EX-99.1

Published on June 4, 2021

KPMG LLP Suite 1800 420 20th Street North Birmingham, AL 35203-3207 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. Report of Independent Registered Public Accounting Firm To the Shareholder and Board of Directors BBVA USA Bancshares, Inc.: Opinion on the Consolidated Financial Statements We have audited the accompanying consolidated balance sheets of BBVA USA Bancshares, Inc. and subsidiaries (the Company) as of December 31, 2020 and 2019, the related consolidated statements of income, comprehensive income, shareholder’s equity, and cash flows for each of the years in the three-year period ended December 31, 2020, and the related notes (collectively, the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2020 and 2019, and the results of its operations and its cash flows for each of the years in the three-year period ended December 31, 2020, in conformity with U.S. generally accepted accounting principles. Change in Accounting Principle As discussed in Note 1 to the consolidated financial statements, the Company has changed its method of accounting for the recognition and measurement of credit losses as of January 1, 2020 due to the adoption of Accounting Standards Codification Topic 326, Financial Instruments – Credit Losses (ASC 326). Basis for Opinion These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion. Exhibit 99.1

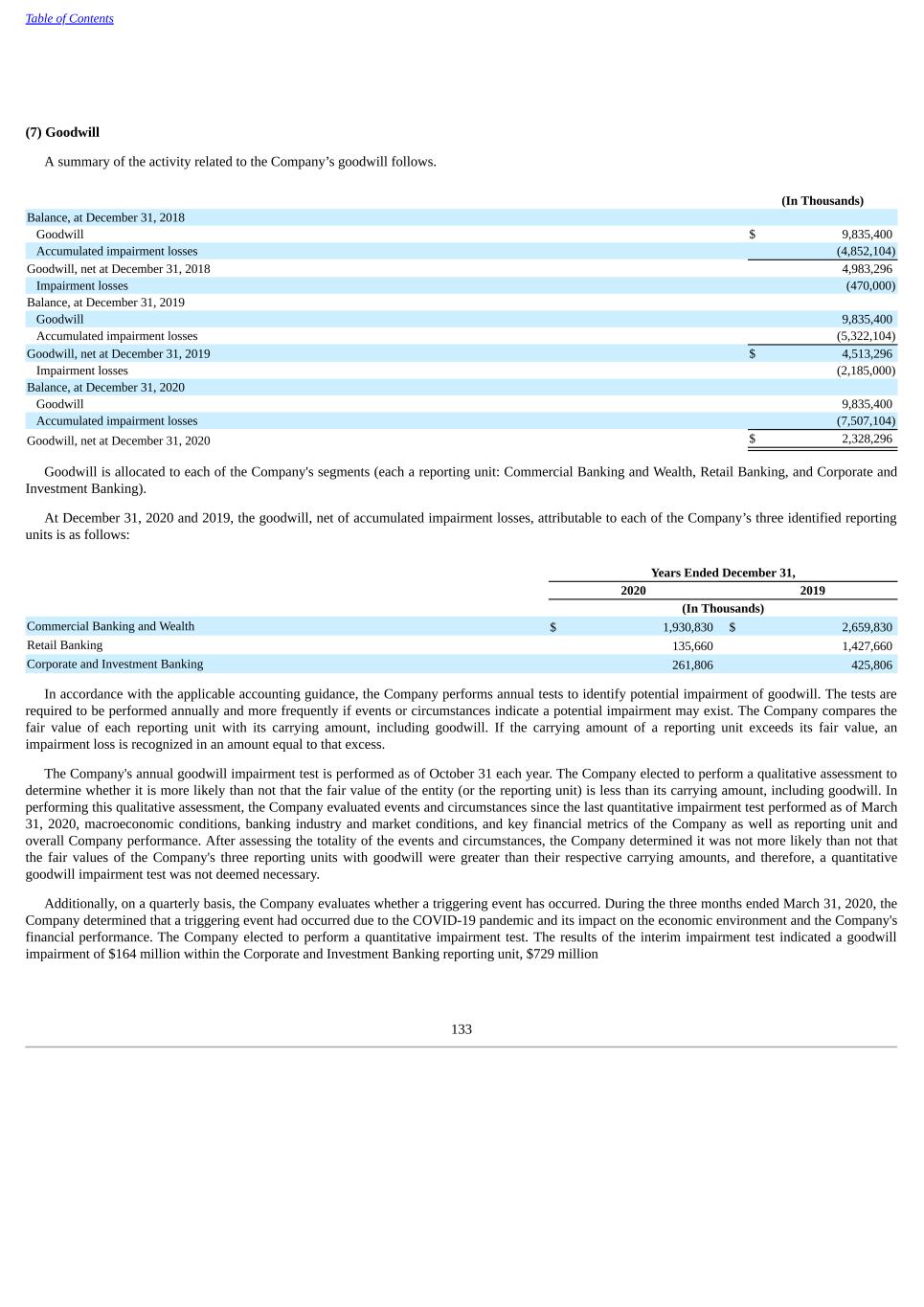

2 Critical Audit Matters The critical audit matters communicated below are matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate. Valuation of Goodwill As discussed in Notes 1 and 7 to the consolidated financial statements, the goodwill balance as of December 31, 2020 was $2.3 billion, of which $1.9 billion related to the Commercial Banking and Wealth reporting unit, $136 million related to the Retail Banking reporting unit, and $262 million related to the Corporate and Investment Banking reporting unit. The Company performs goodwill impairment testing on an annual basis and more frequently if events or circumstances indicate a potential impairment may exist. During the three months ended March 31, 2020, the Company determined that a triggering event had occurred due to the impact of COVID-19 pandemic and its impact on the economic environment and the Company’s financial performance. The Company elected to perform a quantitative impairment test which indicated a goodwill impairment of $164 million within the Corporate and Investment Banking reporting unit, $729 million within the Commercial Banking and Wealth reporting unit, and $1.3 billion within the Retail Banking reporting unit resulting in the Company recording a goodwill impairment charge of $2.2 billion. A test of goodwill for impairment consists of comparing the fair value of each reporting unit with its carrying amount, including goodwill. If the carrying amount of a reporting unit exceeds its fair value, an impairment loss is recognized in an amount equal to that excess. The estimated fair value of the reporting unit is determined using a blend of the income approach and market approach, inclusive of both the guideline public company method and the guideline transaction method. We identified the interim evaluation of the goodwill impairment measurement for the Commercial Banking and Wealth, Retail, and Corporate and Investment Banking reporting units as a critical audit matter. The degree of subjectivity associated with the assessment of certain assumptions to estimate the fair value of the reporting units required a high degree of auditor judgment. Specifically, subjective auditor judgment was required to assess the estimated future cash flow assumptions, discount rates, and long-term growth rates used in the income approach and market multiples used in the market approach. Minor changes to those assumptions could have had a significant effect on the Company’s measurement of the fair value of the reporting units and goodwill impairment. Additionally, the audit effort associated with this estimate required specialized skills and knowledge. The following are the primary procedures we performed to address this critical audit matter. We evaluated the design and tested the operating effectiveness of certain internal controls related to the measurement of goodwill impairment for the reporting units, including controls over the: • development of future cash flow assumptions by reporting unit • development of the long term growth rates, discount rates, and market multiple assumptions by reporting unit.

3 We evaluated the Company’s analysis to assess potential goodwill impairment for compliance with U.S. generally accepted accounting principles. We evaluated the reasonableness of the Company’s future cash flows for the reporting units, by comparing the future cash flow assumptions to historic projections and internal analysis and external data. We compared the Company’s previous cash flow projections to actual results to assess the Company’s ability to accurately forecast. In addition, we involved valuation professionals with specialized skills and knowledge, who assisted in: • evaluating the discount rates and long term growth rates by comparing the inputs to the development of the assumptions to publicly available data • evaluating market multiples by comparing the market multiples to publicly available data for comparable entities and assessing the resulting market multiples • assessing the results of management’s goodwill impairment measurement considering the income and market approach by reviewing and evaluating the work and documentation of the specialist engaged by the Company. Allowance for Loan Losses Evaluated on a Collective Basis As discussed in Note 1 to the consolidated financial statements, the Company adopted ASC 326 as of January 1, 2020. The total allowance for loan losses as of January 1, 2020 was $1.1 billion, which included the allowance for loan losses evaluated on a collective basis (the January 1, 2020 collective ALL). As discussed in Note 3 to the consolidated financial statements, the Company’s allowance for loan losses was $1.7 billion, which included the allowance for loan losses evaluated on a collective basis (the December 31, 2020 collective ALL) as of December 31, 2020. The January 1, 2020 collective ALL and the December 31, 2020 collective ALL (together, the collective ALL) includes the measure of expected credit losses on a collective basis for those loans that share similar risk characteristics. The Company estimated the collective ALL using (1) discounted cash flows, and (2) default probabilities and loss severities, which are based on relevant internal and external available information that relates to past events, current conditions, and reasonable and supportable economic forecasts. The Company disaggregates the portfolio into segments; incorporating obligor risk ratings for commercial loans and credit scores for consumer loans. The Company estimates the present value of cash shortfalls resulting from the sum of the marginal losses occurring in each time period, over the remaining life of the loan. The marginal losses are derived from the projection of principal balance, inclusive of principal cash flow and prepayment estimates, and parameters reflecting the severity of losses (LGD) in the case of default that is given by the marginal probability of default (PD) for each period of the portfolio’s lifetime. The Company estimates a point in time PD and LGD utilizing recent historical data per portfolio, which are then transformed via macroeconomic models using correlated macroeconomic variables included in the forecasted scenarios. After the forecast period, the Company reverts to long run historical average default probabilities and loss severities using a linear function, with reversion speeds that differ by portfolio. A portion of the collective ALL is comprised of adjustments, based on qualitative factors, to the loss estimates described above when it is determined that expected credit losses may not have been captured in the loss estimates. We identified the assessment of the January 1, 2020 collective ALL and the December 31, 2020 collective ALL as a critical audit matter. A high degree of audit effort, including specialized skills and knowledge, and subjective and complex auditor judgment was involved in the assessment of the collective ALL due to significant measurement uncertainty. Specifically, the assessment encompassed the evaluation of the collective ALL methodology, including the methods and models used to estimate (1) the PD and LGD, and their significant assumptions, including portfolio segmentation, the economic forecast scenario and macroeconomic variables, the reasonable and supportable forecast periods, and obligor risk ratings for commercial loans, and (2) the qualitative factors, principally the alternative economic forecast scenarios. The assessment also included an evaluation of the conceptual soundness and performance of the PD and

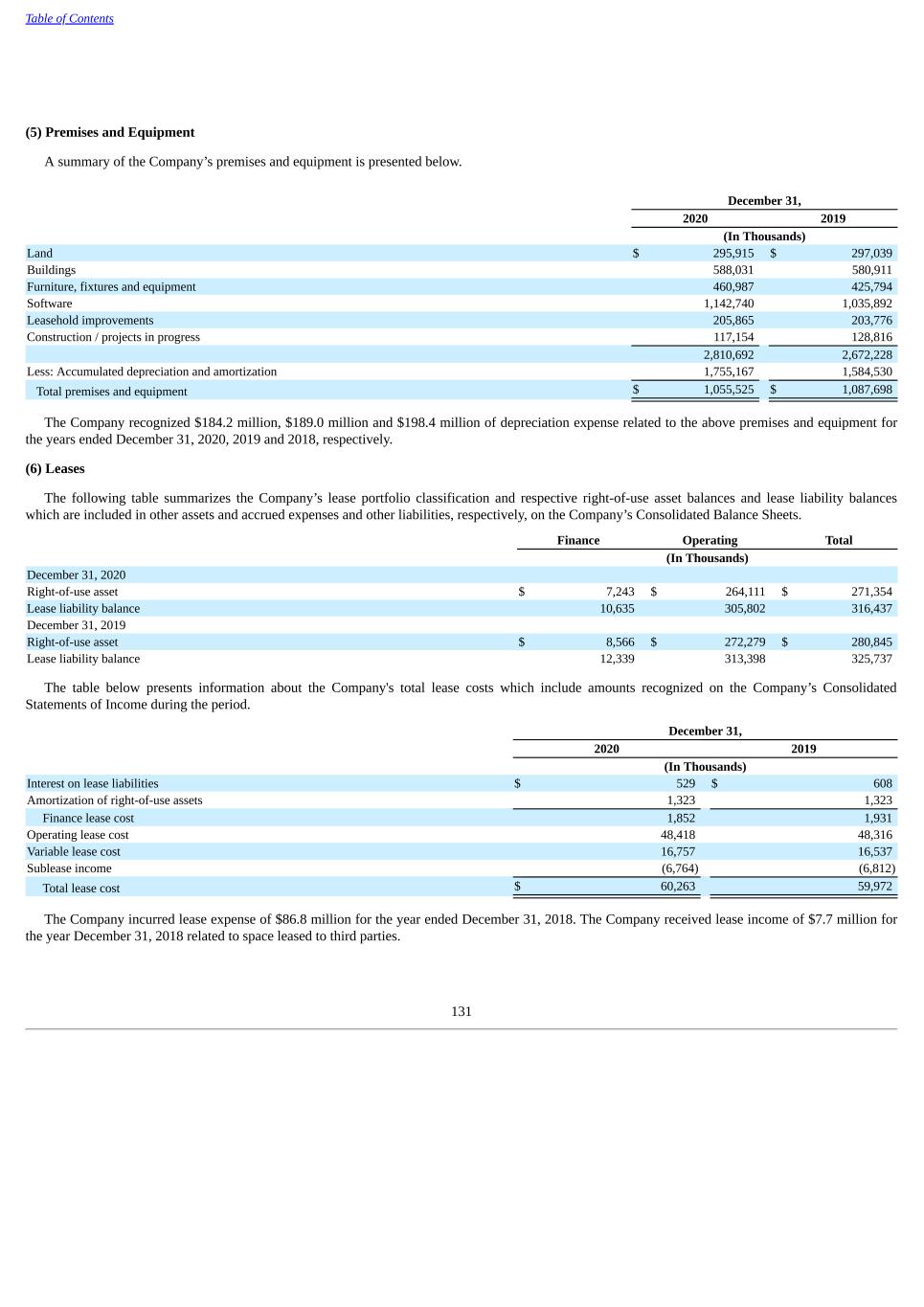

4 LGD models. In addition, auditor judgment was required to evaluate the sufficiency of audit evidence obtained. The following are the primary procedures we performed to address this critical audit matter. We evaluated the design and tested the operating effectiveness of certain internal controls related to the measurement of the collective ALL estimates, including controls over the: • development of the collective ALL methodology • development of the PD and LGD models and forecasts • identification and determination of the significant assumptions used in the PD and LGD models • development of obligor risk ratings for commercial loans • development of the qualitative factors, including the alternative economic scenarios • performance monitoring of the PD and LGD models for the December 31, 2020 collective ALL. We evaluated the Company’s process to develop the collective ALL estimates by testing certain sources of data, factors, and assumptions that the Company used, and considered the relevance and reliability of such data, factors, and assumptions. We involved credit risk professionals with specialized skills and knowledge who assisted in: • evaluating the Company’s collective ALL methodology for compliance with U.S. generally accepted accounting principles • assessing the conceptual soundness and performance of the PD and LGD models by inspecting the model documentation to determine whether the models are suitable for their intended use • evaluating judgments made by the Company relative to the development and performance testing of the PD and LGD models by comparing them to relevant Company-specific metrics and trends and the applicable industry and regulatory practices • evaluating the methodology used to develop the economic forecast scenarios and underlying assumptions by comparing it to the Company’s business environment and relevant industry practices • assessing the economic forecast scenario through comparison to publicly available forecasts • testing the long run historical average default probabilities and loss severities and reasonable and supportable forecast periods to evaluate the length of each period by comparing them to specific portfolio risk characteristics and trends • determining whether the loan portfolio is segmented by similar risk characteristics by comparing to the Company’s business environment and relevant industry practices • testing individual obligor risk ratings for a selection of commercial loans by evaluating the financial performance of the borrower, sources of repayment, and any relevant guarantees or underlying collateral • evaluating the methodology used to develop the qualitative factors and the effect of those factors on the collective ALL compared with relevant credit risk factors and consistency with credit trends and identified limitations of the underlying quantitative models.

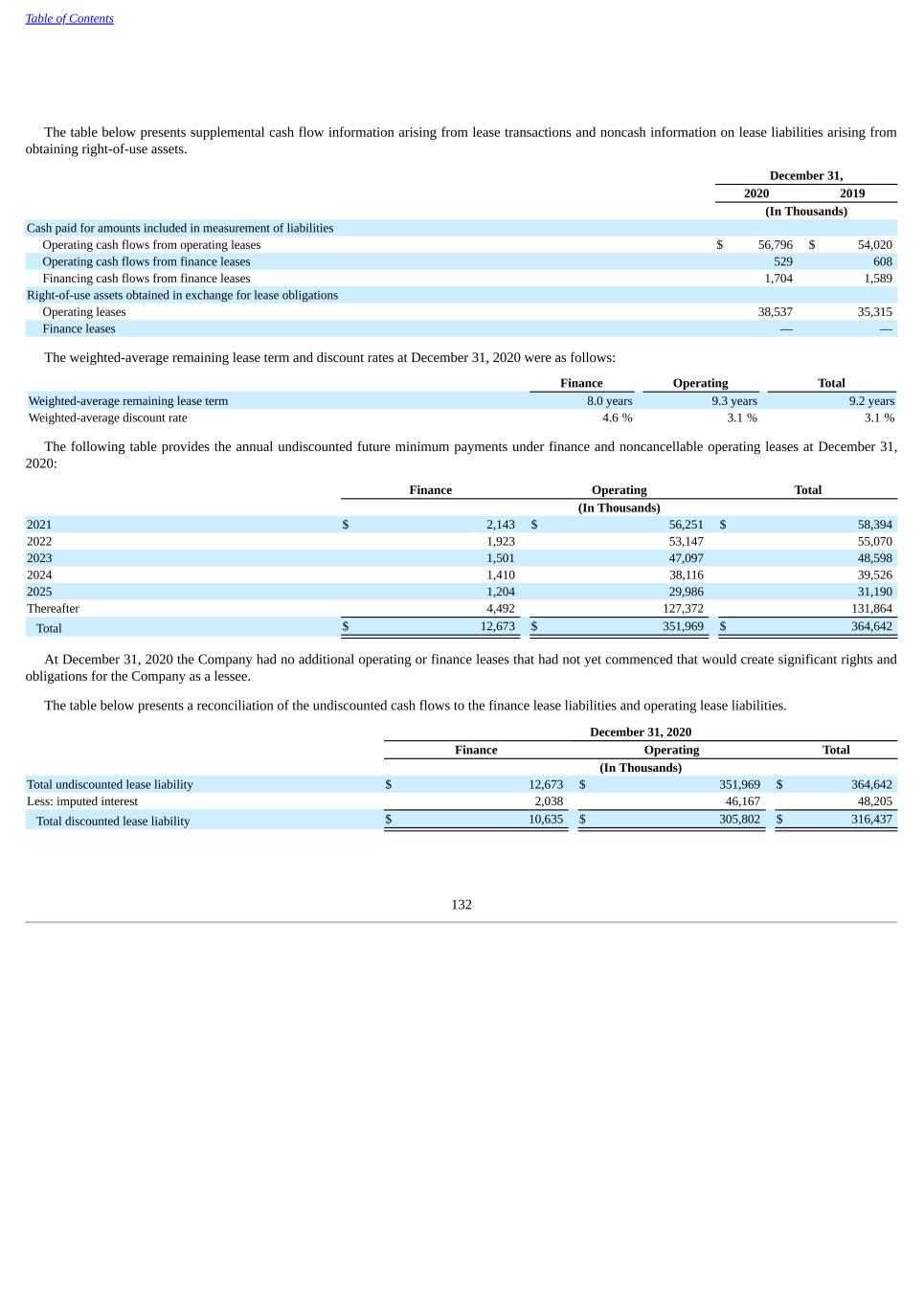

5 We also assessed the sufficiency of the audit evidence obtained related to January 1, 2020 collective ALL and the December 31, 2020 collective ALL estimates by evaluating the: • cumulative results of the audit procedures • qualitative aspects of the Company’s accounting practices • potential bias in the accounting estimates. We have served as the Company’s auditor since 2016. Birmingham, Alabama February 25, 2021

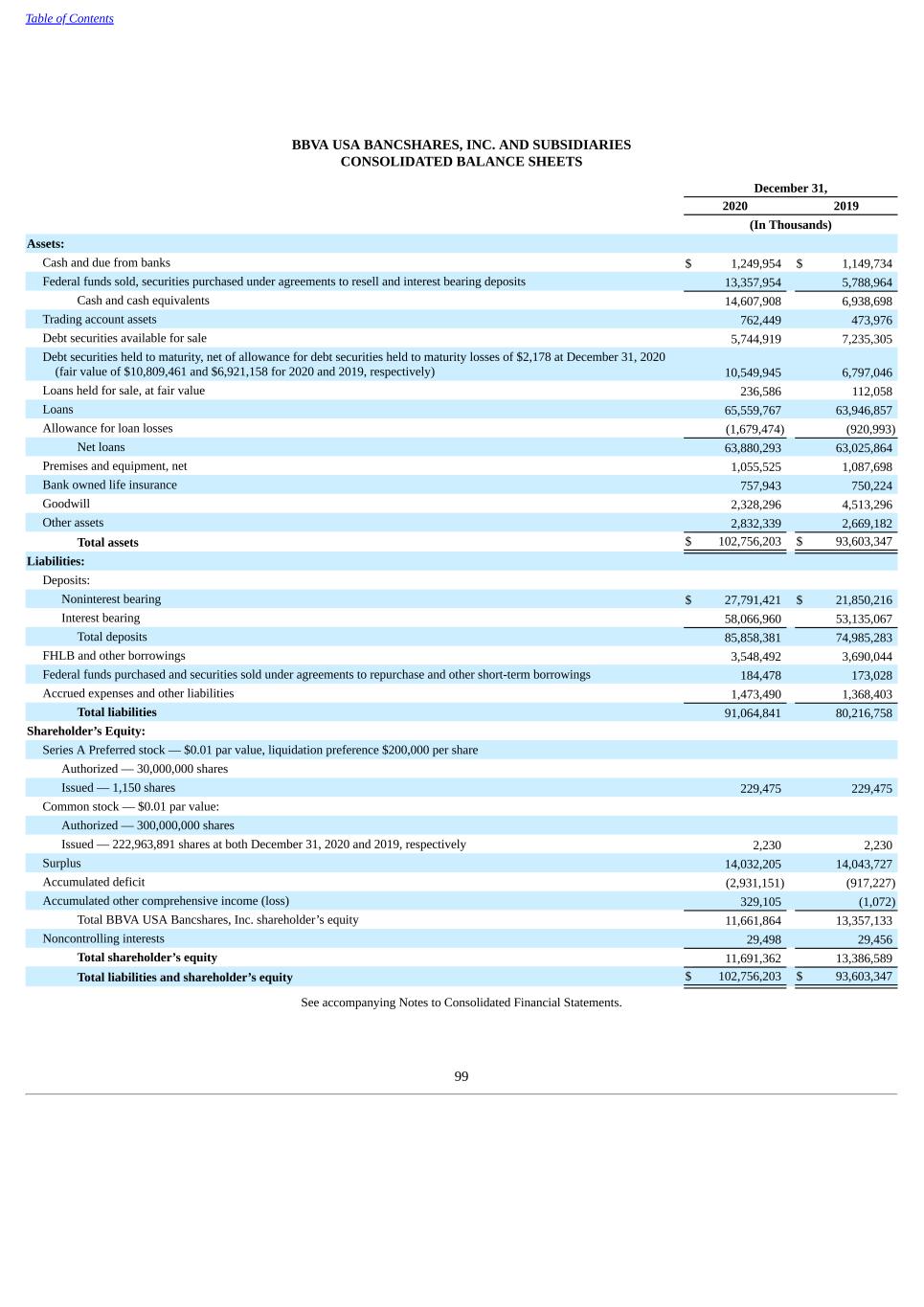

Table of Contents BBVA USA BANCSHARES, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, 2020 2019 (In Thousands) Assets: Cash and due from banks $ 1,249,954 $ 1,149,734 Federal funds sold, securities purchased under agreements to resell and interest bearing deposits 13,357,954 5,788,964 Cash and cash equivalents 14,607,908 6,938,698 Trading account assets 762,449 473,976 Debt securities available for sale 5,744,919 7,235,305 Debt securities held to maturity, net of allowance for debt securities held to maturity losses of $2,178 at December 31, 2020 (fair value of $10,809,461 and $6,921,158 for 2020 and 2019, respectively) 10,549,945 6,797,046 Loans held for sale, at fair value 236,586 112,058 Loans 65,559,767 63,946,857 Allowance for loan losses (1,679,474) (920,993) Net loans 63,880,293 63,025,864 Premises and equipment, net 1,055,525 1,087,698 Bank owned life insurance 757,943 750,224 Goodwill 2,328,296 4,513,296 Other assets 2,832,339 2,669,182 Total assets $ 102,756,203 $ 93,603,347 Liabilities: Deposits: Noninterest bearing $ 27,791,421 $ 21,850,216 Interest bearing 58,066,960 53,135,067 Total deposits 85,858,381 74,985,283 FHLB and other borrowings 3,548,492 3,690,044 Federal funds purchased and securities sold under agreements to repurchase and other short-term borrowings 184,478 173,028 Accrued expenses and other liabilities 1,473,490 1,368,403 Total liabilities 91,064,841 80,216,758 Shareholder’s Equity: Series A Preferred stock — $0.01 par value, liquidation preference $200,000 per share Authorized — 30,000,000 shares Issued — 1,150 shares 229,475 229,475 Common stock — $0.01 par value: Authorized — 300,000,000 shares Issued — 222,963,891 shares at both December 31, 2020 and 2019, respectively 2,230 2,230 Surplus 14,032,205 14,043,727 Accumulated deficit (2,931,151) (917,227) Accumulated other comprehensive income (loss) 329,105 (1,072) Total BBVA USA Bancshares, Inc. shareholder’s equity 11,661,864 13,357,133 Noncontrolling interests 29,498 29,456 Total shareholder’s equity 11,691,362 13,386,589 Total liabilities and shareholder’s equity $ 102,756,203 $ 93,603,347 See accompanying Notes to Consolidated Financial Statements. 99

