EXHIBIT 99.1

Published on November 7, 2019

Exhibit 99.1 BancAnalysts Association of Boston Conference November 7, 2019 The PNC Financial Services Group

Cautionary Statement Regarding Forward-Looking and Non- GAAP Financial Information This presentation is not intended as a full business or financial review and should be viewed in the context of all of the information made available by PNC in its SEC filings and on our corporate website. The presentation contains forward-looking statements regarding our outlook for earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix. We provide greater detail regarding these as well as other factors in our 2018 Form 10-K, subsequent Form 10-Qs, and in our other subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss in this presentation or in our SEC filings. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake to update those statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against undue reliance on any forward-looking statements. We include non-GAAP financial information in this presentation. Non-GAAP financial information includes financial metrics such as fee income, tangible book value, pretax, pre-provision earnings and return on tangible common equity. Reconciliations for such financial information may be found in our presentation, in these slides, including the Appendix, in other materials on our corporate website, and in our SEC filings. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this information and the related reconciliations may be useful to investors, analysts, regulators and others to help understand and evaluate our financial results, and with respect to adjusted metrics, because we believe they better reflect the ongoing financial results and trends of our businesses and increase comparability of period-to-period results. We may also use annualized, pro forma, estimated or third party numbers for illustrative or comparative purposes only. These may not reflect actual results. References to our corporate website are to www.pnc.com under “About Us - Investor Relations.” Our SEC filings are available both on our corporate website and on the SEC’s website at www.sec.gov. We include web addresses here as inactive textual references only. Information on these websites is not part of this presentation. 2

Progress on Our Strategic Priorities Designed to create long-term value Expanding our leading banking franchise to new markets and digital platforms Deepening customer relationships by delivering a superior banking experience and financial solutions Leveraging technology to innovate and enhance products, services, security and processes 3

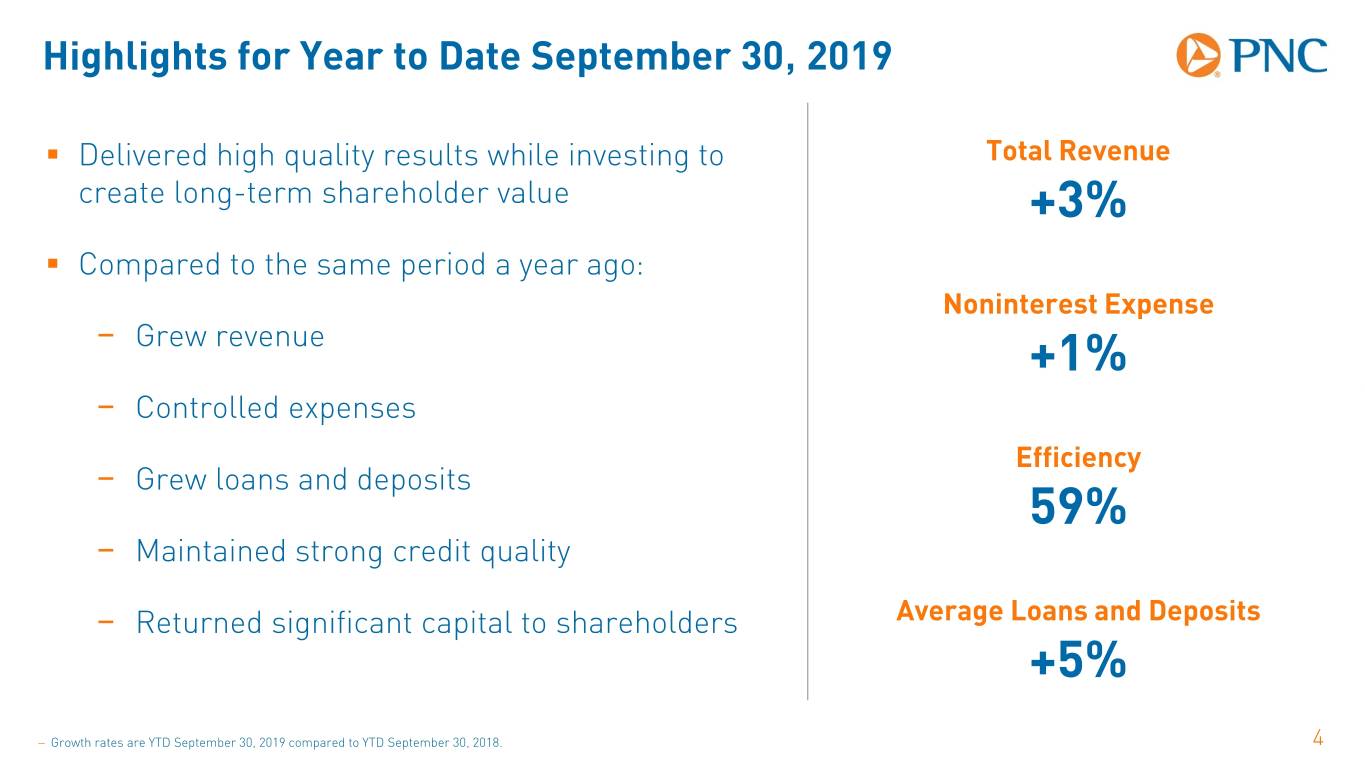

Highlights for Year to Date September 30, 2019 . Delivered high quality results while investing to Total Revenue create long-term shareholder value +3% . Compared to the same period a year ago: Noninterest Expense − Grew revenue +1% − Controlled expenses Efficiency − Grew loans and deposits 59% − Maintained strong credit quality − Returned significant capital to shareholders Average Loans and Deposits +5% − Growth rates are YTD September 30, 2019 compared to YTD September 30, 2018. 4

