EXHIBIT 99.1

Published on May 21, 2020

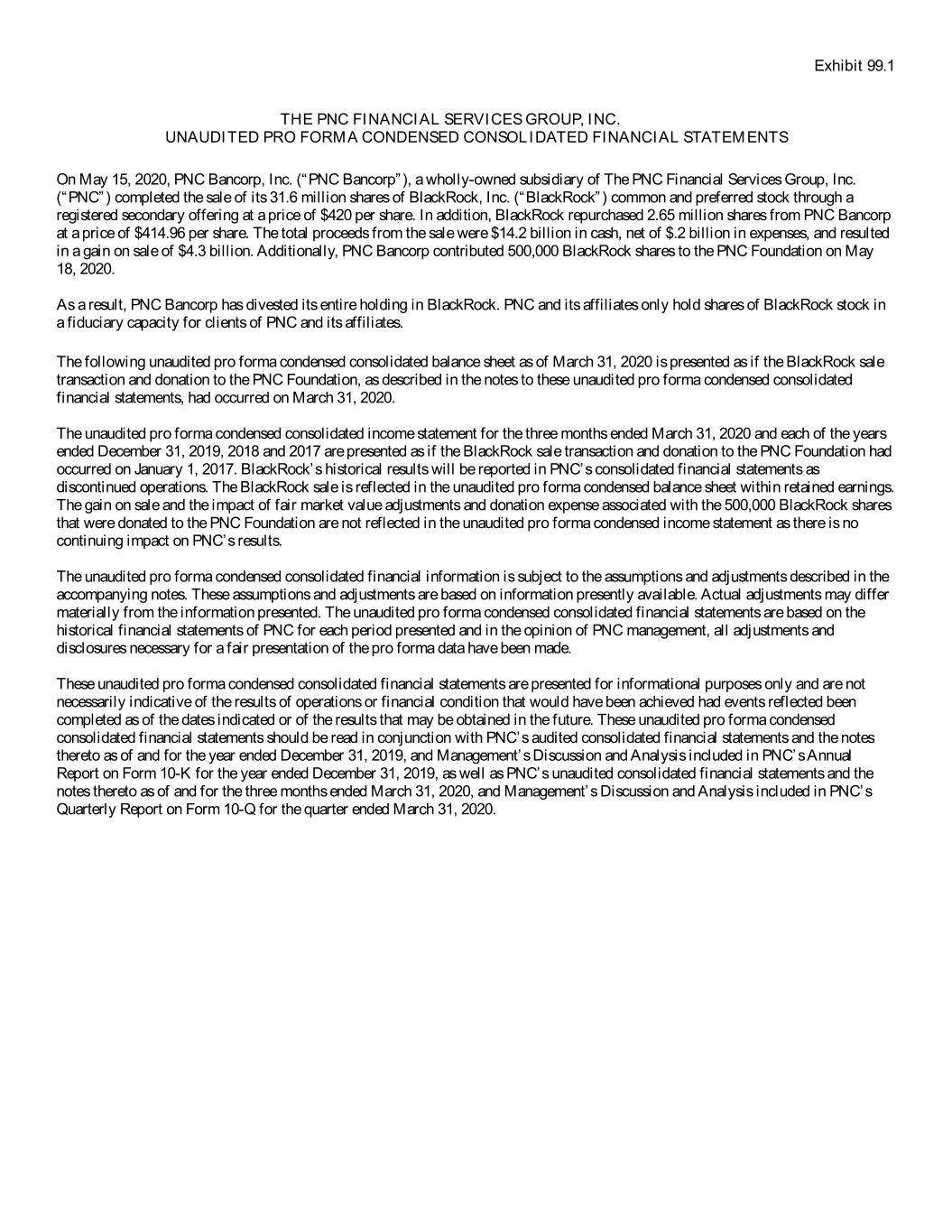

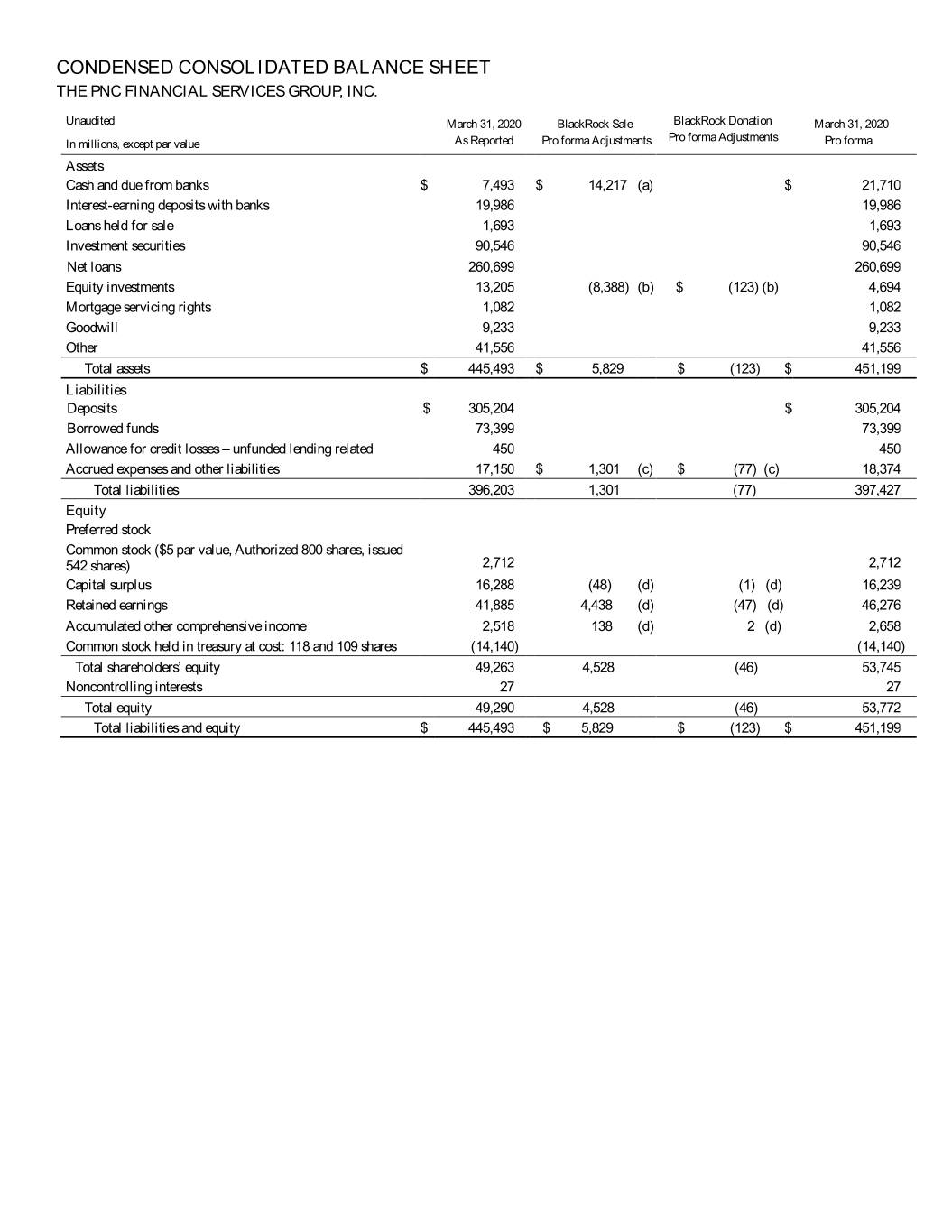

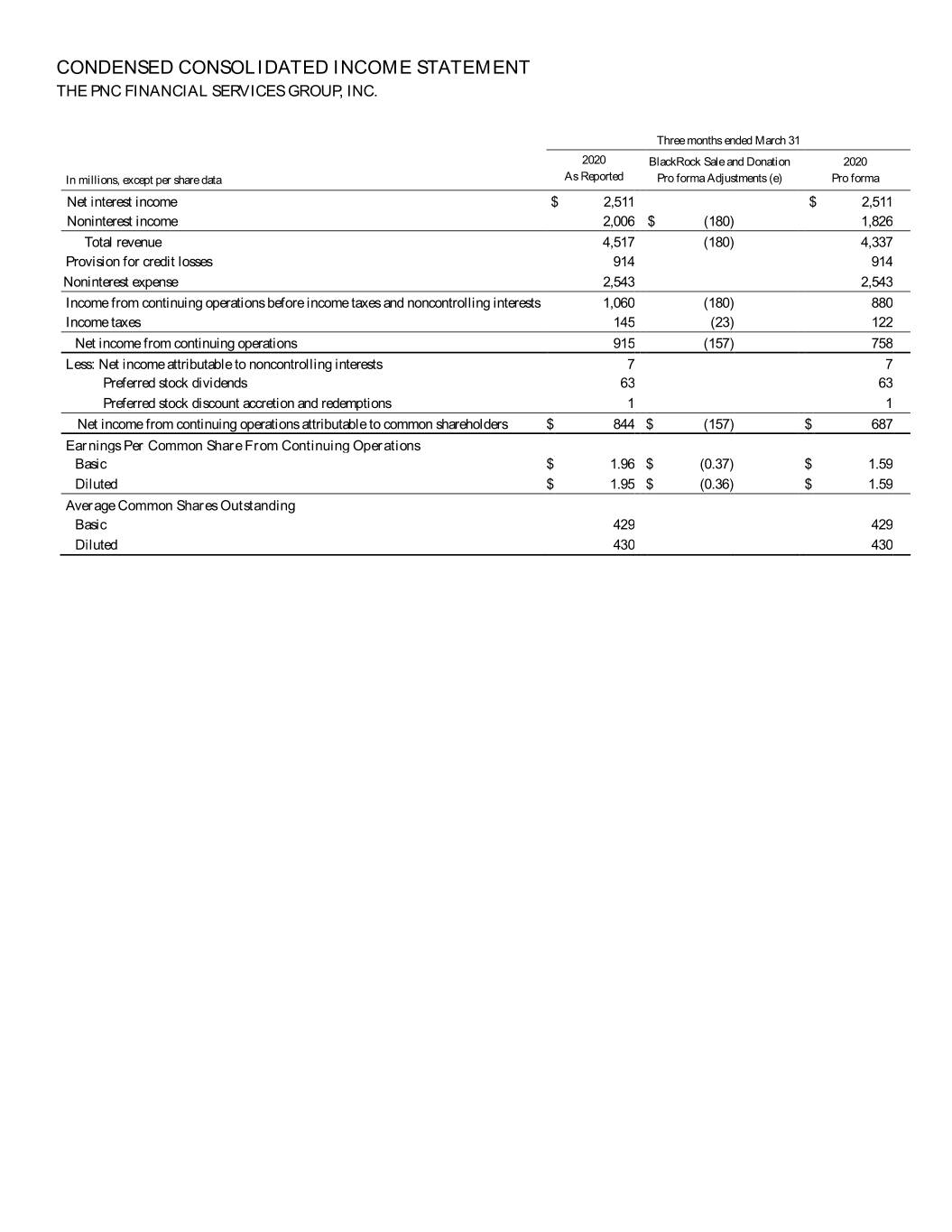

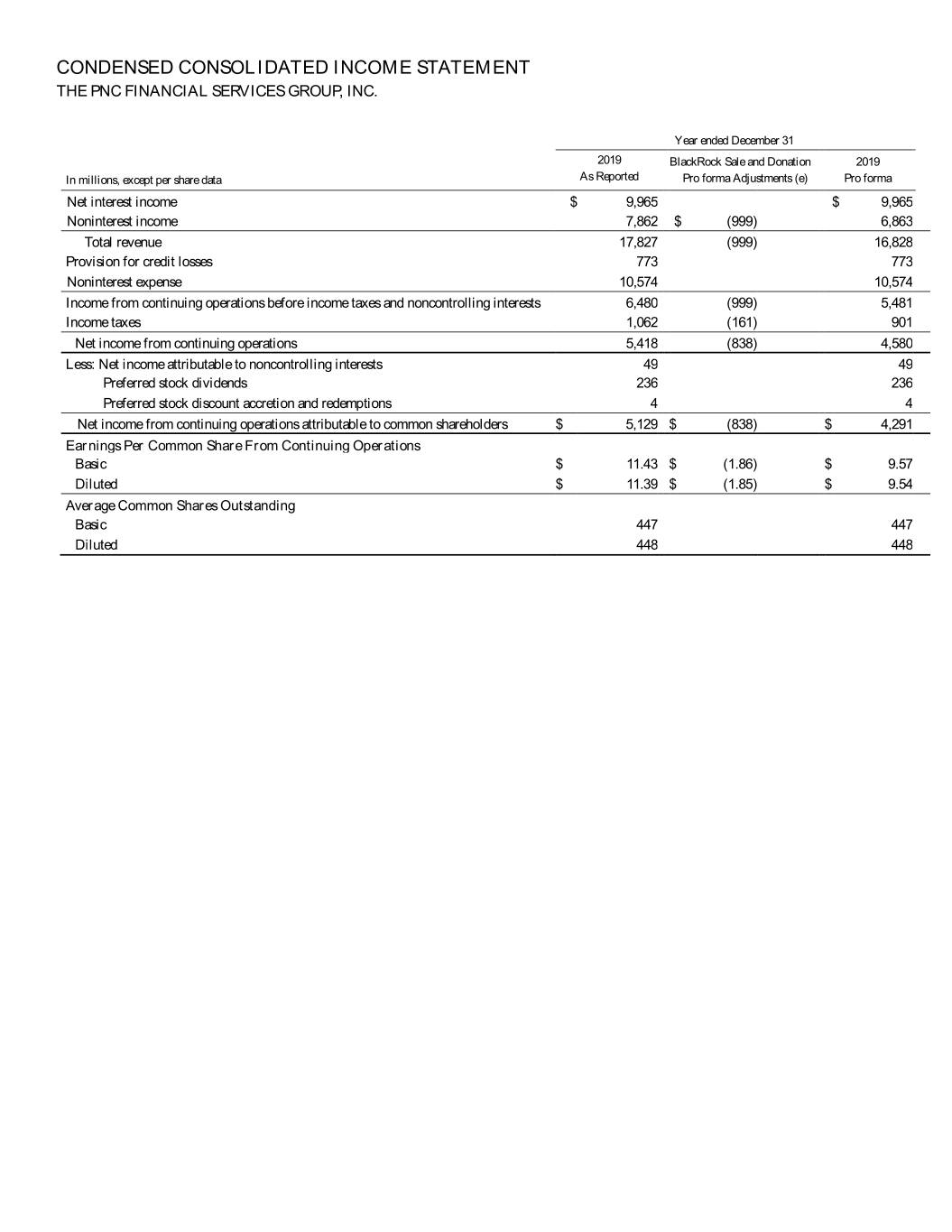

Exhibit 99.1 THE PNC FINANCIAL SERVICES GROUP, INC. UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS On May 15, 2020, PNC Bancorp, Inc. (“PNC Bancorp”), a wholly-owned subsidiary of The PNC Financial Services Group, Inc. (“PNC”) completed the sale of its 31.6 million shares of BlackRock, Inc. (“BlackRock”) common and preferred stock through a registered secondary offering at a price of $420 per share. In addition, BlackRock repurchased 2.65 million shares from PNC Bancorp at a price of $414.96 per share. The total proceeds from the sale were $14.2 billion in cash, net of $.2 billion in expenses, and resulted in a gain on sale of $4.3 billion. Additionally, PNC Bancorp contributed 500,000 BlackRock shares to the PNC Foundation on