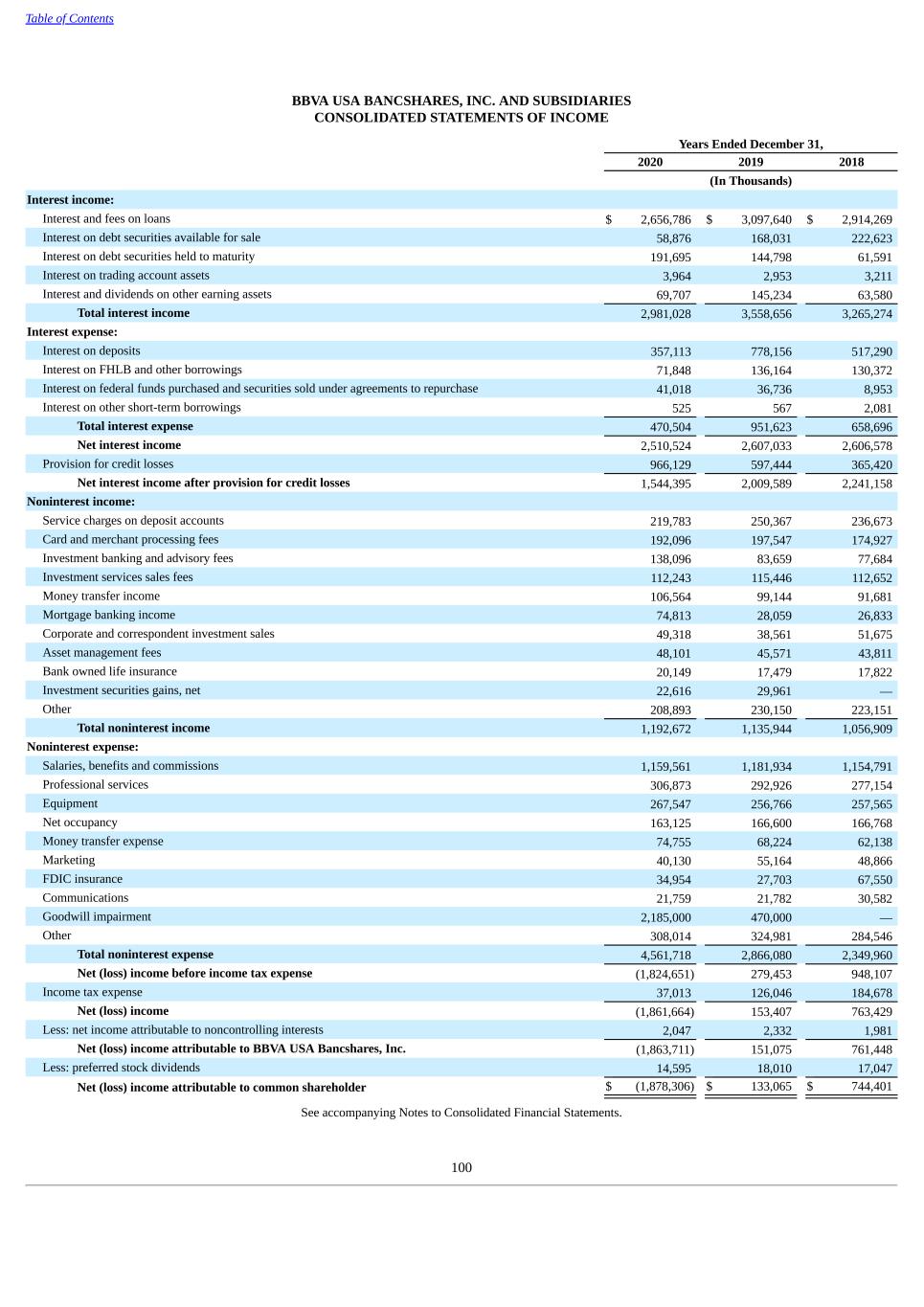

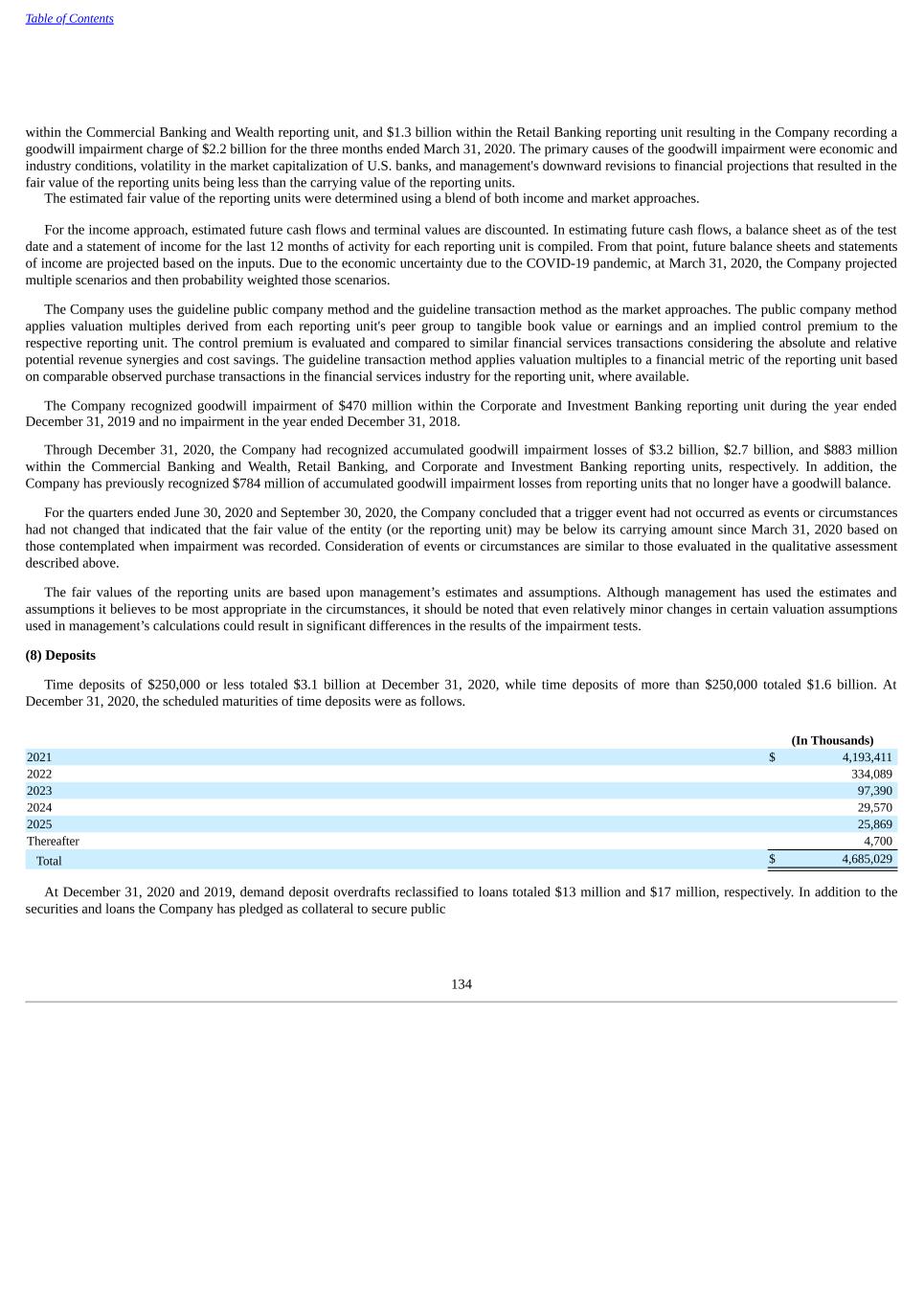

Table of Contents BBVA USA BANCSHARES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME Years Ended December 31, 2020 2019 2018 (In Thousands) Interest income: Interest and fees on loans $ 2,656,786 $ 3,097,640 $ 2,914,269 Interest on debt securities available for sale 58,876 168,031 222,623 Interest on debt securities held to maturity 191,695 144,798 61,591 Interest on trading account assets 3,964 2,953 3,211 Interest and dividends on other earning assets 69,707 145,234 63,580 Total interest income 2,981,028 3,558,656 3,265,274 Interest expense: Interest on deposits 357,113 778,156 517,290 Interest on FHLB and other borrowings 71,848 136,164 130,372 Interest on federal funds purchased and securities sold under agreements to repurchase 41,018 36,736 8,953 Interest on other short-term borrowings 525 567 2,081 Total interest expense 470,504 951,623 658,696 Net interest income 2,510,524 2,607,033 2,606,578 Provision for credit losses 966,129 597,444 365,420 Net interest income after provision for credit losses 1,544,395 2,009,589 2,241,158 Noninterest income: Service charges on deposit accounts 219,783 250,367 236,673 Card and merchant processing fees 192,096 197,547 174,927 Investment banking and advisory fees 138,096 83,659 77,684 Investment services sales fees 112,243 115,446 112,652 Money transfer income 106,564 99,144 91,681 Mortgage banking income 74,813 28,059 26,833 Corporate and correspondent investment sales 49,318 38,561 51,675 Asset management fees 48,101 45,571 43,811 Bank owned life insurance 20,149 17,479 17,822 Investment securities gains, net 22,616 29,961 — Other 208,893 230,150 223,151 Total noninterest income 1,192,672 1,135,944 1,056,909 Noninterest expense: Salaries, benefits and commissions 1,159,561 1,181,934 1,154,791 Professional services 306,873 292,926 277,154 Equipment 267,547 256,766 257,565 Net occupancy 163,125 166,600 166,768 Money transfer expense 74,755 68,224 62,138 Marketing 40,130 55,164 48,866 FDIC insurance 34,954 27,703 67,550 Communications 21,759 21,782 30,582 Goodwill impairment 2,185,000 470,000 — Other 308,014 324,981 284,546 Total noninterest expense 4,561,718 2,866,080 2,349,960 Net (loss) income before income tax expense (1,824,651) 279,453 948,107 Income tax expense 37,013 126,046 184,678 Net (loss) income (1,861,664) 153,407 763,429 Less: net income attributable to noncontrolling interests 2,047 2,332 1,981 Net (loss) income attributable to BBVA USA Bancshares, Inc. (1,863,711) 151,075 761,448 Less: preferred stock dividends 14,595 18,010 17,047 Net (loss) income attributable to common shareholder $ (1,878,306) $ 133,065 $ 744,401 See accompanying Notes to Consolidated Financial Statements. 100

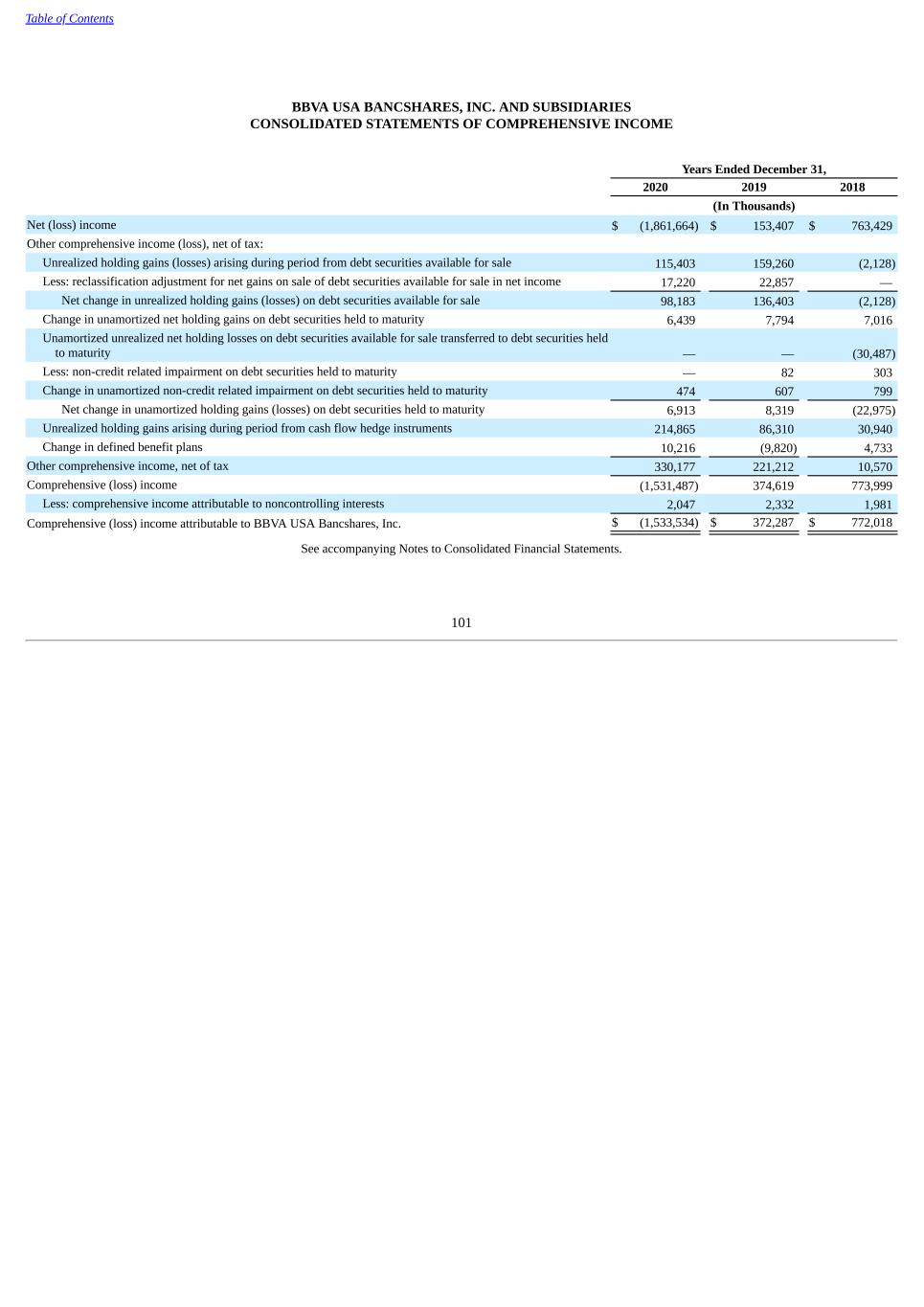

Table of Contents BBVA USA BANCSHARES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years Ended December 31, 2020 2019 2018 (In Thousands) Net (loss) income $ (1,861,664) $ 153,407 $ 763,429 Other comprehensive income (loss), net of tax: Unrealized holding gains (losses) arising during period from debt securities available for sale 115,403 159,260 (2,128) Less: reclassification adjustment for net gains on sale of debt securities available for sale in net income 17,220 22,857 — Net change in unrealized holding gains (losses) on debt securities available for sale 98,183 136,403 (2,128) Change in unamortized net holding gains on debt securities held to maturity 6,439 7,794 7,016 Unamortized unrealized net holding losses on debt securities available for sale transferred to debt securities held to maturity — — (30,487) Less: non-credit related impairment on debt securities held to maturity — 82 303 Change in unamortized non-credit related impairment on debt securities held to maturity 474 607 799 Net change in unamortized holding gains (losses) on debt securities held to maturity 6,913 8,319 (22,975) Unrealized holding gains arising during period from cash flow hedge instruments 214,865 86,310 30,940 Change in defined benefit plans 10,216 (9,820) 4,733 Other comprehensive income, net of tax 330,177 221,212 10,570 Comprehensive (loss) income (1,531,487) 374,619 773,999 Less: comprehensive income attributable to noncontrolling interests 2,047 2,332 1,981 Comprehensive (loss) income attributable to BBVA USA Bancshares, Inc. $ (1,533,534) $ 372,287 $ 772,018 See accompanying Notes to Consolidated Financial Statements. 101

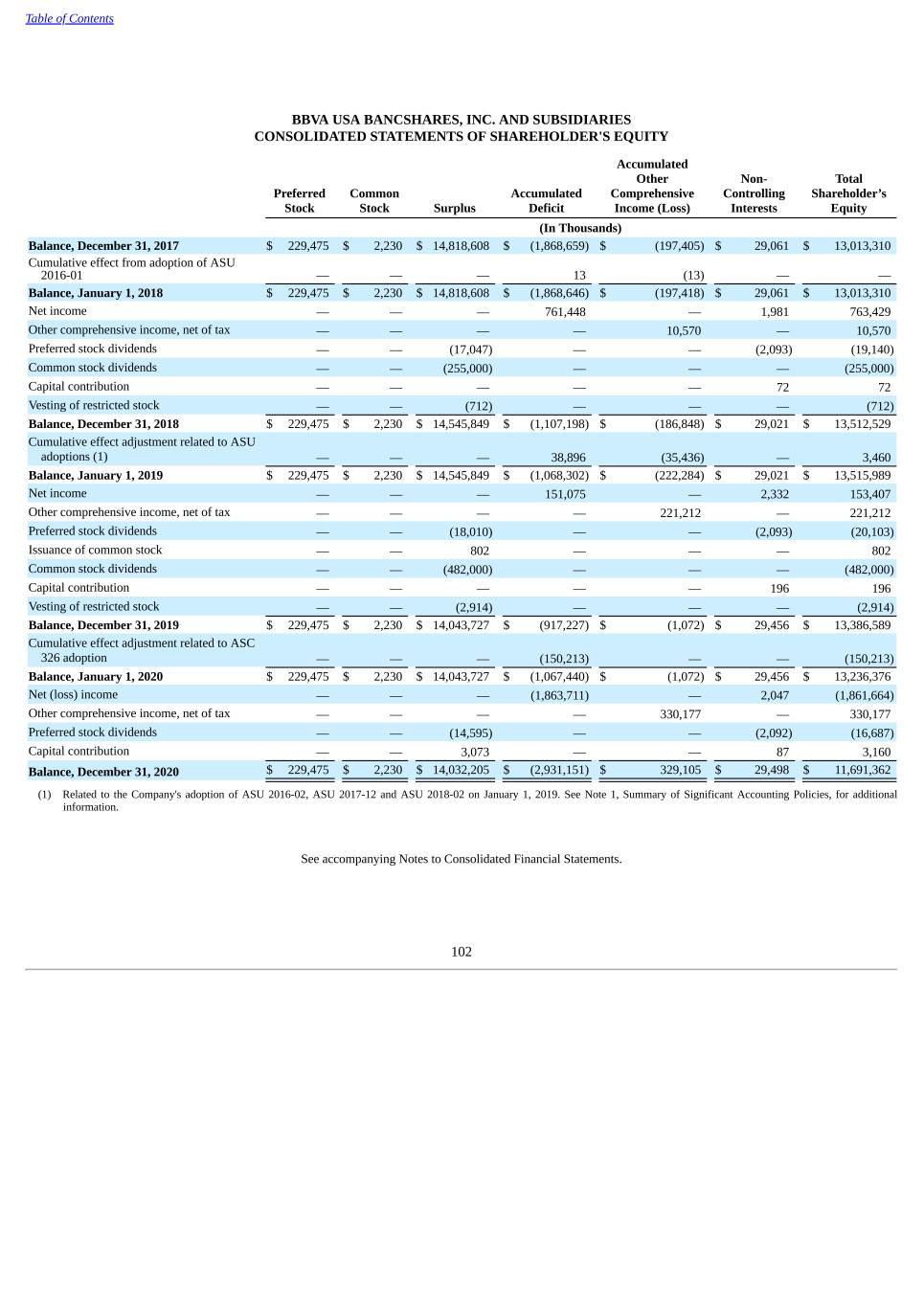

Table of Contents BBVA USA BANCSHARES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREHOLDER'S EQUITY Preferred Stock Common Stock Surplus Accumulated Deficit Accumulated Other Comprehensive Income (Loss) Non- Controlling Interests Total Shareholder’s Equity (In Thousands) Balance, December 31, 2017 $ 229,475 $ 2,230 $ 14,818,608 $ (1,868,659) $ (197,405) $ 29,061 $ 13,013,310 Cumulative effect from adoption of ASU 2016-01 — — — 13 (13) — — Balance, January 1, 2018 $ 229,475 $ 2,230 $ 14,818,608 $ (1,868,646) $ (197,418) $ 29,061 $ 13,013,310 Net income — — — 761,448 — 1,981 763,429 Other comprehensive income, net of tax — — — — 10,570 — 10,570 Preferred stock dividends — — (17,047) — — (2,093) (19,140) Common stock dividends — — (255,000) — — — (255,000) Capital contribution — — — — — 72 72 Vesting of restricted stock — — (712) — — — (712) Balance, December 31, 2018 $ 229,475 $ 2,230 $ 14,545,849 $ (1,107,198) $ (186,848) $ 29,021 $ 13,512,529 Cumulative effect adjustment related to ASU adoptions (1) — — — 38,896 (35,436) — 3,460 Balance, January 1, 2019 $ 229,475 $ 2,230 $ 14,545,849 $ (1,068,302) $ (222,284) $ 29,021 $ 13,515,989 Net income — — — 151,075 — 2,332 153,407 Other comprehensive income, net of tax — — — — 221,212 — 221,212 Preferred stock dividends — — (18,010) — — (2,093) (20,103) Issuance of common stock — — 802 — — — 802 Common stock dividends — — (482,000) — — — (482,000) Capital contribution — — — — — 196 196 Vesting of restricted stock — — (2,914) — — — (2,914) Balance, December 31, 2019 $ 229,475 $ 2,230 $ 14,043,727 $ (917,227) $ (1,072) $ 29,456 $ 13,386,589 Cumulative effect adjustment related to ASC 326 adoption — — — (150,213) — — (150,213) Balance, January 1, 2020 $ 229,475 $ 2,230 $ 14,043,727 $ (1,067,440) $ (1,072) $ 29,456 $ 13,236,376 Net (loss) income — — — (1,863,711) — 2,047 (1,861,664) Other comprehensive income, net of tax — — — — 330,177 — 330,177 Preferred stock dividends — — (14,595) — — (2,092) (16,687) Capital contribution — — 3,073 — — 87 3,160 Balance, December 31, 2020 $ 229,475 $ 2,230 $ 14,032,205 $ (2,931,151) $ 329,105 $ 29,498 $ 11,691,362 (1) Related to the Company's adoption of ASU 2016-02, ASU 2017-12 and ASU 2018-02 on January 1, 2019. See Note 1, Summary of Significant Accounting Policies, for additional information. See accompanying Notes to Consolidated Financial Statements. 102

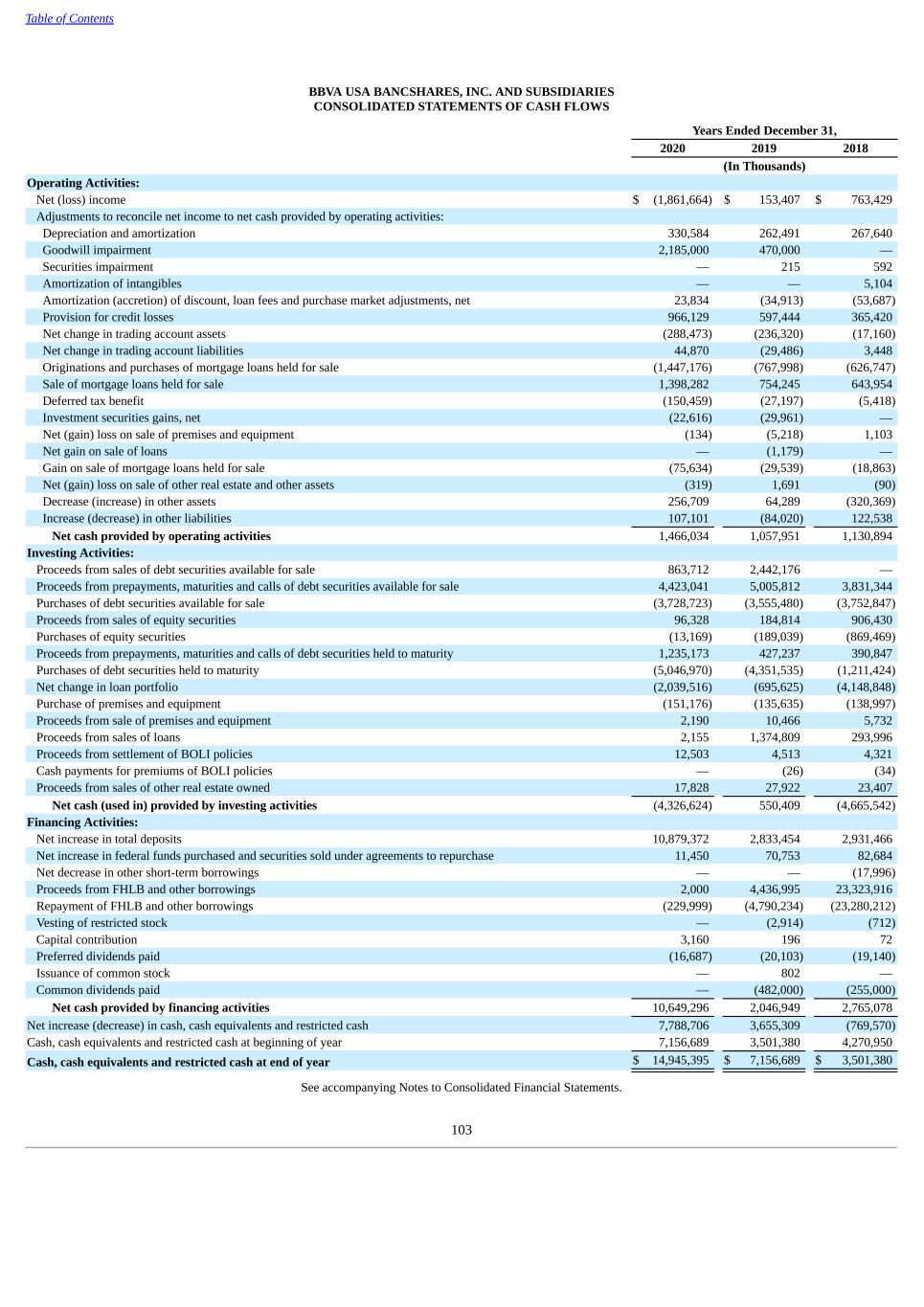

Table of Contents BBVA USA BANCSHARES, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS Years Ended December 31, 2020 2019 2018 (In Thousands) Operating Activities: Net (loss) income $ (1,861,664) $ 153,407 $ 763,429 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 330,584 262,491 267,640 Goodwill impairment 2,185,000 470,000 — Securities impairment — 215 592 Amortization of intangibles — — 5,104 Amortization (accretion) of discount, loan fees and purchase market adjustments, net 23,834 (34,913) (53,687) Provision for credit losses 966,129 597,444 365,420 Net change in trading account assets (288,473) (236,320) (17,160) Net change in trading account liabilities 44,870 (29,486) 3,448 Originations and purchases of mortgage loans held for sale (1,447,176) (767,998) (626,747) Sale of mortgage loans held for sale 1,398,282 754,245 643,954 Deferred tax benefit (150,459) (27,197) (5,418) Investment securities gains, net (22,616) (29,961) — Net (gain) loss on sale of premises and equipment (134) (5,218) 1,103 Net gain on sale of loans — (1,179) — Gain on sale of mortgage loans held for sale (75,634) (29,539) (18,863) Net (gain) loss on sale of other real estate and other assets (319) 1,691 (90) Decrease (increase) in other assets 256,709 64,289 (320,369) Increase (decrease) in other liabilities 107,101 (84,020) 122,538 Net cash provided by operating activities 1,466,034 1,057,951 1,130,894 Investing Activities: Proceeds from sales of debt securities available for sale 863,712 2,442,176 — Proceeds from prepayments, maturities and calls of debt securities available for sale 4,423,041 5,005,812 3,831,344 Purchases of debt securities available for sale (3,728,723) (3,555,480) (3,752,847) Proceeds from sales of equity securities 96,328 184,814 906,430 Purchases of equity securities (13,169) (189,039) (869,469) Proceeds from prepayments, maturities and calls of debt securities held to maturity 1,235,173 427,237 390,847 Purchases of debt securities held to maturity (5,046,970) (4,351,535) (1,211,424) Net change in loan portfolio (2,039,516) (695,625) (4,148,848) Purchase of premises and equipment (151,176) (135,635) (138,997) Proceeds from sale of premises and equipment 2,190 10,466 5,732 Proceeds from sales of loans 2,155 1,374,809 293,996 Proceeds from settlement of BOLI policies 12,503 4,513 4,321 Cash payments for premiums of BOLI policies — (26) (34) Proceeds from sales of other real estate owned 17,828 27,922 23,407 Net cash (used in) provided by investing activities (4,326,624) 550,409 (4,665,542) Financing Activities: Net increase in total deposits 10,879,372 2,833,454 2,931,466 Net increase in federal funds purchased and securities sold under agreements to repurchase 11,450 70,753 82,684 Net decrease in other short-term borrowings — — (17,996) Proceeds from FHLB and other borrowings 2,000 4,436,995 23,323,916 Repayment of FHLB and other borrowings (229,999) (4,790,234) (23,280,212) Vesting of restricted stock — (2,914) (712) Capital contribution 3,160 196 72 Preferred dividends paid (16,687) (20,103) (19,140) Issuance of common stock — 802 — Common dividends paid — (482,000) (255,000) Net cash provided by financing activities 10,649,296 2,046,949 2,765,078 Net increase (decrease) in cash, cash equivalents and restricted cash 7,788,706 3,655,309 (769,570) Cash, cash equivalents and restricted cash at beginning of year 7,156,689 3,501,380 4,270,950 Cash, cash equivalents and restricted cash at end of year $ 14,945,395 $ 7,156,689 $ 3,501,380 See accompanying Notes to Consolidated Financial Statements. 103

BBVA USA BANCSHARES, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (1) Summary of Significant Accounting Policies Nature of Operations BBVA USA Bancshares, Inc., headquartered in Houston, Texas, is a wholly owned subsidiary of BBVA. The Bank, the Company's largest subsidiary, headquartered in Birmingham, Alabama, operates banking centers in Alabama, Arizona, California, Colorado, Florida, New Mexico and Texas. The Bank operates under the brand name BBVA USA, which is a trade name and trademark of BBVA USA Bancshares, Inc. The Bank performs banking services customary for full service banks of similar size and character. Such services include receiving demand and time deposits, making personal and commercial loans and furnishing personal and commercial checking accounts. The Bank offers, either directly or through its subsidiaries and affiliates, a variety of services, including portfolio management and administration and investment services to estates and trusts; term life insurance, variable annuities, property and casualty insurance and other insurance products; investment advisory services; a variety of investment services and products to institutional and individual investors; discount brokerage services, mutual funds and fixed-rate annuities; and lease financing services. Proposed Acquisition by PNC On November 15, 2020, PNC entered into a Stock Purchase Agreement with BBVA for the purchase by PNC of 100% of the issued and outstanding shares of the Company for $11.6 billion in cash on hand in a fixed price structure. PNC is not acquiring BSI, Propel Venture Partners Fund I, L.P. and BBVA Processing Services, Inc. Immediately following the closing of the stock purchase, PNC intends to merge the Parent with and into PNC, with PNC continuing as the surviving entity. Post-closing, PNC intends to merge BBVA USA with and into PNC Bank, National Association, an indirect wholly owned subsidiary of PNC, with PNC Bank continuing as the surviving entity. The transaction is subject to regulatory approvals and certain other customary closing conditions. Basis of Presentation The accompanying Consolidated Financial Statements include the accounts of the Company and its subsidiaries for the years ended December 31, 2020, 2019 and 2018. All intercompany accounts and transactions and balances have been eliminated in consolidation. The Company has evaluated subsequent events through the filing date of this Annual Report on Form 10-K, to determine if either recognition or disclosure of significant events or transactions is required. The accounting policies followed by the Company and its subsidiaries and the methods of applying these policies conform with U.S. GAAP and with practices generally accepted within the banking industry. Certain policies that significantly affect the determination of financial position, results of operations and cash flows are summarized below. Use of Estimates The preparation of the Consolidated Financial Statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period, the most significant of which relate to the allowance for loan losses and goodwill impairment. Actual results could differ from those estimates. Correction of Immaterial Accounting Error During the year ended December 31, 2018, income tax expense included $11.4 million of income tax expense related to the correction of an error in prior periods that resulted from an incorrect calculation of the proportional amortization of the Company's Low Income Housing Tax Credit investments. This error primarily related to 2017 and was corrected in the second quarter of 2018. 104

Table of Contents The Company has evaluated the effect of this correction on prior interim and annual periods' consolidated financial statements in accordance with the guidance provided by SEC Staff Accounting Bulletin No. 108, codified as SAB Topic 1.N, Considering the Effects of Prior Year Misstatements When Quantifying Misstatements in Current Year Financial Statements, and concluded that no prior annual period is materially misstated. In addition, the Company has considered the effect of this correction on the Company's December 31, 2018 financial results, and concluded that the impact on these periods was not material. Cash and cash equivalents The Company classifies cash on hand, amounts due from banks, federal funds sold, securities purchased under agreements to resell and interest bearing deposits as cash and cash equivalents. These instruments have original maturities of three months or less. Securities Purchased Under Agreements to Resell and Securities Sold Under Agreements to Repurchase Securities purchased under agreements to resell and securities sold under agreements to repurchase are generally accounted for as collateralized financing transactions and are recorded at the amounts at which the securities were acquired or sold plus accrued interest. The securities pledged or received as collateral are generally U.S. government and federal agency securities. The Company's policy is to take possession of securities purchased under agreements to resell. The fair value of collateral either received from or provided to a third party is continually monitored and adjusted as deemed appropriate. Securities The Company classifies its debt securities into one of three categories based upon management’s intent and ability to hold the debt securities: (i) trading account assets and liabilities, (ii) debt securities held to maturity or (iii) debt securities available for sale. Debt securities held in a trading account are required to be reported at fair value, with unrealized gains and losses included in earnings. The Company classifies purchases, sales, and maturities of trading securities held for investment purposes as cash flows from investing activities. Cash flows related to trading securities held for trading purposes are reported as cash flows from operating activities. Debt securities held to maturity are stated at cost adjusted for amortization of premiums and accretion of discounts. The related amortization and accretion is determined by the interest method and is included as a noncash adjustment in the net cash provided by operating activities in the Company’s Consolidated Statements of Cash Flows. The Company has the ability, and it is management’s intention, to hold such securities to maturity. Debt securities available for sale are recorded at fair value. Increases and decreases in the net unrealized gain or loss on the portfolio of debt securities available for sale are reflected as adjustments to the carrying value of the portfolio and as an adjustment, net of tax, to accumulated other comprehensive income. See Note 19, Fair Value Measurements, for information on the determination of fair value. Interest earned on trading account assets, debt securities available for sale and debt securities held to maturity is included in interest income in the Company’s Consolidated Statements of Income. Net realized gains and losses on the sale of debt securities available for sale, computed principally on the specific identification method, are shown separately in noninterest income in the Company’s Consolidated Statements of Income. Net gains and losses on the sale of trading account assets and liabilities are recognized as a component of other noninterest income in the Company’s Consolidated Statements of Income. The Company records its HTM debt securities at amortized cost when management has the positive intent and ability to hold them to maturity. Debt securities are classified as AFS when they might be sold before they mature. The Company records its AFS debt securities at fair value with unrealized holding gains and losses reported in other comprehensive income. The Company measures expected credit losses on held to maturity debt securities on a collective basis by major security type. The estimate of expected credit losses considers historical credit loss information that is adjusted for current conditions and reasonable and supportable forecasts. The majority of the Company's HTM debt securities portfolio consists of U.S. government entities and agencies which are either explicitly or implicitly guaranteed by the U.S. government, are highly rated by major credit rating agencies and inherently have minimal risk of nonpayment and therefore has applied a zero credit loss assumption for these securities. 105