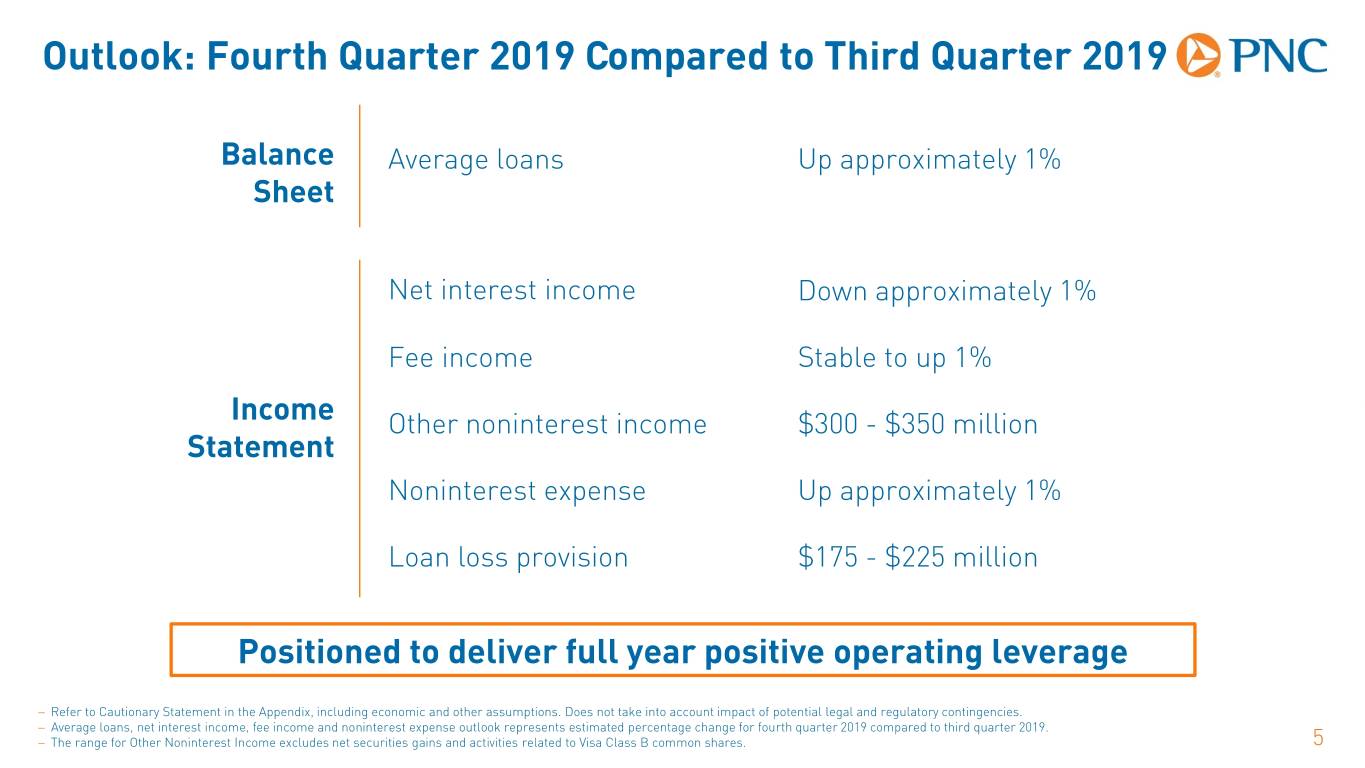

Outlook: Fourth Quarter 2019 Compared to Third Quarter 2019 Balance Average loans Up approximately 1% Sheet Net interest income Down approximately 1% Fee income Stable to up 1% Income Other noninterest income $300 - $350 million Statement Noninterest expense Up approximately 1% Loan loss provision $175 - $225 million Positioned to deliver full year positive operating leverage − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies. − Average loans, net interest income, fee income and noninterest expense outlook represents estimated percentage change for fourth quarter 2019 compared to third quarter 2019. − The range for Other Noninterest Income excludes net securities gains and activities related to Visa Class B common shares. 5

Balance Sheet Trends and Interest Rate Risk Management Gagan Singh, Chief Investment Officer The PNC Financial Services Group

Agenda . Balance sheet trends . Approach to interest rate risk management and outlook for interest rates . Securities portfolio trends 7

Balance Sheet Trends $ billions 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 9/30/19 CAGR Commercial lending $128.4 $133.5 $137.9 $147.4 $152.3 $160.2 4.8% Consumer lending 76.4 73.2 72.9 73.0 74.0 77.2 0.2% Total loans $204.8 $206.7 $210.8 $220.5 $226.2 $237.4 3.2% Investment securities $55.8 $70.5 $75.9 $76.1 $82.7 $87.9 10.0% Interest-earning deposits with banks $31.8 $30.5 $25.7 $28.6 $10.9 $19.0 (10.2)% Deposits $232.2 $249.0 $257.2 $265.1 $267.8 $285.6 4.4% Equity $46.1 $46.0 $46.9 $47.6 $47.8 $49.5 1.5% 8 − The compound average growth rate represents the time period of 12/31/14 to 9/30/19.

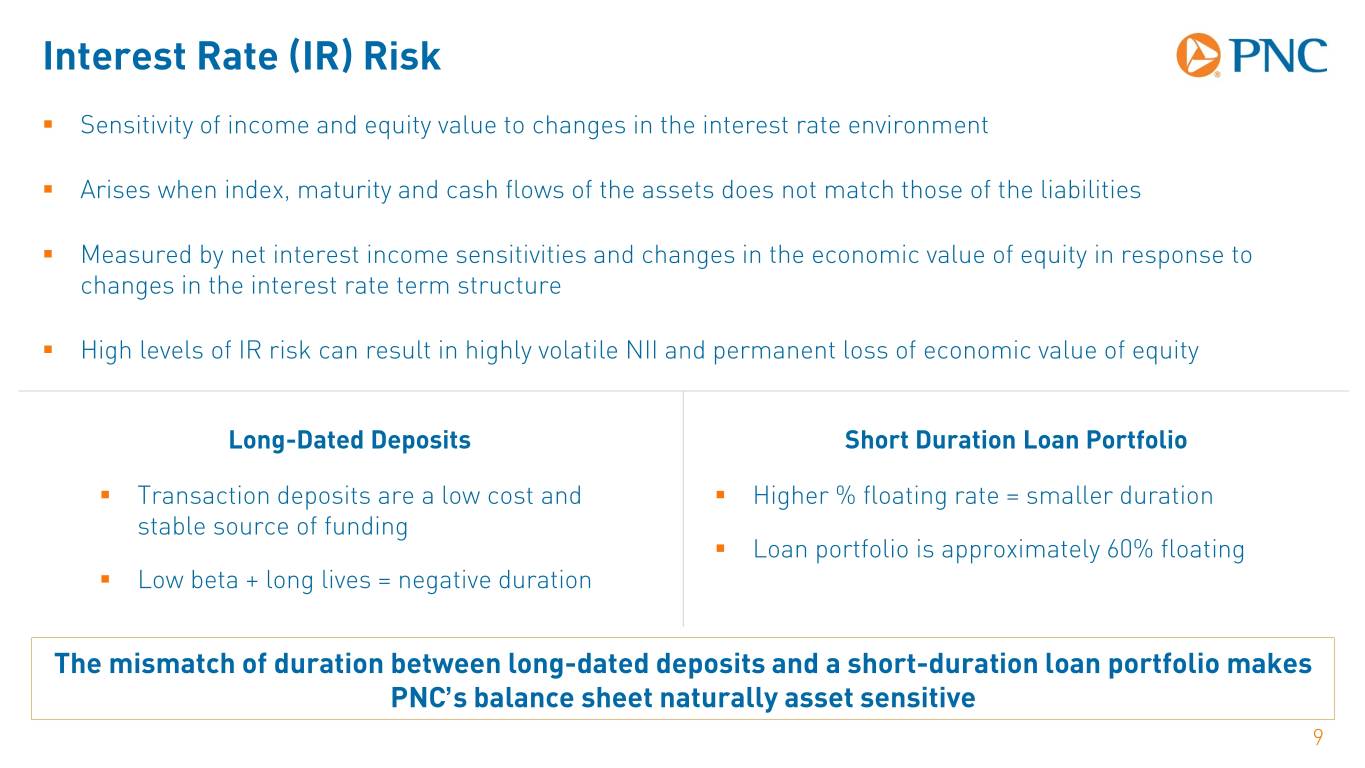

Interest Rate (IR) Risk . Sensitivity of income and equity value to changes in the interest rate environment . Arises when index, maturity and cash flows of the assets does not match those of the liabilities . Measured by net interest income sensitivities and changes in the economic value of equity in response to changes in the interest rate term structure . High levels of IR risk can result in highly volatile NII and permanent loss of economic value of equity Long-Dated Deposits Short Duration Loan Portfolio . Transaction deposits are a low cost and . Higher % floating rate = smaller duration stable source of funding . Loan portfolio is approximately 60% floating . Low beta + long lives = negative duration The mismatch of duration between long-dated deposits and a short-duration loan portfolio makes PNC’s balance sheet naturally asset sensitive 9