May 18, 2020. As a result, PNC Bancorp has divested its entire holding in BlackRock. PNC and its affiliates only hold shares of BlackRock stock in a fiduciary capacity for clients of PNC and its affiliates. The following unaudited pro forma condensed consolidated balance sheet as of March 31, 2020 is presented as if the BlackRock sale transaction and donation to the PNC Foundation, as described in the notes to these unaudited pro forma condensed consolidated financial statements, had occurred on March 31, 2020. The unaudited pro forma condensed consolidated income statement for the three months ended March 31, 2020 and each of the years ended December 31, 2019, 2018 and 2017 are presented as if the BlackRock sale transaction and donation to the PNC Foundation had occurred on January 1, 2017. BlackRock’s historical results will be reported in PNC’s consolidated financial statements as discontinued operations. The BlackRock sale is reflected in the unaudited pro forma condensed balance sheet within retained earnings. The gain on sale and the impact of fair market value adjustments and donation expense associated with the 500,000 BlackRock shares that were donated to the PNC Foundation are not reflected in the unaudited pro forma condensed income statement as there is no continuing impact on PNC’s results. The unaudited pro forma condensed consolidated financial information is subject to the assumptions and adjustments described in the accompanying notes. These assumptions and adjustments are based on information presently available. Actual adjustments may differ materially from the information presented. The unaudited pro forma condensed consolidated financial statements are based on the historical financial statements of PNC for each period presented and in the opinion of PNC management, all adjustments and disclosures necessary for a fair presentation of the pro forma data have been made. These unaudited pro forma condensed consolidated financial statements are presented for informational purposes only and are not necessarily indicative of the results of operations or financial condition that would have been achieved had events reflected been completed as of the dates indicated or of the results that may be obtained in the future. These unaudited pro forma condensed consolidated financial statements should be read in conjunction with PNC’s audited consolidated financial statements and the notes thereto as of and for the year ended December 31, 2019, and Management’s Discussion and Analysis included in PNC’s Annual Report on Form 10-K for the year ended December 31, 2019, as well as PNC’s unaudited consolidated financial statements and the notes thereto as of and for the three months ended March 31, 2020, and Management’s Discussion and Analysis included in PNC’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020.