Table of Contents Under the revised guidance of ASC 326, if the fair value of a security falls below the amortized cost basis, the security will be evaluated to determine if any of the decline in value is attributable to credit losses or other factors. In making this assessment, the Company considers the extent to which fair value is less than amortized cost, any changes to the rating of the security, and adverse conditions specially related to the security, among other factors. If it is determined that a credit loss exists then an allowance for credit losses is recorded for the credit loss, limited by the amount that the fair value is less than the amortized cost basis. If the credit subsequently improves, the allowance is reversed. When the Company intends to sell an impaired AFS debt security or it is more likely than not that the security will be required to be sold prior to recovering the amortized cost basis, the security's amortized cost basis is written down to fair value through income. A debt security is placed on nonaccrual status at the time any principal or interest payments become 90 days delinquent. The Company has elected to not measure an allowance on its accrued interest receivable as a result of the timely reversal of interest receivable deemed uncollectible. Interest accrued but not received for a security placed on nonaccrual is reversed against interest income. Loans Held for Sale Loans held for sale are recorded at either estimated fair value, if the fair value option is elected, or the lower of cost or estimated fair value. The Company applies the fair value option accounting guidance codified under the FASB's ASC Topic 825, Financial Instruments, for single family real estate mortgage loans originated for sale in the secondary market. Under the fair value option, all changes in the applicable loans’ fair value, which includes the value attributable to the servicing of the loan, are recorded in earnings. Loans classified as held for sale that were not originated for resale in the secondary market are accounted for under the lower of cost or fair value method and are evaluated on an individual basis. Loans Loans that management has the intent and ability to hold for the foreseeable future or until maturity or pay-off are considered held-for-investment. Loans are stated at amortized cost, net of the allowance for loan losses. Amortized cost, or the recorded investment, is the principal balance outstanding, adjusted for charge-offs, deferred loan fees and direct costs on originated loans and unamortized premiums or discounts on purchased loans. Accrued interest receivable is reported in other assets on the Company’s Consolidated Balance Sheets. Interest income is accrued on the principal balance outstanding and is recognized on the interest method. Loan fees, net of direct costs and unamortized premiums and discounts are deferred and amortized as an adjustment to the yield of the related loan over the term of the loan and are included as a noncash adjustment in the net cash provided by operating activities in the Company’s Consolidated Statement of Cash Flows. The Company has elected to not measure an allowance on its accrued interest receivable as a result of the timely reversal of interest receivable deemed uncollectible. It is the general policy of the Company to stop accruing interest income and apply subsequent interest payments as principal reductions when any commercial, industrial, commercial real estate or construction loan is 90 days or more past due as to principal or interest and/or the ultimate collection of either is in doubt, unless collection of both principal and interest is assured by way of collateralization, guarantees or other security. Accrual of interest income on consumer loans, including residential real estate loans, is generally suspended when any payment of principal or interest is more than 90 days delinquent or when foreclosure proceedings have been initiated or repossession of the underlying collateral has occurred. When a loan is placed on a nonaccrual status, any interest previously accrued but not collected is reversed against current interest income unless the fair value of the collateral for the loan is sufficient to cover the accrued interest. In general, a loan is returned to accrual status when none of its principal and interest is due and unpaid and the Company expects repayments of the remaining contractual principal and interest or when it is determined to be well secured and in the process of collection. Charge-offs on commercial loans are recognized when available information confirms that some or all of the balance is uncollectible. Consumer loans are subject to mandatory charge-off at a specified delinquency date consistent with regulatory guidelines. In general, charge-offs on consumer loans are recognized at the earlier of the month of liquidation or the month the loan becomes 120 days past due; residential loan deficiencies are charged off in the month the loan becomes 180 days past due; and credit card loans are charged off before the end of the month when the loan becomes 180 days past due with the related interest 106

Table of Contents accrued but not collected reversed against current income. The Company determines past due or delinquency status of a loan based on contractual payment terms. Troubled Debt Restructurings A loan is accounted for as a TDR if the Company, for economic or legal reasons related to the borrower’s financial difficulties, grants a concession to the borrower that it would not otherwise consider. A TDR typically involves a modification of terms such as establishment of a below market interest rate, a reduction in the principal amount of the loan, a reduction of accrued interest or an extension of the maturity date at a stated interest rate lower than the current market rate for a new loan with similar risk. The Company’s policy for measuring the allowance for credit losses on TDRs, including TDRs that have defaulted, is consistent with its policy for other loans held for investment. The Company’s policy for returning nonaccrual TDRs to accrual status is consistent with its return to accrual policy for all other loans. Allowance for Loan Losses The allowance for loan losses is a valuation account that is deducted from the loans’ amortized cost basis to present the net amount expected to be collected on the loans. Loans are charged off against the allowance when management believes the uncollectibility of a loan balance is confirmed. Management uses discounted cash flows, default probabilities and loss severities to calculate the allowance for loan losses. Management estimates the allowance balance over the estimated life of the loans using relevant available information, from internal and external sources, relating to past events, current conditions, and reasonable and supportable forecasts. Historical credit loss experience provides the basis for the estimation of expected credit losses. Adjustments to historical loss information are made for differences in current loan-specific risk characteristics such as differences in underwriting standards, portfolio mix, delinquency level, or term as well as for changes in environmental conditions, such as changes in unemployment rates, gross domestic product, or other relevant factors. The Company has internally developed a macroeconomic forecast which projects over a four-year reasonable and supportable forecast period. Management may change the horizon of the forecast based on changes in sources of forecast information or Management's ability to develop a reasonable and supportable economic forecast. After the reasonable and supportable forecast period, the Company reverts to long run historical average default probabilities and loss severities using a linear function, with a reversion speeds that differ by portfolio. Economic Forecast: Management selects economic variables it believes to be most relevant based on the composition of the loan portfolio and customer base, including forecasted levels of employment, gross domestic product, real estate price indices, interest rates and corporate bond spreads. The Company uses an internally formulated and approved single baseline economic scenario for the collective estimation. However, management will assess the uncertainty associated with the baseline scenario in each period, and may make adjustments based on alternative scenarios applied through the qualitative framework. Determining the period to estimate expected credit losses: Expected credit losses are estimated over the contractual term of the loans, adjusted for expected prepayments when appropriate. The contractual term excludes expected extensions, renewals, and modifications unless management has a reasonable expectation at the reporting date that a troubled debt restructuring will be executed with an individual borrower, or an extension or renewal option is included in the contract at the reporting date that is not unconditionally cancellable by the Company. While the Company does have contracts with extension or renewal options included, the vast majority are considered unconditionally cancellable. The Company monitors the entire loan portfolio so that risks in the portfolio can be identified on a timely basis and an appropriate allowance maintained. Loan review procedures, including loan grading, periodic credit rescoring and trend analysis of portfolio performance, are utilized by the Company in order to ensure that potential problem loans are identified. Management’s involvement continues throughout the process and includes participation in the work-out process and recovery activity. These formalized procedures are monitored internally and by regulatory agencies. The allowance for credit losses is measured on a collective basis when similar risk characteristics exist. The Company has identified the following portfolio segments: commercial, financial and agricultural; commercial real estate; residential real estate; and consumer. Commercial loans utilize internal risk ratings aligned with regulatory classifications to assess risks. Consumer loans utilize credit scoring models as the basis for assessing risk 107

Table of Contents of consumer borrowers. The Company estimates the present value of cash shortfalls resulting from the sum of the marginal losses occurring in each time period, on an annual basis, over the estimated remaining life of the loan. The marginal losses are derived from the projection of principal balance, inclusive of principal cash flow and prepayment schedules, and parameters reflecting the severity of losses (LGD) in the case of default that is given by the marginal probability of default (Marginal PD) for each period of the portfolio’s lifetime. The Company estimates a point in time Marginal PD and LGD utilizing recent historical data per portfolio, which are then transformed via macroeconomic models using the aforementioned correlated macroeconomic variables included in the forecasted scenario. The allowance for credit losses on loans that do not share similar risk characteristics are estimated on an individual basis. Individual evaluations are typically performed for nonaccrual loans and certain accruing loans, based on dollar thresholds. These loans receive specific reserves allocated based on the present value of the loan's expected future cash flows, discounted at the loan's original effective rate, except where foreclosure or liquidation is probable or when the cash flows are predominately dependent on the value of the collateral. In these circumstances, impairment is measured based upon the fair value less cost to sell of the collateral. The Company adjusts the loss estimates described above when it is determined that expected credit losses may not have been captured in the loss estimates. To adjust the loss estimates, the Company considers qualitative factors such as changes in risk profile/composition; current economic and business conditions and uncertainty of outlook, potentially including alternative economic scenarios; limitations in the data or models used in the collective estimation; credit risk management practices; and other external/environmental factors. In order to estimate an allowance for credit losses on letters of credit and unfunded commitments, the Company uses a process consistent with that used in developing the allowance for loan losses. The Company estimates future fundings of current, noncancellable, unfunded commitments based on historical funding experience of these commitments before default and adjusted based on historical cancellations. Allowance for loan loss factors, which are based on product and loan grade, and are consistent with the factors used for loans, are applied to these funding estimates and discounted to the present value to arrive at the reserve balance. The allowance for credit losses on letters of credit and unfunded commitments is recognized in accrued expenses and other liabilities on the Company’s Consolidated Balance Sheets with changes recognized within noninterest expense in the Company’s Consolidated Statements of Income. See Note 15, Commitments, Contingencies and Guarantees for additional information. The allowance for loan losses for periods before 2020 is established as follows: • Loans with outstanding balances greater than $1 million that are nonaccrual and all TDRs are evaluated individually consistent with ASC 310, and specific reserves are allocated based on the present value of the loan’s expected future cash flows, discounted at the loan’s original effective interest rate, except where foreclosure or liquidation is probable or when the primary source of repayment is provided by real estate collateral. In these circumstances, impairment is measured based upon the fair value less cost to sell of the collateral. • Loans in the remainder of the portfolio are collectively evaluated for impairment consistent with ASC 450 using statistical models based on historical performance data, adjusted for qualitative factors. Premises and Equipment Premises, furniture, fixtures, equipment, assets under capital leases and leasehold improvements are stated at cost less accumulated depreciation or amortization. Land is stated at cost. In addition, purchased software and costs of computer software developed for internal use are capitalized provided certain criteria are met. Depreciation is computed principally using the straight-line method over the estimated useful lives of the related assets, which ranges between 1 and 40 years. Leasehold improvements are amortized on a straight-line basis over the lesser of the lease terms or the estimated useful lives of the improvements. Leases The Company leases certain land, office space, and branches. These leases are generally for periods of 10 to 20 years with various renewal options. The Company, by policy, does not include renewal options for facility leases as part of its right-of-use assets and lease liabilities unless they are deemed reasonably certain to be exercised. Variable 108

Table of Contents lease payments that are dependent on an index or a rate are initially measured using the index or rate at the commencement date and are included in the measurement of lease liability. Variable lease payments that are not dependent on an index or a rate or changes in variable payments based on an index or rate after the commencement date are excluded from the measurement of the lease liability and recognized in profit and loss in accordance with ASC Topic 842, Leases. Variable lease payments are defined as payments made for the right to use an asset that vary because of changes in facts or circumstances occurring after the commencement date, other than the passage of time. The Company has made a policy election to not apply the recognition requirements of ASC Topic 842, Leases, to all short-term leases. Instead, the short-term lease payments will be recognized in the income statement on a straight-line basis over the lease term and variable lease payments in the period in which the obligation for those payments is incurred. As a practical expedient, the Company has also made a policy election to not separate nonlease components from lease components and instead account for each separate lease component and the nonlease components associated with that lease component as a single lease component. The Company determines whether a contract contains a lease based on whether a contract, or a part of a contract, that conveys the right to control the use of an identified asset for a period of time in exchange for consideration. The discount rate is determined as the rate implicit in the lease or when a rate cannot be readily determined, the Company’s incremental borrowing rate. The incremental borrowing rate is the rate of interest that the Company would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment. Bank Owned Life Insurance The Company maintains life insurance policies on certain of its executives and employees and is the owner and beneficiary of the policies. The Company invests in these policies, known as BOLI, to provide an efficient form of funding for long-term retirement and other employee benefits costs. The Company records these BOLI policies within bank owned life insurance on the Company’s Consolidated Balance Sheets at each policy’s respective cash surrender value, with changes recorded in noninterest income in the Company’s Consolidated Statements of Income. Goodwill Goodwill represents the excess of the purchase price over the estimated fair value of identifiable net assets associated with acquisition transactions. Goodwill is assigned to each of the Company’s reporting units and tested for impairment annually as of October 31 or on an interim basis if events or circumstances change that would more likely than not reduce the fair value of the reporting unit below its carrying value. If, after considering all relevant events and circumstances, the Company determines it is not more-likely-than-not that the fair value of a reporting unit is less than its carrying amount, then performing an impairment test is not necessary. If the Company elects to bypass the qualitative analysis, or concludes via qualitative analysis that it is more-likely-than-not that the fair value of a reporting unit is less than its carrying value, a goodwill impairment test is performed. If the carrying amount of a reporting unit exceeds its fair value, an impairment loss is recognized in an amount equal to that excess. The Company has defined its reporting unit structure to include: Commercial Banking and Wealth, Retail Banking, and Corporate and Investment Banking. Each of the defined reporting units was tested for impairment as of October 31, 2020. See Note 7, Goodwill, for a further discussion. Other Real Estate Owned Assets acquired through, or in lieu of, loan foreclosure are held for sale and are initially recorded at the lower of recorded balance of the loan or fair value less costs to sell of the collateral assets at the date of foreclosure, establishing a new cost basis. Subsequent to foreclosure, OREO is carried at the lower of carrying amount or fair value less costs to sell and is included in other assets on the Consolidated Balance Sheets. Gains and losses on the sales and write-downs on such properties and operating expenses from these OREO properties are included in other noninterest expense in the Company’s Consolidated Statements of Income. 109

Table of Contents Accounting for Transfers and Servicing of Financial Assets The Company accounts for transfers of financial assets as sales when control over the transferred assets is surrendered. Control is generally considered to have been surrendered when (1) the transferred assets are legally isolated from the Company, even in bankruptcy or other receivership, (2) the transferee has the right to pledge or exchange the assets with no conditions that constrain the transferee and provide more than a trivial benefit to the Company, and (3) the Company does not maintain the obligation or unilateral ability to reclaim or repurchase the assets. If these sale criteria are met, the transferred assets are removed from the Company's balance sheet and a gain or loss on sale is recognized. If not met, the transfer is recorded as a secured borrowing, and the assets remain on the Company's balance sheet, the proceeds from the transaction are recognized as a liability, and gain or loss on sale is deferred until the sale criterion are achieved. The Company has one primary class of MSR related to residential real estate mortgages. These mortgage servicing rights are recorded in other assets on the Consolidated Balance Sheets at fair value with changes in fair value recorded as a component of mortgage banking income in the Company’s Consolidated Statements of Income. See Note 4, Loan Sales and Servicing, for a further discussion. Revenue from Contracts with Customers The following is a discussion of key revenues within the scope of ASC 606, Revenue from Contracts with Customers: • Service charges on deposit accounts - Revenue from service charges on deposit accounts is earned through cash management, wire transfer, and other deposit-related services; as well as overdraft, non-sufficient funds, account management and other deposit-related fees. Revenue is recognized for these services either over time, corresponding with deposit accounts’ monthly cycle, or at a point in time for transactional related services and fees. • Card and merchant processing fees - Card and merchant processing fees consists of interchange fees from consumer credit and debit cards processed by card association networks, merchant services, and other card related services. Interchange rates are generally set by the credit card associations and based on purchase volumes and other factors. Interchange fees are recognized as transactions occur. Merchant services income represents account management fees and transaction fees charged to merchants for the processing of card association transactions. Merchant services revenue is recognized as transactions occur, or as services are performed. • Investment banking and advisory fees - Investment banking and advisory fees primarily represent revenues earned by the Company for various corporate services including advisory, debt placement and underwriting. Revenues for these services are recorded at a point in time or upon completion of a contractually identified transaction. Underwriting costs are presented gross against underwriting revenues. • Money transfer income - Money transfer income represents income from the Parent’s wholly owned subsidiary, BBVA Transfer Holdings, Inc., which engages in money transfer services, including money transmission and foreign exchange services. Money transfer income is recognized as transactions occur. • Asset management, retail investment, and commissions fees - Asset management, retail investment, and commissions fees consists of fees generated from money management transactions and treasury management services, along with mutual fund and annuity sales fee income. Revenue from trade execution and brokerage services is earned through commissions from trade execution on behalf of clients. Revenue from these transactions is recognized at the trade date. Any ongoing service fees are recognized on a monthly basis as services are performed. Trust and asset management services include asset custody and investment management services provided to individual and institutional customers. Revenue is recognized monthly based on a minimum annual fee, and the market value of assets in custody. Additional fees are recognized for transactional activity. Insurance revenue is earned through commissions on insurance sales and earned at a point in time. These revenues are recorded in asset management fees and investment services sales fees within non-interest income in the Company's Consolidated Statements of Income. 110

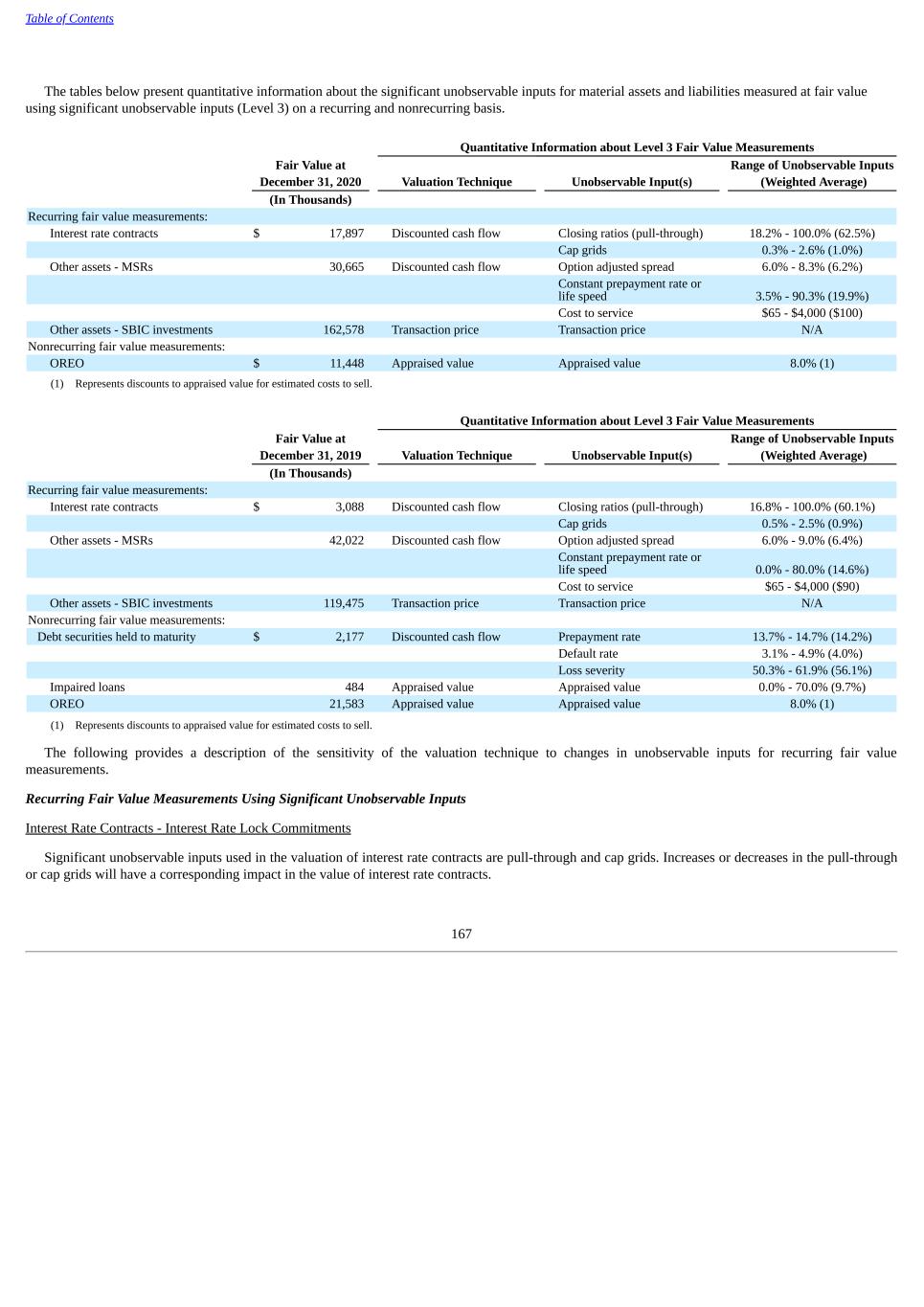

Table of Contents Advertising Costs Advertising costs are generally expensed as incurred and recorded as marketing expense, a component of noninterest expense in the Company’s Consolidated Statements of Income. Income Taxes The Company and its eligible subsidiaries file a consolidated federal income tax return. The Company files separate tax returns for subsidiaries that are not eligible to be included in the consolidated federal income tax return. Based on the laws of the respective states where it conducts business operations, the Company either files consolidated, combined or separate tax returns. Deferred tax assets and liabilities are determined based on temporary differences between financial reporting and tax bases of assets and liabilities and are measured using the tax rates and laws that are expected to be in effect when the differences are anticipated to reverse. The effect on deferred tax assets and liabilities of a change in tax rates is recognized as income or expense in the period the change is incurred. In evaluating the Company's ability to recover its deferred tax assets within the jurisdiction from which they arise, the Company must consider all available evidence, including scheduled reversals of deferred tax liabilities, projected future taxable income, tax planning strategies, and the results of recent operations. A valuation allowance is recognized for a deferred tax asset, if based on the available evidence, it is more likely than not that some portion or all of a deferred tax asset will not be realized. The Company recognizes income tax benefits associated with uncertain tax positions, when, in its judgment, it is more likely than not of being sustained on the basis of the technical merits. For a tax position that meets the more-likely-than-not recognition threshold, the Company initially and subsequently measures the tax benefit as the largest amount that the Company judges to have a greater than 50% likelihood of being realized upon ultimate settlement with the taxing authority. The Company recognizes interest and penalties related to unrecognized tax benefits as a component of other noninterest expense in the Company’s Consolidated Statements of Income. Accrued interest and penalties are included within accrued expenses and other liabilities on the Company’s Consolidated Balance Sheets. The Company applies the proportional amortization method in accounting for its qualified Low Income Housing Tax Credit investments. This method recognizes the amortization of the investment as a component of income tax expense. At December 31, 2020 and 2019, net Low Income Housing Tax Credit investments were $585 million and $542 million, respectively, and are included in other assets on the Company's Consolidated Balance Sheets. Noncontrolling Interests The Company applies the accounting guidance codified in ASC Topic 810, Consolidation, related to the treatment of noncontrolling interests. This guidance requires the amount of consolidated net income attributable to the parent and to the noncontrolling interests be clearly identified and presented on the face of the consolidated financial statements. The noncontrolling interests attributable to the Company's REIT preferred securities and mezzanine investment fund (see Note 11, Shareholder's Equity, for a discussion of the preferred securities) are reported within shareholder’s equity, separately from the equity attributable to the Company’s shareholder. The dividends paid to the REIT preferred shareholders and other mezzanine investment fund investors are reported as reductions in shareholder’s equity in the Consolidated Statements of Shareholder’s Equity, separately from changes in the equity attributable to the Company’s shareholder. Accounting for Derivatives and Hedging Activities A derivative is a financial instrument that derives its cash flows, and therefore its value, by reference to an underlying instrument, index or referenced interest rate. These instruments include interest rate swaps, caps, floors, financial forwards and futures contracts, foreign exchange contracts, options written and purchased. The Company mainly uses derivatives to manage economic risk related to commercial loans, long-term debt and other funding sources. The Company also uses derivatives to facilitate transactions on behalf of its customers. 111

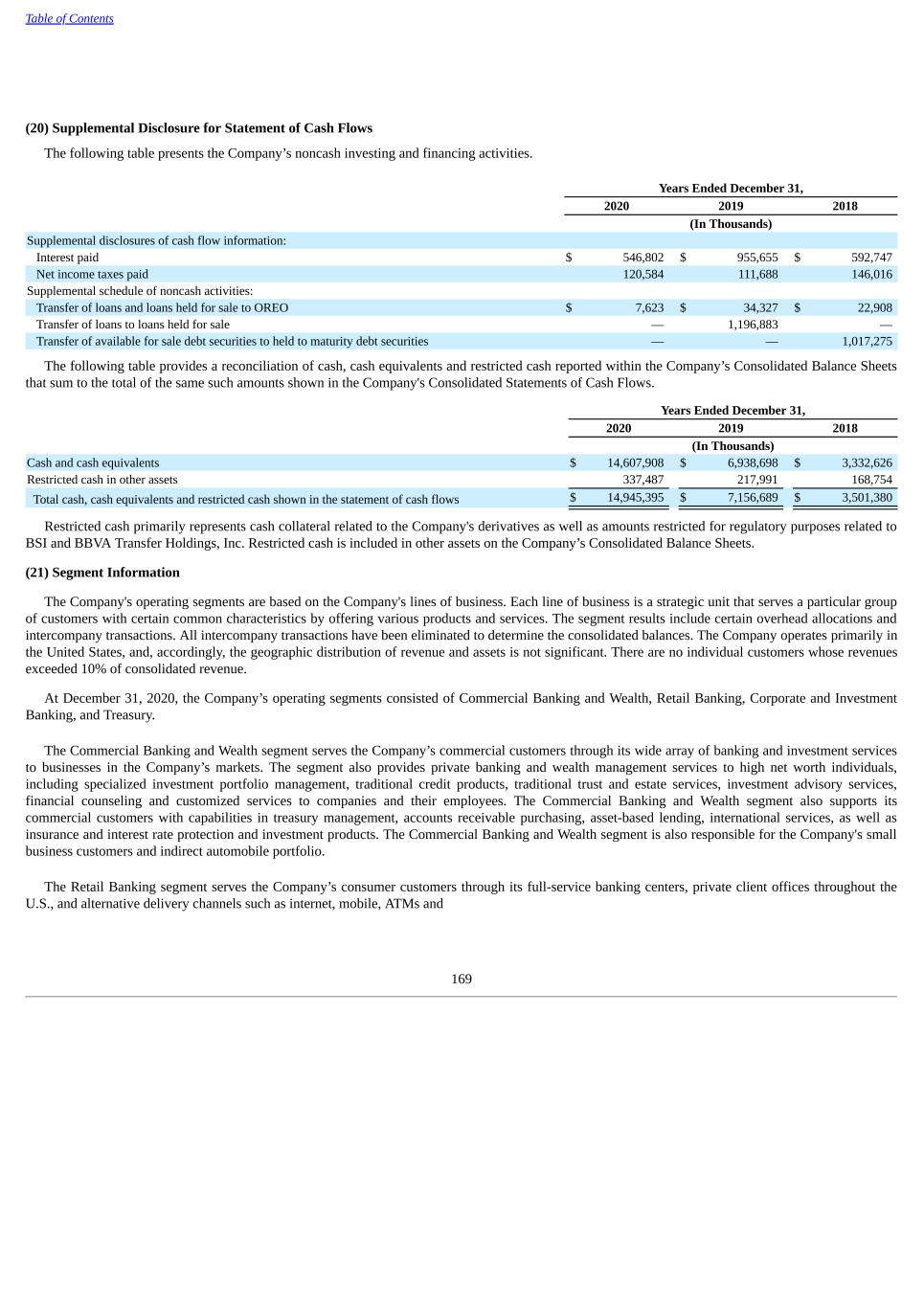

Table of Contents All derivative instruments are recognized on the Company’s Consolidated Balance Sheets at their fair value. The Company does not offset fair value amounts under master netting agreements. Fair values are estimated using pricing models and current market data. On the date the derivative instrument contract is entered into, the Company designates the derivative as (1) a fair value hedge, (2) a cash flow hedge, or (3) a free-standing derivative. Changes in the fair value of a derivative instrument that is highly effective and that is designated and qualifies as a fair value hedge, along with the loss or gain on the hedged asset or liability that is attributable to the hedged risk (including losses or gains on firm commitments), are recorded in earnings. Changes in the fair value of a derivative instrument that is highly effective and that is designated and qualifies as a cash flow hedge are recorded in accumulated other comprehensive income, until earnings are affected by the variability of cash flows (e.g., when periodic settlements on a variable-rate asset or liability are recorded in earnings). Changes in the fair value of a free-standing derivative and settlements on the instruments are reported in earnings. The Company formally documents all relationships between hedging instruments and hedged items, as well as its risk management objective and strategy for undertaking various hedge transactions. This process includes linking all derivative instruments that are designated as fair value or cash flow hedges to specific assets and liabilities on the Company’s Consolidated Balance Sheets or to specific firm commitments or forecasted transactions. The Company also formally assesses, both at the hedge’s inception and on an ongoing basis, whether the derivative instruments that are used in hedging transactions are highly effective in offsetting changes in fair values or cash flows of hedged items. The Company discontinues hedge accounting prospectively when: (1) it is determined that the derivative instrument is no longer highly effective in offsetting changes in the fair value or cash flows of a hedged item (including firm commitments or forecasted transactions); (2) the derivative instrument expires or is sold, terminated or exercised; (3) the derivative instrument is de-designated as a hedge instrument because it is unlikely that a forecasted transaction will occur; (4) a hedged firm commitment no longer meets the definition of a firm commitment; or (5) management determines that designation of the derivative instrument as a hedge instrument is no longer appropriate. When hedge accounting is discontinued because it is determined that the derivative instrument no longer qualifies as an effective fair value or cash flow hedge, the derivative instrument continues to be carried on the Company’s Consolidated Balance Sheets at its fair value, with changes in the fair value included in earnings. Additionally, for fair value hedges, the hedged asset or liability is no longer adjusted for changes in fair value and the existing basis adjustment is amortized or accreted as an adjustment to the yield over the remaining life of the asset or liability. For cash flow hedges, when hedge accounting is discontinued, but the hedged cash flows or forecasted transaction are still expected to occur, the unrealized gains and losses that were accumulated in other comprehensive income are recognized in earnings in the same period when the earnings are affected by the hedged cash flows or forecasted transaction. When a cash flow hedge is discontinued, because the hedged cash flows or forecasted transactions are not expected to occur, unrealized gains and losses that were accumulated in other comprehensive income are recognized in earnings immediately. Recently Adopted Accounting Standards Credit Losses In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses, which introduces new guidance for the accounting for credit losses on instruments within its scope. The new approach changes the impairment model for most financial assets, and will require the use of an “expected credit loss” model for financial instruments measured at amortized cost and certain other instruments. This model applies to receivables, loans, held-to-maturity debt securities, and off-balance sheet credit exposures. This model requires entities to estimate the lifetime expected credit loss on such instruments and record an allowance that represents the portion of the amortized cost basis that the entity does not expect to collect. This allowance is deducted from the financial asset’s amortized cost basis to present the net amount expected to be collected. The new expected credit loss model also applies to purchased financial assets with credit deterioration, superseding current accounting guidance for such assets. The amended guidance also amends the impairment model for available-for-sale debt securities, requiring entities to determine whether all or a portion of the unrealized loss on such securities is a credit loss, and also eliminating the 112