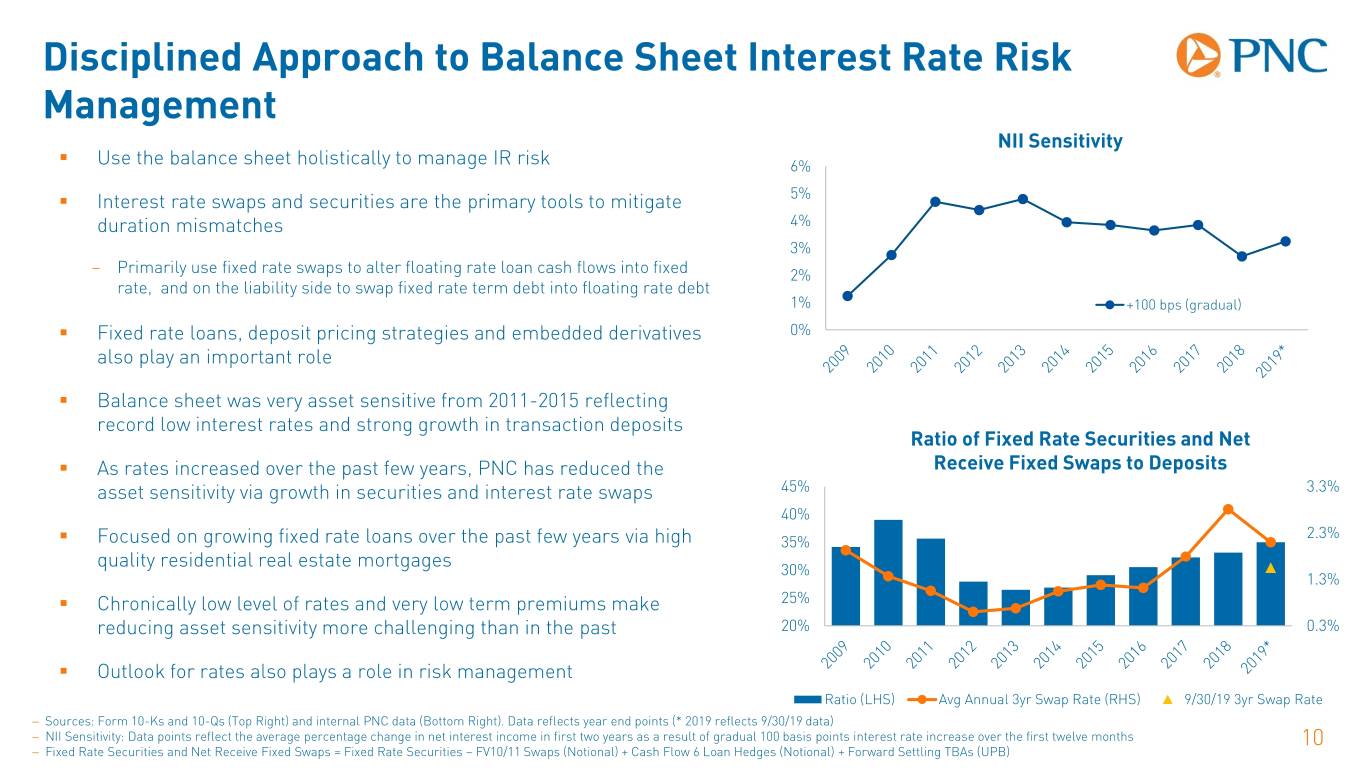

Disciplined Approach to Balance Sheet Interest Rate Risk Management NII Sensitivity . Use the balance sheet holistically to manage IR risk 6% . Interest rate swaps and securities are the primary tools to mitigate 5% duration mismatches 4% 3% – Primarily use fixed rate swaps to alter floating rate loan cash flows into fixed 2% rate, and on the liability side to swap fixed rate term debt into floating rate debt 1% +100 bps (gradual) . Fixed rate loans, deposit pricing strategies and embedded derivatives 0% also play an important role . Balance sheet was very asset sensitive from 2011-2015 reflecting record low interest rates and strong growth in transaction deposits Ratio of Fixed Rate Securities and Net . As rates increased over the past few years, PNC has reduced the Receive Fixed Swaps to Deposits asset sensitivity via growth in securities and interest rate swaps 45% 3.3% 40% 2.3% . Focused on growing fixed rate loans over the past few years via high 35% quality residential real estate mortgages 30% 1.3% . Chronically low level of rates and very low term premiums make 25% reducing asset sensitivity more challenging than in the past 20% 0.3% . Outlook for rates also plays a role in risk management Ratio (LHS) Avg Annual 3yr Swap Rate (RHS) 9/30/19 3yr Swap Rate − Sources: Form 10-Ks and 10-Qs (Top Right) and internal PNC data (Bottom Right). Data reflects year end points (* 2019 reflects 9/30/19 data) − NII Sensitivity: Data points reflect the average percentage change in net interest income in first two years as a result of gradual 100 basis points interest rate increase over the first twelve months 10 − Fixed Rate Securities and Net Receive Fixed Swaps = Fixed Rate Securities – FV10/11 Swaps (Notional) + Cash Flow 6 Loan Hedges (Notional) + Forward Settling TBAs (UPB)

