EXHIBIT 99.2

Published on January 16, 2019

Exhibit 99.2 Fourth Quarter 2018 Earnings Conference Call January 16, 2019 The PNC Financial Services Group

Cautionary Statement Regarding Forward-Looking and Non-GAAP Financial Information Our earnings conference call presentation is not intended as a full business or financial review and should be viewed in the context of all of the information made available by PNC in its SEC filings and on its corporate website. The presentation contains forward-looking statements regarding our outlook for earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations. Forward-looking statements are necessarily subject to numerous assumptions, risks and uncertainties, which change over time. The forward-looking statements in this presentation are qualified by the factors affecting forward-looking statements identified in the more detailed Cautionary Statement included in the Appendix. We provide greater detail regarding these as well as other factors in our 2017 Form 10-K and our 2018 Form 10-Qs, and in our subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss in this presentation or in our SEC filings. Future events or circumstances may change our outlook and may also affect the nature of the assumptions, risks and uncertainties to which our forward-looking statements are subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not assume any duty and do not undertake to update those statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. We include non-GAAP financial information in this presentation. Non-GAAP financial information includes financial metrics that have been adjusted for the impact of 2017 tax legislation and other significant items as well as fee income, tangible book value, pretax, pre-provision earnings and return on tangible common equity. Reconciliations for such financial information may be found in our presentation, in these slides, including the Appendix, in other materials on our corporate website, and in our SEC filings. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this information and the related reconciliations may be useful to investors, analysts, regulators and others to help understand and evaluate our financial results, and with respect to adjusted metrics, because we believe they better reflect the ongoing financial results and trends of our businesses and increase comparability of period-to-period results. We may also use annualized, pro forma, estimated or third party numbers for illustrative or comparative purposes only. These may not reflect actual results. References to our corporate website are to www.pnc.com under “About Us - Investor Relations.” Our SEC filings are available both on our corporate website and on the SEC’s website at www.sec.gov. We include web addresses here as inactive textual references only. Information on these websites is not part of this presentation. 2

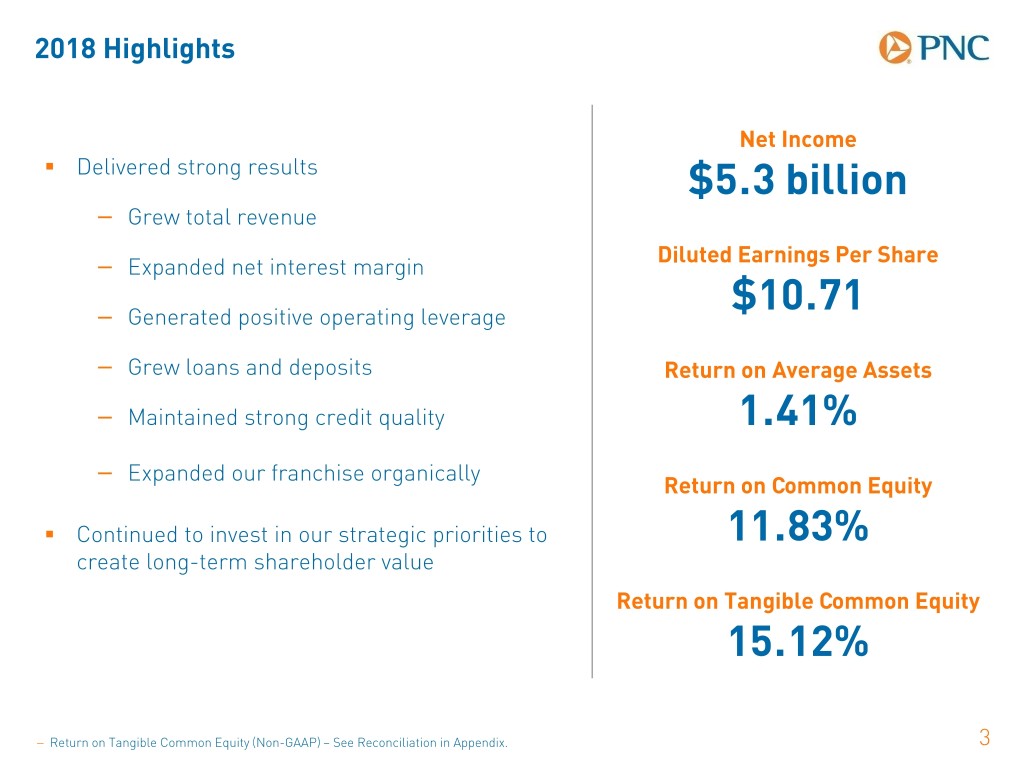

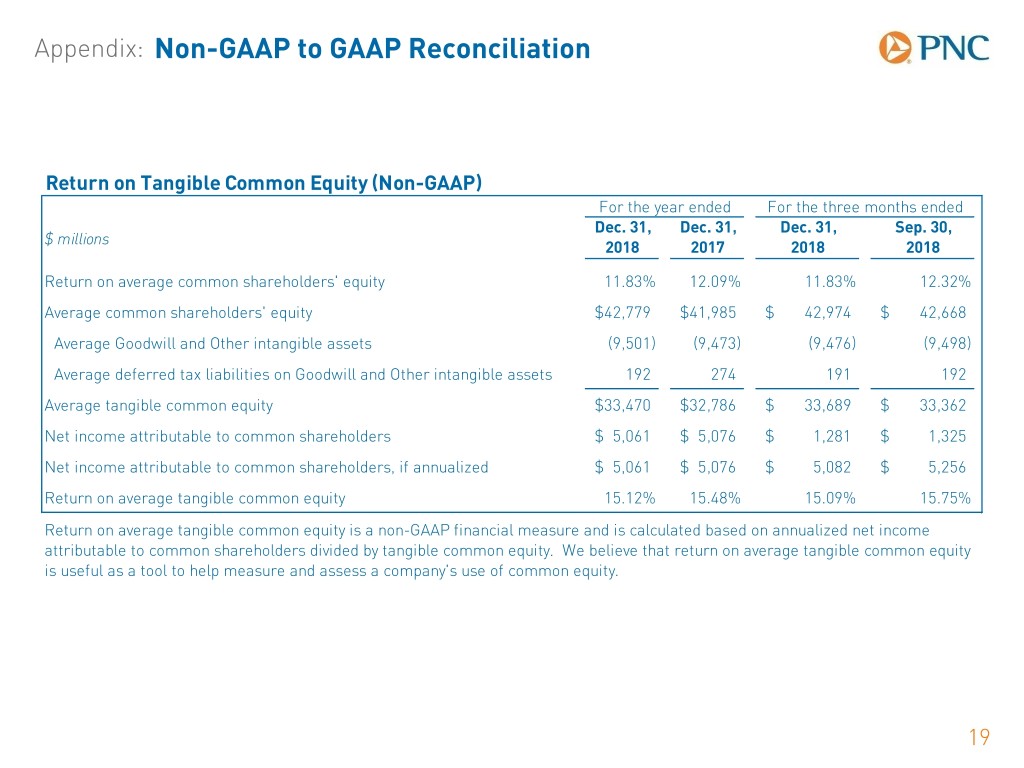

2018 Highlights Net Income . Delivered strong results $5.3 billion − Grew total revenue Diluted Earnings Per Share − Expanded net interest margin − Generated positive operating leverage $10.71 − Grew loans and deposits Return on Average Assets − Maintained strong credit quality 1.41% − Expanded our franchise organically Return on Common Equity . Continued to invest in our strategic priorities to 11.83% create long-term shareholder value Return on Tangible Common Equity 15.12% − Return on Tangible Common Equity (Non-GAAP) – See Reconciliation in Appendix. 3