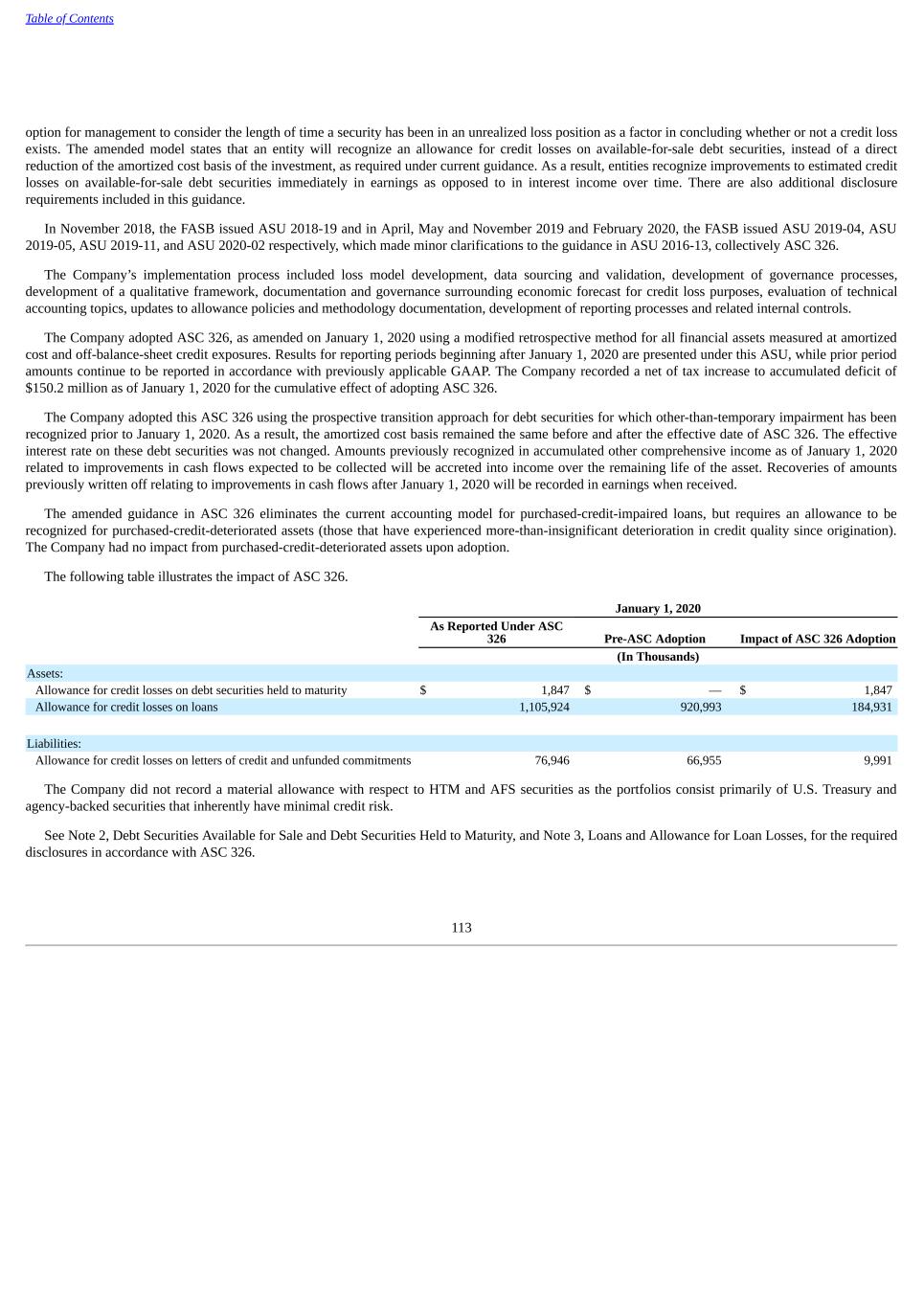

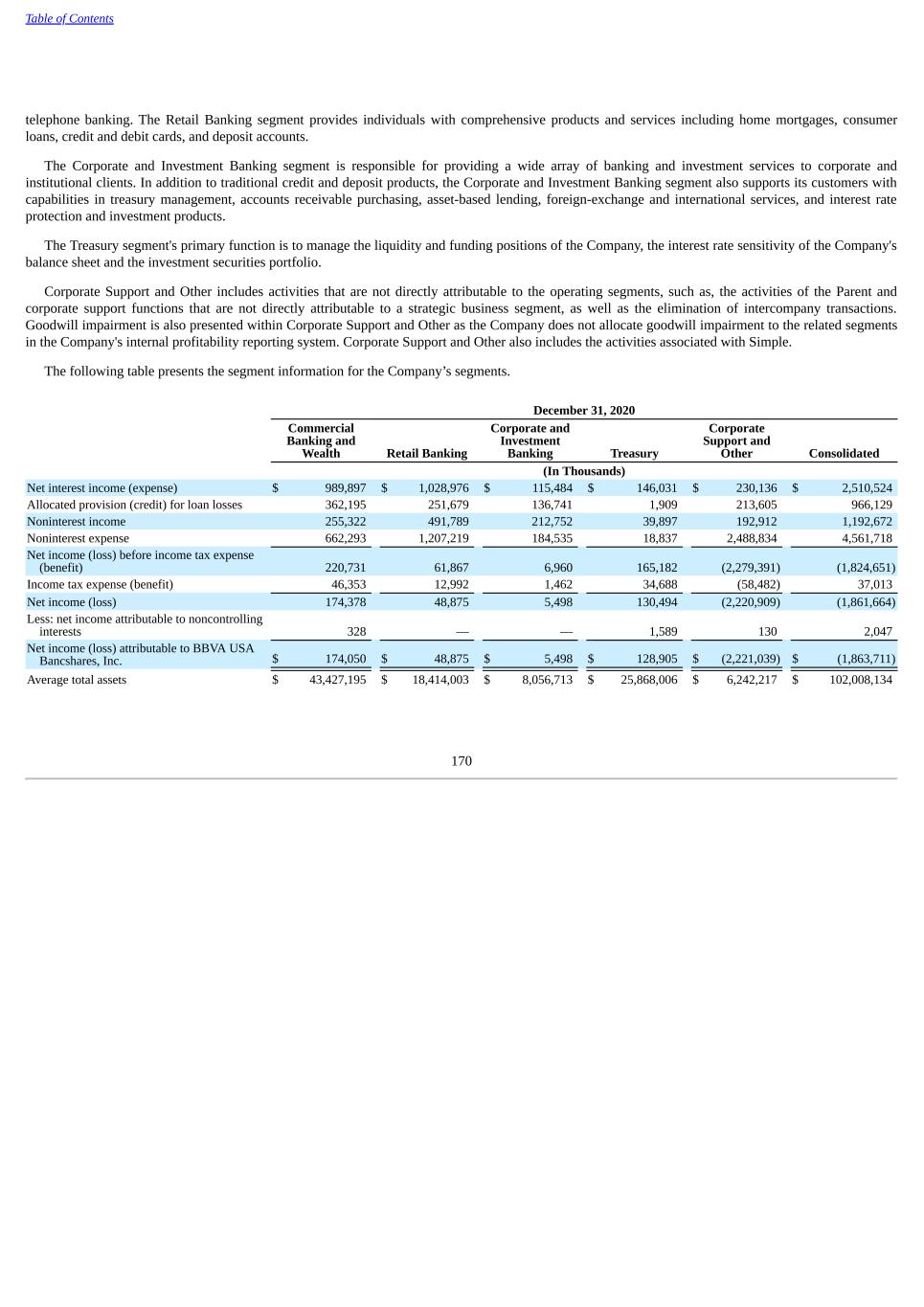

Table of Contents option for management to consider the length of time a security has been in an unrealized loss position as a factor in concluding whether or not a credit loss exists. The amended model states that an entity will recognize an allowance for credit losses on available-for-sale debt securities, instead of a direct reduction of the amortized cost basis of the investment, as required under current guidance. As a result, entities recognize improvements to estimated credit losses on available-for-sale debt securities immediately in earnings as opposed to in interest income over time. There are also additional disclosure requirements included in this guidance. In November 2018, the FASB issued ASU 2018-19 and in April, May and November 2019 and February 2020, the FASB issued ASU 2019-04, ASU 2019-05, ASU 2019-11, and ASU 2020-02 respectively, which made minor clarifications to the guidance in ASU 2016-13, collectively ASC 326. The Company’s implementation process included loss model development, data sourcing and validation, development of governance processes, development of a qualitative framework, documentation and governance surrounding economic forecast for credit loss purposes, evaluation of technical accounting topics, updates to allowance policies and methodology documentation, development of reporting processes and related internal controls. The Company adopted ASC 326, as amended on January 1, 2020 using a modified retrospective method for all financial assets measured at amortized cost and off-balance-sheet credit exposures. Results for reporting periods beginning after January 1, 2020 are presented under this ASU, while prior period amounts continue to be reported in accordance with previously applicable GAAP. The Company recorded a net of tax increase to accumulated deficit of $150.2 million as of January 1, 2020 for the cumulative effect of adopting ASC 326. The Company adopted this ASC 326 using the prospective transition approach for debt securities for which other-than-temporary impairment has been recognized prior to January 1, 2020. As a result, the amortized cost basis remained the same before and after the effective date of ASC 326. The effective interest rate on these debt securities was not changed. Amounts previously recognized in accumulated other comprehensive income as of January 1, 2020 related to improvements in cash flows expected to be collected will be accreted into income over the remaining life of the asset. Recoveries of amounts previously written off relating to improvements in cash flows after January 1, 2020 will be recorded in earnings when received. The amended guidance in ASC 326 eliminates the current accounting model for purchased-credit-impaired loans, but requires an allowance to be recognized for purchased-credit-deteriorated assets (those that have experienced more-than-insignificant deterioration in credit quality since origination). The Company had no impact from purchased-credit-deteriorated assets upon adoption. The following table illustrates the impact of ASC 326. January 1, 2020 As Reported Under ASC 326 Pre-ASC Adoption Impact of ASC 326 Adoption (In Thousands) Assets: Allowance for credit losses on debt securities held to maturity $ 1,847 $ — $ 1,847 Allowance for credit losses on loans 1,105,924 920,993 184,931 Liabilities: Allowance for credit losses on letters of credit and unfunded commitments 76,946 66,955 9,991 The Company did not record a material allowance with respect to HTM and AFS securities as the portfolios consist primarily of U.S. Treasury and agency-backed securities that inherently have minimal credit risk. See Note 2, Debt Securities Available for Sale and Debt Securities Held to Maturity, and Note 3, Loans and Allowance for Loan Losses, for the required disclosures in accordance with ASC 326. 113

Table of Contents Fair Value Measurements In August 2018, the FASB issued ASU 2018-13, Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurements. The amendments in this ASU modified the disclosure requirements for fair value measurements in Topic 820, Fair Value Measurements. The Company adopted this ASU on January 1, 2020. The adoption of this standard did not have material impact on the financial condition or results of operation of the Company. See Note 19, Fair Value Measurements, for the modified disclosure in accordance with this ASU. Internal-Use Software In August 2018, the FASB issued ASU 2018-15, Customer's Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That is a Service Contract. The amendments in this ASU align the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software and hosting arrangements that include an internal-use software license. The Company adopted this ASU on January 1, 2020. The adoption of this standard did not have material impact on the financial condition or results of operation of the Company. 114