CONDENSED CONSOLIDATED BALANCE SHEET THE PNC FINANCIAL SERVICES GROUP, INC. Unaudited March 31, 2020 BlackRock Sale BlackRock Donation March 31, 2020 Pro forma Adjustments In millions, except par value As Reported Pro forma Adjustments Pro forma Assets Cash and due from banks $ 7,493 $ 14,217 (a) $ 21,710 Interest-earning deposits with banks 19,986 19,986 Loans held for sale 1,693 1,693 Investment securities 90,546 90,546 Net loans 260,699 260,699 Equity investments 13,205 (8,388) (b) $ (123) (b) 4,694 Mortgage servicing rights 1,082 1,082 Goodwill 9,233 9,233 Other 41,556 41,556 Total assets $ 445,493 $ 5,829 $ (123) $ 451,199 Liabilities Deposits $ 305,204 $ 305,204 Borrowed funds 73,399 73,399 Allowance for credit losses – unfunded lending related 450 450 Accrued expenses and other liabilities 17,150 $ 1,301 (c) $ (77) (c) 18,374 Total liabilities 396,203 1,301 (77) 397,427 Equity Preferred stock Common stock ($5 par value, Authorized 800 shares, issued 542 shares) 2,712 2,712 Capital surplus 16,288 (48) (d) (1) (d) 16,239 Retained earnings 41,885 4,438 (d) (47) (d) 46,276 Accumulated other comprehensive income 2,518 138 (d) 2 (d) 2,658 Common stock held in treasury at cost: 118 and 109 shares (14,140 ) (14,140 ) Total shareholders’ equity 49,263 4,528 (46) 53,745 Noncontrolling interests 27 27 Total equity 49,290 4,528 (46) 53,772 Total liabilities and equity $ 445,493 $ 5,829 $ (123) $ 451,199

CONDENSED CONSOLIDATED INCOME STATEMENT THE PNC FINANCIAL SERVICES GROUP, INC. Three months ended March 31 2020 BlackRock Sale and Donation 2020 In millions, except per share data As Reported Pro forma Adjustments (e) Pro forma Net interest income $ 2,511 $ 2,511 Noninterest income 2,006 $ (180) 1,826 Total revenue 4,517 (180) 4,337 Provision for credit losses 914 914 Noninterest expense 2,543 2,543 Income from continuing operations before income taxes and noncontrolling interests 1,060 (180) 880 Income taxes 145 (23) 122 Net income from continuing operations 915 (157) 758 Less: Net income attributable to noncontrolling interests 7 7 Preferred stock dividends 63 63 Preferred stock discount accretion and redemptions 1 1 Net income from continuing operations attributable to common shareholders $ 844 $ (157) $ 687 Earnings Per Common Share From Continuing Operations Basic $ 1.96 $ (0.37) $ 1.59 Diluted $ 1.95 $ (0.36) $ 1.59 Average Common Shares Outstanding Basic 429 429 Diluted 430 430

CONDENSED CONSOLIDATED INCOME STATEMENT THE PNC FINANCIAL SERVICES GROUP, INC. Year ended December 31 2019 BlackRock Sale and Donation 2019 In millions, except per share data As Reported Pro forma Adjustments (e) Pro forma Net interest income $ 9,965 $ 9,965 Noninterest income 7,862 $ (999) 6,863 Total revenue 17,827 (999) 16,828 Provision for credit losses 773 773 Noninterest expense 10,574 10,574 Income from continuing operations before income taxes and noncontrolling interests 6,480 (999) 5,481 Income taxes 1,062 (161) 901 Net income from continuing operations 5,418 (838) 4,580 Less: Net income attributable to noncontrolling interests 49 49 Preferred stock dividends 236 236 Preferred stock discount accretion and redemptions 4 4 Net income from continuing operations attributable to common shareholders $ 5,129 $ (838) $ 4,291 Earnings Per Common Share From Continuing Operations Basic $ 11.43 $ (1.86) $ 9.57 Diluted $ 11.39 $ (1.85) $ 9.54 Average Common Shares Outstanding Basic 447 447 Diluted 448 448