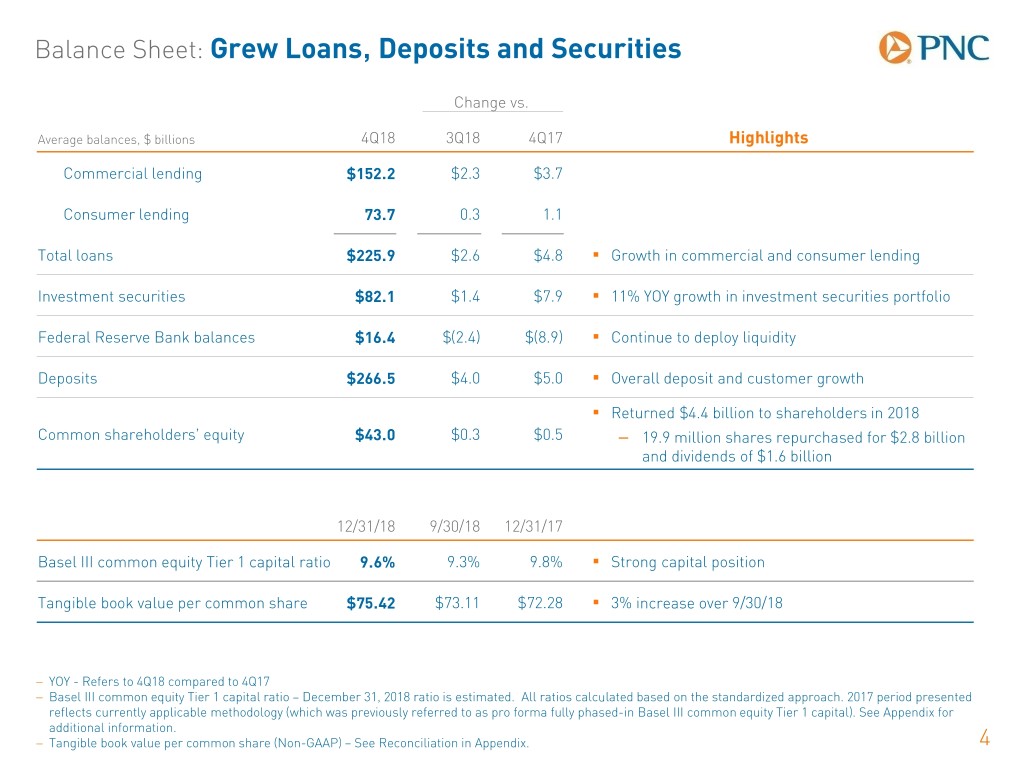

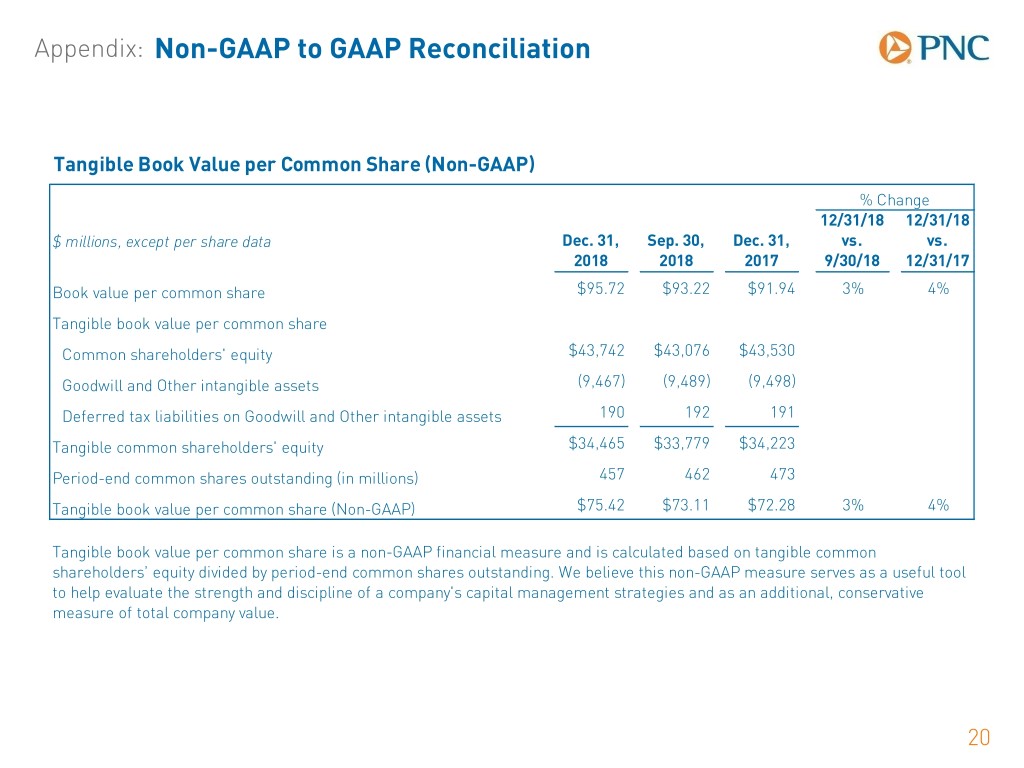

Balance Sheet: Grew Loans, Deposits and Securities Change vs. Average balances, $ billions 4Q18 3Q18 4Q17 Highlights Commercial lending $152.2 $2.3 $3.7 Consumer lending 73.7 0.3 1.1 Total loans $225.9 $2.6 $4.8 . Growth in commercial and consumer lending Investment securities $82.1 $1.4 $7.9 . 11% YOY growth in investment securities portfolio Federal Reserve Bank balances $16.4 $(2.4) $(8.9) . Continue to deploy liquidity Deposits $266.5 $4.0 $5.0 . Overall deposit and customer growth . Returned $4.4 billion to shareholders in 2018 Common shareholders’ equity $43.0 $0.3 $0.5 − 19.9 million shares repurchased for $2.8 billion and dividends of $1.6 billion 12/31/18 9/30/18 12/31/17 Basel III common equity Tier 1 capital ratio 9.6% 9.3% 9.8% . Strong capital position Tangible book value per common share $75.42 $73.11 $72.28 . 3% increase over 9/30/18 − YOY - Refers to 4Q18 compared to 4Q17 − Basel III common equity Tier 1 capital ratio – December 31, 2018 ratio is estimated. All ratios calculated based on the standardized approach. 2017 period presented reflects currently applicable methodology (which was previously referred to as pro forma fully phased-in Basel III common equity Tier 1 capital). See Appendix for additional information. − Tangible book value per common share (Non-GAAP) – See Reconciliation in Appendix. 4

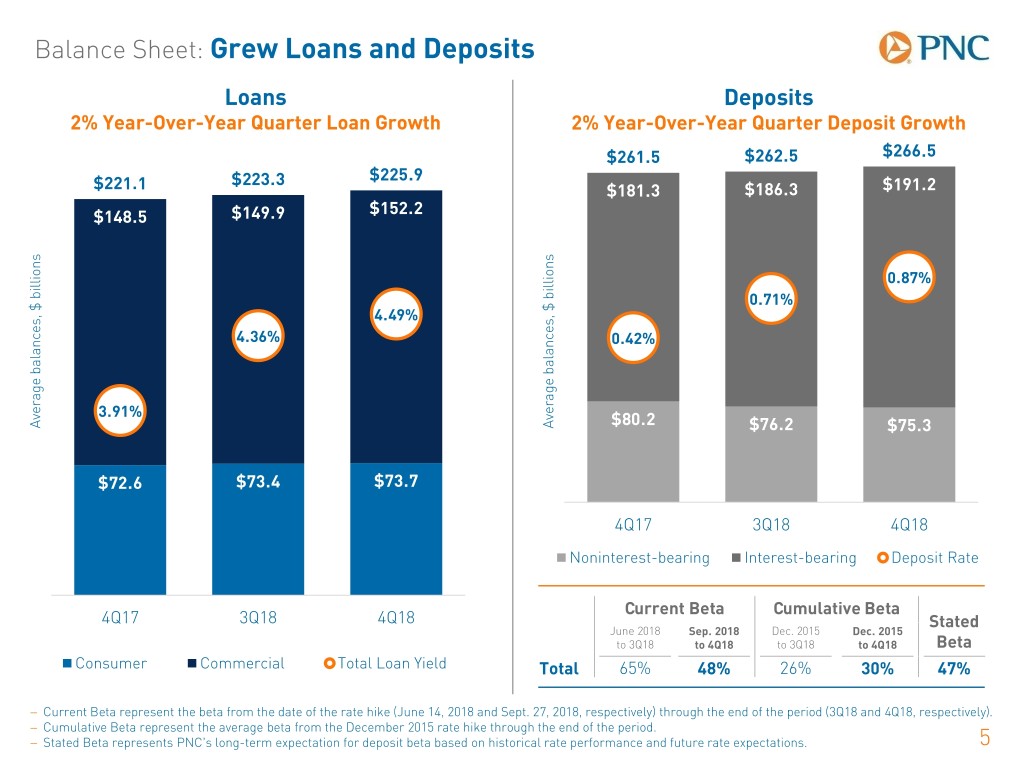

Balance Sheet: Grew Loans and Deposits Loans Deposits 2% Year-Over-Year Quarter Loan Growth 2% Year-Over-Year Quarter Deposit Growth $261.5 $262.5 $266.5 $223.3 $225.9 $221.1 $181.3 $186.3 $191.2 $152.2 $148.5 $149.9 0.87% 0.71% 4.49% 4.36% 0.42% 3.91% Averagebalances,$ billions Averagebalances,$ billions $80.2 $76.2 $75.3 $72.6 $73.4 $73.7 4Q17 3Q18 4Q18 Noninterest-bearing Interest-bearing Deposit Rate Current Beta Cumulative Beta 4Q17 3Q18 4Q18 Stated June 2018 Sep. 2018 Dec. 2015 Dec. 2015 to 3Q18 to 4Q18 to 3Q18 to 4Q18 Beta Consumer Commercial Total Loan Yield Total 65% 48% 26% 30% 47% − Current Beta represent the beta from the date of the rate hike (June 14, 2018 and Sept. 27, 2018, respectively) through the end of the period (3Q18 and 4Q18, respectively). − Cumulative Beta represent the average beta from the December 2015 rate hike through the end of the period. − Stated Beta represents PNC’s long-term expectation for deposit beta based on historical rate performance and future rate expectations. 5

