EX-99.1

Published on December 13, 2021

Exhibit 99.1 THE PNC FINANCIAL SERVICES GROUP, INC. UNAUDITED PRO FORMA CONDENSED COMBINED CONSOLIDATED FINANCIAL STATEMENTS On June 1, 2021, The PNC Financial Services Group, Inc. (“PNC”) completed its previously announced acquisition of BBVA USA Bancshares, Inc. (“BBVA USA Holdco”), including its U.S. banking subsidiary BBVA USA, pursuant to the Stock Purchase Agreement dated November 15, 2020 with Banco Bilbao Vizcaya Argentaria S.A. (“BBVA”) to acquire 100% of the issued and outstanding shares of BBVA USA Holdco for $11.5 billion in cash. PNC did not acquire the following entities as part of the acquisition: BBVA Securities, Inc., Propel Venture Partners Fund I, L.P. and BBVA Processing Services, Inc. (collectively, the “Non-Acquired Subsidiaries”). The unaudited pro forma condensed combined consolidated financial information has been prepared to give effect to the following: The unaudited pro forma condensed combined consolidated statement of income of PNC and BBVA USA Holdco for the nine months ended September 30, 2021, gives effect to the acquisition pursuant to the Stock Purchase Agreement as if it had occurred on January 1, 2020; The acquisition of BBVA USA Holdco by PNC under the provision of the Financial Accounting Standards Board (FASB) Accounting Standards Codification, ASC 805, “Business Combinations” where the assets and liabilities of BBVA USA Holdco have been recorded by PNC at their respective fair values as of the date the acquisition is completed; and Certain reclassifications to conform historical financial statement presentation of BBVA USA Holdco to PNC. The following unaudited pro forma condensed combined consolidated financial information and related notes are based on and should be read in conjunction with (i) the historical audited financial statements of PNC and the related notes included in PNC’s Annual Report on Form 10-K for the year ended December 31, 2020, and the historical unaudited consolidated financial statements of PNC and the related notes included in PNC’s Quarterly Reports on Form 10-Q for the periods ended March 31, 2021, June 30, 2021 and September 30, 2021, each of which is incorporated herein by reference and (ii) the historical audited consolidated financial statements of BBVA USA Holdco and the related notes included in BBVA USA Holdco’s Annual Report on Form 10-K for the year ended December 31, 2020, a copy of which was attached as Exhibit 99.1 to the Current Report on Form 8-K filed by PNC on April 20, 2021 (as amended on June 4, 2021), and the historical unaudited consolidated financial statements of BBVA USA Holdco and the related notes for the period ended March 31, 2021, a copy of which was attached as Exhibit 99.2 to the Current Report on Form 8-K/A filed by PNC on August 5, 2021, each of which is incorporated herein by reference. The unaudited pro forma condensed combined consolidated financial information is provided for illustrative information purposes only. The unaudited pro forma condensed combined financial information is not necessarily, and should not be assumed to be, an indication of the actual results that would have been achieved had the acquisition been completed as of the dates indicated or that may be achieved in the future. The pro forma financial information has been prepared by PNC in accordance with Regulation S-X Article 11, Pro Forma Financial Information, as amended by the Securities and Exchange Commission Final Rule Release No. 33-10786, Amendments to Financial Disclosures about Acquired and Disposed Businesses, as adopted by the SEC on May 20, 2020. The unaudited pro forma condensed combined consolidated financial information also does not consider any potential effects of changes in market conditions on revenues, cost savings, asset dispositions, and share repurchases, among other factors.

