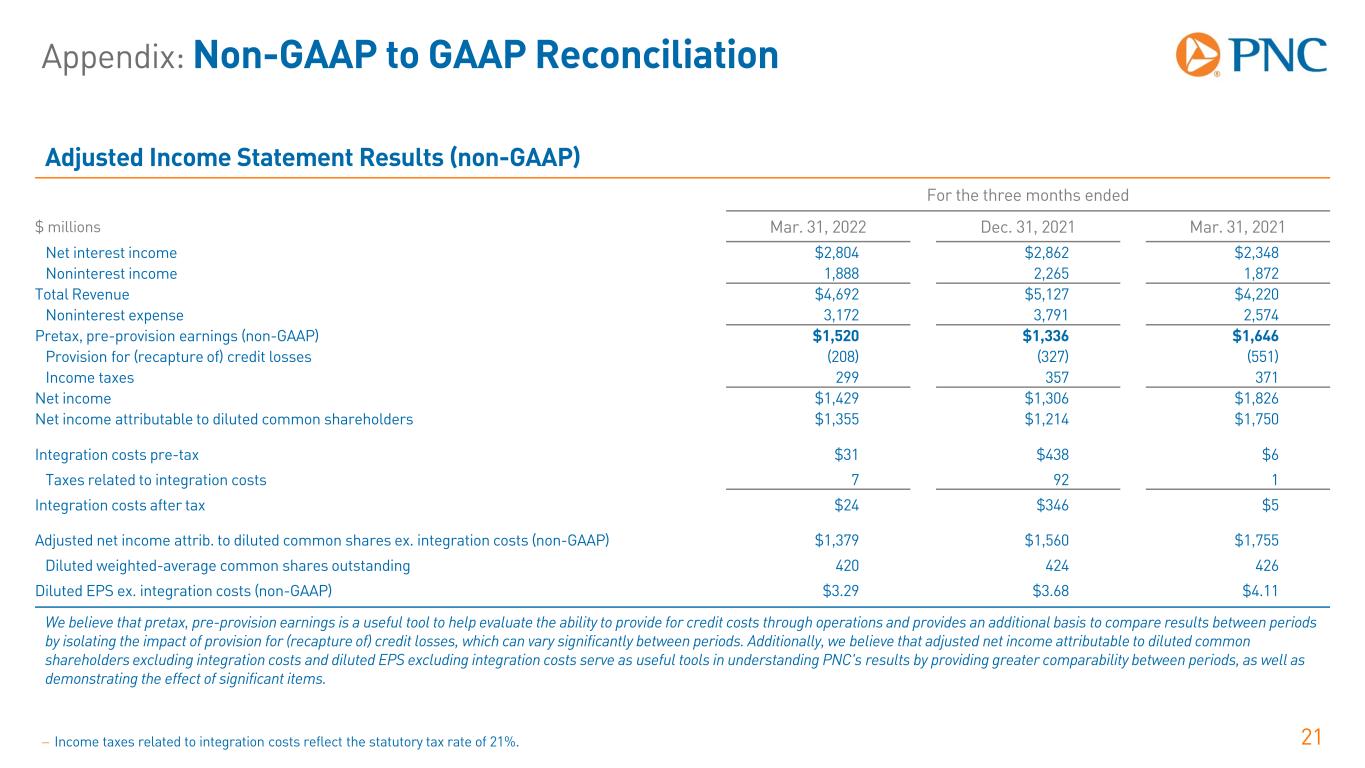

Appendix: Non-GAAP to GAAP Reconciliation 21 Adjusted Income Statement Results (non-GAAP) For the three months ended $ millions Mar. 31, 2022 Dec. 31, 2021 Mar. 31, 2021 Net interest income $2,804 $2,862 $2,348 Noninterest income 1,888 2,265 1,872 Total Revenue $4,692 $5,127 $4,220 Noninterest expense 3,172 3,791 2,574 Pretax, pre-provision earnings (non-GAAP) $1,520 $1,336 $1,646 Provision for (recapture of) credit losses (208) (327) (551) Income taxes 299 357 371 Net income $1,429 $1,306 $1,826 Net income attributable to diluted common shareholders $1,355 $1,214 $1,750 Integration costs pre-tax $31 $438 $6 Taxes related to integration costs 7 92 1 Integration costs after tax $24 $346 $5 Adjusted net income attrib. to diluted common shares ex. integration costs (non-GAAP) $1,379 $1,560 $1,755 Diluted weighted-average common shares outstanding 420 424 426 Diluted EPS ex. integration costs (non-GAAP) $3.29 $3.68 $4.11 We believe that pretax, pre-provision earnings is a useful tool to help evaluate the ability to provide for credit costs through operations and provides an additional basis to compare results between periods by isolating the impact of provision for (recapture of) credit losses, which can vary significantly between periods. Additionally, we believe that adjusted net income attributable to diluted common shareholders excluding integration costs and diluted EPS excluding integration costs serve as useful tools in understanding PNC's results by providing greater comparability between periods, as well as demonstrating the effect of significant items. − Income taxes related to integration costs reflect the statutory tax rate of 21%.