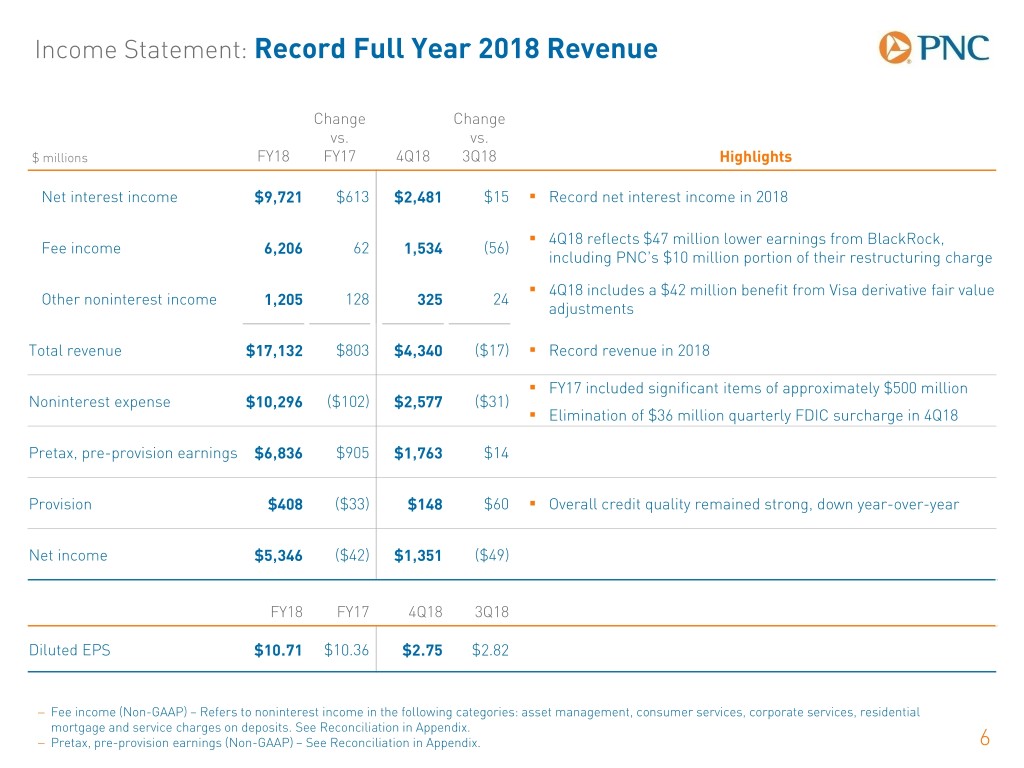

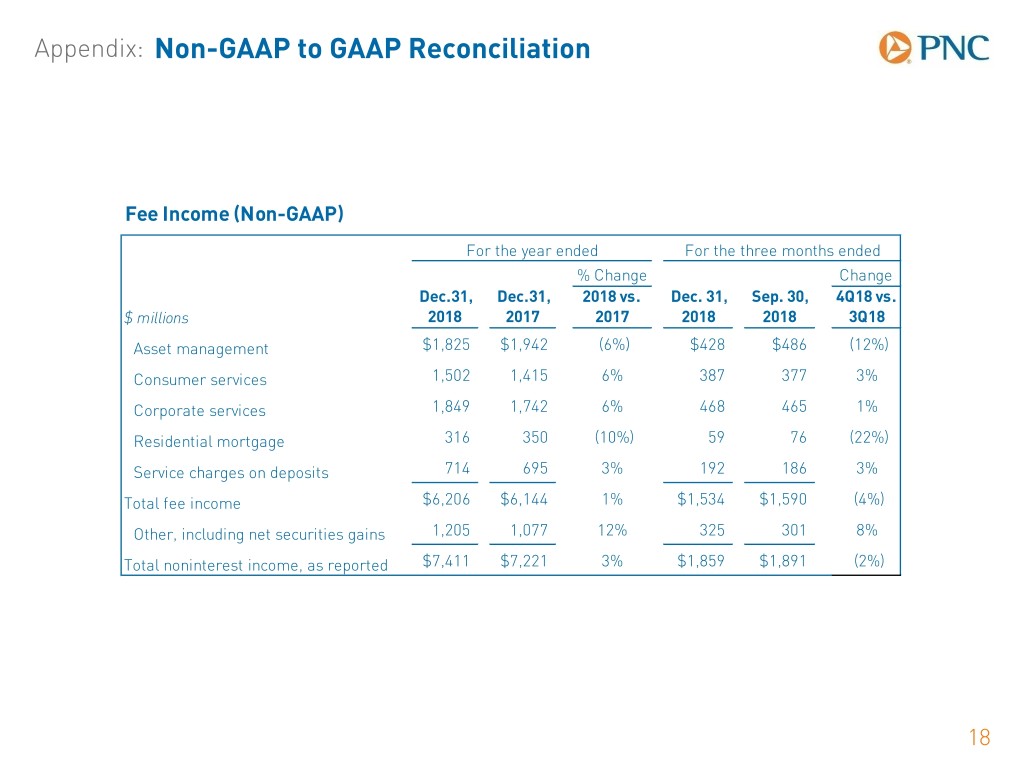

Income Statement: Record Full Year 2018 Revenue Change Change vs. vs. $ millions FY18 FY17 4Q18 3Q18 Highlights Net interest income $9,721 $613 $2,481 $15 . Record net interest income in 2018 . 4Q18 reflects $47 million lower earnings from BlackRock, Fee income 6,206 62 1,534 (56) including PNC’s $10 million portion of their restructuring charge . 4Q18 includes a $42 million benefit from Visa derivative fair value Other noninterest income 1,205 128 325 24 adjustments Total revenue $17,132 $803 $4,340 ($17) . Record revenue in 2018 . FY17 included significant items of approximately $500 million Noninterest expense $10,296 ($102) $2,577 ($31) . Elimination of $36 million quarterly FDIC surcharge in 4Q18 Pretax, pre-provision earnings $6,836 $905 $1,763 $14 Provision $408 ($33) $148 $60 . Overall credit quality remained strong, down year-over-year Net income $5,346 ($42) $1,351 ($49) FY18 FY17 4Q18 3Q18 Diluted EPS $10.71 $10.36 $2.75 $2.82 − Fee income (Non-GAAP) – Refers to noninterest income in the following categories: asset management, consumer services, corporate services, residential mortgage and service charges on deposits. See Reconciliation in Appendix. − Pretax, pre-provision earnings (Non-GAAP) – See Reconciliation in Appendix. 6

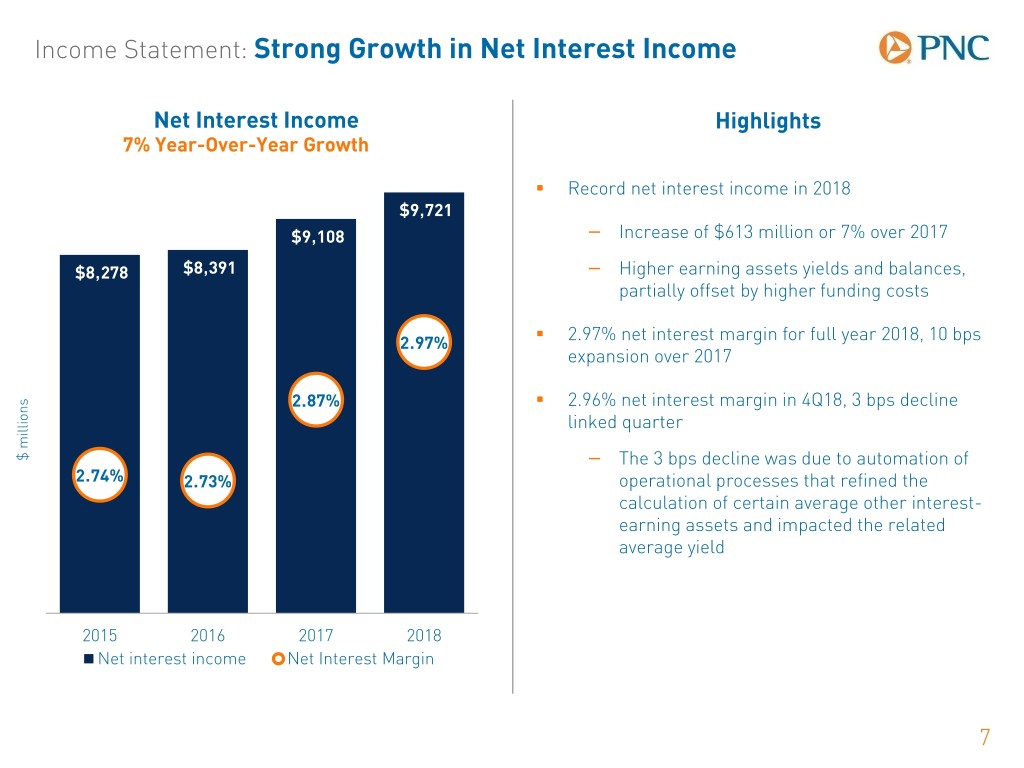

Income Statement: Strong Growth in Net Interest Income Net Interest Income Highlights 7% Year-Over-Year Growth . Record net interest income in 2018 $9,721 $9,108 − Increase of $613 million or 7% over 2017 $8,278 $8,391 − Higher earning assets yields and balances, partially offset by higher funding costs . 2.97% net interest margin for full year 2018, 10 bps 2.97% expansion over 2017 2.87% . 2.96% net interest margin in 4Q18, 3 bps decline linked quarter $ millions$ − The 3 bps decline was due to automation of 2.74% 2.73% operational processes that refined the calculation of certain average other interest- earning assets and impacted the related average yield 2015 2016 2017 2018 Net interest income Net Interest Margin 7