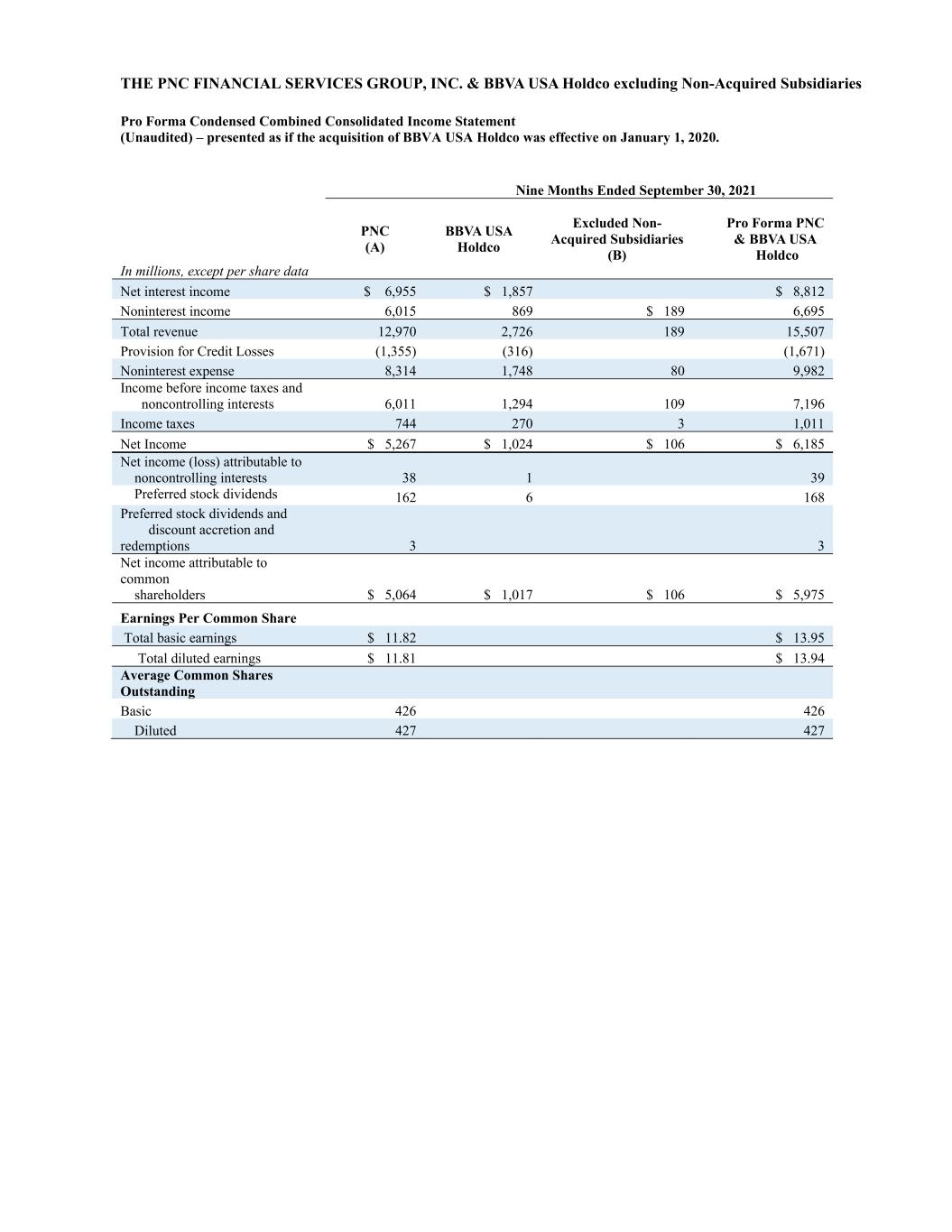

THE PNC FINANCIAL SERVICES GROUP, INC. & BBVA USA Holdco excluding Non-Acquired Subsidiaries Pro Forma Condensed Combined Consolidated Income Statement (Unaudited) – presented as if the acquisition of BBVA USA Holdco was effective on January 1, 2020. Nine Months Ended September 30, 2021 PNC (A) BBVA USA Holdco Excluded Non- Acquired Subsidiaries (B) Pro Forma PNC & BBVA USA Holdco In millions, except per share data Net interest income $ 6,955 $ 1,857 $ 8,812 Noninterest income 6,015 869 $ 189 6,695 Total revenue 12,970 2,726 189 15,507 Provision for Credit Losses (1,355) (316) (1,671) Noninterest expense 8,314 1,748 80 9,982 Income before income taxes and noncontrolling interests 6,011 1,294 109 7,196 Income taxes 744 270 3 1,011 Net Income $ 5,267 $ 1,024 $ 106 $ 6,185 Net income (loss) attributable to noncontrolling interests 38 1 39 Preferred stock dividends 162 6 168 Preferred stock dividends and discount accretion and redemptions 3 3 Net income attributable to common shareholders $ 5,064 $ 1,017 $ 106 $ 5,975 Earnings Per Common Share Total basic earnings $ 11.82 $ 13.95 Total diluted earnings $ 11.81 $ 13.94 Average Common Shares Outstanding Basic 426 426 Diluted 427 427

Note 1. Basis of Presentation The accompanying unaudited pro forma condensed combined consolidated financial information and related notes were prepared in accordance with Article 11 of Regulation S-X. The unaudited pro forma condensed combined consolidated income statement for the nine months ended September 30,2021 combine the historical consolidated income statements of PNC and BBVA USA Holdco, giving effect to the acquisition as if it had been completed on January 1, 2020. The unaudited pro forma condensed combined consolidated financial information and explanatory notes have been prepared to illustrate the effects of the acquisition involving PNC and BBVA USA Holdco under the acquisition method of accounting with PNC treated as the acquirer. The unaudited pro forma condensed combined consolidated financial information is presented for illustrative purposes only and does not necessarily indicate the financial results of the combined company had the companies actually been combined at the beginning of each period presented, nor does it necessarily indicate the results of operations in future periods or the future financial position of the combined company. Note 2. Reclassification Adjustments These unaudited pro forma condensed combined financial statements include certain reclassifications to conform historical financial statement presentation of BBVA USA Holdco to PNC due to differences identified in accounting policies and differences in balance sheet and income statement presentation of BBVA USA Holdco as compared to the presentation of PNC. Note 3. Pro Forma Adjustments to the Unaudited Condensed Consolidated Combined Income Statements (A) Amounts do not represent actual consolidated results for PNC for the nine-months ended September 30, 2021 as those results are inclusive of BBVA. Amounts also include immaterial transaction related adjustments for the nine- months ended September 30, 2021. (B) Represents the income and expenses for the nine months ended September 30, 2021 for the Non-Acquired Subsidiaries.