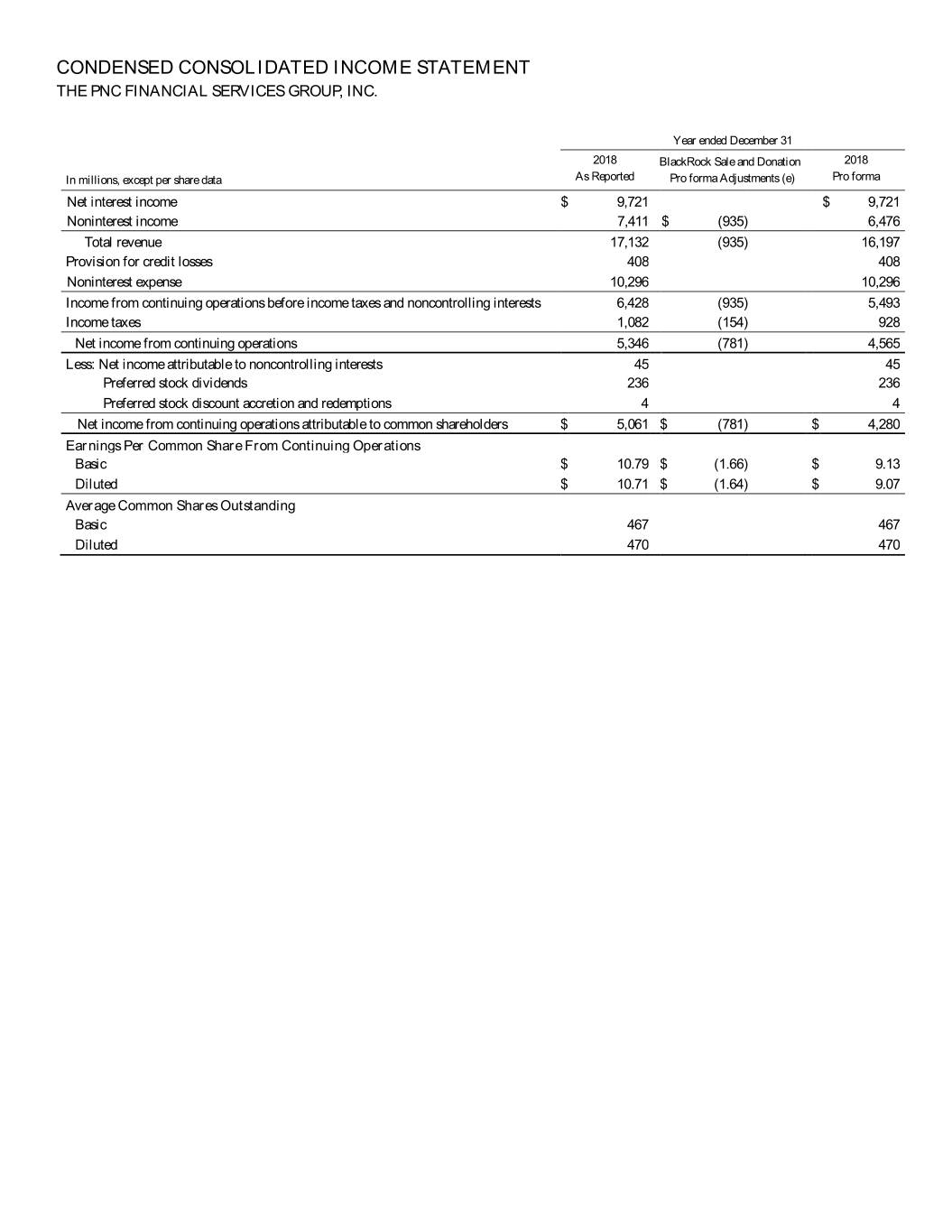

CONDENSED CONSOLIDATED INCOME STATEMENT THE PNC FINANCIAL SERVICES GROUP, INC. Year ended December 31 2018 BlackRock Sale and Donation 2018 In millions, except per share data As Reported Pro forma Adjustments (e) Pro forma Net interest income $ 9,721 $ 9,721 Noninterest income 7,411 $ (935) 6,476 Total revenue 17,132 (935) 16,197 Provision for credit losses 408 408 Noninterest expense 10,296 10,296 Income from continuing operations before income taxes and noncontrolling interests 6,428 (935) 5,493 Income taxes 1,082 (154) 928 Net income from continuing operations 5,346 (781) 4,565 Less: Net income attributable to noncontrolling interests 45 45 Preferred stock dividends 236 236 Preferred stock discount accretion and redemptions 4 4 Net income from continuing operations attributable to common shareholders $ 5,061 $ (781) $ 4,280 Earnings Per Common Share From Continuing Operations Basic $ 10.79 $ (1.66) $ 9.13 Diluted $ 10.71 $ (1.64) $ 9.07 Average Common Shares Outstanding Basic 467 467 Diluted 470 470