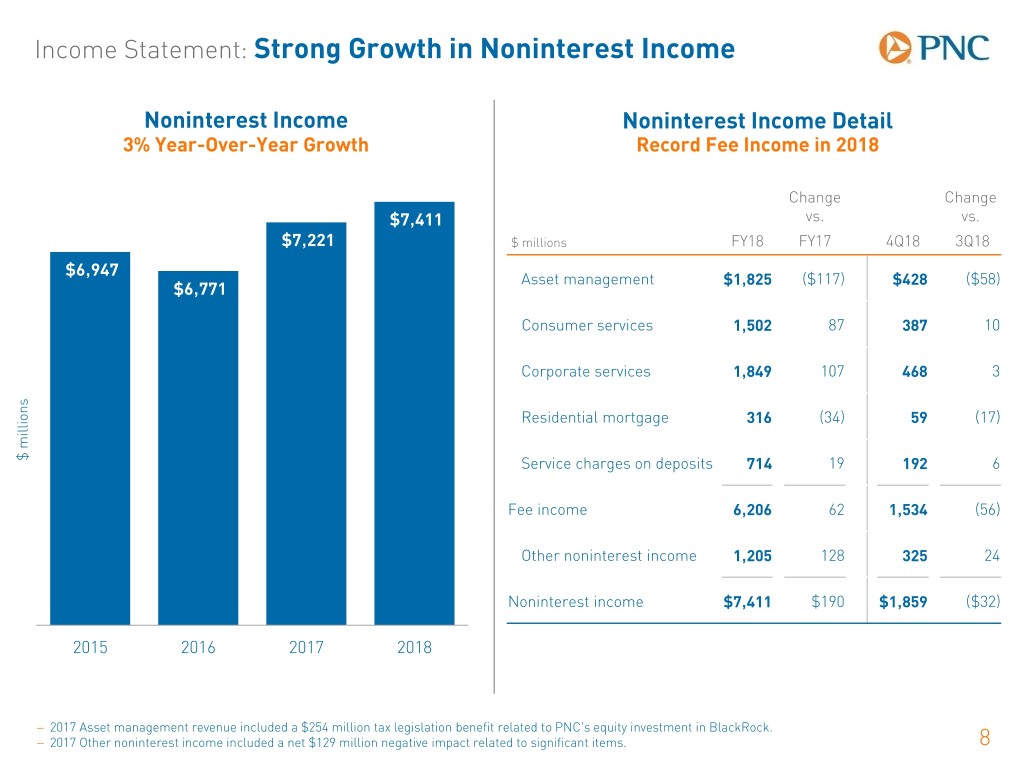

Income Statement: Strong Growth in Noninterest Income Noninterest Income Noninterest Income Detail 3% Year-Over-Year Growth Record Fee Income in 2018 Change Change $7,411 vs. vs. $7,221 $ millions FY18 FY17 4Q18 3Q18 $6,947 Asset management $1,825 ($117) $428 ($58) $6,771 Consumer services 1,502 87 387 10 Corporate services 1,849 107 468 3 Residential mortgage 316 (34) 59 (17) $ millions$ Service charges on deposits 714 19 192 6 Fee income 6,206 62 1,534 (56) Other noninterest income 1,205 128 325 24 Noninterest income $7,411 $190 $1,859 ($32) 2015 2016 2017 2018 − 2017 Asset management revenue included a $254 million tax legislation benefit related to PNC’s equity investment in BlackRock. − 2017 Other noninterest income included a net $129 million negative impact related to significant items. 8

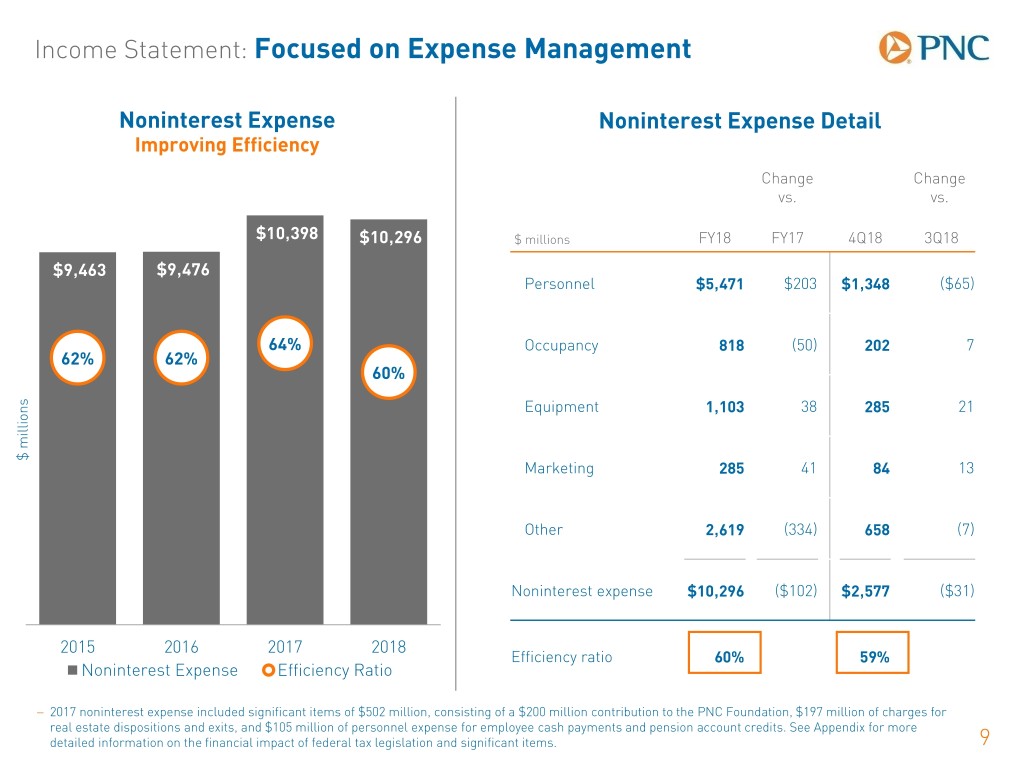

Income Statement: Focused on Expense Management Noninterest Expense Noninterest Expense Detail Improving Efficiency Change Change vs. vs. $10,398 $10,296 $ millions FY18 FY17 4Q18 3Q18 $9,463 $9,476 Personnel $5,471 $203 $1,348 ($65) 64% Occupancy 818 (50) 202 7 62% 62% 60% Equipment 1,103 38 285 21 $ millions$ Marketing 285 41 84 13 Other 2,619 (334) 658 (7) Noninterest expense $10,296 ($102) $2,577 ($31) 2015 2016 2017 2018 Efficiency ratio 60% 59% Noninterest Expense Efficiency Ratio − 2017 noninterest expense included significant items of $502 million, consisting of a $200 million contribution to the PNC Foundation, $197 million of charges for real estate dispositions and exits, and $105 million of personnel expense for employee cash payments and pension account credits. See Appendix for more detailed information on the financial impact of federal tax legislation and significant items. 9

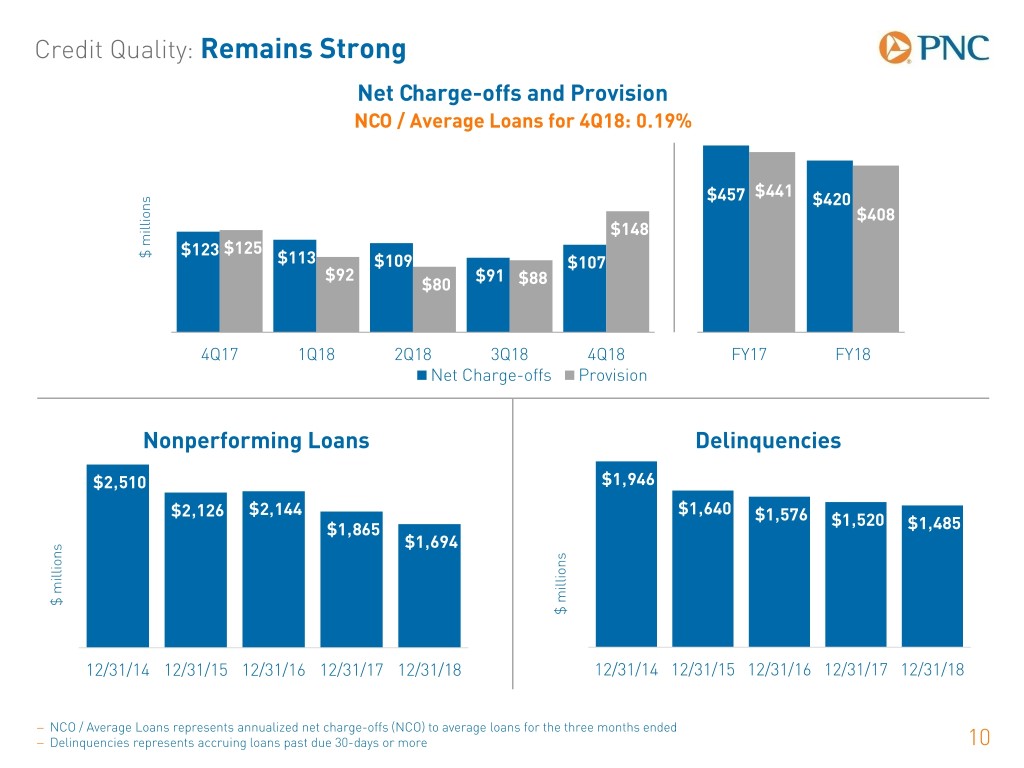

Credit Quality: Remains Strong Net Charge-offs and Provision NCO / Average Loans for 4Q18: 0.19% $441 $457 $420 $408 $148 $125 $ millions$ $123 $113 $109 $107 $92 $91 $80 $88 4Q17 1Q18 2Q18 3Q18 4Q18 FY17 FY18 Net Charge-offs Provision Nonperforming Loans Delinquencies $2,510 $1,946 $2,126 $2,144 $1,640 $1,576 $1,520 $1,865 $1,485 $1,694 $ millions$ $ millions$ 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 − NCO / Average Loans represents annualized net charge-offs (NCO) to average loans for the three months ended − Delinquencies represents accruing loans past due 30-days or more 10