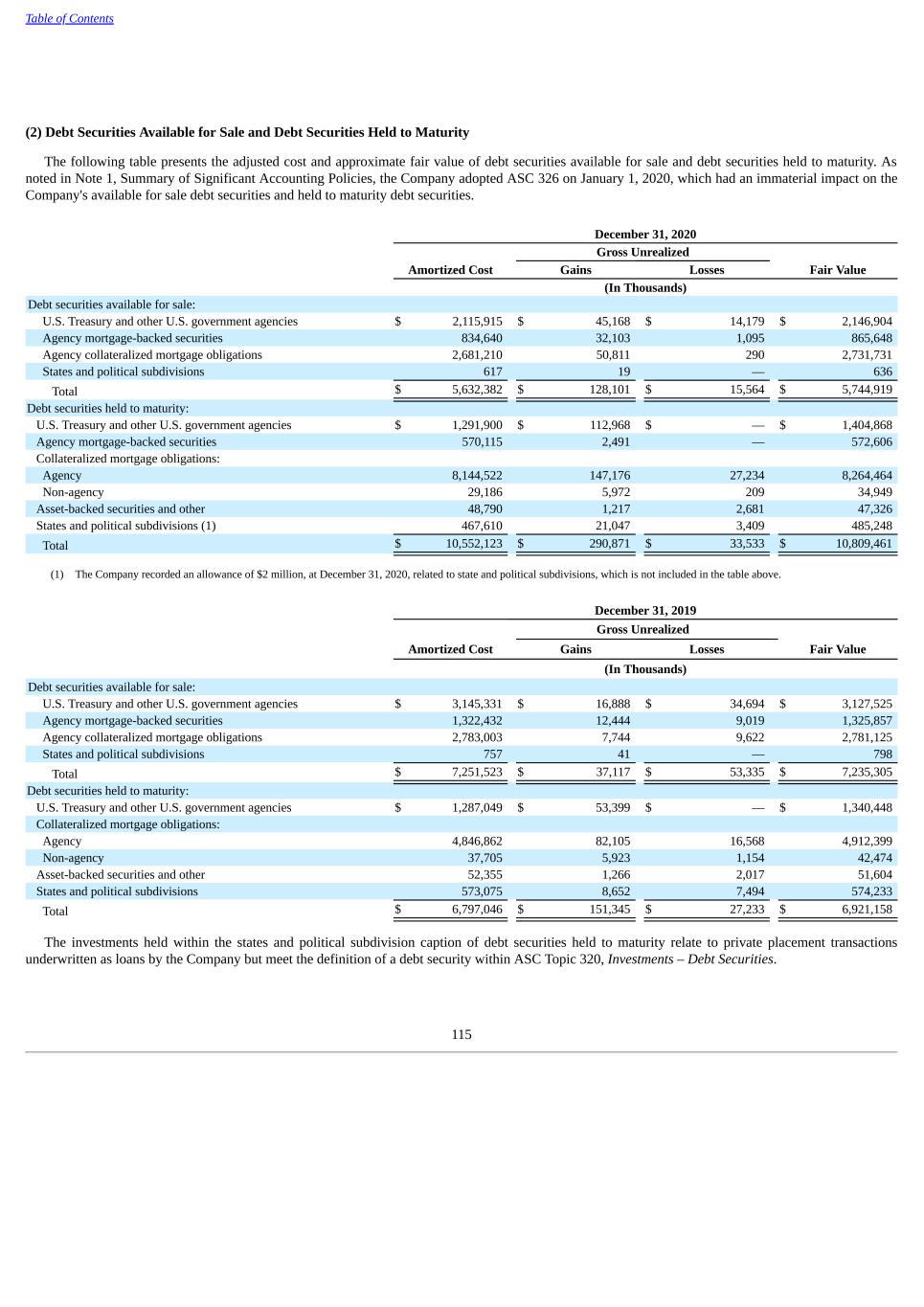

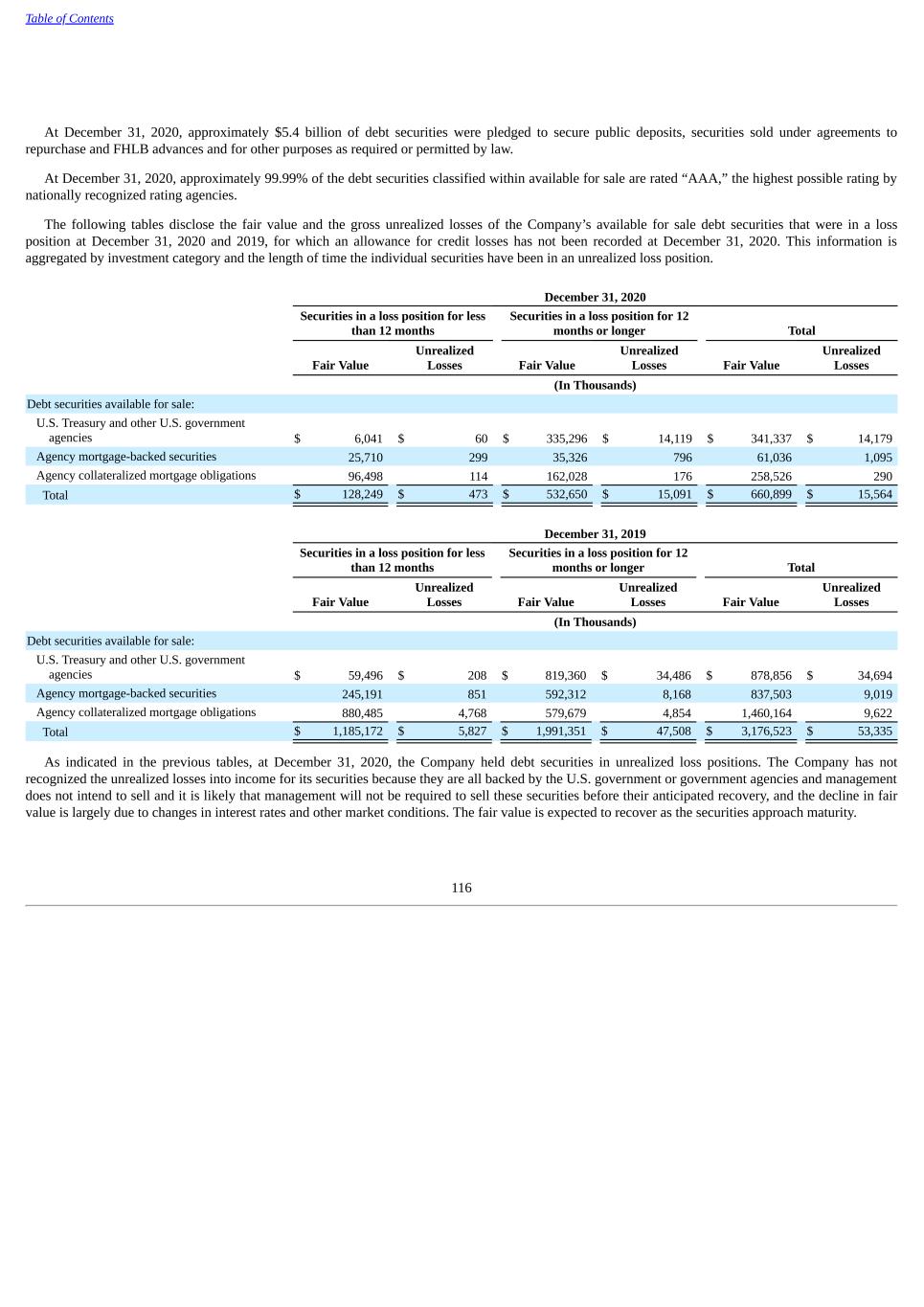

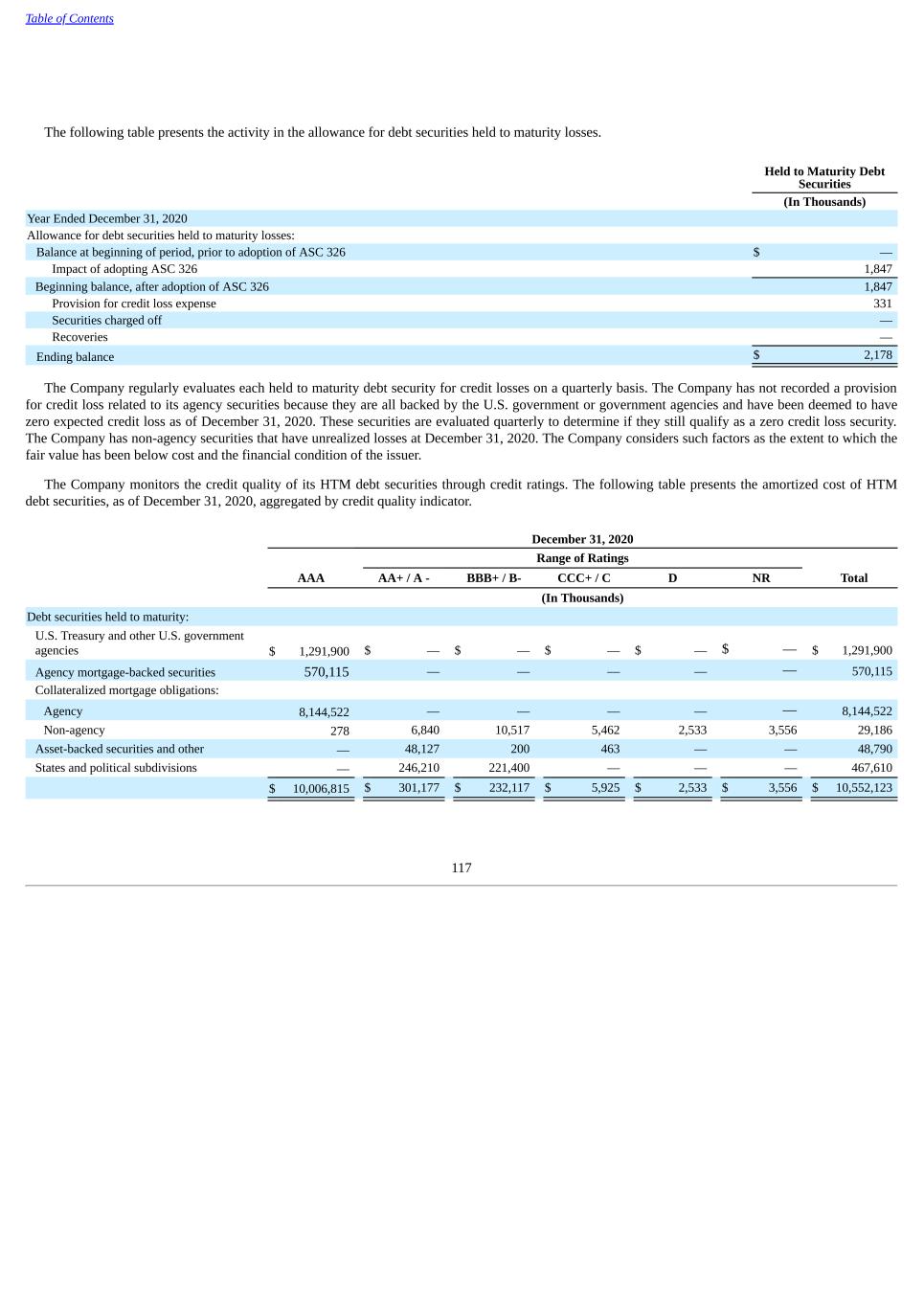

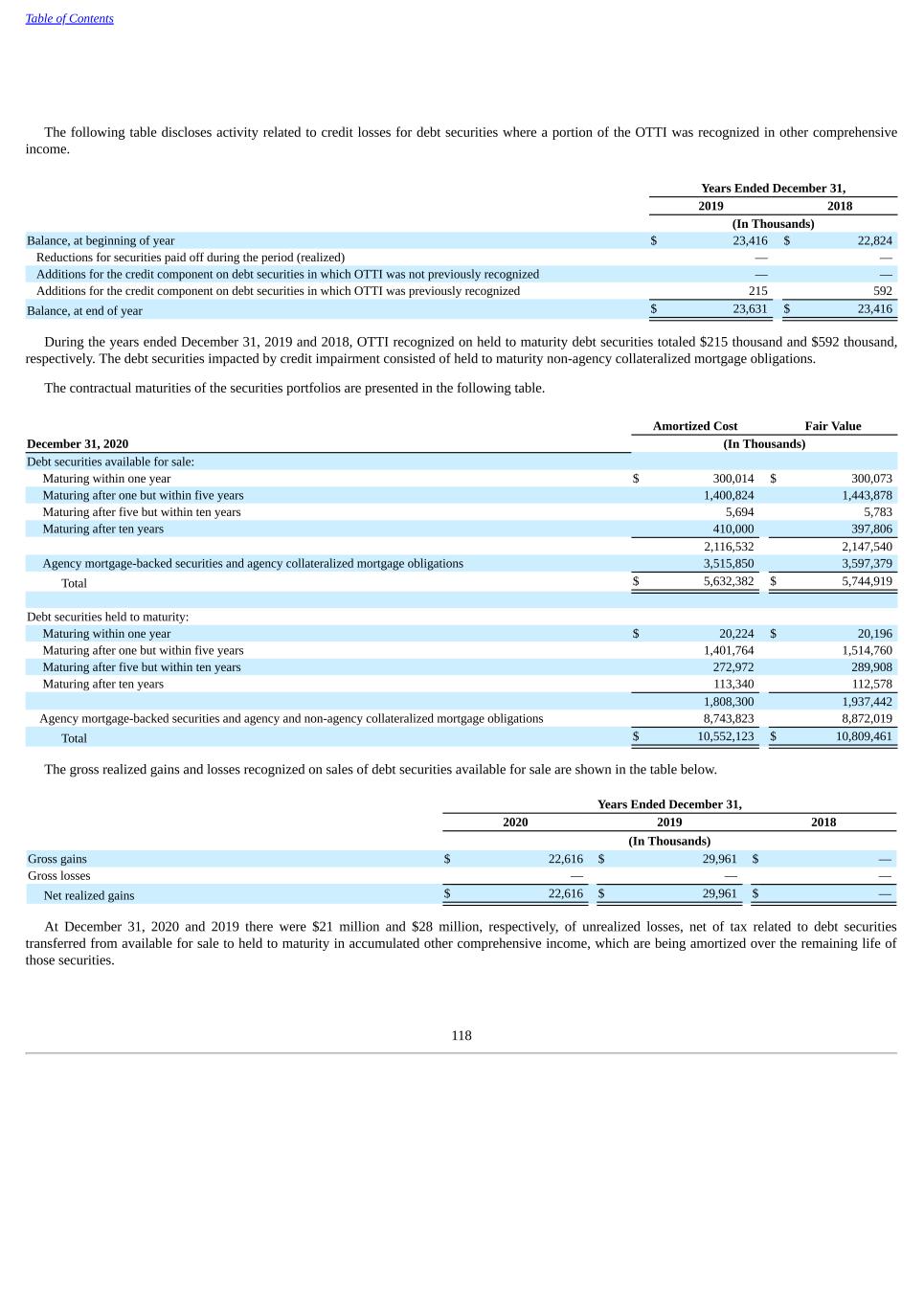

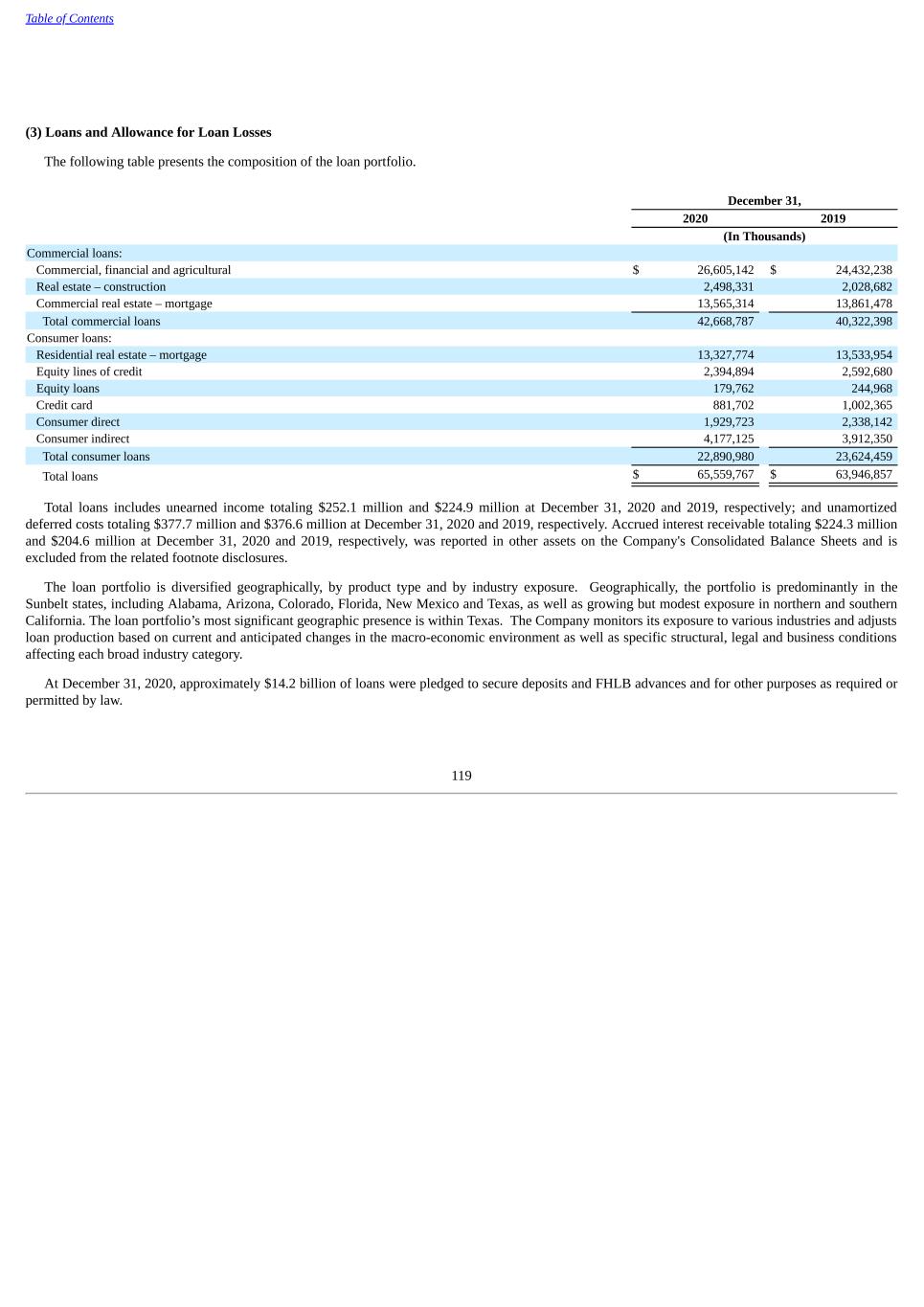

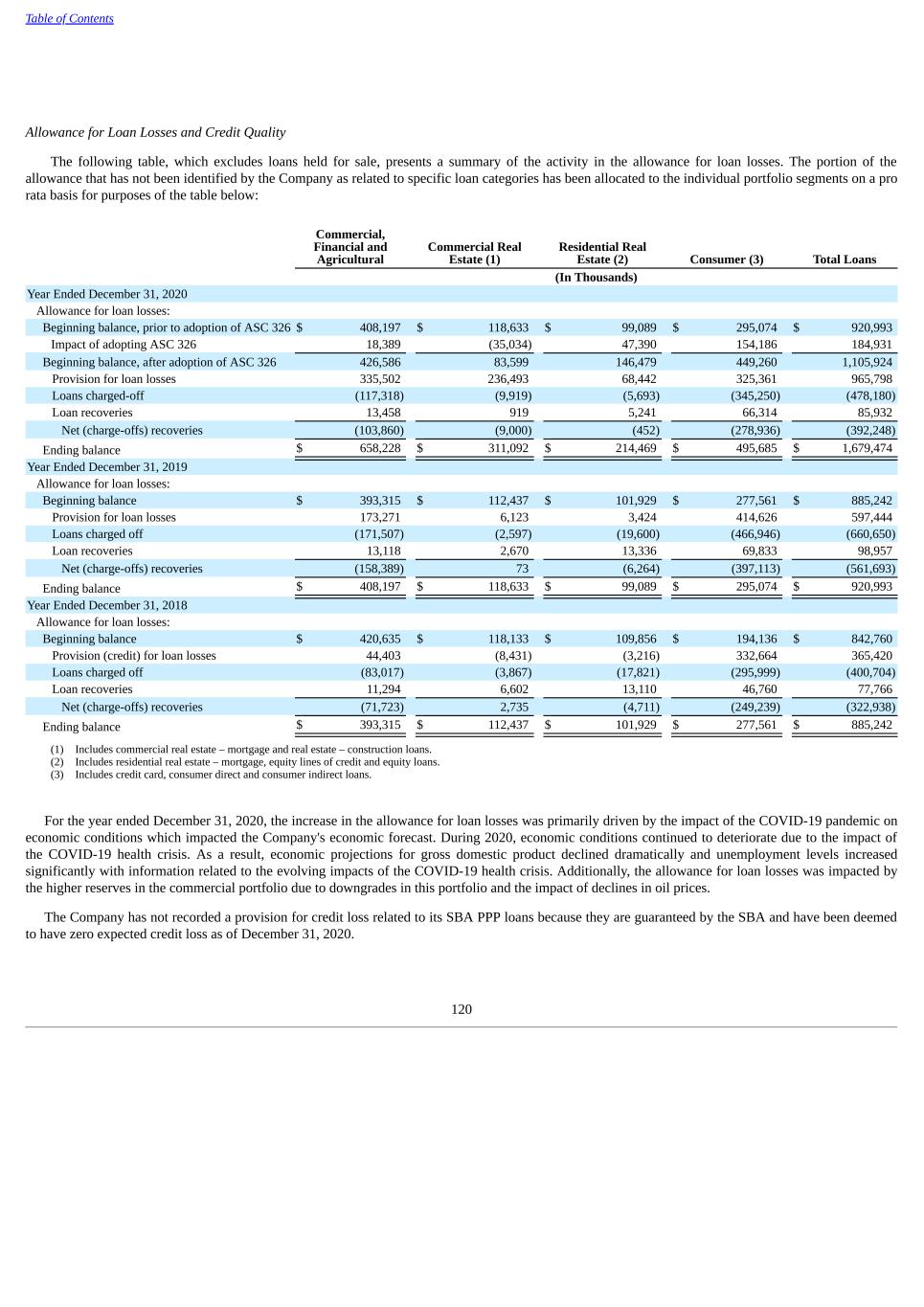

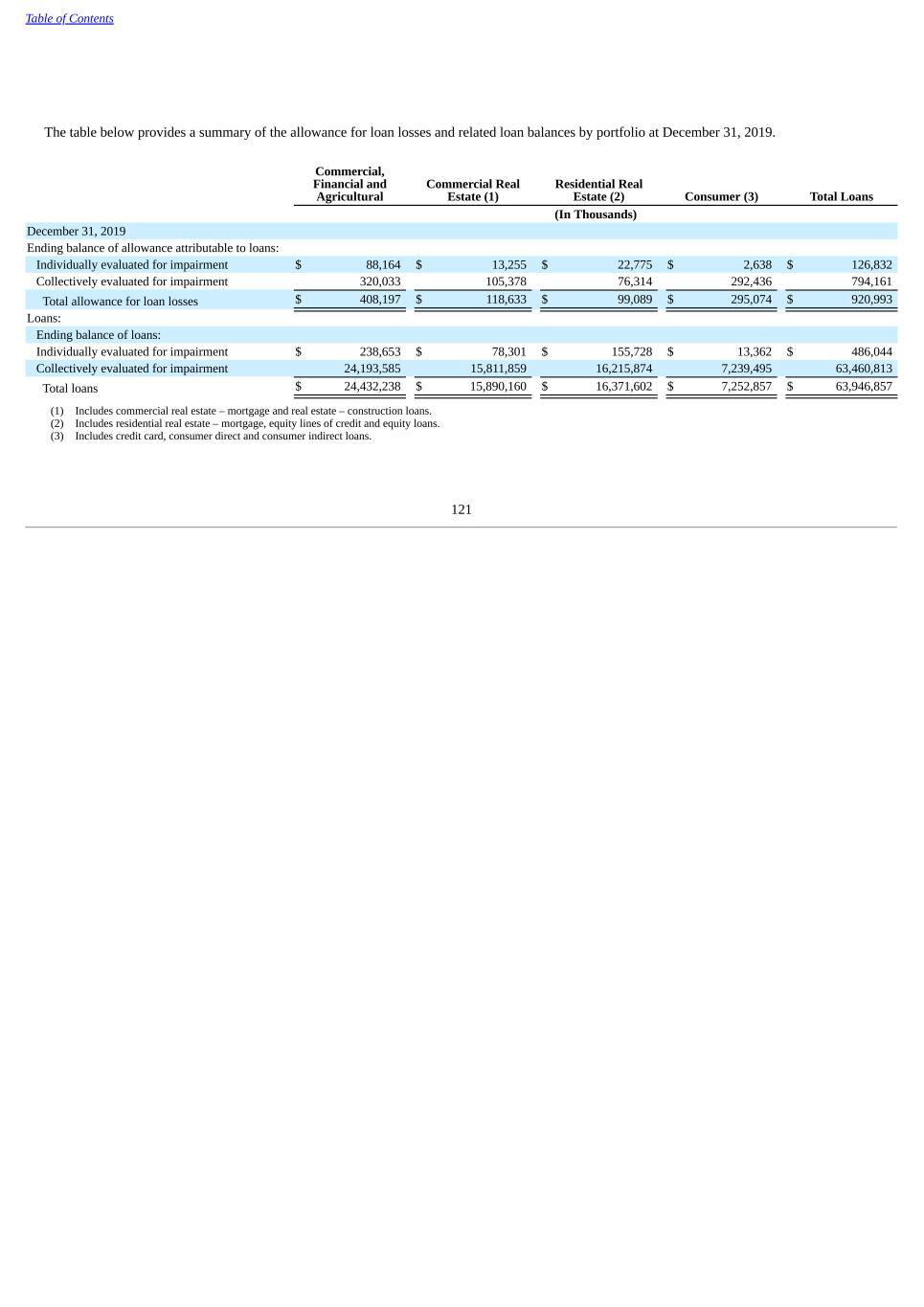

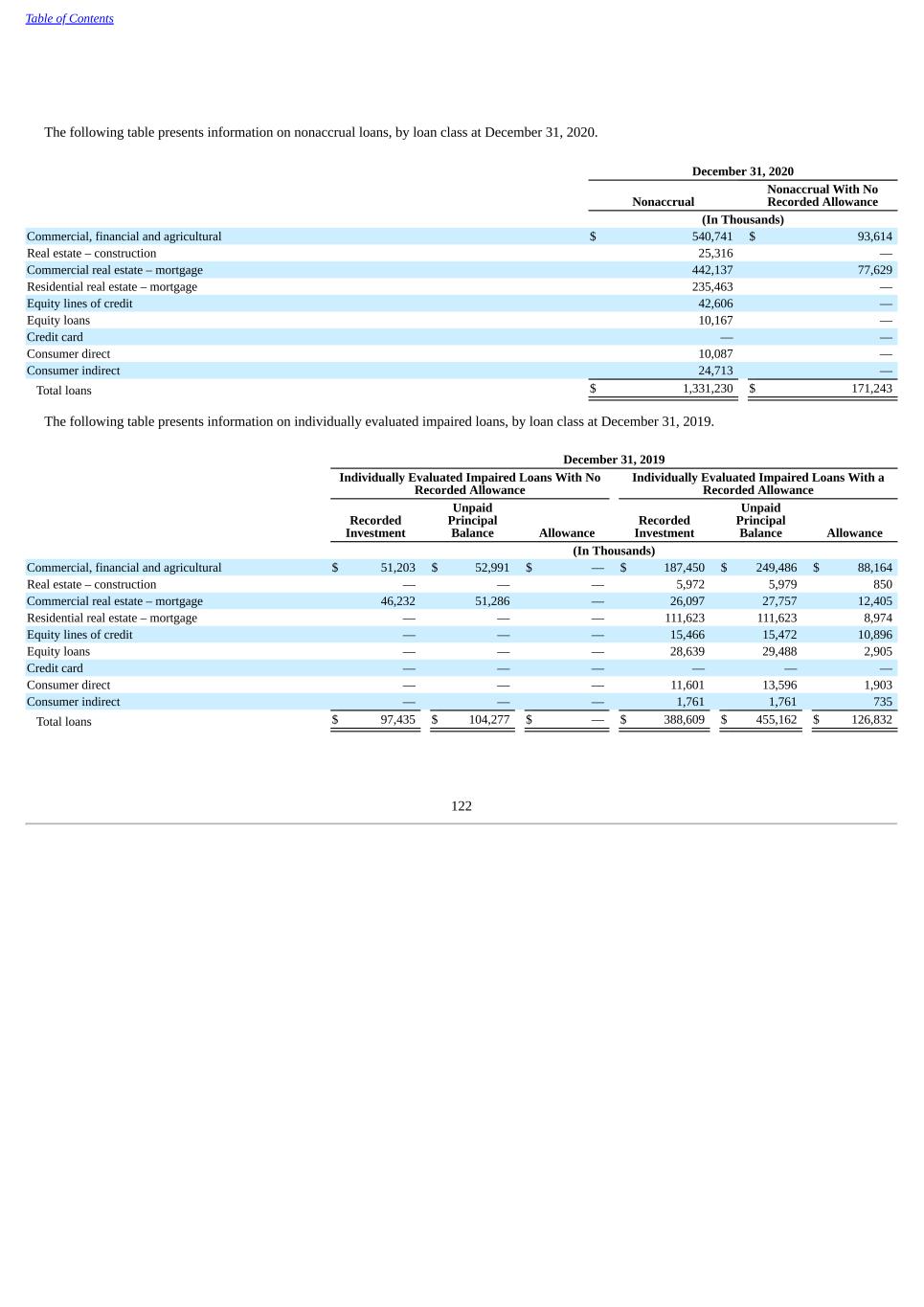

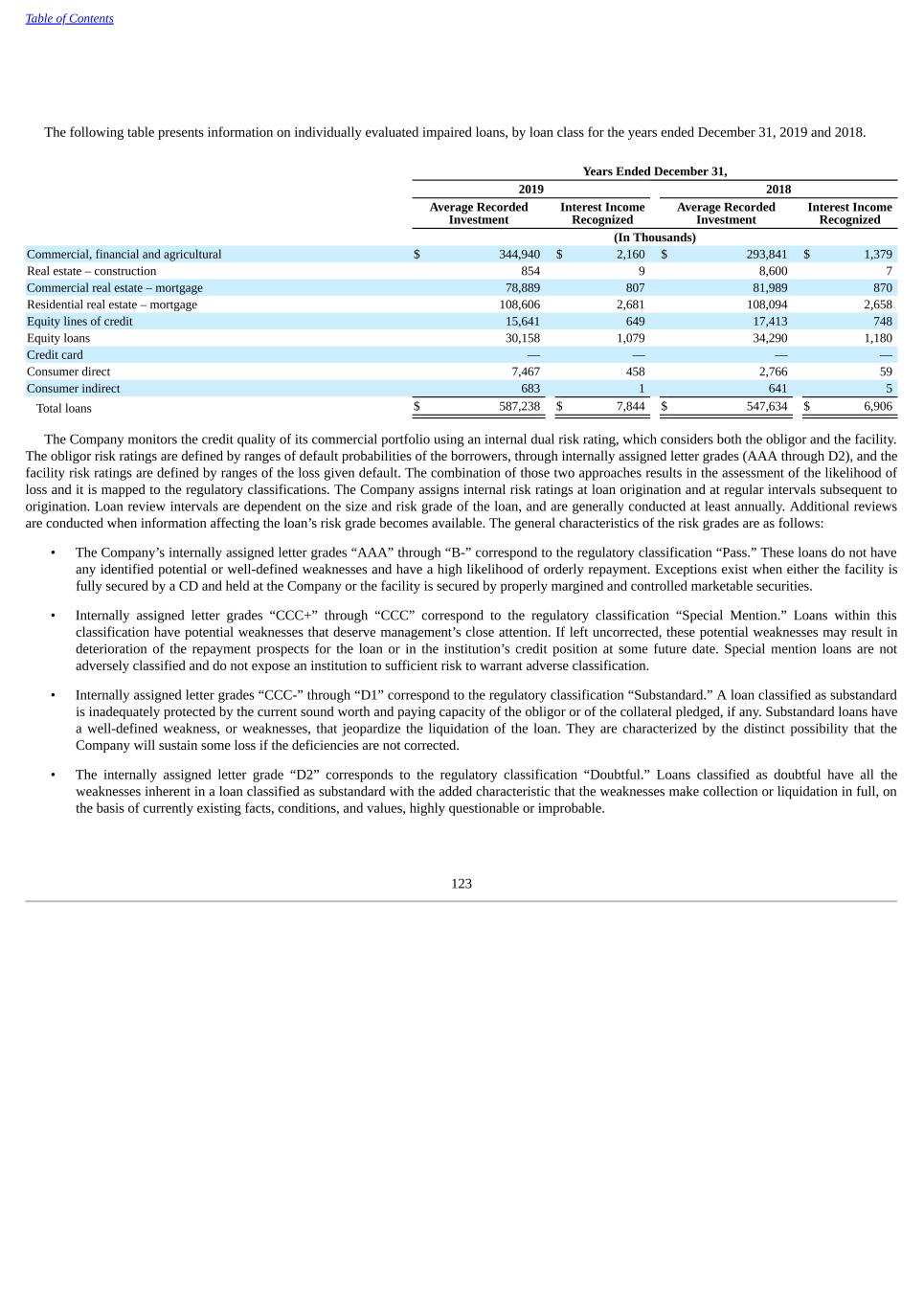

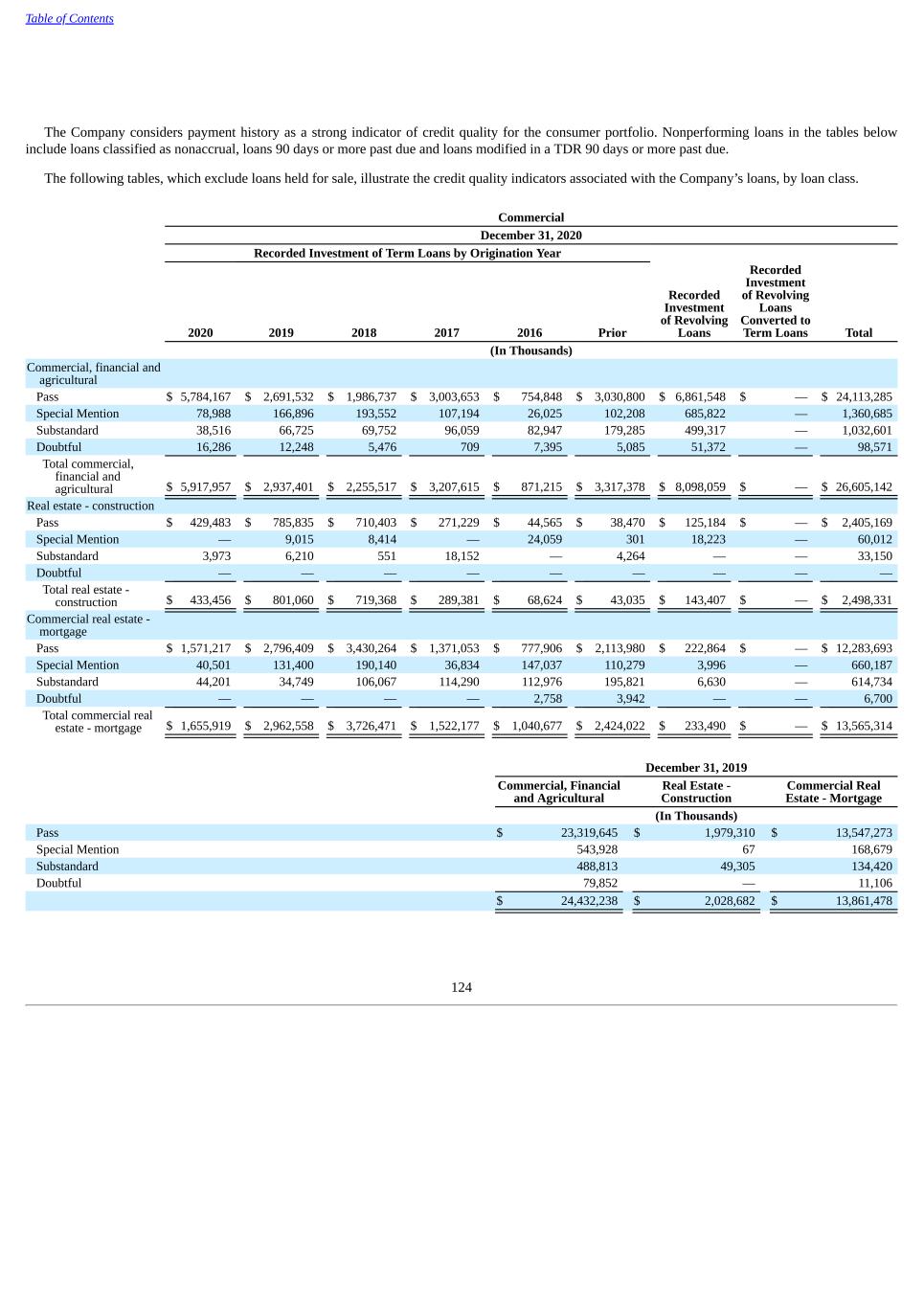

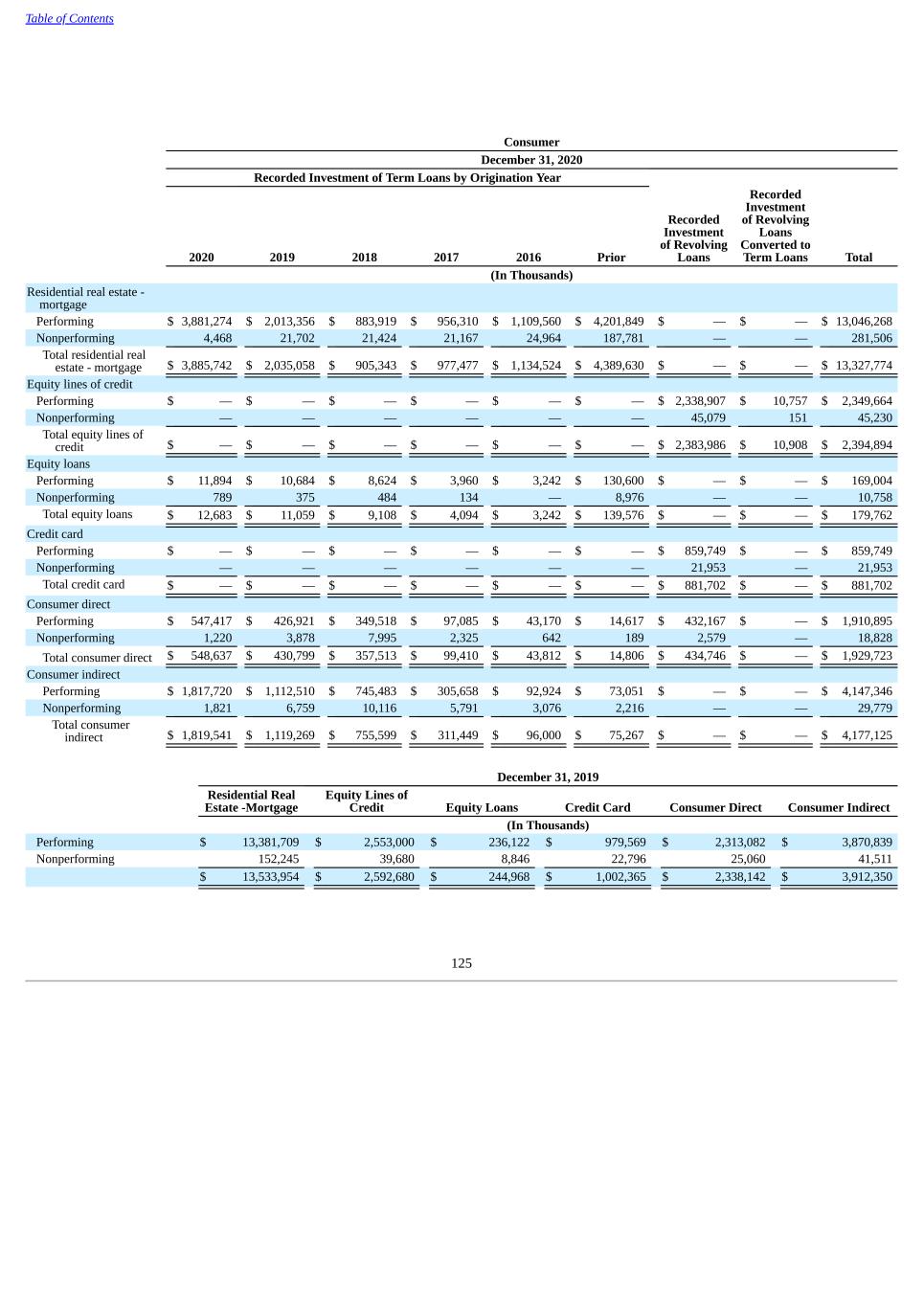

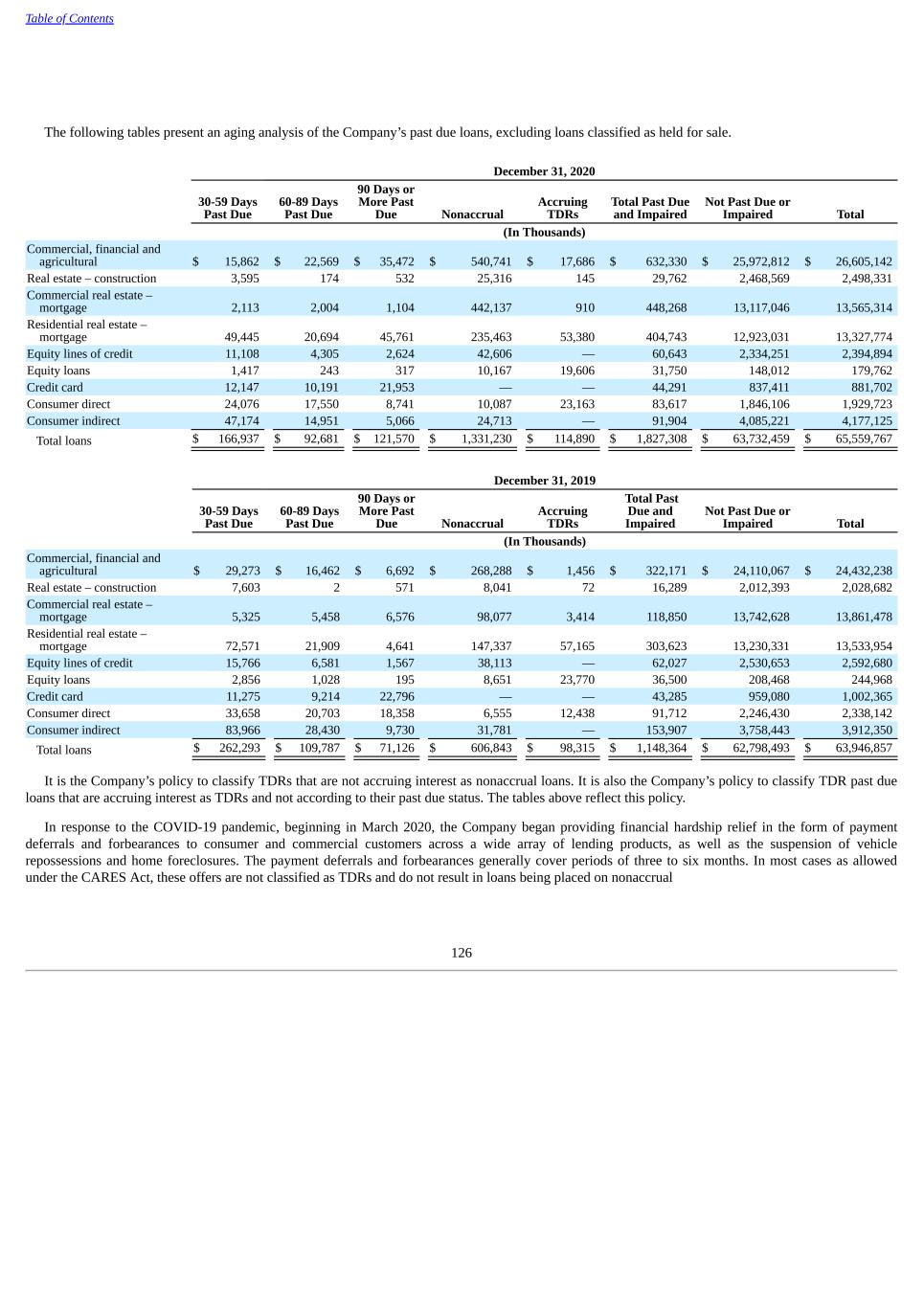

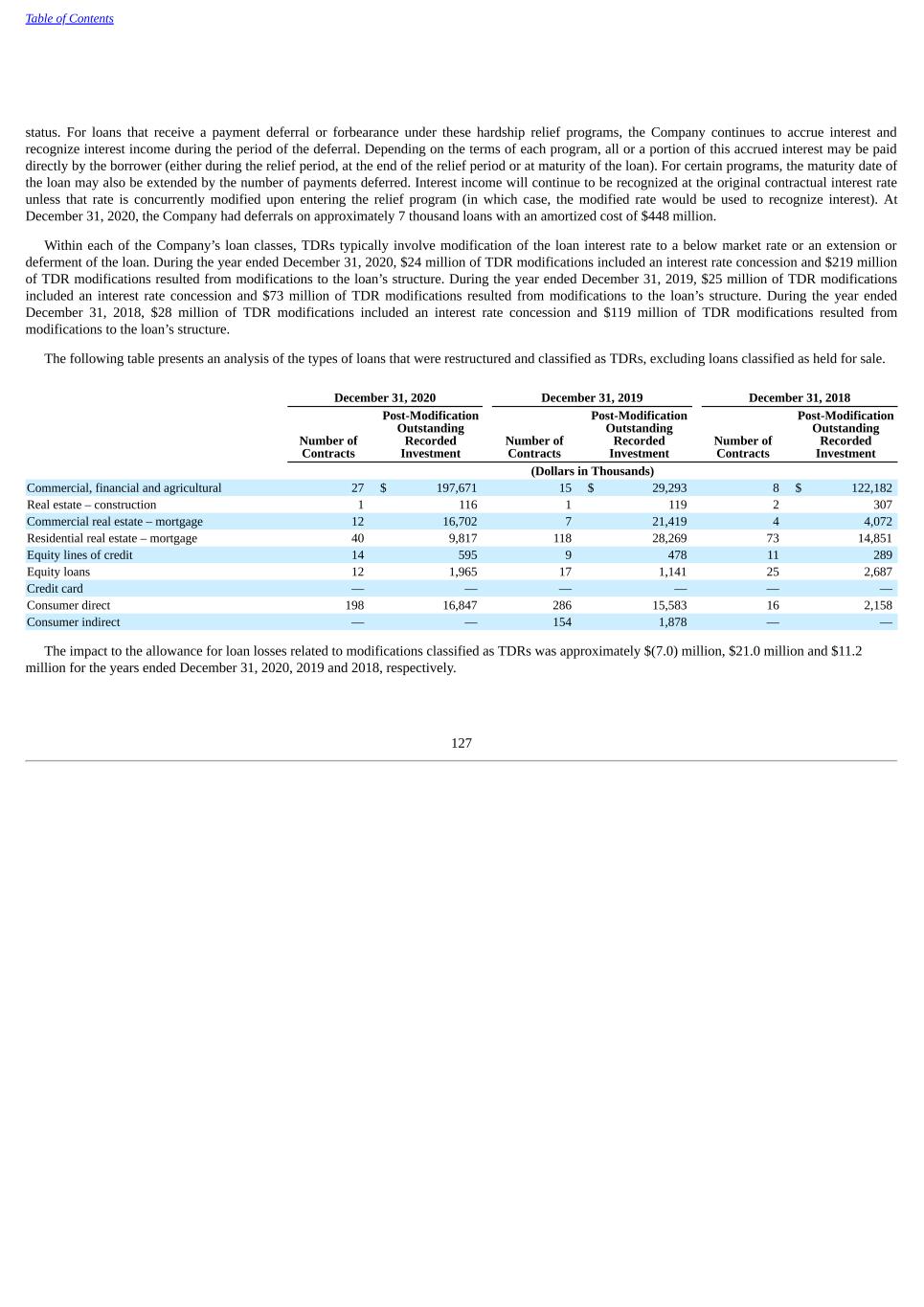

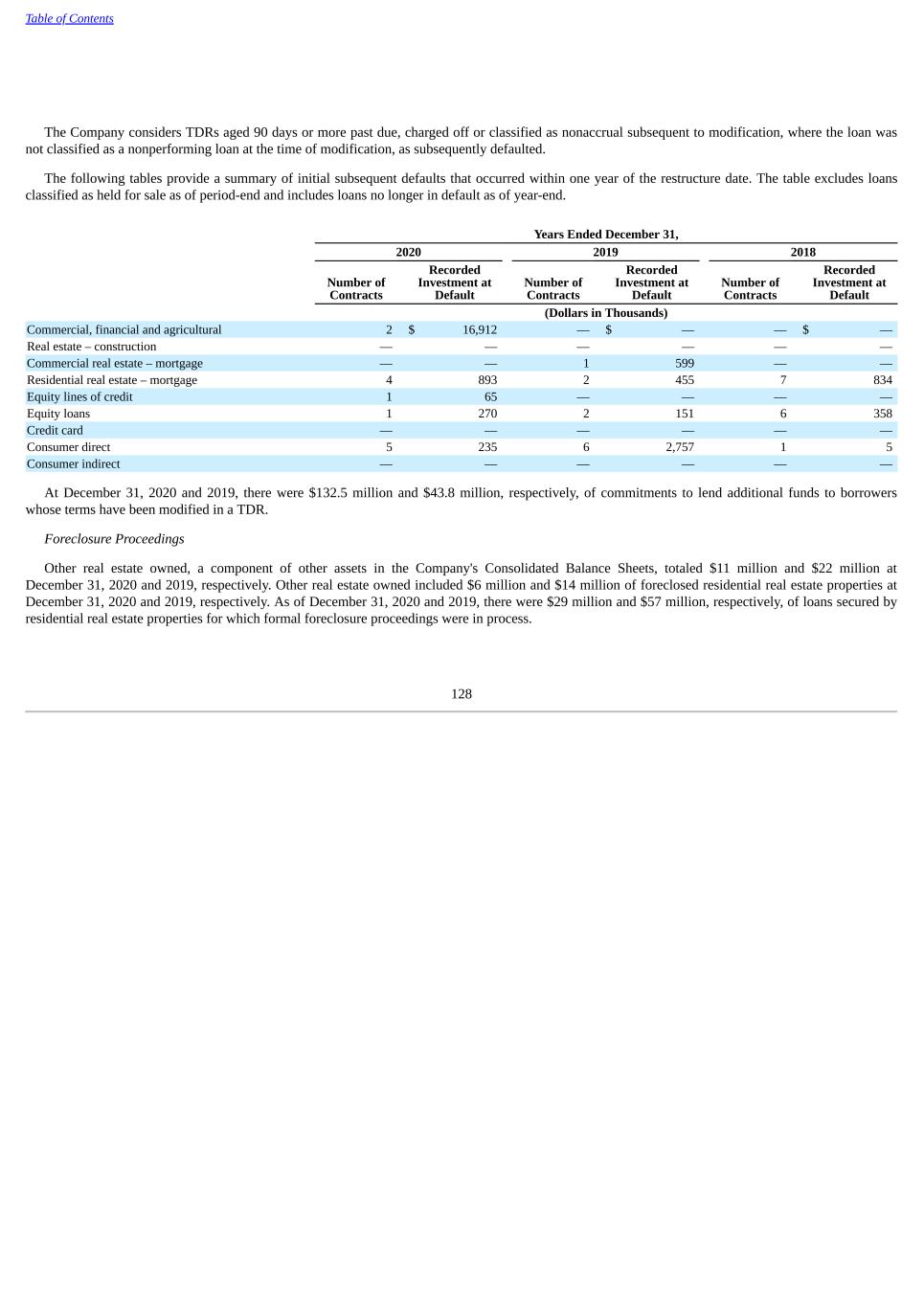

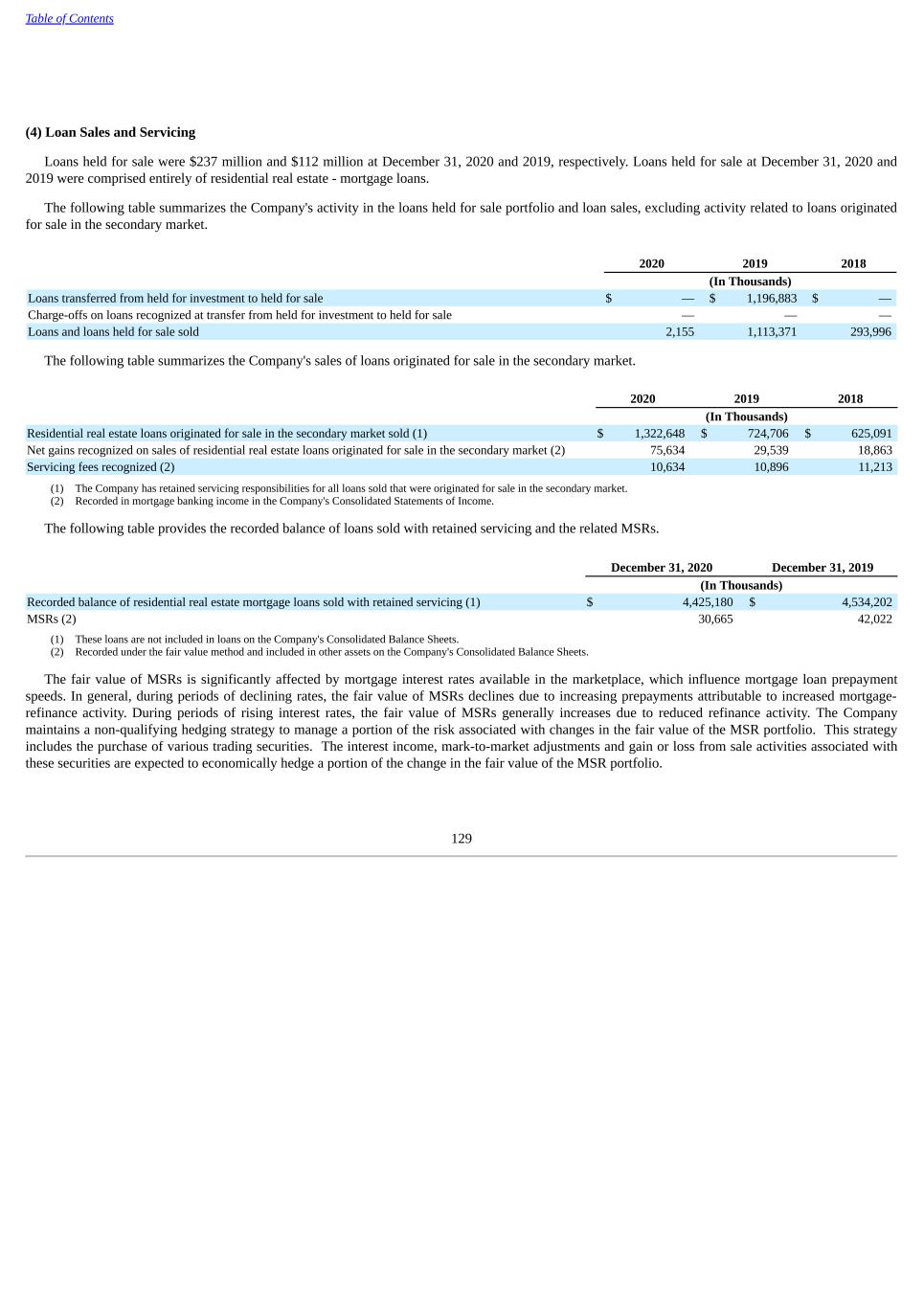

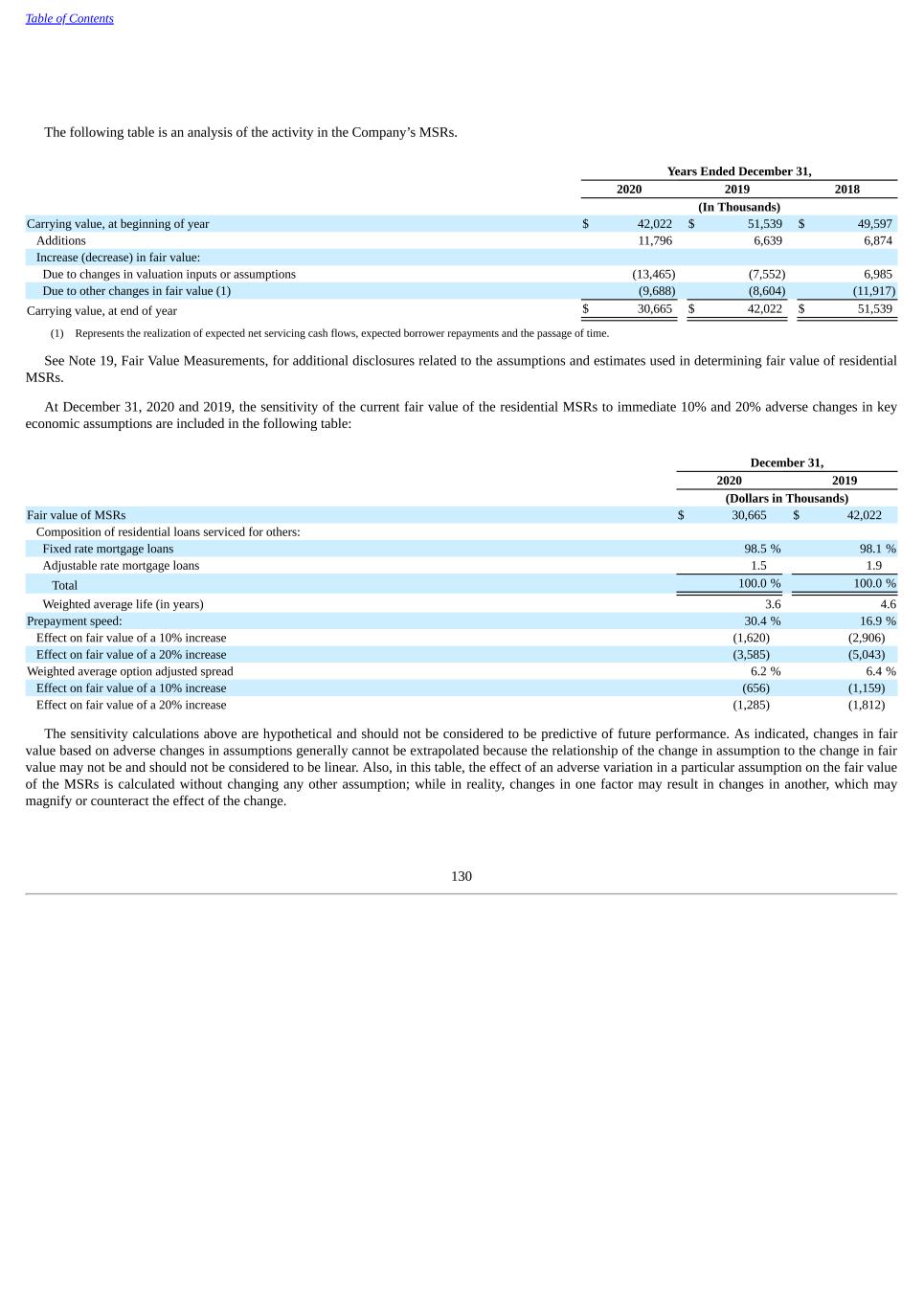

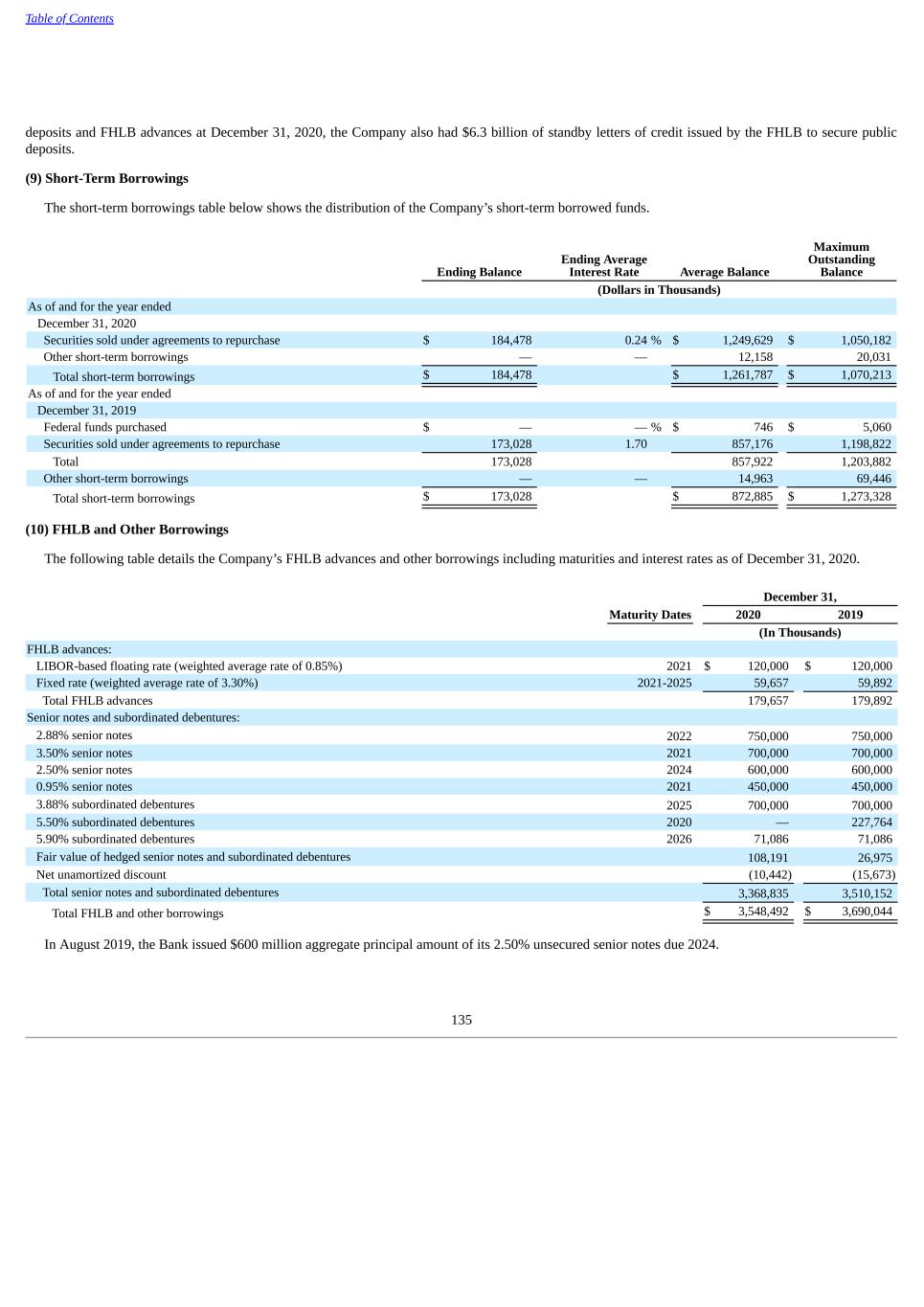

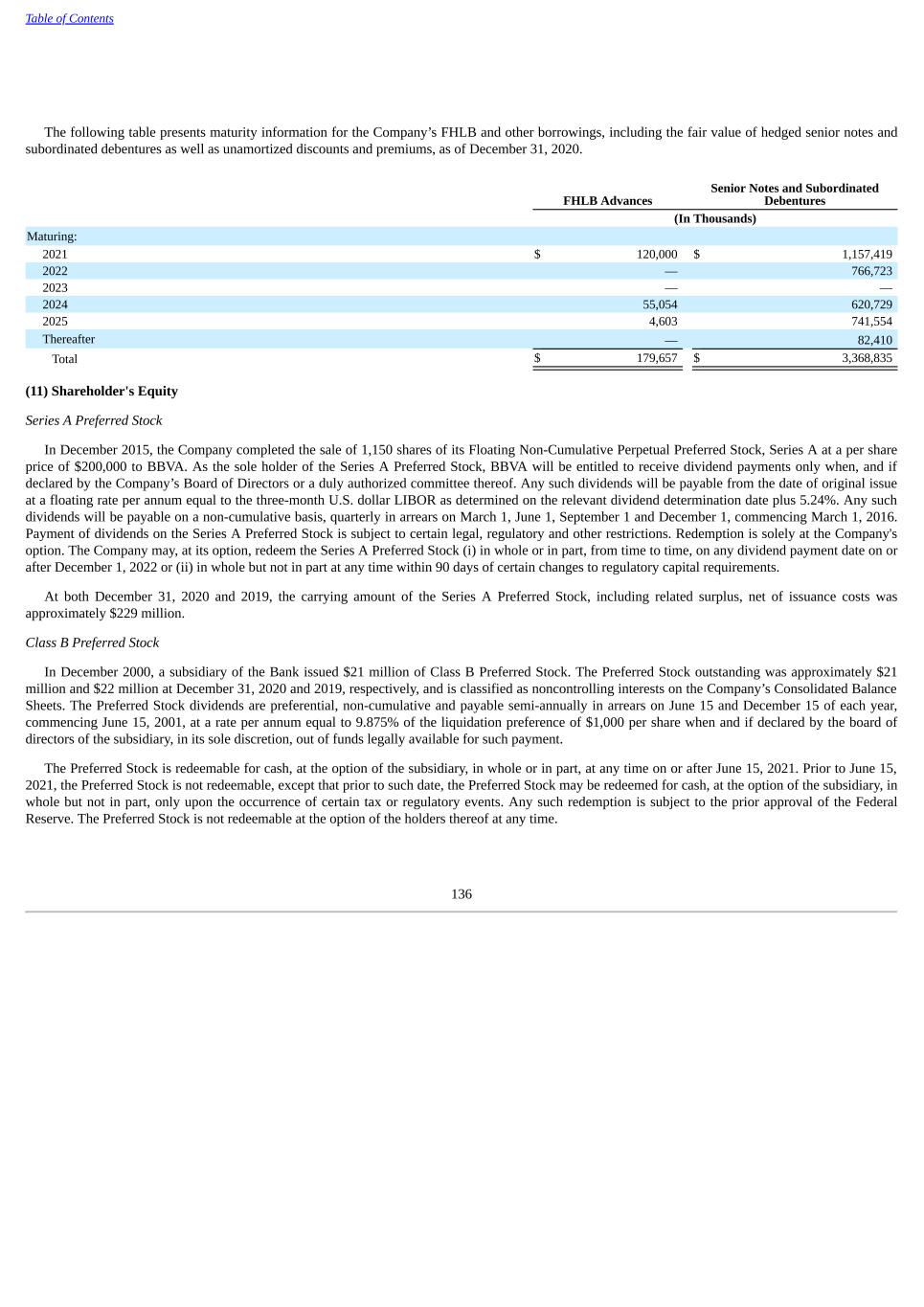

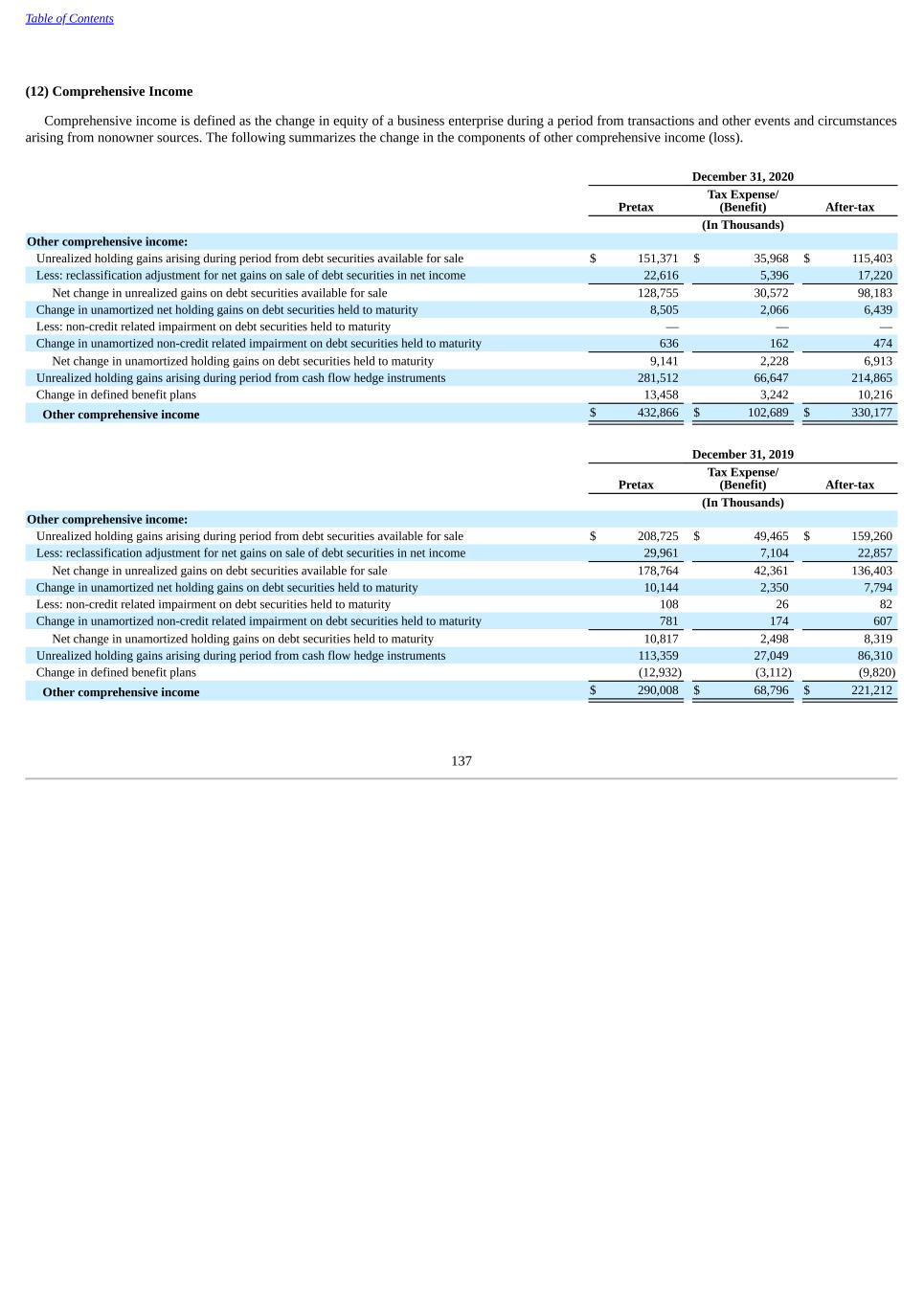

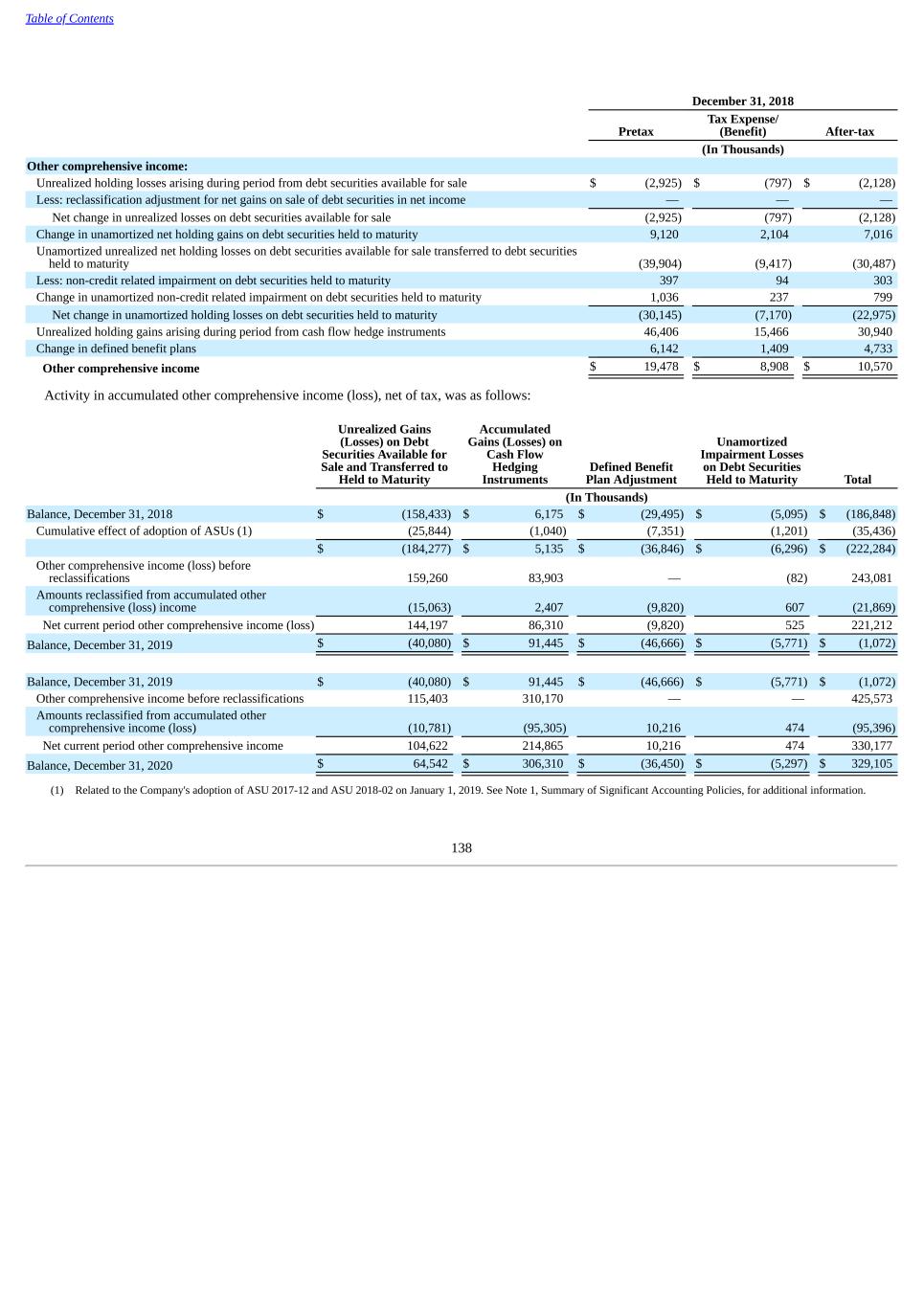

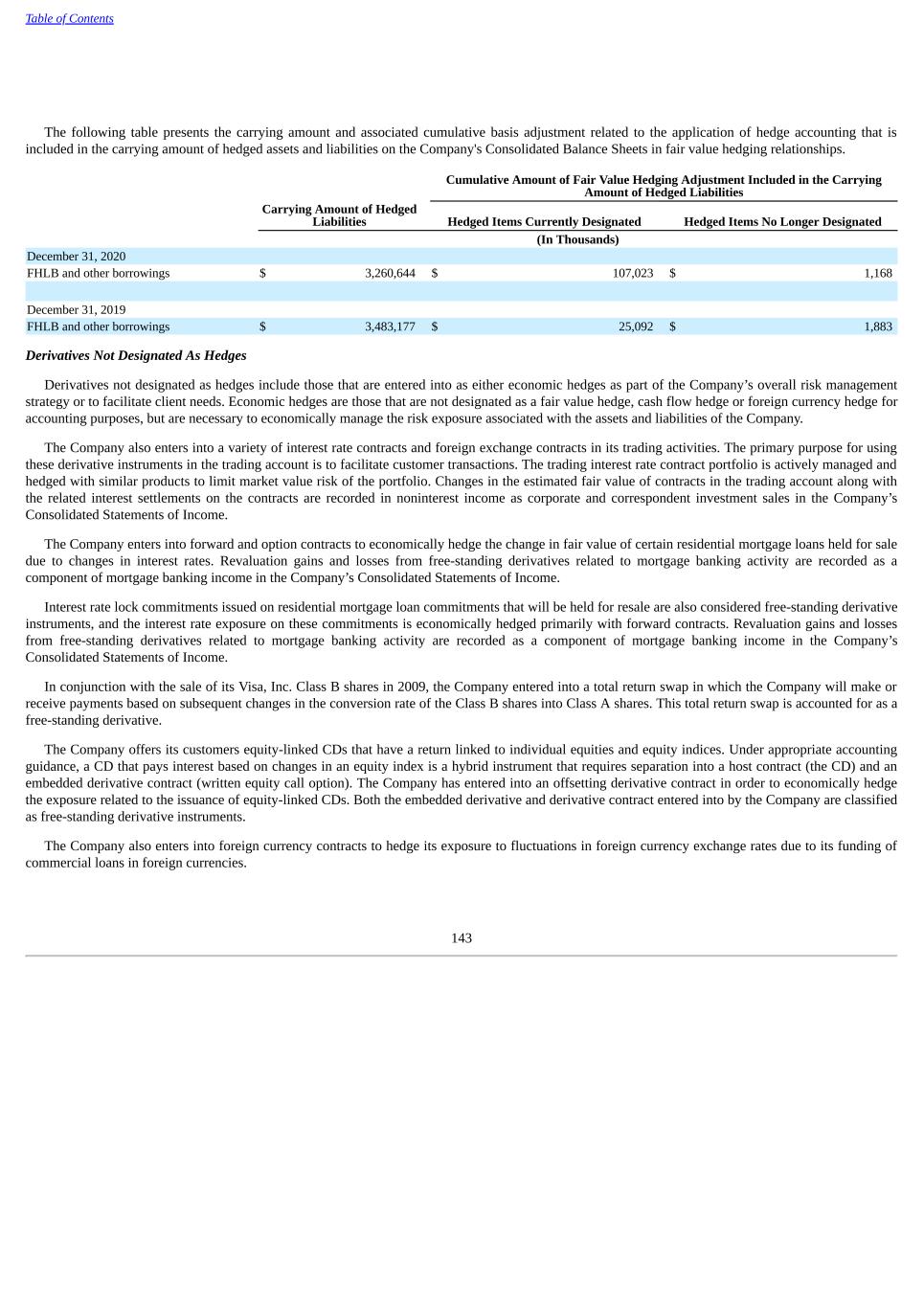

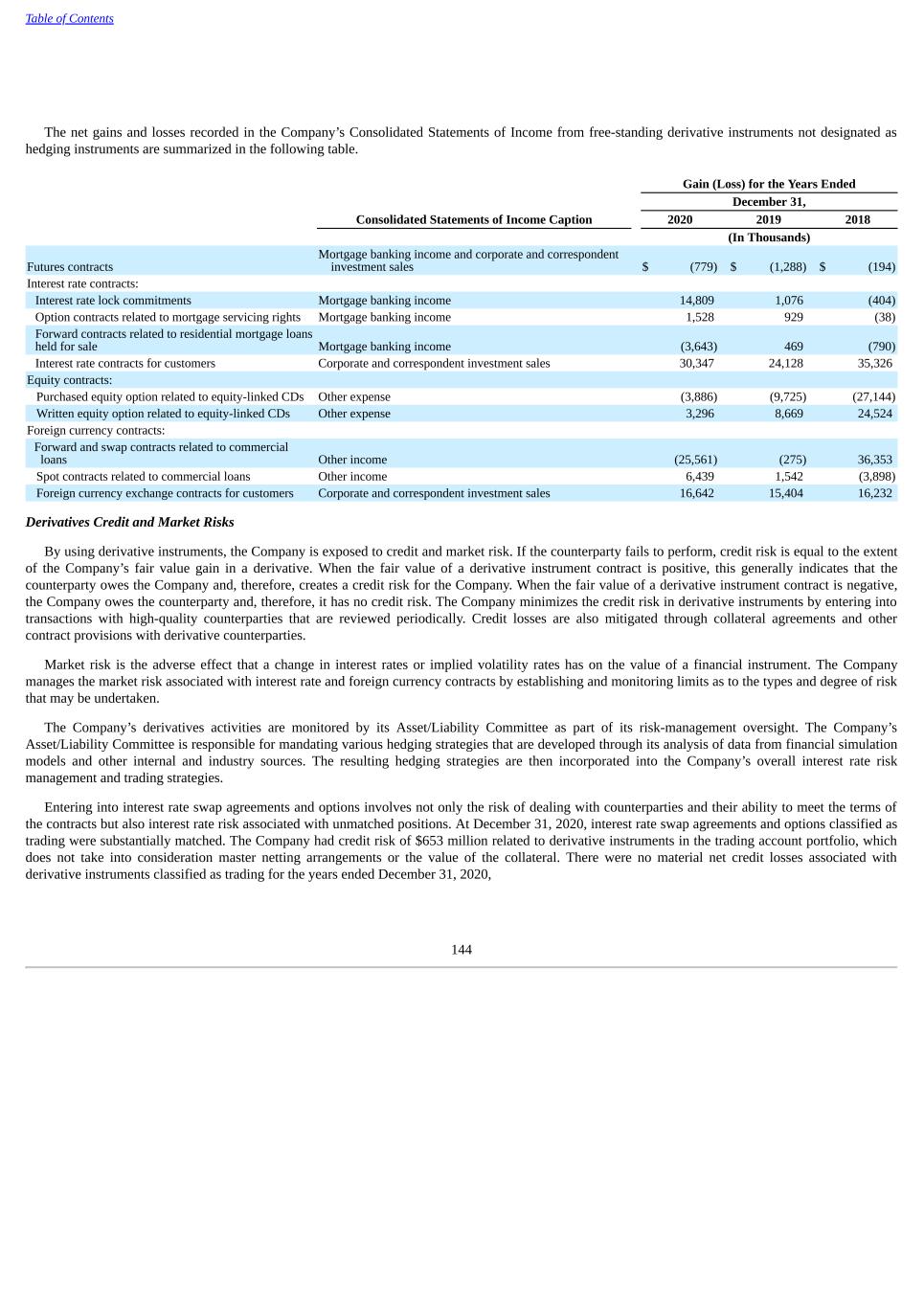

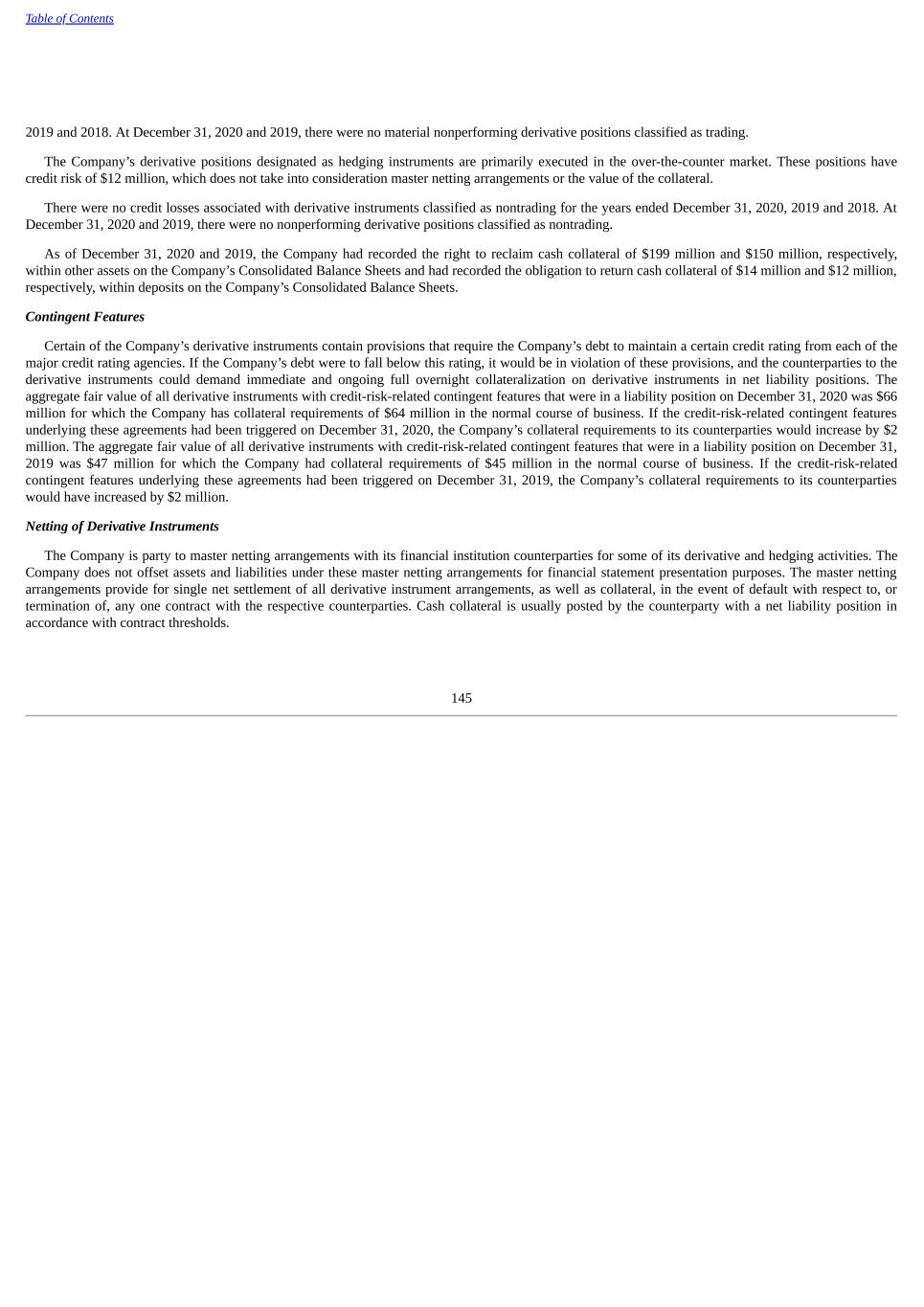

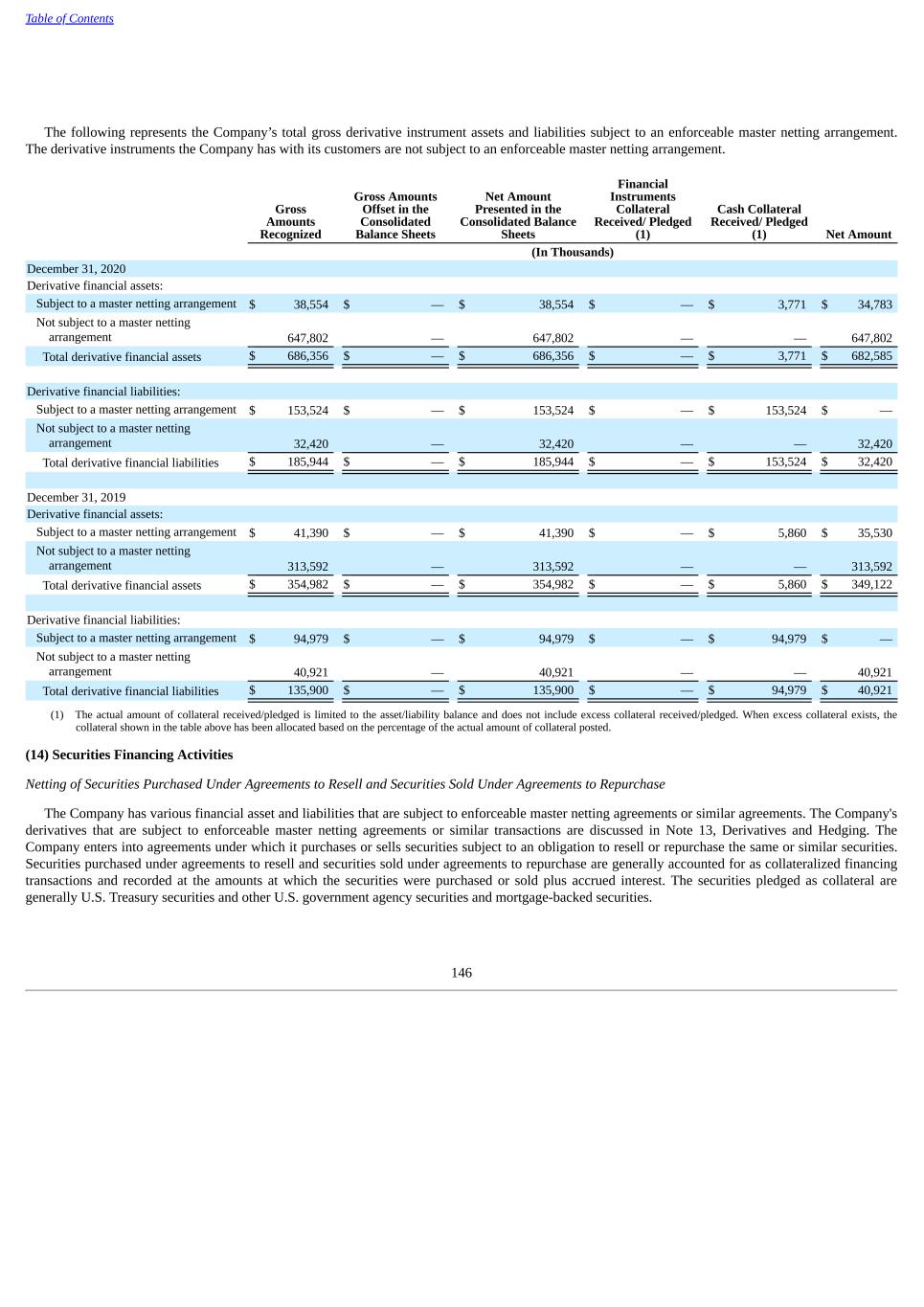

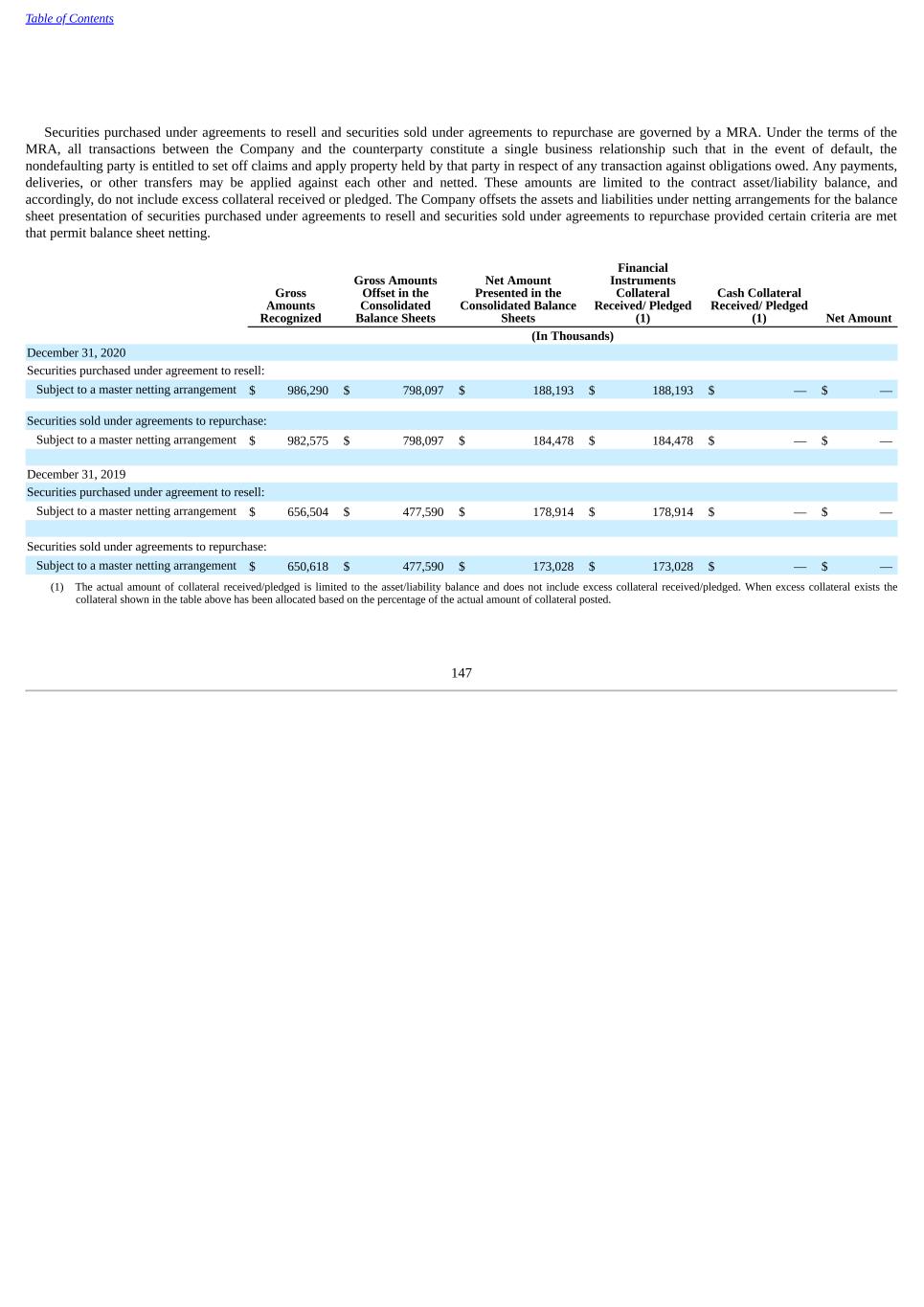