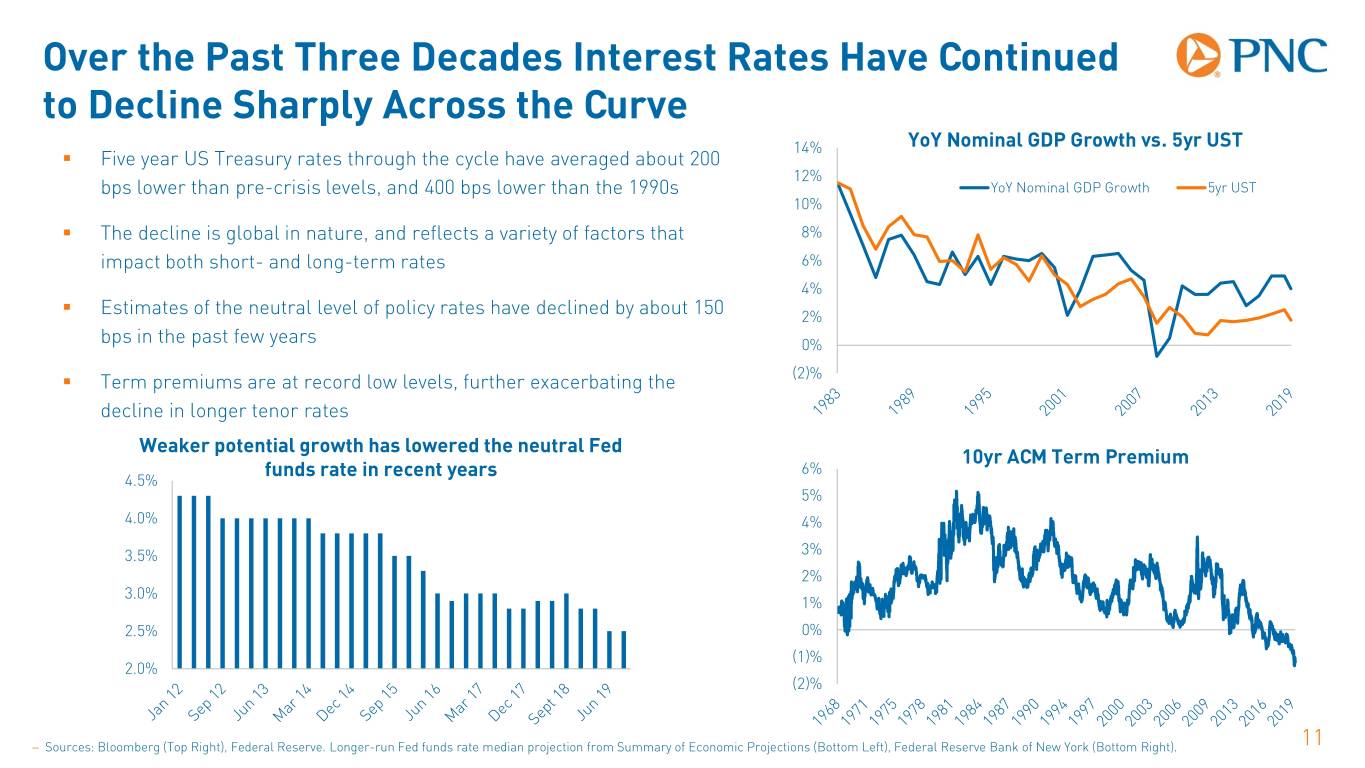

Over the Past Three Decades Interest Rates Have Continued to Decline Sharply Across the Curve 14% YoY Nominal GDP Growth vs. 5yr UST . Five year US Treasury rates through the cycle have averaged about 200 12% bps lower than pre-crisis levels, and 400 bps lower than the 1990s YoY Nominal GDP Growth 5yr UST 10% . The decline is global in nature, and reflects a variety of factors that 8% impact both short- and long-term rates 6% 4% . Estimates of the neutral level of policy rates have declined by about 150 2% bps in the past few years 0% . Term premiums are at record low levels, further exacerbating the (2)% decline in longer tenor rates Weaker potential growth has lowered the neutral Fed 10yr ACM Term Premium funds rate in recent years 6% 4.5% 5% 4.0% 4% 3.5% 3% 2% 3.0% 1% 2.5% 0% (1)% 2.0% (2)% − Sources: Bloomberg (Top Right), Federal Reserve. Longer-run Fed funds rate median projection from Summary of Economic Projections (Bottom Left), Federal Reserve Bank of New York (Bottom Right). 11

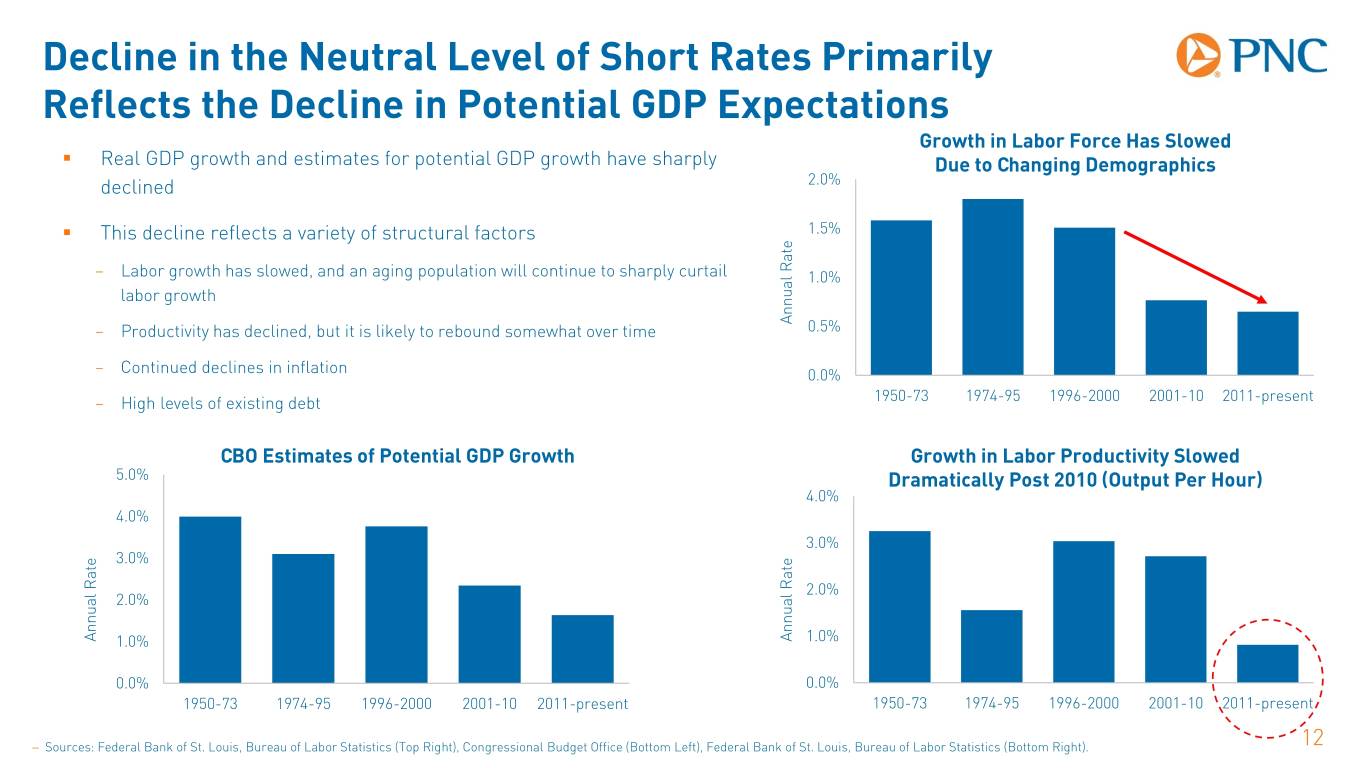

Decline in the Neutral Level of Short Rates Primarily Reflects the Decline in Potential GDP Expectations Growth in Labor Force Has Slowed . Real GDP growth and estimates for potential GDP growth have sharply Due to Changing Demographics declined 2.0% . This decline reflects a variety of structural factors 1.5% – Labor growth has slowed, and an aging population will continue to sharply curtail 1.0% labor growth – Productivity has declined, but it is likely to rebound somewhat over time Annual Rate 0.5% – Continued declines in inflation 0.0% – High levels of existing debt 1950-73 1974-95 1996-2000 2001-10 2011-present CBO Estimates of Potential GDP Growth Growth in Labor Productivity Slowed 5.0% Dramatically Post 2010 (Output Per Hour) 4.0% 4.0% 3.0% 3.0% 2.0% 2.0% Annual Rate 1.0% Annual Rate 1.0% 0.0% 0.0% 1950-73 1974-95 1996-2000 2001-10 2011-present 1950-73 1974-95 1996-2000 2001-10 2011-present − Sources: Federal Bank of St. Louis, Bureau of Labor Statistics (Top Right), Congressional Budget Office (Bottom Left), Federal Bank of St. Louis, Bureau of Labor Statistics (Bottom Right). 12