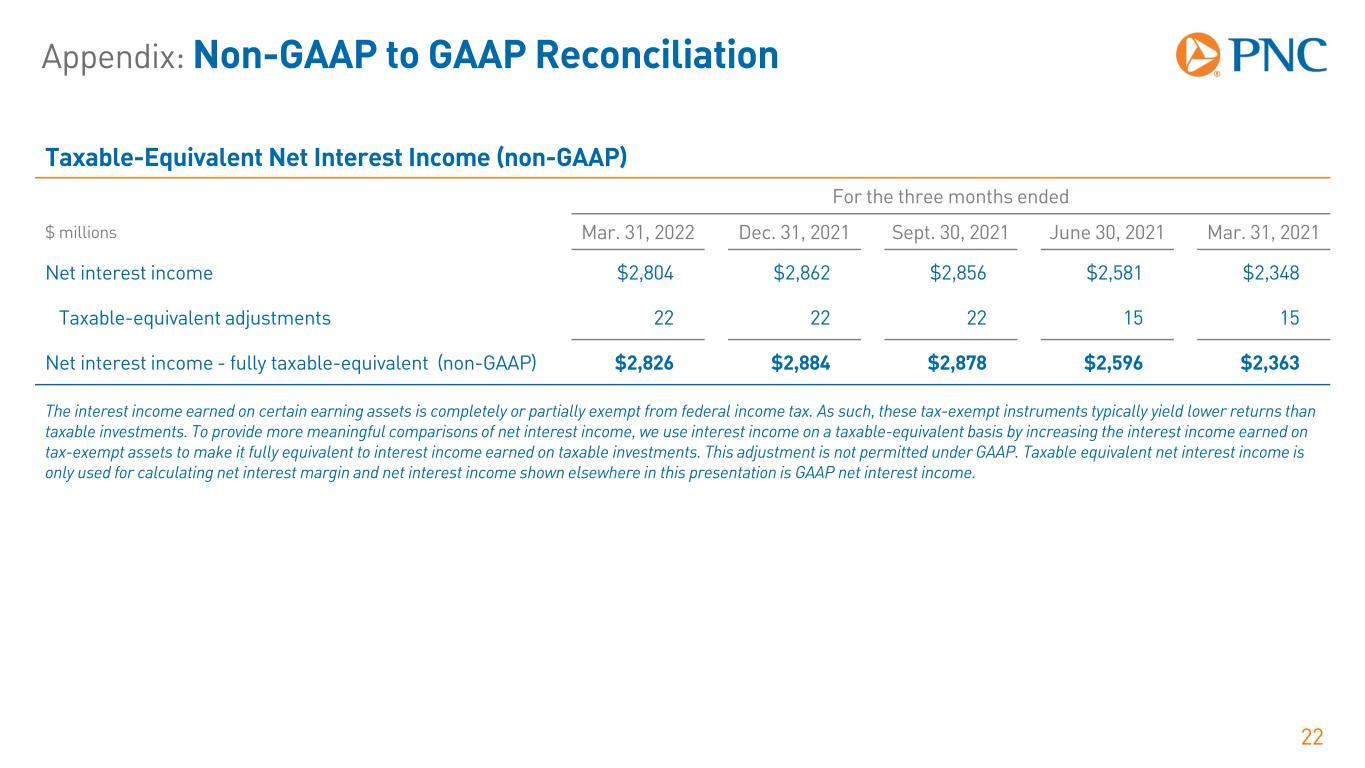

Appendix: Non-GAAP to GAAP Reconciliation 22 Taxable-Equivalent Net Interest Income (non-GAAP) For the three months ended $ millions Mar. 31, 2022 Dec. 31, 2021 Sept. 30, 2021 June 30, 2021 Mar. 31, 2021 Net interest income $2,804 $2,862 $2,856 $2,581 $2,348 Taxable-equivalent adjustments 22 22 22 15 15 Net interest income - fully taxable-equivalent (non-GAAP) $2,826 $2,884 $2,878 $2,596 $2,363 The interest income earned on certain earning assets is completely or partially exempt from federal income tax. As such, these tax-exempt instruments typically yield lower returns than taxable investments. To provide more meaningful comparisons of net interest income, we use interest income on a taxable-equivalent basis by increasing the interest income earned on tax-exempt assets to make it fully equivalent to interest income earned on taxable investments. This adjustment is not permitted under GAAP. Taxable equivalent net interest income is only used for calculating net interest margin and net interest income shown elsewhere in this presentation is GAAP net interest income.