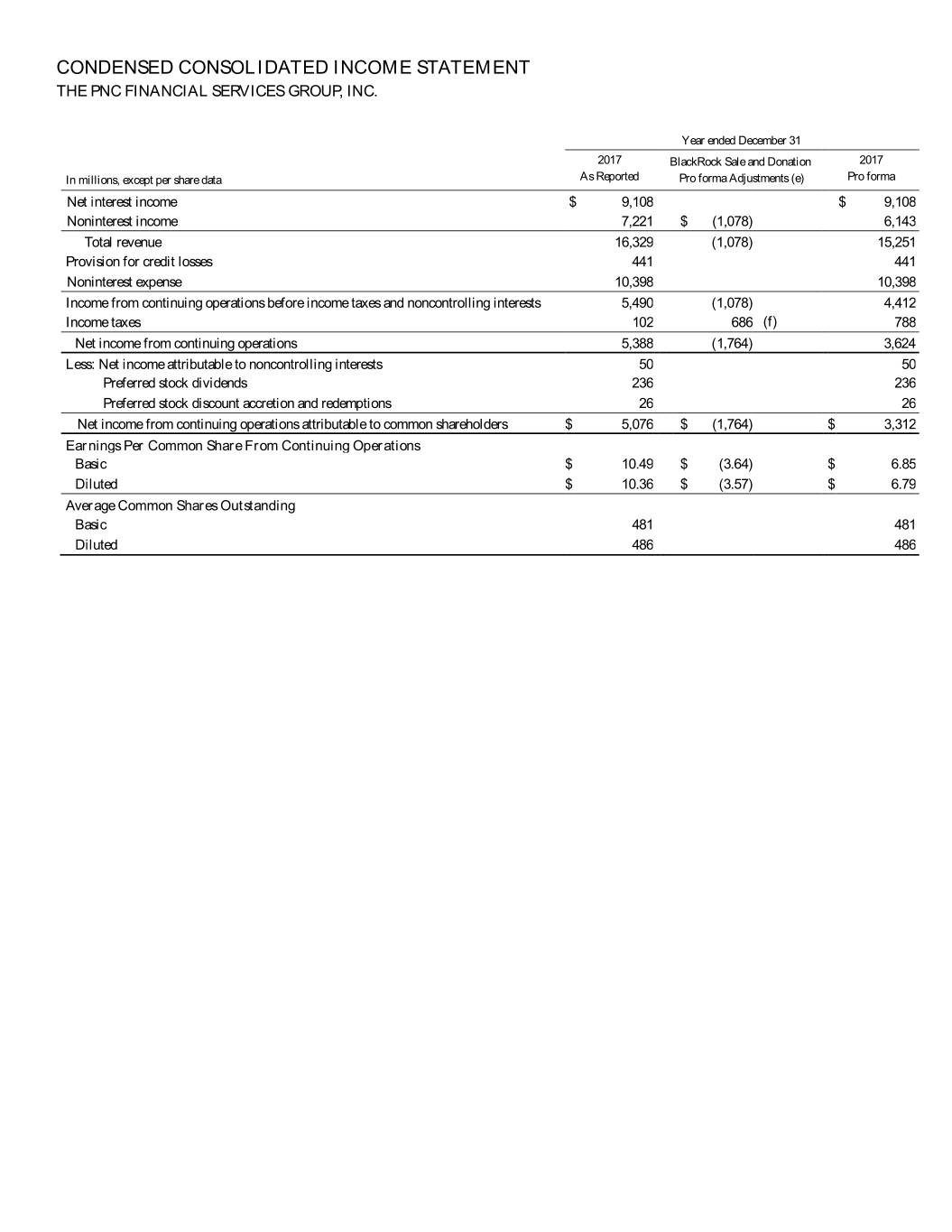

CONDENSED CONSOLIDATED INCOME STATEMENT THE PNC FINANCIAL SERVICES GROUP, INC. Year ended December 31 2017 BlackRock Sale and Donation 2017 In millions, except per share data As Reported Pro forma Adjustments (e) Pro forma Net interest income $ 9,108 $ 9,108 Noninterest income 7,221 $ (1,078) 6,143 Total revenue 16,329 (1,078) 15,251 Provision for credit losses 441 441 Noninterest expense 10,398 10,398 Income from continuing operations before income taxes and noncontrolling interests 5,490 (1,078) 4,412 Income taxes 102 686 (f) 788 Net income from continuing operations 5,388 (1,764) 3,624 Less: Net income attributable to noncontrolling interests 50 50 Preferred stock dividends 236 236 Preferred stock discount accretion and redemptions 26 26 Net income from continuing operations attributable to common shareholders $ 5,076 $ (1,764) $ 3,312 Earnings Per Common Share From Continuing Operations Basic $ 10.49 $ (3.64) $ 6.85 Diluted $ 10.36 $ (3.57) $ 6.79 Average Common Shares Outstanding Basic 481 481 Diluted 486 486