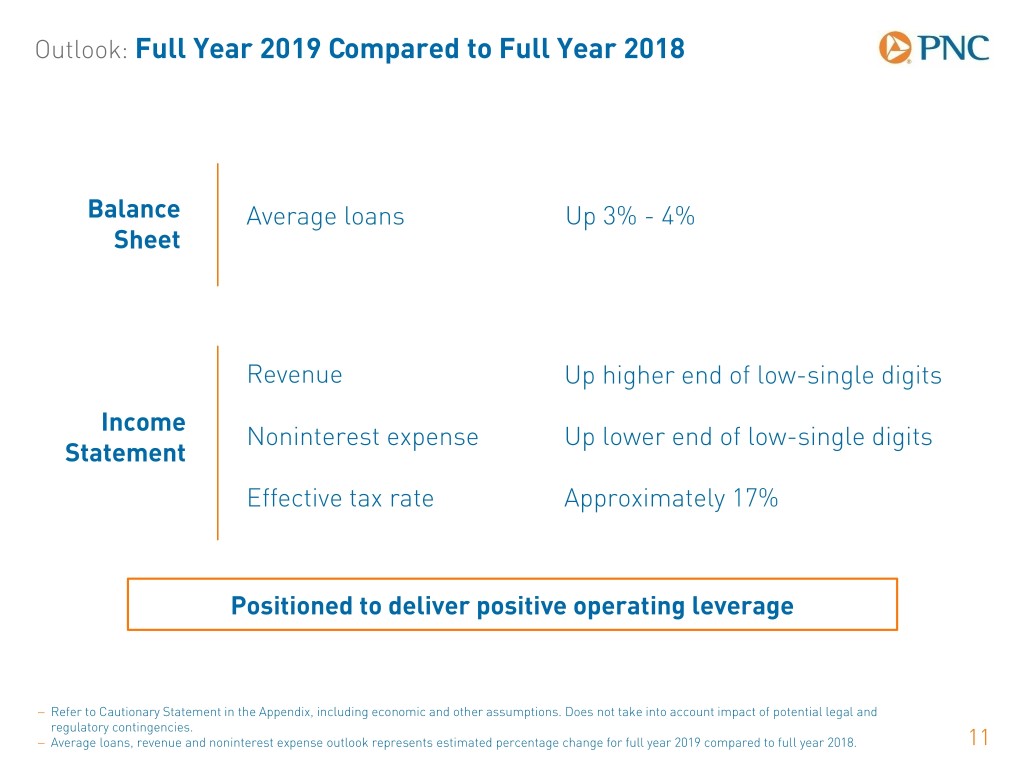

Outlook: Full Year 2019 Compared to Full Year 2018 Balance Average loans Up 3% - 4% Sheet Revenue Up higher end of low-single digits Income Noninterest expense Up lower end of low-single digits Statement Effective tax rate Approximately 17% Positioned to deliver positive operating leverage − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies. − Average loans, revenue and noninterest expense outlook represents estimated percentage change for full year 2019 compared to full year 2018. 11

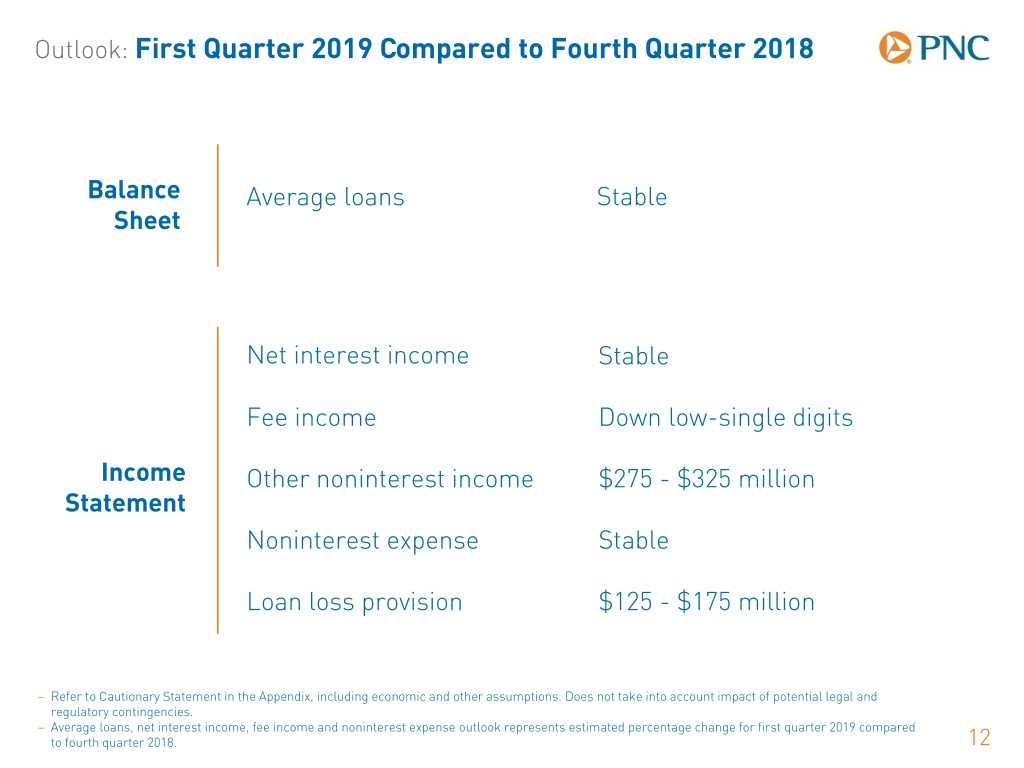

Outlook: First Quarter 2019 Compared to Fourth Quarter 2018 Balance Average loans Stable Sheet Net interest income Stable Fee income Down low-single digits Income Other noninterest income $275 - $325 million Statement Noninterest expense Stable Loan loss provision $125 - $175 million − Refer to Cautionary Statement in the Appendix, including economic and other assumptions. Does not take into account impact of potential legal and regulatory contingencies. − Average loans, net interest income, fee income and noninterest expense outlook represents estimated percentage change for first quarter 2019 compared to fourth quarter 2018. 12

Appendix: Cautionary Statement Regarding Forward-Looking Information This presentation includes “snapshot” information about PNC used by way of illustration and is not intended as a full business or financial review. It should not be viewed in isolation but rather in the context of all of the information made available by PNC in its SEC filings. We also make statements in this presentation, and we may from time to time make other statements, regarding our outlook for earnings, revenues, expenses, tax rates, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting PNC and its future business and operations that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward- looking statements are typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,” “estimate,” “goal,” “will,” “should” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date made. We do not assume any duty to update forward-looking statements. Actual results or future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from historical performance. Our forward-looking statements are subject to the following principal risks and uncertainties. . Our businesses, financial results and balance sheet values are affected by business and economic conditions, including the following: − Changes in interest rates and valuations in debt, equity and other financial markets. − Disruptions in the U.S. and global financial markets. − Actions by the Federal Reserve Board, U.S. Treasury and other government agencies, including those that impact money supply and market interest rates. − Changes in customer behavior due to changing business and economic conditions or legislative or regulatory initiatives. − Changes in customers’, suppliers’ and other counterparties’ performance and creditworthiness. − Impacts of tariffs and other trade policies of the U.S. and its global trading partners. − Slowing or reversal of the current U.S. economic expansion. − Commodity price volatility. 13

Appendix: Cautionary Statement Regarding Forward-Looking Information . Our forward-looking financial statements are subject to the risk that economic and financial market conditions will be substantially different than those we are currently expecting and do not take into account potential legal and regulatory contingencies. These statements are based on our view that U.S. economic growth has accelerated over the past two years to above its long-run trend, due to stimulus from corporate and personal income tax cuts passed in late 2017 and an increase in federal government spending. We expect further gradual improvement in the labor market this year, including job gains and rising wages, will be another positive for consumer spending. However, growth is expected to slow over the course of 2019 as fiscal stimulus fades. Trade restrictions and geopolitical concerns are downside risks to the forecast. Inflation is expected to slow in the first half of 2019, to below the Federal Open Market Committee’s 2 percent objective, because of lower energy prices. Short-term interest rates and bond yields are expected to rise very slowly in 2019. Our baseline forecast is for one more increase in the federal funds rate, in September 2019, pushing the rate to a range of 2.50 to 2.75 percent in the second half of this year. . PNC’s ability to take certain capital actions, including returning capital to shareholders, is subject to review by the Federal Reserve Board as part of PNC’s comprehensive capital plan for the applicable period in connection with the Federal Reserve Board’s Comprehensive Capital Analysis and Review (CCAR) process and to the acceptance of such capital plan and non-objection to such capital actions by the Federal Reserve Board. . PNC’s regulatory capital ratios in the future will depend on, among other things, the company’s financial performance, the scope and terms of final capital regulations then in effect and management actions affecting the composition of PNC’s balance sheet. In addition, PNC’s ability to determine, evaluate and forecast regulatory capital ratios, and to take actions (such as capital distributions) based on actual or forecasted capital ratios, will be dependent at least in part on the development, validation and regulatory approval of related models. . Legal and regulatory developments could have an impact on our ability to operate our businesses, financial condition, results of operations, competitive position, reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business generation and retention, liquidity, funding, and ability to attract and retain management. These developments could include: − Changes resulting from legislative and regulatory reforms, including changes affecting oversight of the financial services industry, consumer protection, pension, bankruptcy and other industry aspects, and changes in accounting policies and principles. − Changes to regulations governing bank capital and liquidity standards. − Unfavorable resolution of legal proceedings or other claims and regulatory and other governmental investigations or other inquiries. These matters may result in monetary judgments or settlements or other remedies, including fines, penalties, restitution or alterations in our business practices, and in additional expenses and collateral costs, and may cause reputational harm to PNC. − Results of the regulatory examination and supervision process, including our failure to satisfy requirements of agreements with governmental agencies. − Impact on business and operating results of any costs associated with obtaining rights in intellectual property claimed by others and of adequacy of our intellectual property protection in general. 14