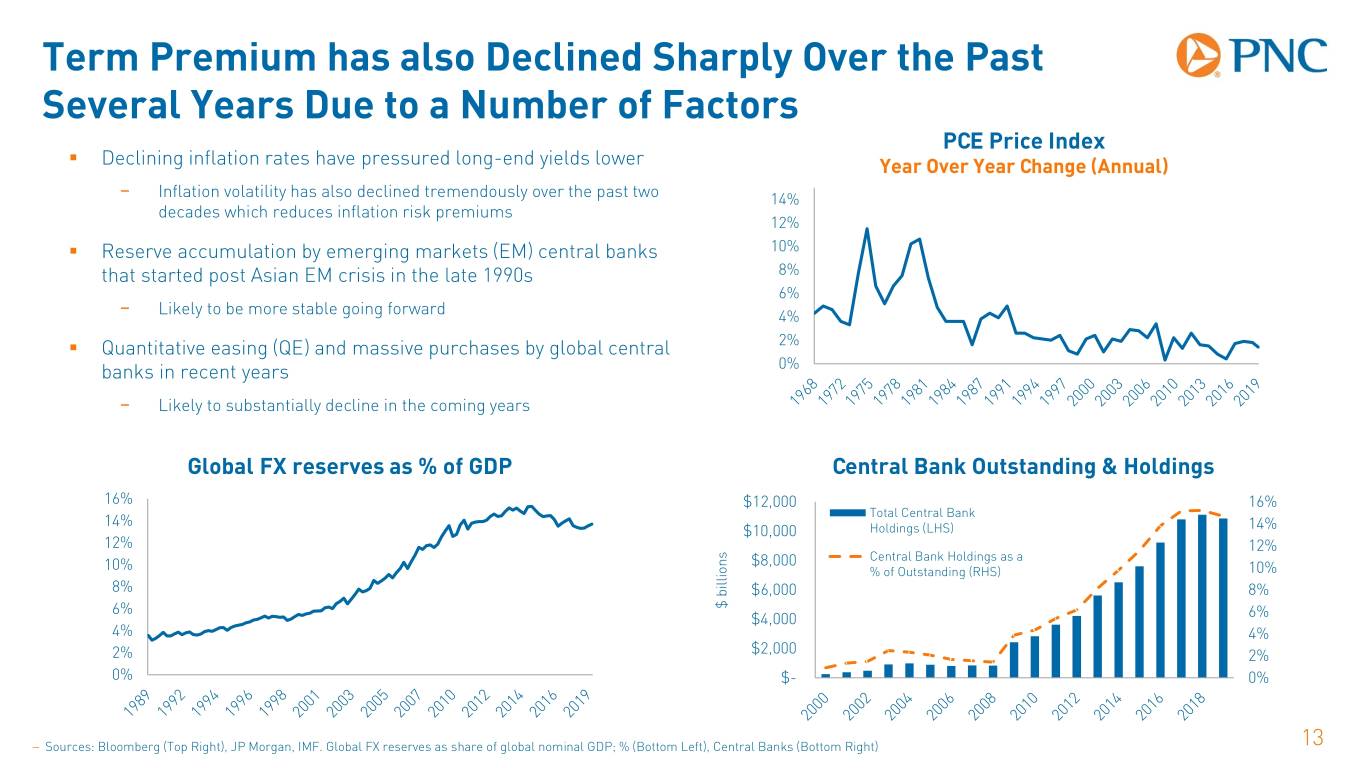

Term Premium has also Declined Sharply Over the Past Several Years Due to a Number of Factors PCE Price Index . Declining inflation rates have pressured long-end yields lower Year Over Year Change (Annual) − Inflation volatility has also declined tremendously over the past two 14% decades which reduces inflation risk premiums 12% . Reserve accumulation by emerging markets (EM) central banks 10% that started post Asian EM crisis in the late 1990s 8% 6% − Likely to be more stable going forward 4% . Quantitative easing (QE) and massive purchases by global central 2% banks in recent years 0% − Likely to substantially decline in the coming years Global FX reserves as % of GDP Central Bank Outstanding & Holdings 16% $12,000 16% Total Central Bank 14% $10,000 Holdings (LHS) 14% 12% 12% $8,000 Central Bank Holdings as a 10% % of Outstanding (RHS) 10% 8% $6,000 8% 6% $ billions $4,000 6% 4% 4% 2% $2,000 2% 0% $- 0% − Sources: Bloomberg (Top Right), JP Morgan, IMF. Global FX reserves as share of global nominal GDP; % (Bottom Left), Central Banks (Bottom Right) 13