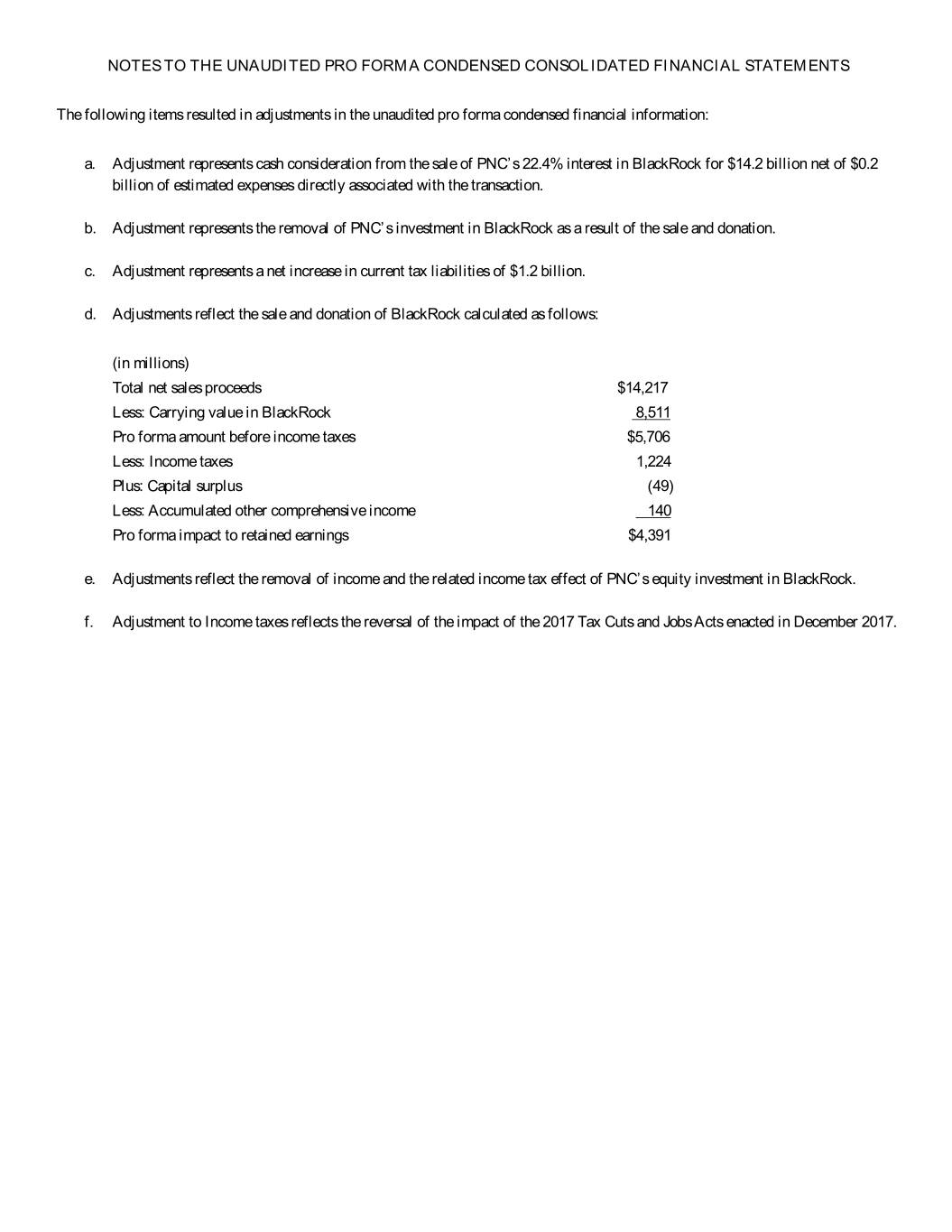

NOTES TO THE UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS The following items resulted in adjustments in the unaudited pro forma condensed financial information: a. Adjustment represents cash consideration from the sale of PNC’s 22.4% interest in BlackRock for $14.2 billion net of $0.2 billion of estimated expenses directly associated with the transaction. b. Adjustment represents the removal of PNC’s investment in BlackRock as a result of the sale and donation. c. Adjustment represents a net increase in current tax liabilities of $1.2 billion. d. Adjustments reflect the sale and donation of BlackRock calculated as follows: (in millions) Total net sales proceeds $14,217 Less: Carrying value in BlackRock 8,511 Pro forma amount before income taxes $5,706 Less: Income taxes 1,224 Plus: Capital surplus (49) Less: Accumulated other comprehensive income 140 Pro forma impact to retained earnings $4,391 e. Adjustments reflect the removal of income and the related income tax effect of PNC’s equity investment in BlackRock. f. Adjustment to Income taxes reflects the reversal of the impact of the 2017 Tax Cuts and Jobs Acts enacted in December 2017.