Appendix: Cautionary Statement Regarding Forward-Looking Information . Business and operating results are affected by our ability to identify and effectively manage risks inherent in our businesses, including, where appropriate, through effective use of systems and controls, third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory capital and liquidity standards. . Business and operating results also include impacts relating to our equity interest in BlackRock, Inc. and rely to a significant extent on information provided to us by BlackRock. Risks and uncertainties that could affect BlackRock are discussed in more detail by BlackRock in its SEC filings. . We grow our business in part through acquisitions and new strategic initiatives. Risks and uncertainties include those presented by the nature of the business acquired and strategic initiative, including in some cases those associated with our entry into new businesses or new geographic or other markets and risks resulting from our inexperience in those new areas, as well as risks and uncertainties related to the acquisition transactions themselves, regulatory issues, and the integration of the acquired businesses into PNC after closing. . Competition can have an impact on customer acquisition, growth and retention and on credit spreads and product pricing, which can affect market share, deposits and revenues. Our ability to anticipate and respond to technological changes can also impact our ability to respond to customer needs and meet competitive demands. . Business and operating results can also be affected by widespread natural and other disasters, pandemics, dislocations, terrorist activities, system failures, security breaches, cyberattacks or international hostilities through impacts on the economy and financial markets generally or on us or our counterparties specifically. We provide greater detail regarding these as well as other factors in our 2017 Form 10-K and our 2018 Form 10-Qs, including in the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments Notes of the Notes To Consolidated Financial Statements in those reports, and in our subsequent SEC filings. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss elsewhere in this presentation or in our SEC filings, accessible on the SEC’s website at www.sec.gov and on our corporate website at www.pnc.com/secfilings. We have included these web addresses as inactive textual references only. Information on these websites is not part of this document. Any annualized, pro forma, estimated, third party or consensus numbers in this presentation are used for illustrative or comparative purposes only and may not reflect actual results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts who cover that company. The analysts’ opinions, estimates or forecasts (and therefore the consensus earnings estimates) are theirs alone, are not those of PNC or its management, and may not reflect PNC’s or other company’s actual or anticipated results. 15

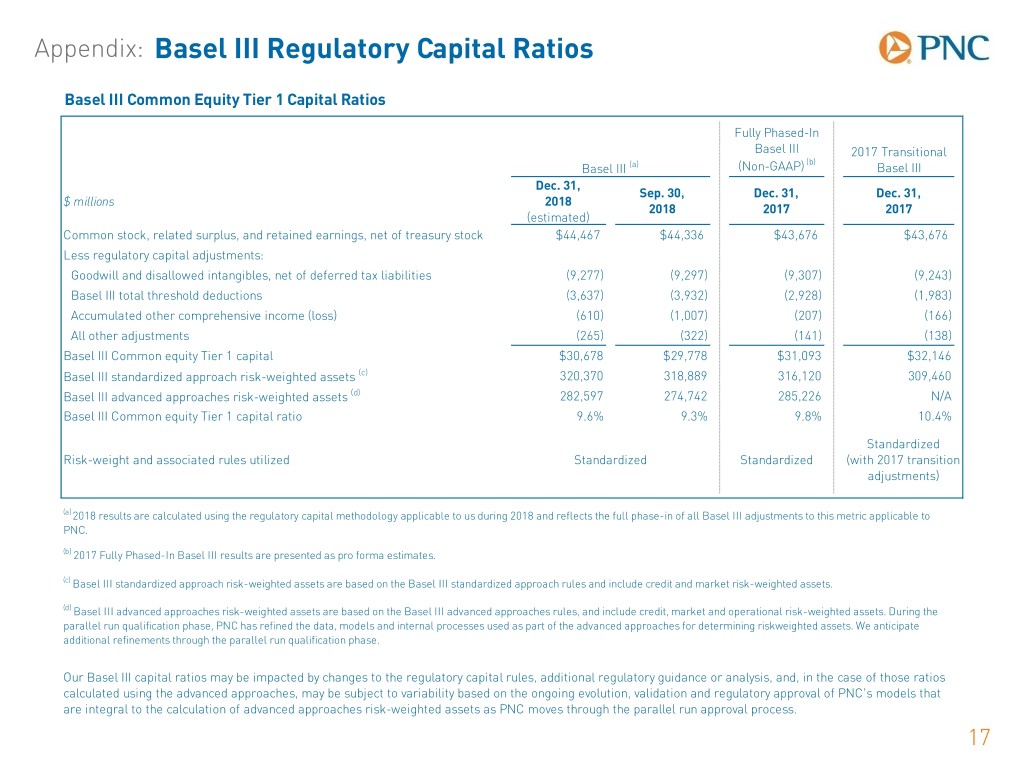

Appendix: Basel III Regulatory Capital Ratios Because PNC remains in the parallel run qualification phase for the advanced approaches, PNC’s regulatory risk-based capital ratios in 2018 and 2017 are calculated using the standardized approach for determining risk-weighted assets. Under the standardized approach for determining credit risk-weighted assets, exposures are generally assigned a pre- defined risk weight. Exposures to high volatility commercial real estate, past due exposures and equity exposures are generally subject to higher risk weights than other types of exposures. With the exception of certain nonqualifying trust preferred capital securities included in PNC's Total risk-based capital, the transitions and multi-year phase-in of the definition of capital under the Basel III rules were completed as of January 1, 2018. Accordingly, we refer to the capital ratios calculated using the definition of capital in effect as of January 1, 2018 and, for the risk-based ratios, standardized risk-weighted assets, as the Basel III ratios. We refer to the capital ratios calculated using the phased-in Basel III provisions in effect for 2017 and, for the risk-based ratios, standardized approach risk-weighted assets, as the 2017 Transitional Basel III ratios. We provide information below regarding PNC’s estimated Basel III December 31, 2018, actual Basel III September 30, 2018, Fully Phased-In Basel III December 31, 2017 and actual December 31, 2017 Transitional Basel III Common equity Tier 1 ratios. Under the Basel III rules applicable to PNC, significant common stock investments in unconsolidated financial institutions (for PNC, primarily BlackRock), mortgage servicing rights and deferred tax assets must be deducted from capital (subject to a phase-in schedule that ended December 31, 2017 and net of associated deferred tax liabilities) to the extent they individually exceed 10%, or in the aggregate exceed 15%, of the institution's adjusted common equity Tier 1 capital. Also, Basel III regulatory capital includes (subject to a phase-in schedule that ended December 31, 2017) accumulated other comprehensive income (loss) related to securities currently and those transferred from, available for sale, as well as pension and other postretirement plans.. 16

Appendix: Basel III Regulatory Capital Ratios Basel III Common Equity Tier 1 Capital Ratios Fully Phased-In Basel III 2017 Transitional (b) Basel III (a) (Non-GAAP) Basel III Dec. 31, Sep. 30, Dec. 31, Dec. 31, $ millions 2018 2018 2017 2017 (estimated) Common stock, related surplus, and retained earnings, net of treasury stock $44,467 $44,336 $43,676 $43,676 Less regulatory capital adjustments: Goodwill and disallowed intangibles, net of deferred tax liabilities (9,277) (9,297) (9,307) (9,243) Basel III total threshold deductions (3,637) (3,932) (2,928) (1,983) Accumulated other comprehensive income (loss) (610) (1,007) (207) (166) All other adjustments (265) (322) (141) (138) Basel III Common equity Tier 1 capital $30,678 $29,778 $31,093 $32,146 Basel III standardized approach risk-weighted assets (c) 320,370 318,889 316,120 309,460 Basel III advanced approaches risk-weighted assets (d) 282,597 274,742 285,226 N/A Basel III Common equity Tier 1 capital ratio 9.6% 9.3% 9.8% 10.4% Standardized Risk-weight and associated rules utilized Standardized Standardized (with 2017 transition adjustments) (a) 2018 results are calculated using the regulatory capital methodology applicable to us during 2018 and reflects the full phase-in of all Basel III adjustments to this metric applicable to PNC. (b) 2017 Fully Phased-In Basel III results are presented as pro forma estimates. (c) Basel III standardized approach risk-weighted assets are based on the Basel III standardized approach rules and include credit and market risk-weighted assets. (d) Basel III advanced approaches risk-weighted assets are based on the Basel III advanced approaches rules, and include credit, market and operational risk-weighted assets. During the parallel run qualification phase, PNC has refined the data, models and internal processes used as part of the advanced approaches for determining riskweighted assets. We anticipate additional refinements through the parallel run qualification phase. Our Basel III capital ratios may be impacted by changes to the regulatory capital rules, additional regulatory guidance or analysis, and, in the case of those ratios calculated using the advanced approaches, may be subject to variability based on the ongoing evolution, validation and regulatory approval of PNC’s models that are integral to the calculation of advanced approaches risk-weighted assets as PNC moves through the parallel run approval process. 17