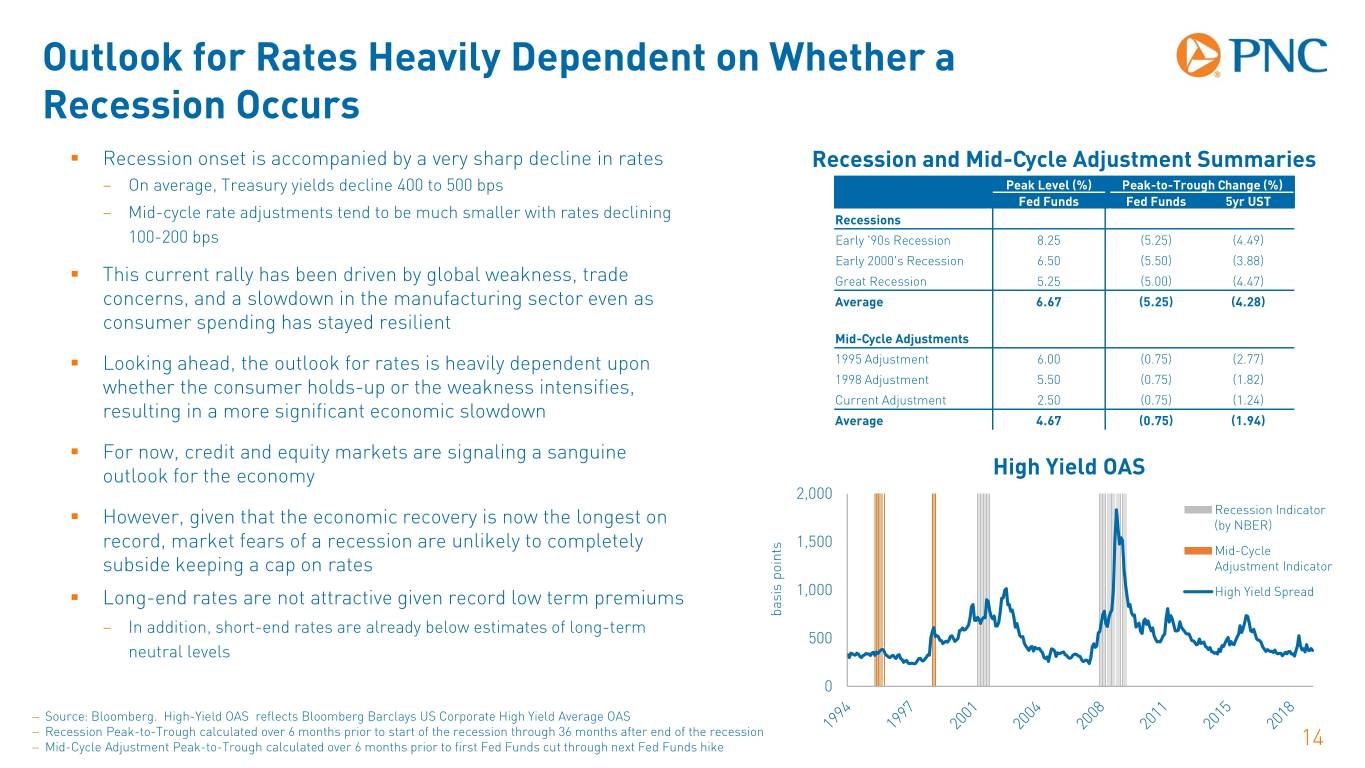

Outlook for Rates Heavily Dependent on Whether a Recession Occurs . Recession onset is accompanied by a very sharp decline in rates Recession and Mid-Cycle Adjustment Summaries – On average, Treasury yields decline 400 to 500 bps Peak Level (%) Peak-to-Trough Change (%) Fed Funds Fed Funds 5yr UST – Mid-cycle rate adjustments tend to be much smaller with rates declining Recessions 100-200 bps Early '90s Recession 8.25 (5.25) (4.49) Early 2000's Recession 6.50 (5.50) (3.88) . This current rally has been driven by global weakness, trade Great Recession 5.25 (5.00) (4.47) concerns, and a slowdown in the manufacturing sector even as Average 6.67 (5.25) (4.28) consumer spending has stayed resilient Mid-Cycle Adjustments . Looking ahead, the outlook for rates is heavily dependent upon 1995 Adjustment 6.00 (0.75) (2.77) whether the consumer holds-up or the weakness intensifies, 1998 Adjustment 5.50 (0.75) (1.82) Current Adjustment 2.50 (0.75) (1.24) resulting in a more significant economic slowdown Average 4.67 (0.75) (1.94) . For now, credit and equity markets are signaling a sanguine outlook for the economy High Yield OAS 2,000 Recession Indicator . However, given that the economic recovery is now the longest on (by NBER) 1,500 record, market fears of a recession are unlikely to completely Mid-Cycle subside keeping a cap on rates Adjustment Indicator . Long-end rates are not attractive given record low term premiums 1,000 High Yield Spread basis points basis – In addition, short-end rates are already below estimates of long-term 500 neutral levels 0 − Source: Bloomberg. High-Yield OAS reflects Bloomberg Barclays US Corporate High Yield Average OAS − Recession Peak-to-Trough calculated over 6 months prior to start of the recession through 36 months after end of the recession − Mid-Cycle Adjustment Peak-to-Trough calculated over 6 months prior to first Fed Funds cut through next Fed Funds hike 14

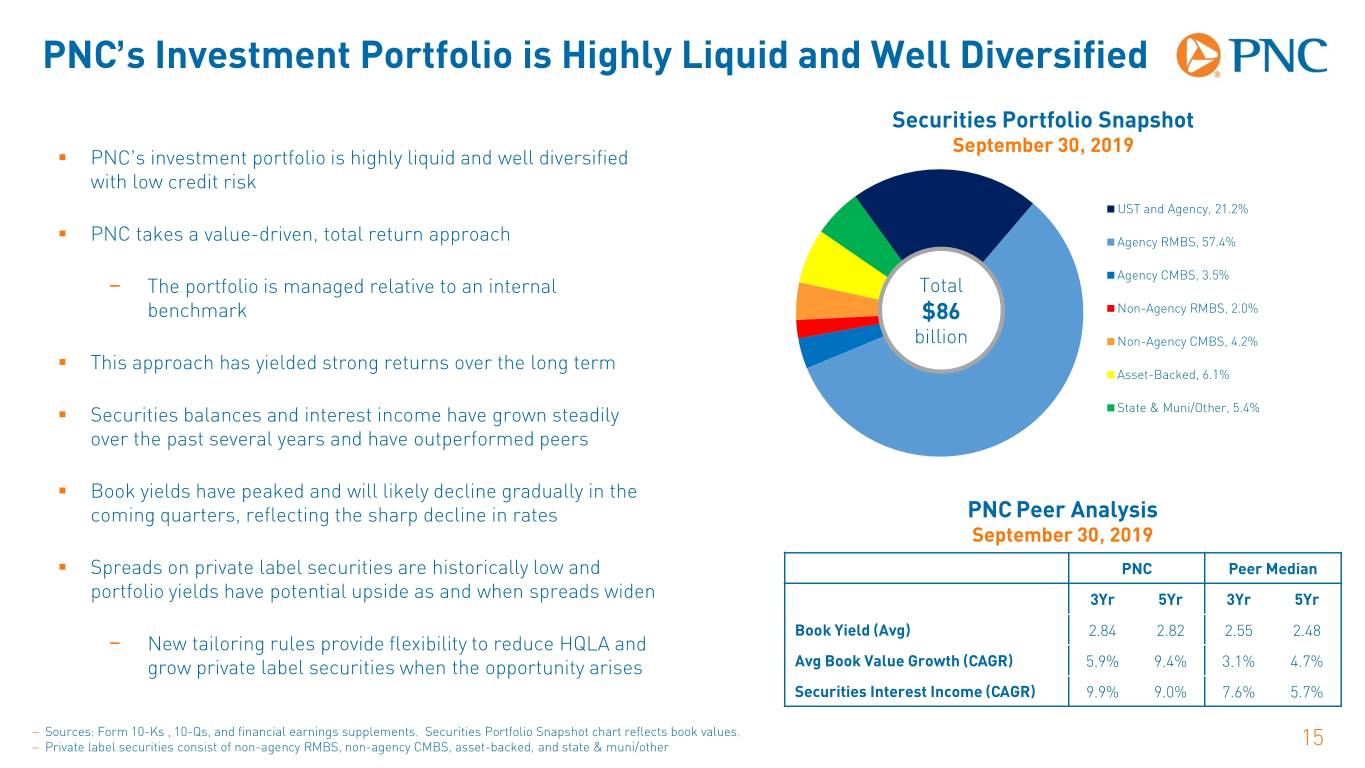

PNC’s Investment Portfolio is Highly Liquid and Well Diversified Securities Portfolio Snapshot September 30, 2019 . PNC’s investment portfolio is highly liquid and well diversified with low credit risk UST and Agency, 21.2% . PNC takes a value-driven, total return approach Agency RMBS, 57.4% Agency CMBS, 3.5% − The portfolio is managed relative to an internal Total benchmark $86 Non-Agency RMBS, 2.0% billion Non-Agency CMBS, 4.2% . This approach has yielded strong returns over the long term Asset-Backed, 6.1% . Securities balances and interest income have grown steadily State & Muni/Other, 5.4% over the past several years and have outperformed peers . Book yields have peaked and will likely decline gradually in the coming quarters, reflecting the sharp decline in rates PNC Peer Analysis September 30, 2019 . Spreads on private label securities are historically low and PNC Peer Median portfolio yields have potential upside as and when spreads widen 3Yr 5Yr 3Yr 5Yr Book Yield (Avg) 2.84 2.82 2.55 2.48 − New tailoring rules provide flexibility to reduce HQLA and grow private label securities when the opportunity arises Avg Book Value Growth (CAGR) 5.9% 9.4% 3.1% 4.7% Securities Interest Income (CAGR) 9.9% 9.0% 7.6% 5.7% − Sources: Form 10-Ks , 10-Qs, and financial earnings supplements. Securities Portfolio Snapshot chart reflects book values. − Private label securities consist of non-agency RMBS, non-agency CMBS, asset-backed, and state & muni/other 15