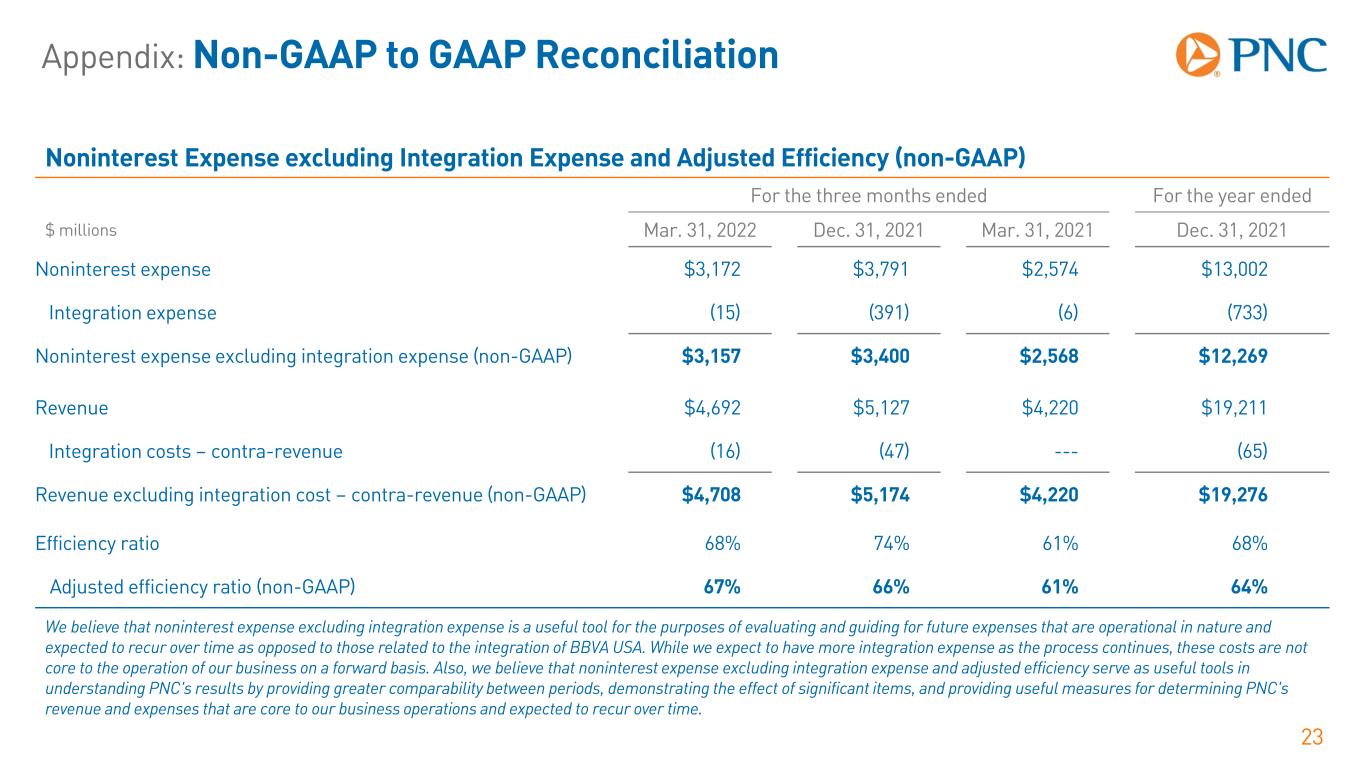

Appendix: Non-GAAP to GAAP Reconciliation 23 Noninterest Expense excluding Integration Expense and Adjusted Efficiency (non-GAAP) For the three months ended For the year ended $ millions Mar. 31, 2022 Dec. 31, 2021 Mar. 31, 2021 Dec. 31, 2021 Noninterest expense $3,172 $3,791 $2,574 $13,002 Integration expense (15) (391) (6) (733) Noninterest expense excluding integration expense (non-GAAP) $3,157 $3,400 $2,568 $12,269 Revenue $4,692 $5,127 $4,220 $19,211 Integration costs – contra-revenue (16) (47) --- (65) Revenue excluding integration cost – contra-revenue (non-GAAP) $4,708 $5,174 $4,220 $19,276 Efficiency ratio 68% 74% 61% 68% Adjusted efficiency ratio (non-GAAP) 67% 66% 61% 64% We believe that noninterest expense excluding integration expense is a useful tool for the purposes of evaluating and guiding for future expenses that are operational in nature and expected to recur over time as opposed to those related to the integration of BBVA USA. While we expect to have more integration expense as the process continues, these costs are not core to the operation