Appendix: Non-GAAP to GAAP Reconciliation Fee Income (Non-GAAP) For the year ended For the three months ended % Change Change Dec.31, Dec.31, 2018 vs. Dec. 31, Sep. 30, 4Q18 vs. $ millions 2018 2017 2017 2018 2018 3Q18 Asset management $1,825 $1,942 (6%) $428 $486 (12%) Consumer services 1,502 1,415 6% 387 377 3% Corporate services 1,849 1,742 6% 468 465 1% Residential mortgage 316 350 (10%) 59 76 (22%) Service charges on deposits 714 695 3% 192 186 3% Total fee income $6,206 $6,144 1% $1,534 $1,590 (4%) Other, including net securities gains 1,205 1,077 12% 325 301 8% Total noninterest income, as reported $7,411 $7,221 3% $1,859 $1,891 (2%) 18

Appendix: Non-GAAP to GAAP Reconciliation Return on Tangible Common Equity (Non-GAAP) For the year ended For the three months ended Dec. 31, Dec. 31, Dec. 31, Sep. 30, $ millions 2018 2017 2018 2018 Return on average common shareholders' equity 11.83% 12.09% 11.83% 12.32% Average common shareholders' equity $42,779 $41,985 $ 42,974 $ 42,668 Average Goodwill and Other intangible assets (9,501) (9,473) (9,476) (9,498) Average deferred tax liabilities on Goodwill and Other intangible assets 192 274 191 192 Average tangible common equity $33,470 $32,786 $ 33,689 $ 33,362 Net income attributable to common shareholders $ 5,061 $ 5,076 $ 1,281 $ 1,325 Net income attributable to common shareholders, if annualized $ 5,061 $ 5,076 $ 5,082 $ 5,256 Return on average tangible common equity 15.12% 15.48% 15.09% 15.75% Return on average tangible common equity is a non-GAAP financial measure and is calculated based on annualized net income attributable to common shareholders divided by tangible common equity. We believe that return on average tangible common equity is useful as a tool to help measure and assess a company's use of common equity. 19

Appendix: Non-GAAP to GAAP Reconciliation Tangible Book Value per Common Share (Non-GAAP) % Change 12/31/18 12/31/18 $ millions, except per share data Dec. 31, Sep. 30, Dec. 31, vs. vs. 2018 2018 2017 9/30/18 12/31/17 Book value per common share $95.72 $93.22 $91.94 3% 4% Tangible book value per common share Common shareholders' equity $43,742 $43,076 $43,530 Goodwill and Other intangible assets (9,467) (9,489) (9,498) Deferred tax liabilities on Goodwill and Other intangible assets 190 192 191 Tangible common shareholders' equity $34,465 $33,779 $34,223 Period-end common shares outstanding (in millions) 457 462 473 Tangible book value per common share (Non-GAAP) $75.42 $73.11 $72.28 3% 4% Tangible book value per common share is a non-GAAP financial measure and is calculated based on tangible common shareholders’ equity divided by period-end common shares outstanding. We believe this non-GAAP measure serves as a useful tool to help evaluate the strength and discipline of a company's capital management strategies and as an additional, conservative measure of total company value. 20

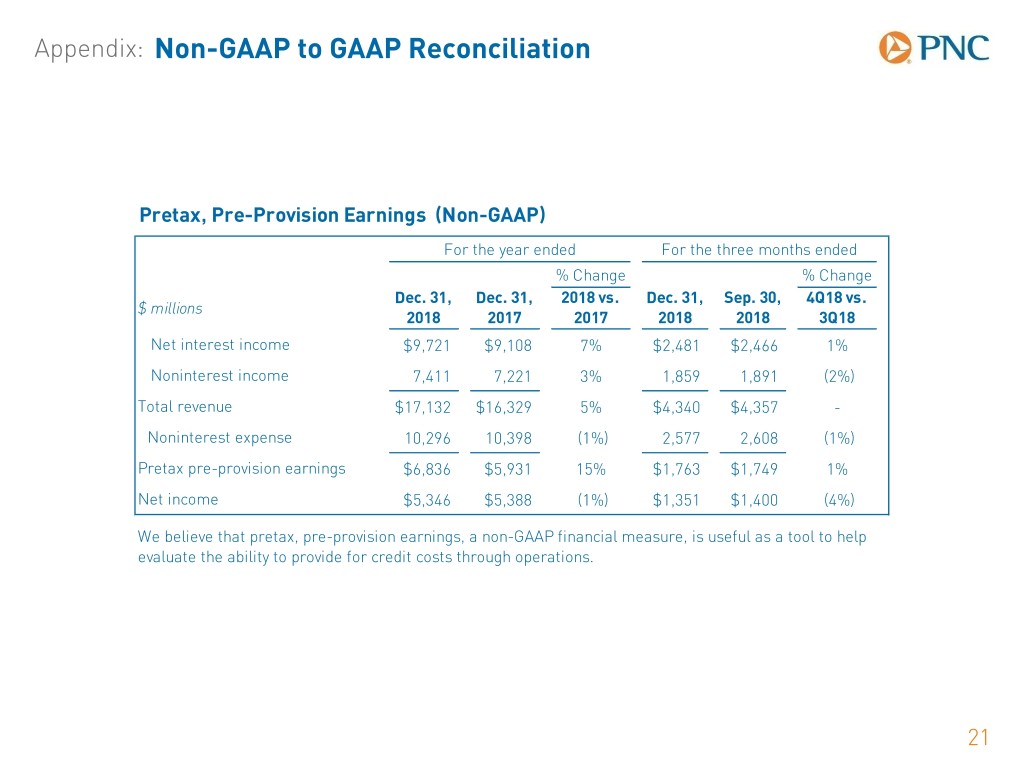

Appendix: Non-GAAP to GAAP Reconciliation Pretax, Pre-Provision Earnings (Non-GAAP) For the year ended For the three months ended % Change % Change Dec. 31, Dec. 31, 2018 vs. Dec. 31, Sep. 30, 4Q18 vs. $ millions 2018 2017 2017 2018 2018 3Q18 Net interest income $9,721 $9,108 7% $2,481 $2,466 1% Noninterest income 7,411 7,221 3% 1,859 1,891 (2%) Total revenue $17,132 $16,329 5% $4,340 $4,357 - Noninterest expense 10,296 10,398 (1%) 2,577 2,608 (1%) Pretax pre-provision earnings $6,836 $5,931 15% $1,763 $1,749 1% Net income $5,346 $5,388 (1%) $1,351 $1,400 (4%) We believe that pretax, pre-provision earnings, a non-GAAP financial measure, is useful as a tool to help evaluate the ability to provide for credit costs through operations. 21

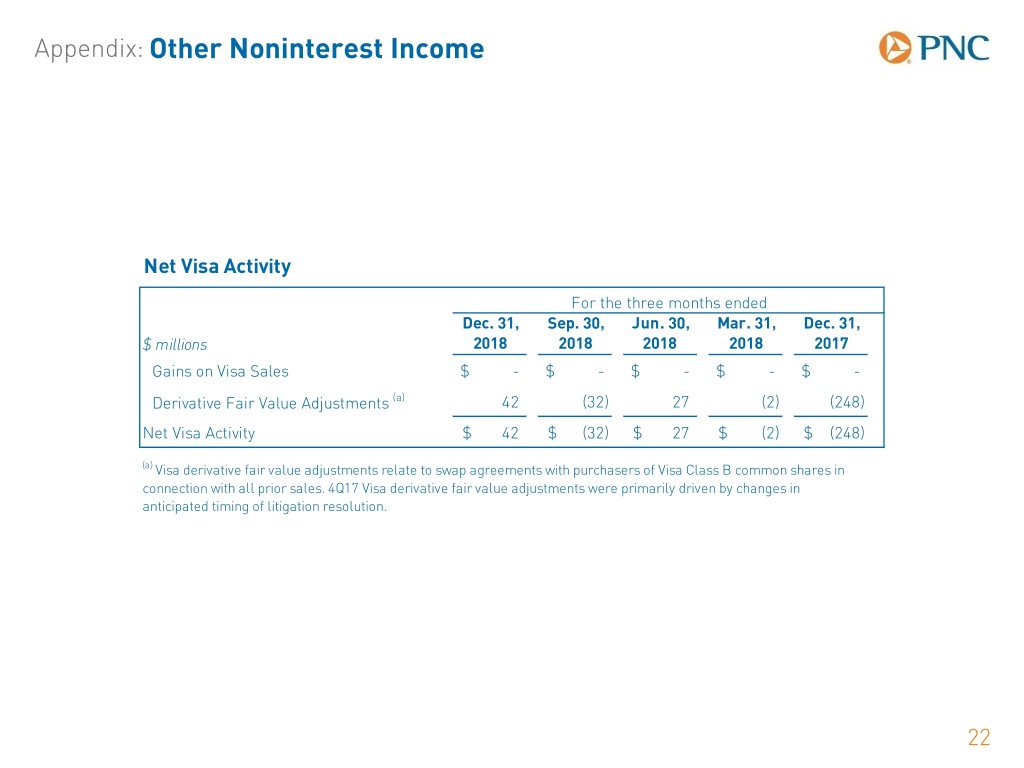

Appendix: Other Noninterest Income Net Visa Activity For the three months ended Dec. 31, Sep. 30, Jun. 30, Mar. 31, Dec. 31, $ millions 2018 2018 2018 2018 2017 Gains on Visa Sales $ - $ - $ - $ - $ - Derivative Fair Value Adjustments (a) 42 (32) 27 (2) (248) Net Visa Activity $ 42 $ (32) $ 27 $ (2) $ (248) (a) Visa derivative fair value adjustments relate to swap agreements with purchasers of Visa Class B common shares in connection with all prior sales. 4Q17 Visa derivative fair value adjustments were primarily driven by changes in anticipated timing of litigation resolution. 22