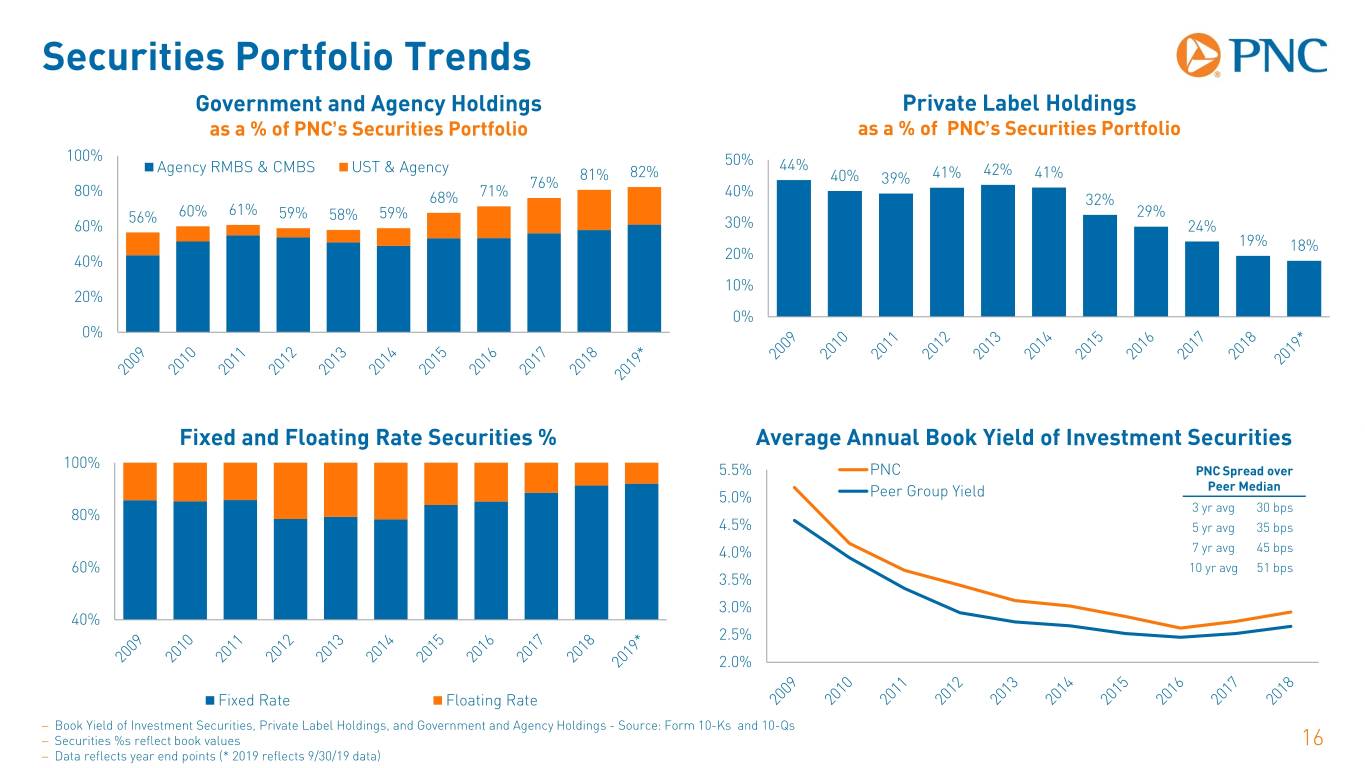

Securities Portfolio Trends Government and Agency Holdings Private Label Holdings as a % of PNC’s Securities Portfolio as a % of PNC’s Securities Portfolio 100% 50% 44% Agency RMBS & CMBS UST & Agency 81% 82% 41% 42% 41% 76% 40% 39% 80% 71% 40% 68% 32% 56% 60% 61% 59% 58% 59% 29% 60% 30% 24% 19% 18% 40% 20% 10% 20% 0% 0% Fixed and Floating Rate Securities % Average Annual Book Yield of Investment Securities 100% 5.5% PNC PNC Spread over Peer Median 5.0% Peer Group Yield 80% 3 yr avg 30 bps 4.5% 5 yr avg 35 bps 4.0% 7 yr avg 45 bps 60% 10 yr avg 51 bps 3.5% 3.0% 40% 2.5% 2.0% Fixed Rate Floating Rate − Book Yield of Investment Securities, Private Label Holdings, and Government and Agency Holdings - Source: Form 10-Ks and 10-Qs − Securities %s reflect book values 16 − Data reflects year end points (* 2019 reflects 9/30/19 data)

Summary . PNC takes a disciplined approach to interest rate risk management . PNC has reduced asset sensitivity of the balance sheet over the past few years via adding fixed rate securities and swaps . Long-term secular forces such as an aging population, declining productivity and declining inflation have driven interest rates down sharply over the past three decades . The economic cycle is aging and imbalances are building, and as the next recession starts, interest rates will likely fall further . However, historically low long-term rates and low term premiums make interest rate risk management more challenging than usual . PNC’s securities portfolio has grown at a robust pace and remains very liquid, low risk, and highly diversified 17

Appendix: Cautionary Statement Regarding Forward-Looking Information This presentation includes “snapshot” information about PNC used by way of illustration and is not intended as a full business or financial review. It should not be viewed in isolation but rather in the context of all of the information made available by PNC in its SEC filings. We also make statements in this presentation, and we may from time to time make other statements, regarding our outlook for earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,” “estimate,” “goal,” “will,” “should” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements speak only as of the date made. We do not assume any duty and do not undertake to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. As a result, we caution against undue reliance on any forward-looking statements. Our forward-looking statements are subject to the following principal risks and uncertainties. . Our businesses, financial results and balance sheet values are affected by business and economic conditions, including the following: − Changes in interest rates and valuations in debt, equity and other financial markets. − Disruptions in the U.S. and global financial markets. − Actions by the Federal Reserve Board, U.S. Treasury and other government agencies, including those that impact money supply and market interest rates. − Changes in customer behavior due to changing business and economic conditions or legislative or regulatory initiatives. − Changes in customers’, suppliers’ and other counterparties’ performance and creditworthiness. − Impacts of tariffs and other trade policies of the U.S. and its global trading partners. − Slowing or reversal of the current U.S. economic expansion. − Commodity price volatility. 18

Appendix: Cautionary Statement Regarding Forward-Looking Information . Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our views that: − U.S. economic growth, after accelerating a few years ago, has slowed since mid-2018 and is expected to slow further through the rest of this year and into 2020. − Job growth will continue into 2020, but at a slower pace due to both difficulty in finding workers and slower economic growth. The unemployment rate is expected to increase slightly in the near term, but the labor market will remain tight, pushing wages higher and supporting continued gains in consumer spending. − Slower global economic growth, trade restrictions and geopolitical concerns are downside risks to the forecast, which have increased in 2019, and risks are weighted to the downside. − Inflation has slowed in 2019, to below the Federal Open Market Committee's (FOMC's) 2% objective, but is expected to gradually increase over the next two years. − Our baseline forecast includes the 0.25% federal funds rate cut on October 30, 2019. We expect the funds rate to remain in a range of 1.50% to 1.75% through the rest of 2019. . PNC’s ability to take certain capital actions, including returning capital to shareholders, is subject to review by the Federal Reserve Board as part of PNC’s comprehensive capital plan for the applicable period in connection with the Federal Reserve Board’s Comprehensive Capital Analysis and Review (CCAR) process and to the acceptance of such capital plan and non-objection to such capital actions by the Federal Reserve Board. . PNC’s regulatory capital ratios in the future will depend on, among other things, the company’s financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of PNC’s balance sheet. In addition, PNC’s ability to determine, evaluate and forecast regulatory capital ratios, and to take actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent at least in part on the development, validation and regulatory review of related models. . Legal and regulatory developments could have an impact on our ability to operate our businesses, financial condition, results of operations, competitive position, reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business generation and retention, liquidity, funding, and ability to attract and retain management. These developments could include: − Changes to laws and regulations, including changes affecting oversight of the financial services industry, consumer protection, bank capital and liquidity standards, pension, bankruptcy and other industry aspects, and changes in accounting policies and principles. − Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries. These matters may result in monetary judgments or settlements or other remedies, including fines, penalties, restitution or alterations in our business practices, and in additional expenses and collateral costs, and may cause reputational harm to PNC. 19