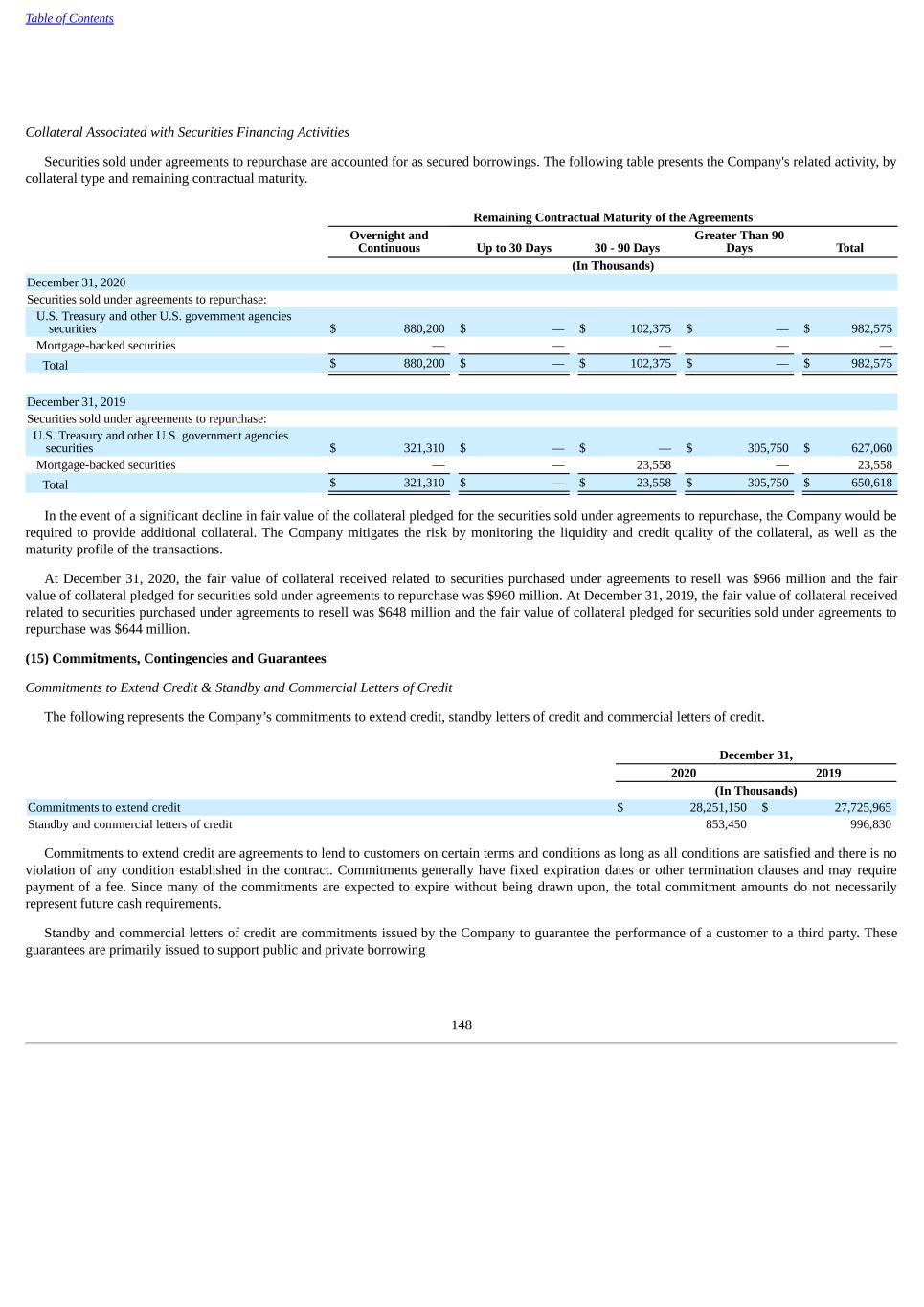

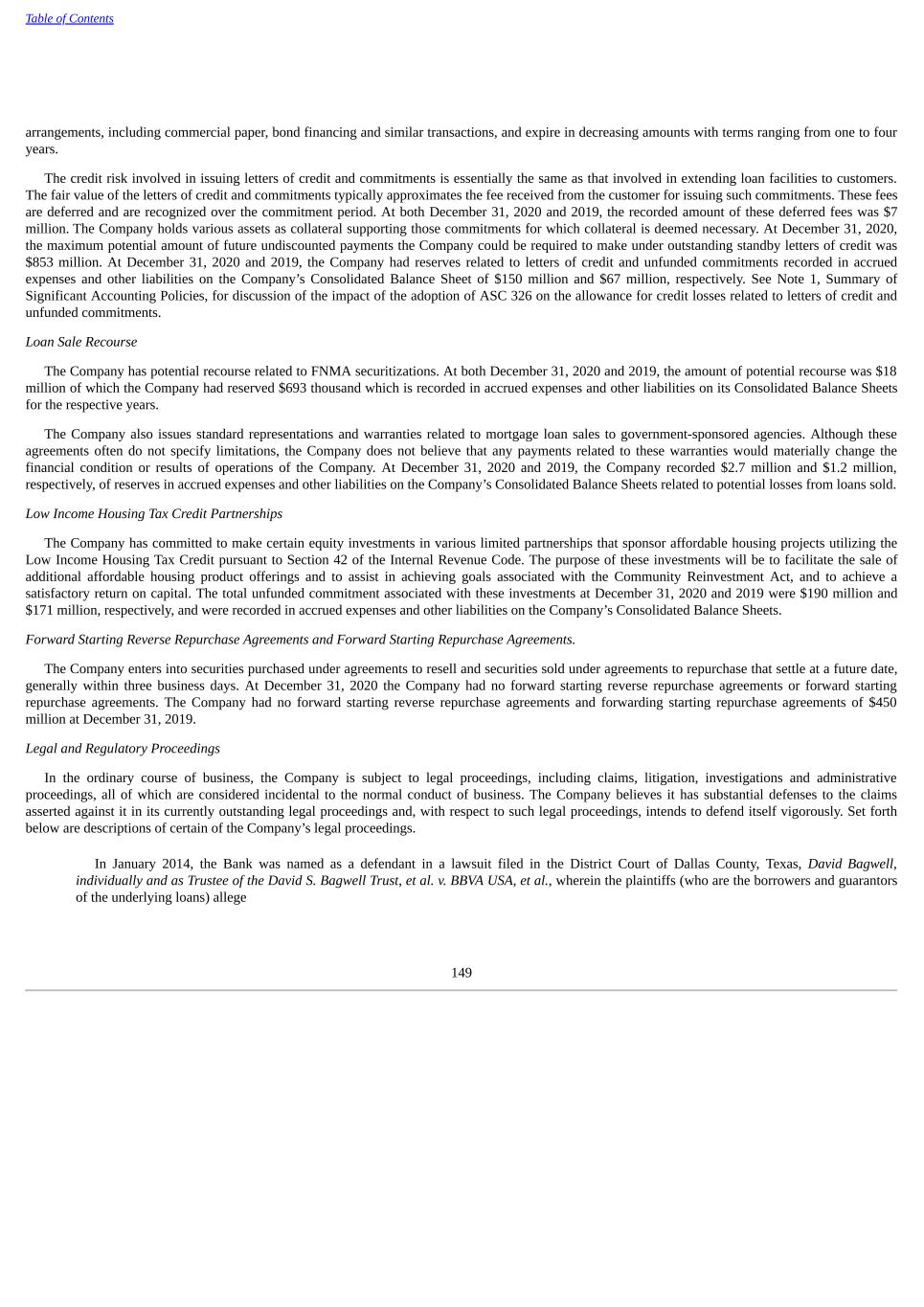

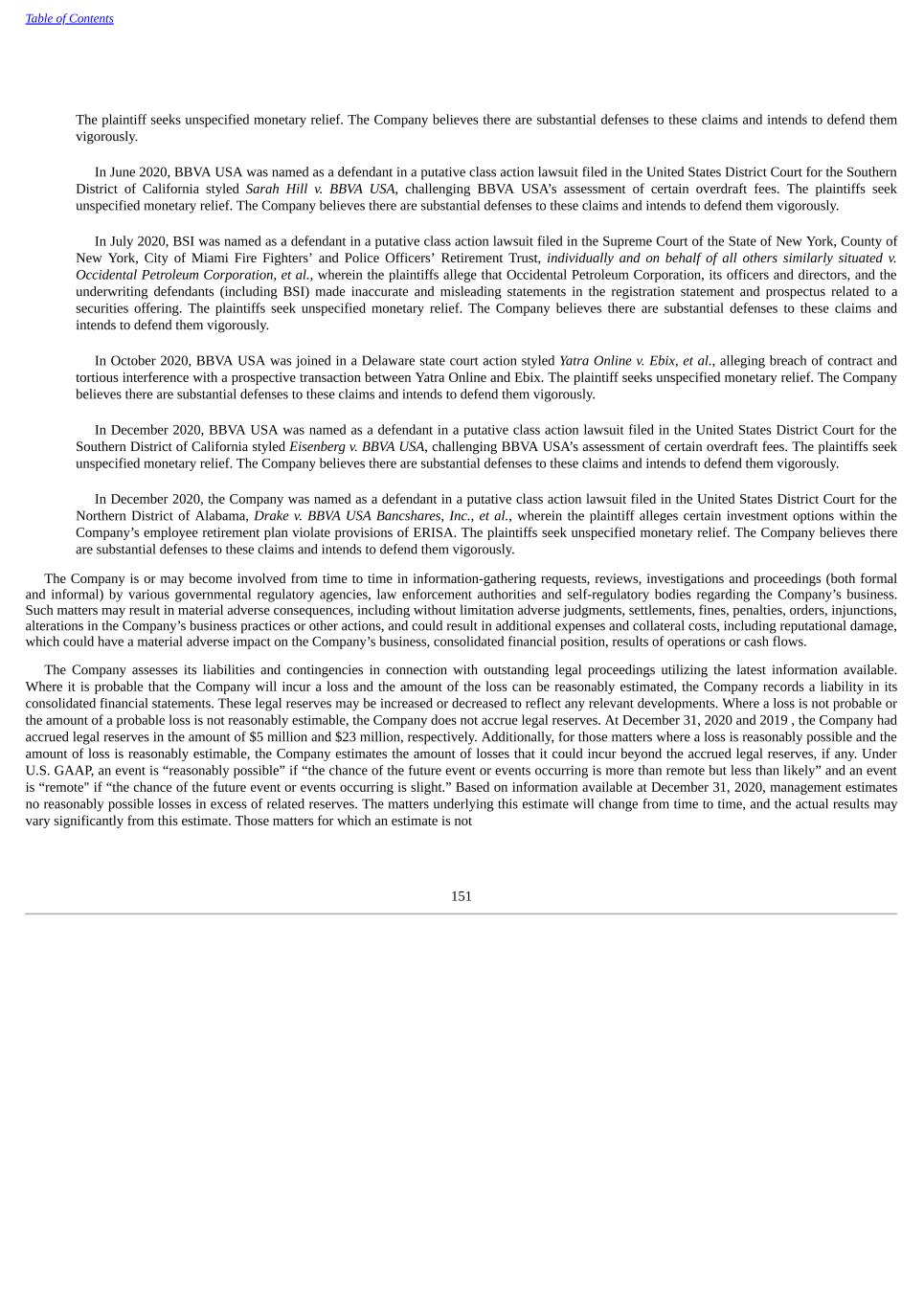

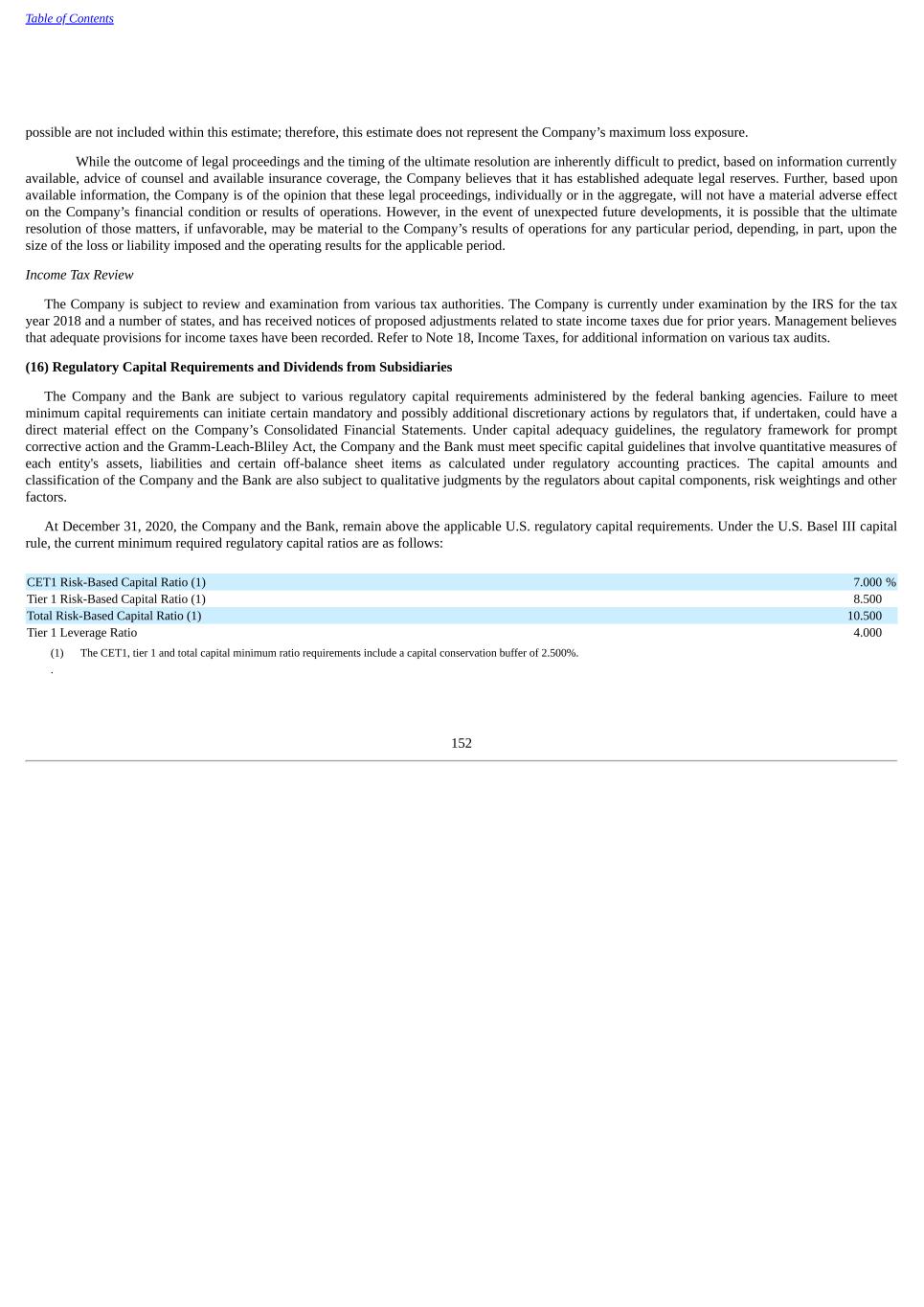

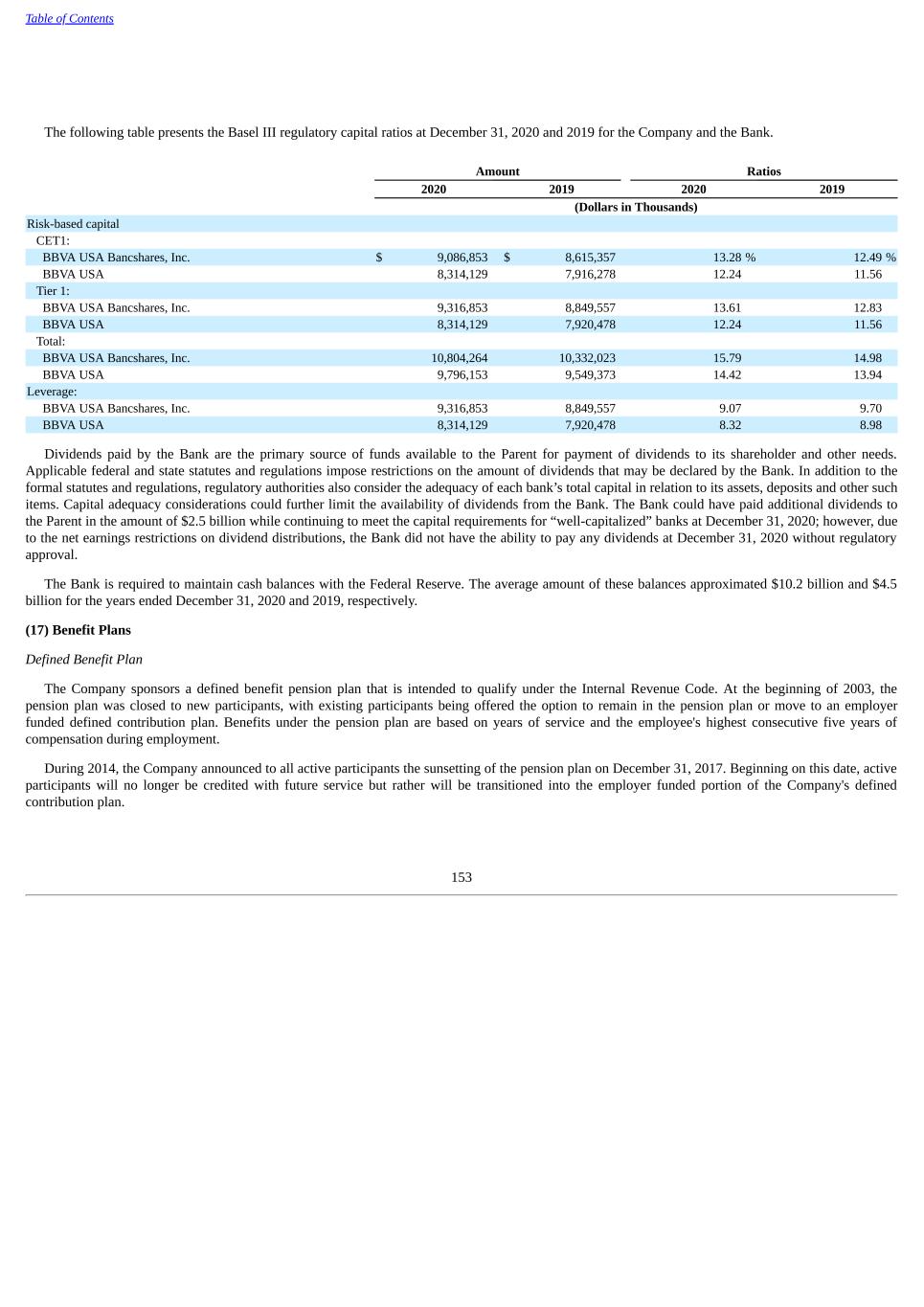

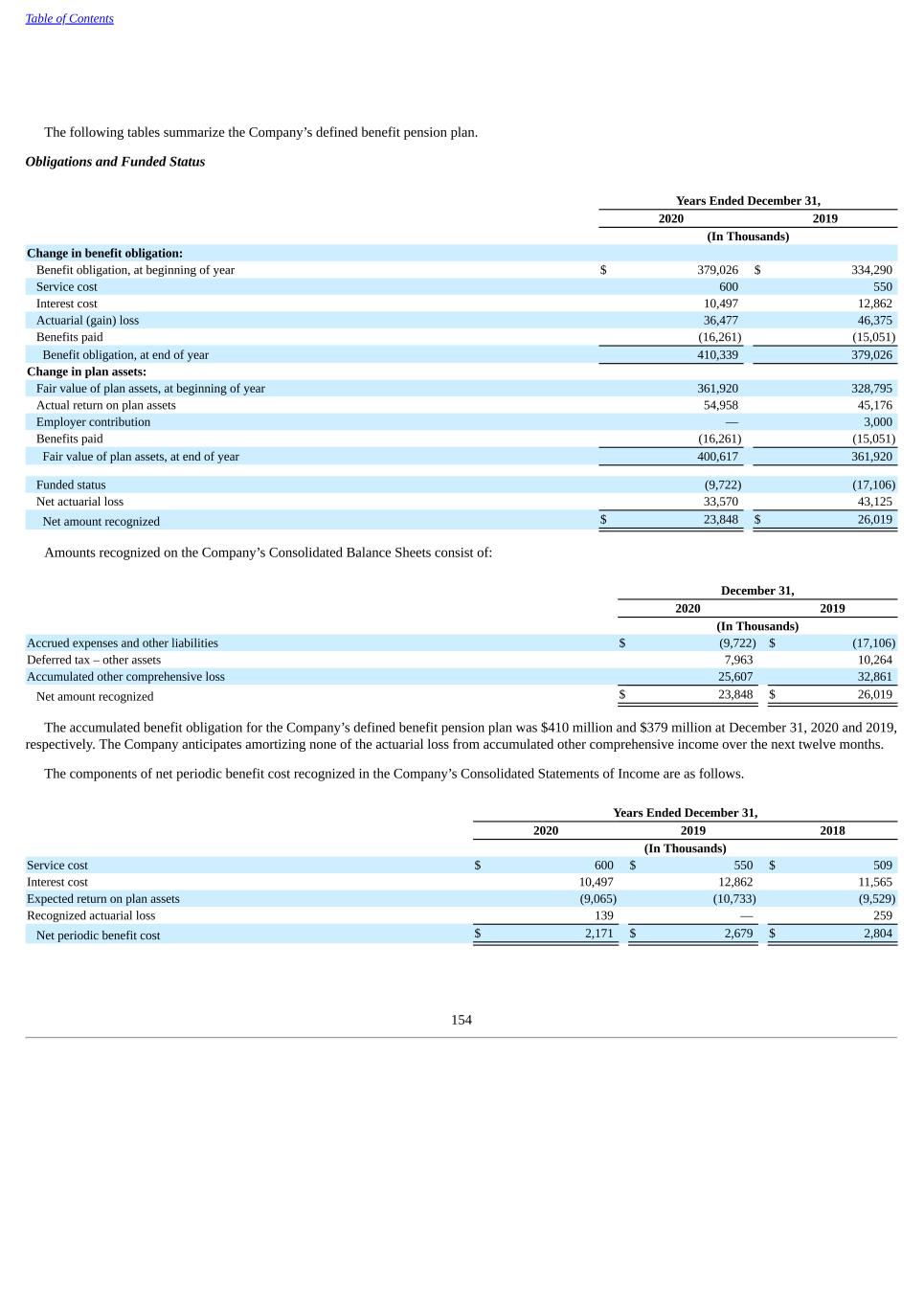

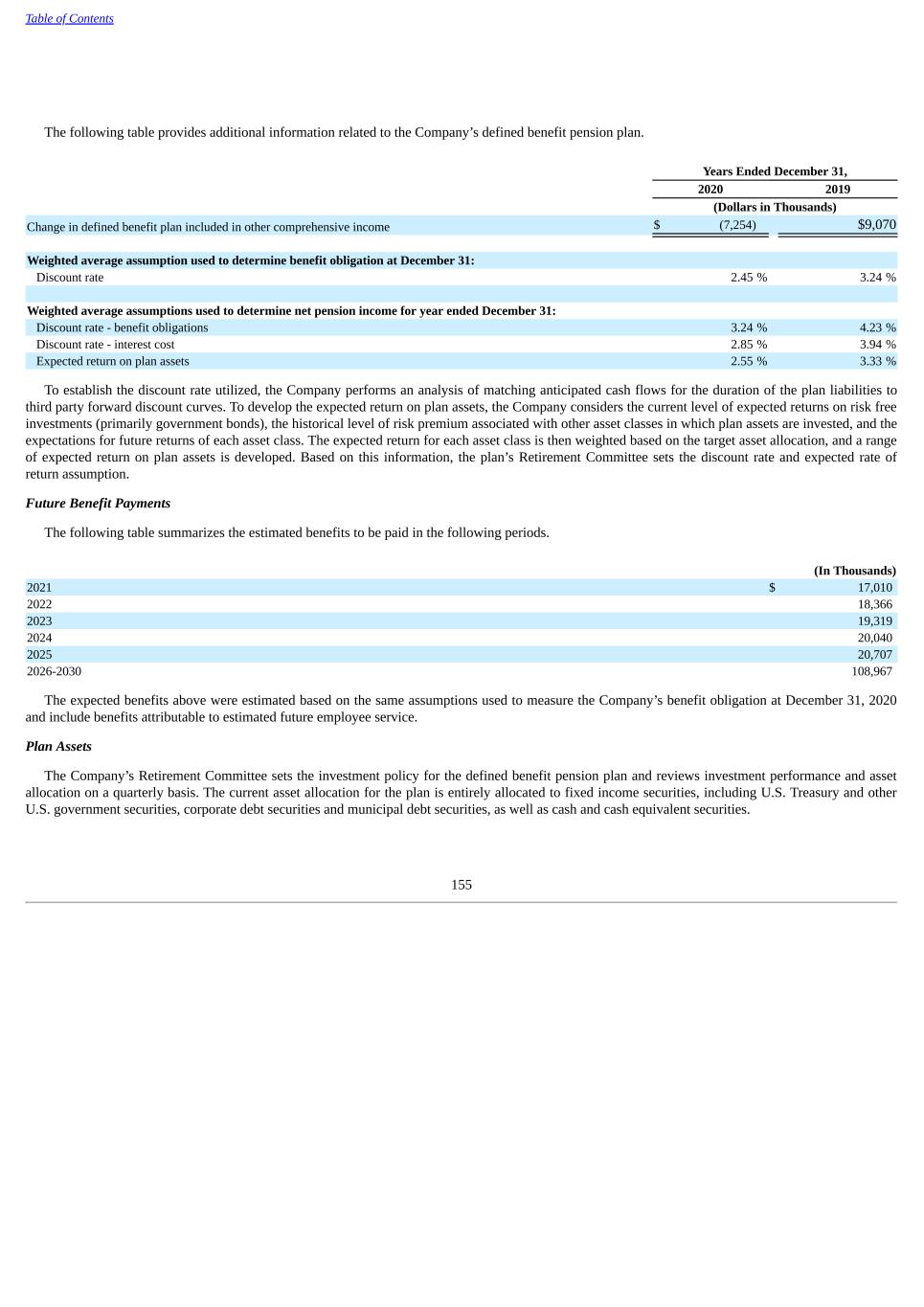

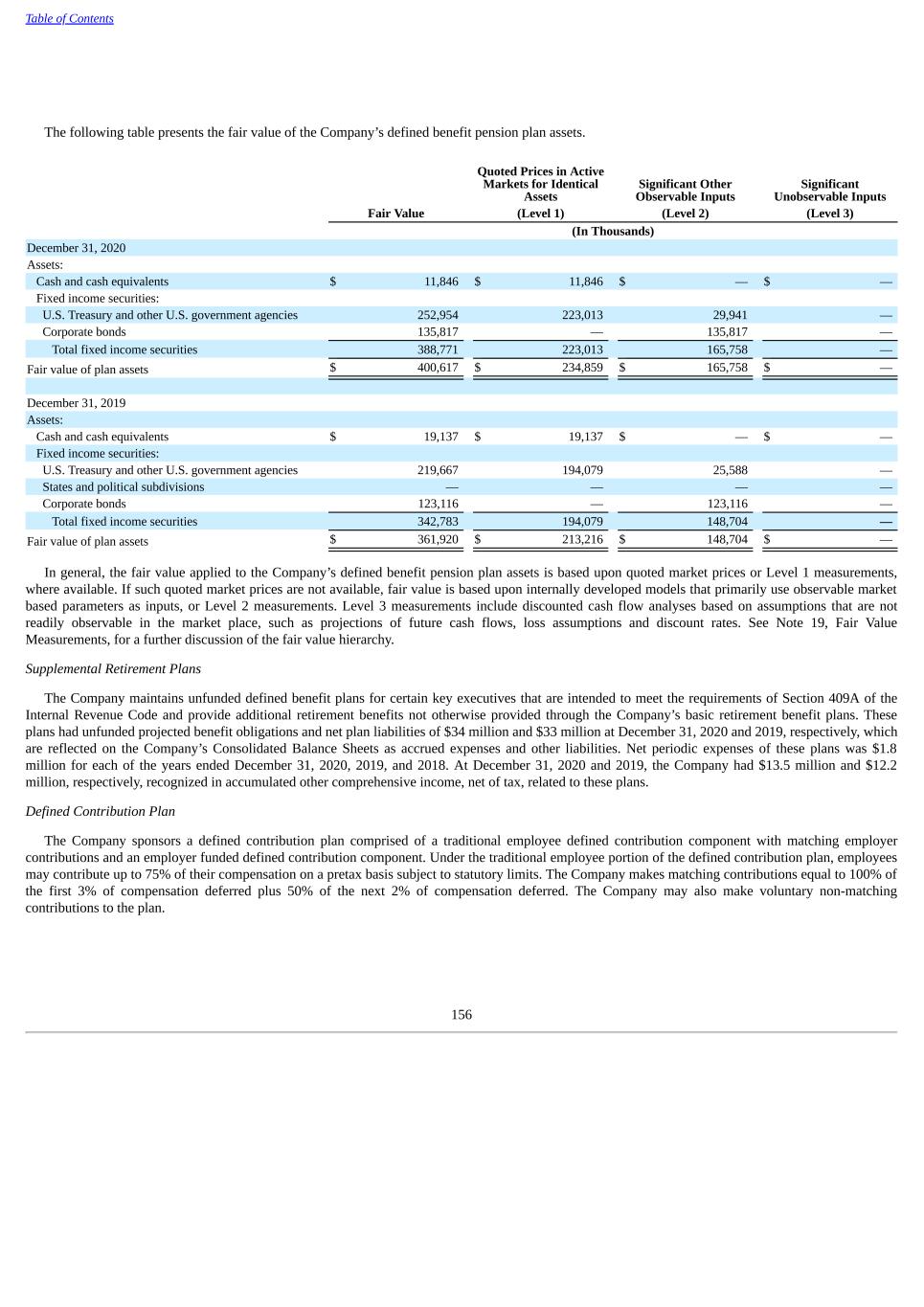

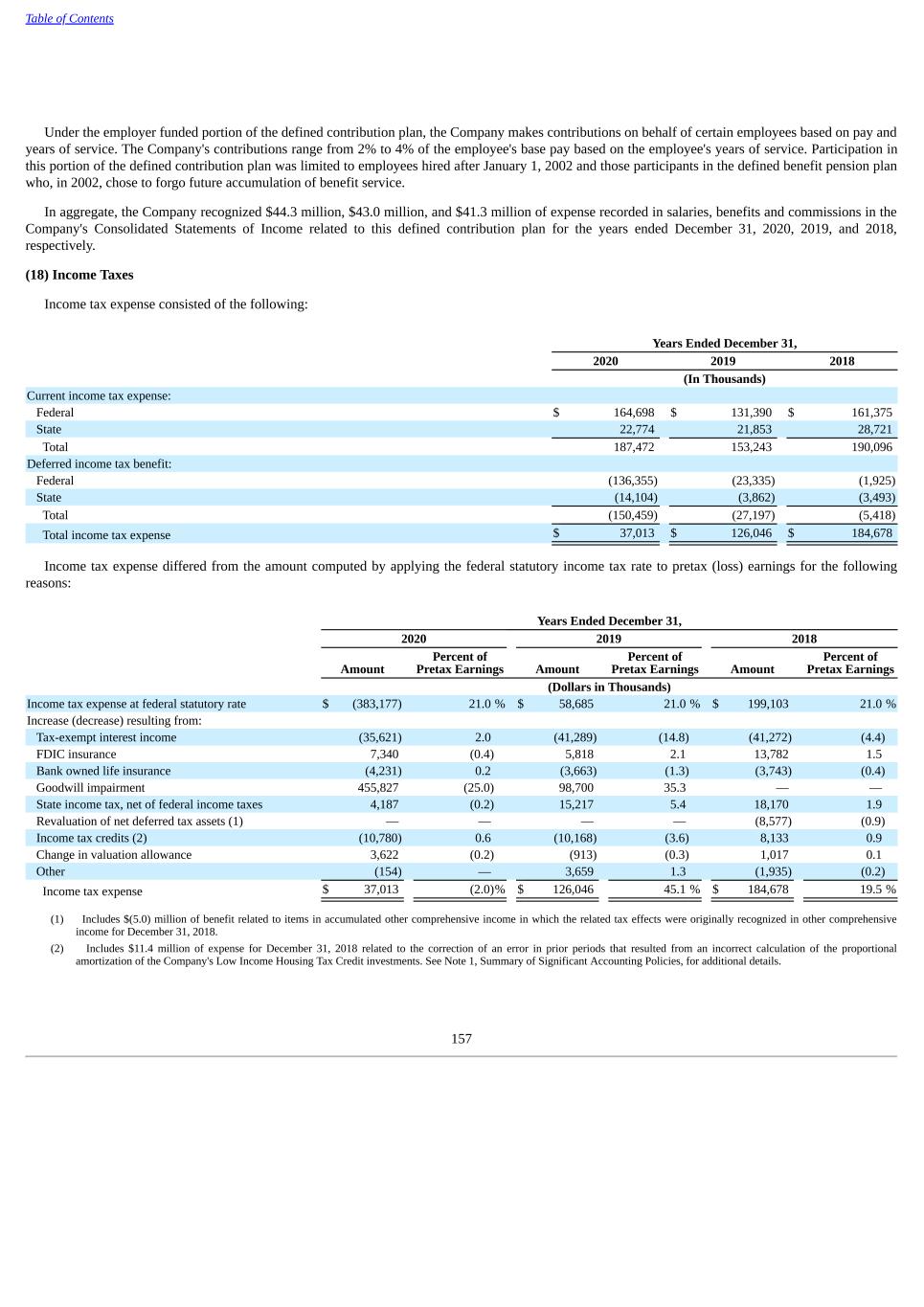

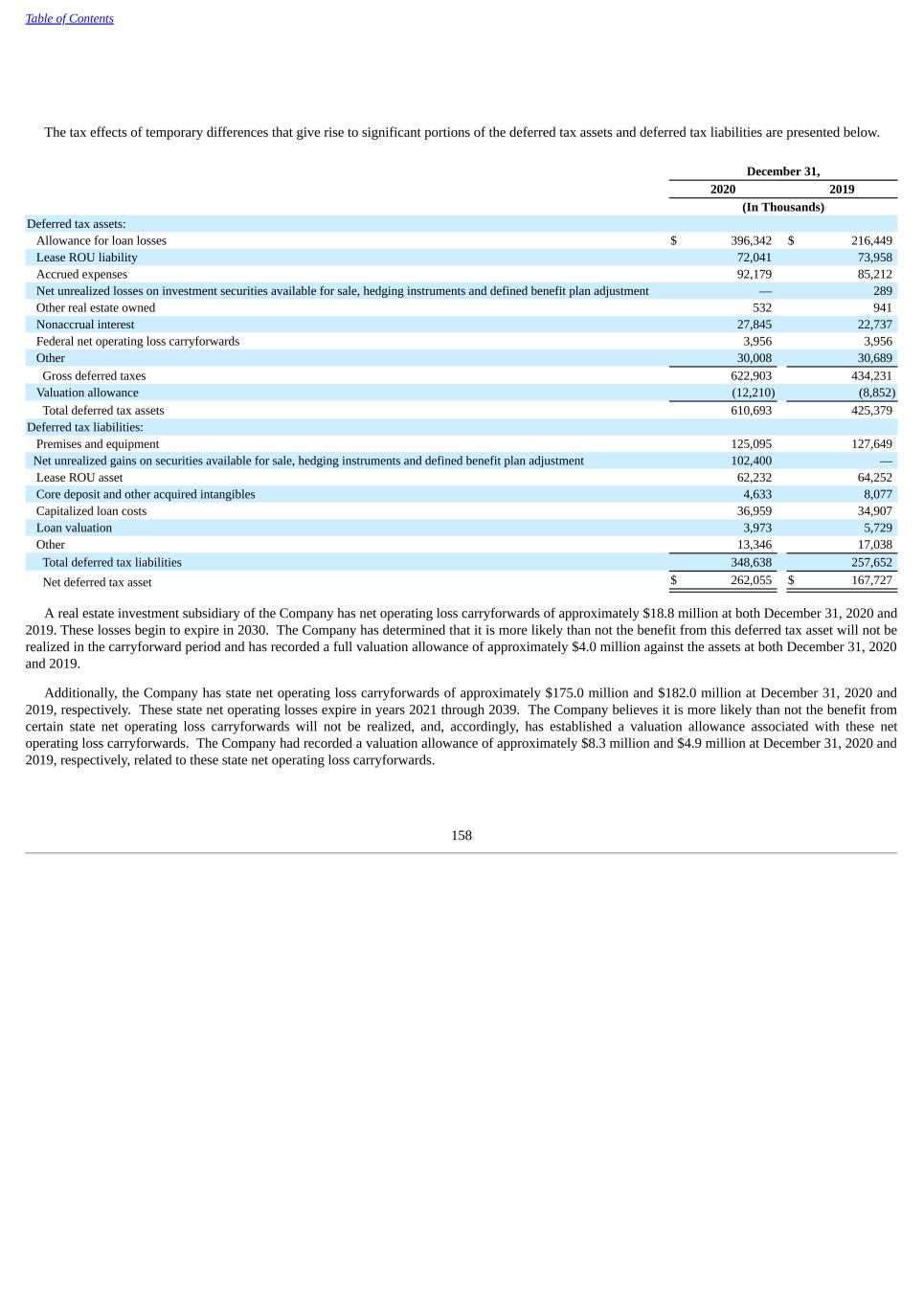

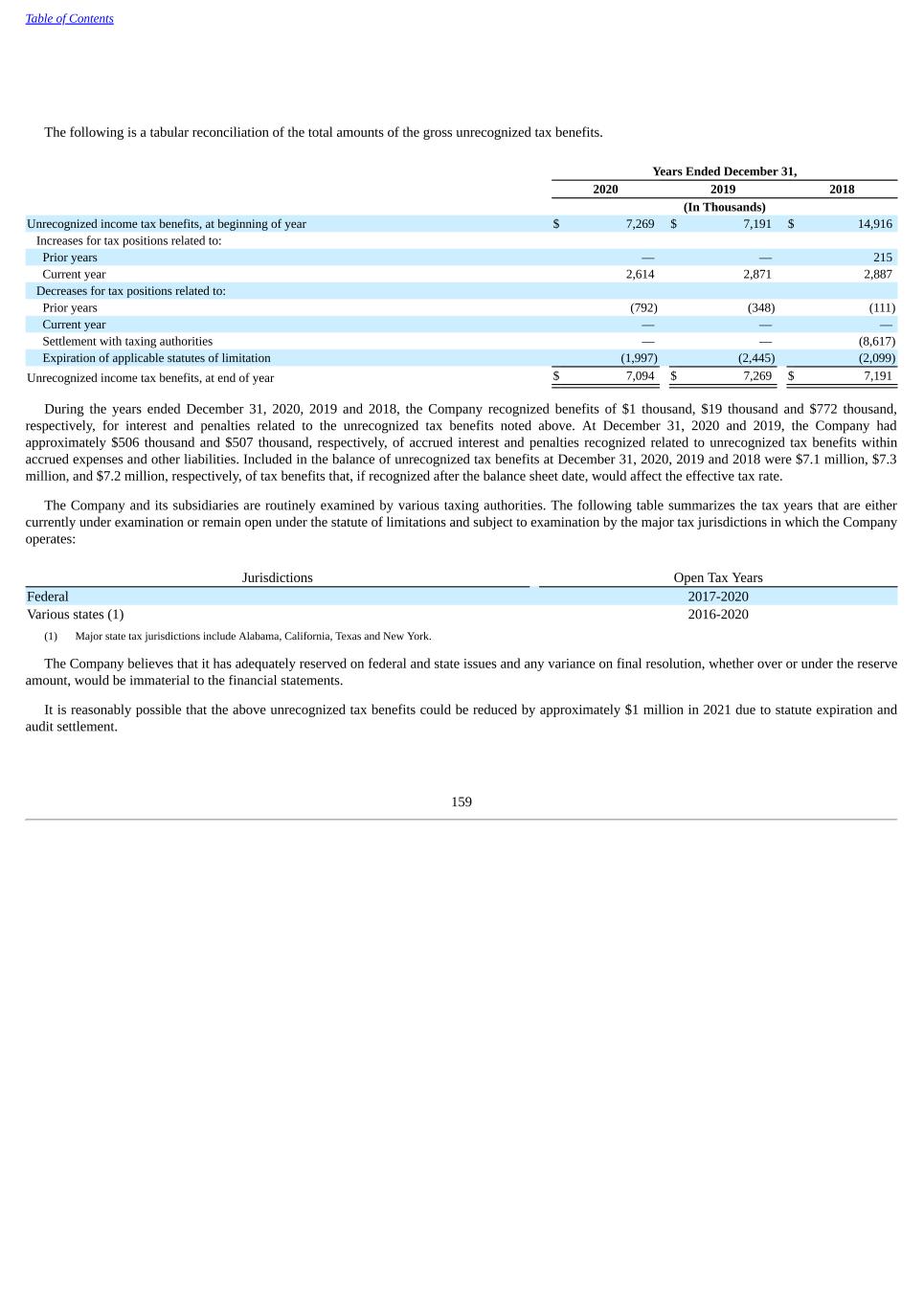

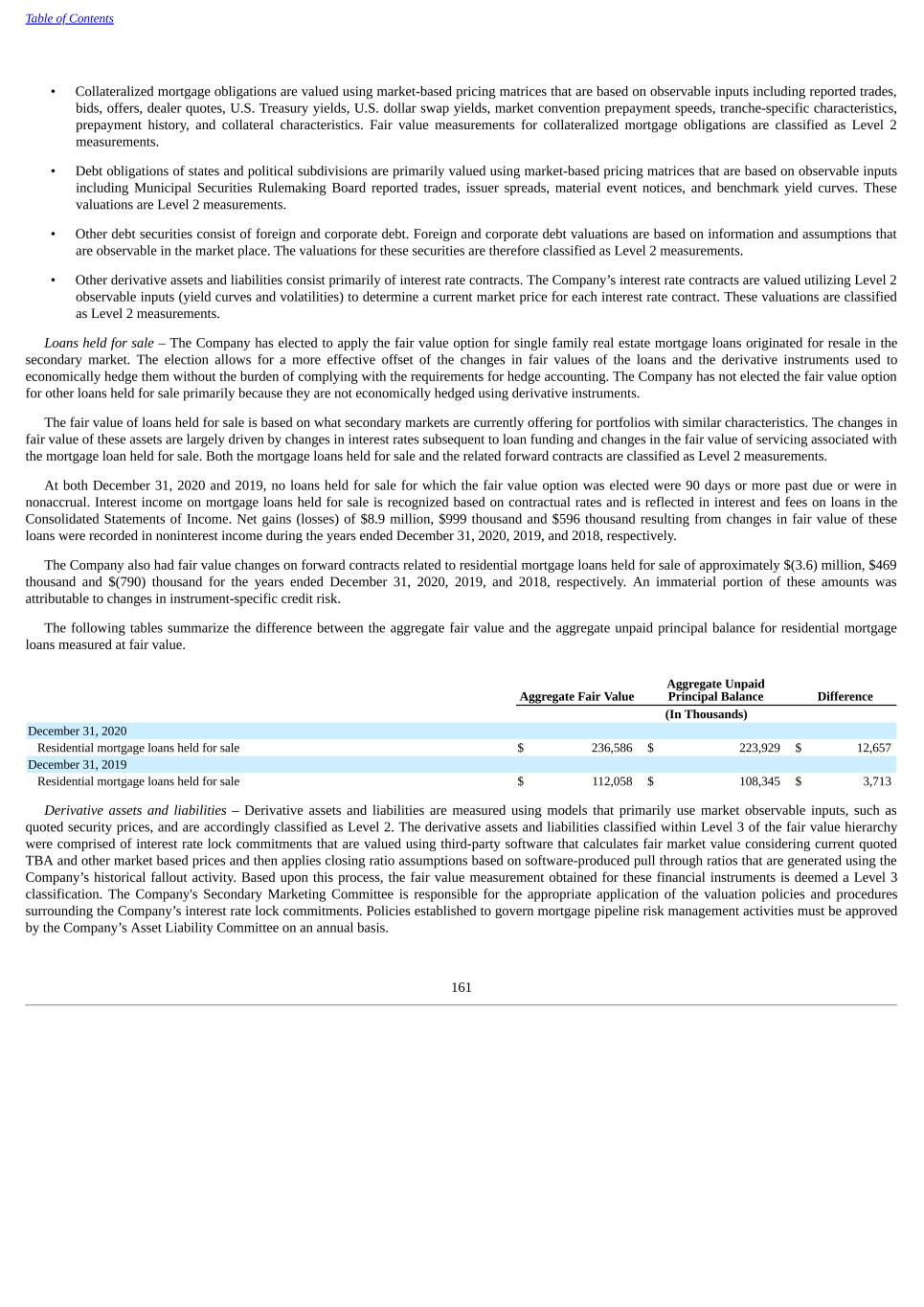

Table of Contents (2) Debt Securities Available for Sale and Debt Securities Held to Maturity The following table presents the adjusted cost and approximate fair value of debt securities available for sale and debt securities held to maturity. As noted in Note 1, Summary of Significant Accounting Policies, the Company adopted ASC 326 on January 1, 2020, which had an immaterial impact on the Company's available for sale debt securities and held to maturity debt securities. December 31, 2020 Gross Unrealized Amortized Cost Gains Losses Fair Value (In Thousands) Debt