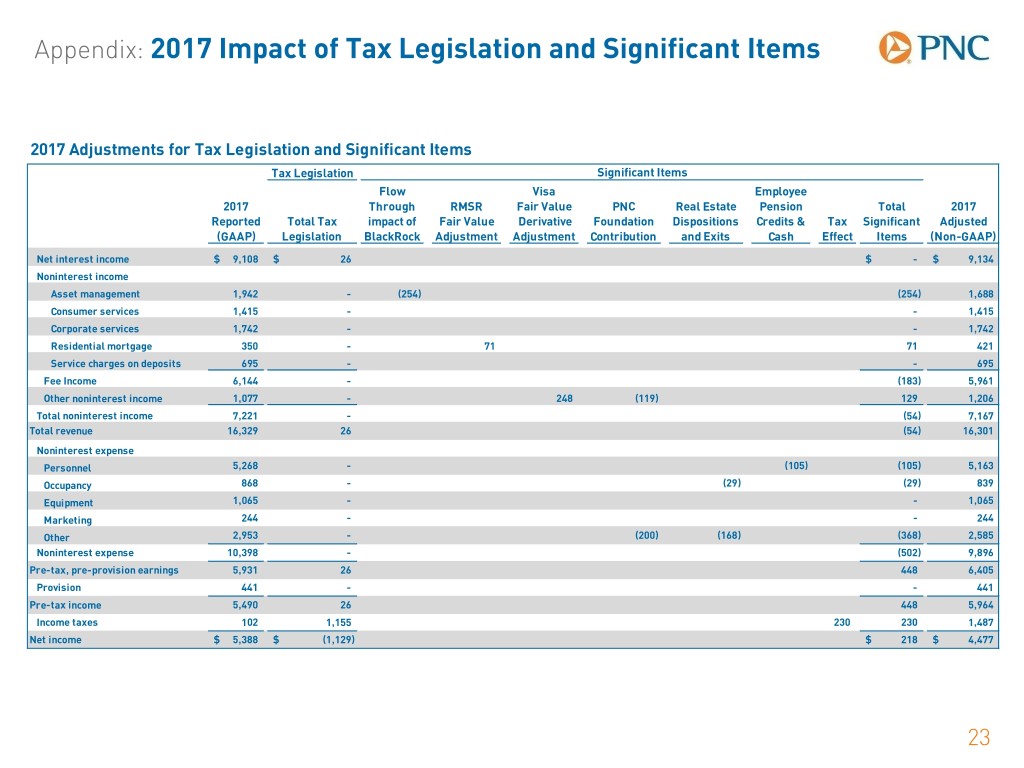

Appendix: 2017 Impact of Tax Legislation and Significant Items 2017 Adjustments for Tax Legislation and Significant Items Tax Legislation Significant Items Flow Visa Employee 2017 Through RMSR Fair Value PNC Real Estate Pension Total 2017 Reported Total Tax impact of Fair Value Derivative Foundation Dispositions Credits & Tax Significant Adjusted (GAAP) Legislation BlackRock Adjustment Adjustment Contribution and Exits Cash Effect Items (Non-GAAP) Net interest income $ 9,108 $ 26 $ - $ 9,134 Noninterest income Asset management 1,942 - (254) (254) 1,688 Consumer services 1,415 - - 1,415 Corporate services 1,742 - - 1,742 Residential mortgage 350 - 71 71 421 Service charges on deposits 695 - - 695 Fee Income 6,144 - (183) 5,961 Other noninterest income 1,077 - 248 (119) 129 1,206 Total noninterest income 7,221 - (54) 7,167 Total revenue 16,329 26 (54) 16,301 Noninterest expense Personnel 5,268 - (105) (105) 5,163 Occupancy 868 - (29) (29) 839 Equipment 1,065 - - 1,065 Marketing 244 - - 244 Other 2,953 - (200) (168) (368) 2,585 Noninterest expense 10,398 - (502) 9,896 Pre-tax, pre-provision earnings 5,931 26 448 6,405 Provision 441 - - 441 Pre-tax income 5,490 26 448 5,964 Income taxes 102 1,155 230 230 1,487 Net income $ 5,388 $ (1,129) $ 218 $ 4,477 23

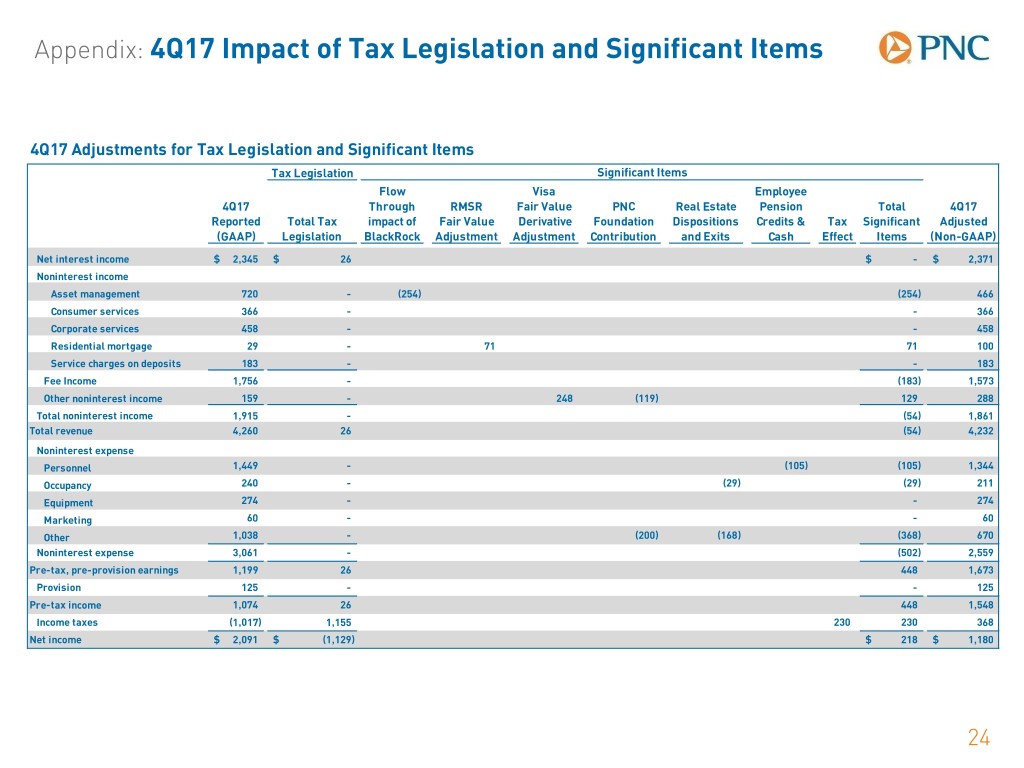

Appendix: 4Q17 Impact of Tax Legislation and Significant Items 4Q17 Adjustments for Tax Legislation and Significant Items Tax Legislation Significant Items Flow Visa Employee 4Q17 Through RMSR Fair Value PNC Real Estate Pension Total 4Q17 Reported Total Tax impact of Fair Value Derivative Foundation Dispositions Credits & Tax Significant Adjusted (GAAP) Legislation BlackRock Adjustment Adjustment Contribution and Exits Cash Effect Items (Non-GAAP) Net interest income $ 2,345 $ 26 $ - $ 2,371 Noninterest income Asset management 720 - (254) (254) 466 Consumer services 366 - - 366 Corporate services 458 - - 458 Residential mortgage 29 - 71 71 100 Service charges on deposits 183 - - 183 Fee Income 1,756 - (183) 1,573 Other noninterest income 159 - 248 (119) 129 288 Total noninterest income 1,915 - (54) 1,861 Total revenue 4,260 26 (54) 4,232 Noninterest expense Personnel 1,449 - (105) (105) 1,344 Occupancy 240 - (29) (29) 211 Equipment 274 - - 274 Marketing 60 - - 60 Other 1,038 - (200) (168) (368) 670 Noninterest expense 3,061 - (502) 2,559 Pre-tax, pre-provision earnings 1,199 26 448 1,673 Provision 125 - - 125 Pre-tax income 1,074 26 448 1,548 Income taxes (1,017) 1,155 230 230 368 Net income $ 2,091 $ (1,129) $ 218 $ 1,180 24