Appendix: Cautionary Statement Regarding Forward-Looking Information − Results of the regulatory examination and supervision process, including our failure to satisfy requirements of agreements with governmental agencies. − Impact on business and operating results of any costs associated with obtaining rights in intellectual property claimed by others and of adequacy of our intellectual property protection in general. . Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory capital and liquidity standards. . Business and operating results also include impacts relating to our equity interest in BlackRock, Inc. and rely to a significant extent on information provided to us by BlackRock. Risks and uncertainties that could affect BlackRock are discussed in more detail by BlackRock in its SEC filings. . We grow our business in part through acquisitions and new strategic initiatives. Risks and uncertainties include those presented by the nature of the business acquired and strategic initiative, including in some cases those associated with our entry into new businesses or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, and the integration of the acquired businesses into PNC after closing. . Competition can have an impact on customer acquisition, growth and retention and on credit spreads and product pricing, which can affect market share, deposits and revenues. Our ability to anticipate and respond to technological changes can also impact our ability to respond to customer needs and meet competitive demands. . Business and operating results can also be affected by widespread natural and other disasters, pandemics, dislocations, terrorist activities, system failures, security breaches, cyberattacks or international hostilities through impacts on the economy and financial markets generally or on us or our counterparties specifically. We provide greater detail regarding these as well as other factors in our 2018 Form 10-K and subsequent 2019 Form 10-Qs, including in the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments Notes of the Notes To Consolidated Financial Statements in those reports, and in our other subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss elsewhere in this presentation or in our SEC filings, accessible on the SEC’s website at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual references only. Information on these websites is not part of this document. Any annualized, pro forma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts’ opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNC’s or other company’s actual or anticipated results. 20

Appendix: Peer Group of Banks The PNC Financial Services Group, Inc. PNC BB&T Corporation BBT Bank of America Corporation BAC Capital One Financial Corporation COF Citizens Financial Group, Inc. CFG Fifth Third Bancorp FITB JPMorgan Chase & Co. JPM KeyCorp KEY M&T Bank Corporation MTB Regions Financial Corporation RF SunTrust Banks, Inc. STI U.S. Bancorp USB Wells Fargo & Company WFC 21

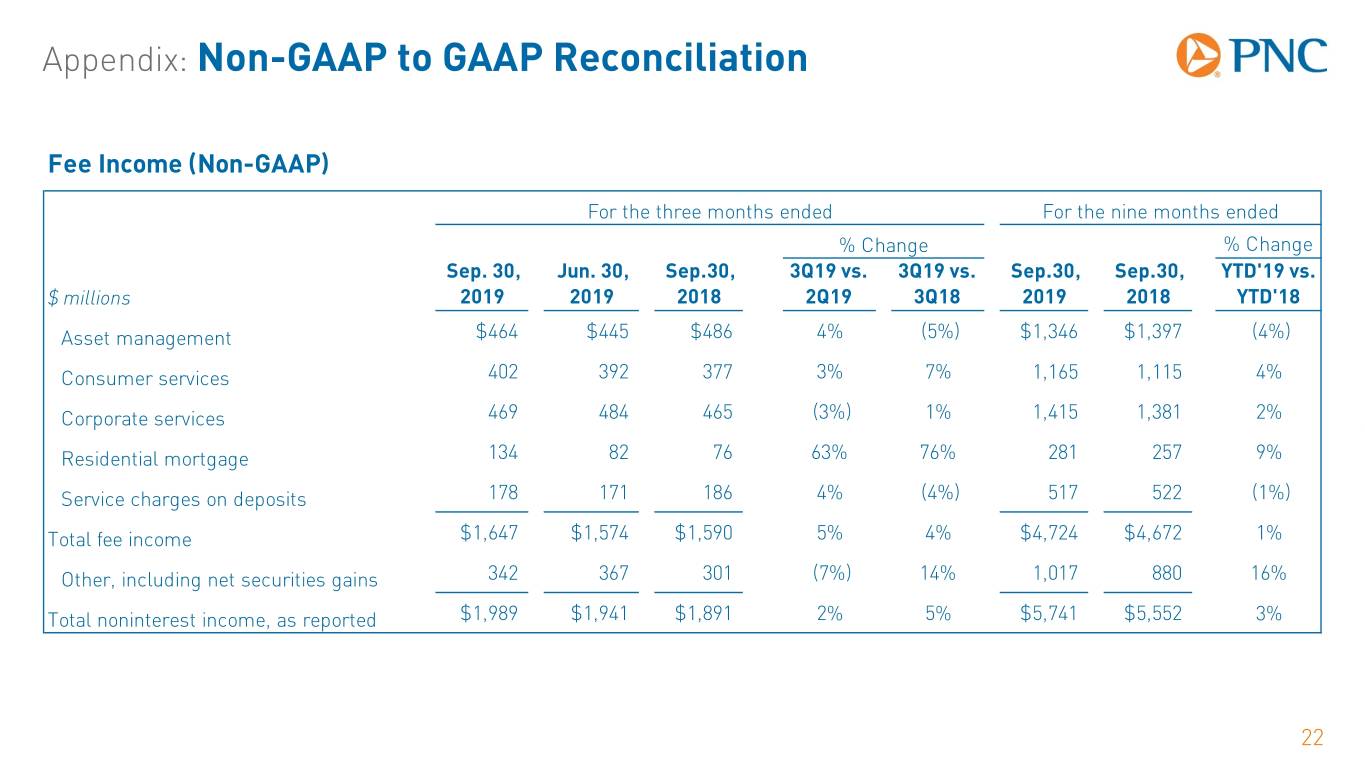

Appendix: Non-GAAP to GAAP Reconciliation Fee Income (Non-GAAP) For the three months ended For the nine months ended % Change % Change Sep. 30, Jun. 30, Sep.30, 3Q19 vs. 3Q19 vs. Sep.30, Sep.30, YTD'19 vs. $ millions 2019 2019 2018 2Q19 3Q18 2019 2018 YTD'18 Asset management $464 $445 $486 4% (5%) $1,346 $1,397 (4%) Consumer services 402 392 377 3% 7% 1,165 1,115 4% Corporate services 469 484 465 (3%) 1% 1,415 1,381 2% Residential mortgage 134 82 76 63% 76% 281 257 9% Service charges on deposits 178 171 186 4% (4%) 517 522 (1%) Total fee income $1,647 $1,574 $1,590 5% 4% $4,724 $4,672 1% Other, including net securities gains 342 367 301 (7%) 14% 1,017 880 16% Total noninterest income, as reported $1,989 $1,941 $1,891 2% 5% $5,741 $5,552 3% 22