securities available for sale: U.S. Treasury and other U.S. government agencies $ 2,115,915 $ 45,168 $ 14,179 $ 2,146,904 Agency mortgage-backed securities 834,640 32,103 1,095 865,648 Agency collateralized mortgage obligations 2,681,210 50,811 290 2,731,731 States and political subdivisions 617 19 — 636 Total $ 5,632,382 $ 128,101 $ 15,564 $ 5,744,919 Debt securities held to maturity: U.S. Treasury and other U.S. government agencies $ 1,291,900 $ 112,968 $ — $ 1,404,868 Agency mortgage-backed securities 570,115 2,491 — 572,606 Collateralized mortgage obligations: Agency 8,144,522 147,176 27,234 8,264,464 Non-agency 29,186 5,972 209 34,949 Asset-backed securities and other 48,790 1,217 2,681 47,326 States and political subdivisions (1) 467,610 21,047 3,409 485,248 Total $ 10,552,123 $ 290,871 $ 33,533 $ 10,809,461 (1) The Company recorded an allowance of $2 million, at December 31, 2020, related to state and political subdivisions, which is not included in the table above. December 31, 2019 Gross Unrealized Amortized Cost Gains Losses Fair Value (In Thousands) Debt securities available for sale: U.S. Treasury and other U.S. government agencies $ 3,145,331 $ 16,888 $ 34,694 $ 3,127,525 Agency mortgage-backed securities 1,322,432 12,444 9,019 1,325,857 Agency collateralized mortgage obligations 2,783,003 7,744 9,622 2,781,125 States and political subdivisions 757 41 — 798 Total $ 7,251,523 $ 37,117 $ 53,335 $ 7,235,305 Debt securities held to maturity: U.S. Treasury and other U.S. government agencies $ 1,287,049 $ 53,399 $ — $ 1,340,448 Collateralized mortgage obligations: Agency 4,846,862 82,105 16,568 4,912,399 Non-agency 37,705 5,923 1,154 42,474 Asset-backed securities and other 52,355 1,266 2,017 51,604 States and political subdivisions 573,075 8,652 7,494 574,233 Total $ 6,797,046 $ 151,345 $ 27,233 $ 6,921,158 The investments held within the states and political subdivision caption of debt securities held to maturity relate to private placement transactions underwritten as loans by the Company but meet the definition of a debt security within ASC Topic 320, Investments – Debt Securities. 115