of our business on a forward basis. Also, we believe that noninterest expense excluding integration expense and adjusted efficiency serve as useful tools in understanding PNC's results by providing greater comparability between periods, demonstrating the effect of significant items, and providing useful measures for determining PNC's revenue and expenses that are core to our business operations and expected to recur over time.

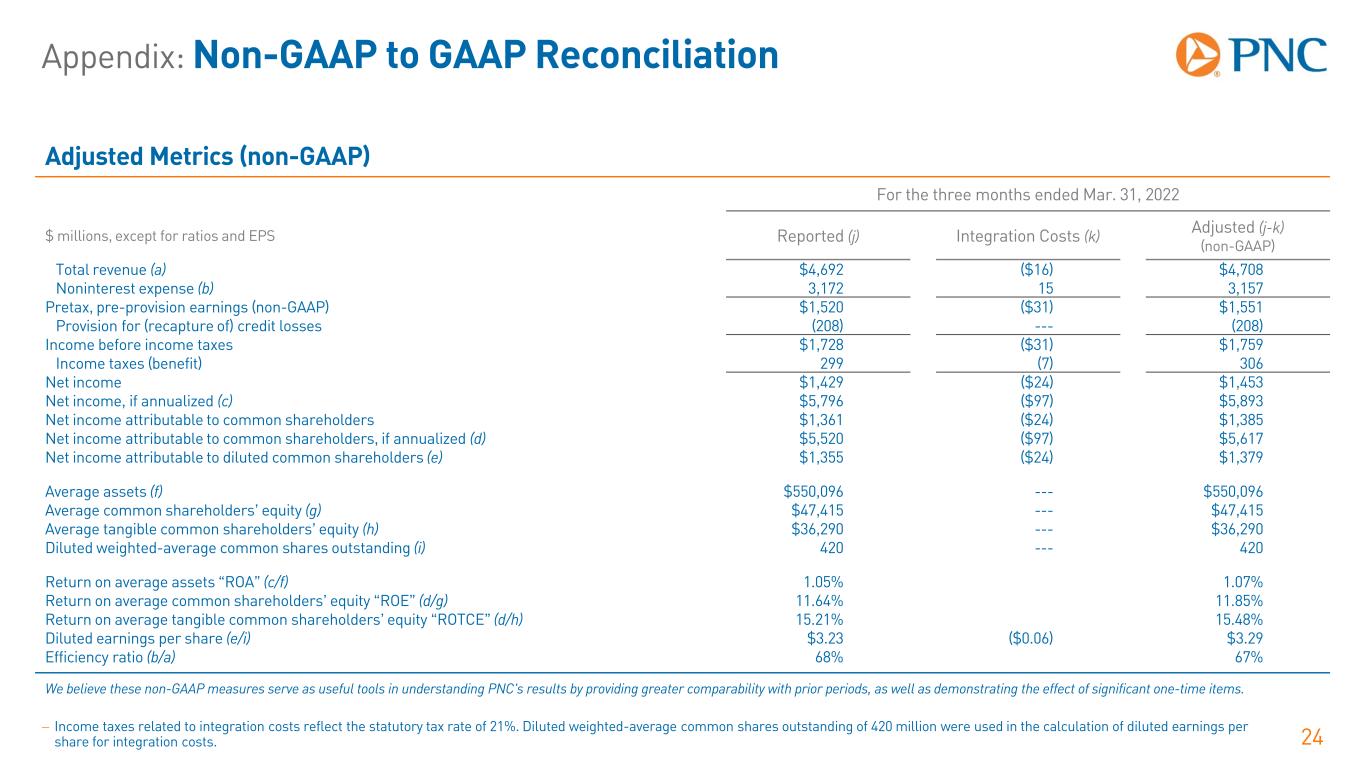

Appendix: Non-GAAP to GAAP Reconciliation 24 Adjusted Metrics (non-GAAP) For the three months ended Mar. 31, 2022 $ millions, except for ratios and EPS Reported (j) Integration Costs (k) Adjusted (j-k) (non-GAAP) Total revenue (a) $4,692 ($16) $4,708 Noninterest expense (b) 3,172 15 3,157 Pretax, pre-provision earnings (non-GAAP) $1,520 ($31) $1,551 Provision for (recapture of) credit losses (208) --- (208) Income before income taxes $1,728 ($31) $1,759 Income taxes (benefit) 299 (7) 306 Net income $1,429 ($24) $1,453 Net income, if annualized (c) $5,796 ($97) $5,893 Net income attributable to common shareholders $1,361 ($24) $1,385 Net income attributable to common shareholders, if annualized (d) $5,520 ($97) $5,617 Net income attributable to diluted common shareholders (e) $1,355 ($24) $1,379 Average assets (f) $550,096 --- $550,096 Average common shareholders’ equity (g) $47,415 --- $47,415 Average tangible common shareholders’ equity (h) $36,290 --- $36,290 Diluted weighted-average common shares outstanding (i) 420 --- 420 Return on average assets “ROA” (c/f) 1.05% 1.07% Return on average common shareholders’ equity “ROE” (d/g) 11.64% 11.85% Return on average tangible common shareholders’ equity “ROTCE” (d/h) 15.21% 15.48% Diluted earnings per share (e/i) $3.23 ($0.06) $3.29 Efficiency ratio (b/a) 68% 67% We believe these non-GAAP measures serve as useful tools in understanding PNC's results by providing greater comparability with prior periods, as well as demonstrating the effect of significant one-time items. − Income taxes related to integration costs reflect the statutory tax rate of 21%. Diluted weighted-average common shares outstanding of 420 million were used in the calculation of diluted earnings per share for integration costs.